4.2. Empirical Results

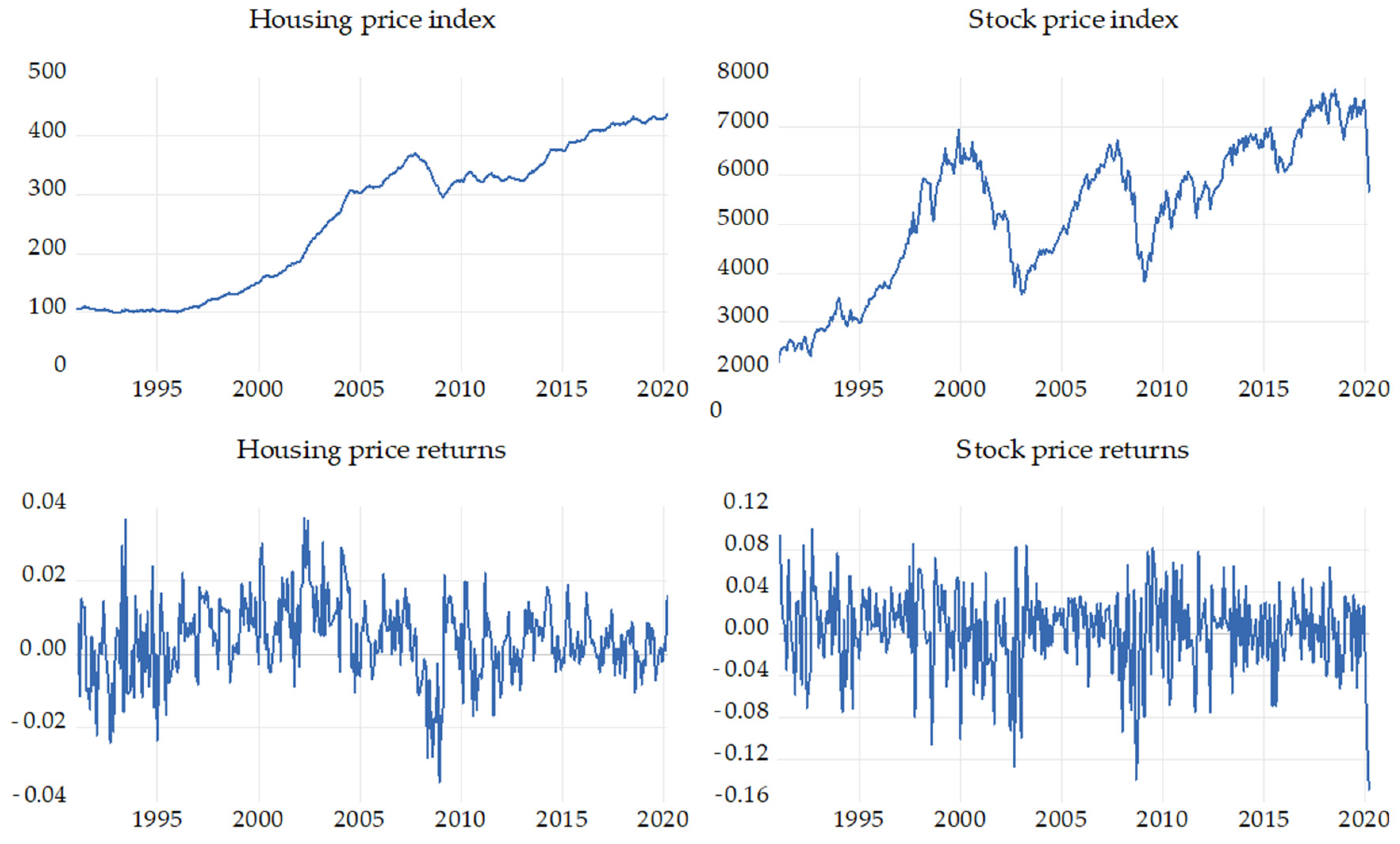

To preliminarily understand the relationship between the housing and stock markets,

Table 3 lists the causality tests of housing price and stock price returns and presents the causality (Periods 1–4) of various estimated lag periods. The Schwarz information criterion is considered when selecting the lag length of the model. The model with four lags is found to have the optimal goodness of fit. The results shown in

Table 3 suggest that all the test results cannot reject the null hypothesis of no causality, indicating that housing price return cannot influence stock price return and that the wealth effect of stock prices on housing prices does not exist.

