1. Introduction

With the rapid development of technology and the advance of the information age, independent innovation capabilities have played a vital role in the economic growth of enterprises and even whole countries. Science and technology are the foundations of a country’s prosperity and innovation is the soul of national progress. At the same time, this also emphasizes that enterprises should carry out scientific innovation, strengthen intellectual property rights, train innovative talents, improve the innovation environment, construct better innovation capacity, and pursue sustainable innovation development (APEC, 2014) [

1]. As is known to all, the innovation ability of a country depends on the development of the micro-economy, especially the high-tech enterprises are at the leading position of innovation and development, which are vital to the lifeline of the entire country.

Catering behavior research first emerged from the issue of the choice of dividend policy. Baker and Wurgler (2004) [

2] proposed a “catering theory” based on the perspective of behavioral finance. With the deepening of research, many scholars have discovered that catering behavior may exist not only in cash dividends but also universally in areas such as innovation investment (Nayak & Choudhury, 2014) [

3], government subsidies (Su et al., 2019) [

4]. From the perspective of catering, most of the catering behaviors of enterprises are based on manipulation to obtain a certain qualification, and most of them are based on the benefits of industrial incentive policies (Song, Wang & Zhang, 2020) [

5].

Based on this point, the paper takes the “Administrative Measures for the determination of high and new technology enterprises” provision for R&D intensity in the “Certification Measures” as the starting point, and focuses on solving the following two issues: (1) Is there an innovative “incentive” catering behavior in the process of identification of high-tech enterprises in China? (2) Does the innovation “incentive” cater to the high-tech enterprise identification process have an impact on the innovation efficiency of the enterprise, and if so, is there an internal mechanism?

The structure of the article is as follows. First, the paper uses the threshold regression model to reveal the existence of catering behaviors in the process of identifying high-tech enterprises, and derives the corresponding catering interval. Secondly, the paper further studies the impact on innovation efficiency of enterprises if there is no innovation catering behavior. Thirdly, in the further study of innovation efficiency, the mediation effect of R&D investment and R&D subsidy is also discussed. Finally, relevant feasibility opinions based on the research results are put forward. Empirical research indicates that this research proves the hypothesis that innovation “incentives” conform to the behavioral assumptions of high-tech companies. Further, it is found that the true internal mechanism of high-tech enterprises that affects innovation efficiency is R&D investment and R&D subsidies.

The contributions of this paper start with “Certification Measures” and use a threshold regression model to verify that the enterprise innovation is “pseudo innovation” for enterprises to cater to the government. It is different from the existing research on high-tech enterprises, which are mostly based on the discrimination of “yes” or “no”, while ignoring the problems of “true” and “false”. This paper combines the enterprise’s “incentive” catering behavior for innovation with the recognition of high-tech qualifications, researches the problems and economic consequences of enterprises’ innovation “incentive” catering behavior in the process of identification, and explores the active catering behavior of enterprises to obtain more government R&D subsidies from the perspective of enterprises themselves. Furthermore, this paper treats the government as a neutral policy issuer and regulator, and enterprises as a rational subject to fight for high-quality scarce resources of the government. This paper also systematically studies the behavior of enterprises as rational subjects and caters to government policies according to the government’s own interests. Additionally, it also reveals the chaotic behavior of innovation in the process of identifying high-tech enterprises from an empirical point of view and verifies the effectiveness of the implementation of high-tech enterprise identification and, to a certain extent, policy. A new perspective for research on high-tech accreditation policies is also provided.

2. Theoretical Analysis and Research Hypotheses

In theory, in a completely free market, companies have no incentive to innovate, and innovation inputs themselves to obtain the property of public goods (Arrow, 1962) [

6]. Therefore, most countries give preferential support to enterprise innovation activities when certain conditions are met. According to “External Control of Organization” published by Pfeffer and Salancik (1979) [

7], the resource dependence theory holds true, due to environmental uncertainty and scarcity of resources.

