Abstract

Under the background of economic development, energy security and environmental demands, the development of clean and low-carbon energy has promoted natural gas and non-fossil energy to become the main direction of world energy development. China’s natural gas consumer market has wide seasonal peaks and valleys. Because China’s natural gas peak shaving practices have some problems, we concluded that interruptible gas management has become a viable short-term emergency peak shaving method for natural gas systems in the transition period. In this paper, we take Shaanxi Province as an example. From the perspective of option pricing, this paper explains the method of using interruptible gas management to deal with the short-term supply and demand imbalance of natural gas. Therefore, we propose an interruptible gas contract trading mode, discuss the content of the interruptible gas contract and the relevant market organization form, and try to use the Black–Scholes model to calculate the option price of the interruptible gas contract. Finally, based on the price of interruptible gas and the option price of the interruptible gas contract to meet the maximum capacity shortage constraint, a provincial natural gas pipeline network company’s optimal purchase model for the interruptible gas was established, and the model was solved using the dynamic queuing method. The results show that the interruptible gas contract can not only reduce the market risk of the provincial natural gas pipeline network company and maintain the stable operation of the gas pipeline, but also reduce the cost of the interruptible users and make up for gas shortage losses.

1. Introduction

In the long-term adjustment of the energy structure, natural gas has gradually become the primary energy source due to five factors: Policy, resources, technology, facilities, and market [1]. With the continuous adjustment of China’s energy consumption structure, the proportion of natural gas in China’s energy consumption structure continues to rise [2]. China’s natural gas production continues to grow, but overall the supply of natural gas is still in short supply [3,4]. Under the interaction of multiple factors, a large-scale “gas shortage” event began to occur in China in the winter of 2017 [5]. “Gas shortage” specific performance: During peak gas usage hours, users’ excessive demand for natural gas results in low air pressure in the pipeline network, causing many users to use gas normally. However, this is not a phenomenon unique to the winter of 2017. In the winter of 2005 and 2009, there was a “gas shortage” in many parts of the country. The main cause of “gas shortage” is the insufficient supply of upstream and the rapid development of downstream, which breaks the domestic supply and demand balance of natural gas [6]. In the context of frequent “gas shortages”, emergency peak shaving strategy has become the key to solving the “gas shortages” problem in the short term. Some problems encountered by peak shaving practices in China are summed up as the following: (1) Underground gas storage (UGS) (see also Appendix A Table A1) construction is rather slow because of the complicated geological conditions; (2) LNG receiving terminals have a weak ability to resist risks in peak shaving; and (3) peak shaving by gas production is not good for the reasonable development of a gas field [7]. In order to quickly respond to the shortage of natural gas supply, interruptible load management has become an important method for the Chinese natural gas system to resolve emergency peak shaving problems during the transition period.

Interruptible load management (ILM) is an important part of demand-side management (DSM). Signing an interruptible load contract is an important way to implement ILM. Since the two oil crises of the 1970s, people have realized that it is not enough to meet the demand-side energy use from the supply side alone. Therefore, in 1984, the American Electric Power Research Institute (EPRI) proposed a DSM power planning method for the power market. This method refers to the planning and implementation measures for power companies to change the shape of the load curve by affecting the way consumers use electricity [8]. Because the gas pipeline network and the power network both belong to the energy supply network, and their loads have similar characteristics affected by the behavior of the end consumer [9,10], their ILM has a certain degree of similarity.

Referring to the definition of ILM in the electricity market, interruptible gas management (IGM) mainly refers to the way that the gas supply enterprises stop or reduce gas supply to some natural gas users in the peak period of gas consumption to achieve the balance of supply and demand in the natural gas market [11]. In 2018, in the Several Opinions of the State Council on Promoting the Coordinated and Stable Development of Natural Gas, the Chinese government pointed out that it is necessary to establish and improve the natural gas demand-side management and peak shaving mechanism. The local government needs to encourage the development of interruptible large industrial users. The government can implement differentiated price policies such as interruptible gas prices to promote peak cutting and valley filling, and guide companies to increase their capacity to adjust gas storage and off-peak seasons [12]. Demand-side ILM has changed the traditional mindset of relying solely on supply to meet demand growth. Under the natural gas market reform, China’s natural gas season peak pressure will continue to increase [13]. IGM will be implemented imminently.

At present, many countries have applied the interruptible gas contract to the natural gas market and achieved significant peak shaving effect. In the Natural Gas Act issued by the British government in 1986, large customers using more than 25,000 British thermal units in the contract market have the right to negotiate directly with manufacturers for pricing [14]. American gas transmission pipeline operators have signed interruptible gas contracts with many power generation customers, industrial customers, hospitals, and large integrated construction industries. Interruptible gas contracts are very common in Canada, with interruptible gas volume accounting for about 20% of industrial gas consumption. About half of France’s industrial customers have signed gas interruption contracts. Russia has about 60 million cubic meters per day of interruptible gas [15].

