A Systematic Review of Research on Sustainability in Mergers and Acquisitions

Abstract

1. Introduction

2. Theoretical Approach

3. Data Collection and Bibliometric Methods

4. Results

4.1. Evaluative Techniques

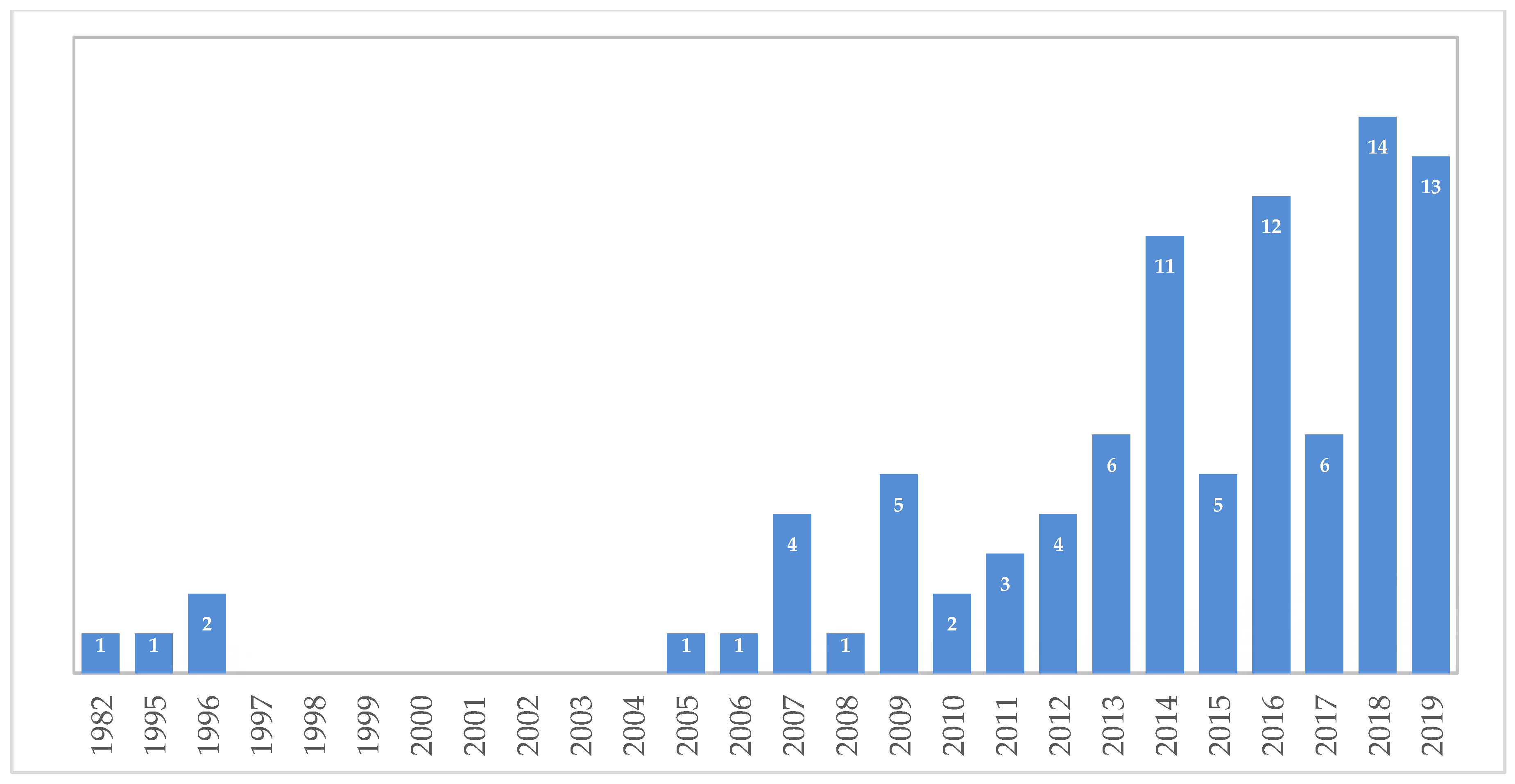

4.1.1. Measures of Productivity

4.1.2. Measures of Impact: Citation Analysis

4.2. Relational Techniques

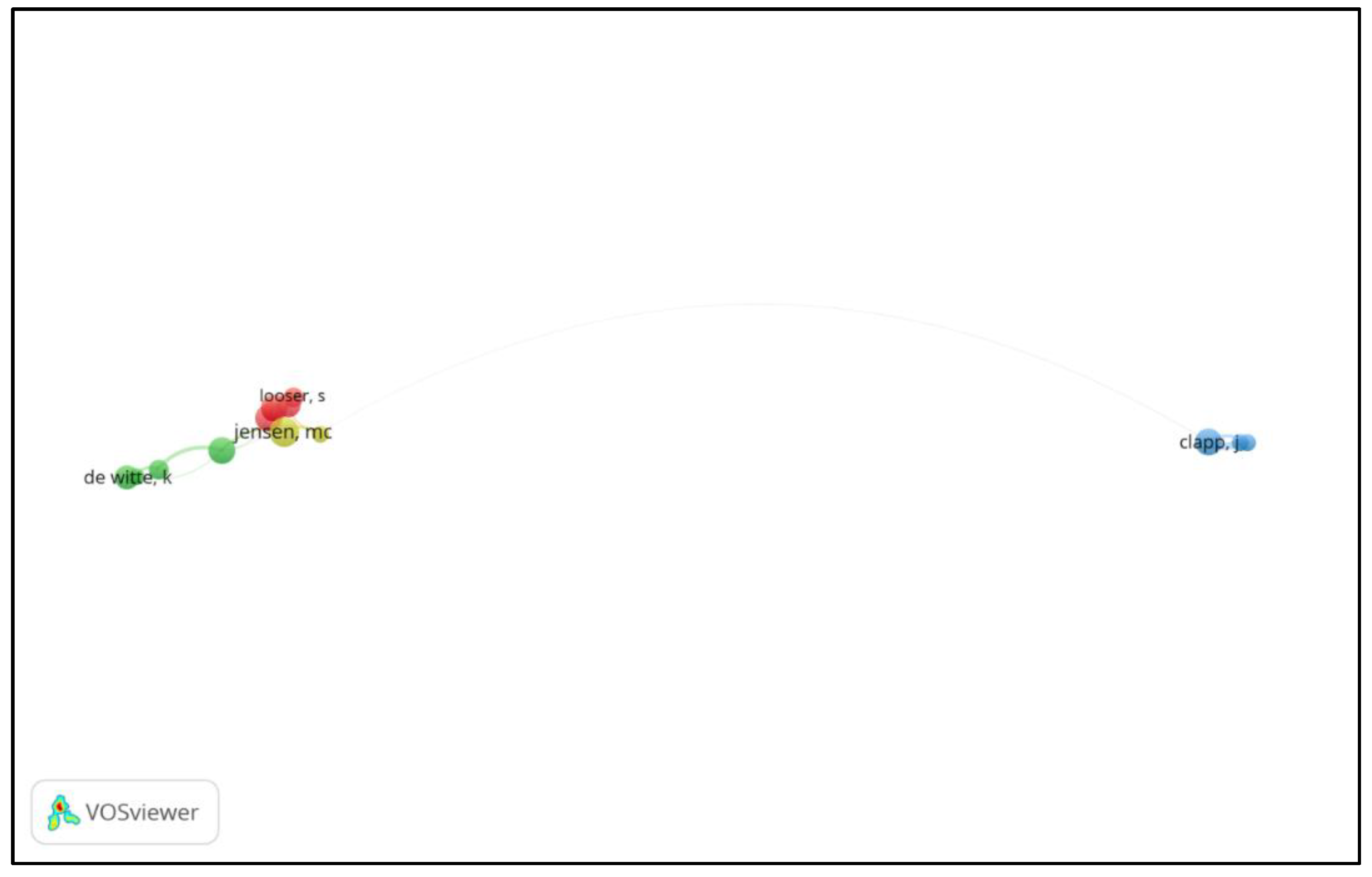

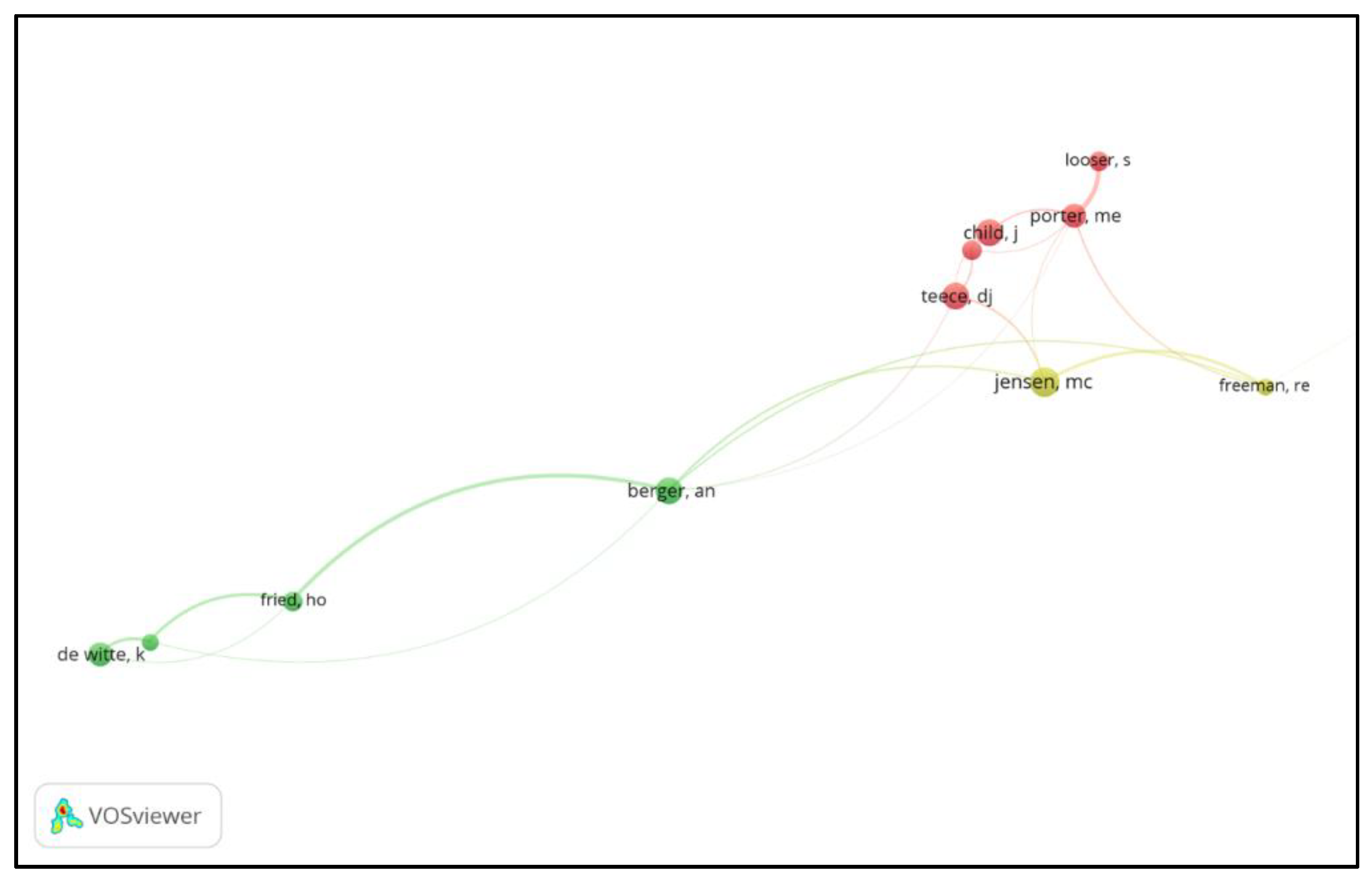

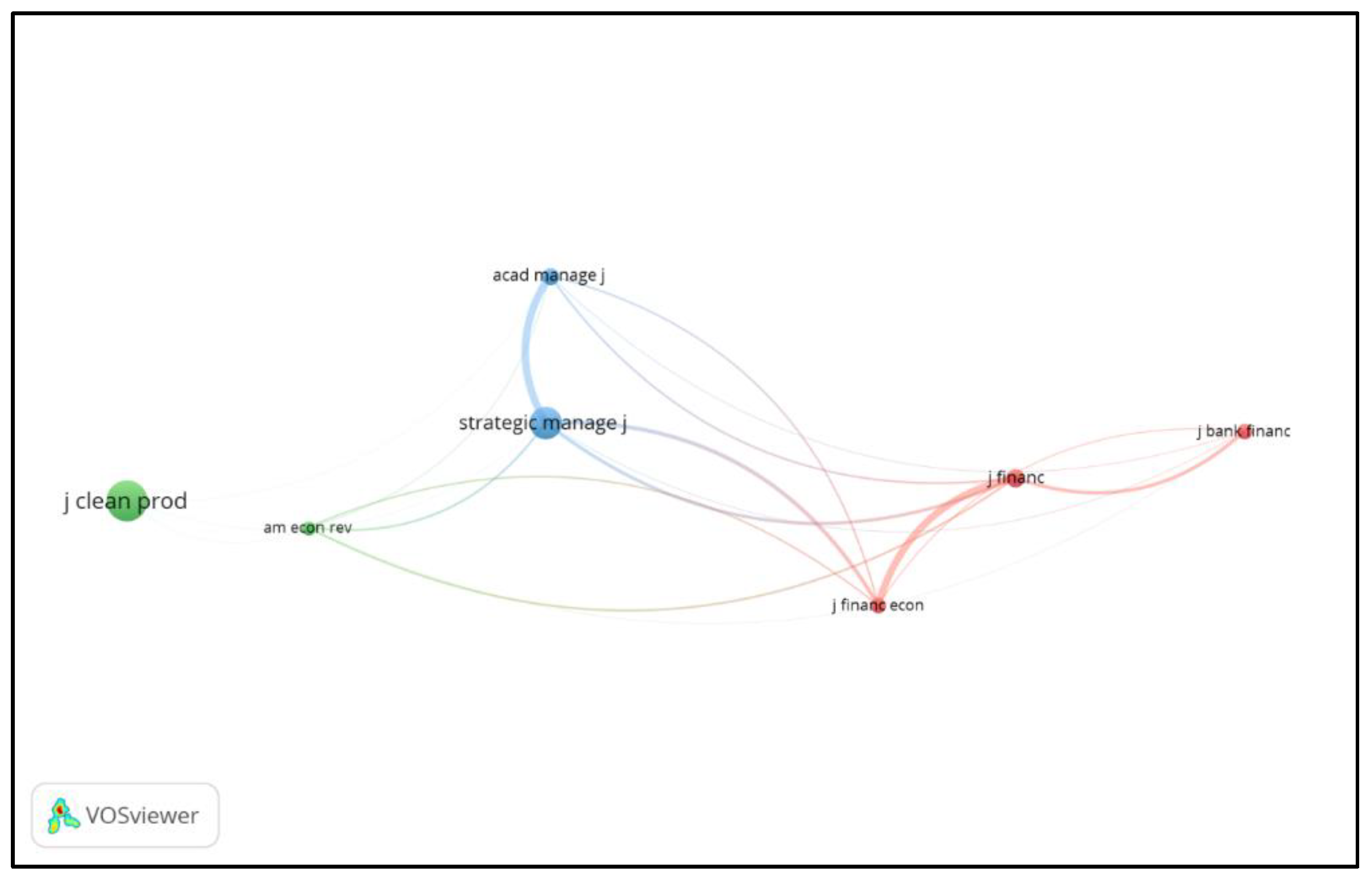

4.2.1. Co-Citation Analysis

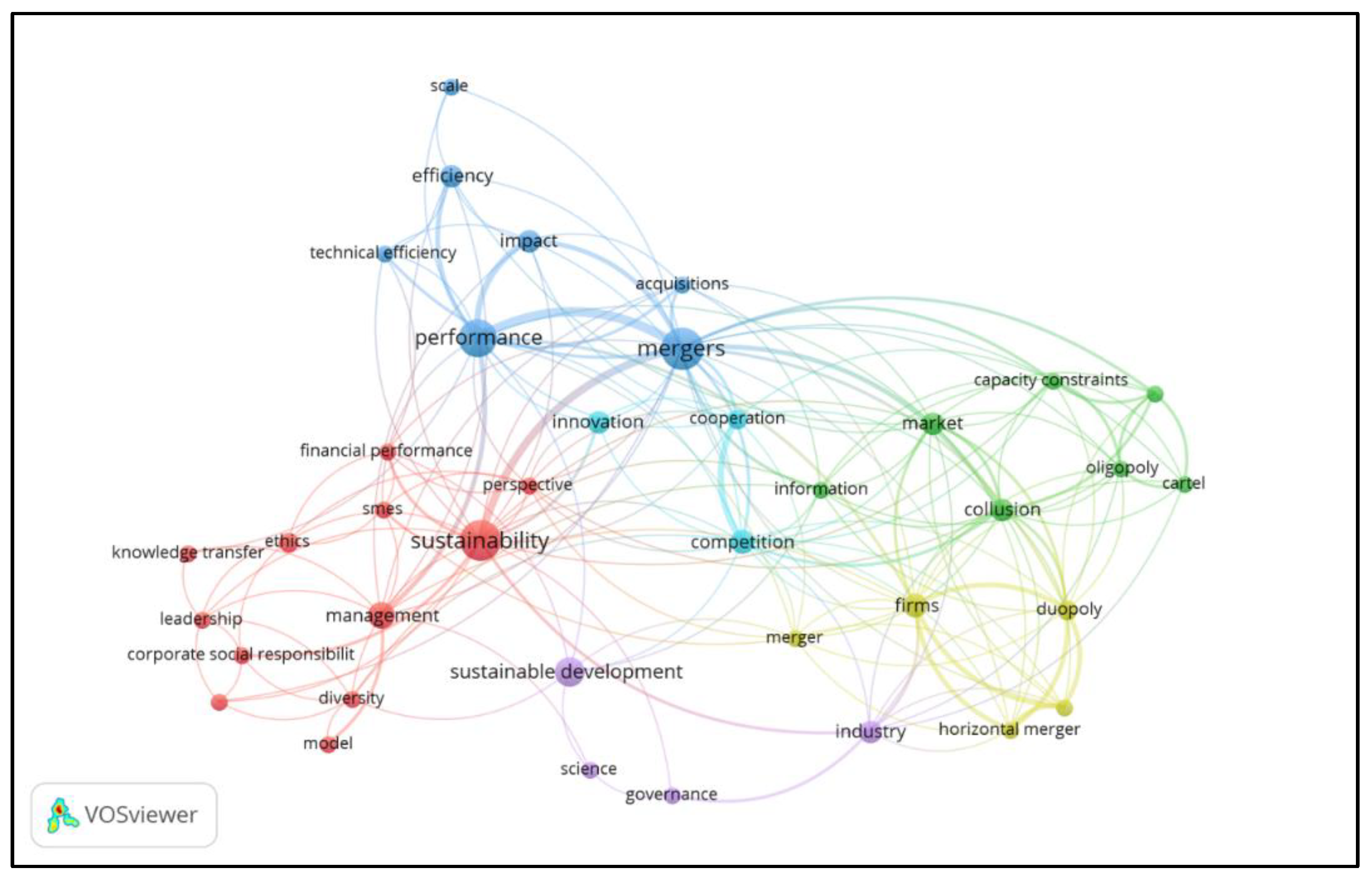

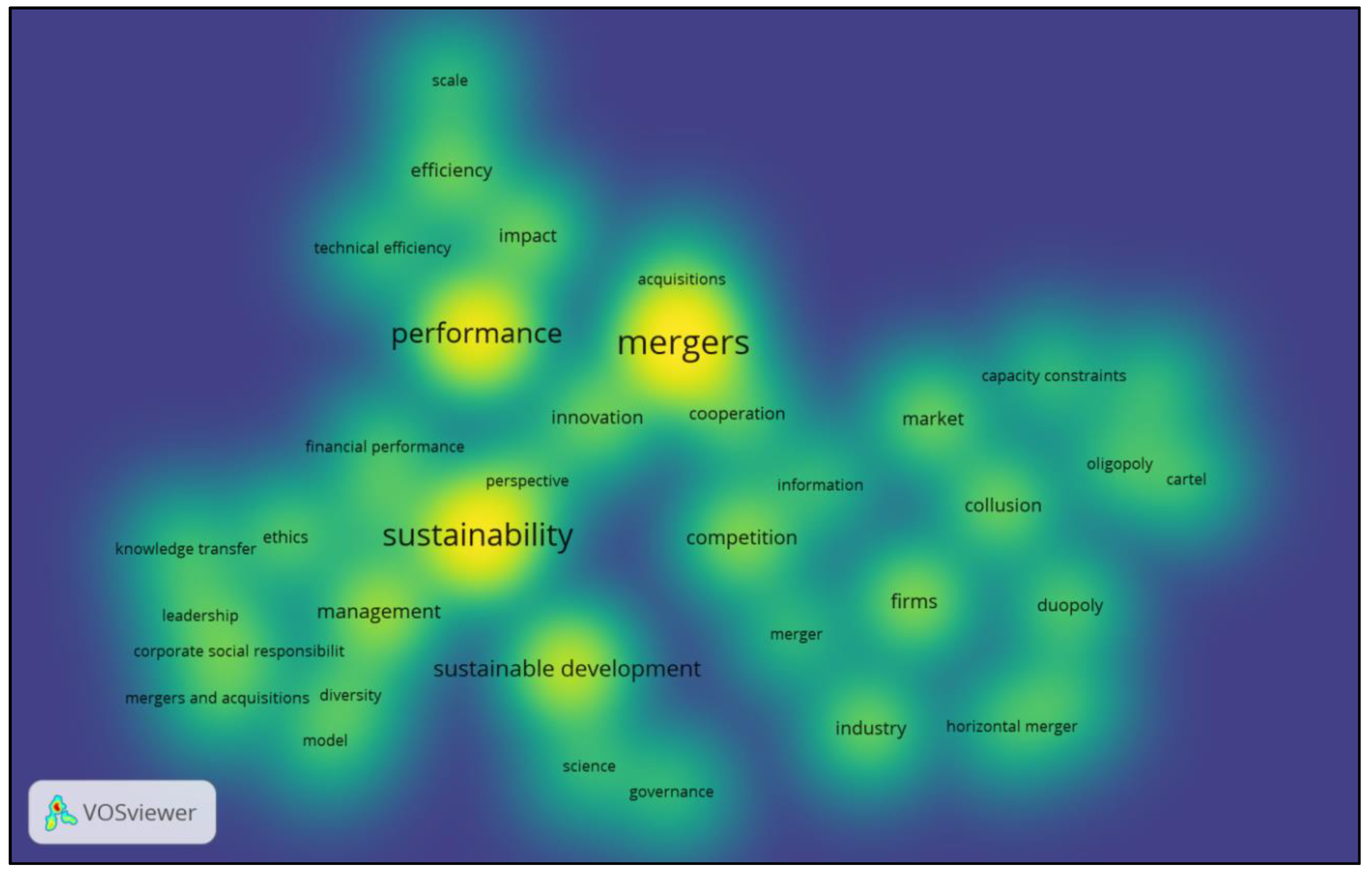

4.2.2. Co-Word Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Purvis, B.; Mao, Y.; Robinson, D. Three pillars of sustainability: In search of conceptual origins. Sustain. Sci. 2019, 14, 681–695. [Google Scholar] [CrossRef]

