Sustainable Financial Products in the Latin America Banking Industry: Current Status and Insights

Abstract

1. Introduction

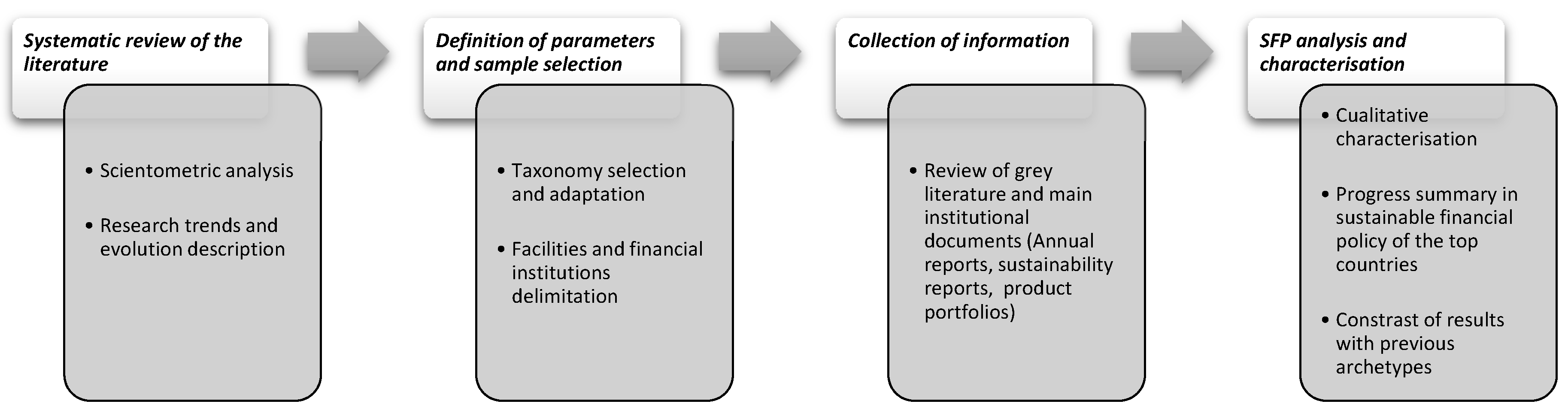

2. Methodology

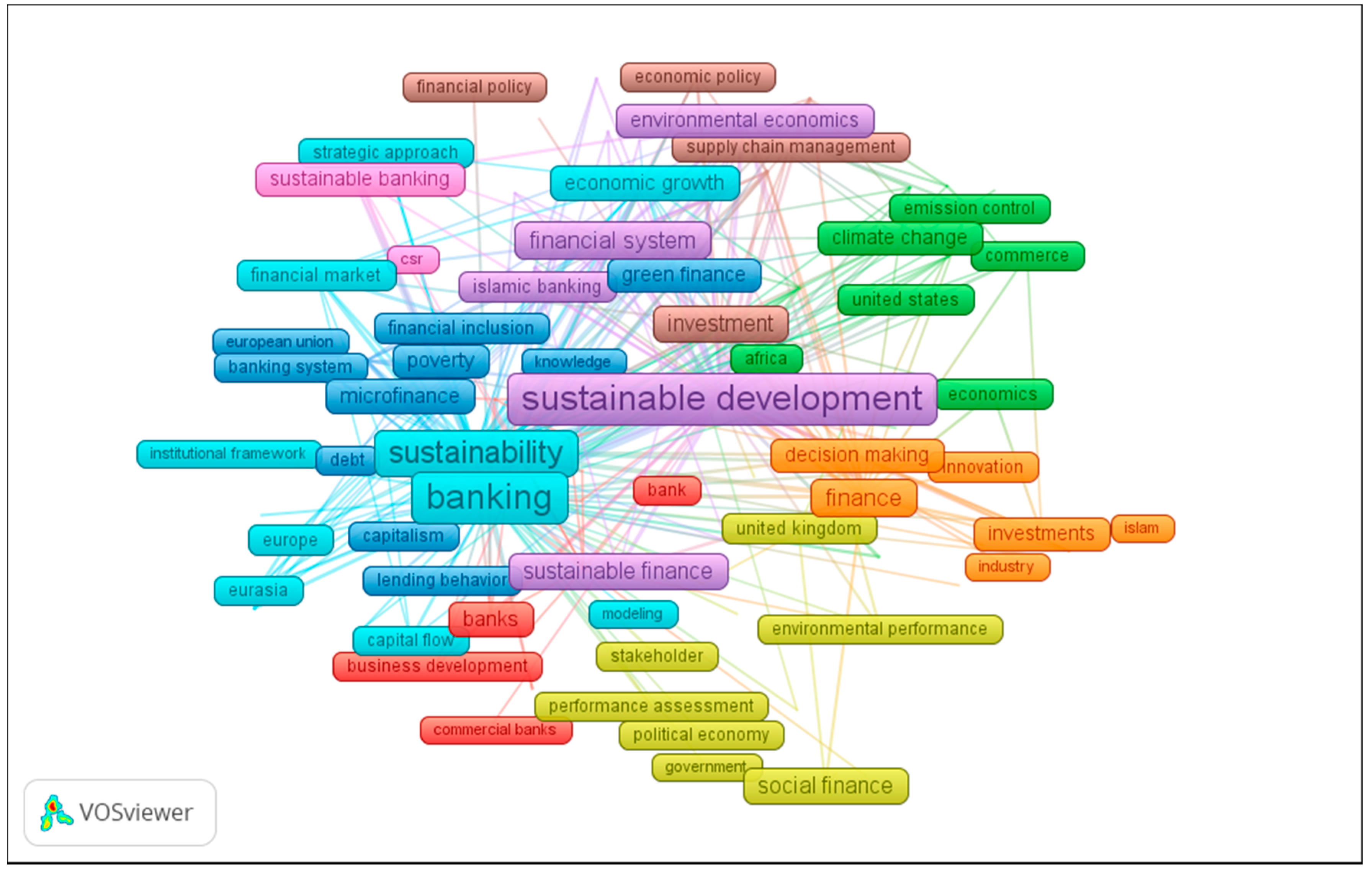

Literature Review

3. Results and Discussion

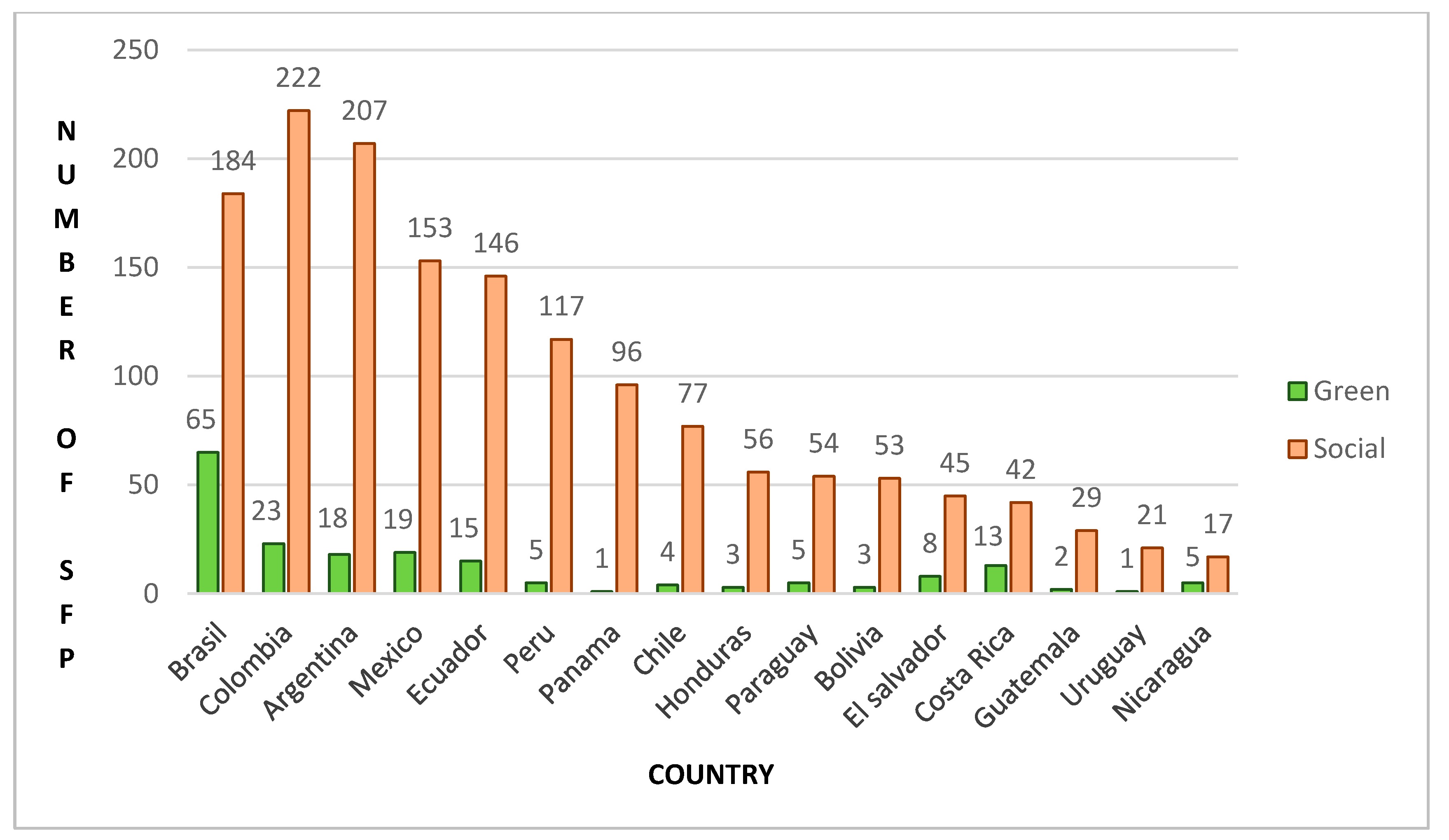

3.1. Results by Countries

3.1.1. Brazil

3.1.2. Colombia

3.1.3. Argentina

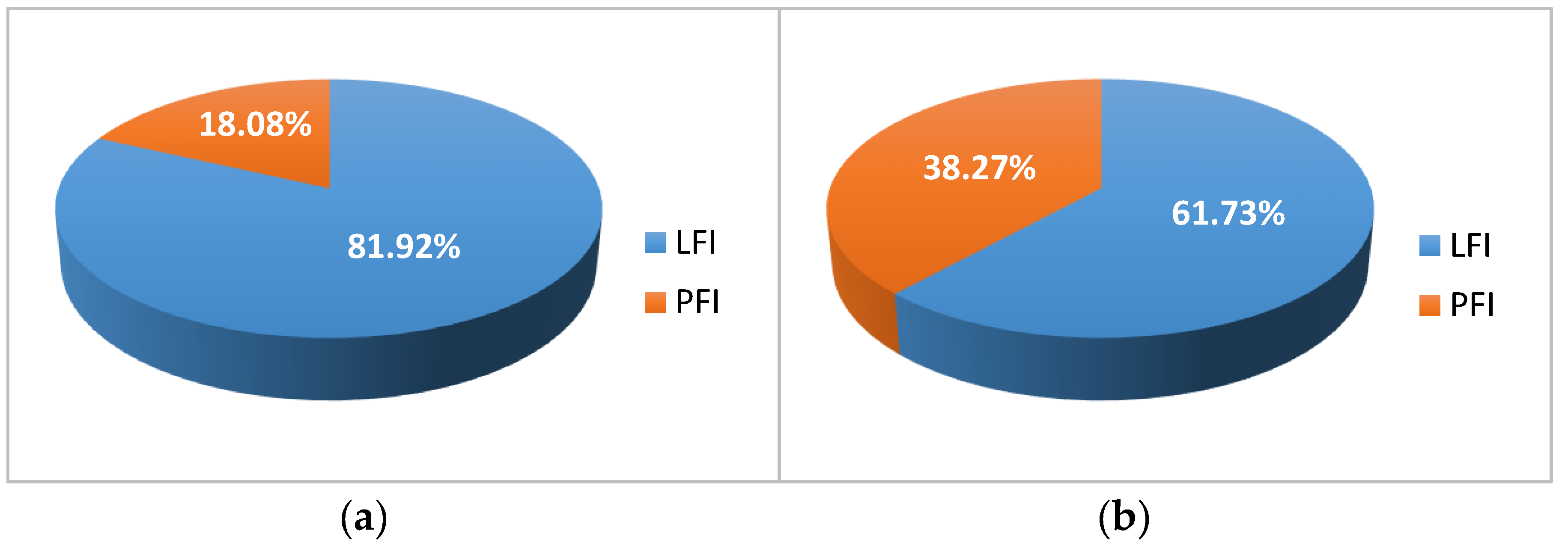

3.2. Results by Kind of Institution

3.3. Results by Products

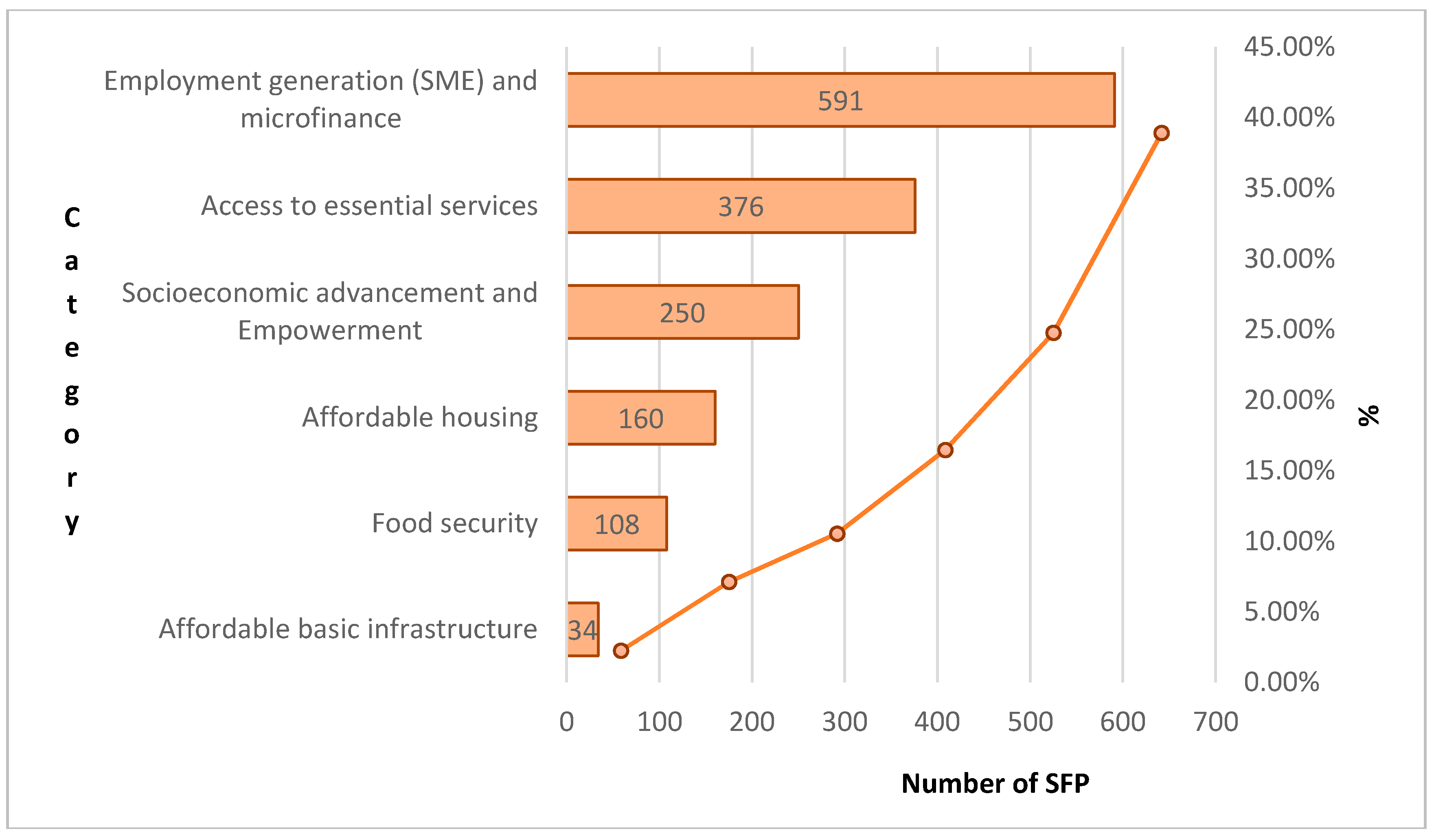

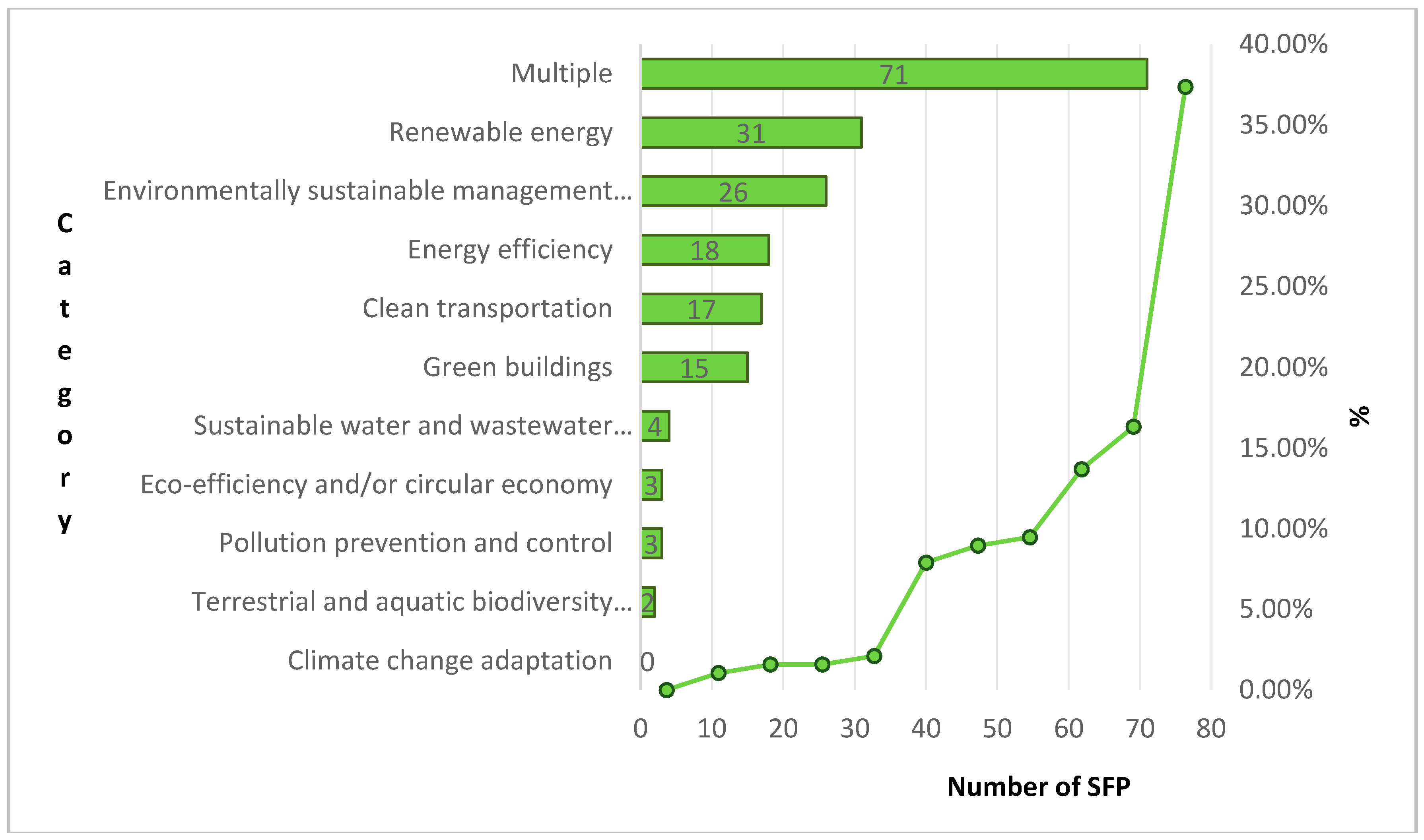

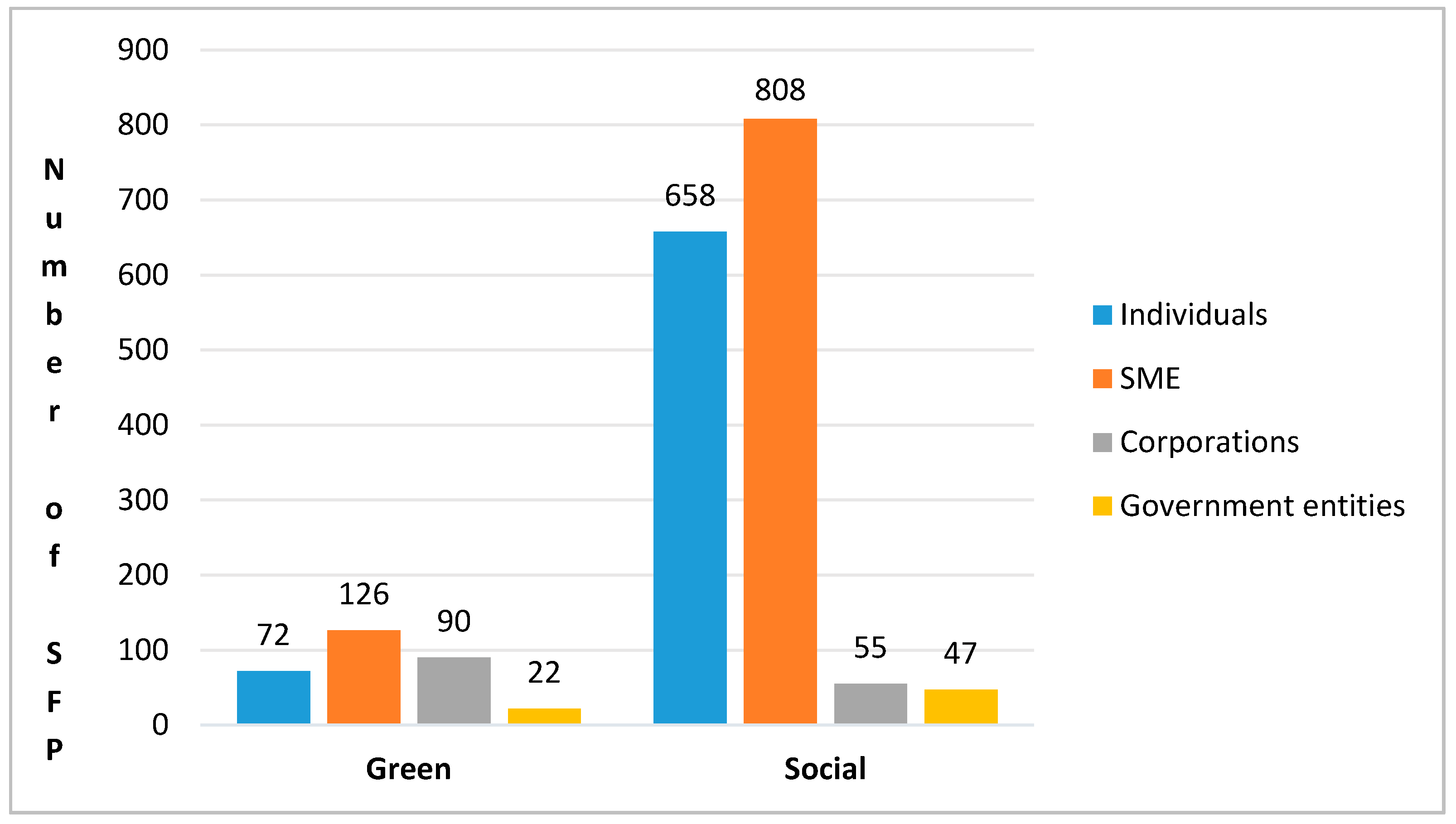

3.4. Segments

3.5. Sustainability and Corporate Social Responsibility Reporting

4. Conclusions and Further Research

- Comparing interest rates for similar SFP but in different countries.

- Developing a credit risk framework to measure how much money a sustainable project could borrow.

- Measuring if SFP could boost the generation of economic value added (EVA).

- Analysing the relation between green bonds and SFP in financial institutions.

- Appraising the participation of monetary flows destined to reach green and social loans in the financial markets at a regional level.

- Assessing the applicability of the archetypes established in [21] now for the banking industry in emerging economies.

