1. Introduction

The electric vehicle (EV) industry is considered an effective way to resolve energy crises, environmental problems, and transportation issues not only in the USA, Japan, and Germany, but also in China. According to the Global EV Outlook, 2016, issued by the International Energy Agency (IEA), almost 1.28 million EVs were sold across the world, and almost 90% of total sales of EVs in 2015 took place in just eight countries: China, the USA, the Netherlands, Norway, the UK, Japan, Germany, and France [

1].

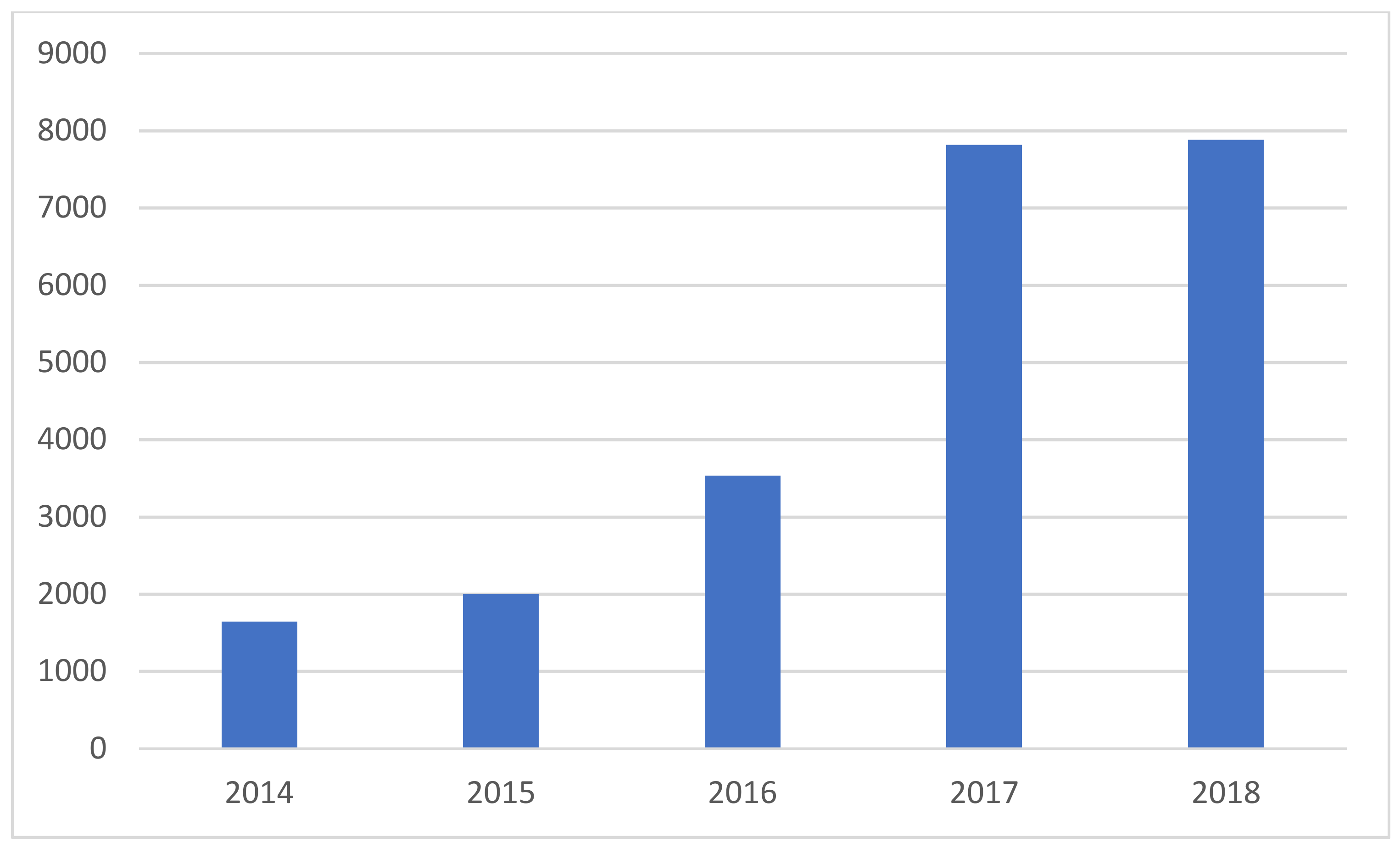

The Chinese government declared the EV industry as one of the national, strategic, emerging industries in 2010, and regarded it as a key part of the strategy plan “Made in China, 2025”. A good number of new policies have been issued to accelerate the development and application of this emerging industry in China. Among those, an important policy, which introduced and demonstrated the use of EVs, especially in the public transportation sector, was the “Ten Cities, One Thousand Vehicles” project, jointly launched by five ministries in January 2009. Such support precipitated the swift progress of the EV industry after 2009. By 2015, more than 200,000 new EVs were registered in China, and China has since become the largest market for EVs [

1].

