The Moderating Effect of R&D Investment on Income and Carbon Emissions in China: Direct and Spatial Spillover Insights

Abstract

:1. Introduction

2. Literature Review

3. Methodology and Data Definitions

3.1. Panel Data Model

3.2. Spatial Durbin Panel Model

3.3. Data Definitions

4. Empirical Results and Discussions

4.1. Model Tests

4.1.1. Test for Stationarity

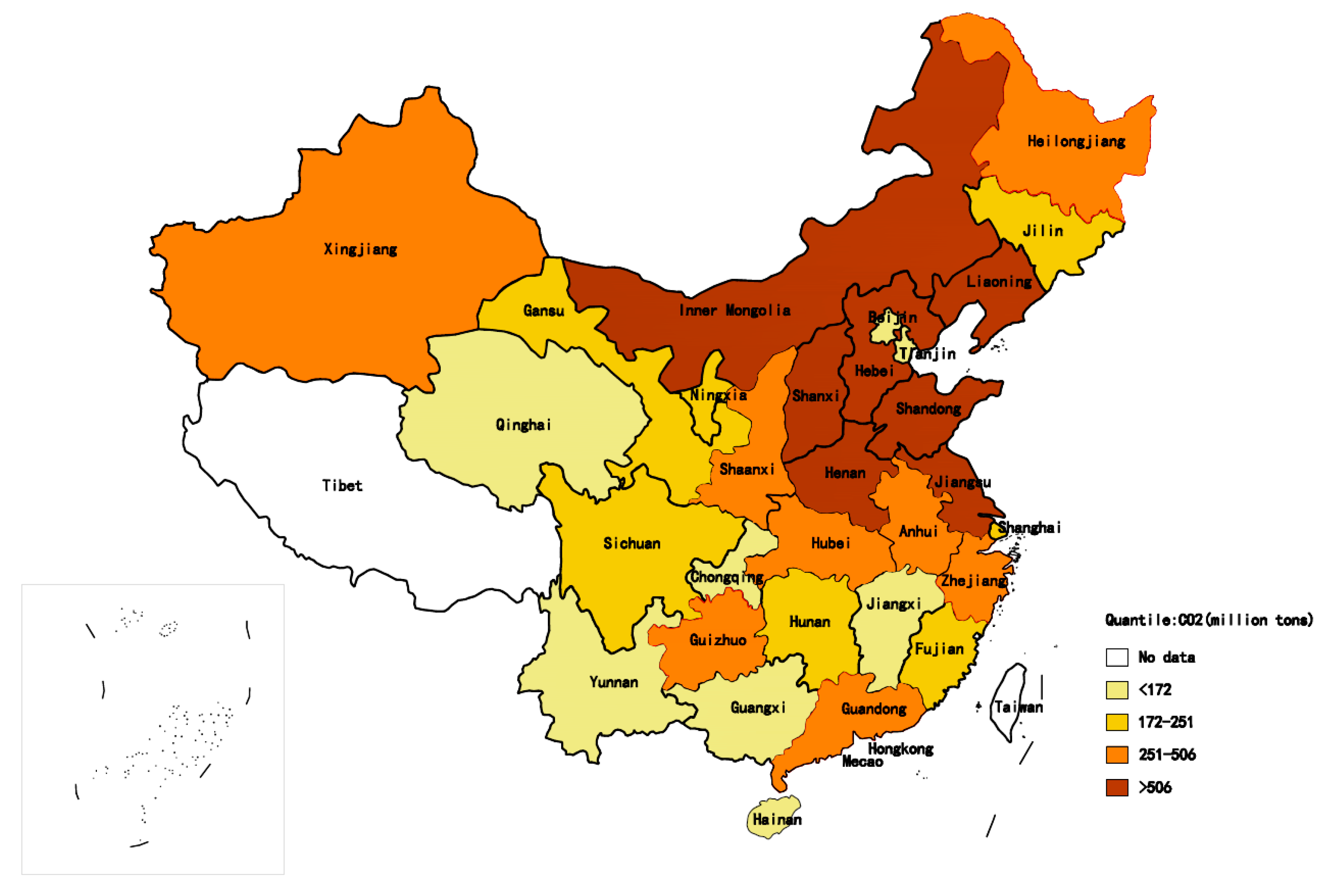

4.1.2. Test for Spatial Dependence of Provincial Carbon Emissions

4.2. Regression Results with Spatial Effects

4.2.1. Direct Moderating Effects of R&D Investment

4.2.2. Spatial Spillover Moderating Effect of R&D Investment

4.2.3. Direct and Spatial Spillover Effects of Other Influencing Factors

- (1)

