Too Costly to Disregard: The Cost Competitiveness of Environmental Operating Practices

Abstract

1. Introduction

2. Theoretical Background

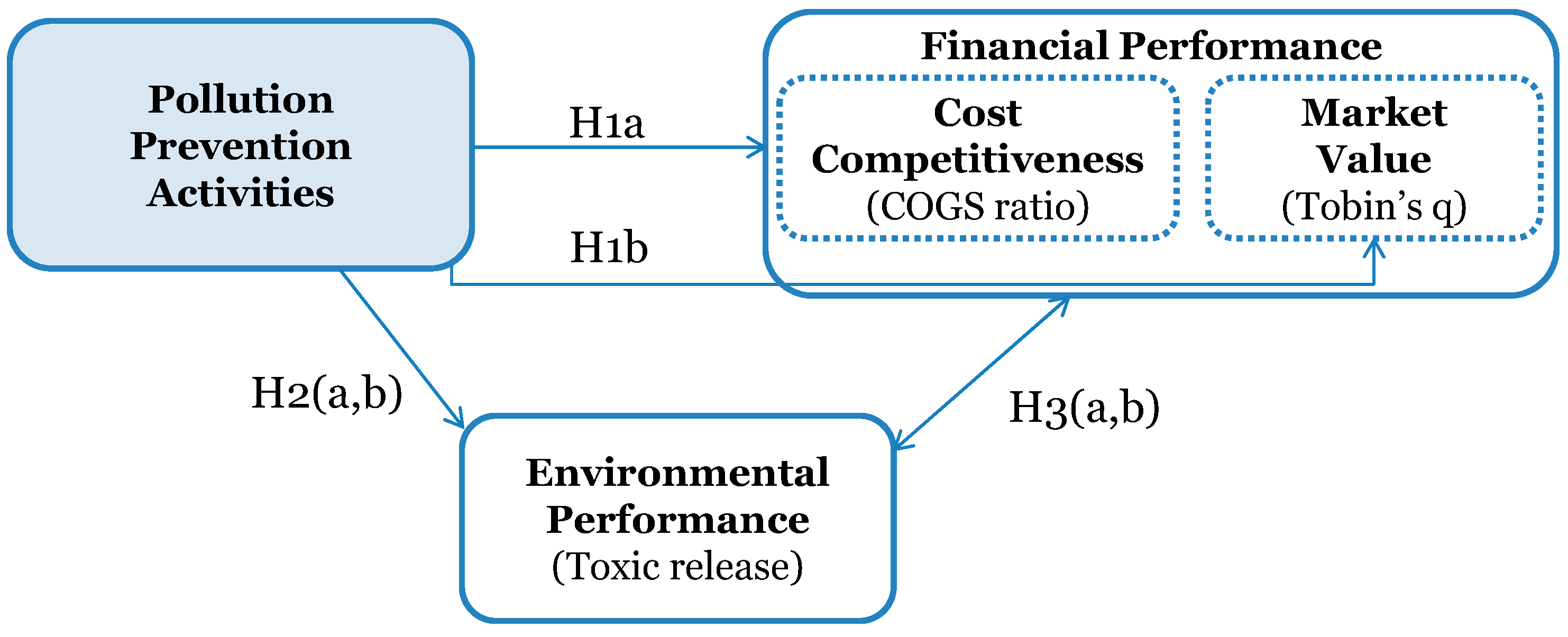

3. Hypotheses Development

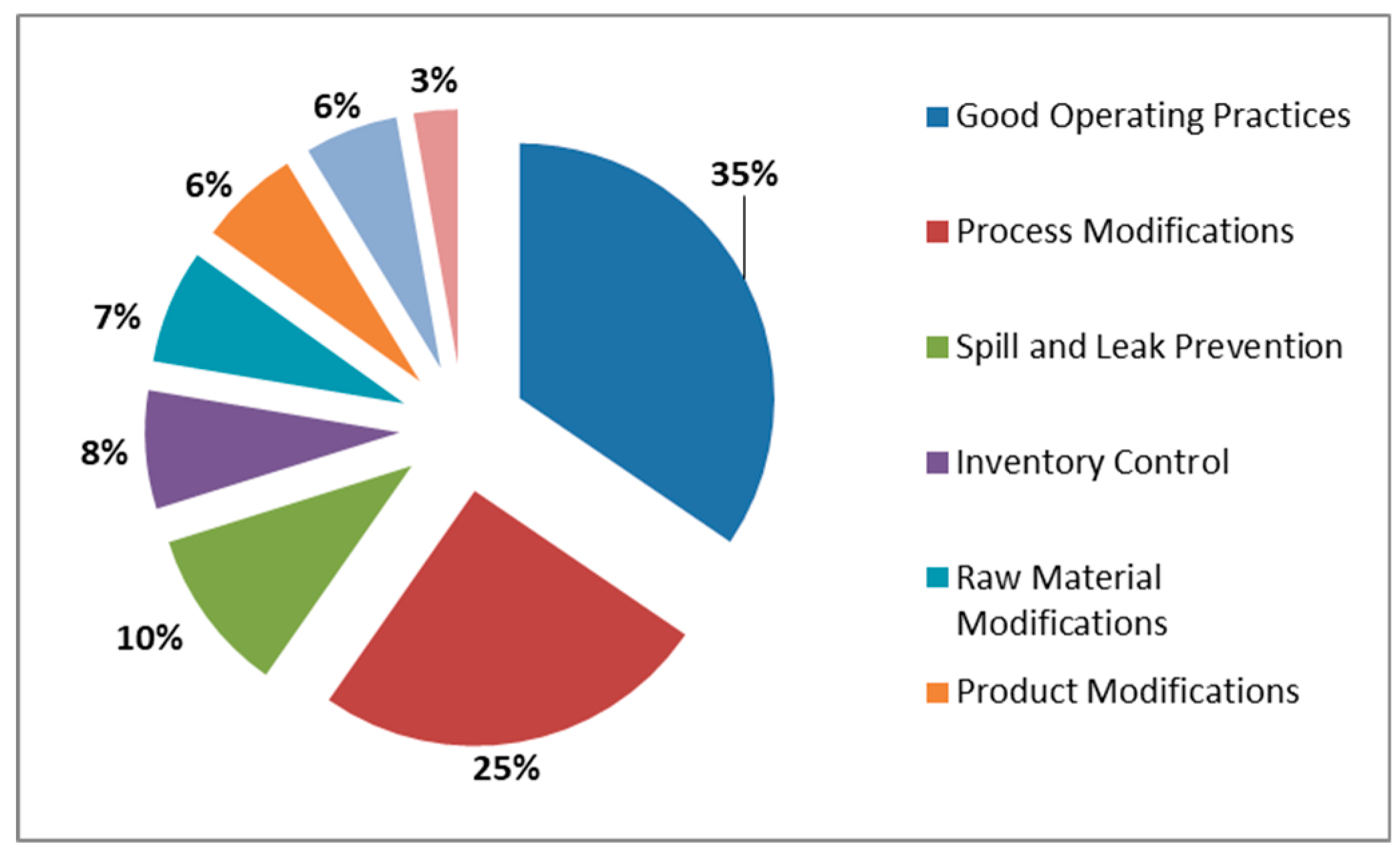

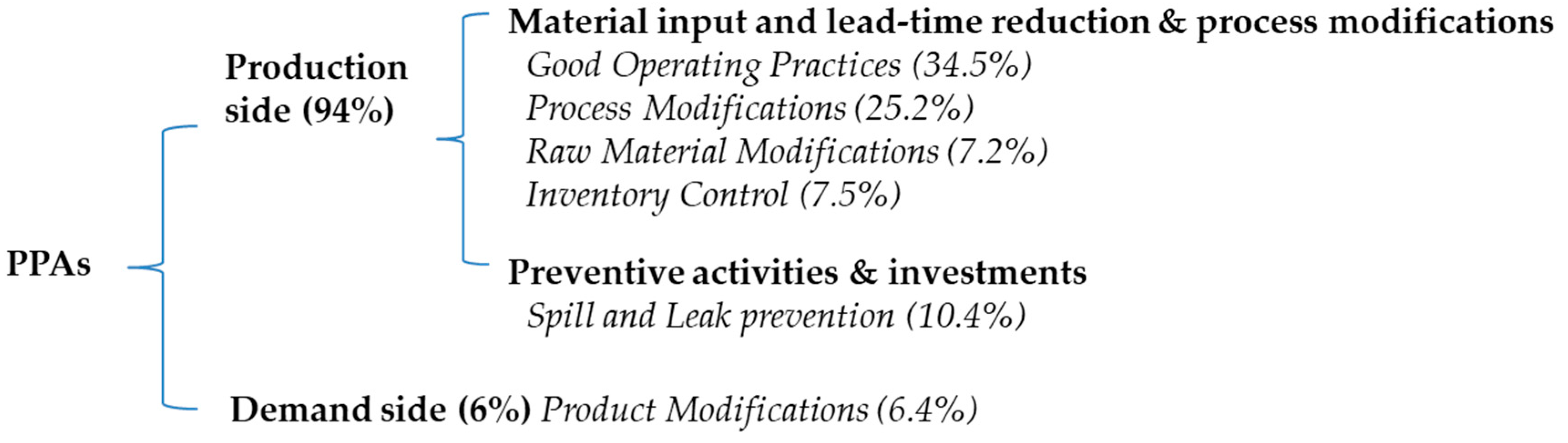

3.1. Toxic Release Inventory (TRI) and Pollution Prevention Activities (PPAs)

3.2. Hypotheses

4. Methods

4.1. Data Collection and Sampling

4.2. Variables

4.2.1. Financial Performance

4.2.2. Environmental Performance and Pollution Prevention Activities (PPAs)

4.2.3. Control Variables

4.3. Model Specifications

5. Results

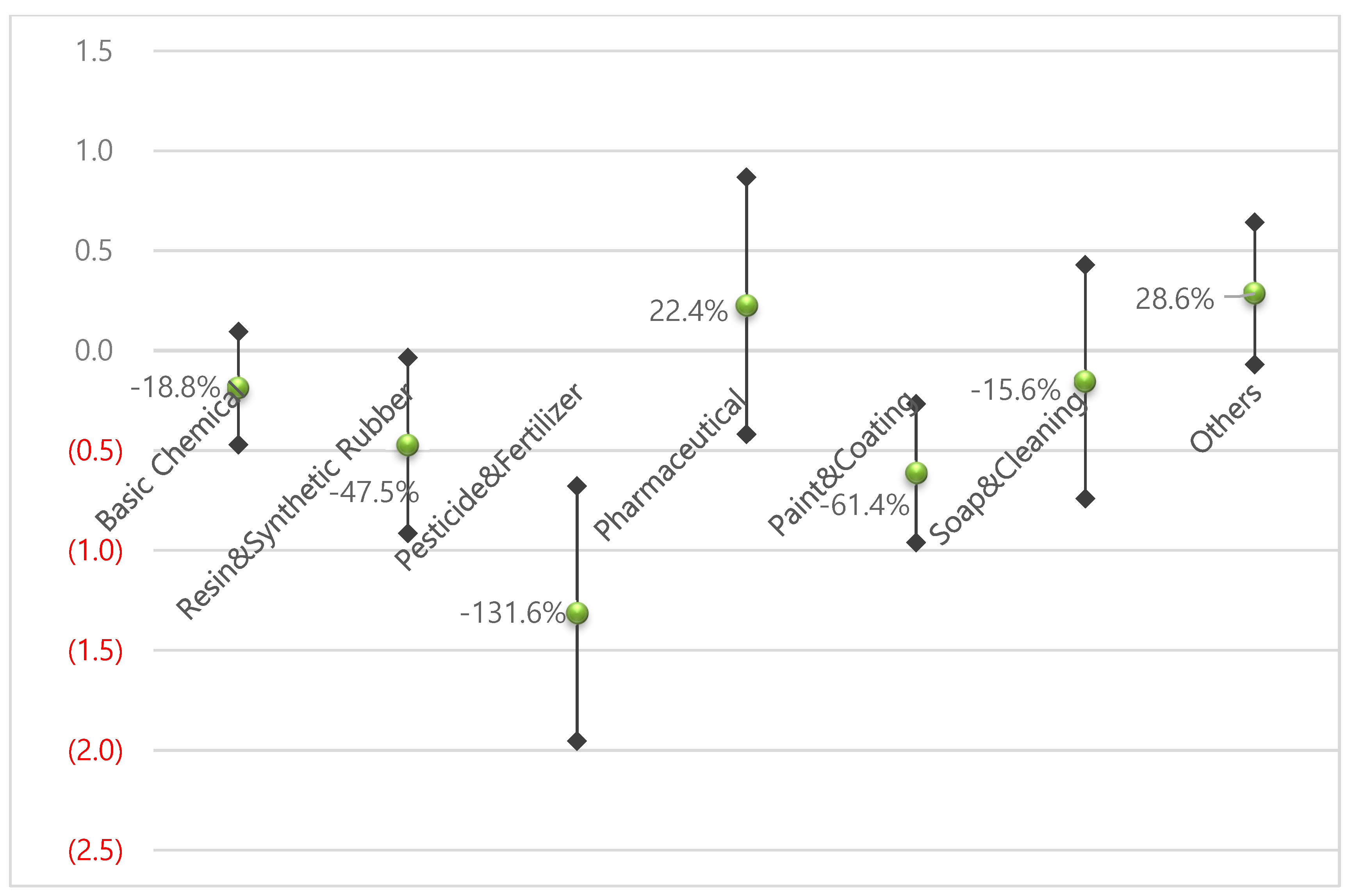

5.1. PPAs and Financial Performance: Firm-Level Analysis

5.2. PPAs and Environmental Performance: Plant-Level Analysis

5.3. Environmental Performance and Financial Performance: Firm-Level Analysis

5.4. Further Analysis

5.4.1. Another Environmental Performance Measure

5.4.2. Other Financial Performance Measures

5.4.3. Endogeneity

5.4.4. Mediation Effect

6. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Lee, G. A New Option for the Sustainable Future: Cleaner Production Technology. Available online: https://unep.or.kr/sub/sub05_01.php?mNum=5&sNum=1&boardid=planet&mode=view&idx=415 (accessed on 24 July 2020).

