How Does Corporate Sustainability Increase Financial Performance for Small- and Medium-Sized Fashion Companies: Roles of Organizational Values and Business Model Innovation

Abstract

1. Introduction

2. Literature Review

2.1. Sustainability in the Fashion Industry

2.2. Organizational Values and Corporate Sustainability

2.3. Business Model Innovation and Corporate Sustainability

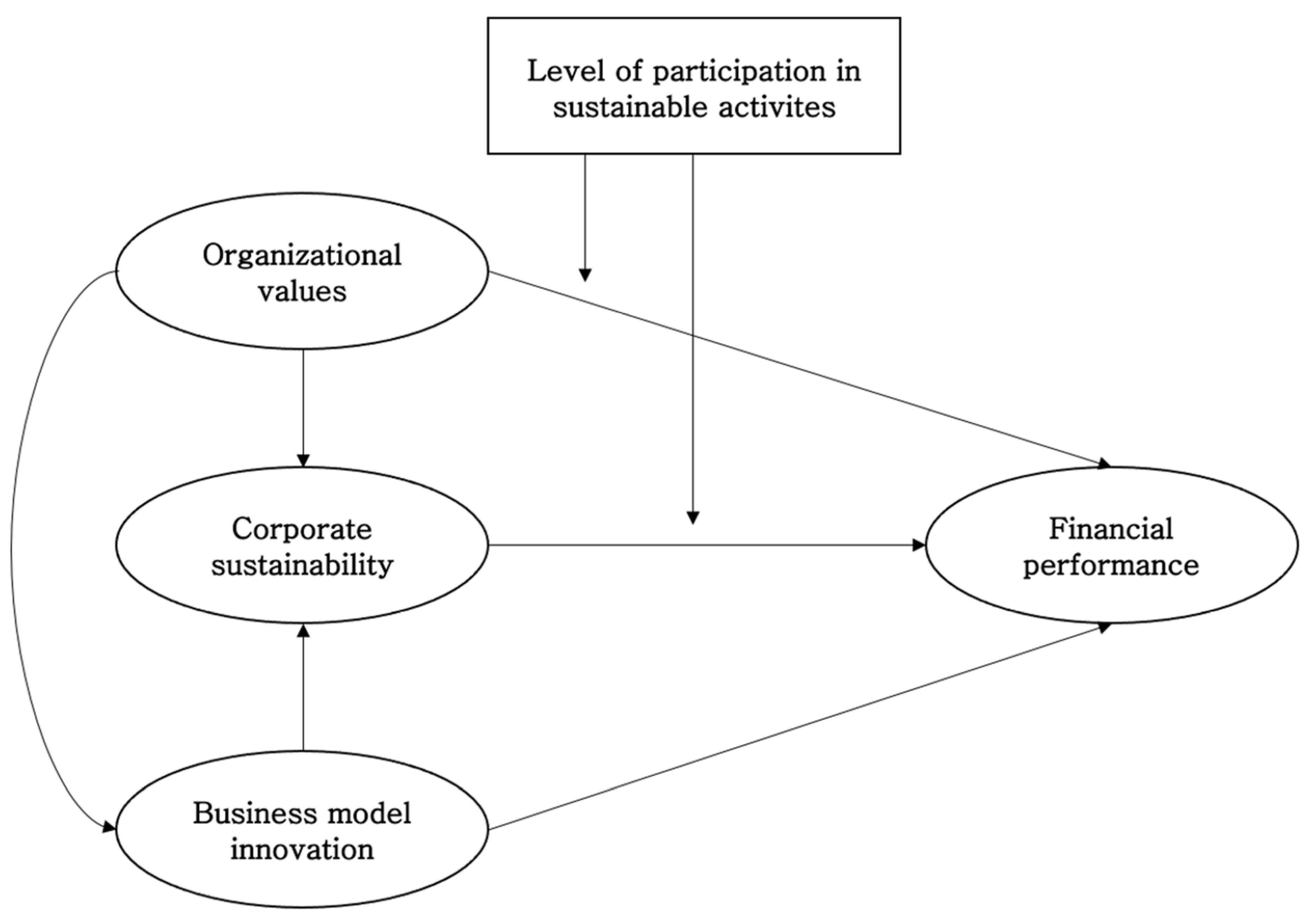

2.4. Impact of Business Model Innovation and Corporate Sustainability on Financial Performance

3. Research Method

3.1. Data Collection

3.2. Measurements

4. Results

4.1. Exploratory Factor Analysis Finding Multiple Dimensions of Organizational Values

4.2. Measurement Model

4.3. Structural Model

4.4. Moderation of Sustainable Activities

5. Discussion

6. Implications

Author Contributions

Funding

Conflicts of Interest

References

- Pedersen, E.R.G.; Gwozdz, W.; Hvass, K.K. Exploring the relationship between business model innovation, corporate sustainability and organisational values within the fashion industry. J. Bus. Ethics 2018, 149, 267–284. [Google Scholar] [CrossRef]

- Yunus, M.; Moingeon, B.; Lehmann-Ortega, L. Building Social Business Models: Lessons from the Grameen Experience. Long Range Plan. 2010, 43, 308–325. [Google Scholar] [CrossRef]

