Evaluating the Minor Coarse Cereals Product Crowdfunding Platform through Evolutionary Game Analysis

Abstract

:1. Introduction and Literature Review

1.1. The Concept and Significance of Crowdfunding

1.2. Characteristics and Classification of Crowdfunding

1.3. Influencing Factors of Crowdfunding Success

1.4. The Application of Crowdfunding:

2. MCC Product Crowdfunding Platform and Construction of Game Model

2.1. MCC Product Crowdfunding Platform

2.2. Game Participants and Analysis

2.3. Assumptions and Variables: Descriptions for Game Model

2.4. Replication Dynamic Equation Construction

2.4.1. For MCC Growers:

2.4.2. For Crowdfunders:

3. Analysis of Evolutionary Game

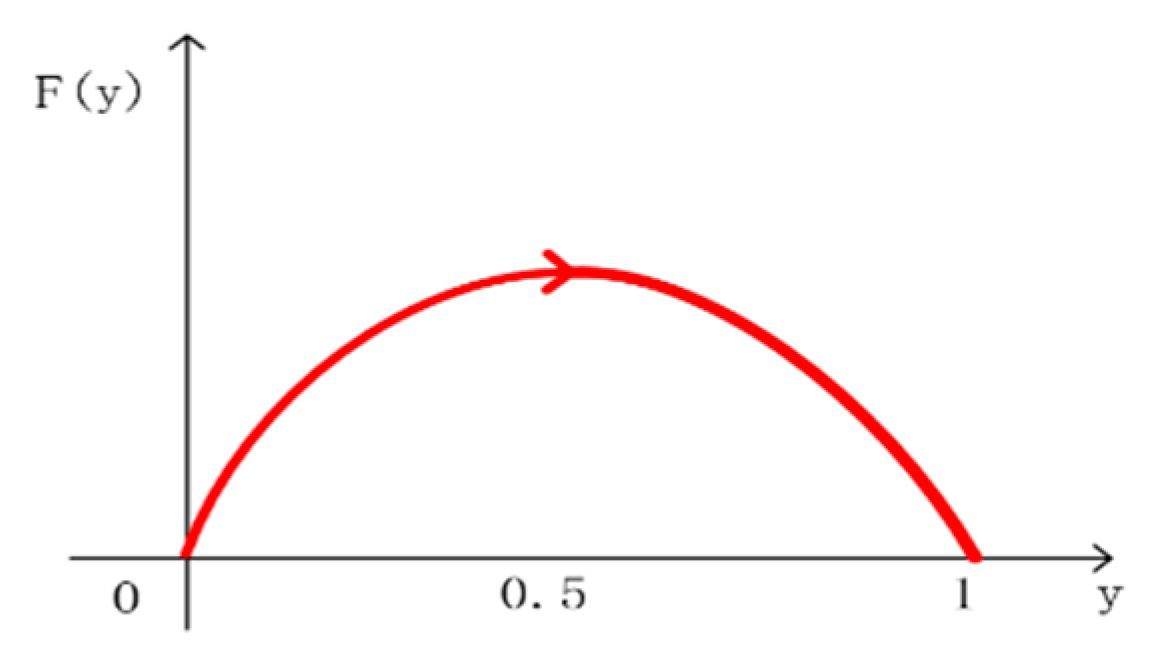

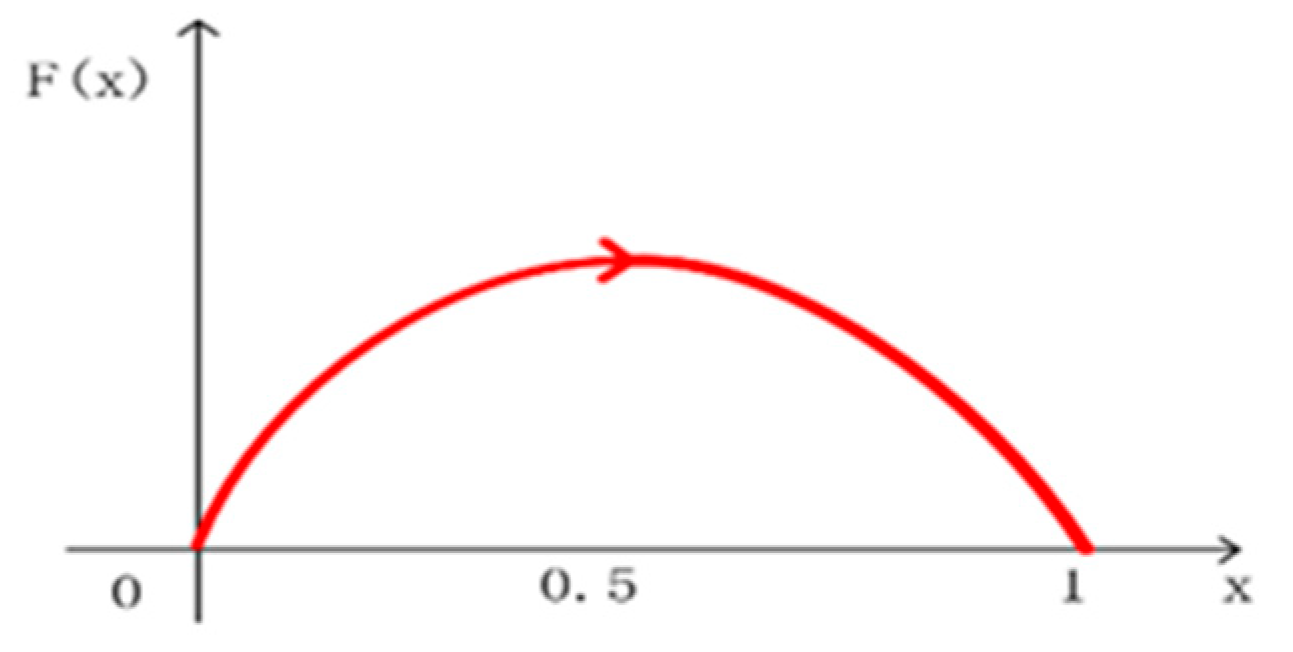

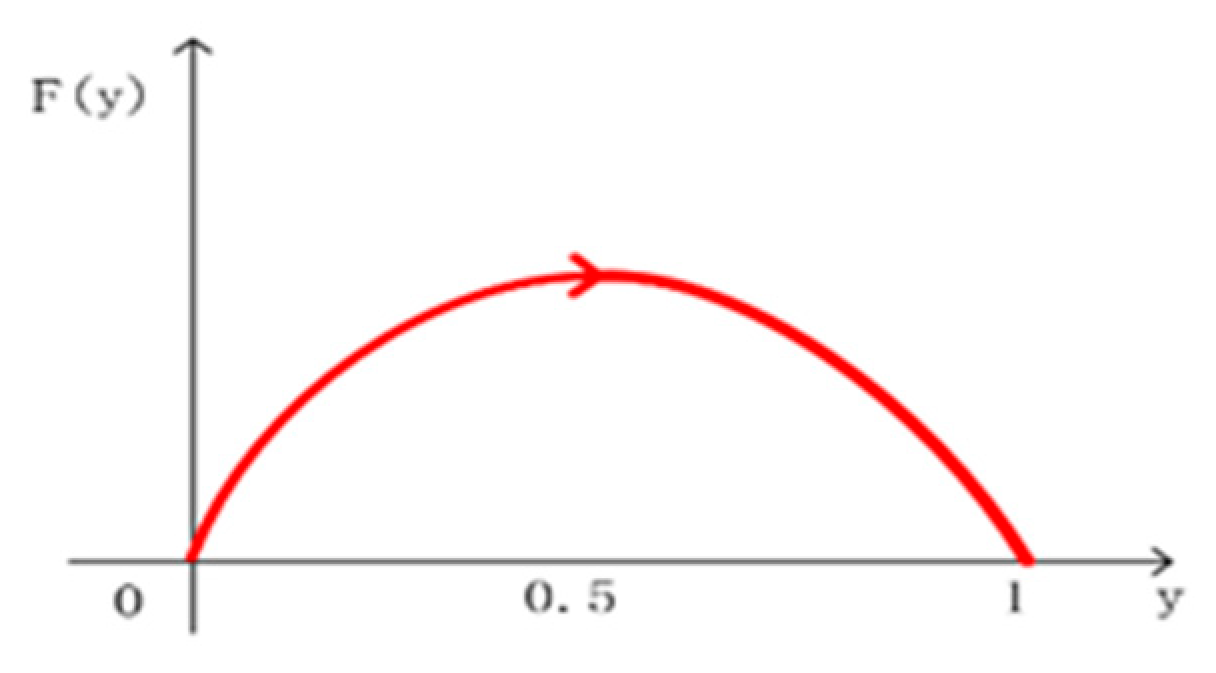

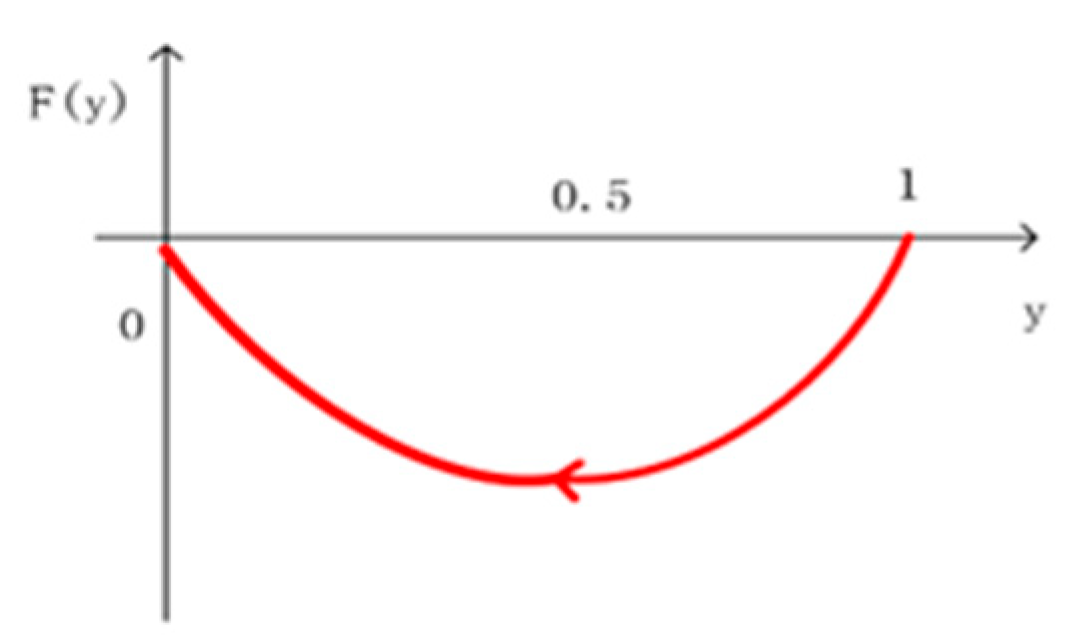

3.1. Evolutionary Game and Steady State of Minor Coarse Cereal Crowdfunders

- (1)

- Let F(y) = dy/dt = y(1 − y) {γP0Q0 + x [(P1 − P0) Q0 − (1 − α) C2]} = 0,then y1 = 0, y2 = 1, x* = −γP0Q0/[(P1 − P0) Q0 − (1 − α) C2],that is, when x* = −γP0Q0/[(P1 − P0) Q0 − (1 − α) C2],F(y) = 0, then at 0 ≤ y ≤ 1 all are in steady state. At this time, no matter which strategy and proportion are adopted for the MCC crowdfunder, the steady state shall not be changed with the time extended.

