Does Corporate Charitable Giving Help Sustain Corporate Performance in China?

Abstract

1. Introduction

2. Literature Review

3. Development of Hypotheses

4. Data and Variables

4.1. Data Collection

4.2. Variables

5. Panel Regression Test and Empirical Results

5.1. RCCG Significantly Enhances Long-Term CP Rather than Short-Term CP

5.2. Impact of CCG on Long-Term CP is Significant for NSOFs

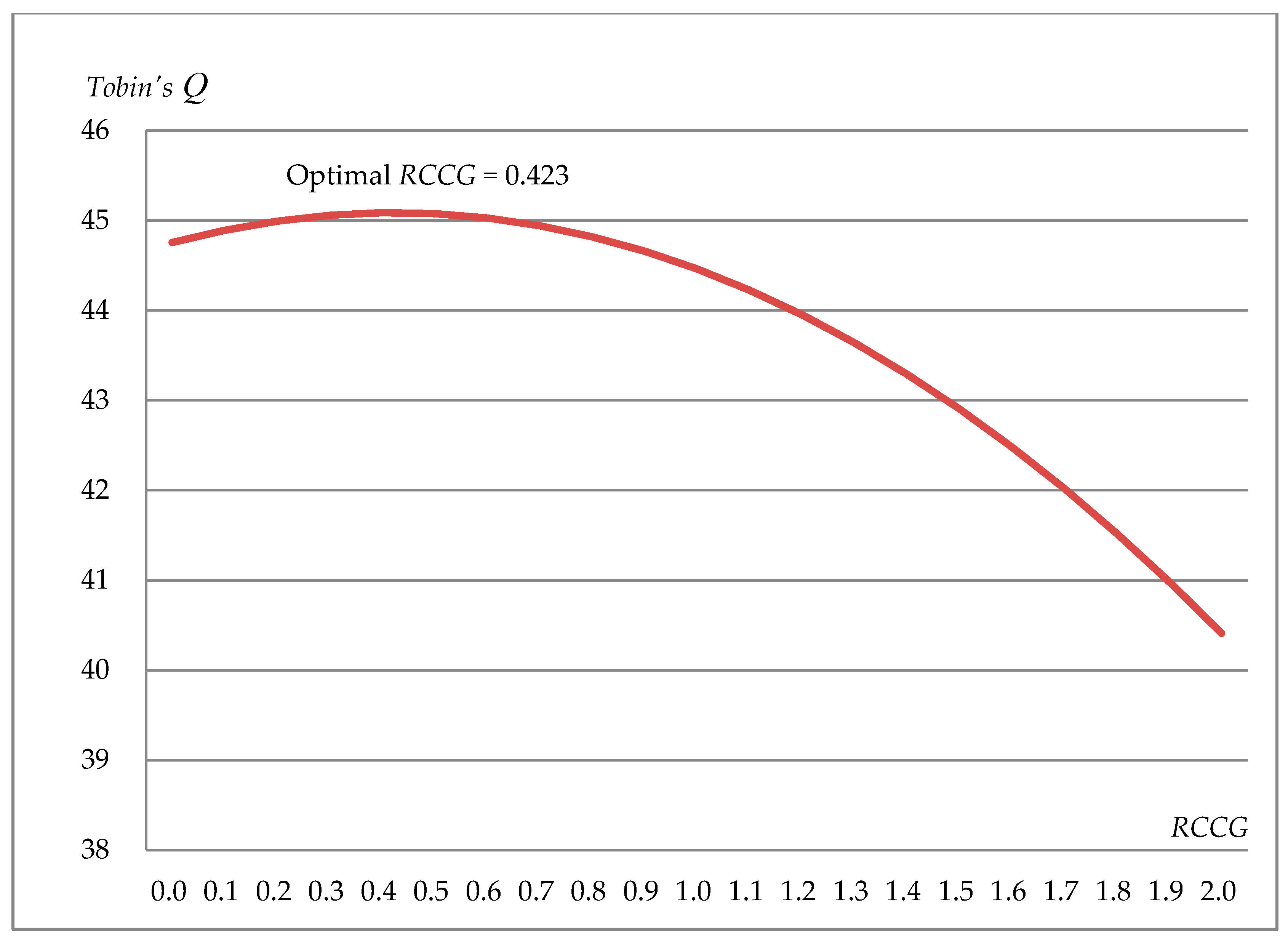

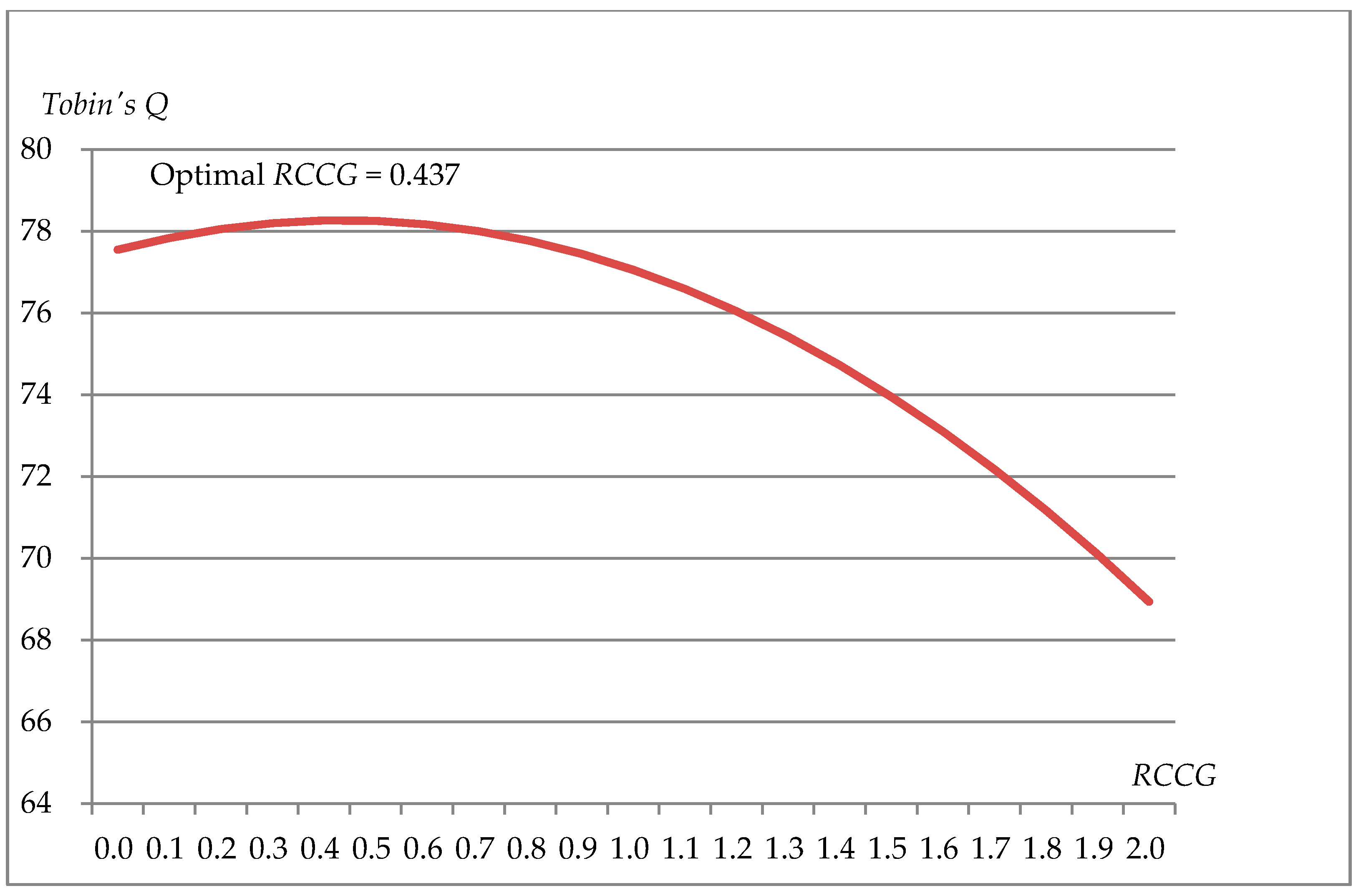

5.3. Optimal Level of RCCG on CP

6. Discussion and Implications

6.1. Discussion

6.2. Policy Implications

7. Limitations and Future Study Considerations

Author Contributions

Funding

Conflicts of Interest

References

- Godfrey, P.C. The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef]

- Brown, W.; Helland, E.; Smith, K. Corporate philanthropic practices. J. Corp. Financ. 2006, 12, 855–877. [Google Scholar] [CrossRef]

- Navarro, P. Why do corporations give to charity? J. Bus. 1988, 61, 65–93. [Google Scholar] [CrossRef]

- Wang, H.; Choi, J.; Li, J. Too little or too much? Untangling the relationship between corporate philanthropy and firm financial performance. Organ Sci. 2008, 19, 143–159. [Google Scholar] [CrossRef]

