Abstract

Existing frameworks offer a holistic way to evaluate a food system based on sustainability indicators but can fall short of offering clear direction. To analyze the sustainability of a geographical indication (GI) system, we adopt a product-centered approach that begins with understanding the product qualification along the value-chain. We use the case of the GI Corsican grapefruit focusing on understanding the quality criteria priorities from the orchard to the store. Our results show that certain compromises written into the Code of Practices threaten the system’s sustainability. Today the GI allows the fruit to be harvested before achieving peak maturity and expectations on visual quality lead to high levels of food waste. Its primary function is to help penetrate mainstream export markets and to optimize labor and infrastructure. Analyzing the stakeholders’ choices of qualification brings to light potential seeds for change in the short run such as later springtime harvests, diversification of the marketing channels, and more leniency on the fruit’s aesthetics. These solutions lead us to reflect on long-term pathways to sustainable development such as reinforcing the fruit’s typicality, reducing food waste, reorganizing human resources, and embedding the fruit into its territory and the local culture.

1. Introduction

The Corsican citrus fruit sector’s use of geographical indications (GIs) is considered a success story, given the challenges the actors have had to overcome since the first orchards were planted in the 1960s, and thanks to the economic prosperity spurring new investments today. By linking quality to origin, farmers and commercial agents have collectively built strong brand equity securing a niche in the French continental market [1]. The sector’s success, infrastructure, and commercial strategies were built around a flagship product, the Corsican clementine, which obtained a GI in 2005 and represents over 80% of commercial volumes produced in the Corsican citrus fruit sector (about 31,000 tons in 2017 according to regional census data). A very distant second is the Corsican grapefruit’s commercial production (at 6500 tons) which also obtained a GI in 2014 [2]. This secondary fruit is considered complementary to the clementine since it extends the growing season. This helps secure the sector’s place on the market by extending their commercial season and allowing for greater return on infrastructure investments.

One might think that the virtuous circle of origin products applies here as their valorization is often associated with the development of sustainable agri-food systems [3,4]. The identification of specific qualities by the local players gave rise to the collective promotion of a product, the clementine, followed by the grapefruit. These citrus fruits were then recognized by the public authorities, through the GI, and by the market, through higher prices. These product enhancements ultimately contribute to renewing the natural and cultural resources required for their production. For this reason, there is increasing interest in growing the local grapefruit production.

Notwithstanding this interest, concerns about market saturation, price ceilings, and risks associated with climate change are raising questions about the sustainability of the sector’s strategy, so reliant on the success of the clementine. Local stakeholders worry that its production is increasing at a rate beyond the market’s capacity to absorb it (at the prices they need) and fear the same for the grapefruit. At the same time, general consumer trends [5,6] and the citrus market data [7,8] suggest that there is growth opportunity for the Corsican grapefruit. The virtuous circle, thought to be propagated by the use of GIs, is put into question as local stakeholders attribute their commercial success today to their GIs, yet question their capacity to secure their future success.

Beyond access to the clementine and the grapefruit, local stakeholders wish to implement a diversification strategy to offer a full range of citrus fruits, like oranges and lemons. This strategy is proving challenging however, since they are willing to continue using a collective approach, qualifying future products in ways that complement the two existing GIs [9]. Since little research has been conducted to understand the qualification of the grapefruit, as compared to that of the clementine [1,10,11], its future prospect within this diversification strategy is not yet clear. The sector’s steering committee and stakeholders are, therefore, investing in research and development activities to help the sector stay resilient [9,12].

The ambient uncertainty circulating among stakeholders in the Corsican citrus fruit sector, paired with short-term thinking (which has potentially overlooked longer-term opportunities and innovations), is the starting point for our work. We believe that there is opportunity for GIs to provide a practical framework for building more sustainable agri-food systems, but that to do so there is still a need to develop effective approaches to harnessing their potential.

GIs have been criticized for their inability to consistently deliver on expected outcomes in terms of social equity, economic development, and adaptability to changing environmental and market conditions [13,14,15,16,17]. Still, they have also been shown to produce positive effects which bring further interest in their development especially by public institutions looking for ways to reform the food system to be more sustainable [18,19,20]. The most concrete example of this is the fact that institutions regulating GIs are increasingly incorporating and mandating agroecological measures into their Codes of Practices (CoPs). This is an evolution and a departure from their original purpose to protect collective intellectual property, today, a controversial topic [15,21], but also an opportunity. Theories on agroecological transition led us to think of sustainability as a space for change [22,23,24], a concept that can be explored in order to help collective local stakeholders, like those implicated in a GI, identify one or more desired future trajectories.

Researchers and extensionists have created tools to evaluate the sustainability of agri-food systems [25,26], such as the Sustainability Assessment of Food and Agriculture (SAFA) by the FAO [27]. These holistic frameworks provide a detailed view of the performance (strengths and weaknesses) of an agri-food system by outlining a range of sustainability indicators for each facet of the same system offering an evaluation of the degree of sustainability of the system considered. Despite these frameworks, it can be difficult for stakeholders to know where to start to re-imagine and re-engineer their systems because the results of these framework analyses present perhaps too broad an overview [22,28]. The local stakeholders’ goal is to identify what their ideal scenario is and to design a pathway (or series of changes) to achieve it.

Rather than use these existing frameworks to evaluate to what extent the GI Corsican grapefruit system is sustainable, we thought it more meaningful to identify and understand the main challenges, the agreements, and the tensions among the GI system’s stakeholders about how the product is qualified. By identifying the controversies within the system, we believed that it would be easier to identify possible pathways for change [29]. To do this, we chose to take a relational method: we adopted a product-centered approach, focusing our analysis on the construction of quality along the value chain, from the field to the store. We hypothesized that analyzing the qualification of a GI product through a product-centered approach can support identifying pathways to sustainable development.

A product’s description goes beyond its physical characteristics; it is a tangible embodiment of the growers’ shared values around quality and production practices [28,30]. Its qualification can also help display the compromises made by the various actors along a supply chain, and the various internal and external constraints they face [1,31,32]. By guiding our analysis with how the product is qualified, it allows us to better understand why certain decisions in the CoP are made during production and on the market, and to pinpoint specific areas that may be problematic.

Whether it is about fruits and vegetables [33], or terroir products from developing countries [34,35], researchers have underscored the fact that GIs are often used as a tool to penetrate globalized mainstream markets by helping to achieve standardized quality criteria that meet those defined by the buyers. According to a GI’s international definition (TRIPS Agreement, 1994), there is an intrinsic relationship between the GI products and their origin. We have seen growing interest in developing GIs by companies operating on long/modern channels since reference to the geographical name is an effective tool to reach consumers looking for local or certified products [36]. In the case of the Corsican grapefruit, we are interested in understanding the logic used by suppliers in applying this strategy, and how they perceived consumer expectations and market trends.

Increasingly, we observe how strong downstream forces from giant retailers are influencing the qualification of these terroir products and their corresponding business models [33,37,38]. For example, retailers have been improving the quality of their private label brands by imposing standards such as Global G.A.P. and further developing regional branding associated directly with products that are certified organic or as a GI [39,40]. In these instances, the quality control criteria are based on traceability and conformity needs. Systematically, the taste is quantified and measured based on a certain threshold of sugar, monitored by the Brix. Visual appearance is the primary means of communicating the quality of the product and shapes much of the commercial strategy [41]. The use of GIs to regulate and commercialize products appears to help standardize the products but it also appears to banalize them.

Other studies suggest a more complex relationship between GIs, local products, and mainstream market channels [31]. In the case of the GI Corsican clementine, Belmin et al. (2018) have shown that GIs constitute niches where terroir and conventional schemes are interacting and combining [1]. The qualification of the product reflects this duality. For example, the Corsican clementine has specific characteristics that distinguish it from other easy peelers, and which are linked to the Mediterranean terroir and its local history. Factors that help distinguish it are its green underside, tangy taste, and the guarantee of freshness evidenced by the fact that it is marketed with the leaves still attached. It is, however, still subject to other forms of standardization as it must meet European criteria for visual quality. Like the Corsican clementine, we examined to what extent these tensions between terroir and conventional market standards exist and impact the sustainability of the Corsican grapefruit’s GI and, by extension, that of the Corsican citrus sector.

