The Influence of Innovation in Tangible and Intangible Resource Allocation: A Qualitative Multi Case Study

Abstract

:1. Introduction

- Explore the influence of Innovation in tangible and intangible resource allocation

- Recognize the importance of performance measurement tools for a more efficient monitoring tangible and intangible resource allocation.

2. Literature Review

2.1. The Relevance of Knowledge for Dynamic Capabilities

2.2. Market Turbulence and Technological Intensity

2.3. Competite Power of Dynamic Capabilities

2.4. Monitoring Learning and Growth and Intellectual Capital

3. Methodology and Participants

3.1. Method

- Explore the influence of Innovation in tangible and intangible resource allocation

- Recognize the importance of performance measurement tools for a more efficient monitoring tangible and intangible resource allocation.

3.2. Participants

3.3. Data Analysis

3.4. Cohesion between Reports

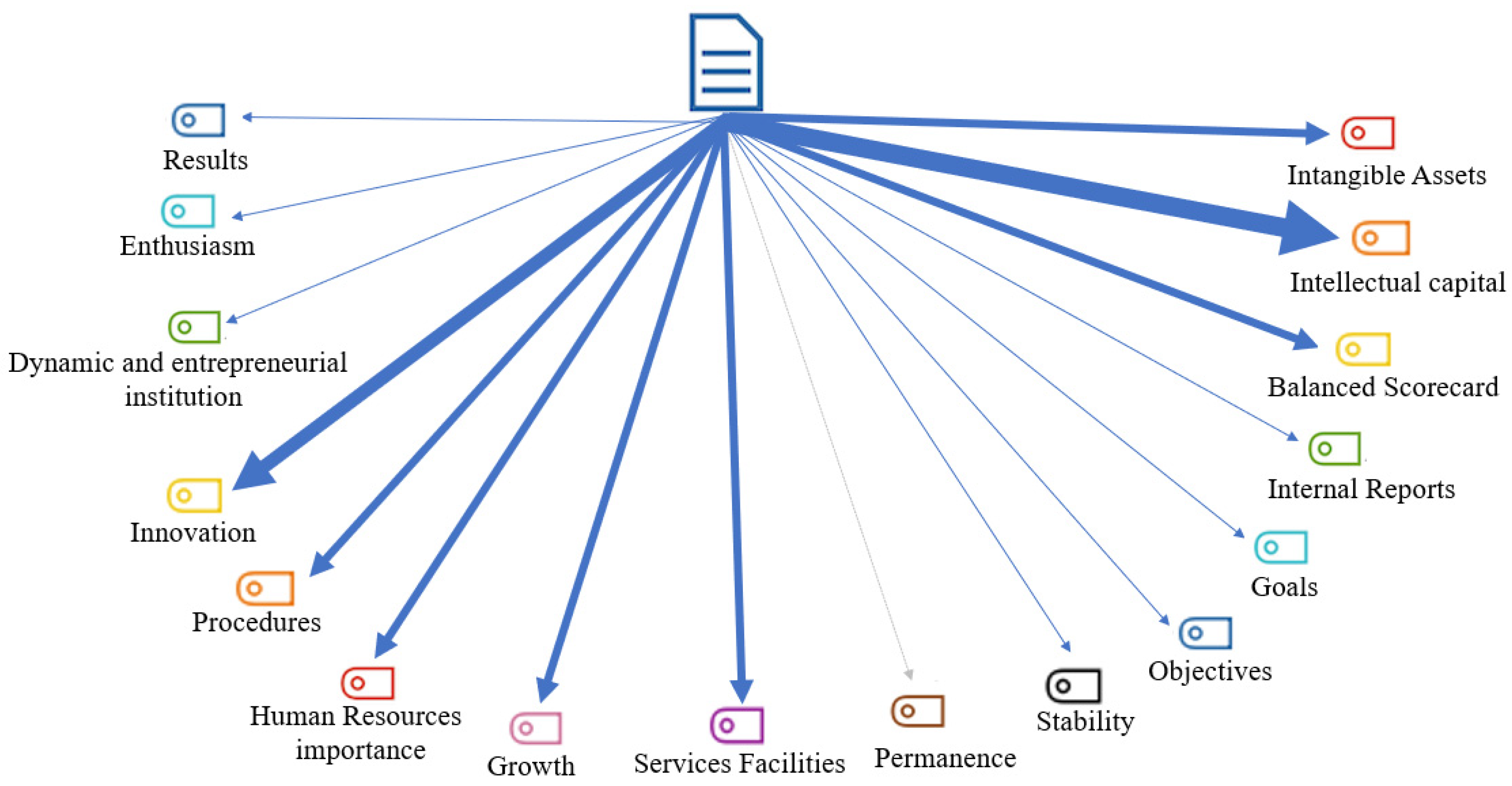

4. Results and Discussion

5. Conclusions

6. Limitations and Suggestions for Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

- What is the legal form of the organization in which you work?

- Since how many years has the organization existed?

- What is the average number of employees in this organization?

- Has the organization had positive or negative results in the past year?

- Are accounting services provided internally or externally to the organization?

- 6

- Regarding the following statements, please state what you perceive about each one of them:

- 6.1

- I personally identify with this institution, which is an extension of my family. Do employees also share this feeling?

- 6.2

- This institution is dynamic and entrepreneurial. All are adventurous and defend the following proverb: “He who does not risk does not gain”.

- 6.3

- This institution is oriented towards the provision of services. The biggest concern is to do the job with the greatest commitment of all.

- 6.4

- This institution attaches importance to human resources. High cohesion and morale are important in this institution.

- 6.5

- This institution attaches importance to the growth and provision of new services. It is important to be quick in the way you face

- 6.6

- This institution gives importance to competition and results. Achieving goals is important at this institution.

- 6.7