Subsequently, Equations (6) and (7) were estimated, and the results are presented in

Table 4, which indicate that autocorrelation or housing price return from the previous period do not influence stock price returns and that autocorrelation is significantly and positively exhibited in housing price returns. The influence of stock prices from the previous period on housing price returns is still insignificant, probably because the model (Equation (4)) does not consider the dynamic correlation between the housing and stock markets and thus yields a poor goodness-of-fit of the model.

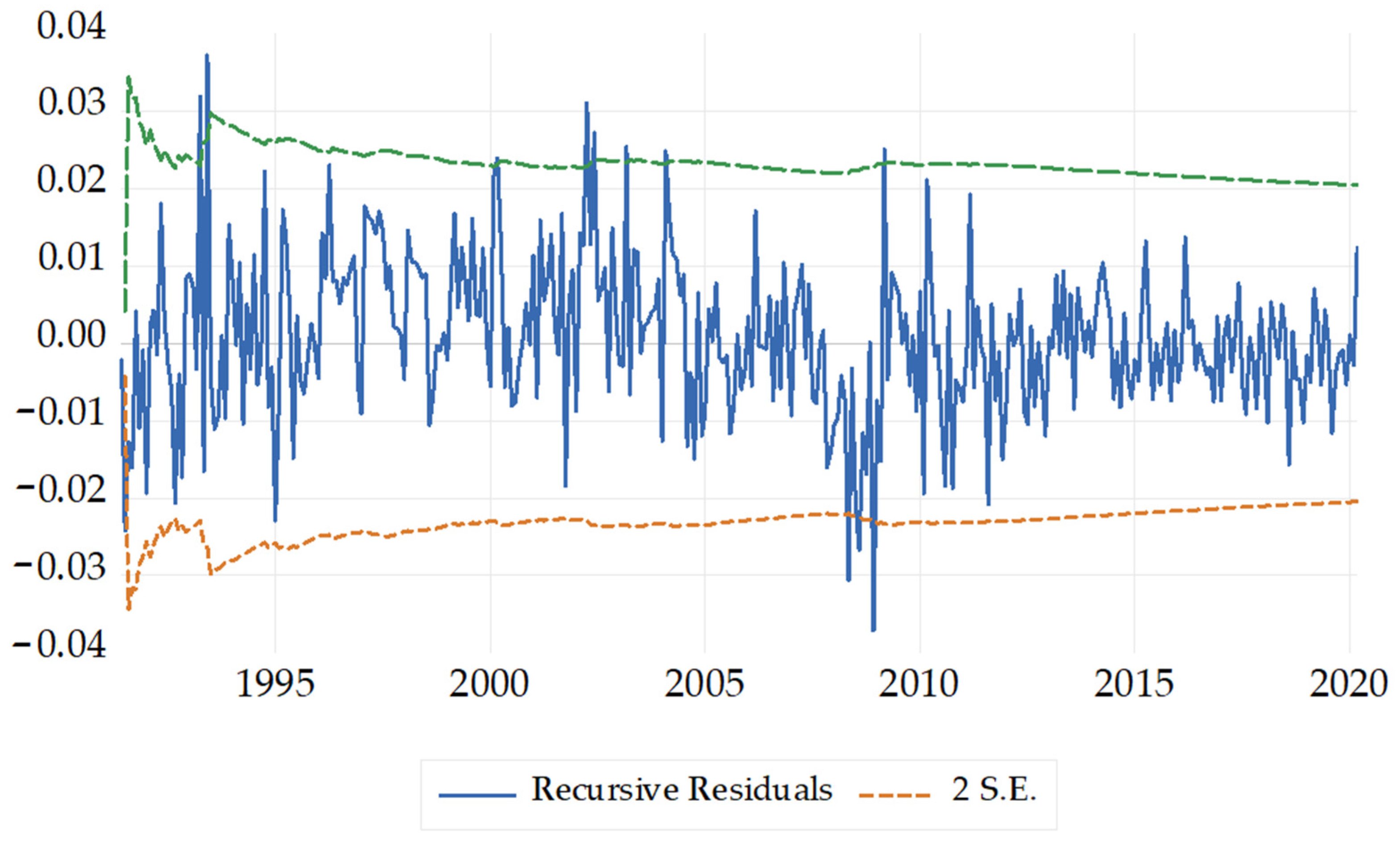

To verify the proposed problems regarding the goodness-of-fit of the model, the recursive residuals are illustrated in

Figure 3. Galpin and Hawkiws [

55] proposed a comparison between recursive residuals and residuals of normal distribution, through which potential problems in changes of regimes, outliers, and omitted predictors in the model can be examined and whether these problems prevented the goodness-of-fit from being correctly estimated can be analyzed.

