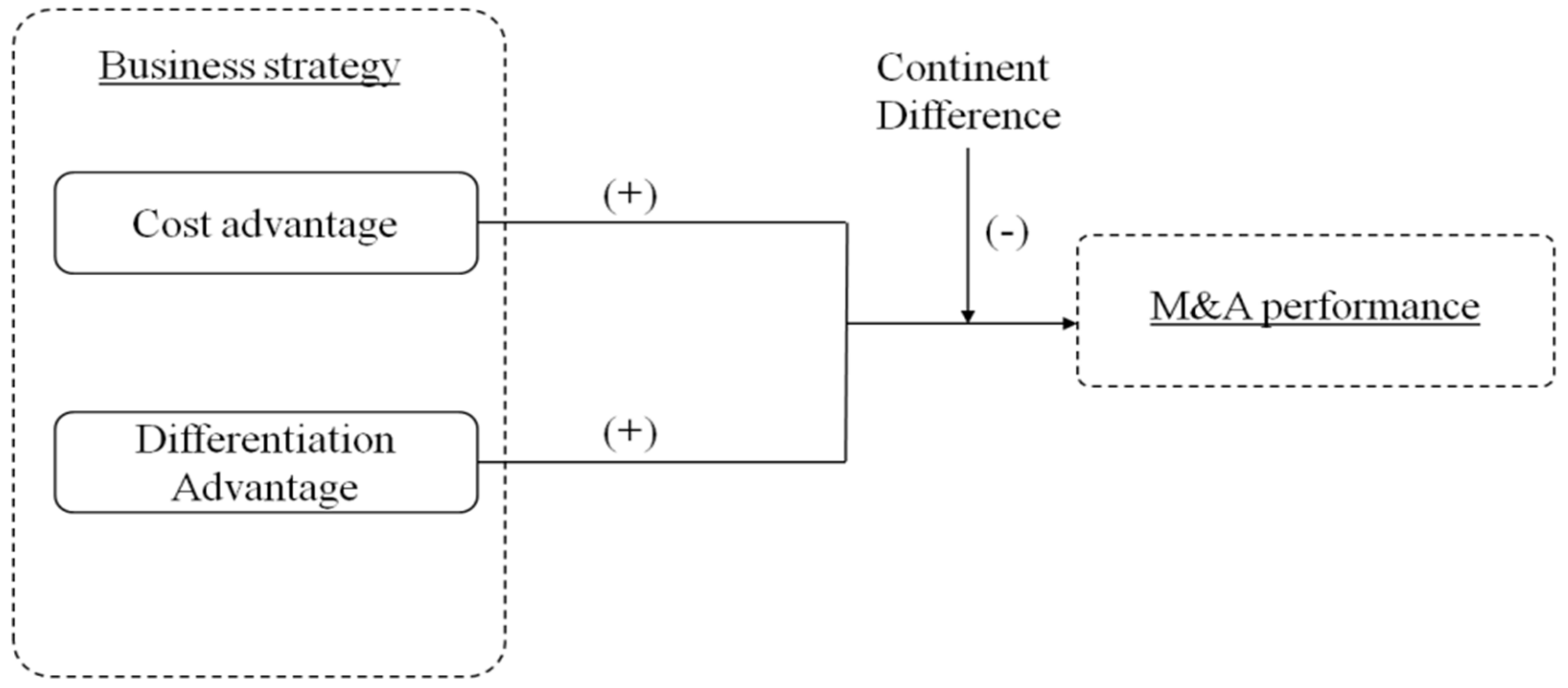

Moderating Effect of the Continental Factor on the Business Strategy and M&A Performance in the Pharmaceutical Industry for Sustainable International Business