- Sommer, A. Managing Green Business Model Transformations; Springer Science & Business Media: Berlin, Germany, 2012. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. Business Model Generation; Wiley: Hobroken, NJ, USA, 2010. [Google Scholar]

- Stubbs, W.; Cocklin, C. Conceptualizing a “Sustainability Business Model”. Organ. Environ. 2008, 21, 103–127. [Google Scholar] [CrossRef]

- Michelini, L.; Fiorentino, D. New business models for creating shared value. Soc. Responsib. J. 2012, 8, 561–577. [Google Scholar] [CrossRef]

- Birkin, F.; Polesie, T.; Lewis, L. A new business model for sustainable development: An exploratory study using the theory of constraints in Nordic organizations. Bus. Strategy Environ. 2009, 18, 277–290. [Google Scholar] [CrossRef]

- Cameron, K.S.; Quinn, R.E. Diagnosing and changing organizational culture. In Reading: Addison-Wesley; John Wiley & Sons: Hoboken, NJ, USA, 1999. [Google Scholar]

- Henri, J.F. Organizational culture and performance measurement systems. Account. Organ. Soc. 2006, 31, 77–103. [Google Scholar] [CrossRef]

- Ogbonna, E.; Harris, L.C. Leadership style, organizational culture and performance: Empirical evidence from UK companies. Int. J. Hum. Resour. Manag. 2000, 11, 766–788. [Google Scholar] [CrossRef]

- Tharp, B.M. Four Organizational Culture Types. Hawort Organizational Culture White Paper. Available online: http://www.academia.edu/download/52182398/Cameron_and_Quinn1360757023.3588organizational_cult98.pdf (accessed on 2 December 2020).

- Denison, D.R.; Spreitzer, G.M. Organizational culture and organizational development: A competing values approach. Res. Organ. Chang. Dev. 1991, 5, 1–21. [Google Scholar]

- Thanetsunthorn, N. The impact of national culture on corporate social responsibility: Evidence from cross-regional comparison. Asian J. Bus. Ethics 2015, 4, 35–56. [Google Scholar] [CrossRef]

- Boons, F.; Lüdeke-Freund, F. Business Models for Sustainable Innovation: State of the Art and Steps Towards a Research Agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Louche, C.; Idowu, S.O.; Filho, W.L. From Risk Management to Value Creation; Greenleaf Publishing: Sheffield, UK, 2010. [Google Scholar]

- Curwen, L.G.; Park, J.; Sarkar, A.K. Challenges and Solutions of Sustainable Apparel Product Development: A Case Study of Eileen Fisher. Cloth. Text. Res. J. 2013, 31, 32–47. [Google Scholar] [CrossRef]

- Forman, M.; Jørgensen, M.S. Organising environmental supply chain management: Experience from a sector with frequent product shifts and complex product chains: The case of the Danish textile sector. Greener Manag. Int. 2004, 45, 43–62. [Google Scholar] [CrossRef]

- Jang, N.K. Product Development Process for Ethical Fashion Design: Fair Trade System Approach. J. Korean Soc. Costume 2013, 63, 17–27. [Google Scholar] [CrossRef][Green Version]

- Giesen, B. Ethical Clothing: New Awareness or Fading Fashion Trend; VDM Verlag: Saarbrücken, Germany, 2008. [Google Scholar]

- Lee, Y.; Kim, S.; Shin, J.; Yoon, C.; Lee, S.; Jang, S.; Jung, S.; Choi, Y. Ethics in Fashion Industry; Kyomoonsa Publishing Company: Seoul, Korea, 2009. [Google Scholar]

- Cotler, A. Why Sustainable Fashion Matters. Forbes Women. Available online: https://www.forbes.com/sites/ellevate/2019/10/07/why-sustainable-fashion-matters/#459d634d71b8 (accessed on 31 January 2020).

- Catharina, M.-P. 2018 Pulse of the Fashion Industry. The Boston Consulting Group. Available online: https://www.bcg.com/en-kr/2018-pulse-of-the-fashion-industry (accessed on 31 January 2020).

- Ählström, J. Corporate Response to CSO Criticism: Decoupling the Corporate Responsibility Discourse from Business Practice. Corp. Soc. Responsib. Environ. Manag. 2010, 17, 70–80. [Google Scholar] [CrossRef]

- Ahn, S.-K.; Ryou, E. CSR expectation from fashion firms and its impact on brand equity. Fash. Text. Res. J. 2013, 15, 73–83. [Google Scholar] [CrossRef]

- Bastholm, S.K.C. Sustainability in the Fashion Industry: Comparison between Korea and Denmark. Master’s Thesis, Seoul National University, Seoul, Korea, 2011, unpublished. [Google Scholar]

- Battaglia, M.; Testa, F.; Bianchi, L.; Iraldo, F.; Frey, M. Corporate Social Responsibility and Competitiveness within SMEs of the Fashion Industry: Evidence from Italy and France. Sustainability 2014, 6, 872–893. [Google Scholar] [CrossRef]

- Colucci, M.; Tuan, A.; Visentin, M. An empirical investigation of the drivers of CSR talk and walk in the fashion industry. J. Clean. Prod. 2020, 248, 119200. [Google Scholar] [CrossRef]

