1. Introduction

Carbon emissions are closely related to energy consumption, especially of coal-fired power generation [

1]. Driven by more and more energy demand, global energy-related CO

2 emissions rose 1.7% to a historic high degree in 2018, among which the power sector accounted for nearly two-thirds of emissions growth, and mostly in coal-fired power plants. In particular, China, India and the United States accounted for 85% of the net increase in emissions [

2]. Thus, to curb carbon emissions, governments have implemented multiple policies to promote renewable energy and curtail the continued rapid construction of coal-fired power plants [

3]. For example, the National Energy Administration (NEA) of China canceled 103 coal-fired power plants in 2017, eliminating 120 gigawatts of future coal-fired power capacity. Although currently China has the world’s largest installed capacity of hydro, solar and wind power, its energy demands are so large due to its industry development that most of the power comes from coal, which accounted for 71% in 2018 [

4]. Furthermore, it is confirmed that coal-fired power generation in which the main emission pollutants consist of particle matter, SO

2 and NOx, is the culprit for the air pollution in China [

5]. As environmental issues are becoming increasingly prominent, coal-fired power plants should take more focus on adopting low-emission and pollution control technologies to optimize production and meet pro-environmental requirement [

6]. In fact, as long as structural adjustment, technological progress, energy conservation, and emission reduction are taken in the progress of coal-fired power generation, it can also be developed cleanly and sustainably [

7]. However, these need a lot of costs to improve technologies and management. Thus, coal-fired power plants would require decisions on their efforts to balance the costs and return on pro-environmental investment.

To effectively solve ecological and environmental problems, reduce carbon emissions, and gradually replace coal and other fossil resources, the development of renewable energy is the key way; thus, governments have implemented multiple policies to promote renewable energy power generation [

8]. Therefore, renewables accounted for a third of net increase in power generation in 2018. Especially for the world’s largest country in renewable energy power generation, China is also the largest contributor to renewables growth [

9]. However, it also evokes some issues, such as the phenomenon of abandoning wind, sun, and water [

10,

11]. These are mainly due to the conflicts between the concentrated, large-scale construction of renewable energy power generation and limited local consumption, lacking in trans-regional market mechanism [

12,

13]. Besides this, renewable energy power generation are unable to ensure stable and continued power due to fluctuating generated power [

14,

15]. Thus, in practice more and more governments would give priority to coal-fired power generation to ensure the stable operation of power supply chain and optimize allocation of power resources and consumption of renewables through direct power purchase transaction by large power users [

16].

The implementation of direct power purchase transaction by large power users would effectively promote the transformation of power market from a single power generation market to a bilateral market with the participation of the selling side, which could not only reduce the costs of large power users, but also provide a highly efficient selling channel for power generation enterprises except power grid enterprises [

17]. Additionally, according to a new report on renewable power generation costs by the International Renewable Energy Agency (IRENA), the current costs of renewable power generation are declining fast, and the power pricing of renewables may be competitive in direct purchase transaction, which will influence the consumption of renewable energy power generation and the emission reduction efforts of coal-fired power plants. As thus, from the perspective of the sustainability in power supply chain, how to allocate the power quantity in direct purchase channel and traditional single-channel is particularly important for both coal-fired and renewable energy power enterprises.

To summarize, it is necessary to take both coal-fired and renewable energy power generation enterprise, and power grid enterprises as a whole power supply chain to make joint decisions of channel selections and emission reductions under the background of direct power purchase transaction reform and the sustainability of the power supply chain. Based on this, this paper focuses on the following questions:

- (1)

What is the impact of direct power purchase transaction by large power users on the allocation of power resources and consumption of renewables in the power supply chain?

- (2)

How to allocate the power quantity in direct purchase channel and traditional single-channel for both coal-fired and renewable energy power enterprises?

- (3)

What are the influencing factors of coal-fired power plant’ decisions in its emission reduction effort?

- (4)

How about the impact of subsidy, preference and cost coefficient on the power supply chain’s optimal decisions?

To address these questions, this paper conducted profit and emission reduction decision models under the scenarios of centralized and decentralized decision in traditional single-channel and dual-channel when considering direct power purchase transaction by large power users. It not only provided managerial insights on dual-channel power supply chain under the mechanism of direct power purchasing and the regulation of emission reduction by coal-fired power plants, but also helped to design the coordination contract to achieve the Pareto improvement of the decentralized and centralized decision-making in power supply chain. Based on these analyses, this paper can present suggestions for power supply chain members to improve their profits and environmental performance, and government to perfect the market-based mechanism and the sustainability for power supply chain. The contributions of this paper are:

Firstly, since the implementation of direct power purchase transaction by large power users would effectively promote the sustainability of power industry, this paper introduced direct purchase transaction in the dual-channel power supply chain for renewable energy power consumption and emission reduction of coal-fired power. Secondly, this paper studied the impact of competition between two manufacturers of one coal-fired power plant and one renewable energy power generation enterprise on their channel selection and emission reduction decisions, and found out the optimal strategies for them in different decision scenarios. Thirdly, strategies were proposed by analyzing the impacts of factors from policy, market and supply chain to achieve the Pareto improvement of profit and emission reduction effort in different scenarios of the power supply chain. It can not only inspire the coal-fired power plant’s initiative for clean production, but also promote the consumption of renewable energy power generation and the profit of whole power supply chain.

The remaining parts of this paper are organized as follows.

Section 2 presents the literature review. In

Section 3, the notations used in this paper are provided.

Section 4 constructs models and derives the equilibrium solutions and discusses the results. In

Section 5, this paper conducts numerical experiments and makes comparison analysis in different scenarios. This paper also provides impacts of parameters on decision variables variations in different scenarios. In

Section 6, this paper provides concluding remarks and future research directions. In addition, all proofs of this paper are provided in

Appendix A and

Appendix B.

