m-Banking Quality and Bank Reputation

Abstract

1. Introduction

2. Literature Review

2.1. Bank Reputation

2.2. Quality of m-Banking

3. Research Model and Hypothesis Development

3.1. m-Banking Safety

3.2. m-Banking Simplicity

3.3. Variability of m-Banking serVices

3.4. Perceived Quality of m-Banking Services and Bank Reputation

4. Methodology

4.1. Research Instrument and Data Collection

4.2. Statistical Analysis

5. Results

5.1. Validity and Reliability Analysis

5.2. Correlation Analysis

5.3. Assessment of Model Fit

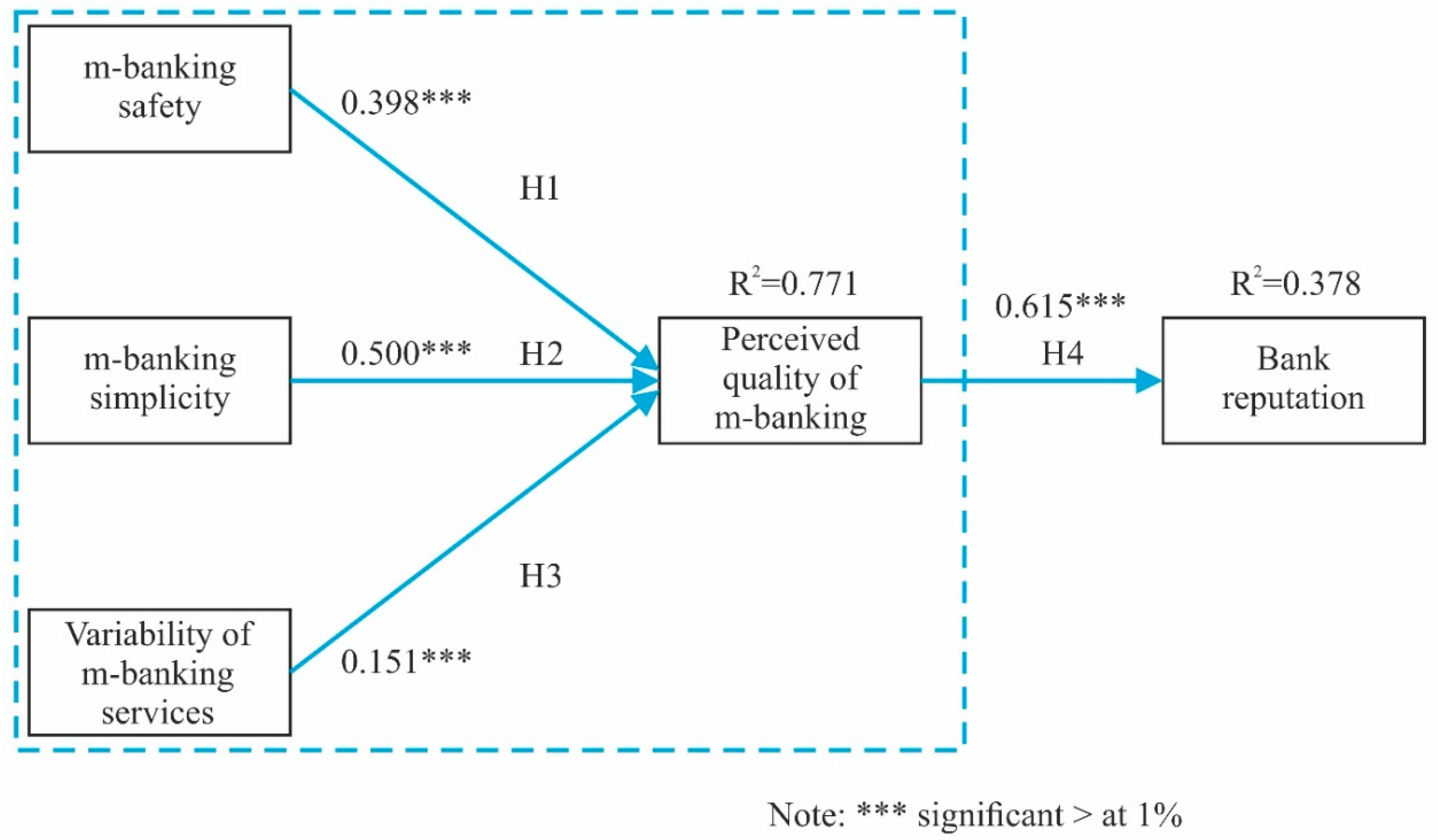

5.4. Hypothesis Testing

6. Discussion

7. Conclusions and Implications

Author Contributions

Funding

Conflicts of Interest

References

- Barney, J.B.; Clark, D.N. Resource-Based Theory—Creating and Sustaining Competitive Advantage; Oxford University Press Inc.: New York, NY, USA, 2007. [Google Scholar]

