The Impact of Flood Risk on the Activity of the Residential Land Market in a Polish Cultural Heritage Town

Abstract

1. Introduction

2. Materials and Methods

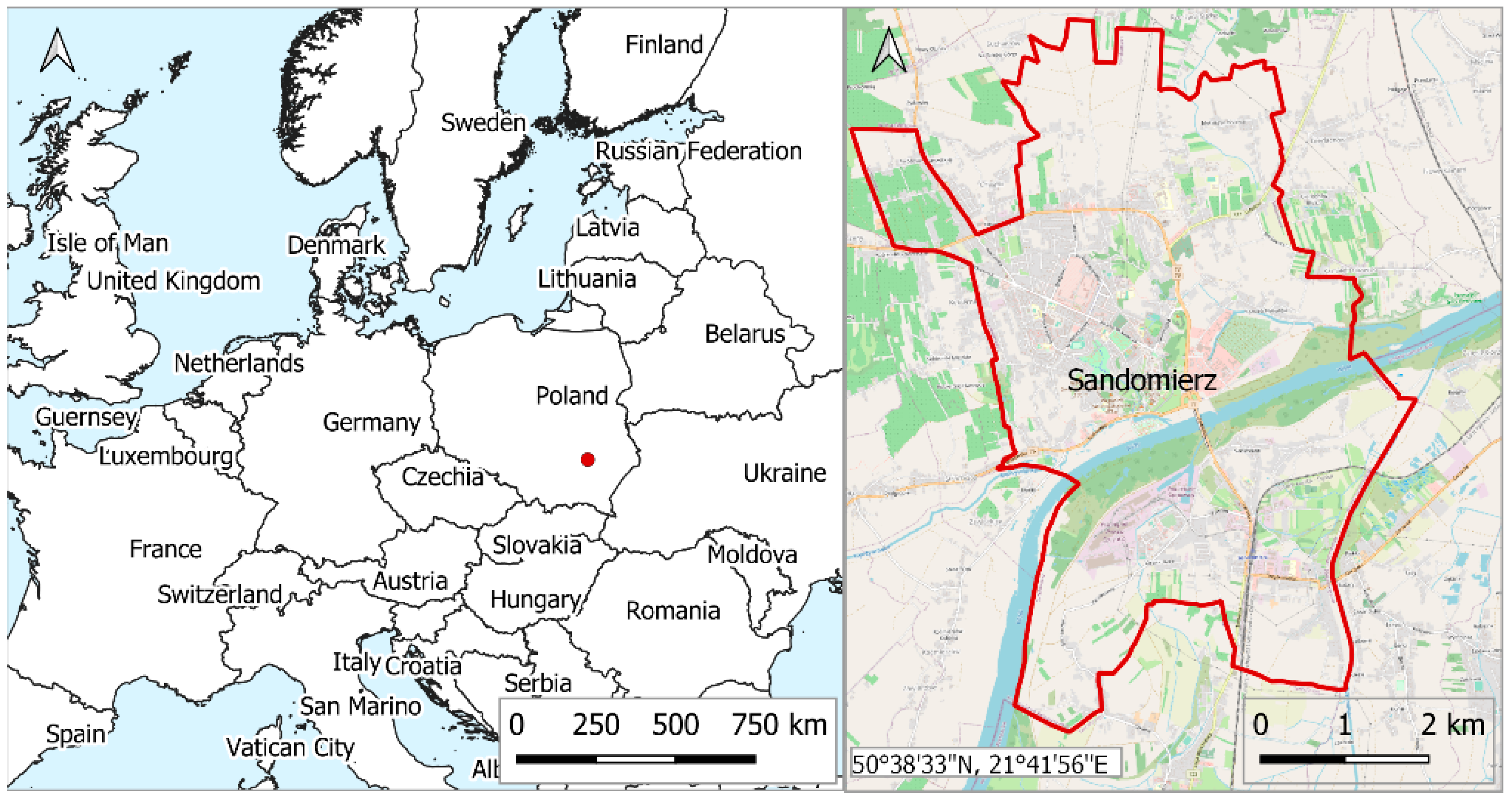

2.1. Study Area

