Announcement Effects of Convertible and Warrant Bond Issues with Embedded Refixing Option: Evidence from Korea

Abstract

1. Introduction

2. Hypothesis Development and Research Methodology

2.1. Hypothesis Development

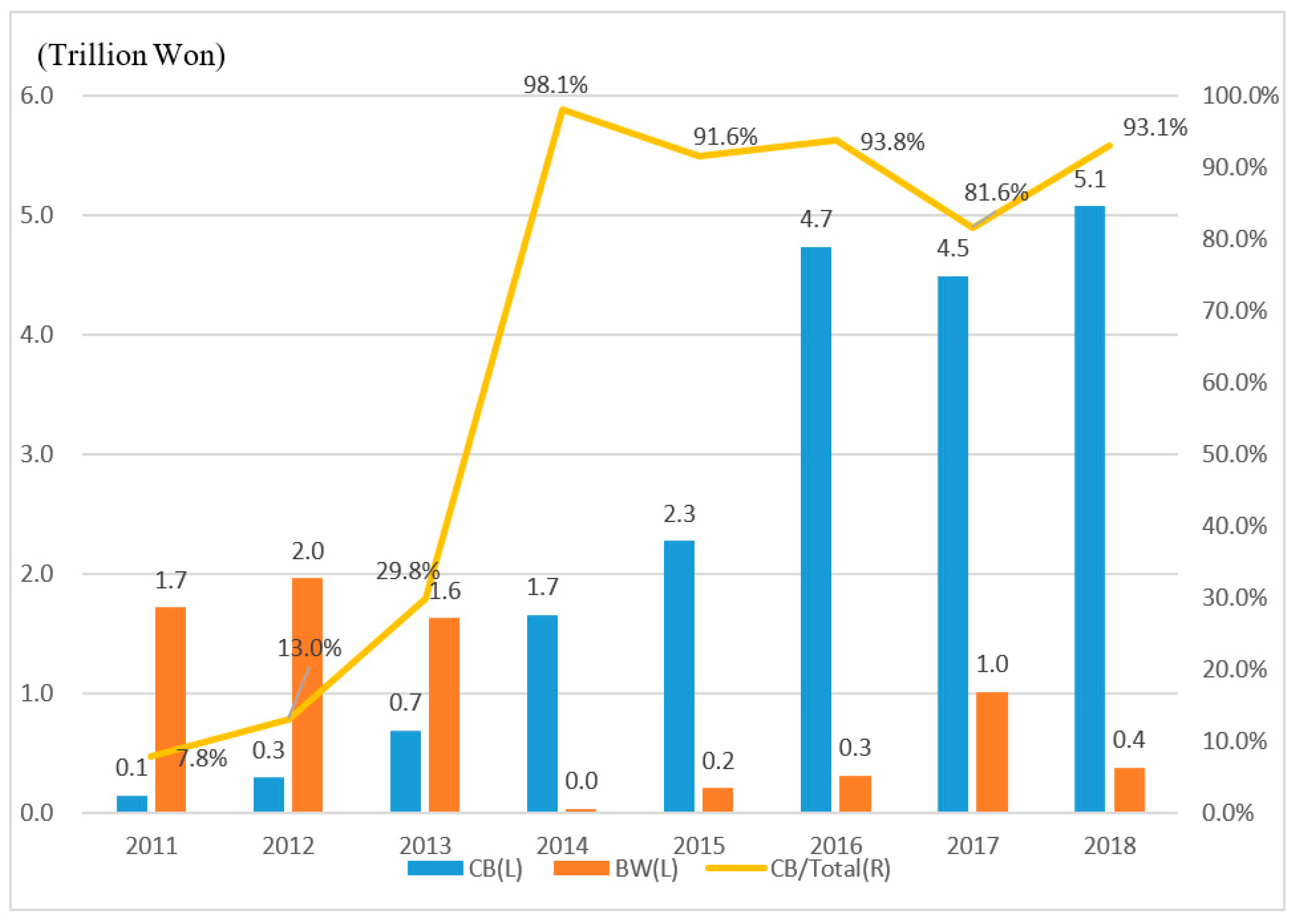

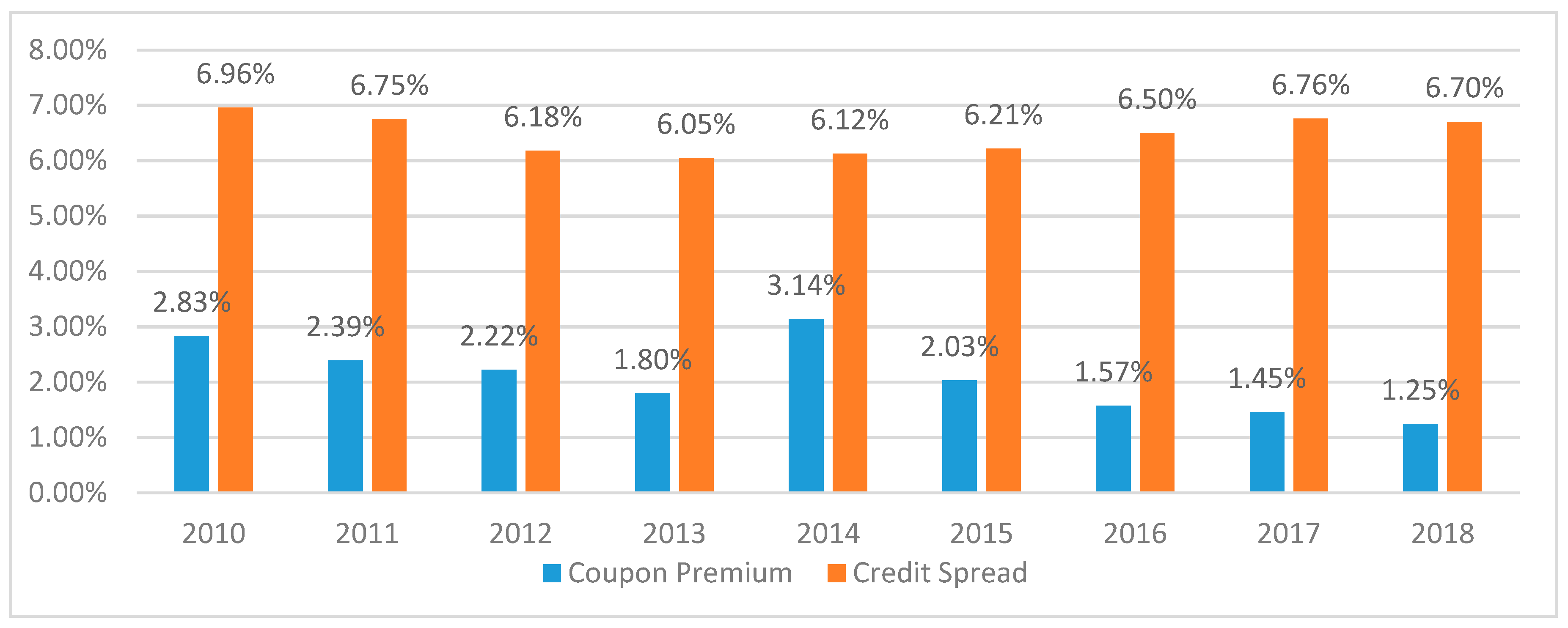

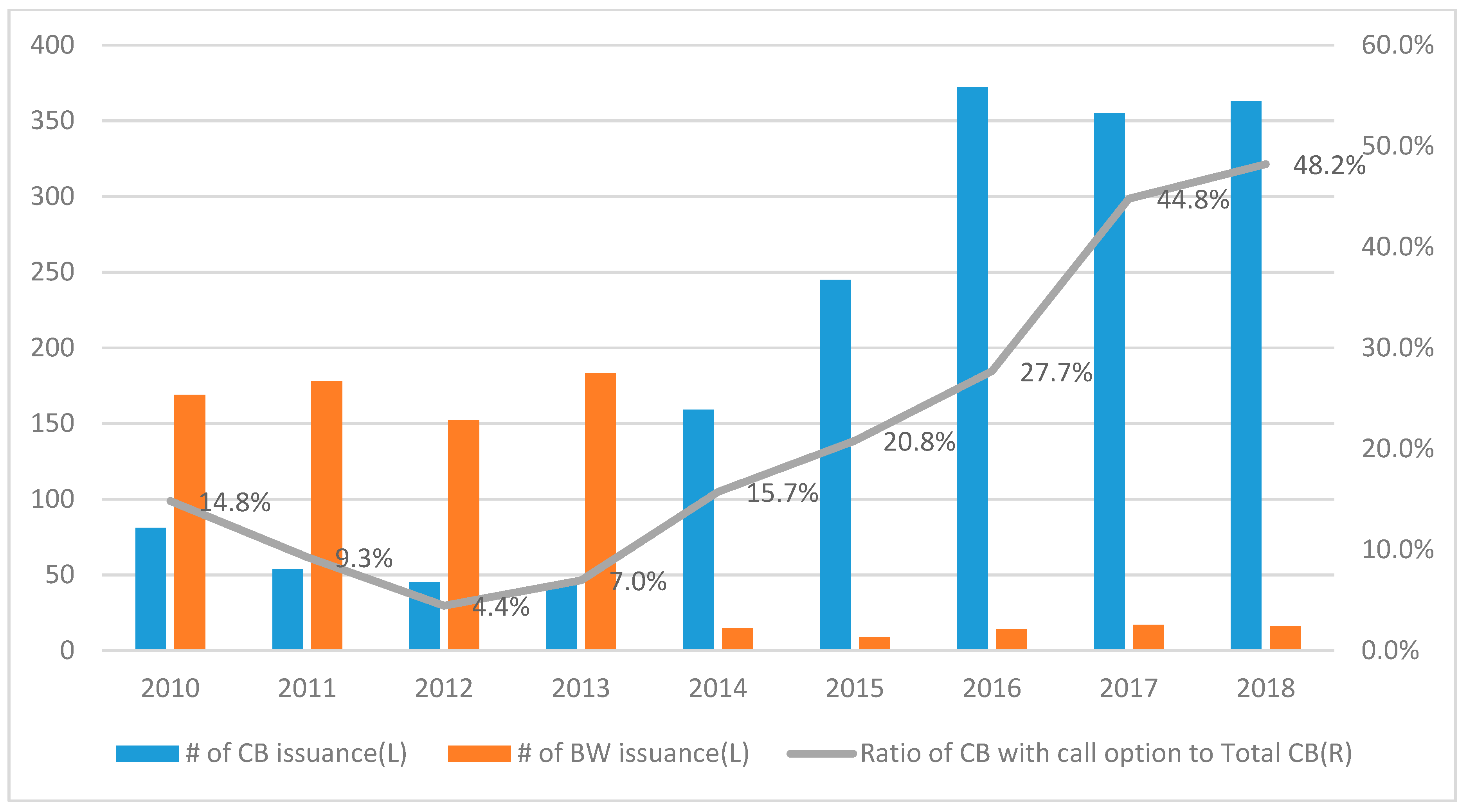

2.2. Data

2.3. Research Design and Variable Descriptions

3. Empirical Analyses Results

3.1. Refixing Option and Market Response

3.2. Market Response to Changes in the Macroeconomic Environment

3.3. Market Response According to Type of Equity-linked Debt and Stock Exchange

3.4. Robustness Test

4. Conclusions

Funding

Conflicts of Interest

Appendix A

| Variable | Classification | Definition |

|---|---|---|

| Ln_asset | Firm-specific | Natural logarithm of total assets |

| Lev | Firm-specific | Debt ratio, calculated as the total debt divided by total assets |

| Perf | Firm-specific | Operating cash flow divided by total assets |

| BTM | Firm-specific | Book-to-market ratio, calculated as book value of common equity divided by market value |

| Stock_run-up | Firm-specific | Cumulative stock return over the window (−60, −4) relative to the announcement date |

| Stock_vol | Firm-specific | Stock return volatility calculated from daily return over the window (−60, −4) relative to the announcement date |

| CW | Firm-specific | Effective bid-ask spread measured following the procedure suggested by Corwin and Schultz (2012) |

| Ln_maturity | Issue-specific | Natural logarithm of the days between the announcement date and the date on which equity-linked debt issued is allowed to be converted to the common stock |

| CV_prm | Issue-specific | Conversion premium, calculated as the conversion price divided by the stock price on five days prior to the announcement date |

| GRT | Issue-specific | Dummy variable that equals to one if equity-linked debt issued is guaranteed and zero otherwise |

| CP_prm | Issue-specific | Coupon premium, calculated as the difference between coupon rate and the risk-free rate, 3-year maturity government bond yield |

| Market_run-up | Market-specific | Cumulative return of KOSPI index over the window (−60, −4) relative to the announcement date |

| Market_vol | Market-specific | Market volatility calculated from daily KOSPI index return over the window (−60, −4) relative to the announcement date |

| Refix | Issue-specific, Target | Dummy variable that equals to one if refixing option is embedded in equity-linked debt issued and zero otherwise |

| DR | Period | Dummy variable that equals to one if the issuance of equity-linked debt announce from 2016 to 2018 and zero otherwise |