- Dierickx, I.; Cool, K. Asset stock accumulation and sustainability of competitive advantage. Manag. Sci. 1989, 35, 1504–1513. [Google Scholar] [CrossRef]

- Dell’Atti, S.; Trotta, A.; Iannuzzi, A.P.; Demaria, F. Corporate social responsibility engagement as a determinant of bank reputation: An empirical analysis. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 589–605. [Google Scholar] [CrossRef]

- Ruiz, B.; García, J. Modelling customer-based bank reputation: The moderating role of uncertainty avoidance. Int. J. Bank Mark. 2019, 37, 340–361. [Google Scholar] [CrossRef]

- Fombrun, C. Reputation: Realizing Value from the Corporate Image; Harvard Business School Press: Boston, MA, USA, 1996. [Google Scholar]

- Ruiz, B.; Esteban, A.; Gutiérrez, S. Determinants of reputation of leading Spanish financial institutions among their customers in a context of economic crisis. BRQ Bus. Res. Q. 2014, 17, 259–278. [Google Scholar] [CrossRef]

- Sanchez, J.L.F.; Luna, L. The creation of value through corporate reputation. J. Bus. Ethics 2007, 76, 335–346. [Google Scholar] [CrossRef]

- Barrios, S.; Burgelman, J.C. Europe needs more Lisbon to make the ICT investments effective. Inter Econ. 2008, 43, 124–134. [Google Scholar] [CrossRef]

- Afshan, S.; Sharif, A. Acceptance of mobile banking framework in Pakistan. Telemat. Inform. 2016, 33, 370–387. [Google Scholar] [CrossRef]

- Reis, J.R.G.; Ferreira, F.A.F.; Monteiro Barata, J.M. Technological innovation in banking services: An exploratory analysis to perceptions of the front office employee. Prob. Perspect. Manag. 2013, 11, 34–49. [Google Scholar]

- Arasli, H.; Katircioglu, S.T.; Mehtap-Smadi, S. A comparison of service quality in the banking industry: Some evidence from Turkish- and Greek-speaking areas in Cyprus. Int. J. Bank Mark. 2005, 23, 508–526. [Google Scholar] [CrossRef]

- Laukkanen, T. Mobile banking. Int. J. Bank Mark. 2017, 35, 1042–1043. [Google Scholar] [CrossRef]

- Calisir, F.; Gumussoy, C.A. Internet banking versus other banking channels: Young consumers’ view. Int. J. Inf. Manag. 2008, 28, 215–221. [Google Scholar] [CrossRef]

- Jun, M.; Palacios, S. Examining the key dimensions of mobile banking service quality: An exploratory study. Int. J. Bank Mark. 2016, 34, 307–326. [Google Scholar] [CrossRef]

- Ganguli, S.; Roy, S.K. Generic technology-based service quality dimensions in banking: Impact on customer satisfaction and loyalty. Int. J. Bank Mark. 2011, 29, 168–189. [Google Scholar] [CrossRef]

- Jayawardhena, C. Measurement of service quality in internet banking: The development of an instrument. J. Mark. Manag. 2004, 20, 185–207. [Google Scholar] [CrossRef]

- Rod, M.; Ashill, N.J.; Shao, J.; Carruthers, J. An examination of the relationship between service quality dimensions, overall internet banking service quality and customer satisfaction: A New Zealand study. Mark. Intell. Plan 2009, 27, 103–126. [Google Scholar] [CrossRef]

- Akturan, U.; Tezcan, N. Mobile banking adoption of the youth market: Perceptions and intentions. Mark. Intell. Plan 2012, 30, 444–459. [Google Scholar] [CrossRef]

- Ha, K.H.; Canedoli, A.; Baur, A.W.; Bick, M. Mobile banking—Insights on its increasing relevance and most common drivers of adoption. Electron. Mark. 2012, 22, 217–227. [Google Scholar] [CrossRef]

