Assessment of Investment Attractiveness of Projects on the Basis of Environmental Factors

Abstract

:1. Introduction

2. Literature Review

3. Methodological Framework

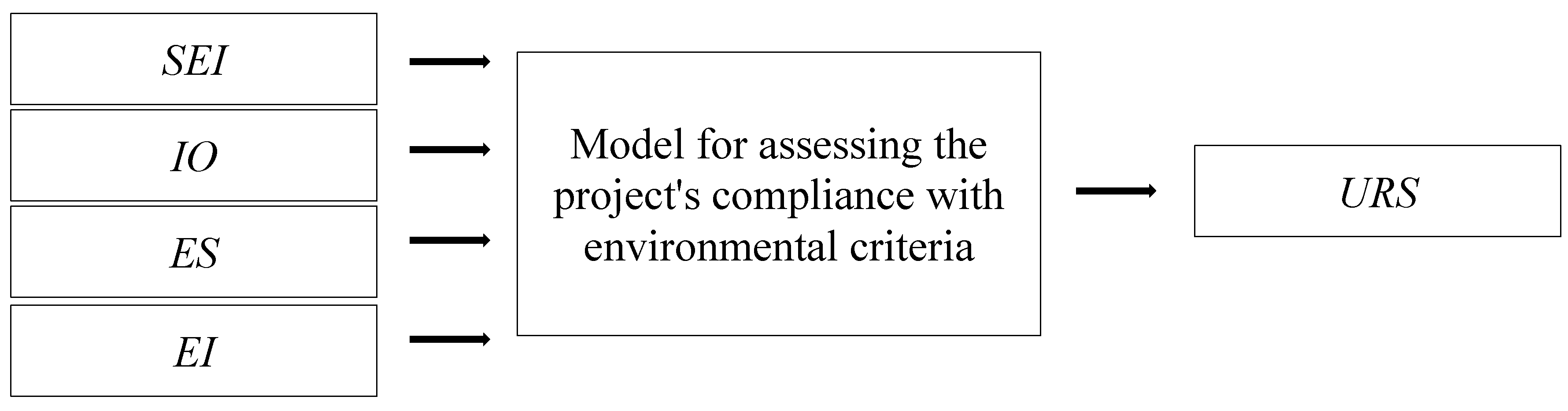

3.1. Problem Statement

- (1)

- the scale of the impact on the environment, both existing and overcome through the implementation of the investment project;

- (2)

- objects of adverse effects that the implementation of the investment project is aimed at overcoming;

- (3)

- the environmental situation in the territory of the investment project;

- (4)

- the type of reduced (preventable) environmental impact (Table 3).

