Strategy Orientation, Innovation Capacity Endowment, and International R&D Intensity of Listed Companies in China

Abstract

1. Introduction

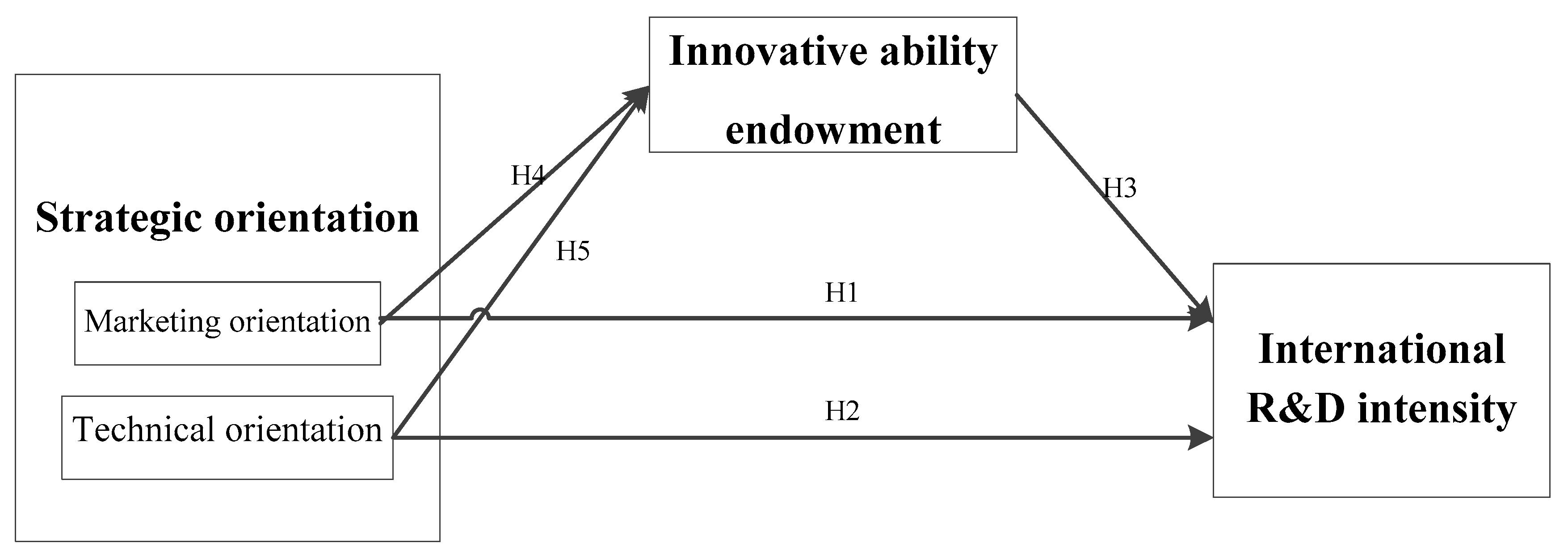

2. Theoretical Background and Hypothesis

2.1. Strategy Orientation and International R&D Intensity

2.2. Innovation Capacity Endowment and International R&D Intensity

2.3. Strategy Orientation and Innovation Capacity Endowment

2.4. The Mediating Role of Innovation Capacity Endowment

3. Design

3.1. Sample Selection

3.2. Variable Setting and Data Source

3.2.1. International R&D Intensity

3.2.2. Strategy Orientation

3.2.3. Innovative Capacity Endowment

3.2.4. Control Variables

3.3. Model Construction

4. Empirical Results and Analysis

4.1. Descriptive Statistics of the Variable

4.2. Results & Discussions

4.2.1. Direct Effects

4.2.2. The Mediating Effect

4.2.3. Robustness Test

5. Conclusions and Suggestion

5.1. Conclusions

5.2. Policy Suggestions

Author Contributions

Funding

Conflicts of Interest

References

- Li, M.; Yu, T. Does R&D internationalization promote enterprise innovation?—The empirical research based on China’s information technology enterprises. Manag. World. 2016, 11, 125–140. [Google Scholar]

