4.1. Empirical Result

Here we use Stata 14 to do the logit regressions. The logit model estimation and test results of marine fishermen’s insurance participate on behavior are shown in

Table 4.

The results of the model test indicate that the fitting effects of the four models are all pass the significance test. Model 1 takes the personal characteristics: age, education level (Edu), experience (Exp), gender, whether used to go out to work (GOW); production characteristic: professional level (PL), mariculture area (Area), whether sea waters registration (SWR), loss of yield value per unit area influenced by different kinds of disasters in recent three years (LYV), whether participate cooperation organization (PCO); and factors about insurance: awareness of insurance (AI) and perception of burden level of premium (PBP) as independent variables. Compared to Model 1, Model 2 drop the independent variables of awareness of insurance (AI) and loss of yield value per unit area influenced by different kinds of disasters in recent three years (LYV). Model 3 add family characteristics: household total income (HTI) and unpaid productive loan (UPL). Considering the test results and logical consistency of the four models, which the positive and negative effects of each influencing factors, the gender, age and education level (Edu) of the fishermen are excluded from the Model 4. According to the R-squared, we find independent variables in Model 4 have higher co-explanatory power than other variables in other models.

In model 5, model 6, and model 7 variable Loss of yield value per unit area influenced by different kinds of disasters in recent three years (LYV) was break as Loss of yield value per unit area influenced by typhoon and flood (LTF), Loss of yield value per unit area influenced by drought (LDro), Loss of yield value per unit area influenced by disease (LDis), Loss of yield value per unit area influenced by pollution (LP). As we know, climate event or natural disaster will influence environmental pollution and disease spread. For example, when the climate is abnormal, shrimps are more likely to get sick, which results in more loss of yield value. In addition, climate disaster will cause a lot of pollution and drought will increase pollution accumulation. The cross-terms LDro*LDis of Loss of yield value per unit area influenced by drought (LDro) and Loss of yield value per unit area influenced by disease (LDis), and LDro*LP of Loss of yield value per unit area influenced by drought (LDro) and Loss of yield value per unit area influenced by pollution (LP) were added in model 6. The cross-terms LTF*LDis of Loss of yield value per unit area influenced by typhoon and flood (LTF) and Loss of yield value per unit area influenced by disease (LDis), and LTF*LP of Loss of yield value per unit area influenced by typhoon and flood (LTF) and Loss of yield value per unit area influenced by pollution (LP) were added in model 7. Therefore, the cross-terms are excepted to have positive impact on mariculture insurance participation.

It is consistent in

Table 5,

Table 6 and

Table 7. As show in

Table 5, climate risk, resulted by typhoon, flood and drought, have a significant positive effect on the insurance participation behavior of mariculture fishermen. However, environmental risk, resulted by disease and pollution, have no significant directly effect on the insurance participation behavior of mariculture fishermen in model 5. When we add Cross terms of climate risk (Loss of yield value per unit area influenced by drought (LDro) and Loss of yield value per unit area influenced by typhoon and flood (LTF)) and environmental risk (Loss of yield value per unit area influenced by disease (LDis) and Loss of yield value per unit area influenced by pollution (LP)) in model 6 and model 7, we can find that the impact of environmental risks becomes significant as climate risks increase (as we can see in

Table 5). Due to the relatively small number of marine fishermen affected by drought, and the number of samples affected by drought and pollution or diseases is too small, the impact of cross term between drought and environmental risks on the insurance participation behavior of farmers is not significant.

The McNemar test is a nonparametric statistical method for diagnosing whether there is difference in the value of the paired categorical data before and after the test. The national premium subsidy for the participation in fishery insurance is taken as an external condition, which will inevitably affect the enthusiasm of fishermen joining the insurance.

Therefore,

Table 6 uses the McNemar test to analyze the willingness of fishermen’s participation in the insurance without and with state subsidies. In

Table 6: “−” means unwillingness and indifference; “+” means willingness. The total sample size is 457. Continuous correction was applied in this paper with a P value < 0.0001. The test found that there is significant difference between the “without subsidy” and “with subsidy” willingness, indicating that the subsidy has a clear positive incentive for the willingness of participation.

4.2. Regression Analysis

(1) Risk and Insurance Participation

Risk resulting in economic loss has a significant positive impact on insurance participation of mariculture fishermen. Risk is measured by the loss of yield value per unit area influenced by different kinds of disasters in recent three years that individuals are facing [

60], which is an important explanatory variable for decision-making [

61]. In theory, the farmers’ risk is influenced by their own bounded rationality [

62] and the risk atmosphere of farmers [

63]. In practice, the constraints of risk can be summarized into the dual dimensions of oneself and external environment [

64].

