4.2. Subsamples by Abnormal Search Volume

We divide price reactions to earnings news by abnormal search frequency. The SUE1–SUE10 firms are independently sorted within SUE deciles into three groups, ASV1, ASV2, and ASV3, based upon abnormal search frequency on the earnings announcement day in each calendar quarter. ASV3 includes stocks with the largest abnormal search frequency. For each abnormal search frequency tertile, we calculate the CARs for the best and the worst earnings surprise deciles and the difference in CARs between the two extreme earnings surprise deciles.

Abnormal announcement day returns measure the stock price response to earnings news; higher abnormal announcement day returns for the best earnings surprise deciles and lower abnormal announcement returns for the worst earnings surprise deciles indicate that investors react more strongly to earnings news on the announcement date. The post-announcement abnormal returns of the two deciles measure underreaction to earnings news, as reflected in the subsequent drift. Our hypothesis predicts a stronger announcement-day reaction and a weaker post-announcement drift for intensive search frequency.

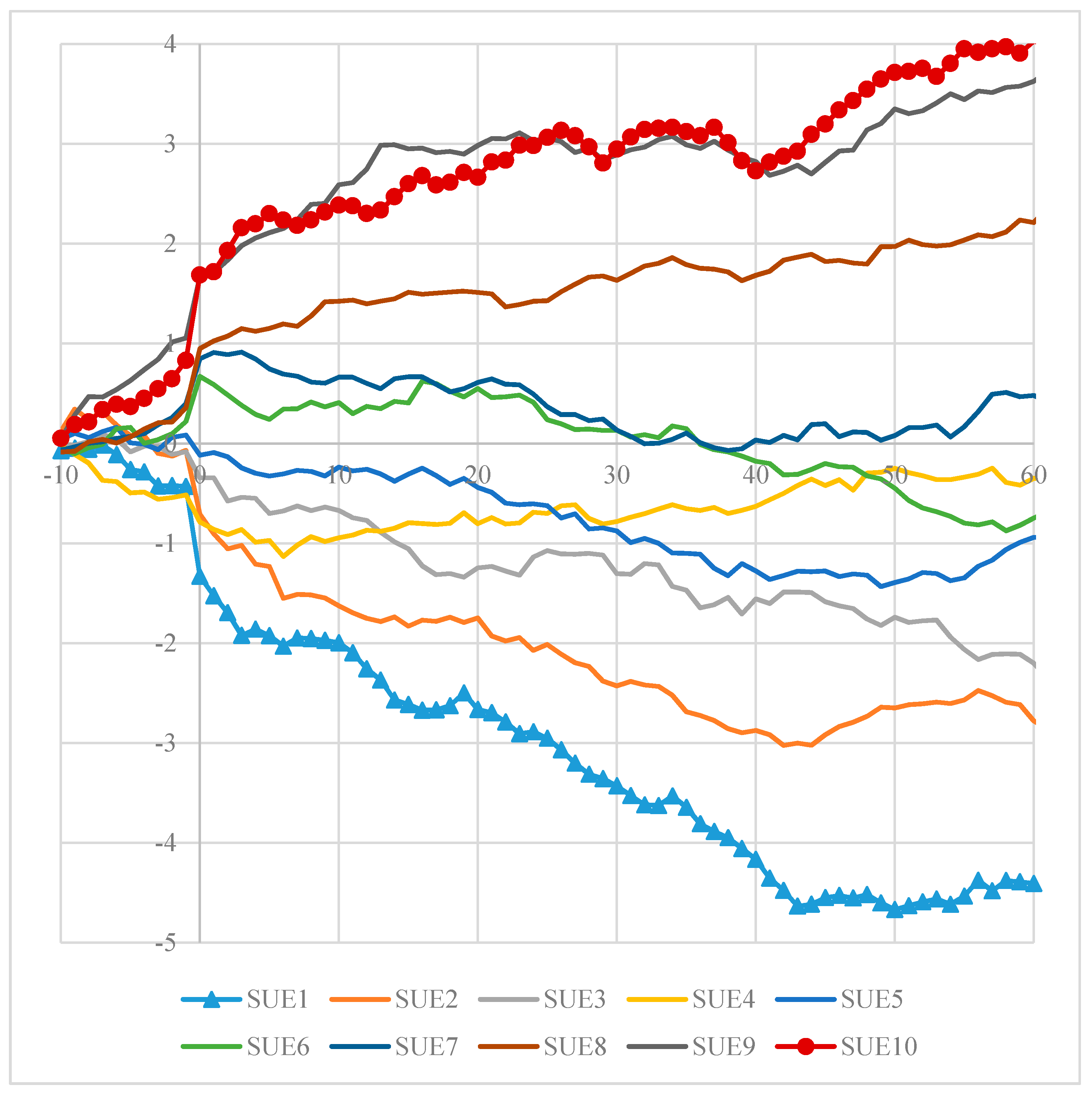

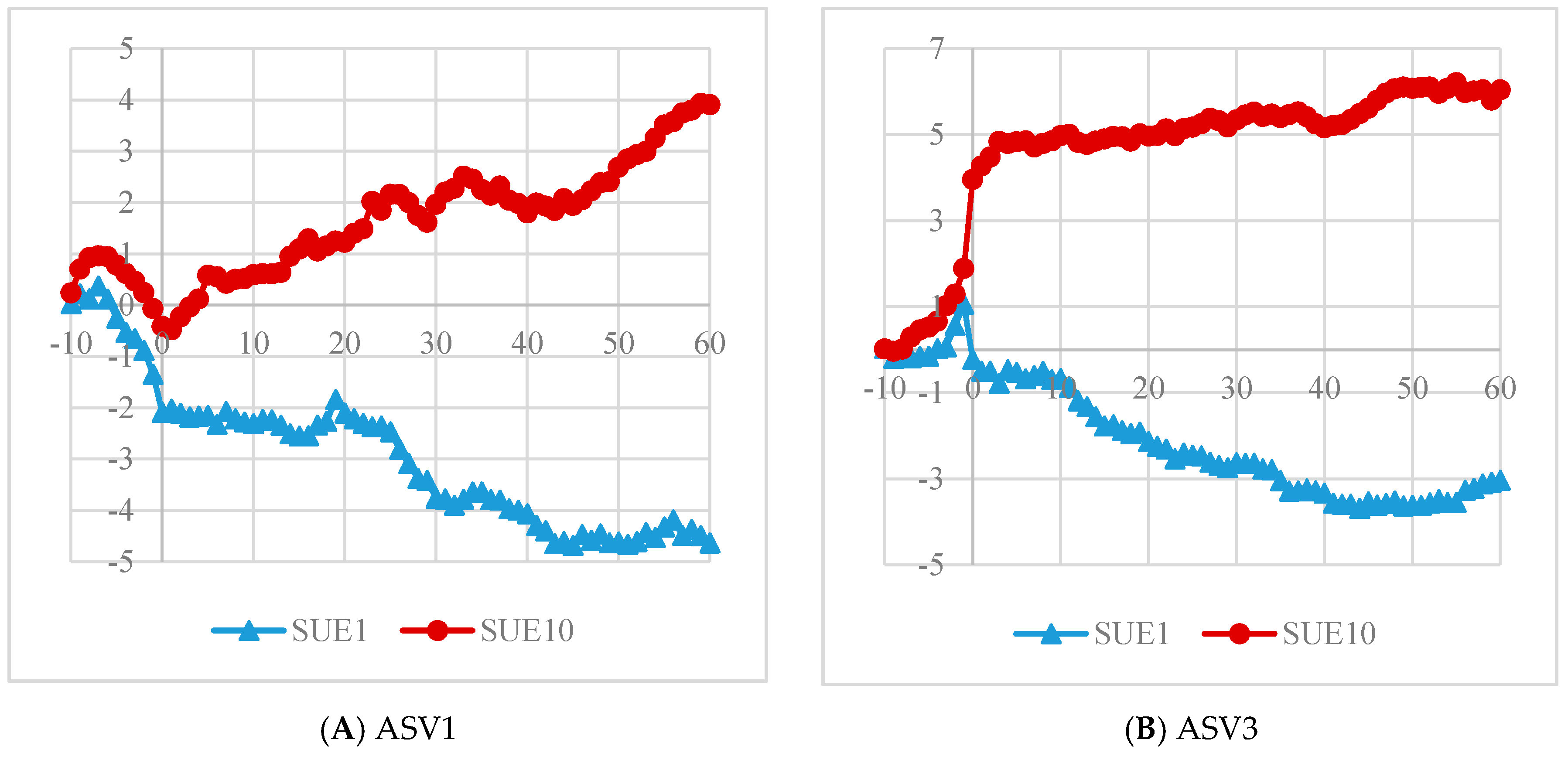

Figure 2 shows the

CAR[−10, 61] for

SUE1 and

SUE10 for

ASV1 and

ASV3, and provides graphical evidence supporting our hypothesis. The post-announcement drift for the most intensively abnormally searched firms (

ASV3) in Panel B is weaker than for the least abnormally searched firms (

ASV1) in Panel A. Especially, for

SUE10 for