- Chen, Y.; Xu, H.; Jing, M. Multidimensional government participation, enterprise dynamic capacities and overseas R&D—An empirical study based on Chinese innovative enterprises. Sci. Res. Manag. 2015, 1, 127–138. [Google Scholar]

- Chen, Y.; Li, Q.; Wang, L. Influencing factors of Chinese enterprises’ overseas R&D investment location selection—based on the regulation effect of host country system quality. Res. Manag. 2016, 37, 73–80. [Google Scholar]

- Kumar, N. Determinants of location of overseas R&D activity of multinational enterprises: The case of US and Japanese enterprisess. Res. Policy 2001, 30, 159–174. [Google Scholar]

- Shimizutani, S.; Todo, Y. What determines overseas R&D activities? The case of Japanese multinational firms. Res. Policy 2008, 37, 530–544. [Google Scholar]

- Serapio, M.G.; Dalton, D.H. Globalization of industrial R&D: An examination of foreign direct investments in R&D in the United States. Res. Policy 1999, 28, 303–316. [Google Scholar]

- Liu, Y.; Liang, X.; Shi, Y. Brokerage and balance: Creating an effective organizational interface for product Modelization in multinational R&D. Res. Policy 2018, 47, 1133–1146. [Google Scholar]

- Yang, Z.; Li, D.; Wang, Y. Internationalization of Chinese Enterprises R&D: Motivations, Structures and Trends. Nankai Bus. Rev. 2010, 13, 44–55. [Google Scholar]

- Jalilvetal, M.R.; Vosta, L.N.; Khalilakbar, R.; Pool, J.K.; Tabaeeian, R.V. The Effects of Internal Marketing and Entrepreneurial Orientation on Innovation in Family Businesses. J. Knowl. Econ. 2019, 10, 1064–1079. [Google Scholar]

- Chen, Z.; Wang, X.; Xu, P. Research on the factors affecting the R&D synergy of enterprise groups and their effects. Res. Manag. 2014, 3, 108–115. [Google Scholar]

- Kotabe, M.; Srinivasan, S.; Aulakh, S. Multi-nationality and Firm Performance: The Moderating Role of R&D and Marketing Capabilities. J. Int. Bus. Stud. 2002, 33, 79–97. [Google Scholar]

- Wang, Y.; Xie, W.; Li, J.; Liu, C. What factors determine the subsidiary mode of overseas R&D by developing-country MNEs? Empirical evidence from Chinese subsidiaries abroad. R&D Manag. 2018, 48, 253–265. [Google Scholar]

- Wang, X.; Yu, F.; Zhong, C. The impact of R&D internationalization on Chinese enterprises’ innovation performance—Based on the perspective of “political connections”. Word Econ. Stud. 2017, 3, 78–86. [Google Scholar]

- Purkayastha, S.; Manolova, S.; Edelman, F. Business group effects on the R&D intensity-internationalization relationship: Empirical evidence from India. J. World Bus. 2016, 53, 104–117. [Google Scholar]

- Adams, P.; Freitas, I.M.B.; Fontana, R. Strategic orientation, innovation performance and the moderating influenceof marketing management. J. Bus. Res. 2019, 97, 129–140. [Google Scholar] [CrossRef]

- Li, F. Endogeneity in CEO power: A survey and experiment. Investig. Anal. J. 2016, 45, 149–162. [Google Scholar] [CrossRef]

- Coles, L.; Li, Z.F.F. An Empirical Assessment of Empirical Corporate Finance. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1787143 (accessed on 20 December 2019).

- Coles, L.; Li, Z.F. Managerial Attributes, Incentives, and Performance. Available online: https://ssrn.com/abstract=1680484 (accessed on 20 December 2019).