Government policies promoted the use of EVs mainly in public transportation. The researchers indicate that plug-in hybrid and electric city buses have the best potential to reduce energy consumption and carbon emissions [

2]. In electric bus lane investment, lower electricity costs can balance infrastructure costs while achieving a reduction of up to 51% in emissions and up to 34% in energy use in the bus fleet [

3]. Especially in Beijing and some other big cities that face air pollution problems, the replacement of traditional vehicles by EVs in public transportation demonstrated the outcome of the development of the EV industry, even though the industry’s development is still at an early stage. The percentage of electric buses has been increasing constantly in recent years, but some problems remain. For example, electric buses are quite expensive and their technology is much more complicated compared to traditional ones. Another challenge comes from different participants involved in the industry. Unlike conventional buses, electric buses need charging facilities. This immediately raises questions on the exact location of those facilities and the role of energy providers (State Grid, Southern Grid, China Potevio, and others), which operate for profit. On the other hand, manufacturers may also apply new strategies when they enter this market. Meanwhile, the subject of government subsidies remains a big issue under fervent debate.

Recent research has produced valuable insights and viewpoints, as researchers examined more carefully several aspects of the EV industry, such as policy implementation, technology innovation, and business model innovation, covering almost the entire supply chain, which includes strategy, R&D, manufacture, promotion and demonstration, marketing, consumption, after-sale services, and battery recycling and reuse. Researchers believe that the development of new energy vehicles is China’s new economic growth point [

4]. The literature review below highlights some important contributions to scholarly understanding of interactions between all parties involved in the industry and pinpoints significant aspects of innovation [

5,

6]. Researchers have also made a detailed analysis of the current status and prospects of electric vehicle technology in China [

7,

8].

Relevant literature often applies Social Network Analysis and Game Theory. Liu and Kokko provide an overview of the Chinese EV industry, discuss the role of state-owned enterprises in the development of the industry, and analyze other main participants and their roles [

9]. Innovation and cooperation in the industry have also attracted considerable scholarly attention, especially from a network perspective [

10,

11], and also from consumers [

12,

13]. Some scholars applied Game Theory to determine the different factors of the EV industry game, to calculate profit maximization and investigate their impact on the development of the industry. Other scholars analyzed the decision-making process over charging stations, cooperative behavior, technical security, and life-cycle costs of the EV industry based on Game Theory [

14,

15,

16,

17]. These studies showed that relationships and networks between key stakeholders greatly affect the industry and the interaction between all participants. As the EV industry has been growing, more and more corporations have entered this industry. The sustainability of the industry’s development depends, not only on government policies, but also on all other factors in the whole value chains.

Further research on organizations and their networks is required, not only to determine the role of the government, but also to analyze the multifold dynamic gaming between all parties involved. An important factor for the industry’s development is the intention of different participants to be involved in the industry. Therefore, we have to know exactly how many important factors affect the development of the EV industry. How do they interact and influence one another within a dynamic system and what will be the results of the policies implemented? Furthermore, what would be an effective policy to increase the use of EVs in public service in the future? To tackle these research questions, this paper will use electric buses operating in public transportation networks as a case study to examine the multifold dynamic gaming between the main stakeholders involved and investigate their decision-making processes and their subsequent effect on the industry. The paper is structured as follows: After the introduction, we present the development of China and Beijing’s EV industry based on policies and empirical evidence on public transportation. The third part briefly illustrates the network and the interactions of all parties involved in the operation of electric buses in Beijing and estimates their individual contribution in this network. In

Section 4, we construct and analyze a Dynamic Game Model. The last two sections include further discussion and conclusions.