Figure 3 shows the recursive residuals estimated in the model. Plus and minus two standard errors are also shown in

Figure 3, based on the assumption of normal distribution, the estimated residuals from the OLS model outside the standard error bands suggest instability in the parameters of the equation.

Figure 3 shows that many points in time exceed the theoretically estimated values, exceeding two times the standard deviation; thus, the goodness-of-fit of this linear model is poor.

Several factors can cause poor goodness-of-fit in the aforementioned model. The CUSUM test (Brown et al., [

54]) is continuously employed to examine whether a low goodness-of-fit is caused by structural changes of the estimated coefficients. The CUSUM test is based on recursive residuals (standardized forecast errors), which are estimated by using the OLS model for coefficients from the

observations. When the test statistic (the cumulated sum of the recursive residuals exceeds the corresponding critical value, the null hypothesis of parameter constancy is rejected. The CUSUM of the recursive residuals for the model and the corresponding critical value are illustrated in

Figure 4, which indicate that the accumulated residual values from 1999M12 to 2008M11 exceed the expected range. Therefore, the coefficients of the model within this period may be inconsistent with the estimated coefficients in other periods, suggesting that the relationship between housing and stock markets may be changeable.

Table 5 estimates Equation (8) to determine whether the excess rate of money growth of the linear model should be incorporated to estimate a high goodness-of-fit. The results in

Table 5 suggest that the autocorrelation of housing price return is not influenced by the excess rate of money growth because

is insignificant.

Table 5 also indicates that

is extremely significant and is a positive value (2.718), showing that the excess rate of money growth significantly influences the relationship between housing price return and stock price return from the previous period. A large excess rate of money growth increases the wealth effect of the stock market on the housing market. When the excess rate of money growth is 0, the stock market does not influence the housing market. This may be explained by the mutual offset between the crowding out of capital and the wealth effect in different industries, which is implied by Equation (3). When the excess rate of money growth is negative, the influence of stock price return from the previous period on housing price return is negative; therefore, the wealth effect no longer exists, and only the capital switching effect remains.

From the results in

Table 5, whether the effect of excess monetary liquidity exists can be observed; in other words, whether the excess rate of money growth is larger than 0 determines whether the wealth effect or capital switching effect can exist. To verify the effect of excess monetary liquidity, which is a crucial factor, the following equation was estimated:

In the aforementioned equation, a dummy variable (

) > 0 in the excess rate of money growth is incorporated. When

> 0,

= 1 or 0 otherwise. In Equation (15), the influence of the excess rate of money growth on the relationship between the housing and stock markets is measured only when excess monetary liquidity exists (i.e., when

> 0).

Table 6 presents the results.

The results shown in

Table 6 correspond with our inference, and the goodness-of-fit of the model (Adj

) is drastically superior to that shown in

Table 4 and

Table 5. When excess monetary liquidity does not exist (i.e., when

≤ 0), the stock price return from the previous period significantly and negatively influences housing price return (the coefficient = −0.0357), indicating that the capital switching effect exists between the housing and stock markets in these conditions. When excess monetary liquidity occurs (i.e., when

> 0), the stock price return from the previous period significantly and positively influences housing price return (the coefficient = 4.3645), and the extent of this positive influence is affected by the excess rate of money growth. Thus, the wealth effect exists between the housing and stock markets in these conditions, and a large excess liquidity indicates a strong wealth effect.

