The Sustainability Performance of Chinese Banks: A New Network Data Envelopment Analysis Approach and Panel Regression

Abstract

:1. Introduction

2. Methodology

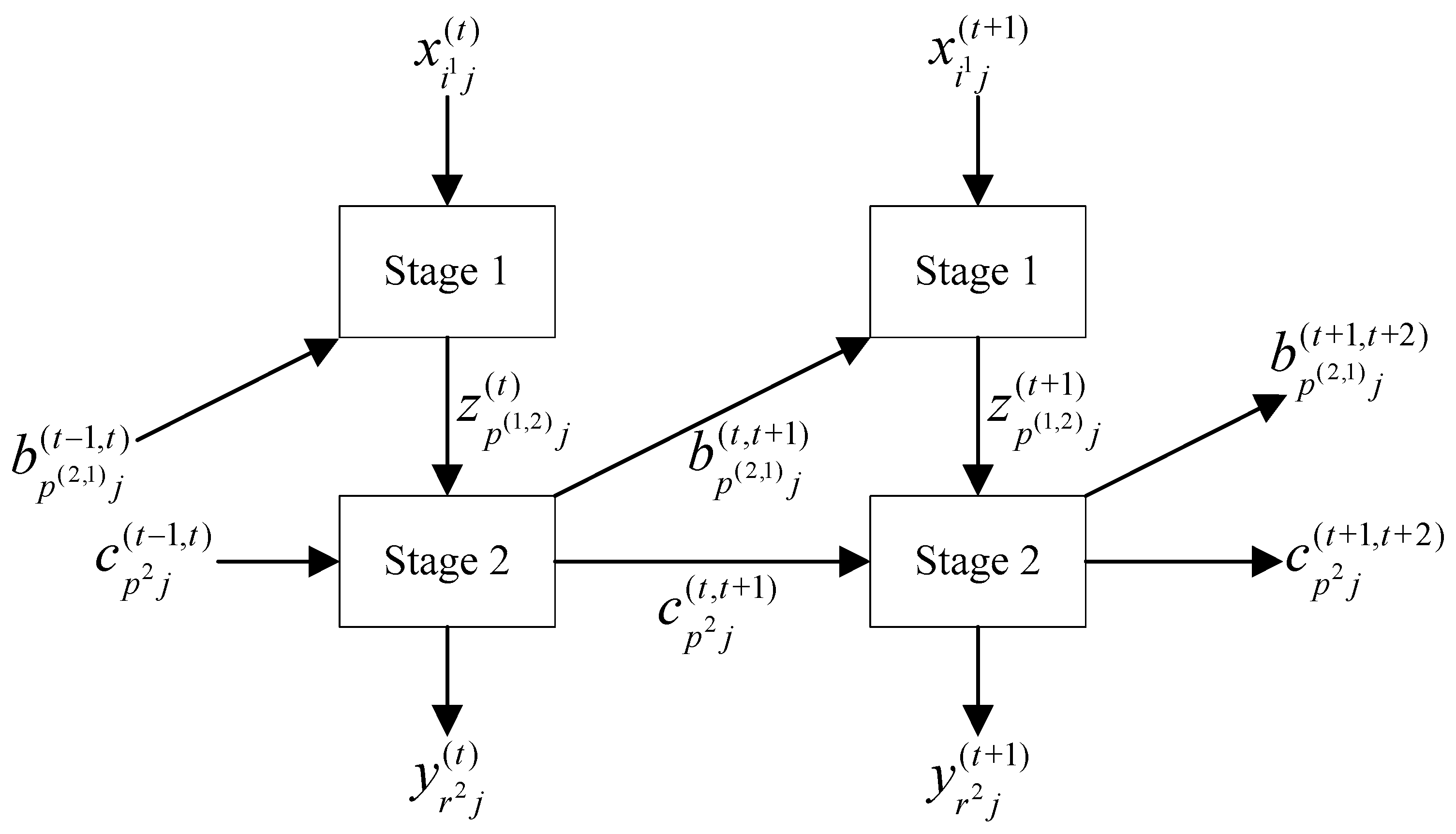

2.1. Nomenclatures and Dynamic Network Structure

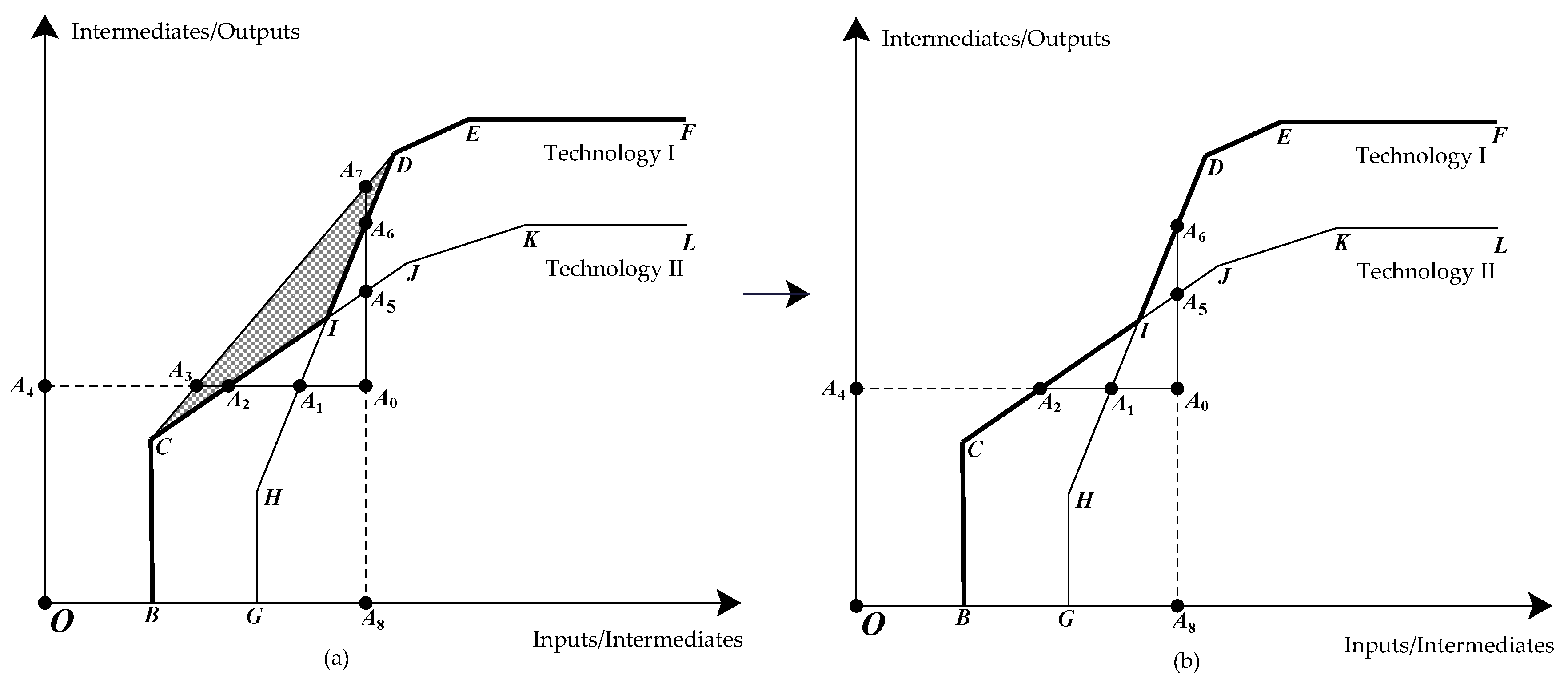

2.2. Graphical Explanations