- Knight, A.; Cavusgil, T. Innovation, Organizational Capabilities, and the Born-Global Firm. J. Int. Bus. Stud. 2004, 35, 124–141. [Google Scholar] [CrossRef]

- Jaworski, B.; Kohli, A. Market or Innovation: Antecedents and Consequences. J. Mark. 1993, 57, 53–70. [Google Scholar] [CrossRef]

- Schaefer, K.J.; Liefner, I. Offshore versus domestic: Can EM MNCs reach higher R&D quality abroad? Scientometrics 2017, 113, 1349–1370. [Google Scholar]

- Jaffe, A.B. Technological Opportunity and Spillovers of R&D: Evidence from Firms’ Patents, Profits, and Market Value. Am. Econ. Rev. 1986, 76, 984–1001. [Google Scholar]

- Hitt, M.A.; Hoskisson, R.E.; Kim, H. International Diversification: Effects on Innovation and Firm Performance in Product-Diversified Firms. Acad. Manag. J. 1997, 10, 767–798. [Google Scholar]

- Child, J.; Rodrigues, S.B. The Internationalization of Chinese Firms: A Case for Theoretical Extension. Manag. Organ. Rev. 2005, 1, 381–410. [Google Scholar] [CrossRef]

- Peng, M.W.; Zhou, J.Q. How Network Strategies and Institutional Transitions Evolved in Asia. Asia Pac. J. Manag. 2005, 22, 321–336. [Google Scholar] [CrossRef]

- Hsu, C.W.; Lien, Y.-C.; Chen, H. R&D internationalization and innovation performance. Int. Bus. Rev. 2015, 24, 187–195. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 2000, 35, 39–67. [Google Scholar]

- Klerkx, L.; Guimon, J. Attracting foreign R&D through international centers of excellence: Early experiences from Chile. Sci. Public Policy 2017, 44, 763–774. [Google Scholar]

- Feng, X.; Zhang, Q. Empirical study on the impact of quality capability on the upgrade of manufacturing enterprises--the joint adjustment of strategic orientation. Technol. Econ. 2017, 36, 70–75. [Google Scholar]

- Thongsri, N.; Chang, A.K.-H. Interactions Among Factors Influencing ProductInnovation and Innovation Behaviour: Market Orientation, Managerial Ties, and Government Support. Sustainability 2019, 11, 2973. [Google Scholar] [CrossRef]

- van de Walet, N.; Boone, C.; Gilsing, V.; Walrave, B. CEO research orientation, organizational context, andinnovation in the pharmaceuticalindustry. R&D Manag. 2019, 10, 1–16. [Google Scholar]

- Slater, F.; Narver, C. Customer-Led and Market-Oriented: Let’s Not Confuse the Two. Strateg. Manag. J. 1998, 19, 1001–1006. [Google Scholar] [CrossRef]

- Day, G.S.; Wensley, R. Assessing advantage: A framework for diagnosing competitive superiority. J. Mark. 1988, 52, 1–20. [Google Scholar] [CrossRef]

- Han, J.K.; Kim, N.; Srivastava, K. Market Orientation and Organizational Performance: Is Innovation a Missing Link? J. Mark. 1998, 62, 30–45. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive Capacity:A Review, Reconceptualization, and Extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Garud, R.; Nayyar, P.R. Transformative capacity: Continual structuring by intertemporal technology transfer. Strateg. Manag. J. 1994, 15, 365–385. [Google Scholar] [CrossRef]

- Wolfram, P.; Agarwal, N.; Brem, A. Reverse technology transfer from the East to the West: Evidence from R&D sites of Western multinationals in China. Eur. J. Innov. Manag. 2018, 21, 443–455. [Google Scholar]

- Zhou, K.Z.; Gao, G.Y.; Yang, Z.; Zhou, N. Developing Strategy Oriented in China: Antecedents and consequences of market and innovation orientations. J. Bus. Res. 2005, 58, 1049–1058. [Google Scholar] [CrossRef]

