Possibilities of House Valuation Automation in the Czech Republic

Abstract

1. Introduction

2. Methods

- HV—value of the detached house (CZK),

- LV—value of the land (CZK),

- OV—value of the actual object itself (CZK).

- OV—value of the actual object itself (CZK),

- α1—coefficient taking into consideration the potential to use the cellar,

- α3—coefficient taking into consideration the potential to use the first floor or attic,

- SUV—structure unit value (CZK/square meter),

- S1—net floor area of the cellar,

- S2—net floor area of the ground floor,

- S3—net floor area of the first floor or attic.

- W—wear given in decimal values,

- MN—number of calendar months that have elapsed since sale.

- Can the ratio between the net floor area and built-up floor area of a detached house be determined?

- Can the value of a detached house be determined as the product of the value of the land and the value of the house as such?

- To what degree do cellars, attics, and other areas that are not intended for permanent occupation influence the value of a detached house?

- Can the entire system be automated?

3. Results

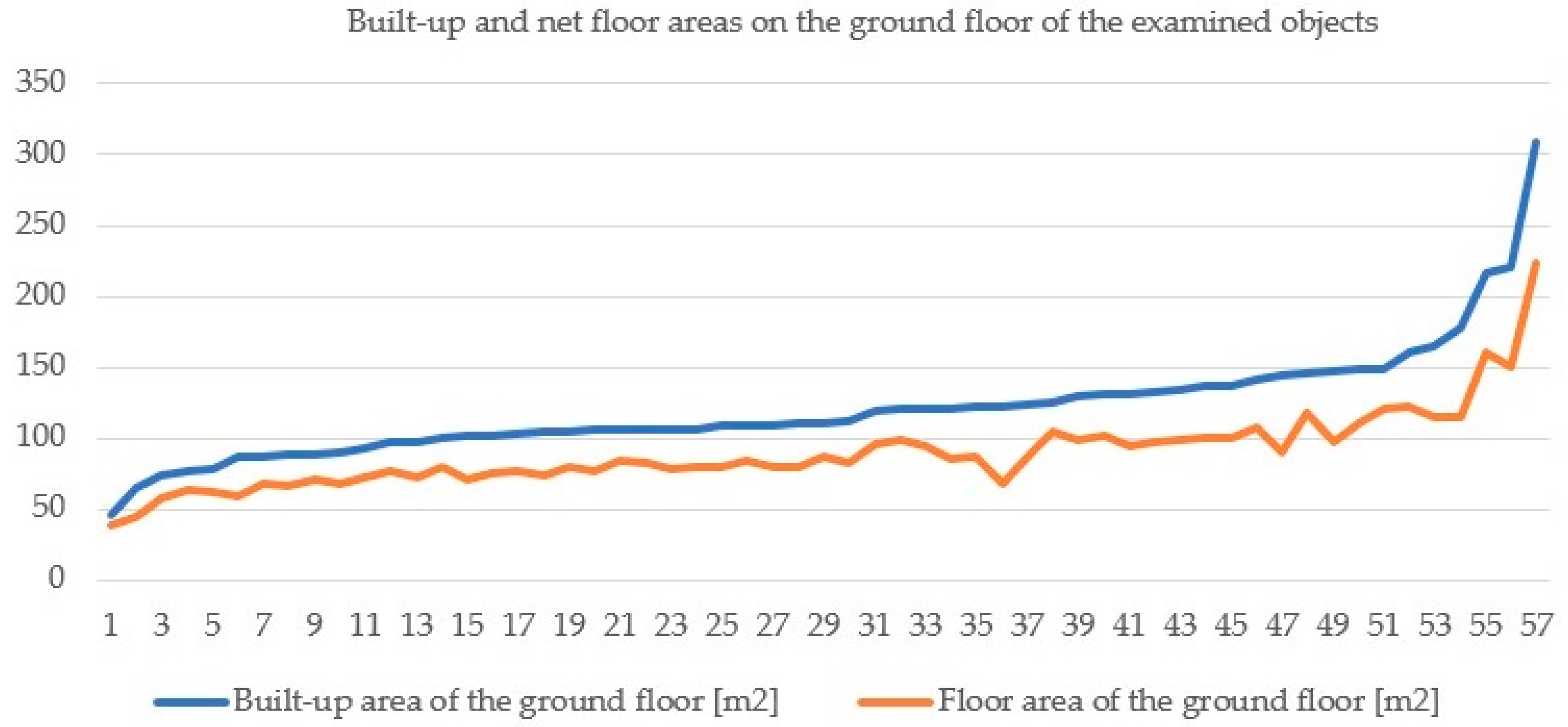

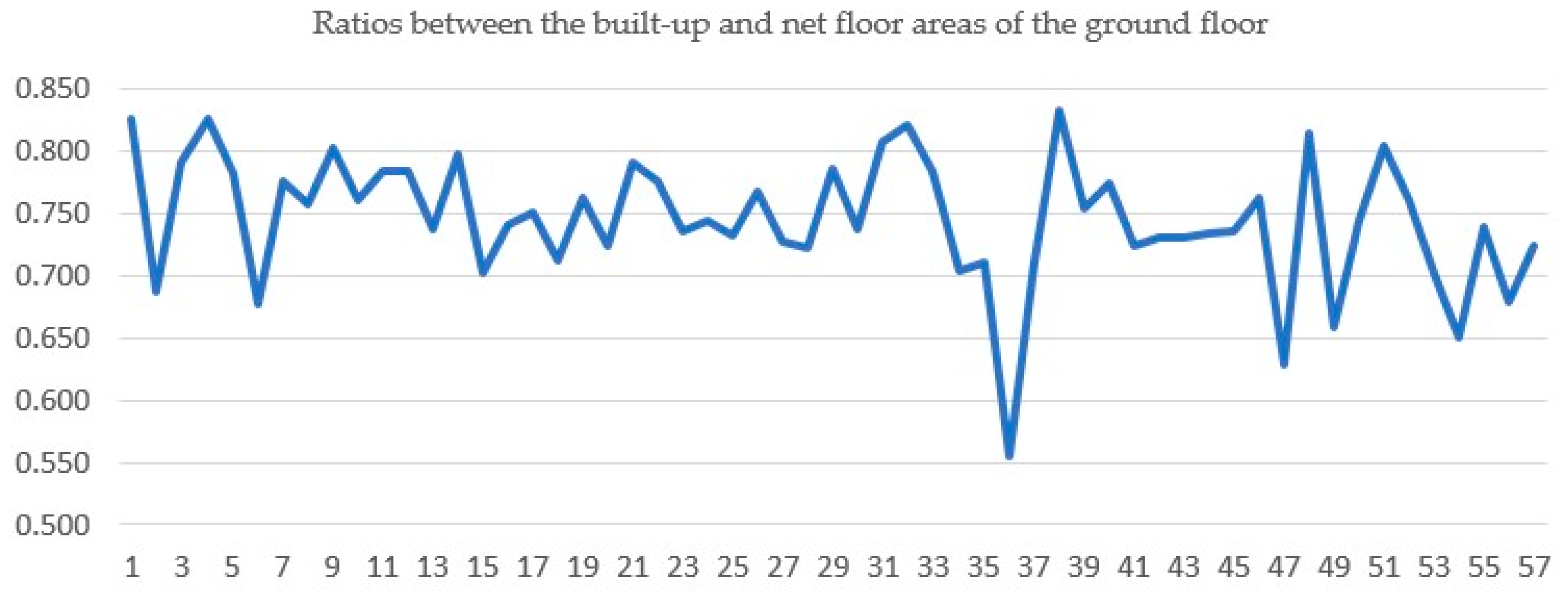

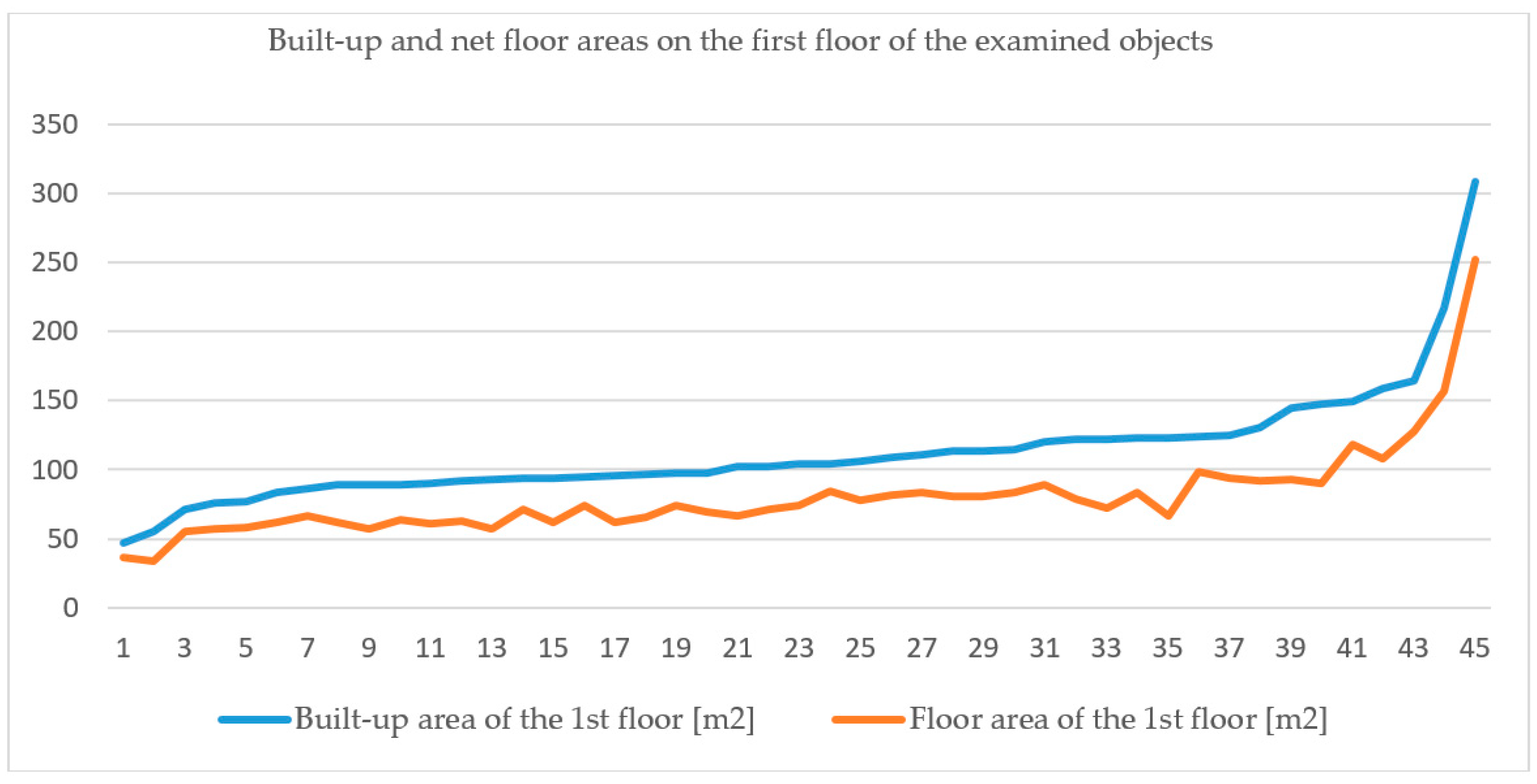

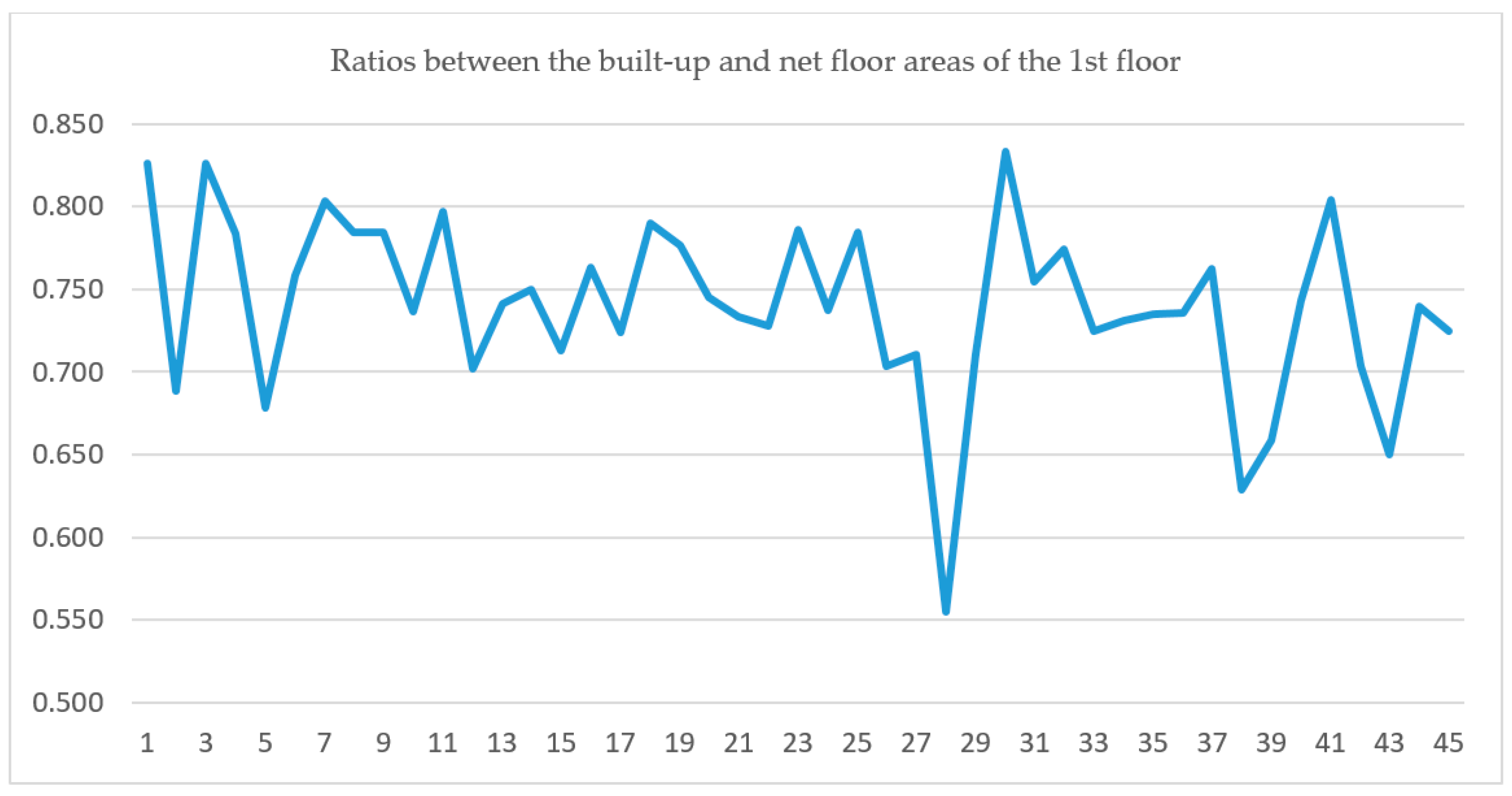

3.1. The Relationship between the Built-Up and Net Floor Areas of Detached Houses

- It is evident that most of the values of the examined ratios fall within an interval between 0.70 and 0.80.

- Greater deviations only apply to single cases; with regard to the numbers, there are slightly more cases where the examined ratio is less than 0.70.

- Houses with a built-up area ranging from 90 to 120 square meters have the most stable examined ratio; the values of houses with a built-up area outside this range deviate much more.

3.2. Determining the Values of Coefficients

- β1 = 336.59,

- β2 = 35,500.09,

- β3 = 19,847.12.

- α1 = 0.009,

- α3 = 0.559.

4. Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Renigier-Bilozor, M.; Janowski, A.; d’Amato, M. Automated valuation model based on fuzzy and rough set theory for real estate market with insufficient source data. Land Use Policy 2019, 87. [Google Scholar] [CrossRef]

- Arribas, I.; Garcia, F.; Guijaro, F.; Oliver, J.; Tamosiuniene, R. Mass appraisal of residential real estate using multilevel modelling. Int. J. Strateg. Prop. Manag. 2016, 20, 77–87. [Google Scholar] [CrossRef]

- Özdilek, Ű. On Price, Cost, and Value. Apprais. J. 2010, 78, 71–79. [Google Scholar]

- Bailey, M.J.; Muth, R.F.; Nourse, H.O. A regression method for real estate price index construction. J. Am. Stat. Assoc. 1963, 58, 933–942. [Google Scholar] [CrossRef]

- Graaskamp, J.; Robbins, M. Business 868 Lecture Notes; University of Wisconsin: Madison, WI, USA, 1987. [Google Scholar]

- Doumpos, M.; Papastamos, D.; Andritsos, D.; Zopounidis, C. Developing automated valuation models for estimating property values: A comparison of global and locally weighted approaches. Ann. Oper. Res. 2020. [Google Scholar] [CrossRef]

- Bitter, C.; Mulligan, G.F.; Dall’erba, S. Incorporating spatial variation in housing attribute prices: A comparison of geographically weighted regression and the spatial expansion method. J. Geogr. Syst. 2007, 9, 7–27. [Google Scholar] [CrossRef]

- Füss, R.; Koller, J.A. The role of spatial and temporal structure for residential rent predictions. Int. J. Forecast. 2016, 32, 1352–1368. [Google Scholar] [CrossRef]

- Yunjong, K.; Seungwoo, C.; Mun, Y.Y. Applying Comparable Sales Method to the Automated Estimation of Real Estate Prices. Sustainability 2020, 12, 5679. [Google Scholar]

- Shehata, W.; Abu Arqoub, M.; Langston, C. From hard bed to luxury home: Impacts of reusing HM Prison Pentridge on property values. J. Hous. Built Environ. 2020. [Google Scholar] [CrossRef]

- Corcoran, C.; Liu, F. Accuracy of Zillow’s home value estimates. Real Estate Issues 2014, 39, 45–49. [Google Scholar]

- Du, M.; Zhang, X. Urban greening: A new paradox of economic or social sustainability? Land Use Policy 2020, 92, 104487. [Google Scholar] [CrossRef]

- Jim, C.Y.; Chen, W.Y. Impacts of urban environmental elements on residential housing prices in Guangzhou (China). Landsc. Urban Plan. 2006, 78, 422–434. [Google Scholar] [CrossRef]

- Case, B.; Clapp, J.; Dubin, R.; Rodriguez, M. Modelling spatial and temporal house price patterns: A comparison of four models. J. Real Estate Financ. Econ. 2004, 29, 167–191. [Google Scholar] [CrossRef]

- Pace, R.; Gilley, O. Generalizing the OLS and grid estimators. Real Estate Econ. 1998, 1, 331–346. [Google Scholar] [CrossRef]

- Bourassa, S.; Cantoni, E.; Hoesli, M. Predicting house prices with spatial dependence: A comparison of alternative methods. J. Real Estate Res. 2010, 32, 139–159. [Google Scholar]

- Ciuna, M.; De Ruggiero, M.; Salvo, F.; Simonotti, M. Automated Procedures Based on Market Comparison Approach in Italy. In Advances in Automated Valuation Modeling. Studies in Systems, Decision and Control; d’Amato, M., Kauko, T., Eds.; Springer: Cham, Germany, 2017; Volume 86, pp. 381–400. [Google Scholar]

- Ciuna, M.; Salvo, F.; Simonotti, M. An Estimative Model of Automated Valuation Method in Italy. In Advances in Automated Valuation Modeling. Studies in Systems, Decision and Control; d’Amato, M., Kauko, T., Eds.; Springer: Cham, Germany, 2017; Volume 86, pp. 85–112. [Google Scholar]

- Morano, P.; Tajani, F.; Locurcio, M. Multicriteria analysis and genetic algorithms for mass appraisals in the Italian property market. Int. J. Hous. Mark. Anal. 2018, 11, 229–262. [Google Scholar] [CrossRef]