- Dickson, M.A. Personal Values, Beliefs, Knowledge, and Attributes Relating to Intentions to Purchase Apparel from Socially Responsible Business. Cloth. Text. Res. J. 2000, 18, 19–30. [Google Scholar] [CrossRef]

- Kim, C.E.; Park, S.J.; Lee, J.H. A Comparative Study on the Corporate Social Responsibility between Domestic Fashion Companies and Global Luxury Fashion Companies: Contents Analysis of Fashion Corporations’ Website. J. Korean Soc. Fash. Des. 2016, 16, 53–69. [Google Scholar] [CrossRef]

- Kolk, A.; Tulder, R.V. The effectiveness of self-regulation: Corporate codes of conduct and child labor. Eur. Manag. J. 2002, 20, 260–271. [Google Scholar] [CrossRef]

- Lee, M.; Ma, Y.; Lee, M. Corporate social responsibility practices of the textiles and apparel industry: Content analysis of website disclosures. J. Fash. Bus. 2017, 21, 45–57. [Google Scholar] [CrossRef][Green Version]

- Lee, S.H.N.; Ha-Brookshire, J.; Chow, P.-S. The moral responsibility of corporate sustainability as perceived by fashion retail employees: A USA-China cross-cultural comparison study. Bus. Strategy Environ. 2018, 27, 1462–1475. [Google Scholar] [CrossRef]

- Jung, S.; Jin, B. Sustainable Development of Slow Fashion Businesses: Customer Value Approach. Sustainability 2016, 8, 540. [Google Scholar] [CrossRef]

- Park, H.S. Differences in Perception of Fashion Corporate Social Responsibility by Ethical Fashion Consumption. J. Korean Soc. Cloth. Text. 2017, 41, 1071–1084. [Google Scholar] [CrossRef]

- Park, S.; Ko, E. The Effect of Technology·Culture Convergence and Sustainability Management Activities of Fashion Brands on Sustainability Evaluation. Fash. Text. Res. J. 2017, 19, 152–165. [Google Scholar] [CrossRef]

- Youn, C.; Kim, S.; Lee, Y.; Choo, H.J.; Jang, S.; Jang, J.I. Measuring retailers’ sustainable development. Bus. Strategy Environ. 2017, 26, 385–398. [Google Scholar] [CrossRef]

- Ameer, R.; Othman, R. Sustainability Practices and Corporate Financial Performance: A Study Based on the Top Global Corporations. J. Bus. Ethics 2012, 108, 61–79. [Google Scholar] [CrossRef]

- Doorey, D.J. The transparent supply chain: From resistance to implementation at Nike and Levi-Strauss. J. Bus. Ethics 2011, 103, 587–603. [Google Scholar] [CrossRef]

- Miron, E.; Erez, M.; Naveh, E. Do personal characteristics and cultural values that promote innovation, quality, and efficiency compete or complement each other? J. Organ. Behav. 2004, 25, 175–199. [Google Scholar] [CrossRef]

- Naranjo-Valencia, J.C.; Jiménez, J.D.; Sanz-Valle, R. Innovation or imitation? The role of organizational culture. Manag. Decis. 2011, 49, 55–72. [Google Scholar] [CrossRef]

- Carmen, M.F.; José, R.; Antonio, L.L. Impact of Organizational Culture Values on Organizational Agility. Sustainability 2017, 9, 2354. [Google Scholar] [CrossRef]

- Chen, Z.; Huang, S.; Liu, C.; Min, M.; Zhou, L. Fit between Organizational Culture and Innovation Strategy: Implications for Innovation Performance. Sustainability 2018, 10, 3378. [Google Scholar] [CrossRef]

- Naïma, C. The relationship between organizational culture and entrepreneurial orientation in family firms: Does generational involvement matter? J. Fam. Bus. Strategy 2017, 8, 87–98. [Google Scholar] [CrossRef]

- Aboramadan, M.; Albashiti, B.; Alharazin, H.; Zaidoune, S. Organizational culture, innovation and performance: A study from a non-western context. J. Manag. Dev. 2019, 39, 437–451. [Google Scholar] [CrossRef]

- Chang, S.-C.; Lee, M.-S. A study on relationship among leadership, organizational culture, the operation of learning organization and employees’ job satisfaction. Learn. Organ. 2007, 14, 155–185. [Google Scholar] [CrossRef]

- Higgins, J.M.; McAllaster, C. Want innovation? Then use cultural artifacts that support it. Organ. Dyn. 2002, 31, 74–84. [Google Scholar] [CrossRef]

- Linnenluecke, M.; Griffiths, A. Corporate Sustainability and Organisational Culture. J. World Bus. 2010, 45, 357–366. [Google Scholar] [CrossRef]

- Mazur, J.; Zaborek, P. Organizational Culture and Open Innovation Performance in Small and Medium-sized Enterprises (SMEs) in Poland. Int. J. Manag. Econ. 2016, 51, 104–137. [Google Scholar] [CrossRef]