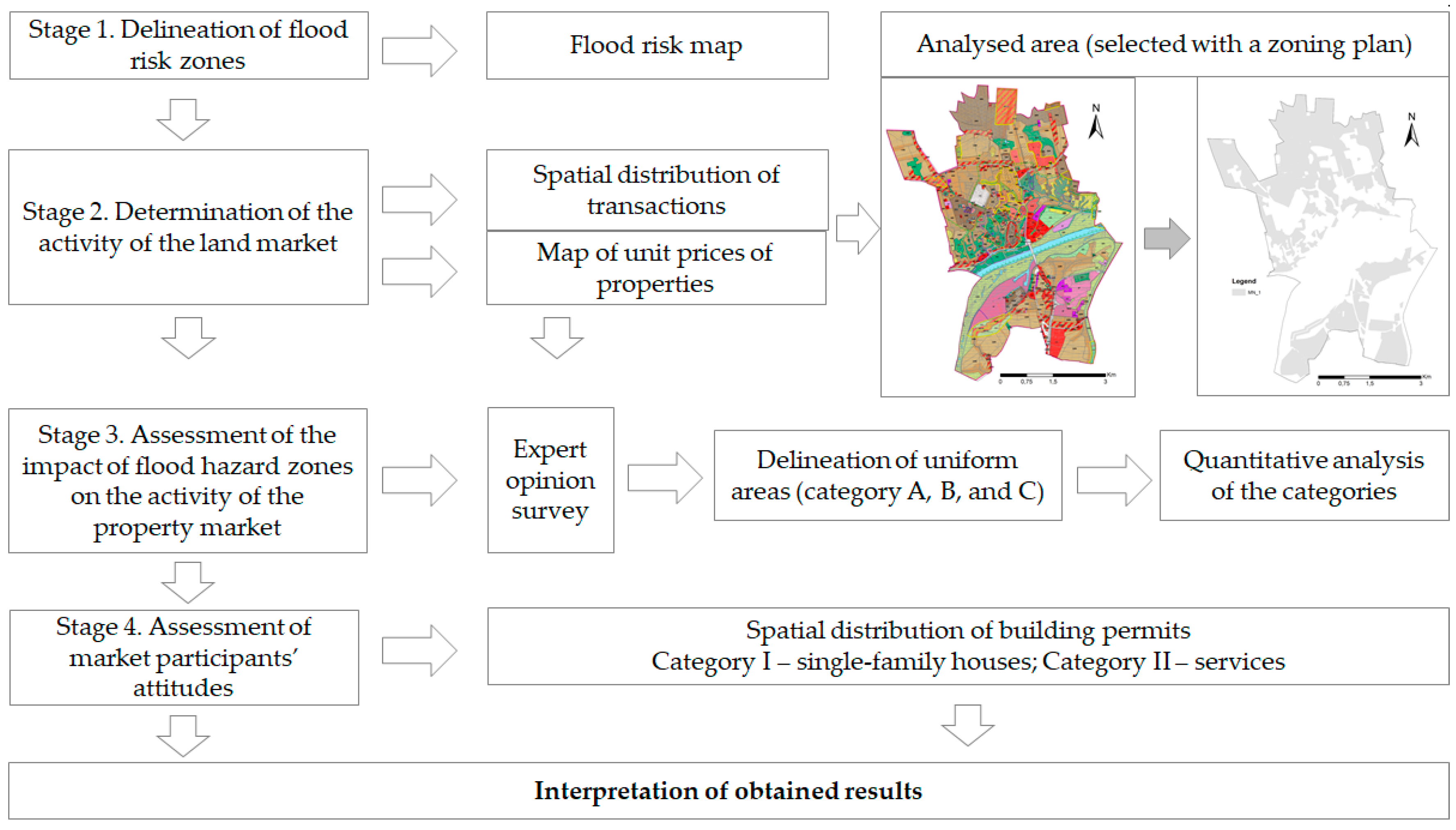

2.2. Research Methodology

3. Results

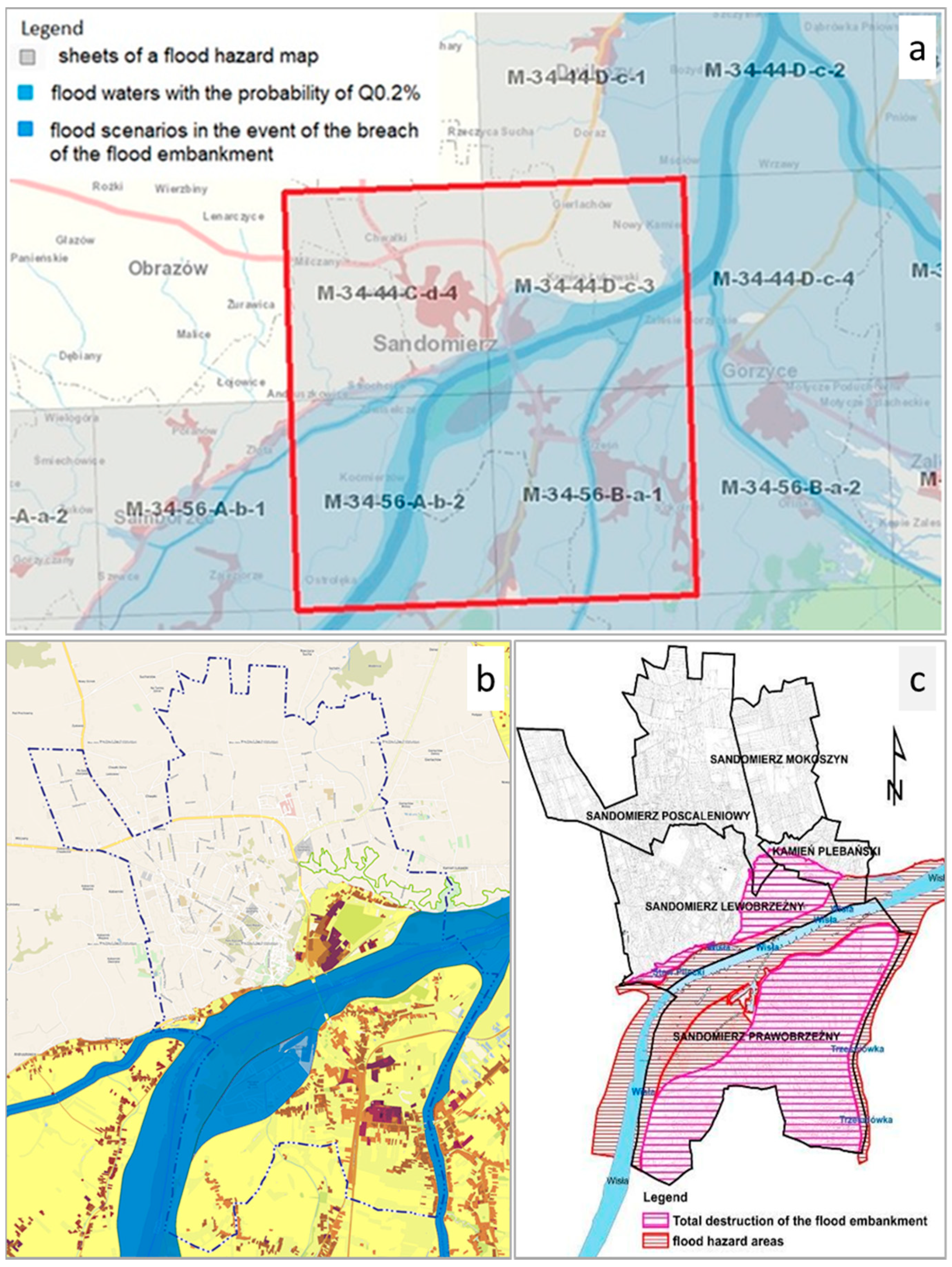

3.1. Stage 1: Identification and Location of Flood Hazard Areas in the Town of Sandomierz

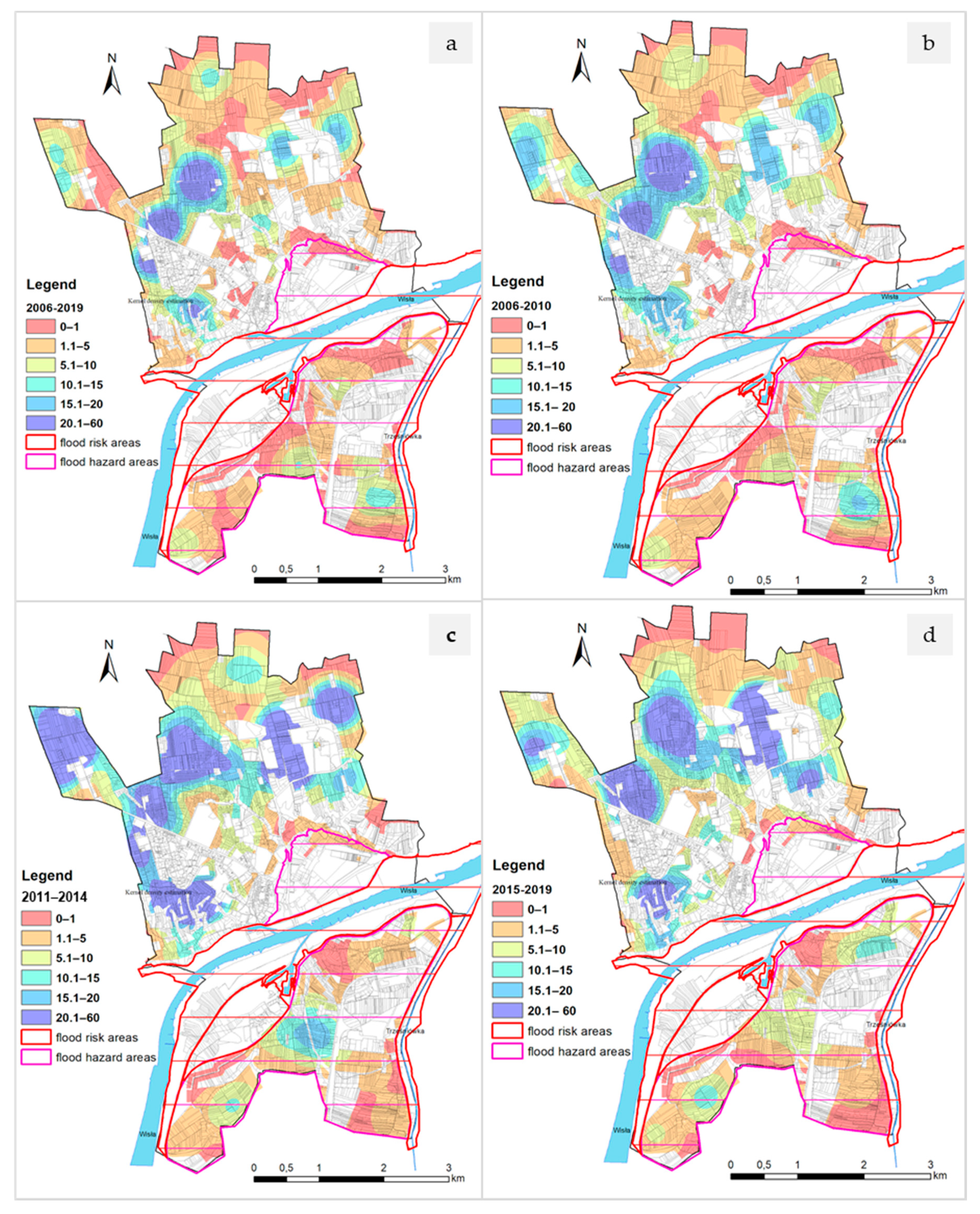