- Coal consumption is the main driving force in increasing local carbon emissions, while the spatial spillover effect of energy structure on neighboring carbon emissions is insignificant. Specifically, the direct effects in Table 6 show a 1% decrease in the coal consumption/total energy consumption leads to an approximate 1.17% (1.14%) decrease in local carbon emissions (per capita), with other conditions unchanged. These results are similar to those of Zhang et al. [59] who also find coal consumption has a major positive effect on carbon emissions. This is because China’s energy supply mainly depends on coal, and coal consumption is the main source of energy-related carbon emissions in China. However, the spatial spillover effects of energy structure in Models 3–4 are not significant.

- (2)

- FDI contributes to constraining both local and neighboring carbon emissions. Specifically, the direct effects of FDI are significantly negative (approximately −0.06 and −0.09) in Model 3 and Model 4, respectively, and the spatial spillover effects are both significantly negative in Models 3 and 4. FDI reduces carbon emissions by introducing advanced technologies of energy conservation, and promoting the technological progress of enterprises. As is explained by Wang et al. [60], if each region can introduce more advanced technologies and more investment from environmental enterprises, FDI can have a positive effect on upgrading the environment performance. This result is also supported by Zhou et al. [61], who found that FDI reduces carbon emissions when analyzing the relationship between industrial structural transformation and carbon dioxide emissions in China.

- (3)

- Patents have an impact on constraining both local and neighboring carbon emissions. The direct effect of patents is significantly negative in both Model 3 and Model 4 at approximately −0.06. The spillover effects of patents are significantly negative in both Model 3 and Model 4, indicating that a province’s patents increase can constrain carbon emissions (per capita) in its neighboring provinces. The application of technological output can improve energy efficiency to some extent and has a negative impact on carbon emissions.

4.3. Robust Analysis for the Moderating Effect of R&D Investment

5. Conclusions and Policy Implications

- (1)

- R&D investment constrains the positive effects of income on local carbon emissions. The corresponding income level of the turning point in local carbon emissions depends on R&D investment, and more R&D investment results in carbon emissions reaching a turning point earlier. Income contributes to the increase in local carbon emissions, but the impact is restrained by R&D investment, with R&D investment moderating the impact even to the opposite direction.

- (2)

- R&D investment in local provinces generally increases the positive influence of local income on neighboring carbon emissions, because the carbon emissions transfer effect driven by R&D investment plays the dominate role rather than the knowledge spillover effect.

- (3)

- The proportion of coal consumption to total energy consumption is the main driver of local carbon emissions. FDI and patents generally constrain carbon emissions not only in local provinces but also in neighboring provinces.

Author Contributions

Funding

Conflicts of Interest

References

- Zhang, Y.J.; Liu, Z.; Zhang, H.; Tan, T.D. The impact of economic growth, industrial structure and urbanization on carbon emission intensity in China. Nat. Hazards 2014, 73, 579–595. [Google Scholar] [CrossRef]

- Ma, C.; Stern, D.I. China’s changing energy intensity trend: A decomposition analysis. Energy Econ. 2008, 30, 1037–1053. [Google Scholar] [CrossRef]

- Liu, Q.; Wang, Q. Sources and flows of China’s virtual SO2 emission transfers embodied in interprovincial trade: A multiregional input–output analysis. J. Clean. Prod. 2017, 161, 735–747. [Google Scholar] [CrossRef]

- Jiao, J.; Jiang, G.; Yang, R. Impact of R&D technology spillovers on carbon emissions between China’s regions. Struct. Chang. Econ. Dyn. 2018, 47, 35–45. [Google Scholar]

