Strategic Sustainability Risk Management in Product Development Companies: Key Aspects and Conceptual Approach

Abstract

1. Introduction

- What are key aspects for successful sustainability risk management in a product development company context?

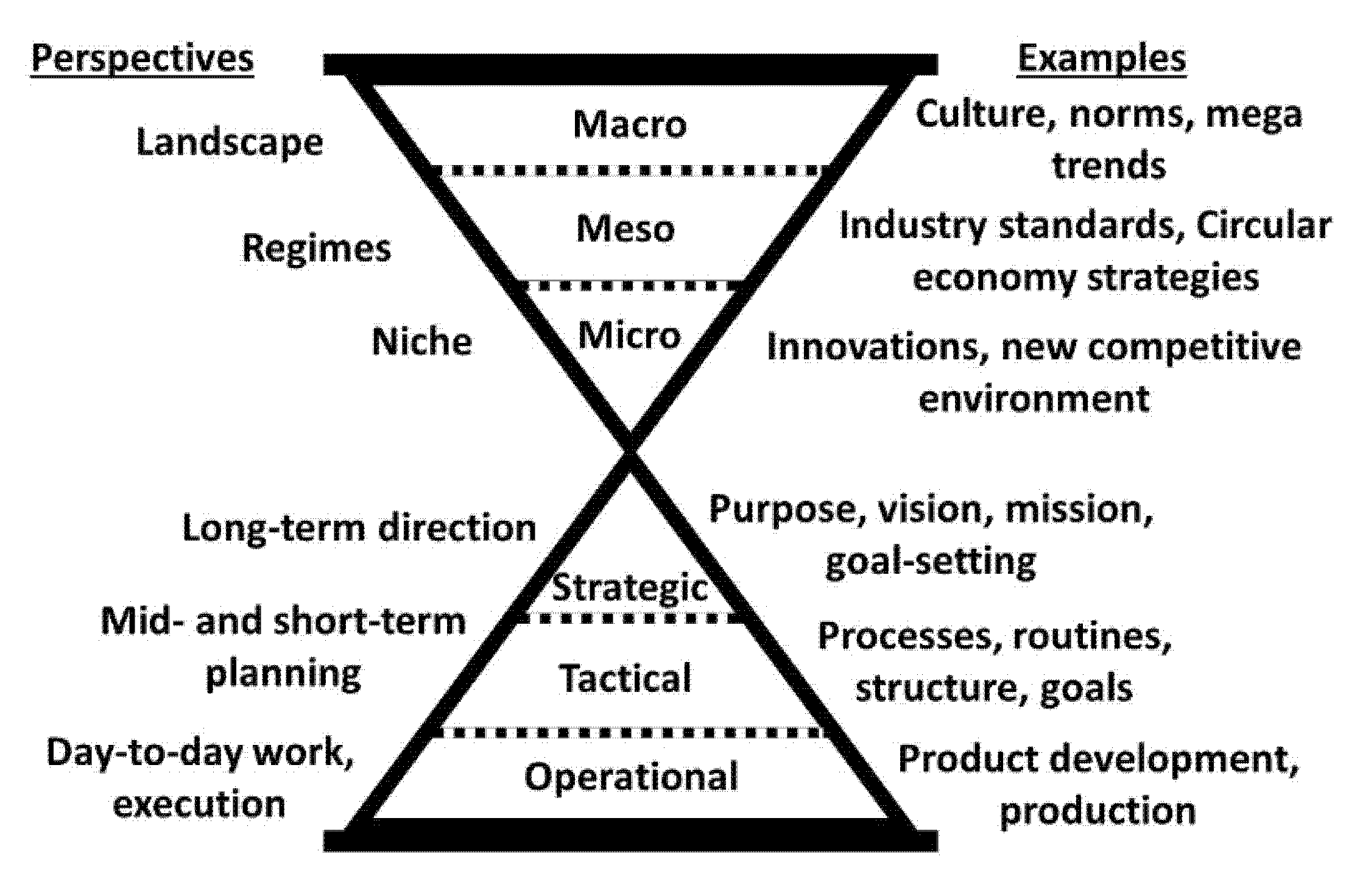

- How can a risk management lens be used to understand the implications of macro-level societal change on micro-level product development company objectives on different levels of decision-making?

