2.1. The First Pillar: A Monetary-Financial Taxonomy to Compare and Classify Different Means of Payment

In modern economies, people demand five means of payment with different features. In

Table 1 we show a monetary-financial taxonomy based on the existing work of the International Monetary Fund [

9] and the Bank of International Settlements [

4]. These five means of payment are cash, bank deposits, e-money, stablecoins and virtual currencies. From a technological perspective we distinguish the format and the payment system as key design features, while from an economic perspective we identify the value, the nature of the means of payment, the issuance and the rate of interest. All these design features drive the shifts in money demand.

The first feature defining a means of payment is the format, which can be either object-based or account-based. The object-based format is tangible and allows anonymous transactions between users, as is currently the case with cash. On the other hand, account-based means of payments consist of a data registration in which every user is recorded in a ledger along with its amount of money and its flow of funds.

Any account-based means of payment has a payment system which involves two components. The first component is the ledger, which can be based either on an indirect ledger approach, for example, bank deposits and e-money, or on a direct ledger approach, for example, Bitcoin and other digital currencies based on Distributed ledger technology (DLT). Moreover, the ledger could be designed either in an anonymous basis, for example, Bitcoin, or in a nominative basis, for example, bank deposits and e-money. The second component is payment services, which mainly involves three phases: the processing of the information, in other words, the transfer of payment data between users’ accounts and the updating of the ledger, the clearing and the settlement processes. When these two components are based on digital technologies, these means of payment are categorized as digital currencies.

The current monetary-financial system is mainly based on an indirect ledger approach in which commercial banks issue on-balance-sheet ledgers, in other words, bank deposits. Because in this indirect ledger approach users transfer claims to one another, the payment system needs clearing and settlement processes, such as the market-based deferred-net-settlement networks, in other words, wholesale interbank clearinghouses such as Visa Europe, and the public real-time gross-settlement networks, such as TARGET2. E-money issuers create alternative payment systems based on indirect ledgers, also known as closed loop networks, in which both the payer and the payment recipient must have an account to transfer the funds. In these closed loop networks, such as PayPal and TransferWise, the only payment service needed is the processing of the information. In DLT-based ecosystems, such as Bitcoin and the Libra Proposal, there is a sole and direct ledger replicated in each member, which jointly participate in the processing of the information.

The economic perspective of this taxonomy is reflected in the remaining features: the nature of the means of payment, its value, the issuance and the rate of interest. The current monetary-financial system has two levels. In the second level intermediaries issue claim-like instruments as means of payments, such as bank deposits and e-money, which are financial assets that poses an obligation for the issuer to redeem these instruments for cash or bank deposits. Nowadays the most demanded means of payments are bank deposits, which are fractional-backed because commercial banks’ assets are mainly comprised of long-term debt and loans. The issuances of e-money are also fractional backed since the e-money institutions’ assets are comprised of short-term debt and cash equivalents. The first level or anchor of the current monetary-financial system is cash issued by the central bank, which is a real-asset-like instrument because its issuance does not pose and obligation for the central bank to redeem. Reserves are means of payments issued by central banks, convertible into cash and restricted to commercial banks and the government.

The price of any goods in the economy is determined by the subjective preferences of the parties involved in an exchange. The means of payment are not an exception and these subjective preferences, in other words, money demand, steam from their effectiveness in fulfilling the three functions of money [

11,

12].

When we talk about the value or the price of a means of payment we mainly refer to an abstract unit of account. The value of the unit of account is represented by the purchasing power, which can be measured by inflation and exchange rates indexes. During the 5000 years of monetary history, money has gradually evolved from having an intrinsic value, in other words, the use value of gold, silver and other commodities to a monetary value, also known as fiat value, in other words, the value guaranteed by public authorities or private institutions. Nowadays, all means of payment only have a monetary value and hence money demand is volatile and directly depends on trust that public authorities keep this current monetary value stable through monetary policy rules implemented by independent central banks. Changes in the value of money are mainly reflected in changes in inflation rates. Inflation is the result of both real and monetary phenomena. From the real side, we can distinguish: (i) a demand-pull inflation due to excess aggregate demand, which could be driven by an over-issuance of money, which in turn could be driven either by fiscal deficits or by bank credit; and (ii) a supply-side or cost-push inflation, which occurs when adverse shocks in aggregate supply, for example, political mismanagement, armed conflict and trade wars, among others, trigger increases in the price of input goods and services. At a later stage, these processes could trigger an inflation driven by monetary causes since the trust in the sovereign currency could be undermined. In this last scenario, users reduce their money demand in a particular denomination because they think that this monetary asset does not properly fulfill the three functions of money. This could raise inflation expectations and hence reduce money demand, in other words, a sovereign currency would be gradually replaced by another currency. This money demand reduction may trigger long-term periods of high inflation and currency depreciation.