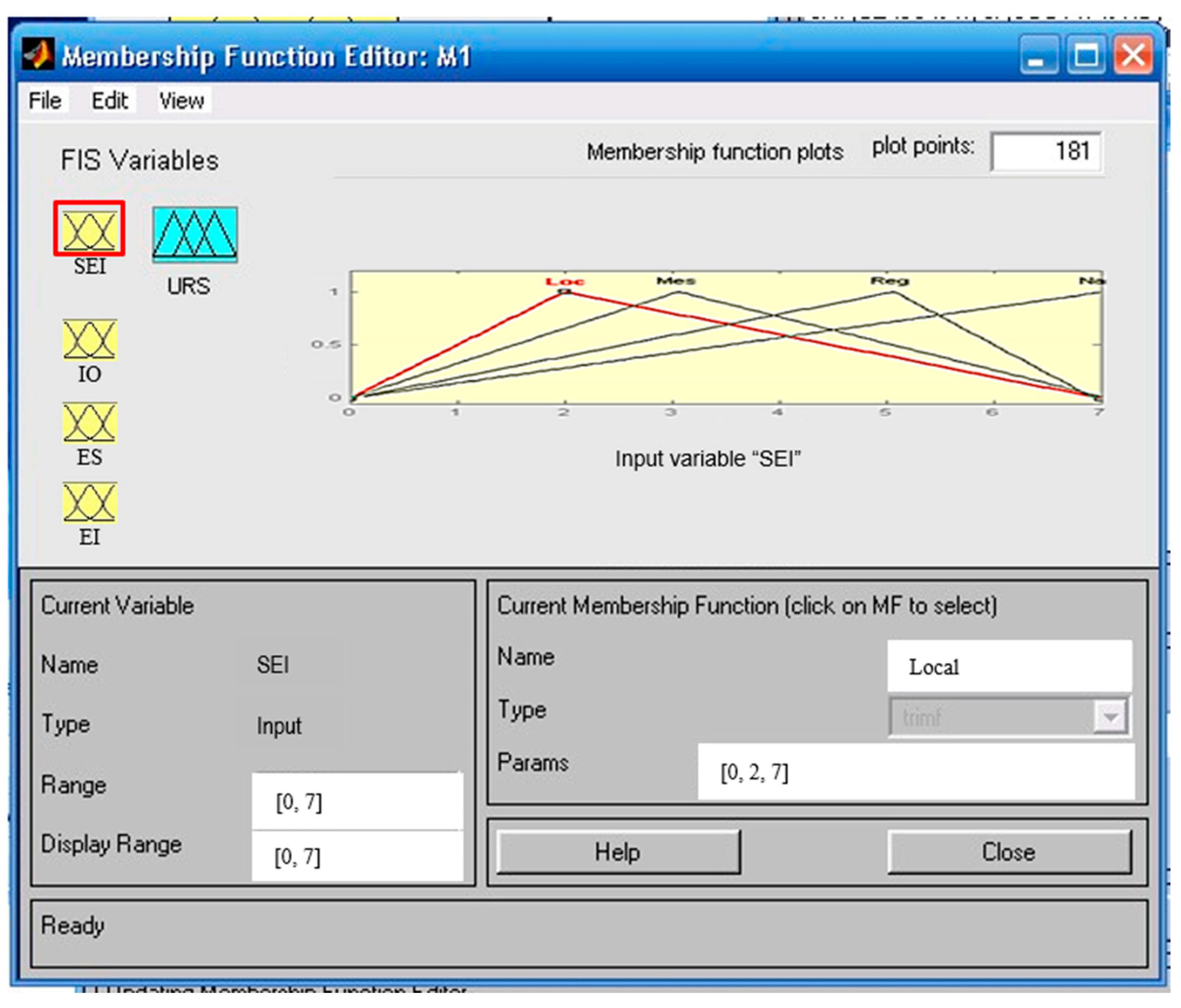

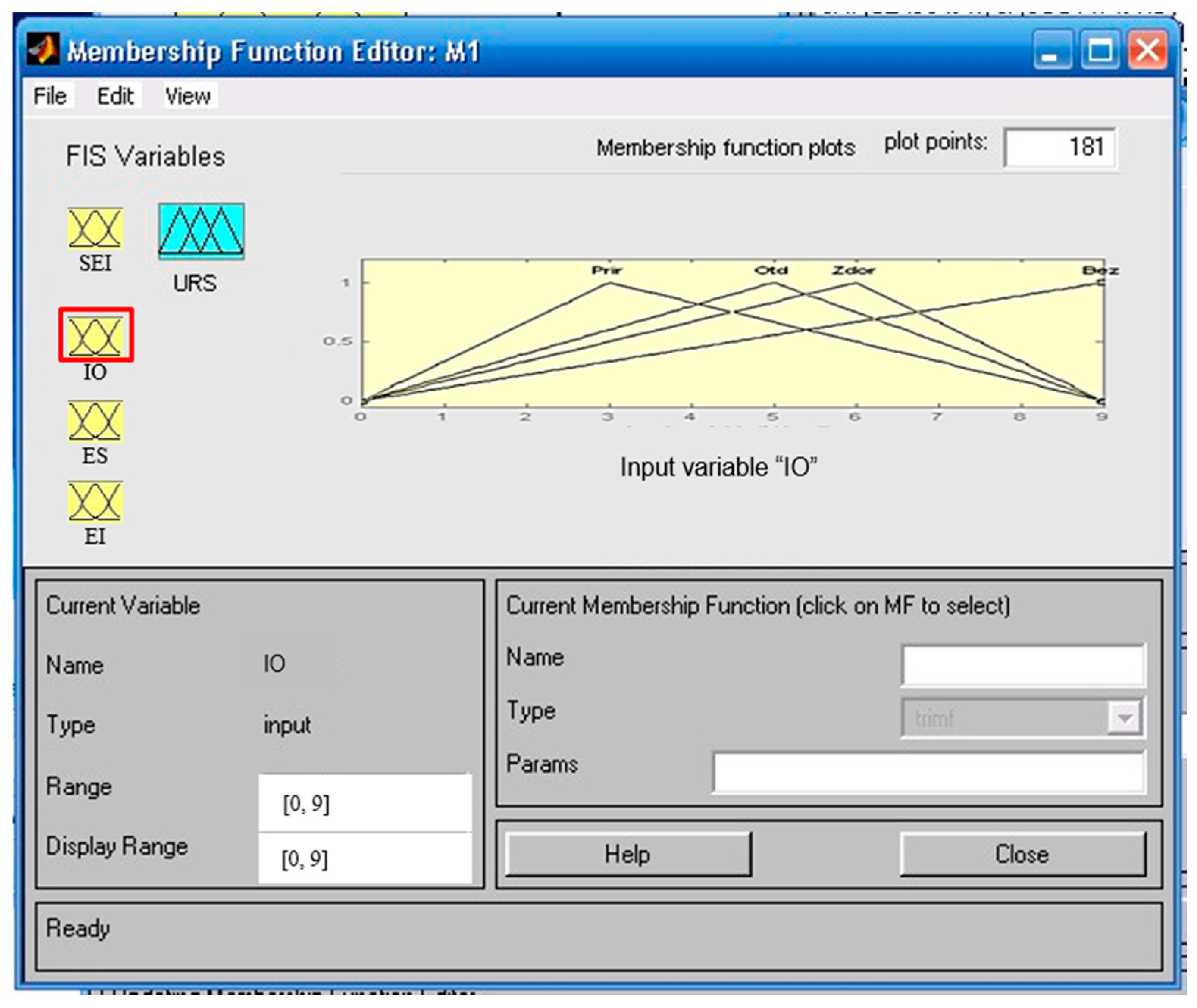

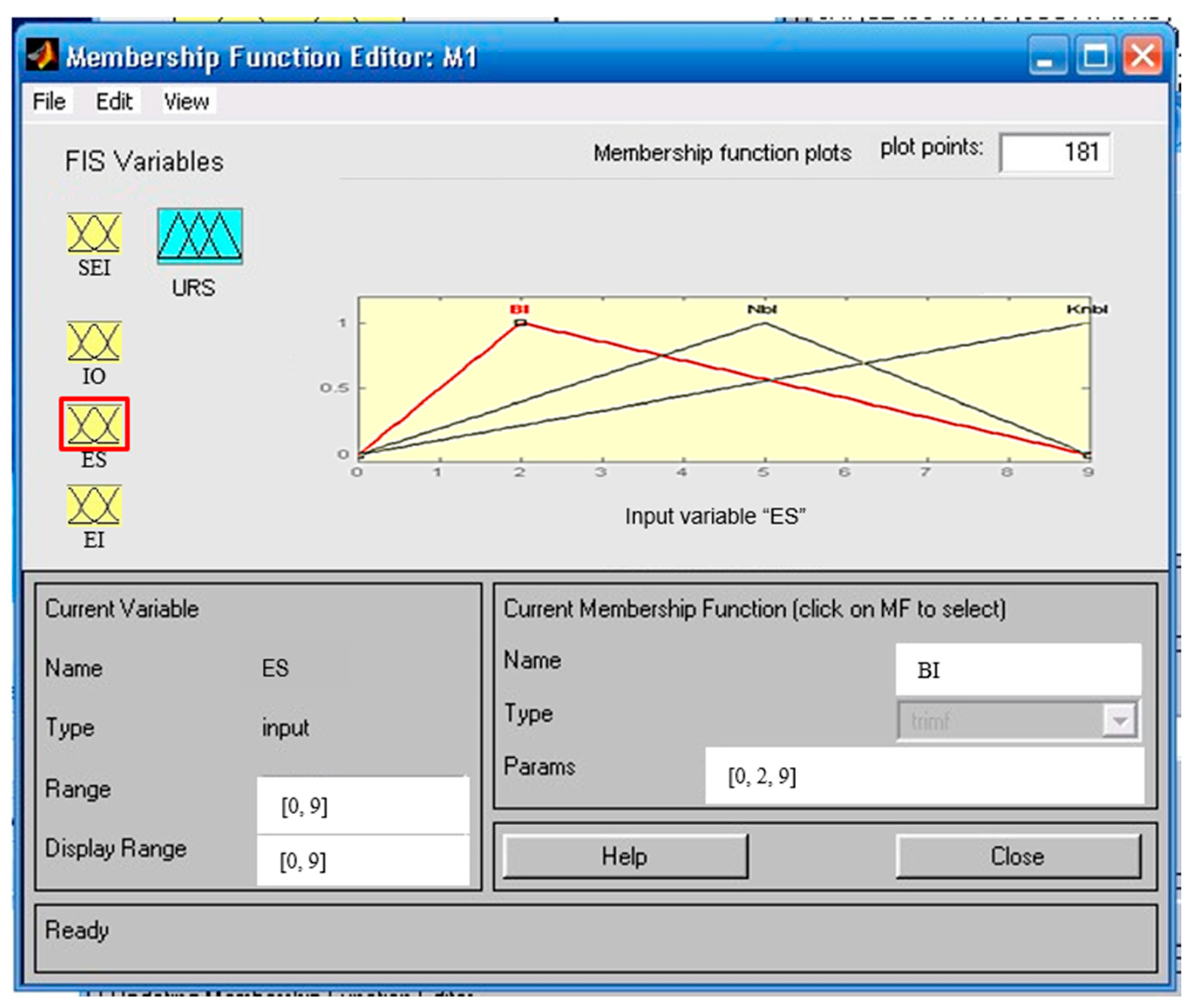

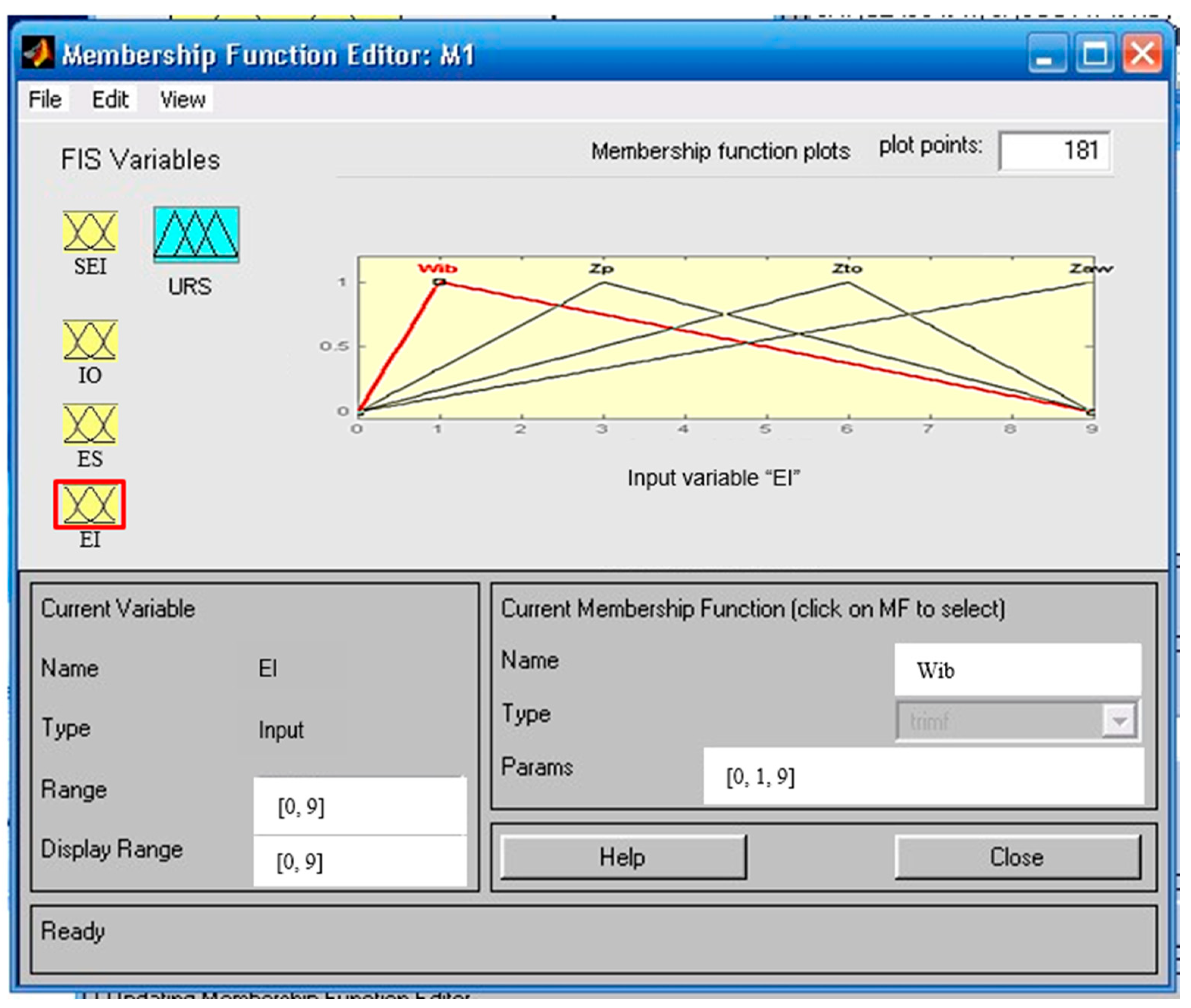

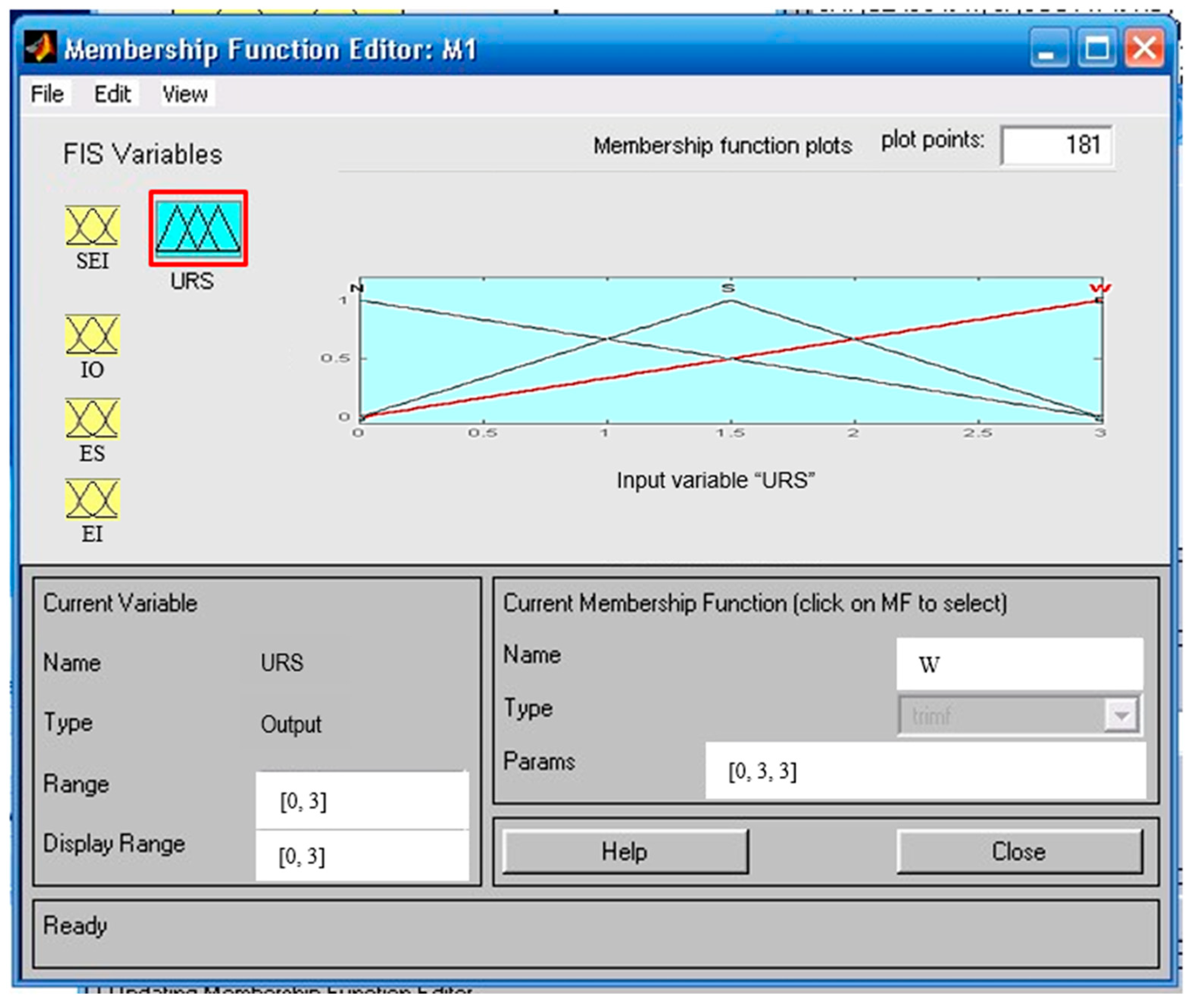

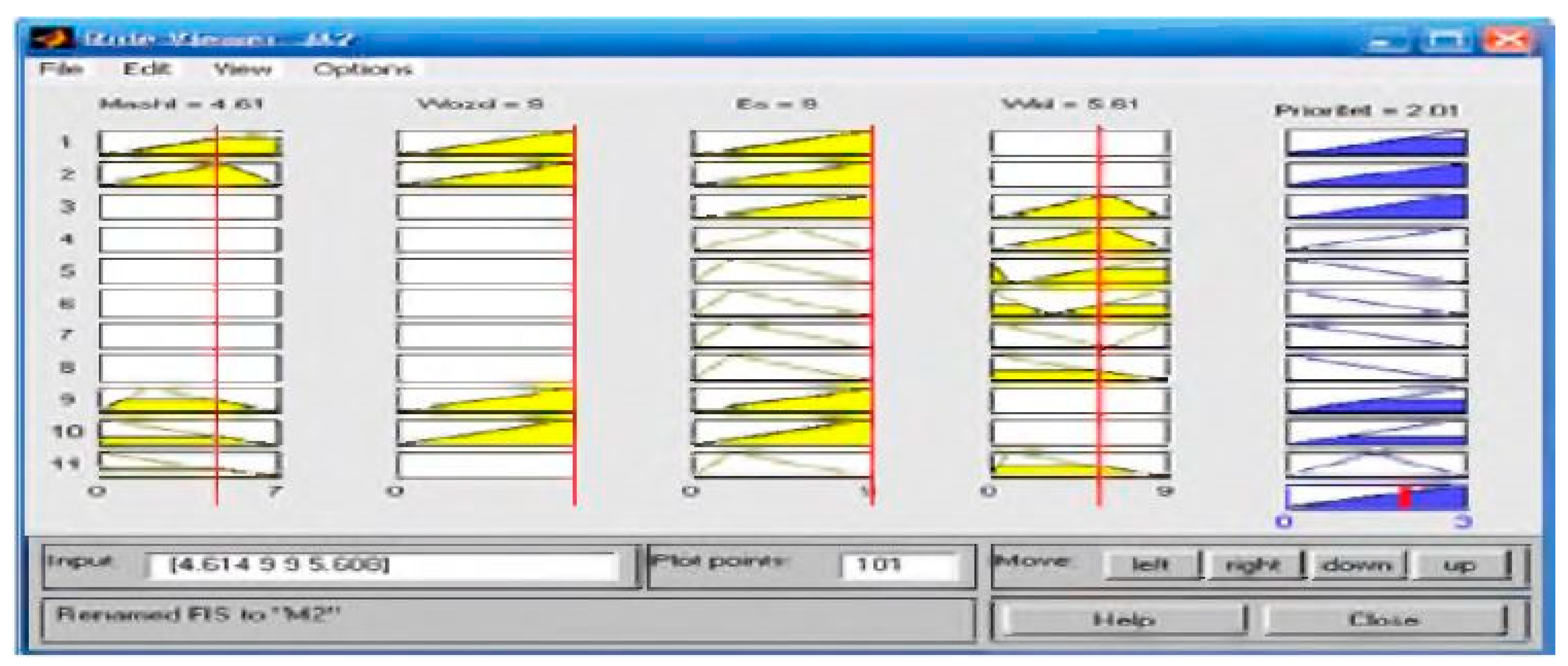

3.2. Problem-Solving Method

- (a)

- if the scale of the investment project’s impact on the environment is national (in our notation, this is ), regional (), local () or local (), the implementation of the investment project is aimed at addressing the safety of the population () and the environmental situation in the territory is extremely