- Jeurissen, R. John Elkington, Cannibals with Forks—Triple Bottom Line of 21st Century Business. J. Bus. Ethics 2000, 23, 229–231. [Google Scholar] [CrossRef]

- Alba-Hidalgo, D.; Benayas del Álamo, J.; Gutiérrez-Pérez, J. Towards a definition of environmental sustainability evaluation in higher education. High. Educ. Policy 2018, 31, 447–470. [Google Scholar] [CrossRef]

- Alhaddi, H. Triple bottom line and sustainability: A literature review. Bus. Manag. Stud. 2015, 1, 6–10. [Google Scholar] [CrossRef]

- Dezi, L.; Battisti, E.; Ferraris, A.; Papa, A. The link between mergers and acquisitions and innovation: A systematic literature review. Manag. Res. Rev. 2018, 41, 716–752. [Google Scholar] [CrossRef]

- Christofi, M.; Vrontis, D.; Thrassou, A.; Shams, S.R. Triggering technological innovation through cross-border mergers and acquisitions: A micro-foundational perspective. Technol. Forecast. Soc. Chang. 2019, 146, 148–166. [Google Scholar] [CrossRef]

- Ferreira, M.P.; Santos, J.C.; de Almeida, M.I.R.; Reis, N.R. Mergers & acquisitions research: A bibliometric study of top strategy and international business journals, 1980–2010. J. Bus. Res. 2014, 67, 2550–2558. [Google Scholar]

- Gomezelj, D.O. A systematic review of research on innovation in hospitality and tourism. Int. J. Con. Hosp. Man. 2016, 28, 516–558. [Google Scholar] [CrossRef]

- Marasco, A.; De Martino, M.; Magnotti, F.; Morvillo, A. Collaborative innovation in tourism and hospitality: A systematic review of the literature. Int. J. Contemp. Hosp. Manag. 2018, 30, 2364–2395. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef]