- This institution gives importance to competition and results. Achieving goals is important at this institution.

- 7

- Regarding organizational objectives and goals, consider that these are monitored through a database.

- 8

- The organizational objectives and strategies are reported only in internal reports.

- 9

- Does the organization apply methods of measuring intellectual capital, not provided for in accounting standards?

- 10

- Do you consider that the organization is characterized by high technological capacity and continuous investment in R&D solutions?

- 11

- Are significant resources (hardware, software, people, among others) allocated to information technology and its users?

- 12

- The real value of an organization is difficult to estimate, when it consists of human capital, because the knowledge and experience of employees is difficult to be quantified.

- 13

- Do you agree that the use of standardized methods of evaluating intellectual capital allows a more realistic assessment of the value of a company?

- 14

- Is the organization’s management sufficiently familiar with the benefits and capabilities of the Balanced Scorecard (BSC) reporting?

References

- Guenther, T.W.; Heinicke, A. Relationships among types of use, levels of sophistication, and organizational outcomes of performance measurement systems: The crucial role of design choices. Manag. Account. Res. 2019, 42, 1–25. [Google Scholar] [CrossRef]

- Hansen, E.G.; Schaltegger, S. The Sustainability Balanced Scorecard: A Systematic Review of Architectures. J. Bus. Ethics 2016, 133, 193–221. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Using the Balanced Scorecard as a Strategic Management System. Harv. Bus. Rev. 1996, 74, 75–85. [Google Scholar] [CrossRef]

- Cabrita, M.R.; Machado, V.C.; Grilo, A. Leveraging knowledge management with the balanced scorecard. In Proceedings of the IEEM2010—IEEE International Conference on Industrial Engineering and Engineering Management, Macao, China, 7–10 December 2010; IEEE: Piscataway, NJ, USA, 2010; pp. 1066–1071. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Agency theory: An assessment and review. Acad. Manag. Rev. 1989, 14, 57–74. [Google Scholar] [CrossRef] [Green Version]

- Zhou, S.S.; Zhou, A.J.; Feng, J.; Jiang, S. Dynamic capabilities and organizational performance: The mediating role of innovation. J. Manag. Organ. 2019, 25, 731–747. [Google Scholar] [CrossRef] [Green Version]

