Economic Impacts of a Low Carbon Economy on Global Agriculture: The Bumpy Road to Paris †

Abstract

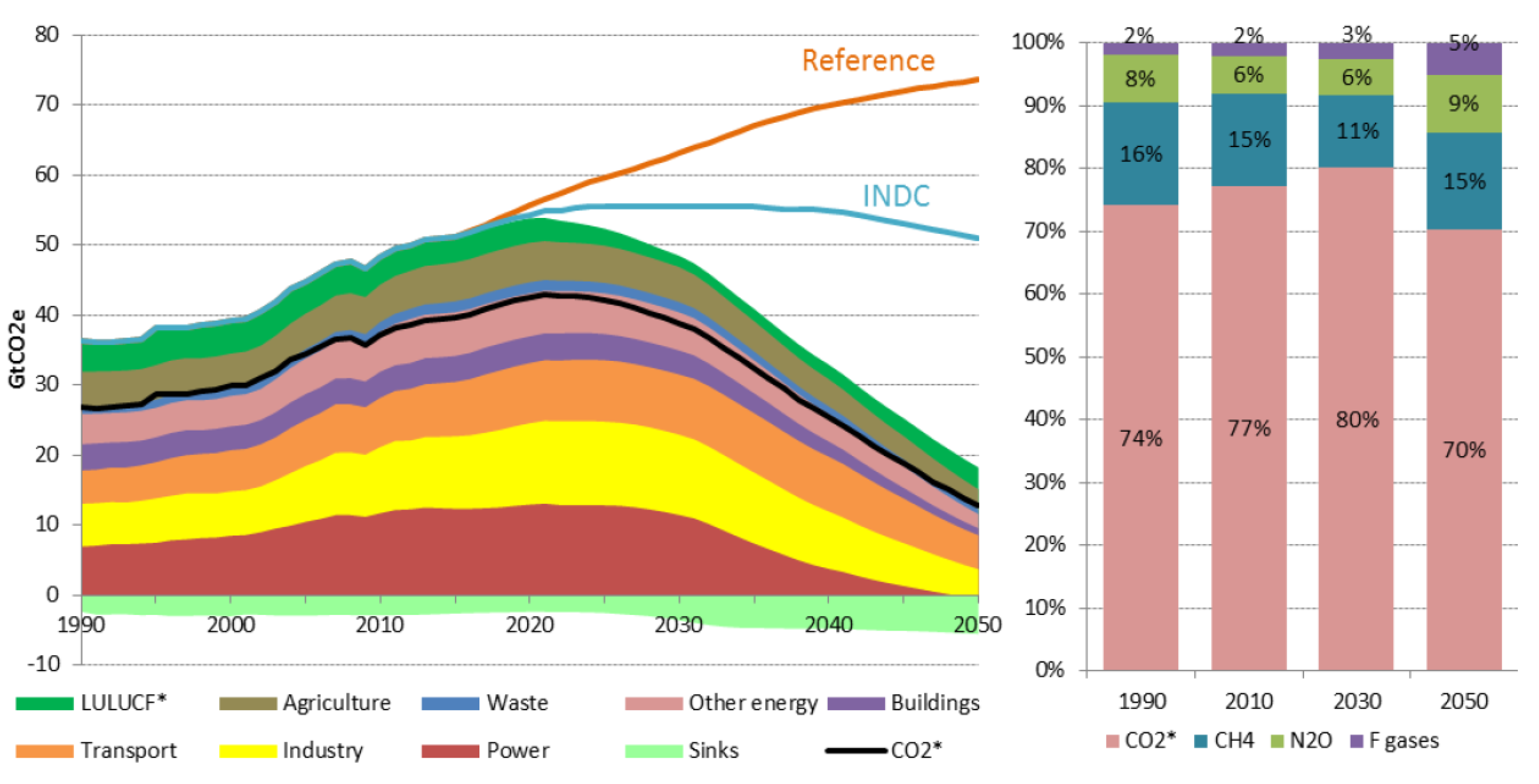

1. Introduction

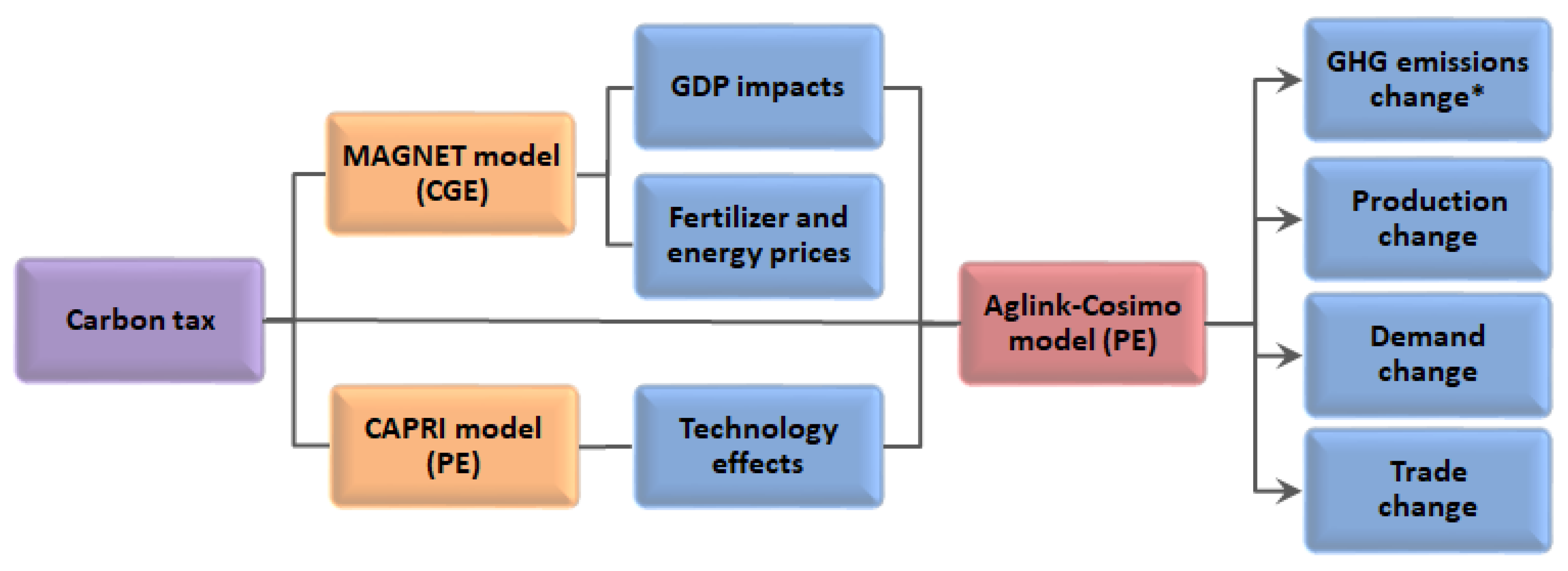

2. A Partial Equilibrium Modelling Framework

3. Scenario Narratives and Design

4. Scenario Analysis and Discussion

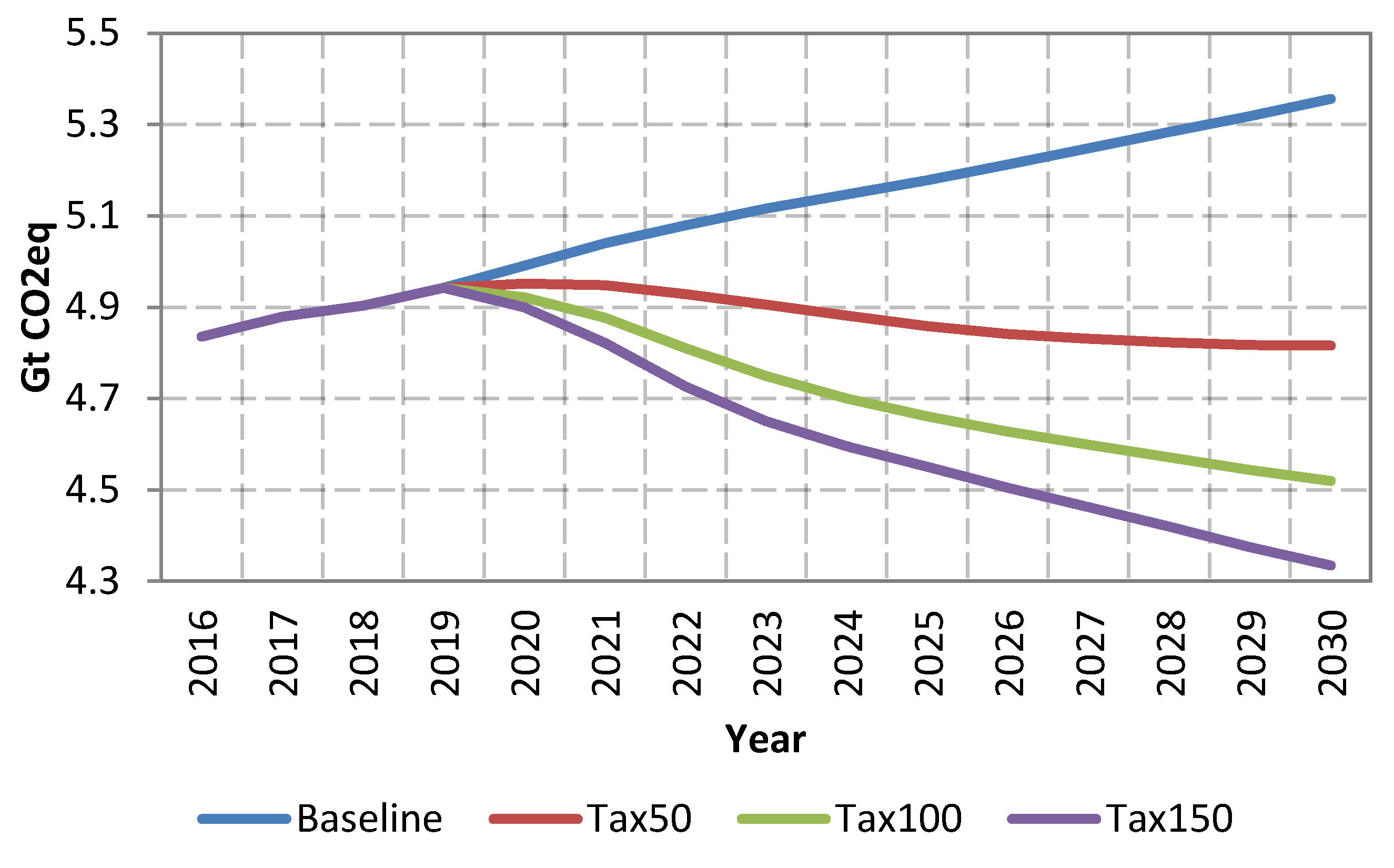

4.1. Baseline

4.2. Macroeconomic Impacts on the Agricultural Sector

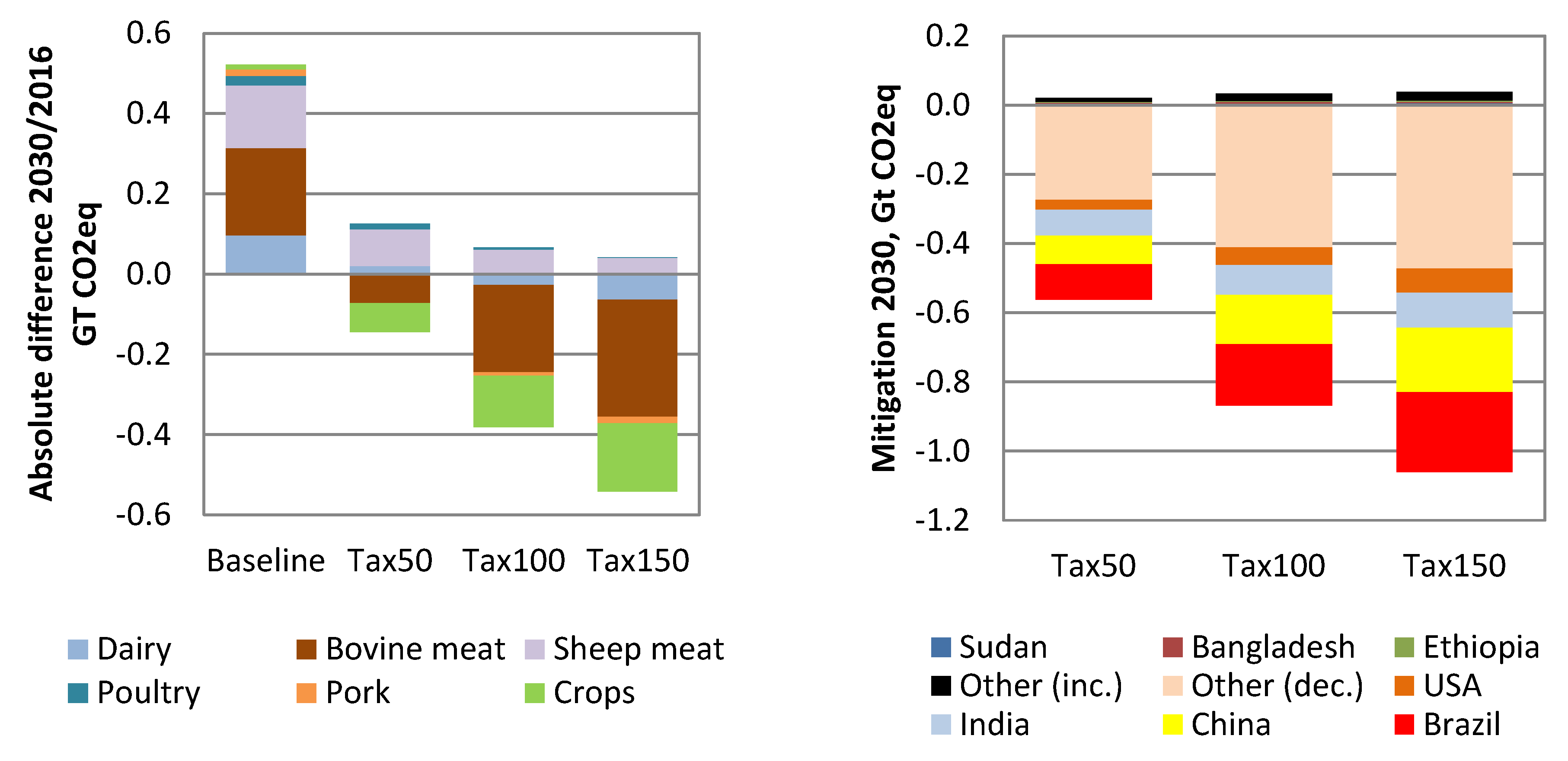

