Identification of Distorted Official Hospitality Statistics’ and Their Impact on DMOs’ Funding’s Sustainability: Case Notes from Slovakia

Abstract

1. Introduction

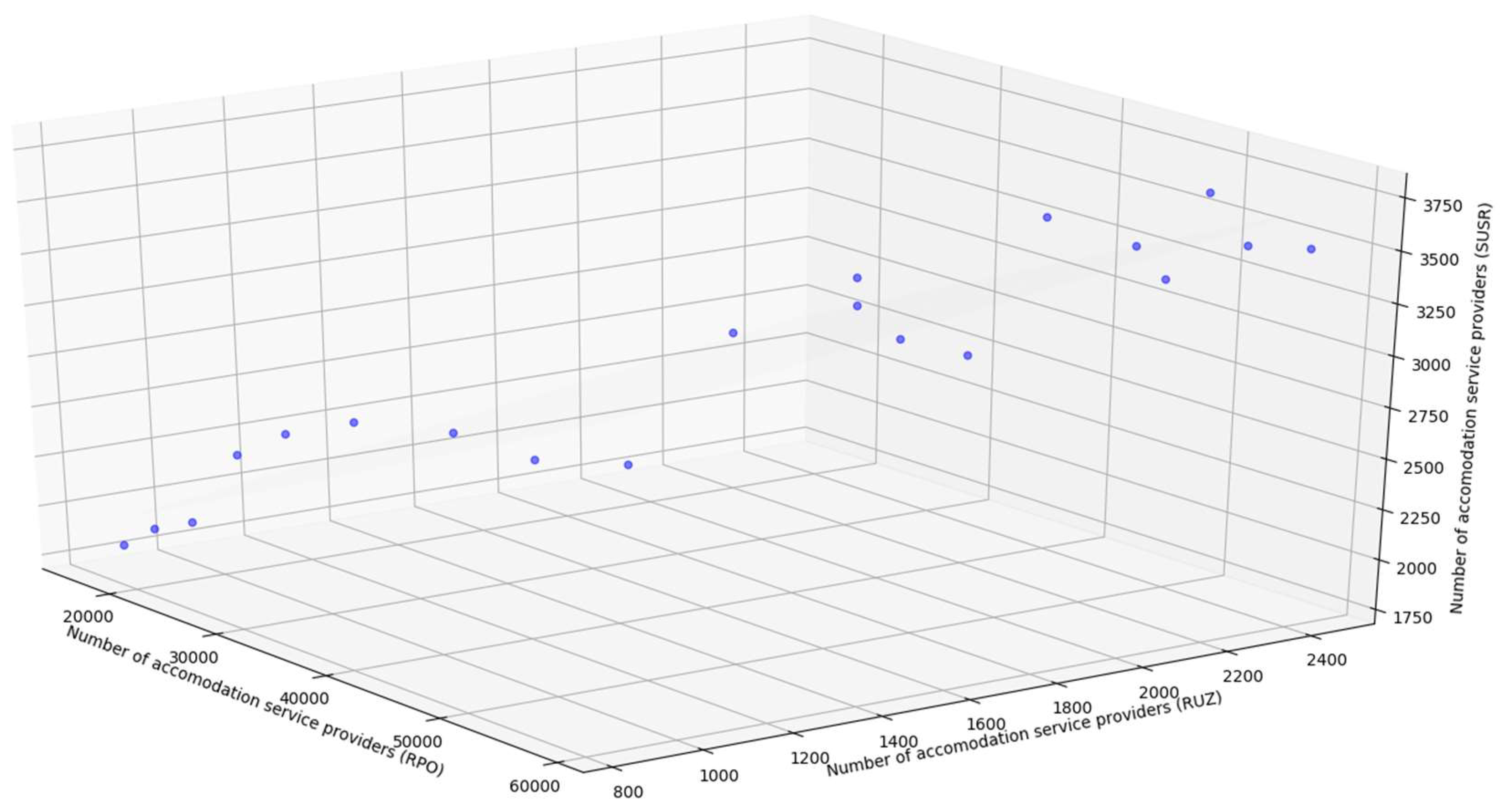

- comparison of SUSR’s data on annual number of accommodation service providers with the data retrieved from RUZ and RPO databases;

- comparison of SUSR’s data on annual number of overnight stays with municipalities’ data on annual levied occupancy tax; and,

- calculation of estimated occupancy tax evasions and proposal of supplementary solutions for SUSR’s system that could lower the resulted deviations between the tested datasets.

