Abstract

Public procurement fulfils an important role in the economy and public expenditure of a country and can be regarded as a critical indicator of the effectiveness of a government, because it is a central aspect of public service delivery. Notwithstanding various reforms made to date to public sector procurement in South Africa and the application of Supply Chain Management as a strategic policy strategic instrument, the South African public procurement system still faces several challenges and has been strongly criticised. This paper aims to understand the current public procurement environment in South Africa, its dilemmas and challenges, and to propose that public procurement be refocused towards a strategically placed business process, implemented by well-trained and competent procurement officials. The purpose is to provide a theoretical foundation as well as practical guidance regarding the role of public procurement in the South African public sector. The methodology involved an intensive literature study and document analysis to evaluate various official policy documents and official publications to determine the status of South African public procurement. The study found that the majority of challenges faced by public procurement in South Africa can probably be attributed to the implementation of the system, rather than to the system itself. In the shorter and longer term, the public procurement system in South Africa will have no choice but to emerge as a stronger, more resilient, streamlined and efficient provider of goods and services for the greater good of all.

1. Introduction

On 23 March 2020, in response to the global COVID-19 pandemic, the South African President, Cyril Ramaphosa, declared a full national lockdown for 21 days, from midnight on 26 March until midnight on 16 April []. The full lockdown was subsequently extended but was stepped down to a less stringent lockdown from 4 June 2020. In the wake of the announcement of the lockdown, various government entities were tasked with ensuring the continuation of essential services, including procurement activities aimed at combatting the disease, addressing the needs of the poor, and maintaining law and order. These procurements are conducted in line with a special National Treasury Regulation which amended certain emergency procurement procedures. Now, more than ever before, the South African public procurement system is required to ensure timely, effective and efficient delivery; moreover, it must do so in the context of the backlogs arising from a system that is already struggling.

According to the Secretary-General of the Organisation for Economic Co-operation and Development (OECD), Angel Gurría, “public procurement, as a major part of the economy and public spending, can be regarded as an indicator of government efficiency” []. The economic downturn over the last few years requires a renewed focus on efficient public procurement, “based on integrity, to ensure requisite delivery of public services, and sustain the trust of the electorate in their government. Hence, governments are increasingly acknowledging the role of public procurement in improving public sector productivity through cost saving initiatives and applying the principles of economies of scale. In addition, tapping into the potential of procurement is seen as a strategic policy lever towards achieving important socio-economic and environmental objectives” [].

This paper focused on four aspects: firstly, the nature of public procurement; secondly, public procurement practices in South Africa; thirdly, the challenges faced by public procurement in South Africa; and fourthly, recommendations for the way forward for public procurement in South Africa.

The paper assesses the extent to which public procurement in South Africa is an economic enabler or a hindrance in the South African economic system. The paper aims to describe the concepts of the role of public procurement by a government in the economy, within the ambit of a developmental state, and of the South African Public Procurement Policy Framework. In doing so, aspects pertaining to reasons for state procurement, including the optimum prescribed foundational principles, are analysed. Finally, in the last two sections, the article considers several implications that arise from the current state of affairs. It argues the need for the successful implementation of structural and capacitating measures, focusing on addressing challenges pertaining to mismanagement, underspending, and a lack of accountability, all of which have had a severe impact on the level of service delivery and economic development in South Africa. Addressing these challenges is critical to economic recovery beyond Covid-19, as well as to the successful delivery of the National Economic and Development Goals.

2. Methodology

The study is an exploratory desktop literature review of various publications, including books, academic journals and other official publications, legislation and policies, newspaper articles, websites as well as dissertations in the field of public procurement. A conceptual analysis approach provided comprehensive insight into current trends and developments of procurement practices in the South African public sector.

The primary function of public procurement is procuring goods and providing services and infrastructure on the best possible terms. Public procurement’s secondary function is to promote broader social, economic and environmental outcomes. The literature indicates that post-apartheid government procurement has mainly focused on pursuing these secondary objectives—particularly focusing on the accelerated social and economic upliftment of historically disadvantaged people or groups of people in South Africa. The strategic application of public procurement in the pursuit of wider socio-economic priorities, is evident in various affirmative action examples found.

In the South African context, preferential procurement occurs in line with the Broad-Based Black Economic Empowerment (B-BBEE) score of companies, which incorporates the degree to which companies contract suppliers with high B-BBEE ratings. This is intended to have a cascading effect on the South African economy and is aimed at demographic and structural transformation. Beyond advancing social objectives, “public procurement in South Africa is also geared towards generating employment opportunities and boosting local manufacturing capacity, among other green and inclusive growth priorities” []. This is evident in the “local content” programme of the National Department of Trade and Industry, which requires that a percentage of the price of public tenders must have “local content” [].

With the above in mind, this article adopted a qualitative research approach using unobtrusive methods. This approach was considered the most appropriate to generate understanding and insights regarding public procurement practices in South Africa. A theoretical framework is essential to gain a clear understanding of the relationships manifested between the various elements and issues of an identified phenomenon—in this case, public sector procurement in the South African public sector []. The documents used are readily available in the public domain. For the purposes of this article, a detailed examination of the available content was possible, focusing on data in trustworthy and reliable documents such as the Auditor General’s reports and policy documents from the National Treasury. The relevant information generated was evaluated through a process of analysis of the phenomenon (public procurement), reflection and synthesis to make meaningful deductions. After analysis of the trustworthy sources [], the authors concluded that the aim of analysis was to develop the concepts in order to gain a better understanding of the study at hand and to develop various recommendations to improve the system of public sector procurement.

3. Literature Review and Background to the Study

States that are considered “developmental” states include “Japan during the 1950s to the 1980s, South Korea for the period 1960s to the 1990s, China since the 1980s, and Brazil since 2000”. These states are often associated with high levels of economic growth. These developing countries are often characterised as having funding constraints, resulting in public sector expenditure making a considerable contribution towards total procurement. Such procurement is for the most part linked to crucial projects aimed at economic and social development. Given the developmental nature and importance of such procurement, the effective functioning of a proper public procurement regime becomes a critical success factor [].

Even before the onset of the COVID-19 pandemic, the South African government faced numerous development challenges: an ever-increasing unemployment crisis, particularly amongst the youth, social and spatial divisions that continue to impede economic growth, a shrinking income-generating tax base, and low economic productivity in comparison to South Africa’s counterparts in BRICS (Brazil, Russia, India, China and South Africa). Given these challenges, South Africa’s level of economic competitiveness is still limited, even though it is driven by the country’s vision of a more labour-intensive and inclusive growth trajectory, one that focuses on value-added exports as a result of a supportive domestic manufacturing industry []. As South Africa’s National Development Plan (NDP) indicates, the government intends to transform itself into a “capable and developmental state able to intervene to correct our historical inequities”, as then Cabinet Minister and former Minister of Finance, Trevor Manuel, stated in the foreword to the NDP (cited in []).

3.1. Contextualisation of Public Procurement

Odhiambo and Kamau [] and Ambe and Badenhorst-Weiss [] argue that “the origins of public procurement can be connected to the responsibility of government administrations to provide goods, services and infrastructure to the people of a country, at a national, regional or local level”. According to the World Bank [], public procurement is a necessary strategic development instrument to promote good governance and to embed the effective and efficient use of public resources, which ultimately results in higher levels of service delivery. Given the ever-increasing focus on sustainable development, the role and focus of public procurement has evolved from a predominantly technical and administrative process to a series of processes built around efficiency, transparency and accountability in using public resources. In pursuit of better development outcomes and economic growth, sound public procurement and management of contracts are essential [].