2. Background

2.1. Transition Design

2.2. Strategic Sustainable Development

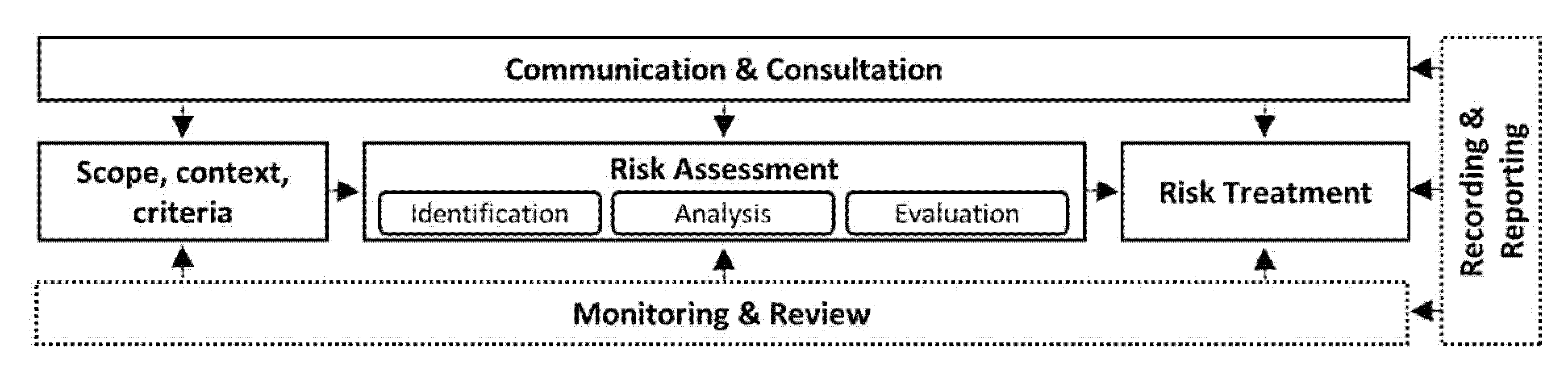

2.3. Sustainability Risk Management in Product Development Companies

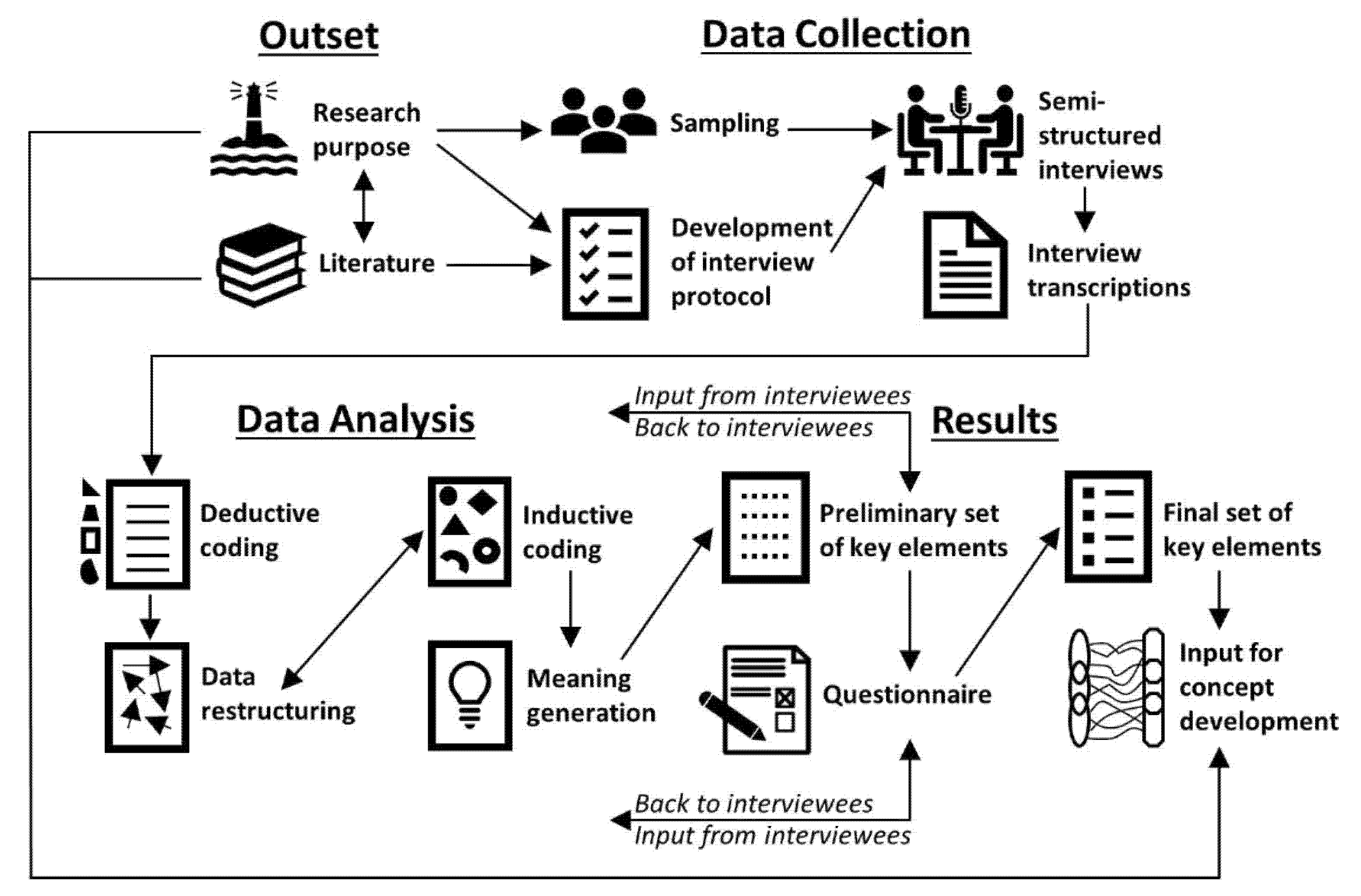

3. Methods

4. Results

4.1. Key Aspects for Strategic Sustainability Risk Management

4.1.1. Sustainability Risk Scope

- KA1: Focus on the connection between the company’s contribution or counteraction to strategic sustainable development of society (considering both environmental and social issues) and the implications of that for company success.

- KA2: Make decision-makers understand that building sustainability-related capabilities ultimately is a matter of company survival.

- KA3: Identify and combine levers for different levels and functions within the company to motivate decision-makers to include sustainability aspects in risk management.

- KA4: Highlight the risks of inaction in light of the sustainability transition.