- Peters, M.D.; Gudergan, S.; Booth, P. Interactive profit-planning systems and market turbulence: A dynamic capabilities perspective. Long Range Plan. 2019, 52, 386–405. [Google Scholar] [CrossRef]

- Giniuniene, J.; Jurksiene, L. Dynamic capabilities, innovation and organizational learning: Interrelations and impact on firm performance. Procedia Soc. Behav. Sci. 2015, 213, 985–991. [Google Scholar] [CrossRef] [Green Version]

- Eustace, C. A new perspective on the knowledge value chain. J. Intellect. Cap. 2003, 4, 588–596. [Google Scholar] [CrossRef]

- Nelson, R.R.; Winter, S.G. An Evolutionary Theory of Economic Change; Belknap Press: Cambridge, MA, USA; London, UK, 1982. [Google Scholar]

- Tripsas, M. Unraveling the Process of Creative Destruction: Complementary Assets and Incumbent Survival in the Typesetter Industry. Strateg. Manag. J. 1997, 18, 119–142. [Google Scholar] [CrossRef]

- Helfat, C.E.; Finkelstein, S.; Mitchell, W.; Peteraf, M.A.; Singh, H.; Teece, D.J.; Winter, S.G. Dynamic Capabilities: Understanding Strategic Change in Organizations; John Wiley Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Winter, S.G. Understanding dynamics capabilities. Strateg. Manag. J. 2003, 24, 991–995. [Google Scholar] [CrossRef] [Green Version]

- Hoopes, D.G.; Madsen, T.L.; Walker, G. Guest editor’s introduction to the special Issue: Why is there a resource-based view. Strateg. Manag. J. 2003, 24, 889–902. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Tabrizi, B.N. Accelerating Adaptive Processes: Product Innovation in the Global Computer Industry. Adm. Sci. Q. 1995, 40, 84–110. [Google Scholar] [CrossRef]

- Nahapiet, J. Social Capital Intellectual Capital and the Organizational Advantage. Acad. Manag. Rev. 1998, 23, 242–266. [Google Scholar] [CrossRef]

- Jiao, H.; Wei, J.; Cui, Y. An empirical study on paths to develop dynamic capabilities: From the perspectives of entrepreneurial orientation and organizational learning. Front. Bus. Res. China 2010, 4, 47–72. [Google Scholar] [CrossRef] [Green Version]

- Augier, M.; Teece, D.J. Dynamic Capabilities and the Role of Managers in Business Strategy and Economic Performance. Organ. Sci. 2009, 20, 410–421. [Google Scholar] [CrossRef]

- Teece, D.; Pisano, G. The dynamic capabilities of firms: An introduction. Ind. Corp. Chang. 1994, 3, 537–556. [Google Scholar] [CrossRef] [Green Version]

- Eriksson, T. Processes, antecedents and outcomes of dynamic capabilities. Scand. J. Manag. 2014, 30, 65–82. [Google Scholar] [CrossRef]

- Dyer, J.; Nobeoka, K. Creating and Managing a High-Performance Knowledge-Sharing Network: The Toyota Case. Strateg. Manag. J. 2000, 21, 345–367. [Google Scholar] [CrossRef]

- Hall, M.J. Knowledge management and the limits of knowledge codification. J. Knowl. Manag. 2006, 10, 117–126. [Google Scholar] [CrossRef]

- Zollo, M.; Winter, S.G. Deliberate learning and the evolution of dynamic capabilities. Organ. Sci. 2002, 13, 339–351. [Google Scholar] [CrossRef]

- Lavie, D. Capability reconfiguration: An analysis of incumbent responses to technological change. Acad. Manag. Rev. 2006, 31, 153–174. [Google Scholar] [CrossRef]

- Castanisa, R.P.; Helfat, C.E. The managerial Rents the managerial Rents Model: Theory. J. Manag. 2001, 27, 661–678. [Google Scholar]

- Zahra, S.; Sapienza, H.J.; Davidsson, P. Entrepreunership and Dynamic Capabilities: A Review, Model and Research Agenda. J. Manag. Stud. 2006, 43, 917–955. [Google Scholar] [CrossRef] [Green Version]