- Huang, J.; Du, D.; Tao, Q. An analysis of technological factors and energy intensity in China. Energy Policy 2017, 109, 1–9. [Google Scholar] [CrossRef]

- Huang, J.; Hao, Y.; Lei, H. Indigenous versus foreign innovation and energy intensity in China. Renew. Sustain. Energy Rev. 2018, 81, 1721–1729. [Google Scholar] [CrossRef]

- Ghisetti, C.; Pontoni, F. Investigating policy and R&D effects on environmental innovation: A meta-analysis. Ecol. Econ. 2015, 118, 57–66. [Google Scholar]

- Kaya, Y. Impact of Carbon Dioxide Emission Control on GNP Growth: Interpretation of Proposed Scenarios; Intergovernmental Panel on Climate Change/Response Strategies Working Group: Pairs, France, May 1989.

- Ehrlich, P.R.; Holdren, J.P. Impact of population growth. Science 1971, 171, 1212–1217. [Google Scholar] [CrossRef] [PubMed]

- Yin, J.; Zheng, M.; Chen, J. The effects of environmental regulation and technical progress on CO2 Kuznets curve: An evidence from China. Energy Policy 2015, 77, 97–108. [Google Scholar] [CrossRef]

- Stern, D.I. The rise and fall of the environmental Kuznets curve. World Dev. 2004, 32, 1419–1439. [Google Scholar] [CrossRef]

- Narayan, P.K.; Narayan, S. Carbon dioxide emissions and economic growth: Panel data evidence from developing countries. Energy Policy 2010, 38, 661–666. [Google Scholar] [CrossRef]

- Agras, J.; Chapman, D. A dynamic approach to the Environmental Kuznets Curve hypothesis. Ecol. Econ. 1999, 28, 267–277. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. Industrial structure, technical progress and carbon intensity in China’s provinces. Renew. Sustain. Energy Rev. 2018, 81, 2935–2946. [Google Scholar] [CrossRef]

- Fan, Y.; Liu, L.C.; Wu, G.; Wei, Y.M. Analyzing impact factors of CO2 emissions using the STIRPAT model. Environ. Impact Assess. Rev. 2006, 26, 377–395. [Google Scholar] [CrossRef]

- Liu, Y.; Zhou, Y.; Wu, W. Assessing the impact of population, income and technology on energy consumption and industrial pollutant emissions in China. Appl. Energy 2015, 155, 904–917. [Google Scholar] [CrossRef]

- Albino, V.; Ardito, L.; Dangelico, R.M.; Petruzzelli, A.M. Understanding the development trends of low-carbon energy technologies: A patent analysis. Appl. Energy 2014, 135, 836–854. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Sheau-Ting, L. Econometric analysis of trade, exports, imports, energy consumption and CO2 emission in six regions. Renew. Sustain. Energy Rev. 2014, 33, 484–498. [Google Scholar] [CrossRef]

- Lee, J.W. The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 2013, 55, 483–489. [Google Scholar] [CrossRef]

- Huang, J.; Liu, Q.; Cai, X.; Hao, Y.; Lei, H. The effect of technological factors on China’s carbon intensity: New evidence from a panel threshold model. Energy Policy 2018, 115, 32–42. [Google Scholar] [CrossRef]

- Yang, Y.; Cai, W.; Wang, C. Industrial CO2 intensity, indigenous innovation and R&D spillovers in China’s provinces. Appl. Energy 2014, 131, 117–127. [Google Scholar]

- Kaika, D.; Zervas, E. The environmental Kuznets curve (EKC) theory. Part B: Critical issues. Energy Policy 2013, 62, 1403–1411. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. The emissions reduction effect and technical progress effect of environmental regulation policy tools. J. Clean. Prod. 2017, 149, 191–205. [Google Scholar] [CrossRef]

- Hao, Y.; Liu, Y.M. The influential factors of urban PM2.5 concentrations in China: A spatial econometric analysis. J. Clean. Prod. 2016, 112, 1443–1453. [Google Scholar] [CrossRef]

- Burnett, J.W.; Bergstrom, J.C.; Dorfman, J.H. A spatial panel data approach to estimating US state-level energy emissions. Energy Econ. 2013, 40, 396–404. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. Identifying the spatial effects and driving factors of urban PM2.5 pollution in China. Ecol. Indic. 2017, 82, 61–75. [Google Scholar] [CrossRef]

