Click to Buy: The Impact of Retail Credit on Over-Consumption in the Online Environment

Abstract

1. Introduction

1.1. Impulse Buying and Overconsumption in Online Retailing

1.2. Purchase Stimuli and Overconsumption in the Online Retail Setting

2. Methodology

2.1. Instrument Design

2.2. Sample and Procedure

3. Results

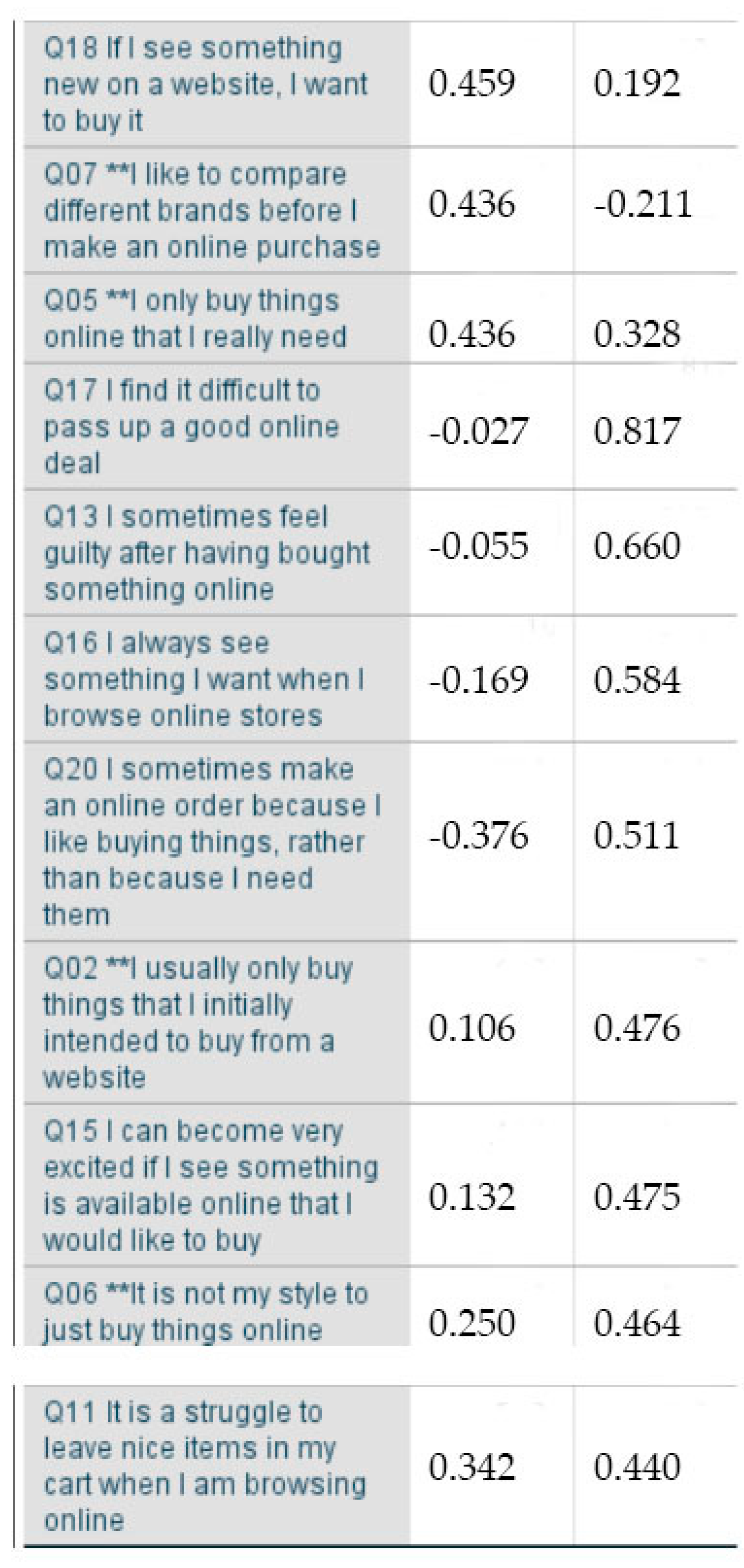

3.1. Validating the Online Impulse Buying Tendency Scale

3.2. Sample Descriptives

3.3. Factors That Predict Online Impulse Buying Tendency

3.4. BNPL Use

3.5. Conversion Tool Sensitivity

4. Discussion and Conclusions

5. Limitations

Author Contributions

Funding

Conflicts of Interest

Appendix A. Factor Loadings

References

- Cherry, C.; Scott, K.; Barrett, J.; Pidgeon, N. Public acceptance of resource-efficiency strategies to mitigate climate change. Nat. Clim. Chang. 2018, 8, 1007–1012. [Google Scholar] [CrossRef]

- Jung, H.J.; Choi, Y.J.; Oh, K.W. Influencing factors of Chinese consumers’ purchase intention to sustainable apparel products: Exploring consumer “attitude-behavioral intention” gap. Sustainability 2020, 12, 1770. [Google Scholar] [CrossRef]

- Allwood, J.M.; Ashby, M.F.; Gutowski, T.G.; Worrell, E. Material efficiency: Providing material services with less material production. Philos. Trans. R. Soc. 2013, 371. [Google Scholar] [CrossRef] [PubMed]

- Helm, S.; Subramaniam, B. Exploring socio-cognitive mindfulness in the context of sustainable consumption. Sustainability 2019, 11, 3692. [Google Scholar] [CrossRef]

- Pereira Heath, M.T.; Chatzidakis, A. ‘Blame it on marketing’: Consumers’ views on unsustainable consumption. Int. J. Consum. Stud. 2012, 36, 656–667. [Google Scholar] [CrossRef]

- Håkansson, A. What is overconsumption?—A step towards a common understanding. Int. J. Consum. Stud. 2014, 38, 692–700. [Google Scholar] [CrossRef]

