Rating the Raters: Evaluating how ESG Rating Agencies Integrate Sustainability Principles

Abstract

1. Introduction

2. Theoretical Background

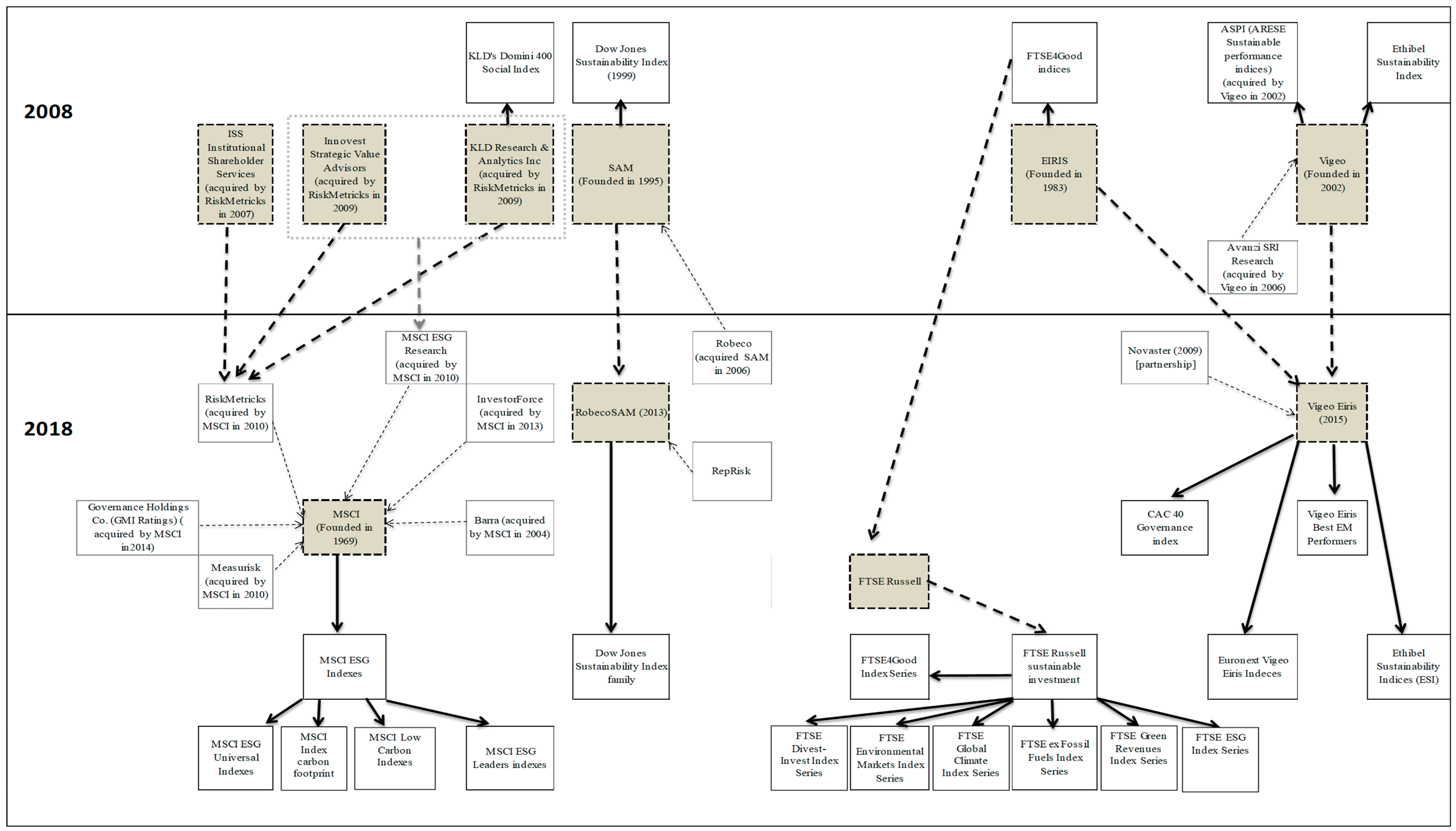

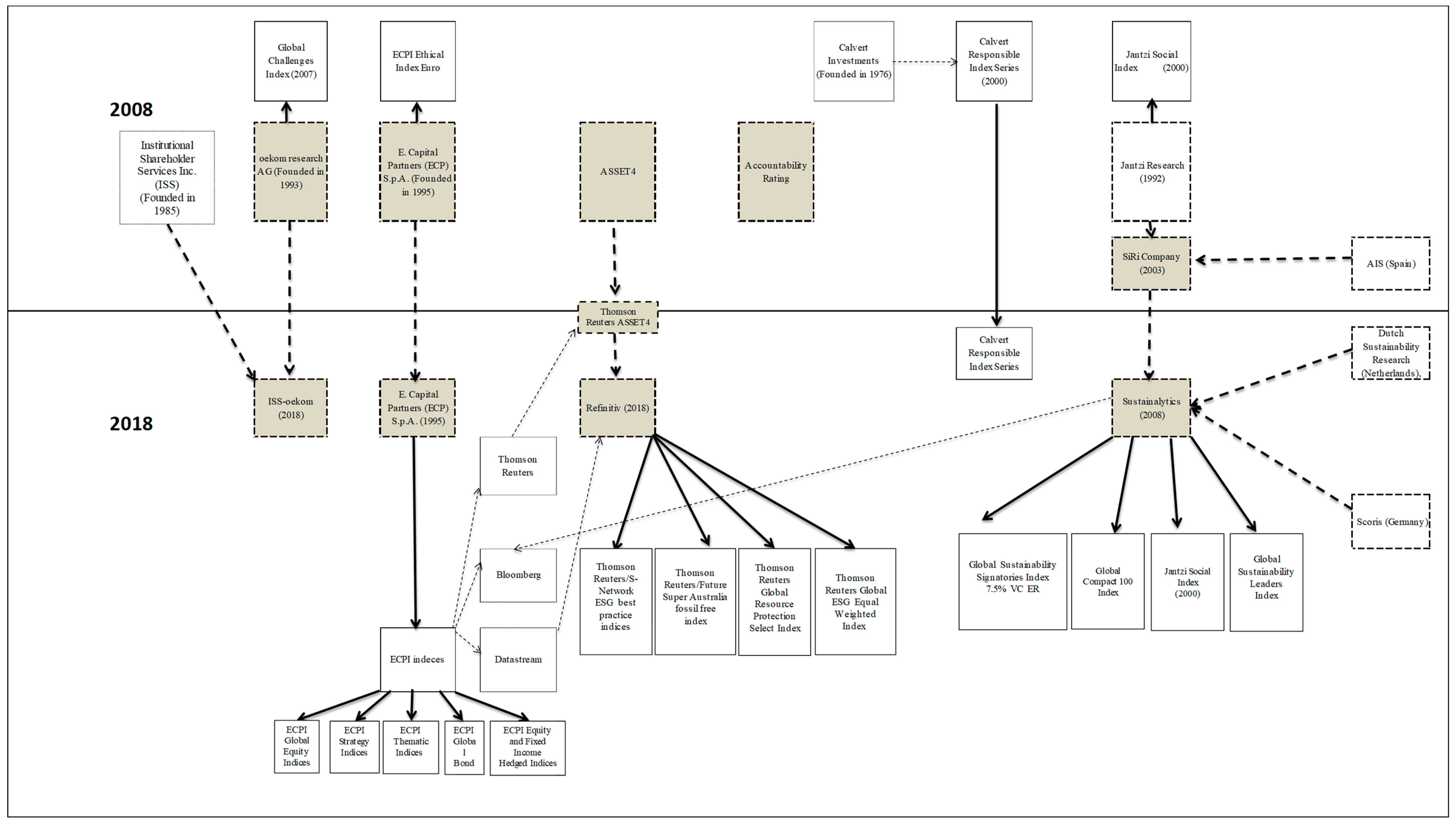

2.1. ESG Rating Agency Industry

2.2. Have ESG Rating Agencies Been Able to Integrate Sustainability Principles into Corporate Sustainability Assessment?

- (i)

- Lack of transparency. ESG rating agencies do not offer complete and public information about the criteria and the assessment process developed by them to evaluate the corporate sustainability performance. This makes understanding what ESG rating agencies are measuring and making comparisons between them difficult [7,19,22,29].

- (ii)

- Commensurability. ESG rating agencies may measure the same concept in different ways. Therefore, if the assessments of ESG ratings are not consistent, which involves evidence of low commensurability, the hypothesized benefits of CSR cannot occur [6].

- (iii)

- (iv)

- Lack of an overall score. Most of the ESG rating agencies provide environmental, social and governance rates to each domain, but they do not provide an overall score of the corporate sustainability performance [32].

- (v)

2.3. Sustainability Principles

- (i)

- Sustainability dimensions and the balance among them. Sustainability is a multidimensional concept [41] where three domains can be distinguished: financial economic, environmental and social. Achieving a balance among the three domains implies not prioritizing or undermining a dimension over the other ones.

