Does ESG Affect the Stability of Dividend Policies in Europe?

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

- -

- -

- -

- -

- -

- -

- The capital structure (Leverage). Most studies suggest that more leveraged firms are less likely to pay dividends (e.g., [66]);

- -

- Firm’s capital intensity ratio (PP&E), which accounts for the need for the investment in fixed assets [53]. The volatility in the dividend payment must be viewed in a setting of CAPEX requirements for fixed assets, replacement and growth.

4. Results, Discussion and Contributions

Author Contributions

Funding

Conflicts of Interest

References

- Khan, M.; Serafeim, G.; Yoon, A. Corporate sustainability: First evidence on materiality. Account. Rev. 2016, 91, 1697–1724. [Google Scholar] [CrossRef]

- BlackRock. Sustainability as BlackRock’s New Standard for Investing (2020 Client Letter); BlackRock Global Executive Committee: New York, NY, USA, 2020. [Google Scholar]

- Fink, L. BlackRock’s Chairman Letter to Shareholders; BlackRock: New York, NY, USA, 2020. [Google Scholar]

- WEF. The Global Risks Report 2020, 15th ed.; World Economic Forum: Davos, Switzerland, 2020. [Google Scholar]

- McKinsey. From ‘Why’ to ‘Why Not’: Sustainable Investing as the New Normal; Private Equity & Principal Investors Practice; McKinsey & Company: New York, NY, USA, 2017. [Google Scholar]

- European Commission. COVID-19 and Green Recovery: How Member States Integrate Sustainable Energy Investments into Their Recovery Plans; Webinar Series; Sustainable Energy Investment Forums; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Lankoski, L. Alternative conceptions of sustainability in a business context. J. Clean. Prod. 2016, 139, 847–857. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating shared value. Harv. Bus. Rev. 2019, 1, 62–77. [Google Scholar]

- Chen, R.C.Y.; Hung, S.-H.; Lee, C.-H. Does corporate value affect the relationship between Corporate Social Responsibility and stock returns? J. Sustain. Financ. Investig. 2017, 7, 188–196. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Lu, W.; Chau, K.W.; Wang, H.; Pan, W. A decade’s debate on the nexus between corporate social and corporate financial performance: A critical review of empirical studies 2002–2011. J. Clean. Prod. 2014, 79, 195–206. [Google Scholar] [CrossRef]

- Santis, P.; Albuquerque, A.; Lizarelli, F. Do sustainable companies have a better financial performance? A study on Brazilian public companies. J. Clean. Prod. 2016, 133, 735–745. [Google Scholar] [CrossRef]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Van Beurden, P.; Gössling, T. The worth of values–a literature review on the relation between corporate social and financial performance. J. Bus. Ethics 2008, 82, 407. [Google Scholar] [CrossRef]

- Wu, M.L. Corporate social performance, corporate financial performance, and firm size: A meta-analysis. J. Am. Acad. Bus. 2006, 8, 163–171. [Google Scholar]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Godfrey, P.C.; Merrill, C.B.; Hansen, J.M. The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strateg. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef]

- Wang, M.; Qiu, C.; Kong, D. Corporate social responsibility, investor behaviors, and stock market returns: Evidence from a natural experiment in China. J. Bus. Ethics 2011, 101, 127–141. [Google Scholar] [CrossRef]

- Ahmad, N.G.; Barros, V.; Sarmento, J.M. The determinants of dividend policy in Euronext 100. Corp. Ownersh. Control 2018, 15, 8–17. [Google Scholar] [CrossRef]

- Nguyen, H.M.; Vuong, T.H.G.; Nguyen, T.H.; Wu, Y.C.; Wong, W.K. Sustainability of Both Pecking Order and Trade-off Theories in Chinese Manufacturing Firms. Sustainability 2020, 12, 3883. [Google Scholar] [CrossRef]

- Benlemlih, M. Corporate social responsibility and dividend policy. Res. Int. Bus. Financ. 2019, 47, 114–138. [Google Scholar] [CrossRef]

- Cheung, A.; Hu, M.; Schwiebert, J. Corporate social responsibility and dividend policy. Account. Financ. 2018, 58, 787–816. [Google Scholar] [CrossRef]