The authors believe that high-tech certification lacks resources as free transfer payments, and not all companies adopt universal support. This is a crucial basis for “Certification Measures”, which lists a series of objective and subjective standards. High-tech enterprises are identified as an “innovation-incentive” industrial policy, facing the company’s strategic catering response behavior, identifying the true innovation intentions of the enterprise is a fairly complicated task. It is relatively economical to give equal resource support to companies that meet the identified standards. According to the theory of information asymmetry and the theory of signal transmission, in the case of information asymmetry between the two sides, the enterprise transmits the information that reaches the recognition threshold to the government department, so as to obtain the recognition of the government department. Secondly, from the perspective of enterprises and the external market, enterprises will obtain the recognition of high-tech enterprises as a good investment signal to the investors in the external market, as well as the enterprise’s innovation capabilities and industry prospects (Shen, Sha & Wu, 2020) [

8], and then help companies obtain the required innovation resources to improve corporate performance (Kleer, 2010) [

9]. An enterprise can only be recognized as a high-tech enterprise and enjoy a series of tax incentives and government subsidies if it releases “innovation signals” that comply with the “Recognition Measures”.

According to the assumption of a rational economic person, once the company applies policy insights, the company or management may obtain asymmetric information. Based on its own interests, the company would consider taking proactive measures to meet the recognition policy which is difficult for the government to really identify whether the applicant company caters to the behavior or the true state of innovation. At the same time, it is difficult to directly identify the catering behavior of application enterprises due to the existence of political connections such as false reports and rent-seeking of intermediary organizations. Therefore, it can be considered that some companies that do not have the corresponding qualifications or no longer meet the conditions, would take appropriate measures to obtain the high-tech enterprise certification or maintain the “high-tech enterprise” certification to obtain the relevant benefits. The following hypotheses are proposed based on the above analysis:

Hypotheses 1 (H1). In the process of high-tech enterprises identify in China, there may be innovative “incentives” catering behavior.

According to the theory of resource dependence and signal transmission, obtaining the title of high-tech enterprise would undoubtedly affect the innovation of the enterprise while also bringing tax relief for the enterprise. Nevertheless, the government and external stakeholders have no ability to identify “authentic” high-tech enterprises, they can only make their own choices by further examining the capabilities of other aspects of the enterprise. Although in this process, the “catering company” still has to pass a high-tech qualification certification, it can still obtain more tax incentives. Qualification certification is only a product of the company’s response to the behavior and cannot directly generate the economic benefits that need to use the conduction mechanism to be completed. If “catering enterprise” intends to enhance its value like a real high-tech enterprise for a long time, it needs to rely on the pulling power policy, like corporate R&D investment and research and development subsidies, to help companies overcome difficulties or achieve sustainable development of the enterprise. Long-term dependence on unproductive behaviors such as catering will certainly inhibit the improvement of innovation efficiency. Therefore, regarding the research of Yi et al. (2017) [

10], a model is established to investigate the effects of the innovation efficiency of high-tech enterprises, explore the impact of innovative “incentive” catering behaviors on corporate innovation efficiency, solve the previously mentioned second major problem, and closely question the mechanism of innovative “incentive” catering behaviors: In the process of high-tech enterprise identification, whether the innovation “incentive” catering behavior has an impact on the innovation efficiency of the enterprise If so, is there a mechanism of action?

