Assessing Sustainable Foreign Direct Investment Performance in Malaysia: A Comparison on Policy Makers and Investor Perceptions

Abstract

1. Introduction

- To identify the valid SFDI attributes based on qualitative information.

- To assess the attributes’ importance and performance level in subjective perception

- To justify and suggest the improvement action strategy from experts’ perception.

2. Literature Review

2.1. Sustainable Foreign Direct Investment

2.2. Proposed Method

2.3. Proposed Attributes

3. Materials and Methods

3.1. Case Background

3.2. Fuzzy Delphi Method

3.3. Fuzzy Importance-Performance Analysis

4. Results

4.1. Fuzzy Delphi Method

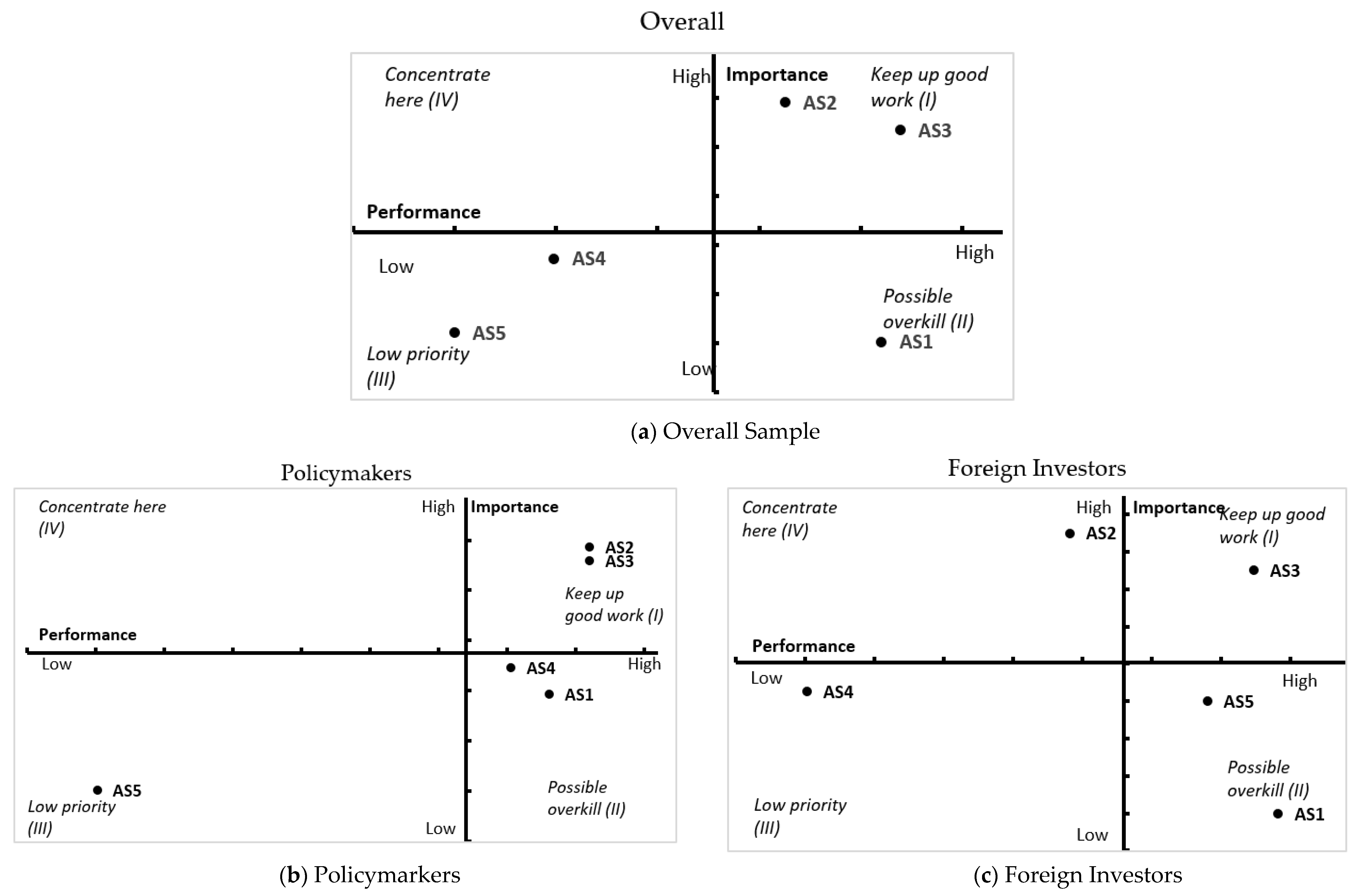

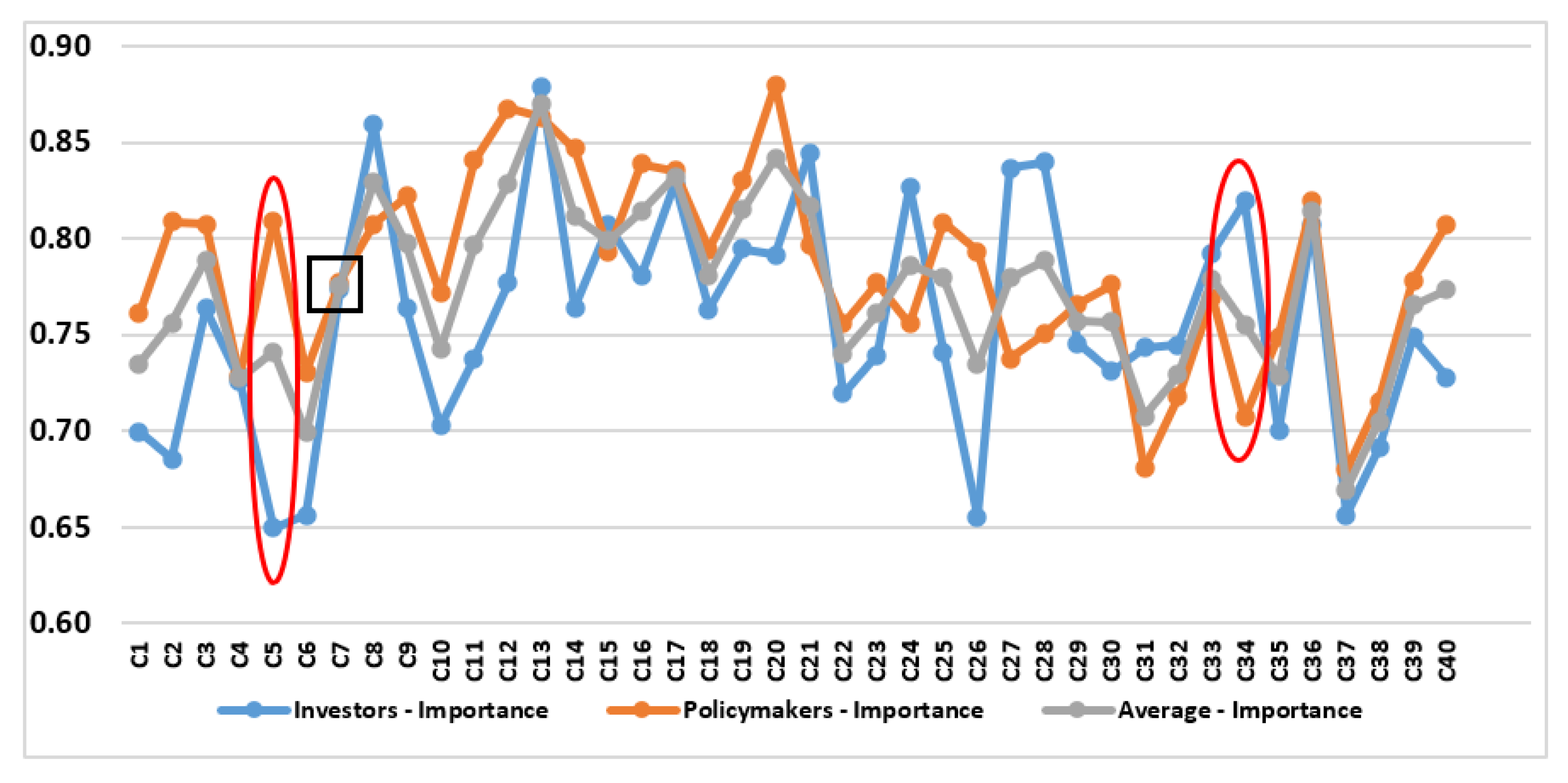

4.2. Fuzzy Importance and Performance Analysis

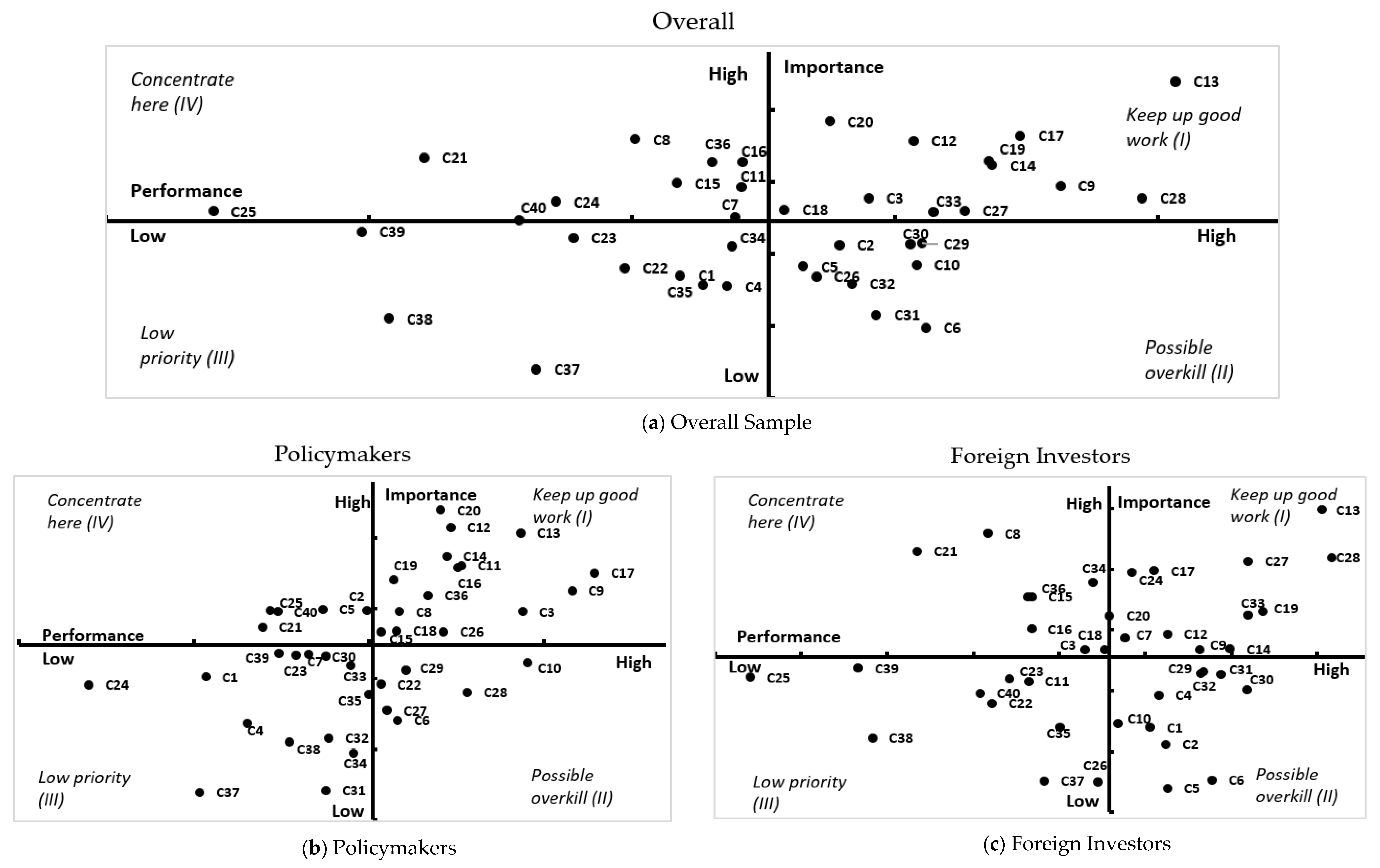

- Quadrant 1 consists of financial market development (C3), business sophistication (C9), infrastructure—Communication (C12), market openness (C13), market potential (C14), transportation system—Roadways (C17), transportation system—Waterways (C18), banking stability (C19), country stability (C20), business freedom (C27), economic freedom (C28), and business regulation (C33).

- Quadrant II contains nine criteria, including access to local finance (C2), international public finance (C5), investment cost (C6), export intensity (C10), rule of law (C26), financial freedom (C29), institutional freedom (C30), investment freedom (C31) and labor freedom (C32).

- Quadrant III included access to land (C1), interest rate (C4), monetary policy uncertainty (C22), price stability (C23), economic partnerships/free trade agreements (C34), guaranteed access to the electric grid (C35), social acceptance (C37), criminal activities (C38), and labor force (C39).

- Quadrant IV concentrates on 10 criteria, comprised of labor cost (C7), profitability (C8), goods market efficiency (C11), productivity (C15), transportation system—Airways (C16), exchange rate stability (C21), world economy uncertainty (C24), bureaucratic quality (C25), protection of foreign investors (C36), and technology readiness (C40). This implies that these criteria need to be focused on for improvement, as they are the key to achieve the SFDI.

- Quadrant I has 15 criteria, including financial market development (C3), profitability (C8), business sophistication (C9), goods market efficiency (C11), infrastructure—Communication (C12), market openness (C13), market potential (C14), productivity (C15), transportation system—Airways (C16), transportation system—Roadways (C17), transportation system—Waterways (C18), banking stability (C19), country stability (C20), rule of law (C26), and protection of foreign investors (C36).

- Quadrant II includes investment cost (C6), export intensity (C10), monetary policy uncertainty (C22), business freedom (C27), economic freedom (C28), and financial freedom (C29).

- Quadrant III contains access to land (C1), interest rate (C4), labor cost (C7), price stability (C23), world economic uncertainty (C24), institution freedom (C30), investment freedom (C31), labor freedom (C32), business regulation (C33), economic partnerships/free trade agreements (C34), guaranteed access to the electric grid (C35), social acceptance (C37), criminal activities (C38), and labor force (C39).

- Quadrant IV only has five highly important criteria, but the performance is not satisfied. The extra attention has to concentrate on these criteria, which are access to local finance (C2), international public finance (C5), exchange rate stability (C21), bureaucratic quality (C25), and technology readiness (C40).