- Barnett, M.L. Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Acad. Manag. Rev. 2007, 32, 794–816. [Google Scholar] [CrossRef]

- Berman, S.L.; Wicks, A.C.; Kotha, S.K.; Jones, T.M. Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Acad. Manag. J. 1999, 42, 488–506. [Google Scholar]

- Griffin, J.J.; Mahon, J.F. The corporate social performance and corporate financial performance debate twenty-five years of incomparable research. Bus. Soc. 1997, 36, 5–31. [Google Scholar] [CrossRef]

- Seifert, B.; Morris, S.A.; Bartkus, B.R. Having, giving, and getting: Slack resources, corporate philanthropy, and firm financial performance. Bus. Soc. 2004, 43, 135–161. [Google Scholar] [CrossRef]

- Gao, F.; Faff, R.; Navissi, F. Corporate philanthropy: Insights from the 2008 Wenchuan earthquake in China. Pac.-Basin Financ. J. 2012, 20, 363–377. [Google Scholar] [CrossRef]

- Lin, S.; Wang, J.; Yao, S.; Chen, J. Market reactions and corporate philanthropy: A case study of the Wenchuan earthquake in China. J. Contemp. China 2012, 21, 299–315. [Google Scholar]

- Wang, H.; Qian, C. Corporate philanthropy and CFP: The roles of stakeholder response and political access. Acad. Manag. J. 2011, 54, 1159–1181. [Google Scholar] [CrossRef]

- Sina News. Available online: http://gongyi.sina.com.cn/gyzx/2011-05-10/095826233.html (accessed on 10 May 2011).

- Zhang, R.; Rezaee, Z.; Zhu, J. Corporate philanthropic disaster response and ownership type: Evidence from Chinese firms’ response to the Sichuan earthquake. J. Bus. Ethics 2009, 91, 51–63. [Google Scholar] [CrossRef]

- Yang, T. Annual Report on China’s Philanthropy Development; Social Sciences Academic Press: Beijing, China, 2017; p. 17. ISBN 978-7-5201-0923-9. [Google Scholar]

- Gao, Y. Philanthropic disaster relief giving as a response to institutional pressure: Evidence from China. J. Bus. Res. 2011, 64, 1377–1382. [Google Scholar] [CrossRef]

- Li, S.; Song, X.; Wu, H. Political connection, ownership structure, and corporate philanthropy in China: A strategic-political perspective. J. Bus. Ethics 2015, 129, 399–411. [Google Scholar] [CrossRef]

- Lin, K.J.; Tan, J.; Zhao, L.; Karim, K. In the name of charity: Political connections and strategic corporate social responsibility in a transition economy. J. Corp. Financ. 2015, 32, 327–346. [Google Scholar] [CrossRef]

- Ma, D.L.; Parish, W.L. Tocquevillian moments: Charitable contributions by Chinese private entrepreneurs. Soc. Forces 2006, 85, 943–964. [Google Scholar] [CrossRef]

- Long, C.; Yang, J. What explains Chinese private entrepreneurs’ charitable behaviors?—A story of dynamic reciprocal relationship between firms and the government. China Econ. Rev. 2016, 40, 1–16. [Google Scholar] [CrossRef]

- Gao, Y.; Lin, L.Y.; Yang, H. What’s the value in it? Corporate giving under uncertainty. Asia Pac. J. Manag. 2017, 34, 215–240. [Google Scholar] [CrossRef]

- Wang, Z. Corporate Governance, Policies and Public Listing: The case of Chinese State-owned Enterprises. In Corporate Governance and CSR: A Focus on Emerging Markets; Boubaker, S., Nguyen, D.K., Eds.; World Scientific Publishing: Singapore, 2014; p. 63. ISBN 978-9-8145-2037-9. [Google Scholar]

- Zhang, M.; Xie, L.; Xu, H. Corporate philanthropy and stock price crash risk: Evidence from China. J. Bus. Ethics 2016, 139, 595–617. [Google Scholar] [CrossRef]

- Su, J.; He, J. Does giving lead to getting? Evidence from Chinese private enterprises. J. Bus. Ethics 2010, 93, 73–90. [Google Scholar] [CrossRef]

- Chen, M.H.; Lin, C.P. The impact of corporate charitable giving on hospitality firm performance: Doing well by doing good? Int. J. Hosp. Manag. 2015, 47, 25–34. [Google Scholar] [CrossRef]