2. Input Data Extraction, Harmonization, and Aggregation

2.1. SUSR’s Capacity and Performances of Accommodation Establishments in Selected Towns [cr1003rr]

2.2. Levied Occupancy Tax and Historical Tax Rates within Tested Cities

2.3. Slovensko.Digital’s Registry of Financial Statements’ Application Programming Interfaces

2.4. Slovensko.Digital’s RPO API

2.5. Finalazitaion of the Base Data Set

3. Approach of Statistical Modeling

Number of accommodation service providers identified in RUZ (n_acc_ruz)

Number of accommodation services providers identified by SUSR (n_acc_susr);

Ratio of officially operating accommodation service providers and accommodation service providers identified in RUZ (rat_acc_rpo) =

Number of accommodation service providers identified in RPO (n_acc_rpo)

Number of accommodation services providers identified by SUSR (n_acc_susr)

Total annual levied occupancy tax levied (real_tax)

Occupancy tax rate per overnight stays (tax_rate)

Total annual number of overnight stays in SUSR (nights_susr)

Total annual number of ASPs in SUSR (n_acc_susr)

Number of taxed overnight stays (n_nights_real_tax_div_tax_rate)

Average number of overnights per ASP for SUSR (avg_night_per_acc_susr)

Number of taxed overnight stays (n_nights_real_tax_div_tax_rate)

Total annual number of overnight stays in SUSR (nights_susr);

×

Average number of overnights per ASP for SUSR (avg_night_per_acc_susr);

Estimated number of overnight stays based on RPO input data (n_nights_rpo) = Number of accommodation service providers identified in RPO (n_acc_rpo)

×

Average number of overnights per ASP for SUSR (avg_night_per_acc_susr);

×

Ratio of taxable overnight stays (ratio_taxable_nights);

Estimated number of taxable overnight stays based on RPO (taxable_nights_rpo) = Estimated number of overnight stays based on RUZ input data (n_nights_rpo)

×

Ratio of taxable overnight stays (ratio_taxable_nights);

×

Occupancy tax rate per overnight stays (tax_rate);

Estimated theoretical possible levied occupancy tax based on RPO (tax_rpo) = Estimated number of taxable overnight stays based on RPO (taxable_nights_rpo)

×

Occupancy tax rate per overnight stays (tax_rate)

Number ASPs based on the mean of input data (avg_acc_ruz_rpo_susr_tax)

×

Average number of overnights per ASP for SUSR (avg_night_per_acc_susr)

4. Results

5. Discussion and Concluding Remarks

Author Contributions

Funding

Conflicts of Interest

References

- PricewaterhouseCoopers LLP. The Impact of Taxes on the Competitiveness of European Tourism: Final Report; Publications Office of the European Union: Luxembourg, 2017; p. 192. [Google Scholar] [CrossRef]

- Hiemstra, S.J.; Ismail, J.A. Impacts of Room Taxes on the Lodging Industry. J. Hosp. & Tour. Res. 1990, 14, 231–241. [Google Scholar]

- Lee, S.K. Revisiting the impact of bed tax with spatial panel approach. Int. J. Hosp. Manag. 2014, 41, 49–55. [Google Scholar] [CrossRef]

- Hamilton, A.; Brooks Marshall, S.; Hobson, H.A. Cities versus Online Travel Companies: Liability for Room Occupancy Taxes. Cornell Hosp. 2012, 53, 357–364. [Google Scholar] [CrossRef]

- Kljucnikov, A.; Krajcik, V.; Vincurova, Z. International sharing economy: The Case of AiRBnB in the Czech Republic. J. Sci. Pap. Econ. & Policy 2018, 11, 126–137. [Google Scholar] [CrossRef]

- Berinde, S.R.; Corpădean, A.G. Assessing the Sustainable Room for Growth for a Particular Romanian Tourism Area of Business: The Case of Accommodation Businesses. Sustainability 2019, 11, 243. [Google Scholar] [CrossRef]

- Durbarry, R. Tourism Taxes: Implications for Tourism Demand in the UK. Rev. Develop. Econ. 2008, 12, 21–36. [Google Scholar] [CrossRef]

- Song, H.; Seetaram, N.; Ye, S. The effect of tourism taxation on tourists’ budget allocation. J. Destin. Mark Manag. 2018, 11, 32–39. [Google Scholar] [CrossRef]