With the rapid development of China’s natural gas market, the demand for natural gas in all walks of life is increasing day by day, but there is no real interruptible gas user in China, so it is necessary to introduce and implement IGM in China’s natural gas market. At the national level, IGM is conducive to the irrational demand for natural gas, promotes the rational use of natural gas, and ensures the safety of the natural gas supply. From the perspective of industry, IGM is an important supplement to supply promotion, which can alleviate the contradiction between market supply and demand, reduce the intensity of seasonal fluctuation of natural gas consumption, and promote the healthy development of the natural gas industry. In terms of resource utilization, IGM can achieve the purpose of saving resources and improving energy efficiency, promoting the concept of energy conservation, enhancing users’ awareness of energy conservation, and setting the correct guidance for the development of the natural gas industry. However, there is a lack of theoretical and empirical research on the occurrence conditions, capacity demand, contract design, trading mode, and other aspects of China’s IGM. Therefore, how to introduce IGM into China’s natural gas market and how to design the content and trading mode of the interruptible gas contract are the key issues of this paper.

The remaining parts of this article are organized as follows. The second part summarizes the existing studies about ILM and IGM. The third part briefly introduces the relevant contents of the interruptible gas contract. The fourth part discusses the optimal purchase model of interruptible gas. The fifth part is a case analysis. The last part provides our conclusions on this topic.

2. Literature Review

In recent years, with the continuous advancement of demand-side management, the theory of ILM for large power users has been relatively mature. The electricity crisis in the United States makes more and more scholars realize the importance of ILM contracts [16,17]. Since electricity prices in joint markets around the world are quite volatile, it is not surprising that various power derivatives are traded to control the financial risks of market participants [18]. Participants in the electricity market use forward transactions through the electricity financial derivatives market to increase the amount of virtual electricity at a time, thereby maintaining the stability of electricity prices in the spot market. Jamss C et al. (1995) believed that the Black–Scholes (B-S) option pricing model provided a powerful and widely used method for option pricing. Therefore, they used the B-S pricing formula to treat ILM contracts as a call option to price them [19]. Rajnish et al. (2002) used forward and option to simulate the pricing of three interruptible load contracts. They derived the explicit mathematical expression of interruptible load options [20]. Wang et al. (2005) discussed the content of the interruptible load contract and the relevant market organization form, gave the optimal purchase model of interruptible load, and demonstrated the effectiveness of the model through actual system examples [21]. Edward J et al. (2006) believed that some users with low requirements for electricity price reliability can reduce their total cost by taking some additional risks, and they can share the net profit of load reduction by signing interruptible contracts [18]. Fanelli et al. (2016) showed that by using the toolkit of interest rate theory, it was possible to evaluate option prices through an electricity market equilibrium model [22]. Hung et al. (2017), based on the real options theory, established the option pricing model for investment opportunity in distributed wind power stations [23].

Due to the late start in the development and utilization of natural gas in China, compared with the power industry, there is less research on IGM in China. Han et al. (2008) believed that the development of interruptible users is conducive to peak cutting and valley filling. It can improve the reliability of the gas supply. This method can be effective in a short period of time and has high technical maturity [24]. Shan et al. (2010) believed that IGM is an effective way for urban gas companies to solve the problem of peak-valley difference, which can be seen in a short time and has a significant effect on improving the reliability of the gas supply [15]. Dong et al. (2018) analyzed the causes of natural gas “gas shortage” in 2017 from the perspective of the supply chain and made recommendations from three perspectives: Natural gas supply, consumer demand, and the development of the industrial chain. He believed that increasing interruptible industrial users had a significant effect on peak shaving of natural gas consumption [25]. LV et al. (2018) believed that in the construction of peak shaving facilities the pipeline transportation fee for interruptible users should be lower than that for fixed users, and they should not bear the peak shaving costs [26]. Zhu and Gong (2015) established a demand response model for industrial and commercial users. They believed that there was an optimal time-sharing price relationship that could effectively reduce the peak-valley load difference of the gas pipeline network and play a role in shaving peak and filling valley [27]. Dong et al. (2017) proposed a decision-making model for selecting the interruptible load in the natural gas reserve market based on AHP (the analytic hierarchy process) [28]. Wang et al. (2016) analyzed the classification of interruptible users, the selection of the interruptible gas price scheme, how to implement the interruptible gas price, and put forward relevant suggestions such as the preferential range of the interruptible gas price, definition of interruptible users, division of peak season and off season, etc. [11]. To sum up, the existing literature on IGM generally focuses on theoretical analysis, and there are few empirical studies on the impact of implementing IGM.

Summarizing previous studies, this paper believes that, with the continuous promotion of the market-oriented reform of natural gas, China will eventually establish an active natural gas market. Because natural gas option transactions occur freely and frequently, using interruptible options in interruptible gas contracts is conducive to avoiding risks in natural gas trading and fully optimizing the allocation of natural gas. Therefore, in this paper, we have introduced ILM into the natural gas market, combined with option pricing theory, proposed an interruptible gas contract transaction model, discussed the content of interruptible gas contracts and related market organization forms, and tried to use the Black–Scholes model to calculate the option price of the interruptible gas contract. Based on this, we can calculate the minimum cost of executing an interruptible gas contract. This is the innovation of this paper, but also for the IGM to make an effective attempt. This has a certain reference value in alleviating the current “gas shortage” problem.

3. Interruptible Gas Contract

This paper is a preliminary exploration of the trading mode of the interruptible gas contract of bilateral direct trading. Through the introduction of the relevant concepts of the interruptible gas option, it highlights the peak shaving advantages of the interruptible gas, selects the interruptible users and puts forward the design idea of the interruptible gas contract according to the characteristics of the interruptible gas.

