1. Introduction

In the current societal conjuncture, dominated by technology and globalization [

1], the triad of ethics, social responsibility and sustainability are part of the same value equation, in which individuals and companies have equally the moral duty to promote values and to respect the rules for the long-term protection of the society in which they live and carry out their activity. In such a value-based society, value is omnipresent [

2] and involves a process of valorization [

3] known under the definition of valuation. In this context, the stronger and non-negotiable demands of the society for adopting a socially responsible business behavior that would take into account the needs and well-being of the current generation, but also of future generations (the prerogative of sustainability), require reflective approaches and new models of management, integrative, in all aspects (economic, social and environmental) and for the benefit of everybody.

A cumulative and synthetic definition, built by us on the basis of explanatory dictionaries, specialized literature and practice in the field, illustrates that a formal valuation process involves a professional reasoning based on a systematic analysis and appreciation of the value, importance, performance, merit, efficiency, effectiveness, capacity, quality of an asset, either a person or entity, resource, tangible/intangible assets, service, plan, program, situation, event, etc. This reasoning starts from a set of collected data and is carried out by reporting to a desirable level, set by specific standards.

Directly, the mission of the authorized valuation consists of accurately determining the value and the growth potential of an asset (including business), as well as the risks that may arise if it is taken over after the valuation. At the same time, but indirectly, we correspondingly highlight a side of social responsibility of the authorized valuation mission by the fact, that associated with the result obtained/estimated in the valuation process, there are also associated state taxes to be paid by participants/owners of this transaction, who have resorted to valuation, but also some aspects of social justice (for instance, those cases of valuation for justice, sharing, minority holdings, and so on). From this perspective, we establish that the valuers who carry out this activity constitute guarantees of a certain security in business, on a market where different players try, more or less objectively, ethically and legally, to maximize their advantages. From this standpoint, the appreciation of value may however be biased, as we shall see below, according to research results, influenced by pressure on the valuer from the client’s side or other third parties, and he may succumb to them if his professional ethics are not strong.

Subsequently, we can emphasize that the common areas that can cause problems in the valuation activity (process), including the authorized valuation, are some issues, including those of an ethical nature: conflicts of interest, competence (valuer’s knowledge and the ability necessary to perform the valuation), erroneous income capitalization rate or cash flow discount rate, determining the value without complying with the principle of diligence in accordance with the standards (even in the event of pressure from clients’ side), as well as the need for the valuer to report whether he uses several professional reference standards and, if so, what they are.

The lack of respect for the basic principles of ethics in evaluation practices is considered by Torrelli [

4] to be directly reflected also in the lack of efficiency of social responsibility practices by means of that effect of the “the funnel path” type, which will have, as a finality, the non-fulfilment of the economic sustainability objectives. In other words, in this funnel path, the ethical behavior of valuers constitutes the starting point for sustainability and social responsibility, given the fact that it influences fiscal transparency (an essential component of fiscal governance) and other elements; besides, it is implicitly reflected in the sustainability and the economic viability of business, as stated by Onofrei et al. [

5]. In this context, companies that promote the values of responsibility and sustainability are acknowledged by rankings in the field through demonstrating “respect for customers and competitors”, responsible behavior towards external and internal stakeholders, “and being a good citizen of the community in which they operate” [

6], which essentially means ethical behavior. Moreover, Mukherjee [

7] insists even on a certain spirit of sustainability that “can only be ignited by addressing such profound issues like meaning of work, purpose of life and the relevance of ethics and values”, while other authors [

8] emphasize that ensuring sustainability requires ethical training through “new and creative skills and competences”.

In his pursuit of the answer to the question of whether “valuation really contributes to the public good?”, Mathison [

9] considers that “valuation is in itself a convenience, a service to be borrowed [....] a service bought and sold, and while many valuers frame their practice into the broader principles of our professional organizations, valuation and valuers are still accountable to those who pay for their services”. From this point of view, it can be estimated that the valuer, by the inherent nature of his contractual relationship, is potentially the subject of a bias, which, in the absence of clear professional and legal regulations, and a strong personal ethics, may reveal itself to the detriment of the public good.

Objectivity in the activity of an authorized valuer is a prerequisite, a professional obligation imposed by the standards of conduct specific to a profession, but also “a state of mind”; he must show “impartiality, intellectual honesty, disinterest, that he is free from any form of conflict of interest” [

10]. From the fact that valuation is employed by a client, who may not adequately understand the role of the valuer, his obligations and the nature of his work, we can ascertain that the result of the valuer’s work may be influenced/burdened by pressures and conflicts of interest, which can manifest themselves in all phases of the valuation process: entering (into collaboration) or contract (valuation), design of the study (of valuation), data collection, data analysis and interpretation, communication of findings, use of findings [

11,

12].

The aim of our research consists of exploring, as an informal ethics audit, the opinion of authorized valuers in Romania, members of The National Association of Authorized Romanian Valuers (ANEVAR), regarding the issue of ethics in their performed activity. In this respect, we mention that our article does not intend to present research on the specifics of ethics audit in the valuation profession, in the strict sense of the definition of this concept [

13], as a specific process and methodology applied for the standardized assessment of the ethical system performance of an organization in the light the stakeholders’ ethics expectations. Through our research, we propose an informal/non-standard audit form, in the sense of capturing the way in which the Romanian authorized valuers perceive the concern for ethics (values, dilemmas, factors of influence, difficulties, need of organizational formal support) in their professional practice.

Following this, the paper is structured in five sections, in accordance with our approach to achieve the research purpose. The first section (following the introduction) is dedicated to obtaining an overview of the valuation process with a special focus on the ethical issues regarding valuer’s ethical behavior. This section also comprises a thorough presentation of the main landmarks of the authorized valuation process in Romania. The next section is dedicated to the review of the specialized literature in order to obtain an up-to-date image with reference to the subject of ethics in the authorized valuation process and to sum up the findings on this very topic. The following sections deal orderly with the method, data analysis and research results. The final section is dedicated to the discussions and conclusions of the research, in which we highlight how the results of our research can contribute to formulating recommendations to relevant associations, in solving ethical issues related to the authorized valuer’s behavior in Romania and other countries, by means of updating the professional standards.

2. An Overview about the Authorized Valuation Activity

In a very simple manner, the Oxford Dictionary defines valuation as the estimation of the monetary value of “something” [

14] and which is performed by a valuer, namely the person whose job consists of estimating the value of that “something” to be traded [

15].

In Encyclopaedia of Evaluation, Fournier [

16] delimits the authorized valuation from other types of valuations in that it is considered to be a process of investigation applied for the collection and synthesis of evidence, which is finalized with conclusions about the condition and value of a business, about the merit, significance, value or quality of a good, program, product, person, policy, offer or plan.

Thomas and Gup [

17] opportunely point out the fact that the results of the valuation process lay the foundation for decision-making, which often “involves large sums of money or assets transferred from one side to the other”. In turn, Damodaran et al., cited by Gil-Lafuente, Castillo-López, and Blanco-Mesa [

18], consider that valuation activity supports the management of a business in key situations, such as in the process of acquisition (purchase-sale) of companies, assets and shares, in quantifying value creation, in identifying the factors that lead to the creation or destruction of company value, in the strategic analysis of the activity and the product/process portfolio, as well as in the evaluation of the impact of the strategic decisions. In addition to these key situations, Thomas and Gup [

17] also add other spheres circumscribed to the authorized valuation activity, among which there exists: determining the property tax owed to authorities, clarifying the situation when a minority shareholder wants to leave the business, making a valuation report necessary for financial statement audit reporting or in missions related to financial audit, determining the value of compensation owed to people with managerial roles or key persons within an entity (directors, division or business units managers and owner-employees).

From a professional perspective, the Appraisal Institute [

19] considers the valuation to be that act or process of elaborating an opinion about value, which can be expressed numerically as a specific quantity, as a range of numbers, or as a relation (for instance, no more than...). We consider this reference to quantitative quantification to be particularly relevant in the context of which the valuation outcome (opinion of value report) is important for a wide range of interested stakeholders (property managers, buyer-clients, financiers/banking institutions, investors, authorities, etc.) by minimizing the risk in their strategic actions.

