The Perception and Knowledge of Financial Risk of the Portuguese

Abstract

1. Introduction

- Knowledge of the securities market rises with the increase in education level;

- Respondents do not always have a good perception of their financial knowledge, regarding banking products;

- The respondents’ perception of the different financial applications’ risk suggests unfamiliarity with the operation and characteristics of these products;

- The interviewees’ perception of their own financial knowledge does not match their results of the questions of the knowledge of investment products;

- The interviewees’ perception of their own financial knowledge does not match their actual knowledge of the products;

- Perception of the most common financial products is good (demand deposits and insurances), which reveals a greater involvement with the financial system.

2. Literature Review

3. Methodology

3.1. Population and Sample

3.2. Data Collecting Methods

3.3. Procedures

4. Results and Discussion

4.1. Exploratory Factor Analysis

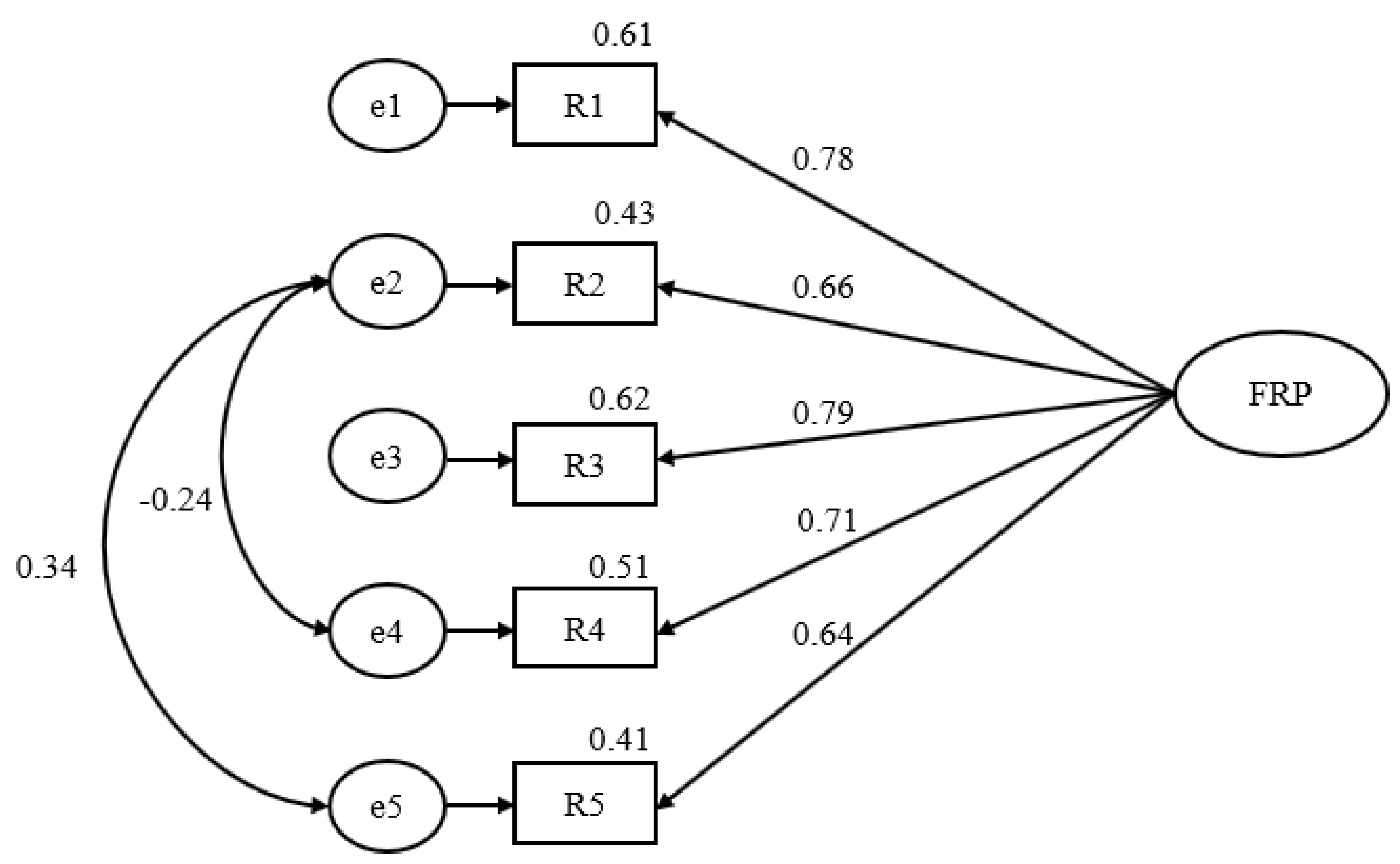

4.2. Confirmatory Factor Analysis

4.3. Descriptive Analysis of Perception and Knowledge of Financial Risk

4.4. Testing the Hypotheses

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Anonymous. BdP, Relatório do Inquérito à Literacia Financeira dos Portugueses; Conselho Nacional de Supervisores Financeiros: Lisboa, Portugal, 2016; Available online: https://www.todoscontam.pt/sites/default/files/SiteCollectionDocuments/Relatorio2InqueritoLiteraciaFinanceira.pdf (accessed on 8 August 2020).

- Allgood, S.; Walstad, W.B. The Effects Of Perceived And Actual Financial Literacy On Financial Behaviors. Econ. Inq. 2016, 54, 675–697. [Google Scholar] [CrossRef]

- INE. Anuário Estatístico de Portugal—2018; INE, Instituto Nacional de Estatística: Lisboa, Portugal, 2019. [Google Scholar]

