Abstract

In our study, we tried to collect empirical studies focusing on the economic impact of Geographical Indications (GIs). Using a systematic literature review approach, we investigated three different aspects: market size, price premium and impacts on rural development. Based on the findings of studies both from the grey and academic literature, the results are quite mixed. Though the number of GI-related empirical studies has risen in recent years, there is a lack of economic data to support policies related to GIs, even in the European Union (EU), where the most important GI system exists. Overall, it is impossible to draw any general conclusions about the economic impact of GIs. Some countries have remarkable GI market size, and some GI products have a determinative role in both domestic and export markets; however, it is not general. Again, some particular GI products of some regions could gain significant price premiums, but due to the associated higher production costs and unequal distribution in the value chain, it might not result in higher producer incomes. The most conflicting empirical results were found in how GIs can contribute to regional prosperity, as evidences of the harmful effects of GIs on rural development were also identified.

1. Introduction

Geographical Indications (GIs) were introduced into international trade treaties by the European Union (EU) during the Uruguay Round trade negotiations. Although strongly resisted by the USA and other New World countries, the 1994 Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement, under the World Trade Organization (WTO) Agreement, created an effective compromise. Since then the EU has been a strong advocate for increasingly strong GI regulation and consultations are currently under way to further strengthen EU GI regulations.

Within the EU, the GI program is managed by the Directorate-General, Agriculture and Regional Development. In this paper, the focus is on how GIs perform as an instrument of agricultural and regional policy, reflecting the EU arrangements. Our particular focus in this study is on the size of the market for GI products, the extent to which they contribute to increased net producer income and the extent to which they contribute to regional development. There are, of course, many other important questions about how GIs operate, for example what price premiums consumers are willing to pay, but these are beyond the scope of this particular study (several comprehensive reviews on GI related WTP exist, however with conflicting results. Even in the European Union, the recognition of GI labels is low and other quality attributes of food products (brand in particular) might have a greater influence on purchasing decision, therefore the role of GIs on WTP for quality food product is not clear).

By 2009 GI systems were used already in 167 countries and regions. Recently China has become the country with the largest number of registered GIs, but for many years the majority of registered GIs were found in the EU [1]. In general, in bilateral trade agreements between the EU and other countries, the number of GIs in the EU (and listed for inclusion in trade treaties) far exceeds the number in partner countries.

The EU-wide system for GIs was first introduced in 1992 [2] and has been revised twice since then (in 2006 [3] and 2012 [4]). The EU system has two major types of GI. Protected Designations of Origin (PDOs) are very similar to the French Appellation d’Origine Contrôlée (AOC) system, already existing before the EU GI system [5,6]. Protected Geographical Indications (PGIs) have a German origin with a strong reputational element but a much lower link to the place of origin [7]. Just five EU Member States (Italy, France, Spain, Portugal and Greece) are the primary users of the EU’s GI system, both in terms of the number of registered products and in economic importance.

Recent trade agreements clearly indicate the political importance for the EU places on GI policy. In current negotiations with both Australia and New Zealand, the EU has again indicated that GIs are an essential element in any trade agreement. This may be surprising considering their limited economic importance in both domestic production and international trade. According to the results of research published in 2019 [8], on average, the share of GI products in the national food and drink industry in 2017 was around 7% in the EU Member States. Further, 58% of EU GI production is sold in domestic markets, and only 22% of EU GI products is sold outside of Europe. Of GI exports, 90% are wines or spirits. The primary beneficiaries of GI labelled exports are France and Italy. But largely due to very limited available data, there is as yet little general analysis of the economic impact of GI policy for either particular product lines or particular countries.

It needs to be said that there are significant methodological challenges in separating the impact of GI policy—which is effectively a regulation about food labelling—from other closely associated characteristics. It is not a simple matter to isolate the effects of a product’s quality in itself, from the place it is made, in itself, from the GI label that proclaims the place-product combination is regulated. Further, a GI labelled product may also carry a trademark and, as will be seen from the literature reviewed below, the GI and trademark labels not always work in harmony. The lack of useful data does not make these challenges any easier.

Despite the limited data, there is a voluminous literature on GIs. Given the data limitations, much of this literature is theoretical or conceptual, drawing conclusions on this basis rather than on empirically verified data. To the best of our knowledge, so far, there were only a few attempts to synthesise the evidence-based literature on GIs.

But these existing GI literature reviews focus mainly on the European system and only give general overviews of the available resources, both in terms of methodologies and disciplines (see Table 1). None had the primary purpose of assessing the empirical results. Rather they considered the GI literature from a specific viewpoint (e.g., welfare implications, consumers’ attitudes, or simply the papers from a given geographical region).

Table 1.

Studies reviewing academic literature on GIs.

Marchesini, et al. [9] conducted a literature review on the perception of agro-foods quality cues in the international environment, where GIs were one of several quality attributes. In his conceptual paper Réquillart [10] reviewed willingness to pay (WTP) research, summarising eight previous studies on consumers’ willingness to pay for GI products. Barjolle, et al. [11] collected the methods used for evaluating GI systems and summarised the results of the EU funded SINER-GI project designed to raise GI awareness. Teuber and her co-authors reviewed the (mainly theoretical) economic literature on GIs, focusing on the welfare implications, concluding with some empirical findings that consumers prefer local and GI food [12,13].

Deselnicu, et al. undertook a meta-analysis of GI food valuation studies and found that “brands [trademarks] and GIs may play a similar role in product differentiation, and thus, be substitutes for each other” ([14], p. 43). Using the same approach, Deselnicu, et al. [15] collected 25 GI valuation studies and found the GI price premium to be lower when other product differentiating tools are also available (e.g., brands/trademarks for processed food products).

Herrmann and Teuber [16] collate a number of WTP studies, finding that origin is valued by consumers, mainly because of quality and cultural preferences. Bienenfeld [17] provides a meta-analysis of willingness to pay, especially for organic foods. Feldmann and Hamm [18] reviewed literature of how consumers react to locally produced foods and found a willingness to pay a price premium. Grunert and Aachmann [19] reviewed the demand side literature, mainly focusing on publications about consumers’ reactions to the EU quality labels. Papers about the implications of GIs available in Elsevier’s Brazil database were meta-analysed by Mirna de Lima, et al. [20]. Dias and Mendes [21] prepared a bibliometric analysis of articles using EU GI labels. They found that the most investigated issues were PGI, olive oil, dairy products (mainly cheese) and chemical composition.

Leufkens [22] tried to quantify and evaluate the overall marginal consumer willingness to pay for the European GI label. Using a meta-analysis and a heterogeneity analysis, he found that consumers have substantial willingness to pay for GIs; however, there are significant differences among products. Caputo, et al. [23] investigated consumers choices regarding traditional food products. They highlighted the low level of recognition of the EU quality labels. Also, they collected the main drivers why consumers seek for traditional products and found that sensory appeal and the natural character, health and safety issues, origin, ethical concerns, price, and convenience are the most important. Lastly, their results indicated that it is not clear what are the most important factors of consumers’ decision-making process about such products.

To the best of our knowledge, the last GI-related review was conducted by Cei, et al. [24], with particular attention given to the economic effects serving rural development initiatives. They concluded that GIs could generate value-added at the end of the value chains: for consumers and retailers in particular. However, on the producers’ level, the results are somewhat mixed and depend on the specific local conditions. A summary of these identified literature review articles is provided in Table 1.

Against this background, the aim of this paper is twofold. First, it updates current knowledge about GIs, focusing on empirically validated results. Second, it tries to identify the key areas where policy-makers need to understand when, where and how GIs work best, updating earlier research conducted by the authors.

To achieve this, the study includes all agricultural and food GI products (also wines and spirits). However, non-agricultural and food products, together with services, are excluded and are not part of this research.

After Section 2 describing the methodology, Section 3 considers the evidences. First general results from the grey literature are summarised, then the next part with three subsections covers three different topics based on the academic literature: the market size for GI products, the effects of GIs on net producer income involving the issue of price premiums, and the GI-related tools to enhance rural development and prosperity. Section 4 draws together the results and findings, identifying key gaps in knowledge and identifying critical areas for policy-oriented research.