- Hong, S. The Environment Management Era: Reduce Costs through Cleaner Production. Available online: https://www.donga.com/news/article/all/20031007/7989035/1 (accessed on 24 July 2020).

- HanwhaChemical Sustainability Report 2005; Hanwha Chemical Corporation: Seoul, Korea, 2005; pp. 1–29.

- HanwhaChemical Sustainability Report 2003; Hanwha Chemical Corporation: Seoul, Korea, 2003; pp. 1–32.

- Dorfman, M. Source Reduction: Environmental dividends from cutting chemical waste. Pollut. Prev. Rev. Autumn 1992, 1992, 403–414. [Google Scholar]

- Barnett, M.L.; Salomon, R.M. Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strateg. Manag. J. 2012, 33, 1304–1320. [Google Scholar] [CrossRef]

- Freeman, R. Strategic Management: A Stakeholder Perspective; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Jones, T.M. Instrumental stakeholder theory: A synthesis of ethics and economics. Acad. Manag. Rev. 1995, 20, 404–437. [Google Scholar] [CrossRef]

- Matsumura, E.M.; Prakash, R.; Vera-Munoz, S.C. Firm-value effects of carbon emissions and carbon disclosures. Account. Rev. 2014, 89, 695–724. [Google Scholar] [CrossRef]