- Naranjo-Valencia, J.C.; Sanz Valle, R.; Jiménez, J.D. Organizational culture as determinant of product innovation. Eur. J. Innov. Manag. 2010, 13, 466–480. [Google Scholar] [CrossRef]

- Sharifirad, M.S.; Ataei, V. Organizational culture and innovation culture: Exploring the relationships between constructs. Leadersh. Organ. Dev. J. 2012, 33, 494–517. [Google Scholar] [CrossRef]

- Adams, R.; Jeanrenaud, S.; Bessant, J.; Denyer, D.; Overy, P. Sustainability-oriented Innovation: A Systematic Review. Int. J. Manag. Rev. 2016, 18, 180–205. [Google Scholar] [CrossRef]

- Prajogo, D.I.; McDermott, C.M. The relationship between multidimensional organizational culture and performance. Int. J. Oper. Prod. Manag. 2011, 31, 712–735. [Google Scholar] [CrossRef]

- Abdelkafi, N.; Täuscher, K. Business Models for Sustainability from a System Dynamics Perspective. Organ. Environ. 2016, 29, 74–96. [Google Scholar] [CrossRef]

- Medeiros, J.F.; Ribeiro, J.L.D.; Cortimiglia, M.N. Success factors for environmentally sustainable product innovation: A systematic literature review. J. Clean. Prod. 2014, 65, 76–86. [Google Scholar] [CrossRef]

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Models and Their Elements. In Proceedings of the International Workshop on Business Models 2002, Lausanne, Switzerland, 4–5 October 2002. [Google Scholar]

- Preuss, L. Innovative CSR: A framework for anchoring corporate social responsibility in the innovation literature. J. Corp. Citizensh. 2011, 42, 17–32. [Google Scholar] [CrossRef]

- Wells, P. Creating sustainable business models: The case of the automotive industry. IIMB Manag. Rev. 2008, 16, 15–24. [Google Scholar]

- Chesbrough, H.; Rosenbloom, R. The Role of the Business Model in Capturing Value from Innovation: Evidence from Xerox Corporation’s Technology Spin-Off Companies. Ind. Corp. Chang. 2002, 11, 529–555. [Google Scholar] [CrossRef]

- Markides, C. Disruptive Innovation: In Need of Better Theory. J. Prod. Innov. Manag. 2006, 23, 19–25. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Vladimirova, D.; Evans, S. Sustainable business model innovation: A review. J. Clean. Prod. 2018, 198, 401–416. [Google Scholar] [CrossRef]

- Mendibil, K.; Hernandez, J.; Espinach, X.; Garriga, E.; Macgregor, S. How can CSR practices lead to successful innovation in SMEs? In Proceedings of the European Operations Management Association 2007, Ankara, Turkey, 17–20 June 2007. [Google Scholar]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Singh, S.K.; Giudice, M.D.; Chierici, R.; Graziano, D. Green innovation and environmental performance: The role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Chang. 2020, 150, 119762. [Google Scholar] [CrossRef]

- Carr, A.Z. Is Business Bluffing Ethical? Harvard Business Review. Available online: https://hbr.org/1968/01/is-buisness-bluffing-ethical (accessed on 31 January 2020).

- Jacobs, M. The environment as stakeholder. Bus. Strategy Rev. 1997, 8, 25–28. [Google Scholar] [CrossRef]

- Schaltegger, S.; Hörisch, J.; Freeman, R. Business Cases for Sustainability—A Stakeholder Theory Perspective. Organ. Environ. 2019, 32, 191–212. [Google Scholar] [CrossRef]

- Starik, M. Should trees have managerial standing? Toward stakeholder status for non-human nature. J. Bus. Ethics 1995, 14, 207–217. [Google Scholar] [CrossRef]

- Warhurst, A. Future roles of business in society: The expanding boundaries of corporate responsibility and a compelling case for partnership. Futures 2005, 37, 151–168. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Hillman, A.J.; Keim, G.D. Shareholder Value, Stakeholder Management, and Social Issues: What’s the Bottom Line? Strateg. Manag. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Backhaus, K.B.; Stone, B.A.; Heiner, K. Exploring the relationship between corporate social performance and employer attractiveness. Bus. Soc. 2002, 41, 292–318. [Google Scholar] [CrossRef]

- Brown, T.; Dacin, P. The Company and the Product: Corporate Associations and Consumer Product Responses. J. Mark. 1997, 61, 68–84. [Google Scholar] [CrossRef]

- Gao, J.; Bansal, P. Instrumental and Integrative Logics in Business Sustainability. J. Bus. Ethics 2013, 112, 241–255. [Google Scholar] [CrossRef]

- Todeschini, B.V.; Cortimiglia, M.N.; Callegaro-De-Menezes, D.; Ghezzi, A. Innovative and sustainable business models in the fashion industry: Entrepreneurial drivers, opportunities, and challenges. Bus. Horiz. 2017, 60, 759–770. [Google Scholar] [CrossRef]

- Aspara, J.; Hietanen, J.; Tikkanen, H. Business model innovation versus replication: Financial performance implications of strategic emphases. J. Strateg. Mark. 2010, 18, 39–56. [Google Scholar] [CrossRef]

- Hamel, G. Strategy innovation and the quest for value. Sloan Manag. Rev. 1998, 39, 7–14. [Google Scholar]