In this article, our analysis is structured as follows: we begin by providing further context on characteristics of the value-chain for the Corsican citrus fruit sector and of the grapefruit production. We then outline the data collected and used to study the grapefruit’s product qualification. We report on the results in two parts. First, we describe the primary quality objectives of the various stakeholder groups along the value-chain, and their key corresponding production and commercialization practices according to prominent themes. Secondly, we provide a typology of stores and wholesalers according to their buying behavior and buying criteria. In our discussion, we address the areas where lock-ins impede change by reflecting on why certain qualities take priority over others. We then identify potential pathways to progress in the sector’s overall sustainability and allow for product line extensions within the sector’s broader diversification strategy. We conclude by illustrating the ways in which this research demonstrates a new approach to analyzing the sustainability of agri-food systems based on quality and origin products.

2. Materials and Methods

According to regional statistics, in 2017, the Corsican citrus sector counted 149 farmers growing the clementine commercially, and another 36, producing the grapefruit, most of whom also producing the clementine) [42]. The grapefruit is commercialized according to several quality schemes: 90% of productive surfaces are GI, 9% are organic only, and only 1% follows no official scheme. Of those under the GI, 43% are also organic. The majority of producers follow specific rules under the GI which place controls on production and commercialization practices as well as on product quality. An overview of the main production and commercialization specifications of the GI Corsican grapefruit is summarized in Table 1. As for organic certification, the main requirements relate to production practices, more specifically the exclusion of synthetic fertilizers and genetically modified organisms [43].

Table 1.

Main specifications for the production of GI Corsican grapefruits 1.

As for the clementine, the grapefruit’s commercialization rests essentially on the marketing of a fresh whole fruit harvested at “maturity” by hand without being submitted to post-harvest conservation treatments. The clementine harvest is typically from mid-September to the end of December, and the grapefruit harvest is from mid-February to early June. This corresponds to a period when there are few grapefruits of comparable quality on the market: Florida’s exports are ending, and South Africa’s have not yet arrived.

Maturity is based on a minimum sugar to acidity ratio. When physicochemical tests reveal that juice, sugar (Brix (E)), and acidity (A) have reached minimum acceptable levels (notably a given E/A), the harvest is systematically triggered. The product specifications for the grapefruit require that all fruits on the tree must be harvested at once; the clementine’s specification imposes several waves of harvesting. In both cases, it is required that the fruits be hand-picked, a task usually fulfilled with the help of temporary skilled labor from Morocco, on 6-month working visas [44].

Today, the Corsican production represents about 0.9% of the total European production of grapefruit, and about 9% of the French market [7]. The majority (80%–90%) of all volumes produced are destined for the French continental market, mainly through chain stores. They pass through four main producer-owned cooperatives who act as conditioning stations and commercial agents, selling into conventional or organic chain stores. The packed fruit is shipped by boat to the port of Marseille (south-east of France) and trucked to the distribution centers in Cavaillon (the logistic hub for fruits and vegetables in the hinterland of Marseille) for subsequent delivery to French stores.

Our goal was to understand the qualification of the Corsican grapefruit by the different stakeholders along the value chain: how they perceive its market, consumer expectations, and community needs; what their quality goals are; and how they achieve them through production and commercialization practices. We adopted a comprehensive qualitative approach, based on semi-directive interviews with a diversified sample set. The value chain was conceptualized into three main groups: growers (2.1); grower associations and commercial agents, including conditioning stations and dispatching to the continent (2.2); and resellers such as wholesalers, brokers, and stores (2.3). Though there were overlapping themes, we prepared tailored interview guides for each group.

We conducted all the interviews during the spring of 2019, mostly in-person, on a one-on-one basis. The timing of the research permitted observation in the field, in conditioning stations, and in distribution centers, during peak production times, and allowed for informal tasting throughout the harvest season.

2.1. Growers

We sought to understand the growers’ motivations for producing grapefruits, their quality goals, and how their production practices have evolved over time to achieve these goals. Notably, growers were asked to describe their ideal grapefruit, the qualities they believed to be most prized in the market, and then to reflect on the sustainability of the fruit production, given their challenges and constraints.

We built a diverse sample set and interviewed 15 growers, see Table 2. We had representation from all six of the producer organizations (POs), as well as the only two growers who commercialize independently (one was organic only, the other was GI and organic). All growers adhere to at least one quality scheme: one organic, five GI and organic, and nine GI. We connected with farms of various sizes, ranging from the smallest orchard (<1 ha) to the largest (>14 ha), and various levels of diversification, from two to more than four commercial crop varieties per farm. There was no evidence of farms exclusively dedicated to the grapefruit.

Table 2.

Description of the diversity within the grower sample. 1

2.2. Commercial Agents

We sought to understand local dynamics and commercial and practical implications of selling grapefruits, as well as gain insights into quality expectations from customers. The interview guide began with a series of general questions related to the commercial operations, then focused on understanding the business relationships between growers and agents, as well as between the agents and various types of stores. Commercial agents were also asked to describe the ideal Corsican grapefruit, and how this ideal compared to the market’s expectation of quality.

We connected with the head offices and the logistics teams of the “big three” producer organization commercial entities (OPAC, AgruCorse, GIE Corsica Comptoir) at the Corsica and Cavaillon locations, and with the local organic producers’ cooperative (ALIMEA), in addition to the two independent farmers who commercialize their own products. Our visit to the mainland (Cavaillon) gave us a better understanding of the logistical and commercial issues related to marketing the Corsican grapefruit and, more specifically, the nature of the relations between the sellers and buyers.

2.3. Wholesalers and Stores

A group of Corsican resellers and stores were surveyed on the quality criteria buyers are looking for; patterns of responses they see amongst buyers; and finally their choice of supplier(s). The interview questionnaire sought to reveal which product qualities took priority, how the stores selected their suppliers, and the future outlook for the grapefruit based on observable consumer trends.

We assumed that the diversity of modern or traditional distribution channels that we could reach in Corsica might give us insight into how the Corsican grapefruit is being commercialized. We constructed our sample so as to have a good representation of the various commercial channels, including supermarkets who usually source through corporate procurement warehouses and are the main buyer of the grapefruit (i.e., 90% of volume).

We considered five different cities on the island, according to demographic and socio-economic profiles: rural area (Corte, Aleria), urban area (Bastia, Ajaccio) and touristic area (Calvi). We contacted the produce buyers responsible for citrus at four different types of businesses in each location. In total 22 businesses were surveyed across the five zones as follows: six wholesalers, three chain stores, five small independent stores, and seven organic stores. We estimated that this would be an appropriate sample size to observe the diversity of the quality criteria across each or within each type of business.

3. Results

In order to illustrate how the stakeholders along the value chain qualify the Corsican grapefruit, our results are presented in three parts. In Section 3.1, we describe the quality objectives of the local citrus sector stakeholders, and how they achieve them. This is summarized according to four main themes: origin (Section 3.1.1), naturalness and freshness as reflected in Section 3.1.2, visual appearance (Section 3.1.3), and maturity (Section 3.1.4). This analysis will reveal the tensions between the goal of achieving optimal sweetness and acidy within the constraints of production norms and commercial realities (Section 3.2). Lastly, in Section 3.3 we present insights gained on local wholesalers and stores.

3.1. Growers’ and Commercial Agents’ Quality Objectives

Growers and commercial agents were asked to express what quality criteria are important to them and to describe what production and commercial practices they utilize to achieve them. Table 3 is a synthesis of their answers. We were able to outline the different dimensions of their quality goals developed afterward: origin, naturalness and freshness, visual appearance, and maturity.

Table 3.

Quality criteria and associated practices at production and commercial levels.

