Characteristics and Influencing Factors of Green Finance Development in the Yangtze River Delta of China: Analysis Based on the Spatial Durbin Model

Abstract

:1. Introduction

2. Method

2.1. Spatial Autocorrelation Analysis

2.1.1. Spatial Weight Matrix

2.1.2. Global Spatial Autocorrelation

2.2. Spatial Durbin Model

- (1)

- If , the model is a spatial Durbin model (SDM)

- (2)

- If , , the model is a spatial autoregression model (SAR)

- (3)

- If and , the model is a spatial error model (SEM)

2.3. Direct Effect and Indirect Effect

2.4. Variable Selection and Data Source

2.4.1. Variable Selection

- (1)

- Development Level of Green Finance (DGF)

- (2)

- Regional Innovation Level (INNO)

- (3)

- Optimization of Industrial Structure (OIS)

- (4)

- Others

2.4.2. Data Source

3. Results Analysis

3.1. Global Spatial Autocorrelation of Green Finance Development

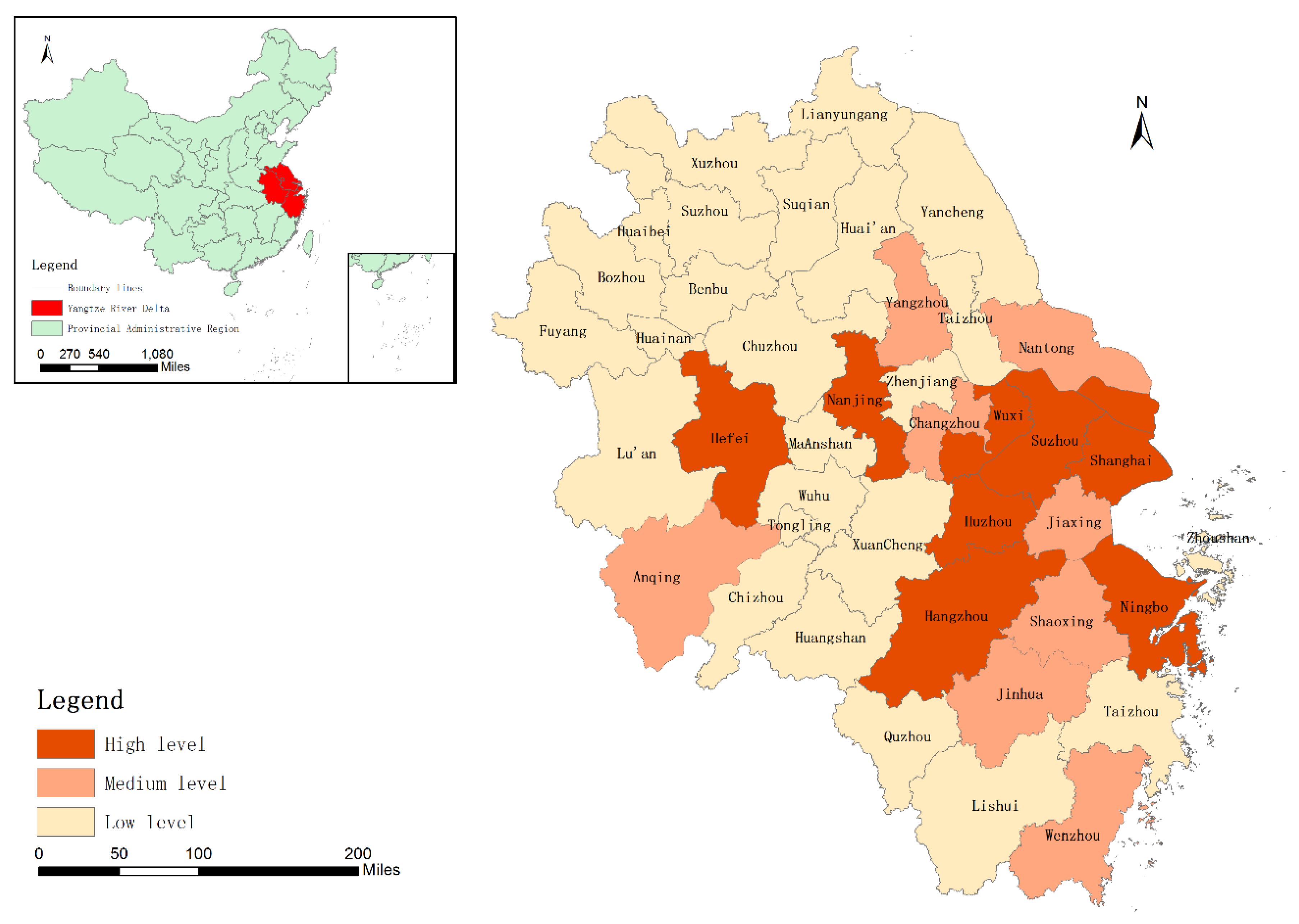

3.2. Spatial Distribution Characteristics of Green Finance Development

3.3. Analysis of the Influencing Factors of Green Finance Development

3.3.1. Wald Test and the LR Test

3.3.2. Model Specification

3.3.3. Regression Results of the Spatial Durbin Model

3.3.4. Direct Effects and Indirect Effects

- (1)

- Direct effects: As shown in Table 5, the direct effects coefficients of GDP (Column 2, Line 1), INNO, and AQ are significant at the significance level of 1%. The coefficient of the direct effects of the GDP is significantly positive. The coefficients of the direct effects of the INNO and AQ are significantly negative. The direct effect coefficient of INNO is significant at a significance level of 1%, while the indirect effect is not significant. By comparing the absolute value of the direct effect coefficient and the indirect effect coefficient, it is found that the GDP, INNO, and AQ are associated with the development level of green finance mainly through the direct effect.

- (2)

- Indirect effects (spillover effect): The indirect effects coefficients of GDP (Column 2, Line 6), DFD, OIS, and INNO are significant at the significance level of 10%. The indirect effect coefficients of DFD and INNO are significantly positive, indicating that the DFD and INNO have positive spatial spillover effects and that the DFD and INNO in neighboring cities will be positively associated with a city’s green finance development. The indirect effect coefficient of OIS is significantly negative, indicating that the OIS has a negative spatial spillover effect. The OIS in neighboring cities will be negatively associated with the improvement of the city’s green finance development level. Likewise, this result shows that the DFD and OIS mainly are associated with green finance development through the spillover effect.

3.4. Robustness Test

4. Conclusions and Suggestions

4.1. Conclusions

- (1)