- Álvarez-Albelo, C.D.; Hernández-Martín, R.; Padrón, N. Air passenger duties as strategic tourism taxation. Tour. Manag. 2016, 60, 442–453. [Google Scholar] [CrossRef]

- Surugiu, C.; Surugiu, M.R. The impact of tourism taxation: Analysis for Romania. J. Tour. – Stud. Res. Tour. 2017, 24, 68–73. [Google Scholar]

- Gago, G.; Labandeira, Z.; Picos, F.; Rodríguez, M. Specific and general taxation of tourism activities: Evidence from Spain. Tour Manag. 2009, 30, 381–392. [Google Scholar] [CrossRef]

- Liu, Y.; Jing, Y.; Cai, E.; Cui, J.; Zhang, Y.; Chen, Y. How Leisure Venues Are and Why? A Geospatial Perspective in Wuhan, Central China. Sustainability 2017, 9, 1865. [Google Scholar] [CrossRef]

- National Council of the Slovak Republic. Act. No. 91/2010 Coll. on Support of Tourism. Available online: http://www.zakonypreludi.sk/zz/2010-91 (accessed on 18 December 2018).

- World Tourism Organization. Indicators of Sustainable Development for Tourism Destinations; World Tourism Organization: Madrid, Spain, 2004; p. 514. ISBN 92-844-0726-5. [Google Scholar]

- National Council of the Slovak Republic. Act No. 253/1998 about Reporting Residence of Citizens and Registry of Citizens. Zákony pre ľudí.sk. Available online: http://www.zakonypreludi.sk/zz/1998-253 (accessed on 18 December 2018).

- National Council of the Slovak Republic. Act No. 540/2001 about State Statistics. Zákony pre ľudí.sk. Available online: http://www.zakonypreludi.sk/zz/2001-540 (accessed on 18 December 2018).

- National Council of the Slovak Republic. Act No. 582/2004 about Local Taxes and Local Fees for Municipal Waste and Small Construction Waste. Zákony pre ľudí.sk. Available online: http://www.zakonypreludi.sk/zz/2004-582 (accessed on 18 December 2018).

- National Council of the Slovak Republic. Act No. 404/2011 about Reporting of Foreigners‘ Residence. Zákony pre ľudí.sk. Available online: http://www.zakonypreludi.sk/zz/2011-404 (accessed on 18 December 2018).

- Sidor, C.; Kršák, B.; Štrba, Ľ. The Role of Open Data on the Road to Destination Business Intelligence: Notes on SK NACE I55. Hotelnictví, Turismus a Vzdělávání; Institute of Hospitality Management in Prague: Prague, Czech Republic, 2017; pp. 166–172. ISBN 978-80-87411-99-5. [Google Scholar]

- Statistical Office of the Slovak Republic. Monthly Questionnaire on Activity of Accommodation Facility. statistics.sk. Available online: https://bit.ly/2sTza1y (accessed on 18 December 2018).

- Statistical Office of the Slovak Republic. Capacity and Performances of Accommodation Establishments in Selected Towns—Yearly Data [cr1003rr]. datacube.statististics.sk. Available online: https://bit.ly/2Tjy7Uf (accessed on 18 December 2018).

- Czech Statistical Office. Capacity of Accommodation Establishments by Category. db.czso.cz. Available online: https://bit.ly/2COigG6 (accessed on 18 December 2018).

- Hungarian Central Statistical Office. Accommodation Services: Annual Time Series Data. statinfo.ksh.hu. Available online: http://statinfo.ksh.hu/Statinfo/themeSelector.jsp?&lang=en (accessed on 18 December 2018).

- Statistics Poland. In Tourism; swaid.stat.gov.pl. Available online: http://swaid.stat.gov.pl/EN/AtlasRegionow/AtlasRegionowMapa.aspx (accessed on 18 December 2018).

- European Commission. NACE Rev. 2—Statistical Classification of Economic Activities in the European Community; The Publications Office of the European Union: Luxembourg, 2008; p. 369. ISSN 1977-0375. [Google Scholar]

- Slovensko.digital. Register účtovných uzávierok API. ekosystem.slovensko.digital. Available online: https://ekosystem.slovensko.digital/otvorene-data (accessed on 18 December 2018).