- Chapple, L.; Clarkson, P.M.; Gold, D.L. The cost of carbon: Capital market effects of the proposed emission trading scheme (ETS). Abacus 2013, 49, 1–33. [Google Scholar] [CrossRef]

- Johnston, D.M.; Sefcik, S.E.; Soderstrom, N.S. The value relevance of greenhouse gas emissions allowances: An exploratory study in the related United States SO2 market. Eur. Account. Rev. 2008, 17, 747–764. [Google Scholar] [CrossRef]

- Konar, S.; Cohen, M.A. Does the market value environmental performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Klassen, R.D.; McLaughlin, C.P. The impact of environmental management on firm performance. Manag. Sci. 1996, 42, 1199–1214. [Google Scholar] [CrossRef]

- Klassen, R.D.; Whybark, D.C. The impact of environmental technologies on manufacturing performance. Acad. Manag. J. 1999, 42, 599–615. [Google Scholar]

- Shahgholian, A. Unpacking the relationship between environmental profile and financial profile; literature review toward methodological best practice. J. Clean. Prod. 2019, 233, 181–196. [Google Scholar] [CrossRef]

- Hang, M.; Geyer-Klingeberg, J.; Rathgeber, A.W. It is merely a matter of time: A meta-analysis of the causality between environmental performance and financial performance. Bus. Strategy Environ. 2019, 28, 257–273. [Google Scholar] [CrossRef]