- Quadrant I contains labor cost (C7), business sophistication (C9), infrastructure—Communication (C12), market openness (C13), market potential (C14), transportation system—Roadways (C17), banking stability (C19), country stability (C20), world economy uncertainty (C24), business freedom (C27), economic freedom (C28), and business regulation (C33).

- Quadrant II is comprised of the criteria that are well-performed but less important for SFDI, including access to land (C1), access to local finance (C2), interest rate (C4), international public finance (C5), investment cost (C6), export intensity (C10), financial freedom (C29), institution freedom (C30), investment freedom (C31), and labor freedom (C32).

- Quadrant III consists of good market efficiency (C11), monetary policy uncertainty (C22), price stability (C23), bureaucratic quality (C25), rule of law (C26), guaranteed access to the electric grid (C35), social acceptance (C37), criminal activities (C38), labor force (C39), and technology readiness (C40).

- Quadrant IV concentrates on the criteria that should be the focus in improving the SFDI investment environment. These criteria are financial market development (C3), profitability (C8), productivity (C15), transportation system—Airways (C16), transportation system—Waterways (C18), exchange rate stability (21), economic partnerships/free trade agreements (C34), and protection of foreign investors (C36).

5. Discussion

5.1. Theoretical Implications

5.2. Policy Implications

5.2.1. Policymakers

5.2.2. Foreign Investors

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Proposed Aspect | Proposed Criteria | Description | References | ||

|---|---|---|---|---|---|

| PA1 | Environmental | PC1 | Access to Land | The degree of ease of acquiring the land in the host country that required to develop projects. | [9,13,36,44] |

| PC2 | Carbon Dioxide (CO2) Emissions | The total carbon dioxide (CO2) emissions in the host country. | |||

| PC3 | Environmental Regulation | The host country has adequate regulation to protect the environmental resources. | |||

| PC4 | Abundance of Natural Resources | The availability of natural resources in the host country. | |||

| PC5 | Non-Renewable Natural Resources | The availability of non-renewable resources in the host country, such as coal, natural gas, and oil. | |||

| PC6 | Renewable Energy Resources | The availability of renewable energy resources in the host country. | |||

| PA2 | Financials | PC7 | Access to local finance | The degree of ease of obtaining financing in the host country’s financial market. | [13,14,20,21,36,37,38,39,40] |

| PC8 | Financial Market Development | The existence of functioning financial market in the host country. | |||

| PC9 | Interest Rate | The costs of financial loan in the host country. | |||

| PC10 | International Public Finance | The financial flows from multilateral or national development banks (outside the host country). | |||

| PC11 | Investment Cost | The amount of capital that investors need for investment in the host country. | |||

| PC12 | Labor Cost | The costs of labor in the host country. | |||

| PC13 | Natural Resources Rental/Costs | The costs of using natural resources in the host country. | |||

| PC14 | Profitability | The degree to which the investments yield profit or financial gain. | |||

| PC15 | Tariff Rate | The tax imposed by the host government on goods and services imported from other countries. | |||

| PC16 | Tax Rate/Burden | The business profit tax paid to the host government or authorities. | |||

| PA3 | Macroeconomics | PC17 | Bilateral Trade/Trade | The exchange of capital, goods, and services between the host country and investors’ home country. | [11,12,20,22,36,37,41,42,56] |

| PC18 | Business Sophistication | The quality of the environment in host country which businesses operate (Business Climate). | |||

