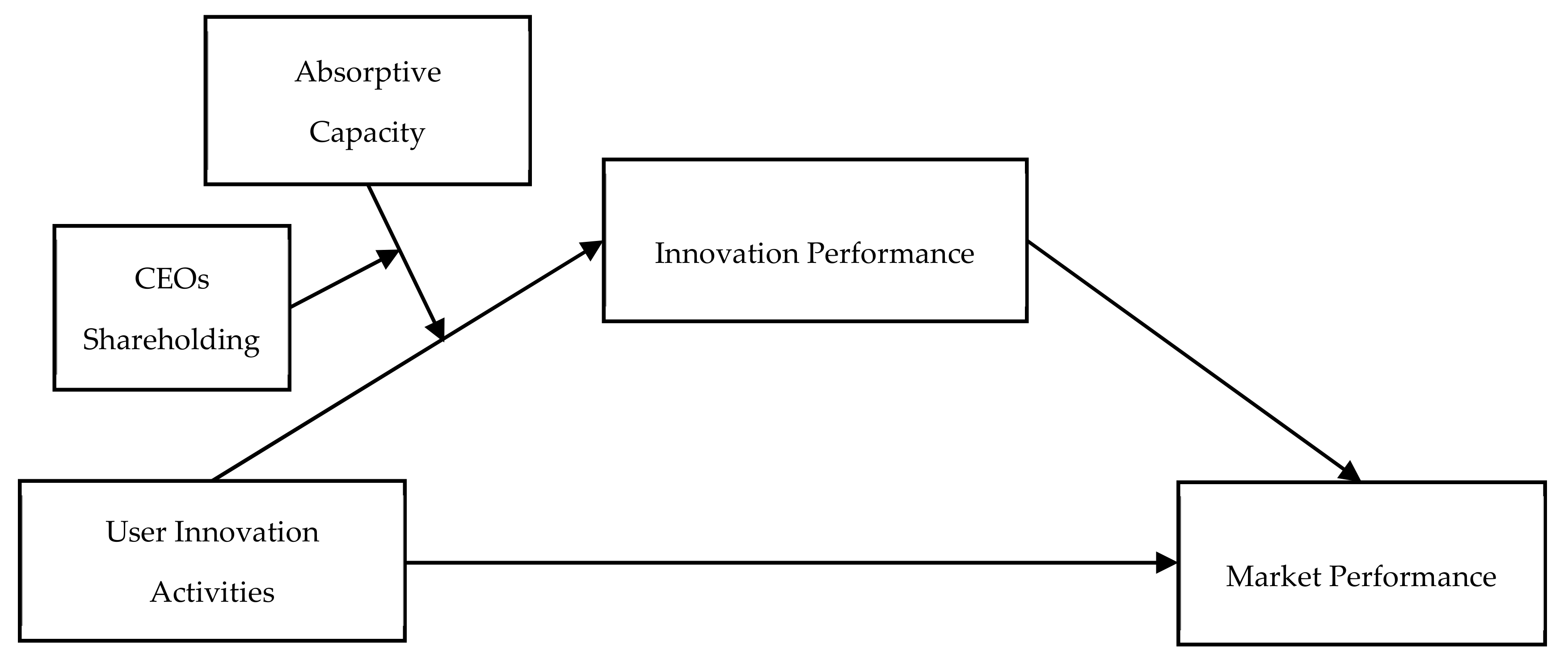

Relationship between User Innovation Activities and Market Performance: Moderated Mediating Effect of Absorptive Capacity and CEO’s Shareholding on Innovation Performance