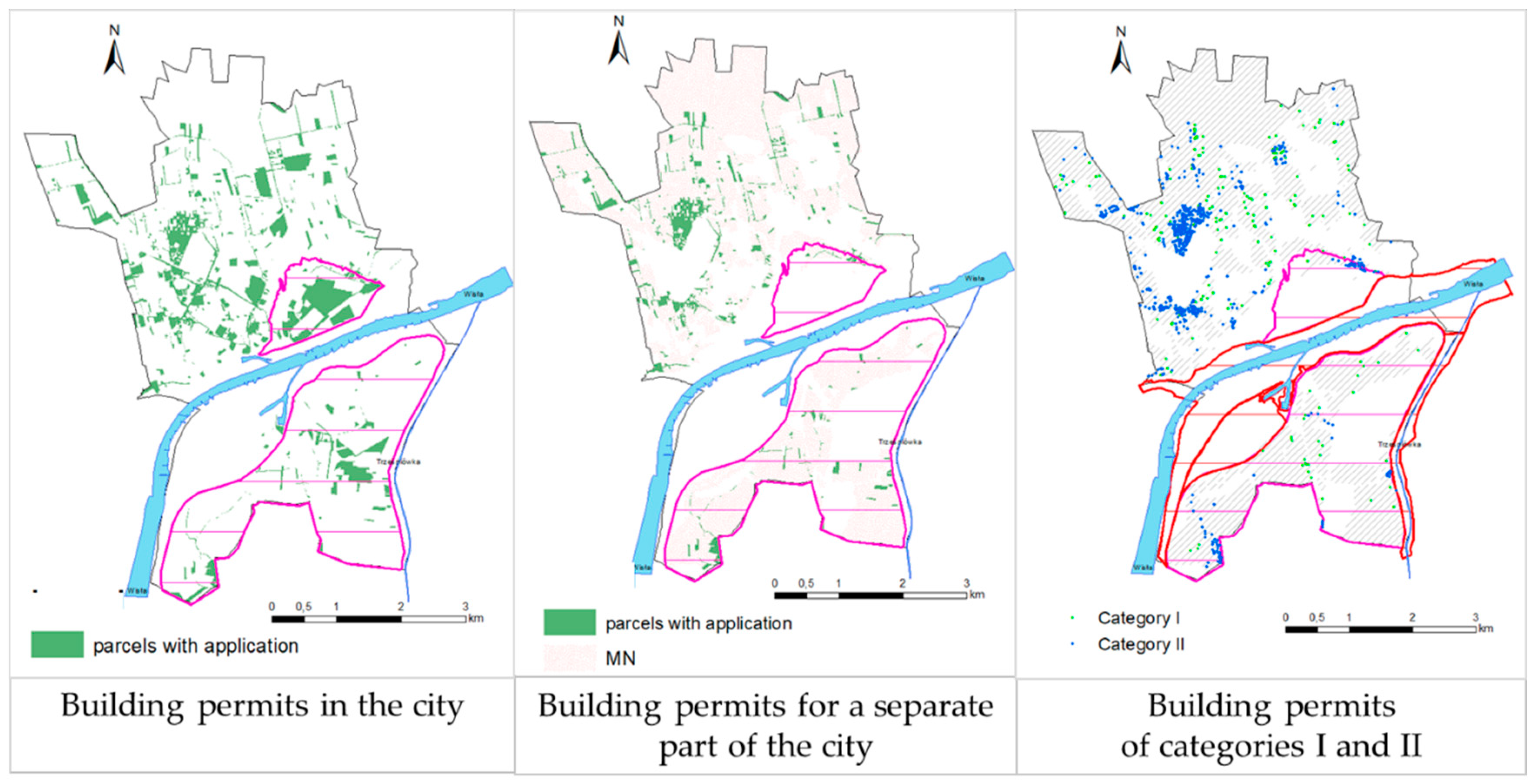

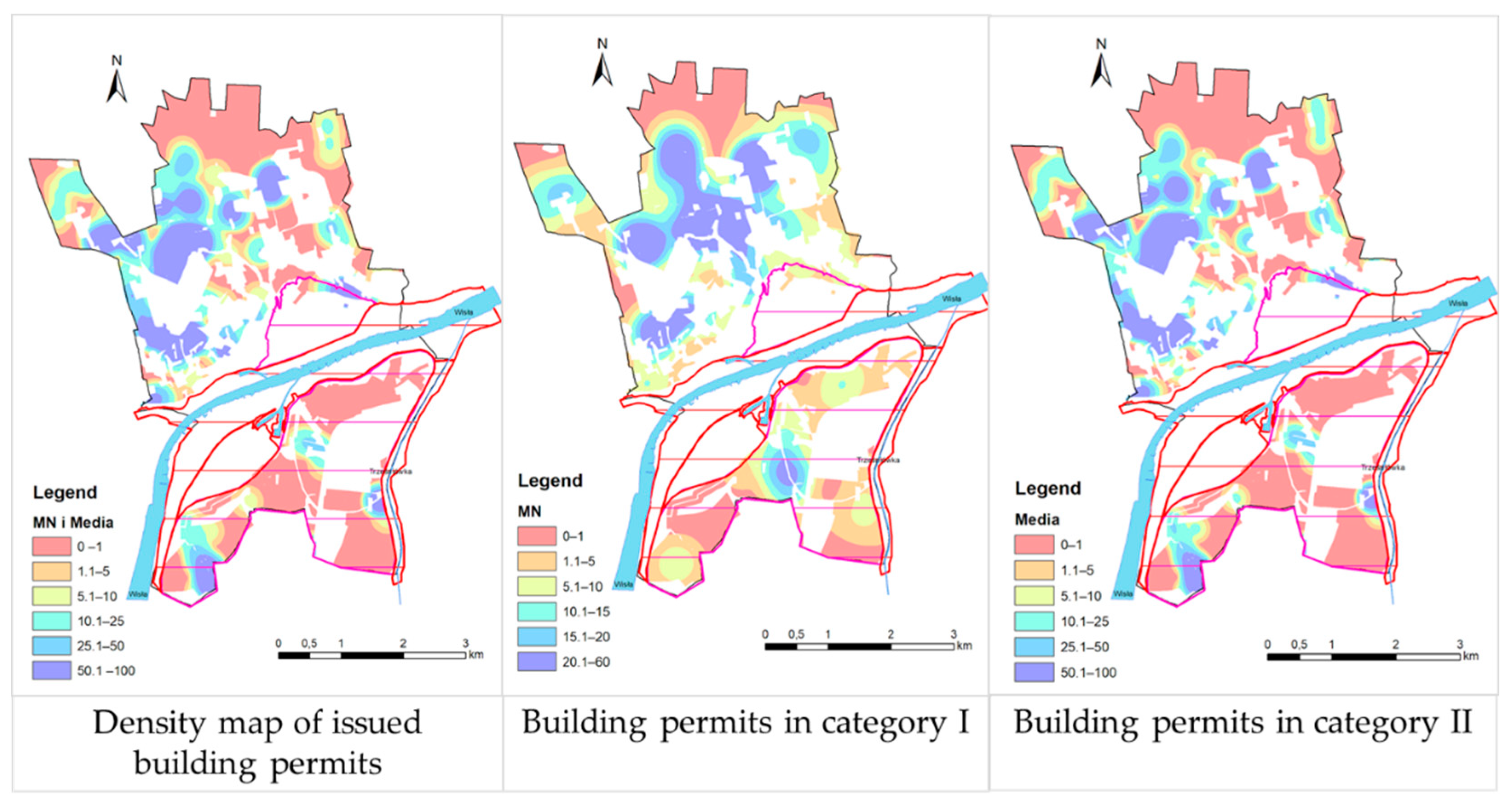

3.2. Stage 2: The Level of Activity in the Market of Land Property Designated for Low-Rise Housing Development in the Town of Sandomierz