- Zhou, T. Understanding users’ initial trust in mobile banking: An elaboration likelihood perspective. Comput. Hum. Behav. 2012, 28, 1518–1525. [Google Scholar] [CrossRef]

- Sagib, G.K.; Zapan, B. Bangladeshi mobile banking service quality and customer satisfaction and loyalty. Manag. Market. 2014, 9, 331–346. [Google Scholar]

- Asfour, H.K.; Haddad, S.I. The impact of mobile banking on enhancing customers’ e-satisfaction: An empirical study on commercial banks in Jordan. Int. Bus. Res. 2014, 7, 145–169. [Google Scholar] [CrossRef]

- Staresinic, B. Povezanost Kvalitete Mobilnog Bankarstva i Reputacije Banaka. Ph.D. Thesis, Faculty of Economics and Business, University of Zagreb, Zagreb, Croatia, 2019. [Google Scholar]

- Trotta, A.; Cavallaro, G. Measuring corporate reputation: A framework for Italian banks. Int. J. Econ. Financ. Stud. 2012, 4, 21–30. [Google Scholar]

- Wang, Y.; Lo, H.P.; Hui, Y.V. The antecedents of service quality and product quality and their influences on bank reputation: Evidence from the banking industry in China. Manag. Serv. Qual. 2003, 13, 72–83. [Google Scholar] [CrossRef]

- Ruiz, B.; García, J.A.; Revilla, A.J. Antecedents and consequences of bank reputation: A comparison of the United Kingdom and Spain. Int. Mark. Rev. 2016, 33, 781–805. [Google Scholar] [CrossRef]

- Ponzi, L.J.; Fombrun, C.J.; Gardberg, N.A. RepTrak™ Pulse: Conceptualizing and validating a short-form measure of corporate reputation. Corp. Reput. Rev. 2011, 14, 15–35. [Google Scholar] [CrossRef]

- Roberts, P.W.; Dowling, G.R. Corporate reputation and sustained superior financial performance. Strateg. Manag. J. 2002, 23, 1077–1093. [Google Scholar] [CrossRef]

- Flatt, S.J.; Kowalczyk, S.J. Corporate reputation as a mediating variable between corporate culture and financial performance. In Proceedings of the 2006 Reputation Institute Conference, New York, NY, USA, 25–28 May 2006. [Google Scholar]

- Krzakiewicz, K.; Cyfert, S. Organizational reputation risk management as a component of the dynamic capabilities management process. Manag. Sci. 2015, 19, 6–18. [Google Scholar] [CrossRef]

- Fombrun, C.J. Corporate reputations as economic asset. In The Blackwell Handbook of Strategic Management; Hitt, M., Freeman, E.R., Harisson, S.J., Eds.; Blackwell Publishers: Oxford, UK, 2001; pp. 289–312. [Google Scholar]

- Neef, D. Managing Corporate Reputation and Risk; Routledge: New York, NY, USA, 2012. [Google Scholar]

- Grgić, D. Indeks reputacije poduzeća: Empirijsko istraživanje u bankovnom sektoru. Market Rev. Mark. Theory Pract. 2012, 24, 23–45. [Google Scholar]

- Barnett, M.L.; Jermier, J.M.; Lafferty, B.A. Corporate reputation: The definitional landscape. Corp. Reput. Rev. 2006, 9, 26–38. [Google Scholar] [CrossRef]

- Rindova, V.P.; Williamson, I.O.; Petkova, A.P.; Sever, J.M. Being good or being known: An empirical examination of the dimensions, antecedents, and consequences of organizational reputation. Acad. Manag. J. 2005, 48, 1033–1049. [Google Scholar] [CrossRef]

- Vitezić, N. Corporate reputation and social responsibility: An analysis of large companies in Croatia. Int. Bus. Econ. Res. J. 2011, 10, 85–96. [Google Scholar] [CrossRef]

- Ennew, C.; Sekhon, H.S. Trust and Trustworthiness in Retail Financial Services; Routledge: London, UK, 2014. [Google Scholar]

- Bitner, M.J.; Brown, S.W.; Meuter, M.L. Technology infusion in service encounters. J. Acad. Mark. Sci. 2000, 28, 138–149. [Google Scholar] [CrossRef]

- Lin, H.F. An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. Int. J. Inf. Manag. 2011, 31, 252–260. [Google Scholar] [CrossRef]