As we can see in

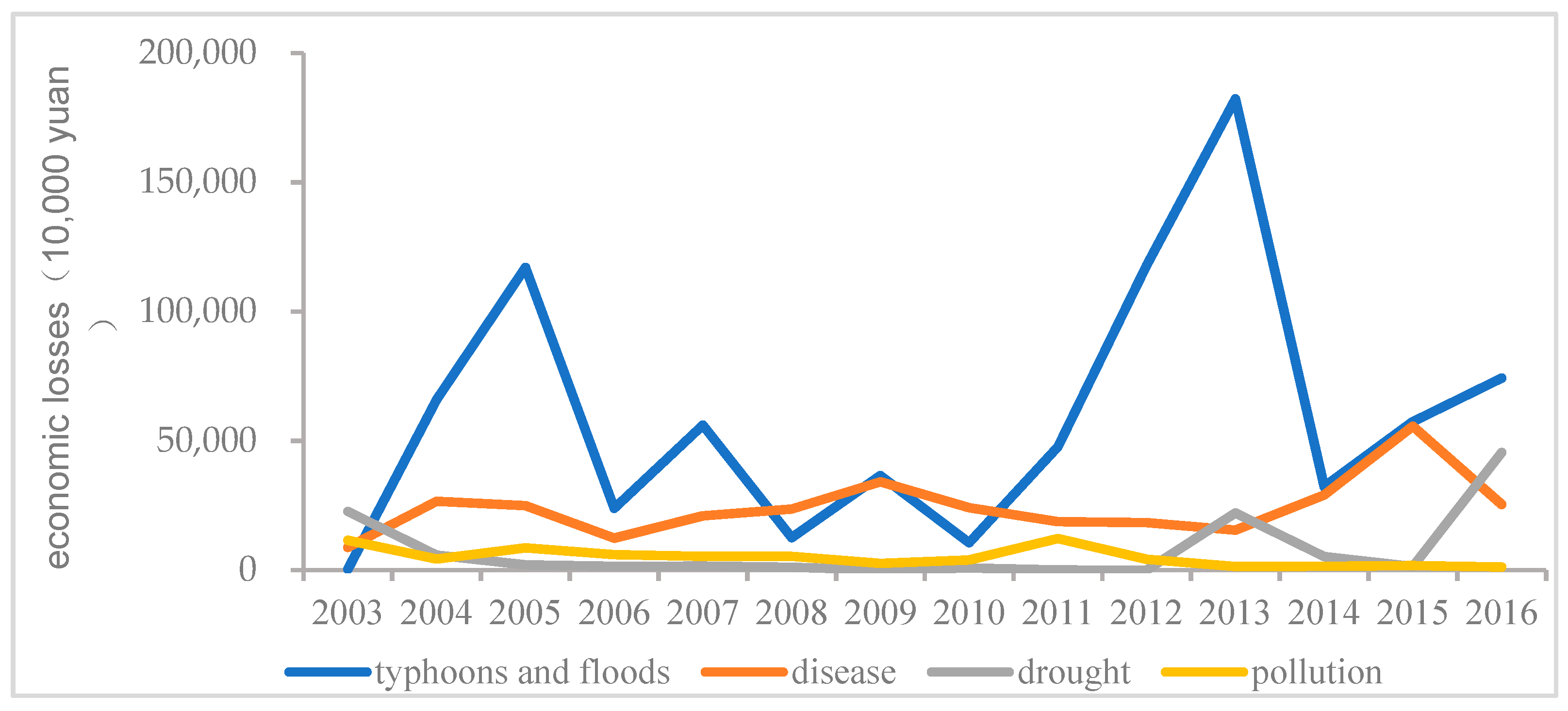

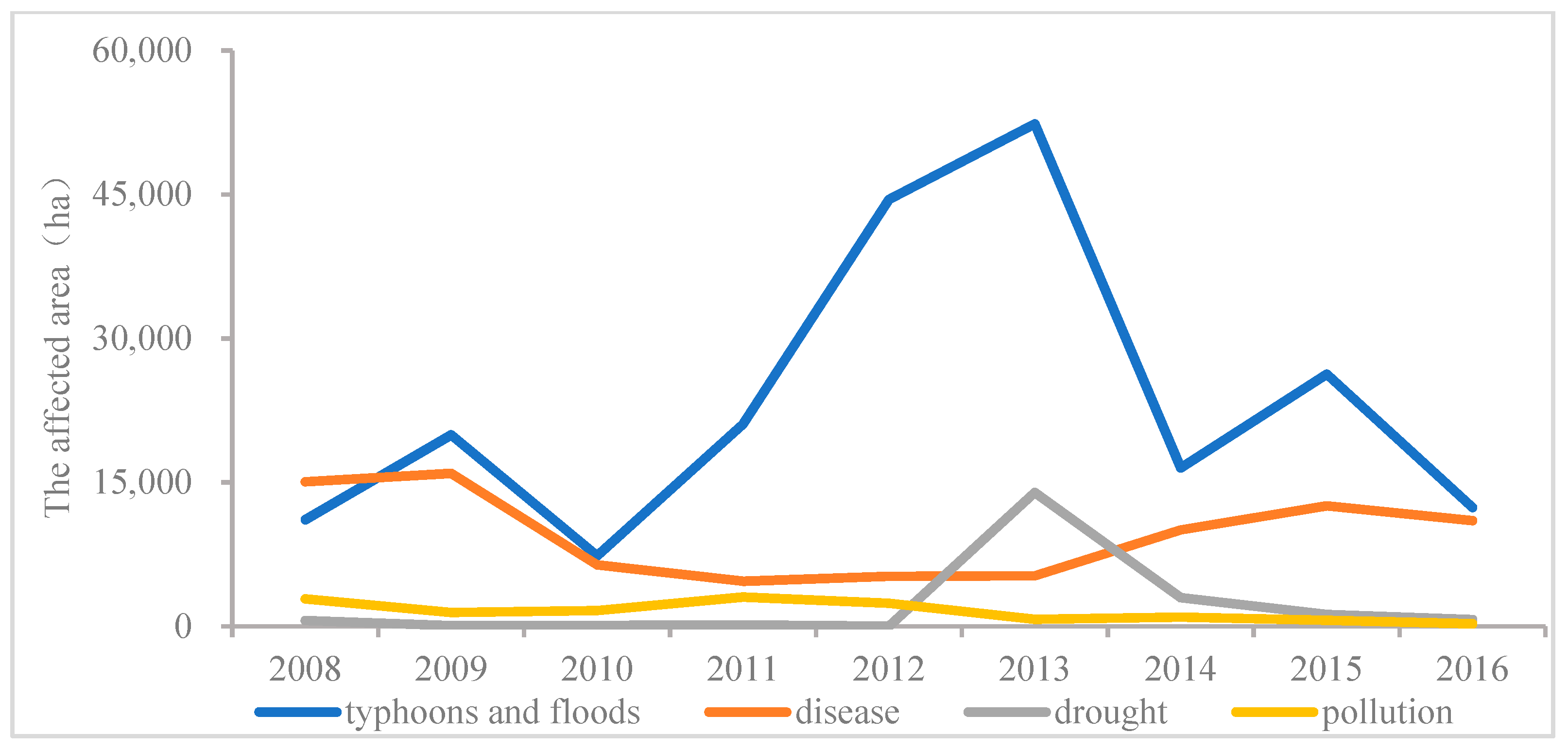

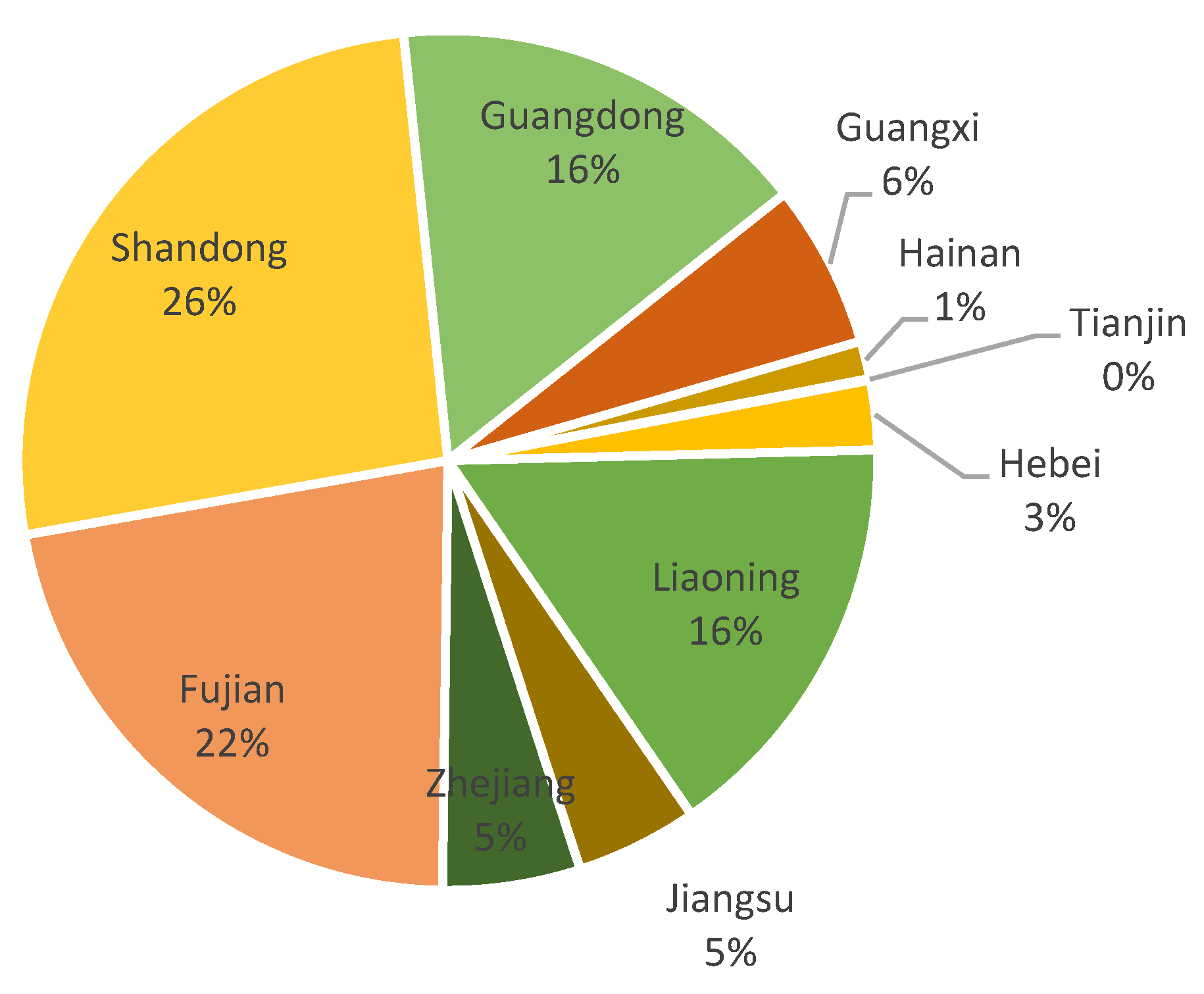

Table 7, the number of fish farmers affected by the typhoon and flood disaster in recent three years is largest, and the disease, pollution and drought. Mariculture risk mainly includes climate risk and environmental risk. Climate risk is represented by the mariculture loss of yield value influenced by typhoon, flood and drought. Environmental risk is represented by the mariculture loss of yield value influenced by disease and pollution. Climate risk, resulted by typhoon, flood and drought, have a significant positive effect on the insurance participation behavior of mariculture fishermen. However, environmental risk, resulted by disease and pollution, have no significant directly effect on the insurance participation behavior of mariculture fishermen in model 5. The impact of environmental risks becomes significant as climate risks increase. When considering mariculture experience as technology level of marine fishermen, the longer experience of marine aquaculture, the smaller technical risks faced by fish farmers, we can make the conclusion that technological risk have a significant positive effect on the insurance participation behavior of mariculture fishermen.