- Mothorpe, C.C.; Wyman, D.M. The appraisal of residential water view properties. Apprais. J. 2017, 85, 130–141. [Google Scholar]

- Lan, F.; Wu, Q.; Zhou, T.; Da, H. Spatial Effects of Public Service Facilities Accessibility on Housing Prices: A Case Study of Xi’an, China. Sustainability 2018, 10, 4503. [Google Scholar] [CrossRef]

- Diao, M.; Zhu, Y.; Zhu, J. Intra-city access to inter-city transport nodes: The implications of high-speed-rail station locations for the urban development of Chinese cities. Urban Stud. 2017, 54, 2249–2267. [Google Scholar] [CrossRef]

- Xue, C.; Ju, Y.; Li, S.; Zhou, Q. Research on the Sustainable Development of Urban Housing Price Based on Transport Accessibility: A Case Study of Xi’an, China. Sustainability 2020, 12, 1497. [Google Scholar] [CrossRef]

- Morancho, A.B. A hedonic valuation of urban green areas. Landsc. Urban Plan. 2003, 66, 35–41. [Google Scholar] [CrossRef]

- Park, J.H.; Lee, D.K.; Park, C.; Kim, H.G.; Jung, T.Y.; Kim, S. Park accessibility impacts housing prices in Seoul. Sustainability 2017, 9, 185. [Google Scholar] [CrossRef]

- Bond, S. HVOTLs in New Zealand. In Towers, Turbines and Transmission Lines: Impacts on Property Value; Wiley Publishing: Hoboken, NJ, USA, 2013; pp. 81–99. [Google Scholar]

- Endah, S. Impact of air pollution on property values: A hedonic price study. J. Ekon. Pembang. Kaji. Masal. Ekon. Dan Pembang. 2013, 14, 52–65. [Google Scholar]

- Simons, R.A.; Saginor, J.D. A meta-analysis of the effect of environmental contamination and positive amenities on residential real estate values. Real Estate Res. 2006, 28, 71–104. [Google Scholar]

- Broome, R. The stigma of Pentridge the view from Coburg 1850–1987. J. Aust. Stud. 1988, 12, 3–18. [Google Scholar] [CrossRef]

- Fik, T.J.; Ling, D.C.; Mulligan, G.F. Modelling spatial variation in housing prices: A variable interaction approach. Real Estate Econ. 2003, 31, 623–646. [Google Scholar] [CrossRef]

- Bourassa, S.C.; Hoesli, M.; Peng, V.S. Do housing submarkets really matter? J. Hous. Econ. 2003, 12, 12–28. [Google Scholar] [CrossRef]

- Kucharska-Stasiak, E. Uncertainty of property valuation as a subject of academic research. Real Estate Manag. Valuat. 2013, 21, 17–25. [Google Scholar] [CrossRef]

- Baraňska, A. Real Estate Mass Appraisal in Selected Countries—Functioning Systems and Proposed Solutions. Real Estate Manag. Valuat. 2013, 21, 35–42. [Google Scholar] [CrossRef]

- Kuta, V.; Endel, S. Bydlení v Souvislostech [Housing in Context]; VSB—Technical University of Ostrava: Ostrava, Czech Republic, 2018. [Google Scholar]

- Himmelberg, C.; Mayer, C.; Sinai, T. Assessing high house prices: Bubbles, fundamentals and misperceptions. J. Econ. Perspect. 2005, 19, 67–92. [Google Scholar] [CrossRef]

- Bradáč, A. Teorie a Praxe Oceňování Nemovitých Věcí [Theory and Practice of Real Estate Valuation]; Akademické Nakladatelství CERM, s.r.o.: Brno, Czech Republic, 2016. [Google Scholar]

- Reichert, A.K. The impact of interest rates, income, and employment upon regional housing prices. J. Real Estate Financ. Econ. 1990, 3, 373–391. [Google Scholar] [CrossRef]

- Oust, A.; Hansen, S.N.; Pettrem, T.R. Combining Property Price Predictions from Repeat Sales and Spatially Enhanced Hedonic Regressions. J. Real Estate Financ. Econ. 2020, 61, 183–207. [Google Scholar] [CrossRef]

- Český Statistický Úřad [Czech Statistical Office]. Ceny Sledovaných Druhů Nemovitostí [Prices of Monitored Types of Real Estate]. 2019. Available online: www.czso.cz (accessed on 14 May 2020).