Obtaining the title of high-tech enterprise will undoubtedly affect the innovation efficiency of the enterprise while bringing tax relief to the enterprise. Catering behavior has seriously distorted the effectiveness of high-tech enterprise policies, resulting in high-quality resources not being allocated to innovative enterprises that need urgent development. As a result, “pseudo high-tech” invests the scarce resources obtained into nonproduction and operation activities, weakens the promotion effect of policy identification on the innovation efficiency of enterprises, caters to the enterprises’ possible intensified use of the resources obtained for a new round of catering behavior, and creates a serious vicious cycle. The substantial innovation-oriented invention is the foundation of our life. The strategic behavior of unilaterally pursuing catering methods can indeed achieve high returns in a short period, but in the long run, it will not increase the efficiency of innovation. The innovation “incentive” catering behavior may induce strategic innovation for the purpose of catering policy. Many catering costs occupy the innovation resources of enterprises, thus damaging the innovation efficiency of enterprises and reducing the efficiency of social resource allocation. Therefore, the fundamental purpose of innovation “incentive” catering behavior is to obtain the tax relief brought by the recognition of high-tech enterprises. If the obtained high-quality innovation resources are not utilized in the innovation activities of the enterprise itself, it would be hard to improve the actual innovation level of the company, which, naturally, would be impossible to improve the innovation efficiency of the enterprise. On the contrary, high-tech enterprises that pass the recognition threshold through hard strength may obtain more room for improvement, and their innovation efficiency performance would be correspondingly better. Based on the above analysis, the following hypothesis is raised.

Hypotheses 2 (H2). Innovation efficiency of high-tech enterprises without innovation “incentive” catering behavior will be better.

Existing studies have examined the impacts of government R&D subsidies on general innovation, and most conclusions are from the investigations of high-tech (Howell, 2017, Liu et al., 2016) [

11,

12] and emerging firms (Geldes et al., 2017, Huergo and Moreno, 2017) [

13,

14]. Innovation “incentive” catering behavior is a strategic innovation activity aimed at obtaining other short-term and high benefits. It largely reflects the “crowding effect” of innovation resources, which poses a huge challenge to the effectiveness of policies. As the cost of R&D investment increases, the company will measure whether the return it brings is sufficient to balance its costs, and companies on the edge of the identification threshold of high-tech companies will only need to spend a small amount of money. In return, after controlling their innovation investment to reach the recognition threshold, catering companies may not have the incentive to continue to increase R&D investment, but only need to keep their investment level stable—at a controllable level, to ensure that the requirements of the identification standards are always met. However, “True high-tech” companies will pay more attention to the improvement of their own innovation capabilities which will not stop at the threshold and stop their R&D activities. As Dai and Wang (2019) [

15] pointed out, in order to release the signal of “innovative enterprises”, enterprises will set up “image projects” to cater to “innovate for innovation”. The independent innovation ability of enterprises is the key point of policy emphasis, so high-tech enterprises focus on innovation behavior aimed at promoting technological progress and maintaining competitive advantages. In addition, due to the government pressure on high-tech enterprises they will promote enterprises’ increased innovation (Lin & Luan 2020) [

16]. Government subsidies, as one of the government’s macro-control measures, have played a vital role in China’s economic development, and government research and development subsidies have a self-evident role in promoting China’s innovation. For enterprises, government R&D grants are a significant source of funding. If an enterprise receives R&D subsidies, it can increase the company’s disposable funds for its management. Therefore, whether from the perspective of the company or from the perspective of the management, companies have an incentive to meet the relevant standards set by the government through dietary behavior, thereby obtaining government R&D subsidies. For the research object of this paper—high-tech enterprises, the government would examine the indicators related to enterprise innovation when issuing R&D subsidies, such as the proportion of enterprise R&D personnel, whether there are a research and development institution, and whether the innovation output is innovative. The requirements for granting R&D subsidies are more stringent than the standards recognized by high-tech enterprises. “True high-tech” companies that do not cater to behaviors pay more attention to the allocation of human and financial resources related to innovation. In government evaluations, indicators related to innovation can better meet the requirements of related indicators, thereby obtaining more R&D subsidies. Based on the above analysis, the authors believe that, compared with companies that do not have catering behaviors, catering behavior cannot really improve the performance of R&D investment and R&D subsidies.

Hypotheses 3 (H3). High-tech enterprises without innovative “incentives” catering behavior, will receive higher R&D investments and subsidies.