- Fabregat-Aibar, L.; Barberà-Mariné, M.G.; Terceño, A.; Pié, L. A bibliometric and visualization analysis of socially responsible funds. Sustainability 2019, 11, 2526. [Google Scholar] [CrossRef]

- Gupta, P.K. Mergers and acquisitions (M&A): The strategic concepts for the nuptials of corporate sector. Innov. J. Bus. Manag. 2012, 1, 60–68. [Google Scholar]

- Leon-Gonzales, R.; Tole, L. The determinants of mergers & acquisitions in a resource-based industry: What role for environmental sustainability? Rev. Econ. Anal. 2015, 7, 111–134. [Google Scholar]

- Seth, A.; Song, K.P.; Pettit, R. Synergy, managerialism or hubris? An empirical examination of motives for foreign acquisitions of US firms. J. Int. Bus. Stud. 2000, 31, 387–405. [Google Scholar] [CrossRef]

- Al-Sharkas, A.A.; Hassan, M.K.; Lawrence, S. The impact of mergers and acquisitions on the efficiency of the US banking industry: Further evidence. J. Bus. Financ. Account. 2008, 35, 50–70. [Google Scholar] [CrossRef]

- Capron, L.; Pistre, N. When do acquirers earn abnormal returns? Strateg. Manag. J. 2002, 23, 781–794. [Google Scholar] [CrossRef]

- Laamanen, T.; Keil, T. Performance of serial acquirers: Toward an acquisition program perspective. Strateg. Manag. J. 2008, 29, 663–672. [Google Scholar] [CrossRef]

- Gaughan, P.A. Mergers, Acquisitions, and Corporate Restructuring, 3rd ed.; John Wiley & Sons: New York, NY, USA, 2002. [Google Scholar]

- Marks, M.L.; Mirvis, P.H. A framework for the human resources role in managing culture in mergers and acquisitions. Hum. Resour. Manag. 2011, 50, 859–877. [Google Scholar] [CrossRef]

