Industry Performance Appraisal Using Improved MCDM for Next Generation of Taiwan

Abstract

1. Introduction

2. Taiwanese Manufacturing Industry Landscape

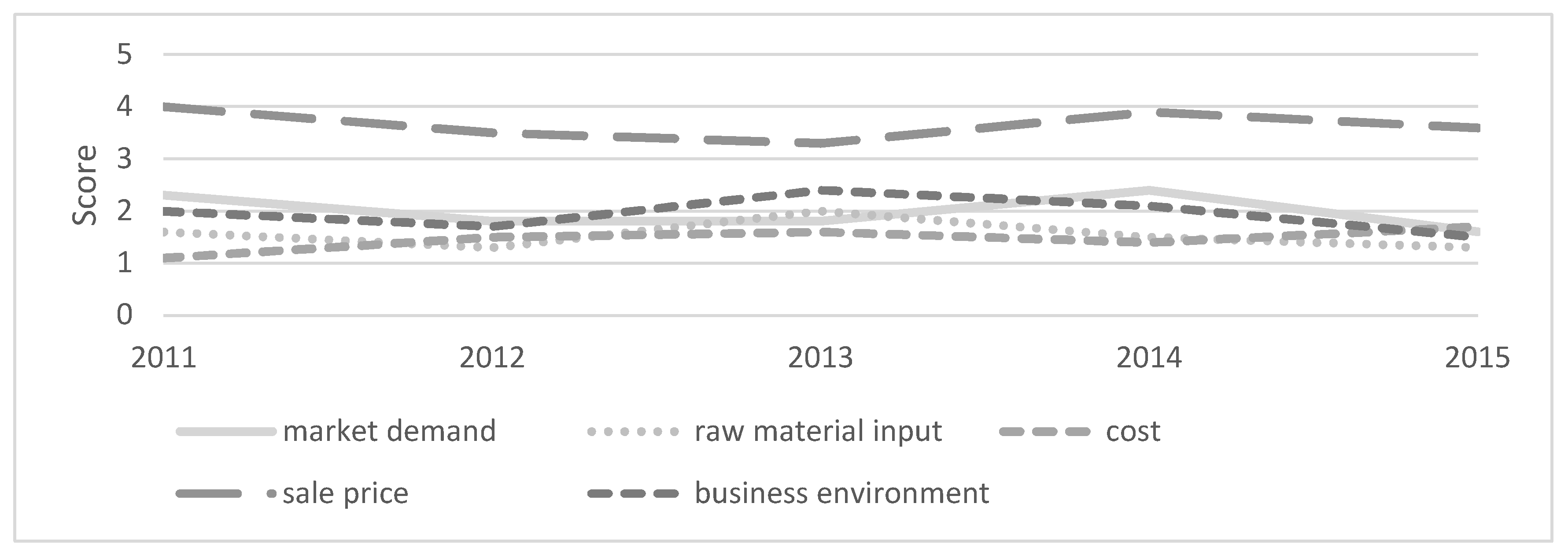

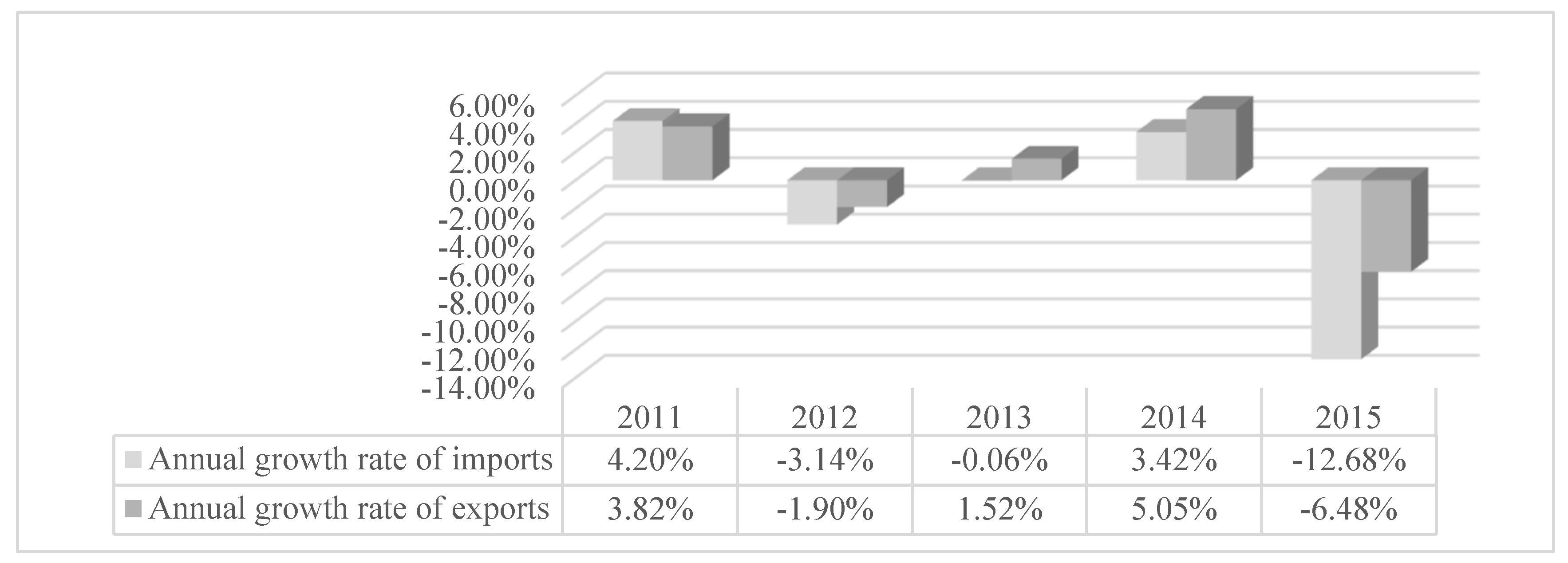

2.1. Major Indicators in Taiwan Manufacturing

2.2. Development Trends of 12 Industries in Taiwan

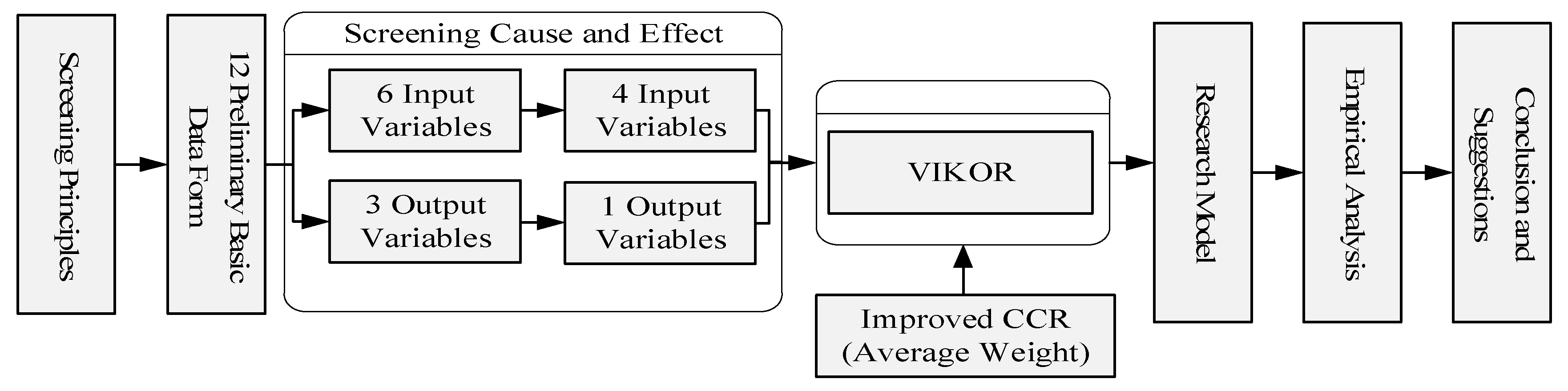

3. Methodology

3.1. Data Envelopment Analysis (DEA)

3.2. Defining Assessment Variables

3.3. VIKOR Method

4. Results and Discussion

4.1. Data Processing

4.2. CCR Efficiency Model Analysis

4.3. CCR and BCC Efficiency Model Analysis

4.4. RTS Analysis

4.5. A&P Analysis of Efficiency and Cross-Efficiency Mode and Judgment of Outliers

4.6. Correlation Analysis of Various Efficiency Models

4.7. Discussion

- The industry is suggested to use design innovation to move towards higher value of its own brands, such as: Footwear, Furniture, Bicycle and Parts, Paper and Paper Products, Wood and of Products of Wood and Bamboo.

- Taiwan’s industrial chain strengthens the cooperation of upstream, midstream, and downstream through digital integration, for example: Tires and Manufacture of Industrial Rubber Products, Bicycles and Parts, Machine Tool (Metal Cutting Types), Fabricated Metal Products, Woven Fabrics of Man-made Fibers, Plastics Products, Parts for Motor Vehicles, Drugs and Medicines.

- The government assists in the introduction of AI (Artificial Intelligence) to improve the quality and competitiveness of the manufacturing industry, such as Footwear, Tires and Manufacture of Industrial Rubber Products, Furniture, Machine Tool (Metal Cutting Types), Paper and Paper Products, Fabricated Metal Products, Woven Fabrics of Man-made Fibers, Plastics Products, Parts for Motor Vehicles, Drugs and Medicines.

4.8. Reseach Limitation and Future Research

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Giffi, C.A.; Rodriguez, M.D.; Gangula, B.; Roth, A.V.; Roth, A.V. Global Manufacturing Competitiveness Index; Deloitte Touche Tohmatsu Limited (DTTL) Global Consumer & Industrial Products Industry Group and the Council on Competitiveness: London, UK, 2016. [Google Scholar]

- Kao, C.; Liu, S.-T. Measuring performance improvement of Taiwanese commercial banks under uncertainty. Eur. J. Oper. Res. 2014, 235, 755–764. [Google Scholar] [CrossRef]

- Chen, S.-L.; Liang, H.-A. Cause mapping of simple and complex marketing strategies. J. Bus. Res. 2014, 67, 2867–2876. [Google Scholar] [CrossRef]

- Sun, Y. Locational Movement of PC Manufacturing Firms in East Asia. In Locational Analysis of Firms’ Activities from a Strategic Perspective; Springer: Berlin/Heidelberg, Germany, 2018; pp. 53–73. [Google Scholar]

- Lii, P.; Kuo, F.-I. Innovation-oriented supply chain integration for combined competitiveness and firm performance. Int. J. Prod. Econ. 2016, 174, 142–155. [Google Scholar] [CrossRef]

- Hsueh, C.-C.; Chen, D.-Z. A taxonomy of patent strategies in Taiwan’s small and medium innovative enterprises. Technol. Forecast. Soc. Chang. 2015, 92, 84–98. [Google Scholar] [CrossRef]

- Chen, C.T.; Pai, P.F.; Hung, W.Z. Applying linguistic VIKOR and knowledge map in personnel selection. Asia Pac. Manag. Rev. 2011, 16, 491–502. [Google Scholar] [CrossRef]

- Chen, Y.-M.; Su, Y.-F.; Lin, F.-J. Country-of-origin effects and antecedents of industrial brand equity. J. Bus. Res. 2011, 64, 1234–1238. [Google Scholar] [CrossRef]

- Chen, Y.-M. The continuing debate on firm performance: A multilevel approach to the IT sectors of Taiwan and South Korea. J. Bus. Res. 2010, 63, 471–478. [Google Scholar] [CrossRef]

- Kao, Y.S.; Nawata, K.; Huang, C.Y. Systemic functions evaluation based technological innovation system for the sustainability of IoT in the manufacturing industry. Sustainability 2019, 11, 2342. [Google Scholar] [CrossRef]

- Johnson, J.H.; Arya, B.; Mirchandani, D.A. Global integration strategies of small and medium multinationals: Evidence from Taiwan. J. World Bus. 2013, 48, 47–57. [Google Scholar] [CrossRef]

- Wu, D.D.; Zhang, Y.; Wu, D.; Olson, D.L. Fuzzy multi-objective programming for supplier selection and risk modeling: A possibility approach. Eur. J. Oper. Res. 2010, 200, 774–787. [Google Scholar] [CrossRef]

- Lin, W.-T. FDI decisions and business-group insider control: Evidence from Taiwanese group-affiliated firms investing in the Chinese market. J. World Bus. 2016, 51, 525–533. [Google Scholar] [CrossRef]

- Hung, S.-W.; Lu, W.-M.; Wang, T.-P. Benchmarking the operating efficiency of Asia container ports. Eur. J. Oper. Res. 2010, 203, 706–713. [Google Scholar] [CrossRef]

- Wiboonchutikula, P.; Phucharoen, C.; Pruektanakul, N. Spillover Effects of Foreign Direct Investment on Domestic Manufacturing Firms in Thailand. Singap. Econ. Rev. 2016, 61, 1640028. [Google Scholar] [CrossRef]

- Emodi, N.V.; Murthy, G.P.; Emodi, C.C.; Emodi, A.S.A. Factors Influencing Innovation and Industrial Performance in Chinese Manufacturing Industry. Int. J. Innov. Technol. Manag. 2017, 14, 1750040. [Google Scholar] [CrossRef]

- Development, C.F.E.P.A.; Executive Yuan, R.O.C.T. Economic Development, R.O.C. (Taiwan) 2016. Available online: https://www.ndc.gov.tw/en/ (accessed on 3 May 2016).

- Tzeng, Z.-C. The Big Dilemma of Taiwan’s Industrial Development Is the Rise of Industrial Enterprises Outside the Industry 2017, National Policy Foundation. Available online: https://www.npf.org.tw/3/17548 (accessed on 20 October 2017).

- Drobyazko, S.; Okulich-Kazarin, V.; Rogovyi, A.; Marova, S. Factors of influence on the sustainable development in the strategy management of corporations. Acad. Strateg. Manag. J. 2019, 18, 1–5. [Google Scholar]

- Chang, A.Y.; Cheng, Y.T. Analysis model of the sustainability development of manufacturing small and medium-sized enterprises in Taiwan. J. Clean. Prod. 2019, 207, 458–473. [Google Scholar] [CrossRef]

- Yang, J.; Chen, M.L.; Fu, C.Y.; Chen, X.D. Environmental policy, tax, and the target of sustainable development. Environ. Sci. Pollut. Res. 2019, 2019, 1–10. [Google Scholar] [CrossRef]

- Feng, D.; Chen, Q.; Song, M.; Cui, L. Relationship between the degree of internationalization and performance in manufacturing enterprises of the Yangtze river delta region. Emerg. Mark. Financ. Trade 2019, 55, 1455–1471. [Google Scholar] [CrossRef]

- Li, G.; Shi, X.; Yang, Y.; Lee, P.K. Green Co-Creation Strategies among Supply Chain Partners: A Value Co-Creation Perspective. Sustainability 2020, 12, 4305. [Google Scholar] [CrossRef]

- Singh, L. Competitiveness, skill formation and industrialization: The South Asian experience. In Manufacturing and Jobs in South Asia; Springer: Singapore, 2019; pp. 213–227. [Google Scholar]

- Lee, Z.Y.; Chu, M.T.; Chen, S.S.; Tsai, C.H. Identifying Comprehensive Key Criteria of Sustainable Development for Traditional Manufacturing in Taiwan. Sustainability 2018, 10, 3275. [Google Scholar] [CrossRef]

- Doyle, J.; Green, R. Efficiency and Cross-Efficiency in DEA: Derivations, Meanings and Uses. J. Oper. Res. Soc. 1994, 45, 567–578. [Google Scholar] [CrossRef]

- Peng, M.; Song, L.; Guohui, L.; Sen, L.; Heping, Z. Evaluation of Fire Protection Performance of Eight Countries Based on Fire Statistics: An Application of Data Envelopment Analysis. Fire Technol. 2012, 50, 349–361. [Google Scholar] [CrossRef]

- Ruggiero, J. Measuring the Cost of Meeting Minimum Educational Standards: An Application of Data Envelopment Analysis. Educ. Econ. 2007, 15, 1–13. [Google Scholar] [CrossRef]

- Sexton, T.R.; Silkman, R.H.; Hogan, A.J. Data envelopment analysis: Critique and extensions. New Dir. Program Eval. 1986, 32, 73–105. [Google Scholar] [CrossRef]

- Sun, L.; Rong, J.; Yao, L. Measuring Transfer Efficiency of Urban Public Transportation Terminals by Data Envelopment Analysis. J. Urban Plan. Dev. 2010, 136, 314–319. [Google Scholar] [CrossRef]

- Opricovic, S.; Tzeng, G.-H. Compromise solution by MCDM methods: A comparative analysis of VIKOR and TOPSIS. Eur. J. Oper. Res. 2004, 156, 445–455. [Google Scholar] [CrossRef]

- Wang, S.C.; Chen, M.K. The use of a hybrid ANP-VIKOR approach for establishing the performance evaluation model of e-business project. Afr. J. Bus. Manag. 2014, 8, 242–252. [Google Scholar] [CrossRef][Green Version]

- Nisel, S. An Extended VIKOR Method for Ranking Online Graduate Business Programs. Int. J. Inf. Educ. Technol. 2014, 4, 103–107. [Google Scholar] [CrossRef]

- Department of Statistics, M.O.E.A. Industrial Production Statistics 2016. Available online: https://www.moea.gov.tw/MNS/dos_e/home/Home.aspx (accessed on 31 January 2016).

- Le Nguyen, H.; Larimo, J.; Wang, Y. Control, innovation and international joint venture performance: The moderating role of internal and external environments. Int. Bus. Rev. 2019, 28, 101591. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Görener, A. Evaluation of product development partners using an integrated AHP-VIKOR model. Kybernetes 2015, 44, 220–237. [Google Scholar] [CrossRef]

- de Carvalho Miranda, R.; Montevechi, J.A.B.; da Silva, A.F.; Marins, F.A.S. Increasing the efficiency in integer simulation optimization: Reducing the search space through data envelopment analysis and orthogonal arrays. Eur. J. Oper. Res. 2017, 262, 673–681. [Google Scholar] [CrossRef]

- Shah, A.A.; Wu, D.; Korotkov, V. Are sustainable banks efficient and productive? A data envelopment analysis and the Malmquist productivity index analysis. Sustainability 2019, 11, 2398. [Google Scholar] [CrossRef]

- Barnum, D.T.; Walton, S.M.; Shields, K.L.; Schumock, G.T. Measuring hospital efficiency with Data Envelopment Analysis: Nonsubstitutable vs. substitutable inputs and outputs. J. Med. Syst. 2011, 35, 1393–1401. [Google Scholar] [CrossRef] [PubMed]

- Flokou, A.; Kontodimopoulos, N.; Niakas, D. Employing post-DEA cross-evaluation and cluster analysis in a sample of Greek NHS hospitals. J. Med. Syst. 2011, 35, 1001–1014. [Google Scholar] [CrossRef] [PubMed]

- Sanjuan, N.; Ribal, J.; Clemente, G.; Fenollosa, M.L. Measuring and Improving Eco-efficiency Using Data Envelopment Analysis. J. Ind. Ecol. 2011, 15, 614–628. [Google Scholar] [CrossRef]

- Schumock, G.T.; Shields, K.L.; Walton, S.M.; Barnum, D.T. Data envelopment analysis: A method for comparing hospital pharmacy productivity. Am. J. Health Syst. Pharm. 2009, 66, 1660–1665. [Google Scholar] [CrossRef] [PubMed]

- Andersen, P.; Petersen, N.C. A Procedure for Ranking Efficient Units in Data Envelopment Analysis. Manag. Sci. 1933, 39, 1261–1264. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Kuosmanen, T.; Kortelainen, M. Measuring Eco-efficiency of Production with Data Envelopment Analysis. J. Ind. Ecol. 2005, 9, 59–72. [Google Scholar] [CrossRef]

- Lee, Z.-Y.; Pai, C.-C. Applying Improved DEA & VIKOR Methods to Evaluate the Operation Performance for World’s Major TFT–LCD Manufacturers. Asia-Pac. J. Oper. Res. 2015, 32, 1550020. [Google Scholar] [CrossRef]

- Nold Hughes, P.A.; Edwards, M.E. Leviathan vs. Lilliputian: A Data Envelopment Analysis of Government Efficiency. J. Reg. Sci. 2000, 40, 649–669. [Google Scholar] [CrossRef]

- Zaim, S.; Bayyurt, N.; Turkyilmaz, A.; Solakoglu, N.; Zaim, H. Measuring and Evaluating Efficiency of Hospitals Through Total Quality Management. J. Transnatl. Manag. 2008, 12, 77–97. [Google Scholar] [CrossRef]

- Zhou, Z.; Wu, J. Applying a Peer-Restricted Cross-Efficiency Approach to Measuring the Performance of International Tourist Hotels in Taipei. J. Hosp. Mark. Manag. 2014, 23, 157–177. [Google Scholar] [CrossRef]

- Afsharian, M.; Ahn, H.; Thanassoulis, E. A DEA-based incentives system for centrally managed multi-unit organisations. Eur. J. Oper. Res. 2017, 259, 587–598. [Google Scholar] [CrossRef]

- Wu, J.; Chu, J.; Sun, J.; Zhu, Q.; Liang, L. Extended secondary goal models for weights selection in DEA cross-efficiency evaluation. Comput. Ind. Eng. 2016, 93, 143–151. [Google Scholar] [CrossRef]

- Chen, C.-J. Research and Application of Design Innovation in Central Taiwan. 2016. Retrieved from Unpublished. [Google Scholar]

- Opricovic, S. Multicriteria optimization of civil engineering systems. Fac. Civ. Eng. Belgrade 1998, 2, 5–21. [Google Scholar]

- Opricovic, S.; Tzeng, G.-H. Extended VIKOR method in comparison with outranking methods. Eur. J. Oper. Res. 2007, 178, 514–529. [Google Scholar] [CrossRef]

- Ali, A.I.; Lerme, C.S.; Seiford, L.M. Components of efficiency evaluation in data envelopment analysis. Eur. J. Oper. Res. 1995, 80, 462–473. [Google Scholar] [CrossRef]

- Golany, B.; Roll, Y. An application procedure for DEA. Omega 1989, 17, 237–250. [Google Scholar] [CrossRef]

- Mahdiloo, M.; Noorizadeh, A.; FarzipoorSaen, R. Optimal direct mailing modelling based on data envelopment analysis. Expert Syst. 2014, 31, 101–109. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

| Manufacturing Industry | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|

| Footwear | −18.58% | −5.86% | −19.45% | 3.31% | −55.11% |

| Tires and Manufacture of Industrial Rubber Products | 25.20% | −7.52% | −4.08% | 7.31% | −6.23% |

| Furniture | 2.46% | 8.20% | 0.54% | 7.36% | 0.67% |

| Bicycles and Parts | 6.79% | 9.62% | -5.53% | 4.35% | 10.33% |

| Machine Tool (Metal Cutting Types) | 26.90% | −6.12% | −13.20% | 9.76% | −8.04% |

| Paper and Paper Products | 1.52% | −4.44% | −2.15% | 2.06% | −3.42% |

| Fabricated Metal Products | 13.57% | −4.32% | −5.33% | 5.24% | −8.04% |

| Woven Fabrics of Man-made Fibers | 5.21% | −7.25% | −0.30% | 2.89% | −1.20% |

| Wood and Products of Wood and Bamboo | 6.42% | 2.74% | 2.16% | 6.80% | −4.79% |

| Plastics Products | 3.37% | −0.50% | −0.85% | 2.73% | −3.43% |

| Parts for Motor Vehicles | 5.44% | 1.43% | −1.12% | 6.99% | 0.59% |

| Drugs and Medicines | −8.42% | 2.91% | 0.64% | 0.41% | 3.74% |

| DMU of Peer Appraisal/DMU | 1 | 2 | … | n |

|---|---|---|---|---|

| 1 | E11 | E12 | E1n | |

| 2 | E21 | E22 | E2n | |

| n | En1 | En2 | Enn | |

| The cross-efficiency value of peer appraisal | e1 | e2 | … | en |

| Criteria | No of Business Units | No of Employees | R&D Plant | Fix Asset Invest | Total Revenue | |||

|---|---|---|---|---|---|---|---|---|

| Item | ||||||||

| Weight | w1 | w2 | w3 | w4 | w5 | |||

| Manufacturer and Performance | 1 | f11 | f12 | f13 | f14 | f15 | ||

| 2 | f21 | f22 | f23 | f24 | f25 | |||

| … | … | … | … | … | … | |||

| n | fn1 | fn2 | fn3 | fn4 | fn5 | |||

| Positive-ideal Solution | ||||||||

| Negative-ideal Solution | ||||||||

| Manufacturer | Distance to Positive-Ideal Solution (Rij) | Distance to Negative Ideal Solution (Sij) | No of Business Units | No of Employees | R&D Plant | Fix Asset Invest | Total Revenue | |

| 1 | R1j | S1j | S11 | S12 | S13 | S14 | S15 | |

| 2 | R2j | S2j | S21 | S22 | S23 | S24 | S25 | |

| … | … | … | … | … | … | … | … | |

| n | Rnj | Snj | Sn1 | Sn2 | Sn3 | Sn4 | Sn5 | |

| Manufacturers/Performance/v-Value | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 |

|---|---|---|---|---|---|

| 1 | I1 | I1 | I1 | I1 | I1 |

| 2 | I2 | I2 | I2 | I2 | I2 |

| … | … | … | … | … | … |

| n | In | In | In | In | In |

| Input | Correlation | Output | ||

|---|---|---|---|---|

| Total Revenue | Productivity | Technical Sales Amount | ||

| No of business units | Coefficient | 0.929 ** | −0.082 | −0.169 |

| Significance | 0 | 0.801 | 0.599 | |

| Number | 12 | 12 | 12 | |

| No of employees | Coefficient | 0.974 ** | 0.026 | −0.176 |

| Significance | 0 | 0.936 | 0.585 | |

| Number | 12 | 12 | 12 | |

| R&D plants | Coefficient | 0.889 ** | 0.028 | −0.178 |

| Significance | 0 | 0.931 | 0.579 | |

| Number | 12 | 12 | 12 | |

| R&D funds | Coefficient | 0.549 | 0.051 | −0.024 |

| Significance | 0.064 | 0.875 | 0.94 | |

| Number | 12 | 12 | 12 | |

| Technical purchase budget | Coefficient | 0.495 | 0.063 | 0.17 |

| Significance | 0.102 | 0.847 | 0.597 | |

| Number | 12 | 12 | 12 | |

| Fix Asset Invest | Coefficient | 0.960 ** | 0.102 | −0.284 |

| Significance | 0 | 0.753 | 0.372 | |

| Number | 12 | 12 | 12 | |

| Industry (DMU) | Input | Output | |||

|---|---|---|---|---|---|

| No of Business Units | No of Employees | R&D Plants | Fix Asset Invest ($) | Total Revenue ($) | |

| Manufacture of Footwear | 486 | 13,295 | 22 | 16,182,000 | 1,223,678,833 |

| Manufacture of Tires and Manufacture of Industrial Rubber Products | 412 | 19,194 | 50 | 228,097,933 | 2,345,783,067 |

| Manufacture of Furniture | 531 | 9533 | 18 | 24,263,367 | 940,315,900 |

| Manufacture of Bicycles and Parts | 816 | 24,687 | 66 | 145,864,767 | 5,182,813,600 |

| Manufacture of Machine Tool (Metal Cutting Types) | 5664 | 105,329 | 332 | 651,436,067 | 13,004,220,000 |

| Manufacture of Paper and Paper Products | 526 | 14,031 | 12 | 116,679,567 | 2,463,959,233 |

| Manufacture of Fabricated Metal Products | 6754 | 106,193 | 150 | 608,700,433 | 12,102,896,400 |

| Manufacture of Woven Fabrics of Man-made Fibers | 1243 | 33,922 | 60 | 185,902,867 | 5,077,752,133 |

| Manufacture of Wood and of Products of Wood and Bamboo | 475 | 4110 | 5 | 29,170,000 | 352,995,067 |

| Manufacture of Plastics Products | 2408 | 40,273 | 66 | 168,155,467 | 4,059,293,800 |

| Manufacture of Parts for Motor Vehicles | 739 | 24,687 | 57 | 228,005,100 | 4,878,503,133 |

| Manufacture of Drugs and Medicines | 108 | 6,237 | 41 | 99,313,800 | 457,642,867 |

| DMU | CCR | Reference Set |

Being Referred | BCC |

BCC c-Value | A&P | Cross | Outliner | D&G |

|---|---|---|---|---|---|---|---|---|---|

| 1 * | 1 | 1 | 6 | 1 | 0.423 | 1.951 | 0.691 | 1.824 | 0.658 |

| 2 * | 0.862 | 11 | 0 | 0.929 | 0.313 | 0.862 | 0.509 | 0.693 | 0.382 |

| 3 * | 0.801 | 1,4,6 | 0 | 1 | 0.488 | 0.801 | 0.568 | 0.409 | 0.661 |

| 4 * | 1 | 4 | 7 | 1 | 0 | 1.364 | 0.994 | 0.372 | 0.640 |

| 5 * | 0.588 | 4 | 0 | 0.588 | 0 | 0.588 | 0.498 | 0.181 | 0.629 |

| 6 * | 1 | 6 | 6 | 1 | 0 | 2.399 | 0.883 | 1.716 | 0.652 |

| 7 * | 0.731 | 1,4,6 | 0 | 0.731 | 0 | 0.731 | 0.556 | 0.313 | 0.645 |

| 8 * | 0.900 | 1,4,6 | 0 | 0.900 | 0 | 0.900 | 0.776 | 0.159 | 0.645 |

| 9 * | 0.504 | 1,4,6 | 0 | 1 | 1 | 0.504 | 0.369 | 0.368 | 0.665 |

| 10 * | 0.721 | 1,4,6 | 0 | 0.721 | 0 | 0.721 | 0.529 | 0.363 | 0.694 |

| 11 * | 1 | 11 | 3 | 1 | 0.202 | 1.057 | 0.863 | 0.225 | 0.621 |

| 12 * | 0.642 | 11 | 0 | 1 | 1 | 0.642 | 0.247 | 1.596 | 0.390 |

| DMU | CCR | BCC | Scale |

|---|---|---|---|

| Manufacture of Footwear | 1 | 1 | 1 |

| Manufacture of Tires and Manufacture of Industrial Rubber Products | 0.862 | 0.929 | 0.929 |

| Manufacture of Furniture | 0.801 | 1 | 0.801 |

| Manufacture of Bicycles and Parts | 1 | 1 | 1 |

| Manufacture of Machine Tool (Metal Cutting Types) | 0.588 | 0.588 | 1 |

| Manufacture of Paper and Paper Products | 1 | 1 | 1 |

| Manufacture of Fabricated Metal Products | 0.731 | 0.731 | 1 |

| Manufacture of Woven Fabrics of Man-made Fibers | 0.900 | 0.900 | 1 |

| Manufacture of Wood and of Products of Wood and Bamboo | 0.504 | 1 | 0.504 |

| Manufacture of Plastics Products | 0.721 | 0.721 | 1 |

| Manufacture of Parts for Motor Vehicles | 1 | 1 | 1 |

| Manufacture of Drugs and Medicines | 0.642 | 1 | 0.642 |

| DMU |

CCR Efficiency |

BCC Efficiency |

Scale Efficiency |

RTS c-value | RTS |

|---|---|---|---|---|---|

| Manufacture of Footwear | 1 | 1 | 1 | 0.423 | increasing |

| Manufacture of Tires and Manufacture of Industrial Rubber Products | 0.862 | 0.929 | 0.929 | 0.313 | increasing |

| Manufacture of Furniture | 0.801 | 1 | 0.801 | 0.488 | increasing |

| Manufacture of Bicycles and Parts | 1 | 1 | 1 | 0 | constant |

|

Manufacture of Machine Tool (Metal Cutting Types) | 0.588 | 0.588 | 1 | 0 | constant |

| Manufacture of Paper and Paper Products | 1 | 1 | 1 | 0 | constant |

| Manufacture of Fabricated Metal Products | 0.731 | 0.731 | 1 | 0 | constant |

|

Manufacture of Woven Fabrics of Man-made Fibers | 0.900 | 0.900 | 1 | 0 | constant |

| Manufacture of Wood and of Products of Wood and Bamboo | 0.504 | 1 | 0.504 | 1 | increasing |

| Manufacture of Plastics Products | 0.721 | 0.721 | 1 | 0 | constant |

| Manufacture of Parts for Motor Vehicles | 1 | 1 | 1 | 0.202 | increasing |

| Manufacture of Drugs and Medicines | 0.642 | 1 | 0.642 | 1 | increasing |

| Spearman Analysis | CCR | A&P | Cross | D&G | |

|---|---|---|---|---|---|

| VIKOR | Coefficient | 0.091 | 0.189 | −0.007 | 0.273 |

| Significance | 0.779 | 0.557 | 0.983 | 0.391 | |

| Number | 12 | 12 | 12 | 12 | |

| DMU | CCR | A&P | Cross | D&G | VIKOR |

|---|---|---|---|---|---|

| Manufacture of Footwear | 2 | 2 | 5 | 4 | 4 |

| Manufacture of Tires and Manufacture of Industrial Rubber Products | 6 | 6 | 9 | 12 | 6 |

| Manufacture of Furniture | 7 | 7 | 6 | 3 | 3 |

| Manufacture of Bicycles and Parts | 1 | 3 | 1 | 8 | 9 |

| Manufacture of Machine Tool (Metal Cutting Types) | 11 | 11 | 10 | 9 | 12 |

| Manufacture of Paper and Paper Products | 3 | 1 | 2 | 5 | 2 |

| Manufacture of Fabricated Metal Products | 8 | 8 | 7 | 6 | 11 |

| Manufacture of Woven Fabrics of Man-made Fibers | 5 | 5 | 4 | 7 | 8 |

| Manufacture of Wood and of Products of Wood and Bamboo | 12 | 12 | 11 | 2 | 1 |

| Manufacture of Plastics Products | 9 | 9 | 8 | 1 | 10 |

| Manufacture of Parts for Motor Vehicles | 4 | 4 | 3 | 10 | 7 |

| Manufacture of Drugs and Medicines | 10 | 10 | 12 | 11 | 5 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, Z.-Y.; Chu, M.-T.; Wang, Y.-T.; Chen, K.-J. Industry Performance Appraisal Using Improved MCDM for Next Generation of Taiwan. Sustainability 2020, 12, 5290. https://doi.org/10.3390/su12135290

Lee Z-Y, Chu M-T, Wang Y-T, Chen K-J. Industry Performance Appraisal Using Improved MCDM for Next Generation of Taiwan. Sustainability. 2020; 12(13):5290. https://doi.org/10.3390/su12135290

Chicago/Turabian StyleLee, Zon-Yau, Mei-Tai Chu, Yu-Ting Wang, and Kuan-Ju Chen. 2020. "Industry Performance Appraisal Using Improved MCDM for Next Generation of Taiwan" Sustainability 12, no. 13: 5290. https://doi.org/10.3390/su12135290

APA StyleLee, Z.-Y., Chu, M.-T., Wang, Y.-T., & Chen, K.-J. (2020). Industry Performance Appraisal Using Improved MCDM for Next Generation of Taiwan. Sustainability, 12(13), 5290. https://doi.org/10.3390/su12135290