- Rakotomavo, M.T. Corporate investment in social responsibility versus dividends? Soc. Responsib. J. 2012, 8, 199–207. [Google Scholar] [CrossRef]

- Samet, M.; Jarboui, A. Corporate social responsibility and payout decisions. Manag. Financ. 2017, 43, 982–998. [Google Scholar] [CrossRef]

- Jensen, M.C. Agency costs of free cash flow, corporate finance, and takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Brown, W.O.; Helland, E.; Smith, J.K. Corporate philanthropic practices. J. Corp. Financ. 2006, 12, 855–877. [Google Scholar] [CrossRef]

- Benartzi, S.; Michaely, R.; Thaler, R. Do changes in dividends signal the future or the past? J. Financ. 1997, 52, 1007–1034. [Google Scholar] [CrossRef]

- Miller, M.H. The Modigliani-Miller propositions after thirty years. J. Econ. Perspect. 1988, 2, 99–120. [Google Scholar] [CrossRef]

- Miller, M.H.; Rock, K. Dividend policy under asymmetric information. J. Financ. 1985, 40, 1031–1051. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 1984. [Google Scholar]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Ould Daoud Ellili, N. Environmental, Social, and Governance Disclosure, Ownership Structure and Cost of Capital: Evidence from the UAE. Sustainability 2020, 12, 7706. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.; Mishra, D.R. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Menz, K.M. Corporate social responsibility: Is it rewarded by the corporate bond market? A critical note. J. Bus. Ethics 2010, 96, 117–134. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G.S. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Kim, C.S.; Mauer, D.C.; Sherman, A.E. The determinants of corporate liquidity: Theory and evidence. J. Financ. Quant. Anal. 1998, 33, 335–359. [Google Scholar] [CrossRef]

- Black, A.; Fraser, P. Stock market short-termism—An international perspective. J. Multinatl. Financ. Manag. 2002, 12, 135–158. [Google Scholar] [CrossRef]

- Harford, J.; Kolasinski, A. Do private equity returns result from wealth transfers and short-termism? Evidence from a comprehensive sample of large buyouts. Manag. Sci. 2014, 60, 888–902. [Google Scholar] [CrossRef]

- Starks, L.T.; Venkat, P.; Zhu, Q. Corporate ESG profiles and investor horizons. SSRN 2017. [Google Scholar] [CrossRef]

- Pan, L. Demystifying ESG Investing Considerations for Institutional Cash Investors. J. Portf. Manag. 2020, 46, 153–156. [Google Scholar] [CrossRef]

- Crespi, F.; Migliavacca, M. The Determinants of ESG Rating in the Financial Industry: The Same Old Story or a Different Tale? Sustainability 2020, 12, 6398. [Google Scholar] [CrossRef]

- Thomson Reuters. Thomson Reuters ESG Scores; Thomson Reuters: New York, NY, USA, 2019. [Google Scholar]

- Del Giudice, A.; Rigamonti, S. Does Audit Improve the Quality of ESG Scores? Evidence from Corporate Misconduct. Sustainability 2020, 12, 5670. [Google Scholar] [CrossRef]

- Drempetic, S.; Klein, C.; Zwergel, B. The influence of firm size on the ESG score: Corporate sustainability ratings under review. J. Bus. Ethics 2019, 1–28. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, Social and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. J. Bus. Ethics 2019, 1–20. [Google Scholar] [CrossRef]

- Rajesh, R. Exploring the sustainability performances of firms using environmental, social, and governance scores. J. Clean. Prod. 2020, 247, 119600. [Google Scholar] [CrossRef]

- Diez-Cañamero, B.; Bishara, T.; Otegi-Olaso, J.R.; Minguez, R.; Fernández, J.M. Measurement of Corporate Social Responsibility: A Review of Corporate Sustainability Indexes, Rankings and Ratings. Sustainability 2020, 12, 2153. [Google Scholar] [CrossRef]

- Torre, M.L.; Mango, F.; Cafaro, A.; Leo, S. Does the ESG Index Affect Stock Return? Evidence from the Eurostoxx 50. Sustainability 2020, 12, 6387. [Google Scholar] [CrossRef]