Li et al. (2011) believed that “gas shortage” reflects the increasingly severe peak-valley difference of natural gas in China, and the pressure of the safe and stable operation of the natural gas supply system is increasing [29]. If purely upstream gas exploration and development enterprises rely on natural gas peak shaving facilities to meet short-term peak gas consumption, the construction tasks of upstream gas companies will be arduous, and it will also cause huge waste of resources. Moreover, if rigid methods such as restricting the gas consumption of heating users are used for peak regulation, it will also violate the original intention of improving the urban atmospheric environment. Therefore, the provincial natural gas pipeline network company can only maintain the system stability by adjusting the gas supply to avoid market risk. However, the adjustment of gas supply by the provincial natural gas pipeline network company shall comply with relevant regulations. Arbitrary interruption of the gas supply will cause adverse effect and great losses to users. Interruptible gas contracts emerge as the times require.

According to the analysis of economic fundamentals, the price of natural gas reflects the supply and demand of the market, and the amount of interruptible gas can be selected based on the price of natural gas. At present, the interruptible gas contract is a contract signed according to the price agreed by both parties for the trading volume of natural gas at a certain time in the future. When the gas price is higher than a certain interruptible gas price, that is, when the “gas shortage” endangers the stability of the gas pipeline network, the provincial natural gas pipeline network companies can interrupt the gas supply of some users, so as to maintain the stability of the gas pipeline network. When the gas price is lower than the interruptible gas price, the gas is supplied to the user normally. This is equivalent to when the real-time gas price exceeds the interruptible gas price, that is, when the system is in short supply, the provincial natural gas pipeline network company will buy back the natural gas that has been sold to the user according to the interruptible gas price, and then the gas supply will be interrupted, so as to increase the virtual natural gas supply in this period.

3.1. Interruptible Gas Users

According to the “Natural Gas Utilization Policy” implemented on 1 December 2012, China’s natural gas users are divided into five categories: Urban gas, industrial fuel, natural gas power generation, natural gas chemical industry, and other users [30,31,32]. The natural gas demand of different user categories and gas projects has both similarities and differences. Therefore, interruptible users and uninterruptible users can be divided according to the characteristics of gas consumption of different users. Refineries, fertilizer plants, steel mills, aluminum plants, and chemical plants are suitable for interruptible users due to their large gas consumption, stable gas consumption, fast start-up and shutdown, great potential for interruption, and the ability to switch to other fuels during peak natural gas hours.

3.2. Contract Trading Mode

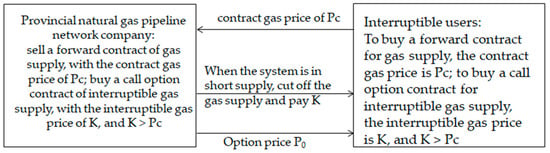

By using financial derivatives, the advantages of forward contract and option trading can be used to apply interruptible gas contracts to IGM. Figure 1 shows the trading model of the interruptible gas contract, which includes the rights and obligations of both parties. The contract includes two agreements: First, interruptible users purchase long-term contracts from provincial grid companies to ensure that the provincial natural gas pipeline network company will deliver the required natural gas to users participating in the IGM during the contract period. The two parties generally negotiate the price of natural gas in these capacities in advance; this is the contract gas price. Generally, the contract gas price will be discounted within a reasonable range to achieve the purpose of encouraging users to participate in IGM. Second, the user sells a natural gas call option of the same capacity to a provincial natural gas pipeline network company. It allows provincial natural gas pipeline network companies to have the right to buy back the corresponding natural gas at the strike price of the option. That is to say, when the natural gas supply is expected to be tight or the market price is high, the provincial natural gas pipeline network company has the right to interrupt the gas supply to the interruptible users and compensate the customers’ losses according to the pre-determined price, which is the interrupted gas price.

Figure 1.

Trading mode of interruptible gas contract between users and the provincial natural gas pipeline network company.

3.3. Content of the Contract

The interruptible gas contract should reflect the characteristics of the interruptible gas option and clearly specify the relevant price. The interruptible gas contract needs to take into account the rights and obligations of both the provincial natural gas pipeline network company and the user, and ensure the good generality of the contract, so as to mobilize the enthusiasm of both the provincial network company and the user to participate in the transaction, improve the participation of the transaction, and then meet the requirements of the gas pipeline network operation on the interruptible gas. Referring to the interruptible load contract in the current market, the content of the contract should include the following: Contract validity, exercise date, advance notice time, interruption duration, option price, interruption gas price, contract gas price, interruption capacity, and other elements. The following is an analysis of the content of the contract.

Contract validity: In order to avoid the trouble caused by frequent signing of contracts to provincial gas network companies and users, the validity period of the contract should be longer. Due to the construction of gas storage and changes in natural gas demand, the validity period of the contract should not be too long. The contract is recommended to be valid for three months, that is, to sign a contract once a quarter.

Exercise date: Due to the dynamic changes in the load conditions of the gas pipeline network, it is not possible to fix an exercise date in the contract. According to the characteristics of the provincial natural gas pipeline network company that under normal circumstances will not exercise an option in advance, this paper adopts the European option exercise method. Provincial natural gas pipeline companies only exercise options on the expiration date. After the provincial natural gas pipeline network company exercises the right, the user shall reduce the gas according to the requirements of the interruptible gas contract.