4.3. Decomposition of Mitigation and Production Impacts

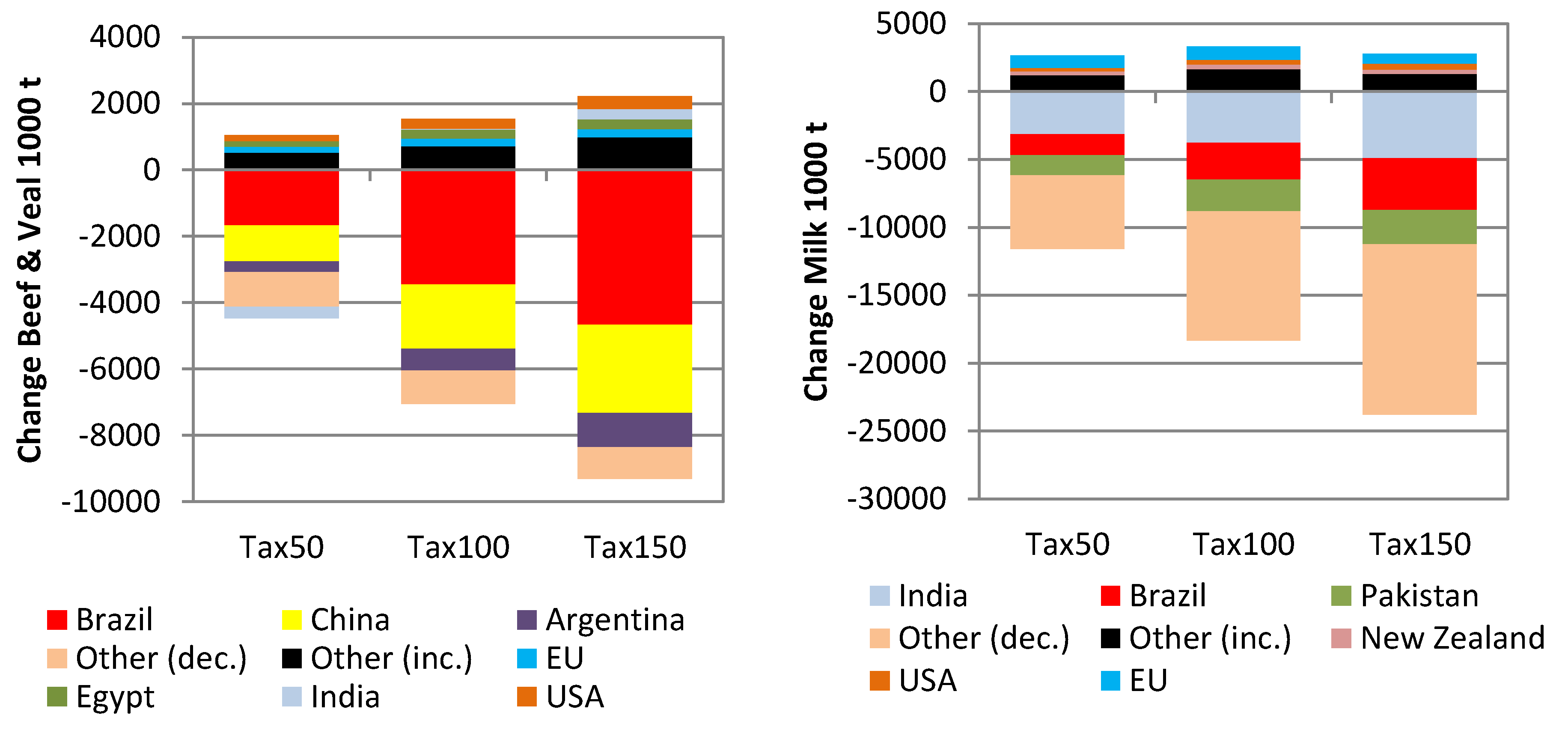

4.4. Impacts on Bovine Meat Production and Consumption Patterns

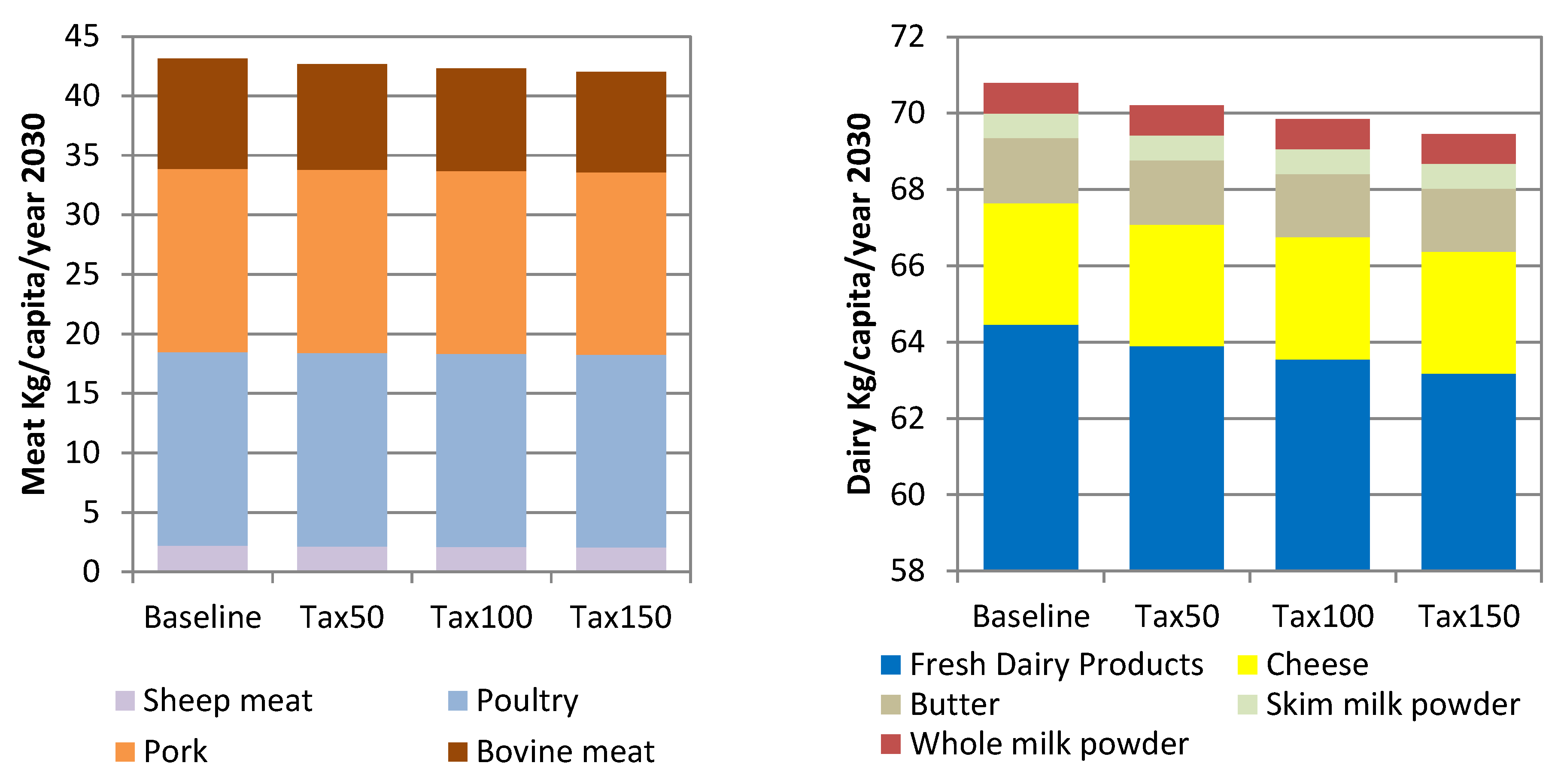

4.5. Impacts on Land Use

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- UNFCCC. Adoption of the Paris Agreement. United Nations Framework Convention on Climate Change, FCCC/CP/2015/L.9/Rev.1. 2015. Available online: http://unfccc.int/resource/docs/2015//l09r01.pdf (accessed on 8 May 2018).