Public procurement is a multifaceted function pertaining to a series of practices relating to government actions within the realm of public policy []. In defining public procurement, the literature indicates that such activities relate to a “government’s activity of purchasing the requisite goods and services it needs to perform its functions” []. Moreover, Ambe and Badenhorst-Weiss [], as well as Hommen and Rolfstam [] describe public procurement as the “attainment (through buying or purchasing, hiring or obtaining by any contractual means) of all goods, construction works and services by the public sector”. This includes all acquisitions effected with the resources available from the budgets at national and local authority levels, public institution funding, domestic or foreign loans guaranteed by the state, as well as foreign aid and revenue received from the economic activities of the state” [,].

Public procurement encompasses a broad spectrum of activities within government entities towards delivery of public services and goods. These interventions are either directly or indirectly aimed at government’s social and political aims and range from “routine items to complex development and construction projects” []. Mazibuko and Fourie [] add a systematic approach in their definition of public procurement as “the supply chain system for the acquisition of all necessary goods and services by the state and its organs when acting in public pursuit or interest”.

Harpe [] identifies three interest groups or parties involved in public procurement: firstly, government as the funding entity; secondly, the general public, in other words, those who benefit from the goods and services procured directly, and indirectly (through the payment of taxes) fund the goods and services procured, and lastly, private enterprises supplying the goods and services. The inclusion of principles of fairness, equity, transparency, competitiveness and cost-effectiveness should also be noted [].

Arrowsmith [] contends that the concept of public procurement refers to the management activities of procurement planning, contract placement and contract administration. The process should be approached as a strategic business management function at all levels, whether national, provincial or local, to manage the complete procurement process effectively and efficiently from the initiation phase of assessing needs, identifying the requisite product/solution and forecasting, to sourcing the most suitable service provider, addressing logistics, managing and mitigating risks, value engineering, implementing supplier relation management, and regulatory compliance. Mazibuko and Fourie [] explain that value for money for the taxpayer can only be achieved by means of effectively managed, carefully planned and well-executed procurements. In doing so, optimum utilisation of scarce budgetary resources is ensured. Given the nature and extent of public procurement, the likelihood that it will influence industry and have an important impact on a country’s economy is undeniable. Arrowsmith [] describes the primary objective of public procurement as “the acquisition of goods or services fulfilling a particular function on the best possible terms”.

In recent years, the effective use of state funds for procurement purposes has increasingly been posited to be a lever for improving the efficiency and effectiveness of public spending. For this reason, increasing the productivity of government spending has become a meaningful pursuit for most governments. A 2017 study by McKinsey observed that “the global fiscal gap of USD 3.3 trillion could be resolved by 2021 if public spending were managed better in line with the practices of the best performing countries” (cited in []).

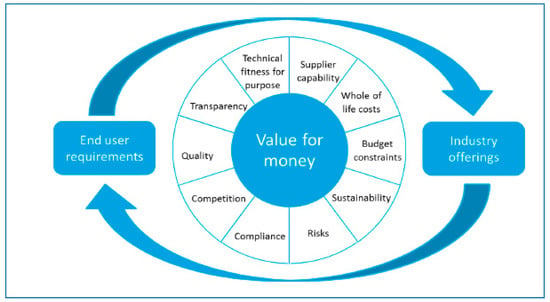

As indicated in Figure 1, defining the optimal value for money solution through procurement requires a careful balancing act.

Figure 1.

Factors to be considered in procuring value for money services [].

The core objective of procurement policies across numerous governmental sectors is to achieve value for money; but instead of merely pursuing the lowest cost offering, procurement entities and officials must reflect on a variety of factors before selecting the solution that best meets the end users’ requirements. Managing this complicated decision process efficiently requires a considerable level of proficiency [].

3.2. A Public Procurement Policy Framework

The South African public sector supply chain management (SCM) has become a popular topic for discussion and debate amongst management practitioners and public policy researchers. This focus is largely a result of the increasing emphasis on the role of public SCM in the fulfilment of the socio-economic imperatives set by the government. Starting in 1995, a South African public procurement reform initiative focused on addressing two main aspects, firstly the “promotion of the principles of good governance”, and secondly, the introduction of a “preference system to address specific socio-economic objectives”. The reform was underpinned by the introduction of various legislative measures, such as the Public Financial Management Act (PFMA) and the Preferential Procurement Policy Framework Act (PPPFA) (cited in []).

In 2016, the South African National Treasury anticipated that between 2016 and 2019 the South African government’s total expenditure across all spheres of government would at least be around ZAR 1.5 trillion (the current exchange rate of South African Rands is ZAR 16.85 per USD 1) towards procurement of goods, services and infrastructural improvements aimed at developing the country in various ways []. At present, the government procurement budget exceeds its employee compensation budget. At around ZAR 926 billion in 2018, public procurement accounts for approximately one fifth of South Africa’s gross domestic product (GDP) [].

The Department of Public Enterprises [] further aims to “advance the re-industrialisation of the South African economy by evaluation of the current procurement legislation framework and its impact on localization”. Box 1 below indicates the current Guiding Frameworks for the South African Economy:

Box 1. Current Guiding Frameworks for the South African Economy.

| The National Development Plan 2030 (National Planning Commission) The National Development Plan (NDP) [] is the underpinning South African public strategic framework for growth and development, as developed in 2012 by the National Planning Commission. The NDP encapsulates the long-term vision of the South African government towards establishing and sustaining an equitable society. With a visionary approach for 2030, the so-called “transformation imperatives” of the 20 years following the development of the NDP “envisage inclusive growth and sustainability through increased levels of employment of young people, growing sound local scale of economic competition, transformed urban landscapes, addressing racial and other societal rifts, and adapting to a low-carbon economy”. The New Growth Path (Economic Development Department) Developed and published by the Economic Development Department in November 2010, the New Growth Path (NGP) promulgates “the necessity of a more labour-intensive growth path in South Africa. The NGP identifies specific target sectors to accelerate this employment increase and recommends complementary competitive and employment-friendly growth macro and micro policy-packages” []. |

Section 217 of the South African Constitution, Act No 108 of 1996, stipulates the primary and broad secondary procurement objectives and requires the national, provincial and local spheres of government, and any other institution identified in national legislation, to contract for goods or services by means of an equitable, fair, transparent, competitive and cost-effective system [].

These five foundational principles form the basis for the entire legislative framework regulating government procurement in South Africa and are echoed in other legislation pertaining to procurement. These acts are in line with Section 217(3) of the Constitution, requiring national legislation prescribing a framework within which the preferential procurement policy must be implemented []. The Public Finance Management Act 1 of 1999 (PFMA) and the Local Government Municipal Finance Management Act 56 of 2003 (MFMA) are the most prominent legislative prescripts [].

The Public Finance Management Act regulates all public financial management practices in South Africa, thus providing for the regulatory framework for national and provincial supply chain management, as well as for state-owned enterprises (SOEs). The PFMA rests on the aforesaid five Constitutional pillars outlined in the Constitution, defining the features of an effective procurement system as “fair, equitable, transparent, competitive and cost-effective” [].