unfavorable (), then the investment project submitted for financing is given a high level of priority ();

- (b)

- if the implementation of an investment project is aimed at reducing the pollution of groundwater, reducing pollution by solid waste () and the environmental situation in the area is extremely unfavorable () or unfavorable (), then the investment project is considered to be high priority level ();

- (c)

- if the environmental situation in the territory is generally favourable () and the project implementation does not reduce the adverse environmental impact ( or or or ), then the investment project should be attributed a low level of priority ();

- (d)

- if the scale of the project’s impact on the environment is local ), the situation in the territory is generally favourable (), and project implementation prevents noise and vibration (), then the investment project is of average priority ().

4. Results and Discussion

- If is and is and is then is ;

- If is and is and is then is ;

- If is and is and is then is ;

- If is and is and is then is ;

- If is and is then is ;

- If is and is then is ;

- If is and is 3.3 and is then is ;

- If is and is then is L;

- If is and is then is L;

- If is and is then is L;

- If is and is then is L.

5. Conclusions

- (a)

- A new approach to the design and environmental analysis of investment projects at the stage of environmental screening, as distinct from the existing inclusion of economic and mathematical models in the chain of analysis of processing semi-structured results of expert assessments. The advantage of the approach is the ability to formally describe and use expert knowledge to evaluate investment projects in terms of the imperatives of economic and environmental development of the region.