In the previous hypothesis analysis, the above content has discussed in detail the relationship between the innovative “incentive” catering behavior of high-tech companies, R&D investment, and R&D subsidies. The impact of corporate R&D investment and subsidies on corporate innovation efficiency is self-evident. As a source of funding for corporate innovation, R&D investment, and corporate R&D subsidies have a fundamental impact on the company’s technological innovation capabilities. Through empirical analysis, many scholars have found that enterprises’ R&D investment and R&D subsidies can significantly affect their innovation. “Pseudo-high-tech” companies have no incentive to control their innovation investment to continue to increase R&D investment after reaching the recognition threshold, but can only maintain their investment level at a controllable level to ensure that they meet the requirements and always meet the certification standards. However, “true high-tech” enterprises will pay more attention to the improvement of their own innovation capabilities. They will not stop their R&D activities at the threshold and continue to increase their R&D investment. Additionally, “true high-tech” enterprises can also get more R&D subsidies, which means enterprises have more funds for innovation activities, so the innovation efficiency of enterprises will also increase at the same time. In light of this, the following assumption is made:

Hypotheses 4 (H4). R&D investment and R&D subsidies play an intermediary role in the relationship between innovation “incentives” catering behavior and corporate innovation efficiency.

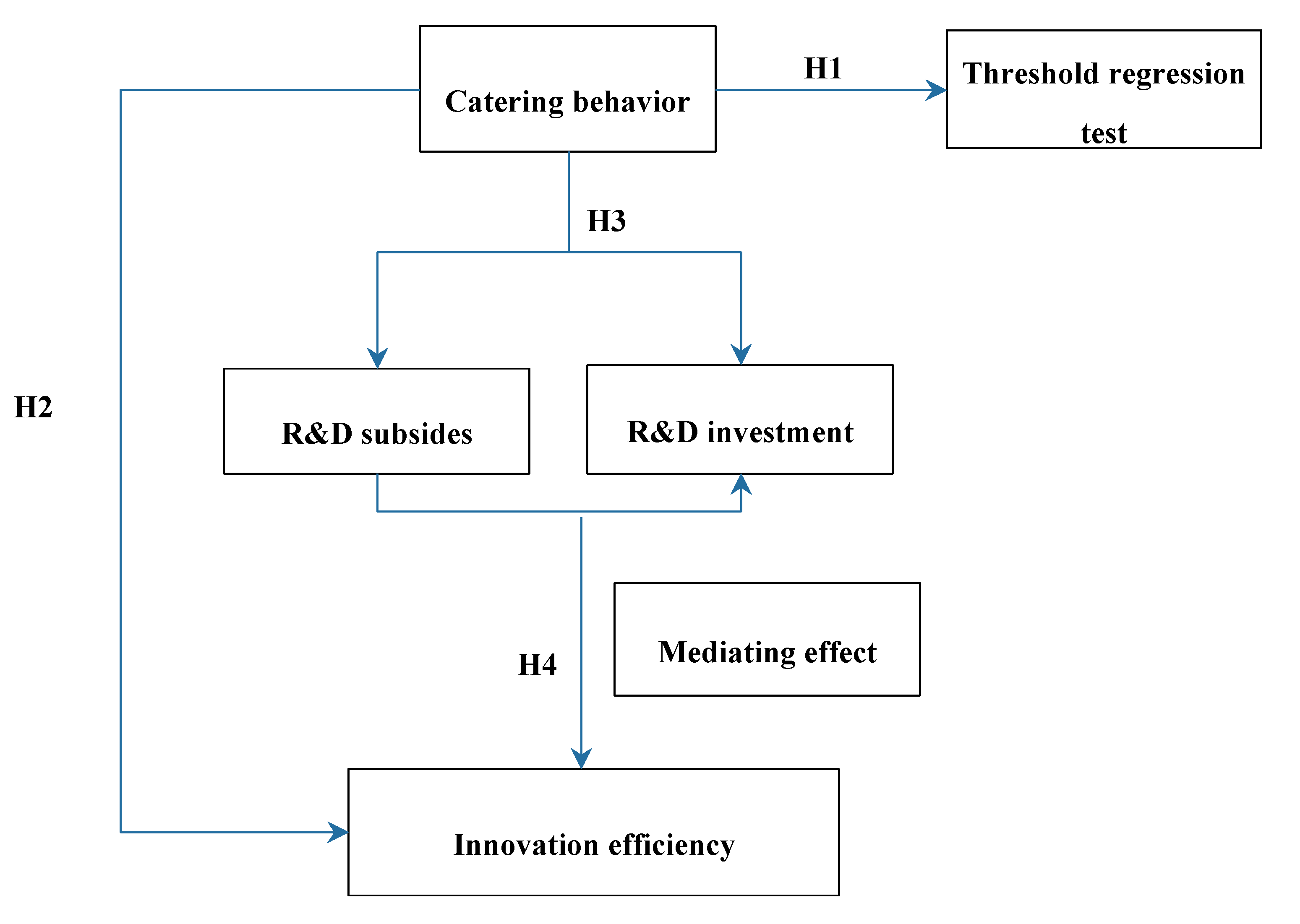

The theoretical model of this paper is shown in

Figure 1.