Appendix B

- Source: own calculations based on data from the Financial Supervisory Service (FSS) Disclosure System of Korea

- In the case of bond with warrant, if the stock price rises above the exercise price and the warrants are exercised, then the new capital flows into the capital account and the company’s debt ratio falls. This paper uses terms centered on convertible bond such as conversion price and conversion rights for the unity and brevity.

- Article 165-10(2) of the Financial Investment Services and Capital Markets Act of Korea stipulates as follows: “In issuing bonds provided for in Article 516-2 (1) of the Commercial Act, no stock-listed corporation may issue corporate bonds allowing a bondholder to transfer only the securities from the preemptive right to new stocks through private placement, notwithstanding Article 516-2 (2) 4 of the same Act. <Amended by Act No. 13448, Jul. 24, 2015>” Since the financial authorities allowed the issuance of public-offering detachable BW again in 2015, only the issuance of privately-placed detachable BW is currently restricted.

- The consumer composite sentiment index is designed to determine the overall perception of consumers of the economy. It is a composite index that utilizes individual indices for 6 consumer sentiments, including current living standards, prospects for living standards, household income outlook, consumption expenditure outlook, current economic judgment, and future economic outlook. Since the relevant data are available from 2003, we implement the regression analysis during the period from 2003 to 2018.

- I further examine the market responses by dividing the full sample into speculative period and investment period. The results are quantitatively and qualitatively similar that the negative announcement effects are weakened during the speculative period. The results are not reported here for the sake of brevity, but are available upon request.

References

- Dutordoir, M.; Li, H.; Liu, F.H.; Verwijmeren, P. Convertible bond announcement effects: Why is Japan different? J. Corp. Financ. 2016, 37, 76–92. [Google Scholar] [CrossRef]

- Long, M.S.; Sefcik, S.E. Participation financing: A comparison of the characteristics of convertible debt and straight bonds issued in conjunction with warrants. Financ. Manag. 1990, 19, 23–34. [Google Scholar] [CrossRef]

- Kwak, Y. An Empirical Analysis of Convertible Bond Issues: Focused on Characteristics of Convertible Bonds and Issuing Firms. Korean Int. Account. Rev. 2012, 41, 525–548. [Google Scholar]

- Kim, Y. An Empirical Analysis of Information Effect and Their Determinants of Issuance Announcement of Convertible Bonds. Korean J. Bus. Adm. 2001, 29, 205–230. [Google Scholar]

- Mayers, D. Why firms issue convertible bonds: The matching of financial and real investment options. J. Financ. Econ. 1998, 47, 83–102. [Google Scholar] [CrossRef]

- Isagawa, N. Convertible debt: An effective financial instrument to control managerial opportunism. Rev. Financ. Econ. 2000, 9, 15–26. [Google Scholar] [CrossRef]

- Lyandres, E.; Zhdanov, A. Convertible debt and investment timing. J. Corp. Financ. 2014, 24, 21–37. [Google Scholar] [CrossRef]

- Dutordoir, M.; Strong, N.; Ziegan, M.C. Does corporate governance influence convertible bond issuance? J. Corp. Financ. 2014, 24, 80–100. [Google Scholar] [CrossRef]

- Huerga, A.; Rodríguez-Monroy, C. Mandatory Convertible Bonds and the Agency Problem. Sustainability 2019, 11, 4074. [Google Scholar] [CrossRef]

- Ross, S.A. The determination of financial structure: The incentive-signalling approach. Bell J. Econ. 1977, 8, 23–40. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Smith, C.W., Jr. Investment banking and the capital acquisition process. J. Financ. Econ. 1986, 15, 3–29. [Google Scholar] [CrossRef]

- Dann, L.Y.; Mikkelson, W.H. Convertible debt issuance, capital structure change and financing-related information: Some new evidence. J. Financ. Econ. 1984, 13, 157–186. [Google Scholar] [CrossRef]

- Eckbo, B.E. Valuation effects of corporate debt offerings. J. Financ. Econ. 1986, 15, 119–151. [Google Scholar] [CrossRef]

- Mikkelson, W.H.; Partch, M.M. Valuation effects of security offerings and the issuance process. J. Financ. Econ. 1986, 15, 31–60. [Google Scholar] [CrossRef]

- Hansen, R.S.; Crutchley, C. Corporate earnings and financings: An empirical analysis. J. Bus. 1990, 63, 347–371. [Google Scholar] [CrossRef]

- Billingsley, R.S.; Smith, D.M. Why do firms issue convertible debt? Financ. Manag. 1996, 25, 93–99. [Google Scholar] [CrossRef]

- Kim, Y.C.; Stulz, R.M. Is there a global market for convertible bonds? J. Bus. 1992, 65, 75–91. [Google Scholar] [CrossRef]

- Brennan, M.J.; Her, C. Convertible Bonds: Test of a Financial Signalling Model; University of California: Los Angeles, CA, USA, 1995. [Google Scholar]

- Lewis, C.M.; Rogalski, R.J.; Seward, J.K. Industry conditions, growth opportunities and market reactions to convertible debt financing decisions. J. Bank. Financ. 2003, 27, 153–181. [Google Scholar] [CrossRef]

- Phelps, K.L.; Moore, W.T.; Roenfeldt, R.L. Equity valuation effects of warrant-debt financing. J. Financ. Res. 1991, 14, 93–103. [Google Scholar] [CrossRef]

- Chang, C.C.; Kam, T.Y.; Chien, C.C.; Su, W.T. The Impact of Financial Constraints on the Convertible Bond Announcement Returns. Economies 2019, 7, 32. [Google Scholar] [CrossRef]

- Hackney, J.; Henry, T.R.; Koski, J.L. Arbitrage vs. informed short selling: Evidence from convertible bond issuers. J. Corp. Financ. 2020, 65, 101687. [Google Scholar] [CrossRef]