- Kontis, V.; Bennett, J.E.; Mathers, C.D.; Li, G.; Foreman, K.; Ezzati, M. Future life expectancy in 35 industrialised countries: Projections with a Bayesian model ensemble. Lancet 2017, 389, 1323–1335. [Google Scholar] [CrossRef]

- Schneider, M. Studies in Risk Perception and Financial Literacy: Applications Using Subjective Belief Elicitation. Ph.D. Thesis, Faculty of Commerce, School of Economics, University of Cape Town, Cape Town, South Africa, 2019. [Google Scholar]

- Savage, L.J. The Foundations of Statistics; Courier Corporation: New York, NY, USA, 1972. [Google Scholar]

- Smith, V.K.; Taylor, D.H.; Sloan, F.A. Longevity expectations and death: Can people predict their own demise? Am. Econ. Rev. 2001, 91, 1126–1134. [Google Scholar] [CrossRef]

- Aren, S.; Zengin, N. Influence of Financial Literacy and Risk Perception on Choice of Investment. Procedia-Soc. Behav. Sci. 2016, 235, 656–663. [Google Scholar] [CrossRef]

- Hillson, D.; Murray-Webster, R. Understanding and Managing Risk Attitude; Gower Publishing: Aldershot, UK, 2007. [Google Scholar]

- Barber, B.M.; Odean, T. Boys will be Boys: Gender, Overconfidence, and Common Stock Investment. Q. J. Econ. 2001, 116, 261–292. [Google Scholar] [CrossRef]

- Wagland, S.P.; Taylor, S. When it comes to financial literacy, is gender really an issue? Australas. Account. Bus. Financ. J. 2009, 3, 3. [Google Scholar]

- Kindle, P.A. Student Perceptions of Financial Literacy: Relevance to Practice. J. Soc. Serv. Res. 2010, 36, 470–481. [Google Scholar] [CrossRef]

- Joo, S.; Grable, J. An Exploratory Framework of the Determinants of Financial Satisfaction. J. Fam. Econ Issues 2004, 25, 25–50. [Google Scholar] [CrossRef]

- Khan, S. Impact of financial literacy, financial knowledge, moderating role of risk perception on investment decision. SSRN Electron. J. 2016, 20. [Google Scholar] [CrossRef]