2.3. Non-Convex Metafrontier Slacks-Based Bank Super-Efficiency

3. Data

4. Empirical Analysis and Econometric Strategy

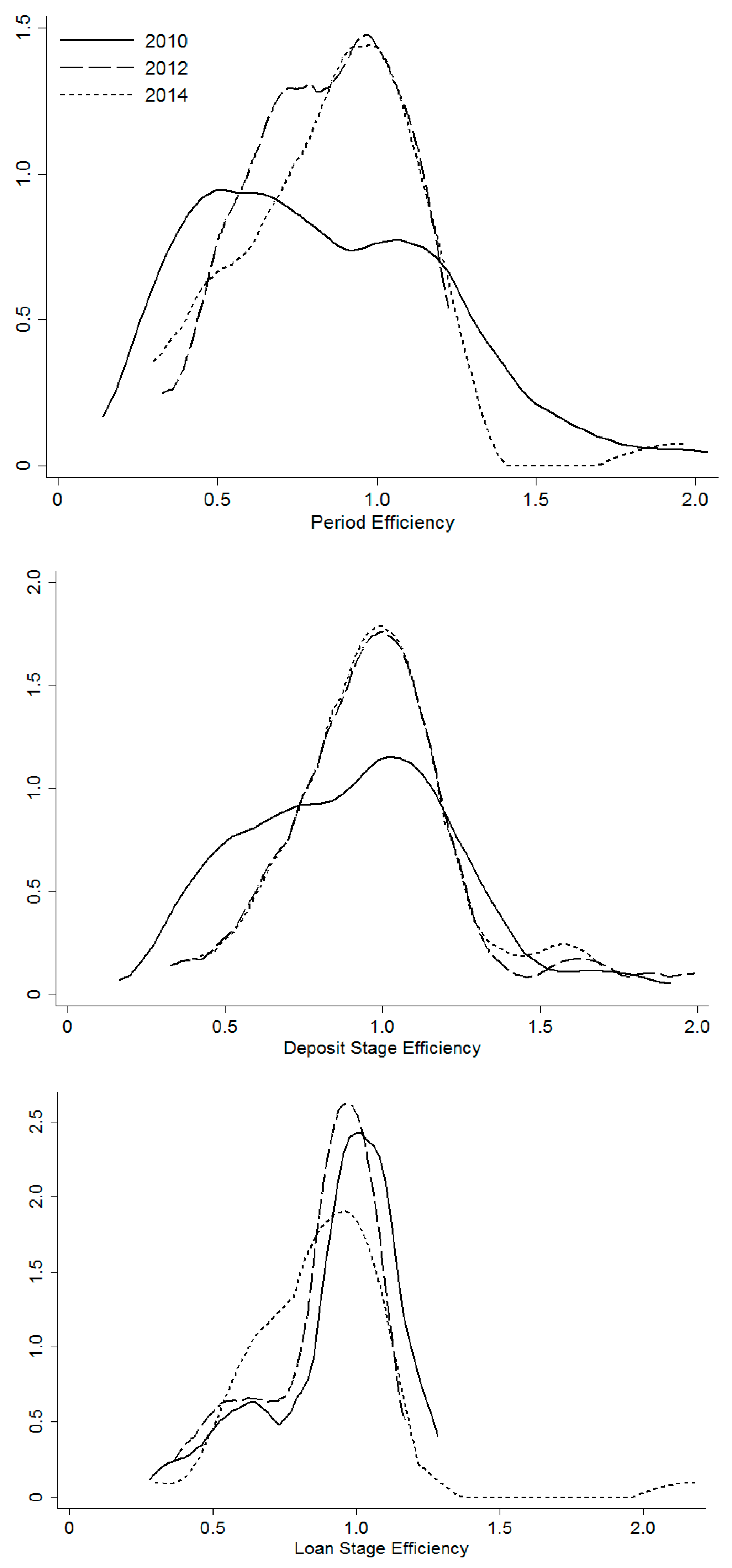

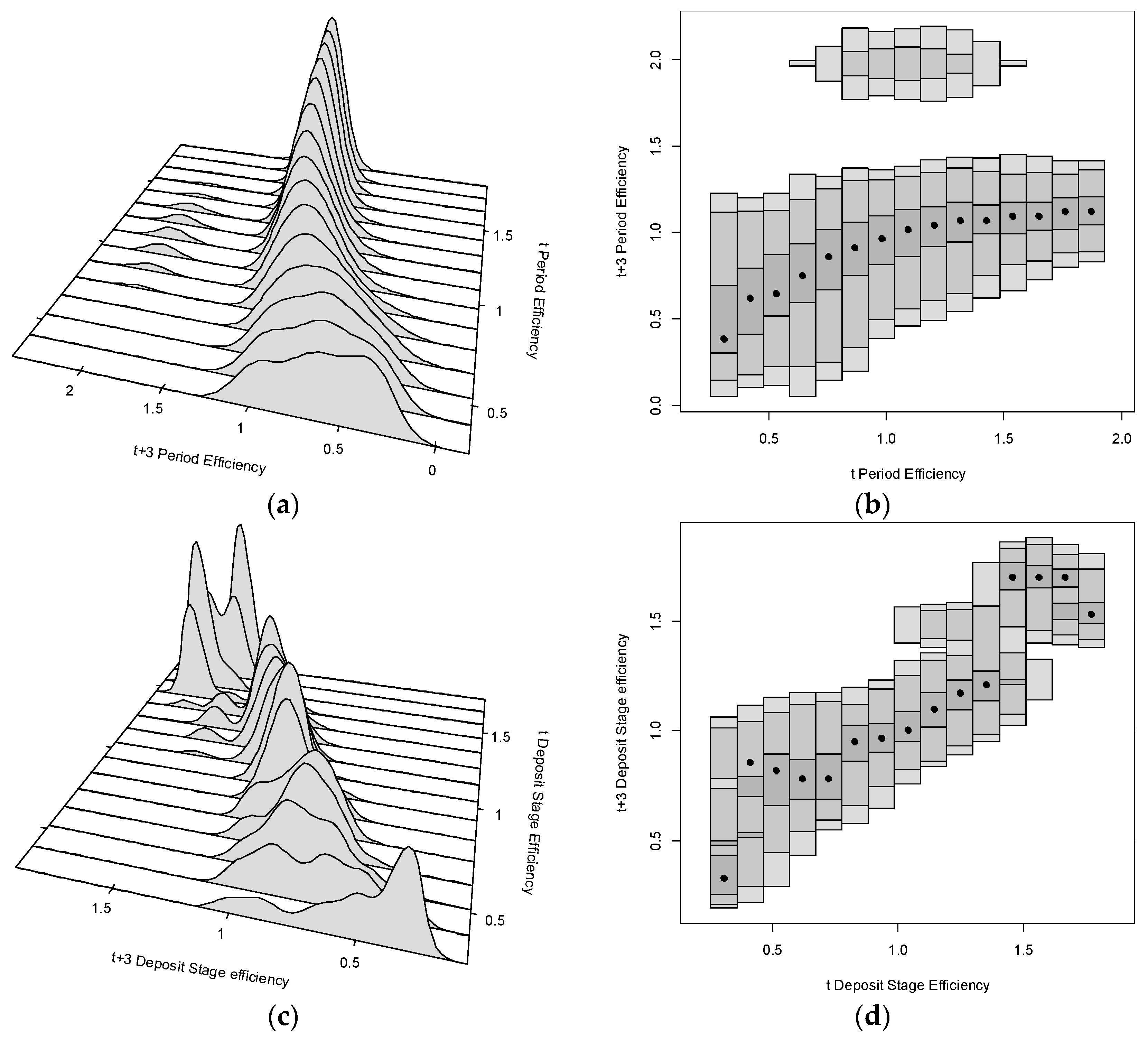

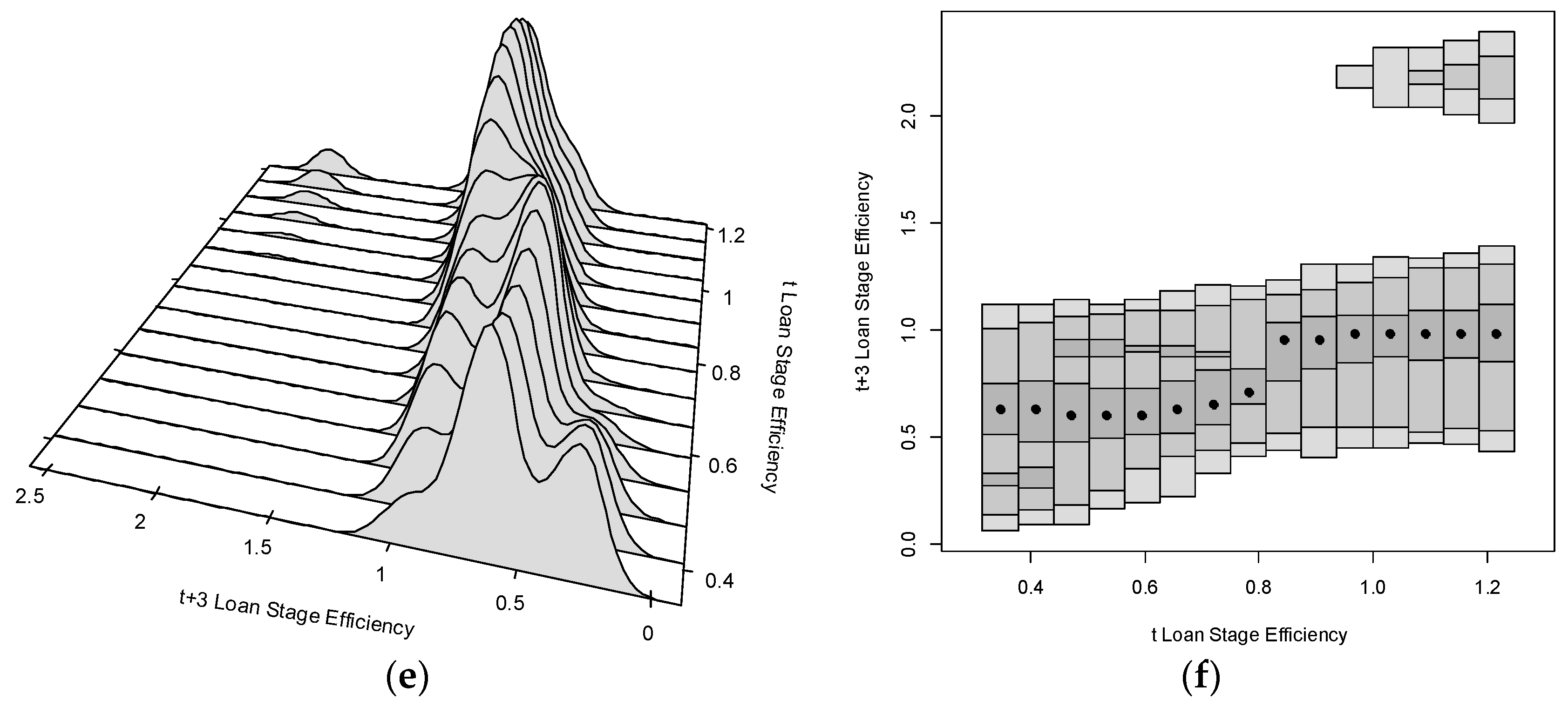

4.1. Measurement Of Bank Efficiency

4.2. Determinants of Bank Efficiency and Estimation Results

5. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

Appendix A. Production Possibility Sets

Appendix B. Bank Efficiency with Reference to Group and Convex Frontiers

Appendix C. Dataset of 36 Banks in China

| NO | Bank Name | Type |

| B1 | China Construction Bank Corporation Joint Stock Company | State-owned banks |