- Dash, M.; Bhusan, P.B.; Samal, S. Determinants of customers’ adoption of mobile banking: An empirical study by integrating diffusion of innovation with attitude. J. Internet Bank. Commer. 2014, 19, 1–21. [Google Scholar]

- Chen, C.S. Perceived risk, usage frequency of mobile banking services. Manag. Serv. Qual. 2013, 23, 410–436. [Google Scholar] [CrossRef]

- Gakere, G.M. An Investigation on the Effects of Mobile Banking Services on Service Quality among United States International University Students. Master’s Thesis, Chandaria School of Business, United States International University-Africa, Nairobi, Kenya, 2016. [Google Scholar]

- Govender, I.; Sihlali, W. A study of mobile banking adoption among university students using an extended TAM. Mediterr. J. Soc. Sci. 2014, 5, 451–459. [Google Scholar] [CrossRef]

- Malaquias, R.F.; Hwang, Y. An empirical study on trust in mobile banking: A developing country perspective. Comput. Hum. Behav. 2016, 54, 453–461. [Google Scholar] [CrossRef]

- Ennew, C.T.; Waite, N. Financial Services Marketing: An International Guide to Principles and Practice; ButterworthHeinemann Elsevier: Oxford, UK, 2007. [Google Scholar]

- Mersha, T.; Adlakha, V. Attributes of service quality: The consumers’ perspective. Int. J. Serv. Ind. Manag. 1992, 3, 34–45. [Google Scholar] [CrossRef]

- Culiberg, B.; Rojšek, I. Identifying service quality dimensions as antecedents to customer satisfaction in retail banking. Econ. Bus. Rev. 2010, 12, 151–166. [Google Scholar]

- Choudhury, K. Service quality and customers’ purchase intentions: An empirical study of the Indian banking sector. Int. J. Bank Mark. 2013, 31, 529–543. [Google Scholar] [CrossRef]

- Sangeetha, J.; Mahalingam, S. Service quality models in banking: A review. Int. J. Islam. Middle East. Financ. Manag. 2011, 4, 83–103. [Google Scholar] [CrossRef]

- Nisha, N. Exploring the dimensions of mobile banking service quality: Implications for the banking sector. Int. J. Bus. Anal. 2016, 3, 60–76. [Google Scholar] [CrossRef]

- Malviya, S. Exploring mobile banking service quality dimensions for public and private sector banks in Indore district of Madhya Pradesh. Int. J. Adv. Res. Comput. Sci. Manag. Stud. 2015, 3, 243–252. [Google Scholar]

- Ozer, A.; Argan, M.T.; Argan, M. The effect of mobile service quality dimensions on customer satisfaction. Procedia Soc. Behav. Sci. 2013, 99, 428–438. [Google Scholar] [CrossRef]

- Hamzah, Z.L.; Lee, S.P.; Moghavvemi, S. Elucidating perceived overall service quality in retail banking. Int. J. Bank Mark. 2017, 35, 781–804. [Google Scholar] [CrossRef]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P.P.; Williams, M.D. Consumer adoption of mobile banking in Jordan: Examining the role of usefulness, ease of use, perceived risk and self-efficacy. J. Enterp. Inf. Manag. 2016, 29, 118–139. [Google Scholar] [CrossRef]

- Munoz-Leiva, F.; Climent-Climent, S.; Liébana-Cabanillas, F. Determinants of intention to use the mobile banking apps: An extension of the classic TAM model. Span. J. Market. ESIC 2017, 21, 25–38. [Google Scholar] [CrossRef]

- Wessels, L.; Drennan, J. An Investigation of Consumer Acceptance of M-Banking in Australia. In Proceedings of the Australian and New Zealand Marketing Academy Conference 2009: Sustainable Management and Marketing, Melbourne, Victoria, 30 November–2 December 2009; Luxton, S.S., Ed.; Promaco Conventions Pty Ltd.: Bateman, Australia, 2009; pp. 1–7. [Google Scholar]

- Peevers, G.; Douglas, G.; Jack, M.A. A usability comparison of three alternative message formats for an SMS banking service. Int. J. Hum. Comput. Stud. 2008, 66, 113–123. [Google Scholar] [CrossRef]

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. User acceptance of computer technology: A comparison of two theoretical models. Manag. Sci. 1989, 35, 982–1003. [Google Scholar] [CrossRef]