- Konstantinov, A.; Mukhin, A. Providing thermal protection when replacing window blocks in historical buildings. In Proceedings of the 3rd International Conference on Sustainable Cities, Moscow, Russia, 18 May 2018. [Google Scholar]

- Kettani, O.; Oral, M. Designing and implementing a real estate appraisal system: The case of Quebec Province, Canada. Socio-Econ. Plan. Sci. 2015, 49, 1–9. [Google Scholar] [CrossRef]

- INEM. Ucelený Přehled o Bydlení a Životních Podmínkách [A Comprehensive Overview of Housing and Living Conditions]. 2020. Available online: www.inem.cz (accessed on 24 May 2020).

- Český Úřad Zeměměřičský a Katastrální [Czech Cadastre of Real Estate]. Státní Správa Zeměměřičství a Katastru [State Administration of Land Surveying and Cadastre]. 2020. Available online: www.cuzk.cz (accessed on 22 May 2020).

- Gehl, J. Cities for People; Island Press: Washington, DC, USA, 2013. [Google Scholar]

| Ratio between Built-Up and Net Floor Areas on the Ground Floors of all Houses | Ratio between Built-Up and Net Floor Areas on the First Floors of all Houses | |

|---|---|---|

| No. of samples | 57 | 45 |

| Maximum | 0.833 | 0.868 |

| Minimum | 0.555 | 0.601 |

| Average | 0.746 | 0.764 |

| Median | 0.744 | 0.769 |

| Determinant deviation | 0.052 | 0.065 |

| Total Sales Prices (CZK) | Plot Sizes (Square Meters) | Local Usual Values of the Plots (CZK) | |

|---|---|---|---|

| No. of samples | 122 | 122 | 122 |

| Maximum | 5,390,000 | 1499 | 2600 |

| Minimum | 799,000 | 192 | 155 |

| Average | 2,917,689 | 804 | 1202 |

| Median | 2,780,000 | 804 | 1200 |

| Determinant deviation | 1,031,117 | 306 | 538 |

| Cellar Floor Area (Square Meters) | Floor Area of Ground Floor (Square Meters) | Floor Area of Attic (Square Meters) | Wear (%) | |