(2) Awareness of Insurance and Insurance Participation

Awareness of insurance has a significant positive impact on insurance participation behavior of mariculture fishermen. Fishermen with a better understanding of the specific provisions, subsidy policies and implementation plan of fishery insurance, could understand the benefits of insurance for the systematic risk dispersion of their own production more, leading to the stronger willingness to participate in fishery insurance. Walker and Salt [

65], Biggs et al. [

66], and Pope et al. [

67] are of the view that improving access to forecasting, early warning systems and climate information can reduce the fisheries sector’s vulnerability to the changing climate. The development of early warning system is of importance for the healthy development of maricultural sector.

In addition to the financial limitations, the awareness of insurance has a significant positive influence. Risk aversion incentives are the main motivation driving fishermen to participate in the insurance. The higher systemic risk is the most important determinant of fishermen insurance participation, since mariculture is a high-input, high-output, and high-risk industry. Education and training have been identified as essential adaptation measures [

68] to improve awareness of mariculture insurance of fish farmers. Education and awareness creation may help fisherfolks to make informed decisions and choices in employing appropriate adaptation measures [

69]. It helps a lot make more objective and accurate decisions on the participation in fishery insurance with a correct and sufficient understanding of the insurance. As

Table 8 shows, there were 56 households who did not know fishery insurance very well (including relatively unknown and totally unknown), accounting for 12.25% of the subjects, only 47 households could fully understand fishery insurance, accounting for 10.28% in 2015. There still have not any particular laws for the insurance of fishery in China, nor any policies for regulating the mutual insurance association. A lack of legislative support and protection, the sustainable development of fishery insurance can’t be guaranteed [

27]. Therefore, the decision of fishermen to participate in insurance is still heavily determined by their awareness of insurance.