- Hayashi, F. Mobile payments: What’s in it for consumers? Econ. Rev. Fed. Reserve Bank Kans. City 2012, 97, 35–66. [Google Scholar]

- Gu, J.C.; Lee, S.C.; Suh, Y.H. Determinants of behavioral intention to mobile banking. Expert Syst. Appl. 2009, 36, 11605–11616. [Google Scholar] [CrossRef]

- Boonsiritomachai, W.; Pitchayadejanant, K. Determinants affecting mobile banking adoption by generation Y based on the unified theory of acceptance and use of technology model modified by the technology acceptance model concept. Kasetsart J. Soc. Sci. 2017, 40, 349–358. [Google Scholar] [CrossRef]

- Huili, Y.; Shanzhi, L.; Yinghui, Y. A study of user adoption factors of mobile banking services based on the trust and distrust perspective. Int. Bus. Manag. 2013, 6, 9–14. [Google Scholar]

- Shanka, M.S. Bank service quality, customer satisfaction and loyalty in Ethiopian banking sector. J. Bus. Admin. Manag. Sci. Res. 2012, 1, 1–9. [Google Scholar]

- Bontis, N.D.; Booker, L.D.; Serenko, A. The mediating effect of organizational reputation on customer loyalty and service recommendation in the banking industry. Manag. Decis. 2007, 45, 1426–1445. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tathan, R.L. Multivariate Data Analysis; Prentice Hall: Upper Saddle River, NY, USA, 2006. [Google Scholar]

- Costello, A.B.; Osborne, J. Best practices in exploratory factor analysis: Four recommendations for getting the most from your analysis. Pract. Assess. Res. Eval. 2005, 10, 1–9. [Google Scholar]

- Feldt, L.S.; Kim, S. A comparison of tests for equality of two or more independent alpha coefficients. J. Educ. Meas. 2008, 45, 179–193. [Google Scholar]

- De Vaus, D. Research Design in Social Research; Sage Publications: London, UK, 2001. [Google Scholar]

- Hooper, D.; Coughlan, J.; Mullen, M.R. Structural equation modelling: Guidelines for determining model fit. Elecron. J. Bus. Res. Methods 2008, 6, 53–60. [Google Scholar]

- Marrara, S.; Pejic-Bach, M.; Seljan, S.; Topalovic, A. FinTech and SMEs—the Italian case. In FinTech as a Disruptive Technology for Financial Institutions; Rafay, A., Ed.; IGI-Global: Hershey, PA, USA, 2019; pp. 42–60. [Google Scholar]

- Dean, D.H. Consumer perception of corporate donations effects of company reputation for social responsibility and type of donation. J. Advert. 2003, 32, 91–102. [Google Scholar] [CrossRef]

- Carter, R.B.; Dark, F.H. An empirical examination of investment banking reputation measures. Financ. Rev. 1992, 27, 355–374. [Google Scholar] [CrossRef]

- Casalo, L.V.; Flavián, C.; Guinalíu, M. The role of security, privacy, usability and reputation in the development of online banking. Online Inf. Rev. 2007, 31, 583–603. [Google Scholar] [CrossRef]

- Dowling, G.R.; Gardberg, N.A. Keeping score: The challenges of measuring corporate reputation. In The Oxford Handbook of Corporate Reputations; Pollock, T.G., Barnett, M.L., Eds.; Oxford University Press: Oxford, UK, 2012; pp. 34–68. [Google Scholar]

| Construct | Code | Item | |

|---|---|---|---|

| m-banking characteristics | Safety of m-banking | S1 | Upgrade of m-banking application is safe |

| S2 | m-banking application is stable | ||

| S3 | Loading of a new version of the application is executed accurately and on time | ||

| S4 | All functionalities of the application are done accurately and on time | ||

| S5 | Usage of m-banking application is safe | ||

| Simplicity of m-banking | M1 | Download and loading of m-banking application is simple | |

| M2 | Activation of m-banking application is simple | ||

| M3 | Search within the m-banking application is simple | ||

| M4 | Carry out of payments in the m-banking application is simple | ||

| M5 | Contacting bank staff through the m-banking application is simple | ||

| Variability of services over m-banking | V1 | The application allows contracting deposit products | |

| V2 | The application allows contracting and/or filling out credit application requirements | ||