Abstract

:1. Introduction

2. Literature Review and Research Questions

2.1. Cost Leadership Strategy and Differentiation Strategy in M&A Performance

2.2. Moderating Effect of the Continental Factor in International Business Strategy Success

3. Method

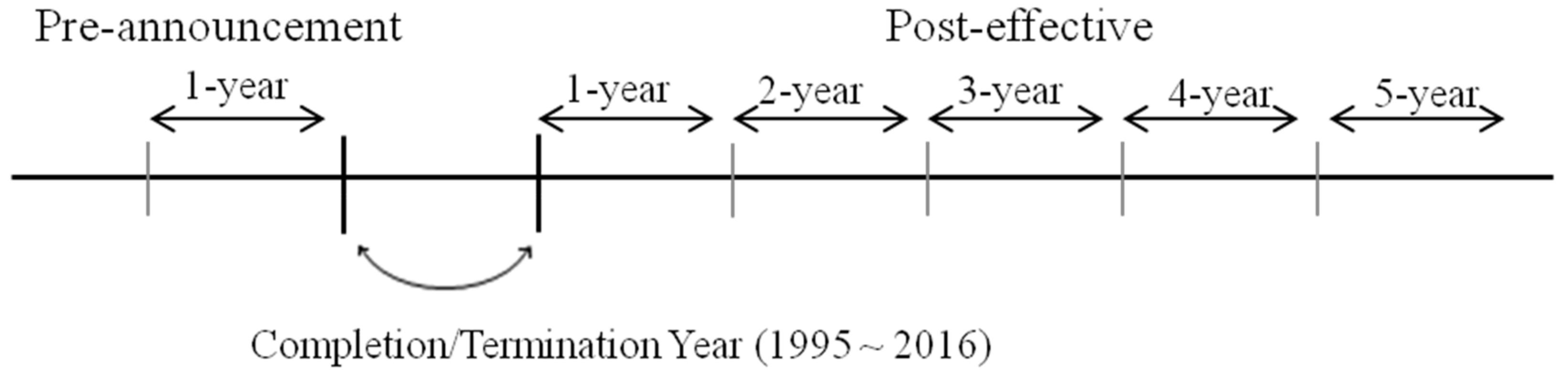

3.1. Sampling and Data Collection

3.2. Data Collection and Descriptive Statistics

3.3. Methods

3.4. Dependent Variable

3.5. Independent Variable

3.5.1. Background of Independent Variable Selection

3.5.2. Cost Leadership

3.5.3. Product Differentiation

3.6. Moderators

3.7. Control Variables

4. Results

5. Conclusions

5.1. Discussion and Implications

5.2. Limitations and Suggestions for Future Studies

Author Contributions

Funding

Conflicts of Interest

References

- Danzon, P.M.; Epstein, A.; Nicholson, S. Mergers and acquisitions in the pharmaceutical and biotech industries. Manag. Decis. Econ. 2007, 28, 307–328. [Google Scholar] [CrossRef] [Green Version]

- You, T.; Chen, X.; Holder, M.E. Efficiency and its determinants in pharmaceutical industries: Ownership, R&D and scale economy. Appl. Econ. 2010, 42, 2217–2241. [Google Scholar]

- James, A.D. The strategic management of mergers and acquisitions in the pharmaceutical industry: Developing a resource-based perspective. Technol. Anal. Strateg. Manag. 2002, 14, 299–313. [Google Scholar] [CrossRef]

- Hassan, M.; Patro, D.K.; Tuckman, H.; Wang, X. Do mergers and acquisitions create shareholder wealth in the pharmaceutical industry? Int. J. Pharm. Healthc. Mark. 2007, 1, 58–78. [Google Scholar] [CrossRef]

- Schweizer, L. The key drivers and success factors for M&A strategies in the biotechnological and pharmaceutical industry. Pharm. Policy Law 2002, 5, 41–62. [Google Scholar]

- Srivastava, R.K. Managing mergers and acquisitions in health care: A case study in the pharmaceutical sector. Int. J. Healthcare Manag. 2018, 1–13. [Google Scholar] [CrossRef]

- Ruffolo, R.R. Why has R&D productivity declined in the pharmaceutical industry? Expert Opin. Drug Discov. 2006, 1, 99–102. [Google Scholar]

- Iwatani, M. Solving Challenges at Japanese Firms with M&A. Nomura J. Cap. Mark. 2009, 1, 7. [Google Scholar]

- Pammolli, F.; Magazzini, L.; Riccaboni, M. The productivity crisis in pharmaceutical R&D. Nature Rev. Drug Discov. 2011, 10, 428–438. [Google Scholar]

- Ringel, M.S.; Choy, M.K. Do large mergers increase or decrease the productivity of pharmaceutical R&D? Drug Discov. Today 2017, 22, 1749–1753. [Google Scholar]