| PC19 | Export Intensity | The degree to which the host government aims to export its products. | |||

| PC20 | Geographical Proximity | The geographical distance between the host country and home country of investors. | |||

| PC21 | Goods Market Efficiency | The exchange between consumers and businesses without host government restrictions, where the products and services can be adequately produced given the conditions of supply and demand. | |||

| PC22 | Infrastructure—Communication | The level of development in communication network and facilities in the host country. | |||

| PC23 | International Visibility | The host country’s international reputation, historical legacy and attractiveness to global capital. | |||

| PC24 | Market Openness | The ability of foreign investors to compete in the host country without any discrimination and restriction. | |||

| PC25 | Market Potential | The potential of product demand in the host country. | |||

| PC26 | Market Size | The current product demand in the host country. | |||

| PC27 | Productivity | The level of efficiency and effectiveness of the workers in conducting their tasks. | |||

| PC28 | Transportation System—Airways | The level of development in airways transportation/logistic infrastructures in the host country. | |||

| PC29 | Transportation System—Railways | The level of development in railways transportation/logistic infrastructures in the host country. | |||

| PC30 | Transportation System—Roadways | The level of development in roadways transportation/logistic infrastructures in the host country. | |||

| PC31 | Transportation System—Waterways | The level of development in waterways transportation/logistic infrastructures in the host country. | |||

| PA4 | Institutional | PC32 | Bureaucratic Quality | The strength and expertise of the host government to govern without drastic changes in policy or interruptions in government services. | [7,10,13,21,22,34,35,36,41,45] |

| PC33 | Control of Corruption | The extent to which public power is exercised for private gain including bribery, cronyism, nepotism, patronage, graft, and embezzlement. | |||

| PC34 | Government Integrity | The degree of host government integrity in handling their tasks without any irregular payments, briberies, and corruption, as well as transparency, in governmental and civil services and government policymaking. | |||

| PC35 | Democratic institutions | The degree of political freedom and civil liberties in the host country, which includes individual rights, such as freedom of speech and press. | |||

| PC36 | Voice & Accountability | The extent to which the host country’s citizens can participate in selecting their government, as well as freedom of expression, freedom of association, and free media. | |||

| PC37 | Enforcement of Contract | The commitment of government and company in the host country to enforce and implement the contract. | |||

| PC38 | Ethnic Tensions | The degree of tension within the host country attributable to racial, nationality, or language divisions. | |||

| PC39 | Government Effectiveness | The quality of the host government’s policy formulation and implementation, commitment to the policies, and the quality of public services. | |||

| PC40 | Informal Economy | The illegal economic activities not monitoring and regulated by the authorities of the host country. | |||

| PC41 | Institutional Reforms | The effort of the host country in rectifying institutional systems to improve and enhance the governance systems. | |||

| PC42 | Judicial Effectiveness | The well-functioning legal framework in the host country for protecting the rights of all citizens against unlawful acts by other, including governments and powerful private parties. | |||

| PC43 | Law & Order | The strength and impartiality of the legal system, as well as the order element, in the host country’s judicial system. | |||

| PC44 | Political Interferences | The degree of involvement of the host country’s political leader(s) in public administrative matters. | |||

| PC45 | Regulation Quality | The ability of the host government to formulate and implement sound policies and regulations that permit and promote private sector development. | |||

| PC46 | Religious Tensions | The domination of society and/or governance by a single religious group that seeks to replace civil law by religious law and to exclude other religions from the political and/or social process in the host country. | |||

| PC47 | Rule of Law | The extent to which agents have confidence in and abide the rules of society in the host country. | |||

| PA5 | Fiscal Environments | PC48 | Fiscal Health | The situation of government’s spending and taxes’ income in the host country. | [7,8,22,23,41] |

| PC49 | Government Debts | The total debts owed by different government levels in the host country. | |||

| PC50 | Government Investment | The total amount of public investment expenditure in providing public goods. | |||

| PC51 | Government Spending | The burden imposed by government expenditures including consumption by the state and all transfer payments related to various entitlement programs. | |||

| PC52 | Military Expenditure | The total amount of military expenditures to prevent terrorist activities in the host country. | |||

| PC53 | Public Health Expenditure | The total amount of host government spending in supplying full health coverage to the population. | |||

| PC54 | Public Infrastructure Expenditure | The total amount of host government spending in their public infrastructure facilities. | |||

| PC55 | R&D in Higher Education Expenditure | The total amount of host government spending for the R & D activities in higher education institutions. | |||

| PA6 | Freedomness | PC56 | Business Freedom | The degree of a company to establish and operate without undue state regulatory interference in the host country. | [7,11,22,40,47] |

| PC57 | Economic Freedom | The degree of an investor to operate, produce, consume and invest in any way they please without intervention of authorities in the host country. | |||

| PC58 | Financial Freedom | The banking system in the host country is efficient and independent from government control and interference in the financial sector. | |||

| PC59 | Institution Freedom | The host country’s government involvement in the allocation of resources through well-established institutions. | |||

| PC60 | Investment Freedom | The absence of restrictions with transparency on the movement of capital and investment in the host country. | |||

| PC61 | Labor Freedom | The degree of the legal and regulatory framework of the host country’s labor market. | |||

| PC62 | Monetary Freedom | The currency and price stability without intervention in the host country’s market (without price control). | |||

| PC63 | Press Freedom | The absence of censorship by the host country’s government in the press operation and journalists are free to print and circulate their opinions. | |||

| PC64 | Trade Freedom | The absence of trade restrictions (tariff/nontariff) in the host country that may hinder the free flow of international commerce. | |||

| PA7 | Policies | PC65 | Auction/Competitive Bidding | The practice of call for competitive bidding for projects with terms and conditions predetermined by the government of the host country. | [7,11,13,14,21,39,48] |

| PC66 | Bilateral Investment Agreement | The agreement between the host country and investors’ home country to provide certain protections for foreign investments in the host country. | |||

| PC67 | Business Regulation | The regulations needed by investors to comply with in the host country, such as time and cost to import, start a business, and enforce the contract. | |||

| PC68 | Economic Partnerships/Free Trade Agreements | The degree of host country in signing and joining the free trade agreement or economic partnership agreement with other countries. | |||

| PC69 | Foreign Ownership Limitation | The maximum threshold of ownership in a company set by the government for foreign investors. | |||

| PC70 | Grants & Subsidy | The policy that offers grants or subsidies to investors, in the host country. | |||

| PC71 | Intellectual Property Right Protection | The extent to which host country’s legal framework allows individuals to acquire, hold and utilize private property, which is secured by clear laws that the government enforces effectively. | |||

| PC72 | Local Content Requirement | The policy that requires companies to use the host country’s manufactured goods and/or services. | |||

| PC73 | Minimum Wages | The lowest wage permitted by law or a special agreement in the host country. | |||

| PC74 | International Integration/Agreements | The degree of host country’s participation in international integration or agreement, as well as international organizations, such as WTO, OIC, AFTA, ASEAN, APEC, and RCEP. | |||

| PC75 | Policy Consistency & Forward Planning | The possibility of government in the host country in changing the policies and plans for future. | |||

| PC76 | Guaranteed access to the electric grid | The guaranteed, transparent, and straightforward access to the electric grid in the host country. | |||

| PC77 | Protection of Foreign Investors | The regulation or standards in the host country that protect the investments and profits made by foreign investors (e.g., Investment Guarantee Agreements (IGAs). | |||

| PC78 | Social Acceptance | The extent of acceptance by the citizens of the host country and/or the residents in the project sites. | |||

| PC79 | Tax Reduction/Exemption | The exemption and reduction on tax permitted by government or authorities in the host country. | |||

| PC80 | Technical Standards | The existence of technical standards in the host country that are aligned with international standards. | |||

| PC81 | Trade Union Regulation | The laws and regulations in the host country that protect trade union. | |||

| PA8 | Stability | PC82 | Banking Stability | The extent to which the host country’s banking system can finance investment projects. | [6,9,11,12,20,34,36,38,43,44] |

| PC83 | Country Stability | The extent to which investor doing business are affected by political and economic turmoil in the host country. | |||

| PC84 | Economic Policy Uncertainty | The uncertainty of macro-economy in the host country. | |||

| PC85 | Exchange Rate Stability | The fluctuation of exchange rate in the host country. | |||

| PC86 | Government Stability | The ability of host country’s government to carry out its declared program(s) and ability to stay in office. | |||

| PC87 | Political Stability | The degree of change in political agents (government and parliamentary forces) through unconstitutional means. | |||

| PC88 | Monetary Policy Uncertainty | The possibility of changing in monetary policy of the host country. | |||

| PC89 | Price Stability | The fluctuation of inflation rate in the host country. | |||

| PC90 | Risk of Natural Disaster | The possibility of a natural disaster occurrence in the host country (haze, flood). | |||

| PC91 | Sovereign Credit Ratings | The short-term and long-term credit ratings and outlooks of sovereign’s debts in the host country. | |||