- Ademola, S.A.; Musa, A.S.; Innocent, I.O. Moderating Effect of Risk Perception on Financial Knowledge, Literacy and Investment Decision. Am. Int. J. Econ. Financ. Res. 2019, 1, 34–44. [Google Scholar] [CrossRef]

- Tavares, F.; Santos, E. Financial Literacy Perception Scale for the Portuguese Population. Sci. Ann. Econ Bus. 2020, 67, 277–290. [Google Scholar]

- Bannier, C.; Neubert, M. Gender differences in financial risk taking: The role of financial literacy and risk tolerance. Econ. Lett. 2016, 145, 130–135. [Google Scholar] [CrossRef]

- Nguyen, L.; Gallery, G.; Newton, C. The joint influence of financial risk perception and risk tolerance on individual investment decision-making. Account. Financ. 2019, 59, 747–771. [Google Scholar] [CrossRef]

- Fernandes, D.; Lynch, J.G.; Netemeyer, R. Financial Literacy, Financial Education, and Downstream Financial Behaviors. Manag. Sci. 2014, 60, 1861–1883. [Google Scholar] [CrossRef]

- Ramalho, T. Modelo estrutural de Literácia Financeira: Um Estudo Sobre o Comportamento Financeiro de Brasileiros Considerando Grupos com Diferentes Níveis de Conhecimento Financeiro e Autoconfiança. Ph.D. Thesis, Universidade Presbiteriana Mackenzie, Sao Paolo, Brazil, 2017. [Google Scholar]

- Kline, R. Principles and Practice of Structural Equation Modeling; Guilford Publications: New York, NY, USA, 2015. [Google Scholar]

- Marôco, J. Análise de Equações Estruturais: Fundamentos Teóricos, Software & Aplicações; ReportNumber, Lda: Pêro Pinheiro, Portugal, 2010. [Google Scholar]

- Pestana, M.; Gageiro, N. Análise de Dados Para Ciências Sociais: A Complementaridade do SPSS; Sílabo: Lisboa, Portugal, 2008. [Google Scholar]

- Marôco, J.; Garcia-Marques, T. Qual a fiabilidade do alfa de Cronbach? Questões antigas e soluções modernas? Laboratório Psicol. 2006, 4, 65–90. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Prentice Hall: Upper Saddle River, NJ, USA, 1998; Volume 5. [Google Scholar]

- Marôco, J. Análise Estatística com o SPSS Statistics.: 7\textordfeminine edição; ReportNumber, Lda: Pêro Pinheiro, Portugal, 2018. [Google Scholar]

- Pallant, J. SPSS Survival Manual: A Step by Step Guide to Data Analysis Using IBM SPSS; Routledge: Abingdon, UK, 2020. [Google Scholar]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Pordata. Base de Dados de Portugal Contemporâneo. 2020. Available online: https://www.pordata.pt/Retratos/2020/Retrato+de+Portugal-85 (accessed on 8 August 2020).

- Arribas, I.; Espinós-Vañó, M.D.; García, F.; Tamošiūnienė, R. Negative screening and sustainable portfolio diversification. Entrep. Sustain. Issues 2019, 6, 1566–1586. [Google Scholar] [CrossRef]

- Arribas, I.; Espinós-Vañó, M.D.; García, F.; Oliver, J. Defining socially responsible companies according to retail investors’ preferences. Entrep. Sustain. Issues 2019, 7, 1641–1653. [Google Scholar] [CrossRef]

- Morgan, P.J.; Trinh, L.Q. Determinants and Impacts of Financial Literacy in Cambodia and Viet Nam. J. Risk Financ. Manag. 2019, 12, 19. [Google Scholar] [CrossRef]

- Santos, G.; Marques, C.S.; Ratten, V. Entrepreneurial women’s networks: The case of D’Uva–Portugal wine girls. Int. J. Entrep. Behav. Res. 2019, 25, 298–322. [Google Scholar] [CrossRef]