In

Table 1 we can draw a distinction between two main categories of means of payment regarding the value: sovereign units of account and private units of account. The first category is the funds, which is defined in Directive (EU) 2015/2366 as banknotes and coins, scriptural money and electronic money. All these forms of means of payment have in something in common, they are either issued or guaranteed by a public authority and therefore they are denominated in sovereign units of account, for example, USD, EUR, JPY, CNY, et cetera. The second category is private digital currencies, which could be sub-categorized into virtual currencies and stablecoins. Virtual currencies are defined in Directive (EU) 2018/843 as a digital representation of value that is neither issued nor guaranteed by a public authority and is accepted as a mean of payment. For this reason, virtual currencies are denominated in their own private units of account, for example, BTC, ETH, et cetera. Stablecoins are also denominated in private units of account, for example, TUSD,

~~~

LBR, et cetera. A higher money demand makes some means of payments more capable of serving as a store of value and for this reason they could reach the category of money. Nowadays, sovereign-denominated means of payments are considered as money while private-denominated means of payment do not fulfill, so far, the store-of-value function. As any asset in the economy, the means of payment could have a real nature or a financial nature. Any means of payment inherently bears two risks: fiat-value risk and operational risk. Fiat-value risk can be defined as the reduction of the value of the unit of account held by the user for the abovementioned reasons. Operational risk could be defined as the risk of suffering losses resulting from inadequate designs and technology failures. Additionally, in the fractional reserve banking system there are claim-like means of payment, for example, bank deposits and e-money which bear credit risk, which is defined as the possibility of suffering losses stemming from the issuer’s failure to redeem the sight obligations. Public authorities’ core tasks are to ensure confidence in money and in payment systems. The fiat-value risk is mitigated by the central bank monetary policy, the operational risk by payment systems oversight and credit risk by prudential and supervision regulation, the lender of last resort (LOLR) function and the deposit insurance schemes. On the other hand, cash and Bitcoin have a real nature, since they do not pose an obligation to convert them into another means of payment, and only bear operational and fiat-value risk.

As is shown in

Table 1, the five means of payment can be issued either passively or actively. These different kinds of issuances will be further developed in

Section 2.2 through sectoral balance sheet dynamics. A passive issuance means that money is issued in an amount determined by the users’ money demand and without limits, as it is currently the case with cash and e-money. On the other hand, an active issuance must follow a certain rule, such as the rule of granting credit in the issuance of bank deposits, the monetary policy rule in central bank reserves and the predefined-mining rule in virtual currencies such as Bitcoin.

Regarding the rate of interest, some account-based means of payment can bear interest, whether it is a positive, a negative or zero interest rate. Bank deposits bear interest, virtual currencies could bear it and e-money cannot because it is prohibited under European Directives. Object-based money like cash could also bear it, but nowadays in all countries it is a non-interest-bearing means of payment.

2.2. The Second Pillar: A Sectoral Balance Sheet Dynamics; The Creation and Destruction Process of Money and Other Means of Payment

In this section we develop the issuance design feature in detail. A passive issuance means that money is issued in an amount determined by the user’s money demand without limits. On the other hand, an active issuance must follow a certain rule. These issuances are studied through sectoral balance sheet dynamics based on double-entry bookkeeping principles. This approach is based on the following works: [

4,

13,

14,

15].