ASV3, post-announcement drift seems to be insignificant, and announcement-day reaction is stronger. Hence, we expect that firms with good news and that have higher searches on the announcement day than usual have higher announcement date returns but lower post-announcement drift.

Panel A of

Table 6, which includes all stocks in both markets, reports results consistent with

Figure 2. It shows that two-day announcement investor reactions to earnings news are stronger for firms with higher search volume. The differences in

CAR[0, 1] between the most searched firms (

ASV3) and the least searched firms (

ASV1) are 2.79% for firms with good earnings news (

SUE10) and −0.879% for firms with bad earnings news (

SUE1), both of which are significant. However, although the two-day announcement abnormal returns of the least searched firms (

ASV1) are significant for both

SUE10 and

SUE1, the differences in

CAR[0, 1] between

ASV3 and

ASV1 are insignificant for firms with both good earnings news (

SUE10) and bad earnings news (

SUE1). For

SUE10, the average abnormal return on only

ASV3 is significantly positive. These results suggest that the market reactions to earnings news are more sensitive when investors search for these firms’ information. It also supports this that the difference between the most and least searched firms in the interdecile spreads (

SUE10−

SUE1) of

CAR[0, 1] is 3.668% and significant. For

ASV3, the mean spread in

CAR[0, 1] between

SUE10 and

SUE1 is 3.935% and significant, while for

ASV1, the mean spread is 0.266% and insignificant. That is, the market reaction to earnings news for less searched firms (

ASV1) rarely varies with the degree of the earnings surprise. Therefore, our hypothesis of stronger announcement-day reactions to earnings news for more searched firms is empirically verified. In addition, the effect of search volume on