| PC92 | Stock Market Volatility | The fluctuation of the stock market in the host country. | |||

| PC93 | World Economy Uncertainty | The uncertainty of the world economy. | |||

| PA9 | Socials | PC94 | Criminal Activities | The frequency of criminal activities in the host country. | [7,8,10,23,35,39,41,46,48,49,56,57] |

| PC95 | Cultural Distance | The degree of differences of customs, religious and beliefs between the host and home countries. | |||

| PC96 | Employment | The number of employed people in the host country. | |||

| PC97 | Gender Equality | The degree of access to rights or opportunities is not affected by gender. | |||

| PC98 | Human Capital | The number of educated labor in the host country. | |||

| PC99 | Immigration | The total amount of foreign entrants with a long-term length of stay in the host country. | |||

| PC100 | Innovation | The degree of capacity for and commitment to technological innovation in the host country. | |||

| PC101 | Labor Force | The number of workers willing to work in the host country. | |||

| PC102 | Languages | The languages used in the host country. | |||

| PC103 | Life Expectancy | The average living period of the host country’s citizens. | |||

| PC104 | NGO Development | The degree of strength of the public sphere and civil society in the host country. | |||

| PC105 | Research & Development | The level of research & development and innovation in the host country. | |||

| PC106 | Technology Absorption | The degree of adoption of technologies by individuals and businesses in the host country. | |||

| PC107 | Technology Readiness | The agility of the host country’s industries in adopting existing technologies to enhance productivity. | |||

| PC108 | Terrorism Attacks | The possibility of terrorism activity in the host country. | |||

| PC109 | Urban Population | The total population of citizens living in urban areas of the host country. |

| Position | Industry | Year of Investment in Malaysia | Amount of Investment (RM) |

|---|---|---|---|

| Area Manager | Trading | 8 | RM 23 m |

| Director’s Secretary | IT | 9 | RM 10 m |

| Director | Construction | 15 | RM 165 m |

| CEO | IT | 5 | RM 6 m |

| CEO | Recycling | 20 | RM 23 m |

| General Manager | Manufacturing | 30 | RM 40 m |

| General Manager | Manufacturing | 30 | USD 2 m (RM 8.4 m) |

| Director | Manufacturing | 30 | RM 5 m |

| Senior Manager | Manufacturing | 29 | RM 4 m |

| Position | Ministries | Year in Experience |

|---|---|---|

| Associate Professor | Ministry of Higher Education | 31 |

| Senior Lecturer | Ministry of Higher Education | 10 |

| Senior Lecturer | Ministry of Higher Education | 8 |

| Professor | Ministry of Higher Education | 32 |

| Executive | Malaysian Investment Development Authority | 12 |

| Assistant Sectary | Ministry of International Trade and Industry | 11 |

| Principal Economist | Ministry of Finance | 15 |

| Assistant Director | Malaysian Investment Development Authority | 10 |

| Assistant Secretary | Ministry of Finance | 5 |

| Senior Assistant Director | Ministry of Finance | 6 |

| Assistant Director | Ministry of International Trade and Industry | 5 |

| Assistant Director | Malaysian Investment Development Authority | 8 |

| Principal Assistant Director | Ministry of International Trade and Industry | 11 |

| Principal Assistant Secretary | Ministry of Finance | 5 |

References

- Sauvant, K.P.; Mann, H. Making FDI more sustainable: Towards an Indicative list of FDI sustainability characteristics. JWIT 2019, 20, 916–952. [Google Scholar] [CrossRef]

- Ji, X.; Umar, M.; Ali, S.; Ali, W.; Tang, K.; Khan, Z. Does fiscal decentralization and eco-innovation promote sustainable environment? A case study of selected fiscally decentralized countries. Sustain. Dev. 2020, in press. [Google Scholar]

- Giddings, B.; Hopwood, B.; O′brien, G. Environment, economy and society: Fitting them together into sustainable development. J. Sustain. Dev. 2002, 10, 187–196. [Google Scholar] [CrossRef]

- Kapuria, C.; Singh, N. Determinants of sustainable FDI: A panel data investigation. Manag. Decis. 2019. ahead-of-print. [Google Scholar] [CrossRef]

- Ozgur, G.; Elgin, C.; Elveren, A.Y. Is informality a barrier to sustainable development? Sustain. Dev. 2020, in press. [Google Scholar] [CrossRef]

- Mourao, P.R. What is China seeking from Africa? An analysis of the economic and political determinants of Chinese outward foreign direct investment based on stochastic frontier models. China Econ. Rev. 2018, 48, 258–268. [Google Scholar] [CrossRef]

- Mahbub, T.; Jongwanich, J. Determinants of foreign direct investment (FDI) in the power sector: A case study of Bangladesh. Energy Strategy Rev. 2019, 24, 178–192. [Google Scholar] [CrossRef]

- Polyxeni, K.; Theodore, M. An empirical investigation of FDI inflows in developing economies: Terrorism as a determinant factor. J. Econ. Asymmetries 2019, 20, e00125. [Google Scholar] [CrossRef]

- Teixeira, A.A.C.; Forte, R.; Assuncao, S. Do countries’ endowments of non-renewable energy resources matter for FDI attraction? A panel data analysis of 125 countries over the period of 1995–2012. J. Int. Econ. 2017, 150, 57–71. [Google Scholar] [CrossRef]

- Kayalvizhi, P.N.; Thenmozhi, M. Does quality of innovation, culture and governance drive FDI? Evidence from emerging markets. Emerg. Mark. Rev. 2018, 34, 175–191. [Google Scholar] [CrossRef]

- Keeley, A.R.; Ikeda, Y. Determinants of foreign direct investment in wind energy in developing countries. J. Clean. Prod. 2017, 161, 1454–1458. [Google Scholar] [CrossRef]

- Keeley, A.R.; Matsumoto, K. Investors’ perspective on determinants of foreign direct investment in wind and solar energy in developing economies—Review and expert opinions. J. Clean. Prod. 2018, 179, 132–142. [Google Scholar] [CrossRef]

- Keeley, A.R.; Matsumoto, K. Relative significance of determinants of foreign direct investment in wind and solar energy in developing countries—AHP analysis. Energy Policy 2018, 123, 337–348. [Google Scholar] [CrossRef]

- Ragosa, G.; Warren, P. Unpacking the determinants of cross-border private investment in renewable energy in developing countries. J. Clean. Prod. 2019, 235, 854–865. [Google Scholar] [CrossRef]

- Chowdhury, S.; Hadas, Y.; Gonzalez, V.A.; Schot, B. Public transport users’ and policy markets’ perceptions of integrated public transport systems. Transp. Policy 2018, 61, 75–83. [Google Scholar] [CrossRef]

- Xu, J.W.; Guo, Q.Y. The interaction effects of economic growth, employment and wage of FDI–Empirical study based on provincial panel data. Economist 2016, 6, 15–23. [Google Scholar]

- Jude, C.; Silaghi, M.I.P. Employment effects of foreign direct investment: New evidence from Central and Eastern European countries. J. Int. Econ. 2016, 145, 32–49. [Google Scholar] [CrossRef]

- Nassir, M.A.; Huynh, T.L.D.; Tram, H.T.X. Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. J. Environ. Manag. 2019, 242, 131–141. [Google Scholar]

- Aust, V.; Morais, A.I.; Pinto, I. How does foreign direct investment contribute to Sustainable Development Goals? Evidence from African countries. J. Clean.Prod. 2020, 245, 118823. [Google Scholar] [CrossRef]

- Alfalih, A.A.; Hadj, T.B. Foreign direct investment determinants in an oil abundant host country: Short and long-run approach for Saudi Arabia. Resour. Policy 2020, 66, 101616. [Google Scholar] [CrossRef]

- Lee, M.; Alba, J.D.; Park, D. Intellectual property rights, informal economy and FDI into developing countries. J. Policy Model. 2018, 40, 1067–1081. [Google Scholar] [CrossRef]

- Economou, F. Economic freedom and asymmetric crisis effects on FDI inflows: The case of four South European economies. Res. Int. Bus. Financ. 2019, 49, 114–126. [Google Scholar] [CrossRef]

- Cro, S.; Martins, A.M. Foreign direct investment in the tourism sector: The case of France. Tour. Manag. Perspect. 2020, 33, 100614. [Google Scholar] [CrossRef]

- Tseng, M.L. A causal and effect decision making model of service quality expectation using grey-fuzzy DEMATEL approach. Expert Syst. Appl. 2009, 36, 7738–7748. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Sadeghi, J.; Mousavi, S.M.; Niaki, S.T.A. Optimizing an inventory model with fuzzy demand, backordering, and discount using a hybrid imperialist competitive algorithm. Appl. Math. Model 2016, 40, 7318–7335. [Google Scholar] [CrossRef]

- Tseng, M.L.; Wu, K.J.; Chiu, A.S.; Lim, M.K.; Tan, K. Service innovation in sustainable product service systems: Improving performance under linguistic preferences. Int. J. Prod. Econ. 2018, 203, 414–425. [Google Scholar] [CrossRef]