3. Problem Assumptions and Notations

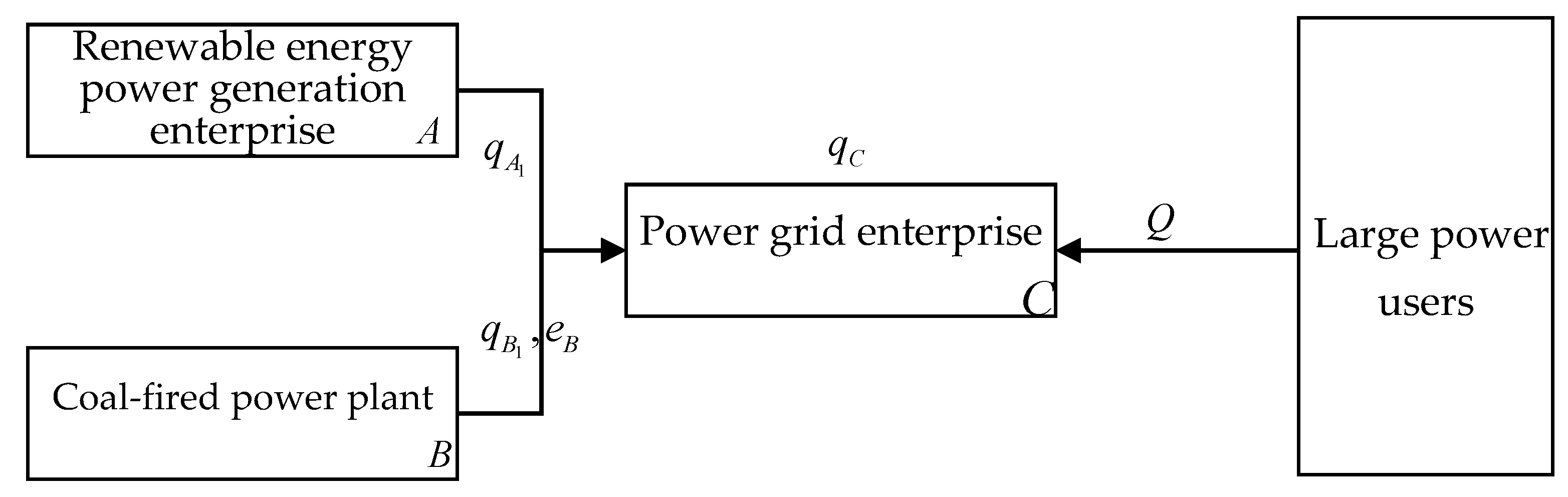

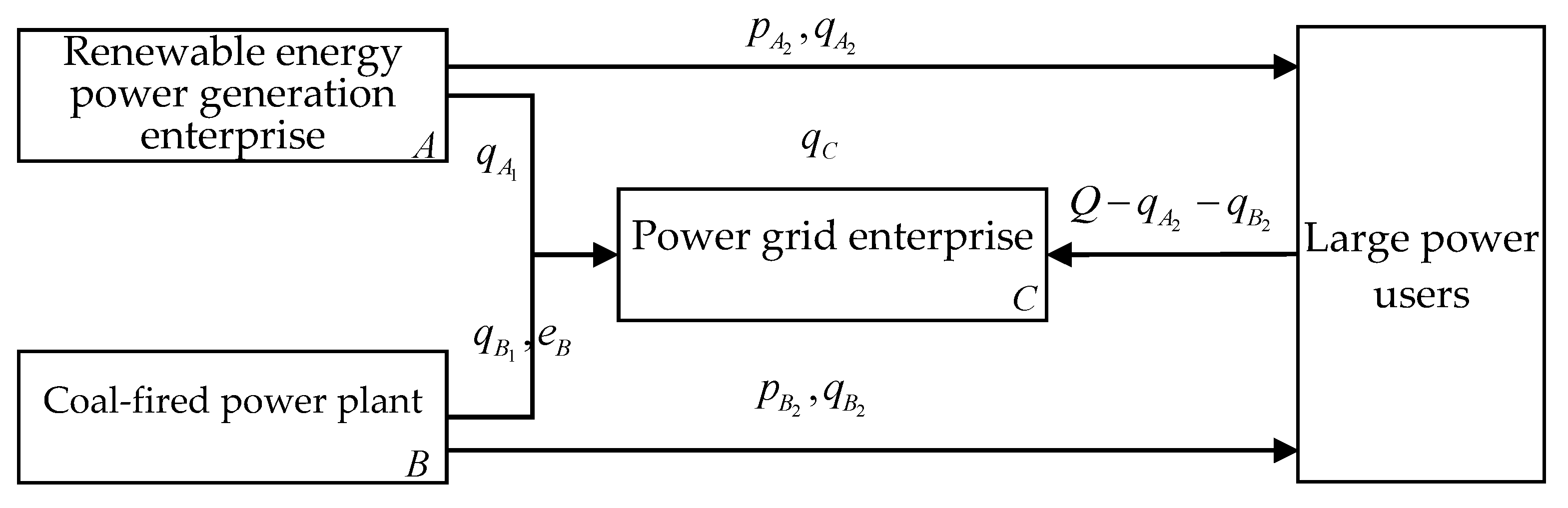

This paper considers a traditional single-channel and a dual-channel power supply chain respectively in the power market under the constraint of emission reduction including two upstream manufacturers which are renewable energy power generation enterprise and coal-fired power plant, as well as a downstream retailer which is power grid enterprise. Models in this paper address the issues of the power generation enterprises’ channel selection strategies and emission reduction decisions. Combining with the actual situation, this paper lists the following notations in

Table 1 where A and B in subscripts are defined for the renewable energy power generation enterprise and coal-fired power plant, and C and S in subscript are defined for power grid enterprise and the whole supply chain respectively. Superscript L and N respectively represents the traditional power supply chain with single-channel and dual-channel power supply chain with direct power purchase, meanwhile superscript c and d respectively denotes centralized and decentralized decision-making scenario.

Other assumptions are presented as follows:

Assumption 1. The unit cost of power generation and its pollution emission coefficient by the coal-fired power plant are certain under the current power generation technology.

Assumption 2. The power network system is security and stable. Power generation enterprises have enough capacity to meet the power order quantity of power grid enterprise, meanwhile the power generation quantity is based on the fixed demand, which means there is no inventory and no response time of power.

Assumption 3. The coal-fired power generation emit much pollution, thus, to balance the performance of economic and environmental, the coal-fired power generation plant must pay a certain environmental cost. Some measures such as technological innovation, equipment upgrading and carbon emission permits trading to reduce the total emission are taken to meet environmental performance requirement.

Assumption 4. Due to the technological limitation, the cost of renewable energy power generation is often higher than that of coal-fired power generation. Hence, the average on-grid power price of nuclear power, biomass and photovoltaic power generation in developing countries is often higher than that of coal-fired power generation besides that of hydropower and wind power, which indicates that.

5. Model Discussions

In this section, we take comparisons in different decision scenarios and different channel power supply chains to find the optimal strategies for each member and the whole power supply chain.

5.1. On-grid Power Strategy

In traditional single-channel power supply chain, renewable energy power generation enterprise A and coal-fired power plant B are competitors in terms of on-grid power. To increase the market share of renewable energy power generation, the best response interval of preference coefficient of power grid enterprise C for coal-fired power generation is given in the following proposition.

Proposition 1. In traditional single-channel power supply chain, there should be:

- (1)

, if the conditionis meet, or else;

- (2)

, if the conditionis meet, or else.

Proposition 1 shows that the required conditions of when the on-grid power of renewable energy power generation enterprise A is greater than that of coal-fired power plant B in traditional single-channel power supply chain. In other words, by adjusting the preference of power grid enterprise C for coal-fired power generation, the dilemma of insufficient consumption of renewable energy in the traditional single-channel power supply chain can be solved. The dilemma of the shortness in on-grid power of renewable energy is mainly due to its immature power generation and transmission technology and intermittent output when compared with coal-fired power generation.

To examine the impact of opening direct power purchase channel on the on-grid power quantity of renewable energy power generation enterprise A and coal-fired power plant B under centralized decision, comparisons between single-channel power supply chain and dual-channel power supply chain are made, and the following proposition is obtained.

Proposition 2. - (1)

For renewable energy power generation enterprise A:;

- (2)

For coal-fired power plant B:.

From Proposition 2(1) we can know that, under centralized decision-making, the on-grid power quantity of renewable energy power generation enterprise

A will decrease with the development of dual-channel compared with traditional single-channel. This is mainly due to the development of direct purchase channel has increased power transactions between renewable energy power generation enterprise

A and large power users. In other words, direct purchase channel is beneficial to promoting power consumption from renewable sources, which is consistent with previous research [

45,

46].

However, Proposition 2(2) shows that the on-grid power quantity of coal-fired power plant

B will increase with the development of dual-channel under centralized decision. This is mainly because of the key role of coal-fired power plant in ensuring the power market and the core position of power grid enterprise in current power market [

47]. As power grid enterprise not only supplies power to large power users, it also supplies power to other power users in the market.

5.2. Direct Purchase Transaction Power Strategy

Proposition 3. In the case of centralized decision, there is, which indicates that the power quantity purchased from coal-fired power plant B in centralized direct channel is greater than that of renewable energy power generation enterprise A.

Proposition 3 shows that in the case of centralized decision, the proportion of coal-fired power generation is greater than that of renewable energy power generation in the direct purchase power transaction by large power users. This is because of the stability and continuity of coal-fired power generation and its low cost, coal-fired power plant remains competitive in the direct power purchase market with large power users [

48], which means large power users are more inclined to transact with coal-fired power plant.

5.3. Emission Reduction Effort’ Strategy

To find which strategy is beneficial to improving emission reduction effort of coal-fired power plant, this paper takes comparisons between traditional single-channel and dual-channel power supply chain in centralized decision scenario, as well as comparisons between decentralized and centralized decision scenario in traditional single-channel power supply chain, then obtain the following proposition.

Proposition 4. For coal-fired power plant B:

- (1)

;

- (2)

if.

Proposition 4(1) indicates that in the scenario of centralized decision, dual-channel power supply chain is more conducive to improving emission reduction efforts of coal-fired power plant than traditional single-channel, which is also supported by other researches [

49,

50]. To some extent, this is because the preference for emission reduction effort of direct-purchase channel from large power users in power supply chain has enhanced emission reduction effort of coal-fired power plant.

Moreover, Proposition 4(2) shows that centralized decision in traditional single-channel is more effective to encourage emission reduction effort of coal-fired power plant than decentralized decision when . In other words, if the condition is satisfied, in which is denoted as subsidized power generation cost of renewable energy power generation enterprise A, the optimal strategy to encourage emission reduction effort of coal-fired power plant should be made in centralized decision scenario. Therefore, how coal-fired power plant B decides emission reduction effort in centralized traditional single-channel depends on the on-grid power price of coal-fired power plant B, which should be lower than the subsidized power generation cost of renewable energy power generation enterprise A.

5.4. Overall Profit’ Strategy

Since the profit function in decentralized decision is too complicated to calculate, this paper will take its analysis in numerical examples. In this section, comparisons with traditional single-channel and dual-channel power supply chain in centralized decision-making scenario are made to find out which strategy is optimal for overall profit. The following proposition is obtained.

Proposition 5. In the case of centralized decision, the overall profit of dual-channel power supply chain is greater than that of traditional single-channel power supply chain, which indicates that.