- United Nations Statistics Division. International Standard Industrial Classification of all Economic Activities; United Nations Publication: New York, NY, USA, 2008; p. 306. ISBN 978-92-1-161518-0. [Google Scholar]

- Slovensko.digital. Register právnických osôb API. ekosystem.slovensko.digital.. Available online: https://ekosystem.slovensko.digital/otvorene-data (accessed on 18 December 2018).

- The PostgreSQL Global Development Group. What is PostgreSQL? postgresql.org. Available online: https://www.postgresql.org/about/ (accessed on 18 December 2018).

- The Open Source Geospatial Foundation. Support-Postgis. postgis.net.. Available online: http://postgis.net/support/ (accessed on 18 December 2018).

- Sidor, C. List of Used Scripts of Queries. github.com. Available online: https://github.com/csabasidor/meta_occupancy_tax (accessed on 18 December 2018).

- Sidor, C. List of Municipality Annual Accounts. github.com. Available online: https://github.com/csabasidor/meta_occupancy_tax (accessed on 18 December 2018).

- Sidor, C. List of Municipality Regulations. github.com. Available online: https://github.com/csabasidor/meta_occupancy_tax (accessed on 18 December 2018).

- Ministry of Finance of the Slovak Republic. RÚZ Open API: verzia 2.0. registeruz.sk.. Available online: http://www.registeruz.sk/cruz-public/home/api (accessed on 18 December 2018).

- Vetró, A.; Canova, L.; Torchiano, M.; Minotas, C.O. Open data quality measurement framework: Definition and application to Open Government Data. Gov. Inf. Q. 2016, 33, 325–337. [Google Scholar] [CrossRef]

- Financial Administration Slovak Republic. E-kasa. financnasprava.sk. Available online: https://www.financnasprava.sk/sk/podnikatelia/dane/ekasa (accessed on 18 December 2018).

- Sidor, C. The impact of public data on the competitiveness of the destination management system in the Slovak Republic, exceeding the Visegrad Group. PhD Thesis, Technical University of Kosice, Kosice, Slovakia, 15 June 2018. [Google Scholar]

- Kirchler, E.; Hoelzl, E.; Wahl, I. Enforced versus voluntary tax compliance: The “slippery slope” framework. J. Econ. Psychol 2008, 29, 210–225. [Google Scholar] [CrossRef]

- Lozza, E.; Castiglioni, C. Tax Climate in the National Press: A New Tool in Tax Behaviour Research. J. Soc. Politic. Psychol. 2018, 6, 401–419. [Google Scholar] [CrossRef]

| Columns | Type | Description |

| municipality_id | integer | Unique identification number of municipalities used by SUSR and RUZ |

| city | text | Name of the city |

| var_type | text | Abbreviation of input data’s variables following a three positional logical concept. n_acc_susr – n stands for variable type (number); acc represents category’s abbreviation (accommodation) and susr represents the source database. |

| 2008–2017 | numeric | Numerical value of the variable within the given year. |

| Dep. Variable: | n_acc | R-squared: | 0.819 | |||

| Model: | OLS | Adj. R-squared | 0.812 | |||

| Method: | Least Squares | F-statistic: | 128.5 | |||

| Date: | Friday, 8 February 2019 | Prob (F-statistic): | 7.55 × 10−22 | |||

| Time: | 10:14:52 | Log-Likelihood: | −627.46 | |||

| No. Observations: | 60 | AIC: | 1261 | |||

| Df Residuals: | 57 | BIC: | 1267 | |||

| Df Model: | 2 | |||||

| coef | std err | t | p>|t| | [0.025 | 0.975] | |

| Intercept | 4.017 × 104 | 1932.35 | 20.788 | 0.000 | 3.63 × 104 | 4.4 × 104 |

| C(source)[T.ruz] | −3.856 × 104 | 2732.75 | −14.111 | 0.000 | −4.4 × 104 | −3.31 × 104 |

| C(source)[T.susr] | −3.73 × 104 | 2732.75 | −13.648 | 0.000 | −4.28 × 104 | −3.18 × 104 |

| Omnibus: | 11.386 | Durbin-Watson: | 0.263 | |||

| Prob(Omnibus): | 0.003 | Jarque-Bera (JB): | 13.678 | |||

| Skew: | −0.762 | Prob(JB): | 0.00107 | |||

| Kurtosis: | 4.775 | Cond. No. | 3.73 | |||

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 25 | 96 | 59 | 66 | 27 | 30 | 40 |