- (b)

- A complex of economic and mathematical models of design and investment analysis at the stage of environmental screening, as distinct from the existing application of the mathematical apparatus of fuzzy algebra and fuzzy logic. The advantage of the models is that one has the possibility of quantitative processing of qualitative information, as reflecting the semi-structured knowledge of specialists.

Author Contributions

Funding

Conflicts of Interest

References

- Chakravorti, B.; Chaturvedi, R.S. Digital Planet 2017. How Competitiveness and Trust in Digital Economies Vary Across the World; The Fletcher School, Tufts University: Medford, MA, USA, 2017; Available online: https://sites.tufts.edu/digitalplanet/files/2017/05/Digital_Planet_2017_FINAL.pdf (accessed on 28 February 2019).

- Nikonova, Y.; Dementiev, A. Tendencies and prospects in the digital economy development in Russia. In SHS Web of Conferences, Proceedings of the International Conference on Advanced Studies in Social Sciences and Humanities in the Post-Soviet Era (ICPSE 2018), Barnaul, Russia, 25–26 May 2018; EDP Sciences: Les Ulis, France, 2018; Volume 55, p. 01011. [Google Scholar]

- Alekseenko, N.V. Ustoychivoe razvitie predpriyatiya kak faktor ekonomicheskogo rosta regiona. Ekonomika i Organizaciya Upravlinnya 2008, 3, 59–65. [Google Scholar]

- Tychinina, N.A. Teoreticheskoe obosnovanie soderzhaniya uchetnoanaliticheskogo obespecheniya ustoychivogo razvitiya predpriyatiya. Vestnik Orenburgskogo Gosudarstvennogo Universiteta 2009, 2, 102–107. [Google Scholar]

- Ryabov, V.M. Ustoychivoe razvitie promyshlennyh predpriyatiy v sovremennyh usloviyah. Vektor Nauki Tol’yattinskogo Gosudarstvennogo Universiteta 2011, 4, 271–273. [Google Scholar]

- Korobkova, Z.V. Ustoychivoe Razvitie Promyshlennyh Predpriyatiy v Globalizirovannoy Ekonomike. Sovershenstvovanie Institucional’nyh Mekhanizmov v Promyshlennosti: Sb. nauch. tr.; IEOPP SO RAN: Novosibirsk, Russia, 2005; pp. 90–101. [Google Scholar]

- Ziyadin, S.; Kabasheva, N. The Basis for Initiating the Eurasian Integration of the Agricultural Sector. Public Adm. Issues 2018, 5, 56–67. [Google Scholar] [CrossRef]

- Rodionova, L.N.; Abdullina, L.R. Ustoychivoe razvitie promyshlennyh predpriyatiy: Terminy i opredeleniya. Neftegazovoe Delo 2007, 1, 50–62. [Google Scholar]

- Kucherova, E.N. Sovremennyy podhod k ustoychivomu razvitiyu predpriyatiya. Vestnik Orenburgskogo Gosudarstvennogo Universiteta 2007, 9, 76–81. [Google Scholar]

- Anpilov, S. Sovremennyy podhod k ustoychivomu razvitiyu predpriyatiya. Osnovy Ekonomiki, Upravleniya i Prava 2012, 1, 53–57. [Google Scholar]

- Bat’kovskiy, A.M. Modeli ocenki ustoychivosti innovacionnogo razvitiya predpriyatiy radioelektronnoy promyshlennosti. Estestvennye i Tekhnicheskie Nauki 2011, 1, 215–219. [Google Scholar]

- Ursul, A.D. Perspektivy evolyucii gosudarstva v modeli ustoychivogo razvitiya. Obschestvennye Nauki i Sovremennost 1996, 2, 134–144. [Google Scholar]

- Ivanov, P.M. Ustoychivoe regional’noe razvitie: Koncepciya i model’ upravleniya. Ekonomika i Matematicheskie Metody 2006, 42, 51–60. [Google Scholar]

- TSapieva, O.K. Ustoychivoe razvitie regiona: Teoreticheskie osnovy i model’. Problemy Sovremennoy Ekonomiki 2010, 2, 307–311. [Google Scholar]

- Rozenberg, G.S.; CHernikova, S.A.; Krasnoschekov, G.P.; Krylov, Y.M.; Gelashvili, D.B. Mify i real ‘nost’ “ustoychivogo razvitiya”. Problemy Prognozirovaniya 2000, 2, 130–154. [Google Scholar]

- Lyubushin, N.P.; Babicheva, N.E.; Galushkina, A.I.; Kozlova, L.V. Analiz metodov i modeley otsenki finansovoy ustoychivosti organizatsiy. Ekonomicheskiy Analiz Teoriya I Praktika 2010, 1, 3–11. [Google Scholar]

- Ziyadin, S.; Suieubayeva, S.; Kabasheva, N.; Moldazhanov, M. Economic rationale for the investment attractiveness of China at present. Економiчний часопис-XXI 2017, 163, 35–40. [Google Scholar] [CrossRef]

- Ziyadin, S.; Khamitova, D.; Khassenova, K.; Suieubayeva, S.; Agumbayeva, A. Economic factors influencing the development of China’s foreign trade policy with Kazakhstan. Економічний часопис-ХХІ 2015, 155, 14–17. [Google Scholar]

- SHalmuev, A.A. Teoretiko-metodologicheskie osnovy ustoychivogo razvitiya regiona. Innovatsii 2006, 3, 28–31. [Google Scholar]

