Progress of Technological Innovation of the United States’ Shale Petroleum Industry Based on Patent Data Association Rules

Abstract

1. Introduction

Literature Review

2. Methodology and Data

2.1. Association Rules

2.2. Data Collection

3. Results

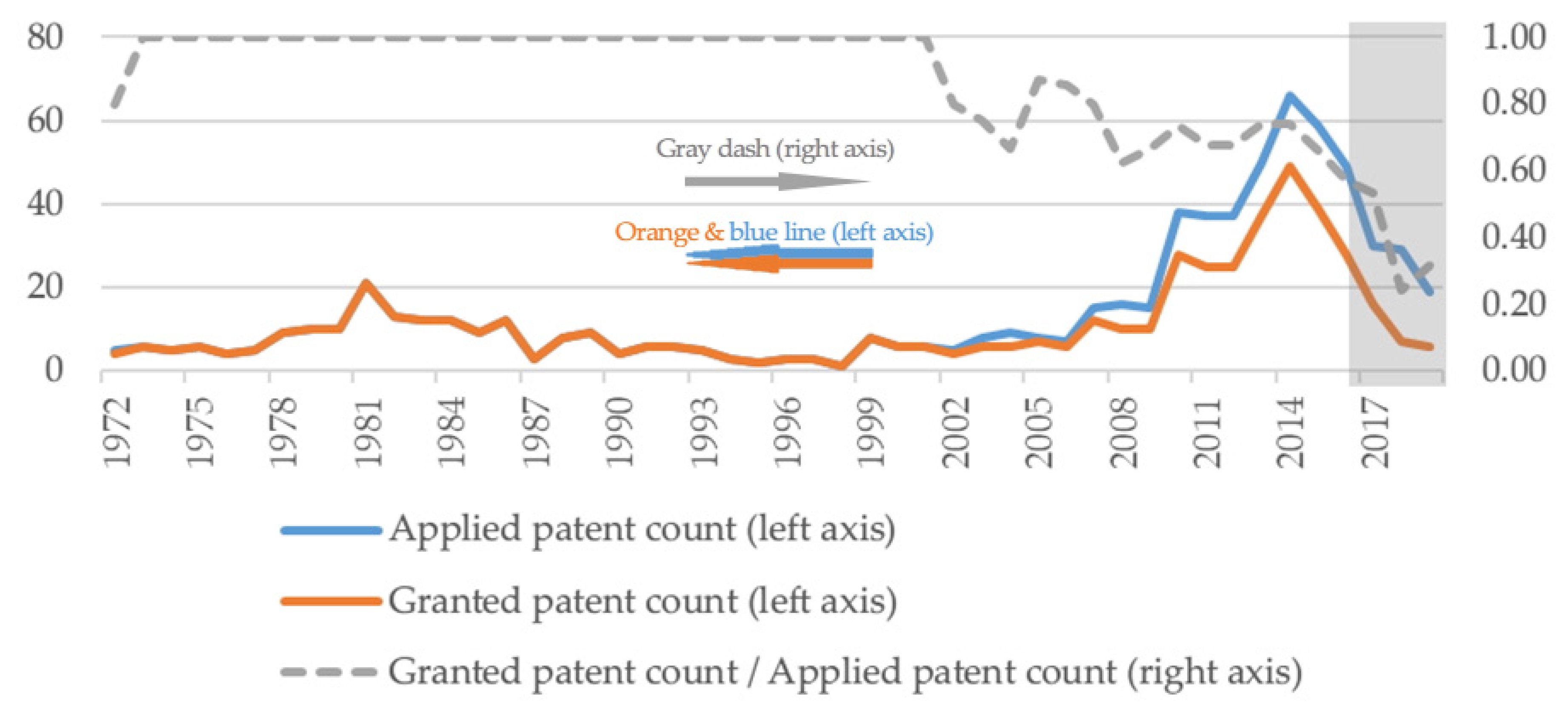

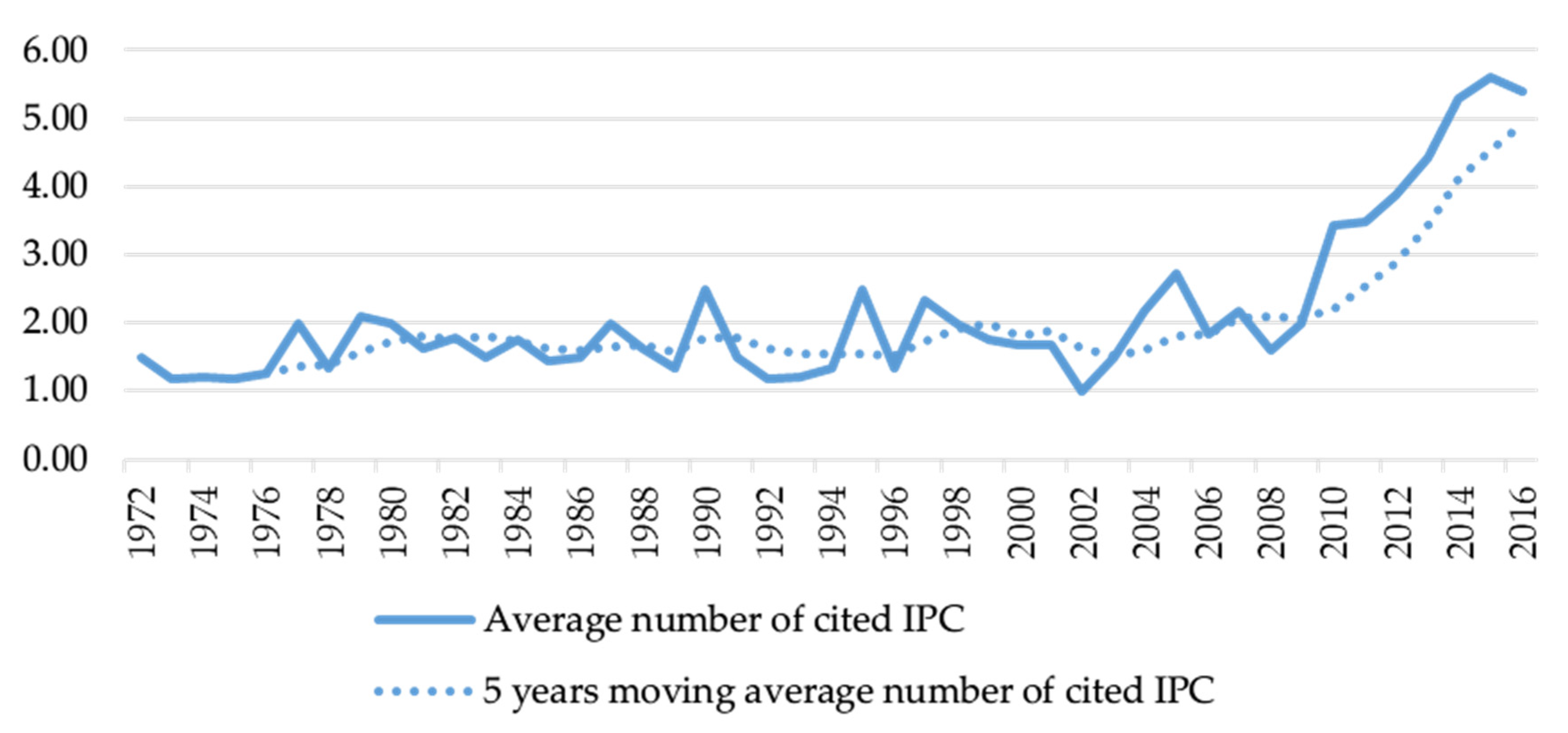

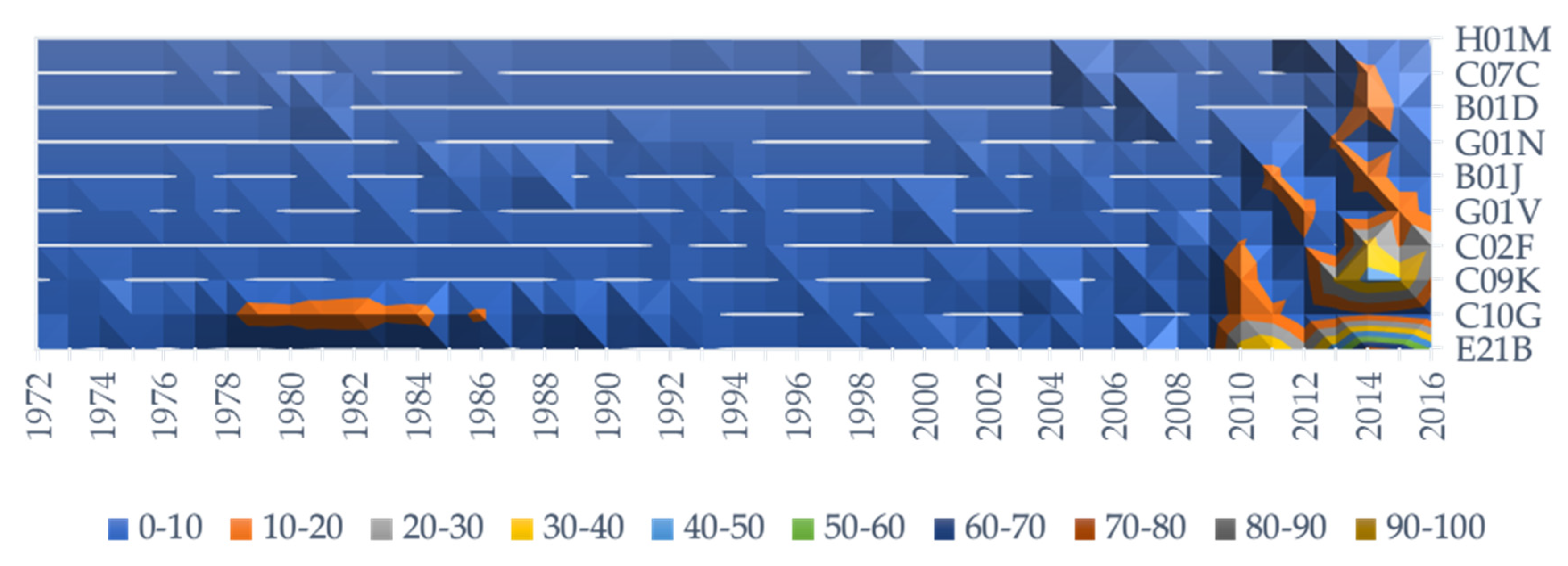

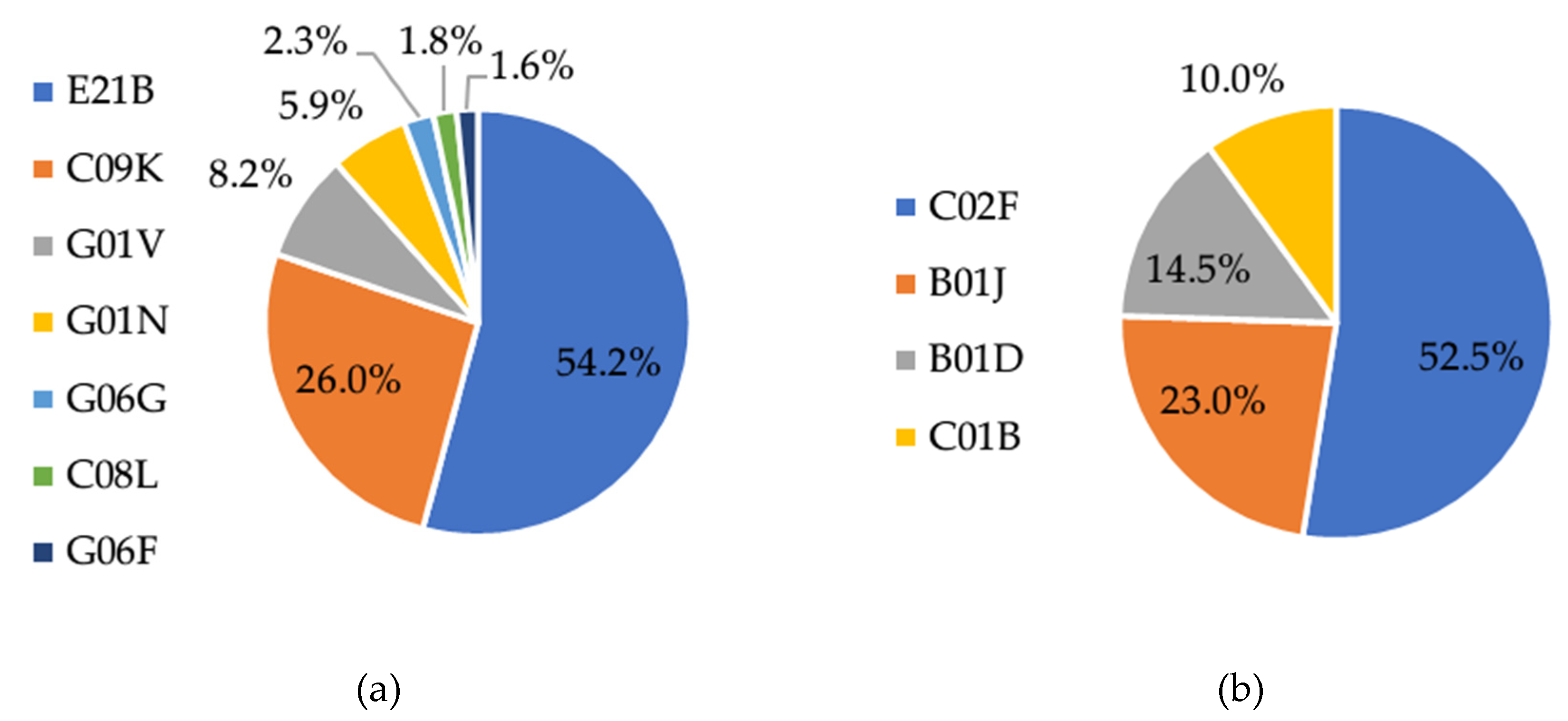

3.1. Statistical Description of the Data

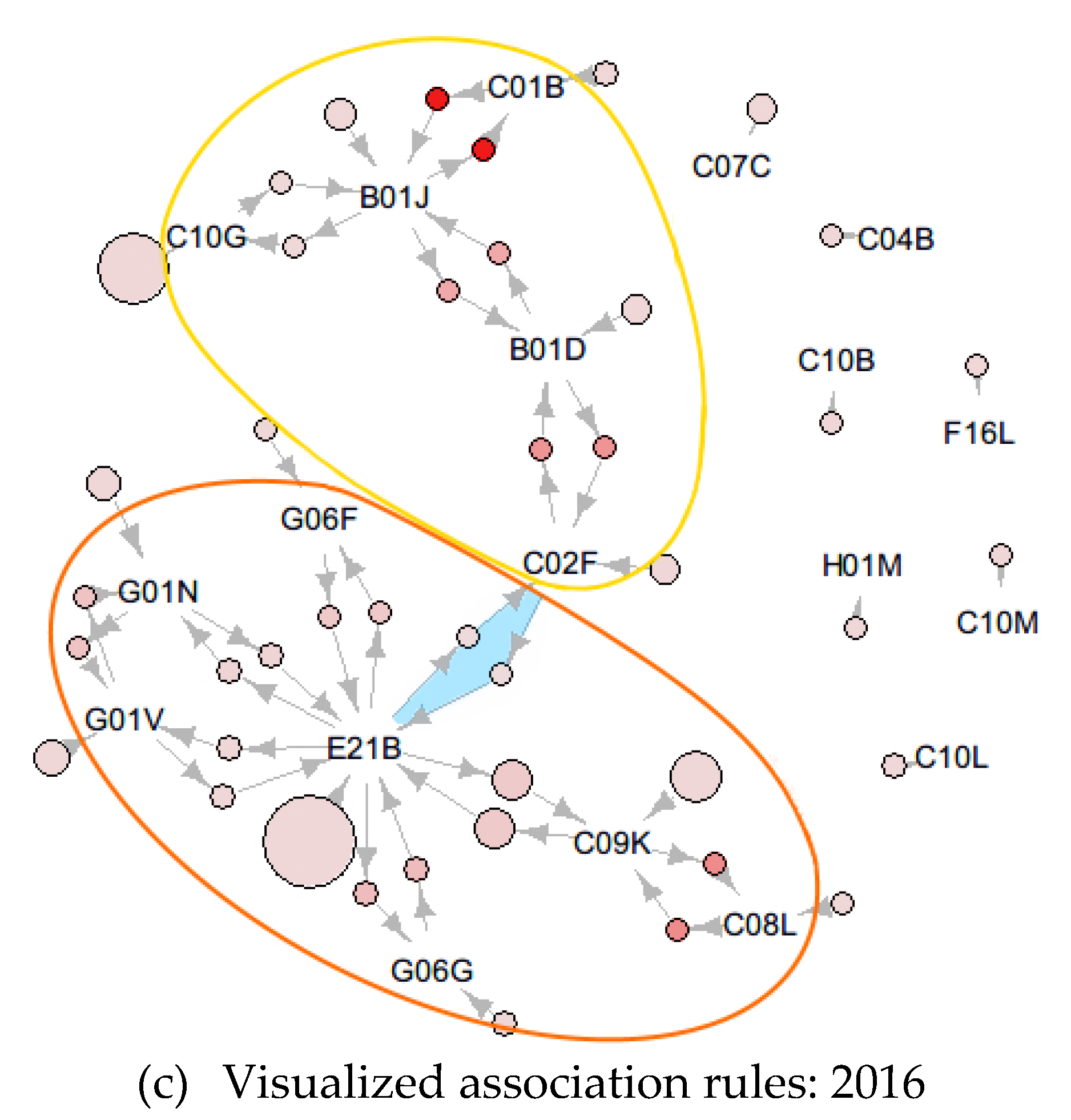

3.2. Association Rules Analysis