- Barros, V.; Matos, P.V.; Sarmento, J.M. What firm’s characteristics drive the dividend policy? A mixed-method study on the Euronext Stock Exchange. J. Bus. Res. 2020, 115, 365–377. [Google Scholar] [CrossRef]

- Barros, V.; Matos, P.V.; Sarmento, J.M.; Vieira, P.R. Do Shareholders Activists influence manager’s decisions on firm’s dividend policy: A mixed-method study. J. Bus. Res. 2021, 122, 387–397. [Google Scholar] [CrossRef]

- Romano, G.; Guerrini, A. Paying Returns to Shareholders of Water Utilities: Evidence from Italy. Sustainability 2019, 11, 2033. [Google Scholar] [CrossRef]

- Choi, J.H.; Kim, S.; Yang, D.-H. Do Managers Pay CSR for Private Motivation? A Dividend Tax Cut Case in Korea. Sustainability 2019, 11, 4041. [Google Scholar] [CrossRef]

- Lee, N.; Lee, J.R.D. Intensity and Dividend Policy: Evidence from South Korea’s Biotech Firms. Sustainability 2019, 11, 4837. [Google Scholar] [CrossRef]

- Pérez-González, F. Large Shareholders and Dividends: Evidence from U.S. Tax Reforms; Working paper; Columbia University: New York, NY, USA, 2002. [Google Scholar]

- Poterba, J. Taxation and corporate payout policy. Am. Econ. Rev. 2004, 94, 171–175. [Google Scholar] [CrossRef]

- Brav, A.; Graham, J.; Harvey, C.; Michaely, R. Payout policy in the 21st century. J. Financ. Econ. 2005, 77, 483–527. [Google Scholar] [CrossRef]

- Chetty, R.; Saez, E. Dividend taxes and corporate behavior: Evidence from the 2003 dividend tax cut. Q. J. Econ. 2005, 120, 791–833. [Google Scholar]

- Ham, C.G.; Kaplan, Z.; Leary, M.T. Do dividends convey information about future earnings? J. Financ. Econ. 2019, 136, 547–570. [Google Scholar] [CrossRef]

- Dewenter, K.; Warther, V. Dividends, asymmetric information, and agency conflicts: Evidence from a comparison of the dividend policies of Japanese and U.S. firms. J. Financ. 1998, 53, 879–904. [Google Scholar] [CrossRef]

- Anderson, R.C.; Reeb, D.M. Founding-family ownership and firm performance: Evidence from the SP 500. J. Financ. 2003, 58, 1301–1328. [Google Scholar] [CrossRef]

- Seida, J. Evidence of tax-clientele-related trading following dividend increases. J. Am. Tax. Assoc. 2001, 23, 1–21. [Google Scholar] [CrossRef]

- Farinha, J. Dividend policy, corporate governance, and the managerial entrenchment hypothesis: An empirical analysis. J. Bus. Financ. Account. 2003, 30, 1173–1209. [Google Scholar] [CrossRef]

- Henry, D. Ownership structure and tax-friendly dividends. J. Bank. Financ. 2011, 35, 2747–2760. [Google Scholar] [CrossRef]

- Almeida, L.; Tavares, F.; Pereira, E. Efeito subprime na distribuição de dividendos em Portugal. FUMEC/FACE J. Belo Horiz. 2015, 14, 9–25. [Google Scholar]

- KPMG. The ESG Imperative for Technology Companies; KPMG LLP: Delaware, DE, USA, 2020. [Google Scholar]

- Lee, B.S.; Mauck, N. Dividend initiations, increases and idiosyncratic volatility. J. Corp. Financ. 2016, 40, 47–60. [Google Scholar] [CrossRef]

- Becker, B.; Jacob, M.; Jacob, M. Payout taxes and the allocation of investment. J. Financ. Econ. 2013, 107, 1–24. [Google Scholar] [CrossRef]

- Ju, L.; Lu, T.; Tu, Z. Capital flight and bitcoin regulation. Int. Rev. Financ. 2016, 16, 445–455. [Google Scholar] [CrossRef]