CAR[0, 1] for the two extreme earnings news deciles is monotonic.

Search intensity is also related with weaker post-earnings announcement drift. The spread in the mean 60-day post-announcement abnormal returns (

CAR[2, 61]) between the good and bad earnings news deciles indicates weaker underreaction to earnings news for more searched firms (

ASV3) than for less searched firms (

ASV1). For

ASV1, the post-announcement abnormal return spread between the extreme earnings surprise deciles is 6.503% and significant, while the

ASV3 spread is smaller (4.324%). The spread in the post-announcement abnormal returns is monotonic across the abnormal search frequency tertiles. These results imply that the investors may underreact less to earnings news by paying attention to the firms, such as by searching for information. It also supports our argument that the difference between the most and least searched firms in the interdecile spreads of

CAR[2, 61] is −2.178% and marginally significant at the 10% level. The sources of this difference are the firms with good earnings news. For

ASV3, the 60-day post-announcement cumulative abnormal returns on the best earnings news deciles are −2.27% smaller than for

ASV1 and significant, whereas the difference between

ASV3 and

ASV1 in

SUE1 is insignificant. Since Da et al. [

3] and Kim [

33] document that internet search volume primarily captures retail investor attention and retail investors are limited in a short sale, the degree of underreaction to firms with good earnings news may be reduced more than with bad news when the firms are highly searched.

