Abstract

This study investigated the effect of entrepreneurial orientation on firm performance with the firm resource orchestration capability and environmental dynamics in moderating roles. Using survey data collected from 301 Korean manufacturing and service firms, we devised a three-way interaction model to uncover the complex and dynamic conditions that maximize the effect of entrepreneurial orientation on firm performance. We found a positive association between entrepreneurial orientation and firm performance. Moreover, our findings indicated that both the firm resource orchestration capability and environmental dynamics played positive moderating roles in the above relationship. The results also showed that, in the case of a high level of environmental dynamics, entrepreneurial orientation was more positively related to firm performance for firms with a high resource orchestration capability. In addition, in the case of low resource orchestration capability, entrepreneurial orientation was associated more positively with firm performance for firms with high environmental dynamics. Thus, this study confirmed the importance of interaction between the three factors for enhancing firm performance. Furthermore, our investigation of substantial moderators provided key insights regarding the conditions that better explain how entrepreneurial orientation promotes firm performance. In addition to two-way interaction, the support for a three-way interaction suggests that moderators of the relationship interact to further explain the relationship. The theoretical and practical implications are discussed.

1. Introduction

In modern society, firms can adapt to the rapidly changing business environment, achieve sustainable and long-term success by constantly adopting new technologies, exploring new business opportunities, and increasing their market value. To survive in this fiercely competitive business environment, firms must continue to develop the ability to meet customers’ needs and create market value more efficiently and effectively than their competitors. Therefore, the interest in sustainability among management scholars, managers, and policy-makers has increased. Given the growing significance of sustainability for firms in this rapidly changing business environment, entrepreneurial orientation (EO) is seen as a key factor for firms to secure sustainable competitive advantage. EO refers to a firm’s strategic decision-making ability as well as to all its activities that drive the firm toward effectively achieving its goals by proactively exploring new business opportunities and market innovation and innovatively utilizing the available resources [1,2,3,4]. In particular, EO is considered an essential element that boosts the performance and sustainable growth of small ventures by propelling them toward adapting to the consistently evolving new markets and effectively motivating technology innovation. In view of such significance, many Korean firms now consider EO-based technology innovation as a basis of their progress, and numerous studies are examining the process of fostering innovative small ventures, which would lead to the creation of new jobs and propel national economic development.

Although many studies found a positive relationship between EO and firm performance [2,5,6,7], some studies failed to find any significant relationship [8,9], whereas other studies found a negative relationship between the two factors [10,11]. These mixed empirical results have raised concerns with regard to applying the findings in practice. More specifically, Covin and Slevin [8] found that EO and a firm’s financial performance were not significantly associated, whereas Li et al. [12] observed that market orientation did not influence new product development. A Korean study revealed mixed results across the sub-dimensions of EO [13]. In essence, despite the consensus on the significance of EO, findings on its association with various types of firm performance have been inconsistent and mixed [8,9,10,11].

While recognizing this problem and in an attempt to address the limitations of past literature, this study took a more systematic and comprehensive approach toward examining the conditions in which EO impacts firm performance from the following theoretical and empirical perspectives: First, in light of the concerns that the effect of EO may vary depending on the complex contingency factors surrounding a firm and that an empirical analysis needs to be performed to study ways to overcome these factors and create new business opportunities [14], we considered the environmental dynamics of firms in general. An environment comprising various technologies, markets, clients, and competitors and its complexity impacts a firm’s strategic decision-making ability, which is ultimately linked to its performance. Hence, we first empirically analyzed the relationship between EO and firm performance and examined the moderating effect of environmental dynamics on their relationship.

Second, some studies have suggested that a firm’s ability to effectively overcome and adapt to its external environment and dynamics is related to its competence [15,16,17]. This means that the difference in performance across firms in the same industry and within the same market environment is linked to the firms’ internal competence. However, existing studies on the relationship between EO and performance have overlooked the importance of internal competence [2,3,6]. The firm resource orchestration capability is one of the most important components of internal competence that needs to be considered. It can be seen as the ability to maximize firm performance by planning appropriate allocation of resources for business, effectively allocating resources, and integrating existing and new resources. Therefore, this study attempts to overcome the limitations of past studies by considering the firm resource orchestration capability as an important moderating variable, thereby recognizing the importance of internal capability when understanding the effect of EO on firm performance.

Third, from a methodological perspective, most previous studies have focused only on the main effect of EO on performance [4,7,18]. Although some studies considered industrial or market environment as moderating variables [16], they failed to provide an adequate explanation of inconsistent outcomes of EO’s effect. Thus, in this study, we attempted to conduct a more comprehensive analysis by first analyzing the main effect of EO on performance and additionally analyzing the effect of a two-way interaction between environmental dynamics and the firm resource orchestration capability as well as the effect of a three-way interaction between EO, internal competence, and external environment (EO × resource orchestration capability × environmental dynamics). Thus, this study attempts to enhance our understanding of the key conditions that maximize the effect of EO on firm performance, ultimately leading to sustainability of a firm.