- Kitous, A.; Keramidas, K.; Vandyck, T.; Saveyn, B. GECO 2016—Global Energy and Climate Outlook, Road from Paris; JRC Science for Policy Reports, EUR 27952 EN; Publications Office of the European Union: Luxembourg, 2016. [Google Scholar]

- Kitous, A.; Keramidas, K. GECO 2016—GHG and Energy Balances; JRC Technical Reports, EUR 27976 EN; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- Wollenberg, E.; Richards, M.; Smith, P.; Havlík, P.; Obersteiner, M.; Tubiello, F.N.; Campbell, B.M. Reducing emissions from agriculture to meet the 2 °C target. Glob. Chang. Biol. 2016, 22, 3859–3864. [Google Scholar] [CrossRef] [PubMed]

- Reisinger, A.; Havlik, P.; Riahi, K.; van Vliet, O.; Obersteiner, M.; Herrero, M. Implications of alternative metrics for global mitigation costs and greenhouse gas emissions from agriculture. Clim. Chang. 2013, 117, 677–690. [Google Scholar] [CrossRef]

- Gernaat, D.E.H.J.; Calvin, K.; Lucas, P.L.; Luderer, G.; Otto, S.A.C.; Rao, S.; van Vuuren, D.P. Understanding the contribution of non-carbon dioxide gases in deep mitigation scenarios. Glob. Environ. Chang. 2015, 33, 142–153. [Google Scholar] [CrossRef]

- Rogelj, J.; Popp, A.; Calvin, K.V.; Luderer, G.; Emmerling, J.; Gernaat, D.; Krey, V. Scenarios towards limiting global mean temperature increase below 1.5 °C. Nat. Clim. Chang. 2018, 8, 325. [Google Scholar] [CrossRef]