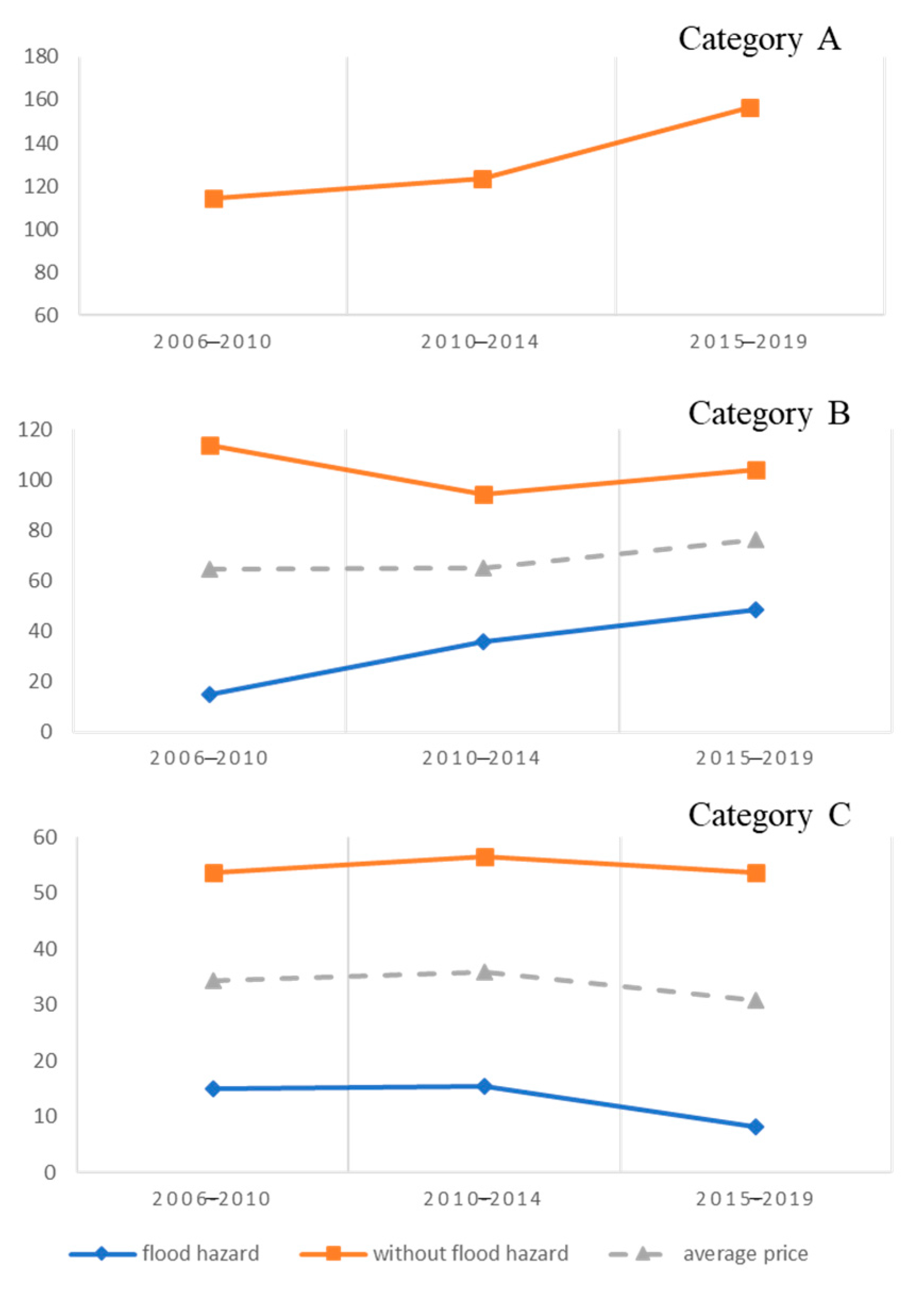

3.3. Stage 3: Assessment of the Effect of Flood Hazard Areas on the Activity of the Land Property Market, and on Prices

- Very favourable—areas most frequently formed through the intensification (compacting) of the existing housing estates (Zone A)

- Favourable—most commonly formed from rural settlement units (Zone B)

- Moderate—including areas less favourable due to the neighbourhood, restricted access to services, etc. (Zone C).

