Optimal Project Planning for Public Rental Housing in South Korea

Abstract

1. Introduction

2. Methodologies

2.1. Genetic Algorithm

2.2. Branch and Bound Method

3. Optimization for Land Development Projects

4. Optimization for Urban Regeneration Projects

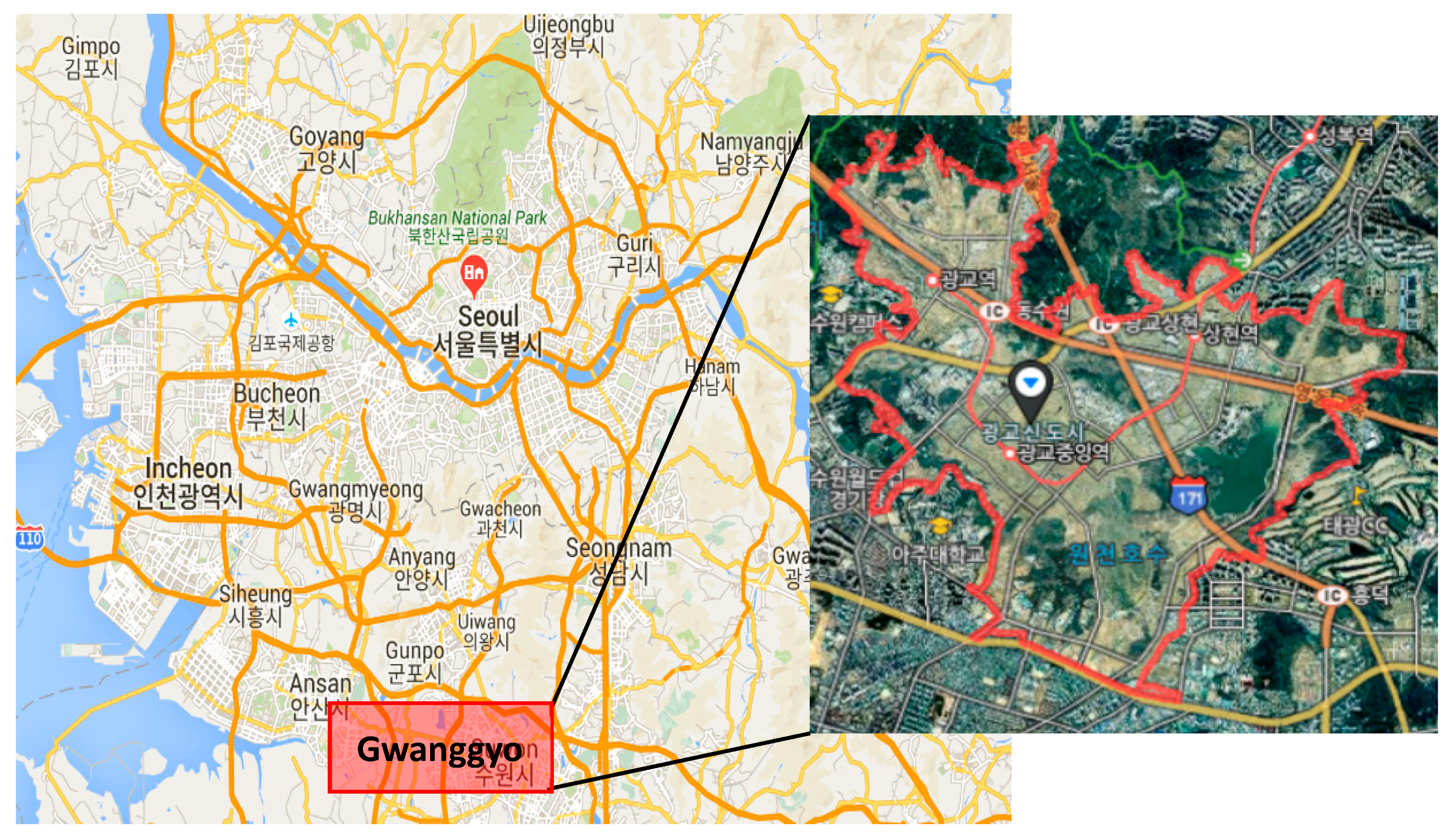

5. Optimal Project Combination for Public Rental Housing

5.1. Public Rental Housing Planning by Arbitrary Selection #1

5.2. Public Rental Housing Planning by Arbitrary Selection #2

5.3. Public Rental Housing Planning Determined by the Branch and Bound Method

5.4. Public Rental Housing Planning by Genetic Algorithm

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- MOLIT. Housing Welfare Roadmap, Ministry of Land; Infrastructure and Transport of Korea: Sejong, Korea, 2017.

- OECD. Housing Dynamics in Korea-Building Inclusive and Smart Cities; OECD: Paris, France, 2018. [Google Scholar]

- Li, X.; Parrott, L. An improved Genetic Algorithm for spatial optimization of multi-objective and multisite land use allocation. Comput. Environ. Urban Syst. 2016, 59, 184–194. [Google Scholar] [CrossRef]

- Ng, S.T.; Skitmore, M.; Wong, K.F. Using genetic algorithms and linear regression analysis for private housing demand forecast. Build. Environ. 2008, 43, 1171–1184. [Google Scholar]

- Cao, K.; Huang, B.; Wang, S.; Lin, H. Sustainable land use optimization using Boundarybased Fast Genetic Algorithm. Comput. Environ. Urban Syst. 2012, 36, 257–269. [Google Scholar] [CrossRef]

- Porta, J.; Parapar, J.; Doallo, R.; Rivera, F.F.; Sante, I.; Crecente, R. High performance genetic algorithm for land use planning. Comput. Environ. Urban Syst. 2013, 37, 45–58. [Google Scholar] [CrossRef]

