Cloud Services and Pricing Strategies for Sustainable Business Models: Analytical and Numerical Approaches

Abstract

1. Introduction

2. Research Background: Cloud Service Models and Pricing Models

2.1. Cloud Services and Practical Pricing Cases

2.2. Cloud Pricing Models

3. The Model

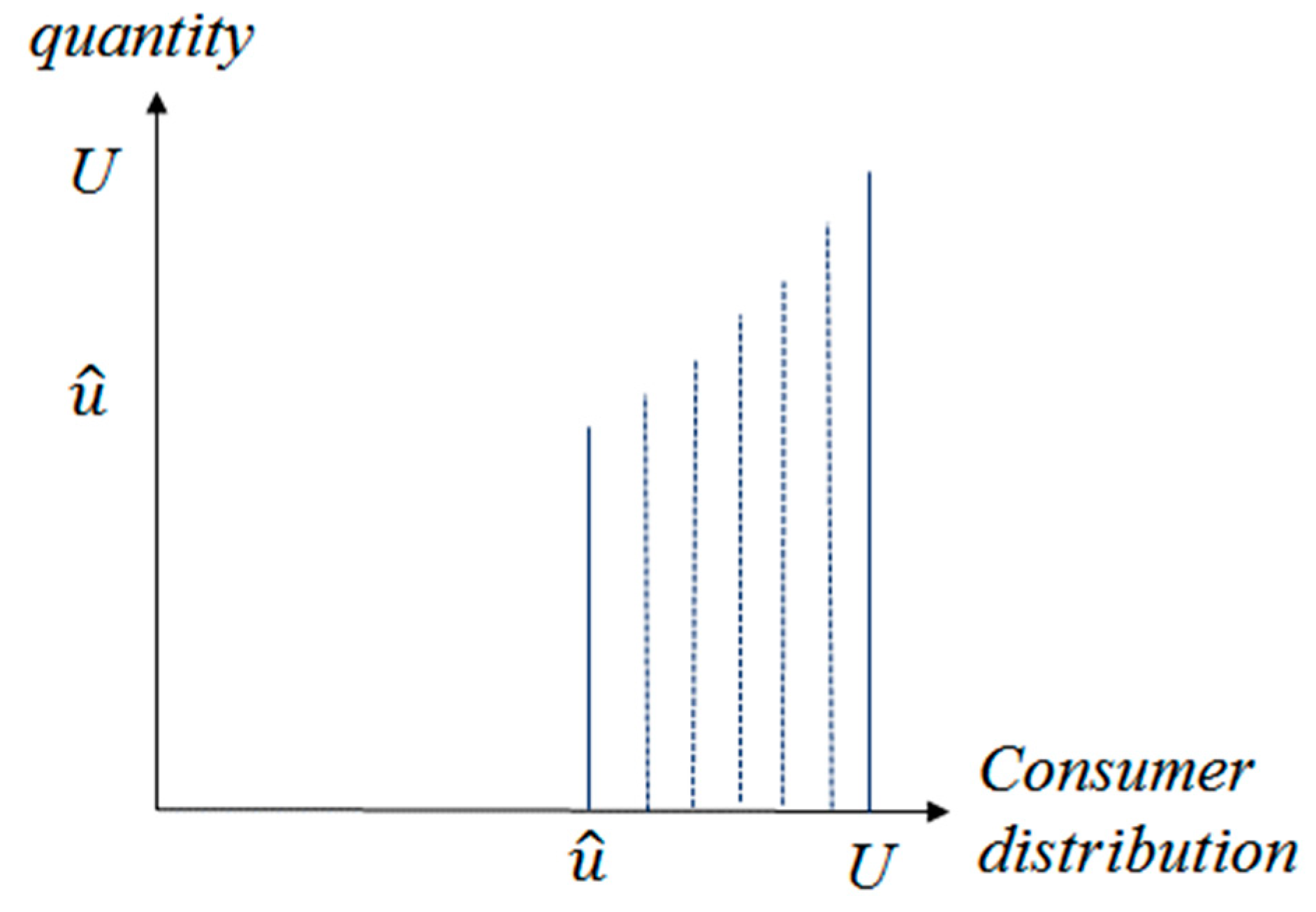

3.1. Model Setting

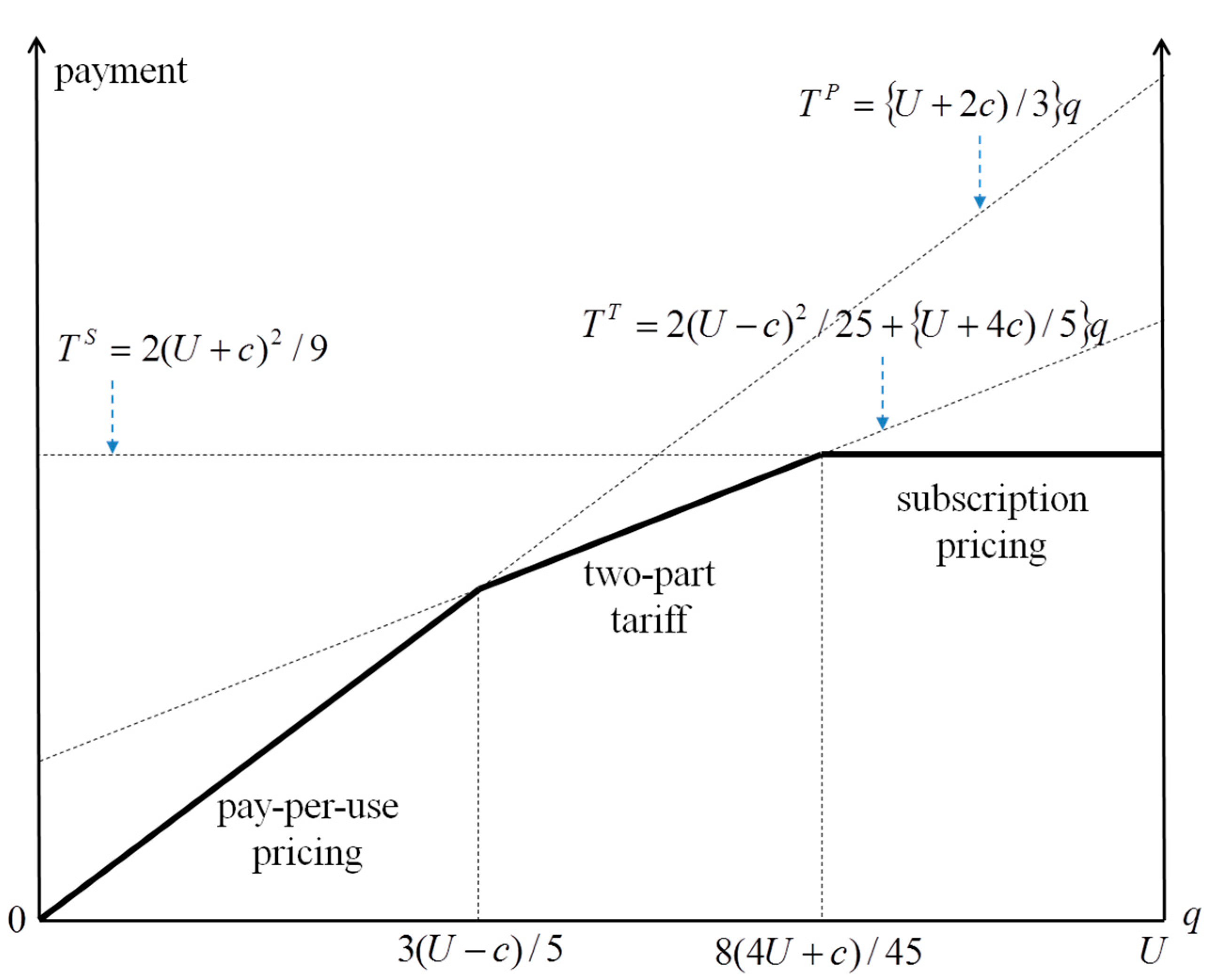

3.2. Subscription Pricing

3.3. Pay-Per-Use Pricing

3.4. Two-Part Tariff Pricing

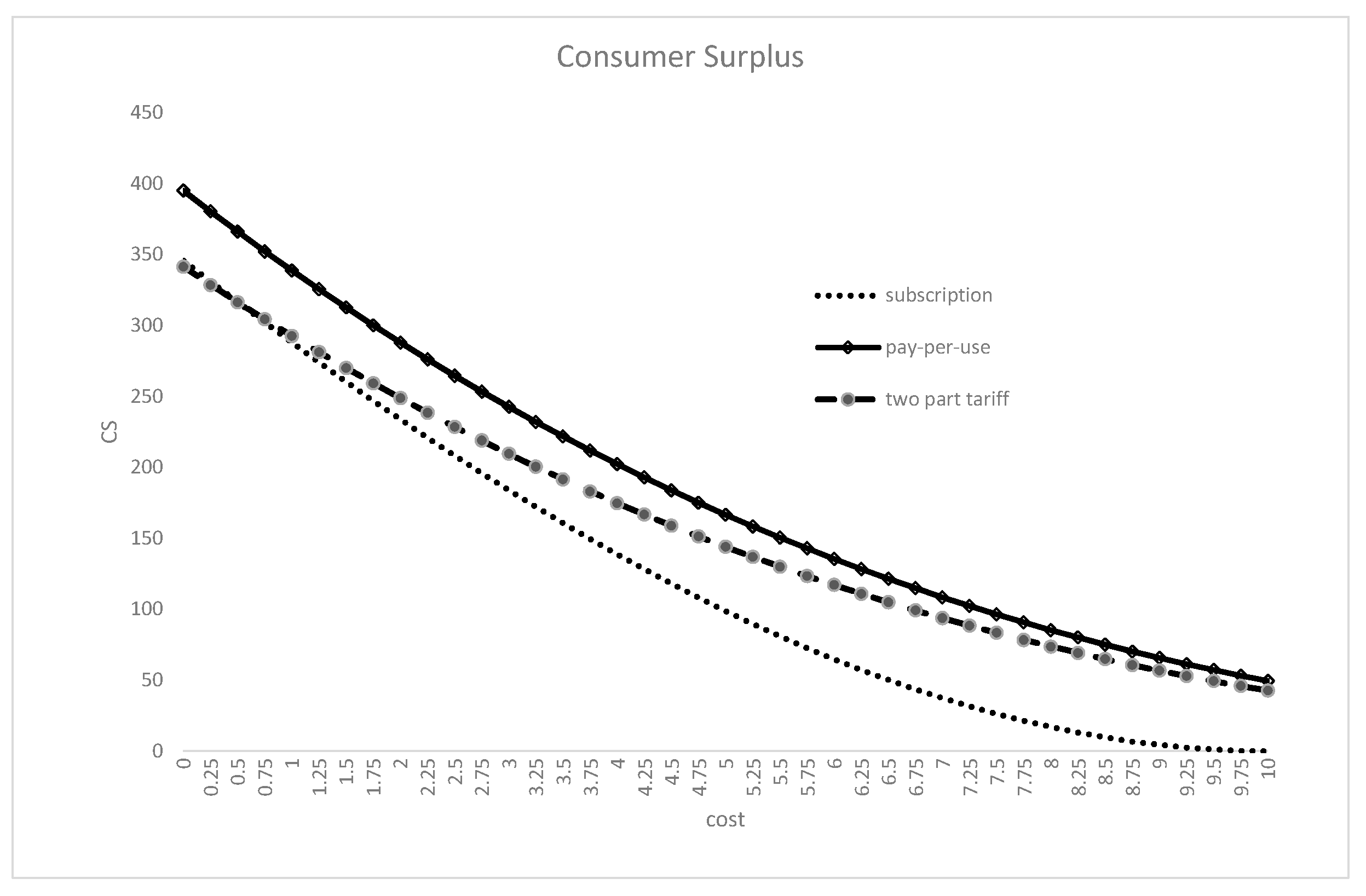

4. Results of the Study

Comparisons and Discussion

