The Optimal Pricing Analysis for Remanufactured Notebooks in a Duopoly Environment

Abstract

1. Introduction

- To propose a duopoly market model for this remanufactured market;

- To use the Cournot model to find the effects on the entire green supply chain of different manufacturers’ market evaluations;

- To establish how manufacturers will be affected under different government subsidy policies and different market competition conditions;

- To determine how the difference in subsidy amount will affect the social welfare of the entire green supply chain under various market conditions.

2. Literature Review

3. Model Formula and Solution

3.1. Notation

3.1.1. Basic Symbols

3.1.2. Input Parameters

3.1.3. Decision Variables

3.1.4. Objective Functions

3.2. Demand Functions in the Duopoly Model

3.3. Cournot Model Solution

4. Sensitivity Analysis

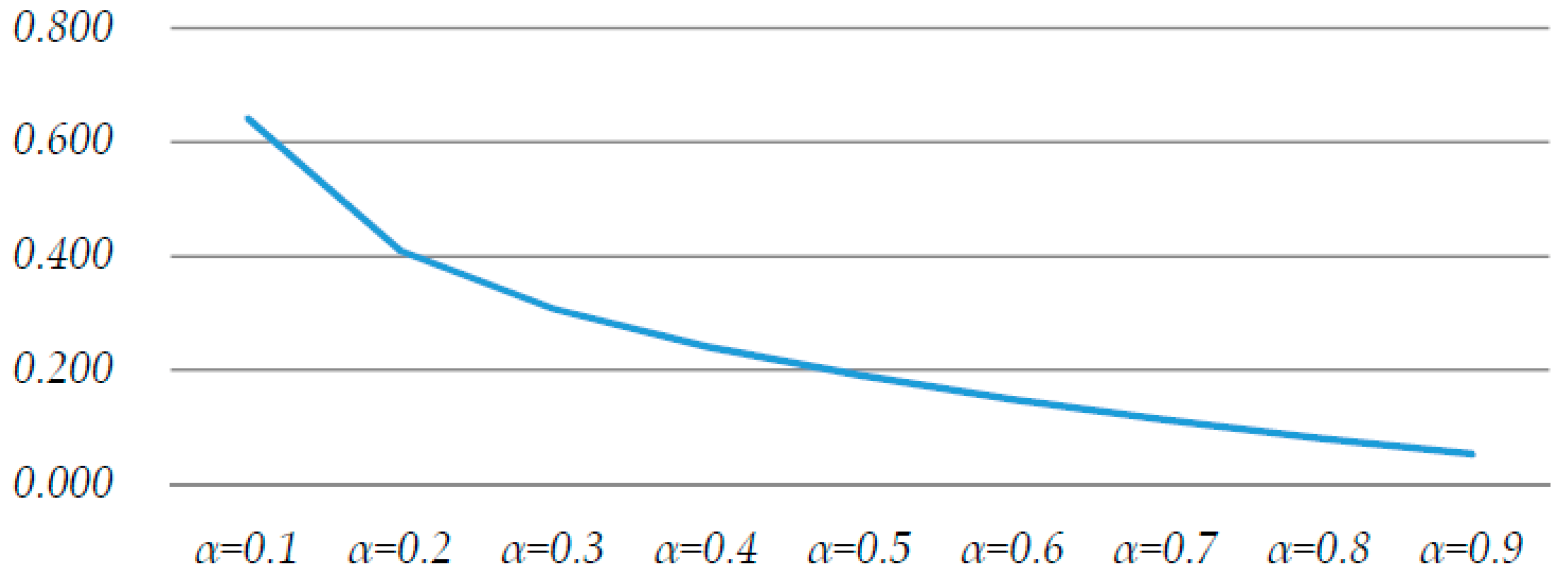