Abstract

1. Introduction

2. Theoretical Background and Previous Research

2.1. Open Innovation and User Innovation Activities

2.2. Absorptive Capacity

2.3. CEO’s Shareholding

3. Research Hypotheses

3.1. Relationship between User Innovation Activities and Market Performance

3.2. Relationship between User Innovation Activities and Innovation Performance

3.3. Mediating Effect of Innovation Performance

3.4. Moderated Mediating Effects of Absorptive Capacity

3.5. Moderated Mediating Effects of the Interaction between CEO’s Shareholding and Absorptive Capacity

4. Research Method

4.1. Sample Selection and Data Collection

4.2. Measurement of Variables

4.2.1. Dependent Variables

4.2.2. Independent Variables and Moderating Variable

Independent Variable

Moderating Variables

4.2.3. Mediating Variable: Innovation Performance

4.2.4. Control Variables

4.3. Statistical Methods

5. Results

5.1. Descriptive Statistics and Correlations

5.2. Findings

5.2.1. Mediation Analysis

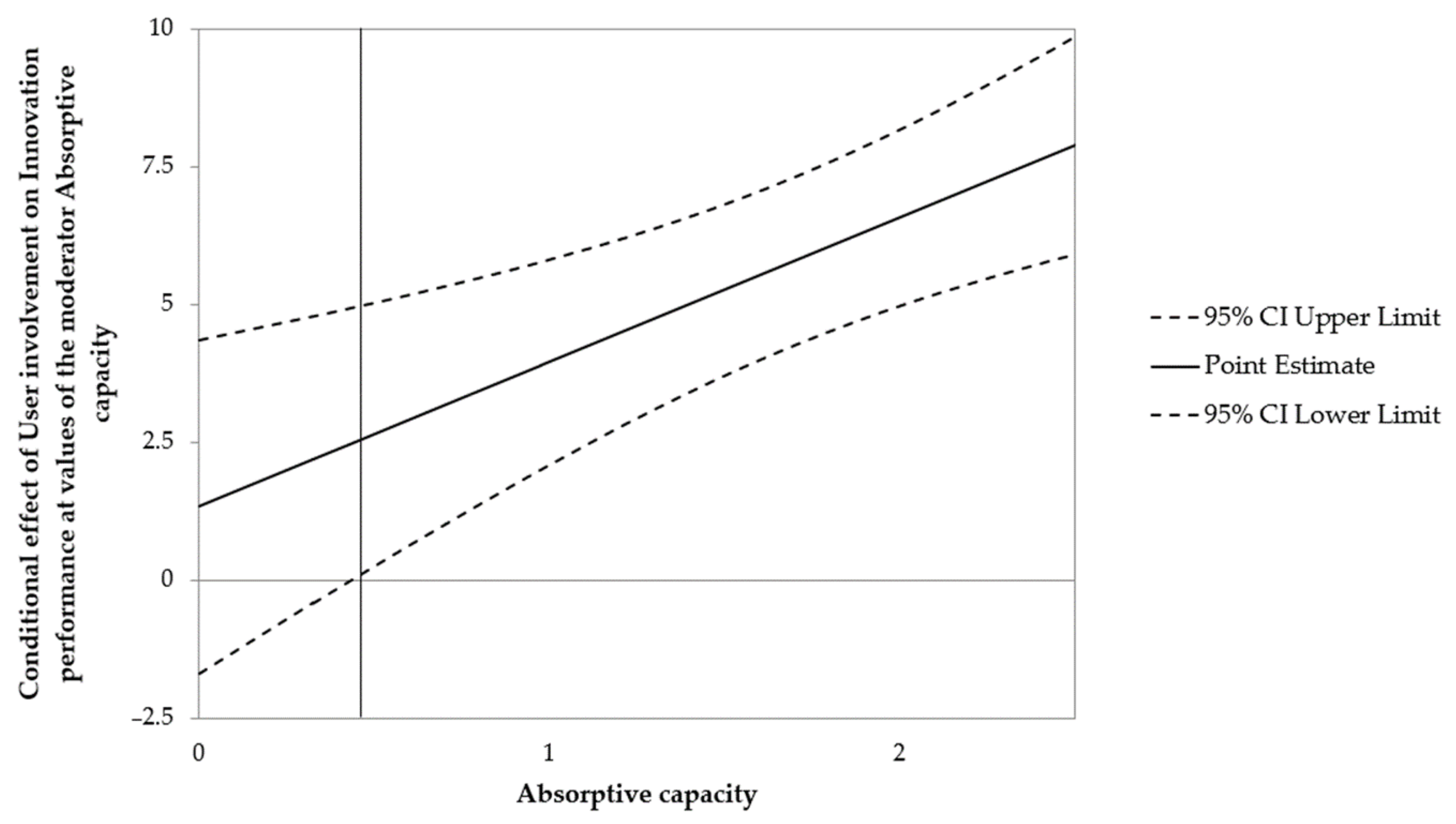

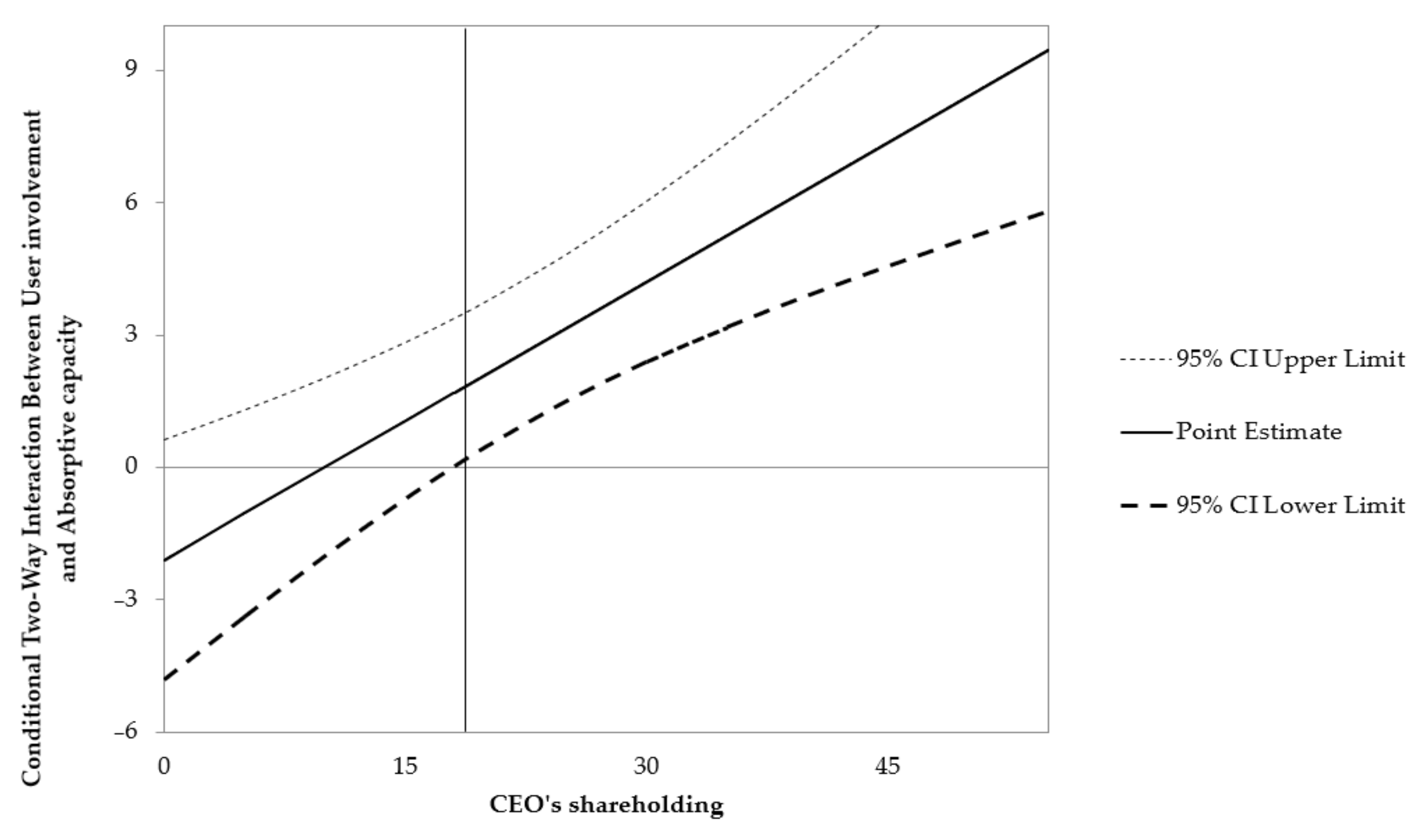

5.2.2. Moderated Mediation and Moderated Moderated Mediation Analyses

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Katila, R.; Ahuja, G. Something old, something new: A longitudinal study of search behavior and new product introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among U.K. manufacturing firms. Strat. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Kim, Y. Consumer user innovation in Korea: An international comparison and policy implications. Asian J. Technol. Innov. 2015, 23, 69–86. [Google Scholar] [CrossRef]

- Von Hippel, E. Democratizing innovation: The evolving phenomenon of user innovation. J. Betr. 2005, 55, 63–78. [Google Scholar] [CrossRef]

- Hoyer, W.D.; Chandy, R.; Dorotic, M.; Krafft, M.; Singh, S.S. Consumer Cocreation in New Product Development. J. Serv. Res. 2010, 13, 283–296. [Google Scholar] [CrossRef]