- Bui, T.D.; Tsai, F.M.; Tseng, M.L.; Ali, M.H. Identifying sustainable solid waste management barriers in practice using the fuzzy Delphi method. Resour. Conserv. Recycl. 2020, 154, 104625. [Google Scholar] [CrossRef]

- Tsai, F.M.; Bui, T.D.; Tseng, M.L.; Wu, K.J.; Chiu, A.S.F. A performance assessment approach for integrated solid waste management using a sustainable balanced scorecard approach. J. Clean. Prod. 2020, 251, 119740. [Google Scholar] [CrossRef]

- Islam, M.S.; Tseng, M.L.; Karia, N.; Lee, C.H. Assessing green supply chain practices in Bangladesh using fuzzy importance and performance approach. Resour. Conserv. Recycl. 2018, 131, 134–145. [Google Scholar] [CrossRef]

- Martilla, J.A.; James, J.C. Importance-performance analysis. J. Mark. 1977, 41, 77–79. [Google Scholar] [CrossRef]

- Tseng, M.L.; Bui, T.D. Identifying eco-innovation in industrial symbiosis under linguistic preferences: A novel hierarchical approach. J. Clean. Prod. 2017, 140, 1376–1389. [Google Scholar] [CrossRef]

- Bui, T.D.; Tsai, F.M.; Tseng, M.L.; Wu, K.J.; Chiu, A.S.F. Effective municipal solid waste management capability under uncertainty in Vietnam: Utilizing economic efficiency and technology to foster social mobilization and environmental integrity. J. Clean. Prod. 2020, 259, 120981. [Google Scholar] [CrossRef]

- Aziz, O.G. Institutional quality and FDI inflows in Arab economies. Financ. Res. Left 2018, 25, 111–123. [Google Scholar] [CrossRef]

- Bailey, N. Exploring the relationship between institutional factors and FDI attractiveness: A meta-analytic review. Int. Bus. Rev. 2018, 27, 139–148. [Google Scholar] [CrossRef]

- Cai, H.; Boateng, A.; Guney, Y. Host country institutions and firm-level R&D influences: An analysis of European Union FDI in China. Res. Int. Bus. Financ. 2019, 47, 311–326. [Google Scholar]

- Ramirez-Aleson, M.; Fleta-Asin, J. Is the importance of location factors different depending on the degree of development of the country? J. Int. Manag. 2016, 22, 29–43. [Google Scholar] [CrossRef]

- Zhang, H.; Yang, X. Trade-related aspects of intellectual property rights agreements and the upsurge in foreign direct investment in developing countries. Econ. Anal. Policy 2016, 50, 91–99. [Google Scholar] [CrossRef]

- Tomohara, A. Does immigration crowd out foreign direct investment inflows? Trade-off between contemporaneous FDI-immigration substitution and ethic network externalities. Econ. Model. 2017, 64, 40–47. [Google Scholar] [CrossRef]

- Sirin, S.M. Foreign direct investment (FDIs) in Turkish power sector: A discussion on investments, opportunities and risks. Renew. Sustain. Energy Rev. 2017, 78, 1367–1377. [Google Scholar] [CrossRef]

- Giammanco, M.D.; Gitto, L. Health expenditure and FDI in Europe. Econ. Anal. Policy 2019, 62, 255–267. [Google Scholar] [CrossRef]

- Halaszovich, T.F.; Kinra, A. The impact of distance, national transportation systems and logistics performance on FDI and international trade patterns: Results from Asian global value chains. Transp. Policy 2018, in press. [Google Scholar] [CrossRef]

- Albulescu, C.T.; Ionescu, A.M. The long-run impact of monetary policy uncertainty and banking stability on inward FDI in EU countries. Res. Int. Bus. Financ. 2018, 45, 72–81. [Google Scholar] [CrossRef]

- Canh, N.Y.; Binh, N.T.; Thanh, S.D.; Schinckus, C. Determinants of foreign direct investment inflows: The role of economic policy uncertainty. J. Int. Econ. 2019, 161, 159–172. [Google Scholar] [CrossRef]

- Yang, J.-H.; Wang, W.; Wang, K.-L.; Yeh, C.-Y. Capital intensity, natural resources, and institutional risk preferences in Chinese Outward Foreign Direct Investment. Int. Rev. Econ. Financ. 2018, 55, 259–272. [Google Scholar] [CrossRef]

- Elheddad, M.M. What determines FDI inflow to MENA countries? Empirical study on Gulf countries: Sectoral level analysis. Res. Int. Bus. Financ. 2018, 44, 332–339. [Google Scholar] [CrossRef]

- Kinuthia, B.K.; Murshed, S.M. FDI determinants: Kenya and Malaysia compared. J. Policy Model. 2015, 37, 388–400. [Google Scholar] [CrossRef]

- Falk, M. A gravity model of foreign direct investment in the hospitality industry. Tour. Manag. 2016, 55, 225–237. [Google Scholar] [CrossRef]

- Blanco, L.R.; Ruiz, I.; Wooster, R.B. The effect of violent crime on sector-specific FDI in Latin America. Oxf. Dev. Stud. 2019, 47, 420–434. [Google Scholar] [CrossRef]

- Malaysian Investment Development Authority. Malaysia Investment Performance Report 2019. 2020. Available online: https://www.mida.gov.my/home/administrator/system_files/modules/photo/uploads/20200421151258_MIDA%20IPR%202019%20fullbook_FINAL.pdf (accessed on 22 April 2020).

- United Nations Conference on Trade and Development (UNCTAD). Foreign Direct Investment: Inward and Outward Flows and Stock, Annual. Available online: https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96740 (accessed on 21 April 2020).

- Laporan Tinjauan Ekonomi. 2020. Available online: https://www.parlimen.gov.my/ipms/eps/2019-10-11/CMD%2026.2019%20BM.pdf (accessed on 9 April 2020).

- Ishikawa, A.; Amagasa, M.; Shiga, T.; Tomizawa, G.; Tatsuta, R.; Mieno, H. The max-min Delphi method and fuzzy Delphi method via fuzzy integration. Fuzzy Sets Syst. 1993, 55, 241–253. [Google Scholar] [CrossRef]

- Dunning, J.H. Toward an eclectic theory of international production: Some empirical tests. J. Int. Bus. 1980, 11, 9–31. [Google Scholar] [CrossRef]

- Ministry of International Trade and Industry. Investment Guarantee Agreement (IGAs). 2020. Available online: https://www.miti.gov.my/index.php/pages/view/771?mid=167 (accessed on 31 May 2020).

- Chen, Y.; Yan, F. International visibility as determinants of foreign direct investment: An empirical study of Chinese Provinces. Soc. Sci. Res. 2018, 76, 23–39. [Google Scholar] [CrossRef] [PubMed]

- Dutta, N.; Kar, S.; Saha, S. Human capital and FDI: How does corruption affect the relationship? Econ. Anal. Policy 2017, 56, 126–134. [Google Scholar] [CrossRef]

| Aspects | Criteria | Description | References | ||

|---|---|---|---|---|---|

| AS1 | Environmental | C1 | Access to Land | The degree of ease of acquiring the land in the host country that required to develop projects. | [13] |

| AS2 | Financial | C2 | Access to local finance | The degree of ease of obtaining financing in the host country’s financial market. | [13,14,36,37,38,40] |

| C3 | Financial Market Development | The existence of a functioning financial market in the host country. | |||

| C4 | Interest Rate | The costs of financial loan in the host country. | |||

| C5 | International Public Finance | The financial flows from multilateral or national development banks (outside the host country). | |||

| C6 | Investment Cost | The amount of capital that investors need for investment in the host country. | |||

| C7 | Labor Cost | The costs of labor in the host country. | |||

| C8 | Profitability | The degree to which the investments yield profit or financial gain. | |||

| AS3 | Macroeconomics | C9 | Business Sophistication | The quality of the environment in the host country in which businesses operate (Business Climate). | [11,20,36,37,41,42] |

| C10 | Export Intensity | The degree to which the host government aims to export its products. | |||

| C11 | Goods Market Efficiency | The exchange between consumers and businesses without host government restrictions, where the products and services can be adequately produced given the conditions of supply and demand. | |||

| C12 | Infrastructure—Communication | The level of development in communication network and facilities in the host country. | |||

| C13 | Market Openness | The ability of foreign investors to compete in the host country without any discrimination and restriction. | |||

| C14 | Market Potential/Growth | The potential of product demand in the host country. | |||

| C15 | Productivity | The level of efficiency and effectiveness of the workers in conducting their tasks. | |||

| C16 | Transportation System—Airways | The level of development in airways transportation/logistic infrastructures in the host country. | |||

| C17 | Transportation System—Roadways | The level of development in roadways transportation/logistic infrastructures in the host country. | |||

| C18 | Transportation System—Waterways | The level of development in waterways transportation/logistic infrastructures in the host country. | |||

| C19 | Banking Stability | The extent to which the host country’s banking system can finance investment projects. | [9,20,38,43,44] | ||