2. Materials and Methods

To achieve a wide-ranging overview of the empirical evidences on GIs, a comprehensive literature review was conducted using five significant online databases: Scopus, Web of Science, JSTOR, ProQuest and Science Direct. The keywords used were “geographic*” and “indication*”. These two keywords had to be included in the title, abstract, or keywords. Also, the article had to contain empirical data and/or analysis. The search was restricted to studies in English or with some information available in English.

We also included key European Commission reports. Finally, our review was also extended to the references found in the most important articles identified and these references were also added to our database.

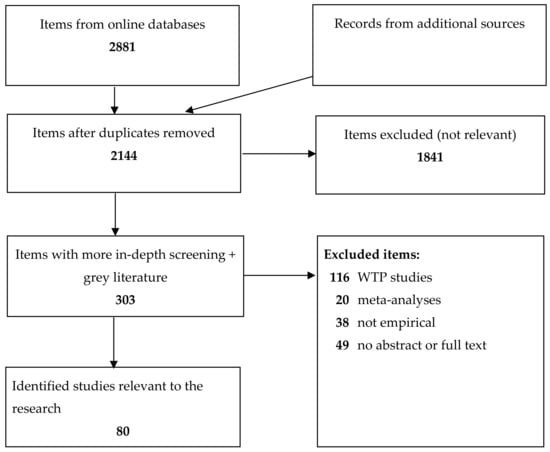

From the online databases, the initial search resulted in 2881 items. To include only relevant studies in the final literature analysis and to exclude duplicates, we used the online software package Covidence. After excluding duplicates, 2144 studies remained that might provide empirical findings on the topics investigated. Figure 1 describes how we screened and identified the relevant literature. The initial screening, based on title and abstract, was independent, but then the authors discussed items with conflicting outcomes. This first screening resulted in 1841 items being excluded. The 303 articles remained were also each screened in more depth by at least two of the authors. Again, authors first screened independently, but then discussed articles with inconsistent results. Items with willingness to pay methodology and meta-analysis were excluded; however, we reviewed the papers identified in these meta-analyses. Also, studies that turned out not to be empirical and where no text was available, were excluded from our research. The final set of relevant studies employing empirical approach was 80 publications from the systematic literature review, including 5 studies from the grey literature, trying to cover all the empirical GI literature published until the end of February 2020.

Figure 1.

Pathway of the systematic literature review.

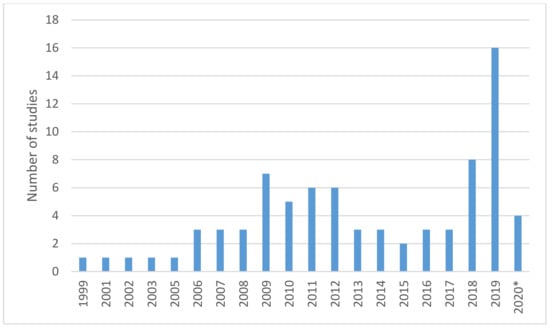

Figure 2 indicates the empirical GI studies by their year of publication. There is a clear growing tendency of such studies in recent years, as more than the third of the publications were published after 2017.

Figure 2.

Empirical GI studies identified in our study, by year of publication. * Our collection covers studies available at the end of February 2020.

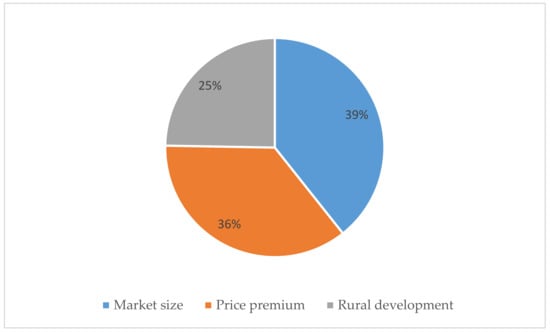

Figure 3 indicates the topics of the articles identified. Obviously, a paper can focus on more than one topic relevant to this study. The numbers clearly indicate that research on GIs is very much about trying to measure the economic importance of the sector and the number of papers about impacts on regional prosperity is quite limited.

Figure 3.

Topics covered by empirical GI studies.

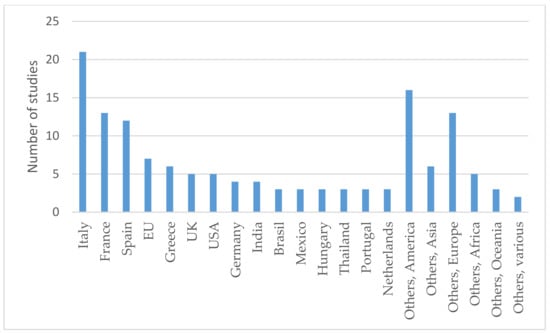

Most of the studies investigated Italy, France and Spain, the primary beneficiaries of the EU GI system. Several extra-EU countries were also often studied, in the Americas in particular (Figure 4).

Figure 4.

The territorial focus of empirical GI studies.

Researchers mainly focused on the empirical investigation of GI food products, as 73% of the papers covered GI food products. Wines and spirits together were the topic of 17% of the papers, while the rest of them covered various product lines.

3. Results

3.1. Grey Literature and Centralised Datasets

One of the most comprehensive reports is conducted by the London Economics. Undertaken for the European Commission (EC), this report highlighted “the lack of comprehensive data on the number of PDO and PGI producers, the size of the agricultural land devoted to PDO/PGI production, the value and volume of production and the value of sales” and noted that this was “a serious constraint to the monitoring and evaluation of the scheme at national and EU level” ([25], p. 254).

The authors of the London Economics report suggest that the number of registered GI products can describe market size. This could however be misleading, as the number of registrations can be influenced by factors such as national procedures and incentives, country-specific institutional characteristics, different social-cultural contexts, the depth of variety within a particular product group etc. There will also be substantial differences between registered GIs in the volume of output, its value and the number of producers. According to the report, the number of GI products is highest in the Mediterranean EU Member States, also with significant market for these products. The report also highlighted the concentration of GI registrations in particular food categories, “Fruit, vegetables and cereals”, “Cheeses”, “Fresh meat (and offal)”, “Oils and fats/olive oils” and “Meat-Based Products” represented more than 80% of the total number of registrations. It is clear that GI labelling either works better or appeals more to producers, in some product lines than in others.

Another major data sources are the contracted reports conducted by AND-International and published in 2008 and 2019 [8,26]. These reports analyse all the four GI regimes (agricultural products and foodstuffs, wines, aromatised wines and spirits). Both primary (direct and indirect surveys) and secondary (centralised datasets) data were included, but it is clear that for some areas only educated guestimates were available. This underlines the problem of the lack of available datasets on GIs again.

Based on the results of the AND-International reports we can assume that the market share of the GI products (all the four regimes, excluding Traditional Specialty Guaranteed foods) in 2017 was around 7% with a sales value of EUR 74.76 billion. GI wines had the highest share in the GI market with 51%, followed by the food products (35%) and spirit drinks (13%), while the market of aromatised wines was hardly measurable (around 0.1%). Compared to the first report (with latest data of 2010) the total sales value of the GI products increased by 37% on an average (an increase of 33%, 65% and 27% and among wines, foods and spirits, respectively). This remarkable growth was mainly caused by the increased number of new GI products; however, the growth of French, Italian and Spanish wines and French spirits was also determinative. The reports also found extreme concentrations. Among wines, 90% of the EU28 sales volume and 95% of the EU28 sales value in 2017 came from France, Italy, Spain, Germany and Portugal. In case of agricultural products and foodstuffs, PGI products had 58% share, and only 42% of GI foods sold had a PDO label, while more than half of these GI products came from only three EU member states (Italy, Germany and France). Among foods, a few product categories had significant shares: cheeses (36%), meat products (16%), beers (13%), fresh meats (12%) and fruits, vegetables and cereals (8%) were the five most important categories, altogether representing 85% of the total GI foods. A huge concentration was also identified. For example, out of the 235 GI cheeses, the Italian, French and Dutch products represented 82% of the total sales value. The GI spirit market was highly dominated by three products representing 90% of the total market (Scotch Whisky, Cognac and Irish Whisky). In 2017, the share of GI products exported had reached 42% of the total sales with 20% of intra-EU markets (e.g., Switzerland) and 22% of extra-EU markets (mostly USA, China and Singapore). The majority of the exported European GI foods came from France, Italy and the UK and was pulled by a very few GI products (e.g., Scotch Whisky).