| 2009 | 26 | 109 | 62 | 61 | 34 | 28 | 38 |

| 2010 | 28 | 113 | 63 | 57 | 33 | 27 | 35 |

| 2011 | 29 | 118 | 64 | 53 | 34 | 27 | 34 |

| 2012 | 37 | 136 | 68 | 86 | 35 | 40 | 33 |

| 2013 | 36 | 128 | 68 | 82 | 36 | 41 | 34 |

| 2014 | 32 | 123 | 67 | 76 | 35 | 39 | 33 |

| 2015 | 36 | 149 | 71 | 84 | 37 | 41 | 38 |

| 2016 | 38 | 151 | 67 | 78 | 36 | 40 | 35 |

| 2017 | 40 | 153 | 67 | 79 | 34 | 38 | 32 |

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 108 031 | 1 549 094 | 283 225 | 230 001 | 210 521 | 164 251 | 174 133 |

| 2009 | 90 473 | 1 331 361 | 220 178 | 163 423 | 166 039 | 117 388 | 155 423 |

| 2010 | 84 595 | 1 381 024 | 262 660 | 169 750 | 211 471 | 116 485 | 150 789 |

| 2011 | 84 719 | 1 526 549 | 254 233 | 188 577 | 187 233 | 146 004 | 169 737 |

| 2012 | 79 813 | 1 722 958 | 258 894 | 162 273 | 155 133 | 149 074 | 154 132 |

| 2013 | 78 756 | 1 919 823 | 285 736 | 184 483 | 171 019 | 162 166 | 146 429 |

| 2014 | 66 416 | 1 793 155 | 262 112 | 169 160 | 162 494 | 158 077 | 142 103 |

| 2015 | 73 773 | 2 257 218 | 305 620 | 169 807 | 166 551 | 181 139 | 204 143 |

| 2016 | 94 273 | 2 603 883 | 350 145 | 221 410 | 237 087 | 198 638 | 216 720 |

| 2017 | 98 775 | 2 719 733 | 367 725 | 238 330 | 294 735 | 194 970 | 202 630 |

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 0.33 | 1.66 | 0.83 | 0.66 | 0.50 | 0.66 | 0.66 |

| 2009 | 0.33 | 1.65 | 1.00 | 0.66 | 0.50 | 0.66 | 0.66 |

| 2010 | 0.33 | 1.65 | 1.00 | 0.66 | 0.50 | 0.66 | 0.70 |

| 2011 | 0.33 | 1.65 | 1.00 | 0.66 | 0.50 | 0.66 | 0.70 |

| 2012 | 1.00 | 1.65 | 1.00 | 1.00 | 0.50 | 0.70 | 1.00 |

| 2013 | 1.00 | 1.65 | 1.50 | 1.00 | 0.50 | 0.70 | 1.00 |

| 2014 | 1.00 | 1.65 | 1.50 | 1.00 | 0.50 | 0.70 | 1.00 |

| 2015 | 1.00 | 1.65 | 1.50 | 1.00 | 0.50 | 0.70 | 1.00 |

| 2016 | 1.00 | 1.65 | 1.50 | 1.00 | 0.50 | 0.70 | 1.00 |

| 2017 | 1.00 | 1.70 | 1.50 | 1.00 | 0.70 | 0.70 | 1.00 |

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 59 782 | 2 844 121 | 239 594 | 149 990 | 153 124 | 128 958 | 166 434 |

| 2009 | 42 676 | 2 254 248 | 245 491 | 109 376 | 96 379 | 76 579 | 154 071 |

| 2010 | 30 990 | 2 321 883 | 248 441 | 111 690 | 110 475 | 94 553 | 148 626 |

| 2011 | 38 306 | 2 414 399 | 264 638 | 123 912 | 103 383 | 98 616 | 145 020 |

| 2012 | 88 447 | 2 488 607 | 281 015 | 158 235 | 84 279 | 114 565 | 174 711 |

| 2013 | 101 601 | 2 681 408 | 429 927 | 182 070 | 74 340 | 126 607 | 161 336 |

| 2014 | 92 049 | 2 759 078 | 413 199 | 180 984 | 74 336 | 130 290 | 167 153 |

| 2015 | 89 455 | 3 166 138 | 523 694 | 184 741 | 76 716 | 141 266 | 241 790 |

| 2016 | 121 750 | 3 562 079 | 502 130 | 208 102 | 108 462 | 152 566 | 228 108 |

| 2017 | 123 554 | 4 958 342 | 547 420 | 227 110 | 205 288 | 158 378 | 227 665 |

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 36 | 236 | 57 | 66 | 28 | 20 | 31 |