Advance notice time: In the actual market transactions, the advance notice time will affect the option price. The shorter the advance notice time, the higher the cost of the user’s power outage and the higher the corresponding option price. Provincial gas pipeline companies prefer to use option contracts with longer lead times as possible being able to reduce costs.

Interruption duration: Due to the complexity of users, it is difficult to quantify the relationship between the interruption loss and the interruption time. However, most users’ interrupted natural gas loss is a non-linear acceleration with the extension of the interrupted gas time. Referring to the practice in the electricity market, the duration of the interruption can generally be divided into 4 h and 8 h. Due to the different requirements for gas reliability in different industries, users can choose the duration of the interruption that is more beneficial to the industry when signing the contract [33].

Option price: Refers to the purchase and sale cost of an option, which is usually used as the premium of the option, and is paid by the buyer of the option to the seller of the option to obtain the option. In this paper, the B-S option pricing model is used to calculate the option price.

Interruption gas price: After the provincial natural gas pipeline network company implements the interruption gas option, the provincial natural gas pipeline company compensates the user according to the actual amount of gas produced during the interruption. The interruption gas price is agreed in the contract in advance to compensate for the loss incurred during the execution of the option.

Contract gas price: In order to motivate the interruptible users to participate in the IGM, the contract gas price should be lower than the interruptible gas price.

Interruption capacity: Users must declare the amount of gas that can be interrupted at the same time as the price of the gas that can be interrupted. When the provincial natural gas pipeline company executes the option, the user can reduce the amount of natural gas that is not less than the amount of gas that is interrupted as required. In order to facilitate the transaction of the contract, 10,000 cubic meters shall be taken as the minimum trading unit of the interrupting gas quantity declaration.

4. Optimal Purchase Model of Interruptible Gas

According to the interrupted gas price and the option cost of the interruptible gas contract, the optimal purchase model of the interruptible gas for the provincial natural gas pipeline network company is established to meet the maximum shortage of natural gas. The solution method of this model uses the dynamic queuing method, which is purchased from small to large according to the interruption cost of each user until the system shortage constraint is satisfied.

4.1. Option Pricing Model

Due to interruptible gas having the characteristic of ‘option’, we use the option pricing method to price interruptible gas. ‘Option’ is the right of the buyer and the seller to buy or sell a certain commodity at a predetermined price at a certain time in the future. There are two famous and widely used methods for option pricing. One is the Black–Scholes option pricing model in partial differential equation method, the other is the binomial tree option pricing model in dynamic programming. The pricing method of the B-S model belongs to the analytical method, and the binomial model belongs to the numerical method. This part mainly compares the option price calculated by the two models.

4.2. Assumption of the Model

- Assuming that the natural gas price obeys geometric Brownian motion (GBM) and satisfies the differential equation:where S is the spot price of natural gas, μ is the yield of natural gas, σ is the volatility of natural gas price, and w(t) is the Brownian motion process.

- In order to prevent the randomness of the execution of natural gas option contract from bringing difficulties to the adjustment and formulation of interruptible gas price, it is assumed that the interruptible gas option was given a European call option;

- There is no risk-free arbitrage opportunity, no transaction costs or taxes in the natural gas market;

- When the real delivery of the interruptible option is carried out, the construction costs of the pipe network and the conversion costs of large users are temporarily not considered;

- During the period of option validity, the risk-free interest rate r is constant.

4.3. Interruptible Gas Contract Model

Based on the above discussion, large users quote the price of interruptible gas by signing the interruptible gas contract, and give the capacity and time that the gas can be interrupted during the validity period of the contract. The provincial natural gas pipeline network company purchases the interrupted gas reasonably according to the price quoted by the large user and the forecast market price of the natural gas. The optimal purchase model for interruptible gas is as follows:

In Formulas (2)–(6), Formula (2) is the objective function, which means that the purchase of interruptible gas costs is the minimum; Formula (3) is a constraint that indicates that the amount of interruptible gas purchased at a certain time is greater than or equal to the amount of gas shortage in the system. Formulas (4)–(6) make up the pricing formula, which is used to calculate the option price, where i is denoted the i-nth user that can provide interruptible gas (where i = 1, 2, 3, …, n); m is the selected number of contracts; is the option price obtained by the i-nth user signing the contract; Ki is the interruptible gas price reported by the i-nth user; Ri is the interrupting capacity of the i-nth user; ti indicates the duration of the outage for the i-nth user; Q represents the shortage of gas in the system; S represents the market spot price of natural gas at time t; N(x) refers to the cumulative probability distribution function with the standard normal distribution variable with the mean value of 0 and a standard deviation of 1 less than x; r is the risk-free interest rate (short-term national bond) calculated by continuous compound interest in t-T time; t represents the moment when the provincial natural gas pipeline company purchases options after signing the contract with the interruptible user; T is the sales time of interruptible gas; σ is the volatility of the natural gas price; d1 and d2 are parameters.

4.3.1. Risk-Free Rate

The risk-free interest rate refers to the interest rate obtained when the fund is invested in the target asset without any risk. Risk-free interest rate r is a very important parameter in the B-S pricing formula, but it is also an ideal parameter. In fact, there is no completely risk-free investment. In China’s capital market, national bonds are generally characterized by high security and low risk of default. Therefore, we can choose the yield of national bonds with the same or similar maturity to the interruptible gas option as a reference to determine the risk-free interest rate. Because the B-S model requires the interest rate to be compounded continuously, and r0 is usually compounded once a year, r0 must be converted so that it functions in the formula calculation [34]. The conversion relationship between them is as follows:

where r is the risk-free interest rate, r0 is the interest rate of the national bonds in the same period, and n is the term of the national bonds.