- Yu, Y.; Choi, Y. Corporate social responsibility and firm performance through the mediating effect of organizational trust in Chinese firms. Chin. Manag. Stud. 2014, 8, 577–592. [Google Scholar] [CrossRef]

- Agle, B.R.; Mitchell, R.K.; Sonnenfeld, J.A. Who matters to CEOs? An investigation of stakeholder attributes and salience, corporate performance, and CEO values. Acad. Manag. J. 1999, 42, 507–525. [Google Scholar]

- Heinze, D.; Sibary, S.; Sikula, A. Relations among corporate social responsibility, financial soundness, and investment value in 22 manufacturing industry groups. Ethics Behav. 1999, 9, 331–347. [Google Scholar] [CrossRef]

- Jin, K.R.; Drozdenko, R.G. Relationships among perceived organizational core values, corporate social responsibility, ethics, and organizational performance outcomes: An empirical study of information technology professionals. J. Bus. Ethics 2010, 92, 341–359. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J. People and Profits? The Search for a Link between a Company’s Social and Financial Performance; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 2001. [Google Scholar]

- Carroll, A.B. Corporate social performance measurement: A commentary on methods for evaluating an elusive construct. Res. Corp. Soc. Perform. Policy 1991, 12, 385–401. [Google Scholar]

- Friedman, M. The social responsibility of business is to increase its profits. New York Times Magazine, 13 September 1970; 122–126. [Google Scholar]

- Porter, M.E.; Kramer, M.R. The competitive advantage of corporate philanthropy. Harv. Bus. Rev. 2002, 80, 5–16. [Google Scholar]

- Liang, H.; Renneboog, L. Corporate donations and shareholder value. Oxf. Rev. Econ. Policy 2017, 33, 278–316. [Google Scholar] [CrossRef]

- Williamson, O. The Economics of Discretionary Behavior: Managerial Objectives in a Theory of the Firm; (Ford Foundation Doctoral Dissertation Series; Prentice Hall: Upper Saddle River, NJ, USA, 1964. [Google Scholar]

- Campbell, L.; Gulas, C.S.; Gruca, T.S. Corporate giving behaviour and decision-maker social consciousness. J. Bus. Ethics 1999, 19, 375–383. [Google Scholar] [CrossRef]

- Lev, B.; Petrovits, C.; Radhakrishnan, S. Is doing good good for you? How corporate charitable contributions enhance revenue growth. Strat. Mgmt. J. 2010, 31, 182–200. [Google Scholar] [CrossRef]

- Seifert, B.; Morris, S.A.; Bartkus, B.R. Comparing big givers and small givers: Financial correlates of corporate philanthropy. J. Bus. Ethics 2003, 45, 195–211. [Google Scholar] [CrossRef]

- Thompson, A.A.; Strickland, A.J. Strategic Management: Concepts and Cases, 13th ed.; Mcgraw-Hill: New York, NY, USA, 2003. [Google Scholar]

- Saiia, D.H.; Carroll, A.B.; Buchholtz, A.K. Philanthropy as strategy when corporate charity “begins at home”. Bus. Soc. 2003, 42, 169–201. [Google Scholar] [CrossRef]

- Post, J.E.; Waddock, S.A. Strategic philanthropy and partnerships for economic progress, philanthropy and economic development. In Philanthropy and Economic Development; America, R.F., Ed.; Greenwood Press: Westport, CT, USA, 1995; pp. 167–191. [Google Scholar]

- Lewin, D.; Sabater, J.M. Corporate Philanthropy and Business Performance. In Corporate Philanthropy at the Crossroads; Burlingame, D.F., Young, D.R., Eds.; Indiana University Press: Bloomington, IN, USA, 1996; pp. 105–112. [Google Scholar]

- Weeden, C. Corporate Social Investing; Berrett-Koehler Press: San Francisco, CA, USA, 1998. [Google Scholar]

- Wang, K.; Chen, M.H.; Lin, C.P.; Gillard, E. The impact of tourism firm’s philanthropy decision on its business objective. Tour. Econ. 2018, 24, 503–509. [Google Scholar] [CrossRef]

- Hategan, C.-D.; Curea-Pitorac, R.-I. Testing the correlations between corporate giving, performance and company value. Sustainability 2017, 9, 1210. [Google Scholar] [CrossRef]

- Gautier, A.; Pache, A. Research on corporate philanthropy: A review and assess. J. Bus. Ethics 2015, 126, 343–369. [Google Scholar] [CrossRef]