| 2009 | 37 | 249 | 57 | 62 | 28 | 22 | 30 |

| 2010 | 40 | 264 | 56 | 66 | 29 | 20 | 30 |

| 2011 | 44 | 278 | 60 | 63 | 26 | 19 | 31 |

| 2012 | 48 | 303 | 65 | 67 | 28 | 18 | 34 |

| 2013 | 51 | 333 | 75 | 74 | 28 | 19 | 37 |

| 2014 | 49 | 342 | 80 | 85 | 29 | 20 | 41 |

| 2015 | 44 | 359 | 87 | 85 | 29 | 19 | 44 |

| 2016 | 45 | 372 | 94 | 93 | 29 | 18 | 42 |

| 2017 | 46 | 388 | 102 | 93 | 32 | 19 | 42 |

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 935 | 3 468 | 2 238 | 1 857 | 502 | 412 | 1 431 |

| 2009 | 952 | 3 744 | 2 244 | 1 812 | 533 | 381 | 1 378 |

| 2010 | 971 | 4 067 | 2 255 | 1 825 | 549 | 378 | 1 362 |

| 2011 | 994 | 4 382 | 2 314 | 1 752 | 553 | 385 | 1 335 |

| 2012 | 1 029 | 4 909 | 2 414 | 1 741 | 587 | 386 | 1 355 |

| 2013 | 1 073 | 5 604 | 2 583 | 1 702 | 682 | 383 | 1 371 |

| 2014 | 1 099 | 6 055 | 2 702 | 1 679 | 674 | 381 | 1 333 |

| 2015 | 1 089 | 6 738 | 2 770 | 1 627 | 681 | 383 | 1 304 |

| 2016 | 1 162 | 7 663 | 2 844 | 1 622 | 703 | 382 | 1 318 |

| 2017 | 1 287 | 8 659 | 2 948 | 1 646 | 772 | 396 | 1 308 |

| Source | N | Mean | SD | SE | 95% Conf. | Interval |

|---|---|---|---|---|---|---|

| RPO | 20 | 40 170 | 14 945.2 | 3 341.849 | 33 449.82 | 46 890.18 |

| RUZ | 20 | 1 609.5 | 535.2206 | 119.679 | 1 368.835 | 1 850.165 |

| SUSR | 20 | 2 873.9 | 626.4254 | 140.073 | 2 592.225 | 3 155.575 |

| F-Value | p-Value |

|---|---|

| 128.52776849735147 | 7.546566927916095 × 10−22 |

| sum_sq | df | mean_sq | F | PR(>F) | eta_sq | omega_sq | |

|---|---|---|---|---|---|---|---|

| Source | 1.92 × 1010 | 2 | 9.6 × 109 | 128.5278 | 7.55 × 10−22 | 0.818503 | 0.809557 |

| Residual | 4.26 × 109 | 57 | 7.467932 × 107 |

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 144 | 245.83 | 96.61 | 100 | 103.7 | 103.33 | 102.5 |

| 2009 | 142.31 | 228.44 | 91.94 | 101.64 | 82.35 | 107.14 | 97.37 |

| 2010 | 142.86 | 233.63 | 88.89 | 115.79 | 87.88 | 111.11 | 105.71 |

| 2011 | 151.72 | 235.59 | 93.75 | 118.87 | 76.47 | 114.81 | 120.59 |

| 2012 | 129.73 | 222.79 | 95.59 | 77.91 | 80 | 85 | 118.18 |

| 2013 | 141.67 | 260.16 | 110.29 | 90.24 | 77.78 | 90.24 | 123.53 |

| 2014 | 153.13 | 278.05 | 119.4 | 111.84 | 82.86 | 105.13 | 133.33 |

| 2015 | 122.22 | 240.94 | 122.54 | 101.19 | 78.38 | 107.32 | 118.42 |

| 2016 | 118.42 | 246.36 | 140.3 | 119.23 | 80.56 | 105 | 122.86 |

| 2017 | 115 | 253.59 | 152.24 | 117.72 | 94.12 | 110.53 | 137.5 |

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 3 740 | 3 612.5 | 3 793.22 | 2 813.64 | 1 859.26 | 4 770 | 2 287.5 |