4.3.2. Volatility

In this paper, the historical volatility of the natural gas price is used to estimate σ. This implies a hypothesis that the volatility of the natural gas price is relatively stable for some time, so that historical volatility is used without excessive deviation. In general, the more data there is, the higher the accuracy of the estimation, but too old historical data may be less relevant for predicting volatility. Therefore, a compromise method is to use the market price of natural gas in the last 90–180 days to calculate the volatility. The calculation process of historical volatility is as follows:

where St is the gas price at time t; St−1 is the natural gas price of the previous day; Rt is the result of natural logarithm calculation, that is, the logarithmic gain of natural gas purchase; s is the standard deviation of Rt; n is the number of data; is the mean value of Rt; τ is the length of the time interval, in years; is the estimate of σ.

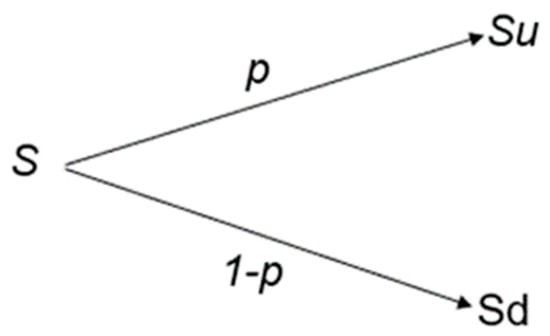

4.4. Binomial Tree Option Pricing Model

The binomial tree option pricing model was first proposed by J.C. Cox, S.A. Ross and M. Rubinstein in 1979 [35]. The Binomial tree model first divides the time interval from the date of option purchase to the date of option expiration. It stipulates that, within each time interval Δt, the price of natural gas S0 has only two possible changes Su or Sd (u > 1, d < 1). Therefore, S0 to Su is called a rise change, and S0 to Sd is called a fall change. The probability of rising is p, and the probability of falling is 1-p. Therefore, the binomial tree model simulates the change of natural gas price during the contract validity period. Its trajectory is shown in Figure 2.

Figure 2.

In the binomial tree model, the price of natural gas changes after time Δt.

The option price formula of the binomial tree model is as follows:

where, f0 is the option price; fu is the option price when the natural gas price rises; fd is the option price when the natural gas price drops; Δt is the unit time interval within the validity of the contract; n is the number of steps; T is the validity of the contract; p is the probability of price rise; r is a risk-free rate; σ is the volatility of the natural gas price.

Through empirical studies, He (2007) has shown that the option pricing error of the binomial tree model with a step of 20 is less than 1% [36]. In this paper, the binomial tree model of n = 20 will be used to price the interrupted natural gas. Other parameters are the same as the B-S model. Table 1 shows the option price calculated by the two models based on a different interruptible gas price.

Table 1.

The option price calculated by the two models.

The data in Table 1 shows that the option price of the two models on interruptible gas are generally close. The results show that the pricing results of the two models are almost the same, which can reflect the value of the interruptible gas contract to a certain extent. The binomial tree model has high transparency and can be adjusted according to the actual situation. In the binomial tree diagram, we can clearly see the results of each step, and it is easy for people to understand. It is difficult to see changes in the gas price and option price in the B-S model. However, the B-S option pricing model gives a clearer quantitative analysis in option trading. With the B-S model, we can get a definitive analytical solution. When the number of options is small, it is more convenient to use the B-S option pricing model. The development and application of the B-S model and the Binomial tree model can provide a basis for supervisors to implement effective contracts, trading systems, and risk control. In the context of energy market reform, it will play an important role in the healthy development of China’s natural gas market.

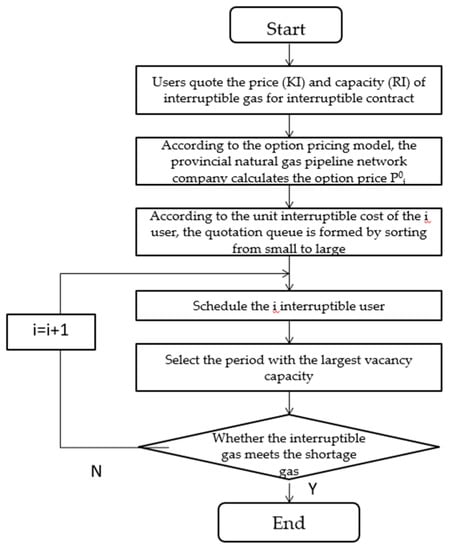

4.5. The Solution of Model

The solution method of this model adopts the dynamic queuing method. This method queues from small to large for each user’s IGM costs, until the system shortage constraint is satisfied. Figure 3 shows the process of the solution.

Figure 3.

Flow chart of queuing method for solving interruptible gas model.

- (1)

- Large users will quote the interrupted gas price (Ki) and interrupted capacity (Ri) of the interruptible gas contract. The provincial natural gas pipeline network company will calculate the option cost according to the option pricing method.

- (2)

- According to the interruption cost f of the i-nth user, it is sorted from small to large.

- (3)

- Select the period when the system gas shortage is the largest, and purchase from the user with the lowest annual cost in turn, until the constraint of Formula (3) is satisfied.