- (ii)

- Intergenerational perspective. This principle implies identifying, evaluating and managing the future and the current needs [39], considering the long-term effects of today’s decisions and a balance between both short- and long-term ones.

- (iii)

- Stakeholder approach. Sustainability involves identifying the current stakeholders’ needs and expectations and the future generations’ needs.

- (iv)

- Life-cycle thinking (LCT). Decision-makers should shoulder economic, environmental and social responsibilities in order to achieve sustainability which cross legal organizational boundaries. In this regard, sustainability involves managing the impacts of upstream and downstream activities and, accordingly, adopting an LCT approach.

3. Methodology

- (i)

- Pre-analysis: We established the objectives of the content analysis, and we selected the material for analysis. Concretely, we analyzed the qualitative and public information provided by the ESG rating agencies on their corporate websites concerning their corporate sustainability analysis criteria in 2008 (see Escrig-Olmedo et al. [7]) and 2018. We browsed the company website in order to seek information on the corporate sustainability assessment, sustainability and ESG data, ESG research and ratings until five clicks.

- (ii)

- (iii)

- Treatment and interpretation: We examined the relevance and the presence or absence of the themes in the content analyzed. We considered that a theme is relevant if it is public on the ESG rating agency website and, moreover, if it is highlighted as a key criterion in the assessment process of the ESG rating agency. Finally, we quantified the percentage of ESG rating agencies in the sample that offered information about specific assessment criteria.

- (i)

- Sustainability dimensions and the balance among them. An ESG rating agency integrates this principle if in its assessment process and methodologies, environmental, social and governance criteria are equally important.

- (ii)

- The intergenerational perspective. An ESG rating agency integrates this principle if the criteria or assessment methodology aspects such as the future and the current needs or specific risks considering both the short and long term are explicitly laid down.

- (iii)

- Stakeholder approach. An ESG rating agency integrates this principle if stakeholders’ needs and expectations are integrated in its criteria and assessment process.

- (iv)

- Life-cycle thinking (LCT). An ESG rating agency applies this principle if the way the company impacts upstream and downstream activities, in accordance with the adoption of a LCT approach, are examined in its criteria and assessment frameworks.