4.1.2. Sustainability Risk Context and Criteria

- KA5: Use risk management as a language that practitioners can relate to in order to understand their self-interest for sustainability proactivity.

- KA6: Actively include the opportunity side of sustainability risks.

- KA7: Establish a CEO lead top-down red thread to identify, assess and manage sustainability risks on the right level of decision-making and the right level of detail.

- KA8: Operationalize what sustainability means for the company.

- KA9: Understand what conceptually differentiates sustainability risks from other types of risks, but in practice, manage them in an integrated way across all levels of decision-making.

- KA10: Include both a short- and long-term time perspective in sustainability risk management.

4.1.3. Sustainability Risk Identification

- KA11: Use risk categories or guiding questions to support sustainability risk identification.

- KA12: Bring in external views and input in sustainability risk identification.

- KA13: Identify sustainability risks in relation to both external and internal stakeholder value creation.

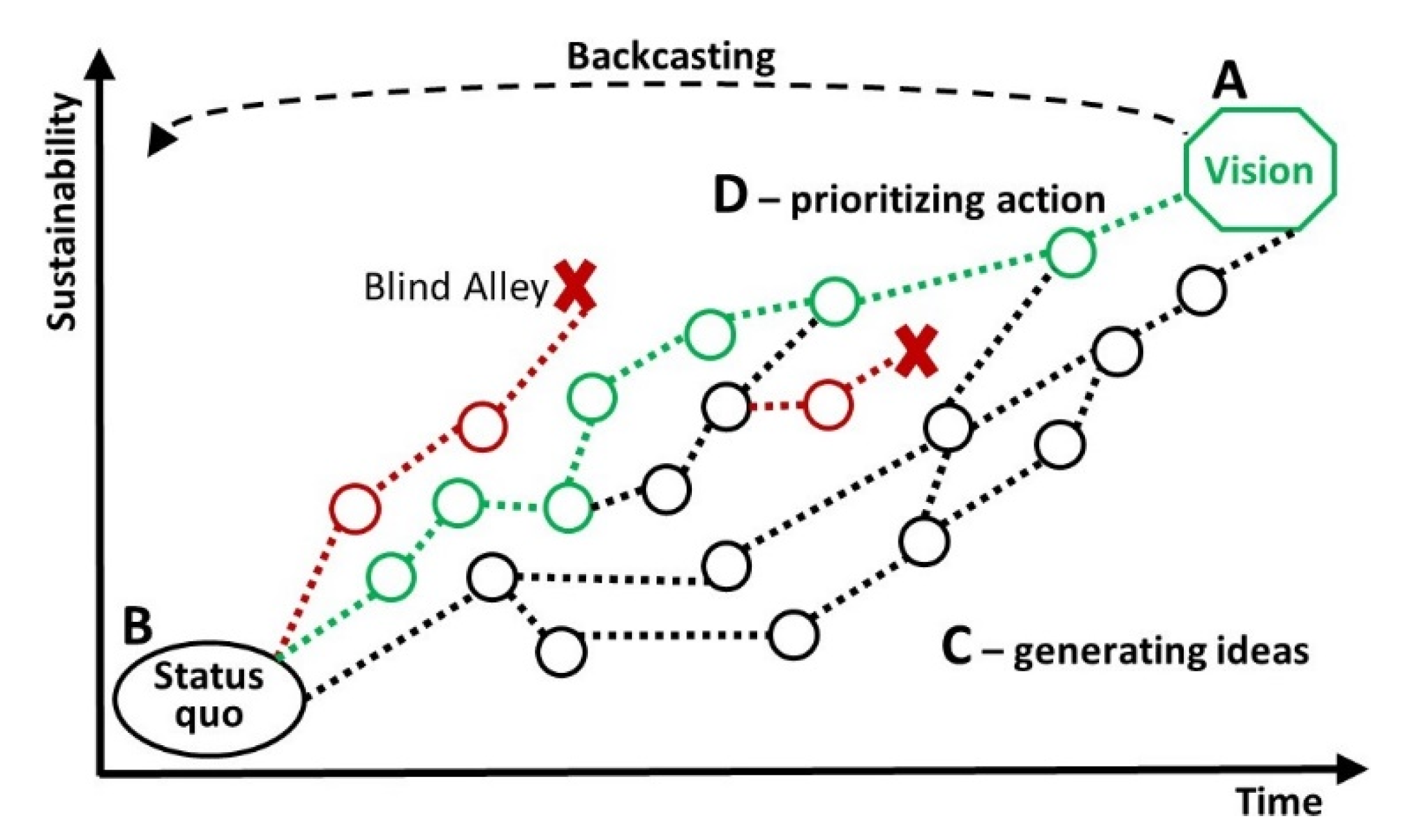

- KA14: Combine scenario exploration based on forecasting from today, with backcasting based on a vision of a sustainable society in the future.

4.1.4. Sustainability Risk Analysis and Evaluation

- KA15: Balance quantitative and qualitative risk assessment and consider both results in decision-making.

- KA16: Define and calibrate the risk appetite, based on company strategy, and align the methodology for sustainability risk assessment across all levels and functions.

- KA17: Test both specific tools for sustainability risk management and the integration of a sustainability perspective in existing tools.

- KA18: Invest in communication and training for sustainability risk management and consider creating a role like chief risk officer or chief sustainability officer.

4.1.5. Sustainability Risk Treatment

- KA19: Use requirements management to treat sustainability risks and apply a risk perspective to ensure that requirements are fulfilled.