- (2)

- When x* ≠ −γP0Q0/[(P1 − P0) Q0 − (1 − α) C2],let F(y) = y (1 − y) {γP0Q0 + x [(P1 − P0) Q0 − (1 − α) C2]} = 0, then y*1 = 0, y*2 = 1 are two possible steady states.F(y) is derived to obtain F(y)’ = (1 − 2y) {γP0Q0 + x [(P1 − P0) Q0 − (1 − α) C2]}.(a) When (P1 − P0) Q0 − (1 − α) C2 > 0, {γP0Q0 + x [(P1 − P0) Q0 − (1 − α) C2]} > 0.Then, F(y)’ = (1 − 2y) {γP0Q0 + x [(P1 − P0) Q0 − (1 − α) C2]}, so F(1)’ < 0, F(0)’ > 0.Therefore, y = 1 is the evolutionary steady state, or ESS, indicating that the crowdfunding strategy will steadily evolve to normal crowdfunding when (P1 − P0) Q0 > (1 − α) C2.(b) When (P1 − P0) Q0 − (1 − α) C2 < 0, there exist two cases:When x > −γP0Q0/[(P1 − P0) Q0 − (1 − α) C2], {γP0Q0 + x [(P1 − P0) Q0 − (1 − α) C2]} < 0,and then F(1)’ > 0, F(0)’ < 0. Therefore, y = 0 is the evolutionary steady state or ESS, which means that the proportion of normal supply by growers is higher, and when it exceeds the critical point as follows:x* = −γP0Q0/[(P1 − P0) Q0 − (1 − α) C2], the crowdfunder will completely adopt the strategy of remorse crowdfunding. When x < −γP0Q0/[(P1 − P0) Q0 − (1 − α) C2], F(1)’ < 0, F(0)’ > 0,then y = 1 is the evolutionary steady state or ESS, and the strategy adopted by the small grain crowdfunder is steady as the normal crowdfunding. This shows that at (P1 − P0) Q0 < (1 − α) C2, the smaller the normal supply ratio x is, below the critical point, the crowdfunding of MCC will be interpreted as normal crowdfunding.