With reference to business evaluation, McDaniel [

20] defines it as a process in which a set of procedures is used in order to estimate the value of an owner’s interest in a business. Important for obtaining a fair business value, all these three components of the definition (process, set of procedures and value estimation) must be approached from an ethical perspective.

An interesting facet in relation to the opinion of value expressed by a valuer in his report is highlighted by Fournier [

16] in a sense that it is a field in which several people are involved at some point and different or even contradictory interests may arise. In this context, valuers may face various ethical challenges, conflicts or dilemmas during the valuation process, an aspect highlighted as well by Morris [

11] in

Encyclopaedia of Evaluation: “The nature of valuation generates many circumstances in which practitioners may encounter challenges, conflicts or dilemmas during their work that are considered to be of an ethical nature”.

The unethical behavior of valuers is pointed out by na Ayuthaya and Swierczek [

21] in the first phase of contracting the valuation and in the last phase of communicating or using the results, phases in which there is the highest probability for the ethical difficulties to occur, whereby the results may be deliberately biased and influenced. From a deontological perspective, Trugman [

10] considers that, before accepting a commitment for a valuation, the authorized valuer must consider whether there is the possibility of a conflict of interest or even if it is just about its possible occurrence. Therefore, in the event of a certain or potential conflict, the recommendation for the valuer is to protect himself by refusing the commitment or to make a signed agreement informing the client that this conflict of interest may possibly occur, if the client still wishes to continue the collaboration process [

10].

The conflicts of interest along with the poor training of valuers represent major factors with a considerable impact in substantiating decisions on the financial market, as highlighted by the US Authority for Financial Services in 2005 in a report in which these were included in the list of weaknesses of the valuation of speculative funds, ultimately contributing to the decline in their reliability [

22].

The potential ethical dilemmas that may arise in the activity of the authorized valuers are equally the focus of the authorities that regulate this sector of activity, also of the academic world and of the practitioners. In this regard, an article on the page of the financial and litigation consulting company Markham Norton Mosteller Wright & Company [

23], addresses to valuers an awareness message about “ethical lapses”, in order to minimize the number and the effect of errors by improving the reasoning applied in valuation, especially regarding the stages of development and reporting of a commitment, by respecting the professional standards.

For a better understanding of our study, general information regarding ANEVAR and its membership requirements are presented below.

According to the available public information [

24] the ANEVAR “aims to organize, coordinate and authorize the exercise of the profession of a certified valuer in Romania, representing and protecting the professional interests of its members, ensuring the independent exercise of the profession of an authorized valuer respecting professional ethics and a high level of professional qualification, as well as the promotion of evaluation standards, methods and techniques throughout the activity of the authorized valuers”.

Important normative acts that regulate the profession of the authorized valuers are [

25]: regulation on the organization and functioning of the ANEVAR—approved by the Romanian Government Decision no. 353/2012; the law for the approval of the Government Ordinance no. 24/2011 on some measures in the field of property valuation (Law no. 99/2013); the code of ethics of the profession of authorized valuer.

ANEVAR member valuers can be the following: trainees, full members, accredited members (individuals), corporate members (legal entities), inactive members, honorary members [

26]. ANEVAR accredited membership is obtained only if the person has at least three years of experience in the evaluation profession and after passing an organized exam [

27].

Among the obligations of ANEVAR full members, we notice that each valuer must follow an annual program equivalent to at least 20 h of continuous training, but also he must sign a professional liability insurance contract for the valuation activity.

According to the Romanian Law that regulates the valuation profession [

28] (Ordinance on some measures in the field of property valuation, CHAPTER III Organization and exercising of the profession of an authorized valuer. Rights and obligations, p. 6), the authorized valuers have the right to receive fees for the activity carried out, fees that are not set as a percentage of the estimated value through the valuation report (Art. 23. a), and the following obligations (Art. 24. b): to elaborate valuation reports according to the standards of evaluation adopted by the Union and (c) to respect the code of ethics of the profession of an authorized valuer, as well as the regulations adopted by the governing bodies’ leadership of the Union (association). It is worth mentioning that valuers are responsible for carrying out their activity and they can be subject to disciplinary, civil or criminal repercussions, as the case may be (Art. 25.).

Accredited membership in ANEVAR is granted for five years from the date of the accreditation examination and may be renewed by passing a new examination conducted in accordance with the specific accreditation rules [

29].

The European Group of Valuers’ Association (TEGoVA) awarded ANEVAR the recognition of the right to grant the status of A Recognized European Valuer (designated using the REVTM mark) to its members who meet the necessary conditions [

30]).

3. Ethics in Valuation—An Overview

Ethics, in the professional activity of an authorized valuer, represents the foundation of business partners’ trust and of social responsibility. In the simplest terms, ethics means the choice by the individual of what is considered to be right, good, beneficial, compared to what is incorrect, bad or unbeneficial. In the profession of an authorized valuer, one can appeal to three great theories of ethics when he himself evaluates his behavior from this point of view or when a third party does it, and namely of professional deontology, of utilitarianism and of virtue.

From the perspective of deontology, ethical conduct implies the fulfilment of the moral duty, the compliance with some general and abstract universal moral principles and values (honesty, responsibility, justice, loyalty, respect for the rights of individuals and for the property [

31]). We often refer to professional deontology in terms of these values and principles adopted by members of a profession.

From the perspective of utilitarianism, it means careful reflection and analysis, both at the individual and organizational levels, on the results and consequences of any decision. Treviño and Nelson [

31] consider that an ethical decision is one whose results maximize the good, the benefits for others, for the society and minimize the evil.

From the perspective of the theory of virtues (virtue ethics), an individual’s moral integrity, character, motivations and intentions (being a good moral agent) are analyzed, and less his decisions and behavior. The principles, rules and consequences are taken into account but in the context of these elements—character and motivation [

31].

Each of these three ethical theories has its own limits in analyzing the nature of the situation and the behavior of a social actor from an ethical perspective. On the whole, any decision that needs to be validated from an ethical point of view, without the possibility of being disputed by any collaborating party, nor by public opinion, must be well grounded on the arguments of several theories of ethics. Consequently, Scheirer [

32] is of the opinion that an ethical evaluation practice implies a need for deep reflection based on ethical knowledge, flexibility and balance.

The respect for professional ethics is one of the requirements that the valuation expert must face [

33], with regard to the direct link highlighted by Cunningham [

34] between professionalism and ethics.

In a suggestive essay, Hurley [

35] emphasizes the importance of ethics and identifies specific aspects of ethics in the professional activity of valuers, in a sense that they must act autonomously, without experiencing any political or ideological control (from outside), and that everything is based on the client’s confidence that the valuer “will not knowingly harm him”, which represents, in fact, “the basic rule of an ethics of public responsibility”. Trust is, at the same time, the compensation received for the ethical behavior. The structure of the residential mortgage industry, the possibility of obtaining a financial commission/incentive for unethical behavior that would facilitate, for instance, loan procurement, or what a good service means in the eyes of the client (a “fast, cheap and high enough…” transaction), open up opportunities that can move the valuer away from following ethical standards. Hurley [

35] also points out that current technology leads to the depersonalization or, in other words, to the institutionalization of clients’ relations, and valuers must be aware that unethical behavior is as harmful to the institution as it is to personal relationships. Valuers must also be aware of the ethical implications of their decisions. Thus, in certain transactions, the report made by the valuer is in fact required to be intended for a party other than the original client with whom the contract was initiated, without disclosing the initial relationship. One question they need to ask themselves is whether their decisions pass the test of publicity, of public scrutiny, but also whether the product they offer is sufficiently “reliable, accurate and meaningful” to ensure their long-term success and perspective, and not just the short-term profit. In this context, reliability in the valuation report is particularly important, given that the work of a valuer is seen as a service [

9], corroborated with the fact that for a field service company the reputation and the quality of services [

31] are essential for its economic survival.

In turn, Sureshchandar et al. [

36] equate organizational social responsibility with ethical behavior, which is reflected in the way clients evaluate the quality of the service provided by the company and the way it contributes to their relationship with the organization (which, we could say, earns their trust).

Consequently, we ascertain that trust is built through honesty, transparency and sustained effort, and through the constant fulfilment of promises, obligations and assumed commitments.