In support of the PFMA, the National Treasury issued the General Procurement Guidelines, thereby pronouncing its committal to an enabling procurement system towards the development of sustainable small, medium and micro businesses. This will contribute towards the shared wealth of South Africa and improved levels of economic and social well-being for all South Africans [,]. These guidelines issued by the National Treasury [] serve as a governmental prescription of core standards or principles of behaviour, as well as the required ethics; they also set out the accountability which the government requires of its public service. If one of the Five Pillars of Procurement collapses, the entire procurement system will be compromised. The Five Pillars must therefore underlie all public procurement frameworks, such as policies, guidelines, and processes. These Five Pillars are the following [,]:

- Value for Money. The use of price as a single indicator is often unreliable, and therefore public entities cannot automatically justify best value for money by based on acceptance of the lowest price offer, as prescribed. Best value for money refers to the “best available outcome when all applicable costs and benefits over the procurement cycle have been taken into consideration”.

- Open and Effective Competition. This requires transparent policies, guidelines, procedures and practices, readily accessible to all parties so that they can compete openly and fairly.

- Ethics and Fair Dealing. This pillar requires all parties to act within ethical standards, based on of mutual respect, trust. They are required to go about their business in a reasonable and rational manner and with integrity.

- Accountability and Reporting. Individuals and organisations are accountable for their plans, actions, and outcomes, and are bound to openness and transparency in administration, by external scrutiny through public reporting.

- Equity. This fifth pillar is vital for public sector procurement in South Africa to guarantee commitment to economic growth, by implementing specific industry support measures with emphasis on the accelerated growth of Small, Medium and Micro Enterprises (SMMEs) and Historically Disadvantaged Individuals.

At a local government level, the Municipal Finance Management Act establishes a supply chain management legislative framework, within municipalities and municipal entities which also includes such levels of procurement. Significantly, Section 112(i) requires each municipality to have and implement its own SCM policy and specifies the five pillars as the founding principles []. It aims to “streamline budgeting, accounting and financial management practices, and defines the roles of the council, mayor and officials in supply chain management. Broadly speaking, the MFMA ensures that local government finances are managed in a sustainable manner to enable municipalities to deliver the best possible service to communities” [].

Other regulatory instruments, such as the 2003 National Treasury Framework for Supply Chain Management and other National Treasury Regulations strengthen the provisions of the PFMA and MFMA, confirm the decentralization of the SCM function to the accounting officer, and institutionalise the integration of various functionalities into a single SCM function [].

The PFMA and the resulting regulatory instructions signify a decline of the traditional approach of “following set rules” in public procurement decisions, and an increase in confidence in management flexibility towards the delivery of provincial or departmental goals []. It can therefore be argued that the South African procurement process has transitioned from a “rules-based system” run by the State Tender Board, to become a more accommodating, open and decentralized process. An important element of this is the introduction of the notion of “accounting officers”, which implies that heads of department are afforded substantial independence, yet with specific obligations and responsibilities [].

As Knight [] points out, “the designation of heads of departments’ functions—in South Africa as well as in other countries with similar legislation—has resulted in their activities having to be more business-inclined”. In this new role, they must become aware of the restricted resources (financial and human) at their disposal but are empowered with flexibility in managing such resources towards delivering the desired outputs and outcomes. Of particular concern here is the structural placement of the SCM unit within the office of the Chief Financial Officer (CFO), as indicated in the National Treasury CFO Handbook [], as well as the National Treasury CEO/AO Training Programme document []. Both documents indicate that there must be an SCM unit, established by the accounting officer. This unit should be exclusively linked to the office of the CFO. According to Fourie [] (p. 5), this renders the function largely a “procedural financial control function that is disconnected from strategic planning and decision-making processes thereby compromising the potential value add to organisational performance and service delivery”.

The Preferential Procurement Policy Framework Act, 5 of 2000 (PPPFA), as discussed by Bowmans [] further specifies the implementation framework of these preferential procurement policies. This includes allocation of preference points for specific goals, in instances of contracting with persons (or categories of persons) who were historically disadvantaged by unfair discrimination practises. Government entities are hence obligated to, in part, apply the supplier’s “scorecard” on B-BBEE criteria during the evaluation and awarding of tenders, evaluate, and award tenders []. With the exception of certain stipulated circumstances, this framework applies to all government procurement in South Africa [].

Recent policy developments reveal a growing dependence on public procurement for “achieving economic transformation and addressing socio-economic imbalances”, originating from South Africa’s pre-1994 discriminatory history. One example is the 2017 Preferential Procurement Regulations, which passed into law on 20 January 2017, replacing the Preferential Procurement Regulations of 2011 []. Arguably the most far-reaching issue is the 2017 regulations’ intensions to allow government to advance certain designated groups in awarding state tenders, based on pre-qualification criteria. For example, Regulation 4 permits “an organ of state to advertise any invitation to tender on condition that only a particular category of bidders may tender. These categories include those with a stipulated minimum B-BBEE status level, exempted micro enterprises (EMEs) and qualifying small business enterprises (QSEs), and bidders who agree to subcontract a minimum of 30% to various categories of EMEs or QSEs” [].

By permitting the application by organs of state of a pre-qualification criterion that necessitates all tenderers to have a minimum B-BBEE status level, the said regulations seem to make provision for entities to side-step the limitations imposed by the PPPFA, in terms of weighting is to be devoted to a tenderer’s B-BBEE status during assessment and awarding of a tender. The new regulations result in the disqualification of certain bidders from tendering at all, notwithstanding the possible functional and cost-effectiveness such bidders might be able to offer. This apparently contradicts the PPPFA’s clear-cut intention to stimulate price as the ultimate decisive factor in granting government tenders, whilst “preference” has a significantly smaller role. It is foreseen that the regulation will be legally opposed [].

In more recent times, in response to the COVID-19 pandemic, even though the Treasury Regulations promulgated under the PFMA still apply to government departments and public entities emergency procurement to deal with the COVID-19 pandemic, the National Treasury Instruction No. 8 of 2019/2020 [] dispenses with the prerequisite of prior Treasury approval, according to the media statement issued on 3 April 2020 []. It also entails other aspects such as the expansion of existing contracts beyond the normal threshold without prior Treasury approval, and deviation from standard competitive bidding processes by an accounting officer without prior Treasury approval for items “deemed a specific requirement”, but all emergency procurement related to COVID-19 must be reported to National Treasury within thirty (30) days. In a similar fashion, MFMA Circular 100 stipulates that all emergency procurement by municipalities and municipal entities to expediate procurement of goods required by these entities to curb the spread the spread of COVID-19, must remain compliant with existing provisions of the entities’ SCM policies, and SCM regulations governing emergency procurement [,]).

4. Discussion on the Issues Arising from the Document Analysis

4.1. Reality of Public Procurement in South Africa: Auditor General Findings

Even with the public procurement reform processes and the reposition of SCM as a strategic instrument, there are still far-reaching challenges facing South African public procurement practices. On 20 November 2019, the SA Auditor General (AGSA), Thembekile Kimi Makwetu, urged governmental leaders to “halt the trend of disappointing audit results, to reinstate public accountability and avert further mismanagement of public funds” []. Releasing his 2018-19 AGSA General Report [] for national and provincial government and their entities, the Auditor General called on all political leaders, accounting officers and the particular authorities, including those providing oversight, for speedy and deliberate action to re-establish accountability. This could be done by acting with deliberate intention on the results of the completed audits, dealing decisively with material irregularities (MIs) that have been identified, and by fully utilising the preventative controls to “turn the tide of detrimental stewardship over public funds” [].