According to Panels B and C in

Table 6, the differences in market reactions to earnings surprises between more and less abnormally searched firms are significant for both the KOSPI and KOSDAQ markets, like in Panel A. For instance, the two-day cumulative announcement return differences between the most and least searched firms are similar and significant for both markets, regardless of whether the news is good or bad. Additionally, the spreads in the

CAR[2, 61] between

SUE10 and

SUE1 monotonically decrease from

ASV1 and

ASV3 in both markets. However, the source of the difference in the

CAR[2, 61] between the most and least searched firms (

ASV3−

ASV1) varies for

SUE10 and

SUE1. For SUE1, market underreaction to bad earnings news is remarkably moderated for

ASV3 in the KOSPI market. For

SUE10, the market underreaction to good earnings news is larger for

ASV1 in the KOSDAQ market than for any other group. These results imply that investors can more quickly react to bad earnings news from intensely searched firms in KOSPI than to bad news from other firms due to their searching and the market effect, and that rarely searched firms in the KOSDAQ attract little attention, even when they have good earnings news.

Overall, the differences between the most and least searched firms in the interdecile spreads (SUE10−SUE1) of CAR[0, 1] and CAR[2, 61] are 3.668% and −2.178%, and are significant. Furthermore, for KOSPI stocks, the differences are 3.736% and −3.460%. Considering that average of daily market returns is 0.035% during the same period and that the differences indicate returns on zero-investment portfolios, the calculated CARs are high enough to earn excess returns with the economic significance. In particular, the differences of the ASV3−ASV1 in the SUE10−SUE1 for CAR[0, 1] are about five times higher than market returns.

To control for the other possible determinants of investor responses to earnings news, we perform panel regressions of

CAR[0, 1] and

CAR[2, 61] on the earnings surprise decile rank (

SUE), the abnormal search frequency decile rank (

ASV), the interaction term

SUE ×

ASV, and control variables in

Table 7. We include firm- and day-fixed effects in the regressions to capture the within-firm effect, and the

t-statistics are adjusted for both heteroskedasticity and within correlation clustered by firm. Hirshleifer et al. [

8] estimate regressions using the decile rank of forecast error as opposed to the forecast error itself, since small negative surprises have a big influence. Thus, we expect that this approach will reduce the outlier effect. We control for other investor attention proxies and characteristics that might be related to cumulative abnormal returns. They include: firm size (

LnSize), the book-to-market value of equity (

BM), where the book value of equity is from the latest available accounting statement and the market value of equity is the market-cap on the announcement date, market-adjusted return (

MadjRet), absolute market-adjusted return (

AbsMadjRet), market-adjusted turnover (

MadjTO), intra-day stock fluctuation (

PrcHL) on the announcement date, the one-week (five trading days) return prior to the announcement date (

Ret[t−5, t−1]), the stock return between one month and one week prior to the announcement date (

Ret[t−20, t−6]), and the standard deviation of the return estimated from daily returns for one week prior to the announcement date (

σ[t−5, t−1]).

MadjRet and

AbsMadjRet are excluded in regressions of

CAR[0, 1].

Column (1) in

Table 7 confirms a positive relation between earnings surprise and earnings announcement day returns. However, the significantly positive effects of not only earnings surprise, but also abnormal search frequency disappear after adding the interaction term (

SUE ×

ASV) and control variables in Column (2). The interaction term has a significantly positive coefficient, which shows that the announcement return is more sensitive to earnings news for firms with higher abnormal searches. This evidence indicates that investor attention is required for good news to be incorporated into prices.