3.1. Factors that Determine the Ethical Behaviour of the Authorized Valuer

Several factors can be enumerated on the list of those that influence the adoption or not of an ethical behavior by an employee/expert engaged in a professional collaboration. Some factors are of an individual nature (the individual’s character and personality, his values, his level of moral and cognitive development, his own motivations and interests); other factors are of an organizational nature (policies and codes of ethics, as well as involved compliance systems, ethical culture, work climate, the manager’s personal example) or are of a sectoral nature, at the level of an industry/sector of activity in which one operates (such as the practices in the field).

In a metaphorical interpretation proposed by the Network for Business Sustainability [

37], there are three categories of factors that determine the employees to behave unethically: “bad apple” (individual factors, including the pursuit of self-interest), “bad cases” (problem specific factors) and “bad barrels” (environmental factors).

The framework defined by Ferrell et al. [

38] of making an ethical decision in business includes the intensity of the ethical issue (its importance, from a moral point of view, for the particular person), the factors at the individual level (gender, education, nationality, age, locus of control) and those at the organizational level (corporate culture—its ethical culture, the influence of those in the group that are significant to the individual—colleagues, managers, subordinates, and, in this case, obedience to authority), as well as the opportunity (conditions that allow or limit the unethical behavior).

Gbadegesin and Ojo [

39] insist upon compliance with ethical principles in property management (including valuation) which is “dictated” by the moral climate at the societal level, the ethical climate at the industry level, market challenges, formal company policies, employees’ behavior (of those in hierarchically superior positions and of peer positions), personal character, ethnic background, personal objectives (financial needs).

What particularizes the profession of valuer is precisely the fact that the valuer (or even the company for which he works) must be authorized/accredited/licensed, and his activity “is the subject of standards [of practice] and possibly of ethics” [

40].

3.2. Values and Ethical Standards Specific to the Profession of an Authorized Valuer

Standards and good practices are necessary for ensuring an appropriate framework in which the professional, yet subjective, judgment of the valuer, which essentially comprises the valuation process, “does not transform into a simple discretion”; therefore, “diligent attention to their progress is, primarily, an ethical duty, which prevails, being more than a professional obligation of the valuer” [

41]. Lastovka [

42] considers that the choice of the valuer and his adherence to the highest ethical standards are the first recommendations of experts for the companies that want their client to enjoy a correct valuation of his business. In this context, the values and standards of ethics that govern the activity of licensed business valuers are generally included in the codes of professional practice, operational the national and international levels.

An analysis performed by Tomáš Krabec [

43] on the development methods of these standards and on their nature highlights that good evaluation practices play an important role and the legislation, the science that provides the methodological background and the interest of valuers and of professional evaluation associations, are the factors that determine their ultimate form. With regard to ethics, we have codes of ethics, which are adopted by professional organizations with the aim of “regularizing the role of morality”. In other words, these codes have the role of illustrating “how their members should act in a certain capacity held” [

44].

The Code Corporate Governance and Ethical Practice for Property Valuers, assumed by the European Group of Valuers’ Association (TEGOVA) [

45], mentions as values/standards—independence/responsibility/integrity, know how (applying only recognized methods), qualification and continuous professional development, discretion, use only of reliable (information) sources, avoidance of conflicts of interest (to prevent the activity for two or more clients for the same issues, except when agreed by them), efficiency and diligence, transparency of expenditures, respectability with regard to marketing/competition, honesty.

The Code of Ethical Principles for Professional Valuer (International Valuation Standards Council (IVSC)) [

46] in Great Britain is based on five fundamental principles, some of which are found in another form in the aforementioned code [

45], namely: integrity, objectivity, competence, confidentiality, professional conduct. This code provides guidance for the application of principles, examples of measures that can be adopted in case a situation emerges which contradicts the ethical principles, but similarly the threats (self-interest, self-review, conflict of interest with the client, advocacy, familiarity, intimidation) and the defense/avoidance measures, if such is the case.

The American Society of Appraisers (ASA) defines the standards related to ethical conduct in the document The Principles of Appraisal Practice and Code of Ethics [

47] (revised version of June 2015), in addition to standards specific to evaluation practice. Thus, there are clarifications regarding what is the valuer’s duty and responsibility, from the “obligation … to develop and describe the appropriate type of value or estimated cost” to the responsibility towards third parties. Obligations to the client, to other valuers and to the society are also specified. A separate section is devoted to principles with a role in “establishing and maintaining the trust of clients and other stakeholders in the validity of the results of the evaluation missions”, through mentioning and explaining the evaluation practices that are unethical and unprofessional, and, therefore, not accepted by code. Similarly, a section on the standards to be followed in the preparation of evaluation reports is present. Unethical and unprofessional conduct from the valuer’s side are mentioned among those six categories of code violations, which can lead to different types of disciplinary actions.

The Uniform Standards of Professional Appraisal Practice (USPAP) [

48] (The Appraisal Foundation) is a document that comprises the generally recognized standards of ethics and performance for the valuer profession in the United States. The standards, adopted by the US Congress in 1989, address all types of valuation services and are reviewed every two years. Their role is to help the valuer “to provide impartial and well-thought-out value opinions”. Compliance with these standards is compulsory for valuers involved in valuations targeting federal government real estate transactions.

The standards imposed on its members by the Appraisal Institute of the USA specified in “Valuers Code of Professional Ethics” [

19], as well as in “Code of Professional Ethics and Explanatory Comments” [

49] (the document version of 2020) defines five “canons” (each being divided according to several rules of ethics) which guide the valuer’s ethical behavior: to refrain from any conduct that is detrimental to the profession and to the public; to keep adequate records; to develop and report unbiased analyses, opinions and conclusions; not to violate confidentiality; not to do any advertisement that is misleading or contrary to the public interest.

The Code of ethics of the profession of an authorized valuer in Romania (ANEVAR) [

50] is similar to the European code mentioned above, and defines the principles of integrity; objectivity, independence, impartiality; confidentiality; professional competence and professional behavior. The wide range of values and standards to be respected by valuers reflects the wide spectrum of multiple unethical behaviors that may occur during the valuation process: lack of objectivity/biased judgments in assessing the value of the appraised asset, lack of transparency, disclosure of confidential information, non-compliance with professional norms, affecting the integrity by accepting compromises and pursuing one’s own interest to the detriment of the public interest, etc.

According to the General and Ethical Standards of the National Association of Certified Valuators and Analysts (NACVA), included in the document presenting the professional standards [

51] are: integrity and objectivity, professional competence, duty of care professional, client reconciliation and communication, planning and supervision, sufficient relevant data, confidentiality, discreditable documents, client interest, documentation, financial interest. On the NACVA webpage (

https://www.nacva.com/standards) we find a synthetic document, particularly useful and clarifying, which compares the professional standards developed by NACVA with those of the International Valuation Standards Council (IVSC), of The Royal Institution of Chartered Surveyors (RICS) and of the Canadian Institute of Chartered Business Valuators (CICBV). The document is intended to be a “general reference tool” for valuers working internationally. Although the standards are formulated differently from association to association, the analysis reflects that they “have more in common than differences”. Similarly, the association provides a comparative table between the NACVA standards and those of national associations - The Institute of Business Appraisers (IBA), The American Institute of CPAs (AICPA), The American Society of Appraisers (ASA) and The Uniform Standards of Professional Appraisal Practice (USPAP).

The new global edition of RICS Valuation—Global Standards [

52] (the RICS’ Red Book, International Valuation Standards (IVS)) which came into force on 31 January 2020, illustrates the concern and the “continuing progress in the development of international standards for ethics and for measurement”. Their general purpose is to ensure consistency, objectivity and transparency, essential elements for ensuring public confidence in the valuation profession. The standards that the valuer must comply with take on three interconnected forms, ethical behavior being implicitly embedded in each of them: professional standards (including the valuer’s ethical conduct, along with the knowledge and competence), technical standards (consistent application of recognized approaches in the field) and performance or delivery standards (referring to the rigor that the valuer must demonstrate in the analysis performed, as well as the objectivity of his reasoning, based on adequate documentation and clarity in relation to which he finalizes the valuation). RICS adheres to the International Ethics Standards (IES), specific to professional services regarding property. Thus, the professional standard (PS) on ethics required for members is PS 2—ethics, competency, objectivity and disclosures [

52]. Under these conditions, the valuer’s ethical reflection consists of demonstrating “professional skepticism”, i.e., an “attitude that includes a questioning mind, critically assessing evidence relied on in the valuation process and being alert to conditions that may cause information provided to be misleading. Members must not allow conflicts of interest to override their professional or business judgment and obligations and must not divulge confidential information [

52].