Table 1 below outlines the difference between irregular expenditure and material irregularity [].

Table 1.

Irregular expenditure vs. material irregularities.

An analysis of AGSA findings as contained in the AGSA reports for the 2016/2017 [], 2017/1018 [] and 2018/2019 [] periods reveals that similar or common issues tend to recur, despite being reported. Table 2 (compiled from [,,]) provides a synopsis of such recurring findings, the periods reported, as well as reasons, and the solutions required.

Table 2.

Auditor General’s findings over the period from 2016/2017 to 2018/2019 [,,].

4.2. Challenges in South African Public Procurement

Although not faultless, the South Africa procurement regime in place, compares favourably with international standards. When considering the AGSA findings as discussed in the previous section, the truth in Harpe’s statement becomes evident: “…many of the problems encountered in public procurement in South Africa probably rather relates to the implementation of the system than the system itself” [].

The main challenges currently evident in public procurement in South Africa are discussed below.

4.2.1. Over- and Underspending of Budgets

On 3 September 2019, National Treasury published the Fourth Quarter of the 2018/19 financial year report for the period ending on 30 June 2019. The report contained financial information pertaining to local government’s revenue and expenditure as well as spending on conditional grants []. The report serves to deliver on national and provincial government oversight over municipalities and identify potential difficulties in municipal budgets and conditional grants implementation. As such, the report indicated 13% underspending of municipalities’ total adjusted expenditure budgets totalling ZAR 57.8 billion []. In comparison to the previous reporting period of 2017/18 during which underspending of ZAR 66.8 billion was recorded [], a decrease of ZAR 9 billion year-on-year was noted for 2018/19. The over- and underspending are summarized in Table 3, as adapted from [].

Table 3.

Analysis of over- and underspending for the period from 2015/16 to 2018/19.

According to Alexander [] and Mbanda and Bonga-Bonga [], the ability to spend either the capital or the infrastructure budget adequately could be regarded as one of the foremost issues encountered by municipalities in South Africa. Analysis of over- and underspending indicates that national and local budgets tend to be underspent, directly impact on service delivery, because the programmes for which these funds were intended then either do not perform as intended, or in some cases never even get off the ground.

To discourage underspending, National Treasury [] in its MTEF Guidelines requires that the allocations for infrastructure projects that are not utilised be returned at the end of the financial year. Municipalities which underspend their respective budgets then receive a reduced budget for the coming year. Underspending could be attributed to various factors; for example, difficulties in the planning and implementation of projects and programmes, including project management and financial management skills shortages, which result in delays in project take-off and ultimately lead to underspending [].

The National Treasury [] claims that factors such as inadequately budgets, a weak revenue management system, assertive capital programmes and operating budget driven non-essential expenditure, add to planned infrastructure spending being below the anticipated level, resulting in the actual infrastructure spending falling short of the budgeted amounts, in some cases as low as 68% below budget, as Table 3 shows.

4.2.2. Contracts Management

Another aspect of concern relates to the management of contracts. According to National Treasury “Transparent or open contracting is a powerful tool that can be used to combat corruption and ensure good governance, value for money and good-quality service delivery” []. To attain effective procurement practices, a compliance audit will measure adherence to all applicable legislation, regulations and policies. The Monitoring and Evaluation (M&E) framework places an obligation on organisations to provide reasonable assurance through a framework of policies and procedures, to ensure that their quality controls are adequate, relevant, and complaint with best practice. The process includes a constant deliberation and evaluation of the components of the quality control system [].

Sadly, the AGSA office on procurement and contract management has repeatedly reported on numerous malpractices []. Practices that currently are not always executed according to legislation, specifically in terms of openness, transparency and fairness, according to the 2015 SCM review [], the following findings are of particular relevance:

- “bid documents were not published (only advertisements were published);

- bid committee meeting evaluation minutes and standard contracts were not made available to the public;

- bids were not opened in public and published—best practice requires that bidders and their prices be made known by public announcement during the opening of bids and by publishing this information;

- the entire evaluation process was not open to scrutiny (close cooperation between the public and private sectors, civil society and other stakeholders is important for the integrity of public sector SCM); and

- progress and contract implementation reports were not made publicly available” [].

4.2.3. Lack of Requisite Capacity, Skills and Knowledge

Current challenges of poorly designed organisational structures and unqualified procurement officials weaken the capacity and capability of procurement. Ngwakwe [] states that: “the responsibility for public financial accountability is vested in the office of the Chief Financial Officer (CFO). This is the office entrusted with the responsibility of managing public funds and any mismanagement of such funds would result in a severely negative impact on all aspects of service delivery and hence on social and economic development”. Fourie [] agrees, and argues that the focus of the revised SCM functionality and procurement officials are designed to perform transactional procurement, not strategic procurement, and have not been able to adapt their focus from the traditional form of provisioning to a progressive strategic procurement approach.

The CFO Handbook [] describes the minimum competencies of a CFO as being technically trained (ideally a Certified Chartered Accountant) and proficient in areas such as strategic management, financial and management accounting (including principles of GAAP/GRAP), business planning and design, internal and external auditing and accounting skills performance measurement, and people skills such as negotiation and communication skills. Sadly, many of the current CFOs are not adequately qualified for their positions. The possibility exists that the non-transparent appointment of finance officers could be the cause of lack of accountability, fraud, financial irregularities, inadequate service delivery and mismanagement, all of which become entrenched in weak finance departments [].

The South African Institute of Government Auditors bemoans the gravity of the financial skills shortage in the public sector []. In a study conducted by Fourie and Poggenpoel [], the main objective was to understand public sector inefficiencies, and in particular why recurring problems are not adequately resolved. Their findings indicated that the least compliant area related to expenditure management, a theme in their research which identified aspects such as internal control deficiencies, and uncompetitive and/or unfair procurement processes in expenditure management. These findings suggest the possibility of ineffective and inefficient management of public funds, which also implies a general lack of capacity, skills and internal financial control mechanisms within the finance departments of the government entities analysed [].

4.2.4. Inadequate Planning and Linking of Demand to the Budget

Of crucial importance is the alignment of procurement plans with the needs and objectives of the institution. Strategic and annual performance plans which are not thought through well, or are unrealistic or of poor quality, could ultimately result in compromised procurement planning and implementation. Fourie [] indicates that poor procurement practices and control could result in the delivery of inappropriate goods and services, inflated prices and increased opportunities for abuse as a result of inadequate specifications and inaccurate costing by officials.

In the 2015 Public Sector Supply Chain Management Review, treasury officials indicated that “…those working in the system need to understand the economic and social power of the purchasing decisions that they make” []. The recommended approach to departmental budgeting as indicated the National Treasury CFO Handbook [] is a bottom-up approach where line managers have their “own” budgets, where key performance indicators are related to the performance contracts, and line managers are devoted and determined to achieve the department’s service delivery objectives [].