- In order to have more understanding of the associations and factors determining the offering / not offering of SFP in Latam countries, an analysis by means of numeric analysis, statistic tests, or even econometric models when suitable.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- United Nations. United Nations Framework Convention on Climate Change. In Adoption of the Paris Agreement; United Nations: New York, NY, USA, 2015; p. 32. [Google Scholar]

- Steffen, W.; Rockström, J.; Richardson, K.; Lenton, T.M.; Folke, C.; Liverman, D.; Summerhayes, C.P.; Barnosky, A.D.; Cornell, S.E.; Crucifix, M.; et al. Trajectories of the Earth System in the Anthropocene. Proc. Natl. Acad. Sci. USA 2018, 115, 8252–8259. [Google Scholar] [CrossRef] [PubMed]

- Bassi, S.; Jennifer, E.; Lucas, T.; Leonardo, M.; Volkery, A. Briefing Green Economy—What Do We Mean by Green Economy? United Nations Environment Programme: Nairobi, Kenya, 2012. [Google Scholar]

- United Nations Development Programme and Oxford Poverty and Human Development Initiative. Global Multidimensional Poverty Index 2019 Illuminating Inequalities; United Nations: New York, NY, USA, 2019. [Google Scholar]

- Falcone, P.M.; Morone, P.; Sica, E. Greening of the financial system and fuelling a sustainability transition: A discursive approach to assess landscape pressures on the Italian financial system. Technol. Forecast. Soc. Chang. 2018, 127, 23–37. [Google Scholar] [CrossRef]