3.1.1. Origin

According to commercial agents, origin is a desired trait associated with labels for all chain stores that try to find high-quality French products to offer alongside more generic ones. In addition to the GI, chain stores use their private label regional brands to position the product and utilize packaging to communicate the product/brand qualities to consumers (i.e., by referencing place-based qualities and official quality labels). According to one agent, consumers trust the quality of those private label brands and the official quality certifications. That is why chain stores specifically look for products with certifications to commercialize under their own brands. As a commercial agent explained, “The marketing is half taken care of when we have an official quality label”.

In order to strengthen the position of the French premium grapefruit in the market, local stakeholders make sure to commercialize their product when there is less competition from other origins.

For the grapefruit we arrive at the end of the season for United States, Israel, and Spain, but before South Africa. So, we have about a month and a half, 45 days, when we are practically the only ones on the market. Because the end of United States is always a bit tired looking, the grapefruits aren’t round anymore they are square, and it’s the beginning of South Africa and Argentina’s harvest which are still a bit green, still on the edge, while at that time, we can produce an extraordinary product. So that’s really important for us.—Commercial agent

It was also reported that French origin is important to consumers buying certified products (GI or organic). It highlights proximity, which is perceived as an environmental benefit and a sign of freshness, since the product travels a shorter distance than similar foreign products. Moreover, interviewed farmers explained that French consumers have more confidence in French regulations when it comes to safety, environmental standards, and overall traceability. They explained how, for a long time now, certain chemical fertilizers and pesticides have been banned in conventional farming in France while still being authorized and used in organic farming in other EU countries like Spain. This perception may come from the fact that there are cases where stricter regulations were applied in France than in other EU countries, as per Regulation 834/2007, Article 34 [45].

Beyond origin, the agents spoke on the strength of the Corsican brand image which evokes many things in the consumer’s mind: beautiful beaches, vacation time, sunshine, wilderness, reasoned agriculture, tradition, artisans, high gustatory quality, freshness, etc. As one grower and commercial agent put it, “We have a huge advantage being in Corsica. Corsica helps sell because of its image of nice terroirs, and an untouched beauty through its countryside and nature. So, selling is easier when we highlight Corsica”. The Corsican grapefruit is positioned as a natural, local product that is held to high product and production standards. The aromas act as signature to 8 farmers out of 15; it is how the fruit is distinguished from other origins. This said, farmers, as well as commercial agents, do not refer to any specific aromatic features.

3.1.2. Naturalness and Freshness

According to interviewees, naturalness is a strong quality criterion, supported by codified eco-friendly farming (GI or organic), and no post-harvest treatments. Many growers (6 out of 15) felt that the absence of pesticide residue was very important, particularly those in organic agriculture. Most growers felt that their grapefruits were produced more naturally than others on the market and that this was a strength. The GI’s product specifications are similar enough to other private certifications that chain stores encourage growers to pursue, such as the Global G.A.P. certification, to facilitate communication on these generic qualification standards.

The responses underscored how the concept of naturalness plays hand in hand with freshness. As one grower explained, “It’s the magic of eating a fruit that has just been picked”. Therefore, the fruit has to be firm and juicy when consumers buy it. The commercial agents all utilize the same just-in-time (JIT) distribution system that they have devised for the clementine, allowing them to commercialize their fruit with the signature green leaf [1]. In about 3–5 days, the fruits go from the field to the grocery store shelves across France.

JIT relies on a complex equilibrium between annual planning and weekly adjustments. Being so large, the chain stores function very systematically and plan far ahead. For this, they need to have guarantees on volumes and quality ahead of time. During harvest time, there is a bit of wiggle room (to account for the product’s maturity), but commercial agents still try to have weekly procurement and promotional plans set months ahead. In order to meet order volumes, the commercial agents will sometimes keep a bit of stock on hand or build it up for a few days in preparation for a big in-store promotion for one of their clients. Even in these cases, the fruit is never stocked for more than two weeks despite the fact that the CoP allows for cold storage up to eight weeks.

3.1.3. Visual Appearance

The visual aspect is one of the factors that was mentioned the most by growers and commercial agents. It deals with many quality criteria that characterize a Star Ruby grapefruit including pink flesh (mentioned by 11 farmers), smooth yellow skin (4 farmers), the red cheek (5 farmers), or the fruit’s freshness and firmness. The visual aspect also includes criteria that have great influence on the farmers and commercial agents’ practices including the size of the fruit (8 of 15 growers), and the absence of visual defects on the skin (all growers).

Farmers are aiming at producing a medium-sized fruit because it brings the highest prices and is the juiciest. While they cannot control this factor, they aim for consistent sizing, avoiding extremes, with golf ball or bowling ball sized fruits that cannot be commercialized. One grower reported how pruning helps control the size of the fruit, “When the trees are carrying higher loads, in general, the size of the fruit is more consistent, it is good. As soon as they are not full enough, there are big variations”. Different clients have different strategies when it comes to selling the grapefruit and so the commercial agents cater to those different demands by offering a range of packaging options. Extreme sizes (too big, too small) are discarded, larger fruits tend to be sold by the unit, medium-sized in flow packs of two, and smaller ones in flow packs of four or in mesh bags.

When it comes to the visual aspect, the top priority for farmers and commercial agents is to reduce the visual defects from marks, dents, and bug bites. When the fruit is marked, it cannot be commercialized under the GI, or the secondary market for transformation. Over the years, growers have improved their pruning techniques to create sunlight chimneys, so the productive branches grow towards the middle, protected by the skirt (foliage). Still, important volumes of grapefruits are discarded (20% to 50%) in the orchards and in the conditioning stations.

Even growers commercializing through organic market channels agreed that, after being reassured about origin and quality by the GI label, consumers buy with their eyes and that is why they have developed a no-tolerance policy for visual defects, i.e., spots or markings. As one grower who produces under both organic and GI labels explains, “If there is a spot on it, garbage”. It is recognized that traditional organic store channels are more lenient on the visual appearance since consumers generally know that there are more production constraints. However, there is a feeling among growers that consumers are becoming less tolerant of this even through these alternative channels. Large chain stores selling organic also require the GI. Therefore, the visual standards are still very strict for most organic grapefruits. Those stores are becoming stricter on marks for conventional and organic fruits, especially with the new trend in using flow-packs of two or four fruits. Commercial agents reminded us that it is not like in a 15 kg case which, according to the GI product specifications, allows up to 30% of the fruit on top level to have marks. In a two-pack, one fruit with marks represents 50% and this can easily deter the customer. Unfortunately, this trend is leading to a higher waste percentage.

3.1.4. Maturity

Notwithstanding fundamentals such as origin, freshness, naturalness, and absence of visual marks, all the commercial agents agree that the grapefruit has to taste good. One commercial agent remarked on its importance, “The gustatory qualities need to match the image. And we have a very nice image”. When they talked about taste, they always referred to the balance of sweetness and acidity which is mostly associated with the maturity of the fruit.

Having the fruit maturing fully on the tree while achieving an internal balance of sweetness and acidity is a priority shared by all farmers, GI and/or organic. This equilibrium is generally reached in March. Harvest is systematically triggered when the fruit meets the required internal standard through physicochemical analysis. Teams of seasonal workers who arrive in October to harvest the clementine also harvest the grapefruit just before leaving Corsica.

As reported by commercial agents, demand currently far outpaces supply. As long as they reach the minimum quality standards, they can commercialize their grapefruits as soon as the market is ready for them. One agent explained how they do not have to work too hard today to communicate on specific product qualities, “What’s the use in marketing if there is not enough product? On the contrary, I am hiding. When I sell a load, I try not to mention it to my other clients because then they will ask me for some, and I don’t have enough for everyone”.

3.2. The Balance between Sweetness and Acidity at the Crossroads between Production Needs and Commercial Realities

Commercial agents recognize that the Corsican grapefruit’s success is in large part due to being able to consistently find the balance between sweetness and acidity (for GI CoP specifications see Table 1). Since they have focused more on this quality criteria, they have seen prices slowly increase to reflect the higher standard. The rep further explained, “We started very low, and little by little we were able to increase the price. Today we are higher than Spain and Turkey, but lower than Florida. We’re positioned today at a premium price”.