- Dierks, R.M.L.; Bruyère, O.; Reginster, J.-Y. Critical analysis of valuation and strategical orientation of merger and acquisition deals in the pharmaceutical industry. Expert Rev. Pharm. Outcomes Res. 2018, 18, 147–160. [Google Scholar] [CrossRef]

- Hitt, M.A.; Ireland, R.D.; Hoskisson, R.E. Strategic Management Cases: Competitiveness and Globalization; Cengage Learning: Boston, MA, USA, 2012. [Google Scholar]

- Lee, W.B.; Cooperman, E.S. Conglomerates in the 1980s: A performance appraisal. Financ. Manag. 1989, 18, 45–54. [Google Scholar] [CrossRef]

- Hankir, Y.; Rauch, C.; Umber, M.P. Bank M&A: A market power story? J. Bank. Financ. 2011, 35, 2341–2354. [Google Scholar]

- Blonigen, B.A.; Pierce, J.R. Evidence for the Effects of Mergers on Market Power and Efficiency; 0898-2937; National Bureau of Economic Research: Cambridge, MA, USA, 2016. [Google Scholar]

- Jensen, M.C. Agency costs of free cash flow, corporate finance, and takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Sirower, M.L. The Synergy Trap: How Companies Lose the Acquisition Game; Simon and Schuster: New York, NY, USA, 1997. [Google Scholar]

- Owen, S.; Yawson, A. Corporate life cycle and M&A activity. J. Bank. Financ. 2010, 34, 427–440. [Google Scholar]

- Wolf, R. Integration key to M&A success. Financ. Exec. 2003, 19, 62–65. [Google Scholar]

- Lin, L.; Lee, C.F.; Kuo, H.C. Merger and Acquisition: Definitions, Motives, and Market Responses; Springer: New York, NY, USA, 2013. [Google Scholar]

- Mulherin, J.H.; Netter, J.M.; Poulsen, A.B. The evidence on mergers and acquisitions: A historical and modern report. In The Handbook of the Economics of Corporate Governance; North-Holland: Amsterdam, The Netherlands, 2017; pp. 235–290. [Google Scholar]

- Kumar, B.R. Mergers and Acquisitions. In Wealth Creation in the World’s Largest Mergers and Acquisitions; Springer: Cham, Switzerland, 2019; pp. 1–15. [Google Scholar]

- Hitt, M.A.; Harrison, J.S.; Ireland, R.D. Mergers & Acquisitions: A Guide to Creating Value for Stakeholders; Oxford University Press: Oxford, UK, 2001. [Google Scholar]

- Vaara, E.; Sarala, R.; Stahl, G.K.; Björkman, I. The impact of organizational and national cultural differences on social conflict and knowledge transfer in international acquisitions. J. Manag. Stud. 2012, 49, 1–27. [Google Scholar] [CrossRef] [Green Version]

- Bauer, F.; Matzler, K. Antecedents of M&A success: The role of strategic complementarity, cultural fit, and degree and speed of integration. Strateg. Manag. J. 2014, 35, 269–291. [Google Scholar]

- Seth, A.; Song, K.P.; Pettit, R.R. Value creation and destruction in cross-border acquisitions: An empirical analysis of foreign acquisitions of US firms. Strateg. Manag. J. 2002, 23, 921–940. [Google Scholar] [CrossRef]

- Shimizu, K.; Hitt, M.A.; Vaidyanath, D.; Pisano, V. Theoretical foundations of cross-border mergers and acquisitions: A review of current research and recommendations for the future. J. Int. Manag. 2004, 10, 307–353. [Google Scholar] [CrossRef]

- Morosini, P.; Shane, S.; Singh, H. National cultural distance and cross-border acquisition performance. J. Int. Bus. Stud. 1998, 29, 137–158. [Google Scholar] [CrossRef]

- Reus, T.H.; Lamont, B.T. The double-edged sword of cultural distance in international acquisitions. J. Int. Bus. Stud. 2009, 40, 1298–1316. [Google Scholar] [CrossRef]

- Zhu, H.; Xia, J.; Makino, S. How do high-technology firms create value in international M&A? Integration, autonomy and cross-border contingencies. J. World Bus. 2015, 50, 718–728. [Google Scholar]

- Ahern, K.R.; Daminelli, D.; Fracassi, C. Lost in translation? The effect of cultural values on mergers around the world. J. Financ. Econ. 2015, 117, 165–189. [Google Scholar] [CrossRef]