- Berg, F.; Kölbel, J.; Rigobon, R. Aggregate Confusion: The Divergence of ESG Ratings; Working Paper; MIT Sloan School: Cambridge, MA, USA, 2020. [Google Scholar]

| Pillar | Category | Indicators in Category | Weights |

|---|---|---|---|

| Environmental | Resource use | 20 | 11.2% |

| Emissions | 22 | 12.4% | |

| Innovations | 19 | 10.7% | |

| Social | Workforce | 29 | 16.3% |

| Human Rights | 8 | 4.5% | |

| Community | 14 | 7.9% | |

| Product Responsibility | 12 | 6.7% | |

| Governance | Management | 34 | 19.1% |

| Shareholders | 12 | 6.7% | |

| CSR Strategy | 8 | 4.5% | |

| Total | 178 | 100% |

| Variable | Definition |

|---|---|

| Dividend | Paid Dividends = 1; Did Not Pay Dividends = 0 |

| DPS regular | Dividend Per Share (DPS) equal as in the previous year = 1; Otherwise = 0 |

| Payout range 2% | Payout ratio (DPS/Earnings Per Share) in the 2% range from the previous year = 1; Otherwise = 0 |

| Dividend Yield range 2% | Dividend Yield (DPS/Stock Price) in the 2% range from the previous year = 1; Otherwise = 0 |