Table 7 presents the estimated results of the TVC model and suggests that the autocorrelation in housing price return exhibits no time-varying characteristics because only the constant term in the equation of the autocorrelation coefficient (

) is significant, and it is a significantly positive value (0.427). Therefore, housing price return is influenced by the return from the previous period, an influence 0.427 fold, and this influence exhibits no changes according to the currency level within the period shown in the data. In addition, the influence of stock price return from the previous period on housing price return changes according to time. Regarding the coefficient (

) equation that indicates the effect of the stock market on the housing market, all the coefficients are significantly differ from 0. The constant term is close to zero (−0.01), hence the effect is mainly influenced by the excess rate of money growth from the previous period and the period before the previous one, in which the coefficients are all positive and are approximately 0.5. If the currency in the previous two periods exhibited no excess liquidity, then the stock market and the housing market may only have little connection (i.e.,

= 0,

= −0.01). Moreover, if

< 0, the stock market may negatively influence the housing market. Hence, the capital switching effect existed. The results in

Table 7 are consistent with those in

Table 6. However, the estimated results of the TVC model clearly explain how the influence of the stock market on the housing market is determined. The results of

Table 7 also consistent with the findings of Lee et al. [

17]. Lee et al. [

17] provided the evidence showing the existence of capital switching activities between housing and stocks, and the relationships between Australian house prices and stock prices can vary depending on the market conditions.