We believe that our research will extend the EO literature by enhancing the knowledge of how and in what conditions the positive effects of EO on firm performance was strengthened. In particular, discovering the relationship between EO and firm performance, along with a series of moderating roles of firm resource orchestration capability and environmental dynamics, can provide useful implications for organizations and managers who want to understand the conditions that promote firm performance through EO.

2. Theoretical Background and Hypotheses

2.1. Entrepreneurial Orientation and Firm Performance

EO can be defined as an organization’s orientation toward pursuing product and market innovation, taking risks, proactively responding to change, and beating competitors [3]. Therefore, researchers argue that EO provides an answer to the question of how to enter a new market while pursuing a new business within the scope of the firm’s business activities [2]. More specifically, EO consists of three important characteristics: Innovativeness, proactiveness, and risk-taking. These characteristics drive an entrepreneur to aggressively take risks and demonstrate proactive and innovative behaviors when making important decisions for a business [19]. Therefore, past studies have reported that EO is closely related to innovation and high performance. For instance, studies have reported that EO ultimately boosts firm performance by influencing new product development and innovation [12,20]. Other studies observed that EO enhances a firm’s competitiveness and eventually contributes to performance by driving the firm toward investing in important resources amid risks and uncertainty and pursuing innovation without fearing the loss in case of failure [4,21]. Thus, EO, which encompasses risk-taking, proactiveness, and innovation-seeking, enables a firm to foster an innovation- and change-driven climate in order to pioneer a new business or enter a new market and capture opportunities before competitors can. Moreover, we can infer that making bold decisions with aggressive risk-taking would positively influence firm performance through innovative product development and processes. We thus established the following hypothesis.

Hypothesis 1.

Entrepreneurial orientation is positively associated with firm performance.

2.2. Moderating Effects of Firm Resource Orchestration Capability

Recent studies have tried to examine the capability of firms to effectively utilize and orchestrate resources to effectively compete and generate profit by looking beyond the important resources that the firms possess [15,16,17,22,23]. These studies suggest that the essential elements required for achieving efficient resource orchestration capability include establishing a resource portfolio, bundling the resources to build capabilities, and leveraging those capabilities to continuously secure profits for stakeholders [23]. From this perspective, EO plays an important role in resource orchestration by establishing a corporate vision. This is because, by clearly envisioning the corporate goals that need to be accomplished, EO substantially contributes toward developing, establishing, allocating, and utilizing the resources necessary to achieve these goals [22].

Therefore, firms with higher resource orchestration capability are able to allocate and utilize resources more efficiently in the process of improving their performance through EO. Firms with resource orchestration capability further the effect of EO on firm performance. In particular, we assumed that such efficient resource orchestration capability would further strengthen the relationship between EO and firm performance by fostering a new capability of allocating and bundling the limited resources as efficiently as possible to generate value-oriented and productive outcome [15,16,17,24]. We thus established the following hypothesis.

Hypothesis 2.

The effect of entrepreneurial orientation on firm performance is stronger with a high level of firm resource orchestration capability.

2.3. Moderating Effects of Environmental Dynamics

High environmental dynamism refers to a high level of change in technological and market conditions [25,26,27,28]. In other words, as customer demands heavily fluctuate in the market, and since innovation and changes in the production technology for major products occur at a rapid pace, environmental dynamics becomes an important conditional variable when studying the relationship between EO and firm performance [29,30,31]. For example, the positive impact of EO on performance is predicted to be low among firms in industries with relatively low environmental dynamics. The reason being that since changes in customer demands and production-related technologies are minimal in stable environments with relatively little uncertainty, firms have low expectations regarding any benefits associated with developing a new market or a new technology, and so the environmental dynamics do not serve as effective inducements. In other words, in a market with low environmental dynamics, it may be more effective to spend directly on advertising to attract the attention of existing customers than seek to unduly push forward a new business project that is accompanied by risks to create new market opportunities or to develop a new technology [32]. Firms will attempt to increase their price competitiveness by innovating the process of an existing technology rather than taking a risk by making a large investment for developing a new technology [28,33].

However, the effect of EO on performance will increase in the case of high environmental dynamics. This may be due to two reasons: First, because higher environmental dynamics generate more market development opportunities and escalates the advantages of being the first mover in the market, the positive impact of EO on firm performance is bolstered [34,35]. Second, in markets with high environmental dynamics, firms profit from being the first mover on a technology or market even before acquiring a complete understanding of the necessary behaviors or performance, and thus, firms frequently seize the opportunity through risk-taking behaviors—an important characteristic of EO [36]. Therefore, we can assume that in markets with high environmental dynamics, firms with higher EO would have a higher potential in gaining a competitive advantage by capturing various market opportunities and developing new technology, thereby improving firm performance. Hence, we hypothesized the following.