In accordance with Section 27(3) of the PFMA, the National Treasury has provided Medium Term Expenditure Framework Technical Guidelines [] to national departments and other public institutions to guide them on the preparation of medium-term budget submissions. These technical guidelines aim to ensure that budgetary submissions stipulate all the pertinent evidence on main strategic proposals required to prepare clear-cut budgetary recommendations [].

4.2.5. Inadequate Monitoring and Evaluation (M&E) of SCM

Shortly after the onset of the post-1994 democratic changes, the White Paper on Transformation in the Public Service introduced the concepts of M&E in 1995, aimed at developing strategies designed to uphold the constant improvement in the impartiality and quantity of service delivery []. However, according to Cloete [] and Abrahams [], M&E remained fragmented, undertaken only intermittently for the purposes of annual departmental reports.

Evaluation can be described as a periodic or regular policy, project or programme review to measure the degree of substantial and valid progress towards achieving specific goals. The constant process of evaluation is a systematic task of the social research methods to establish the strengths and weaknesses of social action which includes the approved programmes, policies, human resources, products and organisation []. The value of evaluations lies in determining the degree of change, improvement in performance as well as the impact thereof, lessons learnt and also to be able to identify areas for policy or program improvement [].

Monitoring, on the other hand, is conceptualised as a non-stop process of evaluating the performed activities, processes, realities and performance during the term of a programme or a project to appraise an organisation’s effectiveness and efficiency towards predetermined objectives []. Monitoring supports managers and policymakers to understand that money is invested to generate the outcomes set out in the plans that were formulated and approved []. M&E is therefore regarded as a non-stop cycle of data collection and analysis, where information is used to bolster and sustain successful strategies in informed decision-making during subsequent stages [].

The institutional design of systems for the capturing, processing, storage and communication of M&E data and information is vital []. Limited availability of public procurement data for monitoring and evaluation purposes results in incomplete evidence to measure the achievement of the operational targets and outcomes []. The reported challenges faced by national and local departments and councils include an existing framework that favour a silo approach, given the apparent absence of a culture of coordination. Further constraints also include inadequate information management systems, and a focus on activities rather than on outcomes [].

The prerequisite for evidence-based policy assessments in public organisations, is an effective M&E capacity [,]. This leads to M&E as a governance instrument as being indicative of good governance []. The Central Supplier Database (CSD) was established in 2016, thirteen years after the PFMA was introduced [] with the intention of creating an enabling environment by strengthening efficient and effective public procurement, reducing bureaucratic delays, (the so-called “red tape”), thereby paving the way for businesses to contract with government. Two noteworthy disparities persist []. The first relates to the meaningful data gap at local government and state entity level, possibly as result of a mismatch between diverse procurement systems across various industry stakeholders and public entities. It results in the second challenge—the inability effectively to quantify broader benefits or the so-called “downstream effects” of aspects such as B-BBEE, at the final beneficiary level. Furthermore, the lack of accurate data contributes to the perceived ineffectiveness of the Black Economic Empowerment policy [].

Fourie [] further highlights the negative impacts of the lack of data on decision-making during planning and the apportionment of limited resources. He states that the measurement of success against the “triple bottom line” of financial, social and environmental performance is unreliable in the absence of a vigorous monitoring and evaluation mechanisms, as it becomes impossible to provide reliable evidence relating to the current performance status, progress and improvements.

4.2.6. Non-Compliance with SCM Policy and Regulations

Compliance could be seen as adherence to rules, standards, or, in this case, to the various regulatory requirements. In his column, the Auditor General [] indicates that testing of such adherence includes aspects such as the following:

- In order to curtail possible material misstatements in the financial and service delivery information in financial statements and annual reports, compliance to finance management acts (the PFMA and MFMA) as well as the Treasury Regulations’ reporting requirements, is essential;

- To prevent noncompliance such as unethical tender processes (government employees or their relatives conducting business with government, amongst others), compliance to SCM prescripts in procuring goods and services;

- Detection and prevention of any unlawful activities such as “irregular, unauthorised and fruitless and wasteful expenditure”;

- Human resource planning and appointment processes;

- Determine the degree to which funding money allocated for special projects, for example funding for the building of clinics or learner transport to/from schools, is in fact spent in line with the purpose as legislated; and

- Compliance to legislative prescripts pertaining to payments of service providers to occur within a 30-day period, in order to avoid late payments [].

Sadly, numerous AGSA reports allude to the lack of accountability as evident in the limited number of, or even absence of, consequence management actions of individuals who, notwithstanding support and guidance, continue to under-perform []. Non-compliance also results in reduced delivery of public goods and service during the various phases of the procurement processes, such as non-transparent processes followed, disruptions in the procurement of goods and services, as well as failure of acquiring such goods and services in a cost effective and proficient manner (“at the right price and at the right time”).

Even though the PFMA makes provision for acceptable deviation reasons, these should not become the norm. As is evident in the AGSA report, unauthorised expenditure remains high, exceeding ZAR 1.3 billion during the 2018/19 review [].

4.2.7. Lack of Accountability and Unethical Behaviour, Resulting in Possible Fraud and Corruption

As indicated in the AGSA’s 2018/2019 Consolidated General Report on National and Provincial Audit Outcomes [], accountability does not only refer to participant and/or decisionmakers to be accountable for their decisions, but also that consequence management should apply to all instances of inaction, poor performance or transgressions. Auditees should be able to implement or at least strongly recommend, “consequences against officials who fail to comply with applicable legislation, continuously underperform or are negligent, and against those whose actions and decisions cause financial losses” [].

Mazibuko and Fourie [] view unethical conduct of procurement officials in the same light as acts of corruption, fraud, nepotism and bribery, all of which have an adverse bearing on the service delivery quality levels. Examples of unethical procurement practices during the bidding and contract management phases include are awarding of bids to employees and their family members, use of “uncompetitive bidding”, the non-disclosure of vital information by suppliers, absence of requisite supporting documents for procurement awards, using incorrect preferential point systems and thresholds, acceptance of less than the required three quotations and lastly, insufficient contract management practises and reporting.

4.2.8. High Level of Decentralisation of the Procurement System

According to Meyer and Auriacombe [], a centralised governance system may have a negative effect, resulting in insufficient service delivery and ultimately an almost passive attitude towards civic obligations amongst citizens. This can happen where the national and provincial government seem to be out of touch with communities’ specific needs and consequently fail to generate a real sustainable impact in communities. A degree of political, administrative, and economic decision-making power and autonomy is needed to align local authorities with the principles of decentralisation.

The aggregate demand for the limited availability of local supply markets in South Africa can lead to increased prices of goods and services. Often government institutions compete against each other for the same resources. Fourie [] found that decentralization contributes to increasing the number of points at which transactions occur and suggests that governmental demand disaggregation could lead to sub-optimum volume leveraging, thereby increasing costs to the whole of government for that product or service. “The implications for the economy are significant—both directly by draining the public purse and therefore hampering economic development, or indirectly by causing macroeconomic instability, and diminishing confidence in the economy as a result of declining foreign investment” [].

The existence of numerous public procurement sites provides a breeding ground for fraud and corruption []. Meyer and Auriacombe [] state that enhancements in public policy outcomes are indicative of the impact and the value of public procurement and that international awareness of evaluating the success of public interventions by appraising the level of improvement and development in the lives of the target community instead of focusing on the activities only, has been increasing in recent times. In South Africa, as is the case in other corruption-prone governments, there are multiple public and private role players who have a vested interest in maintaining the status quo in the public procurement system.