| ETR | Income Tax Expense/EBT (1) |

| Analysts | Number of sell-side Analysts listed as covering each firm |

| Market/Book | Market Value/Book Value of Equity (1) |

| Size | Log Total Assets |

| EBT margin | EBT/Revenue (1) |

| EBT CAGR 3y | Earnings Before Taxes (EBT)/3-year geometric change (1) |

| ROE | Net Income/Equity (1) |

| Leverage | Debt/Equity (1) |

| PP&E | Property, Plant & Equipment (PP&E)/Total Assets (1) |

| Variable | N | Mean | Std. Dev. | 1st Quartile | Median | 3rd Quartile |

|---|---|---|---|---|---|---|

| Dividend | 1914 | 0.886 | 0.318 | 1 | 1 | 1 |

| DPS regular | 1914 | 0.118 | 0.322 | 0 | 0 | 0 |

| Payout range 2% | 1914 | 0.190 | 0.392 | 0 | 0 | 0 |

| Dividend Yield range 2% | 1914 | 0.710 | 0.454 | 0 | 1 | 1 |

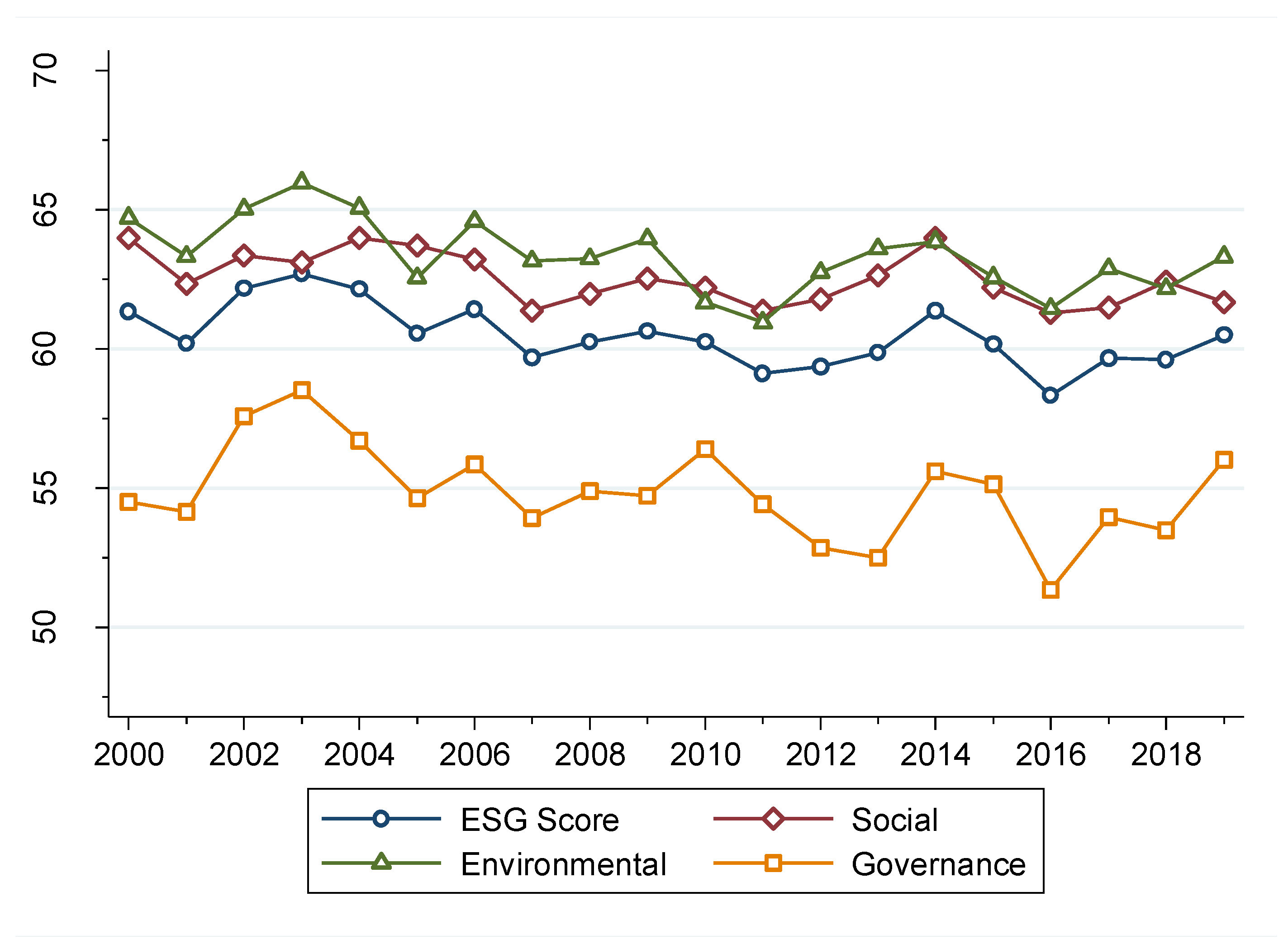

| ESG Score | 1914 | 60.387 | 17.287 | 48.386 | 61.936 | 74.087 |

| Environmental Score | 1914 | 63.242 | 21.917 | 46.303 | 66.387 | 81.796 |

| Social Score | 1914 | 62.468 | 20.916 | 47.223 | 64.655 | 79.684 |

| Governance Score | 1914 | 54.782 | 21.466 | 38.141 | 56.017 | 72.206 |

| ETR | 1914 | 0.226 | 0.354 | 0.181 | 0.253 | 0.313 |

| Analysts | 1914 | 18.308 | 9.524 | 12 | 18 | 24 |

| Market/Book | 1914 | 4.145 | 8.120 | 1.451 | 2.504 | 3.995 |

| Size | 1914 | 22.873 | 1.664 | 21.858 | 22.881 | 24.078 |

| EBT margin | 1914 | 0.107 | 0.140 | 0.044 | 0.087 | 0.155 |

| EBT CAGR 3y | 1914 | −0.027 | 2.251 | −0.247 | 0.070 | 0.299 |

| ROE | 1914 | 0.162 | 0.331 | 0.078 | 0.137 | 0.207 |

| Leverage | 1914 | 0.928 | 1.292 | 0.319 | 0.646 | 1.166 |

| PP&E | 1914 | 0.257 | 0.206 | 0.091 | 0.209 | 0.367 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Dividend | DPS Regular | Payout Range 2% | Dividend Yield Range 2% | |