- Liu, Y.; Tang, W.; He, J.; Liu, Y.; Ai, T.; Liu, D. A landuse spatial optimization model based on genetic optimization and game theory. Comput. Environ. Urban Syst. 2015, 49, 1–14. [Google Scholar] [CrossRef]

- Haque, A.; Asami, Y. Optimizing urban land use allocation for planners and real estate developers. Comput. Environ. Urban Syst. 2014, 46, 57–69. [Google Scholar] [CrossRef]

- Ahn, J.J.; Byun, H.W.; Oh, K.J.; Kim, T.Y. Using ridge regression with genetic algorithm to enhance real estate appraisal forecasting. Expert Syst. Appl. 2012, 39, 8369–8739. [Google Scholar] [CrossRef]

- Taber, J.T.; Balling, R.; Brown, M.R.; Day, K.; Meyer, G.A. Optimizing Transportation Infrastructure Planning with a Multiobjective Genetic Algorithm Model. J. Transp. Res. Board 1999, 1685, 51–56. [Google Scholar] [CrossRef]

- Haque, A.; Asami, Y. Optimizing Urban Land-Use Allocation: Case Study of Dhanmondi Residential Area, Dhaka, Bangladesh. Environ. Plan. B Plan. Des. 2011, 38, 388–410. [Google Scholar] [CrossRef]

- Cao, K.; Batty, M.; Huang, B.; Liu, Y.; Yu, L.; Chen, J. Spatial multi-objective land use optimization: Extensions to the non-dominated sorting genetic algorithm-II. Int. J. Geogr. Inf. Sci. 2011, 25, 1949–1969. [Google Scholar] [CrossRef]

- Stewart, T.J.; Janssen, R.; Herwijnen, M.V. A genetic algorithm approach to multiobjective land use planning. Comput. Oper. Res. 2004, 31, 2293–2313. [Google Scholar] [CrossRef]

- Zhang, H.H.; Zeng, Y.N.; Bian, L. Simulating Multi-Objective Spatial Optimization Allocation of Land Use Based on the Integration of Multi-Agent System and Genetic Algorithm. Int. J. Environ. Res. 2010, 4, 765–776. [Google Scholar]