- KA20: Use the organization’s risk appetite to escalate risks to the right level of decision-making, based on their likelihood and severity.

4.1.6. Communication and Consultation

- KA21: Identify and use existing frameworks that can support sustainability risk management.

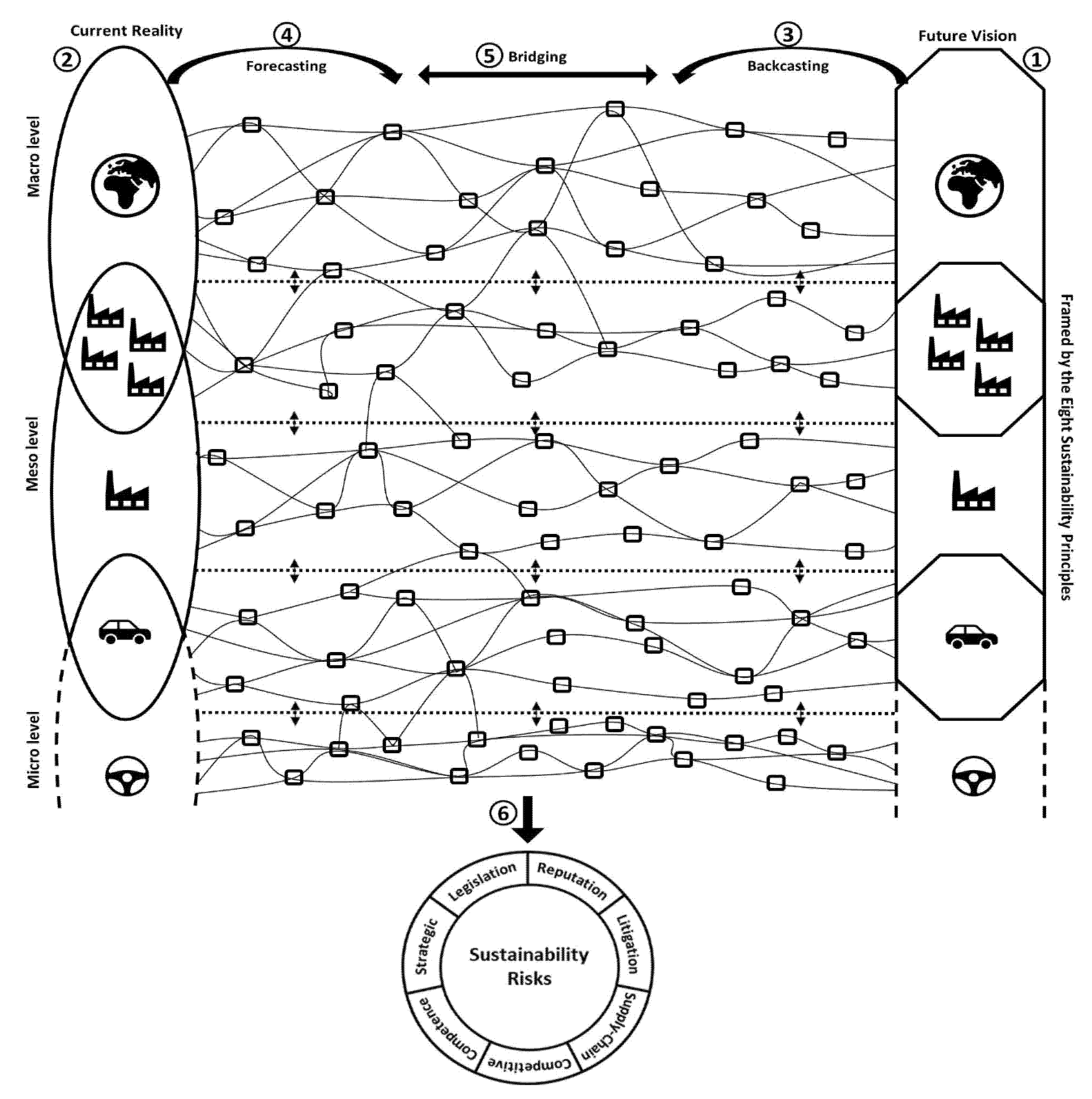

4.2. Conceptual Approach for Strategic Risk Management within the Sustainability Transition

- Visioning: “How could a sustainable version of our society/industry/company/product/etc. look like?” By starting with a vision, a long-term strategic perspective is applied. To ensure that the vision actually is sustainable, the basic sustainability principles are applied as boundary conditions. However, within these boundaries, anything is possible, and the solution space is limited no more than necessary. On the macro level, the SPs might provide enough guidance for backcasting. When zooming in towards the meso- and micro level, the visions should be more elaborated. On the sector level, a vision for a sustainable version of the industry, framed by the SPs, could be used or created if not already existent. On a company level, it would be possible to do backcasting from the Future-Fit Goals. On a product level, a vision of how the value that the product provides could be provided in a sustainable future can be created.Example: A macro-level vision could include that there is no use of fossil fuels and close to zero virgin raw material extraction and all materials are instead biomaterials or kept in circular flows within society. Accordingly, zooming in towards the automobile company and its products, the vision could include that mobility is safe and accessible to all people and that all materials in manufacturing are recycled or biomaterials.

