The Promising Effect of a Green Food Label in the New Online Market

Abstract

:1. Introduction

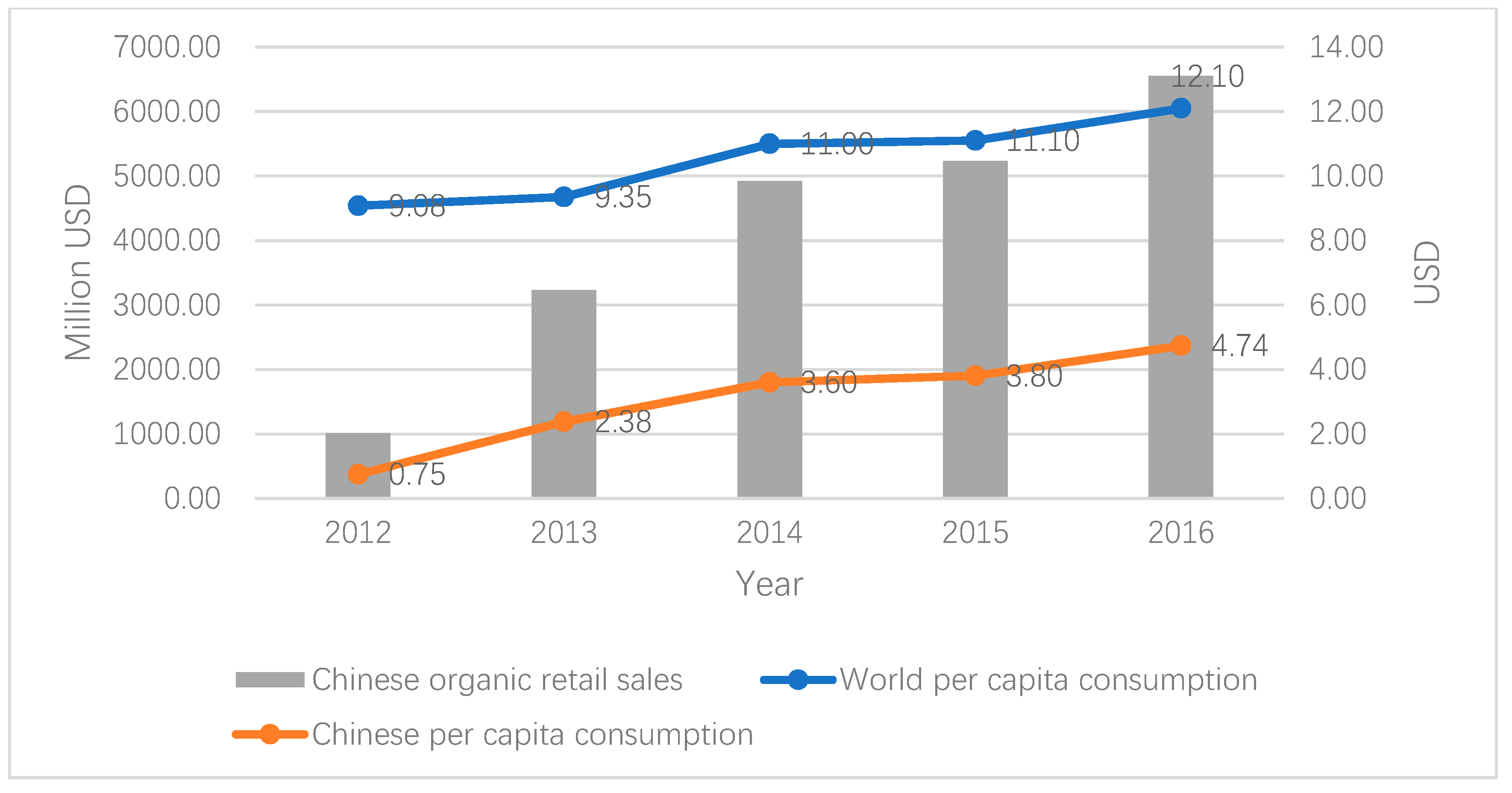

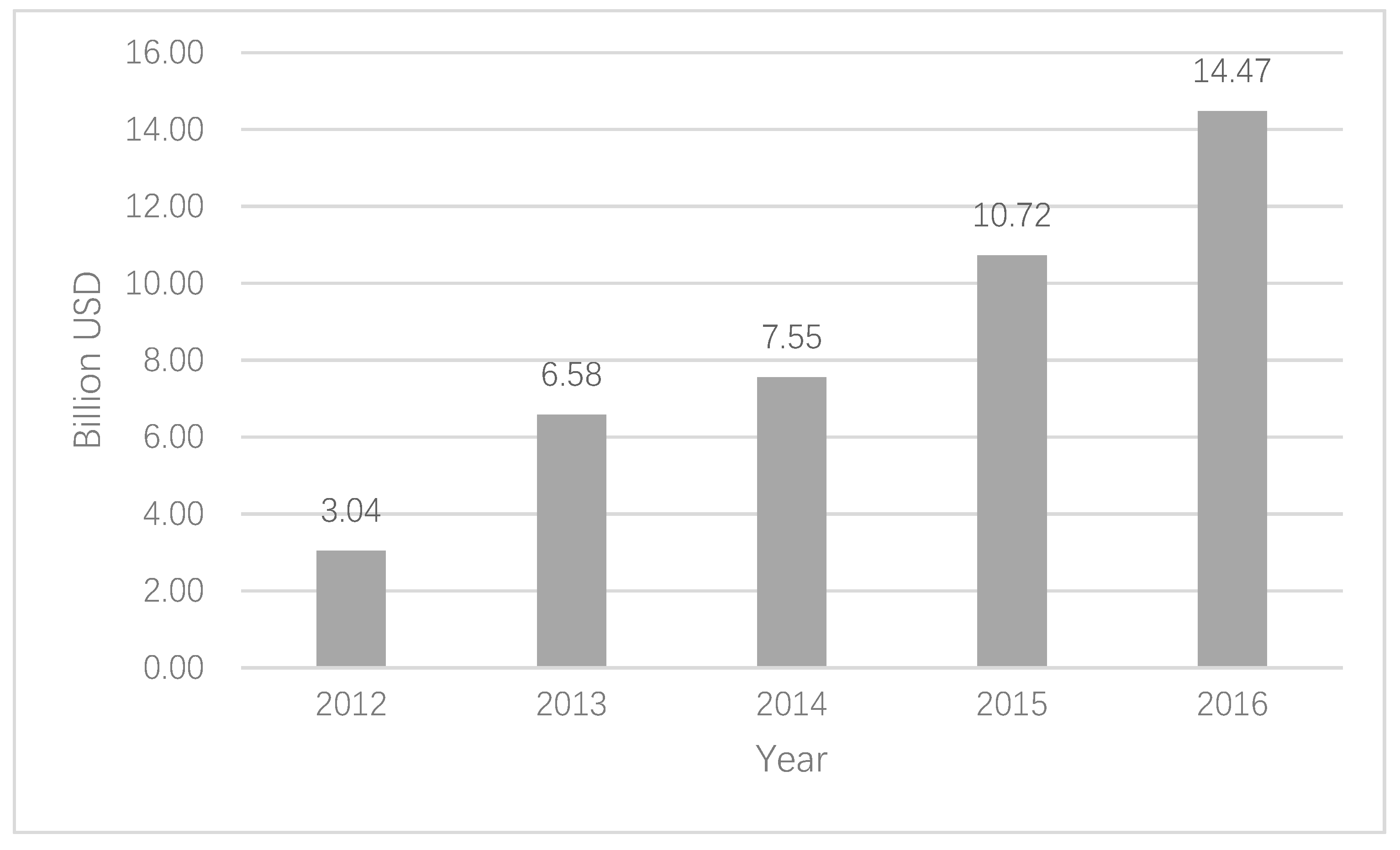

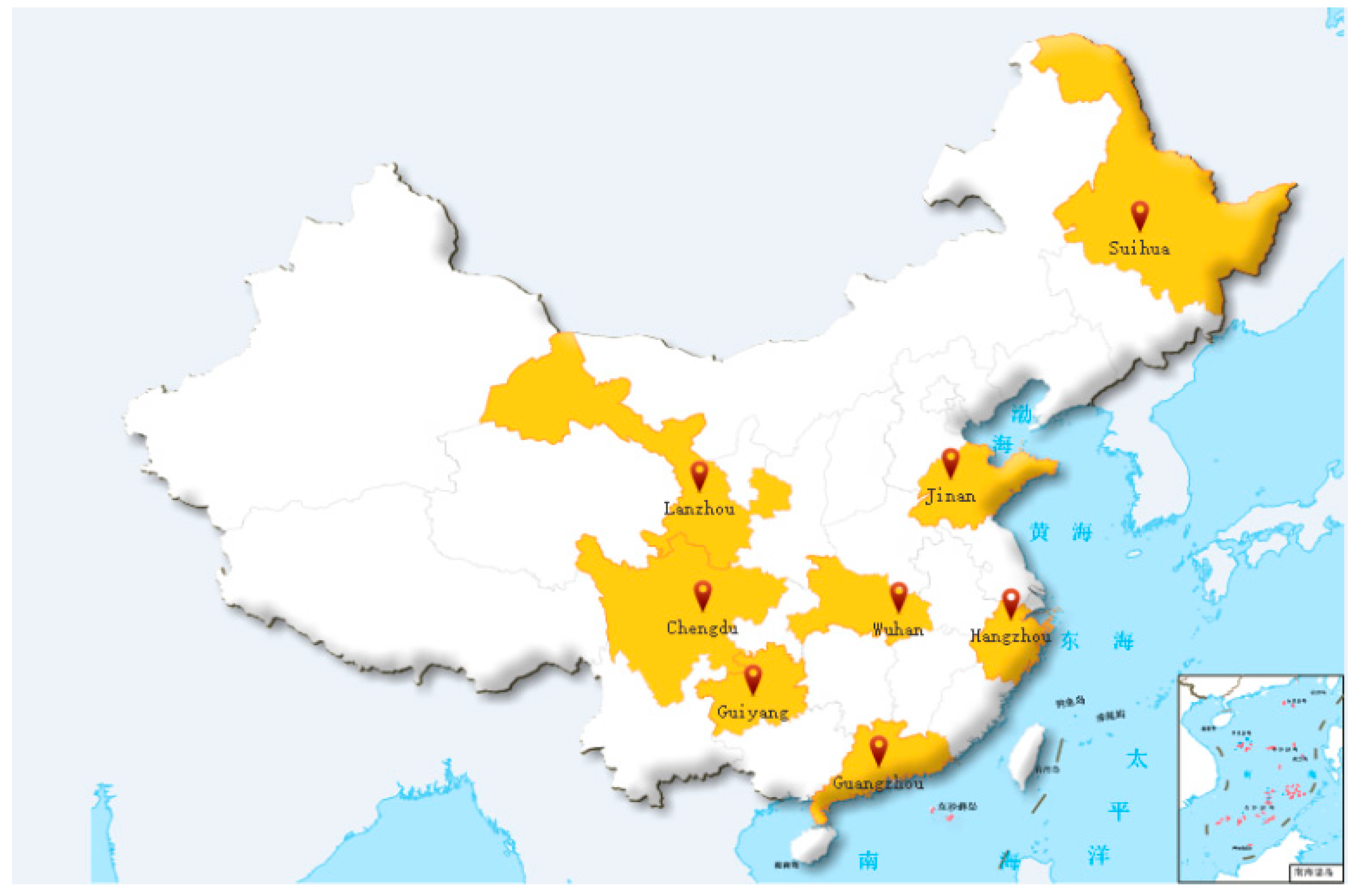

2. Background of Online Food Market Development in China

3. Data and Methodology

3.1. Hedonic Theory

3.2. Data

3.3. Emprical Model

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Type | Description |

|---|---|---|

| Dependent variable | ||

| Price | Continuous | Yuan per liter after claimed discount |

| Independent variables | ||

| Green | Dummy | With green food label = 1, otherwise = 0 |

| Gm | Dummy | With genetically modified ingredient = 1, otherwise = 0 |

| Volume | Continuous | Volume of product |

| Leaching | Dummy | Using leaching method for extraction = 1, otherwise = 0 |

| Variety1 | Dummy | Soybean oil = 1, otherwise = 0 |

| Variety2 | Dummy | Peanut oil = 1, otherwise = 0 |

| Variety3 | Dummy | Rapeseed oil = 1, otherwise = 0 |

| Variety4 | Dummy | Sunflower seed oil = 1, otherwise = 0 |

| Variety5 | Dummy | Olive oil = 1, otherwise = 0 |

| Variety6 | Dummy | Corn oil = 1, otherwise = 0 |

| Variety7 | Dummy | Linseed oil = 1, otherwise = 0 |

| - | Dummy | Other varieties = 1, otherwise = 0 (baseline) |