- Katila, R.; Ahuja, G. Something Old, Something New: A Longitudinal Study of Search Behavior and New Product Introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar]

- Mamun, A.A.; Fazal, S.A.; Mohiuddin, M.; Su, Z. Strategic orientations, the mediating effect of absorptive capacity and innovation: A study among Malaysian manufacturing SMEs. Int. J. Innov. Manag. 2019, 23, 1–25. [Google Scholar] [CrossRef]

- Xu, S.; Wu, F.; Cavusgil, E. Complements or Substitutes? Internal Technological Strength, Competitor Alliance Participation, and Innovation Development. J. Product. Innov. Manag. 2013, 30, 750–762. [Google Scholar] [CrossRef]

- Booltink, W.A.; Saka-Helmhout, A. The effects of R&D intensity and internationalization on the performance of non-high-tech SMEs. Int. Small Bus. J. 2018, 36, 81–103. [Google Scholar]

- Zhang, P.; Huang, Z.; Gao, X. Research on political correlation and innovation capacity of enterprises--the Influence of top management team characteristics. Sci. Sci. Manag. S. & T. 2014, 3, 117–125. [Google Scholar]

- Pan, Q.; Tang, L.; Wei, H. Executive team breaking zone, innovation capacity and internationalization strategy--An empirical study based on data of listed companies. Sci. Sci. Manag. S. & T. 2015, 36, 111–122. [Google Scholar]

- Li, M.; Yu, T. Overseas R&D investment and parent company innovation performance--Based on the adjustment of enterprise resources and internationalization experience. Word Econ. Stud. 2016, 8, 101–113. [Google Scholar]

- Zhang, C.; Lv, Y. An empirical study on the relationship between managerial autonomy and corporate R&D investment--the regulating effect of ownership concentration. Soft Sci. 2017, 9, 110–114. [Google Scholar]

- Awate, S.; Larsen, M.M.; Mudambi, R. Accessing VS sourcing knowledge: A comparative study of R&D internationalization between emerging and advanced economy firms. J. Int. Bus. Stud. 2015, 46, 63–86. [Google Scholar]

- Dang, C.; Li, Z.; Yang, C. Measuring Firm Size in Empirical Corporate Finance. J. Bank. Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Zhang, Y.; Wei, J. Strategic orientation, R&D partner diversity and innovation performance. Stud. Sci. Sci. 2016, 34, 443–452. [Google Scholar]

| Category | Variable | Symbol | Variable Description | Literature Basis |

|---|---|---|---|---|

| Dependent variable | International R&D intensity | ORD | ORD = Number of companies’ international R&D institutions | Chen Yantai (2016) |

| Independent variable | Strategic market orientation | MO | MO = Marketing Expenses/Total Sales | Thomas et al. (1991) and Qin (2012) |

| Strategic technology orientation | TO | TO = R&D investment/total sales | Thomas et al. (1991) and Qin (2012) | |

| Mediator variable | Innovation capacity endowment | IC | IC = Enterprise R&D staff/Total staff | Zhang (2014), Pan, etc. (2015) |

| Moderator | International experience | EXP | EXP = Internationalized operating income/operating income | Sambharya, R.B (1996), Song, Li(2010) |

| Control variable | Enterprise scale | SIZE | SIZE = ln (the total assets of the company at the end of each year) | Hsu et al. (2015) and Li et al. (2016) |

| Enterprise age | AGE | AGE = ln (2015-the establishment date of the enterprise) | Hsu et al. (2015) and Li et al. (2016) | |

| Ownership | STATE | State-owned enterprises = 1; Non-state-owned enterprises = 0 | Hsu et al. (2015) and Li et al. (2016) | |