- Chen, M.H.; Lin, C.P.; Tian, L.; Yang, Y. A theoretical link between corporate giving and hospitality firm performance. Int. J. Hosp. Manag. 2017, 66, 130–134. [Google Scholar] [CrossRef]

- Chen, M.H. The economy, tourism growth and corporate performance in the Taiwanese hotel industry. Tour. Manag. 2010, 31, 665–675. [Google Scholar] [CrossRef]

- Lu, C.; Zhao, X.; Dai, J. Corporate social responsibility and insider trading: Evidence from China. Sustainability 2018, 10, 3163. [Google Scholar] [CrossRef]

- Ye, K.; Zhang, R. Do lenders value corporate social responsibility? Evidence from China. J. Bus. Ethics 2011, 104, 197–206. [Google Scholar] [CrossRef]

- Zhang, M.; Ma, L.; Su, J.; Zhang, W. Do suppliers applaud corporate social performance? J. Bus. Ethics 2014, 121, 543–557. [Google Scholar] [CrossRef]

- Chen, Z.; Cao, Y. Chinese private corporate philanthropy: Social responsibility, legitimacy strategy, and the role of political capital. Chin. Sociol. Rev. 2016, 48, 108–136. [Google Scholar] [CrossRef]

- China Stock Market & Accounting Research Database. Available online: http://us.gtadata.com/Login/Index?versionswitch=&control= (accessed on 27 January 2017).

- China Information. Available online: http://www.cninfo.com.cn/ (accessed on 1 August 2017).

- Brammer, S.; Millington, A. Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strat. Mgmt. J. 2008, 29, 1325–1343. [Google Scholar] [CrossRef]

- Chung, K.H.; Pruitt, S.W. A simple approximation of Tobin’s q. Financ. Manag. 1994, 23, 70–74. [Google Scholar] [CrossRef]

- Baltagi, B.H. Econometric Analysis of Panel Data, 3rd ed.; John Wiley & Sons, Ltd.: West Sussex, UK, 2005. [Google Scholar]

- Hsiao, C. Analysis of Panel Data; Cambridge University Press: Cambridge, UK, 1986. [Google Scholar]

- Hausman, A. Specification tests in econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Dimitrios, A. Applied Econometrics: A Modern Approach Using EViews and Microfit; Palgrave Macmillan: Basingstoke, UK, 2005. [Google Scholar]

- Campbell, D.; Moore, G.; Metzger, M. Corporate philanthropy in the UK 1985–2000: Some empirical findings. J. Bus. Ethics 2002, 39, 29–41. [Google Scholar] [CrossRef]

- Chen, J.; Wang, D.; Tong, J.; Zhang, F. Corporate philanthropy and tunneling: Evidence from China. J. Bus. Ethics 2018, 150, 135–157. [Google Scholar] [CrossRef]

- Balotti, R.F.; Hanks, J.J., Jr. Giving at the office: A reappraisal of charitable contributions by corporations. Bus. Lawyer 1999, 54, 956–996. [Google Scholar]

| All listed SOFs and NSOFs N = 22,652 | RCCG | ROA | ROE | TQ | SG | SIZE | LEV | SOP |

|---|---|---|---|---|---|---|---|---|

| Minimum | 0.00 | −48.32 | −167.11 | 0.01 | −1.05 | 16.52 | 0.01 | 0 |

| Maximum | 0.98 | 4.84 | 37.14 | 91.58 | 461.03 | 28.51 | 96.96 | 1 |

| Mean | 0.03 | 0.03 | 0.03 | 2.16 | 0.50 | 21.71 | 0.54 | 0.4875 |

| Std. Dev. | 0.08 | 0.48 | 1.78 | 2.91 | 2.63 | 1.33 | 1.60 | 0.50 |

| SOFs N = 11,043 | RCCG | ROA | ROE | TQ | SG | SIZE | LEV | |

| Minimum | 0.00 | −6.78 | −72.15 | 0.01 | −1.05 | 16.76 | 0.01 | |

| Maximum | 0.94 | 4.84 | 37.14 | 76.09 | 190.21 | 28.51 | 8.61 | |

| Mean | 0.02 | 0.02 | 0.03 | 1.60 | 0.30 | 22.10 | 0.53 | |

| Std. Dev. | 0.06 | 0.11 | 1.20 | 1.98 | 2.93 | 1.38 | 0.29 | |

| NSOFs N = 11,609 | RCCG | ROA | ROE | TQ | SG | SIZE | LEV | |

| Minimum | 0.00 | −48.32 | −167.11 | 0.06 | −1.00 | 16.52 | 0.01 | |

| Maximum | 0.98 | 2.64 | 26.06 | 91.58 | 461.03 | 27.45 | 96.96 | |

| Mean | 0.04 | 0.02 | 0.02 | 2.74 | 0.63 | 21.46 | 0.48 | |

| Std. Dev. | 0.10 | 0.52 | 2.26 | 3.46 | 10.55 | 1.10 | 1.35 |

| Panel A: SG | Coefficient | t–statistic | p–value | Adjusted R2 | Panel B: ROA | Coefficient | t–statistic | p–value | Adjusted R2 |