- Lettl, C. User involvement competence for radical innovation. J. Eng. Technol. Manag. 2007, 24, 53–75. [Google Scholar] [CrossRef]

- Bogers, M.; West, J. Managing Distributed Innovation: Strategic Utilization of Open and User Innovation. Creat. Innov. Manag. 2012, 21, 61–75. [Google Scholar] [CrossRef]

- Stam, W.; Elfring, T. Entrepreneurial Orientation and New Venture Performance: The Moderating Role of Intra- and Extra industry Social Capital. Acad. Manag. J. 2008, 51, 97–111. [Google Scholar] [CrossRef]

- West, J.; Salter, A.; Vanhaverbeke, W.; Chesbrough, H. Open innovation: The next decade introduction. Res. Policy 2014, 43, 805–811. [Google Scholar] [CrossRef]

- Saldanha, T.J.V.; Washington State University; Mithas, S.; Krishnan, M.S.; University of Maryland. University of Michigan Leveraging Customer Involvement for Fueling Innovation: The Role of Relational and Analytical Information Processing Capabilities. MIS Q. 2017, 41, 367–396. [Google Scholar] [CrossRef]

- Danneels, E. Tight-loose coupling with customers: The enactment of customer orientation. Strat. Manag. J. 2003, 24, 559–576. [Google Scholar] [CrossRef]

- Gassmann, O.; Kausch, C.; Enkel, E. Negative side effects of customer integration. Int. J. Technol. Manag. 2010, 50, 43. [Google Scholar] [CrossRef]

- Hopkins, M.M.; Tidd, J.; Nightingale, P.; Miller, R. Generative and degenerative interactions: Positive and negative dynamics of open, user-centric innovation in technology and engineering consultancies. R&D Manag. 2010, 41, 44–60. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Innovation and Learning: The Two Faces of R & D. Econ. J. 1989, 99, 569. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive Capacity: A Review, Reconceptualization, and Extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Caloghirou, Y.; Kastelli, I.; Tsakanikas, A. Internal capabilities and external knowledge sources: Complements or substitutes for innovative performance? Technovation 2004, 24, 29–39. [Google Scholar] [CrossRef]

- Cui, A.S.; Wu, F. Utilizing customer knowledge in innovation: Antecedents and impact of customer involvement on new product performance. J. Acad. Mark. Sci. 2015, 44, 516–538. [Google Scholar] [CrossRef]

- Lavie, D.; Rosenkopf, L. Balancing Exploration and Exploitation in Alliance Formation. Acad. Manag. J. 2006, 49, 797–818. [Google Scholar] [CrossRef]

- Ritter, T.; Gemünden, H.G. Network competence: Its impact on innovation success and its antecedents. J. Bus. Res. 2003, 56, 745–755. [Google Scholar] [CrossRef]

- Coles, J.; Daniel, N.; Naveen, L. Managerial incentives and risk-taking. J. Financ. Econ. 2006, 79, 431–468. [Google Scholar] [CrossRef]

- Yoo, J.W.; Kim, J. The Effects of Entrepreneurial Orientation and Environmental Uncertainty on Korean Technology Firms’ R&D Investment. J. Open Innov. Technol. Mark. Complex. 2019, 5, 29. [Google Scholar] [CrossRef]

- Hillman, A.J.; Dalziel, T. Boards of Directors and Firm Performance: Integrating Agency and Resource Dependence Perspectives. Acad. Manag. Rev. 2003, 28, 383–396. [Google Scholar] [CrossRef]

- Lynall, M.D.; Golden, B.R.; Hillman, A.J. Board composition from adolescence to maturity: A multitheoretic view. Acad. Manag. Rev. 2003, 28, 416–431. [Google Scholar] [CrossRef]

- Pearce, J.A.; Zahra, S.A. The relative power of ceos and boards of directors: Associations with corporate performance. Strat. Manag. J. 1991, 12, 135–153. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of Ownership and Control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Chesbrough, H.W. The Era of Open Innovation. MIT Sloan Manag. Rev. 2003, 44, 35–41. [Google Scholar]

- Stock, G.N.; Greis, N.P.; Fischer, W.A. Absorptive capacity and new product development. J. High Technol. Manag. Res. 2001, 12, 77–91. [Google Scholar] [CrossRef]

- Henkel, J.; Hippel, E.V. Welfare Implications of User Innovation. J. Technol. Transf. 2004, 30, 73–87. [Google Scholar] [CrossRef]