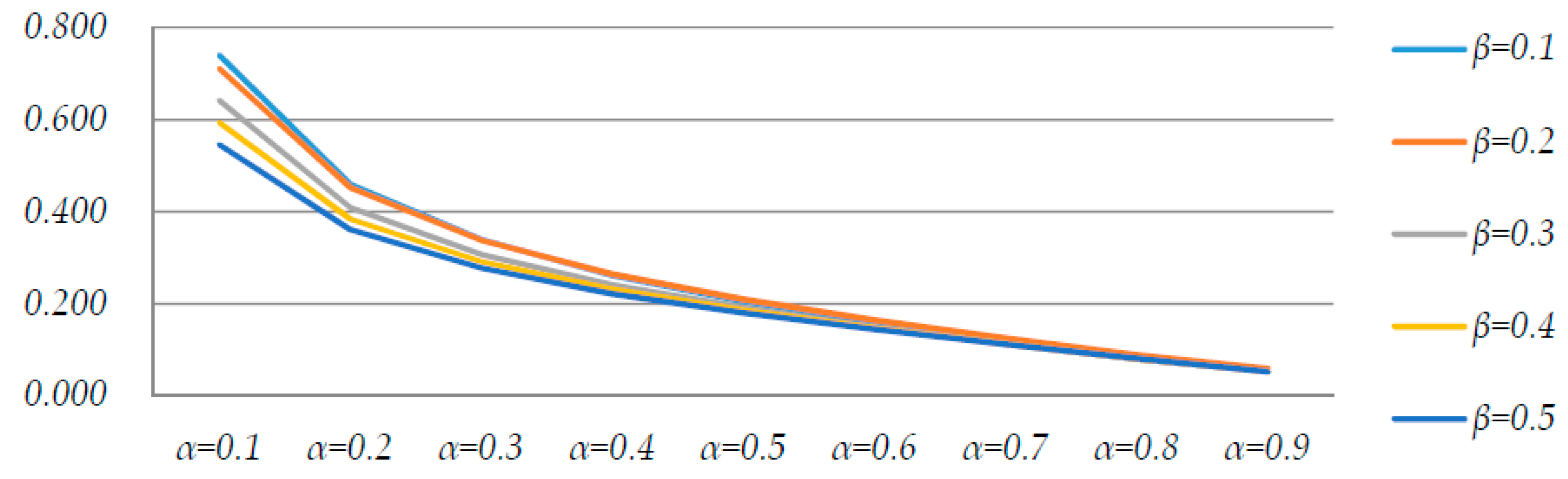

4.1. Changes in Green Supply Chain as a Whole

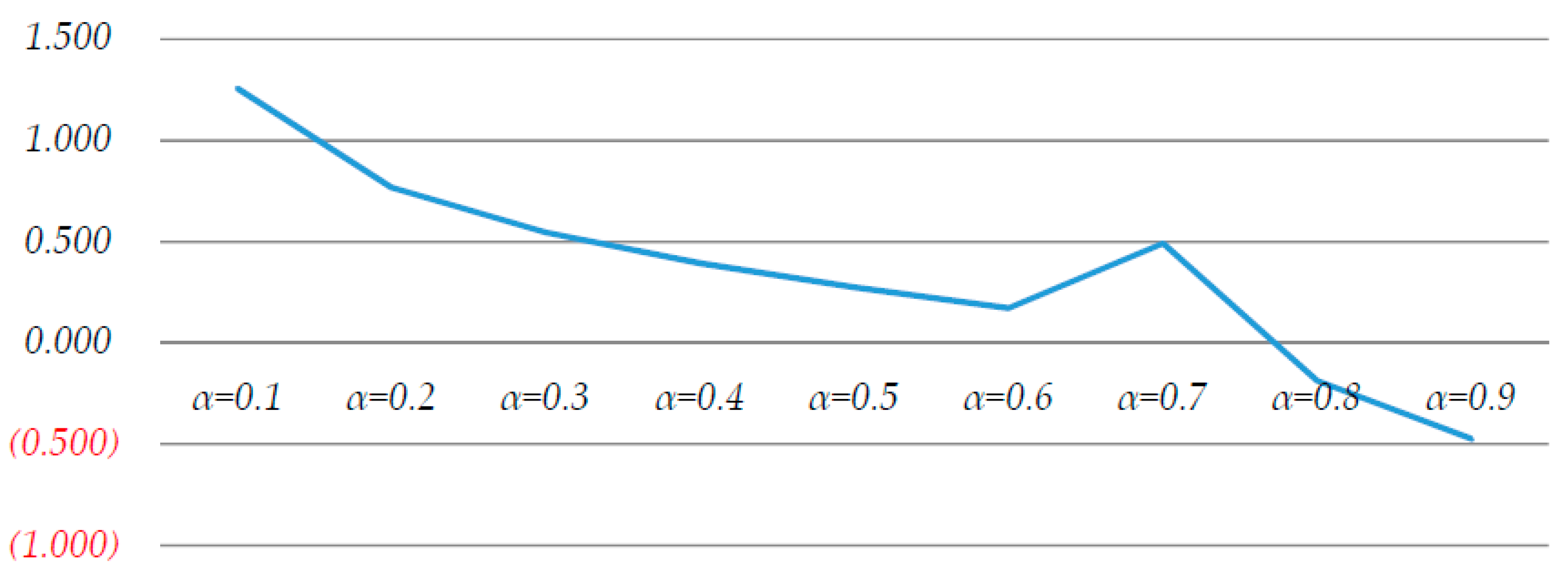

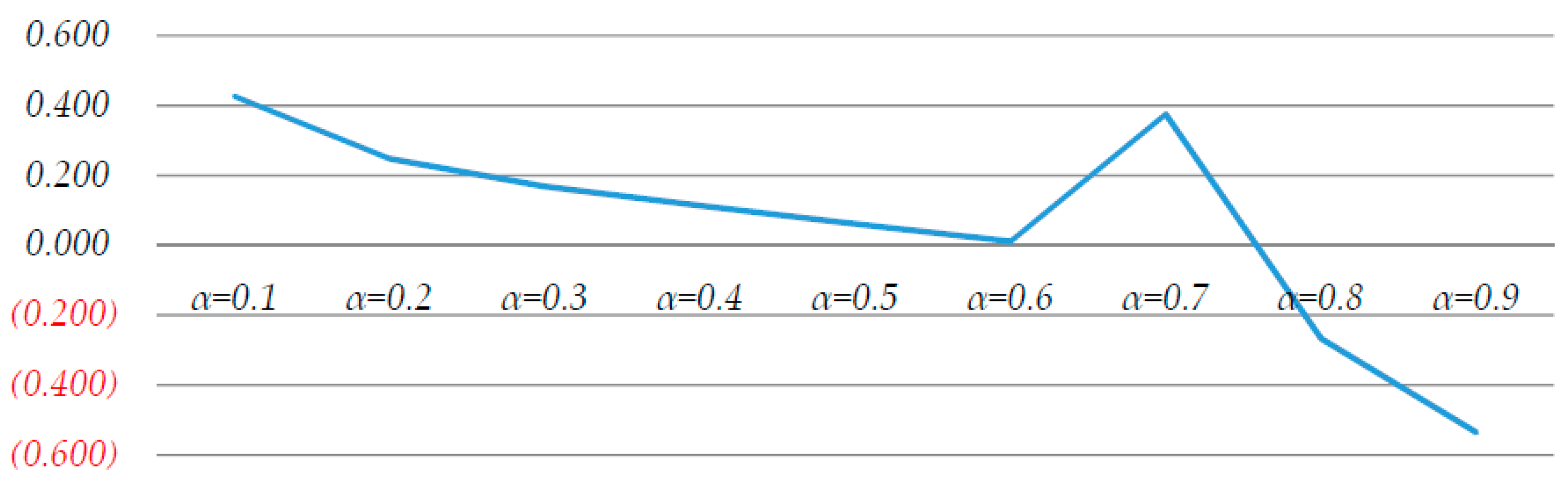

4.2. Effects on Social Welfare

5. Conclusions and Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- United Nations. What is GEI? United Nations Environment Programme (UNEP). Available online: https://www.greeneconomycoalition.org/members/un-environment-programme-gei (accessed on 14 January 2020).