- The development of green finance in the Yangtze River Delta has a clear spatial cluster effect, and there are large regional differences. High levels of green finance development are generally distributed in urban agglomerations, including Shanghai, northern Zhejiang, and southern Jiangsu. The level of green finance development in Zhejiang Province is generally high, and the level of green finance development in Anhui Province is generally low.

- (2)

- The GDP, INNO, and AQ are the most important influencing factors, and the DFD and OIS are not significant.

- (3)

- The GDP is positively correlated with the development of green finance. The INNO and AQ are negatively correlated with the development of green finance.

- (4)

- The GDP, INNO, and AQ are associated with the development level of green finance mainly through direct effects. The DFD and OIS are associated with the development level of green finance mainly through spillover effects. Particularly, the DFD has a positive spillover effect, and in contrast, the OIS has a negative spillover effect. The direct effects of the DFD and OIS are not significant.

4.2. Suggestions

- (1)

- With the construction of the Shanghai International Financial Center as the starting point, the construction of a green financial core circle in the Yangtze River Delta should be promoted [12]. Forming a green financial capital service center and driving the development of green finance in surrounding urban agglomerations through these leading cities will gradually transform the spatial cluster effect of green finance into a spatial spillover effect, thereby providing capital services for the development of green finance in cities in the Yangtze River Delta.

- (2)

- The green finance development system should be improved, and the development of green finance should be accelerated. In the Yangtze River Delta region, green finance accounts for a small percentage of financial development in Anhui Province, northern Jiangsu, and southern Zhejiang. The green financial system is not perfect, and green finance began late. Therefore, regions with higher levels of green finance development, such as Shanghai, southern Jiangsu, and northern Zhejiang, need to play a role in the spatial spillover effect of financial development on green finance, continually integrate the development of green finance and the development of the Yangtze River Delta, and have a positive interaction to jointly promote green development.

- (3)

- The level of urban openness should be expanded, economic development should be accelerated, and the coordinated development of the economy and green finance should be promoted. The level of economic development is a major factor in the imbalance in green finance development, but the spatial spillover effect of the level of economic development in the Yangtze River Delta on green finance is insignificant. It is no longer sufficient to increase the level of openness and economic development of the 26 urban areas in the Yangtze River Delta. It is also necessary to improve the level of openness and economic development of the “40 + 1” urban agglomeration in the Yangtze River Delta to encourage the spatial spillover effects of economic development on green finance.