- (4)

- According to the selected number of contracts, the total purchase cost of the provincial gas pipeline network company for the interruptible gas contract is calculated according to Formula (2).

5. Case Analysis

International natural gas prices were found to have a significant impact on China’s natural gas prices over the long term, but there were obvious regional differences over the short term [37]. In this paper, we take Shaanxi Province as an example. Combined with the actual situation of Shaanxi Province, the implementation of interruptible gas for industrial users should adopt a simpler form. First, let the large users who can be interrupted make a quotation. Then, the provincial natural gas pipeline network companies make optimal scheduling based on the quoted and predicted actual market conditions. Finally, we use B-S to calculate the option price. The validity of the contract should be signed per quarter. There are two types of outage duration: 4 h and 8 h. The data used in this paper are actual system data and user survey data in Shaanxi Province. The natural gas price used in this article is the ex-factory price of natural gas in Shaanxi Province from 1 November 2016 to 31 March 2017. At present, there are 70,100 non-resident users in Shaanxi Province, and 888 industrial users who meet the interruptible conditions. In the peak of winter gas consumption, Shaanxi Province’s maximum daily reduction in the gas limit is 266 × 104 m3; large industrial users reduce the gas limit to about 200 × 104 m3 [38]. Because most users are unwilling to interrupt gas or raise their gas prices significantly in order to ensure normal production and profit, only some industrial users are willing to interrupt gas at reasonable gas prices [28]. Table 2 shows the price quoted for the interruptible gas price for large users who are willing to interrupt the gas.

Table 2.

Indicator data reported by interruptible load users.

The B-S model was used to calculate the option price, and then the interruptible cost was calculated. Finally the cost was arranged from small to large. The results are shown in Table 3.

Table 3.

Interruption cost of different interruptible users.

It is considered that Shaanxi Provincial Natural Gas Pipeline Network Company signs the interruptible gas contract with the interruptible major users. According to the results in the table, the users in Table 1 are queued according to the interruption cost f from small to large. The queuing situation is as shown in Table 3. According to Formula (2), based on meeting the constraints of Formula (3), the purchase cost of the least interruptible gas user combination is selected. Thus, we can choose to interrupt gas users 5, 3, 9, 1, 6, and 2, who participate in the natural gas standby market. The total reserve capacity of natural gas is 204 × 104 m3, which covers the maximum daily reduction of gas capacity of industrial users in Shaanxi Province. Finally, according to the model, the purchase cost of interruptible gas is calculated: minf = 614.4 × 104 Yuan.

6. Conclusions

In a well-functioning natural gas market, natural gas prices are an important economic indicator reflecting the natural gas market. However, due to the occurrence of emergencies, the price of natural gas may fluctuate violently, which is difficult for market participants to accept, so it is inevitable that natural gas options as a risk management tool appear in the natural gas market. In China, which is in the early stage of energy market reform, under the condition that the reasonable energy price mechanism, gas source risk, pipeline transportation, and gas storage capacity have not yet been solved, the interruptible gas contracts combined with natural gas options will be widely concerned. This paper believes that, when the Chinese natural gas market mechanism is established, it is feasible to implement an interruptible gas contract that will promote the rapid development of the Chinese natural gas market.

Compared with the previous literature, this paper uses two option pricing methods. According to the model analysis, it is scientific and reasonable to apply the option pricing model to interruptible pricing. The binomial tree model has high transparency and can be adjusted according to the actual situation. In the binomial tree diagram, we can clearly see the results of each step, and it is easy for people to understand. However, its calculation is more complicated. With the B-S model, we can get a definitive analytical solution. When the number of options is small, it is more convenient to use the B-S option pricing model. Both models have their advantages and disadvantages, so in practice we can choose different methods according to different situations, or we can use the two models to make the calculated interruptible gas option price more reasonable. While there are inevitable limitations in the application of these two models. For example, the assumptions of these two models are very strict and they also cannot reflect the user’s conversion cost and other influencing factors in the formula. We just hope that the two parties signing the interruptible gas contract can refer to the interruptible gas option price calculated by the Black–Scholes model to determine the interruptible gas cost in a more scientific and market-compliant manner.

The seasonality of natural gas demand may cause large fluctuations in the market price of natural gas, which affects the stable operation of the gas pipeline network. Interruptible gas users can participate in the natural gas backup market in the manner of interruptible gas. When the provincial natural gas pipeline network company executes the contract, the interruptible users can obtain the income and option price of selling natural gas at the price of interruptible gas. When the provincial natural gas pipeline network company does not execute the contract, the interruptible user can obtain the proceeds of selling natural gas and the option price at the interruptible gas price. Therefore, we can achieve the purpose of encouraging interruptible users to participate in IGM by selecting the proper interruptible gas price. Due to peak-cutting and valley-filling of natural gas consumption, the interruptible gas contract can reduce the market risk of the provincial natural gas pipeline network companies to a certain extent and maintain the stability of the gas pipeline network.