Nonetheless, this physicochemical analysis approach to evaluating fruit maturity has limits. Some growers feel that quality is compromised when the harvest period is systematically triggered too early based on market openings. The growers prefer when the fruit is sweeter and think this could appeal to a larger segment of the market. They envision that taste-testing should be broadly employed as an added measure for quality control.

Commercial agents recognize that, early in the season, though the fruit meets the GI’s minimum acidity/sugar ratio and juice percentage, it is sometimes on the fence in terms of gustatory quality since it is still too acidic for most people’s taste. One agent even went so far as to admit that, in the early season, “you have to be a hardy person to eat it”. Another reason to begin later is that they feel the grapefruit is a spring/summer fruit people like to eat when the weather warms up.

Commercial agents would like to see the harvest later in the year by a few weeks, but they feel the pressure from growers who want to start harvesting as early as possible so they can finish sooner. Another rep echoed this sentiment by explaining, “The best time to sell is April-May-June, but if you ask the growers when the best time to harvest is, they’ll tell you it’s in November. It’s stressful for them especially since in the springtime there is the flowering, so you either need to pick before or after”. The more the fruit stays on the tree, the sweeter it gets. Leaving the fruit on the tree longer, however, leads to other technical challenges and quality problems. If the growers keep the fruit on the tree until the summertime, the tree suffers as it begins to produce new fruit at the same time as the old. When harvesting, farmers risk knocking off the young fruit. They are also adding another type of spot from fly bites more common in May/June as the weather warms.

Selling average tasting fruit is possible because of the way grapefruits are currently evaluated on the market. As pointed out by most growers, in the market, more importance is placed on external quality markers: consumers wanting a homogenous looking medium-sized grapefruit with no “defects”. One farmer summed up well the feelings of most, “The market demands a nice-looking fruit. Consumers automatically approach the better-looking fruit. So, you know what we do? We cave to the demands of the market and only sell the good-looking fruit”. Moreover, though visual appearance is thought to strengthen the GI’s image, it is not always considered a product differentiator as one independent organic agent explained, “In terms of aesthetics, a nice foreign grapefruit and a nice Corsican Grapefruit, they are both nice fruits. We’re not going to say that the Corsican one is better, it’s not true. The main benefits are certainly the health benefits of the fruit (the absence of chemical residues)”.

This issue of quality is acceptable for local stakeholders because the system has proven to be effective and profitable until now. Though commercial agents have received a bit of negative feedback on the quality for being too acidic, overall, it meets customer expectations and the prices today make it a profitable fruit to sell. It is further helped by the fact that it is commercialized at a time when there is relatively little competition from other origins. At this current (small) volume of production, commercial agents do not think prices in conventional or organic could rise much more before becoming too expensive for the average consumer.

3.3. Insight from the Inquiry on Local Wholesalers and Stores

When asked about their expectations for the Corsican grapefruit, local wholesalers and stores systematically report on seasonality and freshness. Otherwise, expected qualities differ amongst them. We were able to build a typology (Table 4), according to how each store realizes their local citrus procurement, and the importance they give to a label, the expected origin, and the expected grapefruit.

Table 4.

Typology of stores and wholesalers according to their buying behavior and their buying criteria regarding the Corsican grapefruit.

The traditional type comprises of small and medium-sized independent retailers who adhere to traditional buying behavior more common before chain stores arose in the 1980s [33]; they buy grapefruits directly from a producer or another wholesaler they know. Because they trust their suppliers, they do not need labels to guarantee origin or quality of products. When they buy a Corsican product, they expect it to be produced naturally, without pesticides. They are looking for mature, good-looking fruit. Grocers can often wait until the fruits are sweeter, to place orders. To them, price is also important.

The pink and juicy type and the tasty type are quite similar to the traditional type in that they are made up of independent stores and wholesalers. However, both are less specific on their desired product qualities for the grapefruit. The pink and juicy type looks for organic local products even if an organic label is not provided. They also look for the fruit to be mature as indicated by the color and the juiciness. The tasty type does not look for any labels in particular; they just want the fruit to be tasty.

The conventional type deals with chain stores or organic stores that buy local grapefruits through centralized distribution channels. They require the quality labels and rely on them as a way to guarantee the French or Corsican origin and to communicate it to consumers. These stores aim to buy a good-looking fruit; visual appearance (zero default and size) is essential.

There is a hybrid type between the conventional type and the tasty type called the tasty French type. This is comprised of chain stores (conventional and organic) which have the liberty to purchase directly from local wholesalers, but which require the use of national labels (GI, organic), as directed by their corporate head office. For these stores, they prioritize local products and want them to be tasty as well.

These results corroborate with the opinions and sentiments about the market expressed by the other local stakeholder groups: visual appearance, freshness, and naturalness are central quality criteria. Nonetheless, this typology shows a more balanced set of quality expectations between internal and external factors than previously expressed. First, it shows that not all the chain stores belong to the conventional type. Some belong to the French tasty type which means that there are different coexisting procurement philosophies, and some of the stores are open to other forms of qualification where maturity and taste could be as important as visual appearance. Second, wholesalers and independent stores show another procurement logic which could be mobilized by farmers and commercial agents: they are looking for a mature fruit, hence they are ready to wait for the fruit to be sweeter and they do not need any label to guarantee the origin or quality of the product.

4. Discussion

The GI Corsican grapefruit appears to be a commercial success as evidenced by steady price increases and the fact that local actors have been able to capture the added value [2]. Despite this success, our results revealed that the ways local stakeholders prioritize and achieve their quality objectives show important nuances, tensions, and shortcomings along the value-chain that degrade the system’s sustainability. In this section, we will discuss how analyzing the qualification of the GI, taking a product-centered approach, helped us identify potential pathways toward sustainable development.

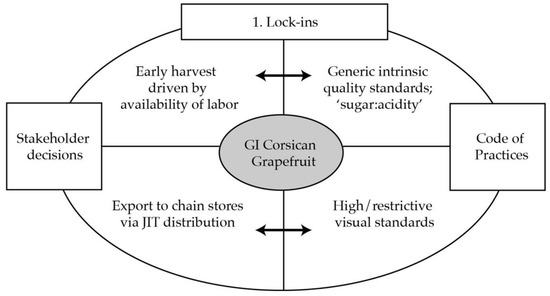

By taking a product-first approach, we observe four main issues or lock-ins which potentially threaten the scheme’s sustainability (Figure 1). These are organized in four interlinked quadrants. Moving clockwise, we start with the internal generic quality standards (taste, aromas, etc.); the external quality standards (visual appearance); the commercial practices (market channels); and finally, seasonal and labor constraints.

Figure 1.

Identified Sustainability Lock-ins for the Case of the GI Corsican Grapefruit.

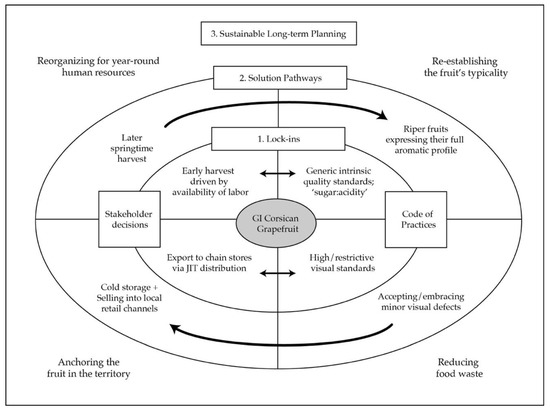

In Section 4.1, we illustrate how the GI CoP is mainly being used to comply with conventional standards (right quadrants of Figure 1); Section 4.1.1. explores how “naturalness”, an important product differentiator, is not actually imposed in the CoP; and Section 4.1.2. discusses how quality control is mainly based on physicochemical standards and a very low tolerance for visual defects. We describe how the qualification of the grapefruit is subject to a broader group of stakeholder decisions related to business constraints (left quadrant of Figure 1), such as using foreign labor and JIT logistics (further elaborated in Section 4.2). Finally, in Section 4.3, we discuss potential system evolutions or sustainability pathways (summarized in Figure 2) to re-establish the fruit’s typicality, reduce food waste, embed the fruit in the territory, and re-organize the work for year-round employment opportunities.