- Jin, Y.H.; Yu, J.S. Analysis of the Risk Factors of Block-unit Housing Rearrangement Project Using Fuzzy Multi-Criteria Decision-Making Method: Focusing on Incheon Metropolitan City Case. J. Korean Urban Manag. Assoc. 2019, 32, 87–112. [Google Scholar]

- Chauhan, N.; Choi, B.-J. Denoising Approaches Using Fuzzy Logic and Convolutional Autoencoders for Human Brain MRI Image. Int. J. Fuzzy Log. Intell. Syst. 2019, 19, 135–139. [Google Scholar] [CrossRef]

- Bae, S.; Yu, J. Estimation of the Apartment Housing Price Using the Machine Learning Methods: The Case of Gangnam-gu, Seoul. J. Korea Real Estate Anal. Assoc. 2018, 24, 69–85. [Google Scholar] [CrossRef]

- Oh, S.-J.; Lim, C.-O.; Park, B.-C.; Lee, J.-C.; Shin, S.-C. Deep Neural Networks for Maximum Stress Prediction in Piping Design. Int. J. Fuzzy Log. Intell. Syst. 2019, 19, 140–146. [Google Scholar] [CrossRef]

- Park, J.H.; Geem, Z.W.; Yu, J.S. The Optimal Investment Portfolio for Land Development Projects of Public Company. Korean Apprais. Rev. 2016, 26, 23–38. [Google Scholar]

- Park, J.H.; Geem, Z.W.; Yu, J.S. The Optimal Project Combination for Urban Regeneration New Deal Projects. Korean Apprais. Rev. 2018, 28, 23–37. [Google Scholar]

- Park, J.H.; Yu, J.S.; Geem, Z.W. Genetic Algorithm-based Optimal Investment Scheduling for Public Rental Housing Projects in South Korea. Int. J. Fuzzy Log. Intell. Syst. 2018, 18, 135–145. [Google Scholar] [CrossRef]

- Lee, J.H.; Lim, S. An Analytic Hierarchy Process (AHP) Approach for Sustainable Assessment of Economy-Based and Community-Based Urban Regeneration: The Case of South Korea. Sustainability 2018, 10, 4456. [Google Scholar]

- MOLIT. Urban Regeneration New Deal Project Seminar Booklet, Ministry of Land; Infrastructure and Transport of Korea: Sejong, Korea, 2017.

- Ha, S.K. The Urban Poor, Rental Accommodations, and Housing Policy in Korea. Cities 2002, 19, 195–203. [Google Scholar] [CrossRef]

| Profit Type | Project | ROI * | Investment (108 KRW) ** | Profit Type *** | Region | Biz Division | Partnership **** | Personnel |

|---|---|---|---|---|---|---|---|---|

| Low profit | A | −2% | 1000 | Non-for-profit | East | New town | Possible | 30 |

| B | 1% | 800 | Non-for-profit | West | New town | Possible | 24 | |

| C | −1% | 600 | Non-for-profit | South | New town | Possible | 18 | |

| High profit | D | 5% | 400 | For-profit | North | New town | Possible | 12 |

| E | 6% | 200 | For-profit | East | New town | Impossible | 6 | |

| F | 5% | 1000 | For-profit | West | Industrial complex | Impossible | 30 | |

| Low profit | G | 2% | 800 | Non-for-profit | South | Industrial complex | Impossible | 24 |

| H | 1% | 600 | Non-for-profit | North | Industrial complex | Impossible | 18 | |

| I | −2% | 400 | Non-for-profit | East | Industrial complex | Possible | 12 | |

| High profit | J | 5% | 200 | For-profit | West | Industrial complex | Possible | 6 |

| K | 6% | 1000 | For-profit | South | Housing | Possible | 30 | |

| L | 5% | 800 | For-profit | North | Housing | Possible | 24 | |

| Low profit | M | −2% | 600 | Non-for-profit | East | Housing | Impossible | 18 |