Hypothesis 3.

The effect of entrepreneurial orientation on firm performance is stronger with a high level of environmental dynamics.

2.4. Three-Way Interaction Effect: The Firm Resource Orchestration Capability, Environmental Dynamics, Entrepreneurial Orientation

Based on the previous discussion on Hypotheses 2 and 3, we anticipated that the firm resource orchestration capability and environmental dynamics would simultaneously interact with EO and influence firm performance. As mentioned earlier in relation to the moderating effect of environmental dynamics, a corporate environment with high dynamism interacts with EO and thus escalates the perceived benefits of increased market development opportunities and expectations from the first-mover advantage through new technology development [35]. We hypothesized that this has a positive impact on firm performance. The positive effects of capturing new market opportunities and being the first mover on performance are doubled by efficiently allocating the limited resources and integrating existing resources with new ones when executing relevant projects and strategies. Therefore, we hypothesized that the firm resource orchestration capability and environmental dynamics mutually interact and influence firm performance, and that they interact with EO and further boost firm performance. Particularly, a combination of high environmental dynamics and high resource orchestration capability of the entrepreneur—which complement each other—mutually escalates the impact and, which, in turn, increases the positive effect on relevant corporate activities such as new technology development and resource bundling, thereby bolstering firm performance. In such conditions, firms will more aggressively take risks, pursue product and process innovation, and proactively pioneer new markets. In other words, it will further strengthen the process through which EO influences performance.

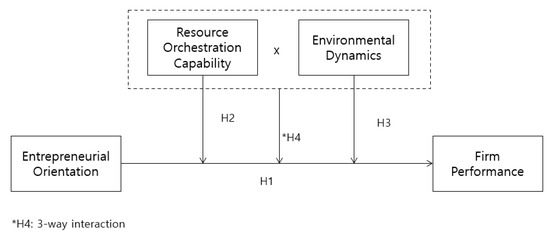

On the other hand, firms with low environmental dynamics and low resource orchestration capabilities anticipate fewer benefits from or are less attracted to new technologies or actively developing markets. Moreover, this attractiveness is further reduced due to low resource orchestration capabilities. Therefore, such firms are expected to promote a stable and efficient operation process and focus more on strategies to increase their share in the existing market as opposed to taking risks, proactively developing markets, or pursuing innovation activities [4,18]. That is, under the condition of low environmental dynamics and low resource orchestration capabilities, the process through which EO influences firm performance may be further weakened. Therefore, we established the following hypothesis pertaining to a three-way interaction effect that encompasses a firm’s internal competence (resource orchestration capability), external environment (environmental dynamics), and EO for a more detailed explanation that considers the dynamic interaction between external environmental conditions and a firm’s internal competence. This study’s conceptual model is illustrated in Figure 1, and we posited the following hypothesis.

Figure 1.

Hypothesized research model.

Hypothesis 4.

There is an interaction between entrepreneurial orientation and firm resource orchestration capability and environmental dynamics on firm performance, such that higher environmental dynamics strengthens the relationship between entrepreneurial orientation and firm resource orchestration capability on firm performance.

3. Methodology

3.1. Data Collection and Sample Characteristics

To conduct an empirical analysis, we collected our data from Korean manufacturing and service firms. Based on the report on the current status of SMEs by the Small and Medium Business Administration, Korean Venture Business Association Member DB, and data from Korea Listed Companies Association, we collected information about the CEOs, category of business, location, and websites of the firms. The first list of probable candidates was developed by utilizing the human network. We examined the overall management and activities of firms based on the collected data and discussed whether the firms were suitable for our study. During this process, we reviewed not only the general status of the firms but also the key details of their personnel as well as the organization, the category and form of business, and their previous financial performances. After selecting firms that met the criteria and after conducting preliminary phone and in-person interviews, the survey was administered via different methods, including in-person, mail, e-mail, and online survey systems, to firms that had responded positively.

We strived to increase the survey response rate by continuously explaining the purpose of the survey to the respective personnel and by requesting their cooperation over a period of two weeks. Where possible, we asked the CEOs of the firms to respond to the survey, however, if the CEO was unavailable, we requested senior managers who were well aware with regard to firm performance and management strategies to fill the questionnaire. A total of 500 questionnaires were distributed, and after excluding questionnaires with inadequate responses or with a central tendency, 301 questionnaires were included in the final analysis. The characteristics of the sample firms included in the analysis were as follows: 43.5% of the firms belonged to the manufacturing sector, while 56.5% of the firms were in the services and other sectors. Further, 29.6% of the firms had less than 100 employees, 9% of the firms had between 101–500 employees, 35.5% had 501–1000 employees, 23.9% had 1001–5000 employees, and only 2% of the firms had more than 5000 employees. The average age of the sample firms was 32.6 years, with 8% of the firms being under 10 years, 15.9% of the firms between 11–20 years, 70.4% between 21–50 years, and 5.7 % of the firms over 51 years old.