- Pinillos, A.A.; Fernández, J.L. De la RSC a la sostenibilidad corporativa: Una evolución necesaria para la creación de valor. Harvard Deusto Bus. Rev. 2011, 207, 4–21. [Google Scholar]

- Masud, M.; Hossain, M.; Kim, J. Is Green Regulation Effective or a Failure: Comparative Analysis between Bangladesh Bank (BB) Green Guidelines and Global Reporting Initiative Guidelines. Sustainability 2018, 10, 1267. [Google Scholar] [CrossRef]

- Zhang, D.; Zhang, Z.; Managi, S. A bibliometric analysis on green finance: Current status, development, and future directions. Financ. Res. Lett. 2019, 29, 425–430. [Google Scholar] [CrossRef]

- González-Ruiz, J.D.; Arboleda, A.; Botero, S.; Rojo, J. Investment valuation model for sustainable infrastructure systems: Mezzanine debt for water projects. Eng. Constr. Archit. Manag. 2019, 26, 850–884. [Google Scholar] [CrossRef]

- Miroshnychenko, I.; Barontini, R.; Testa, F. Green practices and financial performance: A global outlook. J. Clean. Prod. 2017, 147, 340–351. [Google Scholar] [CrossRef]

- Kaufer, J. Social responsibility as a core business model in banking: A case study in the financial sector. J. Sustain. Financ. Invest. 2014, 4, 76–89. [Google Scholar] [CrossRef]