| B2 | Societe Generale (China) Limited | Foreign banks |

| B3 | Hang Seng Bank (China) Limited | Foreign banks |

| B4 | Bank of Guangzhou Co Ltd. | Joint-stock banks |

| B5 | Citibank (China) Co Ltd. | Foreign banks |

| B6 | Credit Agricole CIB (China) | Foreign banks |

| B7 | Fujian Haixia Bank Co Ltd. | Joint-stock banks |

| B8 | China Merchants Bank Co Ltd. | Joint-stock banks |

| B9 | Shanghai Pudong Development Bank | Joint-stock banks |

| B10 | Bank of Qingdao Co Ltd. | Joint-stock banks |

| B11 | CITIC Bank International (China) Limited | Foreign banks |

| B12 | China Guangfa Bank Co Ltd. | Joint-stock banks |

| B13 | China CITIC Bank Corporation Limited | Joint-stock banks |

| B14 | Bank of Communications Co Ltd. | Joint-stock banks |

| B15 | Agricultural Bank of China Limited | State-owned banks |

| B16 | Nanyang Commercial Bank (China) Limited | Foreign banks |

| B17 | Mizuho Bank (China) Ltd. | Foreign banks |

| B18 | HSBC Bank (China) Co Ltd. | Foreign banks |

| B19 | Hana Bank (China) Company Ltd. | Foreign banks |

| B20 | Shinhan Bank (China) Limited | Foreign banks |

| B21 | DBS BANK (China) Limited | Foreign banks |

| B22 | Bank of Taizhou Co Ltd. | Joint-stock banks |

| B23 | Jiangsu Jiangyin Rural Commercial Bank | Joint-stock banks |

| B24 | Industrial & Commercial Bank of China (The) - ICBC | State-owned banks |

| B25 | Jiangsu Jiangnan Rural Commercial Bank Co Ltd. | Joint-stock banks |

| B26 | Industrial Bank Co Ltd. | Joint-stock banks |

| B27 | Chongqing Rural Commercial Bank | Joint-stock banks |

| B28 | Bank of China Limited | State-owned banks |

| B29 | China Minsheng Banking Corporation | Joint-stock banks |

| B30 | Hua Xia Bank Co Limited | Joint-stock banks |

| B31 | Bank of Nanjing | Joint-stock banks |

| B32 | Bank of Tokyo Mitsubishi UFJ (China) Ltd. | Foreign banks |

| B33 | Qishang Bank | Joint-stock banks |

| B34 | Bank of Wenzhou Co Ltd. | Joint-stock banks |

| B35 | Fubon Bank (China) Co Ltd. | Foreign banks |

| B36 | Bank of Beijing Co Ltd. | Joint-stock banks |

References

- Matthews, K. Risk management and managerial efficiency in Chinese banks: A network DEA framework. Omega 2013, 41, 207–215. [Google Scholar] [CrossRef] [Green Version]

- Kuosmanen, T.; Johnson, A.L. Data envelopment analysis as nonparametric least-squares regression. Oper. Res. 2010, 58, 149–160. [Google Scholar] [CrossRef]

- Kuosmanen, T.; Kortelainen, M. Stochastic non-smooth envelopment of data: Semi-parametric frontier estimation subject to shape constraints. J. Product. Anal. 2012, 38, 11–28. [Google Scholar] [CrossRef]

- Huang, T.H.; Chiang, D.L.; Tsai, C.M. Applying the new metafrontier directional distance function to compare banking efficiencies in Central and Eastern European countries. Econ. Model. 2015, 44, 188–199. [Google Scholar] [CrossRef]

- Emrouznejad, A.; Yang, G. A survey and analysis of the first 40 years of scholarly literature in DEA: 1978–2016. Socio-Econ. Plan. Sci. 2018, 61, 4–8. [Google Scholar] [CrossRef]

- Fukuyama, H.; Weber, W.L. A dynamic network DEA model with an application to Japanese Shinkin banks. In Efficiency and Productivity Growth: Modelling in the Financial Services Industry; Wiley: Hoboken, NJ, USA, 2013; pp. 193–213. [Google Scholar]

- Fukuyama, H.; Weber, W.L. Measuring Japanese bank performance: A dynamic network DEA approach. J. Product. Anal. 2015, 44, 249–264. [Google Scholar] [CrossRef]

- Ebrahimnejad, A.; Tavana, M.; Lotfi, F.H.; Shahverdi, R.; Yousefpour, M. A three-stage data envelopment analysis model with application to banking industry. Measurement 2014, 49, 308–319. [Google Scholar] [CrossRef]

- Khodabakhshi, M.; Asgharian, M.; Gregoriou, G.N. An input-oriented super-efficiency measure in stochastic data envelopment analysis: Evaluating chief executive officers of US public banks and thrifts. Expert Syst. Appl. 2010, 37, 2092–2097. [Google Scholar] [CrossRef]

- Halkos, G.E.; Salamouris, D.S. Efficiency measurement of the Greek commercial banks with the use of financial ratios: A data envelopment analysis approach. Manag. Account. Res. 2004, 15, 201–224. [Google Scholar] [CrossRef]

- Puri, J.; Yadav, S.P. A fuzzy DEA model with undesirable fuzzy outputs and its application to the banking sector in India. Expert Syst. Appl. 2014, 41, 6419–6432. [Google Scholar] [CrossRef]

- Wang, K.; Huang, W.; Wu, J.; Liu, Y.H. Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA. Omega 2014, 44, 5–20. [Google Scholar] [CrossRef]

- Zha, Y.; Liang, N.; Wu, M.; Bian, Y. Efficiency evaluation of banks in China: A dynamic two-stage slacks-based measure approach. Omega 2016, 60, 60–72. [Google Scholar] [CrossRef]

- Weber, O. The Sustainability Performance of Chinese Banks: Institutional Impact. 2016. Available online: http://dx.doi.org/10.2139/ssrn.2752439 (accessed on 20 February 2019).

- Tone, K.; Tsutsui, M. Network DEA: A slacks-based measure approach. Eur. J. Oper. Res. 2009, 197, 243–252. [Google Scholar] [CrossRef] [Green Version]

- Lozano, S. Slacks-based inefficiency approach for general networks with bad outputs: An application to the banking sector. Omega 2016, 60, 73–84. [Google Scholar] [CrossRef]

- Fukuyama, H.; Weber, W.L. Japanese Bank Productivity, 2007–2012: A Dynamic Network Approach. Pac. Econ. Rev. 2017, 22, 649–676. [Google Scholar] [CrossRef]

- Yang, W.; Shi, J.; Qiao, H.; Wang, S. Regional technical efficiency of Chinese Iron and steel industry based on bootstrap network data envelopment analysis. Socio-Econ. Plan. Sci. 2017, 57, 14–24. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Dynamic DEA: A slacks-based measure approach. Omega 2010, 38, 145–156. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Dynamic DEA with network structure: A slacks-based measure approach. Omega 2004, 42, 124–131. [Google Scholar] [CrossRef]