3. The Parties Involved in the Operation of Public Electric Buses in Beijing

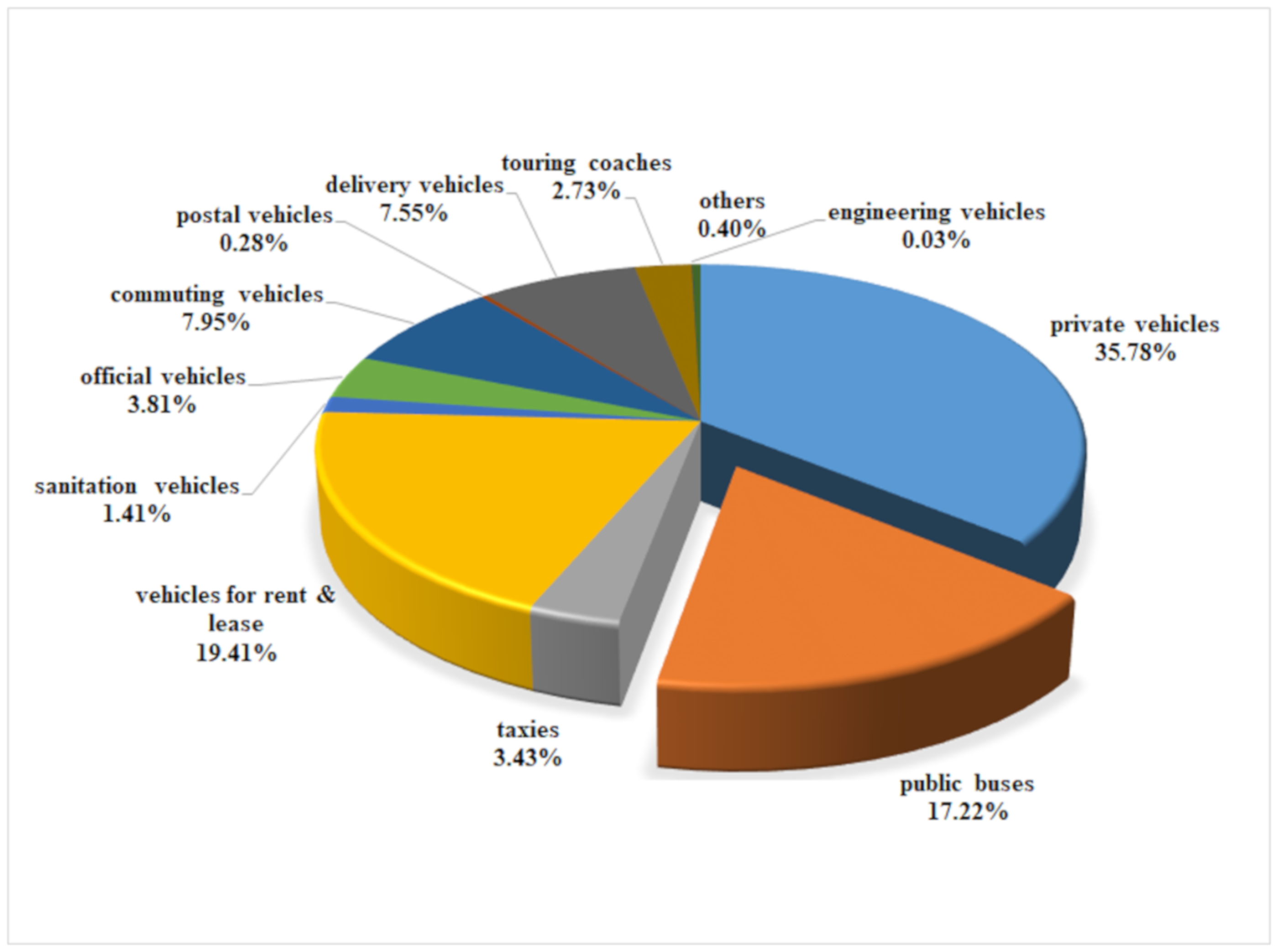

The operation of electric buses in public transportation requires careful consideration of various parameters, such as the development of the automobile industry and the use of private cars, the supply of electric power, the availability and capacity of charging points, and government subsidies and regulations.

In regards to public electric buses in Beijing, a concise network of participants is shown in

Figure 4 and mainly includes the most significant entities involved. As shown in the figure, corporations and their networks are quite simple. The Beijing Public Transport Group purchases electric buses from Beiqi Foton Motor Co. Ltd and Zhuhai Yinlong New Energy Co. Ltd, while electric power and charging infrastructure is provided by the Beijing Electric Power Company (owned by State Grid). The Beijing Public Transport Group also receives subsidies from the local and the central governments. All representative stakeholders in this research have shown in

Table A1 in the

Appendix A. Further analysis of incurring costs and revenues can be found in the next section.