5. Conclusions

Funding

Conflicts of Interest

References

- Buyya, R.; Yeo, C.S.; Venugopal, S.; Broberg, J.; Brandic, I. Cloud computing and emerging IT platforms: Vision, hype, and reality for delivering computing as the 5th utility. Future Gener. Comput. Syst. 2009, 25, 599–616. [Google Scholar] [CrossRef]

- Yeo, C.S.; Venugopal, S.; Chu, X.; Buyya, R. Autonomic metered pricing for a utility computing service. Future Gener. Comput. Syst. 2010, 26, 1368–1380. [Google Scholar] [CrossRef]

- Li, C.-F. Cloud computing system management under flat rate pricing. J. Netw. Syst. Manag. 2011, 19, 305–318. [Google Scholar] [CrossRef]

- Al-Roomi, M.; Al-Ebrahim, S.; Buqrais, S.; Ahmad, I. Cloud computing pricing models: A survey. Int. J. Grid Distrib. Comput. 2013, 6, 93–106. [Google Scholar] [CrossRef]

- Mazrekaj, A.; Shabani, I.; Sejdiu, B. Pricing schemes in cloud computing: An overview. Int. J. Adv. Comput. Sci. Appl. 2016, 7, 80–86. [Google Scholar] [CrossRef]

- Weinhardt, C.; Anandasivam, A.; Blau, B.; Stößer, J. Business models in the service world. IT Prof. 2009, 11, 28–33. [Google Scholar] [CrossRef]