Figure 2.

Conceptual Road Map towards Sustainable Planning for the Case of the GI Corsican Grapefruit.

4.1. Using the GI CoP to Comply with Conventional Standards

The GI CoP is currently being used as a tool to measure the product against conventional standards [33] rather than to exemplify and protect the qualities linked to its origin that help differentiate it on the market. The GI was designed to help homogenize and elevate product quality standards but above all, it is used as a marketing tool to help penetrate modern market channels [34,35,46]. After our analysis, it is unclear if any of the intrinsic qualities of the fruit truly differentiate it from other grapefruits on the market. It is concerning that the grapefruit is marketed as a premium product, and on this basis, expected to have high gustatory qualities, because this leads us to question whether the current points of product differentiation will be sufficient to remain competitive in the long-run.

4.1.1. Naturalness, an Important Differentiator That Is Associated with the GI But Not Imposed in the CoP

Naturalness was cited as an important factor by everyone and reinforced through a no-tolerance policy for post-harvest treatments and by the Corsican brand image (wild, natural). It is a factor that is market-driven and is growing in importance as demand rises for healthy products free from chemical residues [41].

Despite encouraging reasoned agricultural practices, none are written and required in the GI’s CoP. Stakeholders cannot, therefore, guarantee that the GI Corsican grapefruits are more environmentally friendly than conventional ones. As is the case with many GIs in Europe [47,48,49], the impression of naturalness is an intangible factor that is not actually associated with any explicit eco-friendly rule written in the CoP. Though GIs are often viewed as more environmentally friendly, this is not their core purpose. In our case, the GI acts rather as a framework within which a wide variety of agricultural practices can be applied.

Thus, to comply with chain stores’ supplementary expectations, growers are encouraged to pursue other third-party certifications such as the Global G.A.P. or Global Food Safety Initiative (GFSI) (such as BRC, IFS, etc.) [50] and organic (more involved). The former offers further guarantees on traceability; the latter helps meet growing consumer demand for certified organic products.

4.1.2. Quality Control Based on Physicochemical Standards and Very Low Tolerance for Visual Defects

In their collective approach to define and control quality, the sector has utilized two basic forms of quality control which have helped them raise and homogenize quality standards for taste and visual appearance [2,44]. These qualifications do not help define or protect the products’ specificity [1,33,41].

Currently, flavor is only assessed based on physicochemical tests measuring the balance between sweetness and acidity. This does not do much to help guarantee or identify the sensorial profile that distinguishes the Corsican grapefruit from others [51]. There is a dissonance between the local stakeholders’ representation of the ideal Corsican grapefruit and that which the consumers have to guide them in their sensorial experience [28]. This is reinforced by the fact that consumers in Europe and in France generally still do not fully grasp the significance of GIs in terms of what they represent for quality (especially for typicality) [4,15]. Nevertheless, it is important for local stakeholders to continue to strive to educate consumers on the significance behind the GI.

Similarly, controls have been put in place in order to commercialize only the “good looking fruit”. Recall that the product specifications only allow fruits in category I or extra to be commercialized under the GI label. This echoes the approach the local stakeholders took to integrating visual standards into the clementine’s CoP [1], however, then they also identified qualities that spoke to the product’s specificity. For the clementine, the specificity is evidenced by the leaf and the green underside, a mark showing the effects of the local climate on the color of fruit. Leaving the green skin was an important decision that supported the group’s marketing strategy, and also had important implications in the underlying production practices which helped link the product to its terroir. Selling the fruit with the leaf and with some green skin shows that the product did not undergo any post-harvest chemical treatments and that the fruit was carefully harvested at maturity with at least two passes on the tree [1,11].

By contrast, the criteria defined for the grapefruit falls short of elements that could help specify it. The CoP does describe the product as having a “red cheek” (or an orange-red spot) which is a sign of maturity, however, not all the fruits are required to have this in order to be harvested. Variability in quality might be reinforced by one of the rules in the CoP: all fruits in the tree must be harvested at once, and all the trees in one same orchard block must also be harvested at the same time.

The way grapefruits are qualified and harvested has negative consequences on the scheme’s sustainability, especially from an environmental lens. The current system leads to high levels of food waste as anywhere from 20–50% of the fruit that is produced is discarded. This represents a drain on the local environmental and economic resources like water, fertilizers, time, etc.

The organic GI fruits make no exception as they are also held to the same high visual standards. Qualifying the fruit according to these visual standards significantly reduces the profitability of organic production under the GI, where yields are typically lower to begin with and the fruits tend to have more visual defects. Further, since prices of the GI are already at the higher end of the spectrum, the organic growers in the GI feel like they cannot increase the price much to compensate for these losses. Prices for fruits certified under both labels are barely higher than those only certified under the GI. They are at prices comparable to the market leader, Florida, who is the main alternative for the Corsican grapefruit. It is thought that these prices could be maintained so long as demand for Corsican grapefruit continues to surpass supply.

Thus, there is less incentive to pursue stricter agroecological measures. Our case provides an example of how pairing the GI label with the organic one is actually helping reinforce the conventionalization of organic [50,51]. This paradox is strengthened and stabilized by consumer perceptions of the “perfect fruit” [40] and their willingness to pay a premium for origin products [13] —a dimension that we did not seek out in our investigation but that surfaced in many of the interviews.

Despite being fit for human consumption, a large proportion of the grapefruits are discarded, usually due to visual defects. There are currently no alternative markets for the fresh or transformed fruit (juice, jellies, etc.). The CoP also does not allow for fruits that do not meet the GI standard to benefit from the GI label as a transformed product (e.g., food “made with 100% GI Corsican grapefruit” is not authorized). Furthermore, local stakeholders do not envision selling the marked fruits using the label “origin France” as they feel that this would compete with the GI, potentially reducing price premiums.

4.2. Foreign Labor and Just-in-Time Logistics Constraints

Now that we have discussed the lock-ins observed related to the CoP (right side quadrants of Figure 1), we turn our attention to the left-hand side: the broader stakeholder business decisions. We see how these have a symbiotic relationship with the CoP and directly impact the product’s qualification.

Firstly, we have observed how labor acts as a constraint: seasonal workers on six-month working visas are hired for the beginning of the clementine harvest in October, which means that they must wrap up harvesting and leave by the end of March. The minimal ratio between sugar and acidity allows growers to do this. They can start harvesting as early as February, when the fruit can still be acidic. This reinforces the idea that the grapefruit is a secondary product, thought to complement the clementine production [2]. It also shows the compromises being made on the qualification of the grapefruit, as it must bend to fit the needs of the more dominant clementine production including its infrastructure and logistics (JIT distribution) systems.

In the 2000s, the stakeholders considered an alternative commercial model, one where they would store the fruit to sell them on the local summer tourist market [2]. This explains why the CoP authorizes storage for up to eight weeks. Despite this, today producers and commercial agents do not utilize this option because their views on what qualifies as “fresh” erroneously aligns with what they know about the Clementine, i.e., that it is a fragile fruit whose quality characteristics degrade at a fast rate [52]. Since freshness is a top-quality criterion, a JIT distribution system has been devised for the clementine. As a complementary product, the grapefruit production has, by default, adopted the same distribution system, despite the fact that the fruit’s qualities degrade at a much slower rate [39] and that local experts have found that the fruit can even benefit from cold storage which helps refine it, concentrating sugars and thinning the skin [2,53,54,55].

The sector is selling the image of freshness with the idea that consumers are eating a fruit that was just hand-picked from the tree. This reinforces the image of naturalness (associated with eco-friendly farming practices) and health benefits (fresher fruits would have more vitamins) [38]. In the case of the Corsican grapefruit, this is potentially restricting the commercial and distribution options of stocking the fruit for sale during the spring–summer tourist market season.