- Current state assessment: “What are the current sustainability challenges in our society/industry/company/product/etc.?” An understanding of the current reality is necessary to identify the relevant issues that cause unsustainability in the present and to recognize the discrepancy between the future vision and the present reality. In this step, the SPs can be applied as a lens to scan for hot-spots of unsustainability [44]. Such an assessment can be complemented by looking for current misalignments with other elements of the vision.Example: Dependence on fossil energy, freshwater depletion, corruption, discrimination of people based on different grounds, harmful and persistent chemicals in products etc.

- Backcasting: “What must happen in order for our society/industry/company/product/etc. to reach its sustainable vision?” In the third step, potential pathways between the current reality and the envisioned future are explored. To recognize the inherent uncertainty, this is done through scenario modelling, i.e., possible events at different points in time between the present and the future are identified. As described in Section 2.2 and KA14, a strategic perspective is crucial to be able to foresee and anticipate the direction of change on the macro level and to make sure that actions on the micro level lead in the right direction towards full sustainability. The concept therefore applies backcasting from a vision of success. As the sustainability principles are used as boundary conditions for the visions, a “sustainability gap” in the long term is avoided.Example: It can be anticipated that there will be increasing costs for virgin raw materials, fossil energy, and landfilling of waste. Norms around cars and their ownership will be different.

- Forecasting: “What is likely to happen in the near future in our society/industry/company/product/etc., based on the current situation and existing trends?” Using backcasting from a sustainable vision requires a long-term perspective. This comes with challenges, especially from a company perspective, because companies also need to plan for the short- and medium-term (KE10). Using backcasting alone can result in a so-called “reality gap” [2]. At the same time, it is possible to explore the short- and medium-term based on the current reality and recent past, informed by a backcasting perspective. The conceptual approach therefore combines backcasting with exploratory forecasting. Companies often do environmental scans and intelligence studies which can provide input to this step.Example: Events related to ongoing trends, such as population growth, digitalization, automatization, artificial intelligence, increasing electricity demand, and tougher legislation on greenhouse gas emissions. For the company, events could be the ban of fossil-powered vehicles in cities or tax reforms like bonus-malus.

- Bridging: “What could happen in the mid-term that is reasonable based on developments in the short term and sufficient for reaching the sustainable vision in the long-term?” After having outlined the direction of change in the long-term through backcasting and explored possible scenarios in the short-term through forecasting, it is necessary to create a bridge between these two-time perspectives. This is done by identifying events that could provide links in the mid-term, similar to the identification of aligning pathways in the method presented by Gaziulusoy [2].Example: Decentralized renewable energy generation and ownership, radical green tax reforms and internalization or externalities. It could be forbidden to sell fossil-powered cars, at the same time as extensive new infrastructure for alternative technologies could become available.

- Risk Management: “What are the implications of our society’s/industry’s/company’s/product’s transition towards sustainability for reaching our objectives?” While steps three and four had the purpose to explore uncertainty, step five is about assessing the effects of that uncertainty on objectives, i.e., risks. As described by Schulte and Hallstedt [6], it is not enough to look at effects on costs. In line with KA13, effects need instead to be assessed in relation to internal and external stakeholder value creation. That means that the company needs to identify how the previously mapped events, which often have their source in stakeholder actions, could affect the company’s/product development project’s/etc. ability to create value, e.g., in terms of the ability to execute the company strategy, building a strong brand, getting ahead of competitors, keeping low cost, etc. As highlighted in KA11, risk categories can be used to facilitate this step, as well as goal documents and requirement lists. Once identified, the sustainability risks need to be assessed in terms of their likelihood and severity in order to decide on an appropriate risk response. At this point, KA19 is of particular importance: while risks by definition are identified in relation to objectives, changing or setting new objectives, e.g., strategic goals, detailed product requirements or other, play a key role in treating and responding to the identified risks. For example, goals could be set for phasing out certain substances as a response to identified risks in the form of legislative change, brand reputation, or customer demand.Example: For the company, the events might come with threats such as increasing costs for raw materials or decreasing demand for vehicles powered by fossil fuel, but also opportunities. For example, the development of advanced value chains for circularity could enable the continued use of some scarce resources, because they could be kept in closed loops. Developing competitive transportation solutions that are not powered by fossil energy can also represent significant opportunities. Once these risks are identified, the company can continue by assessing their likelihood and severity and prioritize responses accordingly. For example, the portfolio of products and technologies can be changed, and sustainability can be integrated in the requirement setting for new development projects, stating that new products, for example, need to be free of certain substances or achieve a certain energy efficiency.

4.3. Limitations and Future Research Directions

5. Concluding Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Interview Questions

- General Information

- Is it okay for you that I record the meeting?

- How long time have you been working at this company?

- What is your role at the company?

- Can you tell me about your role at the company and your working tasks?

- Theme I: The Concept ‘Sustainability Risk Management’

- 5.

- In what way do you see that your work connects to risk and/or sustainability?

- 6.

- What is your understanding of what sustainability risks are?

- 7.

- If and how are they different to other types of risks?

- 8.

- Do you treat sustainability risks as a separate risk category or integrate a sustainability perspective into other risk categories? Why?

- 9.

- What are the drivers for working with sustainability risk management in your organization?

- 10.

- Which three of these drivers would you consider most important? (the interviewee is shown a list of drivers)

- 11.

- What do you think are pros and cons with using a risk framing to address sustainability issues in companies?

- 12.

- What are your thoughts in relation to this definition? (the definition by Schulte and Hallstedt [6] is presented to the interviewee)

- Theme II: Tools and Methods

- 13.

