Sustainability Assessment of Investments Based on a Multiple Criteria Methodological Framework

Abstract

1. Introduction

2. Methodology

3. Results and Discussion

- : Assessment of alternative scenario i based on criterion j for all experts

- : Performance of an alternative scenario i based on criterion j for each expert

- N: Total number of experts

- : The maximum value displayed by alternative i for criterion j

- : The minimum value displayed by alternative i for criterion j

- N: The number of alternative scenarios (here N = 18)

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Medne, A.; Lapina, I. Sustainability and continuous improvement of organization: Review of process-oriented performance indicators. J. Open Innov. Technol. Mark. Complex. 2019, 5, 49. [Google Scholar] [CrossRef]

- Di Vaio, A.; Varriale, L.; Alvino, F. Key performance indicators for developing environmentally sustainable and energy efficient ports: Evidence from Italy. Energy Policy 2018, 122, 229–240. [Google Scholar] [CrossRef]

- Maslesa, E.; Jensen, P.A.; Birkved, M. Indicators for quantifying environmental building performance: A systematic literature review. J. Build. Eng. 2018, 19, 552–560. [Google Scholar] [CrossRef]

- Pilouk, S.; Koottatep, T. Environmental performance indicators as the key for eco-industrial parks in Thailand. J. Clean. Prod. 2017, 156, 614–623. [Google Scholar] [CrossRef]

- Achillas, C.; Vlachokostas, C.; Moussiopoulos, N.; Perkoulidis, G.; Banias, G.; Mastropavlos, M. Electronic waste management cost: A scenario-based analysis for Greece. Waste Manag. Res. 2011, 29, 963–972. [Google Scholar] [CrossRef]

- Feleki, E.; Vlachokostas, C.; Moussiopoulos, N. Characterisation of sustainability in urban areas: An analysis of assessment tools with emphasis on European cities. Sustain. Cities Soc. 2018, 43, 563–577. [Google Scholar] [CrossRef]

- Manrique, S.; Ballester, M.; Pilar, C. Analyzing the effect of corporate environmental performance on corporate financial performance in developed and developing countries. Sustainability 2017, 9, 1957. [Google Scholar] [CrossRef]

- Banias, G.; Achillas, C.; Vlachokostas, C.; Moussiopoulos, N.; Stefanou, M. Environmental impacts in the life cycle of olive oil: A literature review. J. Sci. Food Agric. 2017, 97, 1686–1697. [Google Scholar] [CrossRef]

- Zheng, Y.; Chen, Z.; Pearson, T.; Zhao, J.; Hu, H.; Prosperi, M. Design and methodology challenges of environment-wide association studies: A systematic review. Environ. Res. 2020, 183. [Google Scholar] [CrossRef]

- Saad, E.; Hegab, H.; Kishawy, H.A. Design for sustainable manufacturing: Approach, implementation, and assessment. Sustainability 2018, 10, 3604. [Google Scholar]

- Ariffin, R.; Ghazilla, R.; Sakundarini, N.; Taha, Z.; Abdul-Rashid, S.; Yusoff, S. Design for environment and design for disassembly practices in Malaysia: A practitioner’s perspectives. J. Clean. Prod. 2015, 108, 331–342. [Google Scholar]

- Arnette, A.; Brewer, B.; Choal, T. Design for sustainability (DFS): The intersection of supply chain and environment. J. Clean. Prod. 2014, 83, 374–390. [Google Scholar] [CrossRef]

- Tian, J.F.; Pan, C.; Xue, R.; Yang, X.T.; Wang, C.; Ji, X.Z.; Shan, Y.L. Corporate innovation and environmental investment: The moderating role of institutional environment. Adv. Clim. Chang. Res. 2020, 11, 85–91. [Google Scholar] [CrossRef]

- Lee, K.H.; Min, B.; Yook, K.H. The impacts of carbon (CO2) emissions and environmental research and development (R&D) investment on firm performance. Int. J. Prod. Econ. 2015, 167, 1–11. [Google Scholar]

- Theofanidou. Environmental Performance of Businesses after the Implementation of Environmental Management System; National Technical University of Athens: Athens, Greece; University of Piraeus: Athens, Greece, 2008; pp. 6–24. [Google Scholar]