3.1. Government

Undoubtedly, the national government holds a dominant position in the Chinese EV industry [

9] (as well as in most other strategically important sectors). Unlike other provinces, in Beijing, local authorities at the municipal level are also involved alongside the central government. Below, we focus on both levels of government administration.

3.1.1. National Level

Several branches of the national government are closely involved in the Chinese EV industry. The four key sectors at the highest level of central government that jointly define the broad policy framework for EVs are the Ministry of Science and Technology (MOST), the National Development and Reform Commission (NDRC), the Ministry of Industry and Information Technology (MIIT), and the Ministry of Finance (MOF). They have been responsible for R&D, strategic policy, long-term investment issues, standards, and subsidy policy in the EV industry since the late 1990s. In addition, several other ministry-level organizations are involved in the development of the EV industry, such as the Environmental Protection Agency (EPA), the State Planning Commission (SPC), the Electric Vehicle Standardization Committee (EVSC), the State Economic and Trade Commission (SETC), and the China Automobile Association (CAA).

3.1.2. Municipal Level

Regarding the regulation and support of R&D, demonstration projects, subsidy policy, and operations at the municipal level, the Beijing Municipal Government is the most important agent among all four entities in the Chinese national level decision-system, as it launched almost all policies (except two) about new-energy vehicles (the other three organizations are the Beijing Science and Technology Commission, the Municipal Finance Bureau, and the Beijing Municipal Traffic Commission; two other bodies, the Beijing Municipal Bureau of Quality Supervision and the Beijing Environment Bureau recently began to operate in the field as well). We noticed that, at the municipal level, the Beijing Science and Technology Commission is responsible, not only for R&D and promotional projects, but also for project coordination.

For the central and local governments, the development of electric vehicles will reduce fuel consumption and exhaust emissions, and help sustain a stable GDP growth rate. While the market remains in the phase of development, authorities should provide support through policies, subsidies (including subsidies to providers of charging infrastructure, manufacturers, and bus companies), and funds for technological innovation.

3.2. Electric Bus Manufactures

Despite the fact that many operators, such as spare parts suppliers, partake, in some form or another, in the EV industry, for the purpose of this paper we focused exclusively on vehicle manufacturers. The latter produce electric, conventional, and hybrid vehicles. Although there are several electric bus manufactures in China, such as BiYaDi (BYD), the Shanghai Sunwin Bus Corporation (SUNWIN), a joint venture invested by SAIC Motor Co., Ltd. (SAIC Motor), the Volvo (China) Investment Corp. (VIC), and the Volvo Bus Corp. (VBC), for the purpose of this paper we consider them as a single entity.

Only two manufactures produce the electric buses that operate in the Beijing public transportation network: the Beiqi Foton Motor Cooperation (Foton) and Zhuhai Yinlong New Energy Co. Ltd (Yinglong). Foton is a subsidiary of Beijing Automotive Industrial Corporation (BAIC), a state-owned company. The company produces high-quality touring coaches and, while it aims to secure more orders from the Beijing Public Transport Group, its market share is still quite small compared to Foton.

