Business Models for Sustainable Finance: The Case Study of Social Impact Bonds

Abstract

1. Introduction

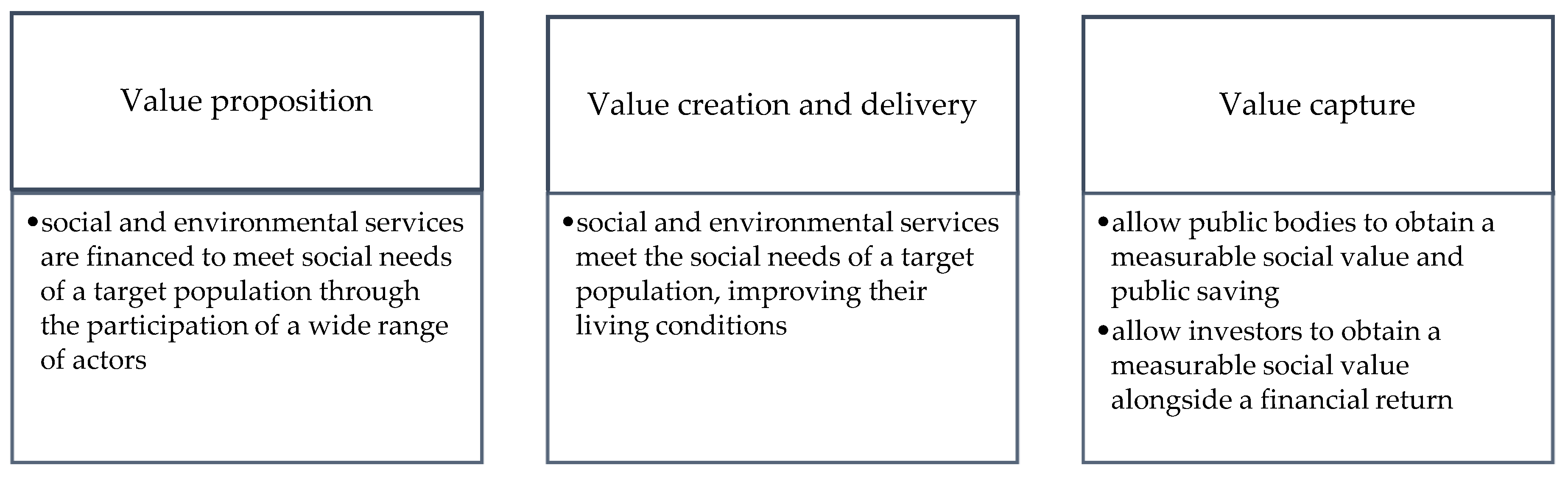

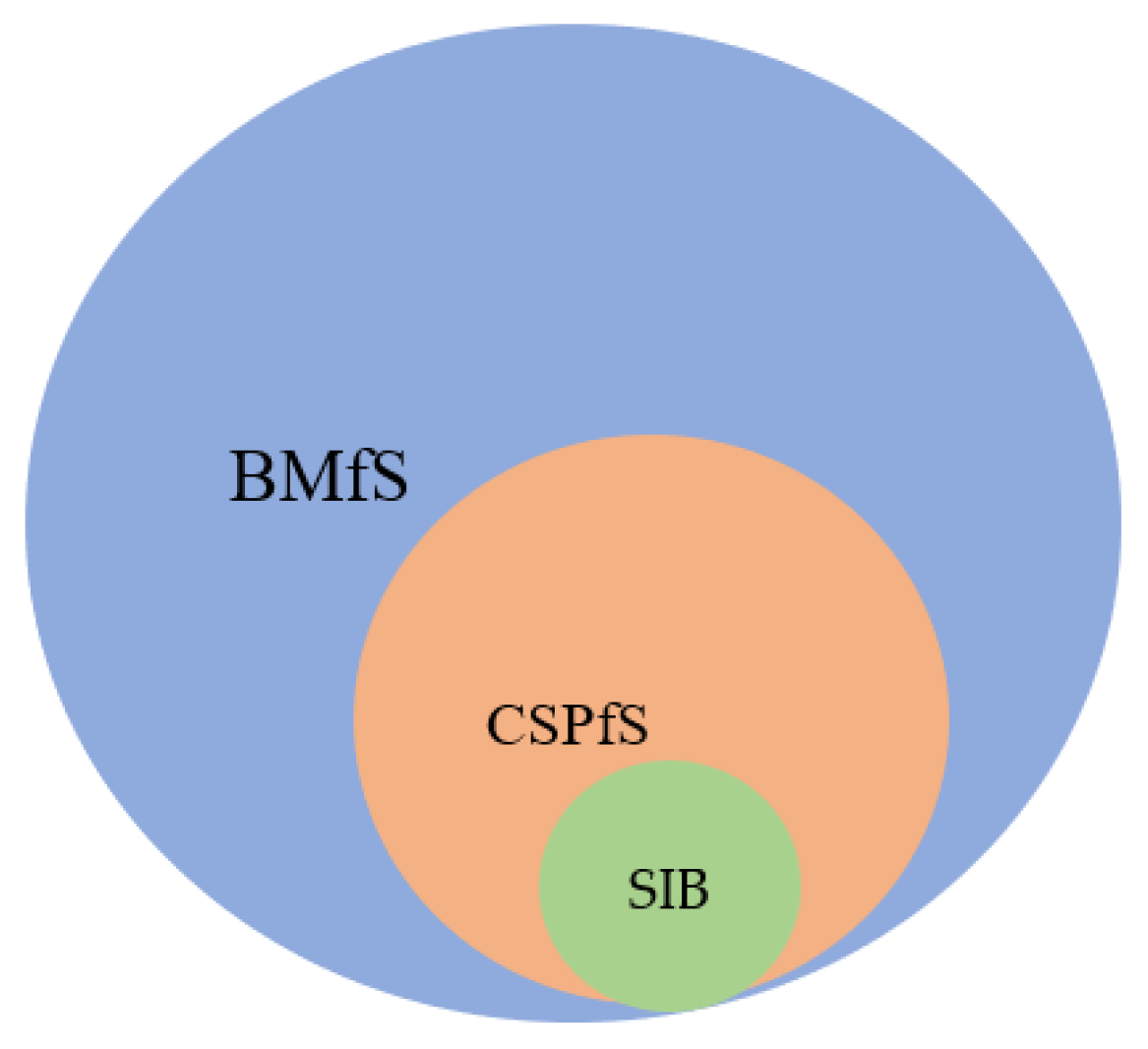

2. Sustainable Business Models: Overview of Literature

2.1. Business Models for Sustainability (BMfS)

2.2. Cross-Sector Partnerships for Sustainability (CSPfS)

2.3. BMfS and CSPfS in the Financial Industry

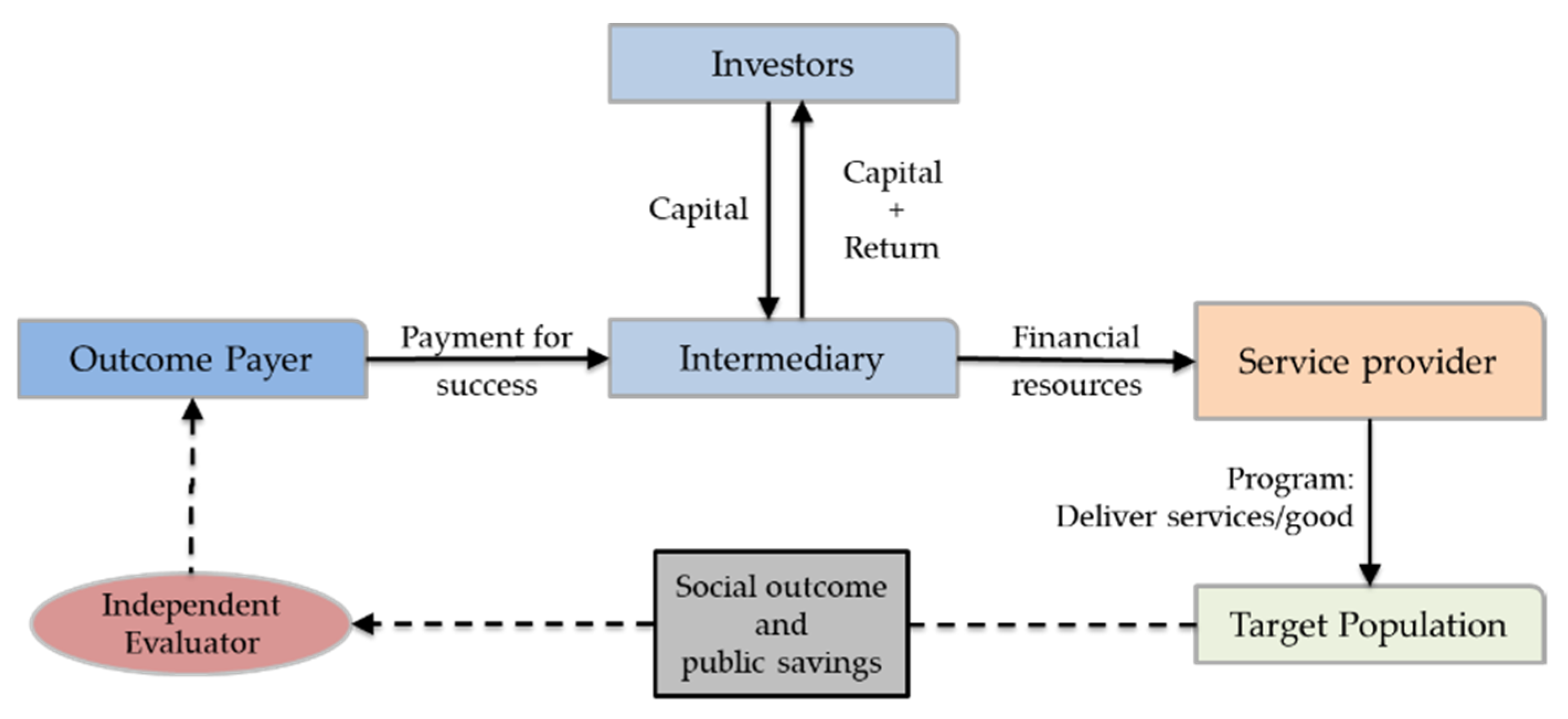

3. Social Impact Bonds (SIBs): Overview

4. Research Design

4.1. Method

4.2. Case Selection

4.3. Data Sources

4.4. Data Analysis

5. Empirical Findings

5.1. The New Narrative of SIBs

5.2. SIBs and Cross-Sector Partnerships: How They Vary Across Sectors and Geographies

5.2.1. Processes and Dynamics Characterizing SIB Design and Structure

5.2.2. Process and Dynamics in the Social Dimension

5.2.3. Process and Dynamics in the Financial Dimension

5.2.4. A Theorization of How SIBs May Vary across Sectors and Geographies

6. Discussion

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Lüdeke-Freund, F.; Dembek, K. Sustainable business model research and practice: Emerging field or passing fancy? J. Clean. Prod. 2017, 168, 1668–1678. [Google Scholar] [CrossRef]