| ESG Score | 0.019 | −0.002 | 0.020 ** | 0.005 |

| (0.014) | (0.013) | (0.009) | (0.007) | |

| Control variables | ||||

| ETR | −0.052 | −0.373 | 0.006 | −0.078 |

| (0.273) | (0.279) | (0.221) | (0.176) | |

| Analysts | 0.051 | −0.015 | 0.028 | 0.042 ** |

| (0.034) | (0.033) | (0.020) | (0.018) | |

| Market/Book | 0.060 ** | −0.058 ** | 0.041 * | 0.069 *** |

| (0.026) | (0.025) | (0.021) | (0.026) | |

| Size | 0.821 *** | −0.875 *** | 0.273 * | 0.284 ** |

| (0.252) | (0.273) | (0.147) | (0.130) | |

| EBT margin | 3.978 *** | −0.729 | 1.769 * | 2.403 ** |

| (1.480) | (0.995) | (0.994) | (1.008) | |

| EBT CAGR 3y | 0.108 ** | −0.066 | 0.013 | 0.078 *** |

| (0.051) | (0.042) | (0.026) | (0.030) | |

| ROE | −0.538 | −0.329 | −0.136 | 0.171 |

| (0.630) | (0.430) | (0.405) | (0.515) | |

| Leverage | −0.423 *** | 0.230 ** | −0.157 | −0.280 *** |

| (0.144) | (0.107) | (0.107) | (0.099) | |

| PP&E | 3.233 * | −2.958 * | 3.558 *** | 0.988 |

| (1.766) | (1.751) | (1.160) | (0.774) | |

| Year FE | Yes | Yes | Yes | Yes |

| Economic Sector FE | Yes | Yes | Yes | Yes |

| Observations | 1914 | 1914 | 1914 | 1914 |

| Wald test | 0.000 | 0.000 | 0.000 | 0.000 |

| Adj R2 | 0.227 | 0.224 | 0.227 | 0.212 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Dividend | DPS Regular | Payout Range 2% | Dividend Yield Range 2% | |

| Environmental Score | 0.014 | 0.002 | 0.010 * | 0.002 |

| (0.010) | (0.010) | (0.006) | (0.004) | |

| Control Variables | ||||

| ETR | −0.040 | −0.368 | 0.000 | 0.073 |

| (0.275) | (0.277) | (0.216) | (0.159) | |

| Analysts | 0.051 | −0.015 | 0.028 | 0.032 ** |

| (0.034) | (0.033) | (0.020) | (0.015) | |

| Market/Book | 0.059 ** | −0.058 ** | 0.038 * | 0.064 *** |

| (0.026) | (0.026) | (0.022) | (0.022) | |

| Size | 0.813 *** | −0.884 *** | 0.263 * | 0.072 |

| (0.251) | (0.275) | (0.148) | (0.100) | |

| EBT margin | 3.962 *** | −0.748 | 1.890 * | 1.980 ** |

| (1.478) | (0.993) | (1.005) | (0.897) | |

| EBT CAGR 3y | 0.107 ** | −0.066 | 0.011 | 0.064 ** |

| (0.051) | (0.042) | (0.026) | (0.028) | |

| ROE | −0.525 | −0.337 | −0.127 | −0.007 |

| (0.627) | (0.435) | (0.420) | (0.453) | |

| Leverage | −0.415 *** | 0.228 ** | −0.146 | −0.223 ** |

| (0.143) | (0.107) | (0.109) | (0.087) | |

| PP&E | 3.110 * | −2.935 * | 3.485 *** | 0.874 |

| (1.750) | (1.735) | (1.173) | (0.559) | |

| Year FE | Yes | Yes | Yes | Yes |

| Economic Sector FE | Yes | Yes | Yes | Yes |

| Observations | 1914 | 1914 | 1914 | 1914 |

| Wald test | 0.000 | 0.000 | 0.000 | 0.000 |

| Adj R2 | 0.228 | 0.224 | 0.223 | 0.217 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Dividend | DPS Regular | Payout Range 2% | Dividend Yield Range 2% | |