In our sectoral balance sheet dynamics, we start from a model that represents the current situation of five economic sectors which hoard, issue and transfer means of payment. The financial figures in the balance sheet of each sector broadly represent the Euro-area economy during 2019, but these figures are less important than the flow of funds. As is shown in

Table A1 of the

Appendix A, the first economic sector is the central bank (I), which is the first level participant in the current fractional reserve banking system. Central banks issue two means of payments, cash and reserves, and on the asset side they own international reserves, main refinancing operations (MRO) and public debt. Commercial banks (II) at a consolidated level are the second tier in the current system. They issue bank deposits, receive MRO funding from the central bank and are linked to foreign banks through a deposit and an asset account aimed at facilitating foreign trade and other cross border capital flows. On the asset side, commercial banks make loans, purchase public debt and use and hoard reserves. The third sector (III) is the government, which issues public debt and owns reserves in order to transfer funds in the context of the public spending. Households and companies (IV) demand money, mainly cash and bank deposits, own real assets as their main source of wealth and on the liability side, receive loans. The last sector is foreign commercial banks (V), which are linked to domestic banks. When analyzing e-money, stablecoins and virtual currencies, the fifth sector will be replaced by the e-money and private digital currency providers. The financial accounting of the flow of funds is implemented in one, two or several steps, and in quantities of 10, which will be represented as follows: 1(+10)2(−10) and 3(+10)2(−10)4(+10), among others.

As was already mentioned in

Section 2.1, in modern economies bank deposits are the most demanded means of payment. For this reason, in this section we focus on examining the main ways through which bank deposits are created. In

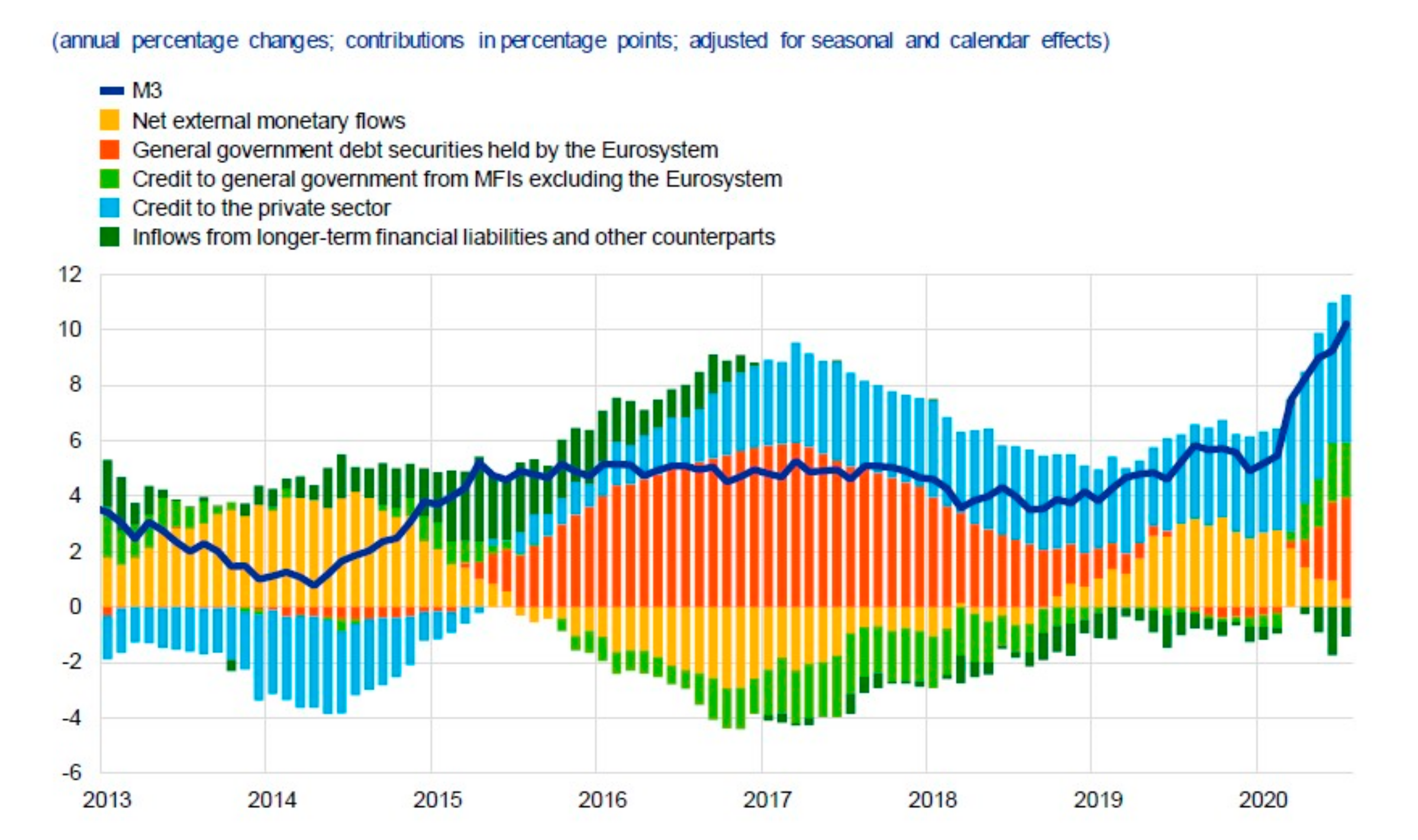

Figure 1 we show the ECB’s monthly monitoring of the broad money growth, which identifies the following three main types of active issuances or counterparts within the bank deposit creation and destruction process, in other words, three sources of money creation by commercial banks, Lending to households and companies, purchases of public debt and net external monetary flows. In March 2019 the money supply measured by the M3 broad money aggregate (€12.5 trillion) primarily comprised bank overnight deposits (€7.3 trillion) and, to a lower percentage, cash (€1.2 trillion) and short-term deposits up to two years (€3.4 trillion). When the ECB launched the asset purchase program (APP) in 2015, during a four-year period, the main source of money creation was purchases of public debt by commercial banks along with credit to the private sector, as

Figure 1 shows. Once the ECB finalized its APP, the main contributors of bank deposits growth were net external flows and credit to the private sector. Today, due to the Great Lockdown caused by the COVID-19 pandemic, the main sources of money creation are credit to the private sector and purchases of public debt.

The processes of money creation in the form of bank deposits are illustrated in

Table A2,

Table A3 and

Table A4.

Table A2 shows how bank deposits are created in the process of bank lending. When commercial banks at a consolidated level make a loan they simultaneously create a matching deposit in the borrower’s bank account and both the balance sheets of the private and the commercial banking sector increase [

16] On the contrary, when that loan is repaid the new bank deposit is destroyed and both balance sheets decrease by the loaned amount.

In

Table A3 we show how public debt purchases by banks create new deposits. In the first step, the government issues public debt that is purchased by commercial banks, which transfer central bank reserves to the government. In the second step, the government, with these new reserves borrowed, implements public spending increasing both the balance sheet of the commercial banks and the households and companies.

Table A4 shows the money creation process regarding external monetary inflows. When a domestic company exports real assets in exchange for foreign currency, the domestic commercial bank’s balance sheet increases while the foreign commercial banks replace the importer’s deposit account with the domestic commercial bank´s deposit account.