- Reus, T.H.; Lamont, B.T.; Ellis, K.M. A darker side of knowledge transfer following international acquisitions. Strateg. Manag. J. 2016, 37, 932–944. [Google Scholar] [CrossRef]

- Miskon, S.; Bandara, W.; Gable, G.; Fielt, E. Success and failure factors of shared services: An IS literature analysis. In Proceedings of 2011 International Conference on Research and Innovation in Information Systems, Kuala Lumpur, Malaysia, 23–24 November 2011; pp. 1–6. [Google Scholar]

- Yoon, C.H.; Costello, F.J.; Kim, C. Assisting Sustainable Entrepreneurial Activities Through the Analysis of Mobile IT Services’ Success and Failure Factors. Sustainability 2019, 11, 5694. [Google Scholar] [CrossRef] [Green Version]

- Urban, B.; Naidoo, R. Business sustainability: Empirical evidence on operational skills in SMEs in South Africa. J. Small Bus. Enterp. Dev. 2012, 19, 146–163. [Google Scholar] [CrossRef]

- Glover, W.J.; Farris, J.A.; Van Aken, E.M.; Doolen, T.L. Critical success factors for the sustainability of Kaizen event human resource outcomes: An empirical study. Int. J. Prod. Econ. 2011, 132, 197–213. [Google Scholar] [CrossRef]

- Luthra, S.; Garg, D.; Haleem, A. The impacts of critical success factors for implementing green supply chain management towards sustainability: An empirical investigation of Indian automobile industry. J. Clean. Prod. 2016, 121, 142–158. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competitors; Simon and Schuster: New York, NY, USA, 2008. [Google Scholar]

- White, R.E. Generic business strategies, organizational context and performance: An empirical investigation. Strateg. Manag. J. 1986, 7, 217–231. [Google Scholar] [CrossRef]

- Day, G.S.; Wensley, R. Assessing advantage: A framework for diagnosing competitive superiority. J. Mark. 1988, 52, 1–20. [Google Scholar] [CrossRef]

- Miller, A.; Dess, G.G. Assessing Porter’s (1980) model in terms of its generalizability, accuracy and simplicity. J. Manag. Stud. 1993, 30, 553–585. [Google Scholar] [CrossRef]

- Banker, R.D.; Mashruwala, R.; Tripathy, A. Does a differentiation strategy lead to more sustainable financial performance than a cost leadership strategy? Manag. Decis. 2014, 52, 872–896. [Google Scholar] [CrossRef]

- Ahammad, M.F.; Tarba, S.Y.; Liu, Y.; Glaister, K.W.; Cooper, C.L. Exploring the factors influencing the negotiation process in cross-border M&A. Int. Bus. Rev. 2016, 25, 445–457. [Google Scholar]

- Uzelac, B.; Bauer, F.; Matzler, K.; Waschak, M. The moderating effects of decision-making preferences on M&A integration speed and performance. Int. J. Hum. Resour. Manag. 2016, 27, 2436–2460. [Google Scholar]

- Gomes, E.; Angwin, D.N.; Weber, Y.; Yedidia Tarba, S. Critical success factors through the mergers and acquisitions process: Revealing pre-and post-M&A connections for improved performance. Thunderbird Int. Bus. Rev. 2013, 55, 13–35. [Google Scholar]

- Mateev, M. Is the M&A announcement effect different across Europe? More evidences from continental Europe and the UK. Res. Int. Bus. Financ. 2017, 40, 190–216. [Google Scholar]

- Bertrand, O.; Madariaga, N. US Greenfield Investments and M&A location: Impact of American continental integration and Insider vs. Outsider position . In Proceedings of Royal Economic Society Annual Conference, Coventry, UK, 7 April 2003. [Google Scholar]

- Haspeslagh, P.C.; Jemison, D.B. Managing Acquisitions: Creating Value through Corporate Renewal; Free Press: New York, NY, USA, 1991; Volume 416. [Google Scholar]

- Haleblian, J.; Devers, C.E.; McNamara, G.; Carpenter, M.A.; Davison, R.B. Taking stock of what we know about mergers and acquisitions: A review and research agenda. J. Manag. 2009, 35, 469–502. [Google Scholar] [CrossRef]