- Hao, Y.; Liu, Y.; Weng, J.H.; Gao, Y. Does the Environmental Kuznets Curve for coal consumption in China exist? New evidence from spatial econometric analysis. Energy 2016, 114, 1214–1223. [Google Scholar] [CrossRef]

- Li, L.; Hong, X.; Peng, K. A spatial panel analysis of carbon emissions, economic growth and high-technology industry in China. Struct. Chang. Econ. Dyn. 2018. [Google Scholar] [CrossRef]

- Yang, Y.; Zhou, Y.; Poon, J.; He, Z. China’s carbon dioxide emission and driving factors: A spatial analysis. J. Clean. Prod. 2019, 211, 640–651. [Google Scholar] [CrossRef]

- Guo, J.; Zhang, Z.; Meng, L. China’s provincial CO2 emissions embodied in international and interprovincial trade. Energy Policy 2012, 42, 486–497. [Google Scholar] [CrossRef]

- Zhang, Z.; Guo, J.; Hewings, G.J.D. The effects of direct trade within China on regional and national CO2 emissions. Energy Econ. 2014, 46, 161–175. [Google Scholar] [CrossRef]

- Wu, A.; Li, G.; Sun, T.; Liang, Y. Effects of industrial relocation on Chinese regional economic growth disparities: Based on system dynamics modeling. Chin. Geogr. Sci. 2014, 24, 706–716. [Google Scholar] [CrossRef]

- Xu, J.; Zhang, M.; Zhou, M.; Li, H. An empirical study on the dynamic effect of regional industrial carbon transfer in China. Ecol. Indic. 2017, 73, 1–10. [Google Scholar] [CrossRef]

- Sun, L.; Wang, Q.; Zhou, P.; Cheng, F. Effects of carbon emission transfer on economic spillover and carbon emission reduction in China. J. Clean. Prod. 2016, 112, 1432–1442. [Google Scholar] [CrossRef]

- Liobikienė, G.; Butkus, M. Environmental Kuznets Curve of greenhouse gas emissions including technological progress and substitution effects. Energy 2017, 135, 237–248. [Google Scholar] [CrossRef]

- Dietz, T.; Rosa, E.A. Effects of population and affluence on CO2 emissions. Proc. Natl. Acad. Sci. USA 1997, 94, 175–179. [Google Scholar] [CrossRef] [PubMed]

- Shao, S.; Yang, L.; Yu, M.; Yu, M. Estimation, characteristics, and determinants of energy-related industrial CO2 emissions in Shanghai (China), 1994–2009. Energy Policy 2011, 39, 6476–6494. [Google Scholar] [CrossRef]

- York, R.; Rosa, E.A.; Dietz, T. STIRPAT, IPAT and ImPACT: Analytic tools for unpacking the driving forces of environmental impacts. Ecol. Econ. 2003, 46, 351–365. [Google Scholar] [CrossRef]

- Iwata, H.; Okada, K.; Samreth, S. A note on the environmental Kuznets curve for CO2: A pooled mean group approach. Appl. Energy 2011, 88, 1986–1996. [Google Scholar] [CrossRef]

- Yuan, J.; Xu, Y.; Hu, Z.; Zhao, C.; Xiong, M.; Guo, J. Peak energy consumption and CO2 emissions in China. Energy Policy 2014, 68, 508–523. [Google Scholar] [CrossRef]

- He, J.; Wang, H. Economic structure, development policy and environmental quality: An empirical analysis of environmental Kuznets curves with Chinese municipal data. Ecol. Econ. 2012, 76, 49–59. [Google Scholar] [CrossRef]

- Wang, P.; Wu, W.; Zhu, B.; Wei, Y. Examining the impact factors of energy-related CO2 emissions using the STIRPAT model in Guangdong Province, China. Appl. Energy 2013, 106, 65–71. [Google Scholar] [CrossRef]

- Zhao, C.; Chen, B.; Hayat, T.; Alsaedi, A.; Ahmad, B. Driving force analysis of water footprint change based on extended STIRPAT model: Evidence from the Chinese agricultural sector. Ecol. Indic. 2014, 47, 43–49. [Google Scholar] [CrossRef]