- What is your approach for how to work with sustainability risks in practice (identify, assess, manage, communicate)?

- How widely is that used?

- Is that approach strategic?

- 14.

- If and how do you relate to existing initiatives such as the TCFD (Task Force on Climate Related Financial Disclosure) or the COSO framework?

- 15.

- How do you use sustainability risk management in your decision-making processes (e.g., when, who, how)?

- 16.

- Is the structure for how you work with sustainability risks on different levels of decision making, e.g., ERM, product development, etc., the same? Why and how do they (not) differ?

- 17.

- How do you aggregate and cascade such risks?

- 18.

- What time perspective do you apply in your risk management processes? Is that the same for sustainability risks?

- Theme III: Barriers and Success Factors

- 19.

- What is the main strength of your approach for sustainability risk management?

- 20.

- What do you think are the main (business) benefits of sustainability risk management in general and with your approach in specific?

- 21.

- What limitations and improvement opportunities do you see with your approach?

- 22.

- What do you think are the main barriers for organizations to engage in sustainability risk management?

- 23.

- In your opinion, what are success factors for making sustainability risk management happen in practice?

Appendix B. Questionnaire Questions

- What’s your name? (Optional)

- Do you consider yourself mostly as an academic or industrial expert?

- To what degree do you find the key aspects and other analysis results useful for … (Likert scale: not at all, To low degree, To some degree, To high degree, No opinion or N/A)

- Getting a clearer understanding of what sustainability risks are?

- Getting insights for how sustainability risks can be identified, assessed, and managed in practice?

- In which areas do you think the key aspects for sustainability risk management are most applicable and useful? (Please order from most important at the top to least important at the bottom): Product and Service Development, Supply Chain Management, High-Level Strategy, Portfolio Management, Manufacturing/Operations.

- Are there any key aspects that you do not agree with? In that case, please explain why.

- Are there any additional key aspects that you find missing? If yes, please explain what that is.

- To what degree do you have a need for the aspects below when it comes to sustainability risk management? (Likert scale: not at all, To low degree, To some degree, To high degree, No opinion or N/A)

- More theory on the concept of sustainability risks.

- A clear definition of sustainability risks.

- Tools and methods for sustainability risk identification.

- Tools and methods for sustainability risk assessment.

- Tools and methods for sustainability risk treatment.

- Tools and methods for sustainability risk communication.

- Including a strategic perspective in sustainability risk management.

- Do you have any other needs regarding sustainability risk management, not mentioned in the list above? (Optional)

- Would you be interested to participate in further research on sustainability risk management and allow us to contact you in this regard in the future? This could for example be testing or taking part in the development of a tool. (This is not binding in any way and you can withdraw your potential interest at any point.) (Yes, No, Maybe)

- Is there anything else you would like to add? (Optional)

References

- Benn, S.; Edwards, M.; Williams, T. Organizational Change for Corporate Sustainability, 4th ed.; Routledge: New York, NY, USA, 2018. [Google Scholar]

- Gaziulusoy, A.I.; Boyle, C.; McDowall, R. System innovation for sustainability: A systemic double-flow scenario method for companies. J. Clean. Prod. 2013, 45, 104–116. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Alshehhi, A.; Nobanee, H.; Khare, N. The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential. Sustainability 2018, 10, 494. [Google Scholar] [CrossRef]

- Bergmann, A. The Link between Corporate Environmental and Corporate Financial Performance—Viewpoints from Practice and Research. Sustainability 2016, 8, 1219. [Google Scholar] [CrossRef]

- Schulte, J.; Hallstedt, S. Company Risk Management in Light of the Sustainability Transition. Sustainability 2018, 10, 4137. [Google Scholar] [CrossRef]

- Robèrt, K.-H.; Broman, G. Prisoners’ dilemma misleads business and policy making. J. Clean. Prod. 2017, 140, 10–16. [Google Scholar] [CrossRef]

- Hallstedt, S.I. Sustainability criteria and sustainability compliance index for decision support in product development. J. Clean. Prod. 2017, 140, 251–266. [Google Scholar] [CrossRef]

- Willard, B. The New Sustainability Advantage: Seven Business Case Benefits of a Triple Bottom Line; New Society Publishers: Gabriola, Island, 2012. [Google Scholar]

- Anderson, D.R. Corporate Survival: The Critical Importance of Sustainability Risk Management; iUniverse: Lincoln, NE, USA, 2005; ISBN 0-595-36460-8. [Google Scholar]

- Loorbach, D.; Van Bakel, J.C.; Whiteman, G.; Rotmans, J. Business strategies for transitions towards sustainable systems. Bus. Strat. Environ. 2009, 19, 133–146. [Google Scholar] [CrossRef]

- Geels, F.W. Technological Transitions and System Innovations: A Co-Evolutionary and Socio-Technical Analysis; Edward Elgar Publishing Limited: Cheltenham, UK, 2005. [Google Scholar]

- Gaziulusoy, A.I.; Öztekin, E.E. Design for Sustainability Transitions: Origins, Attitudes and Future Directions. Sustainability 2019, 11, 3601. [Google Scholar] [CrossRef]

- Weaver, P.; Jansen, L.; van Grootveld, G.; van Spiegel, E.; Vergragt, P. Sustainable Technology Development; Routledge: New York, NY, USA, 2000. [Google Scholar]

- Dreborg, K.H. Essence of backcasting. Futures 1996, 28, 813–828. [Google Scholar] [CrossRef]

- Broman, G.; Robèrt, K.-H. A framework for strategic sustainable development. J. Clean. Prod. 2017, 140, 17–31. [Google Scholar] [CrossRef]

- ISO. 31000: Risk Management—Guidelines. 2018. Available online: https://www.iso.org/standard/65694.html (accessed on 16 December 2020).