Regarding price premium, the AND reports calculated value premiums, using ex-factory and wholesale prices, compared to similar products without GIs and weighted by the GI sales volume. On average, they found 107% value premium for EU GI products, with a slight decrease compared to the 114% identified for 2010. The authors underlined the importance of French products and wines, as their contributions to the total value premium is higher than expected. Also, they calculated a higher value premium for processed products than raw products.

The Areté report [27] conducted between the two above mentioned AND-International reports, confirms their general results based on their few selected cases. The authors found remarkable price premiums for most of their 13 GI case studies, though with extreme variability in the extent. For GI agricultural raw materials, the price premium was limited but significantly higher for PDO than for PGI products. They also found that the producers of the final product usually had more than 70% of total retail value (and also higher gross margins). This also implies that the primary producers’ share is more limited (though this is almost the same for both GI and non GI value chains) and therefore the farmers benefit less than retailers from GI labels.

As an initial step of the research we have also inspected the official databases of the European Commission dedicated to the GI system. eAmbrosia [28] is now the official register of GI products recognised by the European Union. However, this online database is limited to technical information (milestones of the GI products’ registration, product descriptions etc.) and neither empirical nor market data are provided.

EUROSTAT [29] is the official EU statistical database and only collects very basic data on grapes for wines with geographical indication. According to the latest dataset, in 2016, 72% of total grape producing area was dedicated to produce grapes allowed for PDO or PGI wine production, representing 1.2% of the total EU utilized agricultural area.

The European Commission’s Farm Accountancy Data Network (FADN) is aimed to measure the income level of EU agricultural holdings and the impact of the EU Common Agricultural Policy [30]. In its publicly available dataset there is no centralized data available on the impact of geographical indications.

3.2. Academic Literature

3.2.1. The Market Size of GI Products

Regarding the academic literature, only a few studies gave quantitative data on the size of the market. After introducing these few studies, we cover several related aspects: interaction between price and quantity, export and import, institutional issues, wine related studies and trademarks.

Arfini and Capelli [31] measured concentration in the Italian GI sector, but also explored data on the size of the market. Although Italy has the most GI registrations (PDO and PGI together) in the EU, just 15 products generated 90% of the entire Italian PDO turnover. The most important GI products were cheeses and processed meat products, with substantial differences in average turnover. In general, firms producing PGI products had higher values than those producing PDO products. Regarding market destination, PDO products are mainly sold domestically (86%) and other EU markets (8%), while the PGI products exported are sold in more distant markets (e.g., 43% olive oils shipped with PGI labels were sold in extra-EU markets).

Even among well-known GI foods, there are remarkable differences in terms of the size of the market and the value chain. E.g., the Italian Parmigiano Reggiano PDO cheese industry processes the milk from 300,000 farmers (in contrast, the first Brazilian GI cheese Serro is produced only by around 100 dairy farmers [32]) and an annual 3 million wheels of cheese are made by 393 dairies (of which 60% belong to a cooperative), the Spanish Ternasco de Aragón PGI fresh lamb meat is produced by many large cooperative groups but distributed by only three enterprises (of which 66% is a cooperative) [33].

In 2007, the Portuguese GI food market was estimated to have a EUR 70 million sales value, dominated by very small producers. Only about two-thirds of GI product was sold in the real market, the rest being bartered [34].

The real market performance of PDO cheeses in Italy was estimated by Galli, et al. [35], who examined 11 varieties in 2008. On average, a PDO cheese in Italy had EUR 50 million turnover with an average production of 6232 tons. Substantial differences existed between products, and only three of the selected varieties exported more than 20% of their total production.

Also, Italian PDO cheese and olive oil was the subject of the ex-post assessment of Carbone, et al. [36]. Results showed that due to the better connection to the place of origin and therefore reaching niche market segments, smaller producers had better performance than the bigger ones. On the other hand, producers with lower-ranked products (based on the authors’ multi-criteria analysis) usually use conventional distribution channels reaching broader markets with higher volume and turnover.

In Hungary, Jantyik and Török [37] used a mystery shopping approach and found a less than 1% market share of GI foods in the supply of the most dynamically growing discounters.

It is essential to measure the interaction between price and quantity to get a full picture of the potential market size. In our systematic literature review, we found only one study measuring price elasticity. Monier-Dilhan, et al. [38] compared French PDO and non-PDO cheese varieties, using home scan data from the period of 1998–2003. Based on their results, the level of price elasticity of PDO cheeses is similar, or even higher than of non-PDO cheese. The authors also suggest little price substitutability between these products (PDO and non-PDO); however, they were all in possession of several trademarks, which might also influence reputation.

Several studies focused on the export-related performances of GI products. Leufkens [39] found that EU GI policy has some impact on trade: PGI has a trade-creating effect in general, while in case of PDO, only alcoholic products can expect better export performance. On the contrary, the empirical results suggested that PDO food products and PGI wines instead create trade-diverting effects. Other empirical results show that GIs play a more significant role in international trade when the importer has no GI protected product in the same product category [40]. For the European cheese industry, Balogh and Jámbor [41] found a high level of intra-EU exports, as 80% of the cheese exported by EU member states are sold in another EU member state. Regarding GI, they found that countries exporting cheeses with PDO label have a comparative advantage over other countries without GI cheeses.

Belletti, et al. [42] investigated the most exported Tuscan GI products and found that for small scale producers it could be considered as a marketing tool, however, in general, GI is often used as a tool for defending the existing market positions. Among the selected products, olive oils were the most export-oriented. PDO olive oils were targeting the intra-EU markets, while ones with PGI label were usually exported outside of Europe, mainly to the USA. The results also indicated that exporting firms with their own trademarks had less interest in PDO or PGI labels.

Török and Jámbor [43] focused on the European ham trade and found that GIs have a trade affect as exporting countries in possession of PDO/PGI labelled ham had a higher level of comparative advantage.

In Canada, for the cheese market Slade, et al. [44] found that GI-related restrictions might benefit not only the producers/exporters of the GI labelled products but also local/domestic cheeses without GI, as additional information on GIs might stimulate consumption for all cheeses.

Only limited research investigates (potential European) GI labelled imports. For Thai GI fruit and coffee products, Wongprawmas, et al. [45] highlighted that the European market is already an important export destination. Although the Thai government set up their GI system to certify high quality level, results suggest that these products can expect increasing market positions, but that a GI label alone would not guarantee success. Another Asian study focused on the GI tropical fruit durian in Malaysia [46]. Authors found a significant increase in market share; however, due to the small size of producers and to the lack of an institutional organisation, currently, there is no opportunity of attracting export markets. Ghana is among the few African countries certified to export honey to the EU market; however, the export so far is not remarkable. Beekeepers of Ghana, therefore, would like to follow the example of the Oku White honey, which has received the African PGI label, resulting in increasing sales and prices, together with exports to the EU [47]. In Chile, neither the national GI labels nor the public certification trademark is widely used among the producers; therefore they cannot meet their original expectations to increase market share and to reach export markets [48]. Indian GI rice Udupi jasmine is entirely sold in the domestic market, and experts think that e-commerce might strengthen the position of this traditional food outside of the producing region [49].

Several studies focused on GI-related institutional issues. Based on the Spanish beef market Bardají, et al. [50] found that geographical origin and designation of origin are not among the top priorities for retailers. However, as their consumers care about these logos, they sell GI labelled products.

The well-known PDO Parma ham (“Prosciutto di Parma”) was the subject of research of Dentoni, et al. [51]. In-depth interviews indicated remarkable heterogeneity among ham producers, with smaller producers in favour of strict PDO regulations (in terms of controls and standards). In contrast, large scale producers—often producing many non-GI products as well—would prefer more flexibility and would favour of the establishment of a PGI labelled ham. So far, this latter initiative has not happened.

Kizos and Vakoufaris [52] studied the olive oil supply chain of a Greek island. Among small producers, they recorded a high level of self-consumption (up to 29%). Although Greece has a longer GI tradition, the vast majority of the olive oil produced in Lesvos Island is sold in bulk, and only a very small part (less than 1%) marketed with GI labels.