- Kaplan, S.N.; Weisbach, M.S. The success of acquisitions: Evidence from divestitures. J. Financ. 1992, 47, 107–138. [Google Scholar] [CrossRef]

- Bruner, R.F. Does M&A pay? A survey of evidence for the decision-maker. J. Appl. Financ. 2002, 12, 48–68. [Google Scholar]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar]

- Gilinsky, A., Jr.; Newton, S.K.; Atkin, T.S.; Santini, C.; Cavicchi, A.; Casas, A.R.; Huertas, R. Perceived efficacy of sustainability strategies in the US, Italian, and Spanish wine industries. Int. J. Wine Bus. Res. 2015, 27, 164–181. [Google Scholar] [CrossRef]

- Atkin, T.; Gilinsky, A.; Newton, S.K. Sustainability in the wine industry: Altering the competitive landscape? In Proceedings of 6th AWBR International Conference, Bordeaux Management School, Bordeaux, France, 9–10 June 2004; pp. 9–10. [Google Scholar]

- Stankevičiūtė, E.; Grunda, R.; Bartkus, E.V. Pursuing a cost leadership strategy and business sustainability objectives: Walmart case study. Econ. Manag. 2012, 17, 1200–1206. [Google Scholar] [CrossRef]

- Won, J.; Ryu, S. The effect of firm life-cycle and competitive strategy on performance persistence. Korean Acc. J. 2016, 25, 33–65. [Google Scholar]

- Dess, G.G.; Davis, P.S. Porter’s (1980) generic strategies as determinants of strategic group membership and organizational performance. Acad. Manag. J. 1984, 27, 467–488. [Google Scholar]

- Xia, Y.; Tang, T.L.P. Sustainability in supply chain management: Suggestions for the auto industry. Manag. Decis. 2011, 49, 495–512. [Google Scholar] [CrossRef]

- Bretschger, L.; Smulders, S. Sustainability and substitution of exhaustible natural resources: How resource prices affect long-term R&D investments. FEEM 2003, 36, 536–549. [Google Scholar]

- Fursin, G.; Lokhmotov, A.; Plowman, E. Collective Knowledge: Towards R&D sustainability. In Proceedings of 2016 Design, Automation & Test in Europe Conference & Exhibition (DATE), Dresden, Germany, 14–18 March 2016; pp. 864–869. [Google Scholar]

- Grabowski, H.G.; Mueller, D.C. Industrial research and development, intangible capital stocks, and firm profit rates. Bell J. Econ. 1978, 9, 328–343. [Google Scholar] [CrossRef]

- Hoskisson, R.E.; Hitt, M.A.; Johnson, R.A.; Grossman, W. Conflicting voices: The effects of institutional ownership heterogeneity and internal governance on corporate innovation strategies. Acad. Manag. J. 2002, 45, 697–716. [Google Scholar]

- Kogut, B.; Singh, H. The effect of national culture on the choice of entry mode. J. Int. Bus. Stud. 1988, 19, 411–432. [Google Scholar] [CrossRef]

- Barkema, H.G.; Bell, J.H.; Pennings, J.M. Foreign entry, cultural barriers, and learning. Strateg. Manag. J. 1996, 17, 151–166. [Google Scholar] [CrossRef]

- Daniel, T.A.; Daniel, T.; Metcalf, G.S. The Management of People in Mergers and Acquisitions; Greenwood Publishing Group: Westport, CN, USA, 2001. [Google Scholar]

- Stahl, G.K.; Voigt, A. Do cultural differences matter in mergers and acquisitions? A tentative model and examination. Organ. Sci. 2008, 19, 160–176. [Google Scholar] [CrossRef]

- Chakrabarti, R.; Gupta-Mukherjee, S.; Jayaraman, N. Mars-Venus marriages: Culture and cross-border M&A. J. Int. Bus. Stud. 2009, 40, 216–236. [Google Scholar]

- Bauer, F.; Matzler, K.; Wolf, S. M&A and innovation: The role of integration and cultural differences—A central European targets perspective. Int. Bus. Rev. 2016, 25, 76–86. [Google Scholar]

- Tuch, C.; O’Sullivan, N. The impact of acquisitions on firm performance: A review of the evidence. Int. J. Manag. Rev. 2007, 9, 141–170. [Google Scholar] [CrossRef]