4.3. From Provenance to Embeddedness: Identifying Levers for Change

The Corsican citrus fruit sector uses a differentiation strategy based on quality and origin, yet as we have demonstrated, the Corsican grapefruit’s link to its terroir is weak as it is not based on specific and tangible qualities. The stakeholders mainly rely on the seasonality of the fruit (market gap) and the strong reputation of the Corsican brand image to sell it [14]. The grapefruit is positioned as a premium product, after Florida, which remains the market leader in terms of quality, as reflected in the price. The Corsican grapefruit’s success is therefore skewed, relying more on localization and its reputation than on origin [15]. If the fruit, for example, is unable to reach its full aromatic profile and be distinguishable by taste, or if it simply falls short of customer expectations, it could degrade the reputation of all Corsican citrus fruits. Thus, there are high stakes for specifying the GI Corsican grapefruit, collectively, to strengthen the link to its terroir [15,17].

Having discussed the identified lock-ins of the GI Corsican grapefruit, we can envision solution pathways for long-term sustainable planning as illustrated in Figure 2.

Beginning in the bottom right quadrant and moving clockwise, we can visualize as a solution, accepting and embracing minor visual defects (Section 4.3.1) which could help in long-term strategic planning to further define the fruit’s typicality and reduce food waste. Moving forward with these solution pathways would require consensus among the collective to evolve the GI’s CoP [13].

The sector’s long-term diversification strategy rests on introducing new fruits to the mix to produce a cohesive basket of goods and on optimizing all potential market channels. If the local actors introduce a new fruit that is harvested just after the clementine, then the grapefruit could be harvested later. This would allow growers and commercial agents to hire workers on an annual basis, thus, reducing the pressure to harvest so early. Later harvests paired with cold storage could help diversify distribution channels to reach the local spring/summer market. Overall, this could have a positive effect on the product’s gustatory qualities. All of this necessitates, however, further anchoring and embedding of the fruit into its territory (Section 4.3.2).

4.3.1. Precedents of Unconventional GI Fruits Sold in Supermarkets

Being more lenient about the visual aspect to reduce the proportion of discarded fruit could be a lever for encouraging eco-friendly practices such as organic farming. This idea has been observed for other French fruits and vegetables under GI [47]. Corsican citrus stakeholders have already done it with their flagship product: they were able to convince chain stores to sell a smaller, slightly green, and more acidic clementine in a world where big, orange, and sweet prevail [1]. By further specifying their own product, local actors can assert greater control, leaving less room for downstream forces to impose expectations on product appearance [17].

Furthermore, as our results show, chain stores are not a homogeneous group [33] and do authorize a variety of standards. This plurality of purchasing behaviors constitutes potential levers for change to help further specify the Corsican grapefruit. The actors can benefit from the open mindedness of certain buyers in Corsica and elsewhere [17] and work to improve their communications to educate the consumer on things like taste [41].

Being more lenient about the Corsican grapefruit’s appearance would permit the study of possibilities of transformation for the GI. To that matter, the CoP could allow the use of the GI name to be applied to transformed products such as juices and jams that are made using the fruits that do not currently meet the visual standards of the GI (marked and discarded fruits). The collective is considering ways in which they might evolve the GI’s CoP. Some working groups are also looking to invest in a juice factory for this potential scenario.

4.3.2. Perspectives of Embedding the GI Corsican Grapefruit into the Local Food Identity

The local citrus stakeholders have built a strong and cohesive collective organization able to sell Corsican citrus to France and beyond [2,44]. However, qualifying origin products is not only a question of the sector’s business organization, but also a question of how the local society interacts with a product and consumes it [6,42]. Ensuring that an origin product is locally embedded informs how resilient its production will be [56]: local products are “at one level, rooted in a specific territorial context, and at the same time, hold the potential to travel to distant markets” [57].

In other cases, as with ours, the Corsican grapefruit and clementine are products recently developed (1960s), and produced primarily for export markets [2,33,44]. When this is the case, the economic sustainability of the sector is the main focus and other elements important to the broader sustainability of the sector may be compromised.

Locally embedding the Corsican grapefruit would mean creating the conditions for the local society to appropriate the product. This perspective is consistent with the work on local products and their embeddedness [17,58]. This concept also builds on recent work in agroecological transition, which acknowledges that transformations in agri-food systems towards greater sustainability take shape at the territorial level, at the intersection between health, food, environment, and agriculture [20,59,60].

From a practical standpoint, this would entail rethinking relationships between producers, marketers, and local traders to reach consumers locally (locals and tourists). Those stores are entries into the local market. They could absorb more important volumes when the tourism season starts in the spring, providing opportunities to utilize more wholly the products produced. As our findings suggest, not all stores rely on official labels to guarantee or communicate quality. Further study is required to understand the potential for growth on the local market, however, we estimate that even if a portion of currently discarded fruit could be better utilized and consumed locally, this could help significantly reduce food waste. It would also help increase awareness and consumption locally helping to further embed the product into the local society.

Exploiting local channels is a way to rethink farming and marketing practices to find solutions for the immediate future since the CoP need not evolve in order to accommodate them. In fact, this would allow the stakeholders to utilize existing underexploited rules. To that matter, some farmers are considering investing in cold storage facilities to be able to increase volumes and/or to extend their selling season into the summer tourist market. It could also provide the space and context needed to establish the fruit’s typicality by playing on a more informal locally embedded qualification [16], and by removing existing constraints put in place by downstream forces within conventional and longer channels [15].

Diversifying market channels would finally help reduce the sector’s dependence on mainstream continental chain stores and help mitigate against market shocks. We are reminded how vulnerable the sector is to these shocks by recent events such as the “gilet jaune” movement, strikes in sea transportation, and the COVID-19 pandemic and the resulting reduced access to foreign workers.

5. Conclusions

Since grapefruit production was developed to support the sector’s flagship product (the clementine), its qualification has largely been devised for practicality. The quality control is based on conventional market standards for visual appearance, freshness, and instrumental evaluation of taste. This strategy has allowed Corsican producers to raise the quality of their fruits to levels comparable with other market leaders such as Florida. They have also been able to raise their reputation and relative quality based on links to origin which associates the naturalness of the island to the nutritional and ecological advantages of their product.

With this commercial success, the actors find themselves in an ambiguous situation today: they benefit from an undeniable competitive advantage on the French market, as they are the only place in France with the right climatic conditions for citrus production [6], yet they are not considered the most premium product on the French market [7]. Their niche production, which is sold almost exclusively through mainstream grocery stores, is, thus, still constrained and confined to times when there is a gap in the market between productive times from other world zones.

The Corsican grapefruit is essentially commercialized at a time in the year when the producers and commercial agents feel that the quality is compromised; it is still too acidic and does not express its full flavor profile. Even though the fruit is commercialized under the protection of a GI, its flavor and typicality are under-expressed. In this way, the GI is primarily used to help penetrate mainstream markets, relying on reputation of place, rather than as a tool to express and control origin-linked quality standards, or used for sustainable development. The balance of this system has brought on a certain commercial success, but there is growing concern that it cannot be sustained through other long-term market and climate-related threats.

The results of our study have been presented and have proven useful to local industry stakeholders and the GI governing boards, helping to stimulate discussions about the sustainability of their local GI food system. They allowed for constructive conversations reflecting on potential evolutions within their sector to ensure its sustainability.

This first inquiry could be supported by further market and consumer research seeking to better understand quality priorities for citrus and for grapefruit among French and European consumers, as well as market potential across diversified and local channels. Further study on the physiological evolution of the fruit over the season and its effect on the grapefruit’s aromas could help lead further reflections on seasonality and typicality. This would help put in place gustatory controls, through sensory analysis in the GI. Finally, further reflection into the organization of seasonal work would help address socioeconomic issues related to the employment of foreign labor.