- Obersteiner, M.; Bednar, J.; Wagner, F.; Gasser, T.; Ciais, P.; Forsell, N.; Peñuelas, J. How to spend a dwindling greenhouse gas budget. Nat. Clim. Chang. 2018, 8, 7. [Google Scholar] [CrossRef]

- Van Vuuren, D.P.; Stehfest, E.; Gernaat, D.E.; Berg, M.; Bijl, D.L.; Boer, H.S.; Hof, A.F. Alternative pathways to the 1.5 °C target reduce the need for negative emission technologies. Nat. Clim. Chang. 2018, 8, 391. [Google Scholar] [CrossRef]

- Doelman, J.C.; Stehfest, E.; Tabeau, A.; van Meijl, H.; Lassaletta, L.; Gernaat, D.E.; van der Sluis, S. Exploring SSP land-use dynamics using the IMAGE model: Regional and gridded scenarios of land-use change and land-based climate change mitigation. Glob. Environ. Chang. 2018, 48, 119–135. [Google Scholar] [CrossRef]

- Van Meijl, H.; Havlik, P.; Lotze-Campen, H.; Stehfest, E.; Witzke, P.; Domínguez, I.P.; Humpenöder, F. Comparing impacts of climate change and mitigation on global agriculture by 2050. Environ. Res. Lett. 2018, 13, 064021. [Google Scholar] [CrossRef]

- Hasegawa, T.; Fujimori, S.; Havlík, P.; Valin, H.; Bodirsky, B.L.; Doelman, J.C.; Mason-D’Croz, D. Risk of increased food insecurity under stringent global climate change mitigation policy. Nat. Clim. Chang. 2018, 8, 699. [Google Scholar] [CrossRef]

- Frank, S.; Havlík, P.; Stehfest, E.; van Meijl, H.; Witzke, P.; Pérez-Domínguez, I.; Tabeau, A. Agricultural non-CO2 emission reduction potential in the context of the 1.5 °C target. Nat. Clim. Chang. 2019, 9, 66. [Google Scholar] [CrossRef]

- OECD-FAO. Aglink-Cosimo Model Documentation. A Partial Equilibrium Model of the World Agricultural Markets. 2015. Available online: http://www.agri-outlook.org/abouttheoutlook/Aglink-Cosimo-model-documentation-2015.pdf (accessed on 8 May 2018).

- Araujo Enciso, S.R.; Pérez-Domínguez, I.; Santini, F.; Helaine, S. Documentation of the European Commission’s EU Module of the Aglink-Cosimo Modelling System; JRC Science and Policy Reports; Publications Office of the European Union: Luxembourg, 2015; Available online: http://publications.jrc.ec.europa.eu/repository/bitstream/JRC92618/jrc92618%20online.pdf (accessed on 18 December 2017).

- OECD-FAO. OECD-FAO Agricultural Outlook 2017–2030; Organisation for Economic Cooperation and Development, Paris, and Food and Agricultural Organisation of the United Nations, OECD Publishing and FAO: Rome, Italy, 2017. [Google Scholar]

- European Commission. EU Agricultural Outlook. For the Agricultural Markets and Income 2017–2030; DG Agriculture and Rural Development, European Commission: Brussels, Belgium, 2017; Available online: https://ec.europa.eu/agriculture/sites/agriculture/files/markets-and-prices/medium-term-outlook/2017/2017-fullrep_en.pdf (accessed on 8 May 2018).

- Frank, S.; Beach, R.; Havlík, P.; Valin, H.; Herrero, M.; Mosnier, A.; Obersteiner, M. Structural change as a key component for agricultural non-CO2 mitigation efforts. Nat. Commun. 2018, 9, 1060. [Google Scholar] [CrossRef]

- Nekhay, O.; Fellmann, T.; Gay, S.H. A free trade agreement between Ukraine and the European Union: potential effects on agricultural markets and farmers’ revenues. Post-Communist Econ. 2012, 24, 351–363. [Google Scholar] [CrossRef]

- Fellmann, T.; Hélaine, S.; Nekhay, O. Harvest failures, temporary export restrictions and global food security: The example of limited grain exports from Russia, Ukraine and Kazakhstan. Food Secur. 2014, 6, 727–742. [Google Scholar] [CrossRef]

- Enciso, S.R.A.; Fellmann, T.; Dominguez, I.P.; Santini, F. Abolishing biofuel policies: Possible impacts on agricultural price levels, price variability and global food security. Food Policy 2014, 61, 9–26. [Google Scholar] [CrossRef]

- Kavallari, A.; Fellmann, T.; Gay, S.H. Shocks in economic growth = shocking effects for food security? Food Secur. 2014, 6, 567–583. [Google Scholar] [CrossRef]

- Santini, F.; Ronzon, T.; Dominguez, I.P.; Enciso, S.R.A.; Proietti, I. What if meat consumption would decrease more than expected in the high-income countries? Bio-Based Appl. Econ. 2017, 6, 37–56. [Google Scholar]