- Ren, S.; Yuan, B.; Ma, X.; Chen, X. The impact of international trade on China’s industrial carbon emissions since its entry into WTO. Energy Policy 2014, 69, 624–634. [Google Scholar] [CrossRef]

- Wang, C.; Wang, F.; Zhang, X.; Yang, Y.; Su, Y.; Ye, Y.; Zhang, H. Examining the driving factors of energy related carbon emissions using the extended STIRPAT model based on IPAT identity in Xinjiang. Renew. Sustain. Energy Rev. 2017, 67, 51–61. [Google Scholar] [CrossRef]

- Burridge, P. Testing for a common factor in a spatial autoregression model. Environ. Plan. A 1981, 13, 795–800. [Google Scholar] [CrossRef]

- Lesage, J.; Pace, R.K. Introduction to Spatial Econometrics; CRC Press: New York, NY, USA, 2009; Available online: https://journals.openedition.org/rei/pdf/3887.

- Elhorst, J.P. Spatial Econometrics: From Cross-Sectional Data to Spatial Panels; Springer: Berlin, Germany, 2014. [Google Scholar]

- Huang, Y. Drivers of rising global energy demand: The importance of spatial lag and error dependence. Energy 2014, 76, 254–263. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Hao, J.F.; Song, J. The CO2 emission efficiency, reduction potential and spatial clustering in China’s industry: Evidence from the regional level. Appl. Energy 2016, 174, 213–223. [Google Scholar] [CrossRef]

- Eggleston, H.S.; Buendia, L.; Miwa, K.; Ngara, T.; Tanabe, K. IPCC Guidelines for National Greenhouse Gas Inventories; Institute for Global Environmental Strategies: Hayama, Japan, 2006; Volume 2, pp. 48–56. [Google Scholar]

- Zhang, Y.J.; Da, Y.B. The decomposition of energy-related carbon emission and its decoupling with economic growth in China. Renew. Sustain. Energy Rev. 2015, 41, 1255–1266. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Liddle, B.; Lung, S. Revisiting energy consumption and GDP causality: Importance of a priori hypothesis testing, disaggregated data, and heterogeneous panels. Appl. Energy 2015, 142, 44–55. [Google Scholar] [CrossRef]

- Huang, Q.; Chand, S. Spatial spillovers of regional wages: Evidence from Chinese provinces. China Econ. Rev. 2015, 32, 97–109. [Google Scholar] [CrossRef]

- Kang, Y.Q.; Zhao, T.; Yang, Y.Y. Environmental Kuznets curve for CO2 emissions in China: A spatial panel data approach. Ecol. Indic. 2016, 63, 231–239. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; Cambridge Working Papers in Economics; Institute for the Study of Labor (IZA): Bonn, Germany, 2004; Volume 69, p. 1240. [Google Scholar]

- Liu, L.C.; Fan, Y.; Wu, G.; Wei, Y.M. Using LMDI method to analyze the change of China’s industrial CO2 emissions from final fuel use: An empirical analysis. Energy Policy 2007, 35, 5892–5900. [Google Scholar] [CrossRef]

- Zhang, Q.; Yang, J.; Sun, Z.; Wu, F. Analyzing the impact factors of energy-related CO2 emissions in China: What can spatial panel regressions tell us? J. Clean. Prod. 2017, 161, 1085–1093. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, B.; Liu, T. Empirical analysis on the factors influencing national and regional carbon intensity in China. Renew. Sustain. Energy Rev. 2016, 55, 34–42. [Google Scholar] [CrossRef]