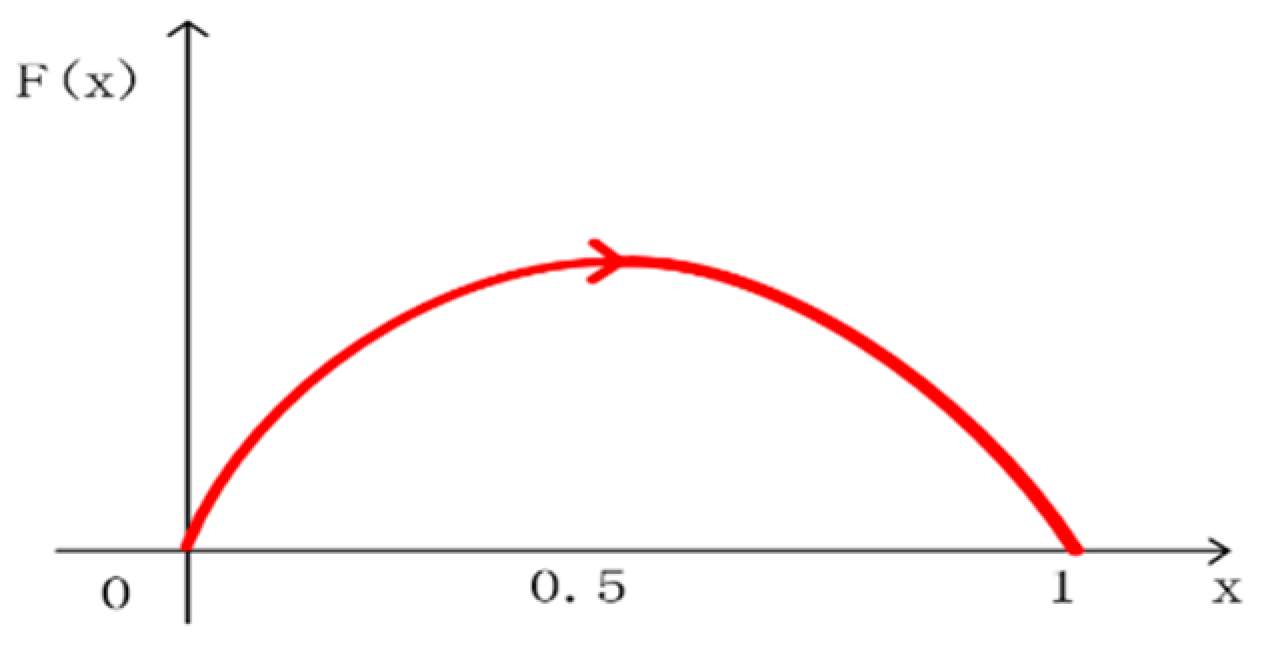

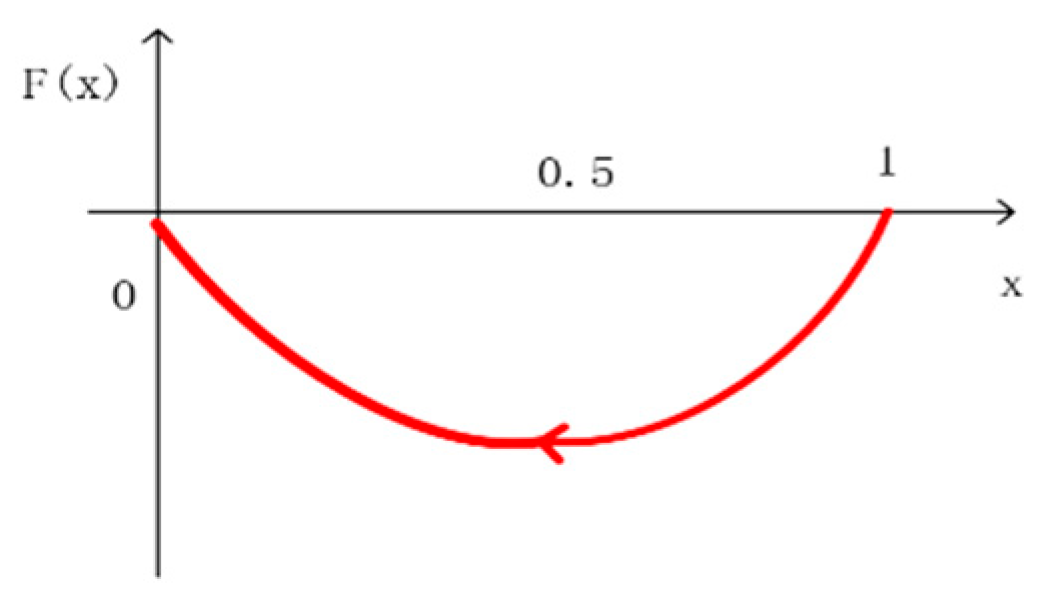

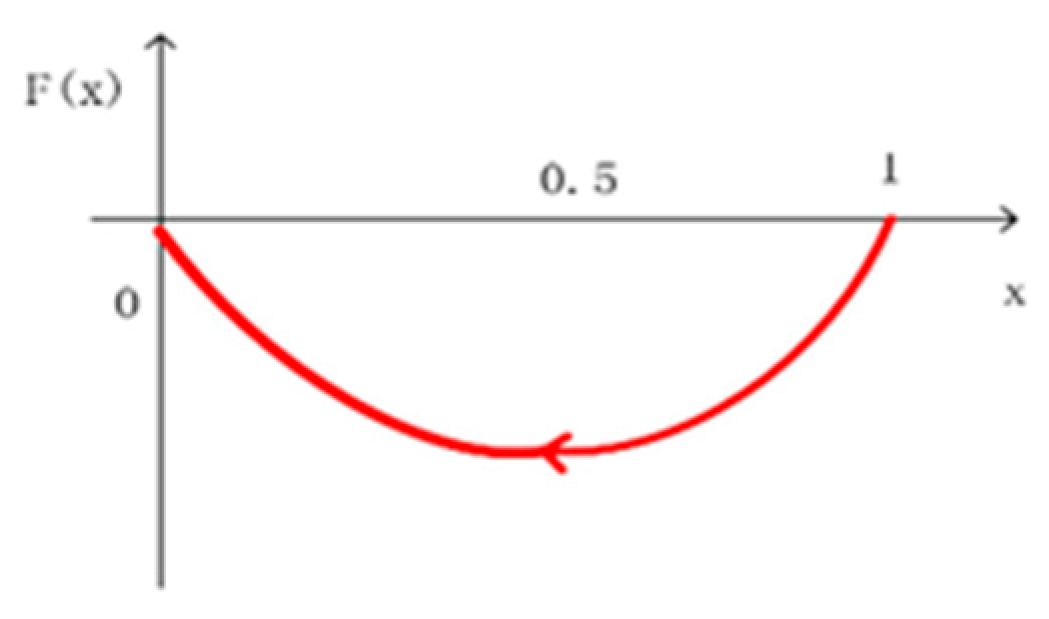

3.2. Evolutionary Game and Steady State of Minor Coarse Cereal Growers

- (1)

- Let F(x) = dx/dt = x (1 – x) [βP0Q0 + y (P0Q0 − αC2 − P1Q0)] = 0,then x1 = 0, x2 = 1, y* = −βP0Q0/[(P0Q0 − αC2 − P1Q0)],that is, when y*= −βP0Q0/[(P0Q0 − αC2 − P1Q0)],F(x) = 0, then at 0 ≤ x ≤ 1 all are in steady state. At this time, no matter which strategy and proportion are adopted for the MCC growers, the steady state shall not be changed with the time extended.

- (2)

- When y*≠ −βP0Q0/[(P0Q0 − αC2 − P1Q0)],let F(x) = x (1 − x)[βP0Q0 + y (P0Q0 − αC2 − P1Q0)] = 0,then x1 = 0, x2 = 1 are two possible steady states.F(x) is derived to obtain F(x)’ = (1 − 2x) [βP0Q0 + y (P0Q0 − αC2 − P1Q0)].It is expressed in two cases:(a) At (P0Q0 − αC2 − P1Q0) > 0:When F(x)’ = (1 − 2x) [βP0Q0 + y (P0Q0 − αC2 − P1Q0)],F(1)’ < 0 F(0)’ > 0. Therefore, x = 1 is the evolutionary steady state, or ESS, indicating that the grower’s strategy will steadily evolve to normal supply at (P0 − P1) Q0 > αC2.(b) At (P0Q0 − αC2 − P1Q0) < 0, there also exist two cases:At y > −βP0Q0/[(P0Q0 − αC2 − P1Q0)], F(x)’ = (1 − 2x) [βP0Q0 + y (P0Q0 − αC2 − P1Q0)], and then F(1)’ > 0, F(0) ’< 0.Therefore, x = 0 is the evolutionary steady state or ESS, which means that at (P0 − P1) Q0 < αC2, the proportion of normal crowdfunding is higher than the critical point y* = −βP0Q0/[(P0Q0 − αC2 − P1Q0)], and then the growers’ strategy will evolve to that of rejecting supply.At y < −βP0Q0/[(P0Q0 − αC2 − P1Q0)], F(1)’ < 0 F(0)’ > 0, then x = 1 is the evolutionary steady state or ESS, and the strategy adopted by the grower is stable as the normal supply. This shows that at (P0 − P1) Q0 < αC2, when the normal crowdfunding ratio is below the critical point y*, the strategy of growers shall evolve into that of normal supply.