|---|---|---|---|---|---|---|---|---|---|

| (Pooled OLS) | (Pooled OLS) | ||||||||

| Constant | –1.91 | –1.82 | 0.07** | 0.00 | Constant | –0.19 | –3.68 | 0.00*** | 0.16 |

| RCCG | –0.86 | –1.14 | 0.26 | RCCG | 0.02 | 0.61 | 0.55 | ||

| LEV | 0.15 | 1.66 | 0.10* | LEV | –0.19 | –67.66 | 0.00*** | ||

| SIZE | 0.12 | 2.56 | 0.01*** | SIZE | 0.01 | 6.03 | 0.00*** | ||

| SOP | –0.55 | –4.29 | 0.00*** | SG | 0.00 | 1.42 | 0.15 | ||

| SOP | –0.01 | –0.87 | 0.38 | ||||||

| Panel C: ROE | Coefficient | t–Statistic | Prob. | Adjusted R2 | Panel D: TQ | Coefficient | t–Statistic | Prob. | Adjusted R2 |

| (Pooled OLS) | (Fixed effects) | ||||||||

| Constant | –0.56 | –2.75 | 0.01*** | 0.00 | Constant | 44.73 | 68.52 | 0.00*** | 0.12 |

| RCCG | 0.16 | 1.09 | 0.28 | RCCG | 0.57 | 2.54 | 0.01*** | ||

| LEV | –0.02 | –2.07 | 0.04** | LEV | –0.02 | –0.65 | 0.52 | ||

| SIZE | 0.03 | 2.91 | 0.00*** | SIZE | –1.94 | –64.89 | 0.00*** | ||

| SG | 0.00 | 0.55 | 0.58 | SG | 0.00 | 2.25 | 0.02** | ||

| SOP | 0.00 | –0.15 | 0.88 | SOP | –0.44 | –5.24 | 0.00*** |

| Panel A: SG | Coefficient | t–Statistic | Prob. | Adjusted R2 | Panel B: ROA | Coefficient | t–Statistic | Prob. | Adjusted R2 |

|---|---|---|---|---|---|---|---|---|---|

| (Pooled OLS) | (Fixed Effects) | ||||||||

| Constant | –0.67 | –0.73 | 0.46 | 0.00 | Constant | –1.02 | –6.15 | 0.00*** | 0.40 |

| RCCG | –0.32 | –0.35 | 0.72 | RCCG | –0.08 | –1.21 | 0.23 | ||

| LEV | 0.24 | 1.37 | 0.17 | LEV | –1.37 | –79.19 | 0.00*** | ||

| SIZE | 0.04 | 0.98 | 0.33 | SIZE | 0.08 | 10.71 | 0.00*** | ||

| SG | 0.00 | –0.29 | 0.77 | ||||||

| Panel C: ROE | Coefficient | t–Statistic | Prob. | Adjusted R2 | Panel D: TQ | Coefficient | t–Statistic | Prob. | Adjusted R2 |

| (Pooled OLS) | (Fixed Effects) | ||||||||

| Constant | –0.36 | –1.68 | 0.09* | 0.00 | Constant | 30.10 | 48.22 | 0.00*** | 0.54 |

| RCCG | 0.12 | 0.56 | 0.57 | RCCG | 0.29 | 1.19 | 0.24 | ||

| LEV | –0.05 | –1.21 | 0.23 | LEV | –0.17 | –2.17 | 0.03** | ||

| SIZE | 0.02 | 1.98 | 0.05** | SIZE | –1.29 | –45.41 | 0.00*** | ||

| SG | 0.00 | 0.18 | 0.86 | SG | 0.00 | 0.87 | 0.38 |

| Panel A: SG | Coefficient | t-Statistic | Prob. | Adjusted R2 | Panel B: ROA | Coefficient | t-Statistic | Prob. | Adjusted R2 |

|---|---|---|---|---|---|---|---|---|---|

| (Pooled OLS) | (Pooled OLS) | ||||||||

| Constant | −3.98 | −1.88 | 0.06** | 0.00 | Constant | 0.04 | 0.40 | 0.69 | 0.21 |