| Origin1 | Dummy | Northeast China = 1, otherwise = 0 |

| Origin2 | Dummy | East China = 1, otherwise = 0 |

| Origin3 | Dummy | North China = 1, otherwise = 0 |

| Origin4 | Dummy | Central China = 1, otherwise = 0 |

| Origin5 | Dummy | South China = 1, otherwise = 0 |

| Origin6 | Dummy | South-west China = 1, otherwise = 0 |

| Origin7 | Dummy | North-west China = 1, otherwise = 0 |

| - | Dummy | Unspecified = 1, otherwise = 0 (baseline) |

| Plastic | Dummy | Container’s material is plastic = 1, otherwise = 0 |

| Color | Continuous | Number of colors in container |

| Giftbox | Dummy | Packaged with a giftbox = 1, otherwise = 0 |

| Discount claim | Dummy | With discount claim = 1, otherwise = 0 |

| Online | Dummy | Online market = 1, offline = 0 |

References

- Tisdell, C. Sustainable development: Differing perspectives of ecologists and economists, and relevance to LDCs. World Dev. 1988, 16, 373–384. [Google Scholar] [CrossRef]

- National Bureau of Statistics of China (NBS). Statistical Communiqué of the People’s Republic of China on the 2017 National Economic and Social Development; National Bureau of Statistics of China: Beijing, China, 2018.