3.2. Measures

3.2.1. Entrepreneurial Orientation

Entrepreneurial Orientation was measured using the nine-item scale employed by Hult et al. [37] and Rhee et al. [38]. One of the sample items was: “Innovation is readily accepted in program/project management in our company. We have a strong proclivity for high-risk projects.” The response scale was measured using a seven-point Likert scale ranging from 1 = strongly disagree to 7 = strongly agree. Cronbach’s alpha was 0.91.

3.2.2. Firm Resource Orchestration Capability

The firm resource orchestration capability was measured using a five-item scale as used by previous studies [15,16,17]. The scale was further modified to suit the purpose of this study. The measurement items specifically included the scope, strength, and capability of the resource adjustment. A sample item included the following statement: “Over the past three years, our company has well acquired and introduced important resources and capabilities that contribute to improving competitiveness.” “Over the past three years, our company has been responding well to competitive environments by reassembling and integrating existing resources and new capabilities.” Responses were measured on a seven-point Likert scale where 1 = strongly disagree and 7 = strongly agree. Cronbach’s alpha was 0.91.

3.2.3. Environmental Dynamism

We employed the six-item scale used by Miller [39] and Wiklund and Shepherd [7] to measure environmental dynamism. Specifically, the measurement items included the speed of environmental change, the rate of emergence of new markets and technologies, and the degree of change in customers and market environments. Some sample items were as follows: “A large number of new product ideas have been made possible through technological breakthroughs” and “Customer needs and products demand rapid change.” The responses were measured on a seven-point Likert scale where 1 = strongly disagree and 7 = strongly agree. Cronbach’s alpha was 0.70.

3.2.4. Firm performance

Supervisors assessed subordinates’ innovative work behavior using the three-item scale adapted from Akgun et al. [40]. A sample item included the statement: “In comparison with your major competitors over the past three years, your company has more market share,” “In comparison with your major competitors over the past three years, your company has more growth rate.” The responses were measured using a seven-point Likert scale where 1 = strongly disagree and 7 = strongly agree, with a Cronbach’s alpha of 0.78.

3.2.5. Control Variables

In this research model, the size and age of the firms, which were assumed to affect the firms’ financial performance [41], were included as control variables. The size was defined as the number of its permanent employees, whereas age was defined as the total period it had remained operational until the present (as of 2018). Furthermore, the firm sectors were divided into manufacturing or service sectors and others.

3.3. Common Method Bias

As all the variables were collected by the same source, it could have resulted in the common method bias (CMB), leading to false internal consistency and potentially misleading results. Thus, to assess the effect of common method variance, we followed the recommendation by Podsakoff et al. [42] and conducted Harman’s single-factor test by loading all the items of the study constructs into an exploratory factor analysis. The results indicated that no single factor explained more than 33% of the covariance among the variables. Thus, it was concluded that CMB did not significantly alter the validity of the study results.

4. Results

4.1. Analysis Strategy

We tested the hypotheses using SPSS 21.0. We also carried out the Cronbach’s alpha test to examine internal reliability (Table 1). Furthermore, we conducted a confirmatory factor analysis (CFA) on the key variables to test the validity of four multi-item measures (Table 2) using AMOS 20.0. It was confirmed that the discriminant validity and internal reliability of the measured variables were suitable for further hypothesis testing. Finally, we conducted a hierarchical regression analysis to test our hypotheses. Specifically, control variables were entered in the first stage, and the main effect was tested in the second stage (the effect of entrepreneurial orientation on firm performance). In the third stage, the interaction terms of the moderators (entrepreneurial orientation × resource orchestration capability. Entrepreneurial orientation × environmental dynamics) were entered to test the two-way interaction effect. Lastly, in the fourth stage, the three-way interaction model was tested by analyzing the interaction terms, entrepreneurial orientation, the firm resource orchestration capability, and environmental dynamics. The moderating effect was tested by measuring the coefficient value and the amount of change in the R2 value at all stages. Additionally, the two-way interaction effect and the three-way interaction effect were graphically reconfirmed.

Table 1.

Means, standard deviations, correlations, and reliabilities.

Table 2.

Model fit statistics for the measurement model.

4.2. Correlation and Reliability Analyses

The descriptive statistics, reliability, and correlations are shown in Table 1. The research variables such as entrepreneurial orientation, the firm resource orchestration capability, environmental dynamics, and firm performance were related to each other (p < 0.001) and showed results that were consistent with the suggested study model. On analyzing the value of the variance inflation factor (VIF), the maximum VIF of the key variables was found to be 3.718. Hence, it was confirmed that there was no multicollinearity problem [43].