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Industries |

| Agriculture and fishing; Food and agriculture; Beverage; Cigarette; Textile product; Clothes, accessory clothes, and fur product; Leather, bag, and shoes manufacturing; Print and recording media reproduction; Insecticide and pesticide; Medical material and medicine; Medical instrument and machine; Glasses, photograph instrument, and optical instrument; Clock and clock component; Home instrument and machine; Office instrument and machine; Aircraft; Combat vehicle; Motorcycle; Furniture; Other instrument and machine. |

Appendix B

| IPC (Cited Count) | Description | |

| E21B(337) | Earth or rock drilling; Obtaining oil, gas, water, slurry, and so forth from well | |

| C09K(162) | Compositions for treating or drilling boreholes or wells | |

| G01V(51) | Detecting through seismic, electric, or magnetic methods | |

| G01N(37) | Investigating or analyzing chemical or physical properties | |

| G06G(14) | Computing with analog computers | |

| C08L(11) | Compositions of macromolecular compounds | |

| G06F(10) | Digital data processing | |

| IPC (Proportion) | Description | |

| E21B43 (64.4%) | Methods or apparatus for obtaining resources such as oil, gas, water, soluble, or meltable materials, and slurries of minerals from wells | |

| E21B49 (8.0%) | Methods or apparatus for testing (or sampling) borehole or well fluids or formations | |

| E21B47 (7.1%) | Surveyance of boreholes or wells | |

| E21B33 (4.5%) | Sealing or packing of boreholes or wells | |

| E21B41 (3.6%) | Equipment for obtaining oil, gas, water, slurry, etc., from wells | |