- Avkiran, N.K. An illustration of dynamic network DEA in commercial banking including robustness tests. Omega 2015, 55, 141–150. [Google Scholar] [CrossRef]

- Kou, M.; Chen, K.; Wang, S.; Shao, Y. Measuring efficiencies of multi-period and multi-division systems associated with DEA: An application to OECD countries’ national innovation systems. Expert Syst. Appl. 2016, 46, 494–510. [Google Scholar] [CrossRef]

- Du, J.; Chen, Y.; Huo, J. DEA for non-homogenous parallel networks. Omega 2015, 56, 122–132. [Google Scholar] [CrossRef]

- Barat, M.; Tohidi, G.; Sanei, M. DEA for nonhomogeneous mixed networks. Asia Pac. Manag. Rev. 2018. [Google Scholar] [CrossRef]

- Wanke, P.; Barros, C.P. Efficiency drivers in Brazilian insurance: A two-stage DEA meta frontier-data mining approach. Econ. Model. 2016, 53, 8–22. [Google Scholar] [CrossRef]

- Battese, G.E.; Rao, D.S.P.; O’Donnel, C.J. A metafrontier production function for estimation of technical efficiencies and technology gaps for firms operating under different technologies. J. Product. Anal. 2004, 21, 91–103. [Google Scholar] [CrossRef]

- O’Donnell, C.J.; Rao, D.S.P.; Battese, G.E. Metafrontier frameworks for the study of firm-level efficiencies and technology ratios. Empir. Econ. 2008, 34, 231–255. [Google Scholar] [CrossRef]

- Tiedemann, T.; Francksen, T.; Latacz-Lohmann, U. Assessing the performance of German Bundesliga football players: A non-parametric metafrontier approach. Cent. Eur. J. Oper. Res. 2011, 9, 571–587. [Google Scholar] [CrossRef]

- Huang, C.W.; Ting, C.T.; Lin, C.H.; Lin, C.T. Measuring non-convex metafrontier efficiency in international tourist hotels. J. Oper. Res. Soc. 2013, 64, 250–259. [Google Scholar] [CrossRef]

- Afsharian, M. Metafrontier efficiency analysis with convex and non-convex metatechnologies by stochastic nonparametric envelopment of data. Econ. Lett. 2017, 160, 1–3. [Google Scholar] [CrossRef]

- Walheer, B. Aggregation of metafrontier technology gap ratios: The case of European sectors in 1995–2015. Eur. J. Oper. Res. 2018, 269, 1013–1026. [Google Scholar] [CrossRef]

- Andersen, P.; Petersen, N.C. A procedure for ranking efficient units in data envelopment analysis. Manag. Sci. 1993, 39, 1261–1264. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef] [Green Version]

- Chiu, Y.H.; Chen, Y.C.; Bai, X.J. Efficiency and risk in Taiwan banking: SBM super-DEA estimation. Appl. Econ. 2011, 43, 587–602. [Google Scholar] [CrossRef]

- Minh, N.K.; Long, G.T.; Hung, H.V. Efficiency and super-efficiency of commercial banks in Vietnam: Performances and determinants. Asia-Pac. J. Oper. Res. 2013, 30, 1–19. [Google Scholar] [CrossRef]

- Avkiran, N.K.; Cai, L. Identifying distress among banks prior to a major crisis using non-oriented super-SBM. Ann. Oper. Res. 2014, 217, 31–53. [Google Scholar] [CrossRef]

- Li, L.; Liu, B.; Liu, W.; Chiu, Y.H. Efficiency evaluation of the regional high-tech industry in China: A new framework based on meta-frontier dynamic DEA analysis. Socio-Econ. Plan. Sci. 2017, 60, 24–33. [Google Scholar] [CrossRef]

- Fukuyama, H.; Weber, W.L. Output Slacks-Adjusted Cost Efficiency and Value-Based Technical Efficiency in DEA Models (Operations Research for Performance Evaluation). J. Oper. Res. Soc. Jpn. 2009, 52, 86–104. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Estimation and inference in two-stage, semi-parametric models of production process. J. Econom. 2007, 136, 31–64. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W. Programming with linear fractional functional. Nav. Res. Logist. Q. 1962, 9, 181–186. [Google Scholar] [CrossRef]

- Afsharian, M.; Podinovski, V.V. A linear programming approach to efficiency evaluation in nonconvex metatechnologies. Eur. J. Oper. Res. 2018, 268, 268–280. [Google Scholar] [CrossRef]

- Inoguchi, M. Nonperforming Loans and Purchase of Loans by Public Asset Management Companies in Malaysia and Thailand. Pac. Econ. Rev. 2016, 21, 603–631. [Google Scholar] [CrossRef] [Green Version]

- Holod, D.; Lewis, H.F. Resolving the deposit dilemma: A new DEA bank efficiency model. J. Bank. Financ. 2011, 35, 2801–2810. [Google Scholar] [CrossRef]

- Zhu, N.; Wang, B.; Wu, Y. Productivity, efficiency, and non-performing loans in the Chinese banking industry. Soc. Sci. J. 2015, 52, 468–480. [Google Scholar] [CrossRef]

- Hyndman, R.J.; Bashtannyk, D.M.; Grunwald, G.K. Estimating and Visualizing Conditional Densities. J. Comput. Graph. Stat. 1996, 5, 315–336. [Google Scholar]

- Altunbas, Y.; Carbo, S.; Gardener, E.P.M.; Molyneux, P. Examining the relationships between capital, risk and efficiency in European banking. Eur. Financ. Manag. 2007, 13, 49–70. [Google Scholar] [CrossRef]

- Chiu, Y.H.; Chen, Y.C. The analysis of Taiwanese bank efficiency: Incorporating both external environment risk and internal risk. Econ. Model. 2009, 26, 456–463. [Google Scholar] [CrossRef]

- Tecles, P.L.; Tabak, B.M. Determinants of bank efficiency: The case of Brazil. Eur. J. Oper. Res. 2010, 207, 1587–1598. [Google Scholar] [CrossRef]

- Barth, J.R.; Lin, C.; Ma, Y.; Seade, J.; Song, F.M. Do bank regulation, supervision and monitoring enhance or impede bank efficiency? J. Bank Financ. 2013, 37, 2879–2892. [Google Scholar] [CrossRef]

- See, K.F.; He, Y. Determinants of Technical Efficiency in Chinese Banking: A Double Bootstrap Data Envelopment Analysis Approach. Glob. Econ. Rev. 2015, 44, 286–307. [Google Scholar] [CrossRef]

- Zhu, N.; Wang, B.; Yu, Z.; Wu, Y. Technical Efficiency Measurement Incorporating Risk Preferences: An Empirical Analysis of Chinese Commercial Banks. Emerg. Mark. Financ. Trade 2016, 52, 610–624. [Google Scholar] [CrossRef]

- Sufian, F. Determinants of bank efficiency during unstable macroeconomic environment: Empirical evidence from Malaysia. Res. Int. Bus. Financ. 2009, 23, 54–77. [Google Scholar] [CrossRef]

- Chen, M.J.; Y, Y.C.; Jan, C.; Chen, Y.; Liu, H. Efficiency and Risk in Commercial Banks–Hybrid DEA Estimation. Glob. Econ. Rev. 2015, 44, 335–352. [Google Scholar] [CrossRef]

- Heffernan, S.; Fu, M. The determinants of bank performance in China. 2008. Available online: http://dx.doi.org/10.2139/ssrn.1247713 (accessed on 20 February 2019).