- Hausman, A. A multi-method investigation of consumer motivations in impulse buying behavior. J. Consum. Mark. 2000, 17, 403–426. [Google Scholar] [CrossRef]

- Liu, Y.; Li, H.; Hu, F. Website attributes in urging online impulse purchase: An empirical investigation on consumer perceptions. Decis. Support Syst. 2013, 55, 829–837. [Google Scholar] [CrossRef]

- Verhagen, T.; van Dolen, W. The influence of online store beliefs on consumer online impulse buying: A model and empirical application. Inf. Manag. 2011, 48, 320–327. [Google Scholar] [CrossRef]

- O’Brien, S. Consumers Cough up $5400 a Year on Impulse Purchases. 2018. Available online: CNBC.com (accessed on 23 February 2019).

- Badgaiyan, A.J.; Verma, A.; Dixit, S. Impulsive buying tendency: Measuring important relationships with a new perspective and an indigenous scale. IIMB Manag. Rev. 2016, 28, 186–199. [Google Scholar] [CrossRef]

- Rook, D.W. The buying impulse. J. Consum. Res. 1987, 14, 189–199. [Google Scholar] [CrossRef]

- Carrington, M.; Neville, B.; Whitwell, G. Lost in translation: Exploring the ethical consumer intention-behavior gap. J. Bus. Res. 2014, 67, 2759–2767. [Google Scholar] [CrossRef]

- Vermeir, I.; Verbeke, W. Sustainable food consumption: Exploring the consumer “attitude–behavioral intention” gap. J. Agric. Environ. Ethics. 2006, 19, 169–194. [Google Scholar] [CrossRef]

- Tanner, C.; Kast, S.W. Promoting sustainable consumption: Determinants of green purchases by Swiss consumers. Psychol. Mark. 2003, 20, 883–902. [Google Scholar] [CrossRef]

- Thorman, D.; Whitmarsh, L.; Demski, C. Policy acceptance of low-consumption governance approaches: The effect of social norms and hypocrisy. Sustainability 2020, 12, 1247. [Google Scholar] [CrossRef]