- Chirico, A.; Hristov, I. The role of sustainability Key Performance Indicators (KPIs) in implementing sustainable strategies. Sustainability 2019, 11, 5742. [Google Scholar]

- Gaidajis, G.; Angelakoglou, K. A conceptual framework to evaluate the environmental sustainability performance of mining industrial facilities. Sustainability 2020, 12, 2135. [Google Scholar]

- Michailidou, A.V.; Vlachokostas, C.; Moussiopoulos, N. A methodology to assess the overall environmental pressure attributed to tourism areas: A combined approach for typical all-sized hotels in Chalkidiki, Greece. Ecol. Indic. 2015, 50, 108–119. [Google Scholar] [CrossRef]

- Berghout, F.; Hertin, J.; Azzone, G.; Carlens, J.; Drunen, M.; Jasch, C.; Noci, G.; Olsthoorn, X.; Tyteca, D.; van der Woerd, F.; et al. Measuring the Environmental Performance of Industry (MEPI). Final Report. 2001. Available online: http://www.sussex.ac.uk/Units/spru/mepi/about/index.php (accessed on 7 July 2020).

- Dizdaroglu, D. The role of indicator-based sustainability assessment in policy and the decision-making process: A review and outlook. Sustainability 2017, 9, 1018. [Google Scholar] [CrossRef]

- European Commission. Science for Environment Policy—Indicators for Sustainable Cities. In-Depth Report Produced for the European Commission DG Environment by the Science Communication Unit; UWE: Bristol, UK, 2018; Available online: http://ec.europa.eu/science-environment-policy (accessed on 7 July 2020).

- Laurent, A.; Olsen, S.I.; Hauschild, M.Z. Carbon footprint as environmental performance indicator for the manufacturing industry. CIRP Annals 2010, 59, 37–40. [Google Scholar] [CrossRef]

- Vlachokostas, C.; Achillas, C.; Chourdakis, E.; Moussiopoulos, N. Combining regression analysis and air quality modelling to predict benzene concentration levels. Atmos. Environ. 2011, 45, 2585–2592. [Google Scholar] [CrossRef]

- Feleki, E.; Vlachokostas, C.; Moussiopoulos, N. Holistic methodological framework for the characterization of urban sustainability and strategic planning. J. Clean. Prod. 2020, 243, 118432. [Google Scholar] [CrossRef]

- Ethridge, M.A. Measuring Environmental Performance: A Primer and Survey of Metrics in Use; Global Environmental Management Initiative (GEMI): Washington, DC, USA, 1998. [Google Scholar]

- International Organization for Standardization. ISO 14031:1999: Environmental Management—Environmental Performance Evaluation—Guidelines; International Organization for Standardization: Geneva, Switzerland, 1999. [Google Scholar]

- Watróbski, J.; Jankowski, J.; Ziemba, P.; Karczmarczyk, A.; Zioło, M. Generalised framework for multi-criteria method selection. Omega 2019, 86, 107–124. [Google Scholar] [CrossRef]

- Cinelli, M.; Coles, S.; Kirwan, K. Analysis of the potentials of multi criteria decision analysis methods to conduct sustainability assessment. Ecol. Indic. 2014, 46, 138–148. [Google Scholar] [CrossRef]

- Hokkanen, J.; Salminen, P. Choosing a solid waste management system using multicriteria decision analysis. Eur. J. Oper. Res. 1997, 98, 19–36. [Google Scholar] [CrossRef]

- Achillas, C.; Aidonis, D.; Vlachokostas, C.; Folinas, D.; Moussiopoulos, N. Re-designing industrial products on a multi-objective basis: A case study. J. Oper. Res. Soc. 2013, 64, 1336–1346. [Google Scholar] [CrossRef]

- Hashemi, S.S.; Hajiagha, S.H.R.; Zavadskas, E.K.; Mahdiraji, H.A. Multicriteria group decision making with ELECTRE III method based on interval-valued intuitionistic fuzzy information. Appl. Math. Model. 2016, 40, 1554–1564. [Google Scholar] [CrossRef]

- Zopounidis, C.; Pardalos, P. (Eds.) Handbook of Multicriteria Analysis; Applied Optimization Series; Springer: Berlin, Germany, 2010. [Google Scholar]