- Benner, M.I.; Tushman, M. Exploitation, exploration, and process management: The productivity dilemma revisited. Acad. Manag. Rev. 2003, 28, 238–256. [Google Scholar] [CrossRef] [Green Version]

- Salunke, S.; Weerawardena, J.; McColl-Kennedy, J.R. The central role of knowledge integration capability in service innovation-based competitive strategy. Ind. Mark. Manag. 2019, 76, 144–156. [Google Scholar] [CrossRef]

- Kien, S.; Vinh, X.; Minh, T.; Vo, T. Heliyon Innovative strategies and corporate pro fi tability: The positive resources dependence from political network. Heliyon 2020, 6, e03788. [Google Scholar] [CrossRef]

- Mikalef, P.; Krogstie, J.; Pappas, I.O.; Pavlou, P. Exploring the relationship between big data analytics capability and competitive performance: The mediating roles of dynamic and operational capabilities. Inf. Manag. 2020, 57, 103169. [Google Scholar] [CrossRef]

- Fainshmidt, S.; Wenger, L.; Pezeshkan, A.; Mallon, M.R. When do dynamic capabilities lead to competitive advantage? The importance of strategic fit. J. Manag. Stud. 2019, 56, 758–787. [Google Scholar] [CrossRef]

- Christensen, C.M.; Bower, J.L. Investment, Customer Power, Strategic of Leading Firms and the Failure. Strateg. Manag. J. 1996, 17, 197–218. [Google Scholar] [CrossRef]

- Cokins, G. Enterprise Performance Management (EPM) and the Digital Revolution. Perform. Improv. 2017, 56, 14–19. [Google Scholar] [CrossRef]

- Makkonen, H.; Pohjola, M.; Olkkonen, R.; Koponen, A. Dynamic capabilities and firm performance in a financial crisis. J. Bus. Res. 2014, 67, 2707–2719. [Google Scholar] [CrossRef]

- Fiol, C.M. Revisiting an identity-based view of sustainable competitive advantage. J. Manag. 2001, 27, 691. [Google Scholar] [CrossRef]

- Ambrosini, V.; Bowman, C. What are dynamic capabilities and are they a useful construct in strategic management? Int. J. Manag. Rev. 2009, 11, 29–49. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Porter, M. Towards a dynamic theory of strategy. Strateg. Manag. J. 1991, 12, 95–117. [Google Scholar] [CrossRef]

- Zahra, S.A. Entrepreneurship in Medium-Size Companies: Exploring the Effects of Ownership and Governance Systems. J. Manag. 2000, 26, 947–976. [Google Scholar] [CrossRef]

- Cancellier, É.L.P.D.L.; Alberton, A.; Barbosa, A. Diferenças na atividade de monitoramento de informações do ambiente externo em pequenas e médias empresas: A influência do porte e da idade. Perspect. Ciênc. Inf. 2011, 16, 168–186. [Google Scholar] [CrossRef] [Green Version]

- Pollalis, Y.; Grant, J.H. Information resources and corporate strategy development. Inf. Strategy Exec. J. 1994, 11, 12–28. [Google Scholar]

- Eisenhardt, K.M. Making fast strategic decisions in high-velocity environments. Acad. Manag. J. 1989, 32, 543–576. [Google Scholar]

- Teece, D.J. Dynamic Capabilities: Routines versus Entrepreneurial Action. J. Manag. Stud. 2012, 49, 1395–1401. [Google Scholar] [CrossRef]

- Harrison, J.S.; Hitt, M.A.; Hoskisson, R.E.; Ireland, R.D. Resource complementarity in business combinations: Extending the logic to organizational alliances. J. Manag. 2001, 27, 679–690. [Google Scholar] [CrossRef]

- Hitt, M.A. Managing Resources: Linkning Unique Resources, Management and Welth Creation in Family Firms. Entrep. Theory Pract. 2003, 27, 339–359. [Google Scholar]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D. Managing firm resources in dynamic environments to create value: Looking inside the black box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef] [Green Version]