- Dentchev, N.; Baumgartner, R.; Dieleman, H.; Jóhannsdóttir, L.; Jonker, J.; Nyberg, T.; Rauter, R.; Rosano, M.; Snihur, Y.; van Hoof, B. Embracing the variety of sustainable business models: Social entrepreneurship, corporate intrapreneurship, creativity, innovation, and other approaches to sustainability challenges. J. Clean. Prod. 2016, 113, 1–4. [Google Scholar] [CrossRef]

- Bocken, N.M.; Short, S.W.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Piscicelli, L.; Ludden, G.D.S.; Cooper, T. What makes a sustainable business models successful? An empirical comparison of two peer-to-peer good-sharing platforms. J. Clean Prod. 2018, 172, 4580–4591. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. The big idea: Creating shared value. Harv. Bus. Rev. 2011, 89, 2. [Google Scholar]

- Salamon, L.M. Of market failure, voluntary failure, and third-party government: Toward a theory of government-nonprofit relations in the modern welfare state. J. Volunt. Act. Res. 1987, 16, 29–49. [Google Scholar] [CrossRef]

- Young, D.R. Alternative models of government-nonprofit sector relations: Theoretical and international perspectives. Nonprofit Volunt. Sect. Q. 2000, 29, 149–172. [Google Scholar] [CrossRef]

- Kolk, A.; Levy, D.; Pinkse, J. Corporate responses in an emerging climate regime: The institutionalization and commensuration of carbon disclosure. Eur. Acc. Rev. 2008, 17, 719–745. [Google Scholar] [CrossRef]

- Breuer, H.; Fichter, K.; Lüdeke-Freund, F.; Tiemann, I. Sustainability-Oriented Business Model Development: Principles, Criteria, and Tools. Int. J. Entrep. Ventur. 2018, 10, 256–286. [Google Scholar] [CrossRef]

- Walker, T.; Kibsey, S.D.; Crichton, R. (Eds.) Designing a Sustainable Financial System: Development Goals and Socio-Ecological Responsibility; Palgrave Macmillan: Basingstoke, UK, 2018; pp. 1–429. [Google Scholar]

- Lehner, O. Routledge Handbook of Social and Sustainable Finance; Routledge: London, UK, 2016. [Google Scholar]

- Carè, R.; Trotta, A.; Rizzello, A. An alternative finance approach for a more sustainable financial system. In Designing a Sustainable Financial System: Development Goals and Socio-Ecological Responsibility; Walker, T., Kibsey, S., Crichton, R., Eds.; Palgrave Macmillan: Basingstoke, UK, 2018. [Google Scholar]

- Yip, A.W.; Bocken, N.M. Sustainable business model archetypes for the banking industry. J. Clean. Prod. 2018, 174, 150–169. [Google Scholar] [CrossRef]

- Alijani, S.; Karyotis, C. Coping with impact investing antagonistic objectives: A multistakeholder approach. Res. Int. Bus. Financ. 2019, 47, 10–17. [Google Scholar] [CrossRef]

- Schinckus, C. Financial innovation as a potential force for a positive social change: The challenging future of social impact bonds. Res. Int. Bus. Financ. 2017, 39, 727–736. [Google Scholar] [CrossRef]

- Austin, J.E.; Seitanidi, M.M. Collaborative value creation: A review of partnering between nonprofits and businesses. Part 2: Partnership processes and outcomes. Nonprofit Volunt. Sect. Q. 2012, 41, 929–968. [Google Scholar] [CrossRef]

- Martí, I. Transformational business models, grand challenges, and social impact. J. Bus. Ethics 2018, 152, 1–12. [Google Scholar] [CrossRef]

- Abdelkafi, N.; Täuscher, K. Business models for sustainability from a system dynamics perspective. Organ. Environ. 2016, 29, 74–96. [Google Scholar] [CrossRef]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Dentchev, N.; Rauter, R.; Jóhannsdóttir, L.; Snihur, Y.; Rosano, M.; Baumgartner, R.; Nyberg, T.; Tang, X.; van Hoof, B.; Jonker, J. Embracing the variety of sustainable business models: A prolific field of research and a future research agenda. J. Clean. Prod. 2018, 194, 695–703. [Google Scholar] [CrossRef]

- Schaltegger, S.; Hansen, E.G.; Lüdeke-Freund, F. Business models for sustainability: Origins, present research, and future avenues. Organ. Environ. 2016, 29, 3–10. [Google Scholar] [CrossRef]

- Abdelkafi, N.; Makhotin, S. Graphical representation methods for business model design and innovation—Analysis, comparison & development of an integrated framework. In Proceedings of the 13th Annual Conference of the European Academy of Management (EURAM), Istanbul, Turkey, 26–29 June 2013. [Google Scholar]

- Johnson, M.W. Seizing the White Space: Business Model Innovation for Growth and Renewal; Harvard Business Press: Boston, MA, USA, 2010. [Google Scholar]

- Lüdeke-Freund, F.; Massa, L.; Bocken, N.; Brent, A.; Musango, J. Business Models for Shared Value; Network for Business Sustainability South Africa: Cape Town, South Africa, 2016. [Google Scholar]

- Stubbs, W.; Cocklin, C. Conceptualizing a “sustainability business model”. Organ. Environ. 2008, 21, 103–127. [Google Scholar] [CrossRef]