3.3. Charging Infrastructure Providers

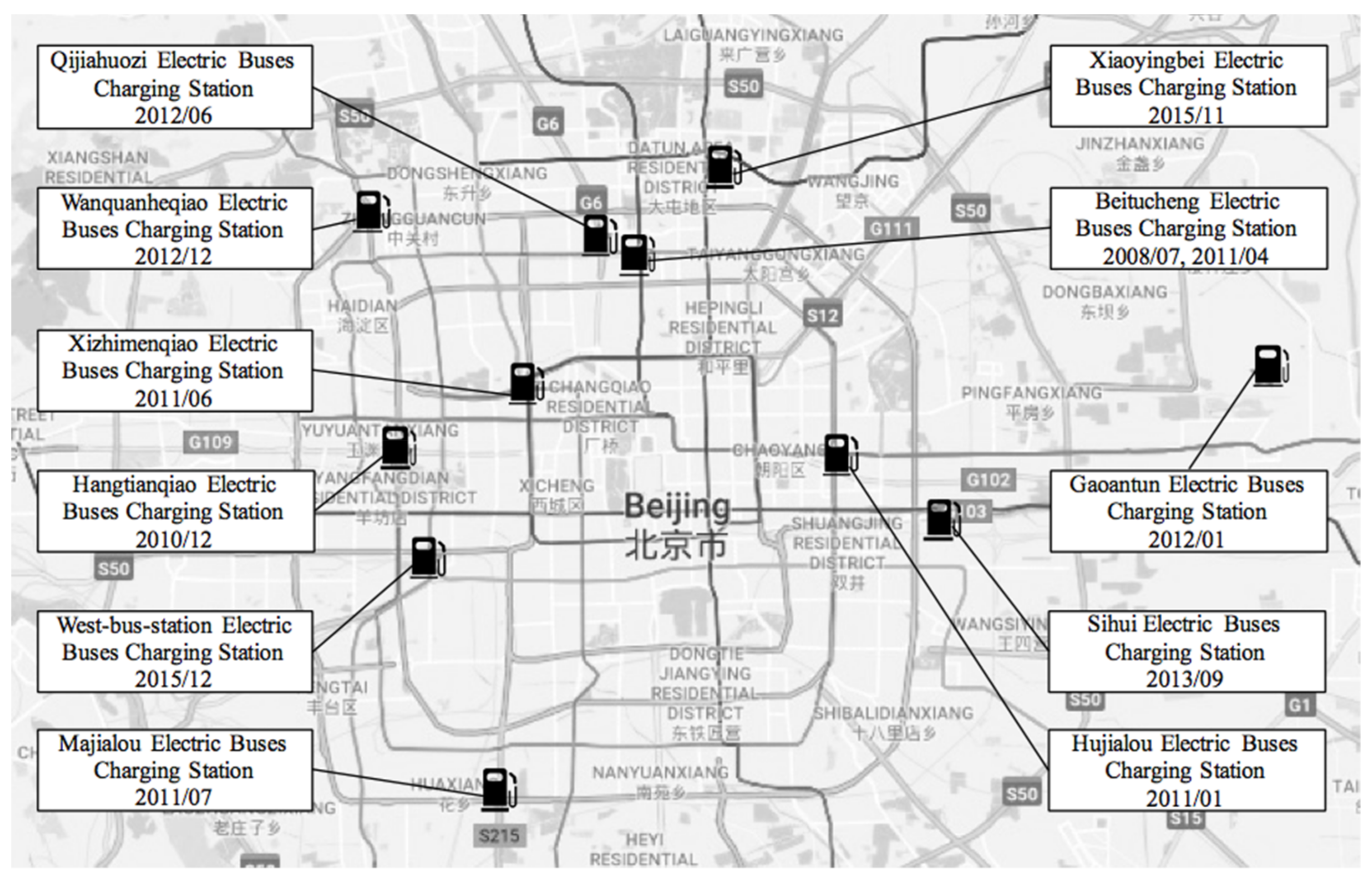

Two providers are responsible for charging infrastructure: State Grid and China Potevio. Whereas China Potevio only provides support to the China Potevio high-tech zone, the public transportation sector is serviced only by State Grid. By the end of 2012, State Grid had built four large charging stations and fifteen charging pile clusters both within and outside the city center. Most of the charging stations and piles also serviced garbage trucks, express transportation, and taxis, with the exception of the Beitucheng charging station, which services only electric buses. In Beijing, State Grid provides two kinds of charging models: battery charging and battery swap. Charging stations are one of the most important factors in the development of electric buses, and we will estimate their effect in the next section.

For a charging infrastructure provider like State Grid, an increase in the number of bus companies that operate electric vehicles, especially types that require only a short time to recharge, is very welcome. To guarantee the successful operation of electric vehicles, these providers should invest considerable resources beforehand to construct sufficient charging stations and purchase enough batteries to supply and support battery replacements. Therefore, the providers can take the cost and subsidies available into consideration before deciding to invest in additional charging stations.

3.4. The User

The sole user of public electric buses is the Beijing Public Transport Group, a state-owned company that is responsible for most of the over-ground public transportation in Beijing, and bought and operates all electric buses in Beijing. Initially, the company used fifty electric buses during the Olympic Games period and is now not only the first, but also the largest, operator of electric buses in China, with a total of 100 electric buses servicing many lines. Buyers of electric buses receive subsidies from the government and see their total costs reduced, which include the purchase cost of vehicles and chargers, maintenance costs, and the cost of electricity.