- (4)

- The economic structure should be adjusted, the development mode should be changed, and environmental protection industries, including environmental protection manufacturing and service industries, should be vigorously cultivated and developed. During the gradual development of green industry, the liquidity of green funds is enhanced, and then green economic effectiveness is improved. In the past, in the process of optimizing the industrial structure in the Yangtze River Delta, the proportion that the secondary industry transferred to the tertiary industry was considered, and the transferred secondary industry and the development of the tertiary industry were not considered much. In the process of optimizing the industrial structure, we must not only suppress investment in high-energy consumption and high-pollution industries but also vigorously develop industries such as environmental protection and clean energy and solve the problem of difficult financing for environmental protection enterprises. It is necessary not only to increase the proportion of the tertiary industry but also to vigorously develop tertiary industries such as finance, insurance, transportation, tourism, and education services related to environmental protection.

- (5)

- Research and investment in green technology should be increased, green development should be promoted with green technology, and green finance should be promoted through green development. A market-oriented green technology innovation system should be established. The proportion of green technology in technological innovation and the investment and financing of green technologies should be increased, striving to solve barriers, such as high technological costs, insufficient funds, and limited information on green enterprises. Finally, the conversion of green technologies into production technologies should be accelerated, and the development of green industries, such as energy-saving and environmental protection industries, clean production industries, and clean energy industries, should be expanded.

- (6)

- The government should provide financial incentives for green companies. The government gives cash rewards to green companies based on the quality and quantity of green technology innovation. The government provides price subsidies during the promotion of green technologies by enterprises. The government formulates corresponding tax reduction measures based on the emission reduction scale of green enterprises or the output of green products.

Author Contributions

Funding

Conflicts of Interest

References

- Zeng, X.W.; Liu, Y.Q.; Man, M.J.; Shen, Q.L. Measurement analysis of China’s green finance development. J. China Exec. Leadersh. Acad. Yan’an 2014, 7, 112–121+105. [Google Scholar]

- Wang, Y.; Pan, D.Y.; Zhang, X. Research on green finance’s contribution to China’s economic development. Comp. Econ. Soc. Syst. 2016, 6, 33–42. [Google Scholar]

- Ren, J. The internal connection and method of coordinated development between green finance and poverty alleviation. Environ. Prot. 2019, 47, 47–49. [Google Scholar]

- Wang, B.; Zheng, L.S. Research on the mechanism path of green finance supporting rural rejuvenation. J. Tech. Econ. Manag. 2019, 11, 84–88. [Google Scholar]

- Labatt, S.; White, R.R. Environmental Finance: A Guide to Environmental Risk Assessment and Financial Products; John Wiley and Sons: Hoboken, NJ, USA, 2002. [Google Scholar]

- Paranque, B.; Revelli, C. Ethico-economic Analysis of Impact Finance: The Case of Green Bonds. Res. Int. Bus. Financ. 2019, 47, 57–66. [Google Scholar]

- Ng, A.W. From sustainability accounting to a green financing system: Institutional legitimacy and market heterogeneity in a global financial centre. J. Clean. Prod. 2018, 195, 585–592. [Google Scholar]

- Sanderson, O. Chapter 20—How to trust green bonds: Blockchain, climate, and the institutional bond markets. In Transforming Climate Finance and Green Investment with Blockchains; Marke, A., Ed.; Academic Press: Cambridge, MA, USA, 2018. [Google Scholar]

- Gianfrate, G.; Peri, M. The green advantage: Exploring the convenience of issuing green bonds. J. Clean. Prod. 2019, 219, 127–135. [Google Scholar]

- Reboredo, J.C.; Ugolini, A. Price connectedness between green bond and financial markets. Econ. Model. 2020, 88, 25–38. [Google Scholar]

- Li, H.; Yuan, Y.C.; Wang, N. Evaluation of coordinated coupling of regional green finance and ecological environment. Stat. Decis. 2019, 35, 161–164. [Google Scholar]

- Chen, S.Y. Green finance boosts the integrated development of the Yangtze River delta. J. Environ. Econ. 2019, 4, 1–7. [Google Scholar]

- Chai, J.X. Analysis on the mechanism and path of green finance affecting macroeconomic growth. Ecol. Econ. 2018, 34, 56–60. [Google Scholar]