| RCCG | −1.20 | −1.04 | 0.30 | RCCG | 0.03 | 0.55 | 0.58 | ||

| LEV | 0.00 | 0.21 | 0.83 | LEV | −0.17 | −55.98 | 0.00*** | ||

| SIZE | 0.22 | 2.28 | 0.02** | SIZE | 0.00 | 0.84 | 0.40 | ||

| SG | 0.00 | 1.27 | 0.20 | ||||||

| Panel C: ROE | Coefficient | t-Statistic | Prob. | Adjusted R2 | Panel D: TQ | Coefficient | t-Statistic | Prob. | Adjusted R2 |

| (Pooled OLS) | (Fixed Effects) | ||||||||

| Constant | −0.99 | −2.54 | 0.01*** | 0.00 | Constant | 77.48 | 34.09 | 0.00*** | 0.73 |

| RCCG | 0.18 | 0.86 | 0.39 | RCCG | 1.13 | 1.70 | 0.09* | ||

| LEV | 0.00 | 0.88 | 0.38 | LEV | 2.36 | 364.31 | 0.00*** | ||

| SIZE | 0.05 | 2.59 | 0.01*** | SIZE | −3.53 | −33.35 | 0.00*** | ||

| SG | 0.00 | 0.44 | 0.66 | SG | 0.00 | 0.81 | 0.42 |

| Panel A: SG | Coefficient | t–Statistic | Prob. | Adjusted R2 | Panel B: ROA | Coefficient | t–Statistic | Prob. | Adjusted R2 |

|---|---|---|---|---|---|---|---|---|---|

| (Pooled OLS) | (Pooled OLS) | ||||||||

| Constant | –1.67 | –1.60 | 0.11 | 0.00 | Constant | –0.19 | –3.68 | 0.00*** | 0.16 |

| RCCG | –2.26 | –1.41 | 0.16 | RCCG | 0.04 | 0.50 | 0.62 | ||

| RCCG2 | 2.72 | 0.96 | 0.34 | RCCG2 | –0.03 | –0.24 | 0.81 | ||

| LEV | 0.04 | 0.90 | 0.37 | LEV | –0.19 | –67.63 | 0.00*** | ||

| SIZE | 0.12 | 2.41 | 0.02** | SIZE | 0.01 | 6.02 | 0.00*** | ||

| SOP | –0.55 | –4.29 | 0.00*** | SG | 0.00 | 1.42 | 0.15 | ||

| SOP | –0.01 | –0.85 | 0.39 | ||||||

| Panel C: ROE | Coefficient | t–Statistic | Prob. | Adjusted R2 | Panel D: TQ | Coefficient | t–Statistic | Prob. | Adjusted R2 |

| (Pooled OLS) | (Fixed effects) | ||||||||

| Constant | –0.56 | –2.75 | 0.01*** | 0.00 | Constant | 44.75 | 68.56 | 0.00*** | 0.47 |

| RCCG | 0.29 | 0.94 | 0.35 | RCCG | 1.59 | 3.34 | 0.00 *** | ||

| RCCG2 | –0.26 | –0.48 | 0.63 | RCCG2 | –1.88 | –2.43 | 0.02** | ||

| LEV | –0.02 | –2.06 | 0.04** | LEV | –0.02 | –0.61 | 0.54 | ||

| SIZE | 0.03 | 2.89 | 0.00*** | SIZE | –1.95 | –64.94 | 0.00*** | ||

| SG | 0.00 | 0.55 | 0.58 | SG | 0.00 | 2.22 | 0.03** | ||

| SOP | 0.00 | –0.11 | 0.91 | SOP | –0.44 | –5.23 | 0.00*** |

| Panel A: SG | Coefficient | t-Statistic | Prob. | Adjusted R2 | Panel B: ROA | Coefficient | t-Statistic | Prob. | Adjusted R2 |

|---|---|---|---|---|---|---|---|---|---|

| (Pooled OLS) | (Fixed effects) | ||||||||

| Constant | −0.65 | −0.71 | 0.48 | 0.00 | Constant | −1.02 | −6.15 | 0.00*** | 0.40 |