- Zhou, X.; Zhang, J.; Li, J. Industrial structural transformation and carbon dioxide emissions in China. Energy Policy 2013, 57, 43–51. [Google Scholar] [CrossRef]

| Variables | Definitions | Sources | Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|---|---|

| Carbon emissions related to the final consumption of coal, oil, and natural gas | 1999–2016 China Statistical Yearbook | 23,204.51 | 17,649.08 | 108,179.15 | 454.95 | 18,905.80 | 1.57 | 5.58 | |

| Carbon emissions per capita, carbon emissions/population | 1999–2016 China Statistical Yearbook | 1.58 | 1.58 | 3.38 | −0.50 | 0.70 | −0.07 | 3.18 | |

| GDP per capita | 1999–2016 China Statistical Yearbook | 20,523.34 | 16,386.36 | 73,442.18 | 2781.18 | 14,575.44 | 1.34 | 4.47 | |

| Population | 1999–2016 China Statistical Yearbook | 4337.81 | 3811.50 | 10,849.00 | 503.00 | 2618.73 | 0.56 | 2.45 | |

| R&D investment | 1999–2016 China Statistical Yearbook | 132.47 | 55.20 | 1225.31 | 0.82 | 199.80 | 2.77 | 11.59 | |

| R&D investment per capita, R&D investment/population | 1999–2016 China Statistical Yearbook | −4.25 | −4.24 | −0.84 | −7.82 | 1.32 | 0.18 | 2.67 | |

| Number of accepted patents | 1999–2016 China Statistical Yearbook | 28,730.64 | 7239.00 | 504,500.00 | 124.00 | 60,541.82 | 4.43 | 26.68 | |

| Actually utilized foreign direct investment (FDI) | 1999–2016 Provincial Statistical Yearbook | 261.63 | 133.39 | 1578.55 | 0.48 | 327.30 | 1.84 | 6.09 | |

| FDI per capita, FDI/population | 1999–2016 Provincial Statistical Yearbook | −3.57 | −3.41 | −0.49 | −7.35 | 1.49 | −0.30 | 2.41 | |

| Added value of Service industry/GDP | 1999–2016 China Statistical Yearbook | 0.41 | 0.40 | 0.80 | 0.28 | 0.08 | 2.40 | 10.64 | |

| Coal consumption/total energy consumption | 1999–2016 China Statistical Yearbook | 0.66 | 0.65 | 1.02 | 0.12 | 0.19 | −0.02 | 2.39 |

| Variable | Without Intercepts or Trends | Individual-Specific Intercepts | Incidental linear Trends |

