Pricing and Service Level Decisions under a Sharing Product and Consumers’ Variety-Seeking Behavior

Abstract

1. Introduction

2. Literature Review

2.1. Service Sharing

2.2. Variety-Seeking Behavior

2.3. SE Pricing Strategy

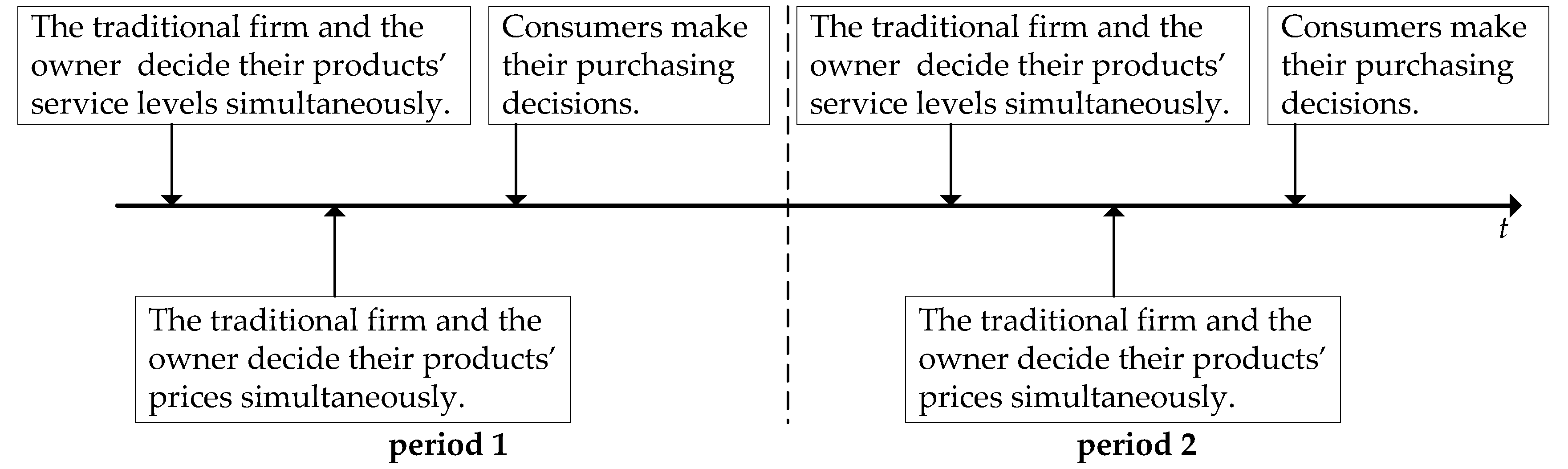

3. Model

4. Analysis

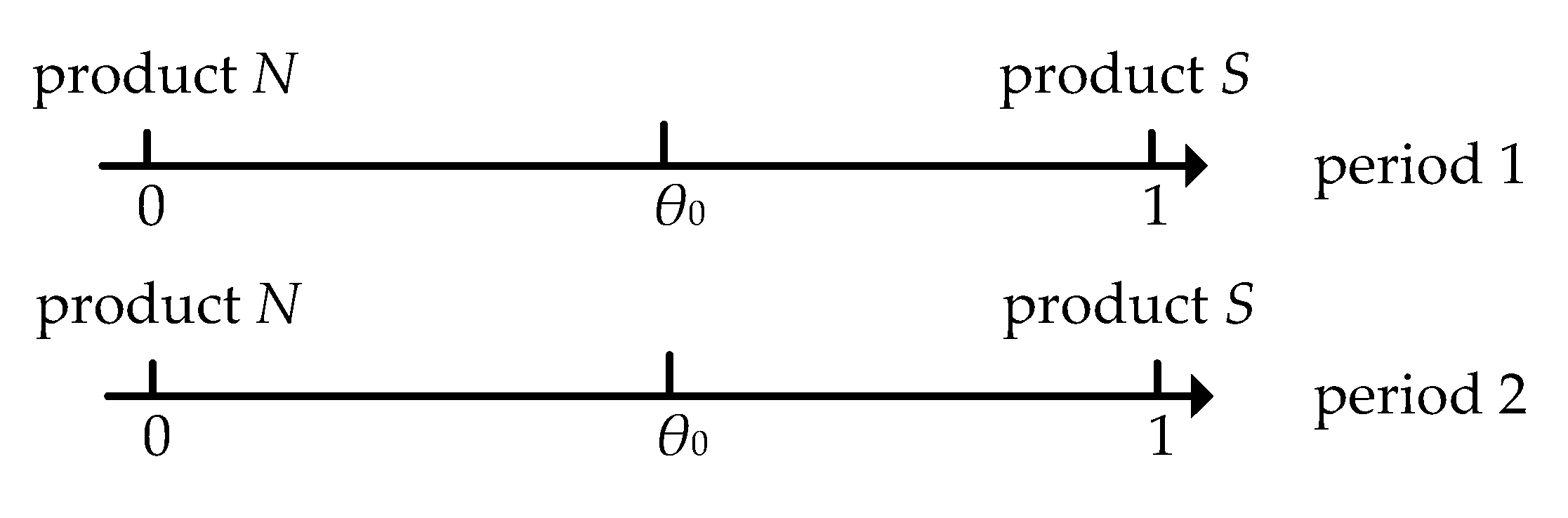

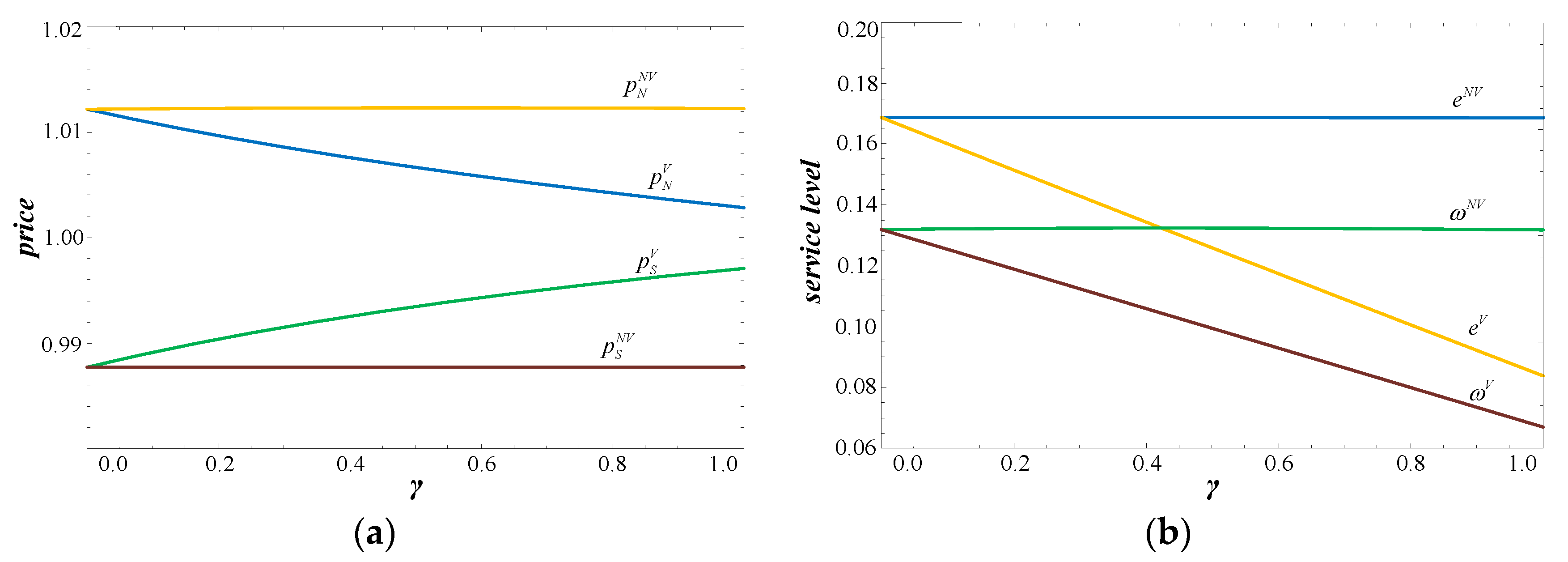