Before testing the research model, we conducted a confirmatory factor analysis to test the validity of the hypothesized four-factor model. As seen in Table 2, we compared the hypothesized model with the other three alternative models. As a further test, we ran a chi-square comparison test between the hypothesized model and the three alternative models. The test results confirmed that all the alternative models differed significantly from the hypothesized model and the model fit of the hypothesized model was better than other alternative models in all aspects. The model fit indices’ cut-off values were CFI and TLI > 0.90, χ2/df < 3, RMR and RMSEA < 0.1 [44,45].

4.3. Hypotheses Testing

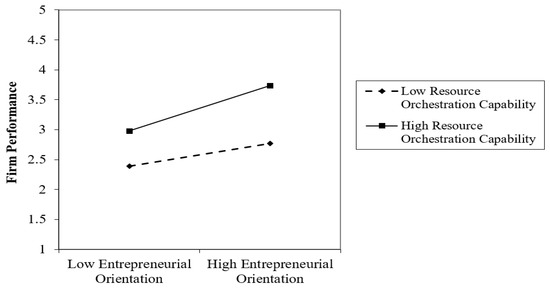

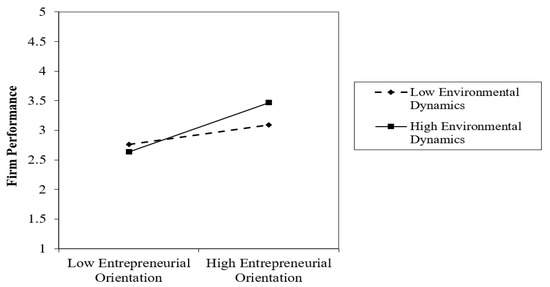

We used the hierarchical regression analysis to test the hypothesized relationships [7,46]. The results of the hierarchical regression analysis are shown in Table 3. Hypothesis 1 was that entrepreneurial orientation has a positive effect on firm performance. In Model 2, entrepreneurial orientation was found to be positively related to firm performance (β = 0.672, p < 0.001), supporting Hypothesis 1. As shown in Model 4, the interaction term of entrepreneurial orientation and the firm resource orchestration capability was positively related to firm performance (β = 0.121, p < 0.05). Moreover, the interaction term of entrepreneurial orientation and environmental dynamics had a statistically significant effect on firm performance (β = 0.161, p < 0.05).

Table 3.

Summary of regression analysis results.

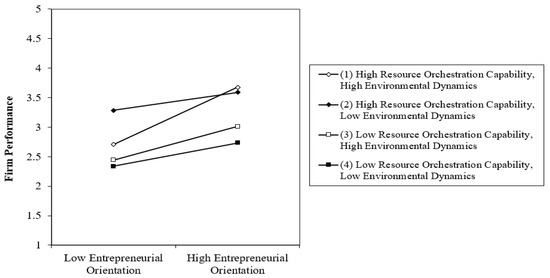

As shown in Figure 2 and Figure 3, when the firm resource orchestration capability and environmental dynamics are high, the positive relationship between entrepreneurial orientation and firm performance is stronger. Thus, Hypotheses 2 and 3 were supported. In order to test Hypothesis 4, we studied the three-way interaction of entrepreneurial orientation, the firm resource orchestration capability, and environmental dynamics for predicting firm performance in the last step of the moderated hierarchical regression model. Here, with β = 0.186 (p < 0.01), we found a significant positive effect in predicting firm performance. As shown in Figure 4, when both the firm resource orchestration capability and environmental dynamics are high, the positive relationship between entrepreneurial orientation and firm performance is stronger than when they are low. Thus, Hypothesis 4 was supported.

Figure 2.

Moderating effect of the firm resource orchestration capability on the relationship between entrepreneurial orientation and firm performance.

Figure 3.

Moderating effect of environmental dynamics on the relationship between entrepreneurial orientation and firm performance.

Figure 4.

Three-way interaction effect of entrepreneurial orientation, the firm resource orchestration capability, and environmental dynamics on firm performance.

5. Discussion

This study aimed to investigate the interaction effect of the firm resource orchestration capability and environmental dynamics on the relationship between EO and firm performance. Past studies on organization and strategic management have suggested that EO is positively associated with firm performance [5,6,7]. However, in the present study, we sought to identify the specific conditions or circumstances in which the positive effect of EO on firm performance can be maximized. The findings indicated that both the firm resource orchestration capability and environmental dynamics are moderating variables that strengthen the relationship between EO and firm performance. Furthermore, in our analysis using the three-way interaction model, firm performance was found to be significantly enhanced when both the firm resource orchestration capability and environmental dynamics were high. At the same time, the positive association between EO and firm performance was weakened when both the firm resource orchestration capability and environmental dynamics were low.

5.1. Theoretical Implications

Based on the findings of our empirical analysis, we derived the following theoretical and practical implications: First, studies on EO have generally focused on examining the direct effect of EO on firm performance [5,7]. Thus, in the present study, we focused on the possibility that the effect of EO on firm performance may vary depending on the complex external environment and the internal organizational capability and on how such contingency factors can be used to create new business opportunities. According to our findings, the positive impact of EO on firm performance is strengthened when firms are exposed to high economic dynamics. In such an environment, firms strive to reap the market pioneer advantage by capturing more market development opportunities and by developing new technologies. Therefore, this study reconfirmed the importance of external environment encompassing the contingency model in enhancing the effect of EO on performance.