3.5. Others

Besides central and local governments, manufacturers, electricity providers, and the user, many other parties operate in the electric bus industry. For example, universities are involved in R&D and promotional activities and influence the whole industry through their interaction with the four main bodies operating in Beijing, as mentioned above. Other entities, such as finance companies, banks, maintenance agencies, and consulting firms, also offer services to particular organizations and thus impact the network, although only indirectly, and thus their importance for the whole industry remains secondary. Hence, for the purposes of this paper, we will not include them in the Game Theory analysis.

4. Dynamic Game Model Construction

We now proceed with the analysis of the Game Theory Model. Game Theory is the process of modeling the strategic interaction between players in a situation containing set rules and outcomes. Game theory is used as a tool within the study of management and economics.

The Game Theory Model in this research will include the central and local government, the bus company (user), the electric bus manufacturers (producer), and providers of charging infrastructure (energy supplier). The payoff functions are as follows:

For the subsidy policies of central and local government, we define the strategy space as and the subsidy percentage of the charging infrastructure provider, electric vehicle manufacturer, and bus company are , which satisfy . Particularly, signifies no subsidy.

For the charging infrastructure provider, suppose we define the strategy space as . Strategy is the total investment of the charging infrastructure provider. signifies no investment.

For the electric bus manufacturer, suppose the strategy space is . Strategy is the price of an electric bus, decided by the manufacturers.

For the bus company, suppose the strategy space is . Strategy represents purchase quantity. signifies no purchase.

In our dynamic game model, we presume that the payoff of the stakeholders is

, and the strategy profile space for all stakeholders is

. The dynamic game model is as follows (see

Figure 5):

(1) The bus company decides the purchase quantity of electric buses as

, and the average annual revenue of each electric bus is

, which is independent of the purchase quantity. The cost of purchasing an electric bus is

, and

is also the selling price decided by the manufacturer operating within an imperfect market. The bus company will receive some subsidies towards the purchasing and operating costs of electric buses. The subsidies can be a certain percentage of the total subsidies from central and local governments every year, and can help towards the variable part of the operating costs of a charging station by covering the cost of electricity. Supposing that the cost of electricity is under government regulation and cannot be decided by the provider of the charging infrastructure, let

be the annual average cost of electricity for one electric bus. Considering that administration costs will rise as the number of electric buses increases, let

be the management efficiency coefficient and

be the cost of management. The payment function of the bus company is Formula (1):

When allowing

, its decision behavior satisfies the following Formula (2):

and the optimal solution will be Formula (3):

(2) The government provides subsidies to the electric bus manufacturer as well. Sales revenue is the main source of revenue for the manufacturer and it can decide the selling price, because of the imperfect market. Suppose the manufacturer costs the electric bus for , after the known purchase behavior of the bus company is . Let be the manufacturing cost of one electric bus.

The payment function of the electric vehicle manufacturer is Formula (4):

Its decision behavior satisfies Formula (5):

and the optimal solution is Formula (6):

(3) The government also provides subsidies to the provider of charging infrastructure. We suppose that the provider invests for the construction of a charging station in full knowledge of the purchase behavior of the bus company, and the provider’s target is to break even with slight profits.

The payment function of the charging infrastructure provider is Formula (7):

Its decision behavior satisfies Formula (8):

Since the provider makes the decision after the bus company and manufacturer have made theirs, its decision behavior satisfies Formula (9):

and the optimal solution is Formula (10):

(4) The government decides its subsidies for the participants in full knowledge of their behavior, and the subsidy return is the industry development and environment protection, which is several times higher than expenditure, define as . Since the subsidy return is eventually reflected in the number of electric vehicles, let , where is a multiplier factor.

The action process of government subsidy is complex. Subsidy is significant to the industry in the initial stages, which means a high return for the government. As the industry develops, the return will marginally decrease, which exhibits a parabola. Hence, the actual cost of subsidy will be higher than the subsidy expenditure. Let

be the actual cost. Then the payment function of government is Formula (11):

Its decision behavior satisfies Formula (12):

and the optimal solution is Formula (13):

(5) Then we can get the Nash equilibrium outcome as follows Formula (14):

The Nash equilibrium solution shows a significantly high correlation between government subsidy behavior and bus company behavior. The optimal subsidy is proportional to the actual subsidy cost factor and the bus company management efficiency coefficient, and inversely proportional to the subsidy return multiplier factor and the bus company operation efficiency coefficient. Regarding the policy’s goal of non-negative profit, the higher the operation revenue, the higher the subsidy return multiplier factor, and the more easily the government achieves the target of payment balance. In this case, the government will not raise the subsidies.