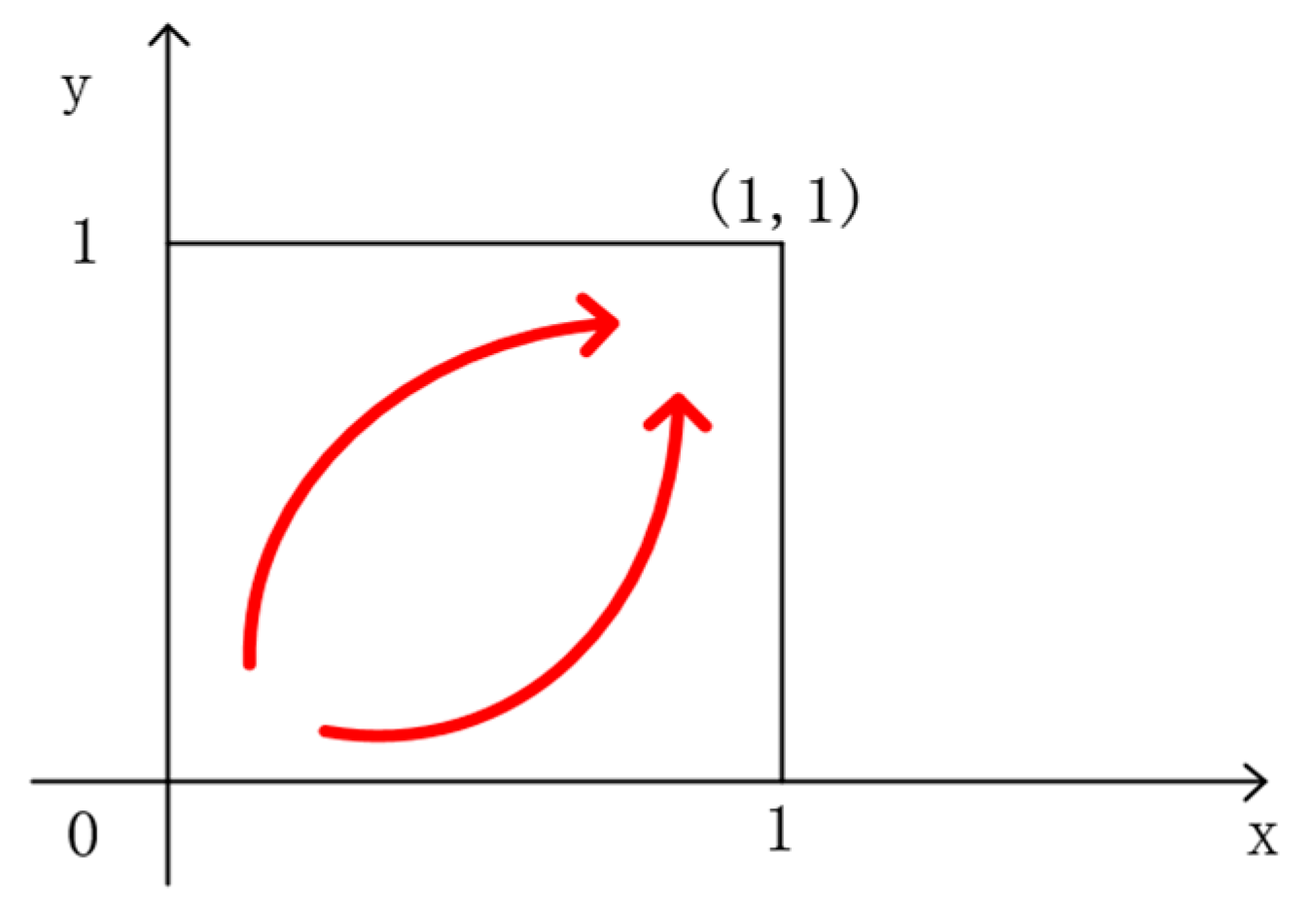

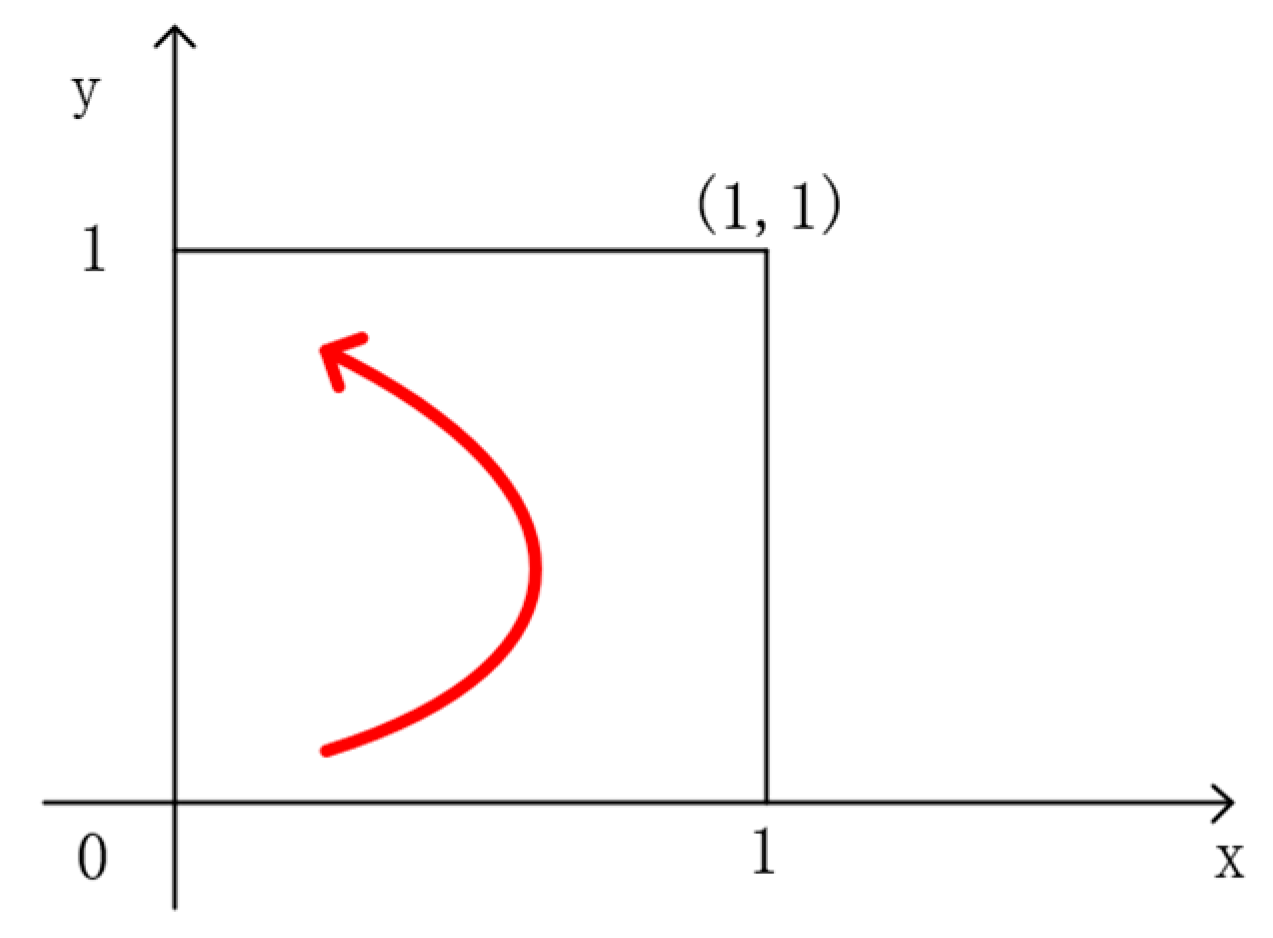

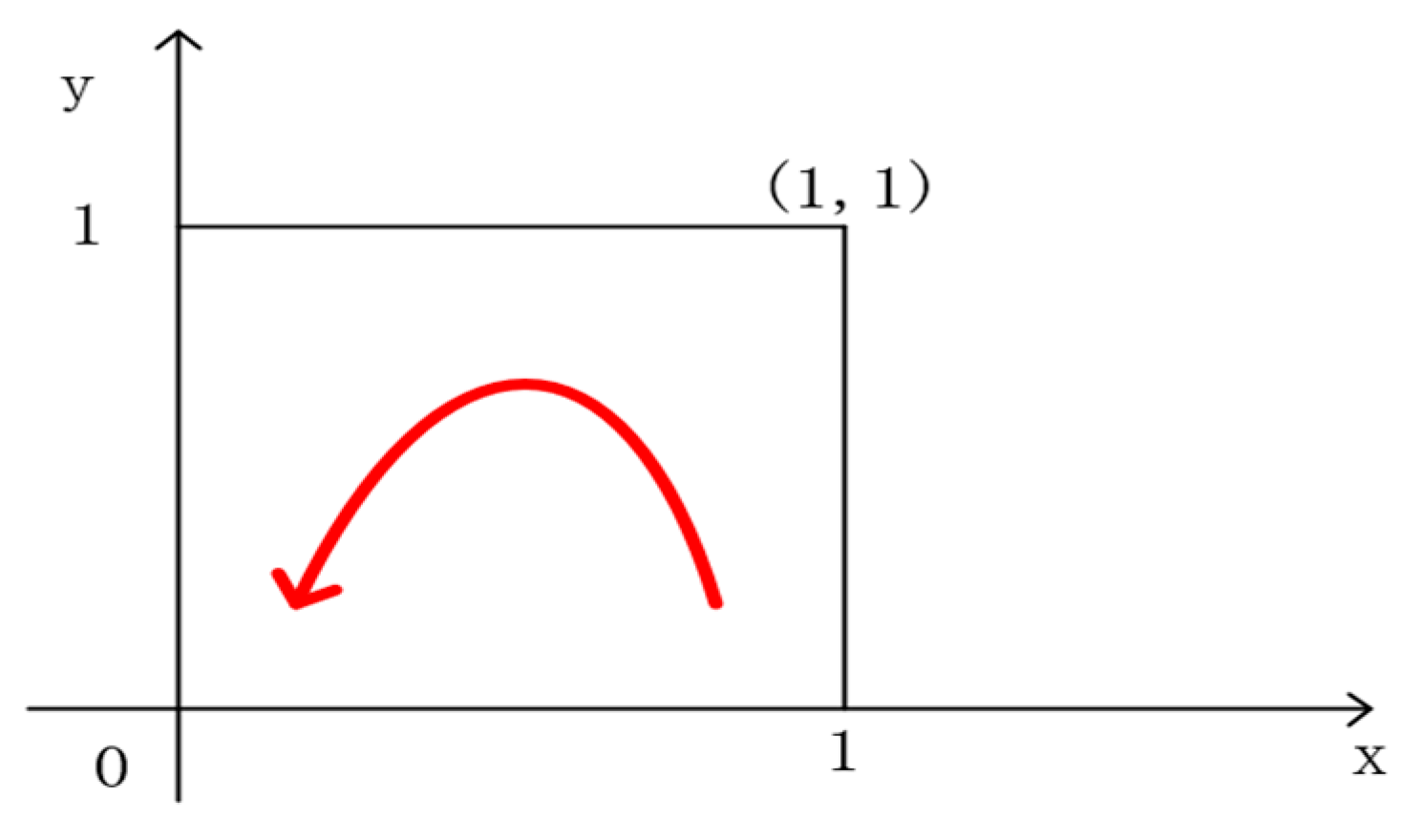

3.3. Combined Model Analysis

4. Analysis of Factors Influencing Evolutionary Game Equilibrium

5. System Design and Conclusions

5.1. System Design

5.2. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Ren, R.; He, J.; Dong, K.; Zhang, L.; Yang, T. Competitiveness Analysis and Countermeasure Suggestions of Small Grains Industry in Gansu Province. Chin. J. Agric. Resour. Reg. Plan. 2014, 8, 141–144. [Google Scholar]

- Wu, Y.H.; Guo, J. Analysis of Green Been Price Fluctutions and Trend. North. Hortic. 2016, 18, 196–201. [Google Scholar]

- Zhang, X.; Wang, L.X.; Liao, Y.C. Sustainable Development of Minor Food Crops in China. Sci. Agric. Sin. 2003, 12, 1595–1598. [Google Scholar]

- Schwienbacher, A.; Larralde, B. Crowdfunding of Small Entrepreneurial Ventures; Social Science Electronic Publishing: London, UK, 2010; Volume 9. [Google Scholar]

- Lambert, T.; Schwienbacher, A. An Empirical Aanalysis of Crowdfunding. Soc. Sci. Res. Netw. 2010, 1, 19–42. [Google Scholar]