| Equity concentration | CR | CR = shareholding ratio of the largest shareholder | FaccioM, Lang (2002), Zhang, Lv (2017) | |

| Category | Variable | Symbol | Variable description | Literature basis |

| Dependent variable | International R&D intensity | ORD | ORD = Number of companies’ international R&D institutions | Chen (2016) |

| Independent variable | Strategic market orientation | MO | MO = Marketing Expenses / Total Sales | Thomas et al. (1991) and Qin (2012) |

| Strategic technology orientation | TO | TO = R&D investment/total sales | Thomas et al. (1991) and Qin (2012) | |

| Mediator variable | Innovation capacity endowment | IC | IC = Enterprise R&D staff/Total staff | Zhang (2014), Pan etc. (2015) |

| Moderator | International experience | EXP | EXP = Internationalized operating income/operating income | Sambharya, R.B (1996), Song, Li (2010) |

| Control variable | Enterprise scale | SIZE | SIZE = ln (the total assets of the company at the end of each year) | Hsu et al. (2015) and Li et al. (2016) |

| Enterprise age | AGE | AGE = ln (2015-the establishment date of the enterprise) | Hsu et al. (2015) and Li et al. (2016) | |

| Ownership | STATE | State-owned enterprises = 1; Non-state-owned enterprises = 0 | Hsu et al. (2015) and Li et al. (2016) | |

| Equity concentration | CR | CR = shareholding ratio of the largest shareholder | FaccioM, Lang (2002), Zhang, Lv (2017) |

| Variables | Mean | Std.Dev. | VIF | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.ORD | 1.2795 | 0.8783 | 1 | ||||||||

| 2.MO | 0.0905 | 0.1576 | 1.06 | −0.199 *** | 1 | ||||||

| 3.TO | 0.0818 | 0.0866 | 1.24 | 0.399 *** | 0.182 *** | 1 | |||||

| 4.IC | 0.2029 | 0.1701 | 1.30 | 0.276 *** | 0.079 | 0.355 *** | 1 | ||||

| 5.SIZE | 1.2324 | 0.8867 | 1.99 | −0.136 ** | −0.077 | −0.306 *** | 0.395 *** | 1 | |||

| 6.AGE | 1.0849 | 0.207 | 1.46 | −0.056 | 0.064 | −0.077 | −0.266 *** | 0.517 *** | 1 | ||

| 7.STATE | 0.1417 | 0.3495 | 1.23 | −0.038 | −0.072 | −0.044 | −0.06 | 0.392 *** | 0.160 ** | 1 | |

| 8.CR | 0.3835 | 0.1757 | 1.21 | 0.041 | -0.108 * | 0.071 | 0.133 ** | −0.339 *** | −0.328 *** | −0.01 | 1 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| SIZE | −0.1081 * | −0.1355 ** | −0.0038 | −0.0375 |