For the provider of charging infrastructure, the influencing factors to the optimal solution are complex and consist of two parts: the first relates to the direct subsidy from the government and the other one to the cost of electricity, the production cost, and the bus company management efficiency. Our model shows a positive correlation between the optimal selling price and net profit of the bus company. The manufacturer has a relatively simple relation with the other participants in this model and has an obvious game relationship with the bus company.

In turn, the bus company is the core participant in this model. Its optimal purchase quantity is proportional to its net profit, which is influenced by many others factors. Although the bus company has a complex interest’s relation with other participants, its key performance is still dependent on the condition of its net profit.

What will happen if there is no subsidy offered? Let that eventuality be . In this case, the bus company will suffer a loss of its fixed income. If the loss is affordable, the bus company will behave in exactly the same way as if a subsidy had been on offer. If not, the bus company will cease to purchase buses. The subsidy affects the other participants in the same way, which indicates that the subsidy is indispensable to the EV industry in its early stages of development. As the participants operate and grow with the subsidy and by accumulating profit, a cancellation of subsidy will not affect the performance of the participants. In the dynamic game model, subsidy is complex and needs to balance its gain and loss more comprehensively.

5. Discussion

5.1. Government Subsidy Is the Important Prerequisite of the Game Model

signifies the provider of the charging infrastructure, the electric bus manufacturer, and the bus company. If is not zero, then the stakeholders (government, user, the charging infrastructure provider, and the electric bus manufacturer) will be motivated to invest and consume and make decisions on the basis of clear costs and gains. Thus, the government will achieve a sustainable and stable rate of industrial development.

The Nash equilibrium solution shows the importance of policy in industrial development and it also reflects a widespread phenomenon, that national governments promote the development of EV industries through policies. As a response to the energy crisis and environment pollution, important automobile-producing countries, such as the USA, Japan, and Germany all regard the development of the EV industry as a national strategy and support its development.

Subsidies play an irreplaceable role in the development of electric vehicles in China [

21]. Hence, government subsidies are an important prerequisite for the game model, as current circumstances in China clearly show. Comparing with the main automobile-producing countries, China is in possession of a similar level of technology, but profits from a huge, growing market, good supply chain conditions, and a government with the ability to take immediate action. Moreover, the development of the EV industry is important not only for manufacturers but also for the central government and its aim to promote economic development within a sustainable environment. By life cycle assessment, electric vehicles allow a significant reduction in terms of climate change because of the absence of exhaust gas emissions during operation [

22]. Not only Beijing, but also the Shenzhen model provides practical lessons for industrial players and policymakers in other cities and shows that electric vehicles have become feasible for delivering bus services in the city [

23]. Therefore, China considers the new energy industry as one of the strategic emerging industries and offers a range of subsidies.

5.2. User Is the Key Factor for the Increased Use of EVs in Public Transportation

In the traditional model, manufacturers produce cars in advance and then sell them to the user within a framework of market competition. Instead, in the EV market, it is usually the user who raises the purchase requirement and then the manufacturers produce cars to meet the requirement. This pattern appears in most cities in China, e.g. the Foton electric bus and the Midi taxi in Beijing, the BYD bus and taxi in Shenzhen, and the Chang’an bus and taxi in Chongqing, where manufacturers produce cars after securing purchase orders from bus and taxi companies. Therefore, the game model shows that, with subsidy as a precondition, the user is the decisive factor in the development of electric vehicles.

The model further indicates that, when the development of the industry breaks the old pattern of ‘demand determines production’ and the relationship between stakeholders in the game drastically changes, then the industry matures. In that case, even though subsidies are phased out gradually, the industry will mature more through the market mechanism.

We can discern some fresh ideas in the new subsidy policy. The policy intends to encourage the maturing of the EV industry by reducing subsidies from 2014 onwards and allowing other brand vehicles to enter the market and break the monopoly of regional manufacturers. Based on the model, we know that the user is the decisive factor in the purchase of electric buses. This poses additional difficulties to the new policy, because there is only one user in each market, owned by the respective regional government.