| C20 | Country Stability | The extent to which investor doing business are affected by political and economic turmoil in the host country. | |||

| C21 | Exchange Rate Stability | The fluctuation of the exchange rate in the host country. | |||

| C22 | Monetary Policy Uncertainty | The possibility of changing in the monetary policy of the host country. | |||

| C23 | Price Stability | The fluctuation of inflation rate in the host country. | |||

| C24 | World Economy Uncertainty | The uncertainty of the world economy. | |||

| AS4 | Institutional and Policy | C25 | Bureaucratic Quality | The strength and expertise of the host government to govern without drastic changes in policy or interruptions in government services. | [13,45] |

| C26 | Rule of Law | The extent to which agents have confidence in and abide by the rules of society in the host country. | |||

| C27 | Business Freedom | The degree of a company to establish and operate without undue state regulatory interference in the host country. | [11,22,40,47] | ||

| C28 | Economic Freedom | The degree of an investor to operate, produce, consume and invest in any way they please without the intervention of authorities in the host country. | |||

| C29 | Financial Freedom | The banking system in the host country is efficient and independent of government control and interference in the financial sector. | |||

| C30 | Institution Freedom | The host country’s government involvement in the allocation of resources through well-established institutions. | |||

| C31 | Investment Freedom | The absence of restrictions with transparency on the movement of capital and investment in the host country. | |||

| C32 | Labor Freedom | The degree of the legal and regulatory framework of the host country’s labor market. | |||

| C33 | Business Regulation | The regulations needed by investors to comply with the host country, such as time and cost to import, start a business, and enforce the contract. | [7,13,39,48] | ||

| C34 | Economic Partnerships/Free Trade Agreements | The degree of the host country in signing and joining the free trade agreement or economic partnership agreement with other countries. | |||

| C35 | Guaranteed access to the electric grid | The guaranteed, transparent and straightforward access to the electric grid in the host country. | |||

| C36 | Protection of Foreign Investors | The regulation or standards in the host country that protect the investments and profits made by foreign investors (e.g., Investment Guarantee Agreements (IGAs). | |||

| C37 | Social Acceptance | The extent of acceptance by the citizens of the host country and/or the residents in the project sites. | |||

| AS5 | Social | C38 | Criminal Activities | The frequency of criminal activities in the host country. | [10,46,49] |

| C39 | Labor Force | The number of workers willing to work in the host country. | |||

| C40 | Technology Readiness | The agility of the host country’s industries in adopting existing technologies to enhance productivity. |

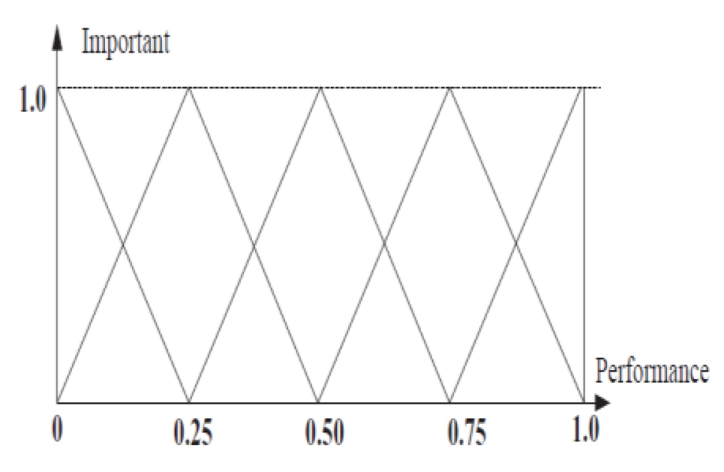

| Linguistic Terms—Importance Level | Linguistic Terms—Performance Level | Corresponding Triangular Fuzzy Number |  |