| V3 | The application allows the purchase of shares in funds | ||

| V4 | The application allows contracting insurance policies | ||

| V5 | The application allows you to sign up for a card | ||

| V6 | The application allows personalized communication | ||

| Perceived quality of m-banking | Q1 | Overall client service through m-banking is excellent | |

| Q2 | M-banking service of my main bank is of extreme quality | ||

| Q3 | M-banking application of my main bank completely satisfies my expectations and needs | ||

| Q4 | The average result regarding overall confidence, safety, and simplicity of using m-banking service of my main bank is adequate | ||

| Q5 | In general, I am satisfied with the quality of m-banking service of my main bank | ||

| Bank reputation | R1 | I have a good feeling regarding my bank | |

| R2 | I trust my bank | ||

| R3 | I respect my bank | ||

| R4 | My bank has a tradition | ||

| R5 | My bank has the strength of an international organization | ||

| R6 | My bank appreciates me as a client | ||

| R7 | Bank has overall a good reputation | ||

| Frequency | % | |

|---|---|---|

| Every day | 31 | 20.1 |

| Several times a week | 41 | 26.6 |

| Once a week | 20 | 12.9 |

| Several times a month | 38 | 24.7 |

| Once a month | 3 | 1.9 |

| Less than once a month | 21 | 13.6 |

| Total | 154 | 100 |

| Dimension | Item | Factor | ||||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | ||

| Safety of m-banking | S1 | 0.815 | ||||

| S2 | 0.772 | |||||

| S3 | 0.747 | |||||

| S4 | 0.699 | |||||

| S5 | 0.702 | |||||

| Simplicity of m-banking | M1 | 0.727 | ||||

| M2 | 0.709 | |||||

| M3 | 0.864 | |||||

| M4 | 0.873 | |||||

| M5 | 0.859 | |||||

| Variability of services over m-banking | V1 | 0.770 | ||||

| V2 | 0.892 | |||||

| V3 | 0.713 | |||||

| V4 | 0.886 | |||||

| V5 | 0.883 | |||||

| V6 | 0.739 | |||||

| Perceived quality of m-banking | Q1 | 0.644 | ||||

| Q2 | 0.647 | |||||

| Q3 | 0.746 | |||||

| Q4 | 0.689 | |||||

| Q5 | 0.748 | |||||

| Bank reputation | R1 | 0.837 | ||||

| R2 | 0.851 | |||||

| R3 | 0.841 | |||||

| R4 | 0.687 | |||||

| R5 | 0.736 | |||||

| R6 | 0.827 | |||||

| R7 | 0.843 | |||||

| Varibale | Item | Standardized Factor Loading | t-Values | p-Value | R2 | Cronbach’s Alpha |

|---|---|---|---|---|---|---|

| Safety of m-banking | S1 | 0.889 | 37.113 | 0.000 | 0.791 | 0.927 |

| S2 | 0.919 | 41.477 | 0.000 | 0.845 | ||

| S3 | 0.769 | 13.314 | 0.000 | 0.592 | ||

| S4 | 0.790 | 16.068 | 0.000 | 0.624 | ||

| S5 | 0.869 | 25.475 | 0.000 | 0.755 | ||

| Simplicity of m-banking | M1 | 0.791 | 13.579 | 0.000 | 0.625 | 0.932 |

| M2 | 0.750 | 13.048 | 0.000 | 0.563 | ||

| M3 | 0.888 | 22.398 | 0.000 | 0.788 | ||

| M4 | 0.905 | 38.320 | 0.000 | 0.820 | ||

| M5 | 0.936 | 53.281 | 0.000 | 0.876 | ||

| Variability of services over m-banking | V1 | 0.694 | 9.822 | 0.000 | 0.482 | 0.887 |