- Weber, Y. Corporate cultural fit and performance in mergers and acquisitions. Hum. Relat. 1996, 49, 1181–1202. [Google Scholar] [CrossRef]

- Öberg, C. The Importance of Customers in Mergers and Acquisitions. Ph.D. Thesis, Institutionen för ekonomisk och industriell utveckling, Linköpin, Sweden, 2008. [Google Scholar]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence informed management knowledge by means of systematic review. Br. J. Man. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Becheikh, N.; Landry, R.; Amara, N. Lessons from innovation empirical studies in the manufacturing sector: A systematic review of the literature from 1993–2003. Technovation 2006, 26, 644–674. [Google Scholar] [CrossRef]

- Leung, X.Y.; Sun, J.; Bai, B. Bibliometrics of social media research: A co-citation and co-word analysis. Int. J. Hosp. Manag. 2017, 66, 35–45. [Google Scholar] [CrossRef]

- Dzikowski, P. A bibliometric analysis of born global firms. J. Bus. Res. 2018, 85, 281–294. [Google Scholar] [CrossRef]

- Castillo-Vergara, M.; Alvarez-Marin, A.; Placencio-Hidalgo, D. A bibliometric analysis of creativity in the field of business economics. J. Bus. Res. 2018, 85, 1–9. [Google Scholar] [CrossRef]

- Hall, C.M. Publish and perish? Bibliometric analysis, journal ranking and the assessment of research quality in tourism. Tour. Manag. 2011, 32, 16–27. [Google Scholar] [CrossRef]

- Oliner, S.D. Mergers and the sustainability of collusion in a Cournot-nash supergame. Econ. Lett. 1982, 9, 305–310. [Google Scholar] [CrossRef]

- Dollery, B.; Kortt, M.A.; de Souza, S. Enduring financial sustainability through “bottom-up” local authority ingenuity and rational “top-down” state regulation: The case of Lake Macquarie City Council. Int. J. Public Admin. 2014, 37, 215–223. [Google Scholar] [CrossRef]

- Dollery, B.; Kortt, M.A.; O’Keefe, S. Local co-governance and environmental sustainability in New South Wales local government: The Lake Macquarie City Council sustainable neighbourhoods program. Econ. Pap. J. Appl. Econ. Policy 2014, 33, 36–44. [Google Scholar] [CrossRef]

- Sinnewe, E.; Kortt, M.A.; Dollery, B. Is biggest best? A comparative analysis of the financial viability of the Brisbane City Council. Aust. J. Public Admin. 2016, 75, 39–52. [Google Scholar] [CrossRef]

- Méndez-Naya, J. Merger profitability in mixed oligopoly. J. Econ. 2008, 94, 167–176. [Google Scholar] [CrossRef]

- Mendez Naya, J. Sustainability of asymmetry of information and strategies of non-merged firms. Trimest. Econ. 2014, 81, 227–240. [Google Scholar]

- Mendez Naya, J. National and international mergers in mixed oligopolies. Estud. Econ. 2016, 39, 87. [Google Scholar]

- Clapp, J. Mega-mergers on the menu: Corporate concentration and the politics of sustainability in the global food system. Glob. Environ. Politics 2018, 18, 12–33. [Google Scholar] [CrossRef]

- Clapp, J. The rise of financial investment and common ownership in global agrifood firms. Rev. Int. Political Econ. 2019, 26, 604–629. [Google Scholar] [CrossRef]

- Merigó, J.M.; Cancino, C.A.; Coronado, F.; Urbano, D. Academic research in innovation: A country analysis. Scientometrics 2016, 108, 559–593. [Google Scholar] [CrossRef]

- Wei, Y.D.; Li, W.; Wang, C. Restructuring industrial districts, scaling up regional development: A study of the Wenzhou model, China. Econ. Geogr. 2007, 83, 421–444. [Google Scholar] [CrossRef]

- Vasconcelos, H. Tacit collusion, cost asymmetries, and mergers. RAND J. Econ. 2005, 36, 39–62. [Google Scholar]

- Moatti, V.; Ren, C.R.; Anand, J.; Dussauge, P. Disentangling the performance effects of efficiency and bargaining power in horizontal growth strategies: An empirical investigation in the global retail industry. Strateg. Manag. J. 2015, 36, 745–757. [Google Scholar] [CrossRef]

- Rusko, R. Exploring the concept of coopetition: A typology for the strategic moves of the Finnish forest industry. Ind. Mark. Manag. 2011, 40, 311–320. [Google Scholar] [CrossRef]

- Sheldon, P.; Nacamulli, R.; Paoletti, F.; Morgan, D.E. Employer association responses to the effects of bargaining decentralization in Australia and Italy: Seeking explanations from organizational theory. Br. J. Ind. Relat. 2016, 54, 160–191. [Google Scholar] [CrossRef]

- Dhingra, R.; Kress, R.; Upreti, G. Does lean mean green? J. Clean. Prod. 2014, 85, 1–7. [Google Scholar] [CrossRef]

- Young, O. Vertical interplay among scale-dependent environmental and resource regimes. Ecol. Soc. 2006, 11, 27. [Google Scholar] [CrossRef]

- Luke, T.W. Corporate social responsibility: An uneasy merger of sustainability and development. Sustain. Dev. 2013, 21, 83–91. [Google Scholar] [CrossRef]

- Bengtsson, S.L.; Östman, L.O. Globalisation and education for sustainable development: Emancipation from context and meaning. Environ. Educ. Res. 2013, 19, 477–498. [Google Scholar] [CrossRef]