- Loncarski, I.; Ter Horst, J.; Veld, C. Why do companies issue convertible bonds? A review of theory and empirical evidence. In Advances in Corporate Finance and Asset Pricing; Elsevier: Amsterdam, The Netherlands, 2006; pp. 311–339. [Google Scholar]

- Ammann, M.; Fehr, M.; Seiz, R. New evidence on the announcement effect of convertible and exchangeable bonds. J. Multinatl. Financ. Manag. 2006, 16, 43–63. [Google Scholar] [CrossRef]

- Duca, E.; Dutordoir, M.; Veld, C.; Verwijmeren, P. Why are convertible bond announcements associated with increasingly negative issuer stock returns? An arbitrage-based explanation. J. Bank. Financ. 2012, 36, 2884–2899. [Google Scholar] [CrossRef]

- Kang, J.K.; Stulz, R.M. How different is Japanese corporate finance? An investigation of the information content of new security issues. Rev. Financ. Stud. 1996, 9, 109–139. [Google Scholar] [CrossRef]

- Abhyankar, A.; Dunning, A. Wealth effects of convertible bond and convertible preference share issues: An empirical analysis of the UK market. J. Bank. Financ. 1999, 23, 1043–1065. [Google Scholar] [CrossRef]

- Kim, H.J.; Han, S.H. Convertible bond announcement returns, capital expenditures, and investment opportunities: Evidence from Korea. Pac. Basin Financ. J. 2019, 53, 331–348. [Google Scholar] [CrossRef]

- Billingsley, R.S.; Lamy, R.E.; Smith, D.M. Units of Debt with Warrants: Evidence Of The “Penalty-Free” Issuance Of An Equity-Like Security. J. Financ. Res. 1990, 13, 187–199. [Google Scholar] [CrossRef]

- Jayaraman, N.; Shastri, K.; Tandon, K. The Valuation Effects of Warrants in New Security Issues; Salomon Brothers Center for the Study of Financial Institutions, Leonard N. Stern School of Business, New York University: New York, NY, USA, 1990. [Google Scholar]

- De Roon, F.; Veld, C. Announcement effects of convertible bond loans and warrant-bond loans: An empirical analysis for the Dutch market. J. Bank. Financ. 1998, 22, 1481–1506. [Google Scholar] [CrossRef]

- Kim, W.; Kim, W.; Kim, H. Death spiral issues in emerging market: A control related perspective. Pac. Basin Financ. J. 2013, 22, 14–36. [Google Scholar] [CrossRef][Green Version]

- Yoon, P. Problems with Privately-placed Detachable Warrant Bonds Issuance System in Korea. Korean J. Financ. Stud. 2015, 44, 25–51. [Google Scholar]

- Dwyer, A.; Lechner, T.; Zhang, Y. An Investigation of Death Spiral Convertible Bonds; Working Paper; Tennessee State University: Nashville, TN, USA, 2018. [Google Scholar]

- Byun, J.; Park, K. The Effect of the Refixing Option in Convertible Bond on Shareholders’ Wealth. Working Paper. 2017. Available online: https://www.earticle.net/Article/A302007 (accessed on 27 October 2020).

- Yoon, P. Refixing Option and Privately-Placed BW Warrant Returns. Korean J. Financ. Stud. 2019, 48, 129–155. [Google Scholar] [CrossRef]

- Mian, G.M.; Sankaraguruswamy, S. Investor sentiment and stock market response to earnings news. Account. Rev. 2012, 87, 1357–1384. [Google Scholar] [CrossRef]

- Shin, H.; Shin, H.; Kim, S.I. The Market Sentiment Trend, Investor Inertia, and Post-Earnings Announcement Drift: Evidence from Korea’s Stock Market. Sustainability 2019, 11, 5137. [Google Scholar] [CrossRef]

- Li, H.; Liu, H.; Siganos, A. A comparison of the stock market reactions of convertible bond offerings between financial and non-financial institutions: Do they differ? Int. Rev. Financ. Anal. 2016, 45, 356–366. [Google Scholar] [CrossRef]

- Stein, J.C. Convertible bonds as backdoor equity financing. J. Financ. Econ. 1992, 32, 3–21. [Google Scholar] [CrossRef]

- Jung, K.; Kim, Y.C.; Stulz, R. Timing, investment opportunities, managerial discretion, and the security issue decision. J. Financ. Econ. 1996, 42, 159–185. [Google Scholar] [CrossRef]

- De Jong, A.; Veld, C. An empirical analysis of incremental capital structure decisions under managerial entrenchment. J. Bank. Financ. 2001, 25, 1857–1895. [Google Scholar] [CrossRef]

- Dutordoir, M.; Van de Gucht, L. Are there windows of opportunity for convertible debt issuance? Evidence for Western Europe. J. Bank. Financ. 2007, 31, 2828–2846. [Google Scholar] [CrossRef]

- Krasker, W.S. Stock price movements in response to stock issues under asymmetric information. J. Financ. 1986, 41, 93–105. [Google Scholar] [CrossRef]

- Green, R.C. Investment incentives, debt, and warrants. J. Financ. Econ. 1984, 13, 115–136. [Google Scholar] [CrossRef]

- Brennan, M.J.; Schwartz, E.S. The case for convertibles. J. Appl. Corp. Financ. 1988, 1, 55–64. [Google Scholar] [CrossRef]

- Corwin, S.A.; Schultz, P. A simple way to estimate bid-ask spreads from daily high and low prices. J. Financ. 2012, 67, 719–760. [Google Scholar] [CrossRef]

- Huang, G.C.; Liano, K.; Manakyan, H.; Pan, M.S. The information content of multiple stock splits. Financ. Rev. 2008, 43, 543–567. [Google Scholar] [CrossRef]

- Datta, S.; Iskandar-Datta, M.; Patel, A. Some evidence on the uniqueness of initial public debt offerings. J. Financ. 2000, 55, 715–743. [Google Scholar] [CrossRef]