- Herstad, S.; Bloch, C.; Ebersberger, B.; Van De Velde, E. National innovation policy and global open innovation: Exploring balances, tradeoffs and complementarities. Sci. Public Policy 2010, 37, 113–124. [Google Scholar] [CrossRef]

- Block, J.H.; Henkel, J.; Schweisfurth, T.G.; Stiegler, A. Commercializing user innovations by vertical diversification: The user–manufacturer innovator. Res. Policy 2016, 45, 244–259. [Google Scholar] [CrossRef]

- Sidhu, J.S.; Commandeur, H.R.; Volberda, H.W. The Multifaceted Nature of Exploration and Exploitation: Value of Supply, Demand, and Spatial Search for Innovation. Organ. Sci. 2007, 18, 20–38. [Google Scholar] [CrossRef]

- Zouaghi, F.; Sánchez, M.; Martinez, M.G. Did the global financial crisis impact firms’ innovation performance? The role of internal and external knowledge capabilities in high and low tech industries. Technol. Forecast. Soc. Chang. 2018, 132, 92–104. [Google Scholar] [CrossRef]

- Kim, C.-Y.; Lim, M.S.; Yoo, J.W. Ambidexterity in External Knowledge Search Strategies and Innovation Performance: Mediating Role of Balanced Innovation and Moderating Role of Absorptive Capacity. Sustainability 2019, 11, 5111. [Google Scholar] [CrossRef]

- Rubio, N.; Villaseñor, N.; Yagüe, M.J. Sustainable Co-Creation Behavior in a Virtual Community: Antecedents and Moderating Effect of Participant’s Perception of Own Expertise. Sustainability 2020, 12, 8151. [Google Scholar] [CrossRef]

- Murovec, N.; Prodan, I. Absorptive capacity, its determinants, and influence on innovation output: Cross-cultural validation of the structural model. Technovation 2009, 29, 859–872. [Google Scholar] [CrossRef]

- Jeong, H.; Shin, K.; Kim, E.; Kim, S. Does Open Innovation Enhance a Large Firm’s Financial Sustainability? A Case of the Korean Food Industry. J. Open Innov. Technol. Mark. Complex. 2020, 6, 101. [Google Scholar] [CrossRef]

- Kim, J.; Choi, S.O. A Comparative Analysis of Corporate R&D Capability and Innovation: Focused on the Korean Manufacturing Industry. J. Open Innov. Technol. Mark. Complex. 2020, 6, 100. [Google Scholar] [CrossRef]

- Egbetokun, A.; Savin, I. Absorptive capacity and innovation: When is it better to cooperate? J. Evol. Econ. 2014, 24, 399–420. [Google Scholar] [CrossRef]

- Schildt, H.; Keil, T.; Maula, M. The temporal effects of relative and firm-level absorptive capacity on interorganizational learning. Strat. Manag. J. 2012, 33, 1154–1173. [Google Scholar] [CrossRef]

- Hurmelinna-Laukkanen, P.; Olander, H. Coping with rivals’ absorptive capacity in innovation activities. Technovation 2014, 34, 3–11. [Google Scholar] [CrossRef]

- Daily, C.M.; Dalton, D.R.; Cannella, A.A. Corporate governance: Decades of dialogue and data. Acad. Manag. Rev. 2003, 28, 371–382. [Google Scholar] [CrossRef]

- Hesterly, W.S.; Liebeskind, J.; Zenger, T.R. Organizational economics: An impending revolution in organization theory? Acad. Manag. Rev. 1990, 15, 402–420. [Google Scholar] [CrossRef]

- Rediker, K.J.; Seth, A. Boards of directors and substitution effects of alternative governance mechanisms. Strat. Manag. J. 1995, 16, 85–99. [Google Scholar] [CrossRef]

- Jensen, M.C. Foundations of Organizational Strategy, 2nd ed.; Harvard University Press: Cambridge, MA, USA, 2001. [Google Scholar]

- Matzler, K.; Veider, V.; Hautz, J.; Stadler, C. The Impact of Family Ownership, Management, and Governance on Innovation. J. Prod. Innov. Manag. 2015, 32, 319–333. [Google Scholar] [CrossRef]

- Minetti, R.; Murro, P.; Paiella, M. Ownership structure, governance, and innovation. Eur. Econ. Rev. 2015, 80, 165–193. [Google Scholar] [CrossRef]