- Liu, Q.; Yan, Z.; Zhou, J. Consumer Choices and Motives for Eco-Labeled Products in China: An Empirical Analysis Based on the Choice Experiment. Sustainability 2017, 9, 331. [Google Scholar] [CrossRef]

- Massey, M.; O’Cass, A.; Otahal, P. A meta-analytic study of the factors driving the purchase of organic food. Appetite 2018, 125, 418–427. [Google Scholar] [CrossRef] [PubMed]

- Young, I.; Waddell, L. Barriers and Facilitators to Safe Food Handling among Consumers: A Systematic Review and Thematic Synthesis of Qualitative Research Studies. PLoS ONE 2016, 11. [Google Scholar] [CrossRef] [PubMed]

- Liu, R.; Pieniak, Z.; Verbeke, W. Consumers’ attitudes and behaviour towards safe food in China: A review. Food Control 2013, 33, 93–104. [Google Scholar] [CrossRef]

- Rana, J.; Paul, J. Consumer behavior and purchase intention for organic food: A review and research agenda. J. Retail. Consum. Serv. 2017, 38, 157–165. [Google Scholar] [CrossRef]

- Lv, H.; Guo, Y.; Wang, J.; Liu, R. Report on the Trend of Fresh Food Consumption; The Boston Consulting Group (BCG), AliResearch: Boston, MA, USA, 2016. [Google Scholar]

- Jaenicke, E.C.; Carlson, A.C. Estimating and Investigating Organic Premiums for Retail-Level Food Products. Agribusiness 2015, 31, 453–471. [Google Scholar] [CrossRef]