- Charlebois, P.; Kanadani Campos, S.; Pérez Domínguez, I.; Jensen, H. Enhancing the Brazilian Land Use Module in Aglink-Cosimo; EUR 28633 EN; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Thompson, W.; Dewbre, J.; Westhoff, P.; Schroeder, K.; Pieralli, S.; Pérez-Domínguez, I. Introducing Medium- and Long-Term Productivity Responses in Aglink-Cosimo; JRC Technical Reports, EUR 28560 EN; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- IPCC. 2006 IPCC Guidelines for National Greenhouse Gas Inventories; Prepared by the National Greenhouse Gas Inventories Programme; IGES: Tokyo, Japan, 2006. [Google Scholar]

- Tubiello, F.N.; Salvatore, M.; Cóndor Golec, R.D.; Ferrara, A.; Rossi, S.; Biancalani, R.; Flammini, A. Agriculture, Forestry and Other Land Use Emissions by Sources and Removals by Sinks; Statistics Division, Food and Agriculture Organization: Rome, Italy, 2014.

- Tubiello, F.N.; Cóndor-Golec, R.D.; Salvatore, M.; Piersante, A.; Federici, S.; Ferrara, A.; Jacobs, H. Estimating Greenhouse Gas Emissions in Agriculture: A Manual to Address Data Requirements for Developing Countries; FAO: Roma, Italy, 2015. [Google Scholar]

- FAOSTAT. FAOSTAT Emissions Database; Food and Agriculture Organization of the United Nations (FAO): Roma, Italy, 2018; Available online: http://www.fao.org/faostat/en/#data/GT (accessed on 8 May 2018).

- Jansson, T.; Pérez Domínguez, I.; Weiss, F. Estimation of greenhouse gas coefficients per commodity and world region to capture emission leakage in European agriculture. Paper Presented at the 119th EAAE Seminar “Sustainability in the Food Sector”, Capri, Italy, 30 June–2 July 2010. [Google Scholar]

- Pérez Domínguez, I.; Fellmann, T.; Weiss, F.; Witzke, P.; Barreiro-Hurle, J.; Himics, M.; Jansson, T.; Salputra, G.; Leip, A. An Economic Assessment of GHG Mitigation Policy Options for EU Agriculture (EcAMPA 2); JRC Science for Policy Report; European Commission, Publications Office of the European Union: Luxembourg, 2016. [Google Scholar]

- Pérez Domínguez, I.; Fellmann, T.; Witzke, H.P.; Jansson, T.; Oudendag, D.; Gocht, A.; Verhoog, D. Agricultural GHG emissions in the EU: An Exploratory Economic Assessment of Mitigation Policy Options; JRC Scientific and Policy Reports; European Commission: Seville, Spain, 2012. [Google Scholar]

- Van Doorslaer, B.; Witzke, P.; Huck, I.; Weiss, F.; Fellmann, T.; Salputra, G.; Leip, A. An Economic Assessment of GHG Mitigation Policy Options for EU Agriculture (EcAMPA). JRC Science for Policy Report; European Commission, Publications Office of the European Union: Luxembourg, 2015. [Google Scholar]

- Lucas, P.L.; van Vuuren, D.P.; Olivier, J.G.; Den Elzen, M.G. Long-term reduction potential of non-CO2 greenhouse gases. Environ. Sci. Policy 2007, 10, 85–103. [Google Scholar] [CrossRef]

- Lamb, A.; Green, R.; Bateman, I.; Broadmeadow, M.; Bruce, T.; Burney, J.; Goulding, K. The potential for land sparing to offset greenhouse gas emissions from agriculture. Nat. Clim. Chang. 2016, 6, 488. [Google Scholar] [CrossRef]

- Aguiar, A.; Narayanan, B.; McDougall, R. An overview of the GTAP 9 data base. J. Glob. Econ. Anal. 2016, 1, 181–208. [Google Scholar] [CrossRef]

- Kavallari, A.; van Meijl, H.; Powell, J.; Rutten, M.; Shutes, L.; Tabeau, A. The MAGNET Model: Module Description; LEI Report 14-057; LEI Wageningen UR (University & Research Centre): Wageningen, The Netherlands, 2014. [Google Scholar]

- Britz, W.; Witzke, P. CAPRI Model Documentation 2014. University of Bonn. Institute for Food and Resource Economics, 2014. Available online: http://www.caprimodel.org/docs/capri_documentation.pdf (accessed on 8 May 2018).