- Easterbrook, F.H. Two agency-cost explanations of dividends. Am. Econ. Rev. 1984, 74, 650–659. [Google Scholar]

| Year | CB | BW | Total | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Refixing Included | Refixing not Included | Total Announcements | Refixing/ Total | Refixing Included | Refixing not Included | Total Announcements | Refixing/ Total | Refixing Included | Refixing not Included | Total Announcements | Refixing/ Total | |

| 2001 | 38 | 34 | 72 | 52.78% | 18 | 2 | 20 | 90.00% | 56 | 36 | 92 | 60.87% |

| 2002 | 32 | 17 | 49 | 65.31% | 6 | 2 | 8 | 75.00% | 38 | 19 | 57 | 66.67% |

| 2003 | 32 | 18 | 50 | 64.00% | 8 | 0 | 8 | 100.00% | 40 | 18 | 58 | 68.97% |

| 2004 | 24 | 17 | 41 | 58.54% | 18 | 6 | 24 | 75.00% | 42 | 23 | 65 | 64.62% |

| 2005 | 114 | 15 | 129 | 88.37% | 77 | 9 | 86 | 89.53% | 191 | 24 | 215 | 88.84% |

| 2006 | 173 | 17 | 190 | 91.05% | 100 | 7 | 107 | 93.46% | 273 | 24 | 297 | 91.92% |

| 2007 | 167 | 21 | 188 | 88.83% | 149 | 10 | 159 | 93.71% | 316 | 31 | 347 | 91.07% |

| 2008 | 155 | 31 | 186 | 83.33% | 186 | 17 | 203 | 91.63% | 341 | 48 | 389 | 87.66% |

| 2009 | 143 | 37 | 180 | 79.44% | 177 | 10 | 187 | 94.65% | 320 | 47 | 367 | 87.19% |

| 2010 | 75 | 6 | 81 | 92.59% | 166 | 3 | 169 | 98.22% | 241 | 9 | 250 | 96.40% |

| 2011 | 50 | 4 | 54 | 92.59% | 175 | 3 | 178 | 98.31% | 225 | 7 | 232 | 96.98% |

| 2012 | 41 | 4 | 45 | 91.11% | 150 | 2 | 152 | 98.68% | 191 | 6 | 197 | 96.95% |

| 2013 | 41 | 2 | 43 | 95.35% | 182 | 1 | 183 | 99.45% | 223 | 3 | 226 | 98.67% |

| 2014 | 157 | 2 | 159 | 98.74% | 15 | 0 | 15 | 100.00% | 172 | 2 | 174 | 98.85% |

| 2015 | 245 | 0 | 245 | 100.00% | 9 | 0 | 9 | 100.00% | 254 | 0 | 254 | 100.00% |

| 2016 | 365 | 7 | 372 | 98.12% | 14 | 0 | 14 | 100.00% | 379 | 7 | 386 | 98.19% |

| 2017 | 330 | 25 | 355 | 92.96% | 17 | 0 | 17 | 100.00% | 347 | 25 | 372 | 93.28% |

| 2018 | 341 | 22 | 363 | 93.94% | 16 | 0 | 16 | 100.00% | 357 | 22 | 379 | 94.20% |

| Total | 2523 | 279 | 2802 | 90.04% | 1483 | 72 | 1555 | 95.37% | 4006 | 351 | 4357 | 91.94% |

| Variable | Obs. | Mean | Std. Dev. | Percentile | ||||

|---|---|---|---|---|---|---|---|---|

| 5% | 25% | 50% | 75% | 95% | ||||

| Refix | 4357 | 0.919 | 0.272 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Ln_asset | 4357 | 17.964 | 1.159 | 16.450 | 17.241 | 17.796 | 18.434 | 20.028 |

| Lev | 4357 | 0.488 | 0.209 | 0.125 | 0.339 | 0.497 | 0.641 | 0.826 |

| Perf | 4357 | −0.042 | 0.159 | −0.300 | −0.100 | −0.017 | 0.045 | 0.155 |

| BTM | 4357 | 0.782 | 1.213 | 0.071 | 0.233 | 0.462 | 0.904 | 2.261 |

| Stock_run-up | 4357 | 0.235 | 2.045 | −0.501 | −0.203 | −0.019 | 0.201 | 1.128 |

| Stock_vol | 4357 | 0.046 | 0.019 | 0.019 | 0.031 | 0.043 | 0.058 | 0.079 |

| CW | 4357 | 0.016 | 0.006 | 0.008 | 0.012 | 0.015 | 0.020 | 0.027 |

| Ln_maturity | 4357 | 5.356 | 0.999 | 3.497 | 4.635 | 5.903 | 5.911 | 5.984 |

| CV_prm | 4357 | 1.238 | 1.714 | 0.897 | 0.983 | 1.022 | 1.092 | 1.590 |

| GRT | 4357 | 0.003 | 0.059 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| CP_prm | 4357 | 0.020 | 0.026 | 0.000 | 0.000 | 0.010 | 0.030 | 0.075 |

| Market_run-up | 4357 | 0.021 | 0.094 | −0.146 | −0.028 | 0.020 | 0.074 | 0.178 |

| Market_vol | 4357 | 0.012 | 0.006 | 0.006 | 0.008 | 0.010 | 0.013 | 0.022 |

| Refix | Ln_asset | Lev | Perf | BTM | Stock_ Run-up | Stock_vol | CW | Ln_ Maturity | CV_prm | GRT | CP_prm | Market_ Run-up | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ln_asset | −0.082 | ||||||||||||

| Lev | −0.034 | 0.361 | |||||||||||

| Perf | −0.009 | 0.284 | 0.002 | ||||||||||

| BTM | −0.194 | 0.335 | 0.043 | 0.026 | |||||||||

| Stock_run-up | 0.016 | −0.045 | 0.042 | −0.075 | 0.066 | ||||||||

| Stock_vol | −0.074 | −0.294 | 0.024 | −0.234 | 0.024 | 0.110 | |||||||

| CW | −0.057 | −0.373 | −0.018 | −0.262 | −0.018 | −0.006 | 0.706 | ||||||

| Ln_maturity | −0.027 | 0.111 | −0.053 | 0.132 | −0.055 | −0.033 | −0.201 | −0.174 | |||||

| CV_prm | −0.149 | 0.041 | 0.037 | −0.060 | 0.216 | −0.026 | 0.105 | 0.068 | −0.015 | ||||

| GRT | −0.040 | −0.008 | 0.020 | 0.007 | 0.021 | 0.000 | 0.014 | 0.000 | 0.015 | 0.027 | |||

| CP_prm | −0.025 | 0.105 | 0.080 | 0.014 | 0.097 | −0.038 | −0.002 | 0.028 | 0.134 | −0.011 | 0.017 | ||