- Zhang, Y.H.; Zhao, J.H. Green credit, technological progress and optimization of industrial structure: An empirical analysis based on pvar model. J. Financ. Econ. 2019, 43–48. [Google Scholar] [CrossRef]

- Zhai, S.; Yin, Y.F.; Qian, C.F. Ecological advantages and mode selection of green finance development: Taking Huzhou as an example. Ecol. Econ. 2019, 35, 56–59+130. [Google Scholar]

- Zhang, C.; Dong, X.J. The dynamic impact of green credit on bank performance: The regulating effect on internet finance. Financ. Econ. Res. 2018, 33, 56–66. [Google Scholar]

- Zhang, L.; Lian, Y.H. Green credit, bank heterogeneity and bank financial performance. Financ. Regul. Res. 2019, 2, 43–61. [Google Scholar]

- Guo, W.W.; Liu, Y.D. Green credit, cost-benefit effect and commercial bank profitability. South China Financ. 2019, 9, 40–50. [Google Scholar]

- Taghizadeh-Hesary, F.; Yoshino, N. The way to induce private participation in green finance and investment. Financ. Res. Lett. 2019, 31, 98–103. [Google Scholar]

- Dong, X.H.; Fu, Y. Time-space dimension analysis of green finance development and influencing factors. Stat. Decis. 2018, 34, 94–98. [Google Scholar]

- Yu, F.J.; Xu, F. Development and influencing factors of green finance in Guangdong province from the perspective of space: An empirical study based on fixed effect spatial durbin model. Sci. Technol. Manag. Res. 2019, 39, 63–70. [Google Scholar]

- Liu, X.H.; Wang, E.X.; Cai, D.T. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar]

- Tolliver, C.; Keeley, A.R.; Managi, S. Drivers of green bond market growth: The importance of nationally determined contributions to the Paris agreement and implications for sustainability. J. Clean. Prod. 2020, 244, 118643. [Google Scholar]

- Eyraud, L.; Clements, B.; Wane, A. Green investment: Trends and determinants. Energy Policy 2013, 60, 852–865. [Google Scholar]

- Shi, B.Z.; Xu, N.; Liu, M.; Deng, M. Impacts and channels of financial agglomeration on green economic efficiency of city: Empirical analysis on 249 cities at level of municipality or above. Tech. Econ. 2018, 37, 87–95. [Google Scholar]

- Zhang, Z.Y.; Li, T.; Ma, Q. Analysis of the threshold effect of financial agglomeration on urban green economic efficiency: Based on the statistical data of nine national central cities in my country. J. Technoecon. Manag. 2020, 284, 98–102. [Google Scholar]

- Yuan, H.X.; Liu, Y.B.; Feng, Y.D. How does financial agglomeration affect the efficiency of green development?—Empirical analysis of SPDM and PTR models based on dual fixed time and space. Chin. J. Manag. Sci. 2019, 27, 61–75. [Google Scholar]

- Zhang, L.L.; Xiao, L.M.; Gao, J.F. Measurement and comparison of China’s green finance development level and efficiency—Based on micro-data of 1040 public companies. Forum Sci. Technol. China 2018, 9, 100–112,120. [Google Scholar]

- Han, C.H.; Zheng, R.G.; Yu, D.F. The impact of China’s industrial structure changes on economic growth and fluctuations. Econ. Res. J. 2011, 5, 4–16. [Google Scholar]

- Elhorst, J.P. Specification and estimation of spatial panel data models. Int. Reg. Sci. Rev. 2003, 26, 244–268. [Google Scholar]

- Lesage, J.; Pace, R.K. Introduction to Spatial Econometrics; Informa UK Limited: London, UK, 2009. [Google Scholar]

- Cheng, Y.Q.; Wang, Z.Y.; Zhang, S.Z.; Ye, X.Y.; Jiang, H.M. Spatial econometric modelling of carbon emission intensity of China’s energy consumption and its influencing factors. Acta Geogr. Sin. 2013, 68, 1418–1431. [Google Scholar]