- Staub, R.B.; Souza, G.D.S.E.; Tabak, B.M. Evolution of bank efficiency in Brazil: A DEA approach. Eur. J. Oper. Res. 2010, 202, 204–213. [Google Scholar] [CrossRef]

- Ayadi, I. Determinants of Tunisian Bank Efficiency: A DEA Analysis. Int. J. Financ. Res. 2013, 4, 128–139. [Google Scholar] [CrossRef]

- Dietsch, M.; Lozano-Vivas, A. How the environment determines banking efficiency: A comparison between French and Spanish industries. J. Bank. Financ. 2000, 24, 985–1004. [Google Scholar] [CrossRef]

- Kutlar, A.; Kabasakal, A.; Ekici, M.S. Efficiency of commercial banks in Turkey and their comparison: Application of DEA with Tobit analysis. Int. J. Math. Oper. Res. 2017, 10, 84–103. [Google Scholar] [CrossRef]

- Fernandes, F.D.S.; Stasinakis, C.; Bardarova, V. Two-stage DEA-Truncated Regression: Application in Banking Efficiency and Financial Development. Expert Syst. Appl. 2018, 96, 284–301. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 7th ed.; Prentice Hall: London, UK, 2012. [Google Scholar]

- Boateng, A.; Huang, W.; Kufuor, N.K. Commercial bank ownership and performance in China. Appl. Econ. 2015, 47, 5320–5336. [Google Scholar] [CrossRef]

- Kasman, A.; Tunc, G.; Vardar, G.; Okan, B. Consolidation and commercial bank net interest margins: Evidence from the old and new European Union members and candidate countries. Econ. Model. 2010, 27, 648–655. [Google Scholar] [CrossRef]

- Alrafadi, K.M.S.; Yusuf, M.M.; Kamaruddin, B.H. Measuring Bank Efficiency and Its Determinants in Developing Countries Using Data Envelopment Analysis: The Case of Libya 2004–2010. Int. J. Bus. Manag. 2015, 10, 1–18. [Google Scholar] [CrossRef]

- Huang, J.; Chen, J.; Yin, Z. A Network DEA Model with Super Efficiency and Undesirable Outputs: An Application to Bank Efficiency in China. Math. Probl. Eng. 2014, 2014, 793192. [Google Scholar] [CrossRef]

- Gardener, E.; Molyneux, P.; Nguyen-Linh, H. Determinants of efficiency in South East Asian banking. Serv. Ind. J. 2011, 31, 2693–2719. [Google Scholar] [CrossRef]

- Vu, H.; Nahm, D. The determinants of profit efficiency of banks in Vietnam. J. Asia Pac. Econ. 2013, 18, 615–631. [Google Scholar] [CrossRef]

| Obs. | Mean | Std. Dev. | Min. | Max. | 95% Confidence Interval | ||

|---|---|---|---|---|---|---|---|

| Lower | Upper | ||||||

| Panel A: Total banks | |||||||

| Original inputs | |||||||

| fixed_asset | 216 | 218.09 | 500.98 | 0.07 | 2003.27 | 151.28 | 284.90 |

| equity | 216 | 1308.36 | 2735.72 | 15.56 | 12,146.59 | 943.53 | 1673.20 |

| personnel_expenses | 216 | 128.78 | 267.82 | 0.56 | 1082.21 | 93.06 | 164.49 |

| Intermediate | |||||||

| deposits | 216 | 22,128.80 | 45,116.27 | 58.73 | 193,406.20 | 16,112.15 | 28,145.44 |

| Final outputs | |||||||

| gross_loans | 216 | 12,580.90 | 24,831.09 | 52.90 | 102,489.00 | 9269.46 | 15,892.34 |

| other_earn_assets | 216 | 11,309.88 | 24,049.12 | 20.78 | 105,917.70 | 8102.73 | 14,517.04 |

| npls | 216 | 303.06 | 644.92 | 0.56 | 2602.24 | 217.05 | 389.07 |

| Panel B: SOBs | |||||||

| Original inputs | |||||||

| fixed_asset | 24 | 1586.73 | 265.79 | 1093.89 | 2003.27 | 1480.40 | 1693.07 |

| equity | 24 | 8600.03 | 2069.33 | 5022.19 | 12,146.59 | 7772.14 | 9427.92 |

| personnel_expenses | 24 | 860.97 | 106.68 | 665.97 | 1082.21 | 818.29 | 903.65 |

| Intermediate | |||||||

| deposits | 24 | 144,080.00 | 21,255.05 | 113,865.60 | 193,406.20 | 135,576.40 | 152,583.60 |

| Final outputs | |||||||

| gross_loans | 24 | 79,262.75 | 10,578.89 | 60,604.36 | 102,489.00 | 75,030.40 | 83,495.11 |

| other_earn_assets | 24 | 76,304.48 | 14,421.35 | 52,742.49 | 105,917.70 | 70,534.85 | 82,074.12 |

| npls | 24 | 2070.54 | 231.12 | 1654.17 | 2602.24 | 1978.07 | 2163.00 |

| Panel C: JSBs | |||||||

| Original inputs | |||||||

| fixed_asset | 114 | 77.95 | 114.88 | 1.96 | 534.54 | 56.86 | 99.04 |

| equity | 114 | 617.15 | 736.29 | 31.62 | 2941.68 | 481.99 | 752.31 |

| personnel_expenses | 114 | 58.93 | 69.77 | 2.11 | 226.96 | 46.12 | 71.73 |

| Intermediate | |||||||

| deposits | 114 | 11,181.78 | 13,461.54 | 389.81 | 54,123.37 | 8710.68 | 13,652.88 |

| Final outputs | |||||||

| gross_loans | 114 | 6895.02 | 8393.22 | 283.63 | 32,906.58 | 5354.30 | 8435.74 |