3.4. Stage 4: Buyers’ Attitude in the Time of Flood Information Pressure

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Echendu, A.J. The impact of flooding on Nigeria’s sustainable development goals (SDGs). Ecosyst. Health Sustain. 2020, 6, 1–13. [Google Scholar] [CrossRef]

- Jonkman, S.N.; Bočkarjova, M.; Kok, M.; Bernardini, P. Integrated hydrodynamic and economic modelling of flood damage in the Netherlands. Ecol. Econ. 2008, 66, 77–90. [Google Scholar] [CrossRef]

- Smith, M.J. Sustainable development goals: Genuine global change requires genuine measures of efficacy. J. Maps. 2020, 16, 1–4. [Google Scholar] [CrossRef]

- Merz, A.; Kreibich, H.; Thieken, A.; Schmidtke, R. Estimation uncertainty of direct monetary flood damage to buildings. Nat. Hazards Earth Syst. Sci. 2004, 4, 153–163. [Google Scholar] [CrossRef]

- Dottori, F.; Salamon, P.; Bianchi, A.; Alfieri, L.; Hirpa, F.A.; Feyen, L. Development and evaluation of a framework for global flood hazard mapping. Adv. Water Resour. 2016, 94, 87–102. [Google Scholar] [CrossRef]

- Alfieri, L.; Salamon, P.; Bianchi, A.; Neal, J.; Bates, P.; Feyen, L. Advances in pan-European flood hazard mapping. Hydrol. Process. 2014, 28, 4067–4077. [Google Scholar] [CrossRef]

- Pappenberger, F.; Dutra, E.; Wetterhall, F.; Cloke, H.L. Deriving global flood hazard maps of fluvial floods through a physical model cascade. Hydrol. Earth Syst. Sci. 2012, 16, 4143–4156. [Google Scholar] [CrossRef]

- Jongman, B.; Hochrainer-Stigler, S.; Feyen, L.; Aerts, J.C.; Mechler, R.; Botzen, W.J.; Bouwer, L.M.; Pflug, G.; Rojas, R.; Ward, P.J. Increasing stress on disaster-risk finance due to large floods. Nat. Clim. Chang. 2014, 4, 264–268. [Google Scholar] [CrossRef]

- Bin, O.; Landry, C.E. Changes in implicit flood risk premiums. empirical evidence from the housing market. J. Environ. Econ. Manag. 2013, 65, 361–376. [Google Scholar] [CrossRef]

- Rajapaksa, D.; Wilson, C.; Shunsuke, M.; Hoang, V.; Lee, B. Flood risk information, actual floods and property values: A quasi-experimental analysis. Econ. Rec. 2016, 92, 52–67. [Google Scholar] [CrossRef]

- Daniel, V.E.; Florax, R.J.; Rietveld, P. Flooding risk and housing value: An economic assessment of environmental hazard. Ecol. Econ. 2009, 69, 355–365. [Google Scholar] [CrossRef]

- Ji, Z.; Li, N.; Xie, W.; Wu, J.; Zhou, Y. Comprehensive assessment of flood risk using the classification and regression three method. Stoch. Environ. Res. Risk Assess. 2013, 27, 1815–1828. [Google Scholar] [CrossRef]

- Halama, A. Zrównoważony rozwój małych miast w aspekcie zagrożenia powodziowego (Sustainable development of small towns in the aspect of flooding). Acta Univ. Lodz. Folia Geogr. Socio-Oecon. 2013, 15, 255–269. [Google Scholar]

- Porter, J.; Demeritt, D. Flood-risk management, mapping, and planning: The institutional politics of decision support in England. Environ. Plan. A 2012, 44, 2359–2378. [Google Scholar] [CrossRef]

- Kurczyński, Z. Mapy zagrożenia powodziowego i katalogów powodziowych, a Dyrektywa Powodziowa (Flood hazard maps and flood catalogs, according to the Floods Directive). Arch. Fotogram. Kartogr. I Teledetekcji 2012, 23, 209–217. [Google Scholar]

- Yannopoulos, S.; Eleftheriadou, E.; Mpouri, S.; Io, G. Implementing the requirements of the European flood directive: The Case of ungauged and poorly gauged watersheds. Environ. Process. 2015, 2, 191–207. [Google Scholar] [CrossRef]

- Kourgialas, N.N.; Karatzas, G.P. A national scale flood hazard mapping methodology: The case of Greece–Protection and adaptation policy approaches. Sci. Total. Environ. 2017, 601602, 441–452. [Google Scholar] [CrossRef]

- Riegert, A. Doraźne metody ochrony przed powodzią (Ad hoc methods of flood protection). Bezp. I Technika Pożar. 2014, 3, 139–147. [Google Scholar]

- Zhang, L. Flood hazards impact on neighborhood house prices: A spatial quantile regression analysis. Reg. Sci. Urban Econ. 2016, 60, 12–19. [Google Scholar] [CrossRef]

- Franczak, P.; Listwan-Franczak, K.; Działek, J.; Biernacki, W. Planowanie przestrzenne na obszarach zalewowych w zlewniach górskich różnego rzędu w dorzeczu górnej Wisły oraz górnej i środkowej Odry. Pr. I Stud. Geogr. 2016, 61, 24–45. [Google Scholar]

- Zhang, Y.; Hwang, S.N.; Lindell, M.K. Hazard proximity or risk perception? Evaluating effects of natural and technological hazards on housing values. Environ. Behav. 2010, 42, 597–624. [Google Scholar] [CrossRef]

- Atreya, A.; Ferreira, S.; Kriesel, W. Forgetting the flood? An analysis of the flood risk discount over time. Land. Econ. 2013, 89, 577–596. [Google Scholar] [CrossRef]

- Bin, O.; Kruse, J.B. Real estate market response to coastal flood hazards. Nat. Hazards Rev. 2006, 7, 137–144. [Google Scholar] [CrossRef]

- Eves, C. The long term impacts of flooding on residential property values. Prop. Manag. 2002, 20, 214–227. [Google Scholar] [CrossRef]