Second, this study sheds light on the fact that the dynamics of a firm’s external environment are deeply related to its internal competence to actively utilize their environmental change as an opportunity for further growth—an aspect that has been partially discussed in previous studies [15,16]. This suggests that the variations in performance across firms in the same market and industrial environment are related to the firms’ internal capabilities in utilizing resources. However, prior studies on the relationship between EO and performance have overlooked the importance of internal competence as a boundary variable. To overcome this limitation, we expanded on the previous studies by taking the firm resource orchestration capability into consideration in our analysis.

Finally, strategic management studies that explained the effect of EO in a more dynamic context of firms have been limited, as most studies focused only on the direct effect of EO on firm performance [2,3,18,21]. Moreover, few studies have investigated the conditional factors that affect the EO’s effect [47,48,49]. Thus, in the present study, we generated a comprehensive explanation by focusing on the contingency theory wherein we analyzed the two-way interaction effect (resource orchestration capability × environmental dynamics) as well as the three-way interaction effect (EO × resource orchestration capability × environmental dynamics) in addition to examining the main effect of EO. Therefore, we could provide a methodological implication for more thoroughly describing the effects of EO, the previous study findings on which have been largely mixed.

5.2. Practical Implications

In addition, this study also presented the following practical implications. First, we observed that EO is important in improving firm performance. Thus, to foster a climate that can improve EO within the organization, CEOs should provide better job training to senior managers and establish organizational support systems for promoting entrepreneurship. Second, considering that the firm resource orchestration capability is crucial to maximizing the effect of EO, firms need to be aware that innovatively bundling and orchestrating their existing resources along with the newly introduced resources and capabilities is as important as securing new resources when pursuing a new business opportunity or pioneering a market if they want to efficiently enforce their strategies. Further, to promote entrepreneurship, it is also important to secure human resources with relevant professional knowledge and develop supportive programs [50] besides cultivating organizational capability to integrate and innovatively reorganize new and existing organizational resources and competences. Therefore, organizations should conduct educational programs and provide support to the managers to foster resource orchestration capability in them.

However, despite its theoretical and practical contributions, this study does have a few limitations. First, as all the variables used in the analysis were collected from a self-reported questionnaire administered at the same time to the same source, it may lead to a common method bias and result in inflated relationships because of single-source effects. Thus, researchers are encouraged to collect data from various sources with time-lag approach for future studies. Second, as this was a cross-sectional study, we could not make causal inferences on the relationship between EO and firm performance. We assumed that EO enhances firm performance, however, it is possible that the effect of EO on firm performance may change over time. Future studies should include longitudinal research to investigate the causality between EO and firm performance. Third, by using a sample that consisted only of Korean firms with limited sector, we are cautious about generalizing the findings to other sectors and firms in different countries. Future research may replicate our findings with different samples and across different country contexts. Finally, we included two moderators in the relationship between EO and firm performance and found that the firm resource orchestration capability and environmental dynamics were crucial for maximizing the effect of EO. However, future research needs to identify other important moderators and mediators that can help firms in innovatively bundling and orchestrating their existing resources with newly introduced resources in the course of pursuing a new business opportunity or pioneering a market to efficiently enforce their EO strategies.

6. Conclusions

This study investigated the important situational factors that maximize the effect of EO on firm performance. Based on our empirical analysis of data collected from 301 manufacturing and service firms in Korea, we found that both the firm resource orchestration capability and environmental dynamics played positive moderating roles in enhancing the effect of EO. In addition, this study also highlighted the importance of interaction between the three factors—EO, the firm resource orchestration capability and environmental dynamics—for enhancing firm performance. Thus, this study has contributed to uncovering the factors that can maximize the effect of EO on firm performance. Despite its limitations, our research on substantial moderators provides useful insights for firms that wish to enhance the effectiveness of entrepreneurship and the key conditions which drive sustainable growth of a firm.

Author Contributions

S.B.C. was the principal researcher and prepared the first draft of the article. W.R.L. participated in collecting the data and statistical analysis of the study S.-W.K. refined the draft into a publishable article and added valuable theoretical and methodological insights based on his knowledge and expertise regarding the topic. All authors have read and agreed to the published version of the manuscript.

Funding

This research received funding from the National Research Foundation of Korea.

Acknowledgments

This work was supported by the Ministry of Education of the Republic of Korea and the National Research Foundation of Korea (NRF-2017S1A5A2A02068449).