- Connolly, C.; Klaiber, H.A. Does Organic Command a Premium When the Food is Already Local? Am. J. Agric. Econ. 2014, 96, 1102–1116. [Google Scholar] [CrossRef]

- Zheng, Q.; Wang, H.H.; Lu, Y. Consumer Purchase Intentions for Sustainable Wild Salmon in the Chinese market and Implications for Agribusiness Decisions. Sustainability 2018, 10, 1377. [Google Scholar] [CrossRef]

- Young, W.; Hwang, K.; McDonald, S.; Oates, C.J. Sustainable Consumption: Green Consumer Behaviour when Purchasing Products. Sustain. Dev. 2010, 18, 20–31. [Google Scholar] [CrossRef]

- Yin, S.J.; Chen, M.; Xu, Y.J.; Chen, Y.S. Chinese consumers’ willingness-to-pay for safety label on tomato: Evidence from choice experiments. China Agric. Econ. Rev. 2017, 9, 141–155. [Google Scholar] [CrossRef]

- D’Souza, C.; Taghian, M.; Lamb, P. An empirical study on the influence of environmental labels on consumers. Corp. Commun. Int. J. 2006, 11, 162–173. [Google Scholar] [CrossRef]

- Grunert, K.G.; Hieke, S.; Wills, J. Sustainability labels on food products: Consumer motivation, understanding and use. Food Policy 2014, 44, 177–189. [Google Scholar] [CrossRef]

- Roheim, C.A.; Asche, F.; Santos, J.I. The elusive price premium for ecolabelled products: Evidence from seafood in the UK market. J. Agric. Econ. 2011, 62, 655–668. [Google Scholar] [CrossRef]