| Market_run-up | −0.015 | −0.022 | 0.014 | 0.037 | −0.038 | 0.058 | −0.077 | −0.094 | −0.074 | −0.036 | 0.029 | 0.014 | |

| Market_vol | −0.206 | −0.103 | −0.005 | −0.099 | 0.209 | 0.001 | 0.361 | 0.374 | −0.222 | 0.121 | 0.033 | 0.028 | −0.243 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| CAR(−1,1) | CAR(−1,1) | CAR(−1,1) | CAR(−1,1) | CAR(−1,1) | CAR(−1,1) | |

| Refix | −0.027 *** | −0.026 *** | −0.026 *** | −0.019 *** | −0.017 *** | −0.017 *** |

| (−4.325) | (−4.170) | (−3.891) | (−4.512) | (−4.083) | (−3.441) | |

| RefixDR | −0.044 ** | −0.045 ** | −0.046 ** | |||

| (−2.296) | (−2.349) | (−2.395) | ||||

| Ln_asset | −0.018 *** | −0.018 *** | −0.018 *** | −0.018 *** | −0.018 *** | −0.018 *** |

| (−16.430) | (−16.488) | (−15.673) | (−17.627) | (−17.599) | (−16.838) | |

| Lev | 0.010 | 0.010 | 0.011 | 0.010 | 0.011 | 0.011 |

| (1.561) | (1.596) | (1.702) | (1.553) | (1.592) | (1.706) | |

| Perf | −0.005 | −0.006 | −0.006 | −0.006 | −0.007 | −0.007 |

| (−0.869) | (−0.887) | (−0.907) | (−1.051) | (−1.064) | (−1.086) | |

| BTM | 0.009 *** | 0.009 *** | 0.009 *** | 0.009 *** | 0.009 *** | 0.009 *** |

| (5.978) | (6.264) | (5.369) | (6.266) | (6.543) | (5.585) | |

| Stock_run-up | −0.001 | −0.001 | −0.001 | −0.001 | −0.001 | −0.001 |

| (−1.212) | (−1.010) | (−0.930) | (−1.163) | (−0.962) | (−0.890) | |

| Stock_vol | 0.013 | 0.021 | 0.020 | −0.004 | 0.003 | 0.001 |

| (0.148) | (0.223) | (0.250) | (−0.051) | (0.036) | (0.011) | |

| CW | −0.113 | −0.120 | −0.125 | −0.057 | −0.062 | −0.071 |

| (−0.483) | (−0.499) | (−0.565) | (−0.238) | (−0.248) | (−0.317) | |

| Ln_maturity | 0.002 | 0.002 | 0.002 | 0.002 | ||

| (1.053) | (1.060) | (1.134) | (1.140) | |||

| CV_prm | 0.001 | 0.001 | 0.001 | 0.001 | ||

| (1.315) | (1.239) | (1.546) | (1.449) | |||

| GRT | −0.029 | −0.029 | −0.031 | −0.032 | ||

| (−0.951) | (−0.936) | (−1.057) | (−1.044) | |||

| CP_prm | 0.054 | 0.054 | 0.053 | 0.054 | ||

| (0.834) | (0.802) | (0.826) | (0.797) | |||

| Market_run-up | 0.007 | 0.009 | ||||

| (0.308) | (0.368) | |||||

| Market_vol | 0.110 | 0.158 | ||||

| (0.157) | (0.227) | |||||

| Constant | 0.406 *** | 0.391 *** | 0.388 *** | 0.395 *** | 0.378 *** | 0.375 *** |

| (18.943) | (14.522) | (12.534) | (20.678) | (14.051) | (11.786) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 4357 | 4357 | 4357 | 4357 | 4357 | 4357 |

| R-squared | 0.041 | 0.041 | 0.041 | 0.042 | 0.043 | 0.043 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CAR(−1,0) | CAR(−1,0) | CAR(0,1) | CAR(0,1) | |

| Refix | −0.012 ** | −0.012 ** | −0.021 *** | −0.020 *** |

| (−2.345) | (−2.221) | (−4.511) | (−4.041) | |

| Ln_asset | −0.013 *** | −0.013 *** | −0.013 *** | −0.013 *** |

| (−12.374) | (−11.764) | (−11.729) | (−11.450) | |

| Lev | 0.013 * | 0.012 * | 0.008 * | 0.009 ** |

| (2.052) | (1.952) | (1.964) | (2.246) | |

| Perf | −0.003 | −0.002 | −0.009 | −0.011 |

| (−0.404) | (−0.303) | (−1.168) | (−1.342) | |

| BTM | 0.005 *** | 0.005 *** | 0.008 *** | 0.008 *** |

| (4.557) | (4.267) | (7.627) | (6.862) | |

| Stock_run-up | −0.001 *** | −0.001 *** | −0.001 | −0.001 |

| (−3.237) | (−4.051) | (−1.101) | (−0.891) | |

| Stock_vol | −0.064 | −0.052 | 0.058 | 0.052 |

| (−0.902) | (−0.756) | (1.097) | (1.190) | |

| CW | −0.239 | −0.206 | −0.217 | −0.289 |

| (−1.415) | (−1.454) | (−1.240) | (−1.496) | |

| Ln_maturity | −0.000 | 0.002 ** | ||

| (−0.053) | (2.421) | |||

| CV_prm | 0.000 | 0.000 | ||

| (1.252) | (0.149) | |||

| GRT | −0.040 * | −0.007 | ||

| (−1.825) | (−0.405) | |||

| CP_prm | 0.078 | 0.039 | ||

| (1.061) | (1.346) | |||

| Market_run-up | 0.010 | 0.010 | ||

| (0.862) | (0.432) | |||

| Market_vol | −0.317 | 0.630 | ||

| (−0.874) | (1.360) | |||

| Constant | 0.267 *** | 0.270 *** | 0.360 *** | 0.337 *** |

| (19.925) | (10.074) | (21.094) | (17.158) | |

| Year FE | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes |

| Observations | 4357 | 4357 | 4357 | 4357 |

| R-squared | 0.034 | 0.035 | 0.038 | 0.039 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CAR(−1,1) | CAR(−1,1) | CAR(−1,1) | CAR(−1,1) | |