- Harrison, D.M.; Smerh, G.T.; Schwartz, A.L. Environmental determinants of housingprices: The impacts of flood zone status. J. Real Estate Res. 2001, 21, 3–20. [Google Scholar]

- Beltrán, A.; Maddison, D.; Elliott, R. The impact of flooding on property prices: A repeat-sales approach. J. Environ. Econ. Manag. 2019, 95, 62–86. [Google Scholar] [CrossRef]

- Atreya, A.; Czajkowski, J. Graduated flood risks and property prices in Galveston county. Real Estate Econ. 2019, 47, 807–844. [Google Scholar] [CrossRef]

- Rajapaksa, D.; Zhou, M.; Lee, B.; Hoang, V.; Wilson, C.; Managi, S. The impact of flood dynamics on property values. Land Use Policy 2017, 69, 317–325. [Google Scholar] [CrossRef]

- Rabassa, M.J.; Zoloa, J.I. Flooding risks and housing markets: A spatial hedonic analysis for La Plata City. Environ. Dev. Econ. 2016, 21, 464–489. [Google Scholar] [CrossRef][Green Version]

- Cupal, M. Flood risk as a price-setting factor in the market value of real property. Procedia Econ. Financ. 2015, 23, 658–664. [Google Scholar] [CrossRef]

- Eves, C.; Wilkinson, S. Assessing the immediate and short-term impact of flooding on residential property participant behaviour. Nat. Hazards 2014, 71, 1519–1536. [Google Scholar] [CrossRef]

- Akbar, D.; Rolfe, J.; Small, G.; Hossain, R. Assessing flood impacts on the regional property markets in Queensland, Australia. Australas. J. Reg. Stud. 2015, 21, 160–177. [Google Scholar]

- Cellmer, R.; Trojanek, R. Towards increasing residential market transparency: Mapping local housing prices and dynamics. ISPRS Int. J. Geo-Inf. 2020, 9, 2. [Google Scholar] [CrossRef]

- Morillo, M.C.; García-Cepeda, F.; Martínez-Cuevas, S.; Molina, I.; García-Aranda, C. Geostatistical study of the rural property market applicable to the region of Murcia (Spain) by M. carmen morillo1 et al. Appl. Spat. Anal. Policy 2017, 10, 585–607. [Google Scholar] [CrossRef]

- Leyland, A.H.; Goldstein, H. (Eds.) Multilevel Modelling of Health Statistics; John Wiley & Sons: Hoboken, NJ, USA; Chichester, UK, 2001. [Google Scholar]

- Matsuyama, Y. Hierarchical linear modeling (HLM). In Encyclopedia of Behavioral Medicine; Gellman, M.D., Turner, J.R., Eds.; Springer: Berlin/Heidelberg, Germany; New York, NY, USA, 2013. [Google Scholar] [CrossRef]

- Goldstein, H. Multilevel Statistical Models, 4th ed.; Wiley: Chichester, UK; Hoboken, NJ, USA, 2011. [Google Scholar]

- Cellmer, R.; Cichulska, A.; Renigier-Biłozor, M.; Biłozor, A. Application of mixed-effect regression models for compiling a land value map. In Proceedings of the Baltic Geodetic Congress, Olsztyn, Poland, 21–23 June 2018. [Google Scholar] [CrossRef]

- Hox, J.J.; Roberts, J.K. Handbook of Advanced Multilevel Analysis; Routledge, Talyor & Francis: New York, NY, USA, 2011. [Google Scholar]

- Silverman, B.W. Density Estimation for Statistics and Data Analysis; Chapman & Hall: London, UK, 1986. [Google Scholar]

- Shultz, S.D.; Fridgen, P.M. Floodplains and property values: Implications for flood mitigation projects. J. Am. Water Resour. Assoc. 2001, 37, 595–603. [Google Scholar] [CrossRef]

- Nakaya, T.; Yano, K. Visualising crime clusters in a space–time cube: An exploratory data-analysis approach using space–time kernel density estimation and scan statistics. Trans. GIS 2010, 14, 223–239. [Google Scholar] [CrossRef]

- Lu, Y.; Wong, D.W. An adaptive inverse-distance weighting spatial interpolation technique. Comput. Geosci. 2008, 34, 1044–1055. [Google Scholar] [CrossRef]

- Chen, F.-W.; Liu, C.-W. Estimation of the spatial rainfall distribution using inverse distance weighting (IDW) in the middle of Taiwan. Paddy Water Environ. 2012, 10, 209–222. [Google Scholar] [CrossRef]

- Handbook on Good Practices for Flood Mapping in Europe. Available online: https://ec.europa.eu/environment/water/flood_risk/flood_atlas/pdf/handbook_goodpractice.pdf (accessed on 21 September 2020).

- Cellmer, R. Modelowanie Przestrzenne w Procesie Opracowywania Map Wartości Gruntów (Spatial Modeling in the Process of Preparing Land Value Maps); University of Warmia and Mazury: Olsztyn, Poland, 2014. [Google Scholar]

- Usman, H.; Lizam, M.; Adekunle, M.U. Property price modelling, market segmentation and submarket classifications: A review. Real Estate Manag. Valuat. 2020, 28, 24–35. [Google Scholar] [CrossRef]

- Ling, Z.; Hui, E.C.M. Structural change in housing submarkets in burgeoning real estate market: A case of Hangzhou, China. Habitat Int. 2013, 39, 214–223. [Google Scholar] [CrossRef]

- Hwang, S. Residential segregation, housing submarkets, and spatial analysis: St. Louis and Cincinnati as a case study. Hous. Policy Debate. 2015, 25, 91–115. [Google Scholar] [CrossRef]