- Ugol’nitskiy, G.A. Ustoychivoe Razvitie Organizatsiy. Sistemnyy analiz, Matematicheskie Modeli i Informatsionnye Tekhnologii Upravleniya; Izdatel’stvo Fiziko-Matematicheskoy Literatury: Russia, Moscow, 2011; 320p. [Google Scholar]

- SHevchenko, I.V.; Litvinskiy, K.O. Ustoychivoe razvitie: Mirovoy opyt i problemy Rossii. Regional’Naya Ekonomika Teoriya i Praktika 2007, 13, 3–9. [Google Scholar]

- Ziyadin, S.; Omarova, A.; Doszhan, R.; Saparova, G.; Zharaskyzy, G. Diversification of R and D results commercialization. Probl. Perspect. Manag. 2018, 16, 331–343. [Google Scholar] [CrossRef]

- Makhov, S.A. Matematicheskoe modelirovanie mirovoy dinamiki i ustoychivogo razvitiya na primere modeli Forrestera. Preprinty Instituta prikladnoy matematiki im. MV Keldysha RAN 2005, 1–6. (In Russian) [Google Scholar]

- Zakharova, E.N. O kognitivnom modelirovanii ustoychivogo razvitiya sotsial’no-ekonomicheskikh sistem. Vestnik Adygeyskogo gosudarstvennogo universiteta. Seriya 1 Regionovedenie Filosofiya Istoriya Sotsiologiya Yurisprudentsiya Politologiya Kul’turologiya 2007, 1, 184–190. [Google Scholar]

- Kolosova, T.; KHavin, D. Innovatsionnyy potentsial kak strategicheskiy resurs povysheniya ustoychivosti razvitiya predpriyatiya. Predprinimatel’Stvo 2011, 5, 49–56. [Google Scholar]

- Badulescu, D.; Bungau, C.; Badulescu, A. Sustainable development through sustainable businesses. An empirical research among master students. J. Environ. Prot. Ecol. 2015, 16, 1101–1108. [Google Scholar]

- Shaikh, A.A.; Karjaluoto, H. Making the most of information technology & systems usage: A literature review, framework and future research agenda. Comput. Hum. Behav. 2015, 49, 541–566. [Google Scholar]

- Watkins, M.; Ziyadin, S.; Imatayeva, A.; Kurmangalieva, A.; Blembayeva, A. Digital tourism as a key factor in the development of the economy. Econ. Ann. XXI 2018, 169, 40–45. [Google Scholar] [CrossRef]

- Ursul, A.D. Informatizatsiya obschestva i perekhod k ustoychivomu razvitiyu tsivilizatsii. Vestnik ROIVT 1993, 1–3, 35–45. [Google Scholar]

- Kanin, D.M.; Parinova, L.V.; L’vovich, I.A. Informatsionnye tekhnologii kak instrumentariy intellektualizatsii upravleniya ustoychivym razvitiem territorii. Informatsiya i Bezopasnost’ 2013, 16, 31–38. [Google Scholar]

- Averchenkov, A.A.; Maksimenko, Y.L. Ekologicheskaya otsenka investitsionnykh proektov: Metodicheskoe posobie TSentr podgotovki i realizatsii mezhdunarodnykh proektov tekhnicheskogo sodeystviya; Upravlenie okruzhayuschey sredoy: Moscow, Russia, 2000; p. 126. (In Russian) [Google Scholar]

- Borodin, A.; Shash, N.; Kiseleva, N.; Streltsova, E.; Biltchak, V. Game-theoretic interpretation of problems of adoption of administrative decisions at the level of the region. Int. J. Civ. Eng. Technol. IJCIET 2019, 10, 1487–1499. [Google Scholar]

- Ilina, I.; Streltsova, E.; Borodin, A.; Yakovenko, I. The impact of public investment on the competitiveness of the Russian R&D sector. Int. J. Mech. Eng. Technol. IJMET 2019, 10, 1128–1140. [Google Scholar]

- Verekhin, A.V.; YAchmeneva, V.M. Otsenka ekologo-ekonomicheskoy bezopasnosti promyshlennogo predpriyatiya s ispol’zovaniem instrumentariya nechetkoy logiki. Ekonomicheskie Nauki Nauchno-Tekhnicheskie Vedomosti SPbGPU 2017, 10, 140–157. [Google Scholar]

- Ivantsova, E.A.; Kuz’min, V.A. Upravlenie ekologo-ekonomicheskoy bezopasnost’yu promyshlennykh predpriyatiy. Vestnik Volgogradskogo gosudarstvennogo universiteta. Seriya 3 Ekonomika Ekologiya 2014, 5, 136–145. [Google Scholar]

- Rogachev, A.F.; SHevchenko, A.A.; Kuz’min, V.A. Otsenivanie ekologo-ekonomicheskoy bezopasnosti promyshlennykh predpriyatiy metodami nechetkoy logiki. Trudy SPIIRAN 2013, 7, 77–87. [Google Scholar]

- Ptuskin, A.S.; Levner, E.; Zhukova, Y.M. Mnogokriterial’naya model’ opredeleniya nailuchshey dostupnoy tekhnologii pri nechetkikh iskhodnykh dannykh. Vestnik Moskovskogo gosudarstvennogo tekhnicheskogo universiteta im. NE Baumana Seriya Mashinostroenie 2016, 6, 105–127. [Google Scholar]