- Hass, J.L.; Palm, V. Using the Right Environmental Indicators: Tracking Progress, Raising Awareness and Supporting Analysis; Nordic Council of Ministers: Copenhagen, Denmark, 2012. [Google Scholar]

- Arcibugi, F.; Nijkamp, P. Economy and Ecology: Towards Sustainable Development; Klumer Academic Publishers: Dordrecht, The Netherlands, 1989. [Google Scholar]

- Wu, Z.; Abdul-Nour, G. Comparison of multi-criteria group decision-making methods for urban sewer network plan selection. CivilEng 2020, 1, 26-48. [Google Scholar] [CrossRef]

- Azziz, M.B.-H. Multiple Criteria Outranking Algorithm: Implementation and Computational Tests. ELECTRE III Method; Department of Engineering and Management, Instituto Superior Técnico: Lisbon, Portugal, 2015. [Google Scholar]

- Vlachokostas, C.; Michailidou, A.V.; Matziris, E.; Achillas, C.; Moussiopoulos, N. A multiple criteria decision-making approach to put forward tree species in urban environment. Urban Clim. 2014, 10, 105–118. [Google Scholar] [CrossRef]

- Rogers, M.; Bruen, M. Choosing realistic values of indifference, preference and veto thresholds for use with environmental criteria within ELECTRE. Eur. J. Oper. Res. 1998, 107, 542–551. [Google Scholar] [CrossRef]

- Xiaoting, W. Study of Ranking Irregularities When Evaluating Alternatives by Using Some ELECTRE Methods and A Proposed New MCDM Method Based on Regret and Rejoicing. Master’s Thesis, Louisiana State University, Baton Rouge, LA, USA, 2007. [Google Scholar]

- Roy, B.; Electre, A. III lgorithme de classement base sur une representation floue des preferences en presence de criteres multiples. Cahiers de CERO 1978, 20, 3–24. [Google Scholar]

- Roy, B.; Bouyssou, D. Aide Multicritere a la Decision: Methods et Cas; Economica: Paris, France, 1993. [Google Scholar]

- Roussat, N.; Dujet, C.; Mehu, J. Choosing a sustainable demolition waste management strategy using multicriteria decision analysis. Waste Manag. 2009, 29, 2–20. [Google Scholar] [CrossRef] [PubMed]

- Moussiopoulos, N.; Achillas, C.; Vlachokostas, C.; Spyridi, D.; Nikolaou, K. Environmental, social and economic information management for the evaluation of sustainability in urban areas: A system of indicators for Thessaloniki, Greece. Cities 2010, 27, 377–384. [Google Scholar] [CrossRef]

- Falqi, I.; Alsulamy, S.; Mansour, M. Environmental performance evaluation and analysis using ISO 14031 guidelines in construction sector industries. Sustainability 2020, 12, 1774. [Google Scholar] [CrossRef]

- Ocampo, A.L.; Estanislao-Clark, E. Developing a framework for sustainable manufacturing strategies selection. DLSU Bus. Econ. Rev. 2014, 23, 115–131. [Google Scholar]

- Michailidou, A.V.; Vlachokostas, C.; Moussiopoulos, N. Interactions between climate change and the tourism sector: Multiple-criteria decision analysis to assess mitigation and adaptation options in tourism areas. Tour. Manag. 2016, 55, 1–12. [Google Scholar] [CrossRef]

- Spyridi, D.; Vlachokostas, C.; Michailidou, A.V.; Sioutas, C.; Moussiopoulos, N. Strategic planning for climate change mitigation and adaptation: The case of Greece. Int. J. Clim. Chang. Strateg. Manag. 2015, 7, 272–289. [Google Scholar] [CrossRef]

- Kourmpanis, B.; Papadopoulos, A.; Moustakas, K.; Kourmoussis, F.; Stylianou, M.; Loizidou, M. An integrated approach for the management of demolition waste in Cyprus. Waste Manag. Res. 2008, 26, 573–581. [Google Scholar] [CrossRef]