- Estevao, C.; Cruz, R.; Ferreira, J.; Ratten, V. Contemporary approaches to performance evaluation of international hotel groups in Portugal. J. Glob. Bus. Adv. 2017, 11, 173–192. [Google Scholar]

- Ferreira, J.J.; Fernandes, C.; Ratten, V. The effects of technology transfers and institutional factors on economic growth: Evidence from Europe and Oceania. J. Technol. Transf. 2019, 44, 1505–1528. [Google Scholar] [CrossRef]

- Miragaia, D.; Ferreira, J.; Ratten, V. Interactions between financial efficiency and sports performance: Strategic data for a sustainable entrepreneurial approach of European professional football clubs. J. Entrep. Public Policy 2019, 8, 84–102. [Google Scholar] [CrossRef]

- Jones, P.; Klapper, R.; Ratten, V.; Fayolle, A. Emerging themes in entrepreneurial behaviours, identities and contexts. Int. J. Entrep. Innov. 2018, 19, 233–236. [Google Scholar] [CrossRef]

- Ferreira, J.J.; Ratten, V. Competitiveness of locations: The effects of regional innovation and entrepreneurial practices. Compet. Rev. 2017, 28, 2–5. [Google Scholar]

- Ferreira, J.; Ratten, V.; Dana, L. Knowledge based spillovers and strategic entrepreneurship. Int. Entrep. Manag. J. 2017, 13, 161–167. [Google Scholar] [CrossRef]

- Ferreira, J.; Fernandes, C.; Ratten, V. International entrepreneurship research: Mapping and cognitive structures. Int. J. Entrep. Small Business 2015, 30, 545–566. [Google Scholar] [CrossRef]

| Conclusion/Theme | Reference |

|---|---|

| Choices depend on what one believes to be a subjective probability, about each result and subjective level of the expected utility, or expected value, subjectively evaluating utility. | [6] |

| Risk may be categorized into objective and subjective. | [5] |

| Risk factor is associated with subjectivity, since it is influenced by many factors, including emotional and cognitive ones. | [9] |

| Risk is a function of profits and losses and results from both. Risk perception and level of financial knowledge impact people’s investment preferences. | [8] |

| Investors who possess a high level of perception or risk tolerance and solid financial literacy and knowledge make good financial decisions. | [15] |

| Risk perception is a factor which may impact the whole investment decision, even when financial literacy and knowledge are present. | [14] |

| Financial advisors must consider tolerance and perception in their advisory procedures, in order to give the most adequate advice to their clients. | [18] |

| Single males take more risks than married males. | [10] |

| In order to shorten the gender gap in investment patterns, it seems to be important to increase financial literacy and risk tolerance among females. | [17] |

| Variables | Descriptive Measurements |

|---|---|

| Age | Minimum: 18; Maximum: 71; Average: 37.43; Standard deviation: 12.04 |

| Gender | Malses: 492 (59.3%); Females: 338 (40.7%) |

| Marital Status | Single, separated, divorced or widowed: 418 (50.4%); Married or in a common-law marriage: 412 (49.6%) |

| Education Level | Up to 9th grade: 16 (1.9%); 12th grade: 188 (22.7%); Bachelor’s degree: 415 (50.0%); Master’s degree or PhD: 211 (25.4%) |

| Training Area | Economics, Management, Finances, Accounting or similar areas: 471 (56.7%); Other areas: 359 (43.3%) |

| Annual Gross Income of the Household | Up to 10,000.00€: 120 (14.5%); Between 10,001.00€ and 20,000.00€: 248 (29.9%); Between 20,001.00€ and 30,000.00€: 173 (20.8%); Between 30,001.00€ and 45,000.00€: 148 (17.8%); Over 45,000.00€: 141 (17.0%) |

| R1—Investing 10% of your annual gross income in a moderate growth mutual fund. |