- Oehmen, J.; Guenther, A.; Herrmann, J.W.; Schulte, J.; Willumsen, P. Risk management in product development: Risk identification, assessment, and mitigation—A literature review. In Proceedings of the Design Society: DESIGN Conference, 26–29 October 2020; Volume 1, pp. 657–666. Available online: https://www.designsociety.org/923/DESIGN+2020+-+16th+International+Design+Conference+is+online+now (accessed on 16 December 2020). [CrossRef]

- Wong, A. Corporate sustainability through non-financial risk management. Corp. Gov. Int. J. Bus. Soc. 2014, 14, 575–586. [Google Scholar] [CrossRef]

- Hallikas, J.; Lintukangas, K.; Kähkönen, A.-K. The effects of sustainability practices on the performance of risk management and purchasing. J. Clean. Prod. 2020, 263, 121579. [Google Scholar] [CrossRef]

- Schulte, J.; Hallstedt, S.I. Challenges for Integrating Sustainability in Risk Management—Current State of Research. In Proceedings of the International Conference on Engineering Design (ICED), Vancouver, BC, Canada, 21–25 August 2017; Volume 2, pp. 327–336. [Google Scholar]

- Boiral, O.; Talbot, D.; Brotherton, M. Measuring sustainability risks: A rational myth? Bus. Strat. Environ. 2020, 29, 2557–2571. [Google Scholar] [CrossRef]

- Aziz, N.A.A.; Manab, N.A. Sustaining our Environment for Better Future; Springer Science and Business Media LLC.: Berlin/Heidelberg, Germany, 2020; pp. 195–208. [Google Scholar]

- Hofmann, H.; Busse, C.; Bode, C.; Henke, M. Sustainability-Related Supply Chain Risks: Conceptualization and Management. Bus. Strat. Environ. 2014, 23, 160–172. [Google Scholar] [CrossRef]

- Hajmohammad, S.; Vachon, S. Mitigation, Avoidance, or Acceptance? Managing Supplier Sustainability Risk. J. Supply Chain Manag. 2015, 52, 48–65. [Google Scholar] [CrossRef]

- Lloyd, S.; Lee, J.; Clifton, A.; Elghali, L.; France, C. Ecodesign through Environmental Risk Management: A Focus on Critical Materials. In Design for Innovative Value towards a Sustainable Society; Matsumoto, M., Umeda, Y., Masui, K., Fukushige, S., Eds.; Springer: Dordrecht, The Netherlands, 2012; pp. 374–379. [Google Scholar]

- Short, T.; Lee-Mortimer, A.; Luttropp, C.; Johansson, G. Manufacturing, sustainability, ecodesign and risk: Lessons learned from a study of Swedish and English companies. J. Clean. Prod. 2012, 37, 342–352. [Google Scholar] [CrossRef]

- Palousis, N.; Luong, L.; Abhary, K. An Integrated LCA/LCC Framework for Assessing Product Sustainability risk. WIT Trans. Inf. Commun. Technol. 2008, 39, 121–128. [Google Scholar] [CrossRef]

- Palousis, N.; Luong, L.; Abhary, K. Sustainability risk identification in product development. Int. J. Sustain. Eng. 2010, 3, 70–80. [Google Scholar] [CrossRef]

- Hallstedt, S.I.; Bertoni, M.; Isaksson, O. Assessing sustainability and value of manufacturing processes: A case in the aerospace industry. J. Clean. Prod. 2015, 108, 169–182. [Google Scholar] [CrossRef]

- Aon. Sustainability—Beyond Enterprise Risk Management. 2007. Available online: https://www.aon.com/about-aon/intellectual-capital/attachments/risk-services/sustainability_beyond_enterprise_risk_management.pdf (accessed on 16 December 2020).

- Pollard, D.; Stephen, D.W. Sustainability, Risk and Opportunity: A Holistic Approach; Chartered Accountants of Canada and Global Accounting Alliance: Toronto, ON, Canada, 2008. [Google Scholar]

- COSO; WBCSD. Enterprise Risk Management: Applying Enterprise Risk Management to Environmental, Social and Governance-Related Risks. 2018. Available online: https://www.wbcsd.org/Programs/Redefining-Value/Business-Decision-Making/Enterprise-Risk-Management/Resources/Applying-Enterprise-Risk-Management-to-Environmental-Social-and-Governance-related-Risks (accessed on 16 December 2020).

- Yilmaz, A.; Flouris, T. Managing corporate sustainability: Risk management process based perspective. Afr. J. Bus. Manag. 2010, 4, 162–171. [Google Scholar]

- Task Force on Climate-Related Financial Disclosures. Recommendations of the Task Force on Climate-related Financial Disclosures—Final Report. 2017. Available online: https://www.fsb.org/wp-content/uploads/P290617-5.pdf (accessed on 16 December 2020).