- Roome, N.; Louche, C. Journeying toward business models for sustainability: A conceptual model found inside the black box of organisational transformation. Organ. Environ. 2016, 29, 11–35. [Google Scholar] [CrossRef]

- Randles, S.; Laasch, O. Theorising the normative business model. Organ. Environ. 2016, 29, 53–73. [Google Scholar] [CrossRef]

- Upward, A.; Jones, P. An ontology for strongly sustainable business models: Defining an enterprise framework compatible with natural and social science. Organ. Environ. 2016, 29, 97–123. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Vladimirova, D.; Evans, S. Sustainable business model innovation: A review. J. Clean. Prod. 2018, 198, 401–416. [Google Scholar] [CrossRef]

- Dobson, K.; Boone, S.; Andries, P.; Daou, A. Successfully creating and scaling a sustainable social enterprise model under uncertainty: The case of ViaViaTravellers Cafes. J. Clean. Prod. 2018, 172, 4555–4564. [Google Scholar] [CrossRef]

- Kokkonen, K.; Ojanen, V. From opportunities to action-An integrated model of small actors’ engagement in bioenergy business. J. Clean. Prod. 2018, 182, 496–508. [Google Scholar] [CrossRef]

- Siegner, M.; Pinkse, J.; Panwar, R. Managing tensions in a social enterprise: The complex balancing act to deliver a multi-faceted but coherent social mission. J. Clean. Prod. 2018, 174, 1314–1324. [Google Scholar] [CrossRef]

- Olofsson, S.; Hoveskog, M.; Halila, F. Journey and impact of business model innovation: The case of a social enterprise in the Scandinavian electricity retail market. J. Clean. Prod. 2018, 175, 70–81. [Google Scholar] [CrossRef]

- Haigh, N.; Hoffman, A.J. Hybrid organizations: The next chapter of sustainable business. Organ. Dyn. 2012, 41, 126–134. [Google Scholar] [CrossRef]

- Googins, B.K.; Rochlin, S.A. Creating the partnership society: Understanding the rhetoric and reality of cross-sectoral partnerships. Bus. Soc. Rev. 2000, 105, 127–144. [Google Scholar] [CrossRef]

- Waddock, S.A. A typology of social partnership organizations. Adm. Soc. 1991, 22, 480–515. [Google Scholar] [CrossRef]

- Warner, M.; Sullivan, R. Putting Partnerships to Work: Strategic Alliances for Development between Government, the Private Sector and Civil Society; Routledge: New York, NY, USA, 2017. [Google Scholar]

- Waddell, S.; Brown, L.D. Fostering intersectoral partnering: A guide to promoting cooperation among government, business, and civil society actors (Vol. 13). Institute for development research (IDR). IDR Rep. 1997, 13, 1–26. [Google Scholar]

- Berger, I.E.; Cunningham, P.H.; Drumwright, M.E. Social alliances: Company/nonprofit collaboration. Calif. Manag. Rev. 2004, 47, 58–90. [Google Scholar] [CrossRef]

- Austrom, D.; Lad, L.J. Issues management alliances: New responses, new values, and new logics. Res. Corp. Soc. Perform. Policy 1989, 11, 233–255. [Google Scholar]

- Ashman, D. Promoting corporate citizenship in the global south: Towards a model of empowered civil society collaboration with business. Institute for development research (IDR). IDR Rep. 2000, 16, 1–24. [Google Scholar]

- McDermott, K.; Kurucz, E.C.; Colbert, B.A. Social entrepreneurial opportunity and active stakeholder participation: Resource mobilization in enterprising conveners of cross-sector social partnerships. J. Clean. Prod. 2018, 183, 121–131. [Google Scholar] [CrossRef]

- van Tulder, R.; Seitanidi, M.M.; Crane, A.; Brammer, S. Enhancing the impact of cross-sector partnerships. J. Bus. Ethics 2016, 135, 1–17. [Google Scholar] [CrossRef]

- McCann, J.E. Design Guidelines for Social Problem-Solving Interventions. J. Appl. Behav. Sci. 1983, 19, 177–189. [Google Scholar] [CrossRef]

- McCann, J.E. Reply to Professor Chiles. J. Appl. Behav. Sci. 1983, 19, 191–192. [Google Scholar] [CrossRef]

- Yan, X.; Lin, H.; Clarke, A. Cross-Sector Social Partnerships for Social Change: The Roles of Non-Governmental Organizations. Sustainability 2018, 10, 558. [Google Scholar] [CrossRef]

- Selsky, J.W.; Parker, B. Cross-sector partnerships to address social issues: Challenges to theory and practice. J. Manag. 2005, 31, 849–873. [Google Scholar] [CrossRef]

- Waddock, S.A. Understanding social partnerships: An evolutionary model of partnership organizations. Adm. Soc. 1989, 21, 78–100. [Google Scholar] [CrossRef]

- Crane, A. Exploring Green Alliances. J. Mark. Manag. 1998, 14, 559–579. [Google Scholar] [CrossRef]

- Mazurkiewicz, P. Corporate self-regulation and multi-stakeholder dialogue. In The Handbook of Environmental Voluntary Agreements; Croci, E., Ed.; Springer: Dordrecht, The Netherlands, 2005; pp. 31–45. [Google Scholar]

- Pinkse, J.; Kolk, A. Addressing the climate change—Sustainable development nexus: The role of multistakeholder partnerships. Bus. Soc. 2012, 51, 176–210. [Google Scholar] [CrossRef]

- United Nations. Global Sustainable Development Goals. 2015. Available online: https://www.un.org/sustainabledevelopment/sustainable-development-goals/ (accessed on 3 September 2018).