| E21B21 (3.6%) | Methods or apparatus for flushing boreholes | |

| E21B7 (3.0%) | Special methods or apparatus for drilling (e.g., directional drilling, flame drilling, driving casing or pipe into borehole, etc.) | |

| E21B36 (2.7%) | Methods or apparatus for heating, cooling, or insulating arrangements for boreholes or wells | |

| E21B37 (0.6%) | Methods or apparatus for cleaning boreholes or wells | |

| E21B25 (0.6%) | Apparatus for obtaining or removing undisturbed cores, e.g., core barrels, core extractors | |

| E21B17 (0.6%) | Drilling apparatus (e.g., drilling rods or pipes, flexible drill strings, kellies, drill collars, sucker rods, casings, tubing) | |

| E21B44 (0.3%) | Automatic control or monitoring systems for drilling or operation | |

| E21B4 (0.3%) | Drives for drilling, used in the borehole | |

| E21B34 (0.3%) | Valve arrangements for boreholes or wells | |

| E21B28 (0.3%) | Vibration generating arrangements for boreholes or wells (e.g., stimulating production) | |

| E21B19 (0.3%) | Handling rods, casings, tubes, or the like outside the borehole | |

Appendix C

Appendix D

| IPC (Cited Count) | Description |

| C02F(105) | Treatment of water, water waste, or sludge |

| B01J(46) | Chemical or physical processes (e.g., catalysis, colloid chemistry) |

| B01D(29) | Separation of liquids, gases, solvents, solids, etc. |

| C01B(20) | Non-metallic elements or compounds |

References

- Florence Geny. Can Unconventional Gas Be a Game Changer in European Gas Markets? Oxrford Institute for Energy Studies, 2010. Available online: https://ora.ox.ac.uk/objects/uuid:6de550f8-8b8f-43e9-a091-e2b0ecbc6b82 (accessed on 3 August 2020).

- The U.S. Energy Information Administration. Annual Energy Outlook 2020. 2020. Available online: https://www.eia.gov/outlooks/aeo/pdf/AEO2020%20Full%20Report.pdf (accessed on 3 August 2020).

- EIA Adds New Play Production Data to Shale Gas and Tight Oil Reports. Available online: https://www.eia.gov/todayinenergy/detail.php?id=38372 (accessed on 3 August 2020).

- Munasib, A.; Rickman, D.S. Regional economic impacts of the shale gas and tight oil boom: A synthetic control analysis. Reg. Sci. Urban Econ. 2015, 50, 1–17. [Google Scholar] [CrossRef]

- Paredes, D.; Komarek, T.; Loveridge, S. Income and employment effects of shale gas extraction windfalls: Evidence from the Marcellus region. Energy Econ. 2015, 47, 112–120. [Google Scholar] [CrossRef]

- Wang, Q.; Chen, X.; Jha, A.N.; Rogers, H. Natural gas from shale formation—The evolution, evidences and challenges of shale gas revolution in United States. Renew. Sustain. Energy Rev. 2014, 30, 1–28. [Google Scholar] [CrossRef]

- Cooper, J.; Stamford, L.; Azapagic, A. Shale gas: A review of the economic, environmental, and social sustainability. Energy Technol. 2016, 4, 772–792. [Google Scholar] [CrossRef]

- Trisha Curtis. US Shale Oil Dynamics in a Low Price Environment. Oxrford Institute for Energy Studies, 2015. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2015/11/WPM-62.pdf (accessed on 3 August 2020).

- Castro-Alvarez, F.; Marsters, P.; de León Barido, D.P.; Kammen, D.M. Sustainability lessons from shale development in the United States for Mexico and other emerging unconventional oil and gas developers. Renew. Sustain. Energy Rev. 2018, 82, 1320–1332. [Google Scholar] [CrossRef]

- International Energy Agency. World Energy Outlook 2009; International Energy Agency: Paris, France, 2009. [Google Scholar]

- Pápay, J. Exploitation of Light Tight Oil Plays. Nafta 2014, 65, 231–237. Available online: https://core.ac.uk/download/pdf/33272860.pdf (accessed on 3 August 2020).

- Rogers, H. Shale gas—The unfolding story. Oxford Rev. Econ. Policy 2011, 27, 117–143. [Google Scholar] [CrossRef]

- Holditch, S.A. Unconventional oil and gas resource development–Let’s do it right. J. Unconv. Oil Gas Resour. 2013, 1, 2–8. [Google Scholar] [CrossRef]

- Holditch, S.A. Tight gas sands. J. Pet. Technol. 2006, 58, 86–93. [Google Scholar] [CrossRef]

- Symington, W.A.; Kaminsky, R.D.; Meurer, W.P.; Otten, G.A.; Thomas, M.M.; Yeakel, J.D. Oil Shale: A Solution to the Liquid Fuel Dilemma, ExxonMobil’s Electrofrac™ Process for In Situ Oil Shale Conversion; ACS Publications: Washington, DC, USA, 2010; pp. 185–216. [Google Scholar]

- Acs, Z.J.; Audretsch, D.B. Patents as a measure of innovative activity. Kyklos 1989, 42, 171–180. [Google Scholar] [CrossRef]

- Seymore, S.B. Rethinking Novelty in Patent Law. Duke Law J. 2011, 60, 919–976. [Google Scholar]

- Rob West. Prospects for US Shale Productivity Gains. Oxford Institute for Energy Study, 2019. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/10/Prospects-for-US-shale-productivity-gains.pdf (accessed on 3 August 2020).