- Resano-Ezcaray, H.; Isabel Sanjuan-Lopez, A.; Miguel Albisu-Aguado, L. Combining Stated and Revealed Preferences on Typical Food Products: The Case of Dry-Cured Ham in Spain. J. Agric. Econ. 2010, 61, 480–498. [Google Scholar] [CrossRef]

- Carlucci, D.; De Gennaro, B.; Roselli, L.; Seccia, A. E-commerce retail of extra virgin olive oil: An hedonic analysis of Italian SMEs supply. Br. Food J. 2014, 116, 1600–1617. [Google Scholar] [CrossRef]

- Roselli, L.; Carlucci, D.; De Gennaro, B.C. What Is the Value of Extrinsic Olive Oil Cues in Emerging Markets? Empirical Evidence from the US E-Commerce Retail Market. Agribusiness 2016, 32, 329–342. [Google Scholar] [CrossRef]

- Wang, H.H.; Hao, N.; Hou, Q.; Wetzstein, M.E.; Wang, Y. Is Fresh Food Shopping Sticky to Retail Channels and Online Platforms? Evidence and Implicaitons in the Digital Era. Agribusinessness Int. J. 2019, 35, 6–19. [Google Scholar] [CrossRef]

- Mikalef, P.; Giannakos, M.; Pateli, A. Shopping and Word-of-Mouth Intentions on Social Media. J. Theor. Appl. Electr. Comer. Res. 2013, 8, 17–34. [Google Scholar] [CrossRef]

- Mikalef, P.; Giannakos, M.N.; Pateli, A.G. Exploring the Business Potential of Social Media: An Utilitarian and Hedonic Motivation Approach. In Proceedings of the 25th Bled eConference eDependability: Reliable and Trustworthy eStructures, eProcesses, eOperations and eServices for the Future, Bled, Slovenia, 17–20 June 2012; p. 21. [Google Scholar]

- CGFDC The Second Session: What Is the Green Food Label. Available online: http://www.greenfood.agri.cn/ztzl/zspj/lsspzsjz/jy/201606/t20160608_5918667.htm (accessed on 20 December 2018).

- CGFDC Logo Implication. Available online: http://jiuban.moa.gov.cn/sydw/lssp/ywlssp/agf/Polices/201108/t20110803_2102224.htm (accessed on 20 December 2018).

- China Green Food Development Center (CGFDC). Green Food Statistical Yearbook; China Green Food Development Center (CGFDC): Beijing, China, 2017. [Google Scholar]

- China Green Food Development Center (CGFDC). Green Food Statistical Yearbook; China Green Food Development Center (CGFDC): Beijing, China, 2016. [Google Scholar]

- Romo Munoz, R.; Lagos Moya, M.; Gil, J.M. Market values for olive oil attributes in Chile: A hedonic price function. Br. Food J. 2015, 117, 358–370. [Google Scholar] [CrossRef]

- Wingfield, N.; Merced, M.J.d.l. Amazon to Buy Whole Foods for $13.4 Billion. Available online: https://www.nytimes.com/2017/06/16/business/dealbook/amazon-whole-foods.html (accessed on 20 December 2018).

- Wang, Y. JD.com Invests $700 Million In Chinese Supermarket Chain Yonghui. Available online: https://www.forbes.com/sites/ywang/2015/08/07/jd-com-invests-700-million-in-chinese-supermarket-chain-yonghui/#3f25f0e5169b (accessed on 20 December 2018).

- eMarketer. Worldwide Retail Ecommerce Sales: Emarketer’s Updated Estimates and Forecast Through 2019; eMarketer: New York, NY, USA, 2016. [Google Scholar]

- China Internet Network Information Center (CNNIC). The 41th Statistical Report on Internet Development in China; China Internet Network Information Center (CNNIC): Beijing, China, 2018. [Google Scholar]

- China Internet Network Information Center (CNNIC). Online Market Report of China in 2015; China Internet Network Information Center (CNNIC): Beijing, China, 2016. [Google Scholar]

- In 2016, China’s Online Retail Sales of Agricultural Products Surged by Nearly 50%. Available online: http://www.gov.cn/shuju/2016-12/19/content_5150125.htm (accessed on 20 December 2018).