- Zupic, I.; Čater, T. Bibliometric methods in management and organization. Organ. Res. Methods 2015, 18, 429–472. [Google Scholar] [CrossRef]

- Small, H. Co-citation in the scientific literature: A new measure of the relationship between two documents. J. Am. Soc. Inf. Sci. 1973, 24, 265–269. [Google Scholar] [CrossRef]

- White, D.; McCain, K. Visualizing a discipline: An author co-citation analysis of information science, 1972–1995. J. Am. Soc. Inf. Sci. 1998, 49, 327–355. [Google Scholar]

- Shafique, M. Thinking inside the box? Intellectual structure of the knowledge base of innovation research (1988–2008). Strateg. Manag. J. 2013, 34, 62–93. [Google Scholar] [CrossRef]

- White, H.D.; Griffith, B.C. Author cocitation: A literature measure of intellectual structure. J. Am. Soc. Inf. Sci. 1981, 32, 163–171. [Google Scholar] [CrossRef]

- McCain, K.W. Mapping authors in intellectual space: A technical overview. J. Am. Soc. Inf. Sci. 1990, 41, 433–443. [Google Scholar] [CrossRef]

- Porter, M.E. Industry structure and competitive strategy: Keys to profitability. Financ. Anal. J. 1980, 36, 30–41. [Google Scholar] [CrossRef]

- Child, J.; Tsai, T. The dynamic between firms’ environmental strategies and institutional constraints in emerging economies: Evidence from China and Taiwan. J. Manag. Stud. 2005, 42, 95–125. [Google Scholar] [CrossRef]

- Child, J.; Rodrigues, S.B. How organizations engage with external complexity: A political action perspective. In Understanding Organizations in Complex, Emergent and Uncertain Environments; Palgrave Macmillan: London, UK, 2012. [Google Scholar]

- Teece, D.J. Firm organization, industrial structure, and technological innovation. J. Econ. Behav. Organ. 1996, 31, 193–224. [Google Scholar] [CrossRef]

- Capron, L.; Mitchell, W.; Swaminathan, A. Asset divestiture following horizontal acquisitions: A dynamic view. Strateg. Manag. J. 2001, 22, 817–844. [Google Scholar] [CrossRef]

- Child, J.; Faulkner, D.; Tallman, S.B. Cooperative Strategy; Oxford University Press: New York, NY, USA, 2005; p. 46. [Google Scholar]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Looser, S.; Wehrmeyer, W. Ethics of the firm, for the firm or in the firm? Purpose of extrinsic and intrinsic CSR in Switzerland. Soc. Responsib. J. 2016, 12, 545–570. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar] [PubMed]

- Teece, D.J. Business models, business strategy and innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating shared value. In Managing Sustainable Business; Springer: Dordrecht, The Netherlands, 2019. [Google Scholar]

- Jensen, M.C. Agency costs of free cash flow, corporate finance, and takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Jensen, M.C. Value maximization, stakeholder theory, and the corporate objective function. Bus. Ethics Q. 2002, 12, 235–256. [Google Scholar] [CrossRef]

- Freeman, R.E.; Ginena, K. Rethinking the purpose of the corporation: Challenges from stakeholder theory. Not. Polit. 2015, 31, 9–18. [Google Scholar]

- Berger, A.N.; Udell, G.F. Small business credit availability and relationship lending: The importance of bank organisational structure. Econ. J. 2002, 112, 32–53. [Google Scholar] [CrossRef]

- Fried, H.O.; Schmidt, S.S.; Yaisawarng, S. Productive, scale and scope efficiencies in US hospital-based nursing homes. INFOR Inf. Syst. Oper. Res. 1998, 36, 103–119. [Google Scholar]

- Fried, H.O.; Lovell, C.K.; Yaisawarng, S. The impact of mergers on credit union service provision. J. Bank. Financ. 1999, 23, 367–386. [Google Scholar] [CrossRef]

- Navas-López, J.E.; Guerras-Martín, L.A. Fundamentals of Strategic Management; Thomson Reuters Civitas: Cizur Menor, España, 2018. [Google Scholar]

- Li, H.J.; An, H.Z.; Wang, Y.; Huang, J.C.; Gao, X.Y. Evolutionary features of academic articles co-keyword network and keywords co-occurrence network: Based on two-mode affiliation network. Phys. A Stat. Mech. Appl. 2016, 450, 657–669. [Google Scholar] [CrossRef]

| Evaluative Techniques | Academic impact and relative influence | Measures of Productivity Historical evolution of publications Distribution of articles by journal Distribution of articles by author |

| Impact Metrics: Citation Analysis The most cited articles | ||

| Relational Techniques | Relationship between units of analysis | Co-Citation Analysis Co-citation analysis of authors Co-citation analysis of journals |

| Co-Word Analysis |

| Database | WoS |

|---|---|

| Geographical scope | Global scientific production |

| Characteristics | Quality indicators: JCR impact factor |

| Immediacy index | |

| Times cited | |

| Quartile | |

| Documents searched | Topic |

| Data range | All years to 2019 |

| Search date | 14 November 2019 |

| Search terms | (Merger * and acquisition * OR “M&A” OR merger *) AND |

| (“Sustainability” OR “Sustainable development”) | |

| Initial number of documents | 224 |

| Inclusion criteria | Article |

| Review | |

| Number of documents | 178 |

| Filtered process | Duplicates |

| Authors not identified | |

| Not related to the topic | |

| Final number of documents | 92 |

| Journal | Number of Documents |

|---|---|

| Sustainability | 11 |

| Entrepreneurship and Sustainability Issues | 2 |

| Estudios de Economía | 2 |

| Journal of Economics | 2 |

| Journal of Cleaner Production | 2 |

| Social Responsibility Journal | 2 |

| Strategic Management Journal | 2 |

| Author | Ref | Tittle | Journal | Year | Doc |

|---|---|---|---|---|---|

| Dollery, B. | [31] | Is Biggest Best? A Comparative Analysis of the Financial Viability of the Brisbane City | Australian J. Public Administration | 2016 | 3 |