- Hu, V.I.; Scholtens, B. Corporate social responsibility policies of commercial banks in developing countries. Sustain. Dev. 2014, 22, 276–288. [Google Scholar] [CrossRef]

- Sarfraz, M.; Qun, W.; Hui, L.; Abdullah, M.I. Environmental Risk Management Strategies and the Moderating Role of Corporate Social Responsibility in Project Financing Decisions. Sustainability 2018, 8, 2771. [Google Scholar] [CrossRef]

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Redondo Hernández, J. ESG Performance and Shareholder Value Creation in the Banking Industry: International Differences. Sustainability 2019, 11, 1404. [Google Scholar] [CrossRef]

- United Nations. Transforming Our World: The 2030 Agenda For Sustainable Development United Nations. United Nations: New York, NY, USA, 2015. [Google Scholar]

- Pomering, A.; Dolnicar, S. Assessing the prerequisite of successful CSR implementation: Are consumers aware of CSR initiatives? J. Bus. Ethics 2009, 85 (Suppl. 2), 285–301. [Google Scholar] [CrossRef]

- Mulder, I.; Koellner, T. Hardwiring green: How banks account for biodiversity risks and opportunities. J. Financ. Invest. 2011, 1, 103–120. [Google Scholar]

- Conley, M.; Williams, C.A. Global Banks as Global Sustainability Regulators? The Equator Principles. Law Policy 2011, 33, 542–575. [Google Scholar] [CrossRef]