- De Los Ríos-Carmenado, I.; Ortuño, M.; Rivera, M. Private–public partnership as a tool to promote entrepreneurship for sustainable development: WWP torrearte experience. Sustainability 2016, 8, 199. [Google Scholar] [CrossRef]

- Brinkerhoff, J.M. Assessing and improving partnership relationships and outcomes: A proposed framework. Eval. Program Plan. 2002, 25, 215–231. [Google Scholar] [CrossRef]

- Brinkerhoff, J.M. Government–nonprofit partnership: A defining framework. Public Adm. Dev. Int. J. Manag. Res. Pract. 2002, 22, 19–30. [Google Scholar] [CrossRef]

- Huxham, C.; Vangen, S. Working together: Key themes in the management of relationships between public and non-profit organizations. Int. J. Public Sect. Manag. 1996, 9, 5–17. [Google Scholar] [CrossRef]

- Clarke, A.; Fuller, M. Collaborative strategic management: Strategy formulation and implementation by multi-organizational cross-sector social partnerships. J. Bus. Ethics 2010, 94, 85–101. [Google Scholar] [CrossRef]

- Brinkerhoff, D.W.; Brinkerhoff, J.M. Public–private partnerships: Perspectives on purposes, publicness, and good governance. Public Adm. Dev. 2011, 31, 2–14. [Google Scholar] [CrossRef]

- Kolk, A.; van Dolen, W.; Vock, M. Trickle effects of cross-sector social partnerships. J. Bus. Ethics 2010, 94, 123–137. [Google Scholar] [CrossRef]

- Dahan, N.M.; Doh, J.P.; Oetzel, J.; Yaziji, M. Corporate-NGO collaboration: Co-creating new business models for developing markets. Long Range Plan. 2010, 43, 326–342. [Google Scholar] [CrossRef]

- Seitanidi, M.M.; Crane, A. Implementing CSR through partnerships: Understanding the selection, design and institutionalization of nonprofit-business partnerships. J. Bus. Ethics 2009, 85, 413–429. [Google Scholar] [CrossRef]

- Vock, M.; van Dolen, W.; Kolk, A. Micro-level interactions in business–nonprofit partnerships. Bus. Soc. 2014, 53, 517–550. [Google Scholar] [CrossRef]

- Global Impact Investment Network—GIIN. About Impact Investing. New York, 2014. Available online: http://www.thegiin.org/ (accessed on 3 September 2018).

- Social Impact Investment Taskforce—SIIT. Impact investment: The Invisible Heart of Markets. London, 2014. Available online: http://www.socialimpactinvestment.org/ (accessed on 3 September 2018).

- Organisation for Econimic Cooperation and Development—OECD. Social Impact Investment. Building the Evidence Base. Paris, 2015. Available online: http://www.oecd.org/sti/ind/social-impact-investment.pdf (accessed on 3 September 2018).

- Organisation for Econimic Cooperation and Development—OECD. Social Impact Investment 2019. The Impact Imperative for Sustainable Development. Available online: https://read.oecd-ilibrary.org/development/social-impact-investment-2019_9789264311299-en#page1 (accessed on 3 September 2018).

- O’Donohoe, N.; Leijonjufvud, C.; Saltuk, Y.; Bugg-Levine, A.; Brandenburg, M. Impact investment. New York: JPMorgan. 2010. Available online: http://ventureatlanta.org/wp-content/uploads/2011/11/JP-Morgan-impact_investments_nov2010. pdf (accessed on 3 September 2018).

- Gustafsson-Wright, E.; Gardiner, S.; Putcha, V. The Potential and Limitations of Impact Bonds: Lessons from the First Five Years of Experience Worldwide; Brookings Institute: Washington, DC, USA, 2015. [Google Scholar]

- Warner, M.E. Private finance for public goods: Social impact bonds. J. Econ. Policy Reform 2013, 16, 303–319. [Google Scholar] [CrossRef]

- Liang, M.; Mansberger, B.; Spieler, A.C. An overview of social impact bonds. J. Int. Bus. Law 2014, 13, 267. [Google Scholar]

- Arena, M.; Bengo, I.; Calderini, M.; Chiodo, V. Social impact bonds: Blockbuster or flash in a pan? Int. J. Public Adm. 2016, 39, 927–939. [Google Scholar] [CrossRef]

- Jackson, E.T. Evaluating social impact bonds: Questions, challenges, innovations, and possibilities in measuring outcomes in impact investing. Community Dev. 2013, 44, 608–616. [Google Scholar] [CrossRef]

- Nazari Chamaki, F.; Jenkins, G.P.; Hashemi, M. Social Impact Bonds: Implementation, Evaluation, and Monitoring. Int. J. Public Adm. 2018, 1–9. [Google Scholar] [CrossRef]

- Disley, E.; Rubin, J.; Scraggs, E.; Burrowes, N.; Culley, D. Lessons Learned from the Planning and Early Implementation of the Social Impact Bond at HMP Peterborough; Ministry of Justice: London, UK, 2011.

- Social Finance. SIB Database. Available online: https://sibdatabase.socialfinance.org.uk (accessed on 3 September 2018).