| [29] | Enduring Financial Sustainability Through Bottom-Up Local Authority Ingenuity and Rational Top-Down State Regulation: The Case of Lake Macquarie City Council | International J. Public Administration | 2014 | ||

| [30] | Local Co-Governance and Environmental Sustainability in New South Wales Local | Economics papers | 2014 | ||

| Kortt, M.A. | [31] | Is Biggest Best? A Comparative Analysis of the Financial Viability of the Brisbane City | Australian J. Public Administration | 2016 | 3 |

| [29] | Enduring Financial Sustainability Through Bottom-Up Local Authority Ingenuity and Rational Top-Down State Regulation: The Case of Lake Macquarie City Council | International J. Public Administration | 2014 | ||

| [30] | Local Co-Governance and Environmental Sustainability in New South Wales Local | Economics papers | 2014 | ||

| Mendez-Naya, J. | [33] | Sustainability of Asymmetry of Information and Strategies of Non-Merged Firms Mergers | Trimestre Económico | 2014 | 3 |

| [34] | National and International Mergers in Mixed Oligopolies | Estudios de Economía | 2012 | ||

| [32] | Merger Profitability in Mixed Oligopoly | Journal of Economics | 2008 | ||

| Clapp, J. | [36] | The Rise of Financial Investment and Common Ownership in Global Agrifood Firms | Review of Int. Political Economy | 2019 | 2 |

| [35] | Mega-Mergers on the Menu: Corporate Concentration and the Politics of Sustainability in the Global Food System | Global Environment Politics | 2018 |

| Title | Authors | Journal | Year | Cites | Ref |

|---|---|---|---|---|---|

| Vertical Interplay Among Scale-Dependent Environmental and Resource Regimes | Young, O. | Ecology and Society | 2006 | 128 | [44] |

| Restructuring Industrial Districts, Scaling Up Regional Development: A Study of the Wenzhou Model, China | Wei, Y.D.; Li, W.; Wang, C. | Economic Geography | 2007 | 99 | [38] |

| Exploring the Concept of Coopetition: A Typology for the Strategic Moves of the Finnish Forest Industry | Rusko, R. | Industrial Marketing Management | 2011 | 66 | [41] |

| Tacit Collusion, Cost Asymmetries, and Mergers | Vasconcelos, H. | Rand Journal of Economics | 2005 | 49 | [39] |

| Does Lean Mean Green? | Dhingra, R.; Kress, R.; Upreti, G. | Journal of Cleaner Production | 2014 | 48 | [43] |

| Disentangling the Performance Effects of Efficiency and Bargaining Power in Horizontal Growth Strategies: An Empirical Investigation in the Global Retail Industry | Moatti, V.; Ren, C.R.; Anand, J. | Strategic Management Journal | 2015 | 19 | [40] |

| Merger Profitability in Mixed Oligopoly | Mendez-Naya, J. | Journal of Economics | 2008 | 17 | [32] |

| Globalisation and Education for Sustainable Development: Emancipation from Context and Meaning | Bengtsson, S.L.; Ostman, L.O. | Environmental Education Research | 2013 | 16 | [46] |

| Employer Association Responses to the Effects of Bargaining Decentralization in Australia and Italy: Seeking Explanations from Organizational Theory | Sheldon, P. Nacamulli, R.; Paoletti, F.; Morgan, D.E. | British Journal of Industrial Relations | 2016 | 15 | [42] |

| Corporate Social Responsibility: An Uneasy Merger of Sustainability and Development | Luke, T.W. | Sustainable Development | 2013 | 15 | [45] |

| Rank | Keywords | Frequency | Total Link Strength |

|---|---|---|---|

| 1 | Mergers | 18 | 46 |

| 2 | Performance | 14 | 31 |

| 3 | Sustainability | 16 | 29 |

| 4 | Sustainable development | 9 | 7 |

| 5 | Management | 7 | 14 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

González-Torres, T.; Rodríguez-Sánchez, J.-L.; Pelechano-Barahona, E.; García-Muiña, F.E. A Systematic Review of Research on Sustainability in Mergers and Acquisitions. Sustainability 2020, 12, 513. https://doi.org/10.3390/su12020513

González-Torres T, Rodríguez-Sánchez J-L, Pelechano-Barahona E, García-Muiña FE. A Systematic Review of Research on Sustainability in Mergers and Acquisitions. Sustainability. 2020; 12(2):513. https://doi.org/10.3390/su12020513

Chicago/Turabian StyleGonzález-Torres, Thais, José-Luis Rodríguez-Sánchez, Eva Pelechano-Barahona, and Fernando E. García-Muiña. 2020. "A Systematic Review of Research on Sustainability in Mergers and Acquisitions" Sustainability 12, no. 2: 513. https://doi.org/10.3390/su12020513

APA StyleGonzález-Torres, T., Rodríguez-Sánchez, J.-L., Pelechano-Barahona, E., & García-Muiña, F. E. (2020). A Systematic Review of Research on Sustainability in Mergers and Acquisitions. Sustainability, 12(2), 513. https://doi.org/10.3390/su12020513