| other_earn_assets | 114 | 5182.33 | 6225.30 | 64.97 | 25,478.56 | 4039.57 | 6325.09 |

| npls | 114 | 135.78 | 164.02 | 2.31 | 675.84 | 105.67 | 165.89 |

| Panel D: FBs | |||||||

| Original inputs | |||||||

| fixed_asset | 78 | 1.79 | 1.97 | 0.07 | 8.84 | 1.36 | 2.23 |

| equity | 78 | 75.01 | 48.80 | 15.56 | 219.24 | 64.18 | 85.84 |

| personnel_expenses | 78 | 5.58 | 6.09 | 0.56 | 25.63 | 4.23 | 6.93 |

| Intermediate | |||||||

| deposits | 78 | 604.84 | 644.61 | 58.73 | 2489.99 | 461.79 | 747.90 |

| Final outputs | |||||||

| gross_loans | 78 | 373.55 | 293.28 | 52.90 | 1170.96 | 308.46 | 438.63 |

| other_earn_assets | 78 | 267.21 | 357.62 | 20.78 | 1302.72 | 187.84 | 346.57 |

| npls | 78 | 3.70 | 2.53 | 0.56 | 10.94 | 3.14 | 4.27 |

| (1) Banks | (2) Years | (3) Convex | (4) Non-Convex | (5) Group | (6) TGR c | (7) TGR nc | |

|---|---|---|---|---|---|---|---|

| Panel A: Deposit Stage | |||||||

| Vertical comparison 1 | B12 [2] | 2010 | 1.0970 | 1.0912 | 1.0912 | 1.0053 | 1.0000 |

| B12 [2] | 2011 | 0.9774 | 0.9736 | 0.9736 | 1.0039 | 1.0000 | |

| Vertical comparison 2 | B28 [1] | 2013 | 1.0000 | 0.9323 | 0.9323 | 1.0726 | 1.0000 |

| B28 [1] | 2014 | 1.0000 | 0.9324 | 0.9324 | 1.0725 | 1.0000 | |

| Horizontal comparison | B9 [1] | 2014 | 0.9966 | 0.9953 | 0.9953 | 1.0013 | 1.0000 |

| B15 [1] | 2014 | 1.2272 | 1.0837 | 1.0837 | 1.1324 | 1.0000 | |

| Panel B: Loan Stage | |||||||

| Vertical comparison 1 | B6 [3] | 2010 | 1.2063 | 1.1977 | 1.1977 | 1.0072 | 1.0000 |

| B6 [3] | 2012 | 0.7231 | 0.7207 | 0.7207 | 1.0033 | 1.0000 | |

| Vertical comparison 2 | B30 [2] | 2013 | 0.9912 | 0.9463 | 0.9463 | 1.0475 | 1.0000 |

| B30 [2] | 2014 | 0.9388 | 0.8985 | 0.8985 | 1.0448 | 1.0000 | |

| Horizontal comparison | B21 [3] | 2013 | 1.2219 | 1.0000 | 1.0000 | 1.2219 | 1.0000 |

| B36 [2] | 2013 | 0.9945 | 0.9467 | 0.9467 | 1.0505 | 1.0000 | |

| Groups | Kolmogorov-Smirnov Test | t-Test (t-Value) | Sign Rank Test (Z-Value) |

|---|---|---|---|

| Period Efficiency | |||

| SOB versus JSB | 0.7474 *** | 4.2095 *** | 4.7980 *** |

| SOB versus FB | 0.7538 *** | 4.4947 *** | 4.7670 *** |

| JSB versus FB | 0.3401 *** | 2.450 8** | 2.9730 *** |

| Deposit Stage Efficiency | |||

| SOB versus JSB | 0.4763 *** | 2.9059 *** | 2.8500 *** |

| SOB versus FB | 0.5692 *** | 1.2918 | 2.9650 *** |

| JSB versus FB | 0.3117 *** | 0.2019 | 2.2380 ** |

| Loan Stage Efficiency | |||

| SOB versus JSB | 0.5368 *** | 2.4636 ** | 2.7690 *** |

| SOB versus FB | 0.5385 *** | 2.4295 ** | 1.9010 * |

| JSB versus FB | 0.2162 *** | 1.2427 | 0.9280 |

| Variable | Definition/Formula | Unit | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|---|

| netloan_ta | % | 48.9860 | 9.4280 | 18.3430 | 77.9390 | |

| liqassets_stfund | % | 27.9940 | 13.3550 | 5.8640 | 84.7480 | |

| net_int_margin | % | 2.8230 | 0.9860 | 1.1100 | 6.9310 | |

| ln_ta | million USD | 9.1260 | 1.2370 | 5.9240 | 11.3230 | |

| shareholder | 1 for foreign banks, 0 otherwise | — | 0.3610 | 0.4810 | 0.0000 | 1.0000 |

| g_gdp | from World Bank | % | 17.2670 | 5.6040 | 11.0000 | 28.4000 |

| g_m2 | from World Bank | % | 8.6830 | 1.1770 | 7.3000 | 10.6000 |

| hhi | the sum of the squares of individual bank loans in the total bank loans | — | 0.1320 | 0.0020 | 0.1290 | 0.1350 |

| netloan_ta | liqassets_stfund | net_int_margin | ln_ta | shareholder | g_gdp | g_m2 | |

|---|---|---|---|---|---|---|---|

| netloan_ta | 1.0000 | ||||||

| liqassets_stfund | −0.5790 *** | 1.0000 | |||||

| net_int_margin | 0.3390 *** | −0.3930 *** | 1.0000 | ||||

| ln_ta | 0.1410 * | −0.5420 *** | 0.1090 | 1.0000 | |||

| shareholder | −0.1140 | 0.6160 *** | −0.5790 *** | −0.6330 *** | 1.0000 | ||

| g_gdp | 0.2650 *** | 0.0180 | 0.0550 | −0.0190 | 0.0000 | 1.0000 | |

| g_m2 | 0.2730 *** | −0.0130 | 0.0230 | −0.020 | 0.0000 | 0.9570 *** | 1.0000 |

| hhi | 0.2500 *** | 0.0210 | 0.0690 | −0.0190 | 0.0000 | 0.9890 *** | 0.9610 *** |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 |

|---|---|---|---|---|---|---|---|---|---|

| netloan_ta | 0.0089 *** | 0.0084 *** | 0.0087 *** | −0.0106 *** | −0.0105 *** | −0.0105 *** | 0.0147 *** | 0.0143 *** | 0.0145 *** |