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Avlonitis, G.J.; Salavou, H.E. Entrepreneurial orientation of SMEs, product innovativeness, and performance. J. Bus. Res. 2007, 60, 566–575. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the entrepreneurial orientation construct and linking it to performance. Acad. Manag. Rev. 1996, 21, 135–172. [Google Scholar] [CrossRef]

- Miller, D. The correlates of entrepreneurship in three types of firms. Manag. Sci. 1983, 29, 770–791. [Google Scholar] [CrossRef]

- Wales, W.J. Entrepreneurial orientation: A review and synthesis of promising research directions. Int. Small Bus. J. 2016, 34, 3–15. [Google Scholar] [CrossRef]

- Lee, C.; Lee, K.; Pennings, J.M. Internal capabilities, external networks, and performance: A study on technology-based ventures. Strateg. Manag. J. 2001, 22, 615–640. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. J. Bus. Ventur. 2001, 16, 429–451. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D. Entrepreneurial orientation and small business performance: A configurational approach. J. Bus. Ventur. 2005, 20, 71–91. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. Strategic management of small firms in hostile and benign environments. Strateg. Manag. J. 1989, 10, 75–87. [Google Scholar] [CrossRef]

- Nwokah, N.G. Strategic market orientation and business performance. Eur. J. Mark. 2008, 42, 279–286. [Google Scholar] [CrossRef]

- Bhuian, S.N. Exploring market orientation in banks: An empirical examination in Saudi Arabia. J. Serv. Mark. 1997, 11, 317–328. [Google Scholar] [CrossRef]

- Sandvik, I.L.; Sandvik, K. The impact of market orientation on product innovativeness and business performance. Int. J. Res. Mark. 2003, 20, 355–376. [Google Scholar] [CrossRef]

- Li, Y.; Liu, Y.; Zhao, Y. The role of market and entrepreneurship orientation and internal control in the new product development activities of Chinese firms. Ind. Mark. Manag. 2006, 35, 336–347. [Google Scholar] [CrossRef]

- Choi, S.B.; Williams, C. Entrepreneurial orientation and performance: Mediating effects of technology and marketing action across industry types. Ind. Innov. 2016, 23, 673–693. [Google Scholar] [CrossRef]

- Rauch, A.; Wiklund, J.; Lumpkin, G.T.; Frese, M. Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future. Entrep. Theory Pract. 2009, 33, 761–787. [Google Scholar] [CrossRef]

- Chadwick, C.; Super, J.F.; Kwon, K. Resource orchestration in practice: CEO emphasis on SHRM, commitment-based HR systems, and firm performance. Strateg. Manag. J. 2015, 36, 360–376. [Google Scholar] [CrossRef]

- Wales, W.J.; Gupta, V.K.; Mousa, F.T. Empirical research on entrepreneurial orientation: An assessment and suggestions for future research. Int. Small Bus. J. 2013, 31, 357–383. [Google Scholar] [CrossRef]

- Wright, M.; Clarysse, B.; Mosey, S. Strategic entrepreneurship, resource orchestration and growing spin-offs from universities. Technol. Anal. Strateg. Manag. 2012, 24, 911–927. [Google Scholar] [CrossRef]

- McGee, J.E.; Peterson, M. The long-term impact of entrepreneurial self-efficacy and entrepreneurial orientation on venture performance. J. Small Bus. Manag. 2019, 57, 720–737. [Google Scholar] [CrossRef]

- Morris, M.H.; Paul, G.W. The relationship between entrepreneurship and marketing in established firms. J. Bus. Ventur. 1987, 2, 247–259. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Yang, Z.; Zhou, N. Developing strategic orientation in China: Antecedents and consequences of market and innovation orientations. J. Bus. Res. 2005, 58, 1049–1058. [Google Scholar] [CrossRef]

- Keh, H.T.; Nguyen, T.T.M.; Ng, H.P. The effects of entrepreneurial orientation and marketing information on the performance of SMEs. J. Bus. Ventur. 2007, 22, 592–611. [Google Scholar] [CrossRef]

- Chirico, F.; Sirmon, D.G.; Sciascia, S.; Mazzola, P. Resource orchestration in family firms: Investigating how entrepreneurial orientation, generational involvement, and participative strategy affect performance. Strateg. Entrep. J. 2011, 5, 307–326. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D. Managing firm resources in dynamic environments to create value: Looking inside the black box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef]

- Grant, R.M. The resource-based theory of competitive advantage: Implications for strategy formulation. Calif. Manag. Rev. 1991, 33, 114–135. [Google Scholar] [CrossRef]

- Augusto, M.; Coelho, F. Market orientation and new-to-the-world products: Exploring the moderating effects of innovativeness, competitive strength, and environmental forces. Ind. Mark. Manag. 2009, 38, 94–108. [Google Scholar] [CrossRef]

- Dean, T.J.; Meyer, G.D. Industry environments and new venture formations in US manufacturing: A conceptual and empirical analysis of demand determinants. J. Bus. Ventur. 1996, 11, 107–132. [Google Scholar] [CrossRef]