| 2009 | 3 661.54 | 3 434.86 | 3 619.35 | 2 970.49 | 1 567.65 | 4 921.43 | 2 471.05 |

| 2010 | 3 467.86 | 3 599.12 | 3 579.37 | 3 201.75 | 1 663.64 | 5 044.44 | 2 780 |

| 2011 | 3 427.59 | 3 713.56 | 3 615.63 | 3 305.66 | 1 626.47 | 4 944.44 | 2 932.35 |

| 2012 | 2 781.08 | 3 609.56 | 3 550 | 2 024.42 | 1 677.14 | 3 387.5 | 3 163.64 |

| 2013 | 2 980.56 | 4 378.13 | 3 798.53 | 2 075.61 | 1 894.44 | 3 343.9 | 3 502.94 |

| 2014 | 3 434.38 | 4 922.76 | 4 032.84 | 2 209.21 | 1 925.71 | 3 417.95 | 3 563.64 |

| 2015 | 3 025 | 4 522.15 | 3 901.41 | 1 936.9 | 1 840.54 | 3 180.49 | 3 150 |

| 2016 | 3 057.89 | 5 074.83 | 4 244.78 | 2 079.49 | 1 952.78 | 3 295 | 3 548.57 |

| 2017 | 3 217.5 | 5 659.48 | 4 400 | 2 083.54 | 2 270.59 | 3 442.11 | 3 965.63 |

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 180 100 | 1 713 640 | 288 720 | 227 258 | 307 533 | 194 250 | 250 700 |

| 2009 | 129 321 | 1 366 211 | 245 491 | 164 723 | 193 568 | 116 029 | 232 077 |

| 2010 | 93 909 | 1 407 202 | 248 441 | 169 227 | 221 878 | 143 262 | 212 322 |

| 2011 | 116 079 | 1 463 272 | 264 638 | 187 745 | 207 634 | 149 418 | 207 172 |

| 2012 | 88 447 | 1 508 247 | 281 015 | 158 235 | 169 266 | 163 664 | 174 711 |

| 2013 | 101 601 | 1 625 096 | 286 618 | 182 070 | 148 680 | 180 868 | 161 336 |

| 2014 | 92 049 | 1 672 168 | 275 466 | 180 984 | 148 672 | 186 128 | 167 153 |

| 2015 | 89 455 | 1 918 872 | 349 129 | 184 741 | 153 432 | 201 809 | 241 790 |

| 2016 | 121 750 | 2 158 836 | 334 753 | 208 102 | 216 924 | 217 951 | 228 108 |

| 2017 | 123 554 | 2 916 672 | 364 947 | 227 110 | 293 269 | 226 254 | 227 665 |

| City/Year | Banská Bystrica | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad | Žilina |