- Heikkilä, M.; Bouwman, H.; Heikkilä, J. From strategic goals to business model innovation paths: An exploratory study. J. Small Bus. Enterp. Dev. 2017, 25, 107–128. [Google Scholar] [CrossRef]

- Gatignon, H.; Xuereb, J.-M. Strategic Orientation of the Firm and New Product Performance. J. Mark. Res. 1997, 34, 77–90. [Google Scholar] [CrossRef]

- Green, D.H.; Barclay, D.W.; Ryans, A.B. Entry strategy and long-term performance: Conceptualization and empirical examination. J. Mark. 1995, 59, 1–16. [Google Scholar] [CrossRef]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An empirical examination of the relationship between corporate social responsibility and profitability. Acad. Manag. J. 1985, 28, 445–463. [Google Scholar] [CrossRef]

- Lopez, V.M.; Garcia, A.; Rodriguez, L. Sustainable development and corporate performance: A study based on the Dow Jones sustainability index. J. Bus. Ethics 2007, 75, 285–300. [Google Scholar] [CrossRef]

- Nelling, E.; Webb, E. Corporate social responsibility and financial performance: The “virtuous circle” revisited. Rev. Quant. Financ. Account. 2009, 32, 197–209. [Google Scholar] [CrossRef]

- Shabbir, M.S.; Wisdom, O. The relationship between corporate social responsibility, environmental investments and financial performance: Evidence from manufacturing companies. Environ. Sci. Pollut. Res. 2020, 27. [Google Scholar] [CrossRef] [PubMed]

- Cooper, A.C.; Gimeno-Gascon, F.J.; Woo, C.Y. Initial human and financial capital as predictors of new venture performance. J. Bus. Ventur. 1994, 9, 371–395. [Google Scholar] [CrossRef]

- Ebben, J.J.; Johnson, A.C. Efficiency, flexibility, or both? Evidence linking strategy to performance in small firms. Strateg. Manag. J. 2005, 26, 1249–1259. [Google Scholar] [CrossRef]

- Gibb, A. Corporate Restructuring and Entrepreneurship: What Can Large Organizations Learn from Small? Enterp. Innov. Manag. Stud. 2000, 1, 19–35. [Google Scholar] [CrossRef]

- Lee, K.S.; Lim, G.H.; Tan, S.J. Dealing with Resource Disadvantage: Generic Strategies for SMEs. Small Bus. Econ. 1999, 12, 299–311. [Google Scholar] [CrossRef]

- Bigliardi, B. The effect of innovation on financial performance: A research study involving SMEs. Innovation 2013, 15, 245–255. [Google Scholar] [CrossRef]

- Chen, M.-J.; Hambrick, D.C. Speed, Stealth, and Selective Attack: How Small Firms Differ From Large Firms in Competitive Behavior. Acad. Manag. 2017, 38, 453–482. [Google Scholar] [CrossRef]

- Dean, T.J.; Brown, R.L.; Bamford, C.E. Differences in large and small firm responses to environmental context: Strategic implications from a comparative analysis of business formations. Strateg. Manag. J. 1998, 19, 709–728. [Google Scholar] [CrossRef]

- Mcmahon, R.G.P. Growth and Performance of Manufacturing SMEs: The Influence of Financial Management Characteristics. Int. Small Bus. J. 2001, 19, 10–28. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.S. Creating and capturing value: Strategic corporate social responsibility, resource-based theory, and sustainable competitive advantage. J. Manag. 2011, 37, 1480–1495. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Yu, M.; Zhao, R. Sustainability and firm valuation: An international investigation. Int. J. Account. Inform. Manag. 2015, 23, 289–307. [Google Scholar] [CrossRef]

- Jose, A.; Lee, S.-M. Environmental Reporting of Global Corporations: A Content Analysis Based on Website Disclosures. J. Bus. Ethics 2007, 72, 307–321. [Google Scholar] [CrossRef]

- Alshehhi, A.; Nobanee, H.; Khare, N. The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential. Sustainability 2018, 10, 494. [Google Scholar] [CrossRef]

- Sullivan, W.; Sullivan, R.; Buffton, B. Aligning individual and organisational values to support change. J. Chang. Manag. 2001, 2, 247–254. [Google Scholar] [CrossRef]

- Josefina, L.M.-L.; Concepción, G.-A.; Pilar, R.-T. Why do patterns of environmental response differ? A stakeholders’ pressure approach. Strateg. Manag. J. 2008, 29, 1225–1240. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Matsoso, M.L.; Benedict, O.H. Financial Performance Measures of Small Medium Enterprises in the 21st Century. J. Econ. 2016, 7, 144–160. [Google Scholar] [CrossRef]

- Menguc, B.; Auh, S.; Ozanne, L. The interactive effect of internal and external factors on a proactive environmental strategy and its influence on a firm’s performance. J. Bus. Ethics 2010, 94, 279–298. [Google Scholar] [CrossRef]

- Quinn, R.E.; Spreitzer, G.M. The psychometrics of the competing values culture instrument and an analysis of the impact of organizational culture on quality of life. In Research in Organizational Change and Development; Woodman, R.W., Pasmore, W.A., Eds.; JAI Press: Greenwich, CT, USA, 1991; pp. 142–155. [Google Scholar]