- Winter, D. Shopping for sustainability: Psychological solutions to overconsumption. In Psychology and Consumer Culture: The Struggle for a Good Life in a Materialistic World; Kasser, T., Kanner, A.D., Eds.; American Psychological Association: Washington, DC, USA, 2004; pp. 69–87. [Google Scholar]

- Thompson, E.R.; Prendergast, G.P. The influence of trait affect and the five-factor personality model on impulse buying. Pers. Individ. Differ. 2015, 76, 216–221. [Google Scholar] [CrossRef]

- Abraham, J.; Dameyasani, A.W. Impulsive buying, cultural values dimensions, and symbolic meaning of money: A study on college students in Indonesia’s capital city and its surrounding. Int. J. Res. Stud. Psychol. 2013, 2, 35–52. [Google Scholar]

- Verplanken, B.; Herabadi, A. Individual differences in impulse buying tendency: Feeling and no thinking. Eur. J. Personal. 2001, 15, S71–S83. [Google Scholar] [CrossRef]

- Rose, P. Mediators of the association between narcissism and compulsive buying: The roles of materialism and impulse control. Psychol. Addict. Behav. 2007, 21, 576. [Google Scholar] [CrossRef]

- Chan, T.K.; Cheung, C.M.; Lee, Z.W. The state of online impulse-buying research: A literature analysis. Inf. Manag. 2017, 54, 204–217. [Google Scholar] [CrossRef]

- Chung, S.; Kramer, T.; Wong, E.M. Do touch interface users feel more engaged? The impact of input device type on online shoppers’ engagement, affect, and purchase decisions. Psychol. Mark. 2018, 35, 795–806. [Google Scholar] [CrossRef]

- Ono, A.; Nakamura, A.; Okuno, A.; Sumikawa, M. Consumer motivations in browsing online stores with mobile devices. Int. J. Electron. Commer. 2012, 16, 153–178. [Google Scholar]

- Gañac, C.G. Investigating consumer optimum stimulation level and exploratory online buying behavior. DLSU Bus. Econ. Rev. 2018, 28, 67–85. [Google Scholar]

- Park, J.; Hill, W.T. Exploring the role of justification and cognitive effort exertion on post-purchase regret in online shopping. Comput. Hum. Behav. 2018, 83, 235–242. [Google Scholar] [CrossRef]

- Park, E.J.; Kim, E.Y.; Funches, V.M.; Foxx, W. Apparel product attributes, web browsing, and e-impulse buying on shopping websites. J. Bus. Res. 2012, 65, 1583–1589. [Google Scholar] [CrossRef]

- Clemons, E.K.; Wilson, J.; Matt, C.; Hess, T.; Ren, F.; Jin, F.; Koh, N.S. Global differences in online shopping behavior: Understanding factors leading to trust. J. Manag. Inf. Syst. 2016, 33, 1117–1148. [Google Scholar] [CrossRef]

- Thaichon, P.; Surachartkumtonkun, J.; Quach, S.; Weaven, S.; Palmatier, R.W. Hybrid sales structures in the age of e-commerce. J. Pers. Sell. Sales Manag. 2018, 38, 277–302. [Google Scholar] [CrossRef]

- Jones, M.A.; Reynolds, K.E.; Mothersbaugh, D.L.; Beatty, S.E. The positive and negative effects of switching costs on relational outcomes. J. Serv. Res. 2007, 9, 335–355. [Google Scholar] [CrossRef]

- Flight, R.L.; Rountree, M.M.; Beatty, S.E. Feeling the urge: Affect in impulsive and compulsive buying. J. Mark. Theory Pract. 2012, 20, 453–466. [Google Scholar] [CrossRef]

- Punj, G. Impulse buying and variety seeking: Similarities and differences. J. Bus. Res. 2011, 64, 745–748. [Google Scholar] [CrossRef]

- Baumeister, R.F. Yielding to temptation: Self-control failure, impulsive purchasing, and consumer behavior. J. Consum. Res. 2002, 28, 670–676. [Google Scholar] [CrossRef]