| RCCG | −1.55 | −0.85 | 0.40 | RCCG | −0.19 | −1.44 | 0.15 | ||

| RCCG2 | 2.79 | 0.78 | 0.44 | RCCG2 | 0.23 | 0.96 | 0.34 | ||

| LEV | 0.24 | 1.36 | 0.18 | LEV | −1.37 | −79.19 | 0.00*** | ||

| SIZE | 0.04 | 0.98 | 0.33 | SIZE | 0.08 | 10.72 | 0.00*** | ||

| SG | 0.00 | 0.15 | 0.88 | ||||||

| Panel C: ROE | Coefficient | t-Statistic | Prob. | Adjusted R2 | Panel D: TQ | Coefficient | t-Statistic | Prob. | Adjusted R2 |

| (Pooled OLS) | (Fixed effects) | ||||||||

| Constant | −0.36 | −1.69 | 0.09* | 0.00 | Constant | 30.11 | 48.23 | 0.00*** | 0.54 |

| RCCG | 0.18 | 0.42 | 0.67 | RCCG | 0.89 | 1.87 | 0.06* | ||

| RCCG2 | −0.14 | −0.16 | 0.87 | RCCG2 | −1.26 | −1.47 | 0.14 | ||

| LEV | −0.05 | −1.21 | 0.23 | LEV | −0.16 | −2.14 | 0.03** | ||

| SIZE | 0.02 | 1.98 | 0.05** | SIZE | −1.29 | −45.43 | 0.00*** | ||

| SG | 0.00 | 0.18 | 0.86 | SG | 0.00 | 0.88 | 0.38 |

| Panel A: SG | Coefficient | t–Statistic | Prob. | Adjusted R2 | Panel B: ROA | Coefficient | t–Statistic | Prob. | Adjusted R2 |

|---|---|---|---|---|---|---|---|---|---|

| (Pooled OLS) | (Pooled OLS) | ||||||||

| Constant | –4.05 | –1.91 | 0.06* | 0.00 | Constant | 0.04 | 0.41 | 0.68 | 0.21 |

| RCCG | –3.03 | –1.20 | 0.23 | RCCG | 0.04 | 0.34 | 0.73 | ||

| RCCG2 | 3.46 | 0.81 | 0.42 | RCCG2 | –0.02 | –0.11 | 0.92 | ||

| LEV | 0.00 | 0.21 | 0.84 | LEV | –0.17 | –55.96 | 0.00*** | ||

| SIZE | 0.23 | 2.33 | 0.02** | SIZE | 0.00 | 0.83 | 0.41 | ||

| SG | 0.00 | 1.27 | 0.20 | ||||||

| Panel C: ROE | Coefficient | t–Statistic | Prob. | Adjusted R2 | Panel D: TQ | Coefficient | t–Statistic | Prob. | Adjusted R2 |

| (Pooled OLS) | (Fixed effects) | ||||||||

| Constant | –0.98 | –2.52 | 0.01*** | 0.00 | Constant | 77.54 | 34.12 | 0.00*** | 0.73 |

| RCCG | 0.35 | 0.76 | 0.45 | RCCG | 3.33 | 2.23 | 0.03** | ||

| RCCG2 | –0.32 | –0.41 | 0.68 | RCCG2 | –3.82 | –1.65 | 0.10* | ||

| LEV | 0.00 | 0.89 | 0.38 | LEV | 2.36 | 364.34 | 0.00*** | ||

| SIZE | 0.05 | 2.56 | 0.01*** | SIZE | –3.54 | –33.39 | 0.00*** | ||

| SG | 0.00 | 0.45 | 0.66 | SG | 0.00 | 0.77 | 0.44 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, K.; Miao, Y.; Su, C.-H.; Chen, M.-H.; Wu, Z.; Wang, T. Does Corporate Charitable Giving Help Sustain Corporate Performance in China? Sustainability 2019, 11, 1491. https://doi.org/10.3390/su11051491

Wang K, Miao Y, Su C-H, Chen M-H, Wu Z, Wang T. Does Corporate Charitable Giving Help Sustain Corporate Performance in China? Sustainability. 2019; 11(5):1491. https://doi.org/10.3390/su11051491

Chicago/Turabian StyleWang, Keling, Yaqiong Miao, Ching-Hui (Joan) Su, Ming-Hsiang Chen, Zhongjun Wu, and Tie Wang. 2019. "Does Corporate Charitable Giving Help Sustain Corporate Performance in China?" Sustainability 11, no. 5: 1491. https://doi.org/10.3390/su11051491

APA StyleWang, K., Miao, Y., Su, C.-H., Chen, M.-H., Wu, Z., & Wang, T. (2019). Does Corporate Charitable Giving Help Sustain Corporate Performance in China? Sustainability, 11(5), 1491. https://doi.org/10.3390/su11051491