- JD Big Data Research Institute. Look at the Trend of Food Online Shopping from Jingdong Big Data; JD Big Data Research Institute: Beijing, China, 2018. [Google Scholar]

- JD Big Data Research Institute. China’s Year of Global Food Pondering—Report on Fresh Food Consumption in 2018; JD Big Data Research Institute: Beijing, China, 2018. [Google Scholar]

- Lancaster, K.J. A New Approach to Consumer Theory. J. Polit. Econ. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- Court, L.M. Entrepreneurial and Consumer Demand Theories for Commodity Spectra. Econometrica 1941, 9, 135–162. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Polit. Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Griffith, R.; Nesheim, L. Hedonic methods for baskets of goods. Econ. Lett. 2013, 120, 284–287. [Google Scholar] [CrossRef]

- Costanigro, M.; Mccluskey, J.J. Hedonic Price Analysis in Food Markets. In The Oxford Handbook of the Economics of Food Consumption and Policy; Lusk, J.L., Roosen, J., Shogren, J.F., Eds.; Oxford University Press: Combridge, MA, USA, 2011. [Google Scholar]

- Karipidis, P.; Tsakiridou, E.; Tabakis, N. The Greek Olive Oil Market Structure. Agric. Econ. Rev. 2005, 6, 64–72. [Google Scholar]

- Edenbrandt, A.K.; Smed, S.; Jansen, L. A hedonic analysis of nutrition labels across product types and countries. Eur. Rev. Agric. Econ. 2018, 45, 101–120. [Google Scholar] [CrossRef]

- Ekeland, I.; Heckman, J.J.; Nesheim, L. Identification and estimation of hedonic models. J. Polit. Econ. 2004, 112, S60–S109. [Google Scholar] [CrossRef]

- Wen, H.; Gui, Z.; Tian, C.; Xiao, Y.; Fang, L. Subway Opening, Traffic Accessibility, and Housing Prices: A Quantile Hedonic Analysis in Hangzhou, China. Sustainability 2018, 10, 2254. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G., Jr. Regression quantiles. Econ. J. Econ. Soc. 1978, 46, 33–50. [Google Scholar] [CrossRef]

- Costanigro, M.; McCluskey, J.J.; Goemans, C. The Economics of Nested Names: Name Specificity, Reputations, and Price Premia. Am. J. Agric. Econ. 2010, 92, 1339–1350. [Google Scholar] [CrossRef]

- Gao, Z.; Yu, X.; Li, C.; McFadden, B.R. The interaction between country of origin and genetically modified orange juice in urban China. Food Qual. Prefer. 2019, 71, 475–484. [Google Scholar] [CrossRef]

| All Sample | Online Sample | Offline Sample | ||

|---|---|---|---|---|

| Price (RMB/L) | 46.92 (80.35) | 58.11 (94.41) | 20.60 (20.23) | |

| Production method | With green food label (%) | 2.86% | 3.25% | 2.03% |

| No green food label (%) | 97.14% | 96.75% | 97.97% | |

| Genetically- modified | With genetically modified ingredients (%) | 7.10% | 6.62% | 8.11% |