| Refix | −0.008 | −0.038 *** | −0.010 | −0.034 *** |

| (−1.095) | (−5.714) | (−1.687) | (−3.280) | |

| Ln_asset | −0.015 *** | −0.019 *** | −0.014 *** | −0.021 *** |

| (−7.426) | (−13.590) | (−4.701) | (−8.846) | |

| Lev | −0.014 | 0.036 ** | 0.019 ** | 0.007 |

| (−1.077) | (2.772) | (2.694) | (1.104) | |

| Perf | −0.005 | −0.006 | −0.014 | 0.003 |

| (−0.417) | (−0.342) | (−0.702) | (0.180) | |

| BTM | 0.011 *** | 0.006 * | 0.008 *** | 0.010 *** |

| (11.475) | (1.980) | (4.522) | (5.125) | |

| Stock_run-up | −0.001 | −0.001 | 0.000 | −0.001 |

| (−1.210) | (−0.567) | (0.231) | (−1.549) | |

| Stock_vol | −0.247 | 0.336 | −0.007 | 0.078 |

| (−1.247) | (1.632) | (−0.045) | (0.509) | |

| CW | 0.576 | −0.806 | −0.379 | −0.247 |

| (0.808) | (−1.422) | (−0.520) | (−0.839) | |

| Ln_maturity | −0.000 | 0.005 *** | 0.001 | 0.003 * |

| (−0.117) | (4.035) | (0.399) | (1.801) | |

| CV_prm | −0.001 *** | 0.003 *** | 0.000 | 0.001 * |

| (−8.677) | (5.250) | (0.034) | (2.117) | |

| GRT | 0.015 * | 0.025 | −0.018 | −0.029 |

| (1.941) | (0.292) | (−0.783) | (−0.683) | |

| CP_prm | −0.034 | 0.099 | 0.107 * | 0.010 |

| (−0.706) | (0.687) | (2.118) | (0.077) | |

| Market_run-up | −0.043 *** | 0.069 | −0.032 | 0.020 |

| (−3.316) | (1.423) | (−1.331) | (0.488) | |

| Market_vol | 1.078 *** | 0.275 | 0.612 | −0.472 |

| (4.814) | (0.309) | (1.558) | (−0.782) | |

| Constant | 0.292 *** | 0.359 *** | 0.293 *** | 0.463 *** |

| (7.378) | (10.110) | (10.130) | (5.574) | |

| Year FE | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes |

| Observations | 1949 | 2256 | 1791 | 2566 |

| R-squared | 0.050 | 0.051 | 0.053 | 0.049 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CAR(−1,1) | CAR(−1,1) | CAR(−1,1) | CAR(−1,1) | |

| Refix | −0.029 *** | −0.029 *** | −0.017 ** | −0.015 ** |

| (−3.790) | (−3.680) | (−2.873) | (−2.712) | |

| RefixCB | 0.003 | 0.005 | ||

| (0.807) | (1.275) | |||

| RefixKOSDAQ | −0.013 *** | −0.013 *** | ||

| (−3.895) | (−3.884) | |||

| Ln_asset | −0.018 *** | −0.018 *** | −0.019 *** | −0.019 *** |

| (−16.622) | (−15.881) | (−19.578) | (−19.306) | |

| Lev | 0.010 | 0.011 | 0.009 | 0.009 |

| (1.560) | (1.707) | (1.362) | (1.499) | |

| Perf | −0.005 | −0.006 | −0.002 | −0.003 |

| (−0.800) | (−0.842) | (−0.374) | (−0.453) | |

| BTM | 0.009 *** | 0.009 *** | 0.009 *** | 0.009 *** |

| (5.934) | (5.294) | (6.035) | (5.415) | |

| Stock_run-up | −0.001 | −0.001 | −0.001 | −0.001 |

| (−1.278) | (−1.017) | (−1.394) | (−1.068) | |

| Stock_vol | 0.009 | 0.015 | 0.012 | 0.020 |

| (0.097) | (0.194) | (0.139) | (0.251) | |

| CW | −0.113 | −0.125 | −0.061 | −0.069 |

| (−0.484) | (−0.566) | (−0.269) | (−0.309) | |

| Ln_maturity | 0.003 | 0.002 | ||

| (1.194) | (1.178) | |||

| CV_prm | 0.001 | 0.001 | ||

| (1.216) | (1.291) | |||

| GRT | −0.029 | −0.030 | ||

| (−0.948) | (−0.986) | |||

| CP_prm | 0.065 | 0.047 | ||

| (0.942) | (0.668) | |||

| Market_run-up | 0.008 | 0.006 | ||

| (0.329) | (0.268) | |||

| Market_vol | 0.103 | 0.088 | ||

| (0.147) | (0.125) | |||

| Constant | 0.406 *** | 0.384 *** | 0.424 *** | 0.406 *** |

| (18.661) | (12.083) | (18.766) | (11.976) | |

| Year FE | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes |

| Observations | 4357 | 4357 | 4357 | 4357 |

| R-squared | 0.041 | 0.042 | 0.042 | 0.043 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| CAR(−3,3) | CAR(−3,3) | CAR(−3,3) | CAR(−3,3) | CAR(−3,3) | CAR(−3,3) | |

| Refix | −0.031 *** | −0.027 *** | −0.025 *** | −0.015 *** | −0.010 ** | −0.008 |

| (−4.610) | (−4.132) | (−4.069) | (−3.639) | (−2.314) | (−1.706) | |

| RefixDR | −0.088 ** | −0.092 ** | −0.094 *** | |||

| (−2.803) | (−2.909) | (−2.989) | ||||

| Ln_asset | −0.030 *** | −0.030 *** | −0.030 *** | −0.029 *** | −0.029 *** | −0.030 *** |

| (−11.562) | (−10.816) | (−10.666) | (−11.825) | (−11.040) | (−10.983) | |

| Lev | 0.029 | 0.029 | 0.030 * | 0.029 | 0.030 | 0.031 * |

| (1.677) | (1.699) | (1.838) | (1.669) | (1.694) | (1.837) | |

| Perf | 0.002 | 0.001 | −0.000 | 0.000 | −0.001 | −0.002 |

| (0.122) | (0.034) | (−0.027) | (0.023) | (−0.071) | (−0.136) | |

| BTM | 0.019 *** | 0.018 *** | 0.018 *** | 0.019 *** | 0.019 *** | 0.018 *** |

| (5.664) | (5.955) | (5.165) | (5.883) | (6.155) | (5.356) | |

| Stock_run-up | −0.002 ** | −0.002 * | −0.002 * | −0.002 ** | −0.002 * | −0.002 * |