Using value chain analysis, Tregear, et al. [53] inspected the case of a Hungarian onion with a PDO label. Onion is mainly sold as a raw material; therefore, onion producers need to capture higher margins and access to bigger markets. They found that market orientation is essential, especially for small producers. Also, diversification might be another way for higher value-added. In practice, it would mean cooperation with other sectors (tourism and hospitality, in particular) that might have a positive impact on the market situation of this product.

Considering the case of the few Baltic GI products, Bardone and Spalvēna [54] identified a growing interest in producing and consuming traditional foods in rural tourism in both Latvia and Estonia. Here these quality labels are part of the rural tourism and preserve cultural heritage.

Corsican clementines have always targeted a niche market, as they could never compete with Spanish products sold in huge quantities. However, mainly due to the PGI registration of this clementine only allowed to be sold with leaves (indicating the freshness of the product), shipments have started growing again after decades of struggling [55].

Many papers investigated the market size of GI wines. Some studies give exact numbers for specific wine GIs, as wine and vine statistics are usually quite comprehensive in the EU member states (e.g., in Germany, Mosel GI wines represents the 10% of the total German wine production [56]). In Brazil, De Mattos Fagundes, et al. [57] found that GI registration can stimulate the market performance of the producers. In the GI region of Vineyard Valley, the number of wineries has more than doubled following GI registration.

Agostino and Trivieri [58] investigated the export performance of quality wines produced in selected regions of France, Italy and Spain. In these countries, the share of the selected wines in the total wine export is high, and has significantly higher prices, compared to ordinary table wines. Also, these high-quality wines have higher export values usually sold in rich importer countries (mainly in Western-Europe and East-Asia). The authors identified differences as French wines benefit more from the GI label than do their Italian and Spanish competitors, both in terms of market share and price level.

The same authors [59] tried to estimate the market performance of Mediterranean wines (PDO, PGI and non-GI) in the BRICS countries (Brazil, Russia, India, China and South Africa), using a bilateral export model. Their results showed that PDO wines have a high market value due to the high prices received mainly by French wines, while PGI wines have only a moderate price premium.

In the case of Tuscan wines, participating in food quality schemes (PDO, PGI, organic) might increase the number of distribution channels, targeting different markets [60].

With a broader context of wines and other alcoholic products, several empirical findings also exist. Teuber [61] investigated a GI apple wine of Germany, both from the supply and the demand side’s perspectives. According to the producers, protection against free-riders and imitations, together with the prevention against price erosion, were the main reasons for the GI registration. From the consumers’ side, the research showed low awareness of the PGI labels, and that consumers tend to pay more for such GI labelled apple wines as they would like to support the local economy. For fruit spirits distilled in Central-Europe Török and Jámbor [62] indicated weakening comparative advantages, especially after the EU accession of these countries after the millennium. Though several Mediterranean GI spirits (grappa, in particular) are prospering, many of the selected Central-European fruit spirits lost their European market despite their GI recognition.

Finally, Drivas and Iliopoulos [63] gave specific attention to the interaction between trademarks and GI labels and found a strong correlation between them. Based on data from 13 European countries, they found that both are mainly used for differentiation, particularly when accessing new markets.

3.2.2. The Price Premium of GI Products

Results from studies investigating price premiums of GI foods differ significantly; therefore, it is essential to keep the location and the product type in mind when interpreting them. First, the attitudes of European consumers are presented briefly, then value premiums in different sectors and value chains are described. The end of this sub-section is dedicated to coffee and wine, where substantial price premiums are more frequently found for premium products.

Van Ittersum and colleagues, in three studies [64,65,66] tested consumers’ preferences for PDO/PGI products. Based on their findings for 13 protected products from 6 European countries, they found that consumers interested in local foods are willing to pay a price premium for a GI product. They also found that low levels of recognition and awareness of these systems among European consumers limit the added value of GI labels [66]. In 2001, they tried to estimate the direct effect of PDO labels on regional food preferences for Italian olive oil. They found that region of origin and the PDO label have different influences but mainly for a specific group of consumers. People living in the product’s region of origin are directly influenced by the region of origin but not by the PDO label itself. Using conjoint analysis, they found an association between higher price and higher quality, but they did not report exact measures of price premiums nor of the proportion of consumers willing to pay these. In his PhD dissertation, van Ittersum [65] summarised his results on GI price premiums saying that consumers’ relative attitudes to regional products significantly influenced the premium they were willing to pay relative to competing products. Similar findings were found later with a Pan-European study [67].

Santos and Ribeiro [68] investigated the GI market for olive oil and cheese in Portugal. They calculated a price premium of 22–30% for three olive oil products, while for cheese 12–23% for two of the four cheeses examined. For the other two cheeses there was no price premium.

Although country of origin labelling (COOL) generally lies beyond the scope of GI policy, we thought it useful to include one US study that indirectly addresses some GI issues. We did this because of the lack of data on US consumer attitudes to products with specific geographical attributes. Carter, et al. [69] report on three US case studies: Vidalia onions, Washington apples and Florida orange juice. They tried to test the success of COOL as a marketing tool and found no evidence that it leads to long-term price premiums. They found that in some cases, product differentiation was not an option because of the characteristics of the product. To benefit from regional attributes, strong control over supply and market entry is required, and this is almost impossible to achieve when the production area is large. Last but not least, they found that advertising and promotion contribute to sales success, but is often not affordable and sometimes legally prohibited.

Hassan and Monier-Dilhan [70] tried to study competition between different types of quality labels. Using a database about the daily food purchases of 8000 French consumers in 2000, they studied six products with labels such as organic, PDO, PGI, and Label Rouge and several trademarked products. They found a price premium for all the products sold with only a quality label (PDO, PGI, organic or Label Rouge). But if the quality label was accompanied by a trademark it had less value in all the cases except the dry-cured ham.

Belletti, et al. [71] calculated the effects of certification costs on the value chains of a PGI olive oil, a PGI beef and a PDO cheese, all from Italy. They found that both the benefits of the GI label and the associated indirect costs differed between products. Besides the direct costs of certification and the more expensive inputs, they identified several indirect costs (e.g., adaption of firm structure, organisation, production process, cost of bureaucracy) and found that these depend highly on how strict the registered code of practice is. This had the consequence that the profitability of these products relies on the form of the regulations.

Bardají, et al. [72] compared two varieties of beef (PGI and non-PGI) in the Navarra region of Spain. Based on monthly wholesale beef prices between 1996 and 2006, they found that PGI beef received a price premium of 7% on average and had better price stability. They also found that the GI product was better able to withstand crises (e.g., BSE) as consumers’ trust was less affected.

In their guide for geographical indications, Giovannucci et al. [1] included several case studies from different countries. They identified price premiums up to 115–145%, but not all products were able to achieve any premium. Some generalisations from these studies are that price premiums can only be achieved over the longer term and that not all specialty products will be able to achieve a price premium based on GI labelling.

The distribution of value-added among supply chain actors was the focus of a study by Roselli, et al. [73]. They investigated an Italian PDO olive oil (Terra di Bari) which represented 15% of the national PDO olive oil market in 2006/2007. By 2009 the Italian olive oil market faced a severe crisis of falling prices. Terra di Bari oil had a price premium ranging from 10% to 15% compared to non-GI olive oils, but among all Italian PDO olive oils, it was among the cheaper ones (with prices 39–55% lower than average). Regarding the distribution of this price premium, they found that within the value chain, the primary producers (the olive farmers) benefitted least from the PDO certification. The extra profit gained from the GI went to the bottling companies and distributors. Although olives suitable for PDO production are more marketable, prices are only slightly higher than for other olives. For Terra di Bari oil, the price premium is collected at the higher level of the value chain (olive mills, packers and brokers). The farmers did not seem to gain any financial benefit from the GI.

Penker and Klemen [74] analysed the costs of EU GI registration and maintenance, using the examples of an Austrian PGI ham and PGI horseradish. They included both direct costs and indirect costs and tried to link them to indirect benefits such as social capital building, intensified cooperation with other rural sectors, higher awareness of and compliance with quality standards. They found that PGI ham, which had a larger output, could afford to subcontract the GI registration process. As a result, the registration costs could then be financed directly by EU funds. This gives larger groups of producers a clear advantage over smaller groups both in terms of costs and time required.