- YAstrebova, N.N. Postroenie ekspertnykh sistem na baze ierarkhicheskogo nechetkogo vyvoda. Programmnye Produkty i Sistemy 2007, 4, 18–21. [Google Scholar]

- Korenevskiy, N.A.; Filist, S.A.; Chursin, G.V. Sintez nechetkikh reshayushchikh pravil dlya mediko-ekologicheskikh prilozheniy na osnove analiza struktury dannykh. Nauchnye vedomosti Belgorodskogo gosudarstvennogo universiteta. Seriya Ekonomika Informatika 2009, 12, 162–169. [Google Scholar]

- Tindova, M.G. Ispol’zovanie nechetkogo logicheskogo vyvoda pri reshenii razlichnykh klassov otsenochnykh zadach. Modeli Sistemy Seti v Ekonomike Tekhnike Prirode i Obshchestve 2013, 3, 106–108. [Google Scholar]

- Alekseev, V.A.; Telegina, M.V.; Yannikov, I.M. Primenenie metodov nechetkoy logiki v zadachakh analiza ekologicheskikh dannykh. Izvestiya YUzhnogo federal’nogo universiteta. Tekhnicheskie nauki 2009, 101, 142–149. [Google Scholar]

- Nedosekin, A.O.; Abdulaeva, Z.I.; SHkatov, M.Y. Razrabotka sistemy sbalansirovannykh pokazateley (SSP) dlya morskoy neftegazovoy smeshannoy kompanii (MNSK) s ispol’zovaniem nechetko-mnozhestvennykh opisaniy. Audit i Finansovyy Analiz 2013, 3, 126–134. [Google Scholar]

| Categories of Investment Projects | Designation from the Model | Criteria for Categories of Investment Projects |

|---|---|---|

| A | Implementation of the investment project may lead to irreversible environmental consequences. | |

| B | The implementation of an investment project may lead to adverse environmental impacts (one or more natural components), but these impacts are easily recognizable and can be avoided by applying environmental or countervailing measures. | |

| C | The implementation of the investment project will not have an adverse impact on the environment and will not lead to any adverse effects. | |

| D | The investment project is not related to industrial production and involves the improvement of the environment. |

| Criteria Designation | Characteristics of Criteria |

|---|---|

| The implementation of the investment project should lead to the elimination of the sources of environmental impact. | |

The implementation of the investment project should be aimed at solving one of several environmental problems:

| |

The implementation of the investment project should not lead to an adverse impact on the environment due to:

|

| Criteria for Determining the Priority of the Investment Project | Score | ||

|---|---|---|---|

| SCALE OF ENVIRONMENTAL IMPACT () | 1.1 | National: covers the economic regions or territory of several regions. | 7 |

| 1.2 | Regional: large city, region. | 5 | |

| 1.3 | Provincial: district, village, rural district. | 3 | |

| 1.4 | Local: industrial zone of the enterprise. | 2 | |

| IMPACT OBJECT () | 2.1 | Public safety: long-term pollution of the environment, causing statistically recorded indicators of deterioration in the health of the population and threat to livelihoods. | 9 |

| 2.2 | Public health: environmental pollution, which may lead to a deterioration in the health of the population. | 6 | |

| 2.3 | Individual natural components: water bodies, atmospheric air, soils, forests, etc. | 5 | |

| 2.4 | Natural resources: minerals, underground and surface waters, flora and fauna. | 3 | |

| ENVIRONMENTAL SITUATION IN THE PROJECT AREA () | 3.1 | Extremely unfavourable: according to long-term observations, the state of the environment is assessed by environmental authorities as extreme. | 9 |

| 3.2 | Unfavourable: indicators of the state of the environment or its individual components many times exceed the maximum permissible values. | 5 | |

| 3.3 | Generally favourable, but there are separate sources of pollution. | 2 | |

| TYPE OF PREVENTABLE ENVIRONMENTAL IMPACT () | 4.1 | Air pollution. | 9 |

| 4.2 | Surface water pollution, groundwater pollution, pollution by hazardous industrial waste. | 6 | |

| 4.3 | Soil pollution. | 3 | |

| 4.4 | Noise, vibration, odours. | 1 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ziyadin, S.; Streltsova, E.; Borodin, A.; Kiseleva, N.; Yakovenko, I.; Baimukhanbetova, E. Assessment of Investment Attractiveness of Projects on the Basis of Environmental Factors. Sustainability 2019, 11, 2544. https://doi.org/10.3390/su11092544

Ziyadin S, Streltsova E, Borodin A, Kiseleva N, Yakovenko I, Baimukhanbetova E. Assessment of Investment Attractiveness of Projects on the Basis of Environmental Factors. Sustainability. 2019; 11(9):2544. https://doi.org/10.3390/su11092544

Chicago/Turabian StyleZiyadin, Sayabek, Elena Streltsova, Alex Borodin, Nataliya Kiseleva, Irina Yakovenko, and Elmira Baimukhanbetova. 2019. "Assessment of Investment Attractiveness of Projects on the Basis of Environmental Factors" Sustainability 11, no. 9: 2544. https://doi.org/10.3390/su11092544

APA StyleZiyadin, S., Streltsova, E., Borodin, A., Kiseleva, N., Yakovenko, I., & Baimukhanbetova, E. (2019). Assessment of Investment Attractiveness of Projects on the Basis of Environmental Factors. Sustainability, 11(9), 2544. https://doi.org/10.3390/su11092544