| N | 1% | 400 | Non-for-profit | West | Housing | Impossible | 12 | |

| O | −2% | 200 | Non-for-profit | South | Housing | Impossible | 6 | |

| High profit | P | 5% | 1000 | For-profit | North | New town | Impossible | 30 |

| Q | 6% | 800 | For-profit | East | New town | Possible | 24 | |

| R | 5% | 600 | For-profit | West | Industrial complex | Possible | 18 | |

| Low profit | S | 1% | 400 | Non-for-profit | South | Industrial complex | Impossible | 12 |

| T | −2% | 200 | Non-for-profit | North | Housing | Impossible | 6 |

| Project | Investment Amount | Non-for- Profit | Project Area | Business Division | Person | Profit (10 billion KRW) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| East | West | South | North | New Town | Industrial Complex | Housing | |||||

| A | - | - | - | - | - | - | - | - | - | - | - |

| B | 8 | 8 | - | 8 | - | - | 8 | - | - | 24 | 0.08 |

| C | - | - | - | - | - | - | - | - | - | - | - |

| D | 4 | 4 | - | - | - | 4 | 4 | - | - | 12 | 0.2 |

| E | 2 | - | 2 | - | - | - | 2 | - | - | 6 | 0.12 |

| F | 10 | - | - | 10 | - | - | - | 10 | - | 30 | 0.5 |

| G | 8 | 8 | - | - | 8 | - | - | 8 | - | 24 | 0.16 |

| H | 6 | 6 | - | - | - | 6 | - | 6 | - | 18 | 0.06 |

| I | - | - | - | - | - | - | - | - | - | - | - |

| J | 2 | - | - | 2 | - | - | - | 2 | - | 6 | 0.1 |

| K | 10 | - | - | - | 10 | - | - | - | 10 | 30 | 0.6 |

| L | 8 | - | - | - | - | 8 | - | - | 8 | 24 | 0.4 |

| M | - | - | - | - | - | - | - | - | - | - | - |

| N | 4 | 4 | - | 4 | - | - | - | - | 4 | 12 | 0.04 |

| O | - | - | - | - | - | - | - | - | - | - | - |

| P | 10 | - | - | - | - | 10 | 10 | - | - | 30 | 0.5 |

| Q | 8 | - | 8 | - | - | - | 8 | - | - | 24 | 0.48 |

| R | 6 | - | - | 6 | - | - | - | 6 | - | 18 | 0.3 |

| S | 4 | 4 | - | - | 4 | - | - | 4 | - | 12 | 0.04 |

| T | - | - | - | - | - | - | - | - | - | - | - |

| Total | 90 | 30 | 10 | 30 | 22 | 28 | 32 | 36 | 22 | 270 | 3.58 |

| Evaluation Criteria | Score Points | Detail Evaluation Criteria | Score Points |

|---|---|---|---|

| Urgency and Necessity of project | 30 | Urgency of project (Region deterioration, Safety) | 15 |

| Necessity of project (Community participation) | 15 | ||

| Feasibility of project plan | 40 | Local government’s organization for project | 5 |

| Relevance of project plan | 10 | ||

| Plan of land acquisition and finance for project | 15 | ||

| Community participation and empowerment training | 10 | ||

| Effect of project | 30 | Housing welfare and improvement of quality of life | 10 |

| Job creation effect | 10 | ||

| Social integration and sustainability | 5 | ||

| Countermeasure towards side-effects of the real estate market | 5 |

| Project Model (Number) | Project Name |

|---|---|

| DM (13) | B1, C1, E1, F2, G3, H1, J2, K1, M1, M2, N1, O1, P1 |

| ESM (2) | A4, B4 |

| PCPM (10) | C3, D3, F3, G4, H2, I2, J3, K2, L3, M3 |

| Project Model (Number) | Project Name |

|---|---|

| DM (13) | B1, C1, E1, F2, G2, G3, H1, K1, L2, N1, O1, P1, P2 |

| ESM (2) | D4, K4 |

| PCPM (10) | A3, H2, I2, J3, K2, L3, M3, N2, O2, P3 |

| Local Govt. (Number) | Project Name | Project Model | Score of Evaluation | Local Govt. (Number) | Project Name | Project Model | Score of Evaluation |