As Proposition 5 shows that renewable energy power generation enterprise A and coal-fired power plant B’s participating in direct power purchase transactions by large power users is conducive to improve overall profit of the power supply chain under centralized decision scenario, which is also confirmed in other dual-channel supply chain management [

51]. In other words, Proposition 5 indicates that direct power purchase transactions between power generation enterprises and large power users is more effective than traditional single-channel in the scenario of centralized decision.

6. Numerical Analysis

This section presents numerical analysis of above theoretical results and explores the differences between different scenarios to explain some managerial insights. Based on the China power yearbook of 2018 and relevant policies, the values of model parameters are set as following: , , , , , , , , , , , , , , , , .

6.1. Decisions and Profits in Different Scenarios

According to the results in

Table 2, the optimal decisions and profits in different scenarios are obtained and compared.

Table 2 shows that when

, there should be

and

, which supports Proposition 1. Meanwhile,

and

can be also found in

Table 2, which corresponds with Proposition 2. Additionally, when compared with decentralized decision scenario, centralized decision scenario can significantly improve the overall profit of the power supply chain, while the emission reduction effort of coal-fired power plant

B would be reduced, which is consistent with Proposition 3. Comparing with traditional single-channel power supply chain, the dual-channel power supply chain in which power generation enterprises participate in direct power purchase transactions with large power users is conducive to significantly improve the emission reduction effort of coal-fired power plant

B, which is consistent with Propositions 3 and 4, and efficiently enhance the profits of each member and whole power supply chain.

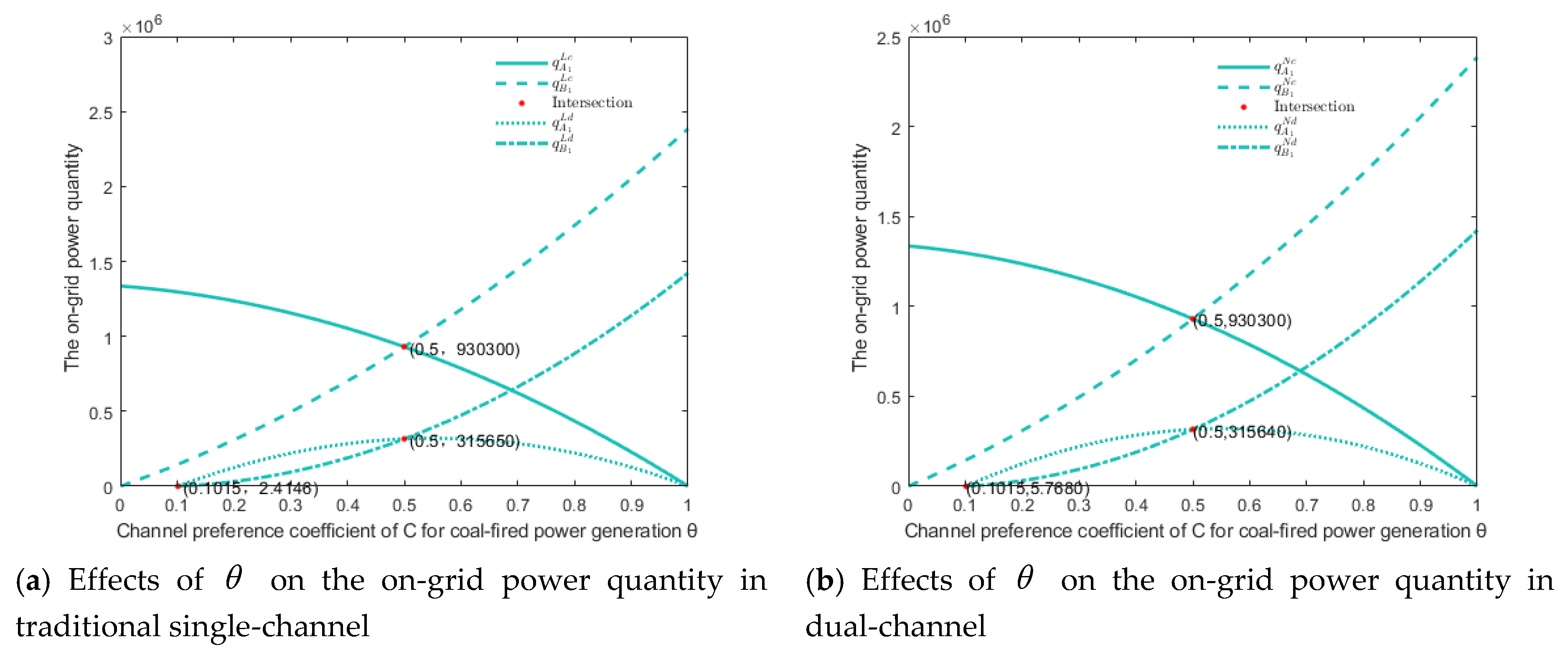

6.2. Impact of Policy Factors

This subsection presents the impact of policy factors including power grid wheeling charge and subsidy to renewable energy power generation on the optimal profits of each member and whole power supply chain, as well as emission reduction effort of coal-fired power plant B and the power quantity purchased in direct and indirect channel from power generation enterprises.