4.1. Benchmark Case: Without Variety Seeking

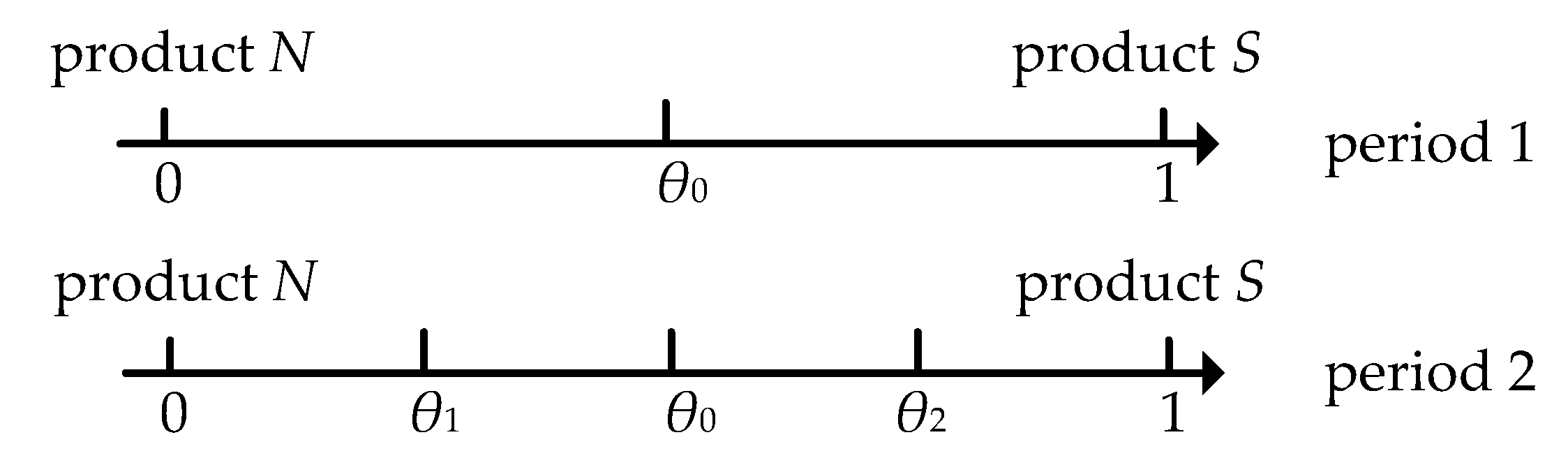

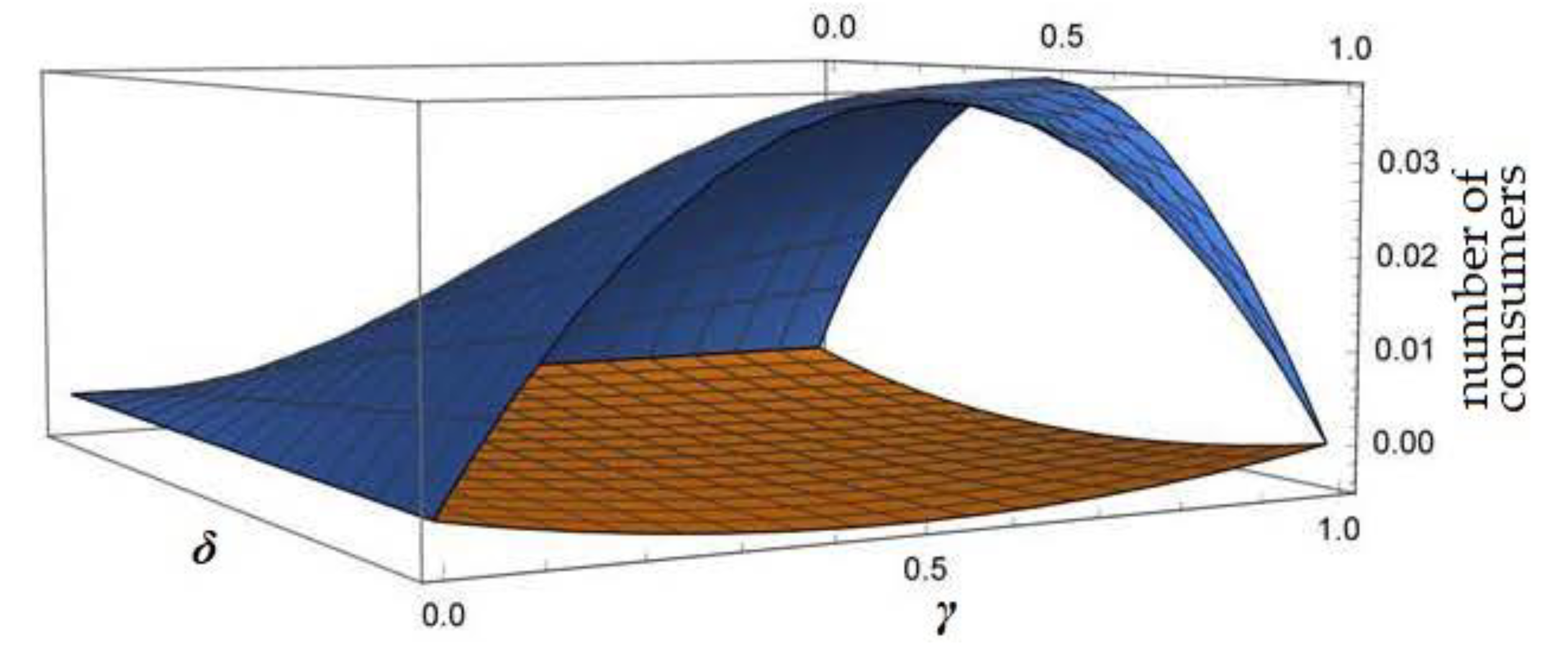

4.2. Variety-Seeking Behavior

- (1)

- Purchase product N during the first period and purchase product N during the second period.

- (2)

- Purchase product S during the first period and purchase product S during the second period.