- Xie, E.; Reddy, K.; Liang, J. Country-specific determinants of cross-border mergers and acquisitions: A comprehensive review and future research directions. J. World Bus. 2017, 52, 127–183. [Google Scholar] [CrossRef]

- Park, C. The effects of prior performance on the choice between related and unrelated acquisitions: Implications for the performance consequences of diversification strategy. J. Manag. Stud. 2002, 39, 1003–1019. [Google Scholar] [CrossRef]

- Aiken, L.S.; West, S.G.; Reno, R.R. Multiple regression: Testing and interpreting interactions; Sage: London, UK, 1991. [Google Scholar]

- Chatterjee, S.; Hadi, A.S. Regression Analysis by Example; John Wiley & Sons: Hoboken, NJ, USA, 2015. [Google Scholar]

- Porrini, P. Can a previous alliance between an acquirer and a target affect acquisition performance? J. Manag. 2004, 30, 545–562. [Google Scholar] [CrossRef]

- Galy, E.; Sauceda, M.J. Post-implementation practices of ERP systems and their relationship to financial performance. Inf. Manag. 2014, 51, 310–319. [Google Scholar] [CrossRef]

- Barney, J.B. Gaining and Sustaining Competitive Advantage; Pearson Higher ed: London, UK, 2014. [Google Scholar]

- Brouthers, K.D.; Brouthers, L.E. Acquisition or greenfield start-up? Institutional, cultural and transaction cost influences. Strateg. Manag. J. 2000, 21, 89–97. [Google Scholar] [CrossRef]

- Elango, B.; Pattnaik, C. Learning before making the big leap. Manag. Int. Rev. 2011, 51, 461. [Google Scholar] [CrossRef]

- Hennart, J.-F.; Park, Y.-R. Greenfield vs. acquisition: The strategy of Japanese investors in the United States. Manag. Sci. 1993, 39, 1054–1070. [Google Scholar] [CrossRef] [Green Version]

- Kumar, V.; Gaur, A.S.; Pattnaik, C. Product diversification and international expansion of business groups. Manag. Int. Rev. 2012, 52, 175–192. [Google Scholar] [CrossRef]

- Chikhouni, A.; Edwards, G.; Farashahi, M. Psychic distance and ownership in acquisitions: Direction matters. J. Int. Manag. 2017, 23, 32–42. [Google Scholar] [CrossRef]

- Malhotra, S. Geographic distance as a moderator of curvilinear relationship between cultural distance and shared ownership. Can. J. Adm. Sci. Rev. Can. Des Sci. De Adm. 2012, 29, 218–230. [Google Scholar] [CrossRef]

- Park, Y.R.; Park, J.M.; Song, Y.A. International Management: An empirical study on the effect of the ownership with cross-border acquisition performance by Korean firms: Focusing on the interaction with cultural distance and acquisition relatedness. J. Int. Area Stud. 2010, 14, 339–362. [Google Scholar]

- Hambrick, D.C. An empirical typology of mature industrial-product environments. Acad. Manag. J. 1983, 26, 213–230. [Google Scholar]

- Christensen, C.M.; Alton, R.; Rising, C.; Waldeck, A. The new M&A playbook. Harv. Bus. Rev. 2011, 89, 48–57. [Google Scholar]

- Busfield, J. Globalization and the pharmaceutical industry revisited. Int. J. Health Serv. 2003, 33, 581–605. [Google Scholar] [CrossRef]

- Tarabusi, C.C.; Vickery, G. Globalization in the pharmaceutical industry, part I. Int. J. Health Serv. 1998, 28, 67–105. [Google Scholar] [CrossRef] [PubMed]

- Bond, P. Globalization, pharmaceutical pricing, and South African health policy: Managing confrontation with US firms and politicians. Int. J. Health Serv. 1999, 29, 765–792. [Google Scholar] [CrossRef] [PubMed]

- Thiers, F.A.; Sinskey, A.J.; Berndt, E.R. Trends in the globalization of clinical trials. Nat. Publ. Group 2008, 7, 13–14. [Google Scholar]