- Iyer, G.R.; Blut, M.; Xiao, S.H.; Grewal, D. Impulse buying: A meta-analytic review. J. Acad. Mark. Sci. 2020, 48, 384–404. [Google Scholar] [CrossRef]

- Mattila, A.S.; Wirtz, J. Congruency of scent and music as a driver of in-store evaluations and behavior. J. Retail. 2001, 77, 272–289. [Google Scholar] [CrossRef]

- Vohs, K.D.; Faber, R.J. Spent resources: Self-regulatory resource availability affects impulse buying. J. Consum. Res. 2007, 33, 537–547. [Google Scholar] [CrossRef]

- Dhar, R.; Wertenbroch, K. Consumer choice between hedonic and utilitarian goods. J. Mark. Res. 2000, 37, 60–71. [Google Scholar] [CrossRef]

- Montgomery, A.; Li, S.; Srinivasan, K.; Liechty, J. Using Web Path Analysis. Researchgate 2002. Available online: https://www.researchgate.net/publication/277290686_Using_Web_Path_Analysis (accessed on 5 September 2020).

- Wu, L.; Chen, K.W.; Chiu, M.L. Defining key drivers of online impulse purchasing: A perspective of both impulse shoppers and system users. Int. J. Inf. Manag. 2016, 36, 284–296. [Google Scholar] [CrossRef]

- Madhavaram, S.R.; Laverie, D.A. Exploring impulse purchasing on the internet. ACR N. Am. Adv. 2004, 31, 59–66. [Google Scholar]

- Beatty, S.E.; Ferrell, M.E. Impulse buying: Modeling its precursors. J. Retail. 1998, 74, 169–191. [Google Scholar] [CrossRef]

- Badgaiyan, A.J.; Verma, A. Does urge to buy impulsively differ from impulsive buying behaviour? Assessing the impact of situational factors. J. Retail. Consum. Serv. 2015, 22, 145–157. [Google Scholar] [CrossRef]

- Stern, H. The significance of impulse buying today. J. Mark. 1962, 26, 59–62. [Google Scholar] [CrossRef]

- Coley, A.; Burgess, B. Gender differences in cognitive and affective impulse buying. J. Fash. Mark. Manag. Int. J. 2003, 7, 282–295. [Google Scholar] [CrossRef]

- Rook, D.; Fisher, R. Normative influences on impulsive buying behavior. J. Consum. Res. 1995, 22, 305–313. [Google Scholar] [CrossRef]

- Dittmar, H.; Long, K.; Meek, R. Buying on the internet: Gender differences in online and conventional buying motivations. Sex Roles 2004, 50, 423–444. [Google Scholar] [CrossRef]

- Chamorro-Premuzic, T. The Psychology of Impulsive Shopping, The Guardian. Available online: https://www.theguardian.com/media-network/2015/nov/26/psychology-impulsive-shopping-christmas-black-friday-sales (accessed on 26 November 2019).

- Childers, T.L.; Carr, C.L.; Peck, J.; Carsoni, S. Hedonic and utilitarian motivations for online retail shopping behavior. J. Retail. 2001, 77, 511–535. [Google Scholar] [CrossRef]

- Akram, U.; Hui, P.; Khan, M.; Tanveer, Y.; Mehmood, K.; Ahmad, W. How website quality affects online impulse buying: Moderating effects of sales promotion and credit card use. Asia Pac. J. Mark. Logist. 2017, 30, 235–256. [Google Scholar] [CrossRef]

- Roberts, J.A.; Jones, E. Money attitudes, credit card use, and compulsive buying among American college students. J. Consum. Aff. 2001, 35, 213–240. [Google Scholar] [CrossRef]

- Lachance, M.J. Young adults’ attitudes towards credit. Int. J. Consum. Stud. 2012, 36, 539–548. [Google Scholar] [CrossRef]

- Soman, D.; Gourville, J.T. Transaction decoupling: How price bundling affects the decision to consume. J. Mark. Res. 2001, 38, 30–44. [Google Scholar] [CrossRef]