| Very Important | Very Good Performance | (0.75, 1.0, 1.0) | |

| Important | Good Performance | (0.5, 0.75, 1.0) | |

| Neutral | Neutral | (0.25, 0.5, 0.75) | |

| Unimportant | Poor Performance | (0, 0.25, 0.5) | |

| Very Unimportant | Very Poor Performance | (0, 0, 0.25) |

| Aspect | Decision | Rankings | |||

|---|---|---|---|---|---|

| AS1 | 0.051 | 0.727 | 0.289 | Accepted | 4 |

| AS2 | 0.116 | 0.856 | 0.419 | Accepted | 1 |

| AS3 | 0.109 | 0.842 | 0.405 | Accepted | 2 |

| AS4 | 0.070 | 0.764 | 0.327 | Accepted | 3 |

| AS5 | 0.046 | 0.718 | 0.280 | Accepted | 5 |

| Threshold | 0.557 |

| Criteria | Decision | Rankings | |||

|---|---|---|---|---|---|

| C1 | −0.194 | 0.694 | 0.299 | Accepted | 32 |

| C2 | −0.214 | 0.714 | 0.304 | Accepted | 29 |

| C3 | 0.111 | 0.764 | 0.410 | Accepted | 10 |

| C4 | 0.179 | 0.696 | 0.393 | Accepted | 20 |

| C5 | 0.173 | 0.702 | 0.394 | Accepted | 19 |

| C6 | −0.152 | 0.652 | 0.288 | Accepted | 39 |

| C7 | 0.139 | 0.736 | 0.403 | Accepted | 15 |

| C8 | 0.072 | 0.803 | 0.420 | Accepted | 5 |

| C9 | 0.104 | 0.771 | 0.411 | Accepted | 9 |

| C10 | −0.199 | 0.699 | 0.300 | Accepted | 30 |

| C11 | −0.260 | 0.760 | 0.315 | Accepted | 25 |

| C12 | −0.301 | 0.801 | 0.325 | Accepted | 21 |

| C13 | 0.373 | 0.877 | 0.532 | Accepted | 1 |

| C14 | −0.282 | 0.782 | 0.320 | Accepted | 23 |

| C15 | 0.088 | 0.787 | 0.415 | Accepted | 7 |

| C16 | −0.293 | 0.793 | 0.323 | Accepted | 22 |

| C17 | 0.059 | 0.816 | 0.423 | Accepted | 3 |

| C18 | 0.119 | 0.756 | 0.408 | Accepted | 11 |

| C19 | 0.082 | 0.793 | 0.417 | Accepted | 6 |

| C20 | 0.033 | 0.842 | 0.429 | Accepted | 2 |

| C21 | 0.064 | 0.811 | 0.421 | Accepted | 4 |

| C22 | −0.194 | 0.694 | 0.299 | Accepted | 33 |

| C23 | 0.148 | 0.727 | 0.400 | Accepted | 16 |

| C24 | −0.266 | 0.766 | 0.317 | Accepted | 24 |

| C25 | 0.125 | 0.750 | 0.406 | Accepted | 13 |

| C26 | −0.181 | 0.681 | 0.295 | Accepted | 35 |

| C27 | 0.135 | 0.740 | 0.404 | Accepted | 14 |

| C28 | 0.119 | 0.756 | 0.408 | Accepted | 12 |

| C29 | 0.169 | 0.706 | 0.395 | Accepted | 18 |

| C30 | 0.157 | 0.718 | 0.398 | Accepted | 17 |

| C31 | −0.164 | 0.664 | 0.291 | Accepted | 37 |

| C32 | −0.176 | 0.676 | 0.294 | Accepted | 36 |

| C33 | −0.236 | 0.736 | 0.309 | Accepted | 26 |

| C34 | −0.198 | 0.698 | 0.299 | Accepted | 31 |

| C35 | −0.184 | 0.684 | 0.296 | Accepted | 34 |

| C36 | 0.088 | 0.787 | 0.415 | Accepted | 8 |

| C37 | −0.145 | 0.645 | 0.286 | Accepted | 40 |

| C38 | −0.163 | 0.663 | 0.291 | Accepted | 38 |

| C39 | −0.227 | 0.727 | 0.307 | Accepted | 28 |

| C40 | −0.230 | 0.730 | 0.308 | Accepted | 27 |

| Threshold | 0.408 |

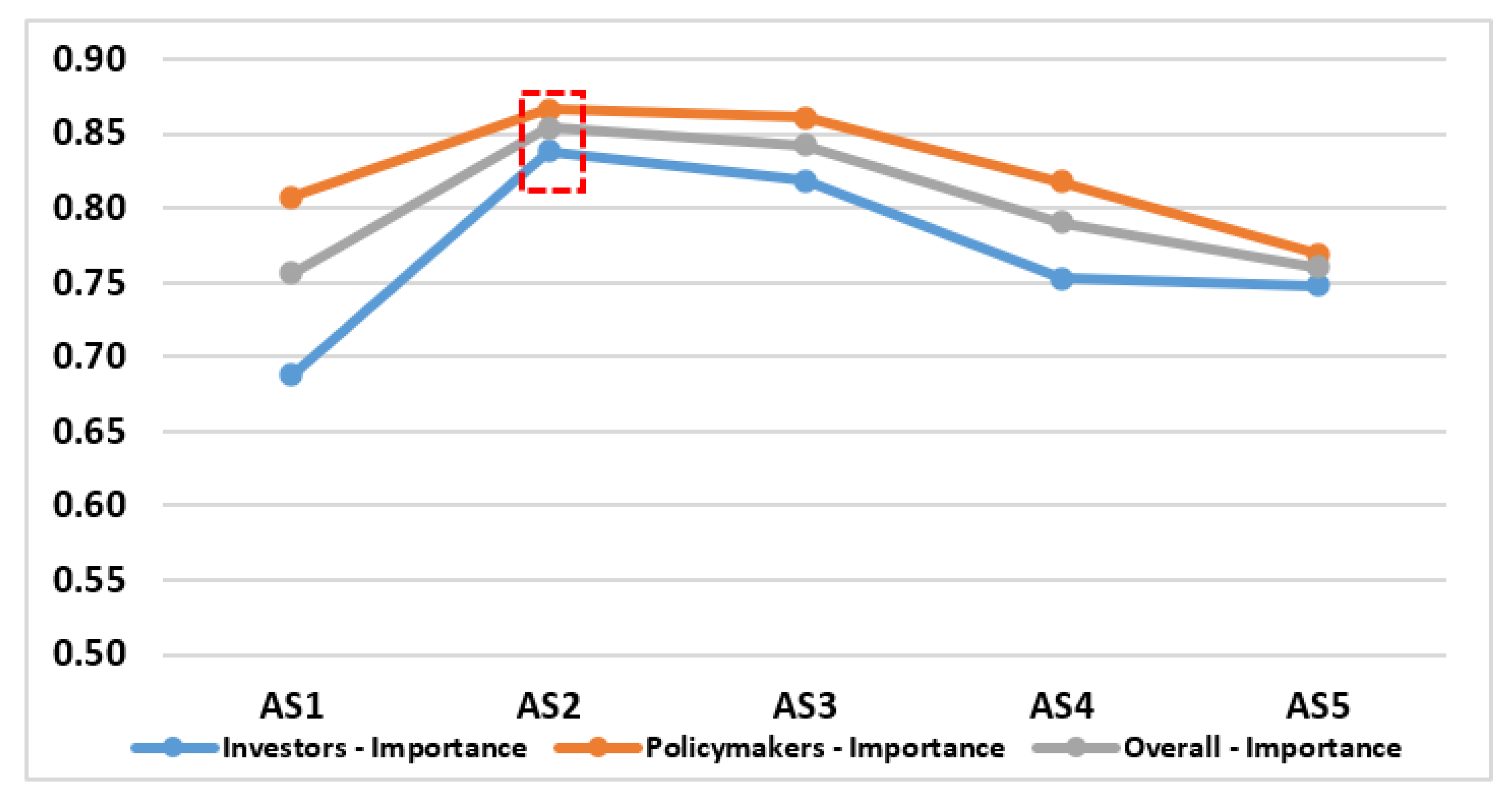

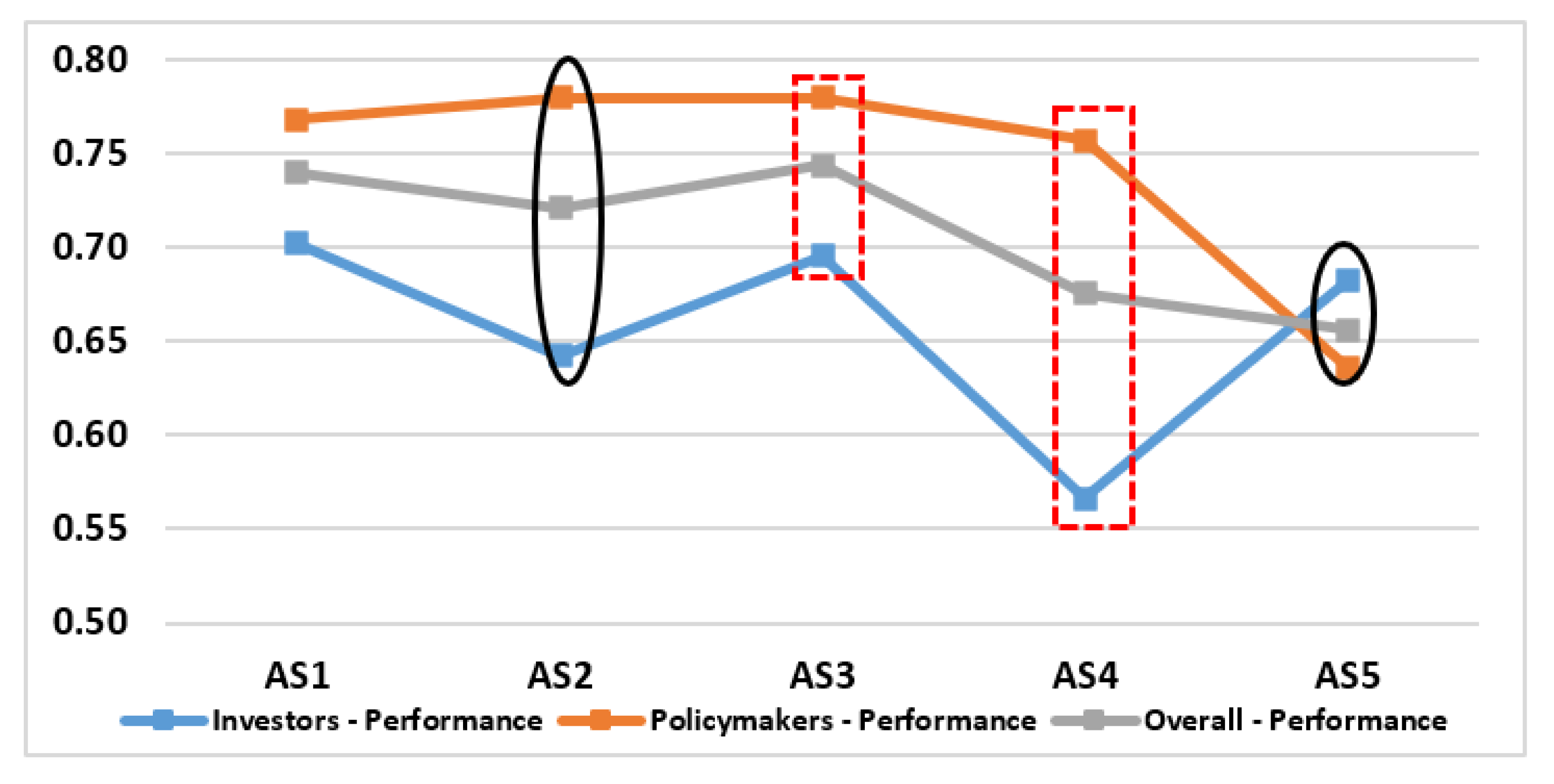

| Aspects | Important—TFN | Performance—TFN | Important | Performance | (I-P) | ||||

|---|---|---|---|---|---|---|---|---|---|

| L | m | u | L | m | u | ||||

| AS1 | 0.534 | 0.784 | 0.952 | 0.524 | 0.774 | 0.922 | 0.756 | 0.740 | 0.016 |

| AS2 | 0.661 | 0.911 | 0.990 | 0.492 | 0.742 | 0.929 | 0.854 | 0.721 | 0.133 |

| AS3 | 0.644 | 0.894 | 0.990 | 0.515 | 0.765 | 0.952 | 0.843 | 0.744 | 0.099 |

| AS4 | 0.572 | 0.822 | 0.977 | 0.444 | 0.694 | 0.890 | 0.790 | 0.676 | 0.115 |

| AS5 | 0.535 | 0.785 | 0.961 | 0.419 | 0.669 | 0.880 | 0.760 | 0.656 | 0.104 |

| Means | 0.801 | 0.707 | |||||||

| Aspects | Important—TFN | Performance—TFN | Important | Performance | (I-P) | ||||

|---|---|---|---|---|---|---|---|---|---|

| L | m | u | L | m | u | ||||

| AS1 | 0.586 | 0.836 | 1.000 | 0.565 | 0.815 | 0.924 | 0.808 | 0.768 | 0.039 |

| AS2 | 0.674 | 0.924 | 1.000 | 0.554 | 0.804 | 0.982 | 0.866 | 0.780 | 0.086 |

| AS3 | 0.666 | 0.916 | 1.000 | 0.554 | 0.804 | 0.982 | 0.861 | 0.780 | 0.081 |

| AS4 | 0.602 | 0.852 | 1.000 | 0.531 | 0.781 | 0.960 | 0.818 | 0.757 | 0.061 |

| AS5 | 0.543 | 0.793 | 0.972 | 0.401 | 0.651 | 0.857 | 0.769 | 0.636 | 0.133 |

| Means | 0.824 | 0.744 | |||||||

| Aspects | Important—TFN | Performance—TFN | Important | Performance | (I-P) | ||||