- Reynolds, D.B. The mineral economy: How prices and costs can falsely signal decreasing scarcity. Ecol. Econ. 1999, 31, 155–166. [Google Scholar] [CrossRef]

- Reynolds, D.B. US Shale-Oil Hubbert Production Peak: Civilization’s Ultimate Energy Forecast. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3640412 (accessed on 3 August 2020).

- Horn, M. OPEC’s optimal crude oil price. Energy Policy 2004, 32, 269–280. [Google Scholar] [CrossRef]

- Umekwe, M.; Baek, J. Do oil prices really matter to US shale oil production? Energy Sources Part B Econ. Plan. Policy 2017, 12, 268–274. [Google Scholar] [CrossRef]

- Osborn, S.G.; Vengosh, A.; Warner, N.R.; Jackson, R.B. Methane contamination of drinking water accompanying gas-well drilling and hydraulic fracturing. Proc. Natl. Acad. Sci. USA 2011, 108, 8172–8176. [Google Scholar] [CrossRef] [PubMed]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Fukui, R.; Greenfield, C.; Pogue, K.; van der Zwaan, B. Experience curve for natural gas production by hydraulic fracturing. Energy Policy 2017, 105, 263–268. [Google Scholar] [CrossRef]

- Kim, J.; Lee, Y. Analyzing the Learning Path of US Shale Players by Using the Learning Curve Method. Sustainability 2017, 9, 2232. [Google Scholar]

- Kim, J.; Lee, Y. Learning Curve, Change in Industrial Environment, and Dynamics of Production Activities in Unconventional Energy Resources. Sustainability 2018, 10, 3322. [Google Scholar] [CrossRef]

- Zhang, M.; Guo, W.; Lei, Z. Patent analysis of shale gas technology in China and implications for its exploitation. Energy Technol. 2014, 2, 1040–1045. [Google Scholar] [CrossRef]

- ISED. Patent Landscape Report: Shale Oil and Gas. 2016. Available online: https://www.ic.gc.ca/eic/site/cipointernet-internetopic.nsf/vwapj/Shale-Oil-Gas-report-May-2017.pdf/$file/Shale-Oil-Gas-report-May-2017.pdf (accessed on 3 August 2020).

- Wei, Y.; Kang, J.; Yu, B.; Liao, H.; Du, Y. A dynamic forward-citation full path model for technology monitoring: An empirical study from shale gas industry. Appl. Energy 2017, 205, 769–780. [Google Scholar] [CrossRef]

- Trisha Curtis. Unravelling the US Shale Productivity Gains. Oxford Institute for Energy Studies. 2016. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2016/11/Unravelling-the-US-Shale-Productivity-Gains-WPM-69.pdf (accessed on 3 August 2020).

- Trisha Curtis, Benjamin Montalbano. Completion Design Changes and the Impact on US Shale Well Productivity. Oxford Institute for Energy Studies, 2017. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2017/11/Completion-Design-Changes-and-the-Impact-on-US-Shale-Well-Productivity-Insight-21.pdf (accessed on 3 August 2020).

- Covert, T. Experiential and Social Learning in Firms: The Case of Hydraulic Fracturing in the Bakken Shale. 2015. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2481321 (accessed on 3 August 2020).

- Ivan Sandrea. US Shale Gas and Tight Oil Industry Performance: Challenges and Opportunities. Oxford Institute for Energy Studies, 2014. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2014/03/US-shale-gas-and-tight-oil-industry-performance-challenges-and-opportunities.pdf (accessed on 3 August 2020).

- Reynolds, D.B.; Umekwe, M.P. Shale-Oil Development Prospects: The Role of Shale-Gas in Developing Shale-Oil. Energies 2019, 12, 3331. [Google Scholar] [CrossRef]

- Jun, S.; Park, S.S.; Jang, D.S. Technology forecasting using matrix map and patent clustering. Ind. Manag. Data Syst. 2012, 112, 786–807. [Google Scholar] [CrossRef]

- Jun, S. Database Theory and Application, Bio-Science and Bio-Technology; IPC code analysis of patent documents using association rules and maps–Patent analysis of database technology; Springer: Berlin/Heidelberg, Germany, 2011; pp. 21–30. [Google Scholar]

- Agrawal, R.; Imieliński, T.; Swami, A. Mining Association Rules between Sets of Items in Large Databases. In Proceedings of the 1993 ACM SIGMOD International Conference on Management of Data, Washington, DC, USA, 26–28 May 1993; pp. 207–216. [Google Scholar]

- Han, J.; Pei, J.; Kamber, M. Data Mining: Concepts and Techniques; Elsevier: Amsterdam, The Netherlands, 2011. [Google Scholar]

- Team, R.C. R: A Language and Environment for Statistical Computing. 2013. Available online: https://www.R-project.org/ (accessed on 17 April 2020).