|---|---|---|---|---|---|---|---|

| 2008 | 166.71 | 110.62 | 101.94 | 98.81 | 146.08 | 118.26 | 143.97 |

| 2009 | 142.94 | 102.62 | 111.5 | 100.8 | 116.58 | 98.84 | 149.32 |

| 2010 | 111.01 | 101.9 | 94.59 | 99.69 | 104.92 | 122.99 | 140.81 |

| 2011 | 137.02 | 95.85 | 104.09 | 99.56 | 110.9 | 102.34 | 122.05 |

| 2012 | 110.82 | 87.54 | 108.54 | 97.51 | 109.11 | 109.79 | 113.35 |

| 2013 | 129.01 | 84.65 | 100.31 | 98.69 | 86.94 | 111.53 | 110.18 |

| 2014 | 138.59 | 93.25 | 105.09 | 106.99 | 91.49 | 117.75 | 117.63 |

| 2015 | 121.26 | 85.01 | 114.24 | 108.79 | 92.12 | 111.41 | 118.44 |

| 2016 | 129.15 | 82.91 | 95.6 | 93.99 | 91.5 | 109.72 | 105.25 |

| 2017 | 125.09 | 107.24 | 99.24 | 95.29 | 99.5 | 116.05 | 112.36 |

| City/Year | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad |

|---|---|---|---|---|---|

| 2008 | 10 178 595 | 2 146 853 | 1 303 151 | 755 670 | 1 617 403 |

| 2009 | 8 316 910 | 1 594 296 | 974 568 | 505 638 | 1 191 906 |

| 2010 | 9 015 489 | 1 880 472 | 1 090 616 | 681 261 | 1 212 072 |

| 2011 | 10 260 953 | 1 839 914 | 1 249 513 | 587 387 | 1 491 599 |

| 2012 | 11 247 128 | 1 842 325 | 671 906 | 501 262 | 1 054 523 |

| 2013 | 15 100 835 | 2 176 384 | 785 931 | 616 696 | 1 134 699 |

| 2014 | 15 778 071 | 2 117 606 | 770 015 | 596 215 | 1 133 926 |

| 2015 | 18 221 765 | 2 394 951 | 682 716 | 585 033 | 1 215 048 |

| 2016 | 23 432 465 | 2 983 786 | 956 975 | 880 099 | 1 376 575 |

| 2017 | 27 147 508 | 3 250 164 | 1 031 160 | 1 264 042 | 1 410 120 |

| City/Year | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad |

|---|---|---|---|---|---|

| 2008 | 16 893 373 | 1 781 562 | 860 080 | 376 255 | 1 073 759 |

| 2009 | 13 722 902 | 1 594 296 | 647 113 | 251 762 | 786 658 |

| 2010 | 14 875 557 | 1 880 472 | 719 807 | 339 206 | 799 968 |

| 2011 | 16 930 572 | 1 839 914 | 824 679 | 292 465 | 984 455 |

| 2012 | 18 557 761 | 1 842 325 | 671 906 | 249 583 | 738 166 |

| 2013 | 24 916 378 | 3 264 576 | 785 931 | 308 348 | 794 289 |

| 2014 | 26 033 817 | 3 176 409 | 770 015 | 298 108 | 793 748 |

| 2015 | 30 065 912 | 3 592 427 | 682 716 | 292 517 | 850 534 |

| 2016 | 38 663 567 | 4 475 679 | 956 975 | 440 050 | 963 603 |

| 2017 | 46 150 764 | 4 875 246 | 1 031 160 | 884 829 | 987 084 |

| City/Year | Bratislava | Košice | Liptovský Mikuláš | Nitra | Poprad |

|---|---|---|---|---|---|

| 2008 | 593.98 | 743.58 | 573.42 | 245.72 | 832.64 |

| 2009 | 608.76 | 649.43 | 591.64 | 261.22 | 1 027.25 |

| 2010 | 640.67 | 756.91 | 644.47 | 307.04 | 846.05 |

| 2011 | 701.23 | 695.26 | 665.54 | 282.89 | 998.27 |

| 2012 | 745.71 | 655.6 | 424.63 | 296.14 | 644.32 |

| 2013 | 929.23 | 759.33 | 431.66 | 414.78 | 627.36 |

| 2014 | 943.57 | 768.74 | 425.46 | 401.03 | 609.22 |

| 2015 | 949.61 | 685.98 | 369.55 | 381.3 | 602.08 |

| 2016 | 1085.42 | 891.34 | 459.86 | 405.72 | 631.6 |

| 2017 | 930.77 | 890.59 | 454.04 | 431.02 | 623.25 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sidor, C.; Kršák, B.; Štrba, Ľ. Identification of Distorted Official Hospitality Statistics’ and Their Impact on DMOs’ Funding’s Sustainability: Case Notes from Slovakia. Sustainability 2019, 11, 1084. https://doi.org/10.3390/su11041084

Sidor C, Kršák B, Štrba Ľ. Identification of Distorted Official Hospitality Statistics’ and Their Impact on DMOs’ Funding’s Sustainability: Case Notes from Slovakia. Sustainability. 2019; 11(4):1084. https://doi.org/10.3390/su11041084

Chicago/Turabian StyleSidor, Csaba, Branislav Kršák, and Ľubomír Štrba. 2019. "Identification of Distorted Official Hospitality Statistics’ and Their Impact on DMOs’ Funding’s Sustainability: Case Notes from Slovakia" Sustainability 11, no. 4: 1084. https://doi.org/10.3390/su11041084

APA StyleSidor, C., Kršák, B., & Štrba, Ľ. (2019). Identification of Distorted Official Hospitality Statistics’ and Their Impact on DMOs’ Funding’s Sustainability: Case Notes from Slovakia. Sustainability, 11(4), 1084. https://doi.org/10.3390/su11041084