Vakoufaris [75] tried to identify the socio-economic and environmental impact of a PDO cheese produced in Lesvos island, Greece. Comparing a non-PDO cheese that is a close substitute and is made in the same region by the same producers, they found that the PDO milk producers and cheesemakers do not receive any premium price. Supermarkets, however, gained a slightly higher price. They also found that the price of PDO certified milk was often lower than average generic milk prices in Greece.

Iraizoz, et al. [76] tried to estimate the overall profitability and efficiency of the PGI beef sector in Spain. Using the EU’s Farm Accountancy Data Network (FADN) dataset, the results show that PGI production is more profitable in the Spanish beef sector. Regarding efficiency, non-PGI farms have better technical efficiency scores, while the PGI-farms are better in scale efficiency.

Some studies have tried to calculate GI price premiums for rice in India and Thailand. For India, Jena and Grote [77] found that the production of Basmati rice was more profitable than non-Basmati varieties but less than the production of sugarcane. For Thailand, Ngokkuen and Grote [78] found that GI producers of Jasmine rice had higher bargaining power than non-GI producers. This potential impact on prices was found to be due to cooperation between GI producers not to a direct effect of GI registration. In a comparative study of India and Thailand, Jena, et al. [79] found a positive effect of GI adoption on the welfare of rice producers, especially in terms of reducing rural poverty. There was, however, no evidence of any GI impact on consumer prices. This lack of an evident price premium calls into question the benefits of GI production in these cases.

Though food discounters in Hungary target price-sensitive consumers, the limited number of GI foods available in their product portfolio is sold with a remarkable price premium, 43% on an average, compared to their closest substitutes [37].

Investigating online sales of fresh produce on the South-Korean market, Lee, et al. [80] declared that indicating GI label as an extrinsic product characteristic might positively influence the sales and the price of the products.

Albayram, et al. [81] studied what determines consumers’ attitudes towards local and/or GI products in respect of a local and a non-local GI olive oil, both from Turkey. Their results demonstrate that consumers’ decisions are highly affected both by the quality and by origin. Where both products are labelled as GI, attributes like brand, package and origin become important. They found that respondents preferred local to non-local GI products because they considered local GI products better in terms of both reputation and quality. It was apparent, however, that the higher price paid for the local GI oil was because it was local not because it was a GI.

For French mountain cheeses (both PDO and PGI varieties) Lamarque and Lambin [6] found a price premium for the GI producers of the milk used to produce the mountain cheese. The dairy farmers producing for the PDO cheese gained 41% higher prices, while the PGI milk producers received only 21%, compared to the non-GI average French farm-gate milk prices.

While there are few systematic studies comparing price premiums for quality products between different food and drink categories, there are a priori reasons for thinking that consumers are willing to pay a higher premium for wines, and perhaps for coffee, than they are for other food products.

Coffee is an important product for many small countries, and several have established geographical indications for their coffee, to build a reputation and enter the growing global specialty coffee market. In Honduras Teuber [82] used internet auction data with a hedonic pricing model and regional dummies. During the first two years, there was no evident impact of the GI label on the price of Marcala coffee. Latin, South-American and Ethiopian coffees were studied by Teuber [83] using a hedonic price model. Data showed that single-origin coffees gain price premiums of between 20 and 58%. The results suggested that while the country and region of production is essential, these attributes are less important than the sensory quality attributes for prices achieved at online coffee auctions.

Wines have the biggest GI market world-wide. There is also reason to suppose that consumers might be willing to pay a higher premium for quality wines than for other agricultural products. It is therefore worth looking separately at the price premium evidence for wines.

The US wine market was often investigated in terms of origin. Bombrun and Sumner [84] analysed the price determinants of wines in California between 1989 and 2000. Of the 125 different appellations, they found that 64 had significant price influencing power. For instance, the well-known Napa Valley wines had an average +61% price premium because of the appellation, compared to standard “California” wines. Costanigro, et al. [85] also tried to estimate the link between the name (origin), reputation and price premiums for California wines. Based on a dataset of 9,261 observations from Wine Spectator between 1992 and 2003 they found that for more expensive wines, the specific names and labels are more valuable than for the cheaper ones. All wines also benefit from collective names. Schamel [86] investigated relative prices in the US market for wines produced both in and outside the USA to determine the value of the producer brands/trademarks and geographical indications. The results identified origin as important. On average top quality wines from New World producers outside the USA never exceeded the prices of average quality wines from the Napa Valley. On the other hand, the top brands from France or Italy had higher prices than the top US brands. This was interpreted as meaning that Old World wines still possessed a higher regional reputation in the US market.

In their study of the Portuguese GI market, Santos and Ribeiro [68] include not only wines but also olive oil and cheese. Using a sample collected from three different types of retailers, and hedonic price function estimation, they found a statistically significant price premium of between 26% and 46% for three of the six wines. In respect of the other three wines, they found price premiums of 1–14%, but these results were not statistically significant.

In both of their papers, Agostino and Trivieri [58,59] analysed the price and volume effects of GI labelling for wines from France, Italy and Spain. They found that in rich importing countries, all three origins have a value premium, caused by both price and volume effects. The price premium was highest for French wines and somewhat lower for Italy and Spain. Similar outcomes are reported for the BRICS markets, indicating that the GI price premium exists not only in rich but also in emerging markets. In the latter study, the French PDO premiums remain the largest, and significantly higher than the Italian and Spanish premiums. Finally, using historical data for selected French wines, Haeck, et al. [87] found that GIs have a determining role on prices of some Champagne wines; however, this was not the case for wines from Bordeaux or Champagne.

3.2.3. The Impact of GI Products on Rural Development

One of the initial goals of EU GI policy is to promote regional prosperity by improving farmers’ income and retaining rural population in less-favored or more remote areas [2]. Many studies state that, for lower-income countries, GI policy has been promoted as an important avenue for raising producer incomes and to promote rural socio-economic development e.g., [32,47,77,88]. In this sub-section, we review the empirical results from studies that considered the impact of GI products on regional prosperity.

Most of the studies we found were case studies with little hard data. They focused on issues such as institutional arrangements and how differences in these affected the likelihood of any increased income remaining in the original product area.

Through a case study of three Tuscan products (PGI olive oil, PGI beef and PDO sheep cheese) Belletti, Burgassi, Marescotti and Scaramuzzi [71] tried to identify the possible effects of GI products on rural development. They highlighted that the most crucial goal is to attach any higher GI income to the GI producing area, rather than further down the value chain. A critical issue is, therefore, what is the direct impact on the income level of the GI farmers and the indirect effect on local employment. Additional regional benefits can be gained by attracting consumers to the producing area so that there are positive spill-over effects from other actors in the local system. In this way, the production of GI foods can interact positively with tourism and handicraft production. They also point to positive non-economic effects from the presence of a GI supply chain, such as maintaining traditional production methods and encouraging social interaction. Based on the example of other well-known Italian and Spanish GI product Arfini et al. [33] highlighted the level of externalities associated with public goods. In case of the Parmigiano Reggiano PDO cheese and Ternasco de Aragón PGI lamb meat, these public goods can be identified not only at the value chain level but also at the territorial level. Cei, et al. [89] tried to assess the effects of GIs in Italy on the NUTS3 level. They found that a higher number of GI schemes causes a higher level of value-added, thus possibly it fosters rural development in these regions.

Tregear, et al. [90] took a multi-country approach, looking at two Italian (fresh fruit and processed meat) and one British (cheese) product. They examined the role that regional food qualification schemes play in rural development. They found that when local institutions try to involve too many actors in developing the GI regulations, there is a risk of losing the distinctive local characteristic. This is because accommodating many actors with different expectations results in too permissive code of practice. Where this happens, there is a looser connection between the GI product and the region of origin. Overall, they concluded that policies such as GIs need to be considered as part of an extended territorial strategy. The success of the GI element depends on a mix of actors and motivations.