- Hahsler, M.; Buchta, C.; Gruen, B.; Hornik, K. arules: Mining Association Rules and Frequent Itemsets. 2019. Available online: https://cran.r-project.org/web/packages/arulesViz/index.html (accessed on 17 April 2020).

- Hahsler, M.; Chelluboina, S. arulesViz: Visualizing Association Rules and Frequent Itemsets. 2020. Available online: https://cran.r-project.org/web/packages/arules/index.html (accessed on 17 April 2020).

- KIPRIS Web Database Service of Patent Information. Available online: http://www.kipris.or.kr/khome/main.jsp (accessed on 17 April 2020).

- International Patent Classification Scheme. Available online: https://www.wipo.int/classifications/ipc/ipcpub/?notion=scheme&version=20200101&symbol=none&menulang=en&lang=en&viewmode=f&fipcpc=no&showdeleted=yes&indexes=no&headings=yes¬es=yes&direction=o2n&initial=A&cwid=none&tree=no&searchmode=smart (accessed on 17 April 2020).

- Table about Industrial Classification and IPC. Available online: https://www.kipo.go.kr/kpo/HtmlApp?c=4031&catmenu=m06_07_05 (accessed on 17 April 2020).

| Field | Contents | Logic |

|---|---|---|

| Title, abstract, claim | Tight gas, tight oil, tight petroleum, tight sand, shale gas, shale oil, shale petroleum, shale formation, shale layer | Included |

| Title, abstract, claim | Heavy oil, oil sand, oil shale, kerogen, tar sand, tar shale, coal tar, coal mine, biofuel | Excluded |

| IPC (International Patent Classification) | A01B27/02, A01C, A01D, A01G, A01H, A01K, A21D, A23B, A23C, A23D, A23F, A23G, A23J, A23K, A23L, A23P, C12J, C13B, C13K, C12C, C12F, C12G, C12H, A24B, A24D, A24F, D04D, D04G, D04H, D06C, D06J, D06M, D06N, D06P, D06Q, A41B, A41C, A41D, A41F, A42B, A42C5, A43B, A43C, A45C, B68B, B68C, B41M, B42D, A01N, A01P, A61P, C07D, C07J, C07K, C12N, C12P, C12Q, C12R, A61K, A61B, A61C, A61D, A61F, A61G, A61H, A61J, A61L, A61M, A61N, A62B, B01L, B04B, C12M, G01T, G03B42, H05G, G02B, G02C, G03D, G02F2, G02F3, G02F7, G03B, G03C5, G03C9, G03C11, G03F, G04B, G04C, G04D, G04F, G04G, G04R, A45D, A47G, A47J, A47L, D06F, E06C, F24B, F24C, H05B, B41L, B41J1, G03G, G06C, G06M, G07B, G07C, G07D, G07G, B64B, B64C, B64D, B64F, B64G, F02K, F03H, F41H7, B62J, B62K11, B62M6, B62M7, A47B, A47C, A47D, A47F, A41G, A44B, A44C, A45B, A45F, A46B, A46D, A63B, A63C, A63D, A63F, A63G, A63H, A63J, A63K, A99Z, B43K, B43L, B43M, B44D, B44F, B68G, B99Z, D07B, F23Q, G09B, G09F, G10B, G10C, G10D, G10F, G10G, G10H | Excluded |