5. Conclusions and Limitations

5.1. Conclusions

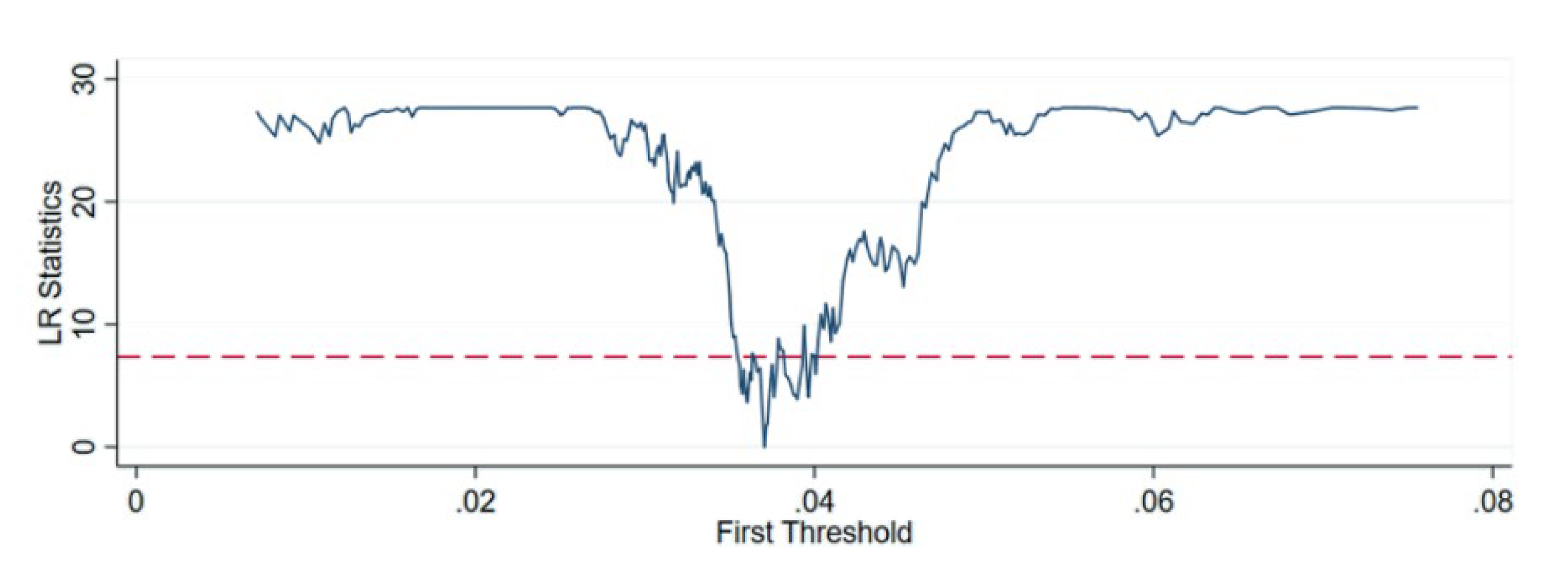

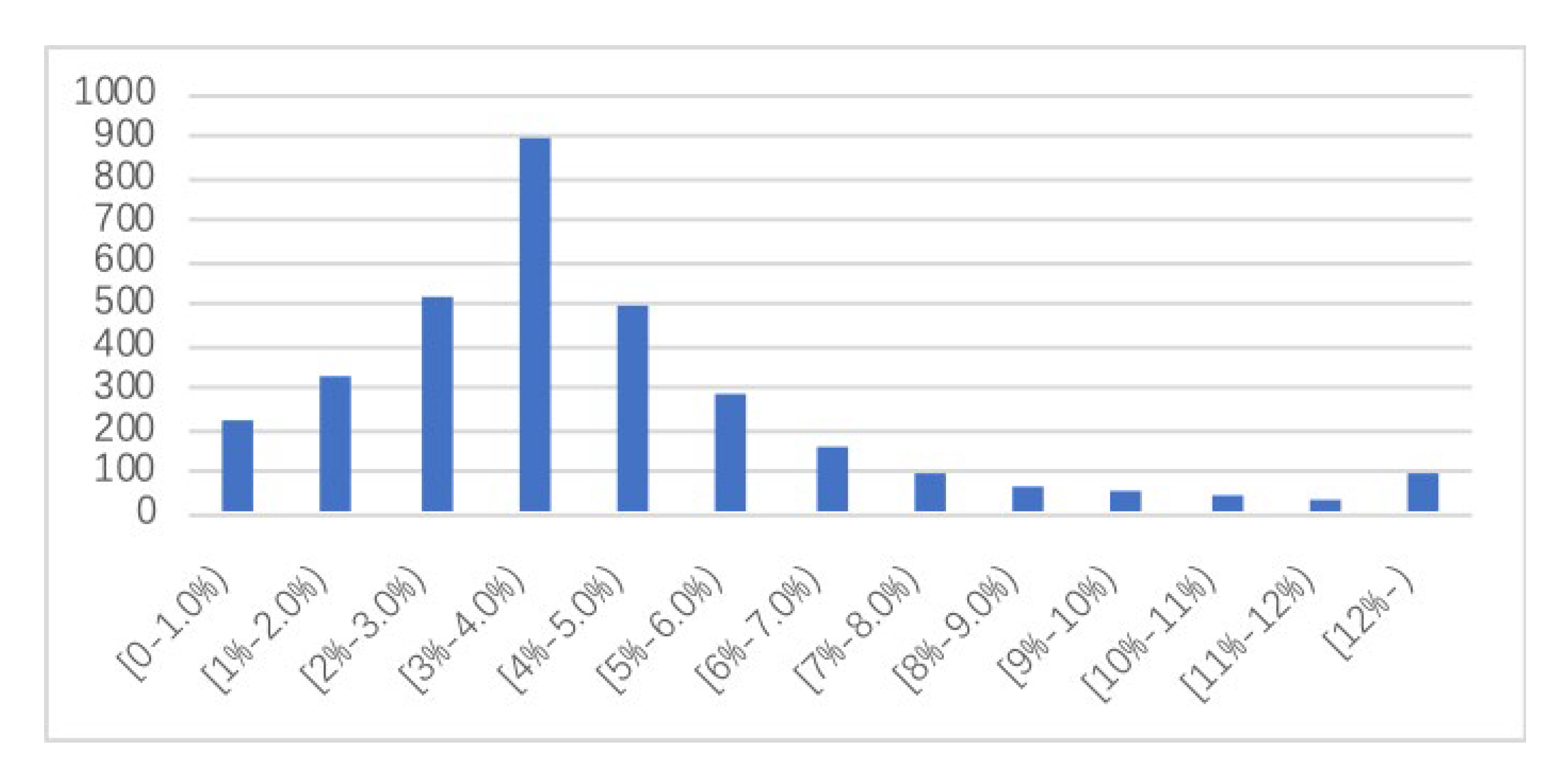

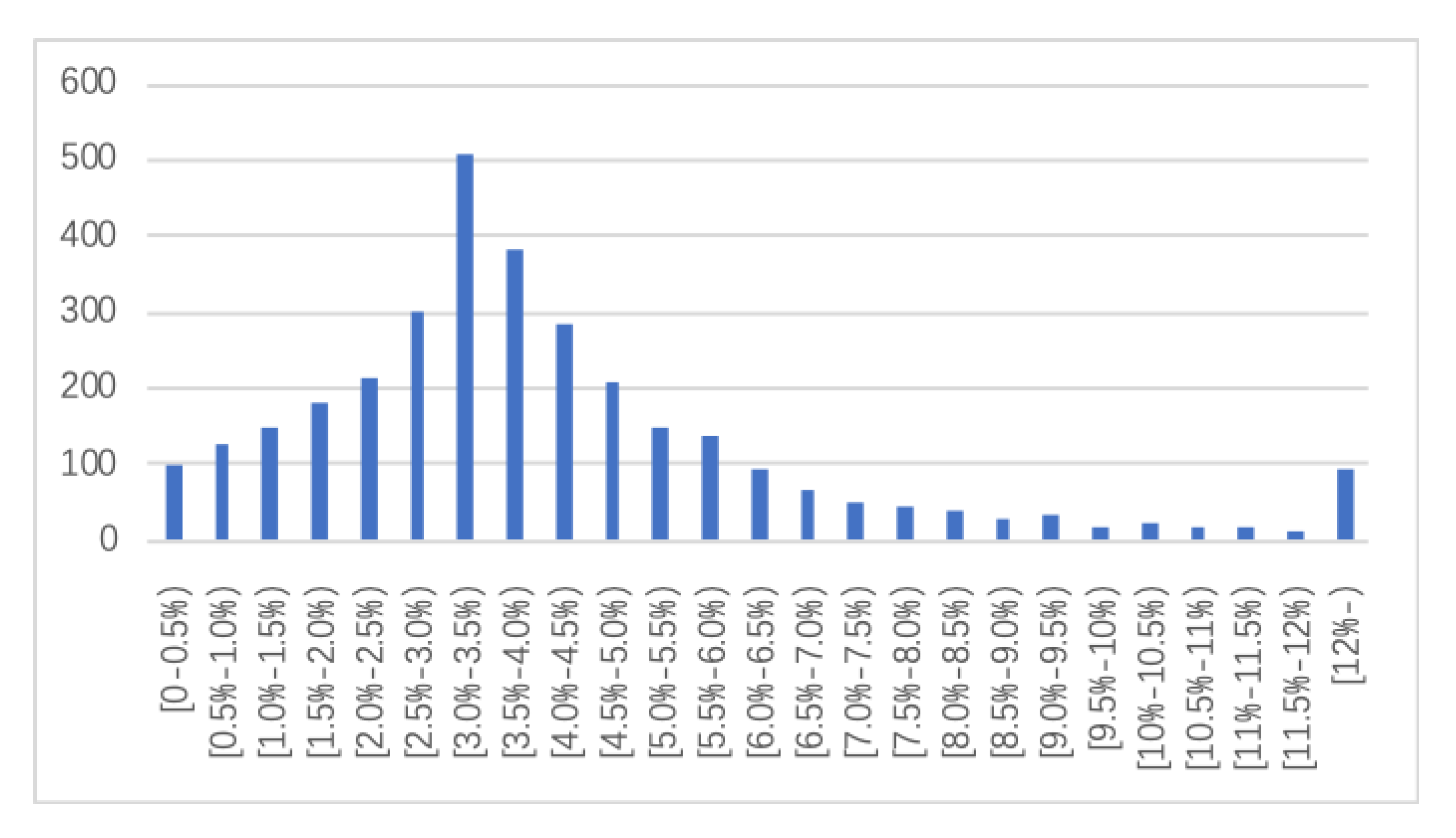

Through empirical inspection of the threshold regression model, this paper finds that there is a threshold effect on the R&D intensity of high-tech enterprises, with a threshold value of 0.0370. The “identification method” is taken as the objective identification standard, which is 6%, 4%, and 3% of the R&D intensity of high-tech enterprises, and this threshold is the limit. Furthermore, the high-tech enterprises in our country are divided into two categories: the existence of innovation input catering behavior and the absence of innovation input catering behavior. The empirical results show that the “one size fits all” objective recognition threshold standard in the recognition method would indeed urge some enterprises to adopt catering behavior, supporting the innovation input catering hypothesis.

Different from previous studies, it is found that the mechanisms of the effect of tax preference on innovation efficiency in real high-tech enterprises are R&D investment and R&D subsidy. The test results demonstrate that the innovation efficiency, R&D investment, and R&D subsidy of high-tech enterprises without innovation input catering behavior have better performances.