- Rizzello, A.; Migliazza, M.C.; Caré, R.; Trotta, A. Social impact investing: A model and research agenda. In Routledge Handbook of Social and Sustainable Finance; Lehner, O.M., Ed.; Routledge: London, UK, 2016; pp. 102–126. [Google Scholar] [CrossRef]

- Fraser, A.; Tan, S.; Lagarde, M.; Mays, N. Narratives of promise, narratives of caution: A review of the literature on Social Impact Bonds. Soc. Policy Adm. 2016, 52, 4–28. [Google Scholar] [CrossRef]

- Albertson, K.; Fox, C.; O’Leary, C.; Painter, G. Payment by Results and Social Impact Bonds: Outcome-Based Payment Systems in the UK and US; Policy Press: Chicago, IL, USA, 2018. [Google Scholar]

- Edmiston, D.; Nicholls, A. Social Impact Bonds: The role of private capital in outcome-based commissioning. J. Soc. Policy 2017, 47, 57–76. [Google Scholar] [CrossRef]

- Shiller, R.J. Capitalism and financial innovation. Financ. Anal. J. 2013, 69, 21. [Google Scholar] [CrossRef]

- Dowling, E. In the wake of austerity: Social impact bonds and the financialisation of the welfare state in Britain. New Political Econ. 2017, 22, 294–310. [Google Scholar] [CrossRef]

- Clifford, J.; Jung, T. Social Impact Bonds. Exploring and understanding an emerging funding approach. In Routledge Handbook of Social and Sustainable Finance; Lehner, O., Ed.; Routledge: London, UK, 2016; pp. 161–176. [Google Scholar]

- Dey, C.; Gibbon, J. New development: Private finance over public good? Questioning the value of impact bonds. Public Money Manag. 2018, 38, 375–378. [Google Scholar] [CrossRef]

- Maier, F.; Meyer, M. Social Impact Bonds and the perils of aligned interests. Adm. Sci. 2017, 7, 24. [Google Scholar] [CrossRef]

- Chiappini, H. Social Impact Funds: Definition, Assessment and Performance; Palgrave Macmillan: London, UK, 2017; pp. 1–168. [Google Scholar]

- De Mariz, F.; Ferreira, J.R. Financial innovation with a social purpose: The growth of Social Impact Bonds. In Research Handbook of Investing in the Triple Bottom Line; Boubaker, S., Cumming, D., Nguyen, D., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2018; pp. 292–313. [Google Scholar]

- Giacomantonio, C. Grant-maximizing but not money-making: A simple decision-tree analysis for social impact bonds. J. Soc. Entrep. 2017, 8, 47–66. [Google Scholar] [CrossRef]

- Butler, D.; Bloom, D.; Rudd, T. Using social impact bonds to spur innovation, knowledge building, and accountability. Community Dev. Invest. Rev. 2013, 9, 53–58. [Google Scholar]

- Smeets, D.J.A. Collaborative learning processes in social impact bonds: A case study from the Netherlands. J. Soc. Entrep. 2017, 8, 67–87. [Google Scholar] [CrossRef]

- Strauss, A. Qualitative Analysis for Social Scientists; Cambridge University Press: Cambridge, UK, 1987. [Google Scholar]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Better stories and better constructs: The case for rigor and comparative logic. Acad. Manag. Rev. 1991, 16, 620–627. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods, 3rd ed.; Sage: Thousand Oaks, CA, USA, 2009. [Google Scholar]

- Yin, R.K. Validity and generalization in future case study evaluations. Evaluation 2013, 19, 321–332. [Google Scholar] [CrossRef]

- Lagoarde-Segot, T. Sustainable finance. A critical realist perspective. Res. Int. Bus. Financ. 2018, 47, 1–9. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Graebner, M.E.; Sonenshein, S. Grand challenges and inductive methods: Rigor without rigor mortis. Acad. Manag. J. 2016, 59, 1113–1123. [Google Scholar] [CrossRef]

- Yin, R.K. Applications of Case Study Research; Sage: London, UK, 1993. [Google Scholar]

- Yin, R.K. Case study research: Design and methods, 5th ed.; Sage: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Gummesson, E. Qualitative Methods in Management Research; Sage: Thousands Oaks, CA, USA, 2000. [Google Scholar]

- Cayaye, A.L.M. Case study research: A multi faceted research approach for IS. Inf. Syst. J. 1996, 6, 227–242. [Google Scholar] [CrossRef]

- Glaser, B.G.; Strauss, A.L. Discovery of Grounded Theory: Strategies for Qualitative Research; Routledge: New York, NY, USA, 1999. [Google Scholar]

- Mintzberg, H. An emerging strategy of direct research. Adm. Sci. Q. 1979, 24, 582–589. [Google Scholar] [CrossRef]

- Corbin, J.; Strauss, A. Grounded Theory Research: Procedures, canons and evacuative criteria. Qual. Sociol. 1991, 13, 3–22. [Google Scholar] [CrossRef]

- Pettigrew, A. Longitudinal field research on change: Theory and practice. Org. Sci. 1990, 3, 267–292. [Google Scholar] [CrossRef]

- Marrelli, A.F. Collecting Data through case studies. Perform. Improv. 2007, 46, 39–44. [Google Scholar] [CrossRef]

- Pettigrew, A.M. Longitudinal field research on change. Longitudinal Field Research Methods. In Longitudinal Field Research Methods: Studying Processes of Organizational Change; Huber, G.P., Van de Ven, A.H., Eds.; SAGE Publications: Thousand Oaks, CA, USA, 1995; pp. 91–125. [Google Scholar]

- Miles, M.B.; Huberman, A. Qualitative Data Analysis: An Expanded Sourcebook; Sage: Thousand Oaks, CA, USA, 1994. [Google Scholar]

- Patton, M.Q. Qualitative Research and Evaluation Methods; Sage: Thousand Oaks, CA, USA, 2002. [Google Scholar]