4.2.9. Lack of Consequence Management at Executive Level

Governance is reflected as the manner in which society manages the affairs in the economic, political and social domain via the interface in and among the state, civil society and private sector by means of an arrangement of established values, sanctioned policies and institutions. The perception that there are no or very few consequences for disregarding the respective regulations, which maintains the repetition of non-compliance findings []. Not addressing the root causes of such behaviour will result in non-compliance’s becoming the norm in the public sector culture and institutionalise an environment which tolerates wrongdoing, fraud and corruption [].

It seems that many South Africans have little confidence in the public sector SCM processes, in fact, the general perception is that the failure of the public sector is failing to fulfil its mandate can be ascribed to the consequence of systemic challenges in the entire public supply chain []. This is evident in the number of service-delivery related protests that have become daily phenomenon in South Africa over the past few years. The Civic Protest Barometer (CPB) as published by the Dullah Omar Institute monitors the trends of civic protests across South Africa, being a specific form of protest focusing on municipalities and their service delivery []. Even though the national number of civic protests in 2017 was at its lowest level in three years, most civic protests can be classified as violent protests. The Barometer indicates that 90% of protests after 2013 entailed some degree of violence; indeed, almost two-thirds of the types of violence involved assault, looting, destruction of property and even death []. This clearly illustrates the perception that people are not satisfied with the quantity or quality service that they are receiving at present [].

5. Improvement Recommendations to Challenges Faced by South African Public Procurement

In their 2015 Recommendation on Public Procurement report, the OECD endorses two principles for improvement []. The first is the efficiency principle, aimed at promoting efficiency by developing processes throughout the public procurement cycle, towards addressing the needs of government and its people []. The second is the evaluation principle, focusing on the acceleration of performance improvements through better-quality evaluation of the effectiveness of the public procurement system, starting from individual procurements right through to the entire procurement system, at all levels of government where practicably possible [].

Ultimately, a government must verify the level of performance achieved against targets that have been set, including the objectives of procurement to attain the value for money in the quest for social upliftment, sustainable development or economic growth and sustainability [].

Table 4 below contains a comparison between seven valuable lessons or recommendations for improving public procurement as per the OECD 2015 Recommendations on Public Procurement [] and the current challenges faced by the South African Public Procurement system:

Table 4.

OECD 2015 Recommendations on Public Procurement—Seven lessons to be learnt.

Governments across the globe are contemplating reforming and upgrading their public procurement systems. One of the most pertinent issues relates to the ability to optimise the relationship between procedural integrity—which in South Africa has resulted in the implementation of more rigid rules—and operational flexibility, which is needed to achieve efficiency and effectiveness, and to promote social aims. The solution probably lies in principles-based regulation and strategic procurement. Strategic procurement acknowledges the significance of ensuring added value across each stage of the procurement process, from demand management, market research and specification, to purchasing, to contract and relationship management and review. South Africa should aspire to instil a principles-based, strategic, developmental procurement system which is agile enough to alter its processes to align with its operational and social policy framework []. The following discussion provides for recommended actions for consideration within the SA Public Procurement framework, taking the OECD Recommendations into consideration Refer to Table 4 above.

5.1. Prevention Is Always Better than Finding a Cure

In line with the first OECD recommendation to have a more managerial and systematic approach pursuing value for money [], current challenges faced in terms of inadequate Planning and Linking of Demand to the Budget as well as poor ineffective contracts management as well as over- and underspending of budgets, could be addressed. The Auditor General mentioned in 2019 that a robust control environment and processes are significant in working towards the success of the set strategic objectives, appropriately addressing the risks, ensuring legislative compliance, and managing public funds to the benefit of citizens []. A proactive approach aimed at identifying risks, avoiding poor-quality financial statements and performance reports, non-compliance and material irregularities, will yield greater results in the long run than having to deal with their consequences, but will require assurance from accounting officers and authorities that preventative controls are in place to ensure that these risks are being mitigated. In addition, by applying the OECD recommended action of ensure an evidentiary process to monitor the performance of the procurement system [], current challenges relating to inadequate M&E functionality and utilisation thereof, could be overcome.

5.2. It Is Virtually Impossible to Get Lost with Clear Directions and a Reliable Map

Recent policy amendments signify a policy shift towards increased dependence on government procurement for increasing the momentum and scope of socio-economic transformation. In an attempt to improve budgetary expenditure challenges faced (over- and underspending of budgets), the OECD recommended action of a strategic approach to inculcate sound stewardship of public funds [] within the procurement function, could go a long way to ensure stringent budgetary control measures. This read together with the government’s commitment towards the review of the entire SCM legislative framework to establish a single procurement law aimed at improved efficiency and eradicating corruption []. It is of critical importance to ensure progressive and future-focused public procurement legislation which remains founded on the principles and values enshrined in the Constitution. Such legislation will provide clear direction to Accounting Officers and other delegated officials who are assigned procurement responsibilities and are accountable for public funds. This roadmap must indicate the way towards national priorities, including developing prospects for SMME growth, supporting local economic development, and enhancing industrialization, whilst at the same time taking specific provincial and local contextual factors into consideration [].

5.3. As the Saying Goes—“Structure Follows Strategy”

The South African Public Sector currently faces a high level of decentralisation of the Procurement System, as discussed above. This could however be alleviated by a more centralised approach, which as per the OECD Seven Lessons Learnt [] which could improve efficiency. Fourie [] reflects that public procurement organisational structures and capabilities, in response to changing from an administrative buying function to that of a tactical and strategic commercial function that are linked to the organisational strategy, performance and sustainability, must adapt appropriately. The capacity to survive and grow in a complex changing environment requires clear and significant public procurement reforms, which must include an element of professionalism, and the requisite skills sets. Fourie [] holds that it is essential to transform the SCM function into a strategic value-driven function, along with a centre-led national procurement strategy that provides for a variety of models and methods of procurement. Moreover, it is necessary to capacitate the procurement function by means of increased investment into addressing the current lack of requisite competence in terms of knowledge, capacity and skills by upskilling public procurement officials and the implementation of suitable IT solutions—these steps must be included in future public strategies and operational plans to ensure the achievement of sustained organisational performance []. Where public entities focus on skills pertaining to purchasing and logistics without also including requiring officials to possess the skills related to demand management, procurement planning, contract management and performance evaluation, the procurement process is not elevated to a strategic level. A study by Brunette and Klaaren [] discloses that professionally qualified engineers and architects are of the opinion that “over-outsourcing reduces them to glorified contract managers”, which culminates in the loss of skills and numbers and eradicates public procurement capacity. In line with the OECD recommended investment in the “professionalisation of the procurement personnel” [], Fourie [] and Brunette and Klaaren [] advocate a procurement skills set which includes commercial and economic expertise, knowledge of supply and value chain processes and principles, people skills such as negotiation, relationship and stakeholder management, research capabilities and advanced discipline-specific knowledge and skills with an emphasis on commodity and category management.

