The Influence of R&D Intensity on Financial Performance: The Mediating Role of Human Capital in the Semiconductor Industry in Taiwan

Abstract

1. Introduction

2. Literature Review and Research Hypotheses

2.1. Deferred Effects of R&D and the Influence of Knowledge Transfer on Financial Performance

2.2. The Influence of RDI on Human Capital in an Organization

2.3. The Influence of Human Capital on Financial Performance

2.4. The Mediating Effects of Human Capital in the Relationship between RDI and Financial Performance Materialized with Knowledge Transfer

3. Research Design and Empirical Analysis

3.1. Research Design

3.1.1. Data Sources

3.1.2. Model Variables

- Dependent variableFinancial performance materialized with knowledge transfer: return on assets (ROA) measures financial performance, innovation performance [40]. Equation: EBITDA/total assets.

- Independent variableRDI (R&D Intensity): R&D expenses and RDI are often used as the measurement of a company’s emphasis on R&D activities (knowledge absorption capability). RDI is a means to the exploration and acquisition of knowledge [40]. Equation: RDIi,t during the current period (RDI = R&D expenses during the year/sales during the year). The symbol RDIi,t-k denotes the deferred effect of RDI on performance. k represents the number of deferred periods.

- MediationHuman capital: This paper refers to the Value Added Human Capital Coefficient (VAHUTM) [41] as the proxy variable for human capital. One example is a study in Thailand on the effect of R&D expenses on intellectual and human capital and the influence on financial performance in the manufacturing industry in 2006–2009 [42]. Value added is defined as net earnings plus wage expenses, interest expenses and income taxes [43]. The term VAICTM (Value Added Intellectual Coefficient) [41] was coined based on [24], which studied Skandia’s market value as driven by intellectual capital. The efficiency in added value creation by utilizing capital is calculated as VACA as expressed in Equation (1), and VAHU as expressed in Equation (2).where CE = tangible assets + financial assets = total assets - intangible assets.Value Added Capital Employed Coefficient (VACA) = Value Added (VA)/Capital Employed (CE)where human capital (HU) = wage costs = direct labor + indirect labor + wage expenses.Value Added Human Capital Coefficient (VAHU) = Value Added (VA)/Human capital (HU)

- Control variable

- (1)

- Firm sizes (SIZE):Large companies have more resources. This affects their operational model and financial performance. On the basis of return to scale, the benefit of R&D investments is contingent on the size of the firm [44]. This paper measures firm size with the natural logarithm of net sales.

- (2)

- Leverage Ratio (LEV):This is an important factor in the evaluation of firm performance and operational risk. Leverage ratio measures the effect of the capital structure on financial performance [45].Equation: (total debt/total assets) * 100%.

- (3)

- Gross Profit Margin (GPM):A high gross margin indicates strong competitiveness or product exclusivity. This creates higher earnings so that the company can spend on new knowledge development, training and education and product R&D. Equation: (Gross profits/net sales) * 100%.

- (4)

- Staff seniority (SS):In the context of human resource management, employees who have served long tenures are more willing to participate in R&D activities [46]. They reported higher knowledge application rates and demonstrated stronger knowledge absorption capability. In other words, they are more able to create higher profits for the company. The senior staff’s productivity curve gradually decreases over time [47].

- (5)

- Company’s History (CH):The history of a company affects how its professional knowledge has been built. Companies with a long history tend to be more conservative and standardized procedures restrict R&D activities. Their long history also presents more opportunities to accumulate resources. Equation: natural logarithm of (current year–inception).

- (6)

- Employee Fluidity (EF):Employees are one of a company’s key resources. Staff turnover is often used to evaluate personnel stability. Staff turnover affects firm performance, innovation, and other internal governance issues.

3.1.3. Methodology and Model Building

3.2. Empirical Analysis

3.2.1. Descriptive Statistics and Correlation Analysis

3.2.2. The Panel Data Model and Empirical Analysis

- Unit root testsUnit root tests determine whether the variables are stationary. Table 1 shows all the variables in the model with p < 0.1); hence, all the variables are stationary and there is no need to conduct differentials on the variables.

- Determination of the R&D lag periodThe lag period indicates the deferred effect of R&D (i.e., deferred performance of knowledge transfer). Based on theoretical inferences and presumptions, this paper defines corporate R&D as the action of knowledge transfer (RDIi, t-k), and argues that the performance is deferred. This begs the question on how long (measured in years) the lag period (k) is. This paper deploys an auto-correlation regression model (Table 2) and conducts ADF––Fisher unit root tests (Table 3) before determining that k = 3 is the optimal choice for the deferred effect of R&D.

- Hausman testsHausman tests are conducted to decide whether a fixed effect model or random effect model is most appropriate for the panel data analysis. As shown in Table 4, the test stats for Model 1 are 168.794 and 22.695, respectively, with p smaller than 0.05 in both cases. The test stats for Model 2 are 62.143 and 17.848, respectively, with p smaller than 0.05 in both. The test stats for Model 3 are 85.921 and 25.171, respectively, with p smaller than 0.05. The test stats for Model 4 are 173.8 and 33.095, respectively, with p smaller than 0.05. As all the test stats fall in the rejection region, a fixed effect model is applicable.

- Panel data analysis

- (1)

- RDI and financial performance materialized with knowledge transferAccording to Table 4, the adjusted R2 is 0.623 for semiconductor companies in Model 1-1. The DW test statistics result on the error term in the regression model stands at 1.654, between 1.5 and 2.5, indicating the mutual independence of error terms and no auto correlation in the model. The F stats result is 15.964 (p < 0.01). When k = 3 for RDI, its influence on the correlation with financial performance materialized with knowledge transfer (measured with ROA) is β = 0.101, t = 3.127, p < 0.01. The RDI in the semiconductor companies sampled shows a significant influence on ROA, and the effect on R&D is deferred. The adjusted R2 is 0.623 for semiconductor companies in Model 1-1. The results of the sampled textile companies, shown in Model 1-2, show that the adjusted R2 is 0.61 and the DW test statistics result is 2.053, indicating the mutual independence of error terms. The F stats result is 14.965 (p < 0.01). When k = 3 for RDI, its influence on the correlation on ROA is β = 0.186, t = 3.127, p < 0.01. The RDI in the textile companies sampled is significantly and positively correlated with ROA, and the effect on R&D is deferred.

- (2)

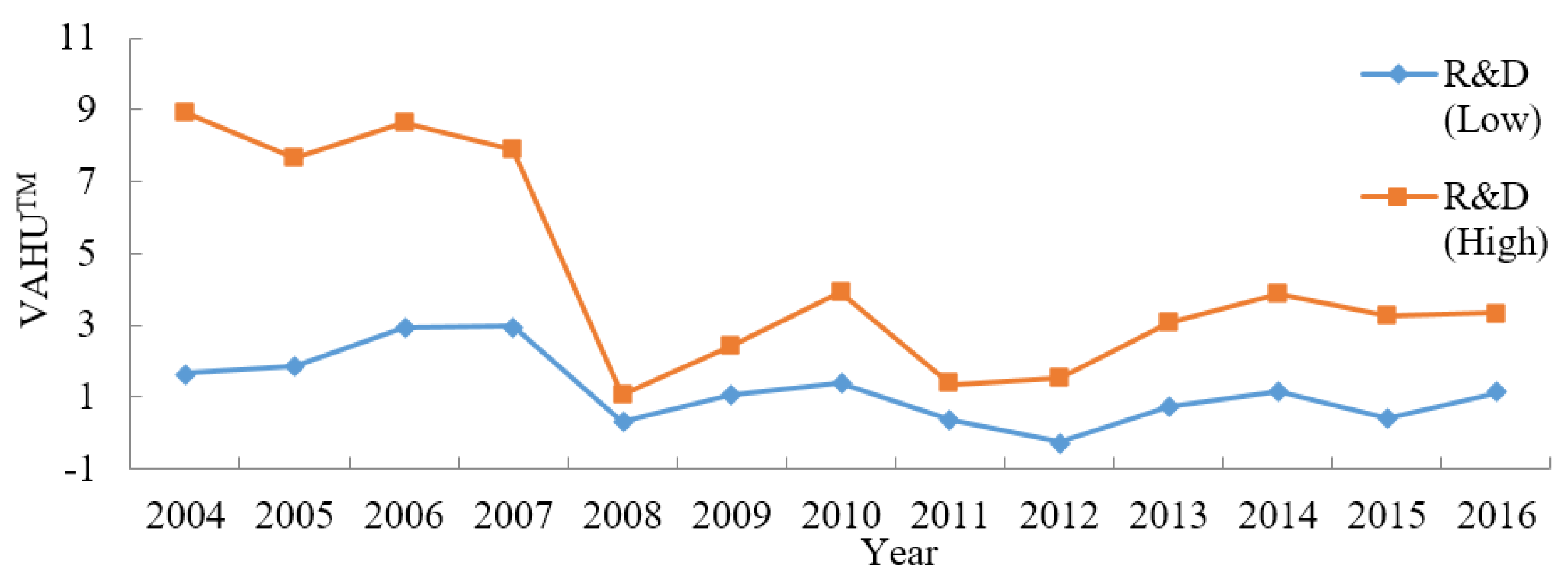

- RDI and human capitalAs shown in Table 4, the adjusted R2 is 0.473 in Model 2-1, and the result of the DW test statistics is 1.539, which is between 1.5 and 2.5, indicating the mutual independence of error terms and no auto correlation. The F stats result is 9.135 (p < 0.01). When k = 3 for RDI in the sampled semiconductor companies, its correlation with human capital (VAHUTM) is β = 0.056, t = 1.95, p < 0.1. The RDI shows significant and positive influence on VAHU, and the effect is deferred. The adjusted R2 in Model 2-2 is 0.289 and the result of the DW test statistics is 2.419, evidencing the mutual independence of error terms. The F stats result is 4.621 (p < 0.01). The influence of RDI on VAHU is insignificant, given p is greater than 0.1.

- (3)

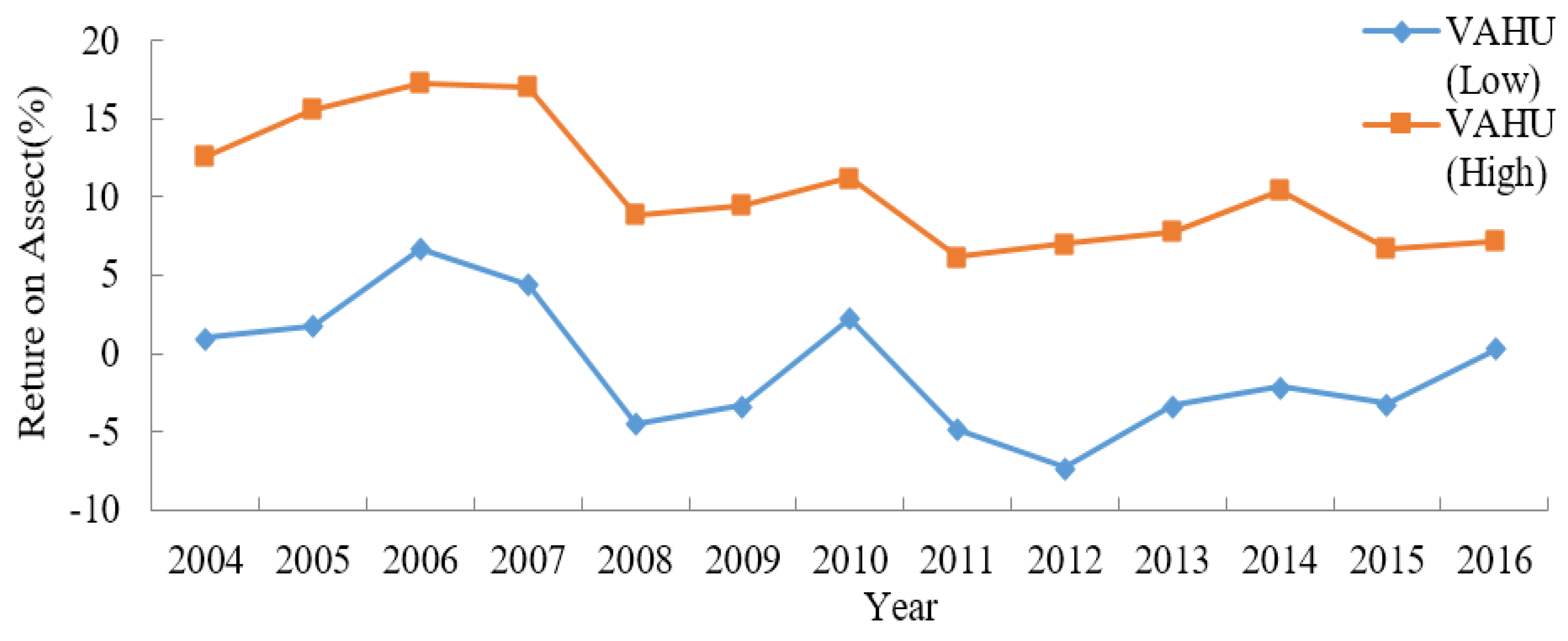

- Human capital and financial performance materialized with knowledge transferThe adjusted R2 is 0.624 in Model 3-1, and the result of the DW test statistics is 1.545, falling between 1.5 and 2.5, which indicates the mutual independence of error terms and no auto correlation in the model. The F stats result is 19.24 (p < 0.01). When k = 1 in the sampled semiconductor companies, the correlation between VAHU and ROA is β = 0.049, t = 2.355, p < 0.05. The VAHU exhibits a significant and positive influence on ROA, and the effect is deferred. The adjusted R2 in Model 3-2 is 0.594, the DW test statistics result is 1.698, evidencing the mutual independence of error terms. The F stats result is 16.637 (p < 0.01). The influence of VAHU on ROA in the textile industry with k at 1 is insignificant, given p greater than 0.1.

- (4)

- The mediating effect of human capital on the relationship between RDI and financial performance materialized with knowledge transfer.Model 4 aims to verify whether human capital (VAHUTM) serves as a mediator in the relationship between RDI and financial performance (measured by ROA). This paper uses Model 1 as the basis, imports the variable VAHU into Model 4, and conducts panel data regression analysis on all the indicators. The test on the mediating effects requires three conditions:

3.3. Case Studies—Semiconductor Companies in Taiwan

4. Results and Discussion

- (1)

- Knowledge transfer starts from the allocation of R&D budgets and the mobilization of personnel. However, it takes time for the benefits of knowledge transfer to translate into performance. The length of this waiting period depends on whether knowledge transfer enhances efficiency or contributes to operations. This is different from the new knowledge and skills acquired via technology transfer and patent purchases. Knowledge transfer begins with knowledge requirements and gap analysis, with externalization, internalization, and application as it outputs. Everything takes time, be it product improvement, new product introductions, or enhancement and innovation of manufacturing processes. This is the reason why R&D’s performance benefits are deferred, and the benefit of knowledge transfer is also deferred. It is the same for all industries.

- (2)

- R&D intensity (RDI) in the semiconductor industry has a positive influence on human capital and financial performance materialized in knowledge transfer, and such influence is deferred in nature, with a higher coefficient than that in the textile industry. Meanwhile, human capital and financial performance are positively correlated, and the performance is deferred in the semiconductor industry. However, this is not obvious in the textile industry. This suggests a higher knowledge intensity in the semiconductor industry than in the textile industry. There is a deferred effect from the requirement for new knowledge to the application of such knowledge. This involves the workforce’s capability, knowledge absorption ability, industry knowledge threshold and corporate resources. From the commencement of R&D activities, budget allocations for employee training, the consolidation, integration and enhancement of old and new knowledge and technology, and the resulting accumulation of human capital also take time, i.e., in the form of deferred effects.

- (3)

- Human capital has mediating effects on the relationship between RDI and knowledge transfer/financial performance. However, such mediating effects are only evident in the semiconductor industry. This implies that R&D investments by semiconductor companies help to enhance operating performance but only through the enhancement of overall human capital. R&D activities are, in fact, the starting point of knowledge transfer. The process of knowledge transfer enriches the knowledge base of the whole organization, develops new skillsets, improves manufacturing processes, or launches new products. This is then reflected in financial performance materialized through knowledge transfer.

5. Conclusions

- (1)

- R&D is the cornerstone of knowledge absorption capability, human capital accumulation and transfer performance. R&D investment creates momentum for the transfer of knowledge. It is an organizational learning method and is often used to measure the level of absorption capability. R&D spending benefits are deferred with respect to performance. It enhances the knowledge and competence levels of the whole organization. The accumulation of human capital provides a meaningful and positive enhancement of knowledge transfer performance (overall innovation capability) and thus improves the financial performance of a company. The absorption capability at the organizational level is the foundation of the knowledge transfer. The greater the absorption capability, the better the knowledge base and competence levels. The accumulation of human capital will benefit the overall innovation capability and operating profits of the organization.

- (2)

- R&D activities offer the best and most feasible option for knowledge transfer and operations. The semiconductor companies in Taiwan may pursue high value-added products, enhance quality and production efficiency, and optimize workflows, or seek to migrate production sites to regions with lower labor and production costs. The latter may be a quick fix and may result in production cost reductions. However, should this be repeated once the local costs increase again? This is worthy of thought. This paper posits that R&D investments are the best solution to improving financial performance. R&D activities as a means to transfer knowledge can enhance innovation capability and develop intellectual properties. This is critical in the semiconductor industry, as it avoids any damages associated with patent litigations or increased bargaining power in negotiations. At the end of 2019, TMSC and GlobalFoundries reached a settlement by cross licensing global patents. That said, R&D activities affect financial performance through profit margins. They also influence operational methods. Companies should focus on RDI to improve commercial viability going forward. In the long run, RDI creates a competitive edge, enhances profitability and generates intangible assets through innovation, creating goodwill and notions not subject to perception from stakeholders or social efficiency.

6. Suggestions for Future Research

- (1)

- This paper refers to the value-added coefficient of human capital, as intellectual capital, and a measure of human capital in an organization. Without digging into the external sources of knowledge and the strength of the macroeconomy, this paper seeks to focus on the internal operation, management, and resource measures. However, there is a long list of influencers, effects and financial performance metrics associated with R&D. Follow-up studies may incorporate issues such as structural capital or external knowledge sources, or compare and contrast the similarities and differences in structural capital or relational capital between high-tech firms and traditional companies.

- (2)

- This paper examines the impact of R&D investments on financial performance only, without exploring the effects on the number of patents. Future studies may refer to the number of patents as a dependent variable to evaluate the efficiency with which R&D investments are translated into patent outputs. It is worth noting that patent outputs are not necessarily the operational indicator most emphasized by companies. This paper focuses on semiconductor companies, albeit with no classification of supply chain activities. Subsequent studies may look at different industry characteristics as a result of external environments, the internal/external scenarios, or different lag periods to yield new insights.

Author Contributions

Funding

Conflicts of Interest

References

- Jordão, R.; Novas, J. Knowledge management and intellectual capital in networks of small- and medium-sized enterprises. J. Intellect. Cap. 2017, 18, 667–692. [Google Scholar] [CrossRef]

- Xu, J.; Shang, Y.; Yu, W.; Liu, F. Intellectual capital, technological innovation and firm performance: Evidence from china’s manufacturing sector. Sustainability 2019, 11, 5328. [Google Scholar] [CrossRef]

- Soo, C.; Tian, A.W.; Teo, S.T.T.; Cordery, J. Intellectual capital-enhancing HR, absorptive capacity, and innovation. Hum. Resour. Manag. 2017, 56, 431–454. [Google Scholar] [CrossRef]

- Lee, K.; Roh, T. Proactive Divestiture and business innovation: R&D input and output performance. Sustainability 2020, 12, 3874. [Google Scholar]

- Jiang, B. 2018 Semiconductor Industry Yearbook; Ministry of Economic Affairs: Taipei, Taiwan, 2018.

- Liu, P.Z. Discussion on the Prosperity and Development Trend of Semiconductor Industry in Taiwan; Institute of Economic Research: Taipei, Taiwan, 2018. [Google Scholar]

- Zanni, T.; Clark, L.; Gentle, C.; Lohokare, S.; Jones, S. Semiconductors: As the Backbone of the Connected World, the Industry’s Future is Bright; KPMG: Taipei, Taiwan, 2019. [Google Scholar]

- Faccin, K.; Balestrin, A.; Martins, B.V.; Bitencourt, C.C. Knowledge-based dynamic capabilities: A joint R&D project in the French semiconductor industry. J. Knowl. Manag. 2019, 23, 439–465. [Google Scholar]

- Chandrasekaran, A.; Linderman, K. Managing knowledge creation in high-tech R&D projects: A multimethod study. Decis. Sci. 2015, 46, 267–300. [Google Scholar]

- Vogel, J. The two faces of R&D and human capital: Evidence from western European regions. Reg. Stud. 2015, 94, 525–551. [Google Scholar]

- Legros, D.; Galia, F. Are innovation and R&D the only sources of firms’ knowledge that increase productivity? An empirical investigation of French manufacturing firms. J. Prod. Anal. 2012, 38, 167–181. [Google Scholar]

- Abu-Shanab, E.; Shehabat, I. The influence of knowledge management practices on e-government success. Trans. Gov. People Process. Policy 2018, 12, 286–308. [Google Scholar] [CrossRef]

- Cantabene, C.; Grassi, I. R&D cooperation in SMEs: The direct effect and the moderating role of human capital. Appl. Econ. 2019, 1–16. [Google Scholar] [CrossRef]

- Park, S.D. The nexus of FDI, R&D, and human capital on Chinese sustainable development: Evidence from a two-step approach. Sustainability 2018, 10, 2063. [Google Scholar]

- Martinez, M.G.; Zouaghi, F.; Garcia, M.S. Capturing value from alliance portfolio diversity: The mediating role of R&D human capital in high and low tech industries. Technovation 2017, 59, 55–67. [Google Scholar]

- Bader, K.; Enkel, E. Understanding a firm’s choice for openness: Strategy as determinant. Int. J. Technol. 2014, 66, 156–182. [Google Scholar] [CrossRef]

- Meyer, S.; Berger, M. Internationalisation of research and development activities of small and medium-sized enterprises in Austria: Strategic drivers for spatial organisation. Z Wirtschaftsgeogr. 2014, 58, 1–17. [Google Scholar] [CrossRef]

- Vicente Oliva, S.; Martínez Sánchez, Á.; Berges Muro, L. R&D best practices, absorptive capacity and project success. Dyna 2015, 82, 109–117. [Google Scholar]

- Harris, R.; Yan, J. The measurement of absorptive capacity from an economics perspective: Definition, measurement and importance. J. Econ. Surv. 2019, 33, 729–756. [Google Scholar] [CrossRef]

- Spithoven, A.; Teirlinck, P. Internal capabilities, network resources and appropriation mechanisms as determinants of R&D outsourcing. Res. Policy 2015, 44, 711–725. [Google Scholar]

- Zouaghi, F.; Sánchez, M.; Martínez, M. Did the global financial crisis impact firms’ innovation performance? The role of internal and external knowledge capabilities in high and low tech industries. Technol. Forecast. Soc. 2018, 132, 92–104. [Google Scholar] [CrossRef]

- Chen, T.C.; Guo, D.Q.; Chen, H.M.; Wei, T.T. Effects of R&D intensity on firm performance in Taiwan’s semiconductor industry. Econ. Res.-Ekon. Istraz. 2019, 32, 2377–2392. [Google Scholar]

- Kumbhakar, S.C.; Ortega-Argilés, R.; Potters, L.; Vivarelli, M.; Voigt, P. Corporate R&D and firm efficiency: Evidence from Europe’s top R&D investors. J. Prod. Anal. 2012, 37, 125–140. [Google Scholar]

- Edvinsson, L. Developing intellectual capital at Skandia. Long Range Plan. 1997, 30, 320–373. [Google Scholar] [CrossRef]

- Wu, T.; Wu, Y. Innovative work behaviors, employee engagement, and surface acting: A delineation of supervisor-employee emotional contagion effects. Manag. Decis. 2019, 57, 3200–3216. [Google Scholar] [CrossRef]

- Youndt, M.A.; Subramaniam, M.; Snell, S.A. Intellectual capital profiles: An examination of investments and returns. J. Manag. Stud. 2004, 41, 335–361. [Google Scholar] [CrossRef]

- Barao, A.; Vasconcelos, J.B.; Rocha, A.; Pereira, R. A knowledge management approach to capture organizational learning networks. Int. J. Inform. Manag. 2017, 37, 735–740. [Google Scholar] [CrossRef]

- Kampkotter, P.; Marggraf, K. Do employees reciprocate to intra-firm trainings? An analysis of absenteeism and turnover rates. Int. J. Hum. Resour. Manag. 2015, 26, 2888–2907. [Google Scholar] [CrossRef]

- Vidal-Salazar, M.D.; Cordón-Pozo, E.; Ferrón-Vilchez, V. Human resource management and developing proactive environmental strategies: The influence of environmental training and organizational learning. Hum. Resour. Manag. 2012, 51, 905–934. [Google Scholar] [CrossRef]

- Harrison, S.; Sullivan, P.H. Profiting from intellectual capital: Learning from leading companies. J. Intellect. Cap. 2000, 1, 33–46. [Google Scholar] [CrossRef]

- Yu, C.; Zhang, Z.; Lin, C.; Wu, Y. Can data-driven precision marketing promote user AD clicks? Evidence from advertising in WeChat moments. Ind. Mark. Manag. 2019. [Google Scholar] [CrossRef]

- Sokolov-Mladenović, S.; Cvetanović, S.; Mladenović, I. R&D expenditure and economic growth: EU28 evidence for the period 2002–2012. Ekon. Istraz. 2016, 29, 1005–1020. [Google Scholar]

- Kianto, A.; Sáenz, J.; Aramburu, N. Knowledge-based human resource management practices, intellectual capital and innovation. J. Bus. Res. 2017, 81, 11–20. [Google Scholar] [CrossRef]

- Blanco-Mazagatos, V.; Quevedo-Puente, E.; Delgado-García, J.B. Human resource practices and organizational human capital in the family firm: The effect of generational stage. J. Bus. Res. 2018, 84, 337–348. [Google Scholar] [CrossRef]

- Chen, T.C. Research on the Influence of Individual and Organization Dynamic Interaction on Knowledge Transfer of Semiconductor Enterprises. Ph.D. Thesis, Huaqiao University, Quanzhou, China, 2019. [Google Scholar]

- Anuar Arshad, M.; Scott, B.; Mahmood, A. An exploration of organizational learning perceptions and understandings in Malaysia. Int. Bus. Manag. 2016, 10, 334–344. [Google Scholar]

- Naanaa, I.D.; Sellaouti, F. Technological diffusion and growth: Case of the Tunisian manufacturing sector. J. Knowl. Econ. 2017, 8, 369–383. [Google Scholar] [CrossRef]

- Tan, C.L.; Chang, Y.P. Does organizational learning affect R&D engineers’ creativity? Asian Soc. Sci. 2015, 11, 137–147. [Google Scholar]

- Alpaslan, B.; Ali, A. The spillover effects of innovative ideas on human capital. Rev. Dev. Econ. 2018, 22, 333–360. [Google Scholar] [CrossRef]

- Vithessonthi, C.; Racela, O.C. Short- and long-run effects of internationalization and R&D intensity on firm performance. J. Multinatl. Financ. Manag. 2016, 34, 28–45. [Google Scholar]

- Pulic, A. Measuring the performance of intellectual potential in knowledge economy. In Proceedings of the 2nd McMaster Word Congress on Measuring and Managing Intellectual Capital by the Austrian Team for Intellectual Potential; McMaster University: Hamilton, ON, USA, 1998; pp. 1–20. [Google Scholar]

- Phusavat, K.; Comepa, N.; Sitko-Litek, A.; Ooi, K.B. Interrelationships between intellectual capital and performance: Empirical examination. Ind. Manag. Data Syst. 2011, 111, 810–829. [Google Scholar] [CrossRef]

- Chen, M.C.; Cheng, S.J.; Hwang, Y.C. An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. J. Intellect. Cap. 2005, 6, 159–176. [Google Scholar] [CrossRef]

- Ciftci, M.; Cready, W.M. Scale effects of R&D as reflected in earnings and returns. J. Acc. Econ. 2011, 52, 62–80. [Google Scholar]

- Tahir, M.; Anuar, M.B.A. The determinants of working capital management and firms performance of textile sector in pakistan. Qual. Quant. 2016, 50, 605–618. [Google Scholar] [CrossRef]

- Wagner, R.; Paton, R.A. Strategic toolkits: Seniority, usage and performance in the German SME machinery and equipment sector. Int. J. Hum. Resour. Manag. 2014, 25, 475–499. [Google Scholar] [CrossRef][Green Version]

- Zwick, T. Seniority wages and establishment characteristics. Labor Econ. 2011, 18, 853–861. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econ. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econ. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Jones, D.C.; Kato, T. The productivity effects of employee stock-ownership plans and bonuses: Evidence from Japanese panel data. Am. Econ. Rev. 1995, 85, 391–414. [Google Scholar]

- Chiou, H. Chemical Research and Statistical Analysis: Analysis of SPSS Chinese Window Resource Analysis; Wu-Nan: Taipei, Taiwan, 2006. [Google Scholar]

- Maddala, G.S.; Wu, S. A comparative study of unit root tests with panel data and a new simple test. Oxford B Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Kenny, D.A.; Kashy, D.A.; Bolger, N. Data analysis in social psychology. Handb. Soc. Psychol. 1998, 1, 233–265. [Google Scholar]

- Topology Research Institute. IC Foundry Industry 2017 Review and 2018 Outlook; Topology Research Institute: Taipei, Taiwan, 2017. [Google Scholar]

- Topology Research Institute. IC Packaging and Testing Industry 2017 Review and 2018 Outlook; Topology Research Institute: Taipei, Taiwan, 2017. [Google Scholar]

- Taiwan Semiconductor Manufacturing Company. Taiwan Semiconductor Manufacturing Company 2017 Annual Report (1); Taiwan Semiconductor Manufacturing Company: Hsinchu, Taiwan, 2018. [Google Scholar]

- Di Maria, E.; De Marchi, V.; Spraul, K. Who benefits from university–industry collaboration for environmental sustainability? Int. J. Sustain. High. Educ. 2019, 20, 1022–1041. [Google Scholar] [CrossRef]

- Link, A.N.; Swann, C.A. R&D as an investment in knowledge based capital. Econ. e Politica Ind. 2016, 43, 11–24. [Google Scholar]

- Ibarra Cisneros, M.A.; Hernandez-Perlines, F. Intellectual capital and Organization performance in the manufacturing sector of Mexico. Manag. Decis. 2018, 56, 1818–1834. [Google Scholar] [CrossRef]

- Xu, J.; Wang, B. Intellectual capital, financial performance and companies’ sustainable growth: Evidence from the Korean manufacturing industry. Sustainability 2018, 10, 4651. [Google Scholar] [CrossRef]

- Song, M.; Pan, X.; Pan, X.; Jiao, Z. Influence of basic research investment on corporate performance: Exploring the moderating effect of human capital structure. Manag. Decis. 2019, 57, 1839–1856. [Google Scholar] [CrossRef]

- Farnese, M.L.; Barbieri, B.; Chirumbolo, A.; Patriotta, G. Managing knowledge in Organizations: A Nonaka’s SECI model operationalization. Front. Psychol. 2019, 10, 2730. [Google Scholar] [CrossRef] [PubMed]

- Xu, J.; Li, J. The impact of intellectual capital on SMEs’ performance in China: Empirical evidence from non-high-tech vs. high-tech SMEs. J. Intellect. Cap. 2019, 20, 488–509. [Google Scholar] [CrossRef]

| Method | ROA | RDI | VAHU | SIZE | LEV | GPM | SS | EF | CH |

|---|---|---|---|---|---|---|---|---|---|

| LLC | −21.861 *** | −298.34 *** | −36.523 *** | −14.773 *** | −16.815 *** | −14.52 *** | −20.152 *** | −34.294 *** | −61.553 *** |

| IPS | −14.674 *** | −29.13 *** | −17.262 *** | −5.822 *** | −9.431 *** | −8.214 *** | −6.148 *** | −21.438 *** | −447.29 *** |

| PP | 932.888 *** | 490.74 *** | 922.948 *** | 666.838 *** | 644.046 *** | 720.407 *** | 698.119 *** | 1333.9 *** | 3076.25 *** |

| Lag (k) | AIC | SIC | HQ |

|---|---|---|---|

| 1 | −2.385 | −2.379 | −2.383 |

| 2 | −2.399 | −2.389 | −2.4 |

| 3 | −2.453 * | −2.44 * | −2.448 * |

| AIC | SIC | |||||||

|---|---|---|---|---|---|---|---|---|

| Lag (k) | k = 1 | k = 2 | k = 3 | k = 4 | k = 1 | k = 2 | k = 3 | k = 4 |

| Chi square | 521.15 *** | 436.237 *** | 509.605 *** | 432.967 *** | 516.736 *** | 441.635 *** | 532.081 *** | 439.486 *** |

| Choi Z | −4.058 *** | −2.253 *** | −3.562 ** | 0.012 | −3.848 *** | −2.343 *** | −3.98 *** | −0.143 |

| Variable | Tech Companies (Semiconductor) | Traditional Companies (Textile) | ||||||

|---|---|---|---|---|---|---|---|---|

| Model 1-1 | Model 2-1 | Model 3-1 | Model 4-1 | Model 1-2 | Model 2-2 | Model 3-2 | Model 4-2 | |

| ROA | VAHU(−1) | ROA | ROA | ROA | VAHU(−1) | ROA | ROA | |

| SIZE | 0.494 *** (5.977) | 0.003 (0.045) | 0.485 *** (7.804) | 0.488 *** (5.92) | 0.406 *** (3.872) | 0.255 (0.148) | 0.165 * (1.77) | 0.398 *** (3.842) |

| LEV | −0.034 (−0.774) | −0.074 * (−1.869) | −0.017 (−0.417) | −0.027 (−0.605) | −0.159 ** (−2.404) | −0.24 *** (−2.83) | −0.162 *** (−2.727) | −0.188 *** (−2.853) |

| GPM | 0.728 *** (17.994) | 0.506 *** (14.018) | 0.7327 *** (20.367) | 0.705 *** (17.134) | 0.592 *** (10.88) | 0.109 *** (1.583) | 0.503 *** (12.547) | 0.606 *** (11.252) |

| EF | −0.025 (−0.999) | 0.012 (0.551) | −0.041 * (−1.793) | −0.024 (−0.954) | −0.011 (−0.299) | −0.126 *** (−2.788) | −0.024 (−0.726) | −0.027 (−0.769) |

| SS | 0.042 (0.748) | 0.119 ** (2.386) | 0.001 (0.001) | 0.036 (0.644) | 0.023 (0.435) | −0.087 *** (−1.278) | −0.031 (−0.612) | 0.009 (0.165) |

| CH | −0.392 *** (−4.541) | −0.304 *** (−3.953) | −0.486 *** (−7.463) | −0.35 *** (−4.005) | 0.275 ** (2.455) | 0.184 (1.299) | 0.309 *** (3.619) | 0.302 *** (2.722) |

| RDI(−3) | 0.101 *** (3.127) | 0.056 * (1.95) | 0.095 *** (3.075) p = 0.002 | 0.186 *** (3.023) | 0.088 (1.134) | 0.198 *** (3.267) p = 0.001 | ||

| VAHU(−1) | 0.049 ** (2.355) | 0.078 *** (2.731) p = 0.006 | −0.048 (−1.528) | −0.13 *** (−3.577) p = 0.001 | ||||

| Adj-R2 | 0.623 | 0.473 | 0.624 | 0.625 | 0.61 | 0.289 | 0.594 | 0.620 |

| D-W | 1.654 | 1.539 | 1.545 | 1.74 | 2.053 | 2.419 | 1.697 | 1.842 |

| F | 15.964 *** | 9.135 *** | 19.24 *** | 15.998 *** | 14.965 *** | 4.621 *** | 16.637 *** | 15.306 *** |

| Hausman | 168.794 *** | 62.14 *** | 85.921 *** | 173.8 *** | 22.695 *** | 17.848 ** | 25.171 *** | 33.095 *** |

| Fixed Effect Model | ||||||||

| Supply Chain | Company | Business | RDI | Staff Turnover | VAHU | ROA | No. of Patents (2018/12) | Global Market Share (2017 Ranking) |

|---|---|---|---|---|---|---|---|---|

| Upper stream | MTK | IC design | 0.079 | 15.1% | 51.973 | 21.292 | 21,630 | 7.83% (W4) |

| Mid stream | TSMC | Foundry | 0.066 | 7.2% | 16.415 | 19.905 | 27,146 | 55.9% [55] (W1) |

| Down stream | ASE | IC testing and packaging | 0.043 | 18.7% | 2.154 | 8.082 | 7421 | 19.2% [56] (W1) |

| Semiconductor | 0.117 | 14.9% | 2.69 | 4.517 | ||||

| Textile | 0.0079 | 15.04% | 0.828 | 1.411 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, T.-C.; Wu, Y.J. The Influence of R&D Intensity on Financial Performance: The Mediating Role of Human Capital in the Semiconductor Industry in Taiwan. Sustainability 2020, 12, 5128. https://doi.org/10.3390/su12125128

Chen T-C, Wu YJ. The Influence of R&D Intensity on Financial Performance: The Mediating Role of Human Capital in the Semiconductor Industry in Taiwan. Sustainability. 2020; 12(12):5128. https://doi.org/10.3390/su12125128

Chicago/Turabian StyleChen, Tsung-Chun, and Yenchun Jim Wu. 2020. "The Influence of R&D Intensity on Financial Performance: The Mediating Role of Human Capital in the Semiconductor Industry in Taiwan" Sustainability 12, no. 12: 5128. https://doi.org/10.3390/su12125128

APA StyleChen, T.-C., & Wu, Y. J. (2020). The Influence of R&D Intensity on Financial Performance: The Mediating Role of Human Capital in the Semiconductor Industry in Taiwan. Sustainability, 12(12), 5128. https://doi.org/10.3390/su12125128