(3) Perception of Burden Level and Insurance Participation

Perception of burden level has a significant negative impact on insurance participation of mariculture fishermen. The promotion of policy mutual insurance by government still needs to be improved. From the view of insurance cost, fishermen become more reluctant to participate in fishery insurance. Insurance demand is found to be negatively related to insurance premium rates [

19]. At present, fishery insurance costs are mainly borne by the fishermen themselves, however, the fishermen income level is low which results in a long-term shortage of fishery insurance demand in China [

70,

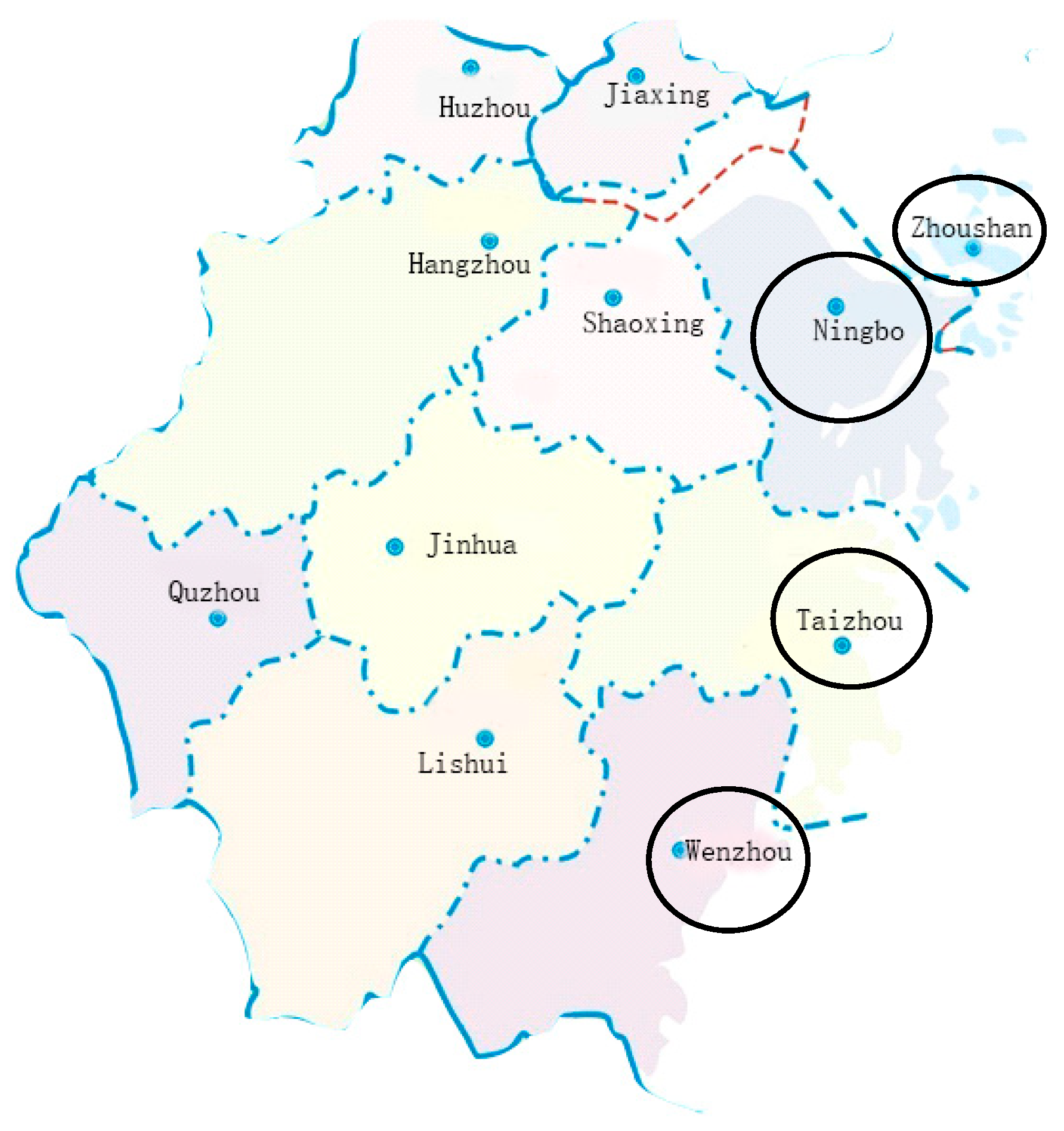

71]. However, the insurance cost of policy-based fishery insurance, with the subsidies of governments at all levels, has not been the largest obstruction for the insurance participation of marine shrimp fishermen in Zhejiang Province.

(4) Government Subsidies and Insurance Participation

Premium subsidies are playing an important role driving fishermen to participate in insurance. The uncertainty of consumer demand, price volatility and information asymmetry pose serious market risks for marine aquaculture development [

72]. Government subsidies play an important role in correcting it [

29,

73,

74]. The effective implementation of insurance is also affected by some technical and political issues. Government subsidies for agricultural premiums have increased the enthusiasm of farmers to participate in insurance [

30]. Subsidies will improve farmers’ ability to pay for agricultural insurance, ease the contradiction between the low incomes of farmers and high agricultural insurance rates [

11,

74,

75]. Studies out of China have the similar conclusion as happened in the US, the higher agricultural insurance subsidies increase the expected marginal net income of US farmers purchasing high-assured crop insurance, leading to the increase of their agricultural insurance participation rate [

76]. According to the survey results, 139 households (30.42% of the total) would change their decisions to choose to participate in insurance because of the subsidies. The premium subsidy policy has an incentive effect for fishermen to participate in fishery insurance. It has increased the participation rate of fishery insurance and promoted the in-depth implementation of the fishery insurance pilot.