- Inauen, M.; Schenker-Wicki, A. The impact of outside-in open innovation on innovation performance. Eur. J. Innov. Manag. 2011, 14, 496–520. [Google Scholar] [CrossRef]

- Zirger, B.J.; Maidique, M.A. A Model of New Product Development: An Empirical Test. Manag. Sci. 1990, 36, 867–883. [Google Scholar] [CrossRef]

- Griffith, R.; Redding, S.; Van Reenen, J. R&D and Absorptive Capacity: Theory and Empirical Evidence. Scand. J. Econ. 2003, 105, 99–118. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Cooper, R.G.; Edgett, S.J.; Kleinschmidt, E.J. New Problems, New Solutions: Making Portfolio Management More Effective. Res. Manag. 2000, 43, 18–33. [Google Scholar] [CrossRef]

- Von Hippel, E. Horizontal innovation networks-by and for users. Ind. Corp. Chang. 2007, 16, 293–315. [Google Scholar] [CrossRef]

- Nambisan, S. Designing Virtual Customer Environments for New Product Development: Toward a Theory. Acad. Manag. Rev. 2002, 27, 392–413. [Google Scholar] [CrossRef]

- Faems, D.; Van Looy, B.; DeBackere, K. Interorganizational Collaboration and Innovation: Toward a Portfolio Approach. J. Prod. Innov. Manag. 2005, 22, 238–250. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Absorptive Capacity, Environmental Turbulence, and the Complementarity of Organizational Learning Processes. Acad. Manag. J. 2009, 52, 822–846. [Google Scholar] [CrossRef]

- Lane, P.K.; Koka, B.R.; Pathak, S. Knowledge of the firm, combinative capacity: A critical review and rejuvenation of the construct. Acad. Manag. Rev. 2006, 31, 833–863. [Google Scholar] [CrossRef]

- Verona, G. A Resource-Based View of Product Development. Acad. Manag. Rev. 1999, 24, 132–142. [Google Scholar] [CrossRef]

- Science and Technology Policy Institute. Report on the Korean Innovation Survey 2014: Manufacturing Sector; Science and Technology Policy Institute: Seoul, Korea, 2014. [Google Scholar]

- Auh, S.; Menguc, B. Balancing exploration and exploitation: The moderating role of competitive intensity. J. Bus. Res. 2005, 58, 1652–1661. [Google Scholar] [CrossRef]

- Buzzell, R.D.; Gale, B.T.; Sultan, R.G.M. Market share-a key to profitability. Harv. Bus. Rev. 1975, 53, 97–106. [Google Scholar]

- Nunnally, J.C. Bychometric Theory, 2nd ed.; McGrow Hill: New York, NY, USA, 1978. [Google Scholar]

- Ferreras-Méndez, J.L.; Newell, S.; Fernández-Mesa, A.; Alegre, J. Depth and breadth of external knowledge search and performance: The mediating role of absorptive capacity. Ind. Mark. Manag. 2015, 47, 86–97. [Google Scholar] [CrossRef]

- Foss, N.J.; Laursen, K.; Pedersen, T. Linking Customer Interaction and Innovation: The Mediating Role of New Organizational Practices. Organ. Sci. 2011, 22, 980–999. [Google Scholar] [CrossRef]

- Cui, H.; Mak, Y. The relationship between managerial ownership and firm performance in high R&D firms. J. Corp. Financ. 2002, 8, 313–336. [Google Scholar] [CrossRef]

- Bronzini, R.; Piselli, P. The impact of R&D subsidies on firm innovation. Res. Policy 2016, 45, 442–457. [Google Scholar]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach, 2nd ed.; Guilford Press: New York, NY, USA, 2017. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Muller, D.; Judd, C.M.; Yzerbyt, V.Y. When moderation is mediated and mediation is moderated. J. Pers. Soc. Psychol. 2005, 89, 852–863. [Google Scholar] [CrossRef] [PubMed]

- James, L.R.; Brett, J.M. Mediators, moderators, and tests for mediation. J. Appl. Psychol. 1984, 69, 307–321. [Google Scholar] [CrossRef]

- Hayes, A.F. An index and test of linear moderaetd mediation. Multivar. Behav. Res. 2015, 50, 1–22. [Google Scholar] [CrossRef]

- Gambardella, A.; Raasch, C.; Von Hippel, E. The User Innovation Paradigm: Impacts on Markets and Welfare. Manag. Sci. 2017, 63, 1450–1468. [Google Scholar] [CrossRef]