- Suddaby, R. From the Editors: What gronde theory is not. Acad. Manag. J. 2006, 49, 633–642. [Google Scholar] [CrossRef]

- Peters, V.; Wester, F. How Qualitative Data Analysis Software may Support the Qualitative Analysis Process. Qual. Quant. 2007, 41, 635–659. [Google Scholar] [CrossRef]

- Strauss, A.L.; Corbin, J. Basics of Qualitative Research, 1st ed.; Sage: Thousand Oaks, CA, USA, 1990. [Google Scholar]

- Meyer, C.B. A case in case study methodology. Field Methods 2001, 13, 329–352. [Google Scholar] [CrossRef]

- Strauss, A.L.; Corbin, J. Basics of Qualitative Research: Grounded Theory Procedures and Techniques; Sage: Thousand Oaks, CA, USA, 1998. [Google Scholar]

- Flick, U. An Introduction to Qualitative Research, 3rd ed.; SAGE Publications: London, UK, 2006. [Google Scholar]

| SIBs Worldwide by Relative Social Issues of Intervention | Number of SIBs |

|---|---|

| Workforce Development | 37 |

| Hosing/Homelessness | 23 |

| Health | 22 |

| Child and Family Welfare | 15 |

| Criminal Justice | 11 |

| Education and Early Years | 11 |

| Poverty and Environment | 2 |

| SIB Name | Country | Year of Launch/Duration | Current Phase | SIB Description and Social Issue of the Intervention | SIB Distinctive Elements | Key Dimensions of the SIB Partnership |

|---|---|---|---|---|---|---|

| NYC ABLE | U.S.A.-New York City-New York | September 2012 (4 Years) | Finished (early termination) | The NYC Adolescent Behavioral Learning Experience (ABLE) SIB Project for incarcerated youth represents the first SIB launched in the U.S.A. aimed to extend to 16–18 year-olds attending school while detained at Rikers Island. It is an evidence-based intervention that focuses on improving personal responsibility and decision-making. The ABLE program did not meet its pre-defined success threshold for reductions in recidivism, and the program was discontinued in 2015. | First SIB issued in the US; unique case of SIB failure to date; presence of mainstream financial (not impact oriented) investor; presence (and relevance) of a high percentage (almost 80%) of capital guarantee; relevance of asymmetries of information in the project design for the failure of the program. | Strong commitment from the city of New York City to promote the partnership; presence of a commercial investor (Goldman Sachs Bank); the presence of a strong support from Bloomberg philanthropies with a capital guarantee determining the success of the SIB funding. |

| KOTO SIB | Finland | January 2017 (3 years) | Implementation | The project supports the integration of between 2500 and 3700 migrants and refugees into the Finnish labor market through the provisions of training and job-matching assistance. | The project target of refugee integration is the first of its kind in Europe and in the world; the SIB was funded not only by private investors but also from The Investment Plan for Europe and the European Fund for Strategic Investments (EFSI) and therefore represents the first experience in Europe of UE institutional investor engagement. | The SIB manager was chosen with a public tendering and, differently from traditional SIB scheme, it is not a specialized SIB intermediary but an impact investor; also, a Finnish institutional impact investor, SITRA, played central role in design phase of the SIB. |

| NEWPIN | Australia-New South Wales | April 2013 (7 years) | Implementation | NEWPIN(the New Parent Infant Network) is an intensive child protection and parent education program that works therapeutically with families under stress. The NEWPIN social benefit bond raised and invested approximately AUD7 million. | The NEWPIN social benefit bond is Australia’s first social impact bond; unique funding and repayment scheme: Investors’ funds were collected via the issuance of a “traditional” bond, and investors receive annually a coupon payment (an average of 15% per annum) | The New South Wales government was the initiator of the SIB and promoted the partnership; investors come from different areas (a combination of high-net-worth individuals, superannuation funds including Christian Super, and not-for-profit organizations); service provider has a solid baseline of delivering social services. |

| PERSPEKTIVE:ARBEIT | Austria-Upper Austria | September 2015 (3 years) | Concluded | First launched in Upper Austria, the issue addressed poverty and marginalization among women affected by violence by helping them to them to find a long-term job, which fulfils certain criteria. | The SIB represents the pilot in Austria; the social intervention funded is unique worldwide. | The SIB impact investor played the role of intermediary within the SIB and does so free of charge; the areas of activity and the financial framework were set by the public commissioner. |

| First Order Code | Second Order Code | Aggregate Dimension |

|---|---|---|

| Social Intervention | Processes and Dynamics Characterizing SIB Design and Structure | Structure |

| Collaborative Process in SIB Design | ||

| Rigidity of Collaborative Processes During the SIB Design | ||

| Main Features of the SIB Governance Structure | ||

| Outcome Metrics | Processes and Dynamics in the Social Dimension | Social Dimension |

| Outcome Thresholds | ||

| Collaborative Performance Management Systems | ||

| SIB Funding Scheme | Processes and Dynamics in the Financial Dimension | Financial Dimension |

| SIB Dimension Influencing the Amount of Financial Returns | ||

| Adoption of Financial Risk Management Systems | ||

| Presence of Capital Guarantee as Element of SIB Attractiveness |

| SIB Name | Value Proposition | Value Creation & Delivery | Value Capture |

|---|---|---|---|

| NYC ABLE | To reduce the reincarceration rate among adolescents at Rikers Island through an evidenced-based intervention that focuses on improving personal responsibility and decision-making | ABLE uses moral reconation therapy (MRT), a cognitive behavioral therapy (CBT) intervention. It is designed to improve social skills, problem solving, self-control, and impulse management. | Outcome that yields payments: Recidivism bed-days avoided Maximum payments possible: USD11.7 million (not including cost of intermediary and evaluation) Public saving: City net savings estimation range from USD 1million to USD 20.5 million on the basis of reduction in re-incarceration rate |