- Karbasivar, A.; Yarahmadi, H. Evaluating effective factors on consumer impulse buying behavior. Asian J. Bus. Manag. Stud. 2011, 2, 174–181. [Google Scholar]

- Erasmus, A.C.; Mathunjwa, G.Q. Idiosyncratic use of credit facilities by consumers in an emerging economy. Int. J. Consum. Stud. 2011, 35, 359–371. [Google Scholar] [CrossRef]

- Houle, J.N. A generation indebted: Young adult debt across three cohorts. Soc. Probl. 2014, 61, 448–465. [Google Scholar]

- Edmunds, S. Generation Now Drives Buy-Now-Pay-Later Schemes, Stuff. 2018. Available online: https://www.stuff.co.nz/business/109412973/finance-companies-tackle-growth-of-buynowpaylater-schemes (accessed on 18 December 2019).

- Edmunds, S. Here’s How Part-Payment Platforms Turn Nasty, Stuff. 2018. Available online: https://www.stuff.co.nz/business/108793316/heres-how-partpayment-platforms-turn-nasty (accessed on 23 November 2019).

- McGowan, M. Afterpay: Buy-now-pay-later scheme soars in popularity but experts sound warning. The Guardian, 21 September 2017. [Google Scholar]

- McNeill, L.S. The place of debt in establishing identity and self-worth in transitional life phases: Young home leavers and credit. Int. J. Consum. Stud. 2014, 38, 69–74. [Google Scholar] [CrossRef]

- Penman, S.; McNeill, L.S. Spending their way to adulthood: Consumption outside the nest. Young Consum. 2008, 9, 155–169. [Google Scholar] [CrossRef]

- Dittmar, H.; Beattie, J.; Friese, S. Gender identity and material symbols: Objects and decision considerations in impulse purchases. J. Eco. Psych. 1995, 16, 491–511. [Google Scholar] [CrossRef]

- Skallerud, K.; Korneliussen, T.; Olsen, S.O. An examination of consumers’ cross-shopping behaviour. J. Retail. Consum. Serv. 2009, 16, 181–189. [Google Scholar] [CrossRef]

- Hoyle, R. Statistical Strategies for Small Sample Research; Sage: Addison, TX, USA, 1999. [Google Scholar]

- Marsh, H.W.; Hau, K.T. Confirmatory Factor Analysis: Strategies for Small Sample Sizes-Statistical Strategies for Small Sample Research; Sage: Austin, TX, USA, 1999. [Google Scholar]

- Boomsma, A.; Hoogland, J.J. The Robustness of LISREL Modeling Revisited: Present and Future a Festschrift in Honor of Karl Jöreskog. 2001. Available online: aboomsma.webhosting.rug.nl (accessed on 5 August 2020).

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 2nd ed.; The Guilford Press: Guilford, NY, USA, 2005. [Google Scholar]

- Muthén, L.K.; Muthén, B.O. How to Use a Monte Carlo Study to Decide on Sample Size and Determine Power. Struct. Equ. Modeling A Multidiscip. J. 2002, 9, 599–620. [Google Scholar]

- Gerbing, D.W.; Anderson, J.C. Monte carlo evaluations of goodness of fit indices for structural equation models. Sociol. Methods Res. 1992, 21, 132–160. [Google Scholar] [CrossRef]

- Wuensch, K.L. Comparing Two Groups’ Factor Structures: Pearson r and the Coefficient of Congruence. 2016. Available online: http://core.ecu.edu/psyc/wuenschk/MV/FA/FactorStructure-TwoGroups.docx (accessed on 5 August 2020).