- Shafique, I.; Kalyar, M.N. Linking Transformational Leadership, Absorptive Capacity and Corporate Entrepreneurship. Adm. Sci. 2018, 8, 9. [Google Scholar] [CrossRef]

- Ahn, J.M.; Minshall, T.; Mortara, L. Understanding the human side of openness: The fit between open innovation modes and CEO characteristics. R&D Manag. 2017, 47, 727–740. [Google Scholar] [CrossRef]

- Cooke, P. World Turned Upside Down: Entrepreneurial Decline, Its Reluctant Myths and Troubling Realities. J. Open Innov. Technol. Mark. Complex. 2019, 5, 22. [Google Scholar] [CrossRef]

- Pyka, A.; Bogner, K.; Urmetzer, S. Productivity Slowdown, Exhausted Opportunities and the Power of Human Ingenuity—Schumpeter Meets Georgescu-Roegen. J. Open Innov. Technol. Mark. Complex. 2019, 5, 39. [Google Scholar] [CrossRef]

- Krishna, V.V. Universities in the National Innovation Systems: Emerging Innovation Landscapes in Asia-Pacific. J. Open Innov. Technol. Mark. Complex. 2019, 5, 43. [Google Scholar] [CrossRef]

- Rasiah, R. Building Networks to Harness Innovation Synergies: Towards an Open Systems Approach to Sustainable Development. J. Open Innov. Technol. Mark. Complex. 2019, 5, 70. [Google Scholar] [CrossRef]

| Variable | M | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|---|---|

| 1. MARKET_PERFOR | 3.289 | 3.456 | 1 | ||||||

| 2. ALLANCE EX | 0.372 | 0.484 | 0.425 ** | 1 | |||||

| 3. FIRM AGE | 30.816 | 17.915 | −0.043 | 0.148 | 1 | ||||

| 4. FIRM SIZE (lg) | 5.717 | 0.927 | 0.364 ** | 0.375 ** | 0.219 ** | 1 | |||

| 5. USER_INNOVA | 0.278 | 0.739 | 0.469 ** | 0.290 ** | −0.075 | 0.198 ** | 1 | ||

| 6. ABSOR_CAPA (R&D lg) | 1.651 | 1.157 | 0.376 ** | 0.347 ** | −0.173 * | 0.061 | 0.042 | 1 | |

| 7. CEO_SHARE | 18.724 | 16.060 | 0.041 | 0.027 | −0.046 | −0.021 | 0.109 | 0.035 | 1 |

| 8. INNO_PERFORM | 4.67 | 8.986 | 0.320 ** | 0.320 ** | −0.100 | 0.274 ** | 0.544 ** | 0.244 ** | 0.237 ** |

| Variables | Market Performance (Model 1–3) | Innovation Performance (Model 4–6) | Market Performance | ||||

|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | |

| B | B | B | B | B | B | B | |

| Control Variables | |||||||

| ALLIA_EX | 2.477 (0.519) *** | 1.839 (0.499) *** | 0.845 (0.511) | 2.719 (1.301) * | 1.280 (1.352) | 1.801 (1.107) | 1.619 (0.496) ** |

| FIRM AGE | −0.030 (0.013) | −0.020 (0.013) | −0.007 (0.012) | −0.061 (0.033) | −0.035 (0.032) | −0.017 (0.028) | −0.015 (0.012) |

| FIRM SIZE | 0.996 (0.275) *** | 0.829 (.258) ** | 0.960 (0.440) *** | 1.487 (0.673) * | 1.547 (0.645) * | 0.994 (0.570) | 0.709 (0.257) ** |

| Independent Variables | |||||||

| USER_INNO | 1.598 (0.311) *** | 2.320 (0.587) *** | 5.609 (0.810) *** | 5.664 (0.775) *** | 6.589 (0.770) *** | 1.144 (0.347) ** | |

| ABSOR_CAPA (R&D lg) | 0.997 (0.202) *** | 1.710 (0.520) ** | 1.419 (0.464) ** | ||||

| CEO SHARE | 0.050 (0.031) | ||||||

| INNO_PERFOR | 0.081 (0.029) ** | ||||||

| Interaction | |||||||

| USER*ABSOR | −0.353 (0.299) | 2.632 (0.791) *** | 2.053 (0.775) ** | ||||

| USER*CEO | 0.084 (0.043) | ||||||

| ABSOR*CEO | 0.097 (0.026) *** | ||||||

| Three-way interaction | |||||||

| USER *ABSOR*CEO | 0.239 (0.047) *** | ||||||

| F-Statistics | 18.513 *** | 22.626 *** | 21.179 *** | 22.294 *** | 19.601 *** | 21.766 *** | 22.294 *** |