|---|---|---|---|---|---|---|---|

| Busan (1) | A1 | DM | 74 | Chungcheong (North) (1) | I1 | DM | 73 |

| A2 | DM | 76 | I2 | PCPM | 89 | ||

| A3 | PCPM | 86 | I3 | ESM | 84 | ||

| A4 | ESM | 83 | I4 | ESM | 76 | ||

| Daegu (1) | B1 | DM | 83 | Chungcheong (South) (1) | J1 | DM | 79 |

| B2 | DM | 83 | J2 | DM | 82 | ||

| B3 | PCPM | 80 | J3 | PCPM | 91 | ||

| B4 | ESM | 83 | J4 | ESM | 79 | ||

| Incheon (1) | C1 | DM | 88 | Jeolla (North) (3) | K1 | DM | 88 |

| C2 | DM | 73 | K2 | PCPM | 94 | ||

| C3 | PCPM | 86 | K3 | ESM | 79 | ||

| C4 | ESM | 75 | K4 | ESM | 86 | ||

| Gwangju (1) | D1 | DM | 74 | Jeolla (South) (2) | L1 | DM | 81 |

| D2 | DM | 73 | L2 | DM | 85 | ||

| D3 | PCPM | 84 | L3 | PCPM | 92 | ||

| D4 | ESM | 83 | L4 | ESM | 79 | ||

| Daejeon (1) | E1 | DM | 92 | Gyeongsang (North) (1) | M1 | DM | 79 |

| E2 | DM | 84 | M2 | DM | 82 | ||

| E3 | PCPM | 83 | M3 | PCPM | 92 | ||

| E4 | ESM | 82 | M4 | ESM | 78 | ||

| Ulsan (1) | F1 | DM | 73 | Gyeongsang (South) (2) | N1 | DM | 85 |

| F2 | DM | 86 | N2 | PCPM | 89 | ||

| F3 | PCPM | 85 | N3 | ESM | 84 | ||

| F4 | ESM | 77 | N4 | ESM | 84 | ||

| Gyeonggi (2) | G1 | DM | 80 | Jeju (2) | O1 | DM | 87 |

| G2 | DM | 82 | O2 | PCPM | 90 | ||

| G3 | DM | 86 | O3 | ESM | 81 | ||

| G4 | PCPM | 85 | O4 | ESM | 80 | ||

| G5 | ESM | 81 | Sejong (3) | P1 | DM | 87 | |

| G6 | ESM | 83 | P2 | DM | 83 | ||

| Gangwon (2) | H1 | DM | 95 | P3 | PCPM | 90 | |

| H2 | PCPM | 89 | P4 | ESM | 77 | ||

| H3 | ESM | 81 | |||||

| H4 | ESM | 83 |

| Type | Housing Project | Construction Period | Investment (108 KRW) | Detail of Investment |

|---|---|---|---|---|

| Sales Housing | Sub Total | 30,345 | ||

| Gimpo-Yangchon | 2008.4~2010.12 | 437 | Land price +Construction cost | |

| Gwanggyo Edu-town 12 | 2009.11~2012.11 | 2613 | Construction cost (GICO’s land) | |

| Gwanggyo Edu--town 13–15 | 2009.12~2012.12 | 2225 | Construction cost (GICO’s land) | |