In this paper, we have shown how using a product-centered approach to understanding the product qualification along the value-chain can provide a useful framework to support sustainable long-term planning in GI food systems. Most notably, this approach helps to identify the nuances and practical implications associated with an agri-food system’s strengths and weaknesses, which in turn, allows us to identify more specific solution pathways. In our case, this approach allowed us to identify key lock-ins based on tensions and compromises. Understanding these has helped us, and the local actors, identify potential solution pathways and plan for long-term sustainability goals related to reorganizing human resources, building upon the fruit’s typicality, reducing food waste, and embedding the product into local society.

By proposing a conceptual framework adapted to the case of the GI Corsican grapefruit, we are helping refine an approach at the territorial level that is part of broader global challenges (agro-ecological transition and transdisciplinarity) [52]. Focusing on the product qualification ultimately allows us to grasp the situation fully. Our study raised issues of governance and of collective choices that should be explored further. Faced with its results, local actors can, by mobilizing and rearranging the alternatives thus exposed, build their own pathways towards sustainable development.

Author Contributions

All authors elaborated the conceptualization, methodology, and analysis; V.K. realized the investigation; M.M., F.C. and S.G. supervised. M.M. and V.K. prepared the original draft with inputs from F.C. and S.G.; all reviewed the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by a European FEDER Project (Innov’Agrumes; 2018–2021).

Acknowledgments

The authors thank all the people that were interviewed for their benevolence towards the work, for their time, and for the honesty and sincerity in their responses.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Belmin, R.; Casabianca, F.; Meynard, J.-M. Contribution of transition theory to the study of geographical indications. Environ. Innov. Soc. Transit. 2018, 27, 32–47. [Google Scholar] [CrossRef]

- Keast, V. Construction of Quality along the Value-Chain for the Corsican Grapefruit. Mémoire de fin d’Etudes; Ecole Supérieure d’Agriculture: Angers, France, 2019. [Google Scholar]

- Vandecandelaere, E.; Arfini, F.; Belletti, G.; Marescotti, A. Linking People, Places and Products: A Guide for Promoting Quality Linked to Geographical Origin and Sustainable Geographical Indications, 2nd ed.; FAO: Roma, Italy, 2010; ISBN 978-92-5-106656-0. [Google Scholar]

- Belletti, G.; Marescotti, A. Origin products, geographical indications and rural development. In Labels of Origin for Food: Local Development, Global Recognition; CABI Publishing: Wallingford, UK, 2011; pp. 75–91. ISBN 978-1-84593-352-4. [Google Scholar]

- Aprile, M.C.; Caputo, V.; Nayga, R.M.; Nayga, J.R.M. Consumers’ preferences and attitudes toward local food products. J. Food Prod. Mark. 2015, 22, 1–26. [Google Scholar] [CrossRef]

- Serrurier, M.; Miladinovic, D.; Bertrand, R. Produits Grande Consommation: Volume en Baisse et Quête de Sens; FranceAgriMer, CTIFL et Interfel: Paris, France, 2019; p. 8. [Google Scholar]

- Imbert, E. Diversification Fruitière: Tendances des Marchés et Pistes de Réflexion pour la Corse; Communication to the Corsican Citrus Sector; CIRAD: Montpellier, France, 2019. [Google Scholar]

- Heng, Y.; Tejeda, M.; House, L.O. An overview of the grapefruit market in France. EDIS 2020, 2020, 4. [Google Scholar] [CrossRef]

- Millet, M.; Saby, L.; Julhia, L.; Casabianca, F. Participatory breeding as an alternative way to produce knowledge? Insights from a French experience on citrus. In Proceedings of the Farming Systems Facing Climate Change and Resource Challenges, Evora, Portugal, 28 March–1 April 2021. [Google Scholar]

- Belmin, R.; Meynard, J.-M.; Julhia, L.; Casabianca, F. Sociotechnical controversies as warning signs for niche governance. Agron. Sustain. Dev. 2018, 38, 44. [Google Scholar] [CrossRef]

- Julhia, L.; Belmin, R.; Meynard, J.-M.; Pailly, O.; Casabianca, F. Acidity drop and coloration in clementine: Implications for fruit quality and harvesting practices. Front. Plant Sci. 2019, 10, 10. [Google Scholar] [CrossRef] [PubMed]

- Julhia, L.; Barzman, M. Prospect’Agrum: Des Visions D’Avenir sur la Filière Agrumicole Corse en 2040; INRA: San Giuliano, France, 2018. [Google Scholar]

- Barham, E.; Sylvander, B. (Eds.) Labels of Origin of Food: Local Development, Global Recognition; CABI Publishing: Wallingford, UK, 2011; ISBN 978-1-84593-352-4. [Google Scholar]

- Belletti, G.; Marescotti, A.; Touzard, J.-M. Geographical indications, public goods, and sustainable development: The Roles of actors’ strategies and public policies. World Dev. 2017, 98, 45–57. [Google Scholar] [CrossRef]

- Gangjee, D.S. Proving provenance? Geographical indications certification and its ambiguities. World Dev. 2017, 98, 12–24. [Google Scholar] [CrossRef]

- Tregear, A.; Arfini, F.; Belletti, G.; Marescotti, A. Regional foods and rural development: The role of product qualification. J. Rural. Stud. 2007, 23, 12–22. [Google Scholar] [CrossRef]

- Bowen, S. Embedding local places in global spaces: Geographical indications as a territorial development strategy. Rural Sociol. 2010, 75, 209–243. [Google Scholar] [CrossRef]

- Vandecandelaere, E.; Teyssier, C.; Barjolle, D.; Jeanneaux, P.; Fournier, S.; Beucherie, O. Strengthening Sustainable Food Systems through Geographical Indications; FAO: Rome, Italy, 2018; p. 158. [Google Scholar]

- Hoang, G.; Le, H.T.T.; Nguyen, A.H.; Dao, Q.M.T. The impact of geographical indications on sustainable rural development: A case study of the Vietnamese Cao Phong orange. Sustainability 2020, 12, 4711. [Google Scholar] [CrossRef]

- Owen, L.; Udall, D.; Franklin, A.; Kneafsey, M. Place-based pathways to sustainability: Exploring alignment between geographical indications and the concept of agroecology territories in Wales. Sustainability 2020, 12, 4890. [Google Scholar] [CrossRef]

- Barham, E. Translating terroir: The global challenge of French AOC labeling. J. Rural Stud. 2003, 19, 127–138. [Google Scholar] [CrossRef]

- Alrøe, H.F.; Sautier, M.; Legun, K.; Whitehead, J.; Noe, E.; Møller, H.; Manhire, J. Performance versus values in sustainability transformation of food systems. Sustainability 2017, 9, 332. [Google Scholar] [CrossRef]

- Forney, J.; Häberli, I. Introducing ‘seeds of change’ into the food system? Localisation strategies in the swiss dairy industry. Sociol. Rural. 2014, 56, 135–156. [Google Scholar] [CrossRef]

- Wezel, A.; Brives, H.; Casagrande, M.; Clément, C.; Dufour, A.; Vandenbroucke, P. Agroecology-territories: Places for sustainable agricultural and food systems and biodiversity conservation. Agroecol. Sustain. Food Syst. 2015, 40, 132–144. [Google Scholar] [CrossRef]

- Schader, C.; Grenz, J.; Meier, M.; Stolze, M. Scope and precision of sustainability assessment approaches to food systems. Ecol. Soc. 2014, 19. [Google Scholar] [CrossRef]

- Brunori, G.; Galli, F.; Barjolle, D.; Van Broekhuizen, R.; Colombo, L.; Giampietro, M.; Kirwan, J.; Lang, T.; Mathijs, E.; Maye, D.; et al. Are local food chains more sustainable than global food chains? Considerations for assessment. Sustainabiliy 2016, 8, 449. [Google Scholar] [CrossRef]

- FAO. SAFA Guidelines: Sustainability Assessment of Food and Agriculture Systems; FAO: Rome, Italy, 2014; ISBN 978-92-5-108485-4. [Google Scholar]