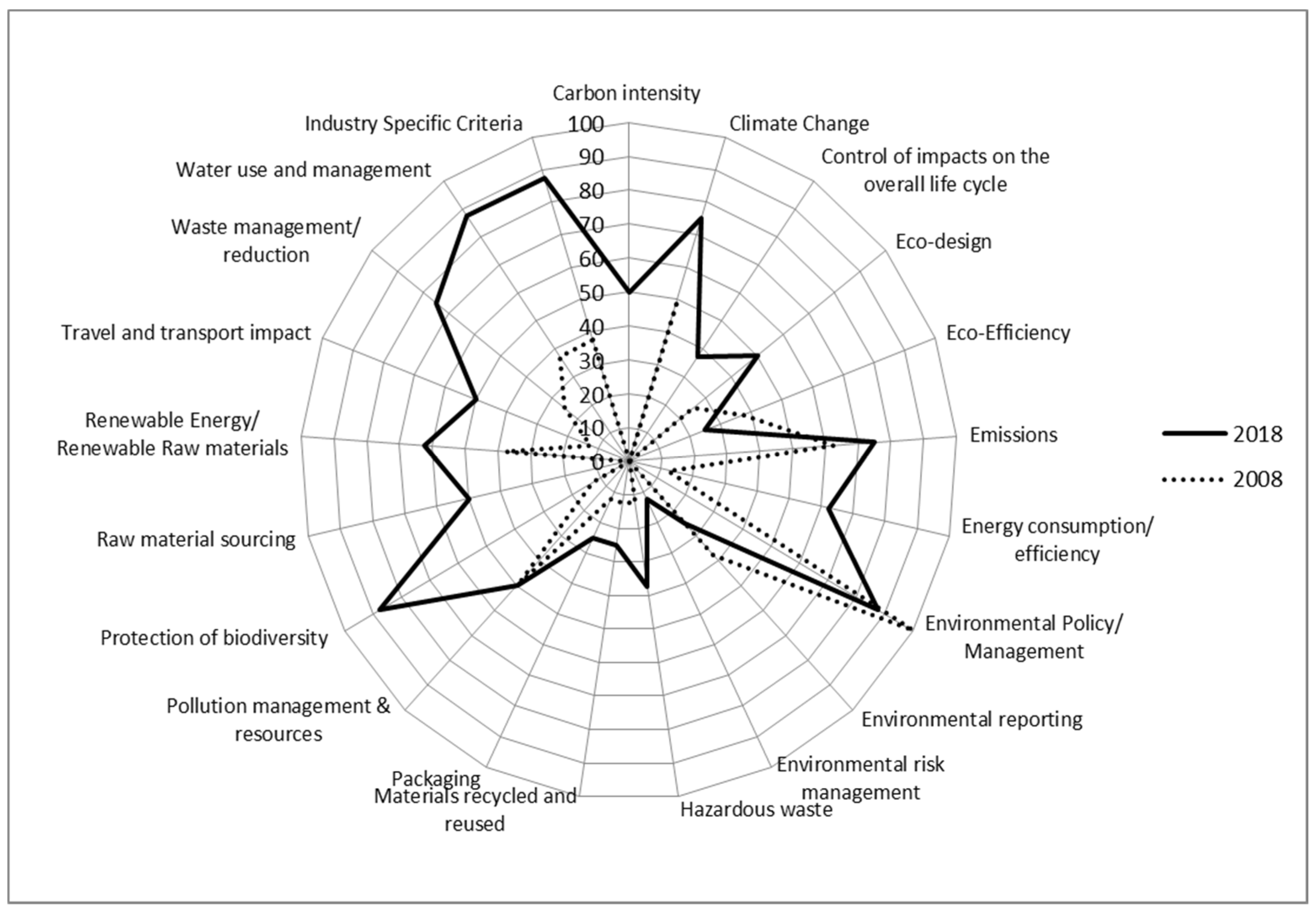

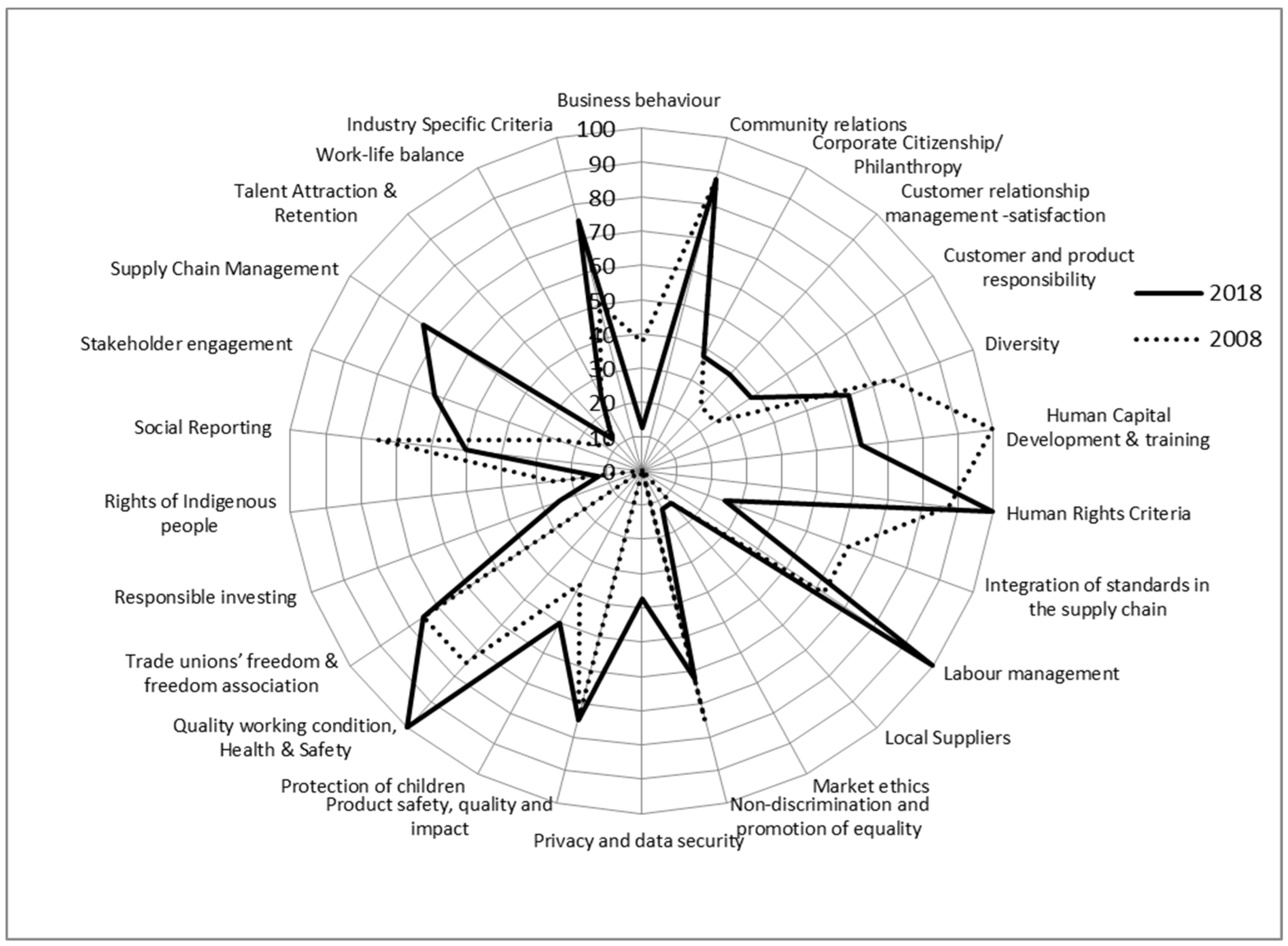

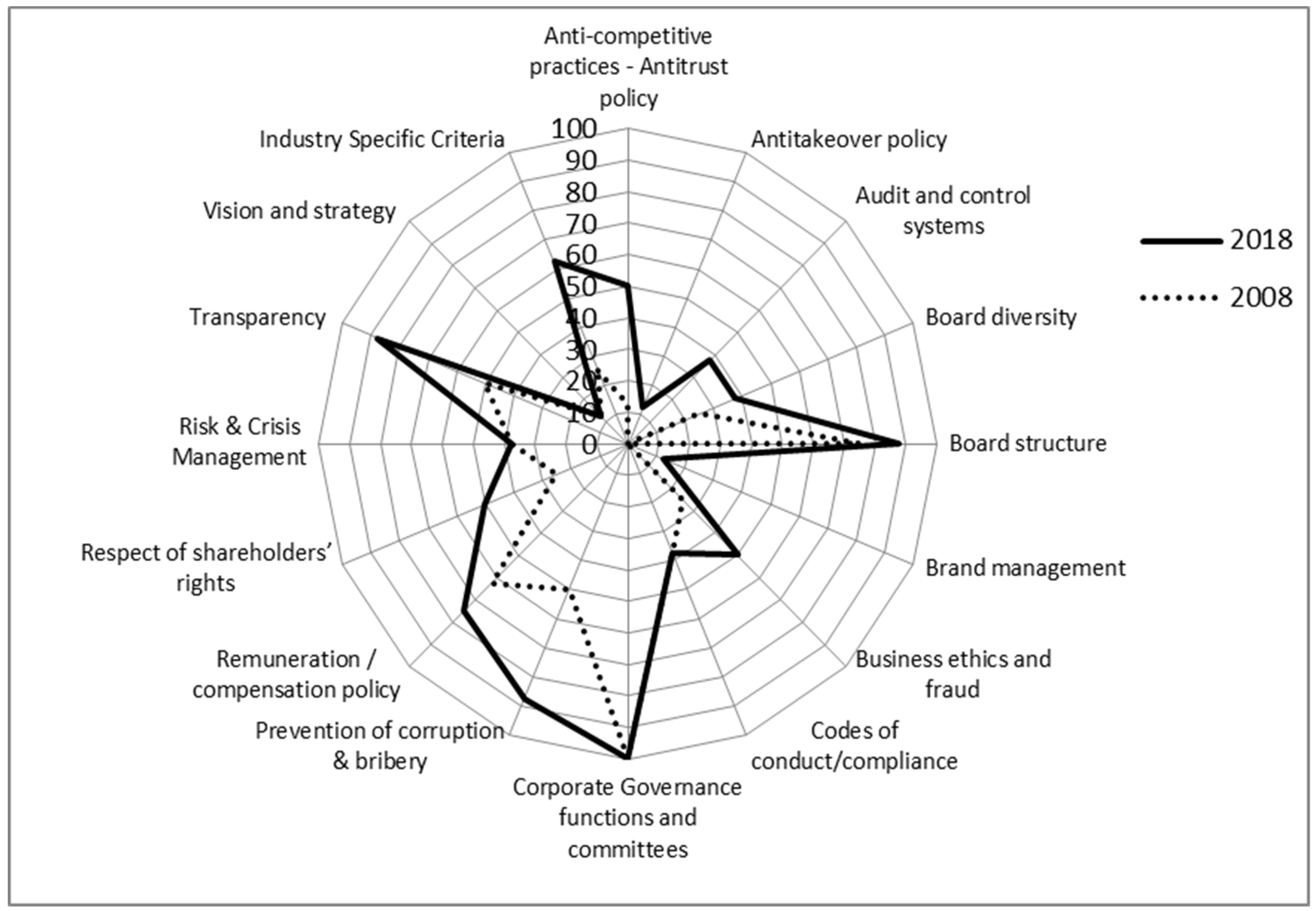

4. Results

5. Discussion and Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Galbreath, J. ESG in focus: The Australian evidence. J. Bus. Ethics. 2013, 118, 529–541. [Google Scholar] [CrossRef]