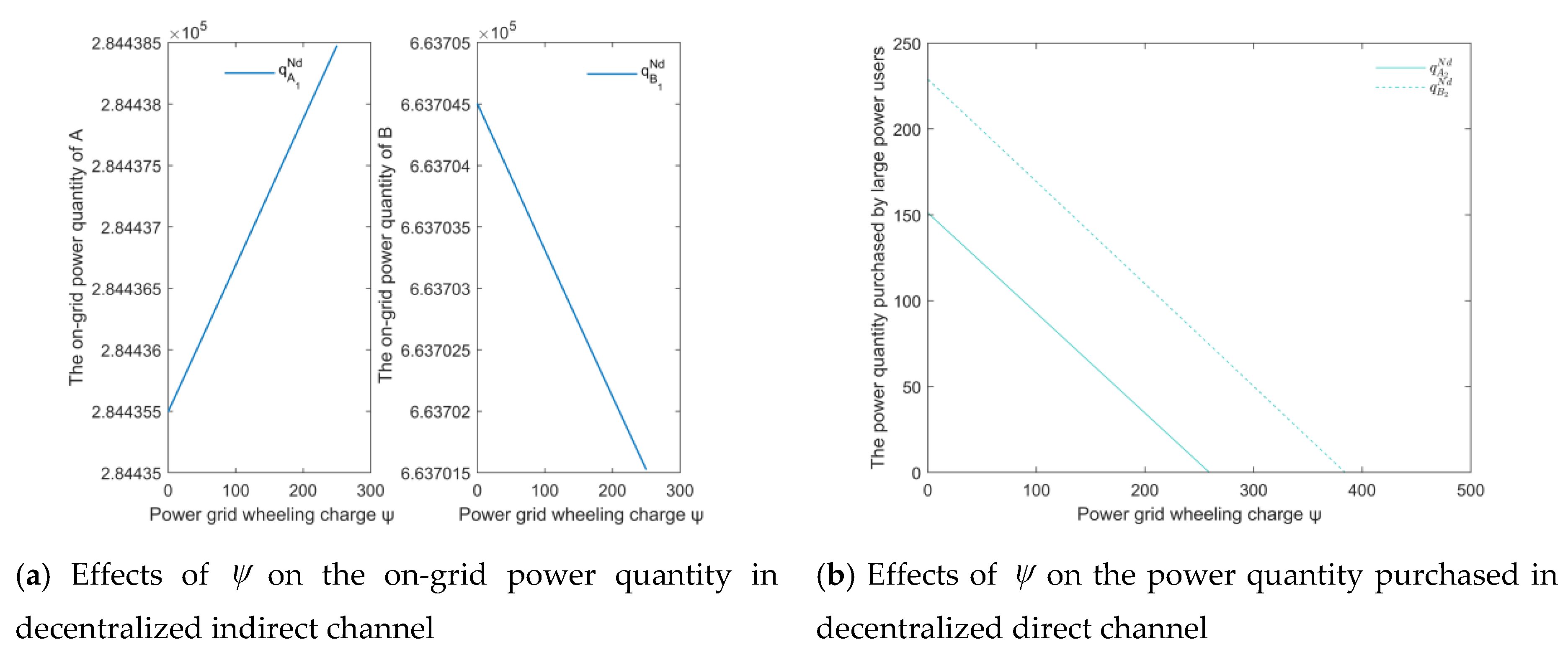

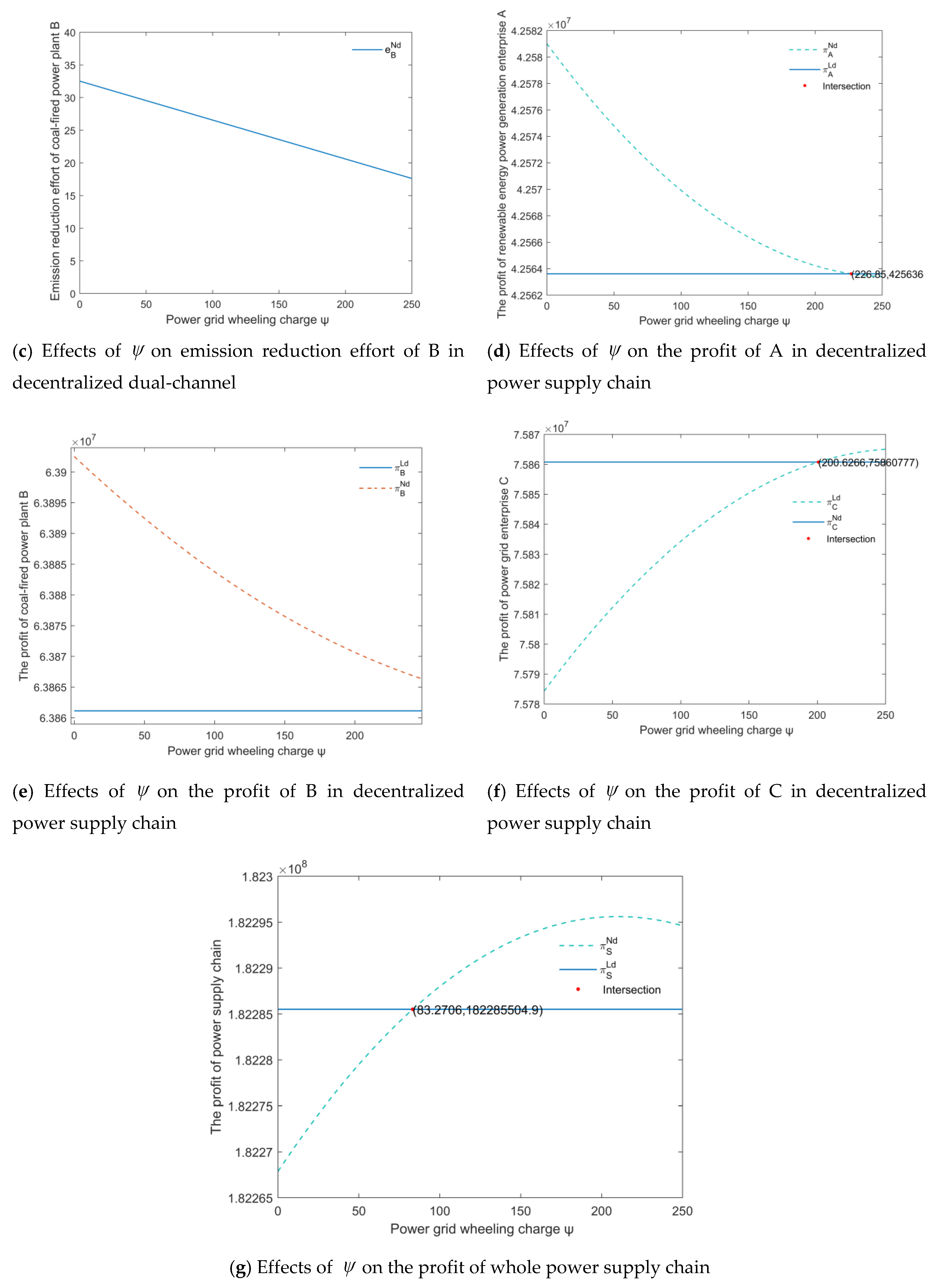

6.2.1. Impact of ψ on the Optimal Results

Power generation enterprises’ participation in the direct power purchase transactions with large power users will erode the market share of power grid enterprise, accordingly its profit would be reduced. To reduce the loss, power grid enterprise would charge power grid wheeling charge from power generation enterprises for the direct power purchase transactions with large power users. In other words, power grid wheeling charge is equivalent to the opening cost of direct power purchase channel for power generation enterprises. Therefore, the value of power grid wheeling charge is particularly important for the optimal result of power supply chain. Based on the above analysis, power grid wheeling charge is only expected to affect the optimal results in the decentralized dual-channel scenario, in which the results are illustrated in

Figure 3a–f.

As seen in

Figure 3a–c, in the scenario of decentralized dual-channel power supply chain, the on-grid power quantity

and

show distinctly opposite trend with power grid wheeling change

. Meanwhile, the power quantity

and

which are purchased separately from power generation enterprise A and B in direct channel by large power users, as well as

which refers to emission reduction effort of coal-fired power plant B will decrease with the increase of power grid wheeling charge

if

and

are met, when

is required. This is because the operation cost of power generation enterprise A and B is increasing. Meanwhile, there is

when

and

, which means the maximum power grid wheeling charge accepted by coal-fired power plant B is higher than that of renewable energy power generation enterprise

A in the scenario of decentralized dual-channel power supply chain. This is mainly because the coal-fired power generation technology is mature with lower cost when compared with mostly renewable energy power generation.

Figure 3d–f depicts the curve of optimal profit for each member in decentralized power supply chain with respect to power grid wheeling charge, respectively. Obviously, in the scenario of decentralized dual-channel power supply chain, as power grid wheeling charge increases, the optimal profit of power generation enterprise

A and

B will decrease, while the optimal profit of power grid enterprise

C will increase. Moreover, the profit of each member in decentralized dual-channel power supply chain is more than that in decentralized single-channel power supply chain, when

is satisfied. In addition, it can be found from

Figure 3g that the whole profit of power supply chain would increase firstly and then decrease with the increase of

. Thus, it is suggested that the government could mobilize the initiative of members’ joining in direct power purchase transactions in decentralized power supply chain by setting a reasonable value of power grid wheeling charge

.

Furtherly, it can be concluded from the above analysis that there is no effect of on and other decision parameters in the scenario of centralized dual-channel power supply chain.