However, a large number of studies have proved that it is not easy for fishery mutual insurance to be perfect purely by policy support. On the one hand, the benefits brought by the increase in production with subsidies may not be able to make up for the losses suffered by the decline in market prices [

76]. On the other hand, government subsidies could lead to the slack of fishermen’s production and even change the motives for insurance [

77].

Brunette and Couture [

77] believe that the government’s post-disaster relief measures have reduced farmers’ willingness to pay for agricultural insurance. Although the impact of post-disaster relief on insurance demand is just on the opposite, agricultural insurance with financial subsidy has become an important tool for farmers to enjoy economic benefits from US government [

19]. The government has not played a leading role in the implementation of fishery insurance, and the local financial support system is also imperfect, with limited subsidy insurance and lack of scientific and pertinent subsidy decision [

42,

71].

Without adequate reinsurance or government subsidies, crop insurers would have to pass the cost of bearing the additional risk onto farmers, rendering individual crop insurance extremely, if not prohibitively, expensive [

8] Agricultural insurance markets were initiated in Europe over 200 years ago in the form of privately offered protection against livestock mortality and named peril events such as crop-hail. Yet, only in the last 50 years has there been a rapid expansion and development in the range and scope of insurance products offered to producers. Most of this expansion is accounted for by an extensive range of government supports, including subsidized premiums, subsidized delivery and loss adjustment expenses, and the public provision of reinsurance services [

78]. As noted, the average farmer receives approximately

$1.88 in indemnities for every dollar paid in premiums [

19]. By 2007, premium subsidies among high income countries totaled almost

$12 billion, with the United States accounting for

$3.8 billion [

79].

(5) Characteristics of Farmers and Insurance Participation

Gender, age, and education are not significant factors and basically do not have explanatory power. There are different research results on the influence of fishermen’s age and education level on their participation in insurance. Some scholars have found that the age and education level of farmers have no significant influence on their willingness to participate in insurance [

11]. However, some scholars also have found that the willingness of participation grows with the decrease of age and increase of education level [

57]. Additionally, it is more difficult for them to accept new things, resulting in the low willingness to purchase insurance. Mariculture is based on household production mostly, in which both men and women are engaged. It is a joint decision of men and women to participate in fishery insurance. It can be seen that the gender of the head of household does not have a significant influence on the participation in fishery insurance. The main reason may be, first of all, fishermen with higher education level are mostly young and middle-aged, with strong ability to learn and master the skills. Secondly, most of the fishermen with low education level are elderly people, with relatively long mariculture time, rich production skills and experience, and strong ability of preventing climate disasters and post-disaster remediation.

(6) Mariculture Experience and Insurance Participation

Mariculture experience has a negative influence on fishermen’s insurance participation. The imperative of climate event requires increased capacity of farmers to make both short- and long-term planning decisions and technology choices [

80]. The longer fishermen are engaged in mariculture, the more experience and methods for culture they have. Experienced fishermen are reluctant to change the existing ways to avoid risks, and do not believe in the protection of other organizations for their own production. Employing the use of traditional ecological knowledge management systems as an adaptation measure proves to be very useful as it imparts additional knowledge and perspectives based on locally developed practices such as fish species management.

(7) Labors Used to Go out to Work and Insurance Participation

As

Table 9 shows, the proposition of insurance participation of labors used to go out to work is lower than that of labors not used to go out to work. Advanced technology is not conducive to the development and promotion of fishery insurance to a certain extent. Some scholars have found that farmers could prevent and share risk through differentiated planting, adopting conservative technology, reciprocal credit, going out to work, or doing business [

13]. Labors used go out to work have a significant positive influence on insurance participation. Labors used go out to work are often younger and educated, which could be a help for them to understand the risks brought by production and the important role of fishery insurance. Meanwhile, migrated workers with cash earning will relieve the burden of mutual insurance payment.