- Jauch, L.K.; Kraft, K.L. Strategic Management of Uncertainty. Acad. Manag. Rev. 1986, 11, 777–790. [Google Scholar] [CrossRef]

- Mitrega, M.; Pfajfar, G. Business relationship process management as company dynamic capability improving relationship portfolio. Ind. Mark. Manag. 2015, 46, 193–203. [Google Scholar] [CrossRef]

- Jantunen, A.; Ellonen, H.K.; Johansson, A. Beyond appearances–Do dynamic capabilities of innovative firms actually differ? Eur. Manag. J. 2012, 30, 141–155. [Google Scholar] [CrossRef]

- Lee, J.; Lee, K.; Rho, S. An evolutionary perspective on strategic group emergence: A genetic algorithm-based model. Strateg. Manag. J. 2002, 23, 727–746. [Google Scholar] [CrossRef]

- Quattrone, P. Management accounting goes digital: Will the move make it wiser? Manag. Account. Res. 2016, 31, 118–122. [Google Scholar] [CrossRef] [Green Version]

- Rikhardsson, P.; Yigitbasioglu, O. Business intelligence & analytics in management accounting research: Status and future focus. Int. J. Account. Inf. Syst. 2018, 29, 37–58. [Google Scholar] [CrossRef] [Green Version]

- Poll, R. Performance, Processes and Costs: Managing Service Quality with the Balanced Scorecard. Libr. Trends 2001, 49, 709–717. [Google Scholar]

- Mooraj, S.; Oyon, D.; Hostettler, D. The balanced scorecard: A necessary good or an unnecessary evil? Eur. Manag. J. 1999, 17, 481–491. [Google Scholar] [CrossRef]

- Cooper, D.J.; Ezzamel, M.; Qu, S. Creating and Poularizing a Management Accounting Idea: The Case of the Balanced Scorecard; Alberta School of Business: Edmonton, AB, Canada, 2011; Unpublished Paper. [Google Scholar]

- Frigo, M.L.; Krumwiede, K.R. The balanced scorecard: A winning performance measurement system. Strateg. Financ. 2000, 81, 50–54. [Google Scholar]

- Lesáková, Ľ.; Dubcová, K. Knowledge and Use of the Balanced Scorecard Method in the Businesses in the Slovak Republic. Procedia Soc. Behav. Sci. 2016, 230, 39–48. [Google Scholar] [CrossRef] [Green Version]

- Lima, A.; Cavalcanti, A.; Ponte, V. Da onda da Gestão da Qualidade a uma Filosofia da Qualidade da Gestão: Balanced Scorecard Promovendo Mudanças. Rev. Contab. Finanç. Ed. Espec. 2004, 15, 79–94. [Google Scholar] [CrossRef] [Green Version]

- García-Valderrama, T.; Mulero-Mendigorri, E.; Revuelta-Bordoy, D. A Balanced Scorecard framework for R&D. Eur. J. Innov. Manag. 2008, 11, 241–281. [Google Scholar]

- Swift, P.; Hwang, A. The Learning Organization Article information. Learn. Organ. 2008, 15, 75–95. [Google Scholar] [CrossRef]

- Luthy, D.H. Intellectual capital and its measurement. In Proceedings of the Asian Pacific Interdisciplinary Research in Accounting Conference (APIRA), Osaka, Japan, 4–6 August 1998; pp. 16–17. [Google Scholar]

- Leite, J.B.D.; Porsse, M.D.C.S. Competição baseada em competências e aprendizagem organizacional: Em busca da vantagem competitiva. Rev. Admin. Contemp. 2003, 7, 121–141. [Google Scholar] [CrossRef]

- Marr, B.; Gray, D.; Neely, A. Why do firms measure their intellectual capital? J. Intellect. Cap. 2003, 4, 441–464. [Google Scholar] [CrossRef]

- Marr, B.; Schiuma, G.; Neely, A. Intellectual capital—Defining key performance indicators for organizational knowledge assets. Bus. Process Manag. J. 2004, 10, 551–569. [Google Scholar] [CrossRef] [Green Version]