| KOTO | To speed up employment of immigrants, pilot new models of education and employment and combine education and work in a flexible way | KOTO -SIB aims to provide jobs for 2500 immigrants over the course of three years, by matching them to labor shortages in the Finnish labor market. These jobs are primarily in manufacturing, construction, trade, and services, where the shortage of skilled workers is particularly acute. | Outcome that yields payments: Increased tax collections and reduced employment benefits over a three-year period Maximum payments possible: €1500 fixed fee for each completed integration training + 50% of tax collections and employment benefit savings versus control group Public saving: reduction of 71% of historical public budget dedicated to provide jobs for immigrants |

| NEWPIN | To restore children in out-of-home care to their families, or prevent children from entering care in the first place | NEWPIN runs a child protection program that works with parents whose children have been placed in out-of-home care with the aim of restoring them safely to their families. Furthermore, the bond will reduce the incidence of child abuse and neglect and aims to break the inter-generational cycles of abuse and neglect. | Outcome that yields payments: the ‘restoration rate’—the proportion of children attending a NEWPIN Mothers Centre who are successfully restored to the care of their family Maximum payments possible: The higher the restoration rate, the more interest that investors receive, with the maximum payable interest rate being 15%. Public savings: Approximately USD 95 million will be generated over the long term, with around 50% to be retained by the government and the balance directed to Uniting Care to fund the NEWPIN program and provide a return to investors. |

| PERSPEKTIVE:ARBEIT | To provide comprehensive and targeted services for women affected by violence in upper Austria, making it possible for them to use reliable employment to exit the cycle of violence for good. | The SIB supports women affected by violence through individual guidance and by working closely with specialized institutions. Using a variety of resources, a holistic approach to helping women work through their experiences and find secure work can enable them to achieve social and financial independence, allowing them to escape structures of violence for good. | Outcome that yields payments: Help 75 women to find a job, which fulfils following criteria

Public savings: €1.8 million derived from multiple sector savings: healthcare, welfare benefits, and unemployment costs. |

| NYC ABLE | KOTO SIB | NEWPIN | PERSPEKTIVE: ARBEIT | |

|---|---|---|---|---|

| Identification of Social Intervention | Partially Collaborative | Top-Down (Commissioner-Led) | Collaborative | Top-Down (Commissioner-Led) |

| Collaborative Process in SIB Design | Medium | Medium | High | Low |

| Factors Determining Rigidity of Collaborative Processes During the SIB Design | National Regulation on Public Procurement | National Regulation on Public Procurement | Absent | National Regulation on Public Procurement |

| Main Features of the SIB Governance Structure | Centrality of Intermediary (through specialized purpose vehicle (SPV)) as SIB Manager Entity | Centrality of the SIB Manager Entity (which is also one of the main SIB Investors) | Two lines of SIB Contracts (Commissioner—Service provider; Commissioner—Funders). Service Provider Centrality | Centrality of Intermediary (through SPV) as SIB Manager Entity |

| NYC ABLE | KOTO SIB | NEWPIN | PERSPEKTIVE: ARBEIT | |

|---|---|---|---|---|

| Identification of Outcome Metrics | Top-Down (Commissioner-Led) | Collaborative Designed | Collaborative Designed | Top-Down (Commissioner-Led) |

| Identification of Outcome Thresholds | Collaborative Designed | Collaborative Designed | Collaborative Designed | Top-Down (Commissioner-Led) |

| Adoption of Collaborative Performance Management Systems | Missing | Adopted | Adopted | Missing |

| NYC ABLE | KOTO SIB | NEWPIN | PERSPEKTIVE: ARBEIT | |

|---|---|---|---|---|

| Identification of SIB Funding Scheme | Top-Down (Commissioner-Led) | Designed by the SIB-Specialized Intermediary | Collaborative Designed | Top-Down (Commissioner-Led) |

| SIB Dimension Influencing the Amount of Financial Returns | Non-Performance Risk | Outcome Thresholds | Outcome Thresholds | Public Savings |

| Adoption of Financial Risk Management Systems | Missing | Adopted | Adopted | Missing |

| Presence of Capital Guarantee as Element of SIB Attractiveness | Present | Absent | Present | Absent |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

La Torre, M.; Trotta, A.; Chiappini, H.; Rizzello, A. Business Models for Sustainable Finance: The Case Study of Social Impact Bonds. Sustainability 2019, 11, 1887. https://doi.org/10.3390/su11071887

La Torre M, Trotta A, Chiappini H, Rizzello A. Business Models for Sustainable Finance: The Case Study of Social Impact Bonds. Sustainability. 2019; 11(7):1887. https://doi.org/10.3390/su11071887

Chicago/Turabian StyleLa Torre, Mario, Annarita Trotta, Helen Chiappini, and Alessandro Rizzello. 2019. "Business Models for Sustainable Finance: The Case Study of Social Impact Bonds" Sustainability 11, no. 7: 1887. https://doi.org/10.3390/su11071887

APA StyleLa Torre, M., Trotta, A., Chiappini, H., & Rizzello, A. (2019). Business Models for Sustainable Finance: The Case Study of Social Impact Bonds. Sustainability, 11(7), 1887. https://doi.org/10.3390/su11071887