| (0.0031) | (0.0031) | (0.0030) | (0.0036) | (0.0035) | (0.0035) | (0.0027) | (0.0027) | (0.0027) | |

| liqassets_stfund | 0.0129 *** | 0.0126 *** | 0.0128 *** | 0.0014 | 0.0015 | 0.0015 | 0.0106 *** | 0.0103 *** | 0.0105 *** |

| (0.0022) | (0.0021) | (0.0022) | (0.0025) | (0.0025) | (0.0025) | (0.0019) | (0.0019) | (0.0019) | |

| net_int_margin | −0.0069 | −0.0072 | −0.0056 | 0.0961 *** | 0.0963 *** | 0.0958 *** | −0.0518 ** | −0.0523 ** | −0.0507 ** |

| (0.0251) | (0.0254) | (0.0251) | (0.0292) | (0.0294) | (0.0292) | (0.0225) | (0.0227) | (0.0224) | |

| shareholder | −0.1487 ** | −0.1447 ** | −0.1453 ** | 0.2948 *** | 0.2949 *** | 0.2938 *** | −0.2650 *** | −0.2619 *** | −0.2617 *** |

| (0.0714) | (0.0717) | (0.0711) | (0.0830) | (0.0832) | (0.0827) | (0.0638) | (0.0641) | (0.0636) | |

| ln_ta | 0.1759 *** | 0.1753 *** | 0.1765 *** | 0.2032 *** | 0.2034 *** | 0.2031 *** | 0.0196 | 0.0189 | 0.0200 |

| (0.0260) | (0.0261) | (0.0260) | (0.0302) | (0.0302) | (0.0302) | (0.0232) | (0.0233) | (0.0232) | |

| g_gdp | −0.0096 | 0.0014 | −0.0084 | ||||||

| (0.0065) | (0.0076) | (0.0058) | |||||||

| g_m2 | −0.0150 | 0.0029 | −0.0138 | ||||||

| (0.0144) | (0.0167) | (0.0129) | |||||||

| hhi | −15.9769 | 1.6172 | −13.8314 | ||||||

| (11.5873) | (13.4638) | (10.3612) | |||||||

| Constant | −1.3942 *** | −1.3696 *** | 0.5579 | −0.8995 ** | −0.9076 ** | −1.0944 | 0.0845 | 0.1095 | 1.7733 |

| (0.3324) | (0.3413) | (1.4992) | (0.3865) | (0.3957) | (1.7420) | (0.2972) | (0.3051) | (1.3406) | |

| Log_lik | 12.4670 | 11.9456 | 12.3517 | −14.6571 | −14.6581 | −14.6660 | 32.6303 | 32.1665 | 32.4824 |

| Wald_chi2 | 95.2300 | 93.6400 | 94.8800 | 55.6000 | 55.6000 | 55.5800 | 41.3300 | 40.1900 | 40.9700 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 |

|---|---|---|---|---|---|---|---|---|---|

| netloan_ta | 0.0161 *** | 0.0162 *** | 0.0154 *** | 0.0091 * | 0.0097 * | 0.0079 | 0.0295 *** | 0.0290 *** | 0.0291 *** |

| (0.0031) | (0.0031) | (0.0031) | (0.0054) | (0.0054) | (0.0056) | (0.0063) | (0.0061) | (0.0063) | |

| liqassets_stfund | 0.0062 *** | 0.0058 *** | 0.0058 ** | 0.0074 * | 0.0073 * | 0.0071 | 0.0174 *** | 0.0169 *** | 0.0171 *** |

| (0.0024) | (0.0022) | (0.0023) | (0.0043) | (0.0043) | (0.0044) | (0.0040) | (0.0039) | (0.0039) | |

| net_int_margin | −0.0002 | −0.0055 | 0.0027 | −0.0403 | −0.0495 | −0.0350 | −0.1159 *** | −0.1190 *** | −0.1140 *** |

| (0.0241) | (0.0237) | (0.0243) | (0.0626) | (0.0599) | (0.0628) | (0.0407) | (0.0390) | (0.0417) | |

| shareholder | −0.1365 * | −0.1417 ** | −0.1253 * | −0.2867 | −0.3055 * | −0.2700 | −0.6258 *** | −0.6242 *** | −0.6198 *** |

| (0.0704) | (0.0695) | (0.0704) | (0.1788) | (0.1744) | (0.1797) | (0.1367) | (0.1349) | (0.1405) | |

| ln_ta | 0.2804 *** | 0.2743 *** | 0.2827 *** | 0.2115 ** | 0.1998 ** | 0.2196 ** | 0.2079 *** | 0.2034 *** | 0.2086 *** |

| (0.0435) | (0.0420) | (0.0442) | (0.0848) | (0.0821) | (0.0878) | (0.0593) | (0.0584) | (0.0599) | |

| g_gdp | −0.0253 *** | −0.0286 ** | −0.0254 ** | ||||||

| (0.0071) | (0.0131) | (0.0112) | |||||||

| g_m2 | −0.0578 *** | −0.0676 ** | −0.0551 ** | ||||||

| (0.0149) | (0.0277) | (0.0242) | |||||||

| hhi | −40.1911 *** | −45.2612 ** | −42.2513 ** | ||||||

| (12.5406) | (23.0346) | (19.6211) | |||||||

| Constant | −2.3263 *** | −2.1290 *** | 2.5706 | −0.9985 | −0.7389 | 4.4685 | −1.9250 *** | −1.7459 *** | 3.2393 |

| (0.4650) | (0.4491) | (1.5764) | (0.8812) | (0.8580) | (2.8745) | (0.6763) | (0.6768) | (2.4475) |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, Y.; Huang, J.; Shao, Y. The Sustainability Performance of Chinese Banks: A New Network Data Envelopment Analysis Approach and Panel Regression. Sustainability 2019, 11, 1622. https://doi.org/10.3390/su11061622

Yu Y, Huang J, Shao Y. The Sustainability Performance of Chinese Banks: A New Network Data Envelopment Analysis Approach and Panel Regression. Sustainability. 2019; 11(6):1622. https://doi.org/10.3390/su11061622

Chicago/Turabian StyleYu, Yantuan, Jianhuan Huang, and Yanmin Shao. 2019. "The Sustainability Performance of Chinese Banks: A New Network Data Envelopment Analysis Approach and Panel Regression" Sustainability 11, no. 6: 1622. https://doi.org/10.3390/su11061622

APA StyleYu, Y., Huang, J., & Shao, Y. (2019). The Sustainability Performance of Chinese Banks: A New Network Data Envelopment Analysis Approach and Panel Regression. Sustainability, 11(6), 1622. https://doi.org/10.3390/su11061622