- Dixon-Fowler, H.R.; Slater, D.J.; Johnson, J.L.; Ellstrand, A.E.; Romi, A.M. Beyond “does it pay to be green?” A meta-analysis of moderators of the CEP–CFP relationship. J. Bus. Ethics 2013, 112, 353–366. [Google Scholar] [CrossRef]

- Dragomir, V.D. How do we measure corporate environmental performance? A critical review. J. Clean. Prod. 2018, 196, 1124–1157. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar]

- Porter, M.E.; Van der Linde, C. Green and competitive-ending the stalemate. Harv. Bus. Rev. 1995, 73, 120–134. [Google Scholar]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar]

- Jasch, C. Environmental performance evaluation and indicators. J. Clean. Prod. 2000, 8, 79–88. [Google Scholar] [CrossRef]

- Bragdon, J.H.; Marlin, J. Is pollution profitable. Risk Manag. 1972, 19, 9–18. [Google Scholar]

- Fogler, H.R.; Nutt, F. A note on social responsibility and stock valuation. Acad. Manag. J. 1975, 18, 155–160. [Google Scholar]

- Blackburn, V.L.; Doran, M.; Shrader, C.B. Investigating the dimensions of social responsibility and the consequences for corporate financial performance. J. Manag. Issues 1994, 6, 195–212. [Google Scholar]

- Barth, M.E.; McNichols, M.F. Estimation and market valuation of environmental liabilities relating to superfund sites. J. Acc. Res. 1994, 32, 177–209. [Google Scholar] [CrossRef]

- Hughes, K. The value relevance of nonfinancial measures of air pollution in the electric utility industry. Acc. Rev. 2000, 75, 209–228. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D. The market valuation of environmental capital expenditures by pulp and paper companies. Acc. Rev. 2004, 79, 329–353. [Google Scholar] [CrossRef]

- Jacobs, B.W.; Singhal, V.R.; Subramanian, R. An empirical investigation of environmental performance and the market value of the firm. J. Oper. Manag. 2010, 28, 430–441. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Thorburn, K.S. Voluntary corporate environmental initiatives and shareholder wealth. J. Environ. Econ. Manag. 2011, 62, 430–445. [Google Scholar] [CrossRef]

- Connors, E.; Johnston, H.H.; Gao, L.S. The informational value of Toxics Release Inventory performance. Sustain. Acc. Manag. Policy J. 2013, 4, 32–55. [Google Scholar] [CrossRef]

- Jacobs, B.W. Shareholder value effects of voluntary emissions reduction. Prod. Oper. Manag. 2014, 23, 1859–1874. [Google Scholar] [CrossRef]

- King, A.; Lenox, M. Exploring the locus of profitable pollution reduction. Manag. Sci. 2002, 48, 289–299. [Google Scholar] [CrossRef]

- EPA. Exploring the Toxic Release Inventory’s Pollution Prevention Information; EPA: Washington, DC, USA, 2013.

- EPA. TRI National Analysis 2018; EPA: Washington, DC, USA, 2020; pp. 1–191.

- Schmidheiny, S.; Timberlake, L. Changing Course: A Global Business Perspective on Development and the Environment; MIT Press: Cambridge, MA, USA, 1992; Volume 1. [Google Scholar]

- Feldman, S.J.; Soyka, P.A.; Ameer, P. Does Improving a Firm’s Environmental Management System and Environmental Performance Result in a Higher Stock Price? ICF Kaiser: Washington, DC, USA, 1996. [Google Scholar]

- Konar, S.; Cohen, M.A. Information as regulation: The effect of community right to know laws on toxic emissions. J. Environ. Econ. Manag. 1997, 32, 109–124. [Google Scholar] [CrossRef]

- Banerjee, S.B.; Iyer, E.S.; Kashyap, R.K. Corporate environmentalism: Antecedents and influence of industry type. J. Mark. 2003, 67, 106–122. [Google Scholar] [CrossRef]

- Darnall, N.; Edwards, D., Jr. Predicting the cost of environmental management system adoption: The role of capabilities, resources and ownership structure. Strateg. Manag. J. 2006, 27, 301–320. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. J. Oper. Manag. 2004, 22, 265–289. [Google Scholar] [CrossRef]

- Gray, R.; Kouhy, R.; Lavers, S. Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Acc. Audit. Acc. J. 1995, 8, 47–77. [Google Scholar] [CrossRef]

- Deegan, C. The legitimising effect of social and environmental disclosures—A theoretical foundation. Acc. Audit. Acc. J. 2002, 15, 282–311. [Google Scholar] [CrossRef]

- The Bank of Korea. Financial Statement Analysis for 2012; The Bank of Korea: Seoul, Korea, 2012; pp. 149–183. [Google Scholar]

- Malkiel, B.G.; Fama, E.F. Efficient capital markets: A review of theory and empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Bharadwaj, A.S.; Bharadwaj, S.G.; Konsynski, B.R. Information technology effects on firm performance as measured by Tobin’s q. Manag. Sci. 1999, 45, 1008–1024. [Google Scholar] [CrossRef]

- Chung, K.H.; Pruitt, S.W. A simple approximation of Tobin’s q. Financ. Manag. 1994, 23, 70–74. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility and financial performance: Correlation or misspecification? Strateg. Manag. J. 2000, 21, 603–609. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Overell, M.B.; Chapple, L. Environmental reporting and its relation to corporate environmental performance. Abacus 2011, 47, 27–60. [Google Scholar] [CrossRef]

- Bae, H.; Wilcoxen, P.; Popp, D. Information disclosure policy: Do state data processing efforts help more than the information disclosure itself? J. Policy Anal. Manag. 2010, 29, 163–182. [Google Scholar] [CrossRef]