| Gimpo-Hangang Ab–1 | 2009.12~2013.2 | 2617 | Land price +Construction cost | |

| Gimpo-Hangang Ab–7 | 2009.12~2013.2 | 3028 | Land price +Construction cost | |

| Wirye A2–11 | 2014.4~2016.9 | 6758 | Land price +Construction cost | |

| Wirye A2–2 | 2015.4~2017.9 | 4661 | Land price +Construction cost | |

| Namyangju-Dasan B2 | 2015.4~2017.11 | 2166 | Construction cost (GICO’s land) | |

| Namyangju-Dasan B4 | 2015.4~2017.11 | 2938 | Construction cost (GICO’s land) | |

| Namyangju-Dasan S1 | 2015.12~2018.6 | 2902 | Construction cost (GICO’s land) | |

| Rental Housing | Gimpo-Hangang Ab-2 | 2012.1~2013.2 | 1091 | Land price +Construction cost |

| Site Name | Number of Houses | ConstructionCompletion | Total Area (m2) (A) | Estimated Construction Cost (KRW) per m2 (B) | Total Construction Cost (108 KRW) of GICO |

|---|---|---|---|---|---|

| Total | 6956 | 804,656 | 8673 | ||

| A10 | 701 | 2013.11 | 111,002 | 1,077,893 | 1196 |

| A11 | 637 | 2013.11 | 102,334 | 1103 | |

| A16 | 224 | 2014.7 | 34,680 | 374 | |

| A19 | 1373 | 2011.11 | 112,458 | 1212 | |

| A23 | 258 | 2014.2 | 39,979 | 431 | |

| A24 | 394 | 2014.2 | 54,883 | 592 | |

| A25 | 146 | 2011.10 | 13,091 | 141 | |

| A26 | 1132 | 2013.12 | 172,477 | 1859 | |

| A30 | 2091 | 2011.12 | 163,752 | 1765 |

| Name of Site | Number of Houses | Investment Amount (100m.) | Selection | Number of Selected Houses | Investment Amount (100m.) | |

|---|---|---|---|---|---|---|

| Rental house (10) | Gwanggyo A10 | 701 | 1196 | X | - | - |

| Gwanggyo A11 | 637 | 1103 | X | - | - | |

| Gwanggyo A16 | 224 | 374 | X | - | - | |

| Gwanggyo A19 | 1373 | 1212 | X | - | - | |

| Gwanggyo A23 | 258 | 431 | X | - | - | |

| Gwanggyo A24 | 394 | 592 | X | - | - | |

| Gwanggyo A25 | 146 | 141 | X | - | - | |

| Gwanggyo A26 | 1132 | 1859 | X | - | - | |

| Gwanggyo A30 | 2091 | 1765 | O | 2091 | 1765 | |

| Gimpo Ab-2 | 559 | 1091 | X | - | - | |

| Sub Total | 7515 | 9764 | 1 site selected | 2091 | 1765 | |

| Sales house (10) | Gimpo-Yangchon | 743 | 437 | O | 743 | 437 |

| Gwanggyo-Edutown 12 | 1764 | 2613 | O | 1764 | 2613 | |

| Gwanggyo-Edutown 13~15 | 1173 | 2225 | O | 1173 | 2225 | |

| Gimpo-Hangang Ab-1 | 1167 | 2617 | O | 1167 | 2617 | |

| Gimpo-Hangang Ab-7 | 1382 | 3028 | O | 1382 | 3028 | |

| Wirye A2-11 | 1540 | 6758 | O | 1540 | 6758 | |

| Wirye A2-2 | 1413 | 4661 | O | 1413 | 4661 | |

| Namyangju-Dasan B2 | 1186 | 2166 | O | 1186 | 2166 | |

| Namyangju-Dasan B4 | 1615 | 2938 | X | - | - | |

| Namyangju-Dasan S1 | 1685 | 2902 | O | 1685 | 2902 | |

| Sub Total | 13,668 | 30,345 | 9 sites selected | 12,053 | 27,407 | |

| Total | 21,183 | 40,109 | 10 sites selected | 14,144 | 29,172 | |

| Name of Site | Number of Houses | Investment Amount (100m.) | Selection | Number of Selected Houses | Investment Amount (100m.) | |