- Guthrie, J. The management, measurement and the reporting of intellectual capital. J. Intellect. Cap. 2001, 2, 27–41. [Google Scholar] [CrossRef]

- Andriessen, D. IC valuation and measurement: Classifying the state of the art. J. Intellect. Cap. 2004, 5, 230–242. [Google Scholar] [CrossRef]

- Dumay, J.C. Intellectual capital measurement: A critical approach. J. Intellect. Cap. 2009, 10, 190–210. [Google Scholar] [CrossRef]

- Kannan, G.; Aulbur, W.G. Intellectual capital: Measurement effectiveness. J. Intellect. Cap. 2004, 5, 389–413. [Google Scholar] [CrossRef]

- Yin, R.K. Qualitative Research from Start to Finish; Guilford Publications: New York, NY, USA, 2015. [Google Scholar]

- Ryan, B.; Scapens, R.W.; Theobold, M. Chapter 1. In Research Methods and Methodology in Finance and Accounting; Academic Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Patton, M.Q. Qualitative Evaluation and Research Methods; SAGE Publications Inc.: Washington, DC, USA, 1990. [Google Scholar]

- Giorgi, A.; Sousa, D. Método fenomenológico de investigação em psicologia. Lisboa Fim de Século 2010, 25, 73–91. [Google Scholar]

- Hernandez, B.; Hidalgo, M.C.; Ruiz, C. Theoretical and methodological aspects of research on place attachment. In Place Attachment: Advances in Theory, Methods and Applications; Routledge: New York, NY, USA, 2014; pp. 125–137. [Google Scholar]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

| Author | Year | Aim | Methodology | Main Conclusions |

|---|---|---|---|---|

| Salunke, Weerawardena, & McColl-Kennedy [28] | 2019 | Exploit how B2B service companies organize and manage knowledge in order to achieve competitive advantage | B2B organizations related to projects of Australia and USA | The knowledge acquired through external and internal sources, must be integrated with the existing knowledge, to provide innovative services that correspond to the needs of the customers. |

| Zhou, Zhou, Feng, and Jiang [6] | 2019 | Understand different dimensions of dynamic capabilities that influence company’s performance | 204 Chinese firms, SEM | There are mechanisms dimensions (detection, integration and reconfiguration capabilities) of dynamic capabilities which influence the company’s performance. |

| Peters, Gudergan and Booth [7] | 2019 | Interactive profit planning based on dynamic capabilities. | Interview of 331 Australian firms | Greater market turbulence strengthens the effect in interactive resources and greater market turbulence reinforces the positive effect of flexibility values. |

| Kien, Vinh, Minh, and Vo [29] | 2020 | Political policy’s effect on innovative activities | 2600 companies in Vietnam, | Innovative activities by itself, in small and media companies, do not promote corporate performance. |

| Mikalef, Krogstie, Pappas and Pavlou [30] | 2020 | Competitive Power | Survey data from 202 chief information officers and IT managers working in Norwegian firms (SEM modeling) | Dynamic capabilities have positive effect and are significant in two types of operational resources: marketing and technological resources. |

| Giniuniene and Jurksiene [8] | 2015 | Relationship between dynamic capabilities, organizational learning and innovations’ impact on company’s performance | Conceptual research paper | Theoretical model for establishing empirical tests. |

| Fainshmidt, Wenger, Pezeshkan, & Mallon [31] | 2019 | The relationship of dynamic capabilities and competitive advantage is dependent on the strategic fit between organizational and environmental factors | Comparative qualitative analysis | Strategic adjustment between organizational and environmental factors, require a rigorous assessment of configurational dynamic resources. |

| Code | Sex | Age | Years of Experience | Qualifications | Occupation | Interview Duration |

|---|---|---|---|---|---|---|

| P1 | Male | 39 years | 14 | Master | Member Board Directors | 65 min |

| P2 | Female | 46 years | 22 | MBA | Controlling Manager | 60 min |

| P3 | Male | 45 years | 23 | Bachelor | Development Manager | 57 min |

| P4 | Male | 54 years | 32 | Bachelor | Administrative and Fin Manager | 72 min |