- Toffel, M.W.; Marshall, J.D. Improving environmental performance assessment: A comparative analysis of weighting methods used to evaluate chemical release inventories. J. Ind. Ecol. 2004, 8, 143–172. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Malone, T.W.; Gurbaxani, V.; Kambil, A. Does information technology lead to smaller firms? Manag. Sci. 1994, 40, 1628–1644. [Google Scholar] [CrossRef]

- Morck, R.; Yeung, B. Why investors value multinationality. J. Bus. Ethics 1991, 64, 165–187. [Google Scholar] [CrossRef]

- Dowell, G.; Hart, S.; Yeung, B. Do corporate global environmental standards create or destroy market value? Manag. Sci. 2000, 46, 1059–1074. [Google Scholar] [CrossRef]

- Massey, R.I. Program assessment at the 20 years mark: Experiences of Massachusetts companies and communities with the Toxics Use Reduction Act (TURA) program. J. Clean. Prod. 2011, 19, 505–516. [Google Scholar] [CrossRef]

- Hamilton, J.T. Pollution as news: Media and stock market reactions to the toxics release inventory data. J. Environ. Econ. Manag. 1995, 28, 98–113. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Hart, S.L.; Dowell, G. Invited editorial: A natural-resource-based view of the firm: Fifteen years after. J. Manag. 2011, 37, 1464–1479. [Google Scholar] [CrossRef]

| Study | Measure of Environmental Performance | Measure of Financial Performance | Empirical Association |

|---|---|---|---|

| Bragdon and Marlin [24] | Evaluation index | EPS growth, ROE, ROC | Positive |

| Fogler and Nutt [25] | Evaluation index | Price earnings (P/E) ratio | Neutral |

| Blackburn et al. [26] | Evaluation index | ROA, abnormal return, EPS | Positive |

| Barth and McNichols [27] | Remediation cost of superfund sites | Market value of equity | Positive |

| Klassen and McLaughlin [13] | Toxic releases/reward disclosure | Stock abnormal return (CAR) | Positive a |

| Hughes [28] | SO2 (sulfur dioxide) emission | Market value of equity | Positive |

| Konar and Cohen [12] | Toxic releases and disclosure | Abnormal return | Positive |

| Clarkson et al. [29] | Environmental capital expenditures | Market value of equity | Conditionally negative |

| Johnston et al. [11] | SO2 emission allowances | Market value of equity | Positive |

| Jacobs et al. [30] | Announcements of diverse environmental information disclosure | Abnormal return | Mixed |

| Fisher-Vanden and Thornburn [31] | Voluntary corporate environmental initiatives (investments) | Abnormal return | Negative, mixed |

| Connors et al. [32] | Toxic releases and disclosure | Abnormal return | Conditionally positive |

| Chapple et al. [10] | Carbon emissions intensity disclosure | Abnormal return | Positive |

| Matsumura et al. [9] | Carbon emissions and disclosure | Market value of equity | Positive |

| Jacobs [33] | GHG emissions reductions | Abnormal return | Positive and diminishing |

| Classification | Variable | Definition |

|---|---|---|

| Cost competitiveness | COGS | Cost of goods sold divided by sales (COGS and sales of firms are retrieved from COMPUSTAT). |

| Market value | Tobin’s q | (logarithm of) The firm’s capital market value at the end of the year divided by the replacement value of its assets. * |

| Environmental practices (pollution prevention activities) | PPA PPA intensity | Dummy variable distinguishing whether the facilities perform the PPAs. (logarithm of) Number of PPAs conducted by firms (aggregated number of PPAs conducted at facility level). |

| Environmental performance | TWTR snTWTR | (logarithm of) Yearly total toxicity-weighted toxic release by facilities, in lbs **. (logarithm of) Total toxicity-weighted releases divided by firms’ sales, in lbs per million USD. |

| Control variables | Total waste generation No. of toxic chemicals Change in production | (logarithm of) Total amount of toxic wastes (toxic releases to be managed before treatment), in lbs. Number of toxic chemicals that the facilities report. Categorical variable indicating change in yearly production that the facilities report. |

| Firm size | (logarithm of) Total assets, in millions USD. | |

| R&D intensity | R&D expenses divided by sales (ratio). | |

| Capital intensity | Capital expenditure divided by sales (ratio). | |

| Net income Leverage | (logarithm of) Net income, in millions USD. Long-term debt divided by total assets (ratio). |

| Variable | Mean | Std. Dev. | N | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|---|---|

| TWTR | 14.60 | 4.99 | 19,292 | 1.000 | |||

| PPA | 0.16 | 0.37 | 21,240 | −0.058 * | 1.000 | ||

| Total waste generation | 10.27 | 3.69 | 20,044 | 0.478 * | −0.041 * | 1.000 | |

| Change in production | 2.32 | 0.92 | 20,222 | 0.168 * | 0.025 * | 0.186 * | 1.000 |

| No. of toxic chemicals | 4.77 | 5.91 | 21,240 | 0.592 * | −0.051* | 0.609 * | 0.261 * |

| Variable | Mean | Std. Dev. | N | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Cost competitiveness (COGS) | 0.59 | 0.20 | 550 | 1.000 | |||||||

| Market value (Tobin’s q) a | 0.51 | 0.37 | 474 | −0.597 * | 1.000 | ||||||

| snTWTR b | 12.87 | 4.63 | 542 | 0.548 * | −0.473 * | 1.000 | |||||

| PPA intensity | 1.60 | 1.31 | 314 | 0.151 * | −0.236 * | 0.415 * | 1.000 | ||||

| Firm size | 8.40 | 1.69 | 557 | −0.445 * | 0.12 | −0.163 * | −0.021 | 1.000 | |||

| R&D intensity | −3.72 | 1.08 | 468 | −0.623 * | 0.347 * | −0.342 * | −0.172 * | 0.354 * | 1.000 | ||