- González-Ruiz, J.D.; Botero-Botero, S.; Duque-Grisales, E. Financial Eco-Innovation as a Mechanism for Fostering the Development of Sustainable Infrastructure Systems. Sustainability 2018, 10, 4463. [Google Scholar] [CrossRef]

- Stern, N. The Economics of Climate Change: The Stern Review; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Campiglio, E. Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 2016, 121, 220–230. [Google Scholar] [CrossRef]

- Yip, W.H.; Bocken, N.M.P. Sustainable business model archetypes for the banking industry. J. Clean. Prod 2018, 174, 150–169. [Google Scholar] [CrossRef]

- Jeucken, H.A.; Bouma, J.J. The changing environment of banks. Greener Manag. Int. 1999, 27, 20–35. [Google Scholar] [CrossRef]

- Alexander, K. Stability and Sustainability in Banking Reform: Are Environmental Risks Missing in Basel III? Cambridge and Geneva: Geneva, Switzerland, 2014. [Google Scholar]

- United Nations. Environment Programme, Sustainable Finance Progress Report; United Nations: Geneve, Switzerland, 2019. [Google Scholar]

- Jeucken, M. Sustainable Finance and Banking: The Financial Sector and the Future of the Planet, 1st ed.; Routledge: London, UK, 2001. [Google Scholar]

- Jeucken, M. Sustainability in Finance: Banking on the Planet; Eburon Academic Publishers: Delft, The Netherlands, 2004. [Google Scholar]

- Urban, M.A.; Wójcik, D. Dirty Banking: Probing the Gap in Sustainable Finance. Sustainability 2019, 11, 1745. [Google Scholar] [CrossRef]

- Clarke, T.; Boersma, M. Sustainable Finance? A Critical Analysis of the Regulation, Policies, Strategies, Implementation and Reporting on Sustainability in International Finance; United Nations Environment Programme: Sydney, Australia, 2016. [Google Scholar]

- United Nations. Environment Programme Finance Initiative, Principles for Responsible Banking: Key Steps to be Implemented by Signatories. United Nations: Washington, DC, USA, 2020. [Google Scholar]

- Korslund, D.; Spengler, L. Financial Capital and Impact Metrics of Values Based Banking; Global Alliance for Banking on Values: Zeist, The Netherlands, 2012. [Google Scholar]

- Bergedieck, L.; Maheshwari, A.; Avendano, F. Green Finance A Bottom-Up Approach to Track Existing Flows; International Finance Corporation: Washington, DC, USA, 2017. [Google Scholar]

- Rosenman, E. The geographies of social finance: Poverty regulation through the ‘invisible heart’ of markets. Prog. Hum. Geogr. 2019, 43, 141–162. [Google Scholar] [CrossRef]

- Emerson, J.; Freundlich, T.; Fruchterman, J.; Berlin, L.; Stevenson, K. Nothing Gained: Addressing the Critical Gaps in Risk-Taking Capital for Social Enterprise; Oxford University: Oxford, UK, 2007. [Google Scholar]

- Weber, O.; Scholz, R.W.; Michalik, G. Incorporating sustainability criteria into credit risk management. Bus. Strateg. Environ. 2010, 19, 39–50. [Google Scholar] [CrossRef]

- Fijałkowska, J.; Zyznarska-Dworczak, B.; Garsztka, P. Corporate social-environmental performance versus financial performance of banks in Central and Eastern European Countries. Sustainability 2018, 10, 772. [Google Scholar] [CrossRef]

- Nizam, E.; Ng, A.; Dewandaru, G.; Nagayev, R.; Nkoba, M.A. The impact of social and environmental sustainability on financial performance: A global analysis of the banking sector. J. Multinatl. Financ. Manag. 2019, 49, 35–53. [Google Scholar] [CrossRef]

- Jan, A.; Marimuthu, M.; Hassan, R. Sustainable business practices and firm’s financial performance in islamic banking: Under the moderating role of islamic corporate governance. Sustainability 2019, 11, 6606. [Google Scholar] [CrossRef]

- Paulet, E.; Parnaudeau, M.; Relano, F. Banking with Ethics: Strategic Moves and Structural Changes of the Banking Industry in the Aftermath of the Subprime Mortgage Crisis. J. Bus. Ethics 2015, 131, 199–207. [Google Scholar] [CrossRef]

- Raut, R.; Cheikhrouhou, N.; Kharat, M.B. Sustainability in The Banking Industry: A Strategic Multi-Criterion Analysis. Bus. Strateg. Environ. 2017, 26, 550–568. [Google Scholar] [CrossRef]

- Zeidan, R.; Boechat, C.; Fleury, A. Developing a Sustainability Credit Score System. J. Bus. Ethics 2015, 127, 283–296. [Google Scholar] [CrossRef]

- Shum, K.; Yam, S.L. Ethics and Law: Guiding the Invisible Hand to Correct Corporate Social Responsibility Externalities. J. Bus. Ethics 2011, 98, 549–571. [Google Scholar] [CrossRef]

- Igbudu, N.; Garanti, Z.; Popoola, T. Enhancing bank loyalty through sustainable banking practices: The mediating effect of corporate image. Sustainability 2018, 10, 4050. [Google Scholar] [CrossRef]

- Dell’Atti, S.; Trotta, A.; Iannuzzi, A.P.; Demaria, F. Corporate Social Responsibility Engagement as a Determinant of Bank Reputation: An Empirical Analysis. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 589–605. [Google Scholar] [CrossRef]

- Ibe-Enwo, G.; Igbudu, N.; Garanti, Z.; Popoola, T. Assessing the Relevance of Green Banking Practice on Bank Loyalty: The Mediating Effect of Green Image and Bank Trust. Sustainability 2019, 11, 4651. [Google Scholar] [CrossRef]

- Ferreira, F.A.; Jalali, M.S.; Meidutė-Kavaliauskienė, I.; Viana, B.A. A metacognitive decision making based-framework for bank customer loyalty measurement and management. Technol. Econ. Dev. Econ. 2015, 21, 280–300. [Google Scholar] [CrossRef]

- Bossle, M.B.; de Barcellos, M.D.; Vieira, L.M.; Sauvée, L. The drivers for adoption of eco-innovation. J. Clean. Prod. 2016, 113, 861–872. [Google Scholar] [CrossRef]

- International Finance Corporation. FELABAN, and EcoBusiness Fund, Green Finance Latin America 2017 Report: What is the Latin American Banking Sector Doing to Mitigate Climate Change? International Finance Corporation: Washington, DC, USA, 2017. [Google Scholar]

- Dingwerth, K.; Eichinger, M. Tamed transparency: How information disclosure under the global reporting initiative fails to empower. Glob. Environ. Polit. 2010, 10, 74–96. [Google Scholar] [CrossRef]

- Rasche, A. A Necessary Supplement: What the United Nations global compact is and is not. Bus. Soc. 2009, 48, 511–537. [Google Scholar] [CrossRef]

- Windolph, S.E. Assessing Corporate Sustainability Through Ratings: Challenges and Their Causes. J. Environ. Sustain. 2011, 1, 1–22. [Google Scholar] [CrossRef]

- Scholtens, B. Corporate social responsibility in the international banking industry. J. Bus. Ethics 2009, 86, 159–175. [Google Scholar] [CrossRef]