- Elbasha, T.; Avetisyan, E. A framework to study strategizing activities at the field level: The example of CSR rating agencies. Eur. Manag. J. 2018, 36, 38–46. [Google Scholar] [CrossRef]

- Avetisyan, E.; Ferrary, M. Dynamics of stakeholders’ implications in the institutionalization of CSR Field in France and in the United States. J. Bus. Ethics. 2013, 115, 115–133. [Google Scholar] [CrossRef]

- Avetisyan, E.; Hockerts, K. The consolidation of the ESG rating industry as an enactment of institutional retrogression. Bus. Strateg. Environ. 2017, 26, 316–330. [Google Scholar] [CrossRef]

- Chatterji, A.K.; Levine, D.I.; Toffel, M.W. How well do social ratings actually measure corporate social responsibility? J. Econ. Manage. Strat. 2009, 18, 125–169. [Google Scholar] [CrossRef]

- Chatterji, A.K.; Durand, R.; Levine, D.I.; Touboul, S. Do ratings of firms converge? Implications for managers, investors and strategy researchers. Strateg. Manage. J. 2016, 37, 1597–1614. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Muñoz-Torres, M.J.; Fernandez-Izquierdo, M.A. Socially responsible investing: Sustainability indices, ESG rating and information provider agencies. Int. J. Sustain. Econ. 2010, 2, 442–461. [Google Scholar] [CrossRef]

- Semenova, N.; Hassel, L.G. On the validity of environmental performance metrics. J. Bus. Ethics. 2014, 132, 1–10. [Google Scholar] [CrossRef]

- Muñoz-Torres, M.J.; Fernández-Izquierdo, M.A.; Rivera-Lirio, J.M.; Escrig-Olmedo, E. Can environmental, social and governance rating agencies favor Business Models that promote a more Sustainable Development? Corp. Soc. Resp. Env. Ma 2019. online first. [Google Scholar]

- DiMaggio, P.; Powell, W. The New Institutionalism in Organizational Analysis; University of Chicago Press: Chicago, IL, USA, 1991. [Google Scholar]

- Waas, T.; Hugé, J.; Verbruggen, A.; Wright, T. Sustainable development: A bird’s eye view. Sustainability 2011, 3, 1637–1661. [Google Scholar] [CrossRef]

- Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á.; Rivera-Lirio, J.M.; Ferrero-Ferrero, I.; Escrig-Olmedo, E.; Gisbert-Navarro, J.V.; Marullo, M.C. An Assessment Tool to Integrate Sustainability Principles into the Global Supply Chain. Sustainability 2018, 10, 535. [Google Scholar] [CrossRef]

- Nawaz, W.; Koc, M. Development of a systematic framework for sustainability management of organizations. J. Clean. Prod. 2018, 171, 1255–1274. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Brit. J. Manage. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Abdelkafi, N.; Täuscher, K. Business models for sustainability from a system dynamics perspective. Organ. Environ. 2016, 29, 74–96. [Google Scholar] [CrossRef]

- Lozano, R. A holistic perspective on corporate sustainability drivers. Corp. Soc. Resp. Env. Ma. 2015, 22, 32–44. [Google Scholar] [CrossRef]

- Windolph, S.E. Assessing corporate sustainability through ratings: Challenges and their causes. J.Environ. Sustain. 2011, 1, 61–81. [Google Scholar] [CrossRef]

- Ben-Eli, M.U. Sustainability: definition and five core principles, a systems perspective. Sustain. Sci. 2018, 13, 1337–1343. [Google Scholar] [CrossRef]

- Scalet, S.; Kelly, T.F. CSR Rating Agencies: What is Their Global Impact? J. Bus. Ethics. 2010, 94, 69–88. [Google Scholar] [CrossRef]

- Lopatta, K.; Kaspereit, T. The world capital markets’ perception of sustainability and the impact of the financial crisis. J. Bus. Ethics. 2014, 122, 475–500. [Google Scholar] [CrossRef]