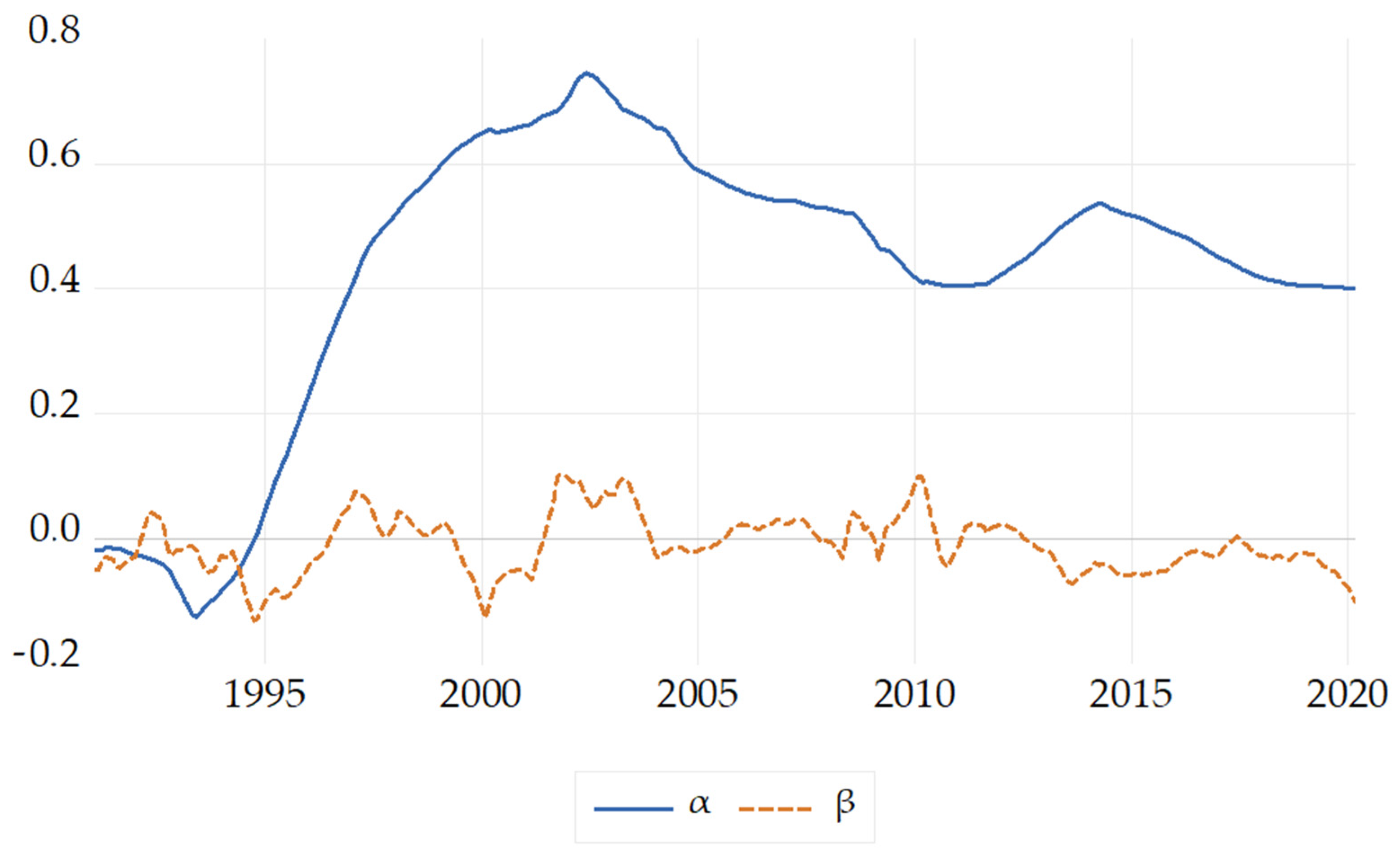

Figure 5 illustrates the model’s estimated autocorrelation coefficient (

) and the coefficient (

) that indicates the influential effect of stock markets on housing markets. The changes in

are minor, but a crucial turning point occurred around 2002. From 1993 to 2002, the autocorrelation coefficient of housing price gradually increased. The autocorrelation coefficient was originally negative in 1993, became positive in 1995, and almost remained at a level higher than 0.5 after 1998. A positive autocorrelation indicates the momentum of housing price changes; in other words, when housing price rises, a positive autocorrelation enables housing price to continuously increase, exhibiting a drastically rising trend in housing price. The estimated results are consistent with the price trends of UK housing and stock market in

Figure 1.