- Girod, B.; van Vuuren, D.P.; Hertwich, E.G. Climate policy through changing consumption choices: Options and obstacles for reducing greenhouse gas emissions. Glob. Environ. Chang. 2014, 25, 5–15. [Google Scholar] [CrossRef]

- Powlson, D.S.; Whitmore, A.P.; Goulding, K.W. Soil carbon sequestration to mitigate climate change: A critical re-examination to identify the true and the false. Eur. J. Soil Sci. 2011, 62, 42–55. [Google Scholar] [CrossRef]

- Oertel, C.; Matschullat, J.; Zurba, K.; Zimmermann, F.; Erasmi, S. Greenhouse gas emissions from soils—A review. Chem. Der Erde-Geochem. 2016, 76, 327–352. [Google Scholar] [CrossRef]

- Thamo, T.; Pannell, D.J.; Kragt, M.E.; Robertson, M.J.; Polyakov, M. Dynamics and the economics of carbon sequestration: common oversights and their implications. Mitig. Adapt. Strateg. Glob. Chang. 2017, 22, 1095–1111. [Google Scholar] [CrossRef]

- Klenert, D.; Mattauch, L.; Combet, E.; Edenhofer, O.; Hepburn, C.; Rafaty, R.; Stern, N. Making carbon pricing work for citizens. Nat. Clim. Chang. 2018, 8, 669–677. [Google Scholar] [CrossRef]

- Nature. Wanted: A fair carbon tax. Nature Editorial. Nature 2018, 564, 161. [Google Scholar]

- Black, R.; Kniveton, D.; Schmidt-Verkerk, K. Migration and climate change: towards an integrated assessment of sensitivity. Environ. Plan. A 2011, 43, 431–450. [Google Scholar] [CrossRef]

- Domínguez, I.P.; Fellmann, T. The need for comprehensive climate change mitigation policies in European agriculture. EuroChoices 2015, 14, 11–16. [Google Scholar] [CrossRef]

| %-Share of Mitigation from Changes in | ||||

|---|---|---|---|---|

| Mitigation (Gigatonnes of Carbon Dioxide Equivalents) | Production Levels | Technical Options | Structural Adjustments | |

| Brazil | 0.230 | 26 | 36 | 39 |

| China | 0.185 | 10 | 66 | 23 |

| United States | 0.069 | 3 | 72 | 25 |

| Pakistan | 0.054 | 15 | 77 | 8 |

| European Union | 0.053 | −2 | 98 | 4 |

| Indonesia | 0.051 | 8 | 84 | 8 |

| Least Developed Countries | −0.035 | 76 | ||

| Consumption | Production | Exports | Imports | |

|---|---|---|---|---|

| Relative share in global (%) | ||||

| United States | 16.2 | 15.6 | 11.3 | 14.9 |

| China | 12.7 | 11.4 | 0.3 | 8.7 |

| Brazil | 10.9 | 14.3 | 20.4 | 0.4 |

| European Union | 9.4 | 9.4 | 2.5 | 2.3 |

| Australia | 1.1 | 3.9 | 17.3 | 0.1 |

| India | 1.4 | 4.1 | 15.8 | 0.0 |

| Vietnam | 2.0 | 0.5 | 0.0 | 9.9 |

| Total | 53.8 | 59.1 | 67.7 | 36.3 |

| Total global (1000 t) | ||||

| World | 78623 | 78747 | 13167 | 13032 |

| Base | Tax50 | Tax100 | Tax150 | |

|---|---|---|---|---|

| 1000 t | % change compared to base | |||

| Africa | 7956 | 4 | 6 | 8 |

| China | 8939 | −12 | −22 | −30 |

| Asia | 9813 | -4 | −1 | 2 |

| Brazil | 11,211 | −15 | −31 | −42 |

| Latin America | 9961 | −7 | −9 | −11 |

| European Union | 7410 | 2 | 3 | 3 |

| Europa | 2804 | −4 | −2 | 1 |

| North America | 13,768 | 1 | 2 | 3 |

| Oceania | 3641 | −2 | −4 | −6 |

| World | 78,747 | −4 | −7 | −9 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jensen, H.; Pérez Domínguez, I.; Fellmann, T.; Lirette, P.; Hristov, J.; Philippidis, G. Economic Impacts of a Low Carbon Economy on Global Agriculture: The Bumpy Road to Paris. Sustainability 2019, 11, 2349. https://doi.org/10.3390/su11082349

Jensen H, Pérez Domínguez I, Fellmann T, Lirette P, Hristov J, Philippidis G. Economic Impacts of a Low Carbon Economy on Global Agriculture: The Bumpy Road to Paris. Sustainability. 2019; 11(8):2349. https://doi.org/10.3390/su11082349

Chicago/Turabian StyleJensen, Hans, Ignacio Pérez Domínguez, Thomas Fellmann, Paul Lirette, Jordan Hristov, and George Philippidis. 2019. "Economic Impacts of a Low Carbon Economy on Global Agriculture: The Bumpy Road to Paris" Sustainability 11, no. 8: 2349. https://doi.org/10.3390/su11082349

APA StyleJensen, H., Pérez Domínguez, I., Fellmann, T., Lirette, P., Hristov, J., & Philippidis, G. (2019). Economic Impacts of a Low Carbon Economy on Global Agriculture: The Bumpy Road to Paris. Sustainability, 11(8), 2349. https://doi.org/10.3390/su11082349