The codes of professional ethics guide members of a profession in adopting a desirable behavior specific to the chosen profession; impose compliance with the values, principles and rules specified therein as a condition of obtaining and maintaining the membership; inform about desirable standards of conduct, situations and risks that may arise; educate and guide the conduct of professionals in the same direction, given that they may initially have a different set of moral values or a different level of cognitive moral development; standardize their way of understanding and application; offer “common lens” in addressing specific aspects in professional activity, minimizing the risks in relation to all stakeholders; ensure a solid foundation in building stakeholder confidence; make members of that profession accountable. Although they are different in role and concept from the norm imposed by law, the codes of professional ethics have a character of conformity; their provisions are imposed on the members and non-compliance attracts penalties. They are considered to have a positive impact by, among other things, “increasing the probability that those, to whom they are addressed, will behave in a certain way” (according to the moral principles defined by professional associations)that to become for them a “habit”, and which inspire them “to do the right things for the right reasons” [

53]; they can constitute “a strong reason for a member to judge an action he wants to take in a particular context” (which does not nullify his personal autonomy and professional reasoning when faced with solving an ethical issue); they can be like a “professional statement” [

53].

Likewise, Chun-Chang [

54] asked in his research counting 296 real estate brokers to investigate whether these codes of business ethics and ethical evaluation (views from the perspective of ethical theories—justice, relativism, utilitarianism etc.) influence ethical reasoning and behavioral intention. The research illustrates that in situations when the “real estate brokers have a good understanding of business codes of ethics; it is expected for them to be more positive in individual ethical decisions” [

54]. According to the results obtained, these codes have a direct influence on the intention of behavior, which led the author to conclude that brokers are less likely to be tempted to be unethical in their practice. The influence through ethical reasoning is indirect, but it is greater than in the case of codes of ethics, which means that “the individual subjective judgment [of the valuer] also has a significant role” in the valuation process [

54].

However, Wolverton and Wolverton [

44] insist that these codes of ethics are not generally recognized as infallible. Despite the many ethical standards imposed on valuers by professional codes of conduct, they do not absolutely guarantee objectivity and independence in the evaluation process, even if they include strict rules of conduct and sanctions for situations in which these are violated. The ingredient that must be at the basis of the codes is the integrity of the members (both in attitude and in reasoning), “for the sake of morality and the common good” [

44].

Moreover, although some of the codes have lines of action that guide a desirable behavior, these principles do not provide a standard answer to all situations involving ethical aspects faced by the valuer: “Unfortunately, situations in which professional guidelines provide ready-made answers are likely to be the exception rather than the rule” [

12].

3.3. Specific Aspects of Ethics in the Professional Valuation Activity

The importance of compliance with the professional ethics norms by authorized valuers is confirmed not only by the standards included in the quasi-present and obligatory codes of practice and professional ethics of profile associations, but also by the multitude of academic investigations conducted on this topic, which aim to identify what the real problems are, as well as the valuers’ opinion in this regard. The results of this research can serve as the starting point for a proper understanding of real reasons for ethical issues, and for the adoption of effective, efficient, and also realistic measures that would have a long-term effect, beyond the issues regarding compliance. In Europe, however, we can say that there is still little clarifying research on the subject.

Marčinskas and Galinienė [

55] explored the ethical potential of property valuers in Lithuania. Their study was based on the professional code that regulates the activity of this category of specialists. This code includes, in addition to the standards found in the other codes mentioned above, obligations to society and consumers, reliability of information, honest remuneration, consumer interests, recognition of one’s own mistakes, penalties for violating the ethical rules. The authors identified three groups of respondents—a relatively small percentage, up to 25% who consider that “the professional rules included in the code are not questionable”, a percentage of 40% who state that “there is a contradiction between business and ethics”, and the rest who showed passivity/ignorance towards this subject. Among the aspects pursued in the research there was the appreciation of the reasons (from a moral perspective) which formed the basis for choosing the profession; the appreciation of one’s own professional competence (compared to that of valuers at the EU level); the professional diligence of colleagues; the dependence of the fees collected by the valuer within the transaction and if there is any connection with the value of the property (prohibited by professional norms, which, through answers, is found to be a tacit disapproval of valuers in this case compared to the norm); the problem of indiscretion in interpreting the information obtained in the carried out activity; the application of sanctions for violating the professional deontological regulations (association between the types and the field of sanction application). In a similar study, on the elements of valuation methodology directly affecting the quality of the business valuation service, the same authors [

56] summarized the valuers’ opinions (based on a survey of 60 valuers and 23 clients), which shows that the winner is explicitly the factor “The most important components of valuers’ professional ethics” (the list of valuer’s professional qualities; the norms regarding unethical behavior; the penalty for unethical behavior), and implicitly “Factors associated with the legal regulation of valuation”, which also includes the Code of Professional Ethics). The study [

56] determines that for the valuers and the clients involved in the survey, the Code of Professional Ethics is considered one of the elements that contributes to the infrastructure of business valuation services (a component of the legal basis).

There is also the opinion [

57] according to which the valuers feel that their ethics are under the assault of clients who expect favorable results, in exchange for securing business collaborations in the future.

Some interesting research [

58], which explored the opinion of real estate inspectors and valuers in Lagos Metropolis, Nigeria, of 137 real estate companies, brings to light another facet of these influences from the clients’ side, namely the idea that large clients are more likely to influence the valuation than small clients. Thus, the study identifies the three most important factors influencing the client (ranked based on the average of the scores), namely: the integrity of the valuer or the evaluation firm, the importance of the evaluation result for the client and the size of the client. Similarly, it is also pointed out that the respondents appreciate that if a valuer takes on more than one task from a client, then he is more likely to be unable to withstand the possible threats from the client’s side in order to make an unrealistic valuation.

Chen and Yu [

59] studied, by means of a questionnaire-based survey, the issue of client’s influence in mortgage valuations, comparing Taiwan (32 respondents with a response rate of 16.3%) and Singapore (31 respondents with a response rate of 70.2%). According to the opinion of the valuers participating in this study, it appears that in both countries the influence of the client on the valuer is a reality, even if there are differences in terms of means of communication, stage of development and market structure. The main generating factor is the lack of transparent market information, especially in Taiwan. Furthermore, in Taiwan compared to Singapore, the percentage of mortgage valuations subject to value adjustments due to the client’s influence, as well as the amount of adjustments, are much higher. The opinion of Taiwanese respondents is that mainly the characteristics of the valuer—the individual, and not the company, determines whether there is such an influence. The different size of the market and the dominance of valuation firms (compared to individual valuers) determine that in Singapore clients who have a long-term relationship with the firm have a stronger influence.

In turn, Crosby, Lizieri, and McAllister [

60] investigated whether clients had influenced the valuations pertaining to measuring performance on the commercial property market in the context of declines registered in the background of the economic crisis since the second half of 2007 in Great Britain. They used the data provided by the Investment Property Databank for this purpose and demonstrated that, in the case of unregistered open-end funds, “a stronger decrease in capital values was registered than in other types of funds”, which, following statistical analyses, could be justified by this influence from the client’s side on fund managers and “not [because of] the differences in the composition of the portfolio” [

60].

In Nigeria, the study conducted by Nwuba, Egwuatu, and Salawu [

61] among property valuers (on a valid sample of 62 respondents) confirms the fact that the client sometimes negatively influences the valuation practice and that he mainly uses rewards/pleas (in the first place—pleas for assistance and keeping the company on the valuer’s list) and data (in the first place the loan amount) and less the threat/constraint. However, it is highlighted that valuers are still tempted to fall under the pressure of other variables—such as the limited valuation market, as well as the environment (corruption, indiscipline at the society level). This influence from the client’s side has negative consequences—including the reduction of the valuer’s integrity and profession.

The research conducted by na Ayuthaya and Swierczek [

21] in Thailand and in Malaysia among several categories of stakeholders (279 valuers, backers and investors) confirms the hypothesis that less influence from the client’s side significantly impacts the reduction of variation in value (resulting from the valuation) but also the supports hypothesis that a smaller variation in value significantly increases the investors’ confidence.