- Figge, F.; Hahn, T. The cost of sustainability capital and the creation of sustainable value by companies. J. Indust. Ecol. 2005, 9, 47–58. [Google Scholar] [CrossRef]

- Ng, C.; Rezaee, Z. Business sustainability performance and cost of equity capital. J. Corp. Financ. 2015, 34, 128–149. [Google Scholar] [CrossRef]

- Ruiz, J.G.; Arboleda, C.A.; Botero, S. A Proposal for Green Financing as a Mechanism to Increase Private Participation in Sustainable Water Infrastructure Systems: The Colombian Case. Procedia Eng. 2016, 145, 180–187. [Google Scholar] [CrossRef]

- Shishlov, I.; Bajohr, T.; Deheza, M.; Cochran, I. Using Credit Lines to Foster Green Lending: Opportunities and Challenges; Institute for Climate Economics: Paris, France, 2017. [Google Scholar]

- United Nations. Environment Programme Finance Initiative, Green Financial Products and Services Current Trends and Future Opportunities in North America; United Nations: Toronto, ON, Canada, 2007. [Google Scholar]

- Collins, D. Green leases and green leasing in theory and in practice: A state of the art review. Facilities 2019, 37, 813–824. [Google Scholar] [CrossRef]

- Migliorelli, M.; Dessertine, P. Time for new financing instruments? A market-oriented framework to finance environmentally friendly practices in EU agriculture. J. Sustain. Financ. Invest. 2018, 8, 1–25. [Google Scholar] [CrossRef]

- Waltman, L. A review of the literature on citation impact indicators. J. Informetr. 2016, 10, 365–391. [Google Scholar] [CrossRef]

- Olawumi, T.O.; Chan, D.W.M. A scientometric review of global research on sustainability and sustainable development. J. Clean. Prod. 2018, 183, 231–250. [Google Scholar] [CrossRef]

- Dominko, M.; Verbič, M. The Economics of Subjective Well-Being: A Bibliometric Analysis. J. Happiness Stud. 2019, 20, 1973–1994. [Google Scholar] [CrossRef]

- Ertz, M.; Leblanc-Proulx, S. Sustainability in the collaborative economy: A bibliometric analysis reveals emerging interest. J. Clean. Prod. 2018, 196, 1073–1085. [Google Scholar] [CrossRef]

- Nájera-Sánchez, J. A Systematic Review of Sustainable Banking through a Co-Word Analysis. Sustainability 2019, 12, 278. [Google Scholar] [CrossRef]

- Loan Market Association. Green Loan Principles, Supporting Environmentally Sustainable Economic Activity; Loan Market Association: London, UK, 2018. [Google Scholar]

- International Capital Market Association. Social Bond Principles, Voluntary Process Guidelines for Issuing Social Bonds; International Capital Market Association: París, France, 2018. [Google Scholar]

- Forstater, M.; Zhang, N. Definitions and Concepts: Background Note; United Nations Environmental Programme: Geneva, The Netherlands, 2016. [Google Scholar]

- European Political Strategy Centre. Financing Sustainability: Triggering Investments for the Clean Economy. EPSC Strateg. Notes 2017, 25, 18. [Google Scholar]

- Almeida, M.; Filkova, M. América Latina y el Caribe Estado Del Mercado De Las Finanzas Verdes; Climate Bonds Initiative: London, UK, 2019. [Google Scholar]

- Sustainable Banking Network. Global Progress Report of the Sustainable Banking Network: Innovations in Policy and Industry Actions in Emerging Markets; Sustainable Banking Network: Washington, DC, USA, 2019. [Google Scholar]

- Lindlein, P. Mainstreaming environmental finance into financial markets—Relevance, potential and obstacles. In Greening the Financial Sector: How to Mainstream Environmental Finance in Developing Countries; Springer: Heidelberg/Berlin, Germany, 2012; pp. 1–30. [Google Scholar]

- Heinemann, K.; Zwergel, B.; Gold, S.; Seuring, S.; Klein, C. Exploring the supply-demand-discrepancy of sustainable financial products in Germany from a financial advisor’s point of view. Sustainability 2018, 10, 944. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Fernández-Izquierdo, Sustainable development and the financial system: Society’s perceptions about socially responsible investing. Bus. Strateg. Environ. 2013, 22, 410–428. [Google Scholar] [CrossRef]

- Weber, O.; Fenchel, M.; Scholz, R.W. Empirical analysis of the integration of environmental risks into the credit risk management process of European banks. Bus. Strateg. Environ. 2008, 17, 149–159. [Google Scholar] [CrossRef]

- Geobey, S.; Weber, O. Lessons in operationalising social finance: The case of Vancouver City Savings Credit Union. J. Sustain. Financ. Invest. 2013, 3, 124–137. [Google Scholar] [CrossRef]

- Weber, I. Corporate sustainability and financial performance of Chinese banks. Sustain. Account. Manag. Policy J. 2017, 8, 358–385. [Google Scholar] [CrossRef]

- Laguir, I.; Marais, M.; El Baz, J.; Stekelorum, R. Reversing the business rationale for environmental commitment in banking: Does financial performance lead to higher environmental performance? Manag. Decis. 2018, 56, 358–375. [Google Scholar] [CrossRef]

- Nikolaou, I.E.; Kourouklaris, G.; Tsalis, T.A. A framework to assist the financial community in incorporating water risks into their investment decisions. J. Sustain. Financ. Invest. 2014, 4, 93–109. [Google Scholar] [CrossRef]

- Zimmermann, S. Same same but different: How and why banks approach sustainability. Sustainability 2019, 11, 2267. [Google Scholar] [CrossRef]

- Bowman, M. The Role of the Banking Industry in Facilitating Climate Change Mitigation and the Transition to a Low-Carbon Global Economy. Environ. Plan. Law J. 2010, 27, 448–468. [Google Scholar]

- Clark, R.; Reed, J.; Sunderland, T. Bridging funding gaps for climate and sustainable development: Pitfalls, progress and potential of private finance. Land Use Policy 2018, 71, 335–346. [Google Scholar] [CrossRef]

- Polzin, F. Mobilising private finance for low-carbon innovation—A systematic review of barriers and solutions. Renew. Sustain. Energy Rev. 2017, 77, 525–535. [Google Scholar] [CrossRef]

- Jo, H.; Kim, H.; Park, K. Corporate Environmental Responsibility and Firm Performance in the Financial Services Sector. J. Bus. Ethics 2015, 131, 257–284. [Google Scholar] [CrossRef]

- Steckel, C.; Jakob, M. The role of financing cost and de-risking strategies for clean energy investment. Int. Econ. 2018, 155, 19–28. [Google Scholar] [CrossRef]

- Amin, A.L.; Dimsdale, T.; Jaramillo, M. Greening the Financial Sector—From Demonstration to Scale in Green Finance. In Designing Smart Green Finance Incentive Schemes: The Role of the Public Sector and Development Banks; E3G Working Paper; Third Generation Environmentalism: London, UK, 2014; p. 32. [Google Scholar]

- Carolina Rezende de Carvalho Ferreira, M.; Amorim Sobreiro, V.; Kimura, H.; Luiz de Moraes Barboza, F. A systematic review of literature about finance and sustainability. J. Sustain. Financ. Invest. 2016, 6, 112–147. [Google Scholar] [CrossRef]

- Sobhani, F.A.; Amran, A.; Zainuddin, Y. Sustainability disclosure in annual reports and websites: A study of the banking industry in Bangladesh. J. Clean. Prod. 2012, 23, 75–85. [Google Scholar] [CrossRef]