- Levkovich, O.; Rouwendal, J.; Brugman, L. Spatial planning and segmentation of the land market: The case of the Netherlands. Land Econ. 2018, 94, 137–154. [Google Scholar] [CrossRef]

- Kousky, C.; Luttmer, E.F.; Zeckhauser, R.J. Private investment and government protection. J. Risk Uncertain. 2006, 33, 73–100. [Google Scholar] [CrossRef]

- Balvers, R.; Du, D.; Zhao, X. What Financial Markets Reveal About Global Warming? Department of Economics, West Virginia University: Morgantown, WV, USA, 2009. [Google Scholar]

- Hallegatte, S. How economic growth and rational decisions can make disaster losses grow faster than wealth. Policy Res. Work. Pap. Ser. 2011, 5617. [Google Scholar] [CrossRef]

- Husby, T.G.; Mechler, R.; Jongman, B. What if Dutch investors started worrying about flood risk? Implications for disaster risk reduction. Reg. Environ. Chang. 2016, 16, 565–574. [Google Scholar] [CrossRef]

- Battisti, F.; Campo, O. A methodology for determining the profitability index of real estate initiatives involving public-private partnerships. A case study: The integrated intervention programs in Rome. Sustainability 2019, 11, 1371. [Google Scholar] [CrossRef]

- Battisti, F.; Campo, O.; Forte, F. A methodological approach for the assessment of potentially buildable land for tax purposes: The Italian case study. Land 2020, 9, 8. [Google Scholar] [CrossRef]

- Malkowska, A.; Gluszak, M. Pro-investment local policies in the area of real estate economics-similarities and differences in the strategies used by communes. Oecon. Copernic. 2008, 7, 269–283. [Google Scholar] [CrossRef]

- Steinberg, F. Strategic urban planning in Latin America: Experiences of building and managing the future. Habitat Int. 2005, 29, 69–93. [Google Scholar] [CrossRef]

- Gaile, L. Improving rural-urban linkages through small town market-based development. Third World Plan. Rev. 1992, 14, 131–148. [Google Scholar] [CrossRef]

- Sklenicka, P.; Molnarowa, K.; Pixova, K.C. Factors affecting farmland prices in the Czech Republic. Land Use Policy 2013, 30, 130–136. [Google Scholar] [CrossRef]

- Wang, S.; Yang, Z.; Liu, H. Impact of urban economic openness on real estate prices: Evidence from thirty-five cities in China. China Econ. Rev. 2011, 22, 42–54. [Google Scholar] [CrossRef]

- Samarashinghe, O.; Sharp, B. Flood prone risk and amenity values: A spatial hedonic analysis. Aust. J. Agric. Resour. Econ. 2010, 54, 457–475. [Google Scholar] [CrossRef]

- Lamond, I. The Impact of Flooding on the Value of Residential Property in the UK; School of Engineering and the Built Environment, University of Wolverhampton: Wolverhampton, UK, 2008. [Google Scholar]

- Kousky, C. Learning from extreme events: Risk perceptions after the flood. Land Econ. 2010, 86, 395–422. [Google Scholar] [CrossRef]

- Naoi, M.; Seko, M.; Sumita, K. Earthquake risk and housing prices in Japan: Evidence before and after massive earthquakes. Reg. Sci. Urban Econ. 2009, 39, 658–669. [Google Scholar] [CrossRef]

- Jung, E.; Yoon, H. Is flood risk capitalized into real estate market value? A mahalanobis-metric matching approach to the housing market in Gyeonggi, South Korea. Sustainability 2018, 10, 4008. [Google Scholar] [CrossRef]

- Morales, P. Current status of the mapping of flood risk and its application in the land. The case of the region of Murcia. Bol. Asoc. Geógr. Esp. 2012, 58, 443–448. [Google Scholar]

| Variable | Effect | Standard Error | t-Value |

|---|---|---|---|

| Date | 0.098 | 0.047 | 2.116 |

| Utilities | 1.050 | 1.913 | 0.549 |

| Area | −0.774 | 2.226 | −0.348 |

| Location | 2.683 | 3.315 | 0.809 |

| Variable | Zone B | Zone C | Variance | Standard Deviation |

|---|---|---|---|---|

| Intercept | 77.267 | 52.957 | 4540.80 | 67.385 |

| Risk | −10.338 | 5.136 | 90.380 | 9.507 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dudzińska, M.; Prus, B.; Cellmer, R.; Bacior, S.; Kocur-Bera, K.; Klimach, A.; Trystuła, A. The Impact of Flood Risk on the Activity of the Residential Land Market in a Polish Cultural Heritage Town. Sustainability 2020, 12, 10098. https://doi.org/10.3390/su122310098

Dudzińska M, Prus B, Cellmer R, Bacior S, Kocur-Bera K, Klimach A, Trystuła A. The Impact of Flood Risk on the Activity of the Residential Land Market in a Polish Cultural Heritage Town. Sustainability. 2020; 12(23):10098. https://doi.org/10.3390/su122310098

Chicago/Turabian StyleDudzińska, Małgorzata, Barbara Prus, Radosław Cellmer, Stanisław Bacior, Katarzyna Kocur-Bera, Anna Klimach, and Agnieszka Trystuła. 2020. "The Impact of Flood Risk on the Activity of the Residential Land Market in a Polish Cultural Heritage Town" Sustainability 12, no. 23: 10098. https://doi.org/10.3390/su122310098

APA StyleDudzińska, M., Prus, B., Cellmer, R., Bacior, S., Kocur-Bera, K., Klimach, A., & Trystuła, A. (2020). The Impact of Flood Risk on the Activity of the Residential Land Market in a Polish Cultural Heritage Town. Sustainability, 12(23), 10098. https://doi.org/10.3390/su122310098