|---|---|---|---|---|---|---|---|---|---|

| L | m | u | L | m | u | ||||

| AS1 | 0.463 | 0.713 | 0.887 | 0.469 | 0.719 | 0.919 | 0.688 | 0.702 | −0.015 |

| AS2 | 0.644 | 0.894 | 0.976 | 0.409 | 0.659 | 0.858 | 0.838 | 0.642 | 0.196 |

| AS3 | 0.614 | 0.864 | 0.976 | 0.462 | 0.712 | 0.912 | 0.818 | 0.695 | 0.123 |

| AS4 | 0.532 | 0.782 | 0.946 | 0.327 | 0.577 | 0.796 | 0.753 | 0.566 | 0.187 |

| AS5 | 0.524 | 0.774 | 0.947 | 0.442 | 0.692 | 0.912 | 0.748 | 0.682 | 0.066 |

| Means | 0.769 | 0.658 | |||||||

| Overall | Policymakers | Foreign Investors | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Important Criteria | Importance | Performance | (I-P) | Importance | Performance | (I-P) | Importance | Performance | (I-P) | |

| C1 | Access to Land | 0.735 | 0.695 | 0.040 | 0.700 | 0.695 | 0.005 | 0.761 | 0.695 | 0.066 |

| C2 | Access to local finance | 0.756 | 0.725 | 0.031 | 0.686 | 0.704 | −0.018 | 0.809 | 0.741 | 0.067 |

| C3 | Financial Market Development | 0.789 | 0.731 | 0.058 | 0.764 | 0.657 | 0.107 | 0.808 | 0.786 | 0.021 |

| C4 | Interest Rate | 0.727 | 0.704 | 0.023 | 0.726 | 0.700 | 0.026 | 0.728 | 0.707 | 0.021 |

| C5 | International Public Finance | 0.741 | 0.719 | 0.023 | 0.650 | 0.705 | −0.055 | 0.809 | 0.729 | 0.080 |

| C6 | Investment Cost | 0.699 | 0.742 | −0.043 | 0.656 | 0.731 | −0.074 | 0.731 | 0.750 | −0.020 |

| C7 | Labor Cost | 0.776 | 0.706 | 0.070 | 0.774 | 0.680 | 0.094 | 0.777 | 0.725 | 0.053 |

| C8 | Profitability | 0.830 | 0.687 | 0.143 | 0.859 | 0.601 | 0.259 | 0.808 | 0.751 | 0.057 |

| C9 | Business Sophistication | 0.797 | 0.767 | 0.030 | 0.764 | 0.724 | 0.040 | 0.822 | 0.800 | 0.022 |

| C10 | Export Intensity | 0.742 | 0.740 | 0.002 | 0.703 | 0.676 | 0.026 | 0.772 | 0.788 | −0.016 |

| C11 | Goods Market Efficiency | 0.796 | 0.707 | 0.090 | 0.737 | 0.624 | 0.113 | 0.840 | 0.768 | 0.072 |

| C12 | Infrastructure—Communication | 0.829 | 0.740 | 0.089 | 0.777 | 0.705 | 0.072 | 0.867 | 0.766 | 0.102 |

| C13 | Market Openness | 0.870 | 0.789 | 0.080 | 0.879 | 0.795 | 0.084 | 0.863 | 0.786 | 0.078 |

| C14 | Market Potential/Growth | 0.811 | 0.755 | 0.057 | 0.764 | 0.741 | 0.023 | 0.847 | 0.764 | 0.082 |

| C15 | Productivity | 0.799 | 0.695 | 0.105 | 0.807 | 0.626 | 0.181 | 0.793 | 0.746 | 0.048 |

| C16 | Transportation System—Airways | 0.814 | 0.707 | 0.107 | 0.781 | 0.626 | 0.155 | 0.839 | 0.768 | 0.071 |

| C17 | Transportation System—Roadways | 0.832 | 0.760 | 0.072 | 0.829 | 0.697 | 0.131 | 0.835 | 0.807 | 0.028 |

| C18 | Transportation System—Waterways | 0.781 | 0.715 | 0.066 | 0.763 | 0.668 | 0.095 | 0.794 | 0.750 | 0.044 |

| C19 | Banking Stability | 0.815 | 0.754 | 0.061 | 0.795 | 0.760 | 0.035 | 0.830 | 0.749 | 0.081 |

| C20 | Country Stability/Risk | 0.842 | 0.724 | 0.118 | 0.792 | 0.671 | 0.120 | 0.880 | 0.763 | 0.117 |

| C21 | Exchange Rate Stability | 0.817 | 0.647 | 0.171 | 0.845 | 0.559 | 0.285 | 0.797 | 0.712 | 0.085 |

| C22 | Monetary Policy Uncertainty | 0.740 | 0.685 | 0.056 | 0.719 | 0.603 | 0.116 | 0.756 | 0.746 | 0.010 |

| C23 | Price Stability | 0.761 | 0.675 | 0.086 | 0.739 | 0.613 | 0.127 | 0.777 | 0.721 | 0.056 |

| C24 | World Economy Uncertainty | 0.786 | 0.672 | 0.115 | 0.827 | 0.684 | 0.143 | 0.756 | 0.662 | 0.094 |

| C25 | Bureaucratic Quality | 0.780 | 0.606 | 0.173 | 0.741 | 0.462 | 0.279 | 0.808 | 0.714 | 0.094 |

| C26 | Rule of Law | 0.734 | 0.721 | 0.013 | 0.655 | 0.664 | −0.009 | 0.793 | 0.763 | 0.030 |

| C27 | Business Freedom | 0.780 | 0.749 | 0.030 | 0.836 | 0.752 | 0.085 | 0.737 | 0.747 | −0.010 |

| C28 | Economic Freedom | 0.788 | 0.783 | 0.005 | 0.840 | 0.800 | 0.039 | 0.750 | 0.770 | −0.020 |

| C29 | Financial Freedom | 0.757 | 0.741 | 0.016 | 0.746 | 0.726 | 0.020 | 0.766 | 0.753 | 0.013 |

| C30 | Institution Freedom | 0.757 | 0.739 | 0.018 | 0.731 | 0.751 | −0.020 | 0.776 | 0.730 | 0.046 |

| C31 | Investment Freedom | 0.707 | 0.733 | −0.025 | 0.743 | 0.736 | 0.007 | 0.681 | 0.730 | −0.049 |

| C32 | Labor Freedom | 0.729 | 0.728 | 0.001 | 0.744 | 0.724 | 0.020 | 0.718 | 0.731 | −0.013 |

| C33 | Business Regulation | 0.779 | 0.743 | 0.036 | 0.792 | 0.752 | 0.040 | 0.769 | 0.737 | 0.033 |

| C34 | Economic Partnerships/Free Trade Agreements | 0.755 | 0.705 | 0.050 | 0.819 | 0.662 | 0.158 | 0.707 | 0.738 | −0.031 |

| C35 | Guaranteed access to the electric grid | 0.728 | 0.699 | 0.029 | 0.700 | 0.642 | 0.058 | 0.749 | 0.742 | 0.007 |

| C36 | Protection of Foreign Investors | 0.814 | 0.701 | 0.113 | 0.807 | 0.624 | 0.184 | 0.819 | 0.759 | 0.060 |

| C37 | Social Acceptance | 0.670 | 0.668 | 0.002 | 0.656 | 0.633 | 0.023 | 0.680 | 0.694 | −0.014 |

| C38 | Criminal Activities | 0.705 | 0.640 | 0.065 | 0.691 | 0.533 | 0.158 | 0.715 | 0.719 | −0.004 |

| C39 | Labor Force | 0.765 | 0.635 | 0.131 | 0.748 | 0.525 | 0.223 | 0.778 | 0.716 | 0.062 |

| C40 | Technology Readiness | 0.774 | 0.665 | 0.109 | 0.728 | 0.596 | 0.132 | 0.808 | 0.716 | 0.092 |

| Means | 0.773 | 0.712 | 0.061 | 0.758 | 0.671 | 0.087 | 0.784 | 0.743 | 0.041 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ling, P.-S.; Lim, M.K.; Tseng, M.-L. Assessing Sustainable Foreign Direct Investment Performance in Malaysia: A Comparison on Policy Makers and Investor Perceptions. Sustainability 2020, 12, 8749. https://doi.org/10.3390/su12208749

Ling P-S, Lim MK, Tseng M-L. Assessing Sustainable Foreign Direct Investment Performance in Malaysia: A Comparison on Policy Makers and Investor Perceptions. Sustainability. 2020; 12(20):8749. https://doi.org/10.3390/su12208749

Chicago/Turabian StyleLing, Pick-Soon, Ming K. Lim, and Ming-Lang Tseng. 2020. "Assessing Sustainable Foreign Direct Investment Performance in Malaysia: A Comparison on Policy Makers and Investor Perceptions" Sustainability 12, no. 20: 8749. https://doi.org/10.3390/su12208749

APA StyleLing, P.-S., Lim, M. K., & Tseng, M.-L. (2020). Assessing Sustainable Foreign Direct Investment Performance in Malaysia: A Comparison on Policy Makers and Investor Perceptions. Sustainability, 12(20), 8749. https://doi.org/10.3390/su12208749