5.4. All Actions Have Consequences and Should Be Managed Accordingly

In a 2019 article examining the Public Audit Amendment Act (PAA) of 2018 and potential impact thereof on the effectiveness of the AGSA, Deliwe [] emphasises the need for the government vigorously to enhance governance and accountability within its institutions—particularly at the executive and institutional leadership levels, if audit outcomes are to be promptly improved. Probably the most prominent procurement issues currently in the public domain are instances relating to non-compliance with SCM Policy and Regulations, apparent unethical behaviour with no clear consequence management for such. The OECD in its recommendation suggests a flexible policy environment to be adaptable to different situations while still ensuring transparency, within the ambit of strict discipline to limit in the use of exceptions []. Firmly and consistently applied consequence management amounts to good governance, including committed and capacitated leadership. In other words, good governance and committed, capacitated leadership requires discipline and the promotion of ethical conduct; in this regard, Deliwe [] reflects that it will be difficult to create a committed, ethical and fully cooperative executive and legislative leadership without a firmly established policy of consequence management. High standards of integrity can be ensured through firm implementation of consequence management policies. In instances where public accountability mechanisms fail, the amended PAA now provides the AGSA with the mandate not only to report on material irregularities (MIs) detected during its audits, but also to take further action in instances where the relevant accounting officers and authorities do not take the appropriate mitigation actions, or where consequence management did not ensue [].

6. Conclusions—Never Has There Been a Better Time to Address Our Shortcomings and Overcome the Obstacles of Our Past

Never in the history of the democratic government of South Africa has public administration been faced with a greater call for building the economy, keeping its people safe and addressing the social imbalances of our country.

This article highlights some of the most prevalent challenges faced by public procurement officials in South Africa today. In order to address these challenges, changes in the approach and management of public procurement from a more strategic perspective is recommended. The current challenges should be approached as opportunities for fundamental, tangible change and structural improvements, given that public procurement reform is at the epicentre of this opportunity [].

Author Contributions

D.F.: Conceptualization, formal analysis, writing of draft preparation and project administration. C.M.: Methodology, formal analysis, review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Eye Witness News. Statement by President Cyril Ramaphosa on Escalation of Measures to Combat Covid-19 Epidemic. 23 March 2020. Available online: https://ewn.co.za/ (accessed on 30 March 2020).

- Organisation for Economic Co-operation and Development (OECD). Public Procurement for Sustainable and Inclusive Growth: Enabling Reform through Evidence and Peer Reviews. 2017, pp. 1–18. Available online: https://www.oecd.org/gov/ethics/Public-Procurement-for%20Sustainable-and-Inclusive-Growth_Brochure.pdf (accessed on 31 March 2020).

- Turley, L.; Perera, O. Implementing sustainable public procurement in South Africa: Where to start. Int. Inst. Sustain. Dev. 2014, 1–63. Available online: www.iisd.org (accessed on 31 March 2020).

- Brunette, R.; Klaaren, J. The Public Procurement Bill Needs Muscle to Empower Whistle-Blowers. The Daily Maverick. 5 March 2020. Available online: https://www.dailymaverick.co.za/article/2020-03-05-the-public-procurement-bill-needs-muscle-to-empower-whistle-blowers/ (accessed on 14 April 2020).

- Auriacombe, C.J. Towards the construction of unobtrusive research techniques: Critical considerations when conducting a literature analysis. Afr. J. Public Aff. 2016, 9, 1–19. [Google Scholar]

- Bowen, G.A. Document analysis as qualitative research method. Qual. Resour. J. 2009, 9, 27–40. [Google Scholar] [CrossRef]

- Burger, P. Facing the conundrum: How useful is the “developmental state” concept in South Africa? South Afr. J. Econ. 2014, 82, 159–180. [Google Scholar] [CrossRef]

- Harpe, S. Public Procurement Law: A Comparative Analysis. Ph.D. Thesis, University of South Africa, Pretoria, South Africa, 2009; pp. i–iii. [Google Scholar]

- Odhiambo, W.; Kamau, P. Public procurement: Lessons from Kenya, Tanzania and Uganda. In OECD Development Centre: Working Paper No. 208; OECD iLibrary: Paris, France, 2003; pp. 1–20. Available online: https://doi.org/10.1787/804363300553 (accessed on 15 October 2020).

- Ambe, I.M.; Badenhorst-Weiss, J.A. Procurement challenges in the South African public sector. J. Transp. Supply Chain Manag. 2012, 6, 243–261. Available online: https://jtscm.co.za/index.php/jtscm/article/view/63 (accessed on 30 March 2020).

- World Bank. Procurement for Development. 2020, pp. 1–4. Available online: https://www.worldbank.org/en/topic/procurement-for-development (accessed on 30 March 2020).

- Mazibuko, G.; Fourie, D.J. Manifestation of unethical procurement practices in the South African public sector. Afr. J. Public Aff. 2017, 9, 106–117. [Google Scholar]

- Arrowsmith, S. Public procurement Regulations: An introduction. EU Asia Inter Univ. Netw. 2010, 1, 1–30. [Google Scholar]

- Hommen, L.; Rolfstam, M. Public procurement and innovation: Towards taxonomy. J. Public Procure. 2009, 9, 20–22. [Google Scholar]

- OECD. Productivity in Public Procurement: A Case Study of Finland: Measuring the Efficiency and Effectiveness of Public Procurement. 2019, pp. 9–10. Available online: https://www.oecd.org/gov/public-procurement/publications/productivity-public-procurement.pdf (accessed on 30 March 2020).

- Deloitte Access Economics. Economic Benefits of Better Procurement Practices. 2015, pp. 47–66. Available online: https://www2.deloitte.com/content/dam/Deloitte/au/Documents/Economics/deloitte-au-the-procurement-balancing-act-170215.pdf (accessed on 31 March 2020).

- Selomo, M.R.; Govender, K.K. Procurement and Supply Chain Management in government institutions: A case study of select departments in the Limpopo Province, South Africa. Dutch J. Financ. Manag. 2016, 1, 1–10. Available online: https://s3.amazonaws.com/academia.edu.documents/50733366/ (accessed on 10 May 2020).

- Mhelembe, K.; Mafini, C. Modelling the link between supply chain risk flexibility and performance in the public sector. South Afr. J. Econ. Manag. Sci. 2019, 22, 1–12. Available online: https://doi.org/10.4102/sajems.v22i1.2368 (accessed on 30 March 2020).

- Department of Public Enterprises. Strategic Plan 2018/2019. Republic of South Africa. 2017; pp. 1–36. Available online: http://www.dpe.gov.za/ (accessed on 8 April 2020).

- National Planning Commission. National Development Plan 2030; 15 August 2012; pp. 456–478. Available online: http://www.gov.za/issues/national-development-plan/index.html (accessed on 8 April 2020).

- Molver, A.; Noeth, G. South Africa. The Government Procurement Law Review. 2017, Volume 5, pp. 212–228. Available online: https://thelawreviews.co.uk/digital_assets/d8b0f256-b922-40d3-815d-9c7584eab2b7/The-Government-Procurement-Review-5th-ed---book.pdf (accessed on 30 March 2020).

- Bowmans. Guide to Government Contracting and Public Procurement in South Africa. 2016, pp. 8–16. Available online: https://www.bowmanslaw.com/wp-content/uploads/2016/12/Guide-Public-Procurement-and-Government-Contracting-in-SA-1.pdf (accessed on 8 April 2020).

- National Treasury. General Procurement Guidelines; 2014; pp. 1–8. Available online: http://www.treasury.gov.za/legislation/pfma/supplychain/General%20Procurement%20Guidelines.pdf (accessed on 10 May 2020).