China is still in the early stages of energy market reform. The price of natural gas lacks competitiveness. Implementation of interruptible gas management may have the following issues: Chinese natural gas price may not be subject to B-S model pricing conditions. Therefore, there may be some errors in the evaluation of the option price of natural gas by using the traditional Black–Scholes option pricing formula. The cost of interruptible gas needs to reflect the user‘s actual loss. This is related to many factors such as early gas outage time, gas outage occurrence time, and continuous gas outage time, which makes it difficult to accurately define the cost. For provincial gas pipeline network companies, interruptible gas can effectively improve the problem of heavy load during peak gas consumption, but it is difficult to accurately define other economic benefits. Information asymmetry exists between the interruptible user and the provincial gas pipeline company. In order to ensure normal production and profit, users are not willing to cut off gas or they will substantially raise their own interruptible gas price. This will not only cause low efficiency of interruptible gas management, but also may cause economic losses to the provincial natural gas pipeline companies. Therefore, the provincial natural gas pipeline companies should consider the characteristics of users scientifically, and the IGM must have different targeted users. For example, the provincial natural gas pipeline network company can organize professionals to understand the gas consumption rules and load characteristics of users.

Author Contributions

Conceptualization, J.C. and L.W.; Methodology, J.C. and L.W.; Software, J.C. and L.W.; Validation, J.C. and L.W.; Formal Analysis, J.C. and L.W.; Investigation, J.C. and L.W.; Resources, J.C. and L.W.; Data Curation, L.W.; Writing—original Draft Preparation, L.W.; Writing—review and Editing, J.C., and L.W.; Visualization, J.C. and L.W.; Supervision, J.C.; Project administration, J.C.; Funding acquisition, J.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

This work was supported by the National Natural Science Foundation of China (No. 71874133).

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Nomenclature section.

Table A1.

Nomenclature section.

| Abbreviation | Full Name |

|---|---|

| UGS | Underground gas storage |

| LNG | Liquified natural gas |

| ILM | Interruptible load management |

| DSM | Demand-side management |

| EPRI | American Electric Power Research Institute |

| IGM | Interruptible gas management |

| B-S | Black–Scholes |

| AHP | Analytic hierarchy process |

| GBM | Geometric Brownian motion |

Appendix B

A B-S sample calculation with MATLAB

| >>price = 3; |

| >>strike = 1.5:0.1:3; |

| >>rate = 0.0257; |

| >>time = 3/12; |

| >>volatility = 0.2746; |

| >>[Call, Put] = blsprice (price, strike, rate, time, volatility) |

A Binomial Tree Option Pricing Model sample calculation with MATLAB

| >>price = 3; |

| >>strike = 1.5; |

| >>rate = 0.0257; |

| >>time = 0.25; |

| >>flag = 1; |

| >>Increment = 0.25/20; |

| >>volatility = 0.2746; |

| >>[AssetPrice, OptionValue] = binprice (price, strike, rate, time, Increment, volatility, flag) |

References

- Huang, W.H.; Chen, J.D.; Fu, C.; Huang, Y. Approach for natural gas to be a primary energy source in China. Front. Eng. Manag. 2019, 6, 467–476. [Google Scholar] [CrossRef]

- BP. BP Energy Outlook 2040 (2018 edition), 2018. Available online: https://www.bp.com/content/dam/.bp/en/corporate/pdf/energy-economics/energy-outlook/bp-energy-outlook-2018.pdf (accessed on 18 June 2018).

- Ding, S. A novel self-adapting intelligent grey model for forecasting China’s natural-gas demand. Energy 2018, 162, 393–407. [Google Scholar] [CrossRef]

- Chen, J.D.; Yu, J.; Ai, B.; Song, M.L.; Hou, W.X. Determinants of Global Natural Gas Consumption and Import–Export Flows. Energy Econ. 2018, 83, 588–602. [Google Scholar] [CrossRef]

- Li, L.L.; Gong, C.Z.; Wang, D.Y.; Zhu, K.J. Multi-agent simulation of the time-of-use pricing policy in an urban natural gas pipeline network: A case study of Zhengzhou. Energy 2013, 52, 37–43. [Google Scholar] [CrossRef]

- Gong, C.Z.; Li, L.L.; Yang, J.; Zhu, K.J. An integrated short-term load forecasting approach for urban gas pipeline network based on EMD, PSR and LSSVM. Syst. Eng. Theory Pract. 2014, 34, 3001–3008. [Google Scholar]

- Wei, H.; Tian, J.; Li, B.; Gao, Y.B.; Wang, Y.; Zhu, L.L. Research on natural gas storage and peak-shaving modes in China. Nat. Gas Ind. 2016, 36, 145–150. [Google Scholar]

- Zhou, M.; Li, G.Y.; Ni, Y.X. A Preliminary Research on Implementation Mechanism of Demand Side Management Under Electricity Market. Power Syst. Technol. 2005, 5, 6–11. [Google Scholar]

- Ali, D.; Hemen, S. Application of echo state networks in short-term electric load forecasting. Energy 2012, 39, 327–340. [Google Scholar]

- Silvano, B.; Derek, W.B.; Francesco, L.; Fany, N. Combining day-ahead forecasts for British electricity prices. Energy Econ. 2013, 35, 88–103. [Google Scholar]

- Wang, F.P.; Wen, W.; Wu, Y.J.; Zhang, J.M. Thoughts on the establishing interruptible natural gas price in China. Nat. Gas Technol. Econ. 2016, 10, 40–43, 82–83. [Google Scholar]

- TSC. Opinions of the State Council on Promoting Coordinated and Stable Development of Natural Gas, 2018. Available online: http://www.gov.cn/zhengce/content/2018-09/05/content_5319419.htm.pdf (accessed on 5 September 2018).