| P5 | Male | 50 years | 27 | PhD | General Manager | 75 min |

| Participants | P1 | P2 | P3 | P4 | P5 |

|---|---|---|---|---|---|

| P1 | 1.00 | 0.75 | 0.88 | 0.88 | 0.88 |

| P2 | 0.75 | 1.00 | 0.63 | 0.88 | 0.75 |

| P3 | 0.88 | 0.63 | 1.00 | 0.75 | 0.88 |

| P4 | 0.88 | 0.88 | 0.75 | 1.00 | 0.75 |

| P5 | 0.88 | 0.75 | 0.88 | 0.75 | 1.00 |

| Themes | Units of Meaning |

|---|---|

| Innovation | I01: “…whenever we work in a highly qualified market, innovation is central …” I02: “…innovation and I believe that it is based on this that we are achieving the current prominence in terms of exports…” I04: “…intellectual capital is measured through several reports…”. |

| Procedures | I03: “…we naturally have regulations, however, we are not totally against excessive formalities…”. I04: “… we have procedures, however we are also given scope to contribute and have critical thinking…” |

| Human Resources | I01: “…all this success that we have been talking about has been achieved thanks to the effort of our human resources. Our ideas come from them and are developed by our resources…” I05: “… Of course, cohesion is important… we usually spend more time in the front-office with the client or thinking about how to develop products for the client…” |

| Growth | I01: “… in the future there will be a need for specialized reports…” I05: “… We are in a highly competitive market, so we really have to give importance to growth and the provision of new services…” |

| Service Facilities | I05: “…to be successful we need our customers to trust us and for that, we must work with greater commitment…” I01: “…we really provide services and innovative products… I agree to say that we are oriented towards providing services…” |

| Balanced Scorecard | 102: “…we currently don’t have the Balanced Scorecard implemented yet, but I think it would be a great asset…” I04: “…Yes, in order to be able to measure the objectives and safeguard the link with the defined strategy, we consider that the BSC is effectively an excellent aid, as it allows to identify the cause–effect links between indicators and communicate the strategy to all stakeholders, whether internal or external to the organization…“ I05: “…Yes, the BSC is an excellent aid for linking the strategy to the indicators, setting goals and communicating the strategy itself. Additionally, it allows us to identify deviations from the defined strategy…” |

| Intellectual Capital | I03: “…Intellectual capital is behind each development, so when we try to determine the cost of a new product or service, we implicitly try to estimate its cost. However, it is not easy to add, as would be the case if palpable raw materials were involved…” I05: “… we are considering the acquisition of an organization that competes with us, so we are fully aware that the value of the company does not correspond linearly to the value of financial reports…” |

| Intangible Assets | I02: “… from time to time, intangible assets will assume a prominent position… in the future there will be detailed reports about them…” I01: “… it is really more difficult to be able to estimate the value of intangibles, however, it is this value that distinguishes us in the market” |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Silva, R.; Oliveira, C. The Influence of Innovation in Tangible and Intangible Resource Allocation: A Qualitative Multi Case Study. Sustainability 2020, 12, 4989. https://doi.org/10.3390/su12124989

Silva R, Oliveira C. The Influence of Innovation in Tangible and Intangible Resource Allocation: A Qualitative Multi Case Study. Sustainability. 2020; 12(12):4989. https://doi.org/10.3390/su12124989

Chicago/Turabian StyleSilva, Rui, and Cidália Oliveira. 2020. "The Influence of Innovation in Tangible and Intangible Resource Allocation: A Qualitative Multi Case Study" Sustainability 12, no. 12: 4989. https://doi.org/10.3390/su12124989

APA StyleSilva, R., & Oliveira, C. (2020). The Influence of Innovation in Tangible and Intangible Resource Allocation: A Qualitative Multi Case Study. Sustainability, 12(12), 4989. https://doi.org/10.3390/su12124989