- Maxwell, J.A. Qualitative Research Design, 2nd ed.; Sage Publications: Thousand Oaks, CA, USA, 2005; ISBN 0803973284. [Google Scholar]

- Fontana, A.; Frey, J.H. Interviewing: The Art of Science. In Handbook of Qualitative Research; Denzin, N.K., Lincoln, Y.S., Eds.; Sage Publications: Thousand Oaks, CA, USA, 1994; pp. 361–376. ISBN 0803946791. [Google Scholar]

- Miles, M.B.; Huberman, M.; Saldana, J. Qualitative Data Analysis: A Methods Sourcebook, 3rd ed.; Sage Publications: Los Angeles, CA, USA; London, UK; New Delhi, India; Singapore; Washington, DC, USA, 2014; ISBN 1452257876. [Google Scholar]

- Blessing, L.T.; Chakrabarti, A. DRM, a Design Research Methodology; Springer Science and Business Media LLC.: Berlin/Heidelberg, Germany, 2009. [Google Scholar]

- Strauss, S.; Corbin, J. Basics of Qualitative Research: Grounded Theory Procedures and Techniques; Sage Publications: Newbury Park, CA, USA, 1990. [Google Scholar]

- Villamil, C.; Hallstedt, S.I. Sustainability integration in product portfolio for sustainable development: Findings from the industry. Bus. Strat. Environ. 2020, 1–16. [Google Scholar] [CrossRef]

- Aven, T. On How to Deal with Deep Uncertainties in a Risk Assessment and Management Context. Risk Anal. 2013, 33, 2082–2091. [Google Scholar] [CrossRef]

- Future-Fit Foundation. Future-Fit Business Benchmark—Methodology Guide, Release 2 v2.0.1. 2017. Available online: https://futurefitbusiness.org/wp-content/uploads/2019/04/FFBB-Methodology-Guide-R2.1.pdf (accessed on 16 December 2020).

- Ny, H.; Macdonald, J.P.; Broman, G.; Yamamoto, R.; Robért, K.-H. Sustainability Constraints as System Boundaries: An Approach to Making Life-Cycle Management Strategic. J. Ind. Ecol. 2008, 10, 61–77. [Google Scholar] [CrossRef]

- Watz, M. Using Group Model Building to Foster Learning for Strategic Sustainable Development. Sustainability 2020, 12, 8350. [Google Scholar] [CrossRef]

- Charnley, F.; Tiwari, D.; Hutabarat, W.; Moreno, M.; Okorie, O.; Tiwari, A. Simulation to Enable a Data-Driven Circular Economy. Sustainability 2019, 11, 3379. [Google Scholar] [CrossRef]

| Expert | Country | Sector |

|---|---|---|

| Industrial Expert 1 | Sweden | Large company in the construction industry |

| Industrial Expert 2 | UK | Small consultancy |

| Industrial Expert 3 | Sweden | Large company in the furniture industry |

| Industrial Expert 4 | Sweden | Large consultancy |

| Industrial Expert 5 | Sweden | Small consultancy |

| Industrial Expert 6 | Singapore | Large consultancy |

| Academic Expert 1 | USA | University |

| Academic Expert 2 | Finland | University |

| Conceptual Approach Design | Based on |

|---|---|

| Starts by envisioning a sustainable future, then assesses the current reality, then explores pathways in between, and then actions are prioritized | ABCD procedure within the FSSD [16] |

| Uses scenario modeling to explore alternative futures | Transition design, TCFD, KA14 |

| Applies short-, medium-, and long-term time perspectives | KA10 |

| Model scenarios using both backcasting and forecasting and do bridging in between to avoid “sustainability gap” and “reality gap” | KA14, Transition design, [2] |

| Do the backcasting from a vision that shows what sustainability means for the company while being framed by the eight SPs | KA8, Strategic Sustainable Development, [16] |

| Uses a layered approach to map scenarios and identify risks on different levels, from macro- to micro level. Thereby, it can also contribute to aligning the company’s risk appetite and methodology | KA7, KA16 |

| Identifies the potential threats and opportunities of the identified events in relation to the company’s ability to create external and internal stakeholder value based on sustainability risk categories | KA1, KA6, KA13, [6] |

| Risk identification is supported by risk categories to ease this step and to highlight different levers and the self-benefit of strategic proactivity | KA3, KA5, KA11 [6,28] |

| Allows for a purely qualitative risk assessment but can also include and benefit from quantitative assessments | KA15 |

| The conceptual approach may be formed into a workshop, which could be used for training and raising understanding and awareness of sustainability risks | KA18 |

| Allows for other existing frameworks to support the conceptual approach, e.g., the FFBB may be used for company visioning and modeling backcasting scenarios | KA21 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schulte, J.; Villamil, C.; Hallstedt, S.I. Strategic Sustainability Risk Management in Product Development Companies: Key Aspects and Conceptual Approach. Sustainability 2020, 12, 10531. https://doi.org/10.3390/su122410531

Schulte J, Villamil C, Hallstedt SI. Strategic Sustainability Risk Management in Product Development Companies: Key Aspects and Conceptual Approach. Sustainability. 2020; 12(24):10531. https://doi.org/10.3390/su122410531

Chicago/Turabian StyleSchulte, Jesko, Carolina Villamil, and Sophie I. Hallstedt. 2020. "Strategic Sustainability Risk Management in Product Development Companies: Key Aspects and Conceptual Approach" Sustainability 12, no. 24: 10531. https://doi.org/10.3390/su122410531

APA StyleSchulte, J., Villamil, C., & Hallstedt, S. I. (2020). Strategic Sustainability Risk Management in Product Development Companies: Key Aspects and Conceptual Approach. Sustainability, 12(24), 10531. https://doi.org/10.3390/su122410531