|---|---|---|---|---|---|---|

| Rental house (10) | Gwanggyo A10 | 701 | 1196 | O | 701 | 1196 |

| Gwanggyo A11 | 637 | 1103 | X | - | - | |

| Gwanggyo A16 | 224 | 374 | X | - | - | |

| Gwanggyo A19 | 1373 | 1212 | O | 1373 | 1212 | |

| Gwanggyo A23 | 258 | 431 | X | - | - | |

| Gwanggyo A24 | 394 | 592 | X | - | - | |

| Gwanggyo A25 | 146 | 141 | X | - | - | |

| Gwanggyo A26 | 1132 | 1859 | O | 1132 | 1859 | |

| Gwanggyo A30 | 2091 | 1765 | O | 2091 | 1765 | |

| Gimpo Ab-2 | 559 | 1091 | X | - | - | |

| Sub Total | 7515 | 9764 | 4 sites selected | 5297 | 6032 | |

| Sales house (10) | Gimpo-Yangchon | 743 | 437 | O | 743 | 437 |

| Gwanggyo-Edutown 12 | 1764 | 2613 | O | 1764 | 2613 | |

| Gwanggyo-Edutown 13~15 | 1173 | 2225 | O | 1173 | 2225 | |

| Gimpo-Hangang Ab-1 | 1167 | 2617 | O | 1167 | 2617 | |

| Gimpo-Hangang Ab-7 | 1382 | 3028 | O | 1382 | 3028 | |

| Wirye A2-11 | 1540 | 6758 | X | - | - | |

| Wirye A2-2 | 1413 | 4661 | O | 1413 | 4661 | |

| Namyangju-Dasan B2 | 1186 | 2166 | O | 1186 | 2166 | |

| Namyangju-Dasan B4 | 1615 | 2938 | O | 1615 | 2938 | |

| Namyangju-Dasan S1 | 1685 | 2902 | O | 1685 | 2902 | |

| Sub Total | 13,668 | 30,345 | 9 sites selected | 12,128 | 23,587 | |

| Total | 21,183 | 40,109 | 13 sites selected | 17,425 | 29,619 | |

| Name of Site | Number of Houses | Investment Amount (100m.) | Selection | Number of Selected Houses | Investment Amount (100m.) | |