| R2—Investing 5% of your annual gross income in highly speculative stocks. |

| R3—Investing 5% of your annual gross income in conservative stocks. |

| R4—Investing 10% of your annual gross income in government bonds (treasury bonds). |

| R5—How willing are you to take risks when you think about your financial investments? |

| Q1—Imagine that a six-sided die is rolled a thousand times. The times the die indicates an even number are counted. Of the values below, what is the most likely result? (A) 157 (B) 298 (C) 512 (D) 754 (E) 919 (F) The answers above are all equally likely (G) I do not know the answer |

| Q2—In the National Lottery, the odds of winning a prize of 10€ are 1%. How many people do you guess would win a prize of 10€ if 1000 people bought a single lottery ticket? (A) 1 (B) 2 (C) 10 (D) 100 (E) 110 (F) The answers above are all equally likely (G) I do not know the answer |

| Q3—If 5 machines take 5 min to make 5 toys, how long would 100 machines take to make 100 toys? (A) 1 min (B) 5 min (C) 10 min (D) 100 min (E) 1000 min (F) 1 day (G) None of the options above (H) I do not know the answer |

| Q4—There are water lilies in a lake. Each day, the number of water lilies in bloom doubles. If it takes 48 days for the whole lake to be in bloom, how long would the water lilies in bloom take to cover half of the lake’s area? (A) 16 days (B) 24 days (C) 25 days (D) 32 days (E) 26 days (F) 22 days (G) 47 days (H) I do not know the answer |

| Factor 1 | ||

| R1—Investing 10% of your annual gross income in a moderate growth mutual fund. | 0.815 | 0.665 |

| R2—Investing 5% of your annual gross income in highly speculative stocks. | 0.761 | 0.579 |

| R3—Investing 5% of your annual gross income in conservative stocks. | 0.824 | 0.679 |

| R4—Investing 10% of your annual gross income in government bonds (treasury bonds). | 0.730 | 0.533 |

| R5—How willing are you to take risks when you think about your financial investments? | 0.783 | 0.613 |

| Eigenvalue | 3.069 | |

| % Explained Variance | 61.39% |

| AV | SD | |

|---|---|---|

| R1—Investing 10% of your annual gross income in a moderate growth mutual fund. | 2.82 | 1.15 |

| R2—Investing 5% of your annual gross income in highly speculative stocks. | 2.12 | 1.10 |

| R3—Investing 5% of your annual gross income in conservative stocks. | 2.64 | 1.15 |

| R4—Investing 10% of your annual gross income in government bonds (treasury bonds). | 2.91 | 1.22 |

| R5—How willing are you to take risks when you think about your financial investments? | 2.53 | 1.12 |

| Scale of Perception of Financial Risk | 2.60 | 0.90 |

| Questions | n | % | |

| Knowledge of Financial Risk | Q1 | 261 | 31.4 |

| Q2 | 372 | 44.8 | |

| Q3 | 267 | 32.2 | |

| Q4 | 184 | 22.2 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tavares, F.; Santos, E.; Tavares, V.; Ratten, V. The Perception and Knowledge of Financial Risk of the Portuguese. Sustainability 2020, 12, 8255. https://doi.org/10.3390/su12198255

Tavares F, Santos E, Tavares V, Ratten V. The Perception and Knowledge of Financial Risk of the Portuguese. Sustainability. 2020; 12(19):8255. https://doi.org/10.3390/su12198255

Chicago/Turabian StyleTavares, Fernando, Eulália Santos, Vasco Tavares, and Vanessa Ratten. 2020. "The Perception and Knowledge of Financial Risk of the Portuguese" Sustainability 12, no. 19: 8255. https://doi.org/10.3390/su12198255

APA StyleTavares, F., Santos, E., Tavares, V., & Ratten, V. (2020). The Perception and Knowledge of Financial Risk of the Portuguese. Sustainability, 12(19), 8255. https://doi.org/10.3390/su12198255