| R2 | 0.163 | 0.235 | 0.248 | 0.336 | 0.379 | 0.422 | 0.355 |

| AdjustedR2 | 0.148 | 0.212 | 0.237 | 0.314 | 0.367 | 0.409 | 0.338 |

| Effect (B) | Boot (se) | p | LLCI | ULCI | |

|---|---|---|---|---|---|

| Total effect of User Innovation activities on Market Performance | 1.598 | 0.311 | 0.000 | 0.984 | 2.212 |

| Direct effect of User Innovation activities on Market Performance | 1.144 | 0.347 | 0.001 | 0.460 | 1.828 |

| Indirect effect of User Innovation activities on Market Performance through Innovation Performance | 0.454 | 0.253 | 0.111 | 1.109 |

| Moderated Mediated Index(β) | Boot SE | Boot LLCI | Boot ULCI | ||

|---|---|---|---|---|---|

| 0.213 | 0.136 | 0.024 | 0.582 | ||

| Moderator (Absorptive Capacity) | Conditional Indirect Effects(β) | Boot SE | Boot LLCI | Boot ULCI | |

| Mediator (Innovation Performance) | 0.493 (−1 SD) | 0.212 | 0.260 | −0.055 | 0.973 |

| 1.651 (mean) | 0.458 | 0.261 | 0.086 | 1.077 | |

| 2.808 (+1 SD) | 0.705 | 0.344 | 0.155 | 1.456 | |

| Moderated Mediated Index(β) | Boots Se | BootLLCI | BootULCI | |||

|---|---|---|---|---|---|---|

| 0.016 | 0.015 | 0.002 | 0.092 | |||

| Moderator (Absorptive Capacity) | Moderator (CEO’s Shareholding) | Conditional Indirect Effects | Boots Se | BootLLCI | BootULCI | |

| Mediator (Innovation Performance) | 0.493 | 2.664 | 0.497 | 0.458 | −0.032 | 1.929 |

| 0.493 | 18.725 | 0.286 | 0.266 | −0.012 | 0.981 | |

| 0.493 | 34.785 | 0.075 | 0.275 | −0.219 | 0.674- | |

| 1.651 | 2.664 | 0.356 | 0.318 | −0.005 | 1.186 | |

| 1.651 | 18.725 | 0.448 | 0.290 | 0.018 | 1.132 | |

| 1.651 | 34.785 | 0.539 | 0.352 | 0.079 | 1.552 | |

| 2.808 | 2.666 | 0.216 | 0.387 | −0.117 | 1.297 | |

| 2.808 | 18.725 | 0.609 | 0.392 | 0.052 | 1.572 | |

| 2.808 | 34.785 | 1.003 | 0.670 | 0.217 | 3.449 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, E.H.; Kim, C.Y.; Yoo, J.W. Relationship between User Innovation Activities and Market Performance: Moderated Mediating Effect of Absorptive Capacity and CEO’s Shareholding on Innovation Performance. Sustainability 2020, 12, 10532. https://doi.org/10.3390/su122410532

Lee EH, Kim CY, Yoo JW. Relationship between User Innovation Activities and Market Performance: Moderated Mediating Effect of Absorptive Capacity and CEO’s Shareholding on Innovation Performance. Sustainability. 2020; 12(24):10532. https://doi.org/10.3390/su122410532

Chicago/Turabian StyleLee, Eun Hwa, Choo Yeon Kim, and Jae Wook Yoo. 2020. "Relationship between User Innovation Activities and Market Performance: Moderated Mediating Effect of Absorptive Capacity and CEO’s Shareholding on Innovation Performance" Sustainability 12, no. 24: 10532. https://doi.org/10.3390/su122410532

APA StyleLee, E. H., Kim, C. Y., & Yoo, J. W. (2020). Relationship between User Innovation Activities and Market Performance: Moderated Mediating Effect of Absorptive Capacity and CEO’s Shareholding on Innovation Performance. Sustainability, 12(24), 10532. https://doi.org/10.3390/su122410532