- Haralambopoulos, D.; Polatidis, H. Renewable energy projects: Structuring a multi-criteria group decision-making framework. Renew. Energy 2003, 28, 961–973. [Google Scholar] [CrossRef]

| Code | Thematic Area | Indicator |

|---|---|---|

| A01 | Recycling | Design for recycling and reuse of materials, and minimization of waste |

| A02 | Gas emissions | Design for minimization of emissions (greenhouse gases, ozone depletion gases, air pollutants, particulate matter, etc.) |

| A03 | Resource savings | Design for energy and other resources (materials, water, etc.) savings, and reduction of non-renewable resources consumption |

| A04 | Biodiversity | Design for biodiversity and habitat conservation |

| A05 | Impact restoration | Design for prevention and remediation of adverse effects on the environment due to the company’s operations |

| A06 | Alternative energy forms | Provision for the use of alternative energy sources |

| A07 | Education | Provision for environmental employees’ training |

| A08 | Health and safety | Provision for employees’ health and safety |

| A09 | Communication & public awareness | Provision for communication with the local community (information and public disclosure of environmental performance, etc.) |

| A10 | Information across supply chain | Provision for information on sustainable development to suppliers and customers |

| A11 | Social actions | Provision for social initiatives (compensations, donations, funding for environmental actions, etc.) |

| A12 | Pollution prevention | Provision for covering the cost of pollution prevention projects |

| A13 | Environmental accounting | Provision for application of environmental accounting |

| A14 | Research, Innovation, Development | Provision for research and development of high-tech and innovative products, development of green products |

| A15 | Environmental policy | Provision for consideration and planning for the implementation of environmental policies and environmental controls, the use of their results in company’s operations |

| A16 | Legal framework | Compliance with the legal framework on environmental legislative framework |

| A17 | Environmental standards | Provision for the implementation of environmental management system (e.g., EMAS, ISO 14000) |

| A18 | Corporate governance | Design for implementation of corporate governance rules |

| Environment [C1] | Society [C2] | Economy [C3] | Technology [C4] | |

|---|---|---|---|---|

| Recycling [A01] | 8.63 | 6.69 | 6.87 | 7.08 |

| Gas emissions [A02] | 8.58 | 7.23 | 6.29 | 7.44 |

| Resources’ savings [A03] | 8.50 | 7.23 | 7.21 | 7.37 |

| Biodiversity [A04] | 8.21 | 6.42 | 5.31 | 5.08 |

| Impact restoration [A05] | 8.48 | 7.23 | 6.65 | 6.42 |

| Alternative energy forms [A06] | 7.85 | 6.31 | 6.56 | 7.21 |

| Education [A07] | 7.12 | 6.44 | 5.69 | 4.75 |

| Health and safety [A08] | 5.87 | 8.02 | 6.29 | 4.96 |

| Communication & public awareness [A09] | 5.88 | 8.04 | 5.25 | 4.10 |

| Information across supply chain [A10] | 6.08 | 7.63 | 5.85 | 4.58 |

| Social actions [A11] | 6.67 | 7.87 | 6.33 | 4.31 |

| Pollution prevention [A12] | 7.33 | 6.10 | 7.83 | 5.62 |

| Environmental accounting [A13] | 6.27 | 4.56 | 6.98 | 4.92 |

| Research, Innovation, Development [A14] | 7.98 | 6.29 | 7.77 | 8.67 |

| Environmental policy [A15] | 7.85 | 6.40 | 6.46 | 6.19 |

| Legal framework [A16] | 7.69 | 6.94 | 6.10 | 4.52 |

| Environmental standards [A17] | 7.65 | 5.69 | 5.83 | 5.08 |

| Corporate governance [A18] | 5.35 | 6.06 | 5.90 | 4.75 |

| Weighting Factor | 31.9 | 23.6 | 25.1 | 19.4 |

| Preference threshold | 0.18 | 0.19 | 0.14 | 0.25 |

| Indifference threshold | 0.05 | 0.06 | 0.04 | 0.08 |

| Scenario | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| [BS] | [S1] | [S2] | [S3] | [S4] | [S5] | [S6] | [S7] | [S8] | [S9] | [S10] | [S11] | |

| Weighting factor for Environmental criterion [C1] | 31.9 | 25 | 25 | 50 | 16.7 | 16.7 | 16.7 | 50 | 0 | 0 | 31.9 | 31.9 |