- Bi, Y.; Tao, J. Research on Poverty Alleviation Mode Based on the Complementarity of Urban and Rural Resources and Its Realizing Path. Manag. World 2016, 8, 174–175. [Google Scholar]

- Xie, S. Economic Game Theory, 4th ed.; Fudan University Press: Shanghai, China, 2017; Volume 2, pp. 220–242. [Google Scholar]

- Xie, S.M. Evolutionary Game Theory under Bounded Rationality. J. Shanghai Univ. Financ. Econ. 2001, 3, 3–9. [Google Scholar]

- Belleflamme, P.; Lambert, T.; Schwienbacher, A. Crowdfunding: Tapping the Right Crowd. J. Bus. Ventur. 2014, 29, 585–609. [Google Scholar] [CrossRef]

- Stanko, M.A.; Henard, D.H. Toward a Better Understanding of Crowdfunding. Openness and the Consequences for Innovation. Res. Policy 2017, 4, 784–798. [Google Scholar] [CrossRef]

- Gerber, E.M.; Hui, J.; Kuo, P.Y. Crowdfunding: Why People are Motivated to Post and Fund Projects on Crowdfunding Platforms. In Proceedings of the International Workshop on Design, Influence, and Social Technologies: Techniques, Impacts and Ethics, Northwestern University Evanston, IL, USA, 2012; Volume 2, pp. 1–10. [Google Scholar]