Some researches, such as the one conducted among South African property valuers [

62] reveals through the answers given to the proposed questions, that they are ethical in their business practices and that they do not give in to pressure, which would lead to unethical conducts. Moreover, just over half of them (51.61%) refer to the ethical standards applied by them when presenting their valuation reports to the client.

In a questionnaire-based survey applied on a final sample of 135 valuers from Malaysia, Achu et al. [

63] tracked their perception of the factors that affect the client’s influence, as well as its impact on the property valuation. The research results showed that the type of client and his size occupy the first two places in the ranking of “the most common sources of influence”, followed, in order, by the valuer’s integrity, his level of experience, the relationship with the client and the size of the valuated company. The authors’ initial conclusion, based on the averages of the answers obtained, is that these factors “could have an impact on the value and type of influence exerted on the valuers”. The authors applied a logistic regression model to analyze whether the client’s size and the amount of value adjustment requested by clients influence the valuers’ decision and discovered that these variables do not have a significant impact.

Mohammad, Mohd Ali, and Jasimin [

64] include the ethical conduct among the “elements of valuer’s behavioral uncertainties”. They believe that this conduct is necessary because it guarantees “consistency and clarity” in the activity carried out, even if changes occur in certain factors, among which could be “the economic situation or the business practices from one market to another”. The authors emphasize that this conduct must have its source in the valuers themselves. Among these elements of behavioral uncertainty, highlighted separately—although it may be at the root of the valuer’s unethical behavior—is the client’s influence who, through various means (powers), can exert pressure on the valuer in order to adjust the value of the valuation in his favor.

The interviews with 15 professionals with experience on the Hungarian real estate market conducted by Pilhál [

65] followed, as well, the ethical issues in the property valuation commitments, and among them were mentioned by experts: the soft influence on the client’s side (mainly attributable to the lack of effective regulations) but also quite common situations of conflict of interest, “either on the client’s side or on the valuer’s side”, due to a legal context and to some internal rules considered to be insufficient.

Consequently, the issue of influence on the client’s side has to do with valuation ethics both through the unprofessional conduct and valuer’s lack of integrity (who may give in to this influence following certain rewards offered by the client), but also through that of the client who interferes with illicit pressure, pursuing his own interest, to the detriment of all players involved and/or affected by the transaction, including the public interest.

4. Method

4.1. Research Purpose and Specific Objectives

Our study, of exploratory nature, aimed to investigate the position of authorized valuers in Romania (members of the ANEVAR) on the issue of ethics in valuation activity carried out by them. In this regard, a questionnaire was designed, which was distributed by ANEVAR to all members with a valid email address in the members’ database.

In direct correlation with our goal proposed in this research, the following research objectives were systematized:

O1. Investigating the concern for ethics and the specific aspects in the authorized valuation activity in Romania;

O2. Identifying the frequent ethical issues faced by the valuer in valuation activity;

O3. Identifying the specific elements that he takes into account/that influence the valuer in valuation activity/process (the need for ethics, specific values, criteria in decision making, a code of ethics);

O4. Identifying the factors that influence ethics in the valuation activity.

A subsidiary objective of those 4 (four) objectives was to identify the recommendations from the respondents’ side about ensuring ethical behavior in valuation activity.

4.2. Research Hypotheses

Consistent with the proposed research goal and following our interest to fulfil the 4 (four) previously structured objectives, 4 (four) univariate research hypotheses were defined, namely:

Hypothesis 1 (H1). Certain existing practices in the field negatively influence the compliance with the ethical principles and norms in valuation activity in Romania.

The first hypothesis (H1) is motivated by several studies and empirical research mentioning the influence of existing external practices in the field like “challenges, conflicts or dilemmas” [

11], (“pressures and conflicts of interest” [

12] and “ethical difficulties to occur” [

21]) and which adversely affect the objectivity of the authorized valuer’s decision.

Hypothesis 2 (H2). Authorized valuers in Romania suffer from external pressures, mainly those related to the client’s influence, which affect the compliance with the ethical principles and norms in valuation activity.

The second hypothesis (H2) is formulated taking into consideration the pressure exerted by the client to influence the authorized evaluation process in his favor, from the perspective of the impact on ensuring objectivity and compliance with professional conduct standards. This phenomenon seems to be a factor that is prevalent in authorized valuation and was highlighted to be present in many countries by authors such as na Ayuthaya and Swierczek [

21], Closer [

57], Amidu [

58], Chen and Yu [

59], Crosby, Lizieri, and McAllister [

60], na Ayuthaya and Swierczek [

21], Nwuba, Egwuatu, and Salawu [

61], Achu et al. [

63], Mohammad, Mohd Ali, and Jasimin [

64], and Pilhál [

65]. For our understanding, the testing of this hypothesis clarifies whether this aspect is also reported by the valuers in Romania; so far, no similar studies have been undertaken.

Hypothesis 3 (H3). The valuer’s code of ethics is not considered to be a sufficient support in solving the specific ethical issues in the activity carried out.

The effectiveness of using ethical codes of conduct in organizations or in practicing a profession, in solving different ethical challenges and dilemmas is widely debated in numerous theoretical studies or empirical research, with arguments for—for example, if they directly influence the intention of the valuer’s behavior [

54] and also against—they do not provide a standard answer to all ethical situations faced by the valuer [

12], or they do not absolutely guarantee the objectivity and the independence during the valuation process [

44]). An answer obtained from the Romanian valuers themselves could further contribute more to the validation of one of the two arguments that are in opposition.

Hypothesis 4 (H4). The authorized valuer in Romania feels the need for guidance regarding the ethics in the activity carried out (specific code of ethics, training programs).

The hypothesis H4 is mainly exploratory, as there is no other empirical research on this topic conducted among Romanian authorized valuers. The results obtained after testing this research hypothesis might be a solid argument for ANEVAR, but also for other international professional associations in the field, if it is the case that it is necessary to adopt future measures in order to support the valuers in their activity to face ethical issues. Furthermore, the research findings will contribute to a better characterization of the profile of the Romanian authorized valuers.

4.3. Method and Instrument of Data Collection

To address the previous hypotheses, an empirical study was conducted in a sample of Romanian certificated valuers, members of ANEVAR. The data were collected by using a Web questionnaire that consisted of 10 sets of questions and demographic data. Five questions had a nominal scale with multiple or single answers, 2 questions had a 6-point Likert scale (from 1—to a very small extent to 6—to a very high extent) and 5 questions with a 6-step scale (totally disagree, totally agree). At the beginning of the questionnaire, a preamble was formulated addressed to the respondents, where the title and goal of the research were specified, as well as the references on research ethics—anonymization of answers, maintaining data confidentiality, information regarding the presentation of research results. The research subjects were informed that correct or incorrect answer options/choices are not followed through the questionnaire, but only those which constitute a valuable source of recommendations for improvements in professional norms and standards for this profession.

The substantiation of the questions was based on the standards and norms of ethics contained in the codes of professional ethics that govern the activity of authorized valuers (both in Romania—of the professional association ANEVAR, but also other international codes), as well as studies in the specialized literature, the great majority being mentioned above in this study.

The questionnaire was designed and made in Google Forms and distributed online, through the central apparatus of ANEVAR, to the members registered in the database who had a valid email address.

Our research in the field of ethics concerning the authorized valuation in Romania is a more extensive one, which started and consisted of the collection of data during the period of 2016–2019. The processing and interpretation of data according to the goal and the research questions addressed are still ongoing. In this study we study data collected in the first semester of 2016, data that will be analyzed dynamically with those collected during 2019. The research was conducted only for strictly academic purposes, with the purpose to identify the general aspects of ethics in the activity of authorized valuation, and offer general recommendations in this area, and does not represent the official point of view of the professional association ANEVAR.

4.4. Research Population and Sample

The classification of valuers in 2016 entered into force on 27 January, when ANEVAR Decision no. 8/2016 was published in the Official Monitor [

66], Part I, No. 59. The ANEVAR table contains four categories of valuers (incumbent, accredited, corporate, inactive). The questionnaire was given only to the incumbents. A total of 4103 valuers held the title of an incumbent valuer at that moment. Of the 4103 incumbents, 91.23% had an email address, and the email opening rate was 53.27%.