| Weighting factor for Social criterion [C2] | 23.6 | 25 | 25 | 16.7 | 50 | 16.7 | 16.7 | 0 | 50 | 0 | 23.6 | 23.6 |

| Weighting factor for Economic criterion [C3] | 25.1 | 25 | 50 | 16.7 | 16.7 | 50 | 16.7 | 50 | 50 | 50 | 25.1 | 25.1 |

| Weighting factor for Technological criterion [C4] | 19.4 | 25 | 0 | 16.7 | 16.7 | 16.7 | 50 | 0 | 0 | 50 | 19.4 | 19.4 |

| Preference threshold | pBS | pBS | pBS | pBS | pBS | pBS | pBS | pBS | pBS | pBS | 1.5 × pBS | 2 × pBS |

| Indifference threshold | qBS | qBS | qBS | qBS | qBS | qBS | qBS | qBS | qBS | qBS | 1.5 × qBS | 2 × qBS |

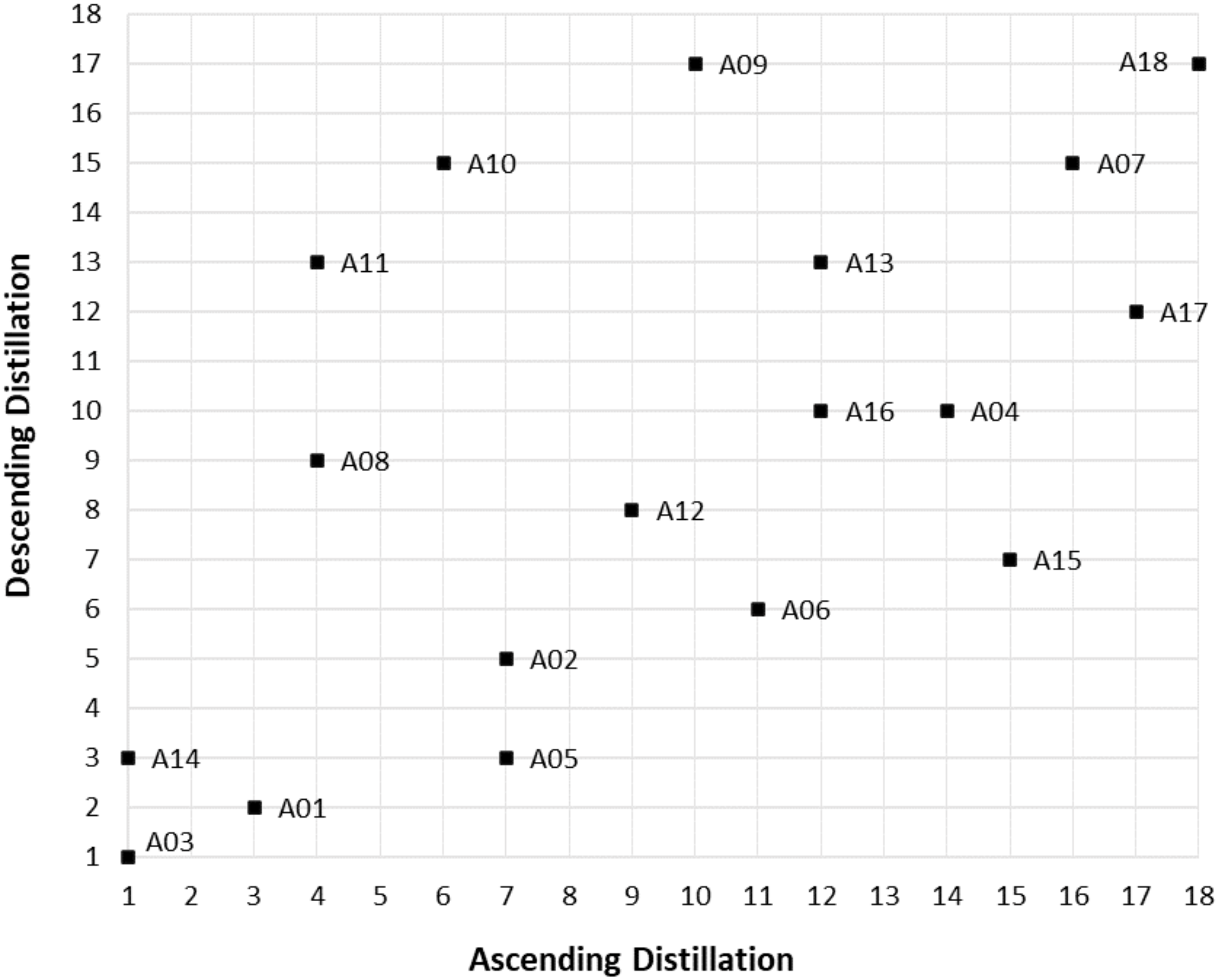

| 1st | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th | 9th | 10th | 11th | 12th | 13th | 14th | 15th | 16th | 17th | 18th | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BS | A3 | A1 | A14 | A5 | A8 | A2 | A11 | A12 | A6 | A10 | A16 | A9 | A15 | A13 | A4 | A7 | A17 | A18 |

| S1 | A3 | A1 | A14 | A5 | A8 | A2 | A11 | A12 | A6 | A10 | A16 | A9 | A15 | A13 | A4 | A7 | A17 | A18 |

| S2 | A3 | A14 | A5 | A1 | A12 | A2 | A8 & A11 | A16 | A10 | A6 | A13 | A9 | A15 | A7 | A4 | A17 | A18 | |

| S3 | A3 | A1 | A14 | A2 | A5 & A8 | A11 | A12 | A6 | A10 | A16 | A9 | A15 | A4 | A13 | A17 | A7 | A18 | |

| S4 | A3 | A2 | A1 | A14 | A5 | A8 | A12 | A15 | A11 | A6 | A10 | A16 | A9 | A4 | A7 | A13 | A17 | A18 |

| S5 | A3 & A14 | A1 | A5 | A12 | A2 & A8 | A6 & A11 | A13 | A16 | A10 | A15 | A4 | A17 | A9 | A7 | A18 | |||

| S6 | A3 &A14 | A1 | A2 | A5 & A8 | A12 | A6 | A10 & A11 | A16 | A4 | A9 & A15 | A13 | A17 | A7 | A18 | ||||