|---|---|---|---|---|

| No. of samples | 95 | 122 | 113 | 122 |

| Maximum | 126 | 126 | 97 | 80 |

| Minimum | 20 | 38 | 10 | 5 |

| Average | 69 | 81 | 57 | 44 |

| Median | 74 | 79 | 60 | 45 |

| Determinant deviation | 22 | 17 | 22 | 20 |

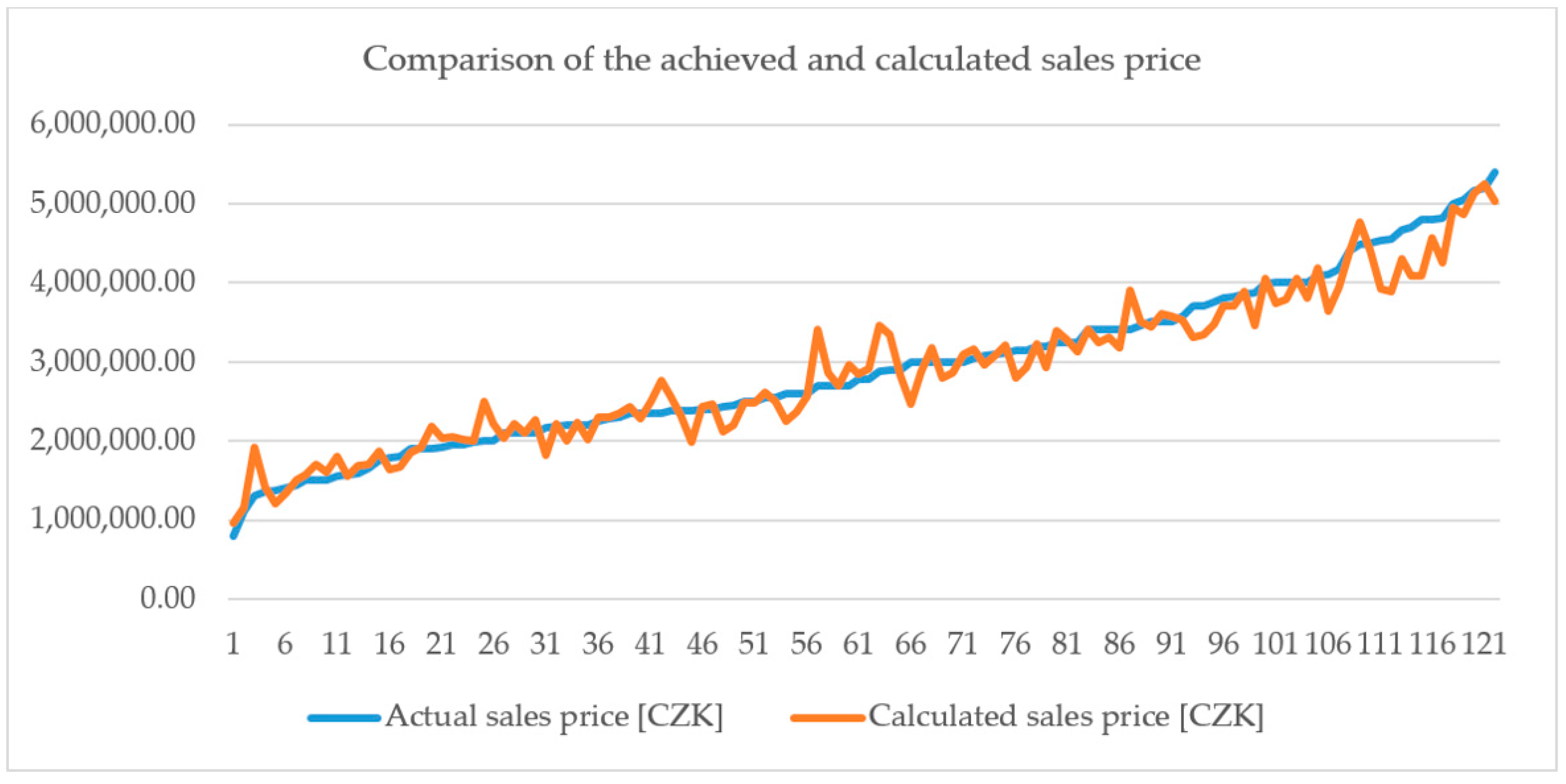

| Correlation coefficient R | 0.992268 | |||

| Correlation determination R2 | 0.984596 | |||

| Coefficients | Median Value Error | Value t | Value p | |

| Cellar floor area | 336.59 | 1309.157 | 0.257103129 | 0.797543181 |

| Floor area of ground floor | 35,500.09 | 1258.894 | 28.19941592 | 1.607 × 10−54 |

| Floor area of attic | 19,847.12 | 1583 | 12.53766161 | 1682 × 10−23 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Endel, S.; Teichmann, M.; Kutá, D. Possibilities of House Valuation Automation in the Czech Republic. Sustainability 2020, 12, 7774. https://doi.org/10.3390/su12187774

Endel S, Teichmann M, Kutá D. Possibilities of House Valuation Automation in the Czech Republic. Sustainability. 2020; 12(18):7774. https://doi.org/10.3390/su12187774

Chicago/Turabian StyleEndel, Stanislav, Marek Teichmann, and Dagmar Kutá. 2020. "Possibilities of House Valuation Automation in the Czech Republic" Sustainability 12, no. 18: 7774. https://doi.org/10.3390/su12187774

APA StyleEndel, S., Teichmann, M., & Kutá, D. (2020). Possibilities of House Valuation Automation in the Czech Republic. Sustainability, 12(18), 7774. https://doi.org/10.3390/su12187774