- Bouncken, R.B.; Komorek, M.; Kraus, S. Crowdfunding: The Current State of Research. Int. J. Econ. Bus. Res. 2015, 14, 407–416. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, X. The Origin, Characteristics and Future of Agricultural Crowd-funding. J. China Agric. Univ. (Soc. Sci. Ed.) 2016, 12, 96–105. [Google Scholar]

- Chang, W.I. Exploring Crowdfunding Performance of Agricultural Ventures: Evidence from FlyingV in Taiwan. In International Conference on E-Infrastructure and E-Services for Developing Countries; Springer: Cham, Switzerland, 2018; Volume 12, pp. 165–273. [Google Scholar]

- Gerrit, K.C.; Ahlers, D.C.; Christina, G.D. Signaling in Equity Crowdfunding. Entrep. Theory Pract. 2015, 4, 955–980. [Google Scholar]

- Xiao, J.; Zhu, H.; Jin, J. Comparative Study and Optimal Selection of Agricultural Crowd-funding Platforms. Rural Econ. 2017, 1, 24–29. [Google Scholar]

- Agrawal, A.; Catalini, C.; Goldfarb, A. Some Simple Economics of Crowdfunding. Innov. Policy Econ. 2014, 1, 63–97. [Google Scholar] [CrossRef]

- Colombo, M.G.; Franzoni, C.; Rossi-Lamastra, C. Internal Social Capital and the Attraction of Early Contributions in Crowdfunding. Entrep. Theory Pract. 2015, 1, 75–100. [Google Scholar] [CrossRef]

- Lin, M.; Viswanathan, S. Home Bias in Online Investments: An Empirical Study of an Online Crowd funding Market. Manag. Sci. 2015, 5, 1393–1414. [Google Scholar] [CrossRef]

- Kshetri, N. Success of Crowd-based Online Technology in Fundraising: An Institutional Perspective. J. Int. Manag. 2015, 2, 100–116. [Google Scholar] [CrossRef]

- Blakley, C.D.; Keith, M.H.; Justin, W. Funders’ Positive Affective Reactions to Entrepreneurs’ Crowdfunding Pitches: The Influence of Perceived Product Creativity and Entrepreneurial Passion. J. Bus. Ventur. 2017, 1, 90–106. [Google Scholar]

- Chung, J.W.; Lee, K.M. A Long-Term Study of a Crowdfunding Platform: Predicting Project Success and Fundraising Amount. In Proceedings of the HT ’15 Proceedings of the 26th ACM Conference on Hypertext & Social Media, Guzelyurt, Northern Cyprus, 1–4 September 2015; Volume 9, pp. 211–220. [Google Scholar]

- Ordanini, A.; Miceli, L.; Pizzetti, M. Crowd-funding: Transforming Customers into Investors through Innovative Service Platforms. J. Serv. Manag. 2011, 4, 443–470. [Google Scholar] [CrossRef]

- Stanko, M.A.; Henard, D.H. How Crowdfunding Inuences Innovation. MIT Sloan Manag. Rev. 2016, 3, 14–18. [Google Scholar]

- Sheng, B.; Liu, Z.Y.; Khalid, U. The Inuence of Online Information on Investing Decisions of reward-based Crowdfunding. J. Bus. Res. 2017, 71, 10–18. [Google Scholar]

- Zheng, H.; Li, D.; Wu, J. The Role of Multidimensional Social Capital in Crowdfunding: A Comparative Study in China and US. Inf. Manag. 2014, 4, 488–496. [Google Scholar] [CrossRef]

- Gerber, E.M.; Hui, J. Crowdfunding: Motivations and Deterrents for Participation. ACM Trans. Comput. Hum. Interact. 2016, 6, 34. [Google Scholar] [CrossRef]

- Zvilichovsky, D.; Inbar, Y.; Barzilay, O. Playing Both Sides of the Market: Success and Reciprocity on Crowdfunding Platforms. Coller Sch. Manag. 2015, 11, 1–45. [Google Scholar] [CrossRef]

- Mollick, E. The Dynamics of Crowdfunding: An Exploratory Study. J. Bus. Ventur. 2014, 29, 1–16. [Google Scholar] [CrossRef]

- Huang, L.; Zhou, Q. Research on Heterogeneous Financing Incentive and Self-feedback Mechanism Design of Creative Crowdfunding. China Ind. Econ. 2014, 7, 135–147. [Google Scholar]

- Song, K.; Li, Y. Risk Analysis and Research on Crowdfunding Model from the Perspective of Crowdfunding Platform. Econ. Probl. 2016, 12, 47–51. [Google Scholar]

- Meer, J. Effects of the Price of Charitable Giving: Evidence from an Online Crowdfunding Platform. J. Econ. Behav. Organ. 2014, 103, 113–124. [Google Scholar] [CrossRef]

- Houston, A.I.; Mcnamara, J.M. John Maynard Smith and the Importance of Consistency in Evolutionary Game Theory. Biol. Philos. 2005, 20, 933. [Google Scholar] [CrossRef]

- Smith, J.M. The Theory of Games and the Evolution of Animal Conflicts. J. Theor. Biol. 1974, 47, 209–221. [Google Scholar] [CrossRef]

- Smith, J.M.; Price, G.R. The Logic of Animal Conflict. Nature 1973, 246, 15–18. [Google Scholar] [CrossRef]

- Friedman, D. On economic applications of evolutionary game theory. J. Evol. Econ. 1998, 8, 15–43. [Google Scholar] [CrossRef]

- Roca, C.P.; Cuesta, J.A.; Sánchez, A. Evolutionary game theory: Temporal and spatial effects beyond replicator dynamics. Phys. Life Rev. 2009, 4, 208–249. [Google Scholar] [CrossRef] [PubMed]

- Association, A.E. Corrigenda: Do People Play Nash Equilibrium? Lessons from Evolutionary Game Theory. J. Econ. Lit. 1998, 4, 1941. [Google Scholar]

- Dong, W.B.; Du, J.G.; Ren, J. Study on the Pioneering of Migrant Workers’ Returning Based on Evolutionary Game Theory. J. South China Agric. Univ. 2013, 12, 58–63. [Google Scholar]