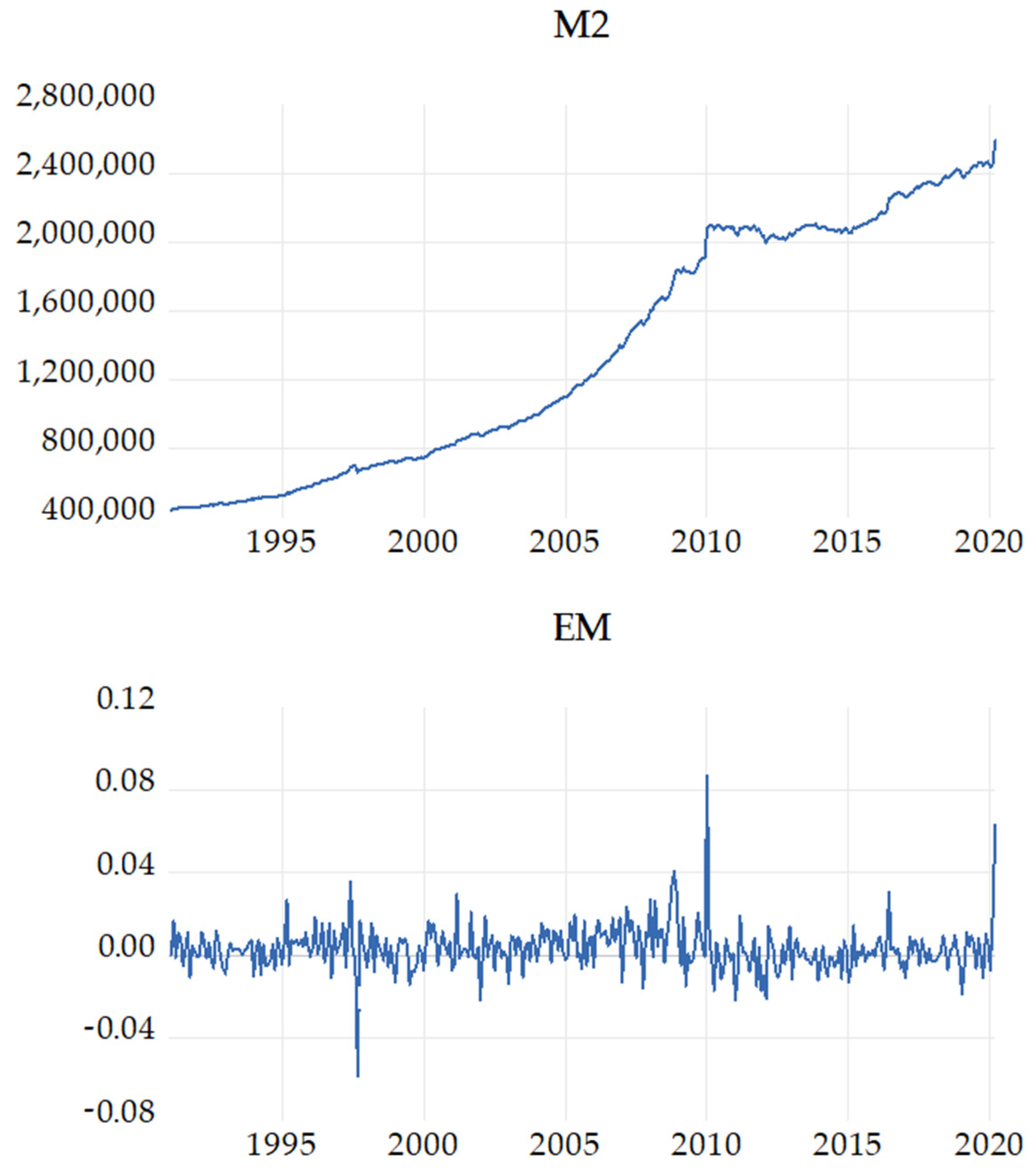

Figure 1 indicates that an evident rising trend in housing price in the UK started in 1999; specifically, before 1995, housing price exhibited a negative autocorrelation, and housing price return fluctuated, thereby preventing the formation of a rising trend. By comparison,

Figure 2 shows that the excess monetary liquidity before 1995 was minor; thus, the relationship between housing and stock markets should involve a crowding out of capital according to the estimated results in

Table 7. The stock market shown in

Figure 1 suggests that an upward wave pattern already existed before 1995.

Regarding the coefficient (

) that indicates the influential effect of the stock market on the housing market,

Figure 5 clearly illustrates the period in which the wealth effect and capital switching effect were present. For example, the capital switching effect was present in the housing and stock markets before 1996, and the wealth effect subsequently appeared from 1996 to 1999. From 1999 to 2001, the capital switching effect was present in the two markets; from 2001 to 2003, the wealth effect emerged in the two markets; after 2003, the wealth and capital switching effects in the two markets became insignificant. However, from 2008 to 2010, the wealth effect was evidently present during two periods.

Figure 2 shows that the two periods of substantial monetary easing occurred from 2008 to mid-2010; specifically, data indicate that the largest excess monetary liquidity in a single month occurred from late 2009 to early 2010, in which a rate of 8.69% was obtained after subtracting the economic growth rate from the money supply rate. This substantial stimulus also caused both the housing and stock markets to rebound sharply and fueled housing and stock price. The patterns of the coefficient (

) show the similar findings with that of Lee et al. [

17]. Lee et al. [

17] well documented the impact of the global financial crisis on the relationships between house prices and stock prices, especially, the capital switching effect was existed during the periods of the global financial crisis happened. The empirical results of this paper not only supported the findings of the previous studies, but also provided substantial evidence showing that excess monetary liquidity is a crucial factor in determining the effect of the stock market on the housing market.

Relevant studies (Quan and Titman, [

56]; Green, [

34]) found that the relationship between the stock market and housing market may differ because of the use of housing market data from different regions. To verify the inference of this study more strictly, the results of using the TVC model to estimate relations between the housing markets and stock markets in 13 regions in the United Kingdom are listed in

Table 8. The table reveals that when the regional housing markets are examined, excessive liquidity still has an extremely large influence.

Table 8 also indicates that the stock market has an increasingly positive influence on the housing market when the money has excessive liquidity in a total of seven regions. For two of the other regional housing markets, when the money has excessive liquidity, the housing prices tend to increase. Finally, in only four regional housing markets (the East Midlands, West Midlands, South West, and East Anglia), the housing and stock markets are not influenced by the excessive liquidity of money. In the West Midlands, the housing and stock markets are independent of each other. This may be because housing markets with certain characteristics (such as high prices) are not related to the stock market (Bangura and Lee, [

19]). This study finds that the house prices in some regions are not related to the stock prices. A possible reason is that this study uses samples that include the home price indices of all transactions (for both living and investment needs), and it does not just discuss the transactions for the investment need. Dieci and Westerhoff [

57], Lee et al. [

17], Pawson and Martin [

58], Bangura and Lee [

59] all study investor behaviors in housing markets. These behaviors are found to influence the risks and returns of the house prices. Therefore, the house prices effects that only consider the investors may be more related to the stock prices.