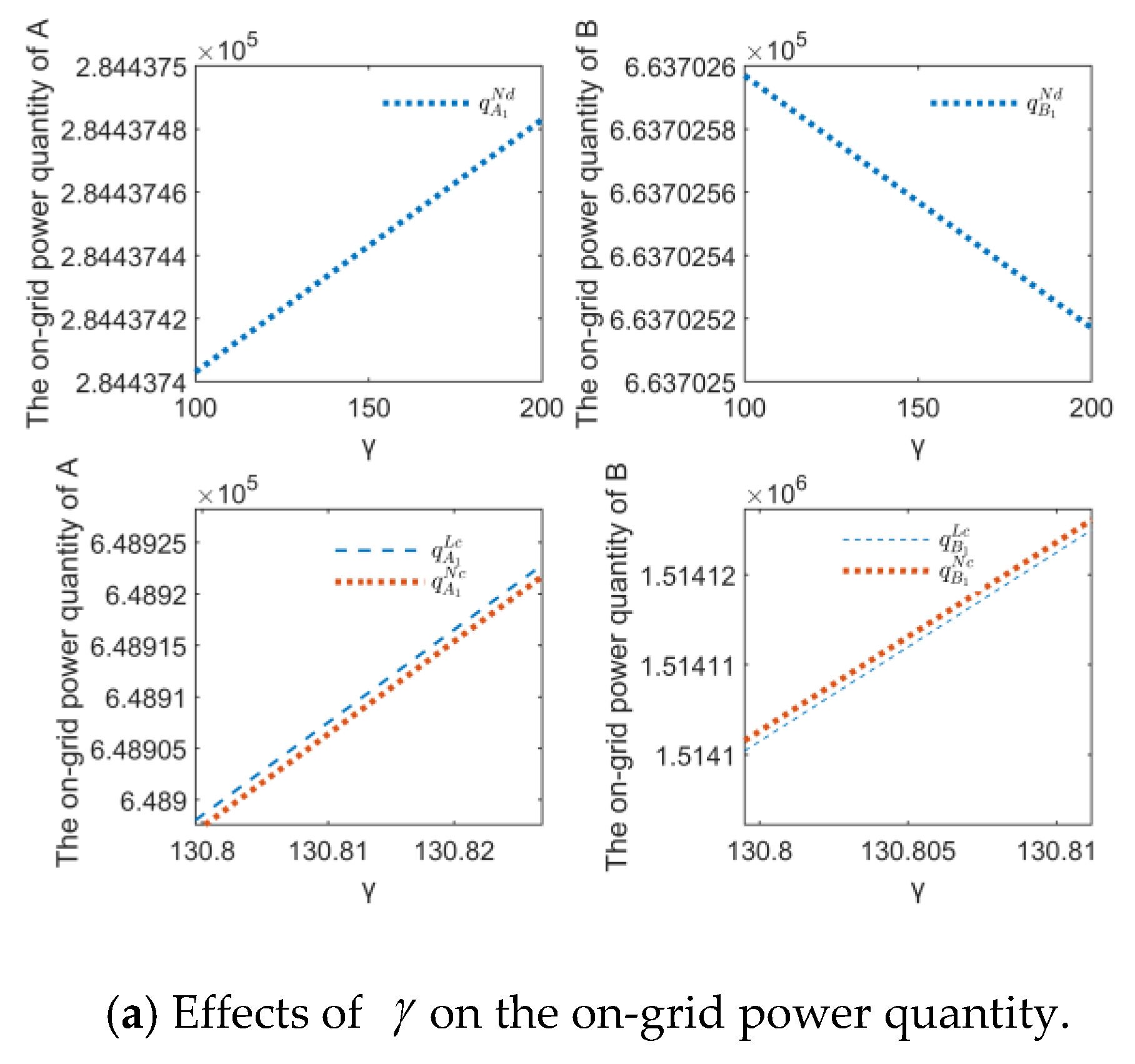

6.2.2. Impact of γ on the Optimal Results

The rapid development of China’s renewable energy power generation industry is mostly related with the subsidy from government; however, the massive installed scale of renewable energy power generation also caused a large gap in subsidies funding and insufficient consumption of huge renewable energy power. These indicate that the government should establish a rational subsidy standard of renewable energy power generation. Thus, the impact of

on the optimal results are illustrated in

Figure 4a–f.

Figure 4a illustrates that the on-grid power quantity of

and

will both increase with increase of the subsidy of renewable energy power generation

in the centralized scenarios. However,

and

show different variation trend with the impact of

in the scenario of decentralized dual-channel. Additionally,

Figure 4b,c show that when

is met, the power quantity purchased from renewable energy power generation enterprise A will increase with increase of

, while it is conversely found on the power quantity purchased from coal-fired power plant

B. Furthermore, in addition to the traditional decentralized single-channel power supply chain, in which

is irrelevant to

, the emission reduction effort of coal-fired power plant B will decrease by increase of

.

Figure 4d,g illustrate that the subsidy of renewable energy power generation can effectively motivate renewable energy power generation enterprise

A and the whole power supply chain. The high degree is

, the higher profits are of renewable energy power generation enterprise

A and the whole power supply chain. However, it can be concluded from

Figure 4d,g that the profits of coal-fired power plant

B and power grid enterprise

C are both negatively correlated with the subsidy of renewable energy power generation in dual-channel power supply chain, while these are irrelevant in traditional single-channel power supply chain. Thus, the subsidy of renewable energy power generation is important to the development of renewable energy power generation and the profit of the whole power supply chain.

From

Figure 4d,e,g, when

is fixed, the profits of power generation enterprise

A,

B and the whole power supply chain in dual-channel are greater than that in traditional single-channel. Conversely, it can be found from

Figure 4f that the profit of power grid enterprise C in dual-channel is lower than that in traditional single-channel when

is fixed. As such, despite of some advantages, the subsidy policy of renewable energy power generation should be adopted in conjunction with other incentives to enhance the efficacy of the whole power supply chain and each member.

Moreover, it can be also concluded from the above analysis that there is no effect of on and in the scenario of decentralized single-channel. As there are , , , and , then we can conclude that will increase with the increasing of in centralized scenarios while have no variations in decentralized scenarios.

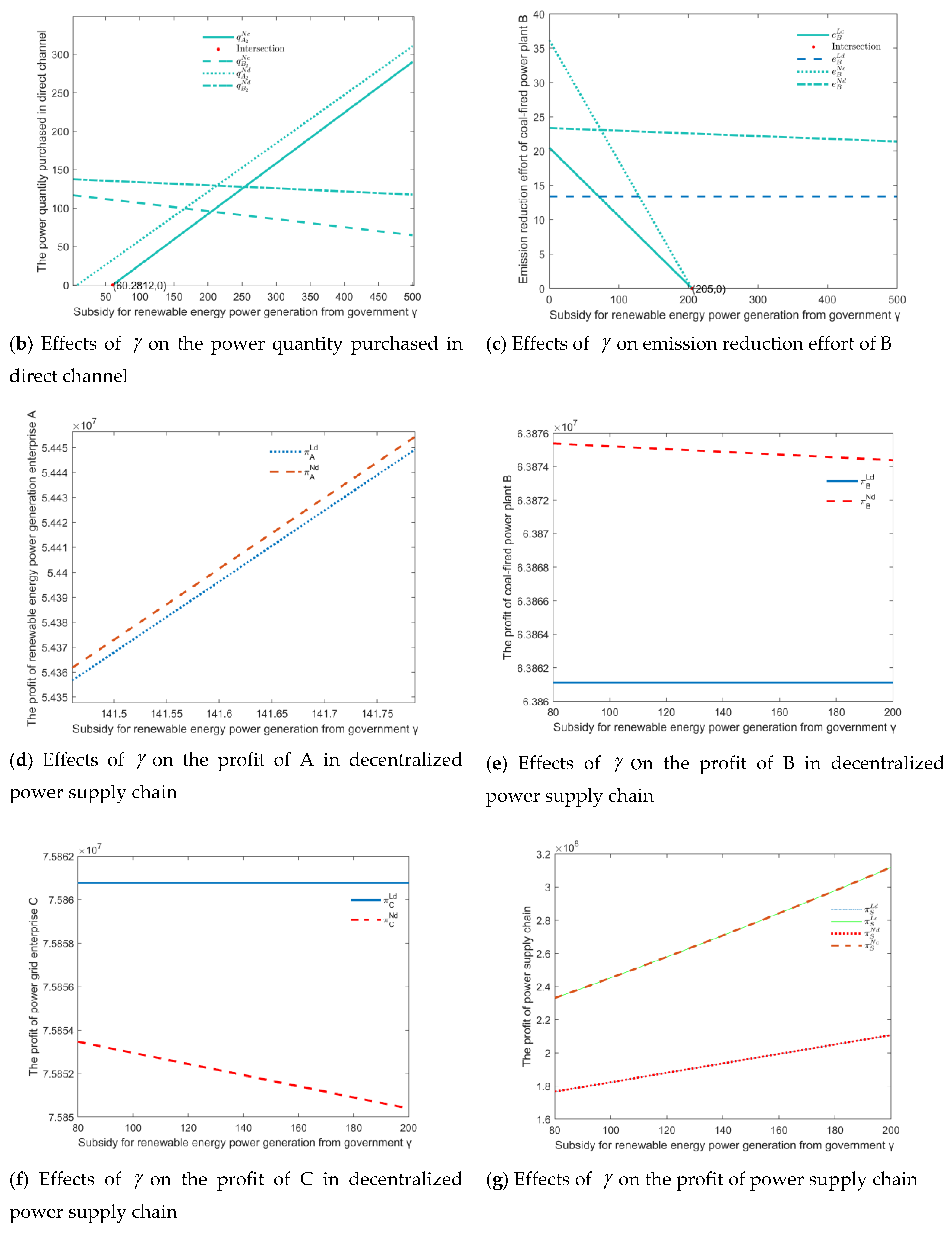

6.2.3. Impact of θ on the Optimal Results

In recent years, with the huge support of policies, the installed capacity of renewable energy power generation in China has been greatly improved. However, the consumption of renewable energy power lags far behind its production due to the intermittent and volatile disadvantage of renewable energy when compared with traditional coal-fired power generation. Although the direct channel of power transaction has enhanced its consumption, the indirect channel of on-grid power is still the main way for the consumption of renewable energy power. Therefore, the impact of on-grid power preference coefficient of coal-fired power generation on power generation enterprise A and B’s on-grid power are shown in

Figure 5a,b.

As seen in

Figure 5a,b, the on-grid power quantity of coal-fired power plant B increases with increase of

θ in different scenarios. However, it is shown that the on-grid power quantity of renewable energy power generation enterprise A decreases with increase of

in centralized scenarios of traditional single-channel and dual-channel, while in decentralized scenarios it will increase firstly and then decrease by

. In the cases of centralized scenario, when

is satisfied, which means power grid enterprise

C has no significant preference for coal-fired power plant

B, the on-grid power quantity of renewable energy power generation enterprise

A will be greater than that of coal-fired power plant B. Meanwhile, in the case of decentralized scenario, when

is satisfied, the on-grid power quantity of renewable energy power generation enterprise A is larger than that of coal-fired power plant

B.