- Rahman, A. Micro-Credit initiatives for equitable and sustainable development: Who pays? World Dev. 1999, 27, 67–82. [Google Scholar] [CrossRef]

- Sustainable Banking Network. A Sustainable Banking Network (SBN) Brazil Flagship Report Addendum to SBN Global Progress Report; Sustainable Banking Network: Washington, DC, USA, 2019. [Google Scholar]

- Inter-American Development Bank. Informe Fintech en América Latina 2018: Crecimiento y Consolidación; Inter-American Development Bank: Washington, DC, USA, 2018. [Google Scholar]

- Sustainable Banking Network. A Sustainable Banking Network (SBN) Colombia Flagship Report Addendum to SBN Global Progress Report; Sustainable Banking Network: Washington, DC, USA, 2019. [Google Scholar]

- United Nations. Environment Programme Finance Initiative, Integración de la Sostenibilidad en las Instituciones Financieras Latinoamericanas: Énfasis en los Aspectos Medio Ambientales; United Nations: Ginebra, Switzerland, 2012. [Google Scholar]

| Categories for Social-Oriented Products | Categories for Green-Oriented Products |

|---|---|

| Affordable basic infrastructure | Renewable energy |

| Access to essential services | Energy efficiency |

| Affordable housing | Climate change adaptation |

| Employment generation including through the potential effect of (SME) financing and microfinance | Pollution prevention and control |

| Food security | Environmentally sustainable management of living natural resources and land use |

| Socioeconomic advancement and empowerment | Terrestrial and aquatic biodiversity conservation |

| Clean transportation | |

| Sustainable water and wastewater management | |

| Eco-efficient and/or circular economy adapted products, production technologies and processes | |

| Green buildings | |

| Multiple |

| Country | Member Association | FI Examined |

|---|---|---|

| Argentina | Asociación de bancos de la Argentina | 62 |

| Bolivia | Asociación de Bancos Privados de Bolivia | 15 |

| Brazil | Federacao Brasileira de Bancos (FEBRABAN) | 79 |

| Chile | Asociación de Bancos e Instituciones Financieras de Chile A.G. | 20 |

| Colombia | Asociación Bancaria y de Entidades Financieras de Colombia (ASOBANCARIA) | 32 |

| Costa Rica | Asociación Bancaria Costarricense | 14 |

| Ecuador | Asociación de Bancos Privados del Ecuador | 28 |

| El Salvador | Asociación Bancaria Salvadoreña (ABANSA) | 13 |

| Honduras | Asociación Hondureña de Instituciones Bancarias (AHIBA) | 16 |

| Mexico | Asociación de Bancos de México | 54 |

| Guatemala | Asociación Bancaria de Guatemala | 18 |

| Nicaragua | Asociación de Bancos Privados de Nicaragua | 7 |

| Panama | Asociación Bancaria de Panamá | 44 |

| Paraguay | Asociación de Bancos de Paraguay | 15 |

| Peru | Asociación de Bancos del Perú | 20 |

| Uruguay | Banco de la República Oriental del Uruguay | 11 |

| Country | Financial Institution | Kind of Institution | No. of SFP Identified |

|---|---|---|---|

| Brazil | Banco Nacional de Desenvolvimento Econômico e Social | PFI | 48 |

| Argentina | Banco de la Pampa | PFI | 30 |

| Colombia | Davivienda | LFI | 29 |

| Brazil | Banco do Nordeste do Brasil | PFI | 29 |

| Chile | Banco del Estado de Chile | PFI | 27 |

| Brazil | Banco Bradesco | LFI | 24 |

| Colombia | Bancolombia | LFI | 23 |

| Ecuador | Banco Pichincha | LFI | 22 |

| Colombia | Banco Agrario de Colombia | PFI | 21 |

| Colombia | Banco de Bogotá | LFI | 21 |

| Category | Type of Facility | Instrument for Delivering Sustainability |

|---|---|---|

| Social-oriented SFP | ||

| Affordable basic infrastructure | Credit/Grants | Refundable and non-refundable loans to meet the credit needs of municipal, regional, and national governments that carry out public investment projects in the energy, transportation, construction, sanitation, communication, and social equipment sectors. Up to 100% of the projects are financed and for the most part the financing is provided by PFI |

| Credit | Long-term loans with differentiated repayment schemes for infrastructure and public services projects developed as public-private partnerships | |

| Personal loans for the installation of natural gas or domestic sanitation networks in houses. These products have fixed interest rates and do not require any guarantee. | ||

| Access to essential services | Savings | Savings accounts with returns and without opening, maintenance, or minimum balance requirements charges, and/or that offer exemption or lower commissions on transactions |

| 100% digital savings accounts, with a special interest rate, debit card, and free transfers | ||

| Savings/currents accounts or integral portfolios specifically designed for SME that meet their basic banking needs and have minimum documentation requirements. Some do not charge for maintenance and include debit cards as well as both cheques and protection for free | ||

| Accounts or savings plans programmed for use in specific personal projects, with automatic debit and where the holder defines the term. They provide interest rates higher than those of traditional savings accounts and allow the choice of deposit frequency | ||

| Credit | Preferential rate credits to afford one’s own and family medical procedures and treatments | |

| Free destination online loans, without guarantee requirement and a lower rate than conventional credit. | ||

| Credit cards with an easy approval (without verification of income or financial references), benefits in the interest rate, discounts in stores and/or an annuity free | ||

| Specific credit cards that donate a percentage of purchases to support a foundation or non-profit organisation dedicated to solutions related to health or education | ||

| Loans to entities, companies, or financial intermediaries for the development of the inclusion and offer of financial services in specific sectors with a deficit of access to credit | ||

| Affordable housing | Savings | Savings accounts that offer tax benefits to natural persons who seek to save in the medium or long term to acquire housing. There is no charge for maintenance fees or minimum opening amounts |

| Savings accounts to verify or complete the income needed to access government subsidies for social and/or priority interest housing | ||

| Credit | Mortgage loans for the purchase of social interest housing, land for construction, expansion, improvement, or legalisation of housing (either traditional or productive housing) for low-income families | |

| Mortgage loans intended for legalisation, purchase, repair, construction, and expansion of productive housing (houses and businesses in the same space) | ||

| Social lease programs offered by PFI structured as a long-term loan, with a low initial fee and a low monthly fee that offer a 0% purchase option at the end of the lease term | ||

| Loans to developers, builders, and housing production agencies for social housing development projects (public and private) with interest rates and more convenient structures. | ||

| Grants | Funds granted by PFI to families for free, to strengthen or improve housing at the structural level | |

| Employment generation (SME financing and microfinance) | Credit | Loans and credit lines to SME in the formal/informal sector to finance indifferent or exclusively working capital, equipment projects, purchase of fixed assets, and investments to increase productivity. Normally, they leave to the borrower’ the choice of payment method and the grace period according to the cash flow. |

| Credit cards aimed especially at entrepreneurs and SMEs for expenses on supplies and fixed assets. Usually with benefits in associated stores and some are exempt from an annuity | ||

| Microcredits mostly oriented to established SMEs but also for those who want to start their own business or professionals who want to grow their line of work. They offer fast disbursement, convenient repayment schemes according to the ability to pay, and generous grace periods | ||