| Aggregate Name | Variable Name | Variable Symbol |

|---|---|---|

| Dependent variable | Development level of green finance | DGF |

| Regional GDP | GDP | |

| Degree of financial development | DFD | |

| Independent variable | Optimization of industrial structure | OIS |

| Regional innovation level | INNO | |

| Air quality | AQ |

| Year | Moran’s I | E(I) | sd(I) | Z | p-Value * |

|---|---|---|---|---|---|

| 2011 | 0.019 * | −0.025 | 0.026 | 1.696 | 0.090 |

| 2012 | 0.040 * | −0.025 | 0.034 | 1.918 | 0.055 |

| 2013 | 0.058 ** | −0.025 | 0.037 | 2.218 | 0.027 |

| 2014 | 0.073 ** | −0.025 | 0.040 | 2.426 | 0.015 |

| 2015 | 0.062 ** | −0.025 | 0.043 | 2.009 | 0.045 |

| 2016 | 0.030 | −0.025 | 0.035 | 1.560 | 0.119 |

| 2017 | 0.033 | −0.025 | 0.041 | 1.408 | 0.159 |

| Wald Test | LR Test | ||

|---|---|---|---|

| Wald(lag) | 39.05 *** | LR(lag) | 37.18 *** |

| Wald(error) | 37.8 *** | LR(error) | 52.56 *** |

| Variable | Spatial Fixed Effects (Column 1) | Time Fixed Effects (Column 2) | Spatial and Time Fixed Effects (Column 3) |

|---|---|---|---|

| GDP | 0.0140 *** | 0.0158 *** | 0.0142 *** |

| (0.002) | (0.003) | (0.002) | |

| DFD | 1.156 | 0.674 | 1.446 |

| (1.058) | (0.729) | (1.093) | |

| OIS | 1.128 | −0.95 | 1.348 * |

| (0.716) | (0.743) | (0.706) | |

| INNO | 0.0378 ** | −0.0882 *** | 0.0395 ** |

| (0.019) | (0.019) | (0.018) | |

| AQ | −0.0071 | −0.0289 *** | −0.0079 |

| (0.008) | (0.009) | (0.008) | |

| W × GDP | −0.0026 | 0.0024 | 0.004 |

| (0.005) | (0.004) | (0.009) | |

| W × DFD | 0.671 | 4.456 ** | 4.779 ** |

| (1.894) | (1.877) | (2.282) | |

| W × OIS | −3.492 * | −7.031 *** | 0.37 |

| (2.036) | (2.681) | (3.523) | |

| W × INNO | −0.0873 *** | 0.0461 | −0.0615 |

| (0.029) | (0.032) | (0.040) | |

| W × AQ | −0.0121 | −0.0092 | −0.0216 |

| (0.021) | (0.016) | (0.035) | |

| −0.144 | −0.78 *** | −0.365 *** | |

| R2 | 0.739 | 0.868 | 0.747 |

| Variable | Spatial Fixed Effects (Column 1) | Time Fixed Effects (Column 2) | Spatial and Time Fixed Effects (Column 3) | |

|---|---|---|---|---|

| GDP | 0.0141 *** | 0.0165 *** | 0.0143 *** | |

| (0.002) | (0.003) | (0.002) | ||

| DFD | 1.084 | 0.402 | 1.272 | |

| (1.067) | (0.846) | (1.124) | ||

| Direct effects | OIS | 1.245 * | −0.497 | 1.419 ** |

| (0.689) | (0.817) | (0.672) | ||

| INNO | 0.0395 ** | −0.0956 *** | 0.0422 ** | |

| (0.019) | (0.021) | (0.018) | ||

| AQ | −0.0067 | −0.0299 *** | −0.0072 | |

| (0.008) | (0.009) | (0.007) | ||

| GDP | −0.0039 | −0.0063 ** | −0.0007 | |

| (0.005) | (0.003) | (0.007) | ||

| DFD | 0.494 | 2.486 * | 3.344 * | |

| (1.699) | (1.483) | (1.956) | ||

| Indirect effects | OIS | −3.269 * | −4.041 ** | −0.111 |

| (1.669) | (1.644) | (2.62) | ||

| INNO | −0.0813 ** | 0.0724 *** | −0.057 * | |

| (0.025) | (0.021) | (0.031) | ||

| AQ | −0.0087 | 0.0082 | −0.0126 | |

| (0.018) | (0.011) | (0.026) | ||

| GDP | 0.0102 *** | 0.0103 *** | 0.0136 ** | |

| (0.004) | (0.002) | (0.006) | ||

| DFD | 1.579 | 2.888 *** | 4.616 ** | |

| (1.274) | (0.851) | (1.892) | ||

| Total effects | OIS | −2.023 | −4.538 *** | −2.773 |

| (1.643) | (1.33) | (2.384) | ||

| INNO | −0.0419 ** | −0.0232 | −0.0148 | |

| (0.019) | (0.023) | (0.031) | ||

| AQ | −0.0154 | −0.0217 | −0.0198 | |

| (0.02) | (0.01) | (0.029) |

| Variable | Spatial Fixed-Effects (Column 1) | Time Fixed-Effects (Column 2) | Spatial and Time-Effects (Column 3) | |