5.3. The User’s Management Efficiency Hinders the Rapid Development of the EV Industry

The game model shows that, with subsidy as a precondition, the management efficiency of the bus company is an influential factor. Subsidy is the motivating factor for these companies to purchase EVs, and their willingness to buy more EVs is determined by the efficiency of their management. Electric buses operating in Beijing, for example, must endure battery restrictions, which creates great gaps in running mileage and undermines consistency. Accordingly, the management of electric buses includes maintenance, battery swap, driver and administrative staff training, line operation, and so on.

Battery swap management has a significant impact on the bus lines currently in operation. Often, prolonged turnaround times for swap batteries results in a shortage of electric buses in these lines. New charging stations, such as the Gaoantun charging station, have high battery replacement efficiency (3 minutes), but there is a great difference between many old stations still in use, like the Beitucheng charging station, and the new ones in terms of scale and mechanization. In the Beitucheng charging station, it often takes 15–20 minutes to change batteries, a time that negatively affects the efficiency of battery replacement and drivers’ rest breaks; perhaps more importantly, station malfunction can have severe consequences for all lines.

Similarly, it would be useful to improve other influential factors, such as the overall management, the foundation of electric bus companies, and driver and staff training. These will improve the management efficiency of users, increase demand, and improve the overall operation of the market, which will eventually help the industry mature.

5.4. The Manufacturer’s Ability to Provide EVs That Meet the Users’ Needs Is a Requirement for the Industry’s Development

For the purpose of our model, we assumed that the government also provides subsidies for manufacturers, sales revenue is the basic source of the manufacturer’s income, and they can decide the selling price (all of which correspond to reality in this industry). According to the front analysis, the management efficiency of users ultimately affects the decision to purchase EVs, and management efficiency is closely related to the technological level the manufacturers possess in areas such as battery range, battery management system, vehicle body technology, motor, power driven system, and others. For example, over the last three years, the power and life of vehicle batteries have doubled, and their price has halved, which provides a safe basis for the users to improve management efficiency and industrialization.

5.5. Providers of Charging Infrastructure Constitute the Basis for the Industry’s Development

In the model, with the preconditions of subsidy from the central and local governments, the providers of charging infrastructure (State Grid and Southern Power Grid) are also responsible for the maintenance and management of existing charging stations. Therefore, the providers play an essential part in the development of the EV industry. At present, most policies on charging stations (or piles) are offering financial subsidies that do not exceed 30% of the total construction investment. With such policies in place and power grid construction, since the end of 2012 in Beijing there were four medium- to large-scale charging stations constructed, and fifteen charging pile groups were built in Xizhimen Bridge, Hujialou, Datun, Yuejialou Bridge, Wanquanhe Bridge, Fengbeilu Bridge, Yanqing, Baic New Energy Base, and elsewhere. This infrastructure provides the basis for the development of the EV industry and the use of electric buses in public transportation.

6. Conclusions

With the increasing emphasis on energy security, environmental protection, automobile industry development, and the requirements of short-distance urban transportation networks, state and local governments consider the new energy vehicle industry as one of the national strategic emerging industries and focus more attention to it. Based on our dynamic game analysis on the main participants (central and local governments, the electric bus manufacturers, users/bus companies, and providers of charging infrastructure), we believe that all participants make decisions on the basis of clear costs and gains, and they will be motivated to invest and consume more when subsidies are on offer. Thus, the government will achieve a sustainable and stable rate of development for this industry.

Our dynamic game model further indicates that the use of EVs in public transportation networks and the government’s subsidy policy are very important currently to the EV industry (in this paper, the term “government” entails both central and local governments). It is important to note at this point that government subsidies are gradually phased out of the market, substituted by low-carbon related policies. As the industry will continue to develop, government policies and regulation are bound to gradually withdraw and allow free-market mechanism to play a more important role. But currently, government policy remains very important for the industry.

As for the other three participants in this model, with subsidy policies in place, users can improve their management efficiency and strengthen the demand for electric vehicles through promotional events and projects; EV manufacturers achieve technological innovations, engage in market promotion, and offer after-sales services and training; providers of charging infrastructure improve the capacity and management of charging stations. Meanwhile, with subsidy policies in place, market participants can build partnerships with the government. This will help them work together to promote the EV industry and strengthen the EV market in many aspects, such as R&D for more products better suited to meet user demand. Thus, this will effectively address the main obstacle in the development of EVs and resolve the participants’ concerns over revenue and return of investment, build an economic guiding mechanism, and then accelerate the development of the Chinese EV industry.