|---|---|---|---|

| −1.045 | −2.486 *** | −2.656 * | |

| −3.659 *** | −3.865 *** | −4.019 *** | |

| −1.005 | −2.457 *** | −2.697 ** | |

| −3.664 *** | −3.926 *** | −4.071 *** | |

| −0.287 | −1.803 | −1.927 | |

| −2.443 *** | −2.502 *** | −2.865 *** | |

| −0.748 | −2.055 | −2.014 | |

| −2.875 *** | −3.126 *** | −3.516 *** | |

| −0.903 | −2.333 ** | −2.538 | |

| −3.828 *** | −3.865 *** | −3.946 *** | |

| −1.181 | −2.017 | −2.240 | |

| −3.740 *** | −3.918 *** | −4.115 *** | |

| −0.870 | −1.311 | −2.036 | |

| −3.080 *** | −3.270 *** | −3.445 *** | |

| −0.944 | −2.397 | −2.465 | |

| −3.448 *** | −3.506 *** | −3.611 *** | |

| −1.342 | −2.618 ** | −2.518 | |

| −3.528 *** | −3.630 *** | −3.840 *** | |

| −1.031 | −0.795 | −1.611 | |

| −2.400 *** | −2.559 *** | −2.884 *** | |

| −1.457 | −2.086 * | −1.958 | |

| −3.332 *** | −3.182 *** | −3.386 *** |

| Year | Moran’s I | Z | p Value |

|---|---|---|---|

| 1998 | 0.2550 | 2.6060 | 0.0090 |

| 1999 | 0.2980 | 2.9710 | 0.0030 |

| 2000 | 0.2710 | 2.7410 | 0.0060 |

| 2001 | 0.3140 | 3.1170 | 0.0020 |

| 2002 | 0.3120 | 3.1120 | 0.0020 |

| 2003 | 0.2820 | 2.8520 | 0.0040 |

| 2004 | 0.3240 | 3.2120 | 0.0010 |

| 2005 | 0.3610 | 3.5720 | 0.0000 |

| 2006 | 0.3440 | 3.4420 | 0.0010 |

| 2007 | 0.3500 | 3.4800 | 0.0010 |

| 2008 | 0.3510 | 3.5220 | 0.0000 |

| 2009 | 0.3270 | 3.2990 | 0.0010 |

| 2010 | 0.3230 | 3.2590 | 0.0010 |

| 2011 | 0.3270 | 3.2510 | 0.0010 |

| 2012 | 0.3130 | 3.1450 | 0.0020 |

| 2013 | 0.3320 | 3.3010 | 0.0010 |

| 2014 | 0.3090 | 3.1230 | 0.0020 |

| 2015 | 0.2920 | 2.9860 | 0.0030 |

| Model 1 (OLS) | Model 2 (OLS) | Model 3 (SDM) | Model 4 (SDM) | |

|---|---|---|---|---|

| LM spatial lag | 1.4001 (0.2370) | 1.9685 (0.1610) | ||

| Robust LM spatial lag | 6.2375 (0.0130) | 16.6173 (0.0000) | ||

| LM spatial error | 3.4277 (0.0640) | 1.1560 (0.2820) | ||

| Robust LM spatial error | 8.2651 (0.0040) | 15.8048 (0.0000) | ||

| Wald spatial lag | 171.6849 (0.0000) | 198.0819 (0.0000) | ||

| LR spatial lag | 145.9280 (0.0000) | 162.7944 (0.0000) | ||

| Wald spatial error | 156.8946 (0.0000) | 185.5712 (0.0000) | ||

| LR spatial error | 142.6244 (0.0000) | 162.5676 (0.0000) | ||

| Regressor | Model 1 | Model 3 | Regressor | Model 2 | Model 4 |

|---|---|---|---|---|---|

| 0.9247 *** | 1.0822 *** | 0.6951 *** | 1.1073 *** | ||

| 1.3383 *** | 0.8743 *** | ||||

| 0.5643 *** | 0.2061 * | 0.4289 *** | 0.1564 *** | ||

| −0.0460 * | −0.0502 * | −0.0587 ** | −0.0487 | ||

| −0.0347 ** | −0.0481 *** | −0.0494 *** | −0.0684 *** | ||

| −0.3228 *** | 0.3195 *** | −0.0968 | 0.3470 *** | ||

| 0.8714 *** | 1.1683 *** | 0.7831 *** | 1.1426 *** | ||

| −0.0466 *** | −0.0222 ** | −0.0299 *** | -0.0165 *** | ||

| 0.2260 *** | 0.2490 *** | ||||

| 0.1863 | 0.5341 *** | ||||

| 0.2438 ** | |||||

| −1.2138 *** | −0.2974 *** | ||||

| −0.0984 ** | −0.1394 *** | ||||

| −0.2520 *** | −0.2763 *** | ||||

| −0.8829 *** | −0.4334 * | ||||

| −0.2221 ** | −0.2692 ** | ||||

| 0.1131 *** | 0.0236 *** | ||||

| Observations | 540 | 540 | Observations | 540 | 540 |

| Corrected R2 | 0.9021 | 0.9057 | Corrected R2 | 0.5450 | 0.8230 |

| log-likelihood | 10.3169 | log-likelihood | 4.9750 | ||

| integration order | I(0) | I(0) | I(0) | I(0) | |

| Pesaran CD test | −1.86 * | −2.34 | −1.95 * | −1.01 |

| Model 3 | Direct Effects | Spatial Spillover Effects | Model 4 | Direct Effects | Spatial Spillover Effects |