| V2 | 0.912 | 32.366 | 0.000 | 0.831 | ||

| V3 | 0.630 | 8.118 | 0.000 | 0.397 | ||

| V4 | 0.901 | 27.473 | 0.000 | 0.811 | ||

| V5 | 0.876 | 18.999 | 0.000 | 0.768 | ||

| V6 | 0.736 | 11.665 | 0.000 | 0.541 | ||

| Perceived quality of m-banking | Q1 | 0.891 | 35.602 | 0.000 | 0.793 | 0.965 |

| Q2 | 0.889 | 27.831 | 0.000 | 0.790 | ||

| Q3 | 0.933 | 69.254 | 0.000 | 0.870 | ||

| Q4 | 0.935 | 43.711 | 0.000 | 0.874 | ||

| Q5 | 0.952 | 73.597 | 0.000 | 0.906 | ||

| Bank reputation | R1 | 0.875 | 21.966 | 0.000 | 0.766 | 0.938 |

| R2 | 0.913 | 19.664 | 0.000 | 0.834 | ||

| R3 | 0.895 | 30.084 | 0.000 | 0.801 | ||

| R4 | 0.705 | 10.209 | 0.000 | 0.497 | ||

| R5 | 0.721 | 10.837 | 0.000 | 0.520 | ||

| R6 | 0.827 | 19.585 | 0.000 | 0.685 |

| Variable | Mean | Std. Dev. | S1 | S2 | S3 | S4 | S6 | M1 | M2 | M3 | M4 | M5 | V1 | V2 | V3 | V4 | V5 | V6 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S1 | 5.15 | 1.57 | 1 | 0.848 ** | 0.671 ** | 0.629 ** | 0.800 ** | 0.538 ** | 0.470 ** | 0.433 ** | 0.476 ** | 0.538 ** | 0.212 ** | 0.132 | 0.258 ** | 0.163 * | 0.146 | 0.348 ** |

| S2 | 5.27 | 1.54 | 1 | 0.703 ** | 0.720 ** | 0.767 ** | 0.590 ** | 0.529 ** | 0.505 ** | 0.562 ** | 0.593 ** | 0.178 * | 0.164 * | 0.203* | 0.158 * | 0.104 | 0.276 ** | |

| S3 | 5.21 | 1.57 | 1 | 0.707 ** | 0.636 ** | 0.481 ** | 0.412 ** | 0.428 ** | 0.426 ** | 0.517 ** | 0.141 | 0.073 | 0.212 ** | 0.118 | 0.071 | 0.225 ** | ||

| S4 | 5.56 | 1.43 | 1 | 0.712 ** | 0.552 ** | 0.422 ** | 0.497 ** | 0.456 ** | 0.510 ** | 0.106 | 0.148 | 0.175* | 0.110 | 0.070 | 0.184 * | |||

| S6 | 5.32 | 1.58 | 1 | 0.596 ** | 0.540 ** | 0.535 ** | 0.528 ** | 0.631 ** | 0.219 ** | 0.203 * | 0.313 ** | 0.204 * | 0.196 * | 0.363 ** | ||||

| M1 | 5.79 | 1.48 | 1 | 0.688 ** | 0.737 ** | 0.688 ** | 0.721 ** | 0.208 ** | 0.162 * | 0.183 * | 0.166 * | 0.085 | 0.225 ** | |||||

| M2 | 5.47 | 1.57 | 1 | 0.704 ** | 0.635 ** | 0.689 ** | 0.265 ** | 0.217 ** | 0.211 ** | 0.212 ** | 0.158 | 0.322 ** | ||||||

| M3 | 5.68 | 1.51 | 1 | 0.803 ** | 0.818 ** | 0.220 ** | 0.232 ** | 0.182* | 0.240 ** | 0.211 ** | 0.264 ** | |||||||

| M4 | 5.73 | 1.44 | 1 | 0.865 ** | 0.221 ** | 0.232 ** | 0.204* | 0.199 * | 0.172 * | 0.290 ** | ||||||||

| M5 | 5.81 | 1.45 | 1 | 0.223 ** | 0.211 ** | 0.275 ** | 0.217 ** | 0.169 * | 0.304 ** | |||||||||

| V1 | 3.88 | 2.00 | 1 | 0.667 ** | 0.657 ** | 0.589 ** | 0.563 ** | 0.246 ** | ||||||||||

| V2 | 3.43 | 1.90 | 1 | 0.535 ** | 0.823 ** | 0.790 ** | 0.445 ** | |||||||||||

| V3 | 4.10 | 2.05 | 1 | 0.547 ** | 0.577 ** | 0.387 ** | ||||||||||||

| V4 | 3.38 | 2.00 | 1 | 0.806 ** | 0.457 ** | |||||||||||||

| V5 | 3.55 | 2.01 | 1 | 0.405 ** | ||||||||||||||

| V6 | 3.90 | 1.92 | 1 |

| Variable | Mean | Std. Dev. | Q1 | Q2 | Q3 | Q4 | Q5 | R1 | R2 | R3 | R4 | R5 | R6 | R7 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Q1 | 5.30 | 1.43 | 1 | 0.849 ** | 0.820 ** | 0.802 ** | 0.846 ** | 0.517 ** | 0.529 ** | 0.474 ** | 0.485 ** | 0.456 ** | 0.434 ** | 0.482 ** |