A total of 558 respondents participated in the research by completing the questionnaire. This means that the response rate was 14.9% compared to the number of valuers with an email address and 27.98% compared to the number of valuers who opened the email in 2016. Given that the research is exploratory, the first of its kind in Romania that it was officially carried out through ANEVAR, and another way of simultaneous access to all valuers does not exist, we consider that a response rate of almost 30% is acceptable. Other studies among valuers had similar response rates (see, for example, the research of the following authors Klamer, Gruis, and Bakker [

67] with a response rate of 14.5%).

Among the respondents, 66.3% (n = 370) are male and 33.7% (n = 188) are female. Age distribution of valuers participating in the study—the highest percentage, 31.7% (n = 177), are over 55 years old; 27.4% (n = 153) are between 46 and 55 years old; 24.2% (n = 135) between 36 and 45 years old; 16.3% (n = 91) between 25 and 35 years old. Only 2 valuers are under the age of 25, which can be explained by the specific requirements for starting the practice of this profession. Regarding the seniority in the authorized activity—most of them (35.3%, n = 197) have a seniority between 5 and 10 years; 31.5% (n = 176) between 11 and 20 years; 20.4% (n = 114) under 5 years and 12.7% (n = 71) over 20 years.

5. Data Analysis and Results

In order to accomplish the above-mentioned objectives, we used descriptive analysis and hypotheses testing.

Table 1 and

Table 2 illustrate the results that reflect the valuers’ opinion regarding the concern for ethics (behavior, norms and standards) and the specific aspects in the authorized valuation activity in Romania, which correspond to the first objective of our research.

A total of 76% (

n = 423) of valuers agree that evaluation ethics is a matter of the valuer’s personal ethics. Almost 60% (

n = 329) of the respondents agree that, in Romania, there is a strong concern for evaluation ethics and over 64% (

n = 359) agree that legal professional norms and standards are sufficiently clear and consistent to ensure correct and appropriate valuations (

Table 1). However, 40% (

n = 227) state that totally ethical behavior can never be ensured throughout the valuation processes.

When asked about the three most frequent ethical values applied in valuation activity carried out, most valuers checked objectivity, independence, impartiality (n = 493; 88.4%), professional competency (n = 383; 68.6%) and integrity (n = 309; 55.4%). Other possible responses were professional behavior (n = 240; 43%); confidentiality (n = 148; 26.5%); reputation (n = 56; 10%); efficiency (n = 43; 7.7%); consistency (n = 1; 0.2%).

Another group of questions were on the specific aspects of ethics in the valuer’s activity in Romania (

Table 2). In response, over 34% of the respondents state that, to a great extent and to a very great extent, there is no strong ethics at the societal level; it is very difficult to be totally ethical in valuation activity and the instability of the economic environment negatively influences the ethics of the evaluation process/Romanian valuer. In addition, the cultural variables of the Romanian environment (for example, the close relations between people, the great distance from the authority) influence the ethics of decisions agreed by 30% of the respondents.

Concerning the frequent problems faced by valuers in Romania, the aspect that is the subject of the second objective of our research, 52% of them said that there were pressures from the clients’ side (for instance, for higher or lower values of valued assets, the conclusions of the report, proposals for manipulation of accounting statements, for evasion, etc.) and insufficient information provided by the clients (

Table 3). Another issue was a certain suggested threshold, said 44% of the valuers from the sample.

An important issue which followed in this research was the criteria applied in making ethical decisions, which constitutes the third objective of our research. The highest affirmative answer (87.3%,

n = 487) was given for the item on professional deontology (compliance with the values of the profession) (

Table 4). A total of 51% (

n = 287) of the respondents answered that personal reputation is a criterium in making ethical decisions.

Moreover, given the importance of the norms and standards of professional conduct that govern the authorized valuation worldwide, the research also looked at the extent to which valuers appreciate the role of the code of ethics in the activity carried out. To a large and to a very large extent, a number of advantages of the code of ethics is appreciated. Therefore, 66% (

n = 370) appreciate that the Code specifies the ethical values to be promoted by valuers, almost 60% (

n = 331) answer that the Code establishes detailed standards of ethical behavior for valuers and offers a general line of action in making ethical decisions, and 40% (

n = 227) appreciate as an advantage of the Code the fact that it offers concrete solutions to valuers’ ethical dilemmas (

Table 5).

With reference to the subsidiary objective of the four research objectives, the valuers’ opinion regarding the Recommendations/concerns for ensuring ethics in valuer’s activity are presented in

Table 6. Therefore, over 52% (

n = 291) of respondents suggest a Code of Ethical Conduct “concrete, with specific situations faced by the valuer and with possible solutions”, and 49% (

n = 273) agree to organized training programs on specific ethical issues. Furthermore, over 46% (

n = 260) of valuers recommend importing good practices on ethical standards from other countries.

The results in

Table 7 show the association between the opinions regarding the advantages of the Code of Ethics and a set of other variables, such as:

The Code of Ethics is too general and a series of specific aspects of ethics in the valuer’s activity. In order to measure these associations between ordinal variables, we used the Gamma coefficient. The results revealed that there is a significant (sig. < 0.05) weak inverse relationship (−0.09 and −0.119, respectively) between Specific aspects of ethics in valuers’ activity—There is no strong ethics at the societal level, it is very difficult to be totally ethical in valuation activity—and two advantages of the Code, namely “establishes detailed standards of ethical behavior for valuers” and “specifies the ethical values to be promoted by valuers” (

Table 7). In other words, as the opinion regarding the advantage of detailed standards, namely “specifies the ethical values to be promoted by valuers”, moves up, the respondents tend to consider, to a lesser extent, that there is no strong ethics at the societal level, “it is very difficult to be totally ethical in valuation activity”.

The advantage of the Code of ethics to establish detailed standards of ethical behavior for valuers, but also the one regarding specifying the ethical values to be promoted by valuers are significant (sig. < 0.01) negative but weak (−0.23) associated with the item “The code of ethics is too general, it does not provide the valuer with answers to specific problems”. As the answers regarding the advantages of the Code of ethics move to a large and a very large extent, the more likely it is for respondents to express negative opinions regarding the fact that it is too general, not providing answers to specific problems.

The opinion concerning the general character of the Code of ethics is significantly (sig. < 0.01) negatively associated with the advantages of the Code regarding the concrete solutions and broad lines of action in the decision-making process.

Consequently, we state that the data in

Table 5,

Table 6 and

Table 7 confirm the research hypotheses H3—“The valuer’s code of ethics is not considered to be a sufficient support in solving the specific ethical issues in the activity carried out” and H4—“The authorized valuer in Romania feels the need for guidance regarding the ethics in the activity carried out (specific code of ethics, training programs)”.

Concerning the fourth objective of our research, from the above we identify that a negative factor that influences ethics in valuation activity constitutes the external pressure from the client’s side. The potential influence of the clients in different forms in the valuation process and the criteria that valuers take into account so as to ensure the ethics of the decision is illustrated by the results of the statistical analysis in

Table 8. Therefore, we notice the importance of the items (we refer to criteria) of personal reputation and social responsibility in the reasoning of the valuer to respect the ethical principles in the activity carried out.

The analysis of the connection between the variable “Pressures from the clients’ side” and the variable “Criteria in making ethical decisions” (

Table 8) shows an association that is significant (sig. < 0.01) direct, moderate to strong, between personal reputation, on the one hand, and gift offering (0.70), corrupt practices (0.518), creative accounting practices (0.723), conflict of interests (0.565) and suggesting/requesting a certain value threshold (0.508), on the other hand. Therefore, we can appreciate that the valuers who have personal reputation as a criterion consider, to a greater extent, that gift offering, corrupt practices, creative accounting practices, conflict of interests and suggesting/requesting a certain value threshold are problems faced in valuation activity.

Furthermore, a significant (sig. < 0.01) direct, moderate to strong link can be registered between social responsibility, on the one hand, and corrupt practices (0.55) and creative accounting practices (0.515), on the other hand. Therefore, the valuers who have as a criterion social responsibility appreciate, to a greater extent that corrupt practices and creative accounting practices are problems faced in valuation activity.