|---|---|---|---|---|---|

| 1.1053 *** | 0.5242 *** | 1.1567 *** | 1.0291 *** | ||

| 0.8999 *** | 0.5390 *** | ||||

| 0.1328 | −1.4315 *** | 0.1415 *** | −0.3286 *** | ||

| −0.0564 * | −0.1341 ** | −0.0590 * | −0.1934 *** | ||

| −0.0633 *** | −0.3223 *** | −0.0869 *** | −0.3713 *** | ||

| 0.2729 ** | −0.9926 *** | 0.3221 *** | −0.4521 | ||

| 1.1698 *** | 0.0581 | 1.1442 *** | 0.0190 | ||

| −0.0154 * | 0.1326 *** | −0.0153 *** | 0.0248 ** |

| Regressor | (1) | (2) | (3) |

|---|---|---|---|

| 0.8705 *** | 1.0835 *** | 1.0623 *** | |

| 1.1282 *** | 0.8776 *** | 0.9214 *** | |

| 0.7068 *** | 0.2106 * | 0.0366 | |

| −0.0138 | −0.0516 * | −0.0620 ** | |

| −0.0420 *** | −0.0479 *** | −0.0516 *** | |

| −0.0012 | 0.3248 *** | 0.3376 *** | |

| 0.7882 *** | 1.1694 *** | 1.1494 *** | |

| −0.0014 | |||

| −0.0628 *** | −0.0227 * | −0.0057 | |

| 0.1710 *** | 0.2300 *** | 0.1090 ** | |

| 0.1853 | 0.1749 | 0.2220 *** | |

| 0.3057 | 0.2352 ** | 0.3636 ** | |

| −0.4141 *** | −1.2254 *** | 0.1968 * | |

| −0.0499 | −0.0950 * | −0.5056 *** | |

| 0.0038 | −0.2512 *** | −0.1039 ** | |

| −0.7524 *** | −0.9006 *** | −0.6151 *** | |

| 0.0964 | −0.2259 * | −0.2295 ** | |

| 0.0014 | |||

| 0.0460 *** | 0.1143 *** | 0.0498 *** | |

| Observations | 540 | 540 | 540 |

| Corrected R2 | 0.9112 | 0.9056 | 0.8352 |

| log-likelihood | 295.1855 | 10.1476 | 282.5486 |

| Regressor | (1) | (2) | (3) |

|---|---|---|---|

| 0.7426 *** | 1.1186 *** | 1.1347 *** | |

| 0.5020 *** | 0.1278 *** | 0.1164 *** | |

| −0.0422 * | −0.0617 ** | −0.0657 ** | |

| −0.0498 *** | −0.0618 *** | −0.0668 *** | |

| −0.0336 | 0.3305 *** | 0.3707 *** | |

| 0.7162 *** | 1.1621 *** | 1.1345 *** | |

| -0.0020 | |||

| −0.0403 *** | −0.0141 *** | -0.0133 *** | |

| 0.1870 *** | 0.2630 *** | 0.2330 *** | |

| 0.0951 | 0.5417 *** | 0.5936 *** | |

| −0.4310 *** | −0.2777 *** | −0.2752 *** | |

| −0.0505 | −0.1504 *** | −0.1417 *** | |

| −0.0018 | −0.2972 *** | −0.2990 *** | |

| −0.7101 *** | −0.4679 ** | −0.4060 ** | |

| 0.0380 | −0.2685 ** | −0.2857 ** | |

| −0.0151 | |||

| 0.0487 *** | 0.0233 *** | 0.0227 *** | |

| Observations | 540 | 540 | 540 |

| Corrected R2 | 0.8948 | 0.8249 | 0.8852 |

| log-likelihood | 284.8129 | 8.3711 | 7.3087 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qi, S.; Peng, H.; Tan, X. The Moderating Effect of R&D Investment on Income and Carbon Emissions in China: Direct and Spatial Spillover Insights. Sustainability 2019, 11, 1235. https://doi.org/10.3390/su11051235

Qi S, Peng H, Tan X. The Moderating Effect of R&D Investment on Income and Carbon Emissions in China: Direct and Spatial Spillover Insights. Sustainability. 2019; 11(5):1235. https://doi.org/10.3390/su11051235

Chicago/Turabian StyleQi, Shaozhou, Huarong Peng, and Xiujie Tan. 2019. "The Moderating Effect of R&D Investment on Income and Carbon Emissions in China: Direct and Spatial Spillover Insights" Sustainability 11, no. 5: 1235. https://doi.org/10.3390/su11051235

APA StyleQi, S., Peng, H., & Tan, X. (2019). The Moderating Effect of R&D Investment on Income and Carbon Emissions in China: Direct and Spatial Spillover Insights. Sustainability, 11(5), 1235. https://doi.org/10.3390/su11051235