The creation process of cash follows a passive issuance rule. This issuance depends on the public demand of this type of money. When people demand cash, commercial banks also demand it from the central bank, which produce it and then issue it in exchange for reserves owned by commercial banks.

At the final stage of the system, users withdraw this cash in exchange for deposits, which decreases the balance sheet of commercial banks.

Table A5 shows how e-money is passively issued by electronic money providers. These institutions increase their liabilities and assets to the same amount with the obligation of holding a reserve comprised by cash equivalents and short-term securities. Private institutions that issue stablecoins could do it, as shown in

Table A6, either passively (step 1), in other words, in the same way as e-money providers, or actively (step 2) by granting long-term loans as commercial banks do. Finally,

Table A7 shows the creation of actively-issued virtual currencies such as Bitcoin, in which miners use electrical power, which is a real asset, in order to create another real asset, the Bitcoin.

2.3. The Third Pillar: The Five Inherent Risks to the Current Fractional Reserve Banking System

In this section we identify five inherent risks to the current fractional reserve banking system stemming from sudden shifts in money demand and supply. Money demand shifts can be split into two categories depending on whether they are driven by technological design features or by economic features. Since official coinage of metal-based money in ancient times, the deposit banking advent in the middle-ages and the eighteen-century with bank-cash issuances to the current rise of digital currencies, technological innovation has always transformed the payment landscape and has driven the shifts in the demand of different means of payment.

Nowadays, digitalization is changing the way we pay. Bank deposits and e-money have grown increasingly thanks to payment innovations such as smartphone apps and touchless credit and debit cards. People are increasingly substituting less technologically advanced means of payment for more advanced ones. This rapid substitution is particularly focused on cash, whose demand is decreasing in many countries and is being replaced by other means of payments, such as bank deposits and e-money. This has raised concerns among policy makers about a potential materialization of a risk of a cashless society. In line with the Bank of Canada’s approach [

17], we identify three adverse effects of a potential materialization of this risk: (i) the financial exclusion in emerging market economies(EME) and advanced market economies(AMEs) of unbanked and underbanked people; (ii) a payment concentration in bank deposits, which prevents people from paying and saving in a credit-risk-free means of payment; and (iii) a less effective monetary policy, since cash disappearance would reduce the central bank’s balance sheet and the demand of reserves.

This digitalization trend could also disrupt the traditional bank-based ecosystem. E-money adoption could be fast due to its attractiveness, as is currently the case in China. A sudden replacement of bank deposit with e-money, stablecoins and virtual currencies could materialize a risk of structural bank disintermediation (II), which consists of a sudden contraction in bank credit to the real economy. This sudden contraction negatively impacts the business models of banks and borrowers, since both are used to operating with a certain amount of credit. Commercial banks would reduce its customer interaction [

18], which reduces credit activity and hence their balance sheet, their profitability and increases the cost of their funding. The substitution of bank deposits for e-money and stablecoins could be assimilated into money market funds (MMF) and investment funds issuances, which disintermediates the banking system and plays an important role in interbank funding, as it is currently the case in US and China.