Figure 5d–f exhibit that the profit of coal-fired power plant

B, power grid enterprise

C and the whole power supply chain will increase as on-grid power preference coefficient of coal-fired power generation increases in both traditional single-channel and dual-channel power supply chain. However,

Figure 5c illustrates that the profit of renewable energy power generation enterprise

A will increase firstly and then decrease with the increase of

θ. In addition, although the difference of respective profit for each member and whole power supply chain between traditional single-channel and dual-channel power supply chain is small, it can be concluded that opening of direct power purchase channel is conducive to improving the profit for each member and the whole power supply chain.

Furthermore, based on the above equations and analysis, it can be concluded that is irrelevant with , , , , and in the direct channel of power supply chain. As there are , , , , then we can conclude that will increase with the increase of in different scenarios.

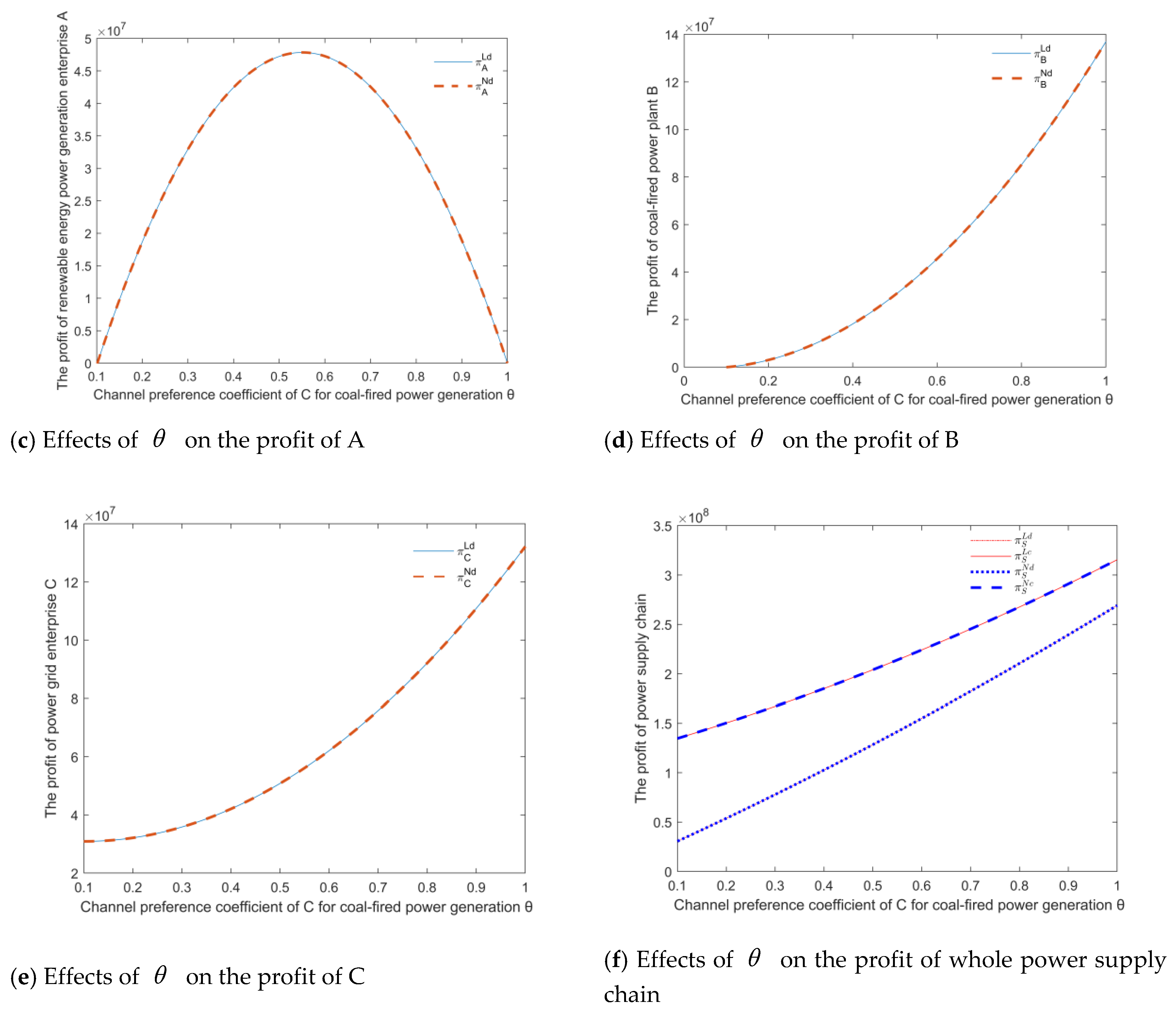

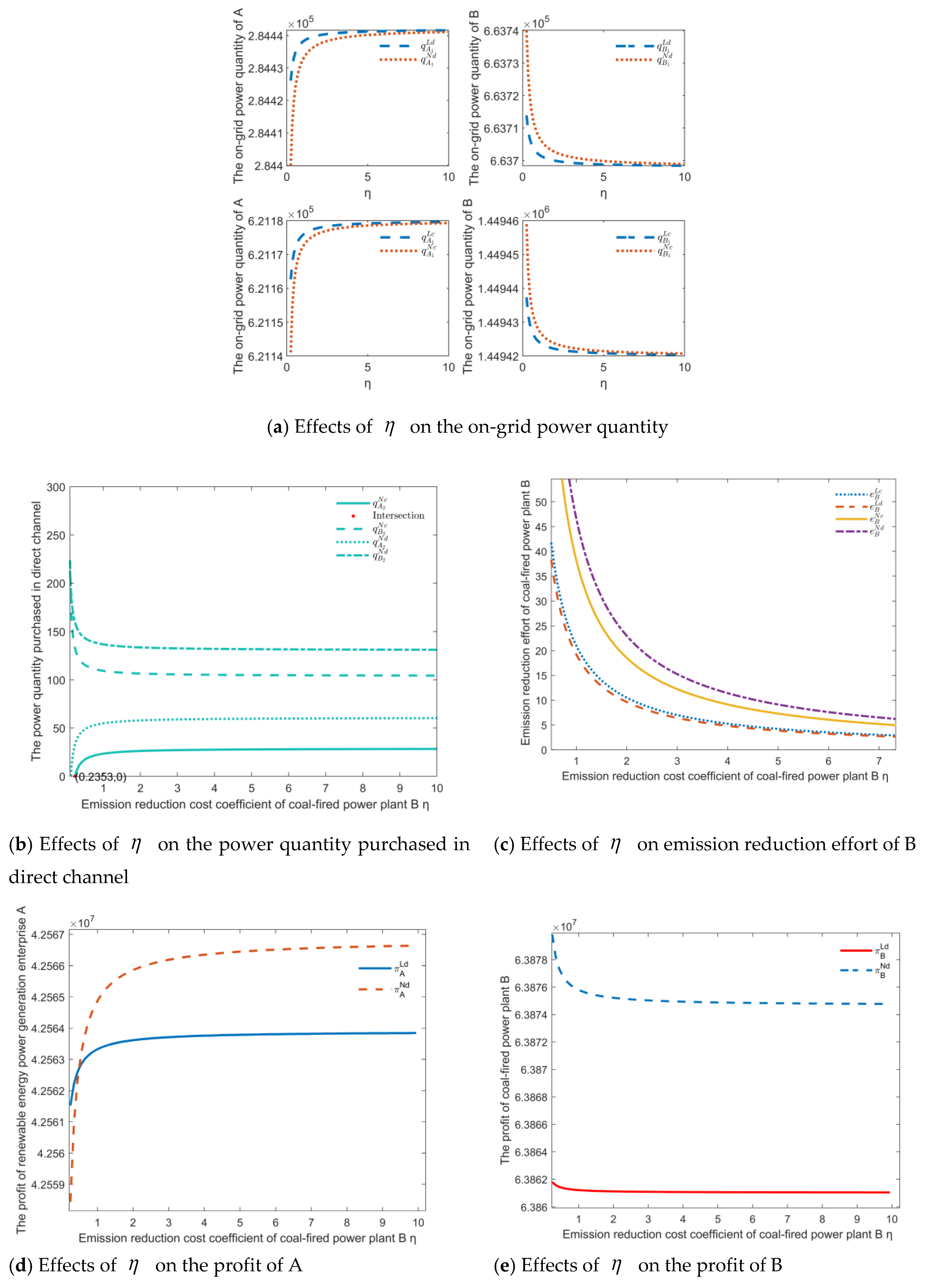

6.2.4. Impact of δ on the Optimal Results

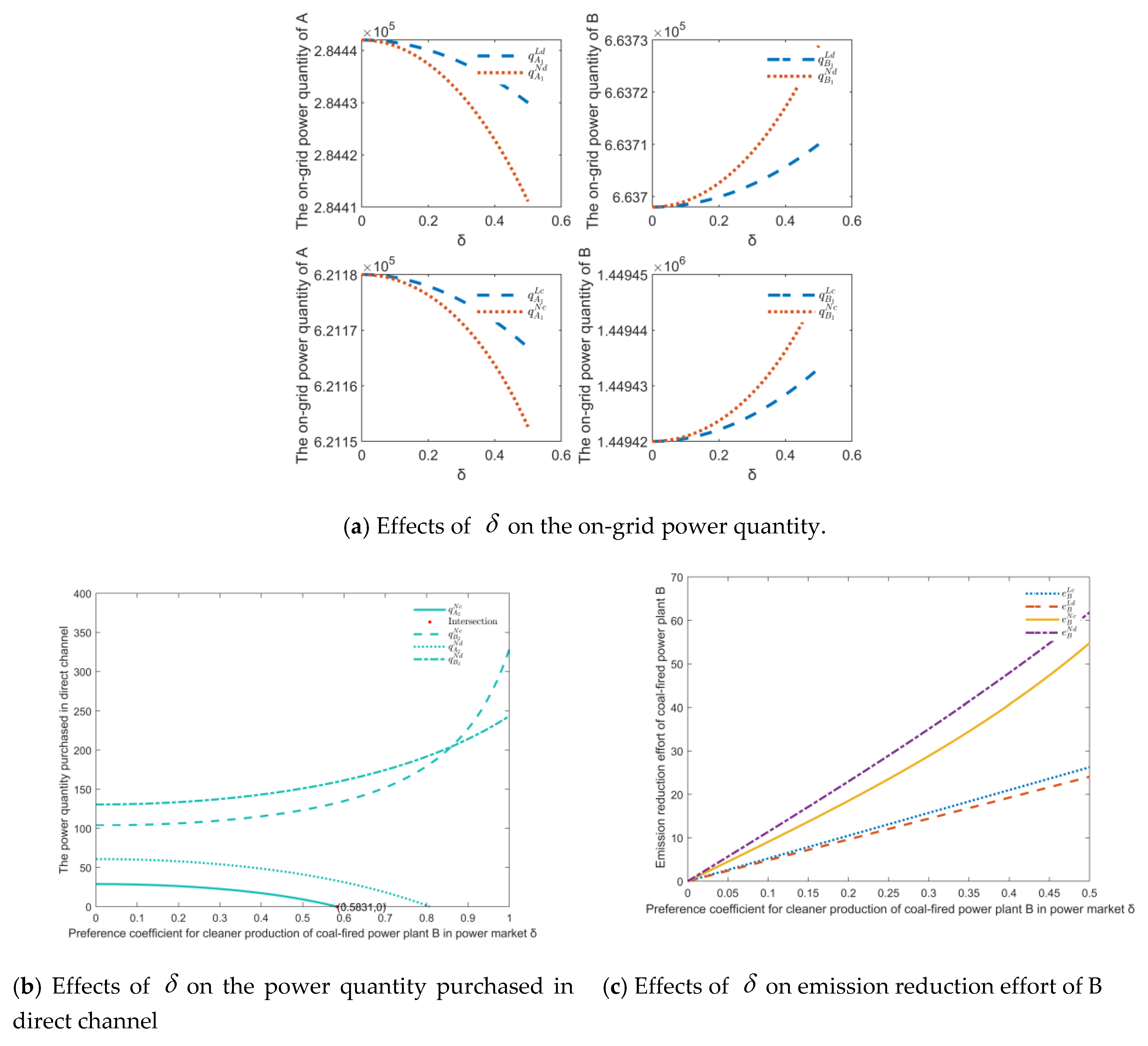

With the increasingly serious problems of environmental pollution and climate change, the pro-environmental awareness of publics is constantly enhanced, and the preference of power market for clean production is increasing. The impacts of preference for cleaner production of coal-fired power plant B in power market on the optimal decisions are illustrated in

Figure 6a–g.

Figure 6a depicts that

will decrease with the increase of

in each scenario, while will show the opposite trend. As seen in

Figure 6b,c, the emission reduction effort and power quantity purchased in direct channel from coal-fired power plant B in centralized and decentralized scenarios will increase with the increase of

, when

is required to ensure the decision variables are greater than 0. Moreover, it can be concluded from

Figure 6c that, the preference for clean production of coal-fired power plant B in power market can more effectively motivate coal-fired power plant B to enhance its emission reduction effort in the dual-channel power supply chain than that in traditional single-channel power supply chain. This is mainly due to the increased profit of coal-fired power plant B in the dual-channel power supply chain that can enable it to invest more funds in emission reduction. On the contrary, the power quantity purchased in direct channel from renewable energy power generation enterprise A in centralized and decentralized scenarios will decrease with the increase of

, and

should be satisfied.

Figure 6d–g depict that with the increase of

, the profit of renewable energy power generation enterprise A will decrease while the profit of coal-fired power plant B, power grid enterprise C and the whole power supply chain will increase in both single-channel and dual-channel. This is because the emission reduction effort of coal-fired power plant B will be enhanced by the increasing

, so that the market share and profit of renewable energy power generation enterprise A will be reduced.

Additionally, it can be seen from the previous expressions of , , and , there is no impact of on in each scenario.