Our analysis shows that there are significant (sig < 0.01) direct, moderate links between the following items (

Table 8):

“Pressures from the clients’ side” with “the moral consequences that have arisen over time as a result of the valuation results” (0.35), with “professional deontology” (0.344), with “personal reputation” (0.225) and with “social responsibility” (0.283);

“Pressure from third parties in order to influence the valuation process” with “the rights of the parties involved” (0.385), with “personal reputation” (0.47) and with “social responsibility” (0.438);

“Insufficient information” with “the rights of the parties involved” (0.316) and with “personal reputation” (0. 293);

“Suggesting/requesting a certain value threshold” with “the rights of the parties involved” (0.396), with “the moral consequences that have arisen over time as a result of the valuation results” (0.36) and with “social responsibility” (0.47).

Consequently, we find that the data in

Table 8 confirm the research hypotheses H1—“Certain existing practices in the field negatively influence the compliance with the ethical principles and norms in valuation activity in Romania” and H2—“Authorized valuers in Romania suffer from external pressures, mainly those related to the client’s influence, which affect the compliance with the ethical principles and norms in valuation activity”.

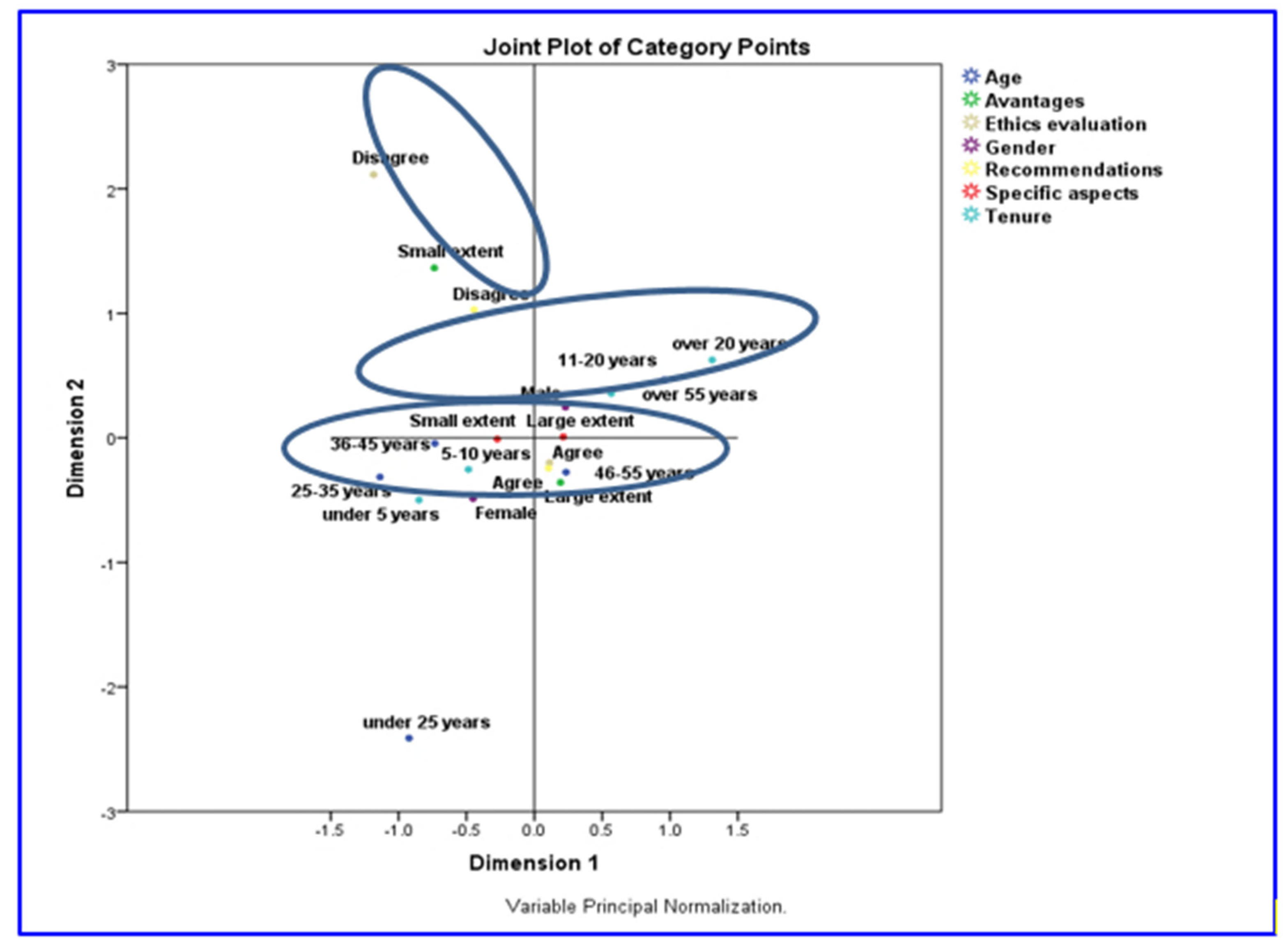

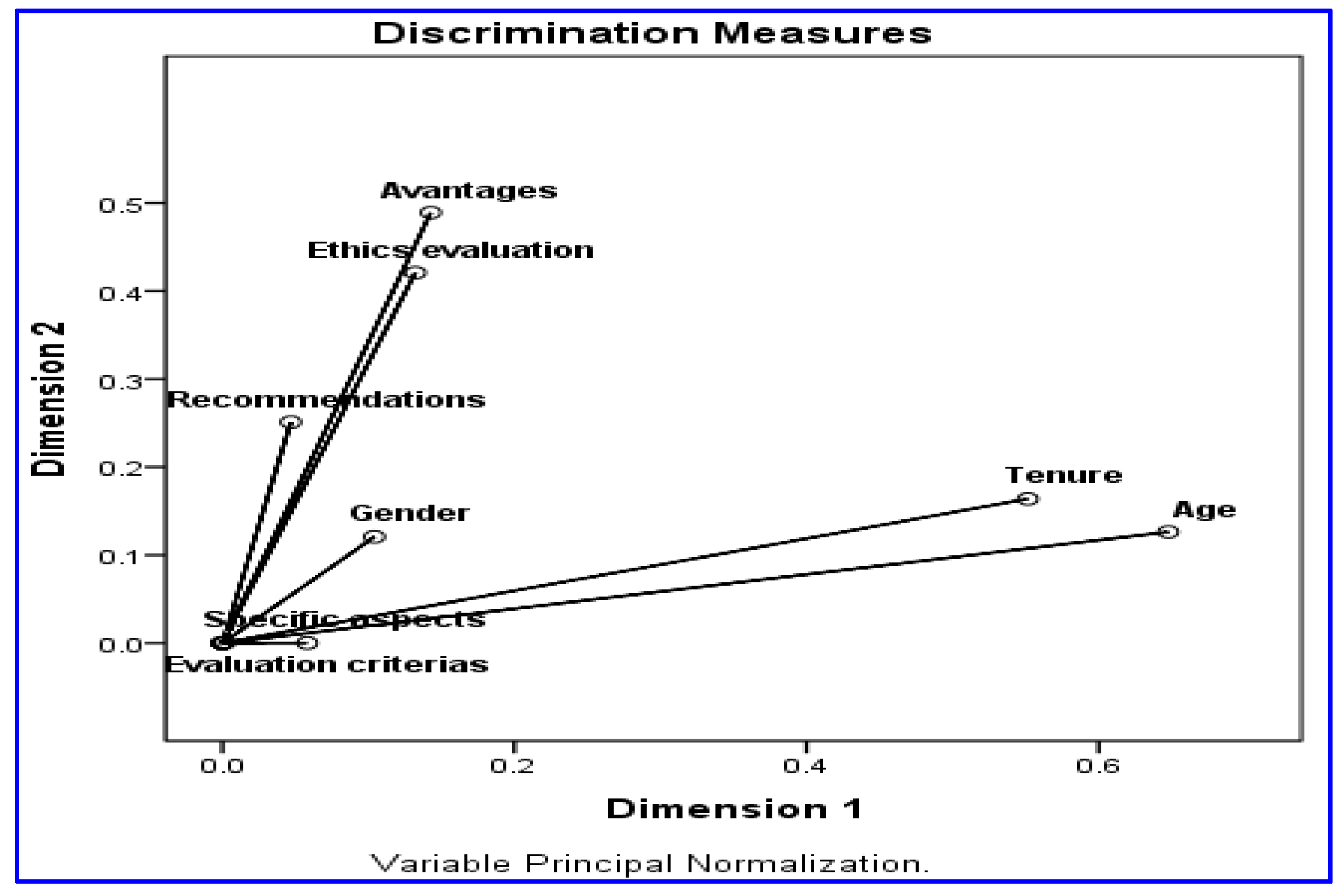

With the aim of summarizing the associations among the opinions on ethics and demographic measures we used multiple correspondence analysis as it is an appropriate exploratory method of data analysis in the study of the relationship between two nonnumeric variables. We examined the proximity between the modalities of different nominal variables which means that these modalities tend to appear together in observations; the proximity between the modalities of the same nominal variable means that the observation groups associated with these modalities are similar in their nature [

68].