| Non-genetically modified ingredients (%) | 92.90% | 93.38% | 91.89% | |

| Product size | Volume (L) | 3.63 (2.41) | 3.43 (2.69) | 4.05 (1.61) |

| Extraction method | Leaching (%) | 17.94% | 13.12% | 27.93% |

| Pressing (%) | 82.06% | 86.88% | 72.07% | |

| Variety | Soybean oil (%) | 7.69% | 3.80% | 15.77% |

| Peanut oil (%) | 16.62% | 17.46% | 14.86% | |

| Rapeseed oil (%) | 18.81% | 17.03% | 22.52% | |

| Sunflower seed oil (%) | 6.95% | 6.07% | 8.78% | |

| Olive oil (%) | 1.98% | 1.74% | 2.48% | |

| Sesame oil (%) | 1.46% | 2.06% | 0.23% | |

| Corn oil (%) | 15.89% | 15.84% | 15.99% | |

| Camellia oil (%) | 5.78% | 8.46% | 0.23% | |

| Linseed oil (%) | 5.86% | 7.92% | 1.58% | |

| Canola oil (%) | 0.73% | 0.76% | 0.68% | |

| Rice oil (%) | 1.46% | 1.95% | 0.45% | |

| Grapeseed oil (%) | 0.22% | 0.33% | 0.00% | |

| Tea seed oil (%) | 0.07% | 0.11% | 0.00% | |

| Wheatgerm oil (%) | 0.15% | 0.22% | 0.00% | |

| Walnut oil (%) | 0.22% | 0.33% | 0.00% | |

| Perilla oil (%) | 0.15% | 0.22% | 0.00% | |

| Pumpkin seed oil (%) | 0.22% | 0.33% | 0.00% | |

| Sue seed oil (%) | 0.07% | 0.11% | 0.00% | |

| Hemp seed oil (%) | 0.51% | 0.76% | 0.00% | |

| Blend oil (%) | 15.16% | 14.50% | 16.43% | |

| Place of origin | North-east China (%) | 7.61% | 3.90% | 15.32% |

| North-west China (%) | 11.86% | 8.57% | 18.69% | |

| North China (%) | 5.93% | 3.47% | 11.04% | |

| South-west China (%) | 3.07% | 1.84% | 5.63% | |

| Central China (%) | 33.16% | 30.91% | 37.84% | |

| South China (%) | 9.66% | 11.17% | 6.53% | |

| East China (%) | 7.47% | 9.44% | 3.38% | |

| Unspecified (%) | 21.24% | 30.70% | 1.57% | |

| Container material | Plastic (%) | 87.04 % | 82.32% | 96.85 % |

| Glass (%) | 10.76% | 15.29% | 1.35% | |

| Tin can (%) | 2.20% | 2.39% | 1.80% | |

| Number of colors printed on container | 2.25 (0.74) | 2.41 (0.59) | 1.90 (0.89) | |

| Packaged with a giftbox (%) | 3.59% | 4.99% | 0.68% | |

| With discount claim (%) | 34.04% | 42.41% | 16.67% | |

| Observations | Number of products | 1366 | 922 | 444 |

| Online Interactive Coefficients | ||||||||

|---|---|---|---|---|---|---|---|---|

| Variables | Coef. | SE | % of Price | MIP | Coef. | SE | % of Price | MIP |

| Green | −0.08 | 0.07 | −7.82 | −3.32 | 0.22 ** | 0.10 | 24.61 | 10.45 |

| GM | −0.37 *** | 0.06 | −31.20 | −13.25 | −0.05 | 0.09 | −4.74 | −2.01 |

| Ln(volume) | −0.26 *** | 0.03 | −23.05 | 0.00 | 0.04 | |||

| Leaching | −0.24 *** | 0.05 | −21.49 | −9.13 | −0.06 | 0.08 | −5.57 | −2.37 |

| Soybean oil | −0.21 | 0.14 | −18.94 | −8.05 | −0.02 | 0.16 | −1.77 | −0.75 |

| Peanut oil | 0.52 *** | 0.11 | 68.37 | 29.04 | −0.41 *** | 0.13 | −33.37 | −14.17 |

| Rapeseed oil | −0.32 *** | 0.11 | −27.53 | −11.69 | −0.03 | 0.13 | −2.63 | −1.12 |

| Sunflower seed oil | −0.08 | 0.08 | −7.30 | −3.10 | −0.29 ** | 0.12 | −25.32 | −10.76 |

| Olive oil | 0.59 *** | 0.12 | 79.50 | 33.77 | −0.02 | 0.21 | −1.99 | −0.85 |

| Corn oil | −0.11 | 0.07 | −10.15 | −4.31 | −0.31 *** | 0.10 | −26.51 | −11.26 |

| Linseed oil | 0.57 *** | 0.21 | 76.83 | 32.63 | −0.13 | 0.23 | −12.01 | −5.10 |

| Northeast China | −0.24 ** | 0.12 | −21.65 | −9.20 | 0.07 | 0.19 | 7.62 | 3.23 |

| East China | −0.16 | 0.13 | −14.62 | −6.21 | −0.04 | 0.14 | −3.56 | −1.51 |

| North China | −0.36 *** | 0.11 | −30.51 | −12.96 | 0.32 * | 0.18 | 38.13 | 16.19 |

| Central China | 0.04 | 0.10 | 4.48 | 1.90 | 0.28 ** | 0.13 | 31.78 | 13.50 |

| South China | −0.12 | 0.12 | −10.86 | −4.61 | 0.20 | 0.16 | 22.51 | 9.56 |

| Southwest China | −0.20 | 0.15 | −17.96 | −7.63 | 0.41 | 0.29 | 50.08 | 21.27 |

| Northwest China | −0.27 *** | 0.08 | −23.89 | −10.15 | 0.48 ** | 0.21 | 61.93 | 26.31 |