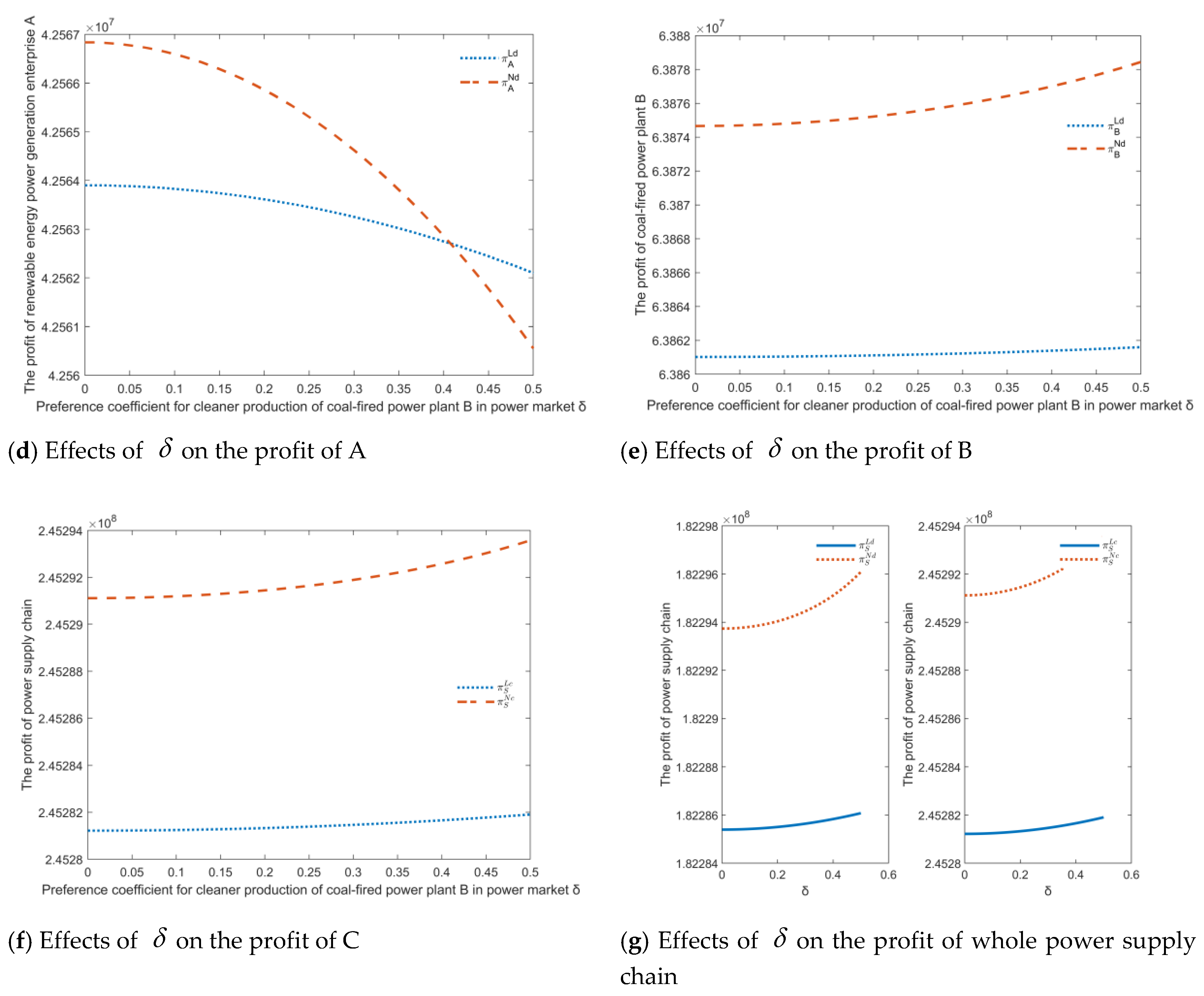

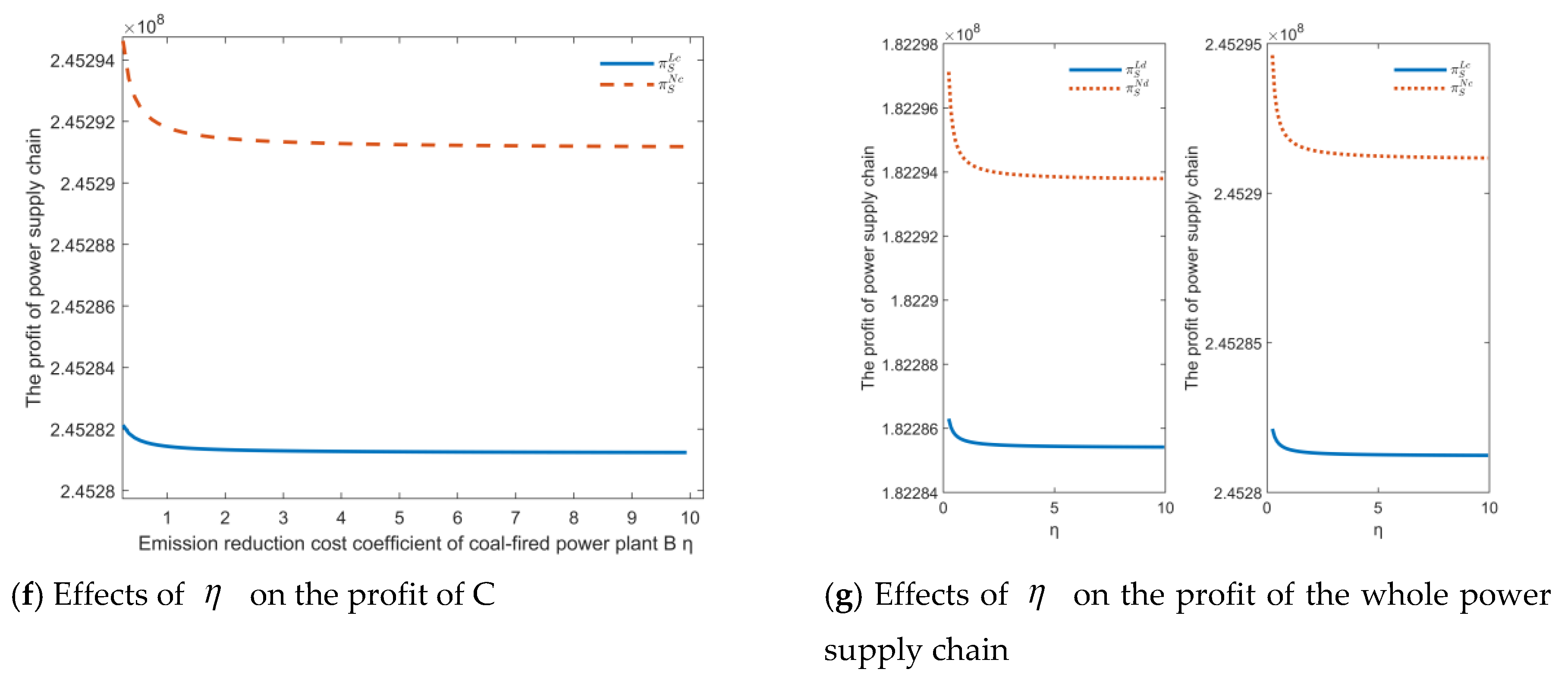

6.2.5. Impact of η on the Optimal Results

Under the requirement of clean production, the impact of emission reduction cost of coal-fired power plant

B on the optimal decisions are demonstrated in

Figure 7a–g.

As seen in

Figure 7a, it can be concluded that the on-grid power quantity of renewable energy power generation enterprise A and coal-fired power plant B exhibit exactly opposite with the increase of

. From

Figure 7b,c, with the requirement of decision variables should be above 0, when

is satisfied, the emission reduction effort and power quantity purchased in direct channel from coal-fired power plant B in centralized and decentralized scenarios will decrease with the increase of

. Conversely, the power quantity purchased in direct channel from renewable energy power generation enterprise A in centralized and decentralized scenarios will increase with the increase of

. Furthermore,

Figure 6d–g exhibit that with the increase of

, the profit of renewable energy power generation enterprise A will increase while the profit of coal-fired power plant B, power grid enterprise C and the whole power supply chain will decrease in both single-channel and dual-channel. This is mainly due to the increase of emission reduction cost coefficient, the willingness of coal-fired power plant B to invest in emission reduction will decrease, and accordingly the lower emission reduction efforts will weaken the competitive advantage of coal-fired power plant B in the power supply chain.

Further, as previous expressions of , , and show, there is no impact of on in each scenario.

From the above numerical studies, the decision variables variations with parameters of

,

,

,

and

in different scenarios could be summarized in

Table 3.

7. Conclusions

With the marketization reform of power supply chain, the centralized and decentralized decisions of power quantity and emission reduction effort in the traditional single-channel and dual-channel power supply chain with direct power purchase transactions by large power users were analyzed in this paper. Based on these, the optimal decisions and profits in four different scenarios were derived. Finally, the optimal decisions and profits in different scenarios by numerical analysis were compared, and the impact of parameters’ variations on the decision variables were analyzed.

The main findings are summarized as follows. (1) The on-grid power preference coefficient of coal-fired power generation has a significant influence on the on-grid power quantity of renewable energy power generation enterprise A in traditional single-channel power supply chain. (2) In the centralized scenario, the direct power purchasing channel is conducive to promote the consumption of renewable energy power generation, as well as the on-grid power quantity and emission reduction effort of coal-fired power plant B and the profit of whole power supply chain. (3) Power grid wheeling charge has negative relationship with direct channel power quantity, on-grid power quantity of B, emission reduction effort of B, and profits of A and B, while has a positive relationship with on-grid power quantity of A and profit of C in decentralized dual-channel power supply chain. (4) The emission reduction effort of coal-fired power plant B could be enhanced by preference coefficient for clean production, while reduced by power grid wheeling charge, emission reduction cost coefficient and subsidy for renewable energy power generation. (5) The profit of whole power supply chain would increase with increase of on-grid power preference coefficient of coal-fired power generation, subsidy for renewable energy power generation and preference coefficient for clean production, while decrease with increase of emission reduction cost coefficient of coal-fired power plant B in all scenarios, and additionally increase firstly and then decrease by the increase of power grid wheeling charge in the scenario of decentralized dual-channel power supply chain.

The findings provide useful managerial insights for government and power supply chain to promote clean production of coal-fired power plant, consumption of renewable energy power generation and profit of whole power supply chain. For government, subsidy for renewable energy power generation and power grid wheeling charge should be adopted as policy instruments. A subsidy for renewable energy power generation and power grid wheeling charge has a negative relationship with emission reduction effort of coal-fired power plant B, while it has a positive relationship with the profit of whole power supply chain. Thus, a reasonable value of subsidy for renewable energy power generation and power grid wheeling charge should be necessary for these optimal strategies. Furthermore, this research is also implicational for clean production of power supply chain. Firstly, on-grid power preference coefficient of coal-fired power generation and preference coefficient for clean production could be applied as market incentive instruments for power supply chain, as they are positively related with profit of whole power supply chain, and preference coefficient for clean production is also positively related with emission reduction effort of coal-fired power plant B. Secondly, emission reduction cost coefficient should be reduced to promote clean production of coal-fired power plant B and profit of whole power supply chain.

However, there are several limitations to deep exploring in this research. First, this paper assumes all the information is common knowledge to members in the power supply chain. Discussions under asymmetric information could be made in further research. Second, as the security and optimal operation of a power network system is important in modern power systems which has been a concern of previous researches [

52,

53], it also should be studied in our future research. Third, this paper supposes all decisions are static, which can be considered in multi-period for future research. Forth, channel preference for direct power purchasing transactions in dual-channel supply chain can be considered in future. Fifth, there is a lack of some sensitivity analysis (i.e., how the change in the price of power from coal or renewables would influence the power market and policy), as well as of concrete values of the results obtained in numerical analysis which are only the curves of the trends because of the computational complexity.