| (−2.572) | (−2.083) | (−1.949) | (−2.482) | (−2.000) | (−1.878) | |

| Stock_vol | −0.267 | −0.259 | −0.285 | −0.303 | −0.296 | −0.324 |

| (−0.979) | (−0.979) | (−1.138) | (−1.126) | (−1.142) | (−1.323) | |

| CW | −0.759 | −0.751 | −0.865 | −0.649 | −0.635 | −0.755 |

| (−1.178) | (−1.163) | (−1.305) | (−1.031) | (−1.006) | (−1.183) | |

| Ln_maturity | 0.007 ** | 0.007 ** | 0.007 ** | 0.007 ** | ||

| (2.430) | (2.521) | (2.526) | (2.618) | |||

| CV_prm | 0.003 *** | 0.003 *** | 0.003 *** | 0.003 *** | ||

| (3.257) | (3.016) | (3.572) | (3.300) | |||

| GRT | −0.062 | −0.063 | −0.068 | −0.068 | ||

| (−1.460) | (−1.445) | (−1.627) | (−1.621) | |||

| CP_prm | 0.064 | 0.070 | 0.062 | 0.069 | ||

| (0.624) | (0.675) | (0.616) | (0.672) | |||

| Market_run-up | 0.057 | 0.060 | ||||

| (1.439) | (1.530) | |||||

| Market_vol | 1.427 | 1.525 | ||||

| (1.606) | (1.712) | |||||

| Constant | 0.577 *** | 0.527 *** | 0.500 *** | 0.554 *** | 0.501 *** | 0.471 *** |

| (11.567) | (9.200) | (8.976) | (11.510) | (8.637) | (8.126) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 4289 | 4289 | 4289 | 4289 | 4289 | 4289 |

| R-squared | 0.037 | 0.039 | 0.040 | 0.039 | 0.041 | 0.042 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| CMAR(−1,1) | CMAR(−1,1) | CMAR(−1,1) | CMAR(−1,1) | CMAR(−1,1) | CMAR(−1,1) | |

| Refix | −0.021 *** | −0.019 *** | −0.020 *** | −0.013 *** | −0.011 ** | −0.011 ** |

| (−3.436) | (−3.309) | (−3.120) | (−3.035) | (−2.665) | (−2.293) | |

| RefixDR | −0.046 ** | −0.047 ** | −0.047 ** | |||

| (−2.602) | (−2.669) | (−2.685) | ||||

| Ln_asset | −0.015 *** | −0.015 *** | −0.015 *** | −0.015 *** | −0.015 *** | −0.015 *** |

| (−16.132) | (−16.292) | (−15.471) | (−17.763) | (−17.754) | (−16.925) | |

| Lev | 0.006 | 0.007 | 0.007 | 0.006 | 0.007 | 0.007 |

| (0.774) | (0.889) | (0.862) | (0.786) | (0.904) | (0.884) | |

| Perf | 0.013 * | 0.011 | 0.011 | 0.012 * | 0.010 | 0.010 |

| (2.026) | (1.585) | (1.539) | (1.919) | (1.468) | (1.413) | |

| BTM | 0.005 *** | 0.005 *** | 0.005 *** | 0.005 *** | 0.005 *** | 0.005 *** |

| (4.069) | (4.100) | (3.867) | (4.528) | (4.535) | (4.198) | |

| Stock_run-up | 0.001 | 0.001 | 0.001 | 0.001 | 0.001 | 0.001 |

| (1.238) | (1.182) | (1.104) | (1.223) | (1.167) | (1.092) | |

| Stock_vol | 0.231 *** | 0.248 *** | 0.264 *** | 0.212 *** | 0.229 *** | 0.245 *** |

| (4.886) | (4.996) | (5.676) | (4.397) | (4.590) | (5.114) | |

| CW | 0.192 | 0.194 | 0.267 | 0.250 | 0.255 | 0.323 |

| (0.736) | (0.710) | (1.058) | (0.944) | (0.907) | (1.258) | |

| Ln_maturity | 0.004 | 0.004 | 0.004 * | 0.004 * | ||

| (1.714) | (1.729) | (1.797) | (1.808) | |||

| CV_prm | 0.000 | 0.000 | 0.000 | 0.000 | ||

| (0.068) | (0.290) | (0.308) | (0.565) | |||

| GRT | −0.024 | −0.025 | −0.027 | −0.028 | ||

| (−0.859) | (−0.880) | (−0.978) | (−0.999) | |||

| CP_prm | 0.009 | 0.006 | 0.008 | 0.006 | ||

| (0.130) | (0.088) | (0.117) | (0.080) | |||

| Market_run-up | 0.025 | 0.026 | ||||

| (1.144) | (1.208) | |||||

| Market_vol | −0.358 | −0.308 | ||||

| (−0.623) | (−0.538) | |||||

| Constant | 0.347 *** | 0.321 *** | 0.322 *** | 0.335 *** | 0.308 *** | 0.308 *** |

| (17.503) | (14.461) | (12.657) | (21.118) | (14.392) | (11.926) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 4357 | 4357 | 4357 | 4357 | 4357 | 4357 |

| R-squared | 0.047 | 0.048 | 0.049 | 0.049 | 0.050 | 0.050 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, Y. Announcement Effects of Convertible and Warrant Bond Issues with Embedded Refixing Option: Evidence from Korea. Sustainability 2020, 12, 8933. https://doi.org/10.3390/su12218933

Kim Y. Announcement Effects of Convertible and Warrant Bond Issues with Embedded Refixing Option: Evidence from Korea. Sustainability. 2020; 12(21):8933. https://doi.org/10.3390/su12218933

Chicago/Turabian StyleKim, Yongsik. 2020. "Announcement Effects of Convertible and Warrant Bond Issues with Embedded Refixing Option: Evidence from Korea" Sustainability 12, no. 21: 8933. https://doi.org/10.3390/su12218933

APA StyleKim, Y. (2020). Announcement Effects of Convertible and Warrant Bond Issues with Embedded Refixing Option: Evidence from Korea. Sustainability, 12(21), 8933. https://doi.org/10.3390/su12218933