| Capital intensity | −3.13 | 0.60 | 552 | −0.181 * | 0.155 * | 0.099 | −0.214 * | 0.182 * | 0.024 | 1.000 | |

| Net income | 5.67 | 1.87 | 474 | −0.546 * | 0.348 * | −0.232 * | −0.067 | 0.908 * | 0.397 * | 0.230 * | 1.000 |

| Leverage | 0.23 | 0.12 | 556 | 0.138 * | −0.103 | 0.251 * | 0.054 | 0.173 * | −0.207 * | 0.078 | 0.121 |

| Corporate-Level Models | CModel 1 | CModel 2 | CModel 3 | CModel 4 |

|---|---|---|---|---|

| Estimation | OLS Fixed | GLS Robust | Dynamic Panel | OLS Fixed |

| Variables | COGS | COGS | COGS | Tobin’s q |

| PPA intensity | −0.0150 ** | −0.0150 ** | −0.00931 *** | −0.00416 |

| (0.00630) | (0.00641) | (0.00330) | (0.0164) | |

| snTWTR | 0.00471 ** | 0.00471 * | 0.00330 *** | −0.0139 ** |

| (0.00200) | (0.00251) | (0.00106) | (0.00544) | |

| Firm Size | −0.0285 *** | −0.0285 *** | −0.00201 | −0.234 *** |

| (0.00457) | (0.00644) | (0.00249) | (0.0263) | |

| R&D intensity | −0.0327 *** | −0.0327 ** | −0.0241 *** | 0.00164 |

| (0.0104) | (0.0131) | (0.00543) | (0.0274) | |

| Capital intensity | 0.0145 | 0.0145 | −0.0216 *** | 0.0833 ** |

| (0.0117) | (0.0251) | (0.00594) | (0.0344) | |

| COGSt−1 | 0.681 *** | |||

| (0.0304) | ||||

| Net income | 0.223 *** | |||

| (0.0239) | ||||

| Leverage | 0.253 | |||

| (0.166) | ||||

| Business Sector | ||||

| Resin, synthetic rubber, fibers | 0.105 *** | 0.105 *** | 0.0186 | 0.0266 |

| (NAICS 3252) | (0.0240) | (0.0217) | (0.0127) | (0.0654) |

| Pesticide, fertilizer, others | −0.104 *** | −0.104 *** | −0.0187 | 0.261 *** |

| (3253) | (0.0335) | (0.0256) | (0.0166) | (0.0812) |

| Pharmaceutical and medicine | −0.244 *** | −0.244 *** | −0.0603 *** | 0.283 *** |

| (3254) | (0.0317) | (0.0289) | (0.0183) | (0.0812) |

| Paint and coating | −0.0105 | −0.0105 | −0.00274 | 0.126 * |

| (3255) | (0.0262) | (0.0206) | (0.0133) | (0.0700) |

| Soap, cleaning, andtoilet prep. | −0.116 *** | −0.116 *** | −0.0309 ** | 0.267 *** |

| (3256) | (0.0273) | (0.0311) | (0.0141) | (0.0683) |

| Others | 0.00269 | 0.00269 | 0.0120 | 0.0386 |

| (3259) | (0.0267) | (0.0223) | (0.0135) | (0.0692) |

| Not categorized | 0.113 ** | 0.113 *** | 0.0404 * | |

| (0.0471) | (0.0249) | (0.0239) | ||

| Constant | 0.839 *** | 0.839 *** | 0.0373 | 1.482 *** |

| (0.0793) | (0.196) | (0.0489) | (0.235) | |

| Business sector fixed | YES | YES | YES | YES |

| Year fixed | YES | YES | YES | YES |

| Observations | 279 | 279 | 235 | 218 |

| R-squared | 0.738 | 0.738 | 0.943 | 0.582 |

| Plant-Level Models | PModel 1 | PModel 2 | PModel 3 | PModel 4 | PModel 5 |

|---|---|---|---|---|---|

| Estimation | OLS Fixed | GLS Robust | Random Effects | Dynamic Panel | PPA# Business Interaction |

| Variables | TWTR | TWTR | TWTR | TWTR | TWTR |

| PPA | −0.259 *** | −0.259 *** | −0.225 *** | −0.142 *** | −0.188 |

| (0.0793) | (0.0816) | (0.0533) | (0.0457) | (0.145) | |

| Total waste generation | 0.373 *** | 0.373 *** | 0.530 *** | 0.0754 *** | 0.372 *** |

| (0.00967) | (0.0123) | (0.0109) | (0.00580) | (0.00969) | |

| No. of toxic chemicals | 0.267 *** | 0.267 *** | 0.204 *** | 0.0581 *** | 0.267 *** |

| (0.00579) | (0.0134) | (0.00596) | (0.00353) | (0.00579) | |

| Change in Production | 0.251 *** | 0.251 *** | 0.112 *** | 0.197 *** | 0.249 *** |

| (0.0333) | (0.0349) | (0.0164) | (0.0195) | (0.0333) | |

| TWTRt−1 | 0.831 *** | ||||

| (0.00413) | |||||

| Business Sector | |||||

| Resin, synthetic rubber, fibers | −0.411 *** | −0.411 *** | −0.215 | −0.131 ** | −0.370 *** |

| (0.0931) | (0.0913) | (0.156) | (0.0533) | (0.100) | |

| Pesticide, fertilizer, others | 0.212 | 0.212 * | 0.492 * | 0.0552 | 0.398 *** |

| (0.132) | (0.125) | (0.264) | (0.0752) | (0.144) | |

| Pharmaceutical and medicine | −3.588 *** | −3.588 *** | −2.633 *** | −0.668 *** | −3.663 *** |