- Ozkan-Canbolat, E.; Beraha, A.; Bas, A. Application of Evolutionary Game Theory to Strategic Innovation. Procedia-Soc. Behav. Sci. 2016, 235, 685–693. [Google Scholar] [CrossRef]

- Kuechle, G. Persistence and heterogeneity in entrepreneurship: An evolutionary game theoretic analysis. J. Bus. Ventur. 2011, 26, 458–471. [Google Scholar] [CrossRef]

- John, P.W. Mainstream Efforts to Tell a Better Story-Natural Selection as a Misplaced Metaphor: The Problem of Corporate Power. J. Econ. Issues 2010, 44, 991–1008. [Google Scholar]

- Liu, W.W.; Yang, J.N. The Evolutionary Game Theoretic Analysis for Sustainable Cooperation Relationship of Collaborative Innovation Network in Strategic Emerging Industries. Sustainability 2018, 10, 4585. [Google Scholar] [CrossRef]

- Shen, H.; Peng, Y.; Guo, C.X. Analysis of the Evolution Game of Construction and Demolition Waste Recycling Behavior Based on Prospect Theory under Environmental Regulation. Int. J. Environ. Res. Public Health 2018, 15, 1518. [Google Scholar] [CrossRef] [PubMed]

- Liu, Z.; Chen, M.C.; Chao-Liang, M.A. Perceived Value Structure of Investors and Pricing Strategy of Crowdfunding Products. Financ. Forum 2016, 5, 47–58. [Google Scholar]

- Chen, Y.T.; Zhang, R.; Liu, B. Decisions on Production and Pricing with Strategic Consumers for Green Crowdfunding Products. Int. J. Environ. Res. Public Health 2017, 9, 1090. [Google Scholar] [CrossRef] [PubMed]

- Strauss, R. Crowdfunding, Demand Uncertainty and Moral Hazard: A Mechanism Design Approach; Sfb 649 Discussion Paper; Humboldt University: Berlin, Germany, 2015; Volume 7. [Google Scholar]

- He, J.; Zhang, L.; Fu, X.; Tsai, F.-S. Fair but Risky? Recycle Pricing Strategies in Closed-Loop Supply Chains. Int. J. Environ. Res. Public Health 2018, 15, 2870. [Google Scholar]

| Stakeholders | Symbol | Description |

|---|---|---|

| MCC growers | Us | The benefits of normal supply |

| Ur | The benefits of rejecting supply | |

| Ua | The average benefits of mixed normal supply and rejecting supply | |

| X | Normal supply; the supply according to crowdfunding transactions | |

| 1-X | Rejecting supply; not supply of the crowdfunding transactions | |

| crowdfunders | Uc | The benefits of normal crowdfunding |

| Uw | The benefits of remorse crowdfunding | |

| Ue | The average benefits of mixed normal crowdfunding and remorse crowdfunding | |

| Y | Normal crowdfunding; buying according to crowdfunding transactions | |

| 1-Y | Remorse crowdfunding; not buying of the crowdfunding transactions |

| Crowdfunders | |||

|---|---|---|---|

| Normal Crowdfunding: y | Remorse Crowdfunding: (1 − y) | ||

| Growers | normal supply: x | P0Q0 + P1(Q1 − Q0) − C1 − αC2, (P1 − P0)Q0 − (1 − α)C2 | P1Q1 + γP0Q0 − C1, −γP0Q0 |

| rejecting supply: (1 − x) | P1Q1 − βP0Q0 − C1, βP0Q0 | P1Q1 − βP0Q0 − C1 + γP0Q0, −γP0Q0 + βP0Q0 | |

| Equilibrium Point | Trace Symbol | Determinant Symbol | Equilibrium Results |

|---|---|---|---|

| (0,0) | + | + | Unstable |

| (0,1) | − | Saddle point | |

| (1,0) | − | Saddle point | |

| (1,1) | − | + | ESS |

| (x*,y*) | 0 | − | Saddle point |

| Equilibrium Point | Trace Symbol | Determinant Symbol | Equilibrium Results |

|---|---|---|---|

| (0,0) | + | + | Unstable |

| (0,1) | − | Saddle point | |

| (1,0) | − | + | ESS |

| (1,1) | − | Saddle point | |

| (x*,y*) | 0 | − | Saddle point |

| Equilibrium Point | Trace Symbol | Determinant Symbol | Equilibrium Results |

|---|---|---|---|

| (0,0) | + | + | Unstable |

| (0,1) | − | + | ESS |

| (1,0) | − | Saddle point | |

| (1,1) | − | Saddle point | |

| (x*,y*) | 0 | − | Saddle point |

| Equilibrium Point | Trace Symbol | Determinant Symbol | Equilibrium Results |

|---|---|---|---|

| (0,0) | + | + | Unstable |

| (0,1) | − | − | Unstable |

| (1,0) | + | Saddle point | |

| (1,1) | + | + | Unstable |

| (x*,y*) | 0 | − | Saddle point |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, Z.; Hafeez, M.; Liu, L.; Mahmood, M.T.; Wu, H. Evaluating the Minor Coarse Cereals Product Crowdfunding Platform through Evolutionary Game Analysis. Sustainability 2019, 11, 1299. https://doi.org/10.3390/su11051299

Yu Z, Hafeez M, Liu L, Mahmood MT, Wu H. Evaluating the Minor Coarse Cereals Product Crowdfunding Platform through Evolutionary Game Analysis. Sustainability. 2019; 11(5):1299. https://doi.org/10.3390/su11051299

Chicago/Turabian StyleYu, Zhiyuan, Muhammad Hafeez, Lihan Liu, Muhammad Tariq Mahmood, and Hong Wu. 2019. "Evaluating the Minor Coarse Cereals Product Crowdfunding Platform through Evolutionary Game Analysis" Sustainability 11, no. 5: 1299. https://doi.org/10.3390/su11051299

APA StyleYu, Z., Hafeez, M., Liu, L., Mahmood, M. T., & Wu, H. (2019). Evaluating the Minor Coarse Cereals Product Crowdfunding Platform through Evolutionary Game Analysis. Sustainability, 11(5), 1299. https://doi.org/10.3390/su11051299