Although the generally accepted lower limit for Cronbach’s alpha is 0.70, a smaller value (alpha = 0.5 in the case of the instrument used in our research) is acceptable in exploratory research where a small alpha score can be due to a reduced number of questions, poor interrelatedness between items, or heterogeneous constructs. In this research, there are heterogeneous constructs to capture a two-dimensional picture of the data, and the methodological procedure was conducted accounting for this limitation. A joint plot of category points and discrimination measures was obtained.

The synthesis study conducted by Taber [

69] on the reported values of the Cronbach coefficient in various researches in the science of education, published in well-known journals, illustrates the variability in accepting different values, and the need for researchers to interpret the value of the coefficient taking into account the particularity of the study, the dimensionality they want to measure, the number of items in the research instrument or the response scale [

69].

There were no clear differentiating values allocated to each of the obtained dimensions; all discrimination measures are below 0.5, except with two maximum values of 0.552 (“Tenure”) and 0.648 (“Age”) for the first dimension. For the second dimension all discrimination measures are below 0.5, with a maximum value of 0.489 for “Advantages” and 0.421 for “Ethics evaluation” (

Table 9). The opinion on ethics evaluation—disagree is most commonly associated with the opinions on advantages—small extent and recommendations—disagree (

Figure 1). Therefore, we ascertain that valuers who do not agree with the ethical evaluation, do not agree with the recommendations and consider to a small extent the advantages of the code. Moreover, with regard to ethics evaluation—agree, advantages—large extent and recommendations—agree are associated.

The most discriminant variables for dimension 1 hierarchically are “Age” and “Tenure”; regarding dimension 2, the most discriminant variables are “Ethics valuation”, “Advantages” and “Recommendations” (

Figure 1 and

Figure 2).

Finally, in dimension 1, “Age” is correlated significantly with “Tenure”. Associations were found for dimension 2, between “Ethics evaluation”, “Advantages” and “Recommendations”. Only associations above 0.25 were considered to have meaningful practical significance.

6. Discussions and Conclusions

Our research shows that slightly more than half of the authorized valuers in Romania consider that there is a strong concern for ethics in valuation and that the code of ethics ensures the ethics of valuation. Among the frequent problems faced by the valuers are the pressures from the clients’ side (for instance, for higher or lower values of valued assets, the conclusions of the report, proposals for manipulation of accounting statements, for evasion, etc.), insufficient information provided by the clients and suggesting/requesting a certain value threshold.

It is also worth noting that more than 30% of Romanian valuers mention that the cultural variables of the Romanian environment (for example, close relationships between people, great distance from the authority) influence ethics in decision-making in valuation activity, that there is no strong ethics at the societal level and that the instability of the economic environment constitute the factors that negatively influence the ethics in valuation activity.

Each organization (including each professional association) has its own organizational culture, its own system of values and ethical norms, but this system is influenced by the national cultural specifics of the social environment where it operates. Once this external variable is internalized by internal stakeholders (owners, managers, employees), this will influence the organizational practice [

70]. However, it is important to emphasize the fact that a lack of knowledge of this aspect of internalization, of awareness and of a rigorous attention given to avoid the manifestation of such negative influences, may constitute a major risk for any organization/association with negative consequences concerning the sustainability of its activity.

Our study confirms the research Hypothesis 1 (H1) “that authorized valuers in Romania suffer from external pressures, which may affect the compliance with the ethical standards”, and “that certain practices—such as, for example—the pressure from the clients’ side, negatively influence the compliance with the ethical principles and norms in valuation activity in Romania” (research hypothesis H2). We ascertain that this practice is present as a general ethical challenge in the activity of professionals in the field, regardless of the geographical area in which they carry out their profession.

The results obtained based on the opinion of Romanian valuers regarding clients’ negative influence in valuation process are in unison with other studies mentioned in this article [

21,

59,

60,

61,

63,

64,

67,

71], which brought attention to this issue.

For a major percentage (87.3%), professional deontology is an essential criterion in making an ethical decision, and for slightly over a half of them it is personal reputation (51.4%). The statistical analysis shows a significant moderate direct link between the potential influences from the clients’ side and personal reputation and social responsibility as ethical decision criteria for the Romanian valuer. However, surprisingly, social responsibility is a criterion that guides a very small percentage (22.8%) of authorized valuers in Romania. This last aspect may signal that the choice of this answer can only be formal from the respondents’ side.

Although the following were recognized by the majority of respondents as advantages of the code of ethics—establishes detailed standards of ethical behavior for valuers (59.3%), specifies the ethical values to be promoted by valuers (66.3%), offers a general line of action in making ethical decisions (58%), 53.3% of respondents feel the need for a concrete “code of ethical conduct”, with specific situations faced by the valuer and possible solutions (an aspect that correlates with the fact that only 40.7% offer concrete solutions to the valuer’s ethical dilemmas). The correlation of the variable “The Code of ethics is too general…” with the advantages of the code shows only a significant weak inverse link, which means that indeed this regulatory tool does not constitute sufficient support for the valuer in solving various ethical issues. Consequently, the research hypothesis H3—“The valuer’s code of ethics is not considered to be a sufficient support in solving the specific ethical issues in the activity carried out” is confirmed, as is the research hypothesis H4—“The authorized valuer in Romania feels the need for guidance regarding the ethics in the activity carried out (specific code of ethics, training programs)”.

Almost half of the respondents (49%) recommend organizing training programs on specific ethical topics (theories of ethics, ethical dilemmas, tools).

An important contribution of the research is that it highlights the ethical issues faced by the Romanian valuer but also the ethical criteria that guide his decision. We can say that it is a study that promotes a closer dialogue with the professional, gives him a “voice”, beyond the professional standards, thus opening a “door” towards the way he thinks and acts when he carries out his work from a moral principle perspective. In addition, our research highlights that the code of ethics is too general, it does not include too much concrete guidance on various ethical dilemmas faced by the valuer.

Although it approached the investigation of ethical values and practices, in order to be a more concrete topic effectively related to the known reality, so more accessible to the respondents, this research is implicitly related to the sustainability of this professional practice. Specifically, the conclusions of the study can serve as a support for possible new debates, reflections and decisions between professionals and representatives of the associations at local, national and international levels. Therefore, the study can be considered a source of information for evaluating the sustainability of the authorized valuation activity, from the perspective of care and efforts for ethics. From this point of view, any organization (in our case the professional associations of authorized valuers) must build its sustainability (“a value-laden concept”) according to “its own organizational reality”, as suggested by Tourais and Videira [

72].

We believe that it is time for training programs intended for professionals in the field and the codes of professional ethics to incorporate new, holistic issues, which are already being debated internationally in all areas, with direct reference to those of social responsibility and economic sustainability.

The main limitation of the research is that it captures only the general aspects of the professional’s position with reference to the importance of ethics in the activity of an authorized valuer, and possibly only at the declarative level, the respondents’ opinion, ethics being a generally sensitive topic, which could generate restraints and formal responses. Thus, a broader statistical analysis between the respondents’ demographic variables and their position regarding the ethical issues in their performed activity could constitute the subject of some future research.

We mention that so far this topic has not been the subject of other similar research in Romania, on the general issue, our analysis thus having a pioneering character in the specialized literature for the case of our country mainly, but also for that of Eastern Europe. The results are useful both to the academic world and to professional profile associations that can better understand the ethical issues faced by valuers, their position towards them, as well as the training needs, but also the improvement of professional standards and the code of ethics that regulate the ethical conduct for correct response to ethical dilemmas that arise during their activity.