| (0.134) | (0.133) | (0.258) | (0.0785) | (0.147) | |

| Paint and coating | −2.075 *** | −2.075 *** | −1.306 *** | −0.280 *** | −1.996 *** |

| (0.0888) | (0.0850) | (0.163) | (0.0521) | (0.0976) | |

| Soap, cleaning, andtoilet prep. | −1.543 *** | −1.543 *** | −0.925 *** | −0.144 * | −1.556 *** |

| (0.130) | (0.113) | (0.227) | (0.0750) | (0.144) | |

| Others | −1.117 *** | −1.117 *** | −0.515 *** | −0.160 *** | −1.212 *** |

| (0.0894) | (0.0965) | (0.130) | (0.0518) | (0.0977) | |

| PPA interacted with: | |||||

| Resin, synthetic rubber, fibers | −0.287 | ||||

| (0.267) | |||||

| Pesticide, fertilizer, others | −1.128 *** | ||||

| (0.356) | |||||

| Pharmaceutical and medicine | 0.412 | ||||

| (0.358) | |||||

| Paint and coating | −0.426 * | ||||

| (0.229) | |||||

| Soap, cleaning, and toilet preparation | 0.0321 | ||||

| (0.332) | |||||

| Others | 0.474 ** | ||||

| (0.232) | |||||

| Constant | 9.796 *** | 9.796 *** | 8.328 *** | 1.102 *** | 9.801 *** |

| (0.147) | (0.152) | (0.152) | (0.0933) | (0.147) | |

| Business sector fixed effects | YES | YES | YES | YES | YES |

| Year fixed effects | YES | YES | YES | YES | YES |

| Observations | 18,545 | 18,545 | 18,545 | 14,719 | 18,545 |

| R-squared | 0.363 | 0.363 | N/A | 0.831 | 0.364 |

| Business Sectors | Total Number of Plants | Number of PPA Performing Plants | Share of PPA Performing Plants (%) |

|---|---|---|---|

| Basic chemicals | 7086 | 953 | 13.5 |

| Resin, synthetic rubber, and artificial synthetic fibers | 2820 | 388 | 13.6 |

| Pesticide, fertilizer and other agricultural chemicals | 1333 | 195 | 14.3 |

| Pharmaceutical and medicine | 1185 | 215 | 18.2 |

| Paint and coating | 3477 | 672 | 19.3 |

| Soap, cleaning, and toilet preparation | 1489 | 253 | 17.0 |

| Others | 3850 | 656 | 17.1 |

| Total | 21,240 | 3332 | 15.7 |

| Corporate Models | CModel 5 | CModel 6 | CModel 7 | CModel 8 |

|---|---|---|---|---|

| Estimation | OLS Fixed | Dynamic Panel | GLS Robust | OLS Fixed |

| Variables | COGS | COGS | COGS | Tobin’s q |

| TWTR | 0.00345 ** | 0.00181 *** | 0.00345 *** | −0.00717 * |

| (0.00144) | (0.000604) | (0.00130) | (0.00393) | |

| Firm size | −0.0394 *** | −0.00182 | −0.0394 *** | −0.294 *** |

| (0.00427) | (0.00184) | (0.00753) | (0.0252) | |

| R&D intensity | −0.0214 ** | −0.0219 *** | −0.0214 | 0.0308 |

| (0.00893) | (0.00395) | (0.0188) | (0.0268) | |

| Capital intensity | 0.0334 *** | −0.0145 *** | 0.0334 ** | 0.0591 * |

| (0.0114) | (0.00456) | (0.0167) | (0.0322) | |

| COGSt−1 | 0.777 *** | |||

| (0.0224) | ||||

| Net income | 0.254 *** | |||

| (0.0227) | ||||

| Leverage | 0.124 | |||

| (0.145) | ||||

| Business Sectors | ||||

| Resin and synthetic rubber | 0.109 *** | 0.00245 | 0.109 *** | −0.0637 |

| (0.0257) | (0.0103) | (0.0186) | (0.0675) | |

| Pesticide and fertilizer | −0.121 *** | −0.0113 | −0.121 *** | 0.196 ** |

| (0.0310) | (0.0123) | (0.0316) | (0.0804) | |

| Pharmaceutical and medicine | −0.219 *** | −0.0291 ** | −0.219 *** | 0.220 *** |

| (0.0268) | (0.0118) | (0.0268) | (0.0725) | |

| Paint and coating | −0.0337 | −0.0109 | −0.0337 * | 0.0343 |

| (0.0252) | (0.00987) | (0.0178) | (0.0659) | |

| Soap and cleaning and toilet preparation | −0.108 *** | −0.0290 *** | −0.108 *** | 0.298 *** |

| (0.0259) | (0.0104) | (0.0274) | (0.0674) | |

| Others | −0.0168 | −0.00171 | −0.0168 | −0.116 * |

| (0.0267) | (0.0105) | (0.0190) | (0.0658) | |

| Not categorized | 0.115 ** | 0.0175 | 0.115 *** | |

| (0.0559) | (0.0215) | (0.0230) | ||

| Constant | 1.003 *** | 0.0116 | 1.003 *** | 1.828 *** |

| (0.0703) | (0.0348) | (0.155) | (0.220) | |

| Business sector fixed | YES | YES | YES | YES |

| Year fixed | YES | YES | YES | YES |

| Observations | 455 | 367 | 455 | 334 |

| R-squared | 0.614 | 0.946 | 0.614 | 0.518 |

| Hypotheses Relevant | H2B | H2B | H3B | H3B |

|---|---|---|---|---|

| Explanatory Variables | Toxicity-Weighted TR | Simple Toxic Release | Toxicity-Weighted TR/PPA Intensity | Simple TR/PPA Intensity |