- Shah, S. Globalization of clinical research by the pharmaceutical industry. Int. J. Health Serv. 2003, 33, 29–36. [Google Scholar] [CrossRef] [PubMed]

| Completion/Termination Date | A-A | A-E | E-A | E-E | Total |

|---|---|---|---|---|---|

| 1995−1999 | 2 | - | - | 5 | 7 |

| 2000−2004 | 105 | 13 | 6 | 77 | 201 |

| 2005−2009 | 231 | 41 | 13 | 170 | 455 |

| 2010−2014 | 318 | 24 | 10 | 92 | 444 |

| 2015−2016 | 144 | 19 | 5 | 28 | 196 |

| Total | 800 | 97 | 34 | 372 | 1303 |

| MV | IV | △ROA (−1,1) | △ROA (−1,2) | △ROA (−1,3) | △ROA (−1,4) | △ROA (−1,5) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Beta | Sig. | Beta | Sig. | Beta | Sig. | Beta | Sig. | Beta | Sig. | ||

| A−A | CR | −0.008 | 0.829 | −0.113 ** | 0.007 | −0.127 ** | 0.004 | −0.134 ** | 0.004 | −0.206 *** | 0 |

| R&D | 0.005 | 0.897 | −0.029 | 0.490 | −0.036 | 0.409 | −0.040 | 0.386 | −0.052 | 0.287 | |

| A-E | CR | −0.208 † | 0.073 | −0.211 † | 0.086 | −0.218 † | 0.088 | 0.162 | 0.224 | −0.248 † | 0.070 |

| R&D | −0.070 | 0.540 | −0.065 | 0.593 | −0.061 | 0.629 | 0.050 | 0.708 | −0.095 | 0.485 | |

| E-E | CR | 0.025 | 0.680 | 0.027 | 0.675 | 0.642 *** | 0.000 | 0.129 † | 0.066 | 0.091 | 0.226 |

| R&D | −0.039 | 0.527 | −0.040 | 0.524 | −0.013 | 0.791 | −0.014 | 0.837 | −0.065 | 0.389 | |

| E-A | CR | 0.421 * | 0.039 | 0.463 * | 0.029 | 0.270 | 0.190 | 0.086 | 0.685 | 0.367 † | 0.090 |

| R&D | 0.638 ** | 0.003 | 0.548 * | 0.011 | 0.566 ** | 0.009 | 0.419 † | 0.055 | 0.475 * | 0.030 | |

| Statistics | Cost Ratio | R&D Expenditure Ratio | |||||

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 1 | 2 | 3 | ||

| R | 0.027 | 0.086 | 0.142 | 0.072 | 0.091 | 0.101 | |

| R-square | 0.001 | 0.007 | 0.020 | 0.005 | 0.008 | 0.010 | |

| Adjusted R-square | −0.001 | 0.005 | 0.016 | 0.004 | 0.005 | 0.006 | |

| Std. error of the estimate | 21.217 | 21.162 | 21.039 | 21.171 | 21.152 | 21.147 | |

| Change statistics | R-square change | 0.001 | 0.007 | 0.013 | 0.005 | 0.003 | 0.002 |

| F change | 0.518 | 4.656 | 9.206 | 3.611 | 2.224 | 1.335 | |

| df1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| df2 | 700 | 699 | 698 | 700 | 699 | 698 | |

| Sig. F change | 0.472 | 0.031 * | 0.003 ** | 0.058 † | 0.136 | 0.248 | |

| Durbin–Watson | 2.017 | 2.014 | |||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kwon, J.; Kim, C.; Lee, K.C. Moderating Effect of the Continental Factor on the Business Strategy and M&A Performance in the Pharmaceutical Industry for Sustainable International Business. Sustainability 2020, 12, 4985. https://doi.org/10.3390/su12124985

Kwon J, Kim C, Lee KC. Moderating Effect of the Continental Factor on the Business Strategy and M&A Performance in the Pharmaceutical Industry for Sustainable International Business. Sustainability. 2020; 12(12):4985. https://doi.org/10.3390/su12124985

Chicago/Turabian StyleKwon, Jinhee, Cheong Kim, and Kun Chang Lee. 2020. "Moderating Effect of the Continental Factor on the Business Strategy and M&A Performance in the Pharmaceutical Industry for Sustainable International Business" Sustainability 12, no. 12: 4985. https://doi.org/10.3390/su12124985

APA StyleKwon, J., Kim, C., & Lee, K. C. (2020). Moderating Effect of the Continental Factor on the Business Strategy and M&A Performance in the Pharmaceutical Industry for Sustainable International Business. Sustainability, 12(12), 4985. https://doi.org/10.3390/su12124985