- Bernard, S. Remanufacturing. J. Environ. Manag. 2011, 62, 337–351. [Google Scholar] [CrossRef]

- Alizadeh-Basban, N.; Taleizadeh, A.A. A hybrid circular economy—Game theoretical approach in a dual-channel green supply chain considering sale’s effort, delivery time, and hybrid remanufacturing. J. Clean. Prod. 2019. [Google Scholar] [CrossRef]

- Stock, J.R. Reverse Logistics in the Supply Chain. Available online: https://www.lomag-man.org/reverselogistique/ReverseLogisticsintheSupplyChain7_J-stock.pdf (accessed on 14 January 2020).

- Wang, J.N. Circular Economy is A Strategy Choice for Environmental Protection in the 21st Century. Res. Environ. Sci. 2002, 15, 34–37. [Google Scholar]

- Wisner, J.D.; Leong, G.K.; Tan, K.C. Principles of Supply Chain Management: A Balanced Approach; Thomson South-Western: Mason, OH, USA, 2005. [Google Scholar]

- Kainuma, Y.; Tawara, N. A Multiple Attribute Utility Theory Approach to Lean and Green Supply Chain Management. Int. J. Prod. Econ. 2006, 101, 99–108. [Google Scholar] [CrossRef]

- Hazen, B.T.; Hall, D.J.; Hanna, J.B. Reverse Logistics Disposition Decision-making: Developing a Decision Framework via Content Analysis. Int. J. Phys. Distr. Log. 2012, 42, 244–274. [Google Scholar] [CrossRef]

- Zhao, M.; Canova, M.; Tian, H.; Shu, G. Design space exploration for waste heat recovery system in automotive application under driving cycle. Energy 2019, 176, 980–990. [Google Scholar] [CrossRef]

- Govindan, K.; Palaniappan, M.; Zhu, Q.; Kannan, D. Analysis of Third Party Reverse Logistics Provider Using Interpretive Structural Modeling. Int. J. Prod. Econ. 2012, 140, 204–211. [Google Scholar] [CrossRef]

- Savaskan, R.C.; van Wassenhove, L.N. Reverse Channel Design: The Case of Competing Retailers. Manag. Sci. 2006, 52, 1–14. [Google Scholar] [CrossRef]

- Jacobs, B.W.; Subramanian, R. Sharing Responsibility for Product Recovery Across the Supply Chain. Prod. Oper. Manag. 2011, 21, 85–100. [Google Scholar] [CrossRef]

- Mayers, K.; Lifset, R.; Bodenhoefer, K.; Van Wassenhove, L.N. Implementing Individual Producer Responsibility for Waste Electrical and Electronic Equipment Through Improved Financing. J. Ind. Ecol. 2013, 17, 186–198. [Google Scholar] [CrossRef]

- Atasu, A.; Savary, M.; van Wassenhove, L.N. Remanufacturing as a Marketing Strategy. Manag. Sci. 2008, 54, 1731–1747. [Google Scholar] [CrossRef]

- Amin, S.H.; Zhang, G. An Integrated Model for Closed-loop Supply Chain Configuration and Supplier Selection: Multi-objective Approach. Expert. Syst. Appl. 2012, 39, 6782–6791. [Google Scholar] [CrossRef]

- Dey, P.K.; Cheffi, W. Green Supply Chain Performance Measurement using the Analytic Hierarchy Process: A Comparative Analysis of Manufacturing Organisations. Prod. Plan. Control. 2013, 24, 702–720. [Google Scholar] [CrossRef]

- Zhang, C.T.; Wang, H.X.; Ren, M.L. Research on pricing and coordination strategy of green supply chain under hybrid production mode. Comput. Ind. Eng. 2014, 72, 24–31. [Google Scholar] [CrossRef]

- Giri, B.C.; Sharma, S. Optimal Production Policy for a Closed-loop Hybrid System with Uncertain Demand and Return under Supply Disruption. J. Clean. Prod. 2016, 112, 2015–2028. [Google Scholar] [CrossRef]

- Sheu, J.B.; Chou, Y.H.; Hu, C.C. An Integrated Logistics Operational Model for Green-supply Chain Management. Transp. Res. Part E Logist. Transp. Rev. 2005, 41, 287–313. [Google Scholar] [CrossRef]

- Matsukawa, I. The Welfare Effects of Environmental Taxation on a Green Market Where Consumers Emit a Pollutant. Environ. Resour. Econ. 2012, 52, 87–107. [Google Scholar] [CrossRef]