| Hypotheses | Outcome |

|---|---|

| Hypothesis 1 (H1) | Supported |

| Hypothesis 2 (H2) | Supported |

| Hypothesis 2a (H2a) | Supported |

| Hypothesis 2b (H2b) | Supported |

| Hypothesis 3 (H3) | Supported |

| OIBT | OIBT-cog | OIBT-aff | ||

| Cognitive items (factor 1 highest loading) | ||||

| 1 | I usually think carefully before I buy something from an online store * | 0.739 | 0.885 | −0.078 |

| 8 | Before I make an online order, I always carefully consider whether I need it * | 0.675 | 0.834 | −0.103 |

| 10 | I often buy things online without thinking | 0.785 | 0.744 | 0.155 |

| 4 | Most of my online purchases are planned in advance * | 0.687 | 0.742 | 0.025 |

| 3 | If I buy something online, I usually do it spontaneously | 0.733 | 0.726 | 0.108 |

| 9 | I’m used to online shopping ‘on the spot’ | 0.754 | 0.617 | 0.268 |

| 12 | I sometimes cannot suppress the feeling of wanting to buy something and just make an online purchase | 0.668 | 0.522 ** | 0.268 ** |

| 19 | I am a bit reckless in buying things online | 0.769 | 0.500 ** | 0.431 ** |

| 18 | If I see something new on a website, I want to buy it | 0.556 | 0.445 ** | 0.210 ** |

| 7 | I like to compare different brands before I make an online purchase * | 0.248 | 0.433 | −0.193 |

| 5 | I only buy things online that I really need * | 0.632 | 0.414 | 0.351 |

| Affective items (factor 2 highest loading) | ||||

| 17 | I find it difficult to pass up a good online deal | 0.559 | −0.058 | 0.828 |

| 13 | I sometimes feel guilty after having bought something online | 0.424 | −0.090 | 0.684 |

| 16 | I always see something I want when I browse online stores | 0.261 | −0.184 | 0.578 |

| 20 | I sometimes make an online order because I like buying things, rather than because I need them | 0.703 | 0.360 | 0.513 |

| 15 | I can become very excited if I see something is available online that I would like to buy | 0.460 | 0.107 | 0.493 |

| 2 | I usually only buy things that I initially intended to buy from a website * | 0.434 | 0.094 ** | 0.473 ** |

| 6 | It is not my style to just buy things online * | 0.557 | 0.236 ** | 0.466 ** |

| 11 | It is a struggle to leave nice items in my cart when I am browsing online | 0.621 | 0.333 | 0.435 |

| Items excluded from the final scale | ||||

| 14 | I’m not the kind of person who ‘falls in love at first sight’ with things I see online * | 0.217 | 0.051 | 0.231 |

| Model sig. | Adjusted R2 | Dependent Variable | Independent Variable | Standardised Coefficients (β) | Sig. (β) |

|---|---|---|---|---|---|

| 0.000 | 0.375 | OIBT score | BNPL user * | 0.1733 | 0.040 ** |

| Credit card user * | −0.084 | 0.287 | |||

| Overdraft account user * | 0.181 | 0.030 ** | |||

| Average weekly income | −0.043 | 0.644 | |||

| Conversion tool sensitivity score | 0.502 | 0.000 ** |

| Model sig. | Adjusted R2 | Dependent Variable | Independent Variable | Standardised Coefficients (β) | Sig. (β) |

|---|---|---|---|---|---|

| 0.000 | 0.282 | Conversion sensitivity score | Average weekly income | −0.011 | 0.894 |

| OIBT score | −0.544 | 0.000 ** |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ah Fook, L.; McNeill, L. Click to Buy: The Impact of Retail Credit on Over-Consumption in the Online Environment. Sustainability 2020, 12, 7322. https://doi.org/10.3390/su12187322

Ah Fook L, McNeill L. Click to Buy: The Impact of Retail Credit on Over-Consumption in the Online Environment. Sustainability. 2020; 12(18):7322. https://doi.org/10.3390/su12187322

Chicago/Turabian StyleAh Fook, Lauren, and Lisa McNeill. 2020. "Click to Buy: The Impact of Retail Credit on Over-Consumption in the Online Environment" Sustainability 12, no. 18: 7322. https://doi.org/10.3390/su12187322

APA StyleAh Fook, L., & McNeill, L. (2020). Click to Buy: The Impact of Retail Credit on Over-Consumption in the Online Environment. Sustainability, 12(18), 7322. https://doi.org/10.3390/su12187322