|---|---|---|---|---|---|---|

| Rental house (10) | Gwanggyo A10 | 701 | 1196 | O | 701 | 1196 |

| Gwanggyo A11 | 637 | 1103 | X | - | - | |

| Gwanggyo A16 | 224 | 374 | O | 224 | 374 | |

| Gwanggyo A19 | 1373 | 1212 | O | 1373 | 1212 | |

| Gwanggyo A23 | 258 | 431 | O | 258 | 431 | |

| Gwanggyo A24 | 394 | 592 | O | 394 | 592 | |

| Gwanggyo A25 | 146 | 141 | O | 146 | 141 | |

| Gwanggyo A26 | 1132 | 1859 | X | - | - | |

| Gwanggyo A30 | 2091 | 1765 | O | 2091 | 1765 | |

| Gimpo Ab-2 | 559 | 1091 | X | - | - | |

| Sub Total | 7515 | 9764 | 7 sites selected | 5187 | 5711 | |

| Sales house (10) | Gimpo-Yangchon | 743 | 437 | O | 743 | 437 |

| Gwanggyo-Edutown 12 | 1764 | 2613 | O | 1764 | 2613 | |

| Gwanggyo-Edutown 13~15 | 1173 | 2225 | O | 1173 | 2225 | |

| Gimpo-Hangang Ab-1 | 1167 | 2617 | O | 1167 | 2617 | |

| Gimpo-Hangang Ab-7 | 1382 | 3028 | O | 1382 | 3028 | |

| Wirye A2-11 | 1540 | 6758 | X | - | - | |

| Wirye A2-2 | 1413 | 4661 | O | 1413 | 4661 | |

| Namyangju-Dasan B2 | 1186 | 2166 | O | 1186 | 2166 | |

| Namyangju-Dasan B4 | 1615 | 2938 | O | 1615 | 2938 | |

| Namyangju-Dasan S1 | 1685 | 2902 | O | 1685 | 2902 | |

| Sub Total | 13,668 | 30,345 | 9 sites selected | 12,128 | 23,587 | |

| Total | 21,183 | 40,109 | 16 sites selected | 17,315 | 29,298 | |

| Name of Site | Number of Houses | Investment Amount (100m.) | Selection | Number of Selected Houses | Investment Amount (100m.) | |

|---|---|---|---|---|---|---|

| Rental house (10) | Gwanggyo A10 | 701 | 1196 | X | - | - |

| Gwanggyo A11 | 637 | 1103 | O | 637 | 1103 | |

| Gwanggyo A16 | 224 | 374 | X | - | - | |

| Gwanggyo A19 | 1373 | 1212 | O | 1373 | 1212 | |

| Gwanggyo A23 | 258 | 431 | X | - | - | |

| Gwanggyo A24 | 394 | 592 | O | 394 | 592 | |

| Gwanggyo A25 | 146 | 141 | O | 146 | 141 | |

| Gwanggyo A26 | 1132 | 1859 | O | 1132 | 1859 | |

| Gwanggyo A30 | 2091 | 1765 | X | - | - | |

| Gimpo Ab-2 | 559 | 1091 | X | - | - | |

| Sub Total | 7515 | 9764 | 5 sites selected | 5773 | 6672 | |

| Sales house (10) | Gimpo-Yangchon | 743 | 437 | O | 743 | 437 |

| Gwanggyo-Edutown 12 | 1764 | 2613 | O | 1764 | 2613 | |

| Gwanggyo-Edutown 13~15 | 1173 | 2225 | O | 1173 | 2225 | |

| Gimpo-Hangang Ab-1 | 1167 | 2617 | O | 1167 | 2617 | |

| Gimpo-Hangang Ab-7 | 1382 | 3028 | O | 1382 | 3028 | |

| Wirye A2-11 | 1540 | 6758 | X | - | - | |

| Wirye A2-2 | 1413 | 4661 | O | 1413 | 4661 | |

| Namyangju-Dasan B2 | 1186 | 2166 | O | 1186 | 2166 | |

| Namyangju-Dasan B4 | 1615 | 2938 | O | 1615 | 2938 | |

| Namyangju-Dasan S1 | 1685 | 2902 | O | 1685 | 2902 | |

| Sub Total | 13,668 | 30,345 | 9 sites selected | 12,128 | 23,587 | |

| Total | 21,183 | 40,109 | 14 sites selected | 17,901 | 30,259 | |

| Method | Arbitrary Selection #1 | Arbitrary Selection #2 | Branch & Bound Method | Genetic Algorithm |

|---|---|---|---|---|

| Number of Public Rental Houses | 2091 | 5297 | 5187 | 5773 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, J.H.; Yu, J.-S.; Geem, Z.W. Optimal Project Planning for Public Rental Housing in South Korea. Sustainability 2020, 12, 600. https://doi.org/10.3390/su12020600

Park JH, Yu J-S, Geem ZW. Optimal Project Planning for Public Rental Housing in South Korea. Sustainability. 2020; 12(2):600. https://doi.org/10.3390/su12020600

Chicago/Turabian StylePark, Jae Ho, Jung-Suk Yu, and Zong Woo Geem. 2020. "Optimal Project Planning for Public Rental Housing in South Korea" Sustainability 12, no. 2: 600. https://doi.org/10.3390/su12020600

APA StylePark, J. H., Yu, J.-S., & Geem, Z. W. (2020). Optimal Project Planning for Public Rental Housing in South Korea. Sustainability, 12(2), 600. https://doi.org/10.3390/su12020600