| Environmental performance | −0.00717 * | −0.0276 *** | −0.0139 ** | −0.0196 *** |

| (0.00393) | (0.00638) | (0.00544) | (0.00749) | |

| PPA intensity | −0.00416 | −0.00762 | ||

| (0.0164) | (0.0160) | |||

| Size | −0.294 *** | −0.300 *** | −0.234 *** | −0.247 *** |

| (0.0252) | (0.0246) | (0.0263) | (0.0265) | |

| R&D intensity | 0.0308 | 0.0274 | 0.00164 | 0.00850 |

| (0.0268) | (0.0261) | (0.0274) | (0.0270) | |

| Capital intensity | 0.0591 * | 0.0638 ** | 0.0833 ** | 0.0721 ** |

| (0.0322) | (0.0312) | (0.0344) | (0.0338) | |

| Net income | 0.254 *** | 0.250 *** | 0.223 *** | 0.227 *** |

| (0.0227) | (0.0222) | (0.0239) | (0.0239) | |

| Leverage | 0.124 | 0.0959 | 0.253 | 0.204 |

| (0.145) | (0.142) | (0.166) | (0.164) | |

| Constant | 1.828 *** | 1.921 *** | 1.482 *** | 1.476 *** |

| (0.220) | (0.213) | (0.235) | (0.234) | |

| Business Sector Fixed | YES | YES | YES | YES |

| Year Fixed | YES | YES | YES | YES |

| Observations | 334 | 334 | 218 | 218 |

| R-squared | 0.518 | 0.540 | 0.582 | 0.582 |

| Financial Measures (DVs) | Indication | Calculations | Coefficient of PPA Intensity | Coefficient of Environmental Performance |

|---|---|---|---|---|

| EBIT ratio | Operating profit | Earnings before interest and taxes/sales | Insignificant | Insignificant |

| Net income (ratio) | The final(net) profit | (log) Net income/sales | Insignificant | Insignificant |

| ROA | Asset efficiency | Net income/average assets | Insignificant | Insignificant |

| VARIABLES | OLS Fixed | Dynamic Panel | 2SLS | 2SLS |

|---|---|---|---|---|

| COGS Ratio | COGS Ratio | IV (cumppa) | IV (lagppa) | |

| PPA intensity | −0.0150 ** | −0.00931 *** | −0.0139 *** | −0.0144 *** |

| (0.00630) | (0.00330) | (0.00394) | (0.00410) | |

| TWTR(EP) | 0.00471 ** | 0.00330 *** | 0.00365 *** | 0.00382 *** |

| (0.00200) | (0.00106) | (0.00104) | (0.00112) | |

| Firm size | −0.0285 *** | −0.00201 | −0.00188 | −0.00333 |

| (0.00457) | (0.00249) | (0.00240) | (0.00259) | |

| R&D intensity | −0.0327 *** | −0.0241 *** | −0.0242 *** | −0.0244 *** |

| (0.0104) | (0.00543) | (0.00523) | (0.00540) | |

| Capital intensity | 0.0145 | −0.0216 *** | −0.0228 *** | −0.0229 *** |

| (0.0117) | (0.00594) | (0.00575) | (0.00615) | |

| COGS t−1 | 0.681 *** | 0.676 *** | 0.641 *** | |

| (0.0304) | (0.0294) | (0.0313) | ||

| Constant | 0.839 *** | 0.0373 | 0.0386 | 0.0693 |

| (0.0793) | (0.0489) | (0.0468) | (0.0499) | |

| Observations | 279 | 235 | 235 | 210 |

| R-squared | 0.738 | 0.943 | 0.943 | 0.941 |

| No PPA (0) | Yes PPA (1) | (0)–(1) | |

|---|---|---|---|

| COGS ratio | 0.602 | 0.599 | 0.002 |

| (0.055) | (0.028) | (0.056) | |

| (ln)Tobin’s q | 0.835 | 0.622 | 0.212 |

| (0.117) | (0.044) | (0.103) ** | |

| Firm size (in sssets) | 7.707 | 8.494 | −0.787 |

| (0.337) | (0.277) | (0.446) | |

| (ln)R&D intensity | −3.162 | −3.694 | 0.531 |

| (0.308) | (0.174) | (0.332) | |

| (ln)Capital intensity | −3.250 | −3.050 | −0.199 |

| (0.213) | (0.098) | (0.206) | |

| Operating income (ratio) | 0.130 | 0.147 | −0.017 |

| (0.039) | (0.010) | (0.326) | |

| (In)Net income | 5.114 | 5.884 | −0.771 |

| (0.481) | (0.302) | (0.544) | |

| Leverage | 0.350 | 0.256 | 0.094 |

| (0.047) | (0.187) | (0.043) ** | |

| ROE | 0.489 | 0.202 | 0.286 |

| (0.185) | (0.024) | (0.143) * |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yoo, S.; Eom, J.; Han, I. Too Costly to Disregard: The Cost Competitiveness of Environmental Operating Practices. Sustainability 2020, 12, 5971. https://doi.org/10.3390/su12155971

Yoo S, Eom J, Han I. Too Costly to Disregard: The Cost Competitiveness of Environmental Operating Practices. Sustainability. 2020; 12(15):5971. https://doi.org/10.3390/su12155971

Chicago/Turabian StyleYoo, Soyoung, Jiyong Eom, and Ingoo Han. 2020. "Too Costly to Disregard: The Cost Competitiveness of Environmental Operating Practices" Sustainability 12, no. 15: 5971. https://doi.org/10.3390/su12155971

APA StyleYoo, S., Eom, J., & Han, I. (2020). Too Costly to Disregard: The Cost Competitiveness of Environmental Operating Practices. Sustainability, 12(15), 5971. https://doi.org/10.3390/su12155971