|---|---|---|---|---|

| GDP | 0.0140 *** | 0.0160 *** | 0.0143 *** | |

| (0.002) | (0.003) | (0.002) | ||

| DFD | 0.862 | 0.638 | 1.424 | |

| (1.045) | (0.719) | (1.101) | ||

| OIS | 0.38 | −1.389 | 1.296 * | |

| (0.733) | (0.805) | (0.729) | ||

| INNO | 0.0350 ** | −0.0924 *** | 0.0380 ** | |

| (0.018) | (0.019) | (0.019) | ||

| AQ | −0.0068 | −0.0276 *** | −0.0276 *** | |

| (0.01) | (0.01) | (0.007) | ||

| GDP | 0.0141 *** | 0.0164 *** | 0.0145 *** | |

| (0.002) | (0.003) | (0.002) | ||

| DFD | 0.811 | 0.519 | 1.304 | |

| (1.022) | (0.779) | (1.119) | ||

| Direct effects | OIS | 0.401 | −1.112 | 1.331 * |

| (0.718) | (0.798) | (0.698) | ||

| INNO | 0.0344 ** | −0.0970 *** | 0.0391 ** | |

| (0.017) | (0.021) | (0.018) | ||

| AQ | −0.00658 | −0.0284 *** | −0.00729 | |

| (0.01) | (0.01) | (0.007) | ||

| GDP | −0.00279 | −0.00372 ** | −0.00291 | |

| (0.004) | (0.002) | (0.003) | ||

| DFD | 0.289 | 1.162 | 2.093 | |

| (1.187) | (0.961) | (1.356) | ||

| Indirect effects | OIS | −2.625 | −2.836 ** | 0.899 |

| (1.721) | (1.278) | (1.48) | ||

| INNO | −0.0518 *** | 0.0509 ** | −0.0253 | |

| (0.018) | (0.021) | (0.022) | ||

| AQ | −0.0055 | 0.0076 | −0.0153 | |

| (0.014) | (0.009) | (0.013) | ||

| GDP | 0.0113 *** | 0.0126 *** | 0.0116 *** | |

| (0.003) | (0.002) | (0.003) | ||

| DFD | 1.1 | 1.681 *** | 3.397 *** | |

| (1.101) | (0.542) | (1.123) | ||

| Total effects | OIS | −2.224 | −3.949 *** | 2.23 |

| (2.052) | (1.063) | (1.836) | ||

| INNO | −0.0175 | −0.0461 ** | 0.0138 | |

| (0.022) | (0.023) | (0.031) | ||

| AQ | −0.0121 | −0.0207 * | −0.0226 | |

| (0.019) | (0.011) | (0.016) | ||

| 0.0828 | −0.278 *** | −0.124 ** | ||

| R2 | 0.714 | 0.87 | 0.727 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xie, H.; Ouyang, Z.; Choi, Y. Characteristics and Influencing Factors of Green Finance Development in the Yangtze River Delta of China: Analysis Based on the Spatial Durbin Model. Sustainability 2020, 12, 9753. https://doi.org/10.3390/su12229753

Xie H, Ouyang Z, Choi Y. Characteristics and Influencing Factors of Green Finance Development in the Yangtze River Delta of China: Analysis Based on the Spatial Durbin Model. Sustainability. 2020; 12(22):9753. https://doi.org/10.3390/su12229753

Chicago/Turabian StyleXie, Hualin, Zhenyi Ouyang, and Yongrok Choi. 2020. "Characteristics and Influencing Factors of Green Finance Development in the Yangtze River Delta of China: Analysis Based on the Spatial Durbin Model" Sustainability 12, no. 22: 9753. https://doi.org/10.3390/su12229753

APA StyleXie, H., Ouyang, Z., & Choi, Y. (2020). Characteristics and Influencing Factors of Green Finance Development in the Yangtze River Delta of China: Analysis Based on the Spatial Durbin Model. Sustainability, 12(22), 9753. https://doi.org/10.3390/su12229753