Williams and Penker [91] conducted 25 in-depth interviews with large retailers and stakeholders directly involved in producing and or marketing Jersey Royal and Welsh Lamb. The study identified only indirect impacts on rural development, finding outcomes such as increased transparency and fairness due to GI regulations.

Tequila is a Mexican GI first registered in 1974 and is not only the oldest Mexican GI but also perhaps the most well-known non-European GI. Issues related to the product description were investigated by Bowen and Zapata [92], using several rounds of semi-structured interviews with agave farmers, tequila producers and distributors, government officials, and leaders of farmer associations. The authors found that the sole production requirement was geographic boundaries. They found that because the boundaries covered a very large area, including territories without any tradition and without the required biophysical conditions for cultivating agave, over time the link between the production locality and quality has been eroded. The GI was not recognised in the USA and Canada until 1994, and not until 1997 in the EU. Since then demand for tequila has grown, and traditional agave cultivation and artisanal tequila production has been replaced by modern, industrialised techniques operated by large (international) companies which have entered the market. The expansion of the tequila market thus resulted in a substantial shift in control and ownership, accompanied by concentration, industrialisation, and standardisation. Local actors have lost their influence on tequila production, resulting in economic insecurity among farm households dependent on agave production.

In their multi-criteria analysis of 11 different Italian PDO cheeses, Galli et al. [35] also looked at rural development issues. In assessing rural development, they considered factors like the share of production sold on local and regional markets and the presence of local events for the promotion of PDO products. They found that products with good market performance such as Pecorino Romano and Gorgonzola had high exports and increasing market share. But this was associated with a low contribution to rural development (and also low bargaining power and limited product differentiation). In contrast, small PDO producers of Robiola di Roccaverano, Murazzano and Raschera, with strong production traditions it had much better outcomes in terms of their contribution to rural development.

By analysing the value chain of GI olive oil in Lesvos island, Kizos and Vakoufaris [52] highlighted that a GI label could help smaller producers achieve higher incomes as they have relatively more freedom in choosing between supply chains. On the other hand, large bottlers have to cooperate and satisfy international retailers, so for them, the GI label does not necessarily lead to economic success. As a consequence, there is less association between large bottlers and regional prosperity.

Similar to the case of tequila, Bowen and De Master [93] found that how a GI system was introduced could be harmful to heritage-based food systems. With their comparative fieldwork in France and Poland, they investigated several cheeses (Corsican cheese and Comté from France, Oscypek cheese from Poland) and the multifunctional quality initiatives in the Polish Narew River region. Their most significant finding was that by pursuing extra-local markets, the production processes changed and started losing their former characteristics of regional distinctiveness. They found differences between the three cheese cases. For Comté, heritage and tradition were integrated into a code of practice that benefited small scale local producers. For the other two cheeses, they found that extra-local actors played a larger role. This led to the introduction of so-called “invented traditions” designed to maximise commercial profit—but these were not part of the local production system. Overall, they suggest that GI initiatives can be a good tool for rural development provided special attention is given to the social-organisational context when setting up the code of practices.

Another comparative study tried to assess the role of institutional policies supporting quality food labels using the example of a Mexican sausage (without GI) and the Spanish Iberian Ham (in possession of several PDO labels) [94]. The authors found that that differences in geopolitical context resulted in disadvantages for the Mexican sausage as they could not achieve the GI recognition. In contrast, the Iberian Ham, supported by the EU GI policy, has reached substantial development, as the PDO ham producers became very successful in terms of entrepreneurial vision, capacity building in local actors, heritage preservation and self-employment

A positive correlation between GIs and regional prosperity was identified by Ngokkuen and Grote [78]. They analysed the impact of GI adoption on household welfare and poverty reduction among Jasmine rice producers in North-East Thailand. Based on a cross-sectional survey with 541 Jasmine rice producer families (180 GI certified farms and 361 non-GI farms), they found a significant and positive effect of GI certification adoption on household welfare and poverty reduction. They found GI producers to have significantly higher consumption expenditures (both annual and monthly) and a lower incidence of poverty (using national and regional poverty lines). GI farmers also owned considerably more land, productive assets and vehicles. The education level of the household head was higher, and GI farmers generally had more social capital (were a member of cooperatives, participated in village meetings, accessed information on GIs and followed good agricultural practices). However, the authors highlighted a major limitation of their research—that as the adoption of GI certification was endogenous. The different outcomes for GI and non-GI farmers could not be interpreted as caused by the adoptions of GI processes. Despite this, they argued that the positive household prosperity outcome was a pure effect of the GI certification adoption. Similar results were found for India: Jena and Grote [77] found that the adoption of Basmati rice had increased household welfare.

In the case of the Malaysian fruit durian, the GI helped to build up its own terroir and to preserve agro-diversity together with local identity. These were also helpful in promoting a touristic brand for durian orchard owners [46]. Similar results were found in Latvia and Estonia, where the local GI foods are part of rural tourism. Therefore, the EU quality labels help in the promotion and the preservation of these cultural heritages [54]. In Croatia, the existence of olive oils with protected geographical indications enables additional recognition of the olive oil producing region; thus, GIs can heavily contribute to the olive tourism developments [95].

For Indonesian GI coffee Neilson, et al. [96] found only a little evidence that current GI schemes of Indonesia have tangible economic benefits for the producers and the producing region. This is mainly due to the lack of supportive local institutional settings on a strategic level. However, some intangible benefits can be identified, mainly the promotion of the sense of regional pride and cultural identity, but this hardly results in achieving rural development outcomes.

A case study of the Nicaraguan GI cheese Queso Chontaleno highlights problems that are common in many developing countries [88]. The introduction of the Queso Chontaleno GI also meant more competitive pressure on the local production system. In South America, the introduction of such GIs has often been found to benefit mostly the local elite and not farmers or cheese producers. In the Queso Chontaleno case, international organisations assisted with the GI registration, but traditional producers were not really involved, so the code of practice did not reflect their interests. For example, there were no provisions for institutionalising the link between product and terroir. Mancini suggests that for a GI to contribute positively to regional prosperity, three factors are essential. First, it is crucial to set up proper quality standards to define the method of production. Second, it should be clearly stated how the GI valorises the producing area (the terroir). Third, there should be a strong collective organisation to foster cohesion among GI producers.

The case of the Brazilian cheese Serro with an indication of provenance also showed that the recognition of a GI might stimulate territorial development goals; however, it has many limitations in several aspects and results heavily depend on other factors. GI is most of all a tool for territorial development that can encourage cooperation between actors in rural areas [32].

In Japan, among GI farms producing Tonburi, Tashiro, et al. [97] differentiated the effects based on their time horizon. In the short term, GI registration might contribute to the spread of cultural capital among farmers; however, over a long term, GI and the associated traditional ecological knowledge negatively affects production maintenance and landscape management.

Lamarque and Lambin [6] investigated what GIs can do for the prosperity of marginal mountain areas in France. They compared a PDO, a PGI and a non-GI cheese using farm surveys. Their results showed that high standards for the GI cheeses are associated with more extensive agricultural practices, especially in the case of PDO farmers, though the differences between PDO and PGI farmers are minor. In this way, the GI schemes can indirectly contribute to retaining population in these regions, as extensive agricultural practices are more labour-intensive.

Based on the case of Hungarian PDO onions Tregear et al. [53] found that the impact of such a nascent GI on the prosperity of the producing area is very limited. To meet regional development expectations, the building of effective networks with regional actors external to the value chain (outside of onion production and distribution) is crucial. Although the onion is deeply embedded in the local culture (e.g., onion themed attractions like onion themed spa and cultural centre) and this PDO variety is well known in Hungary, the PDO onion struggles to become the basis for a “basket of goods” rural development strategy. The reputation of this product is appreciated only locally and in Hungary.