- Chun, S.-H.; Choi, B.-S. Service models and pricing schemes for cloud computing. Clust. Comput. 2014, 17, 529–535. [Google Scholar] [CrossRef]

- Chun, S.-H.; Choi, B.-S.; Ko, Y.W.; Hwang, S.H. The Comparison of Pricing Schemes for Cloud Services. In Frontier and Innovation in Future Computing and Communications. Lecture Notes in Electrical Engineering; Park, J., Zomaya, A., Jeong, H.Y., Obaidat, M., Eds.; Springer: Dordrecht, The Netherlands, 2014; Volume 301. [Google Scholar]

- Wu, S.Y.; Banker, R.D. Best pricing strategy for information services. J. Assoc. Inf. Syst. 2010, 11, 339–366. [Google Scholar] [CrossRef]

- NIST Definition of Cloud Computing v15. Available online: http://www.nist.gov/itl/cloud/upload/cloud-def-v15.pdf (accessed on 10 November 2019).

- Durkee, D. Why cloud computing will never be free. Commun. ACM 2010, 53, 62–69. [Google Scholar] [CrossRef]

- Pan, Y.; Zhang, J. Parallel programming on cloud computing platforms. J. Converg. 2012, 3, 23–28. [Google Scholar]

- Walterbusch, M.; Martens, B.; Teuteberg, F. Evaluating cloud computing services from a total cost of ownership perspective. Manag. Res. Rev. 2013, 36, 613–638. [Google Scholar] [CrossRef]

- Osterwalder, A. The Business Model Ontology–A Proposition in a design science approach. Ph.D. Thesis, University of Lausanne, Lausanne, Switzerland, 2004. [Google Scholar]

- Samimi, P.; Patel, A. Review of pricing models for grid & cloud computing. In Proceedings of the 2011 IEEE Symposium on Computers & Informatics 2011, Kuala Lumpur, Malaysia, 20–23 March 2011; pp. 634–639. [Google Scholar]

- Ali, T.M.; Hany, H.A. Pricing models for cloud computing services, a survey. Int. J. Comput. Appl. Technol. Res. 2016, 5, 126–131. [Google Scholar]

- Jäätmaa, J. Financial Aspects of Cloud Computing Business Models. Master’s Thesis, Aalto University, Espoo, Finland, 2010. [Google Scholar]

- Chen, S.; Lee, H.; Moinzadeh, K. Pricing Schemes in Cloud Computing: Utilization-Based vs. Reservation-Based. Prod. Oper. Manag. 2019, 28, 82–102. [Google Scholar] [CrossRef]

- Available online: https://aws.amazon.com/ec2/pricing/on-demand (accessed on 10 November 2019).

- Available online: https://cloud.google.com/appengine/pricing (accessed on 10 November 2019).

- Lai, K. Markets are dead, long live markets. ACM SIGecom Exch. 2005, 5, 1–10. [Google Scholar] [CrossRef]

- Sharma, B.; Thulasiram, R.K.; Thulasiraman, P.; Garg, S.K.; Buyya, R. Pricing cloud compute commodities: A novel financial economic model. In Proceedings of the CCGRID’12, 2012 12th IEEE/ACM International Symposium on Cluster, Cloud and Grid Computing, Ottawa, ON, Canada, 13–16 May 2012; pp. 451–457. [Google Scholar]

- Macias, M.; Guitart, J. A genetic model for pricing in cloud computing markets. In Proceedings of the 2011 ACM Symposium on Applied Computing, TaiChung, Taiwan, 21–24 March 2011; pp. 113–118. [Google Scholar]

- Mihailescu, M.; Teo, Y.M. Dynamic resource pricing on federated clouds. In Proceedings of the 2010 10th IEEE/ACM International Conference on Cluster, Cloud and Grid Computing, Melbourne, VIC, Australia, 17–20 May 2010. [Google Scholar] [CrossRef]

- Huang, J.; Kauffman, R.J.; Ma, D. Pricing strategy for cloud computing: A damaged services perspective. Decis. Support Syst. 2015, 78, 80–92. [Google Scholar] [CrossRef]

- Tirole, J. The Theory of Industrial Organization; The MIT Press: Cambridge, MA, USA; London, UK, 1995. [Google Scholar]

- Oi, W.Y. A Disneyland dilemma: Two-part tariffs for a Mickey Mouse monopoly. Q. J. Econ. 1971, 85, 77–96. [Google Scholar] [CrossRef]