| Social Score | 0.013 | −0.005 | 0.010 | 0.010 * |

| (0.011) | (0.009) | (0.007) | (0.006) | |

| Control Variables | ||||

| ETR | −0.069 | −0.374 | −0.007 | −0.078 |

| (0.276) | (0.281) | (0.220) | (0.176) | |

| Analysts | 0.049 | −0.014 | 0.028 | 0.041 ** |

| (0.034) | (0.033) | (0.020) | (0.017) | |

| Market/Book | 0.060 ** | −0.058 ** | 0.040 * | 0.070 *** |

| (0.026) | (0.025) | (0.021) | (0.025) | |

| Size | 0.824 *** | −0.873 *** | 0.268 * | 0.288 ** |

| (0.252) | (0.272) | (0.148) | (0.129) | |

| EBT margin | 3.906 *** | −0.701 | 1.861 * | 2.380 ** |

| (1.479) | (1.000) | (1.001) | (0.999) | |

| EBT CAGR 3y | 0.107 ** | −0.065 | 0.013 | 0.079 *** |

| (0.052) | (0.043) | (0.027) | (0.030) | |

| ROE | −0.512 | −0.321 | −0.148 | 0.168 |

| (0.626) | (0.427) | (0.401) | (0.504) | |

| Leverage | −0.415 *** | 0.232 ** | −0.154 | −0.287 *** |

| (0.144) | (0.105) | (0.106) | (0.098) | |

| PP&E | 3.051 * | −2.973 * | 3.585 *** | 1.010 |

| (1.737) | (1.734) | (1.171) | (0.775) | |

| Year FE | Yes | Yes | Yes | Yes |

| Economic Sector FE | Yes | Yes | Yes | Yes |

| Observations | 1914 | 1914 | 1914 | 1914 |

| Wald test | 0.000 | 0.000 | 0.000 | 0.000 |

| Adj R2 | 0.225 | 0.224 | 0.224 | 0.213 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Dividend | DPS Regular | Payout Range2% | Dividend Yield Range2% | |

| Governance Score | 0.008 | −0.001 | 0.015 ** | −0.001 |

| (0.009) | (0.008) | (0.007) | (0.005) | |

| Control variables | ||||

| ETR | −0.057 | −0.372 | −0.014 | −0.083 |

| (0.269) | (0.278) | (0.221) | (0.178) | |

| Analysts | 0.052 | −0.015 | 0.032 * | 0.042 ** |

| (0.035) | (0.033) | (0.020) | (0.018) | |

| Market/Book | 0.060 ** | −0.058 ** | 0.037 * | 0.068 *** |

| (0.027) | (0.025) | (0.022) | (0.026) | |

| Size | 0.822 *** | −0.878 *** | 0.261 * | 0.283 ** |

| (0.254) | (0.274) | (0.145) | (0.131) | |

| EBT margin | 4.056 *** | −0.739 | 1.626 * | 2.426 ** |

| (1.499) | (0.985) | (0.965) | (1.007) | |

| EBTCAGR 3y | 0.108 ** | −0.066 | 0.011 | 0.078 *** |

| (0.051) | (0.042) | (0.026) | (0.030) | |

| ROE | −0.527 | −0.331 | −0.113 | 0.169 |

| (0.642) | (0.432) | (0.418) | (0.510) | |

| Leverage | −0.409 *** | 0.230 ** | −0.149 | −0.275 *** |

| (0.149) | (0.106) | (0.107) | (0.100) | |

| PP&E | 3.136 * | −2.956 * | 3.536 *** | 0.946 |

| (1.712) | (1.762) | (1.142) | (0.771) | |

| Year FE | Yes | Yes | Yes | Yes |

| Economic Sector FE | Yes | Yes | Yes | Yes |

| Observations | 1914 | 1914 | 1914 | 1914 |

| Wald test | 0.000 | 0.000 | 0.000 | 0.000 |

| AdjR2 | 0.226 | 0.224 | 0.227 | 0.213 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Verga Matos, P.; Barros, V.; Miranda Sarmento, J. Does ESG Affect the Stability of Dividend Policies in Europe? Sustainability 2020, 12, 8804. https://doi.org/10.3390/su12218804

Verga Matos P, Barros V, Miranda Sarmento J. Does ESG Affect the Stability of Dividend Policies in Europe? Sustainability. 2020; 12(21):8804. https://doi.org/10.3390/su12218804

Chicago/Turabian StyleVerga Matos, Pedro, Victor Barros, and Joaquim Miranda Sarmento. 2020. "Does ESG Affect the Stability of Dividend Policies in Europe?" Sustainability 12, no. 21: 8804. https://doi.org/10.3390/su12218804

APA StyleVerga Matos, P., Barros, V., & Miranda Sarmento, J. (2020). Does ESG Affect the Stability of Dividend Policies in Europe? Sustainability, 12(21), 8804. https://doi.org/10.3390/su12218804