5.2. Suggestions

The key to an enterprise’s development through technological innovation is to give full play to its subjective initiative and increase its enthusiasm for independent research and development, and make the innovation capability of the enterprise sustainable. From the perspective of the enterprise itself, it can be seen from the results of empirical research that if they rely solely on catering behaviors to obtain high-tech qualifications, then they cannot fundamentally resolve the problem of the insufficient innovation ability of enterprises, and deeper influencing factors should be considered. The immediate short-term benefits should be based on the role of technological innovation and research and development subsidies in promoting the efficiency of corporate innovation.

Under the current economic development model, the government should allocate resources reasonably. For example, to better survive and develop in fierce competition, companies have enough motivation to actively or passively win the trust of government officials, which is also the result of the government’s resources. Nonetheless, actively seeking political connections to obtain government R&D subsidies, only to a certain extent guarantees funding sources for technological innovation. To truly give play to the incentive effect of the R&D subsidy policy, enterprises should invest funds in R&D projects in accordance with regulations after obtaining resources to avoid transfers. Through the rational use of R&D subsidies to ensure a certain level of the input–output rate, it is possible to improve the efficiency of the use of government R&D subsidies to promote the innovation and development of the company. Meanwhile, in the process of enterprise development, the uncertainty brought about by the institutional environment must be continuously monitored and business strategy adjusted continuously. Therefore, enterprises should use corporate resources for the company’s business development and technological innovation, fully participate in market competition, and resolve financing constraints through multiple channels, instead of relying on political connections to obtain funds from the government. After all, the relationship between the government and enterprises is unsustainable, and there is no long-term guarantee that the company’s R&D funds will be in place. At the same time, enterprises should also implement technology innovation incentive mechanisms, introduce research and development personnel, improve research and development efficiency, and improve the innovation capacity of enterprises.

5.3. Limitation

The research on the catering behavior of high-tech enterprises is limited to the aspect of innovation investment, without comprehensive consideration of other elements of the “Certification Measures”. The paper starts from the objective provisions of the R&D intensity in the “Assessment Measures”, and empirically tests the catering behavior of high-tech enterprises’ innovation input and its impact on innovation efficiency. In the definition of catering behavior, only the identification standard of R&D intensity is considered, without in-depth consideration of the possible catering phenomena in subjective indicators such as the proportion of R&D personnel, the proportion of new product sales revenue, and patents.

The response of the capital market to corporate innovation investment should be further investigated. When considering the economic consequences of high-tech enterprises, the article only examines the innovation efficiency of enterprises and does not thoroughly examine the impact of such aspects on enterprise value. Moreover, considering that the development of the stock market is not completely sound, whether there will be adverse selection of innovation investment catering behavior of high-tech enterprises is unclear. Thus, the research on the response of the capital market to the catering behavior of high-tech enterprises is also a relatively urgent issue. This paper does not cover it further and needs to be strengthened later.