- Scott, M.E.; Cocchi, D.; Campbell-Gemmell, J. Defining a fit for purpose statistically reliable sustainability indicator. Sustain. Account. Mana. 2014, 5, 262–267. [Google Scholar]

- Saadaoui, K.; Soobaroyen, T. An analysis of the methodologies adopted by CSR rating agencies. Sustain. Account. Mana. 2018, 9, 43–62. [Google Scholar] [CrossRef]

- Rivera, J.M.; Muñoz, M.J.; Moneva, J.M. Revisiting the relationship between corporate stakeholder commitment and social and financial performance. Sustain. Dev. 2017, 25, 482–494. [Google Scholar] [CrossRef]

- Taylor, J.; Vithayathil, J.; Yim, D. Are corporate social responsibility (CSR) initiatives such as sustainable development and environmental policies value enhancing or window dressing? Corp. Soc. Resp. Env. Ma. 2018. [Google Scholar] [CrossRef]

- Mackenzie, C.; Rees, W.; Rodionova, T. Do responsible investment indices improve corporate social responsibility? FTSE4Good’s impact on environmental management. Corp. Gov. 2013, 21, 495–512. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Slager, R.; Gond, J.-P.; Moon, J. Standardization as institutional work: The regulatory power of a responsible investment standard. Organ. Stud. 2012, 33, 763–790. [Google Scholar] [CrossRef]

- Sandberg, J.; Juravle, C.; Hedesstrom, T.M.; Hamilton, I. The heterogeneity of socially responsible investment. J. Bus. Ethics. 2009, 87, 519–533. [Google Scholar] [CrossRef]

- Chatterji, A.; Levine, D. Breaking down the wall of codes: evaluating non-financial performance measurement. Calif. Manage. Rev. 2006, 48, 29–51. [Google Scholar] [CrossRef]

- Delmas, M.; Blass, V.D. Measuring corporate environmental performance: The trade-offs of sustainability ratings. Bus. Strateg. Environ. 2010, 19, 245–260. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á.; Rivera-Lirio, J.M. Lights and shadows on sustainability rating scoring. Rev. Manag. Sci. 2014, 8, 559–574. [Google Scholar] [CrossRef]

- Liern, V.; Pérez-Gladish, B. Ranking corporate sustainability: a flexible multidimensional approach based on linguistic variables. Int. T. Oper. Res. 2018, 25, 1081–1100. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á.; Rivera-Lirio, J.M. Measuring corporate environmental performance: a methodology for sustainable development. Bus. Strateg. Environ. 2017, 26, 142–162. [Google Scholar] [CrossRef]

- Busch, T.; Bauer, R.; Orlitzky, M. Sustainable development and financial markets: Old paths and new avenues. Bus. Soc. 2016, 55(3), 303–329. [Google Scholar] [CrossRef]

- Griggs, D.; Stafford-Smith, M.; Gaffney, O.; Rockström, J.; Öhman, M.C.; Shyamsundar, P.; Steffen, W.; Glaser, G.; Kanie, N.; Noble, I. Policy: Sustainable development goals for people and planet. Nature 2013, 495, 305–307. [Google Scholar] [CrossRef] [PubMed]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone Publishing Ltd.: Oxford, UK, 1997. [Google Scholar]

- Freeman, E. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- International Organization for Standardization (ISO). International Organization for Standardization, ISO 26000:2010—Guidance on Social Responsibility; ISO: Genève, Switzerland, 2010. [Google Scholar]

- World Commission on Environment and Development (WCED). Our Common Future. 1987. Available online: www.un-documents.net/our-common-future.pdf (accessed on 11 January 2019).

- Lindsey, T.C. Sustainable principles: Common values for achieving sustainability. J. Clean Prod. 2011, 19, 561–565. [Google Scholar] [CrossRef]

- Boggia, A.; Cortina, C. Measuring sustainable development using a multi-criteria model: A case study. J. Environ. Manage. 2010, 91, 2301–2306. [Google Scholar] [CrossRef]

- US SIF. Report on US Sustainable, Responsible and Impact Investing Trend. 2018. Available online: https://www.ussif.org/files/Trends/Trends%202018%20executive%20summary%20FINAL.pdf (accessed on 20 January 2019).

- Eurosif. European SRI Study. 2018. Available online: http://www.eurosif.org/wp-content/uploads/2018/11/European-SRI-2018-Study.pdf (accessed on 20 January 2019).