| Plastic | −0.50 *** | 0.13 | −39.47 | −16.76 | −0.46 *** | 0.16 | −36.93 | −15.69 |

| Ln(color) | −0.06 | 0.04 | −6.04 | -0.07 | 0.08 | |||

| Giftbox | −0.20 | 0.18 | −18.29 | −7.77 | 0.89 *** | 0.21 | 143.27 | 60.85 |

| Discount claim | −0.10 *** | 0.03 | −9.27 | −3.94 | 0.20 *** | 0.04 | 22.63 | 9.61 |

| Soybean oil * Northeast China | 0.07 | 0.16 | 7.27 | 3.09 | −0.11 | 0.26 | −10.15 | −4.31 |

| Soybean oil * Central China | −0.23 | 0.17 | −20.47 | −8.69 | −0.32 | 0.20 | −27.31 | −11.60 |

| Peanut oil * Central China | −0.33 ** | 0.14 | −27.75 | −11.79 | −0.02 | 0.17 | −1.67 | −0.71 |

| Peanut oil * South China | −0.30 * | 0.18 | −26.21 | −11.13 | 0.17 | 0.21 | 18.29 | 7.77 |

| Rapeseed oil * North China | 0.57 *** | 0.13 | 76.83 | 32.63 | −0.70 *** | 0.21 | −50.19 | −21.32 |

| Rapeseed oil * Central China | 0.07 | 0.14 | 6.88 | 2.92 | −0.30 | 0.21 | −26.14 | −11.10 |

| Rapeseed oil * Southwest China | 0.34 * | 0.18 | 40.49 | 17.20 | −0.73 ** | 0.31 | −51.86 | −22.03 |

| Rapeseed oil * Northwest China | 0.30 *** | 0.11 | 34.58 | 14.69 | −0.61 *** | 0.22 | −45.39 | −19.28 |

| Sunflower seed oil * Central China | −0.18 | 0.12 | −16.47 | −7.00 | −0.11 | 0.17 | −10.68 | −4.54 |

| Corn oil * Northeast China | −0.01 | 0.12 | −1.40 | −0.59 | 0.15 | 0.21 | 16.07 | 6.82 |

| Corn oil * Central China | −0.18 * | 0.10 | −16.14 | −6.85 | −0.05 | 0.14 | −4.95 | −2.10 |

| Corn oil * South China | −0.17 | 0.16 | −15.97 | −6.78 | 0.12 | 0.20 | 12.64 | 5.37 |

| Constant | 3.97 *** | 0.16 | 0.61 *** | 0.18 | ||||

| Observations | 1344 | |||||||

| R-squared | 0.82 | |||||||

| Interactive Effects | ||||

|---|---|---|---|---|

| Green food | Coef. | SE | Coef. | SE |

| q10 | 0.00 | 0.09 | 0.26 | 0.19 |

| q20 | −0.06 | 0.08 | 0.24 ** | 0.11 |

| q30 | −0.07 | 0.08 | 0.31 *** | 0.11 |

| q40 | −0.10 | 0.07 | 0.33 *** | 0.10 |

| q50 | −0.06 | 0.07 | 0.25 ** | 0.10 |

| q60 | −0.08 | 0.08 | 0.24 ** | 0.11 |

| q70 | −0.09 | 0.10 | 0.20 | 0.13 |

| q80 | −0.10 | 0.12 | 0.20 | 0.15 |

| q90 | 0.06 | 0.16 | 0.00 | 0.23 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, Y.; Wang, H.H.; Jin, S.; Delgado, M.S. The Promising Effect of a Green Food Label in the New Online Market. Sustainability 2019, 11, 796. https://doi.org/10.3390/su11030796

Jiang Y, Wang HH, Jin S, Delgado MS. The Promising Effect of a Green Food Label in the New Online Market. Sustainability. 2019; 11(3):796. https://doi.org/10.3390/su11030796

Chicago/Turabian StyleJiang, Yu, H. Holly Wang, Shaosheng Jin, and Michael S. Delgado. 2019. "The Promising Effect of a Green Food Label in the New Online Market" Sustainability 11, no. 3: 796. https://doi.org/10.3390/su11030796

APA StyleJiang, Y., Wang, H. H., Jin, S., & Delgado, M. S. (2019). The Promising Effect of a Green Food Label in the New Online Market. Sustainability, 11(3), 796. https://doi.org/10.3390/su11030796