The active issuance of claim-like means of payment by commercial banks, in other words, bank deposits make them operate with a structural liquidity shortage, since they cannot convert all their overnight deposits into cash and into deposits in other banks on a one-to-one basis. A sudden migration from bank deposits to e-money and stablecoins would replace retail deposits, which are a stable source of funding, by wholesale deposits, which are a less stable source of funding. This could trigger a risk of systemic bank runs (III).

The second category of sudden shifts in money demand is related to the fiat-value design feature and hence with the unit of account of a means of payment. As mentioned in

Section 2.1, nowadays all means of payment have a monetary value and hence money demand depends on trust in the issuer to keep this fiat value stable. This trust could be rapidly undermined for monetary and real causes and hence people could substitute means of payments denominated in domestic units of account for others denominated in foreign units of account in a gradual process known as official and unofficial dollarization [

19]. This process could materialize a risk of currency substitution (IV), both domestically and internationally [

20]. The main consequence of the potential materialization of this risk is the loss of the monetary sovereignty, which could trigger (i) long-term periods of high inflation, (ii) exchange rate depreciations, which would undermine the country’s ability to import and export in its own currency [

21] and hence increase the country’s foreign-denominated debt, and (iii) a subordination to a foreign country’s monetary policy. The currency substitution process is eased by fractional reserve banking systems, which are linked by international correspondent banks.

There could be a second scenario of currency substitution, the one in which the sovereign currency is replaced by private digital currencies, such as Bitcoin and stablecoins [

20]. In Europe and US, Facebook´s issuance announcements [

22,

23] of its own fiat-backed digital currency, the stablecoin Libra, has raised concerns among authorities due to probable adverse impacts on monetary sovereignty in case this stablecoin is widely accepted. The second step of

Table A6 shows how stablecoin providers would actively issue stablecoins by making loans if these means of payment would be used as a store of value and hence become widely accepted.

Regarding the sudden shifts in money supply, they are explained by the commercial banks’ ability to create new bank-deposit money in the process of bank lending. This money creation process is the main cause of economic and financial bubbles risk (V). In the current fractional reserve banking system, money creation mainly depends on banks’ willingness to supply credit. Sudden changes in this willingness could trigger credit booms which profoundly distort the resources allocation process and, therefore, the productive and consumption structure, in other words, create financial and economic bubbles. These money creation processes finally stop because commercial banks face limits in their lending activity. When these bubbles finally burst, the economic activity collapses and innumerable adverse effects arise, such as high unemployment rates, GDP contractions and banking, currency and debt crises, as was the case during both the Great Recession and the Great Depression.

In this paper we assume that the main cause of the economic crisis is the overshooting of the money supply by commercial banks. In order to clarify this, we will make two main assumptions. First, economic crises are generally defined as a negative GDP annual growth rate for two consecutive quarters. The second assumption is that an economic crisis has two main causes: (i) exogenous factors, such as the Great Lockdown (COVID-19), wars, natural disasters, trade wars and secular stagnation, among others; and (ii) an endogenous factor, which is the current money creation process already described driven by commercial banks and which could have either a domestic or a foreign origin.

These assumptions are based on the following works: [

1,

2,

3,

24,

25,

26]. The work of Richard Vague is worth mentioning because he takes an in-depth look at all endogenous-economic crises since 1844. Specifically, he defines the endogenous cause of economic crisis as an increase in the private debt-to-GDP ratio by 18 percent accumulated over five years [

27]. Moreover, if this ratio reaches 150 percent the risk of an economic crisis increases significantly.