- Hayes, A.F. Introduction to Mediation, Moderation and Conditional Process. Analysis Second Edition: A Regression-Based Approach; The Guilford Press: New York, NY, USA, 2018. [Google Scholar]

- Hofstede, G. Dimensionalizing Cultures: The Hofstede Model in Context. Online Read. Psychol. Cult. 2001, 2, 2307-0919. [Google Scholar] [CrossRef]

| Characters | Details | Frequency | Percent (%) |

|---|---|---|---|

| Company category | Design & merchandizing | 118 | 54.1 |

| Manufacturing (sewing) | 30 | 13.8 | |

| Retailing | 46 | 21.1 | |

| Strategy consulting | 24 | 11 | |

| Company size | Private business | 68 | 31.2 |

| Small–mid sized | 115 | 52.8 | |

| Major company | 17 | 7.8 | |

| Non-profit | 18 | 8.3 | |

| Company history | Under 5 years | 56 | 25.7 |

| 6–15years | 70 | 32.1 | |

| 16–25 years | 34 | 15.6 | |

| Over 25 years | 54 | 24.8 | |

| Unanswered | 4 | 1.8 | |

| Job position | General staff | 140 | 64.2 |

| Manager | 44 | 20.2 | |

| Executives | 33 | 15.1 | |

| Researcher | 1 | 0.5 | |

| Job task | Design | 94 | 43.1 |

| Merchandizing | 46 | 21.1 | |

| Marketing | 28 | 12.8 | |

| Research & development | 14 | 6.4 | |

| Distribution | 11 | 5.0 | |

| Education | 9 | 4.1 | |

| Manufacturing | 7 | 3.2 | |

| Buying | 6 | 2.8 | |

| Promotion | 3 | 1.4 |

| Variable | Item | Details | 5-Likert Scale |

|---|---|---|---|

| Business model innovation | BMI_1 | Focus on developing radically new products and/or services. | 1 = Strongly disagree, 3 = Neutral, 5 = Strongly agree |

| BMI_2 | Focus on identifying and serving entirely new markets and customer segments. | ||

| BMI_3 | Focus on developing and/or acquiring new resources and competences (technology, people, IT systems). | ||

| BMI_4 | Focus on developing new core processes and activities (design, logistics, marketing). | ||

| BMI_5 | Focus on establishing relationships with new strategic business partners (suppliers, distributors, end users). | ||

| BMI_6 | Focus on developing new tools for building customer relationships (personal service, memberships, bonus systems). | ||

| BMI_7 | Focus on selling products and/or services through new channels (own stores, partner stores, online). | ||

| BMI_8 | Focus on making major changes in the combination of costs incurred when operating the company. | ||

| BMI_9 | Develops new ways of generating revenue (products, services, leasing, sponsorships). | ||

| Organizational value | OV_1 | Participation and open discussion | 1 = Strongly disagree, 3 = Neutral, 5 = Strongly agree |

| OV_2 | Empowers employees to act | ||

| OV_3 | Assesses employee concerns and ideas | ||

| OV_4 | Human relations, teamwork, and cohesion | ||

| OV_5 | Flexibility and decentralization | ||

| OV_6 | Expansion, growth, and development | ||

| OV_7 | Innovation and change | ||

| OV_8 | Creative problem-solving processes | ||

| OV_9 | Control and centralization | ||

| OV_10 | Routinization, formalization, and structure | ||

| OV_11 | Stability, continuity, and order | ||

| OV_12 | Predictable performance outcomes | ||

| OV_13 | Task focus, accomplishment, and goal achievement | ||

| OV_14 | Direction, objective setting, and goal clarity | ||

| OV_15 | Efficiency, productivity, and profitability | ||

| OV_16 | Outcome excellence and quality | ||

| Corporate sustainability | CS_1 | Has clearly defined social and environmental objectives. | 1 = Totally disagree, 5 = Totally agree |

| CS_2 | Allocates substantial resources to social and environmental improvements. | ||

| CS_3 | Regularly measures and reports social and environmental performance. | ||

| CS_4 | Always tries to substitute polluting materials/products with less polluting ones. | ||

| CS_5 | Managers and employees receive training and education on social and environmental responsibility. | ||

| CS_6 | Management always considers social and environmental impacts when making important business decisions. | ||

| CS_7 | Recognizes and rewards managers/employees who contribute to social and environmental improvements. | ||

| CS_8 | Is open, honest, and transparent in its internal and external communication of social and environmental impacts. | ||

| CS_9 | Works hard to ensure high social and environmental standards in the supply chain. | ||

| CS_10 | Actively promotes social and environmental-friendly customer/consumer behavior. | ||

| Financial performance | FP_1 | Development in sales | 1 = Much worse, 5 = much better |

| FP_2 | Development in earnings | ||

| FP_3 | Development in market share |

| Component | Cronbach’s α | Variance Accounted for | ||||

|---|---|---|---|---|---|---|

| Var. | Flexibility | Rational | Hierarchy | Total (Eigenvalue) | % of Variance | |