4.2.1. No Adjustment to the Service Level

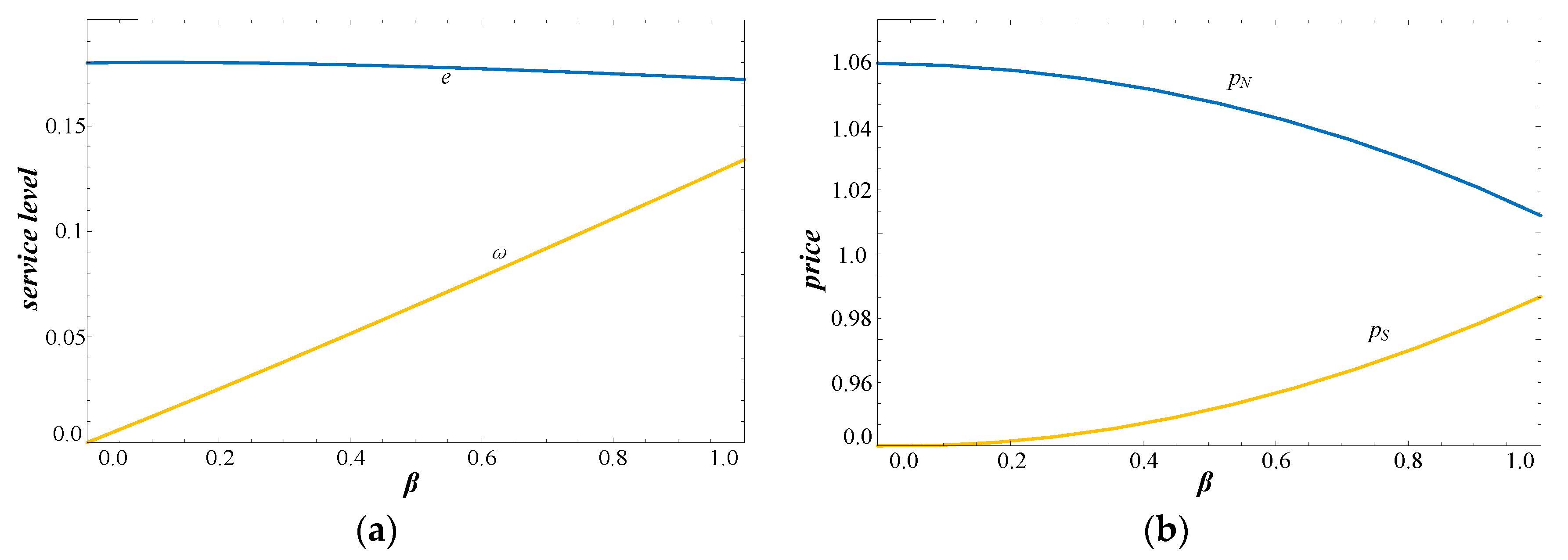

4.2.2. Adjusting Service Level

5. Discussion and Conclusions

6. Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A

- (1)

- The service levels are , .

- (2)

- The prices are , .

- (3)

- The profits are , .

- (1)

- The service levels are , .

- (2)

- The prices are , .

- (3)

- The profits are , .

References

- Belk, R. Sharing. J. Consum. Res. 2010, 36, 715–734. [Google Scholar] [CrossRef]

- Benjaafar, S.; Kong, G.; Li, X.; Courcoubetis, C. Peer-to-peer product sharing: Implications for ownership, usage and social welfare in the sharing economy. Manag. Sci. 2019, 65, 477–493. [Google Scholar] [CrossRef]

- Iyengar, S.S.; Lepper, M.R. When choice is demotivating: Can one desire too much of a good thing? J. Personal. Soc. Psychol. 2000, 79, 995–1006. [Google Scholar] [CrossRef]

- Tussyadiah, I.P.; Pesonen, J. Impacts of peer-to-peer accommodation use on travel patterns. J. Travel Res. 2015, 55, 1022–1040. [Google Scholar] [CrossRef]

- Guttentag, D.; Smith, S.; Potwarka, L.; Havitz, M. Why tourists choose Airbnb: A motivation-based segmentation study. J. Travel Res. 2018, 57, 342–359. [Google Scholar] [CrossRef]

- Lin, P.M.; Fan, D.X.; Zhang, H.Q.; Lau, C. Spend less and experience more: Understanding tourists’ social contact in the Airbnb context. Int. J. Hosp. Manag. 2019, 83, 65–73. [Google Scholar] [CrossRef]

- Zervas, G.; Proserpio, D.; Byers, J.W. The Rise of the Sharing Economy: Estimating the Impact of Airbnb on the Hotel Industry. J. Mark. Res. 2017, 54, 687–705. [Google Scholar] [CrossRef]

- Farronato, C.; Fradkin, A. The Welfare Effects of Peer Entry in the Accommodation Market: The Case of Airbnb; NBER Working Paper; NBER: Cambridge, MA, USA, 2018. [Google Scholar]

- Seetharaman, P.B.; Che, H. Price competition in markets with consumer variety seeking. Mark. Sci. 2009, 28, 516–525. [Google Scholar] [CrossRef]

- Shin, J.; Sudhir, K. A customer management dilemma: When is it profitable to reward one’s own customers? Mark. