1. Introduction

Currently, accounting business processes are undergoing a transformation through digitalization and sustainability.

The sustainability of an enterprise is largely determined by the level of innovation potential, especially in the process of development of smart sustainable cities. Nowadays, the convergence of two conceptions, the smart city and the sustainable city, generate the data-driven smart sustainable city. The smart sustainable city consists of smart sustainable organizations, which are based on smart sustainable processes supported by cognitive and big data technologies. These organizations need to find sustainable solutions to deal with the complexity of financial and accounting data. Advances in Internet technologies have made it possible to gather, store, and process large amounts of interactive enterprise data [

1]. When creating smart sustainable cities, big data and cognitive technologies generate useful information and insights for citizens, enterprises, and policymakers. The new digital technologies link big data and cognitive analytics with operational sustainability practices for sustainable business management. Transforming large amounts of data into knowledge allows them to empower cognition as well as support decision-making routines [

1]. According to the IBM company, “the opportunities that cognitive Internet of Things solutions can deliver in the sustainability space are enormous, and early adopters are gaining a competitive advantage. As sustainability moves into the mainstream on Wall Street, organizations that are able to harness the power of cognitive technologies to advance their goals while helping the planet will lead the way” [

2].

The background analysis indicates that accounting for sustainability entails the reporting of ecological and social information and the integrated reporting of sustainability information along with financial reporting. Moreover, the emerging technologies should provide users with sustainability reports, auditing, and the assurance of sustainability information, sustainability implications of financial failure, accounting, and auditing failures.

For years, scientists have emphasized the role of cognitive abilities in behavioral accounting, judgments, and decision making [

3,

4,

5,

6,

7,

8,

9,

10]. Individuals with good cognitive abilities are better equipped to acquire the knowledge needed to perform their jobs at the highest levels [

11].

In recent years, the impact of cognitive abilities on different professions in the finance and accounting sphere has increased. On the other hand, some people are unwilling to recognize the importance of increasing the level of cognitive abilities for a better use of information technologies. The number of works in which scientists attempt to analyze the impact of cognitive skills and cognitive technologies is also constantly increasing.

For years, various definitions of cognitive abilities have been proposed, from the more common to the more concrete. For example, Carroll’s definition states that “cognitive ability can be defined as variation across individuals in the successful performance of tasks primarily involving processing of mental information” [

12]. According to one of the most recent definitions, “cognitive abilities are aspects of mental functioning, such as memorizing and remembering; inhibiting and focusing attention; the speed of information processing; and spatial and causal reasoning” [

13].

In this paper, cognitive abilities are treated in more practical terms. They are the cognitive skills required by an employee to use cognitive technologies more efficiently and in order to increase the effectiveness of accounting processes, including the acceleration of decision-making processes.

Originally associated with artificial intelligence, the researchers began to use the term “cognitive computing” from the 1990s. Cognitive computing has attracted real attention since 2011.

Cognitive computing refers to the computer systems inspired by the human brain, which have natural language processing capability, learn from experience, interact with humans in a natural way, and help make decisions based on learning processes [

3,

4,

5,

6,

7,

8,

9,

10,

11,

12,

13,

14,

15,

16].

Cognitive computing can also help accountants with deep analytics. According to Deloitte, “cognitive analytics” is a term used to describe “how organizations apply analytics and cognitive computing technologies to help humans make smarter decisions” [

17].

In 2017, John Baron, Managing Director of the professional segment of the Tax and Accounting Business in Thomson Reuters, argued that “very soon, cognitive computing will begin to impact the accountant profession. It can be used in risk mining, grouping and connecting entities, detecting abnormalities in structured and unstructured data, and improving the user experience” [

18].

Moreover, in 2019 Forbes wrote that “the use of cognitive technologies already has changed the accounting profession. Automated solutions make the accountant’s job easier, eliminating much of the manual processing of data. Such tools also provide transparency into digitized financial data to validate the quality and accuracy of ledgers, compressing the margin of error” [

19].

In recent years, the convergence of Big Data and Artificial Intelligence (AI) in finance and the accounting area is gaining popularity. Cognitive Analytics relates to Big Data technologies. “With the advent of big data, which grows larger, faster and more diverse by the day, cognitive computing systems are now used to gain knowledge from data as experience and then generalize what they have learned in new situations” [

20].

However, many accountants are wondering if Artificial Intelligence will be a job-killer in the accounting profession. Most firms believe cognitive computing will be a “job-creator, relieving accountants of time-consuming and mundane process work and freeing up space to work on more complex work” [

21]. Scientists suggest that accounting is a business field that is “likely to be augmented by IT technology rather than fully automated” [

22].

According to Jim Boomer, “it will serve as a complement to the evolution of accountants from technical advisors to strategic, value-added advisors”, which does not mean that cognitive computing does not present any risks to the accountant profession [

21]. The experts suggest that managers will need to transform and expand their practice toward more advisory services. The commonality between research on human cognitive processes and auditing is usually described with regard to two issues: judgment and risk [

23]. The importance of using these capabilities, especially for managers and auditors, are confirmed by many scientists. Accountants should also consider the directions in which they can enhance their knowledge and skills to prepare for the big data challenge [

23,

24]. Financial and accounting managers, as the leaders and advisors, should maximize their big data analytics skills [

25,

26,

27].

In the literature on sustainable development, there is still a gap in the impact of modern information technologies on management accounting, and on the achievement of sustainable development by enterprises. These technologies are predominantly cognitive and big data technologies. Moreover, there is no research into the desired skills and abilities of management accountants in practice. In order to analyze the impact of cognitive technologies on managerial accounting, a literature study has been conducted.

The main contributions of this paper are the literature study on the future of management accounting and on the impact of cognitive technologies on management accounting, the labor market research, and the current management accountant skills model.

Since two methodological approaches were chosen, namely a theoretical and a practical approach to the management accountant skills model creation, the literature study was focused on scientific papers and non-scientific literature sources, such as market reports and experts’ opinions.

Most of the papers in this area are based on a qualitative approach, by analyzing the experts’ opinions. In this paper, the quantitative approach of labor market analysis was selected to fulfill the research gap in the area of management accounting skills analysis; therefore, the results of the present study have meaningful practical implications.

The paper is structured as follows. First, a review of the literature is provided, outlining the issues raised by the research on the impact of cognitive technologies on management accounting and the management accountant profession in terms of sustainability. This is followed by a survey conducted on selected labor markets and the description of the results of that survey. The research aimed to create the current management accountant skills model, with an emphasis on modern Information Technologies (IT). Finally, conclusions and future perspectives are presented.

3. Materials and Methods

The research was conducted in November-January 2019. First, data were collected at the beginning of November, and after that results have been checked two times until the beginning of December, during a 1-month period. A similar procedure was conducted in December and January. The empirical research was conducted according to the framework presented in

Figure 1. The quantitative approach was selected to fulfill the research gap in the area of management accounting skills analysis.

The labor markets of the selected countries were examined. The goal was to compare the demand for management accountant positions in different continents and countries according to the following criteria: differentiation in GDP level, labor force, IT development level, geographical position (different continents and different European regions), population differentiation. The 5 following countries were taken into consideration: the United States of America, Canada, Poland, the United Kingdom, and Ukraine.

At the beginning, the most popular job search websites were selected, and their comparison was carried out. The following selection criteria were used: (1) the largest number of current management accountants posts, (2) ability to provide “advanced search” with the finding options, which allowed us to search for specific key words within the job posts’ textual content, (3) applicability in studied countries. Consequently, the “Indeed” job search website was chosen.

About 33 of thousands of job posts were analyzed. For all selected countries, the same research procedure was used. To filter the job posts, the website searching mechanism was used. For this purpose, the following keywords were entered in the webpage search field: “cognitive”, “analytics”, “cognitive analysis”, “Cognos”, and also “big data”, “large data”, “large data sets”, “large amounts of data”, etc. For skills analysis, “cognitive skills” and “cognitive abilities” key words were used. For position analysis, the following key words were primarily used: “management accountant”, “accounting manager”, “managerial accountant”, and similar.

The website searching mechanism found many relevant positions, such as: Accounting Manager, Senior Accounting Manager, Manager Accounting and Reporting, Department Budget Manager, Cost Accounting Manager, etc.

Based on the list of obtained, the number of job offers for management accountants (MA) and relevant positions containing cognitive skills requirements, cognitive analytics skills, and big data skills requirements was calculated. The results are presented in

Table 1. After that, the additional core competencies were identified by using the following key words: “Project management”, “Business process management”, “Change management”, “ERP” [

93], etc.

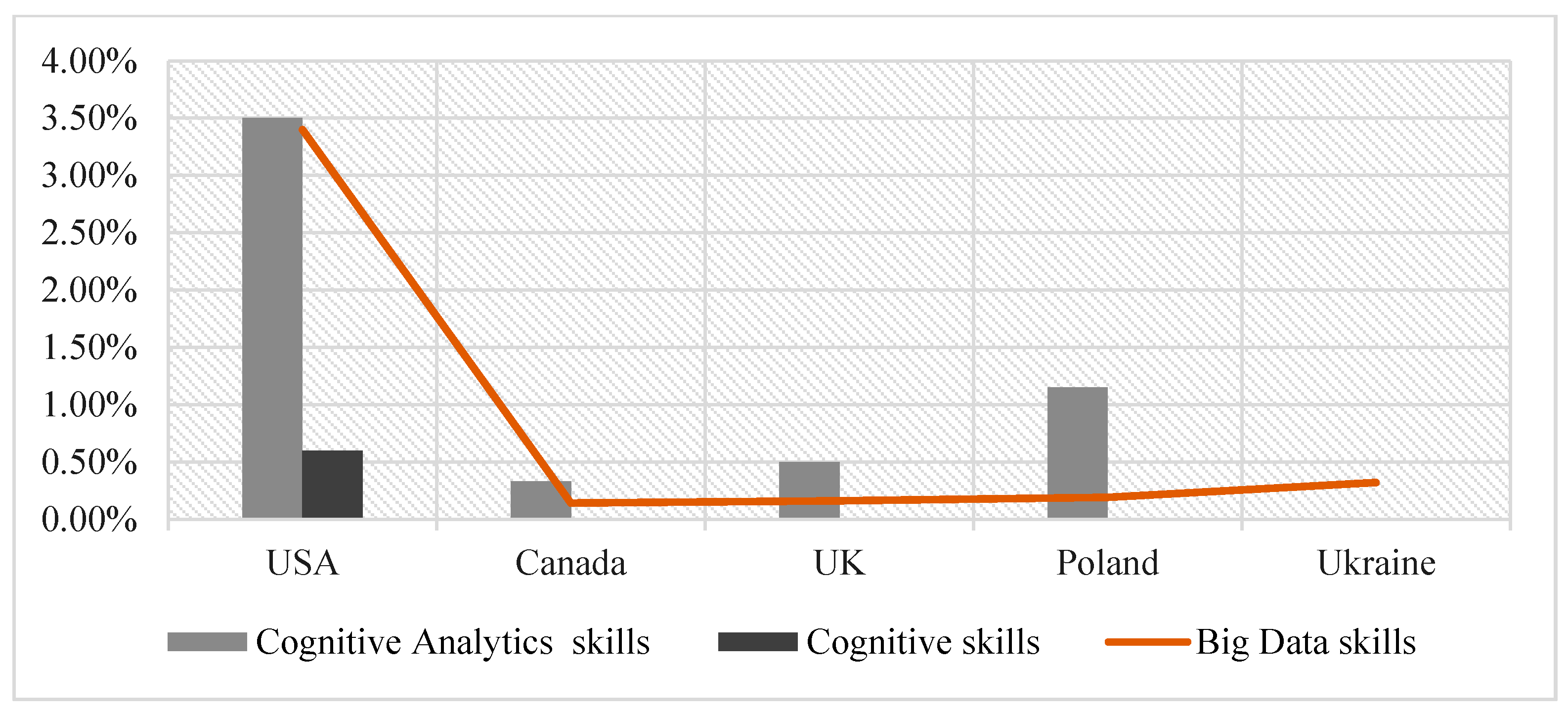

The significant difference in the number of offers among the studied countries was noticed (

Figure 2). The demand for management accountant positions in the Polish and Ukrainian labor markets was more than 30 times lower than in the United States labor market.

The filtered searches in the indeed.com website yielded 18,398 offers in the United States in November, 17,600 offers in December, and 17,496 offers in January (

Table 1,

Table A1,

Table A2,

Table A3 and

Table A4). It was found that cognitive analytics skills are currently very important for management accountants. Comprehensive cognitive skills were required only in 9–18 positions, and 173 companies were looking for professionals with different concrete cognitive abilities—with cognitive flexibility, cognitive thinking, cognitive skills to synthesize multiple inputs and reach a single optimal solution, and similar. In 3.1% of the total number of offers, companies require from management accountants knowledge of the Cognos system. In December and January, the situation on the labor market was subject to slight fluctuations (

Table 2 and

Table 3,

Table A5,

Table A6,

Table A7,

Table A8,

Table A9,

Table A10,

Table A11 and

Table A12). The descriptive statistics are presented in the

Appendix A.

However, the comparison of this data should be further considered in terms of labor market statistics (

Table 4).

The following data were acquired. According to NationMaster database the United States labor force was 154.9 million. It was ranked at 4th place, that is, 8 times more than Canada and many times more than the other studied countries. The Canadian labor force was made up of 18.59 million people, and the United Kingdom’s 31.45 million. Poland’s labor force comprises 17 million of people, while Ukraine’s labor force comprises 22.06 million. On the other hand, the UK’s labor force per 1000 was 505.05 m, 1% more than that of the United States, which was 500.77. In Canada, the labor force per 1000 was 544.74, 9% more than in the United States. Poland’s labor force per 1000 was 445.22, and in Ukraine, the labor force per 1000 was 480.92 [

93]. In terms of labor force per 1000 analysis, the United States was in the leading position. However, the labor force statistics analysis significantly eliminates the difference in size demand between Canada and the United Kingdom. The results of labor force statistics analysis allow for the elimination of the difference in size demand between Canada, the United Kingdom, and the United States, and gives these countries an advantage. Poland and Ukraine are in lower positions, but with better results due to a lower rate of labor force and labor force per 1000.

In the next step, the obtained data were filtered, and information about the demand in selected labor markets was analyzed in detail. Additionally, the descriptive statistics were calculated in order to prove the data’s usefulness and to enable further analysis and data comparison for future and deeper research. These statistics are presented in the

Appendix A.

In the United States, predominantly, the software experience required included, among other systems: Cognos, SAP, Essbase, Oracle Hyperion, Alteryx and Micro-Strategy Peoplesoft, SQL, Excel, DOMO, Lawson, JD Edwards, QAD, CostPoint, etc.

In Canada, the number of job offers for management accountants was about 3.5 times lower than in the United States in November (

Table 1). The total of 5272 offers was filtered. It was found that 38% required big data skills; 36% required cognitive analytics skills; 0% required cognitive skills; 10% required different cognitive abilities. The popularity of Cognos and Tableau software skills requirement was noticed. In December and January, the demand for big data skills and cognitive skills dropped dramatically (

Table 2 and

Table 3).

The software currently required for management accountants in Canada included, among others: AS 400, Cognos, Epicor, MS SSAS, SSRS, MS Power BI, QlikView, Tableau, PMP, PeopleSoft, SAP, Oracle Hyperion, NetSuite, Workday, Microsoft Dynamics, Adaptive Insights, etc.

In the United Kingdom, the total number of offers was about 9000 in November, with a subsequent decrease in the following months (

Table 1). It was found that 57% of offers required Cognos experience in November; 3% required with cognitive abilities; 0% required cognitive skills; 60% required with big data skills.

The software experience required in the United Kingdom most often concerned the following systems: Essbase, Cognos, Oracle Hyperion, Anaplan, Spotfire, Microsoft Power BI, Sage, eFinancials, Excel, SAP Hana, Vector, Wims, Capex, Caseware, Lawson, JD Edwards, SAS software. Additionally, some companies were looking for experienced managers with knowledge of VBA, Python, SQL, and R.

A total of 563 offers were filtered in Poland in November, 548 in December, and 518 in January (

Table 1,

Table 2 and

Table 3). It was found that 3% of offers required Cognos experience; none required cognitive skills; 4% required big data skills.

The software experience required was related to the following systems: SAP, Excel, Oracle, Sage. Additionally: Power Query, Power BI, SQL. In Poland, specialists with Tableau software experience were looked for more often than with Cognos. No job posts with cognitive abilities requirements were found.

In order to analyze the demand in Ukraine, the rabota.ua job searching portal was also checked, because of its greater popularity when compared to indeed.com. Very few companies were looking for management accountants with big data skills and cognitive analytic skills (from 1 to 3% of offers depending on the month), and no offers mentioned cognitive abilities.

In Ukraine, 1C was the preferred software (354 offers in November). The significant popularity of MS Excel was also noticed. It was also found several job posts with SAP, Oracle, and Cognos experience requirements, but no offers mentioned Tableau experience. Sometimes, companies (for example, Deloitte) were looking for management accountants only with BI, MySQL, or R skills.

5. Discussion

Summarizing the results obtained from the literature study and labor market research, it was concluded that the main technologies that have an impact on managerial accounting development are: big data technologies, cloud computing, cognitive computing, ERP systems, payment platforms, e-commerce platforms, Business Intelligence technologies. These technologies create new IT trends toward cognitive managerial accounting.

The research also revealed that the additional competencies needed for management accountants are, among others: ata anagement and Information Management skills, Change Management skills, Quality Management skills, strong IT and systems knowledge, Supply Chain Management skills, Program Management skills, Project Management skills, IT system implementation skills, and Business Process Management skills. So, the experts’ opinion [

43,

89,

92,

95] on the core competencies of future management accountants were confirmed. Additionally, we observed the increasing popularity of the cognitive ability “to understand the big picture” in the United Kingdom, Canada, and the United States.

On the basis of the literature study from

Section 2 (especially regarding [

76,

87,

92,

96,

97]) and the labor market analysis from

Section 3 (on the basis of the appearance frequency in job posts), the current model of management accountants’ core skills and abilities was created (

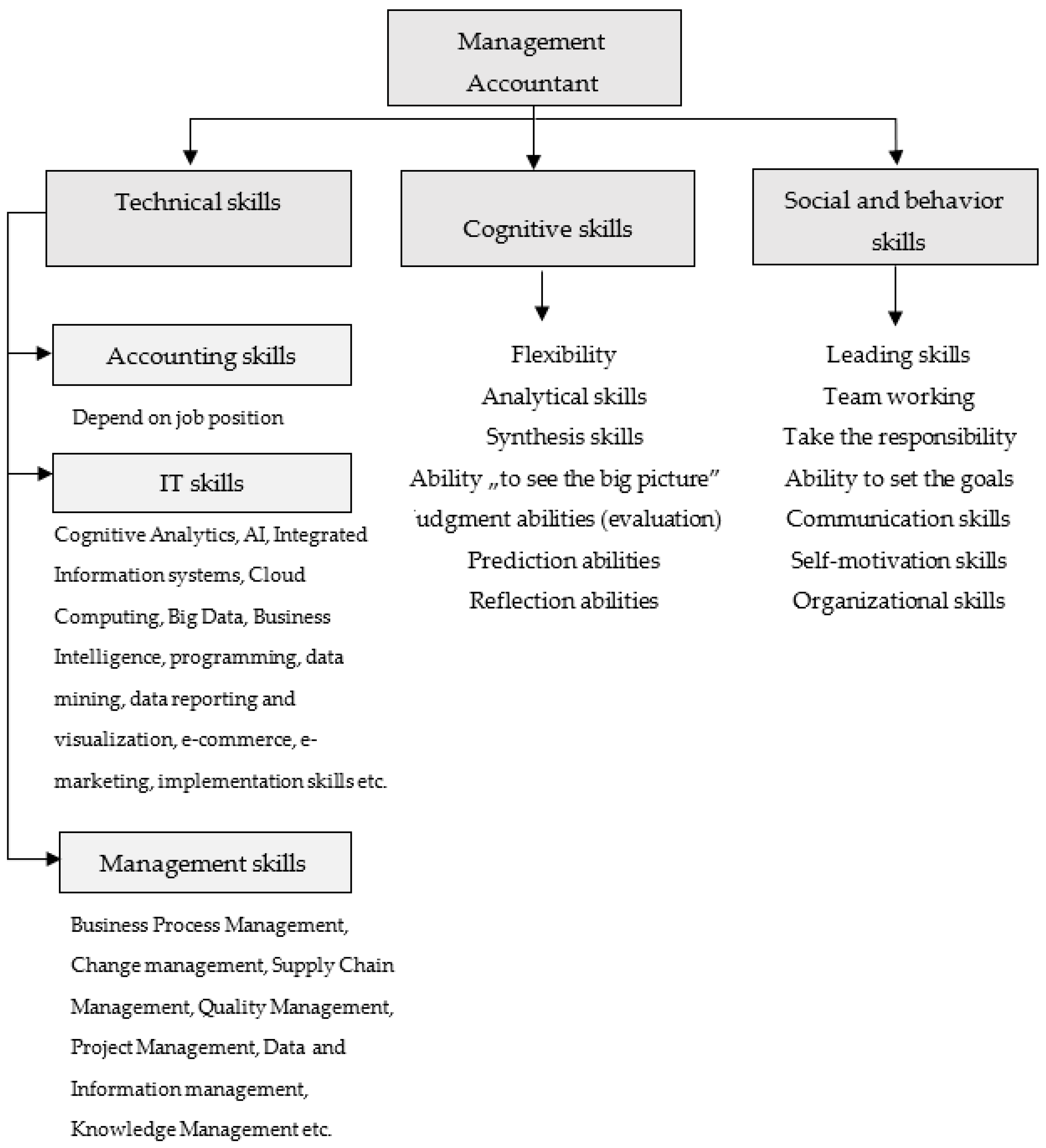

Figure 7).

The model considers two methodological approaches: the theoretical and the practical approach. In this model, one set of competencies is defined for a broad range of similar job positions corresponding to management accounting. The skills model of management accountant positions is built around 3 main groups: technical (specific skills), cognitive skills, and social and behavior skills. Due to the generic character of the skills considered, the model was qualified as a generic skills model.

The procedure of model creation was constructed in line with the methodological requirements presented in the literature on the subject [

98,

99,

100,

101,

102,

103,

104].

The following methodological approach was used in order to build the current management accountant skills model (

Figure 7).

The first stage was the target group identification. In this case, the target group consisted of management accountants and similar job positions. The second stage was the purpose and range establishing. The main purpose was to create a current model taking into consideration cognitive technologies and cognitive abilities and clearly highlighting them. The third stage was the selection of data collection methods. Among different methods, such as literature reviews, surveys, focus groups, interviews, etc., the literature review and labor market survey were selected. First, the literature study was conducted. The next stage was the model structure creation. Based on the literature study, the main structure of the model was created, including building the skills hierarchy by synthesizing them into the three main groups and providing a description with the relevant competencies for each group.

To evaluate and extend the results of the literature review, the labor market research was conducted. The next stage was the model validation through a labor market research and the model complementation with additional abilities corresponding with the main groups. At this stage, the frequency of the occurrence of abilities in job posts was analyzed. The last stage was the model revision and correction. The abilities that frequently appear in job posts and were not identified as a result of a literature study were added to the model. The abilities that do not appear in labor market analysis were excluded from the model. The model revision should be continuous. The enterprises should develop the framework checking current demand and market tendencies.

Based on the literature, a total of 30 competencies were derived. Various authors underline the key competencies required. The model contains three skill groups (

Figure 8):

The research has several limitations. First, it was hard to identify and exclude repeated job posts. The second limitation was that the study investigates only the “conscious demand”. That means that the research was based only on the job posts which contain the concrete definition of technologies like “big data”, “cognitive analytics”, and more soft definitions like “large data sets” analysis or “large amounts of data”. It could be presumed that some enterprises are also looking for management accountants with advanced cognitive analytics skills. However, they do not specify it sufficiently in job posts.

6. Conclusions

The era of cognitive technologies is approaching. However, many doubts related to the future of the accountant profession have appeared. Management accountants need to stay up to date with technological advances and accounting software.

Currently, cognitive technologies are already changing the labor markets of the surveyed countries, serving as an essential addition to the accounting profession. They are a tool for deep data analysis and decision making. Routine work is still carried out using ERP and financial systems.

Cognitive Analytics skills are currently required for managerial accountant positions, especially in the United States’ labor market, where cognitive technologies are used by many companies. The Cognitive Analytics skills are currently predominantly required in U.S.A. companies or international large companies. The number of positions where knowledge of cognitive technologies is required in Polish and Ukrainian markets is negligible. Small and medium enterprises still implement the concept of traditional or cloud accounting with Microsoft Excel analytics. In international companies, additionally, geographical analysis skills and knowledge of multidimensional visualization tools are required. The demand for additional advanced competencies in the field of data, information, and knowledge management for managerial positions in accounting was also proved and noticed.

To wrap up, most posted jobs were targeting highly qualified specialists. Therefore, high education institutions need to modernize and modify their programs in order to meet the labor market expectations. Moreover, future management accountants should not only be technically strong, but also have high cognitive abilities in order to support strategic decision-making and drive the business forward through increasingly large data sets.

The created skills model considers the management accountant profession in terms of smart sustainable business management. It takes into consideration the cognitive abilities and technical skills which are necessary for using cognitive information technologies. The proposed model had the advantage of being based on job offers, which clearly define competencies required of management accountants, associated with new technology skills and cognitive abilities. This enables the calculation of the “aware” demand.

There is a wide range of practical applications for the developed skills model. First, it can serve as the basis for developing a competency model in enterprises. In addition, the model can be used as a starting point for the development of new and more sustainable curricula at universities, as well as the creation of new training courses, including IT courses for various educational organizations. This model also indicates the directions of software development for management accounting users.

In the future, the number of analyzed countries should be enlarged. Such a comparison could reveal the geographical spread directions of cognitive technology development in the sphere of managerial accounting. It may also help high education institutions to prepare educational programs for the next decade.