| OV_1 | 0.800 | 0.188 | −0.192 | 0.907 | 5.292 | 33.074 |

| OV_2 | 0.814 | 0.287 | −0.140 | |||

| OV_3 | 0.797 | 0.344 | −0.159 | |||

| OV_4 | 0.809 | 0.181 | −0.067 | |||

| OV_5 | 0.785 | 0.298 | −0.184 | |||

| OV_6 | 0.799 | 0.14 | −0.077 | |||

| OV_7 | 0.713 | 0.197 | −0.159 | |||

| OV_8 | 0.712 | 0.417 | −0.215 | |||

| OV_9 | −0.280 | 0 | 0.810 | 0.866 | 3.720 | 23.250 |

| OV_10 | −0.223 | 0.109 | 0.889 | |||

| OV_11 | 0.077 | 0.235 | 0.793 | |||

| OV_12 | 0.049 | 0.753 | 0.252 | 0.715 | 2.355 | 14.716 |

| OV_13 | 0.162 | 0.786 | 0.112 | |||

| OV_14 | 0.327 | 0.741 | 0.019 | |||

| OV_15 | 0.193 | 0.868 | 0.036 | |||

| OV_16 | 0.350 | 0.758 | 0.062 | |||

| Total | 11.366 | 71.040 | ||||

| Construct | Variable | Factor Loading | Cronbach α | AVE | CR |

|---|---|---|---|---|---|

| Flexibility | OV_1 | 0.785 | 0.935 | 0.631 | 0.932 |

| OV_2 | 0.821 | ||||

| OV_3 | 0.885 | ||||

| OV_4 | 0.8 | ||||

| OV_5 | 0.859 | ||||

| OV_6 | 0.716 | ||||

| OV_7 | 0.669 | ||||

| OV_8 | 0.8 | ||||

| Hierarchy | OV_9 | 0.762 | 0.779 | 0.586 | 0.803 |

| OV_10 | 0.924 | ||||

| OV_11 | 0.568 | ||||

| Rational | OV_12 | 0.548 | 0.858 | 0.529 | 0.847 |

| OV_13 | 0.709 | ||||

| OV_14 | 0.776 | ||||

| OV_15 | 0.805 | ||||

| OV_16 | 0.769 | ||||

| Business model innovation | BMI_1 | 0.676 | 0.898 | 0.487 | 0.895 |

| BMI_2 | 0.741 | ||||

| BMI_3 | 0.696 | ||||

| BMI_4 | 0.715 | ||||

| BMI_5 | 0.695 | ||||

| BMI_6 | 0.721 | ||||

| BMI_7 | 0.681 | ||||

| BMI_8 | 0.686 | ||||

| BMI_9 | 0.669 | ||||

| Corporate sustainability | CS_1 | 0.84 | 0.956 | 0.687 | 0.956 |

| CS_2 | 0.876 | ||||

| CS_3 | 0.854 | ||||

| CS_4 | 0.83 | ||||

| CS_5 | 0.816 | ||||

| CS_6 | 0.88 | ||||

| CS_7 | 0.775 | ||||

| CS_8 | 0.771 | ||||

| CS_9 | 0.808 | ||||

| CS_10 | 0.832 | ||||

| Financial performance | FP_1 | 0.865 | 0.907 | 0.782 | 0.915 |

| FP_2 | 0.909 | ||||

| FP_3 | 0.878 |

| FLEX | HI | DC | BMI | CS | FP | |

|---|---|---|---|---|---|---|

| Flexibility (FLEX) | 0.795 | |||||

| Hierarchy (HI) | −0.324 ** | 0.765 | ||||

| Rational (DC) | 0.511 ** | 0.180 ** | 0.727 | |||

| Business model innovation (BMI) | 0.517 ** | 0.012 | 0.366 ** | 0.698 | ||

| Corporate sustainability (CS) | 0.487 ** | −0.101 | 0.464 ** | 0.245 ** | 0.829 | |

| Financial performance (FP) | 0.300 ** | 0.069 | 0.350 ** | 0.300 ** | 0.249 ** | 0.884 |

| Hypotheses | β a | SE b | CV c | p | |||

|---|---|---|---|---|---|---|---|

| H1_a | Flexibility | → | Business model innovation | 0.634 | 0.115 | 5.52 | 0.00 |

| H1_b | Hierarchy | → | 0.238 | 0.075 | 3.195 | 0.001 | |

| H1_c | Rational | → | −0.003 | 0.109 | −0.029 | 0.976 | |

| H2_a | Flexibility | → | Corporate sustainability | 0.385 | 0.126 | 3.043 | 0.002 |

| H2_b | Hierarchy | → | 0.024 | 0.078 | 0.309 | 0.758 | |

| H2_c | Rational | → | 0.381 | 0.115 | 3.319 | 0.00 | |

| H3 | Business model innovation | → | −0.078 | 0.087 | −0.896 | 0.37 | |

| H4_a | Flexibility | → | Financial performance | 0.04 | 0.114 | 0.35 | 0.727 |

| H4_b | Hierarchy | → | 0.043 | 0.069 | 0.62 | 0.535 | |

| H4_c | Rational | → | 0.229 | 0.105 | 2.172 | 0.03 | |

| H5 | Business model innovation | → | 0.141 | 0.079 | 1.793 | 0.073 | |

| H6 | Corporate sustainability | → | 0.071 | 0.067 | 1.058 | 0.29 | |

| Sustainability Activities | Responses | Percent of Cases (%) | |

|---|---|---|---|

| n | Percent (%) | ||

| Production on demand | 60 | 9.10% | 23.80% |

| Differentiating prices for eco-friendly/social products or services | 57 | 8.70% | 22.60% |

| Development of eco-friendly/social products | 51 | 7.80% | 20.20% |

| Product development through co-operation with partners | 50 | 7.60% | 19.80% |

| Innovative product reducing related cost | 43 | 6.60% | 17.10% |

| Repair | 38 | 5.80% | 15.10% |

| Maximize material productivity or energy efficiency | 32 | 4.90% | 12.70% |

| Industrial symbiosis | 32 | 4.90% | 12.70% |

| Recycling raw materials/replacing them with natural processes | 31 | 4.70% | 12.30% |

| Free service for eco-friendly/social products or customer behavior | 26 | 4.00% | 10.30% |

| Recycle | 24 | 3.70% | 9.50% |

| Experience-oriented customer service | 23 | 3.50% | 9.10% |

| Crowd funding | 20 | 3.00% | 7.90% |

| Product recycling | 18 | 2.70% | 7.10% |

| Internal sourcing | 18 | 2.70% | 7.10% |

| Commercial use of social missions (e.g., donations) | 15 | 2.30% | 6.00% |

| Shortening the supply chain | 15 | 2.30% | 6.00% |

| Co-operative possession | 12 | 1.80% | 4.80% |

| Reproduction/used goods sales | 10 | 1.50% | 4.00% |

| Development of digital supply chain platform | 10 | 1.50% | 4.00% |

| Social business model | 10 | 1.50% | 4.00% |

| Subscription service model | 9 | 1.40% | 3.60% |

| Social enterprise model (no stake) | 9 | 1.40% | 3.60% |

| Connected/shared economy | 8 | 1.20% | 3.20% |

| Product development with a hybrid model | 7 | 1.10% | 2.80% |

| Used goods improvement | 7 | 1.10% | 2.80% |

| Participate in a waste exchange platform such as garbage online | 5 | 0.80% | 2.00% |

| Buy one, donate one | 5 | 0.80% | 2.00% |

| Eco-friendly supply chain management | 5 | 0.80% | 2.00% |

| Microfinance | 4 | 0.60% | 1.60% |

| Micro level distribution and retail | 2 | 0.30% | 0.80% |

| Total | 656 | 100.00% | 260.30% |

| Interaction | R2 chng | F | df1, df2 | p |

|---|---|---|---|---|

| Corporate sustainability × Groups by sustainable activities | 0.021 | 5.355 | (1, 210) | 0.022 |

| Groups by sustainable activities | Effect | se | t | p |

| Low (n = 47) | −0.002 | 0.069 | −0.027 | 0.978 |

| High (n = 171) | 0.355 | 0.144 | 2.464 | 0.015 |

| Indirect Effect | Flexibility → Corporate sustainability → Financial performance | |||

| Index | BootSE | BootLLCI | BootULCI | |

| Groups | 0.121 | 0.080 | 0.007 | 0.321 |

| Effect | BootSE | BootLLCI | BootULCI | |

| Low group | −0.001 | 0.030 | −0.053 | 0.069 |

| High group | 0.120 | 0.079 | 0.015 | 0.318 |

| Indirect Effect | Rational → Corporate sustainability → Financial performance | |||

| Index | BootSE | BootLLCI | BootULCI | |

| Groups | 0.140 | 0.090 | 0.011 | 0.357 |

| Effect | BootSE | BootLLCI | BootULCI | |

| Low group | −0.001 | 0.032 | −0.061 | 0.068 |

| High group | 0.140 | 0.086 | 0.020 | 0.347 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, S.J.; Jang, S. How Does Corporate Sustainability Increase Financial Performance for Small- and Medium-Sized Fashion Companies: Roles of Organizational Values and Business Model Innovation. Sustainability 2020, 12, 10322. https://doi.org/10.3390/su122410322

Yang SJ, Jang S. How Does Corporate Sustainability Increase Financial Performance for Small- and Medium-Sized Fashion Companies: Roles of Organizational Values and Business Model Innovation. Sustainability. 2020; 12(24):10322. https://doi.org/10.3390/su122410322

Chicago/Turabian StyleYang, Su Jin, and Seyoon Jang. 2020. "How Does Corporate Sustainability Increase Financial Performance for Small- and Medium-Sized Fashion Companies: Roles of Organizational Values and Business Model Innovation" Sustainability 12, no. 24: 10322. https://doi.org/10.3390/su122410322

APA StyleYang, S. J., & Jang, S. (2020). How Does Corporate Sustainability Increase Financial Performance for Small- and Medium-Sized Fashion Companies: Roles of Organizational Values and Business Model Innovation. Sustainability, 12(24), 10322. https://doi.org/10.3390/su122410322