- Liu, G.X.; Dong, X.C.; Jiang, Q.Z.; Dong, C.; Li, J.M. Natural gas consumption of urban households in China and corresponding influencing factors. Energy Policy 2018, 122, 17–26. [Google Scholar] [CrossRef]

- Zhao, J.; Pan, Y.X. The Practice of Market-oriented Reform of EU Natural Gas Industry and Its Enlightenment to China. Price Theory Pract. 2016, 12, 82–85. [Google Scholar]

- Shan, X. Study on the Promotion of Load Regulation and Energy Saving in China′s Natural Gas Market. Price Theory Pract. 2010, 10, 31–32. [Google Scholar]

- Chen, C.S.; Leu, J.T. Interruptible load control for Taiwan power company. IEEE Trans. Power Syst. 1990, 5, 460–465. [Google Scholar] [CrossRef]

- Malik, A.S. Simulation of DSM resources as generating units in probabilistic production costing framework. IEEE Trans. Power Syst. 1998, 13, 460–465. [Google Scholar] [CrossRef]

- Edward, J.A.; Xinin, H.; Donald, W. Forward contracts in electricity markets: The Australian experience. Energy Policy 2006, 35, 3089–3103. [Google Scholar]

- Jamss, C.C. Valuing options for electric power resources. Electr. J. 1995, 8, 43–49. [Google Scholar]

- Rajnish, K.; Shmuel, S.O. Exotic Options for Interruptible Electricity Supply Contracts. Oper. Res. 2002, 50, 835–850. [Google Scholar]

- Wang, J.X.; Wang, X.F.; Wang, X.L. Study on Model of Interruptible Load Contract in Power Market. Proc. CSEE 2005, 25, 11–16. [Google Scholar]

- Fanelli, V.; Maddalena, L.; Musti, S. Asian options pricing in the day-ahead electricity market. Appl. Energy 2016, 27, 196–202. [Google Scholar] [CrossRef]

- Huang, S.J.; Yu, B.; Zhang, Z.Y. A Study on Investment Strategies for Distributed Wind Power Stations Based on Real Options. Chin. J. Manag. Sci. 2017, 25, 97–106. [Google Scholar]

- Han, J.L. Study on Peak-shaving Based on Development of Interruptible Consumer Market. Gas Heat 2008, 28, 49–52. [Google Scholar]

- Dong, X.C.; Li, J.M. Study on the causes and Countermeasures of natural gas “gas shortage” in China. Price Theory Pract. 2018, 2, 47–50. [Google Scholar]

- Lv, M.; Xu, D.; Cong, W. Research on Peaking Pricing of Natural Gas in China. Price Theory Pract. 2018, 5, 35–38. [Google Scholar]

- Zhu, K.J.; Gong, C.Z.; Li, L.L.; Yu, S.W. Time-of-Use Pricing and Government Subsidy Policy for Industrial User in an Urban Gas Pipeline Network. J. Syst. Manag. 2015, 24, 588–594. [Google Scholar]

- Dong, D.P. Research on Interruptible Load Participate in the Reserve Market under Natural Gas Market. Sci. Technol. Ind. 2017, 17, 62–65. [Google Scholar]

- Li, H.X.; Du, Y.Y.; Bao, Y.P. A View on Natural Gas Peak-shaving in China from The Perspective of Power Demand Side Management. Nat. Gas Ind. 2011, 31, 107–109, 133. [Google Scholar]

- Wang, T.; Lin, B.Q. China′s natural gas consumption and subsidies—From a sector perspective. Energy Police 2014, 65, 541–551. [Google Scholar] [CrossRef]

- Zhang, Y.; Ji, Q.; Fan, Y. The price and income elasticity of China′s natural gas demand: A multisectoral perspective. Energy Police 2018, 113, 332–341. [Google Scholar] [CrossRef]

- Lin, B.Q.; Kuang, Y.M. Natural gas subsidies in the industrial sector in China: National and regional perspectives. Appl. Energy 2020, 260. [Google Scholar] [CrossRef]

- Li, C.R. Design of Interruptible Electricity Pricing Mechanism in Power Market. Energy Technol. Econ. 2012, 24, 11–15, 38. [Google Scholar]

- Dai, J. Warrants Pricing: The Classic B-S Model vs. CSR Model. Chin. J. Manag. Sci. 2009, 17, 20–26. [Google Scholar]

- Zhang, M.J.; Qin, X.Z.; Nan, J.X. Binomial tree model of the European option pricing based on the [triangular intuitionistic fuzzy numbers. Syst. Eng. Theory Pract. 2013, 33, 34–40. [Google Scholar]

- He, Y.Y. A Comparison of the Rate of Convergence between Binomial Model and Trinomial Model for Pricing American Options. J. Hangzhou Teach. Coll. (Nat. Sci. Ed.) 2007, 6, 424–429. [Google Scholar]

- Chai, J.; Wei, Z.H.; Hu, Y.; Su, S.P.; Zhang, Z.G. Is China′s natural gas market globally connected? Energy Police 2019, 132, 940–949. [Google Scholar] [CrossRef]

- Zhang, D.M.; Tian, G. Analysis of Shaanxi Natural Gas supply and Demand Balance and Countermeasures. Oil Gas Storage Transp. 2017, 36, 132–137. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).