- Abbott, W.F.; Monsen, R.J. On the Measurement of Corporate Social Responsibility: Self reported Disclosures as a Method of Measuring Corporate Social Involvement. Acad. Manage. J. 1979, 22, 501–515. [Google Scholar]

- Beattie, V.; McInnes, B.; Fearnley, S. A methodology for analysing and evaluating narratives in annual reports: a comprehensive descriptive profile and metrics for disclosure quality attributes. Account. Forum 2004, 28, 205–236. [Google Scholar] [CrossRef]

- Bardin, L. Análise de conteúdo (Edição revista e actualizada); Lisboa: Edições, Portugal, 2009; p. 70. [Google Scholar]

- Moneva, J.M.; Rivera-Lirio, J.M.; Muñoz-Torres, M.J. The corporate stakeholder commitment and social and financial performance. Ind. Manage. Data Syst. 2007, 107, 84–102. [Google Scholar] [CrossRef]

- García-Pérez, I.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Microfinance literature: A sustainability level perspective survey. J. Clean Prod. 2017, 142, 3382–3395. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S.; Guedhami, O.; Suh, J. Corporate social responsibility and credit ratings. J. Bus. Ethics. 2013, 117, 679–694. [Google Scholar] [CrossRef]

| ESG Rating Agencies and Information Provider Agencies 1 (2008) → (2018) | Number of Companies Analyzed by ESG Rating Agencies | Other Important Facts |

|---|---|---|

| Around 22,000 companies Around 4000 companies Around 4100 companies Around 7000 companies Around 20,000 companies Around 4500 companies Around 9000 companies Around 4000 companies | Companies across 87 countries Companies across 47 developed and emerging markets It is used by 46 of the top 50 asset managers and by 1200 investors worldwide. 2000 institutional clients, 115 markets covered. Companies across 60 countries Expanded to 11,000 companies in Q2 2019. A multicultural team of 145 analysts |

| ESG Rating Agencies | (1) Sustainability Dimensions 1 | (2) Balance | (3) Intergenerational Perspective | (4) Stakeholder Approach | (5) Life-Cycle Thinking |

|---|---|---|---|---|---|

| REFINITIV | EC EN SO CG | ✕ | ✕ | ✓ | ✕ |

| ECP | EN SO CG | ✓ | ✓ | ✓ | ✕ |

| FTSE Russell ESG Ratings | EN SO CG | ✓ | ✕ | ✓ | ✕ |

| MSCI ESG Research | EC EN SO CG | ✓ | ✓ | ✓ | ✕ |

| ISS-oekom | EN SO CG | ✓ | ✕ | ✓ | ✕ |

| RobecoSAM | EN SO CG | ✕ | ✓ | ✓ | ✕ |

| Sustainalytics | EN SO CG | ✕ | ✓ | ✓ | ✕ |

| Vigeo EIRIS | EN SO CG | ✓ | ✕ | ✓ | ✕ |

| ESG rating agencies | EC EN SO CG | ≠ | ≠ | ✓ | ✕ |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Escrig-Olmedo, E.; Fernández-Izquierdo, M.Á.; Ferrero-Ferrero, I.; Rivera-Lirio, J.M.; Muñoz-Torres, M.J. Rating the Raters: Evaluating how ESG Rating Agencies Integrate Sustainability Principles. Sustainability 2019, 11, 915. https://doi.org/10.3390/su11030915

Escrig-Olmedo E, Fernández-Izquierdo MÁ, Ferrero-Ferrero I, Rivera-Lirio JM, Muñoz-Torres MJ. Rating the Raters: Evaluating how ESG Rating Agencies Integrate Sustainability Principles. Sustainability. 2019; 11(3):915. https://doi.org/10.3390/su11030915

Chicago/Turabian StyleEscrig-Olmedo, Elena, María Ángeles Fernández-Izquierdo, Idoya Ferrero-Ferrero, Juana María Rivera-Lirio, and María Jesús Muñoz-Torres. 2019. "Rating the Raters: Evaluating how ESG Rating Agencies Integrate Sustainability Principles" Sustainability 11, no. 3: 915. https://doi.org/10.3390/su11030915

APA StyleEscrig-Olmedo, E., Fernández-Izquierdo, M. Á., Ferrero-Ferrero, I., Rivera-Lirio, J. M., & Muñoz-Torres, M. J. (2019). Rating the Raters: Evaluating how ESG Rating Agencies Integrate Sustainability Principles. Sustainability, 11(3), 915. https://doi.org/10.3390/su11030915