4. Discussion

Our research highlights the fact that there is only very limited relevant empirical economic data available on the impact of GI policy. In the EU this lack is particularly evident. A major reason is that the EC has not yet set up any comprehensive dataset to evaluate and improve GI policy—so far, there is no EU-wide data collection about the production and the markets of PDO and PGI products. The available official database eAmbrosia (integrating the former DOOR, E-BACCHUS and E-SPIRIT DRINKS databases) is a simple registration database with no economic data. In the EU, the FADN system collects accountancy microdata on agricultural holdings reporting harmonised information at three levels: region, economic size and type of farming. However, the design of the data collection does not effectively measure the impacts of GI production. The centralised EU FADN dataset is a summary of the results of national surveys that are not entirely the same, and only a few (e.g., the Italian and Hungarian) collect data on GIs, mainly about whether the selected farm is producing any GI product. In some of the Mediterranean EU countries, with the most significant GI production, specific initiatives exist to gather national market data (e.g., the Italian Qualivita). However, on the whole, we can conclude that there is a lack of statistics on the EU GI sector, even though other European food quality schemes (organic production, in particular) are supported with centralised data collection and through EUROSTAT (the EC’s Directorate-General providing statistical information) easily accessible datasets are available.

The most fundamental issue is how large the market for GI foods might actually be. This, of course, depends critically on the consumers’ willingness to pay for these (higher quality) goods. Due to methodological problems and lack of systematic data, we did not include WTP studies in this particular review. But the available data do show that the most important GI market is the internal market of the EU. Nonetheless, despite the well-known European commitment to food quality, GI labelled products form only a minor part of total EU agri-food production (7% in 2017). There are a few GI products with both significant market size (domestic and export) and remarkable market share, but these are a small set of all registered GI products and are concentrated in only a few countries, mainly in the Mediterranean EU countries.

What the limited available studies so show is that there is considerable heterogeneity between different GI products and between the outcomes for similar GI products in different regions. Consequently, it is difficult to determine if there are specific types of product, or specific places, where GI labelling is more likely to achieve a price premium. This hinders the effective development of GI policy on the ground. Based on the available data it is not possible to recommend where an investment in GI labelling will generate a good return. Certainly, many wines achieve premiums related to quality. But there is as yet no clear evidence as to whether the higher premiums observed for wines translate across to foods. There are suggestions that regional coffees can obtain good premiums, but there are many cases where efforts to achieve such premiums by using GI labelling for a coffee has not (or at least not yet) been successful. There are also suggestions that a small number of meats and cheeses with global distribution chains, may also achieve valuable premiums.

If one cannot know when a GI label will achieve a higher price for a product, how can one know the impact of GI labelling policy on farmer prosperity? The studies available do show that farmers can achieve higher prices—but they also show that this is not a certainty. They show that there are higher costs associated with producing GI products—intrinsic costs in producing a higher quality product and indirect costs associated with complying with the GI regulation. But the empirical studies that address the issue of the impact of GIs on net producer income are insufficient to say when, where and how this might occur. One issue they do point to, however, is that it cannot be assumed that any higher net income will flow to primary producers rather than to actors higher up the value chain.

The studies we have found point to a possible pattern where PDOs usually gain higher price premiums than PGIs and products with higher value-added also generally gain higher premiums. There were, however, exceptions to this pattern. It was also reported that when different quality labels are attached to a given product (especially a GI label and a trademark), the value of the GI label can be low as consumers prefer and/or are more aware of other quality cues.

Given the lack of clear data on market size, price premium and impact on net producer income, it is not surprising that the material on the role of GIs in regional development is thin when it comes to hard data. Obviously, some criteria need to be met if GIs are to contribute positively to regional prosperity: there must be higher net producer income, and this must attach to the farmers or processors located nearby.

Also, there are other mechanisms that could enhance any positive regional development impact of GIs. One of the most important indirect impacts can be on regional employment. If the labour needed for a GI product is significant—as it can be for traditional and labour-intensive production methods—then a GI can make a positive contribution to regional prosperity. However, care needs to be taken that this does not simply perpetuate low wages associated with traditional agricultural methods. Employment generation needs to be accompanied by reasonable incomes.

Positive spill-over effects from other actors in the local system can also be important, for example, where there are synergies between GI food production, tourism and even handicraft production. In many regions, a particular regional brand is used across a range of product types and indeed across industry sectors. How regional branding inter-relates with GI labelling needs more study.

On the other hand, as several papers found, attempting to increase local income by accessing extra-local markets can result in negative effects on regional prosperity. One conclusion is that great care needs to be taken in designing and implementing a GI strategy for a product. The GI code of practice can play an important role via identifying the right geographical boundaries and practices to ensure a vital connection between the product and the production area. To turn the yields from GIs into regional prosperity requires consideration of all these factors.

Author Contributions

Conceptualisation, Á.T. and H.V.J.M.; methodology, Á.T. and H.V.J.M.; software Á.T. and H.V.J.M.; formal analysis, Á.T., L.J., Z.M.M. and H.V.J.M.; investigation, Á.T., L.J., Z.M.M. and H.V.J.M.; writing—original draft preparation, Á.T. and H.V.J.M.; writing—review and editing, Á.T., L.J., Z.M.M. and H.V.J.M.; visualisation Á.T., L.J., Z.M.M. and H.V.J.M.; supervision, Á.T. and H.V.J.M.; funding acquisition, Á.T. and H.V.J.M. All authors have read and agreed to the published version of the manuscript.

Funding

This paper was supported by the János Bolyai Research Scholarship and by the National Research, Development and Innovation Office project FK124800 “Economical and Social Impacts of Food Quality Schemes and Short Food Supply Chains in Hungary”. The initial stage of the research was conducted by Áron Török and Hazel Moir at the Australian National University Centre for European Studies and supported by the Jean Monnet program of the European Commission.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Giovannucci, D.; Josling, T.; Kerr, W.; O’Connor, B.; Yeung, M.T. Guide to Geographical Indications: Linking Products and Their Origins; International Trade Centre: Geneva, Switzerland, 2009. [Google Scholar]

- Communities, The Council of the European Communities. Not a Person Write Full Name Council Regulation (EEC) No 2081/92 of 14 July 1992 on the Protection of Geographical Indications and Designations of Origin for Agricultural Products and Foodstuffs. 1992. Available online: https://eur-lex.europa.eu/eli/reg/1992/2081/oj (accessed on 6 November 2020).

- Union, The Council of the European Union. Council Regulation (EC) No 510/2006 of 20 March 2006 on the Protection of Geographical Indications and Designations of Origin for Agricultural Products and Foodstuffs. 2006. Available online: https://eur-lex.europa.eu/eli/reg/2006/510/oj (accessed on 6 November 2020).

- Union, The European Parliament and the Council of the European Union. Regulation (EU) No 1151/2012 of the European Parliament and of the Council of 21 November 2012 on Quality Schemes for Agricultural Products and Foodstuffs. 2012. Available online: https://eur-lex.europa.eu/eli/reg/2012/1151/oj (accessed on 6 November 2020).

- Ilbery, B.; Kneafsey, M.; Bamford, M. Protecting and promoting regional speciality food and drink products in the European Union. Outlook Agric. 2000, 29, 31–37. [Google Scholar] [CrossRef]

- Lamarque, P.; Lambin, E.F. The effectiveness of marked-based instruments to foster the conservation of extensive land use: The case of Geographical Indications in the French Alps. Land Use Pol. 2015, 42, 706–717. [Google Scholar] [CrossRef]

- Gangjee, D. Melton Mowbray and the GI pie in the sky: Exploring cartographies of protection. Intellect. Prop. Q. 2006, 3, 291. [Google Scholar]

- AND-International. Study on Economic Value of EU Quality Schemes, Geographical Indications (GIs) and Traditional Specialities Guaranteed (TSGs); AND International: Paris, France, 2012. [Google Scholar]

- Marchesini, S.; Hasimu, H.; Regazzi, D. Literature Review on the Perception of Agro-Foods Quality Cues in the International Environment; Federal Reserve Bank of St. Louis: St. Louis, MO, USA, 2007.

- Réquillart, V. On the Economics of Geographical Indications in the EU. In Proceedings of the Workshop on Geographic Indications and Brands: Firms Strategies and Public Policies, France, Toulouse, 14–15 June 2007. [Google Scholar]

- Barjolle, D.; Paus, M.; Perret, A.O. Impacts of geographical indications-review of methods and empirical evidences. Geography 2009, 3, 1–18. [Google Scholar] [CrossRef]

- Teuber, R.; Anders, S.; Langinier, C. The Economics of Geographical Indications: Welfare Implications; Federal Reserve Bank of St. Louis: St. Louis, MO, USA, 2011.