| Q2 | 5.39 | 1.47 | 1 | 0.837 ** | 0.824 ** | 0.821 ** | 0.587 ** | 0.613 ** | 0.528 ** | 0.557 ** | 0.514 ** | 0.494 ** | 0.542 ** | |

| Q3 | 5.34 | 1.55 | 1 | 0.876 ** | 0.902 ** | 0.458 ** | 0.516 ** | 0.398 ** | 0.443 ** | 0.491 ** | 0.368 ** | 0.458 ** | ||

| Q4 | 5.40 | 1.41 | 1 | 0.892 ** | 0.562 ** | 0.603 ** | 0.469 ** | 0.492 ** | 0.523 ** | 0.434 ** | 0.506 ** | |||

| Q5 | 5.37 | 1.55 | 1 | 0.485 ** | 0.509 ** | 0.402 ** | 0.458 ** | 0.488 ** | 0.382 ** | 0.462 ** | ||||

| R1 | 5.00 | 1.67 | 1 | 0.818 ** | 0.768 ** | 0.642 ** | 0.640 ** | 0.708 ** | 0.713 ** | |||||

| R2 | 4.94 | 1.78 | 1 | 0.865 ** | 0.646 ** | 0.611 ** | 0.728 ** | 0.704 ** | ||||||

| R3 | 4.82 | 1.74 | 1 | 0.603 ** | 0.585 ** | 0.747 ** | 0.740 ** | |||||||

| R4 | 5.29 | 1.53 | 1 | 0.557 ** | 0.536 ** | 0.586 ** | ||||||||

| R5 | 5.03 | 1.71 | 1 | 0.610 ** | 0.719 ** | |||||||||

| R6 | 4.82 | 1.81 | 1 | 0.797 ** | ||||||||||

| R7 | 5.23 | 1.59 | 1 |

| Fitness Indicator | Model Estimated | Explanations |

|---|---|---|

| Chi-square (χ2) | 658.034 | χ2 is not significant |

| Degrees of freedom (df) | 343 | |

| p-value | 0.000 | |

| χ2/df | 1.918 | Very good, close to 2 |

| NNFI | 0.897 | Good fit, >0.8 |

| CFI | 0.907 | Satisfactory fit, >0.9 |

| RMSEA | 0.077 | Acceptable fit, <0.08 |

| 90% confidence interval of RMSEA | (0.068–0.086) | Upper limit <0.10, a good result |

| Hypothesis | Path Coeffcient | Std. Error | Z-Value | p-Value | R-Squared |

|---|---|---|---|---|---|

| safety → perceived quality | 0.398 | 0.123 | 3.235 | 0.001 *** | 0.771 |

| simplicity → perceived quality | 0.500 | 0.120 | 4.172 | 0.000 *** | |

| variability → perceived quality | 0.151 | 0.044 | 3.455 | 0.001 *** | |

| perceived quality → reputation | 0.615 | 0.078 | 7.934 | 0.000 *** | 0.378 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pejić Bach, M.; Starešinić, B.; Omazić, M.A.; Aleksić, A.; Seljan, S. m-Banking Quality and Bank Reputation. Sustainability 2020, 12, 4315. https://doi.org/10.3390/su12104315

Pejić Bach M, Starešinić B, Omazić MA, Aleksić A, Seljan S. m-Banking Quality and Bank Reputation. Sustainability. 2020; 12(10):4315. https://doi.org/10.3390/su12104315

Chicago/Turabian StylePejić Bach, Mirjana, Berislava Starešinić, Mislav Ante Omazić, Ana Aleksić, and Sanja Seljan. 2020. "m-Banking Quality and Bank Reputation" Sustainability 12, no. 10: 4315. https://doi.org/10.3390/su12104315

APA StylePejić Bach, M., Starešinić, B., Omazić, M. A., Aleksić, A., & Seljan, S. (2020). m-Banking Quality and Bank Reputation. Sustainability, 12(10), 4315. https://doi.org/10.3390/su12104315