| S7 | A3 | A1 | A14 | A5 | A12 | A2 | A6 & A13 | A15 | A4 | A16 | A11 & A17 | A8 | A7 | A10 | A18 | A9 | ||

| S8 | A3 | A8 | A5 | A14 | A11 | A1 | A10 & A18 | A2 | A12 | A6 | A16 | A9 | A15 | A13 | A7 | A4 | A17 | |

| S9 | A14 | A3 | A1 | A12 | A5 | A2 | A5 & A13 | A15 | A8 | A17 | A16 | A18 | A4 & A10 & A11 | A7 | A9 | |||

| S10 | A3 | A14 | A1 | A8 | A2 | A5 | A11 | A12 | A6 | A16 | A10 | A15 | A4 | A9 | A13 & A17 | A7 | A18 | |

| S11 | A3 | A14 | A1 | A2 & A5 | A8 | A12 | A6 | A11 | A16 | A10 | A15 | A4 | A7 | A9 | A17 | A13 | A18 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ovezikoglou, P.; Aidonis, D.; Achillas, C.; Vlachokostas, C.; Bochtis, D. Sustainability Assessment of Investments Based on a Multiple Criteria Methodological Framework. Sustainability 2020, 12, 6805. https://doi.org/10.3390/su12176805

Ovezikoglou P, Aidonis D, Achillas C, Vlachokostas C, Bochtis D. Sustainability Assessment of Investments Based on a Multiple Criteria Methodological Framework. Sustainability. 2020; 12(17):6805. https://doi.org/10.3390/su12176805

Chicago/Turabian StyleOvezikoglou, Paraskevi, Dimitrios Aidonis, Charisios Achillas, Christos Vlachokostas, and Dionysis Bochtis. 2020. "Sustainability Assessment of Investments Based on a Multiple Criteria Methodological Framework" Sustainability 12, no. 17: 6805. https://doi.org/10.3390/su12176805

APA StyleOvezikoglou, P., Aidonis, D., Achillas, C., Vlachokostas, C., & Bochtis, D. (2020). Sustainability Assessment of Investments Based on a Multiple Criteria Methodological Framework. Sustainability, 12(17), 6805. https://doi.org/10.3390/su12176805