- Knight, L. Public Procurement; Routledge: London, UK, 2007; pp. 16–24. [Google Scholar]

- National Treasury. Chief Financial Officers Handbook for Departments; 2014; pp. 27–55. Available online: https://oag.treasury.gov.za/Publications/ (accessed on 10 May 2020).

- National Treasury. CEO/AO Training Programme. 2013; pp. 8–12. Available online: http://oag.treasury.gov.za (accessed on 10 May 2020).

- Fourie, D. Centralized, Decentralized and Collaborative Participatory Public Procurement: Quo Vadis. In Proceedings of the 9th Global Conference Forum for Economists International, Amsterdam, The Netherlands, 19–22 May 2017. [Google Scholar]

- National Treasury Instruction No. 8 of 2019/2020. Media statement: 3 April 2020; South Africa. Available online: http://www.treasury.gov.za (accessed on 5 April 2020).

- National Treasury Media Statement. 19 March 2020; South Africa. Available online: http://www.treasury.gov.za (accessed on 5 April 2020).

- AGSA. Auditor General South Africa Media Release: Auditor-General report “Act Now on Accountability”; 2019; pp. 1–19. Available online: https://www.agsa.co.za/Portals/0/Reports/PFMA/201819/MR/2019%20PFMA%20media%20release.pdf (accessed on 30 March 2020).

- AGSA. PFMA 2018/2019 Consolidated General Report on National and Provincial Audit Outcomes; 2019; pp. 12–38. Available online: https://www.agsa.co.za/Reporting/PFMAReports/PFMA2018-2019.aspx (accessed on 10 May 2020).

- AGSA. PFMA 2016/2017 Consolidated General Report on National and Provincial Audit Outcomes; 2017; pp. 60–82. Available online: https://www.agsa.co.za/Reporting/PFMAReports/PFMA2016-2017.aspx (accessed on 10 May 2020).

- AGSA. PFMA 2017/2018 Consolidated General Report on National and Provincial Audit Outcomes; 2018; pp. 15–22. Available online: https://www.agsa.co.za/Reporting/PFMAReports/PFMA2017-2018.aspx (accessed on 10 May 2020).

- National Treasury. Media Statement Local Government Revenue and Expenditure: Fourth Quarter Local Government Section 71 Report (Preliminary Results) for the Period: 1 July 2018–30 June 2019, 3 September 2019. pp. 1–7. Available online: http://pmg-assets.s3-website-eu-west-1.amazonaws.com/191015_Media_statement.pdf (accessed on 10 May 2020).

- Alexander, D.P. An Assessment of Capital Budget Planning and Municipal Borrowing as Funding Source in the Overstrand Municipality in the Western Cape; University of Cape Town: Cape Town, South Africa, 2015; pp. 8–12. [Google Scholar]

- Mbanda, V.; Bonga-Bonga, L. Municipal Infrastructure Spending Capacity in South Africa: A Panel Smooth Transition Regression (PSTR) Approach. MPRA Paper No. 91499. University of Johannesburg: Johannesburg, 16 January 2019; pp. 1–15. Available online: https://mpra.ub.uni-muenchen.de/91499/ (accessed on 10 May 2020).

- National Treasury. Medium Term Expenditure Framework, Technical Guidelines 2020; 2019; pp. 1–22. Available online: http://www.treasury.gov.za/publications/guidelines/2020%20MTEF%20Technical%20Guidelines.pdf (accessed on 10 May 2020).

- National Treasury. Principles of Public Administration and Financial Management Delegations. Cabinet Memorandum 56 of 2013; 2013; pp. 30–35. Available online: http://www.treasury.gov.za/legislation/pumas/delegations/ (accessed on 10 May 2020).

- National Treasury. 2015 Public Sector Supply Chain Management Review. 2015; Volume 3, pp. 15–25. Available online: http://www.treasury.gov.za/publications/other/SCMR%20REPORT%202015.pdf (accessed on 10 May 2020).

- AGSA Compliance with Laws and Regulations in Government will Fulfil the Aspirations of Citizens. Auditor-General Column. 2014. Available online: https://www.agsa.co.za/portals/0/AG/Compliance_with_laws.pdf (accessed on 10 May 2020).

- Ngwakwe, C.C. Public sector financial accountability and service delivery. J. Public Adm. 2012, 47, 311–329. Available online: https://journals.co.za/content/jpad/47/si-1/EJC121938 (accessed on 10 May 2020).

- Fourie, D.; Poggenpoel, W. Public sector inefficiencies: Are we addressing the root causes? South Afr. J. Account. Res. 2017, 31, 169–180. Available online: https://doi.org/10.1080/10291954.2016.1160197 (accessed on 1 April 2020). [CrossRef]

- Abrahams, M.A. A review of the growth of monitoring and evaluation in South Africa: Monitoring and evaluation as a profession, an industry and a governance tool. Afr. Eval. J. 2015, 3, 1–8. Available online: http://dx.doi.org/10.4102/aej.v3i1.14 (accessed on 10 May 2020). [CrossRef]

- Cloete, G.S. Measuring Good Governance in South Africa. 2009, pp. 1–8. Available online: https://www.researchgate.net/profile/G_S_Cloete/publication/242124530_Measuring_Good_Governance_in_South_Africa/links/5d372ce4a6fdcc370a59a27a/Measuring-Good-Governance-in-South-Africa.pdf (accessed on 10 May 2020).

- Mertens, D.M.; Ginsberg, P.E. The Handbook of Social Research Ethics; Sage: Los Angeles, CA, USA, 2009; pp. 3–26. [Google Scholar]

- Porter, S.; Goldman, I. A growing demand for monitoring and evaluation in Africa. Afr. Eval. J. 2013, 1, 8–9. Available online: http://dx.doi.org/10.4102/aej.v1i1.25 (accessed on 10 May 2020). [CrossRef]

- Sithomola, T.; Auriacombe, C.J. Developing a monitoring and evaluation (M&E) classification system to improve democratic good governance. Int. J. Soc. Sci. Humanit. Stud. 2019, 11, 86–101. Available online: https://www.researchgate.net/profile/Tshilidzi_Sithomola/publication/333043553 (accessed on 10 May 2020).

- Shai, L.; Molefinyana, C.; Qui, G. Public procurement in the context of Broad-Based Black Economic Empowerment (BBBEE) in South Africa—Lessons learned for sustainable public procurement. Sustainability 2019, 11, 7164. Available online: www.mdpi.com/journal/sustainability) (accessed on 1 April 2020). [CrossRef]

- Meyer, N.; Auriacombe, C. Good urban governance and city resilience: An Afrocentric approach to sustainable development. Sustainability 2019, 11, 5514. Available online: https://www.mdpi.com/2071-1050/11/19/5514 (accessed on 10 May 2020). [CrossRef]

- Dullah Omar Institute. Civic Protest Barometer 2018 Fact Sheet #3—Violence in Protests. 2020. Available online: https://dullahomarinstitute.org.za/acsl/barometers/civic-protest-barometer-2018-factsheet-3-violence-in-protests-final.pdf/view (accessed on 10 May 2020).

- Deliwe, M.C. The potential impact of the Public Audit Amendment Act of 2018, on the effectiveness of the Auditor-General South Africa. South. Afr. J. Account. Audit. Res. 2019, 21, 47–57. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).