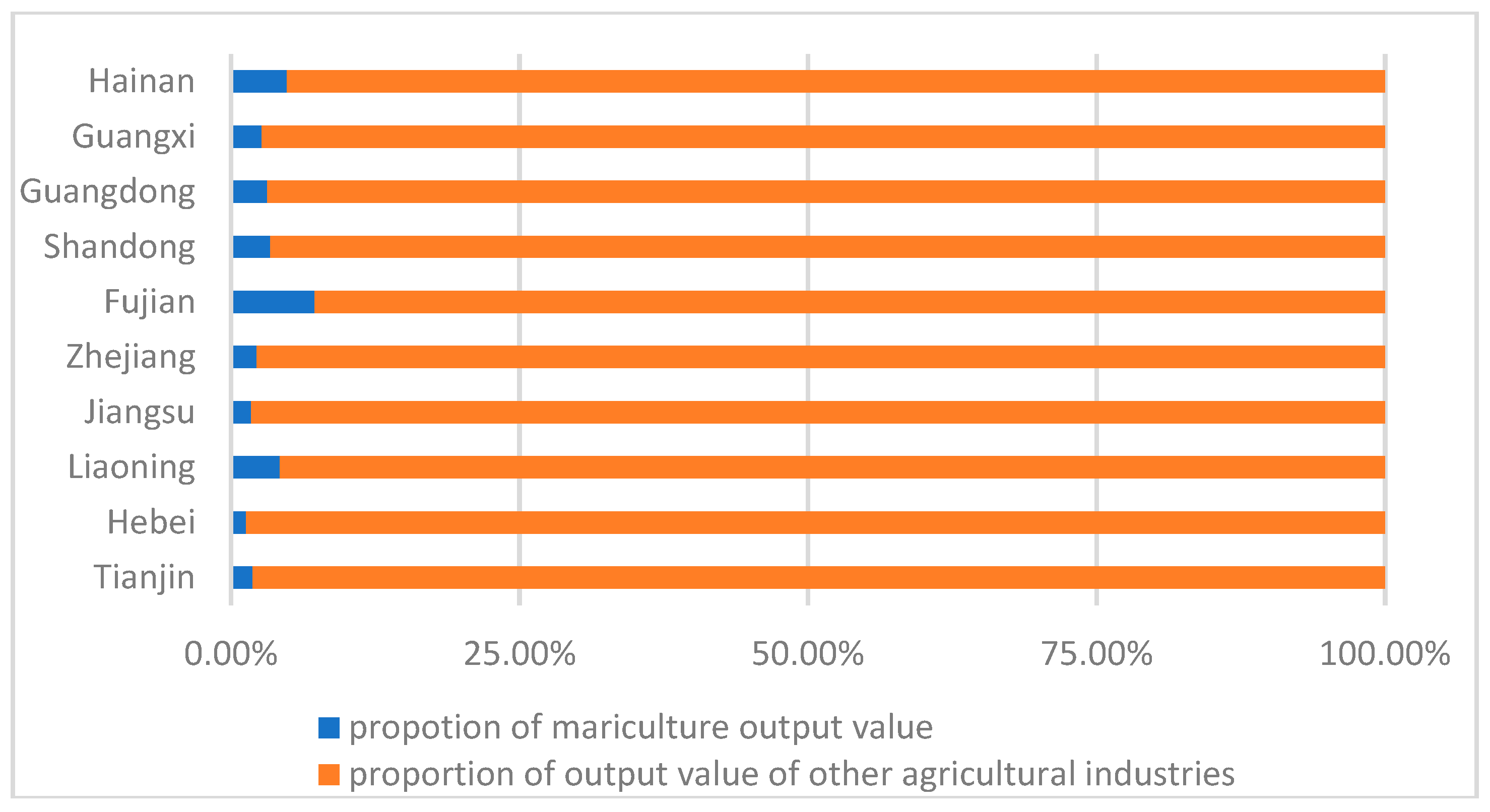

(8) Production Specialization and Insurance Participation

Total household income has a positive influence on fishery insurance participation. Holthausen and Baur [

58] found that household income structure has a significant influence on farmers’ participation behavior. The production specialization, measured by the proportion of income from mariculture to the total income has a positive influence on the participation of aquaculture insurance. The higher the proportion, the greater the importance of mariculture to fishermen’s families. It is more necessary and urgent for specialized fishermen to spread production risks than part-time fishermen. Therefore, fishermen with higher degree of specialization have more enthusiasm to participate in fishery insurance. When agricultural income is not the main source of income, farmers’ willingness to purchase agricultural insurance is not strong. Not only the income structure, but also the total income level will affect the willingness of farmers to purchase insurance [

57].

(9) Farming Scale and Insurance Participation

As

Table 10 shows the proportion of marine aquaculture area greater than 30 mu is higher than that of marine aquaculture area less than 30 mu. The commercial companies prefer the large-scale fishery and aquaculture companies to those small-scale ones which, therefore, need the support from government, especially when they suffer great economic losses [

27]. The mariculture area has a significant positive influence on fishermen’s participation behavior. Goodwin [

81], Goodwin and Smith [

82] found that agricultural insurance is inelastic relative to the area insured [

81,

82]. consisting with the finding of Ning, Li, and Zhong, the total cultivated land area is an important factor affecting farmers’ purchase of agricultural insurance [

30]. Fishermen with larger aquaculture areas are bearing larger system risks, leading to higher willingness to participate in insurance. However, in the regression of Model 3 and Model 4, when the total household income and the household unpaid production loan were added to the independent variables, the influence of the size of mariculture area on the fishermen’s willingness to participate in insurance became insignificant. The possible reason is, fishermen are always paying attention to the guarantee of overall income and risk reduction.