- Millet, M.; Casabianca, F. Sharing values for changing practices, a lever for sustainable transformation? The case of farmers and processors in interaction within localized cheese sectors. Sustainability 2019, 11, 4520. [Google Scholar] [CrossRef]

- Amilien, V.; Moity-Maïzi, P. Controversy and sustainability for geographical indications and localized agro-food systems: Thinking about a dynamic link. Br. Food J. 2019, 121, 2981–2994. [Google Scholar] [CrossRef]

- Deaton, B.J.; Busch, L.; Samuels, W.J.; Thompson, P.B. A note on the economy of qualities: Attributing production practices to agricultural practices. J. Rural Soc. Sci. 2010, 25, 99–110. [Google Scholar]

- Callon, M.; Méadel, C.; Rabeharisoa, V. The economy of qualities. Econ. Soc. 2002, 31, 194–217. [Google Scholar] [CrossRef]

- Sonnino, R.; Marsden, T. Beyond the divide: Rethinking relationships between alternative and conventional food networks in Europe. J. Econ. Geogr. 2005, 6, 181–199. [Google Scholar] [CrossRef]

- Bernard de Raymond, A. En Toute Saison. Le Marché des Fruits et Légumes en France; Tables des Hommes; Presses Universitaires de Rennes: Rennes, France, 2013; ISBN 978-2-7535-2866-6. [Google Scholar]

- Sautier, D.; Biénabe, E.; Cerdan, C. Geographical indications in developing countries. In Labels of Origin for Food: Local Development, Global Recognition; CABI Publishing: Wallingford, UK, 2011; pp. 138–153. [Google Scholar]

- Durand, C.; Fournier, S. Can geographical indications modernize Indonesian and Vietnamese agriculture? Analyzing the role of national and local governments and producers’ strategies. World Dev. 2017, 98, 93–104. [Google Scholar] [CrossRef]

- Belletti, G.; Marescotti, A. Costi e benefici delle denominazioni geografiche (DOP e IGP). Agriregionieuropa 2007, 3, 11–13. [Google Scholar]

- Coppola, A.; Ianuario, S. Environmental and social sustainability in producer organizations’ strategies. Br. Food J. 2017, 119, 1732–1747. [Google Scholar] [CrossRef]

- Freidberg, S. Fresh: A Perishable History, 1st ed.; Harvard University Press: Cambridge, UK, 2009; ISBN 978-0-674-05722-7. [Google Scholar]

- Fulponi, L. Private voluntary standards in the food system: The perspective of major food retailers in OECD countries. Food Policy 2006, 31, 1–13. [Google Scholar] [CrossRef]

- Hatanaka, M.; Bain, C.; Busch, L. Third-party certification in the global agrifood system. Food Policy 2005, 30, 354–369. [Google Scholar] [CrossRef]

- Kyriacou, M.C.; Rouphael, Y. Towards a new definition of quality for fresh fruits and vegetables. Sci. Hortic. 2018, 234, 463–469. [Google Scholar] [CrossRef]

- Delsol, C.; Serpentini, M.; Bianchini, A.; Albertini, C.; Alfonsi, E. Chiffres Clés de l’Agriculture Corse. Bilan de Campagne 2017; DRAAF de Corse: Bastia, France, 2018. [Google Scholar]

- Migliorini, P.; Wezel, A. Converging and diverging principles and practices of organic agriculture regulations and agroecology. A review. Agron. Sustain. Dev. 2017, 37, 63. [Google Scholar] [CrossRef]

- Belmin, R. Construction de la Qualité de la Clémentine de Corse sous Indication Géographique Protégée. Analyse des Pratiques Agricoles et du Système Socio-Technique. Ph.D. Thesis, Université de Corse-Pascal Paoli, Corte, France, 2016. [Google Scholar]

- Poméon, T.; Desquilbet, M.; Monier-Dilhan, S. Entre standards privés et normes publiques, la diversité des agricultures biologiques. Pour 2015, 227, 89. [Google Scholar] [CrossRef]

- Calboli, I. Geographical indications of origin at the crossroads of local development, consumer protection and marketing strategies. IIC-Int. Rev. Intellect. Prop. Compet. Law 2015, 46, 760–780. [Google Scholar] [CrossRef]

- Marescotti, A.; Quinones-Ruiz, X.; Edelmann, H.; Belletti, G.; Broscha, K.; Altenbuchner, C.; Penker, M.; Scaramuzzi, S. Are protected geographical indications evolving due to environmentally related justifications? An analysis of amendments in the fruit and vegetable sector in the European Union. Sustainability 2020, 12, 3571. [Google Scholar] [CrossRef]

- Belletti, G.; Marescotti, A.; Sanz-Cañada, J.; Vakoufaris, H. Linking protection of geographical indications to the environment: Evidence from the European Union olive-oil sector. Land Use Policy 2015, 48, 94–106. [Google Scholar] [CrossRef]

- Riccheri, M.; Gorlach, B.; Schlegel, S.; Keefe, H.; Leipprand, A. Assessing the Applicability of Geographical Indications as a Means to Improve Environmental Quality in Affected Ecosystems and the Competitiveness of Agricultural Products; Final report of the IPDEV project; IDEAS: Minneapolis, MN, USA, 2006. [Google Scholar]

- Wirth, D. Geographical indications, food safety, and sustainability: Conflicts and synergies. Bio-Based Appl. Econ. 2016, 5, 135–151. [Google Scholar] [CrossRef]

- Casabianca, F.; De Sainte Marie, C. Typical food products and sensory assessment Designing and implementing typicality trials. In Proceedings of the Socio-Economics of Origin Labelled Products: Spatial, Institutional and Co-Ordination Aspects, Le Mans, France, 28–30 October 1999; Sylvander, B., Barjolle, D., Arfini, F., Eds.; Actes et Communications, n° 17-2. INRA: Paris, France, 1999; pp. 270–276. [Google Scholar]

- De Sainte Marie, C. Le Désenchantement de la Clémentine de Corse ? … ou Comment les « Facteurs Naturels » Remodèlent la Figure du Marché; INRA: Avignon, France, 2003; p. 11. [Google Scholar]

- Pailly, O.; Tison, G.; Amouroux, A. Harvest time and storage conditions of ‘Star Ruby’ grapefruit (Citrus paradisi Macf.) for short distance summer consumption. Postharvest Boil. Technol. 2004, 34, 65–73. [Google Scholar] [CrossRef]

- Lee, H.; Nagy, S. Quality changes and nonenzymic browning intermediates in grapefruit juice during storage. J. Food Sci. 1988, 53, 168–172. [Google Scholar] [CrossRef]

- Legave, J.M.; Tisne-Agostini, D.; Jacquemond, C. Le Pomelo Star Ruby et sa Culture en Corse; INRA: San-Giuliano, France, 1991. [Google Scholar]

- Gonano, S. The agro-industrial district of the “Castelmagno” cheese: Social and economic implications for the rural environment of a small Piedmontese valley. In Proceedings of the 52nd EAAE Seminar, Typical and Traditional Products: Rural Effect and Agro-Industrial Problems, Parma, Italy, 19–21 June 1997; Arfini, F., Mora, C., Eds.; Universita di Parma: Parma, Italy, 1997; pp. 553–556. [Google Scholar]

- Sonnino, R. The power of place: Embeddedness and local food systems in Italy and the UK. Anthropol. Food 2007, 2. [Google Scholar] [CrossRef]

- Kirwan, J. Alternative strategies in the UK agro-food system: Interrogating the alterity of farmers’ markets. Sociol. Rural. 2004, 44, 395–415. [Google Scholar] [CrossRef]

- Lamine, C. Sustainability and resilience in agrifood systems: Reconnecting agriculture, food and the environment. Sociol. Rural. 2014, 55, 41–61. [Google Scholar] [CrossRef]

- Lamine, C.; Magda, D.; Amiot, M.-J. Crossing sociological, ecological, and nutritional perspectives on agrifood systems transitions: Towards a transdisciplinary territorial approach. Sustainability 2019, 11, 1284. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).