| Food Security | Credit | Loans, credit lines, and microcredits for agricultural and livestock working capital and investment. Many of these include technical assistance |

| Credit cards to finance exclusively the purchase of supplies, machinery, and services necessary to fully cover the agricultural or livestock production cycle or related industries through flexible payment plans in line with the natural cycles of the productive project. They feature special discounts at certain distributors and stores, as well as a preferential interest rate. Some are free of monthly maintenance fees | ||

| Savings/Credit | Debit cards and fiduciary guarantee loans for the payment of food pensions legally ordered | |

| Special plans for products and services aimed at small and medium enterprises linked to rural businesses or family/subsistence farmers. | ||

| Socioeconomic advancement and Empowerment | Savings | Current and savings accounts free of commissions or charges for opening, use, or maintenance intended for artisans, vulnerable populations such as victims of armed conflict, or marginalised rural areas. |

| Savings accounts designed for immigrants and their remittances, as well as for the receipt of subsidies and state aid from government social programs. They are exempt from fee collection, minimum balance, or annuity and with direct credit. | ||

| Savings/Credit | Collective savings accounts with which people can save collectively achieve goals with friends or family, and communal credits through the formation of a group with a certain minimum of participants who must be active micro-entrepreneurs. There may be individualised fees. | |

| Current accounts, savings accounts, and/or loans for investment, social development projects or patrimonial recovery for cooperatives, civil society organisations or associations of the popular and solidarity economy, with a personalised payment frequency according to the cash flow and productive cycle. | ||

| Current savings accounts, or unsecured loans directly to the account for retirees and pensioners with special interest rates and without account maintenance fees. The opening and usage of some of these are digital. | ||

| Bank accounts and financing of activities that are framed in the productive sectors, strategic adaptation of infrastructure, or the purchase of goods and services for people with disabilities. | ||

| Loans and credit cards for personal expenses, household equipment, or for development of economic activities led by women and associations or organisations in situations of violence, with benefits in shops and associated businesses, with no spouse signature requirement and the possibility of training and emergency assistance. | ||

| Credit | Accessible educational loans and credit lines for technical, technological, pre-graduate, or postgraduate programs accessible under conditions according to the type of program such as a preferential fixed rate, flexible payment plan, ease of early cancellation, and grace period for the entire period of studies. | |

| Special financing provided by PFI for municipalities and government entities for the construction or improvement of public space, community equipment, green areas and/or co-ownership land in neighbourhoods with problems of urban deterioration, segregation, and social vulnerability; this also includes the implementation of social development programs and culture support | ||

| Financing for acquisition of assets and investments for the development of small-scale rural tourism, or adventure and other forms of non-traditional tourism | ||

| Credit/Grants | Non-refundable subsidies and loans for educational institutions and/or applied research, technological development, innovation, and knowledge transfer projects to promote social and territorial development processes | |

| Green-oriented SFP | ||

| Renewable energy | Credit | Development loans for the expansion/modernisation of the national energy frontier through the financing of projects for the generation and transmission of non-conventional renewable energies |

| Loans for the acquisition of solar panels for family use, as well as other household items related to the use of renewable energies that allow the transformation of expenses into energy savings in the family environment under the distributed clean generation scheme, as well as a preferential rate loan for SMEs and corporations with productive projects related to renewable energy. | ||

| Energy efficiency | Credit | Loans with preferential conditions for people to invest in high-energy efficiency home appliances or environmental impact reduction technologies for the home, usually in shops designated by the bank. |

| Credits for technical advice, investment projects, replacement of machinery and purchase of new energy-efficient equipment that cause lower consumption of electricity, cost reduction, and improvements in the competitiveness of SME and companies. Characterised by payment terms according to needs and the flow of the project to be financed and is subject to a verification/guarantee scheme for potential energy savings. | ||

| Pollution prevention and control | Credit | Development loans for institutional level activities of improvement and recovery of contaminated or degraded soils and areas as well as projects to strengthen the business capacity of reduction and mitigation of socio-environmental risks. |

| Environmentally sustainable management of living natural resources and land use | Credit | Loans with extended rate and grace period bonus, and non-refundable subsidies to prevent, monitor, and combat deforestation, in addition to promoting the conservation of protected areas and the sustainable use of forests with responsible exploitation and certification practices. |

| Loans for investments in low carbon agriculture programs and agro-ecologic productive systems with sustainable practices such as waste management, pasture reform, irrigated agriculture, biotechnology, and eco-efficiency technologies from small to large scale. | ||

| Terrestrial and aquatic biodiversity conservation | Credit | Credit lines for investments in the recovery and conservation of ecosystems and biodiversity provided by PFI. |

| Collaboration credit cards, which donate a certain percentage of funds from purchases made to funds/NGOs dedicated to promoting wildlife conservation and biodiversity. | ||

| Clean transportation | Credit | Loans for the acquisition of bicycles, motorcycles, and automobiles (mostly private but also commercial) hybrids, electric, or lower emissions vehicles. They offer a lower interest rate than the credits for traditional vehicles and finance up to 100% of the commercial value with a quick disbursement by being able to exempt the vehicle from an initial fee or co-debtor. Car conversion to vehicular natural gas is also supported. |

| Sustainable water and wastewater management | Credit | Exclusive credit lines to finance projects for the efficient and sustainable use of water for public drainage works and resource reuse in condominiums and houses. |

| Eco-efficiency and/or circular economy | Credit | Loans provided by PFI for investments in process and product efficiency through the application of a preventiveor clean production approach and use of supplies from renewable sources or of less environmental impact as rawmaterial |

| Green buildings | Credit | Loans for builders and real estate developers for projects (housing or commerce) with sustainable architecture or access to eco-efficiency certifications |

| Credit/Grants | Mortgage loans, green leases, and state subsidies to access housing units and projects built under sustainability criteria or with environmental certifications, and with a lower financial cost than other similar alternatives. | |

| Multiple | Savings | Green low-cost savings accounts, debit, and credit cards which raise funds for the placement of environmental credits or where the customer can support sustainability issues by contributing with its use to the maintenance and development of non-profit environmental organisations |

| Credit | Loans, microcredits, and ecological credit lines to finance projects that explicitly focus on two or more green categories mentioned above, or which through their generality enable a vast range of destinations for general sustainability or environmental protection and improvement projects with differentiated interest rates, assistance, and schemes of amortisation. | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mejia-Escobar, J.C.; González-Ruiz, J.D.; Duque-Grisales, E. Sustainable Financial Products in the Latin America Banking Industry: Current Status and Insights. Sustainability 2020, 12, 5648. https://doi.org/10.3390/su12145648

Mejia-Escobar JC, González-Ruiz JD, Duque-Grisales E. Sustainable Financial Products in the Latin America Banking Industry: Current Status and Insights. Sustainability. 2020; 12(14):5648. https://doi.org/10.3390/su12145648

Chicago/Turabian StyleMejia-Escobar, Juan Camilo, Juan David González-Ruiz, and Eduardo Duque-Grisales. 2020. "Sustainable Financial Products in the Latin America Banking Industry: Current Status and Insights" Sustainability 12, no. 14: 5648. https://doi.org/10.3390/su12145648

APA StyleMejia-Escobar, J. C., González-Ruiz, J. D., & Duque-Grisales, E. (2020). Sustainable Financial Products in the Latin America Banking Industry: Current Status and Insights. Sustainability, 12(14), 5648. https://doi.org/10.3390/su12145648