| Year | From (ix) | To (iy) | Support | Confidence | Lift |

|---|---|---|---|---|---|

| 2002 | C09K | E21B | 0.014 | 0.273 | 2.932 |

| E21B | C09K | 0.014 | 0.150 | 2.932 | |

| G01V | E21B | 0.014 | 0.273 | 2.932 | |

| E21B | G01V | 0.014 | 0.150 | 2.932 | |

| C10B | C10G | 0.019 | 1.000 | 2.129 | |

| C10G | C10B | 0.019 | 0.040 | 2.129 | |

| 2009 | C09K | E21B | 0.033 | 0.375 | 2.757 |

| E21B | C09K | 0.033 | 0.243 | 2.757 | |

| G01V | E21B | 0.015 | 0.286 | 2.100 | |

| E21B | G01V | 0.015 | 0.108 | 2.100 | |

| C10B | C10G | 0.015 | 0.800 | 2.053 | |

| C10G | C10B | 0.015 | 0.038 | 2.053 | |

| C10M | C10G | 0.011 | 0.429 | 1.100 | |

| C10G | C10M | 0.011 | 0.028 | 1.100 | |

| C07C | C10G | 0.011 | 0.300 | 0.770 | |

| C10G | C07C | 0.011 | 0.028 | 0.770 | |

| B01J | C10G | 0.011 | 0.250 | 0.642 | |

| C10G | B01J | 0.011 | 0.028 | 0.642 | |

| 2016 | C01B | B01J | 0.016 | 0.571 | 9.581 |

| B01J | C01B | 0.016 | 0.267 | 9.581 | |

| C08L | C09K | 0.012 | 0.857 | 5.599 | |

| C09K | C08L | 0.012 | 0.078 | 5.599 | |

| C02F | B01D | 0.012 | 0.261 | 5.249 | |

| B01D | C02F | 0.012 | 0.240 | 5.249 | |

| B01D | B01J | 0.012 | 0.240 | 4.024 | |

| B01J | B01D | 0.012 | 0.200 | 4.024 | |

| G06G | E21B | 0.020 | 1.000 | 2.842 | |

| E21B | G06G | 0.020 | 0.056 | 2.842 | |

| G01N | G01V | 0.012 | 0.188 | 2.358 | |

| G01V | G01N | 0.012 | 0.150 | 2.358 | |

| G06F | E21B | 0.012 | 0.667 | 1.895 | |

| E21B | G06F | 0.012 | 0.034 | 1.895 | |

| C09K | E21B | 0.099 | 0.649 | 1.845 | |

| E21B | C09K | 0.099 | 0.282 | 1.845 | |

| G01N | E21B | 0.028 | 0.438 | 1.243 | |

| E21B | G01N | 0.028 | 0.079 | 1.243 | |

| G01V | E21B | 0.030 | 0.375 | 1.066 | |

| E21B | G01V | 0.030 | 0.085 | 1.066 | |

| B01J | C10G | 0.014 | 0.233 | 0.954 | |

| C10G | B01J | 0.014 | 0.057 | 0.954 | |

| C02F | E21B | 0.012 | 0.261 | 0.741 | |

| E21B | C02F | 0.012 | 0.034 | 0.741 |

| IPC (%) | Number of IPC Citations by Period | |||

|---|---|---|---|---|

| 1972 ~ 2001 | 2002 ~ 2009 | 2010 ~ 2016 | 1972~2016 | |

| E21B | 27 | 28 | 337 | 392 |

| (6.888%) | (7.143%) | (85.969%) | ||

| C09K | 11 | 20 | 162 | 193 |

| (5.699%) | (10.363%) | (83.938%) | ||

| C02F | 2 | 8 | 105 | 115 |

| (1.739%) | (6.957%) | (91.304%) | ||

| C10G | 159 | 8 | 51 | 218 |

| (72.936%) | (3.670%) | (23.394%) | ||

| G01V | 14 | 3 | 51 | 68 |

| (20.588%) | (4.412%) | (75.000%) | ||

| B01J | 14 | 5 | 46 | 65 |

| (21.538%) | (7.692%) | (70.769%) | ||

| G01N | 8 | 2 | 37 | 47 |

| (17.021%) | (4.255%) | (78.723%) | ||

| B01D | 5 | 9 | 29 | 43 |

| (11.628%) | (20.930%) | (67.442%) | ||

| C07C | 6 | 10 | 24 | 40 |

| (15.000%) | (25.000%) | (60.000%) | ||

| C01B | 0 | 1 | 20 | 21 |

| (0.000%) | (4.762%) | (95.238%) | ||

| Others | 92 | 24 | 211 | 327 |

| (28.135%) | (7.339%) | (64.526%) | ||

| Total | 338 | 118 | 1073 | 1529 |

| (22.106%) | (7.717%) | (70.177%) | ||

| Network | Position | 1972 ~ 2001 | 1972 ~ 2009 | 1972 ~ 2016 |

|---|---|---|---|---|

| Network 1 | Center IPC | E21B | E21B | E21B |

| Surrounding IPCs | C09K, G01V | C09K, G01V | C09K, G01V, G01N, G06F*, G06G*, C08L* | |

| Network 2 | Center IPC | C10G | C10G | - |

| Surrounding IPCs | C10B | C10B, C10M | - | |

| Network 3 | Center IPC | - | - | B01J |

| Surrounding IPCs | - | - | B01D, C01B, C02F |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.-H.; Lee, Y.-G. Progress of Technological Innovation of the United States’ Shale Petroleum Industry Based on Patent Data Association Rules. Sustainability 2020, 12, 6628. https://doi.org/10.3390/su12166628

Kim J-H, Lee Y-G. Progress of Technological Innovation of the United States’ Shale Petroleum Industry Based on Patent Data Association Rules. Sustainability. 2020; 12(16):6628. https://doi.org/10.3390/su12166628

Chicago/Turabian StyleKim, Jong-Hyun, and Yong-Gil Lee. 2020. "Progress of Technological Innovation of the United States’ Shale Petroleum Industry Based on Patent Data Association Rules" Sustainability 12, no. 16: 6628. https://doi.org/10.3390/su12166628

APA StyleKim, J.-H., & Lee, Y.-G. (2020). Progress of Technological Innovation of the United States’ Shale Petroleum Industry Based on Patent Data Association Rules. Sustainability, 12(16), 6628. https://doi.org/10.3390/su12166628