As a linear relationship in bad earnings news groups between abnormal search frequency and

CAR[2, 61] is not observed in

Table 6, inconsistently with good news groups, we separate positive earnings surprises from negative earnings surprises and conduct panel regressions in Columns (3) and (4) of

Table 7. According to Column (3), the positive and significant coefficient on

SUE confirms the existence of post-earnings-announcement drift for firms with better earnings news. The significantly negative coefficient on the interaction term

SUE ×

ASV implies that investor attention alleviates upside post-earnings-announcement drift with control variables such as market-adjusted returns and market-adjusted turnover. Although other attention variables, such as abnormal returns on the announcement date, may lead searching activity and, thus, mitigate the post-earnings-announcement drift, the evidence indicates that the relation between the abnormal search frequency and the post-earnings-announcement drift for firms with good earnings surprises is robust to the inclusion of the other attention variables. As expected from the non-monotonicity of a relationship in bad earnings news groups between

ASV and

CAR[2, 61] in

Table 6, the coefficient on the interaction term

SUE × ASV in Column (4) is insignificant. This asymmetric result may be caused by short-sale constraint to retail investors who use internet search engines to acquire firm information. In addition, the results are comparable to those of Ben-Rephael et al. [

4], who propose a proxy for institutional attention. They find that institutional attention facilitates information incorporation on the announcement day and induces fewer upside and downside drifts in the future.

4.3. Search Volume Effect across Firm Size

The aggregate search frequency is correlated with firm size, as in Panel A of

Table 3, although abnormal search frequency is not. This is acceptable because people can search for firms that they already know, and large firms are probably known more. Thus, firm size is one of the attention proxies and may be associated with the degree of post-earnings-announcement drift. Studies such as that of Bernard and Thomas [

30] find that post-earnings-announcement drift is stronger for smaller firms. Therefore, we investigate how the abnormal search frequency effect on market reaction to earnings news varies by firm size.

Earnings surprise deciles and firm size tertiles are formed based on quarterly independent double sorts of quarterly earnings announcements by the corresponding

SUE and the market-cap on the day of the announcement. We also form abnormal search frequency tertiles within the earnings surprise deciles based upon the

ASV on the announcement day in each calendar quarter.

Table 8 shows the announcement and post-announcement cumulative abnormal returns of portfolios.

According to the results, the spread in cumulative abnormal announcement day returns between earnings surprise deciles 10 and 1 (

SUE10−

SUE1) are significantly positive for all size tertiles. Moreover, the spread in post-announcement cumulative abnormal returns between earnings surprise deciles 10 and 1 is significantly negative, except for the large size tertiles. Therefore, the abnormal search volume effect on reaction to earnings surprise is largely robust to firm size. However, the difference between more and less searched firms in the interdecile spreads (

SUE10−

SUE1) of the

CAR[2, 61] for large firms is insignificant, because large firms have enough attention and, thus, search intensity cannot have a significant effect on post-announcement reaction, though it affects only announcement reaction. This result is consistent with Hirshleifer et al. [

8].

The CAR[0, 61], the total effect of earnings news on stock prices, of the more searched firms (ASV3) is larger for firms with the best earnings news and smaller for firms with the worst news than less searched firms (ASV1), but is not significantly different. For medium-sized firms, the CAR[0, 61] of the more searched firms is also not significantly different from that of the less searched firms. Nevertheless, the announcement cumulative abnormal returns of the more searched firms in portfolios with good news (SUE10) are significantly higher than for less searched firms in all size tertiles. Furthermore, the post-announcement cumulative abnormal returns of the more searched firms in SUE10 are lower than for ASV1, but significant only in the median tertiles. For SUE1, the post-announcement CARs of ASV1 are also significantly lower than for ASV3 only in the median tertiles, while the differences in announcement CARs between ASV3 and ASV1 are significant for both large and medium firms.

Overall, the results confirm our hypothesis best for medium firms. The sources of the abnormal search volume effect on post-earnings announcement drift are median stocks and small firms. As we argued above, large firms have sufficient attention. Additionally, it is not easy to sell the stocks of small firms, even when their worst earnings surprises are uncovered. Note that Korean stocks are mainly traded by retail investors. Their short-sale constraints, particularly for small firms, may inhibit them from reacting to bad news. As supporting evidence, we find that the difference in the CAR[0, 1] of SUE1 between ASV3 and ASV1 is bigger for larger firms.