- Mitra, S.; Webster, S. Competition in Remanufacturing and the Effects of Government Subsidies. Int. J. Prod. Econ. 2008, 111, 287–298. [Google Scholar] [CrossRef]

- Zhao, R.; Neighbour, G.; Han, J.J.; McGuire, M.; Deutz, P. Using Game Theory to Describe Strategy Selection for Environmental Risk and Carbon Emissions Reduction in the Green Supply Chain. J. Loss Prev. Process Ind. 2012, 25, 927–936. [Google Scholar] [CrossRef]

- Daugbjerg, C.; Sønderskov, K.M. Environmental Policy Performance Revisited: Designing Effective Policies for Green Markets. Polit. Stud. 2012, 60, 399–418. [Google Scholar] [CrossRef]

- Xue, D.; Teunter, R.H.; Zhu, S.X.; Zhou, W. Entering the High-End Market by Collecting and Remanufacturing a Competitor’s High-End Cores. Omega 2019. [Google Scholar] [CrossRef]

- Kopel, M.; Loffler, C. Commitment, First-Mover-, and Second-Mover Advantage. J. Econ. 2008, 94, 143–166. [Google Scholar] [CrossRef]

- Zhu, W.; Xu, X.E. Second-Mover Advantages with Asymmetric Costs and Information Updates: A Product Life Cycle Perspective. Manag. Decis. Econ. 2011, 32, 527–533. [Google Scholar] [CrossRef]

- Toyasaki, F.; Boyaci, T.; Verter, V. An Analysis of Monopolistic and Competitive Take-Back Schemes for WEEE Recycling. Prod. Oper. Manag. 2011, 20, 805–823. [Google Scholar] [CrossRef]

- Sheu, J.B. Bargaining Framework for Competitive Green Supply Chains under Governmental Financial Intervention. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 573–592. [Google Scholar] [CrossRef]

- Sheu, J.B.; Chen, Y.J. Impact of Government Financial Intervention on Competition Among Green Chains. Int. J. Prod. Econ. 2012, 138, 201–213. [Google Scholar] [CrossRef]

- Liu, Z.L.; Anderson, T.D.; Cruz, J.M. Consumer Environmental Awareness and Competition in Two-Stage Supply Chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Chiang, W.K.; Chhajed, D.; Hess, J.D. Direct Marketing, Indirect Profits: A Strategic Analysis of Dual-Channel Supply-Chain Design. Manag. Sci. 2003, 49, 1–20. [Google Scholar] [CrossRef]

- Ferrer, G.; Swaminathan, J.M. Managing New and Remanufactured Products. Manag. Sci. 2006, 52, 15–26. [Google Scholar] [CrossRef]

- Heese, H.S.; Cattani, K.; Ferrer, G.; Gilland, W.; Roth, A.V. Competitive Advantage through Take-Back of Used Products. Eur. J. Oper. Res. 2005, 164, 143–157. [Google Scholar] [CrossRef]

- Liu, Z.; Diallo, C.; Chen, J.; Zhang, M. Optimal Pricing and Production Strategies for New and Remanufactured Products under a Non-Renewing Free Replacement Warranty. Int. J. Prod. Econ. 2019. [Google Scholar] [CrossRef]

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsaur, R.-C. The Optimal Pricing Analysis for Remanufactured Notebooks in a Duopoly Environment. Sustainability 2020, 12, 636. https://doi.org/10.3390/su12020636

Tsaur R-C. The Optimal Pricing Analysis for Remanufactured Notebooks in a Duopoly Environment. Sustainability. 2020; 12(2):636. https://doi.org/10.3390/su12020636

Chicago/Turabian StyleTsaur, Ruey-Chyn. 2020. "The Optimal Pricing Analysis for Remanufactured Notebooks in a Duopoly Environment" Sustainability 12, no. 2: 636. https://doi.org/10.3390/su12020636

APA StyleTsaur, R.-C. (2020). The Optimal Pricing Analysis for Remanufactured Notebooks in a Duopoly Environment. Sustainability, 12(2), 636. https://doi.org/10.3390/su12020636