(10) Aquaculture Registration and Insurance Participation

The implementation of the policy of aquaculture registration has promoted the participation of insurance (see

Table 11). Compared with the lease of short-term contracts, fishermen who have registered the mariculture areas are more concerned about the long-term development of production. In order to ensure stable and sustainable development, fishermen are more willing to participate in mutual insurance. Essentially, the contract is a commitment on behaviors of the parties on both sides, and also an arrangement of bilateral coordination regarding behaviors [

83]. As the bond of market transactions, the contract is the institutional arrangement regarding the rights and obligations of the assets. Incomplete contract arrangements of farmland property rights are another issue that has attracted lots of attention in China [

84]. Under the household contract responsibility system, farmers were given the residual rights of land use and usufruct [

84]. However, the government intervened heavily on rights allocation by making frequent land adjustments [

84], which has led to incomplete farmland property rights [

85] and then damaged farmer’s long-term intentions of investment in land [

84]. In the evolution of China’s farmland system, although the residual control rights and the residual claim rights of farmlands have been gradually relaxed by the government [

86], farmland property rights should be further clarified [

87].

(11) Income and Insurance Participation

The impact of total income on fishermen’s willingness to participate in insurance is not obvious when considering the other fishermen families characteristics. When these factors are neglected, the total income becomes a significant positive factor for the fishermen’s willingness to participate in insurance. One possible reason is that the pressure to pay for insurance will be less stressful for fishermen with higher total income. In order to ensure the stability of mariculture production and the benefits of farming, fishermen with higher incomes would be more willing to participate in fishery insurance.

(12) Unpaid Productive Loan and Insurance Participation

Unpaid productive loan has a significant positive impact on mariculture insurance participation. High risks in fishery production, as well as other issues related to payment, make it hard for some financial institutions to offer loans to fishery. In order to minimize the risks, the financial institutions prefer to provide loans to those with insured assets. That means, without insurance, the financial institutes would be hesitate to offer the loans, which limits the fishermen input and the development of fishery [

27].

Unpaid productive loans will also promote fishermen’s participation in fishery insurance (see

Table 12). There is more risk on production based on loan than that based on fishermen’s own property under the same condition. The fishermen also have a lower ability of diversifying risk and keeping sustainable development. Fishermen with more unpaid productive loans have a stronger need to participate in fishery insurance under the same production conditions. Therefore, it is necessary to establish and enhance the direct relations between the fishery insurance and the financial credit, because the fishery insurance could not only effectively increase the investment from some financial institutions, but also encourage the fishermen’s input and their adoption of new technique to improve the productivity and their payment capacity [

27].

(13) Participating in Cooperative Organization and Insurance Participation

Participating in cooperative organization has negative impact on mariculture insurance participation. As

Table 13 shows, the most involved organizations of marine farmers are cooperatives, except for mutual insurance association. The participation rate of marine farmers who join cooperatives is only 33.06%. The fishery in developing countries is mostly managed by fishermen or small-scale fishing farmers [

88], who will suffer great losses by climate disasters and who should be protected by the fishery insurance. But due to the fact that most of these fishermen or farmers often live and work separately, they find it hard to get their preferred insurance from the private insurance companies. Then the fishery cooperatives and mutual associations would come to their aids. The cooperatives and associations can organize those fishermen together and offer them a risk diversification project to reduce their risks of losses brought by climate disasters [

27]. The main functions of the National Federation of Fishermen’s Cooperative are to arrange the input of fishery and the supply of facilities, to transfer the technical skills to fishermen, to provide insurance to fishermen, to raise and sell fish, to provide consulting services, to provide training, to promote fishery export, and communicate with the government and related departments [

27].

Mariculture technology risks are mainly manifested in two aspects: technical shortage and application deviation [

72]. Due to the slow progress or even the lack of formal agricultural finance and insurance in China, the contract of production, processing and sale with firms are the commonly adopted approaches for farmers to avoid agricultural risks [

89]. Participating organizations can help fishermen to improve production technology and management level, provide excellent breeding varieties, and purchase high-quality and low-cost production materials, thereby improving product quality, reducing market information asymmetry, and ensuring product sales. We can see that participating in aquaculture cooperative economic organizations can reduce the systemic risks faced by fishermen a lot and reduce the enthusiasm of fishermen for insurance.