- Teuber, R. Protecting Geographical Indications: Lessons Learned from the Economic Literature. In Proceedings of the Paper Presented at the EAAE 2011 Congress, Zurich, Switzerland, 30 August–2 September 2011. [Google Scholar]

- Deselnicu, O.C.; Costanigro, M.; McFadden, D.T. The Value and Role of Food Labels: Three Essays Examining Information Flows in the Food System for Experience and Credence Attributes. Ph.D. Thesis, Colorado State University, Fort Collins, CO, USA, 2012. [Google Scholar]

- Deselnicu, O.C.; Costanigro, M.; Souza-Monteiro, D.M.; McFadden, D.T. A Meta-analysis of Geographical Indication Food Valuation Studies: What Drives the Premium for Origin-Based Labels? J. Agric. Resour. Econ. 2013, 38, 204–219. [Google Scholar]

- Herrmann, R.; Teuber, R. Geographically Differentiated Products. In The Oxford Handbook of the Economics of Food Consumption and Policy; Oxford University Press: Oxford, UK, 2012. [Google Scholar] [CrossRef]

- Bienenfeld, J.M.; Roe, B. Consumer Willingness to Pay for Organic, Environmental and Country of Origin Attributes of Food Products. Br. Food J. 2014, 107, 320–343. [Google Scholar]

- Feldmann, C.; Hamm, U. Consumers’ perceptions and preferences for local food: A review. Food Qual. Prefer. 2015, 40, 152–164. [Google Scholar] [CrossRef]

- Grunert, K.G.; Aachmann, K. Consumer reactions to the use of EU quality labels on food products: A review of the literature. Food Control 2016, 59, 178–187. [Google Scholar] [CrossRef]

- Mirna de Lima, M.; Cláudia Souza, P.; Passador, J.L. Implications of Geographical Indications: A Comprehensive Review of Papers Listed in Capes’ Journal Database. RAI 2016, 13, 315–329. [Google Scholar]

- Dias, C.; Mendes, L. Protected Designation of Origin (PDO), Protected Geographical Indication (PGI) and Traditional Speciality Guaranteed (TSG): A bibiliometric analysis. Food Res. Int. 2018, 103, 492–508. [Google Scholar] [CrossRef]

- Leufkens, D. The problem of heterogeneity between protected geographical indications: A meta-analysis. Br. Food J. 2018, 120, 2843–2856. [Google Scholar] [CrossRef]

- Caputo, V.; Sacchi, G.; Lagoudakis, A.; Cavicchi, A.; Santini, C. Chapter 3—Traditional Food Products and Consumer Choices: A Review. Case Stud. Tradit. Food Sect. 2018, 47–87. [Google Scholar] [CrossRef]

- Cei, L.; Defrancesco, E.; Stefani, G. From Geographical Indications to Rural Development: A Review of the Economic Effects of European Union Policy. Sustainability 2018, 10, 3745. [Google Scholar] [CrossRef]

- London Economics. Evaluation of the CAP Policy on Protected Designations of Origin (PDO) and Protected Geographical Indications (PGI); London Economics: London, UK, 2008. [Google Scholar]

- AND-International. Value of Production of Agricultural Products and Foodstuffs, Wines, Aromatised Wines and Spirits Protected by a Geographical Indication (GI); AND-International: Paris, France, 2012. [Google Scholar]

- Areté. Study on Assessing the Added Value of PDO/PGI Products. 2013. Available online: https://ec.europa.eu/info/food-farming-fisheries/key-policies/common-agricultural-policy/cmef/products-and-markets/assessing-added-value-pdo-pgi-products_en (accessed on 6 November 2020).

- European Commission. eAmbrosia—The EU Geographical Indications Register. 2020. Available online: https://ec.europa.eu/info/food-farming-fisheries/food-safety-and-quality/certification/quality-labels/geographical-indications-register/ (accessed on 6 November 2020).

- European Commission. EUROSTAT. 2020. Available online: https://ec.europa.eu/eurostat (accessed on 6 November 2020).

- European Commission. Farm Accountancy Data Network. 2020. Available online: https://ec.europa.eu/agriculture/rica/database/database_en.cfm (accessed on 6 November 2020).

- Arfini, F.; Capelli, M.G. The resilient character of PDO/PGI products in dynamic food markets. In Proceedings of the 113th EAAE Seminar “A Resilient European Food Industry and Food Chain in a Challenging World”, Chania, Greece, 3–6 September 2009. [Google Scholar]

- De Lima Medeiros, M.; Terra, L.A.A.; Passador, J.L. Geographical indications and territorial development: A soft-system methodology analysis of the Serro Case. Syst. Res. Behav. Sci. 2020, 37, 82–96. [Google Scholar] [CrossRef]

- Arfini, F.; Cozzi, E.; Mancini, M.C.; Ferrer-Perez, H.; Gil, J.M. Are Geographical Indication Products Fostering Public Goods? Some Evidence from Europe. Sustainability 2019, 11, 272. [Google Scholar] [CrossRef]

- Tibério, L.; Francisco, D. Agri-food traditional products: From certification to the market—Portuguese recent evolution. Reg. Sci. Inq. 2012, 4, 57–86. [Google Scholar]

- Galli, F.; Carbone, A.; Caswell, J.A.; Sorrentino, A. A multi-criteria approach to assessing pdos/pgis: An italian pilot study. Int. J. Food Syst. Dyn. 2011, 2, 219–236. [Google Scholar]

- Carbone, A.; Caswell, J.; Galli, F.; Sorrentino, A. The Performance of Protected Designations of Origin: An Ex Post Multi-criteria Assessment of the Italian Cheese and Olive Oil Sectors. J. Agric. Food Ind. Organ. 2014, 12, 121–140. [Google Scholar] [CrossRef]

- Jantyik, L.; Török, Á. Estimating the Market Share and Price Premium of GI Foods—The Case of the Hungarian Food Discounters. Sustainability 2020, 12, 1094. [Google Scholar] [CrossRef]

- Monier-Dilhan, S.; Hassan, D.; Orozco, V. Measuring Consumers’ Attachment to Geographical Indications; Federal Reserve Bank of St. Louis: St. Louis, MO, USA, 2011.

- Leufkens, D. EU’s regulation of geographical indications and their effects on trade flows. Ger. J. Agric. Econ. 2017, 66, 223–233. [Google Scholar]

- Sorgho, Z.; Larue, B. Do Geographical Indications Really Increase Trade? A Conceptual Framework and Empirics. J. Agric. Food Ind. Organ. 2018, 16. [Google Scholar] [CrossRef]

- Balogh, J.M.; Jámbor, A. Determinants of revealed comparative advantages: The case of cheese trade in the European Union. Acta Aliment. 2017, 46, 305–311. [Google Scholar] [CrossRef]

- Belletti, G.; Burgassi, T.; Manco, E.; Marescotti, A.; Pacciani, A.; Scaramuzzi, S. The roles of geographical indications in the internationalisation process of agri-food products. In International Marketing and Trade of Quality Food Products; Canavari, M., Cantore, N., Castellini, A., Pignatti, E., Spadoni, R., Eds.; Wageningen Academic Publishers: Wageningen, The Netherlands, 2009; pp. 201–221. [Google Scholar] [CrossRef]

- Török, Á.; Jámbor, A. Determinants of the revealed comparative advantages: The case of the European ham trade. Agric. Econ. 2016, 62, 471–481. [Google Scholar] [CrossRef]

- Slade, P.; Michler, J.D.; Josephson, A. Foreign geographical indications, consumer preferences, and the domestic market for cheese. Appl. Econ. Perspect. Policy 2019, 41, 370–390. [Google Scholar] [CrossRef]

- Wongprawmas, R.; Canavari, M.; Haas, R.; Asioli, D. Gatekeepers’ Perceptions of Thai Geographical Indication Products in Europe. J. Int. Food Agribus. Mark. 2012, 24, 185–200. [Google Scholar] [CrossRef][Green Version]

- Airriess, C. Constructing durian terroir and geographical indications in Penang, Malaysia. Singap. J. Trop. Geogr. 2020, 41, 6–22. [Google Scholar] [CrossRef]