- Schmalense, R. Monopolistic two-part pricing arrangements. Bell J. Econo. 1981, 12, 445–466. [Google Scholar] [CrossRef]

| Usage | Storage | Usage | Data Transfer |

|---|---|---|---|

| S3 Standard Storage | Data Transfer out from Amazon S3 to Internet | ||

| First 50 TB/month | $0.023 per GB | Up to 1 GB/month | $0.000 per GB |

| Next 450 TB/month | $0.022 per GB | Next 9.999 TB/month | $0.09 per GB |

| Over 500 TB/month | $0.021 per GB | Next 40 TB/month | $0.085 per GB |

| S3 Standard-Infrequent Access | Next 100 TB/month | $0.07 per GB | |

| All storage/month | $0.0125 per GB | Over 150 TB/month | $0.05 per GB |

| Resource | Unit | Unit Cost |

|---|---|---|

| Standard environment instances | Cost per hour per instance (Instance Class B1) | $0.05 |

| Flexible environment instances | ||

| vCPU | per core hour | $0.0526 |

| Memory | per GB per hour | $0.0071 |

| Persistent disk | per GB per month | $0.0400 |

| Google Cloud Datastore calls | ||

| Stored data (1 GB free quota per day) | per GB per month | $0.18 |

| Search | ||

| Total storage (documents and indexes) | per GB per month | $0.18 |

| Other resources | ||

| Outgoing Network Traffic | Gigabytes | $0.12 |

| Incoming Network Traffic | Gigabytes | Free |

| Blobstore, Logs, and Task Queue Stored Data | Gigabytes per month | $0.026 |

| Dedicated Memcache | Gigabytes per hour | $0.06 |

| Logs API | Gigabytes | $0.12 |

| SSL Virtual IPs (VIPs) | Virtual IP per month | $39.00 |

| Sending Email, Shared Memcache, Cron, APIs | No additional charge | |

| Product | Description | Price (Per User Per Month) |

|---|---|---|

| Out-of-the-box CRM for up to 5 users | Basic sales and marketing for up to 5 users | $25 |

| Lightning Professional | Complete CRM for any size team | $75 |

| Lightning Enterprise | Deeply customizable sales CRM for your business | $150 |

| Unlimited | Unlimited CRM power and support | $300 |

| Company and Its Service | Pricing Schemes |

|---|---|

| Google Drive | 15 GB–Free, 100 GB–$1.99, 1 TB–$9.99 per month |

| Dropbox | 2 GB–Free, 1 TB–$9.99 per month |

| Apple’s iCloud | 5 GB–Free, 20 GB–$0.99, 200 GB–$3.99, 1 TB–$9.99 per month |

| Microsoft’s OneDrive | 15 GB–Free, 100 GB–$1.99, 200 GB–$3.99, 1 TB–$6.99 per month |

| Company and Its Service | Pricing Schemes |

|---|---|

| Amazon Web Services (EC2) | t3.nano: $0.0098 per hour |

| Amazon Web Service (S3) | Storage: after 50 TB $0.023 USD/GB Data transferred in GB: after 1 GB $0.09 per GB |

| Google App Engine | Standard runtime instances (Class B1): $0.05 per hour |

| Subscription (A) | Pay-Per-Use (p) | Two-Part Tariff (A, p) | |

|---|---|---|---|

| Price | |||

| Number of consumers | |||

| Total services | |||

| Consumer surplus | |||

| when c is very low, when c is not low | |||

| Profits (producer surplus) | |||

| Social welfare | |||

| Subscription (A) | Pay-Per-Use (p) | Two-Part Tariff (A, p) | |

|---|---|---|---|

| Price | |||

| Number of consumers | |||

| Total Services (Q) | |||

| Consumer surplus | |||

| when c is very low | |||

| Profits producer surplus | |||

| (equal is holds when c = 0) | |||

| Social welfare | |||

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chun, S.-H. Cloud Services and Pricing Strategies for Sustainable Business Models: Analytical and Numerical Approaches. Sustainability 2020, 12, 49. https://doi.org/10.3390/su12010049

Chun S-H. Cloud Services and Pricing Strategies for Sustainable Business Models: Analytical and Numerical Approaches. Sustainability. 2020; 12(1):49. https://doi.org/10.3390/su12010049

Chicago/Turabian StyleChun, Se-Hak. 2020. "Cloud Services and Pricing Strategies for Sustainable Business Models: Analytical and Numerical Approaches" Sustainability 12, no. 1: 49. https://doi.org/10.3390/su12010049

APA StyleChun, S.-H. (2020). Cloud Services and Pricing Strategies for Sustainable Business Models: Analytical and Numerical Approaches. Sustainability, 12(1), 49. https://doi.org/10.3390/su12010049