| (0.0643) | (0.0640) | (0.0611) | (0.0596) | |

| AGE | 0.01396 | 0.0306 | −0.0237 | 0.0294 |

| (0.0452) | (0.039) | (0.0418) | (0.0423) | |

| STATE | 0.0138 | 0.0102 | −0.0101 | −0.0068 |

| (0.0355) | (0.0347) | (0.0317) | (0.0320) | |

| CR | −0.0051 | −0.0259 | 0.0007 | 0.0016 |

| (0.0290) | (0.0420) | (0.0343) | (0.0366) | |

| MO | −0.4087 *** | |||

| (0.1155) | ||||

| TO | 0.6092 *** | |||

| (0.0944) | ||||

| IC | 0.1585 *** | |||

| (0.0358) | ||||

| N | 254 | 254 | 254 | 254 |

| Log likelihood | −313.4671 | −309.5593 | −307.1078 | −309.4802 |

| Waldchi2 | 5.02 | 18.38 | 79.30 | 23.50 |

| Prob > chi2 | 0.0047 | 0.0171 | 0.0248 | 0.0003 |

| Variable | Model 5: DV = ORD | Model 6: DV = IC | Model 7: DV = ORD |

|---|---|---|---|

| SIZE | −0.0281 | −0.2955 *** | 0.0154 |

| (0.0575) | (0.0681) | (0.0515) | |

| AGE | −0.0081 | −0.1168 | 0.0114 |

| (0.0389) | (0.0765) | (0.0371) | |

| STATE | −0.0147 | 0.0857 | −0.0296 |

| (0.0298) | (0.0599) | (0.0273) | |

| CR | −0.0240 | −0.0207 | −0.0178 |

| (0.0365) | (0.0568) | (0.0342) | |

| MO | −0.4929 *** | 0.0483 | −0.5119 *** |

| (0.1255) | (0.1253) | (0.1289) | |

| TO | 0.6700 *** | 1.0790 ** | 0.6028 *** |

| (0.1027) | (0.5883) | (0.1040) | |

| IC | - | - | 0.1296 *** |

| - | - | (0.0283) | |

| N | 254 | 254 | 254 |

| Log likelihood/R2 | −301.7024 | 0.2330 | −299.0917 |

| Wald chi2/F | 70.40 ** | 8.36 *** | 80.08 *** |

| Model a | Model b | |||

|---|---|---|---|---|

| Market Orientation-Innovation Capacity Endowment-International R&D Intensity | Technology Orientation-Innovation Capacity Endowment-International R&D Intensity | |||

| Bootstrap estimation | b | HE | b | HE |

| Control variable | ||||

| MO | - | - | −0.2901 | 0.0449 |

| TO | 0.6984 *** | 0.0888 | - | - |

| SIZE | 0.0161 | 0.0267 | 0.0161 | 0.0267 |

| AGE | 0.011 | 0.0233 | 0.011 | 0.0233 |

| STATE | −0.0154 | 0.0207 | −0.0154 | 0.0207 |

| CR | 0.0006 | 0.0207 | 0.0006 | 0.0207 |

| Path analysis | ||||

| X-M | 0.0483 | 0.1316 | 1.079 *** | 2.2512 |

| M-Y | 0.0837 *** | 0.0217 | 0.0837 *** | 0.0217 |

| Total effect | −0.2859 *** | 0.046 | 0.7926 *** | 0.088 |

| Direct effect | −0.2901 *** | 0.0449 | 0.6984 *** | 0.0888 |

| Indirect effect | 0.0042 | 0.0117 | 0.0942 ** | 0.0758 |

| Bootstrap 90% CI | [−0.0109,0.0273] | [0.0241,0.2652] | ||

| Bootstrap 95% CI | [−0.0153,0.0314] | [0.0158,0.3101] | ||

| Bootstrap 99% CI | [−0.0248,0.0421] | [−0.0072,0.4500] | ||

| R2 | 0.3582 | 0.3852 | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, J.; Chen, H.; Tsai, F.-S. Strategy Orientation, Innovation Capacity Endowment, and International R&D Intensity of Listed Companies in China. Sustainability 2020, 12, 344. https://doi.org/10.3390/su12010344

He J, Chen H, Tsai F-S. Strategy Orientation, Innovation Capacity Endowment, and International R&D Intensity of Listed Companies in China. Sustainability. 2020; 12(1):344. https://doi.org/10.3390/su12010344

Chicago/Turabian StyleHe, Jianhong, Hongmin Chen, and Fu-Sheng Tsai. 2020. "Strategy Orientation, Innovation Capacity Endowment, and International R&D Intensity of Listed Companies in China" Sustainability 12, no. 1: 344. https://doi.org/10.3390/su12010344

APA StyleHe, J., Chen, H., & Tsai, F.-S. (2020). Strategy Orientation, Innovation Capacity Endowment, and International R&D Intensity of Listed Companies in China. Sustainability, 12(1), 344. https://doi.org/10.3390/su12010344