- Mu, J.; Di Benedetto, C.A. Strategic orientations and new product commercialization: Mediator, moderator, and interplay. RD Manag. 2011, 41, 337–359. [Google Scholar] [CrossRef]

- Slater, S.F.; Narver, J.C. Does competitive environment moderate the market orientation-performance relationship? J. Mark. 1994, 58, 46–55. [Google Scholar] [CrossRef]

- Kreiser, P.M.; Marino, L.D.; Weaver, K.M. Reassessing the environment-EO link: The impact of environmental hostility on the dimensions of entrepreneurial orientation. In Academy of Management Proceedings; Academy of Management: Briarcliff Manor, NY, USA, 2002; Volume 2002, pp. G1–G6. [Google Scholar]

- Kuratko, D.F.; Morris, M.H.; Schindehutte, M. Understanding the dynamics of entrepreneurship through framework approaches. Small Bus. Econ. 2015, 45, 1–13. [Google Scholar] [CrossRef]

- Suarez, F.F.; Lanzolla, G. The role of environmental dynamics in building a first mover advantage theory. Acad. Manag. Rev. 2007, 32, 377–392. [Google Scholar] [CrossRef]

- Carroll, G.R.; Swaminathan, A. Why the microbrewery movement? Organizational dynamics of resource partitioning in the US brewing industry. Am. J. Sociol. 2000, 106, 715–762. [Google Scholar] [CrossRef]

- Gao, G.Y.; Zhou, K.Z.; Yim, C.K.B. On what should firms focus in transitional economies? A study of the contingent value of strategic orientations in China. Int. J. Res. Mark. 2007, 24, 3–15. [Google Scholar] [CrossRef]

- Han, J.K.; Kim, N.; Srivastava, R.K. Market orientation and organizational performance: Is innovation a missing link? J. Mark. 1998, 62, 30–45. [Google Scholar] [CrossRef]

- Santos-Vijande, M.L.; Álvarez-González, L.I. Innovativeness and organizational innovation in total quality oriented firms: The moderating role of market turbulence. Technovation 2007, 27, 514–532. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P.H. Innovation in conservative and entrepreneurial firms: Two models of strategic momentum. Strateg. Manag. J. 1982, 3, 1–25. [Google Scholar] [CrossRef]

- Hult, G.T.M.; Hurley, R.F.; Knight, G.A. Innovativeness: Its antecedents and impact on business performance. Ind. Mark. Manag. 2004, 33, 429–438. [Google Scholar] [CrossRef]

- Rhee, J.; Park, T.; Lee, D.H. Drivers of innovativeness and performance for innovative SMEs in South Korea: Mediation of learning orientation. Technovation 2010, 30, 65–75. [Google Scholar] [CrossRef]

- Miller, D. The structural and environmental correlates of business strategy. Strateg. Manag. J. 1987, 8, 55–76. [Google Scholar] [CrossRef]

- Akgün, A.E.; Keskin, H.; Byrne, J.C.; Aren, S. Emotional and learning capability and their impact on product innovativeness and firm performance. Technovation 2007, 27, 501–513. [Google Scholar] [CrossRef]

- Youndt, M.A.; Snell, S.A. Human resource configurations, intellectual capital, and organizational performance. J. Manag. Issues 2004, 16, 337–360. [Google Scholar]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Hocking, R.R.; Pendleton, O.J. The regression dilemma. Commun. Stat. Theory Methods 1983, 12, 497–527. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practice of Structural Equation Modeling; Guilford Press: New York, NY, USA, 2005. [Google Scholar]

- Steiger, J.H. Structural model evaluation and modification: An interval estimation approach. Multivar. Behav. Res. 1990, 25, 173–180. [Google Scholar] [CrossRef]

- Hoch, J.E.; Pearce, C.L.; Welzel, L. Is the most effective team leadership shared? J. Pers. Psychol. 2010, 9, 105–116. [Google Scholar] [CrossRef]

- Arunachalam, S.; Ramaswami, S.N.; Herrmann, P.; Walker, D. Innovation pathway to profitability: The role of entrepreneurial orientation and marketing capabilities. J. Acad. Mark. Sci. 2018, 46, 744–766. [Google Scholar] [CrossRef]

- Li, Y.H.; Huang, J.W.; Tsai, M.T. Entrepreneurial orientation and firm performance: The role of knowledge creation process. Ind. Mark. Manag. 2009, 38, 440–449. [Google Scholar] [CrossRef]

- Scuotto, V.; Del Giudice, M.; Garcia-Perez, A.; Orlando, B.; Ciampi, F. A spill over effect of entrepreneurial orientation on technological innovativeness: An outlook of universities and research based spin offs. J. Technol. Transf. 2019, 1–21. [Google Scholar] [CrossRef]

- Jo, S.J. History of Business and Management; Hankyung Book Publishing: Seoul, Korea, 2019. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).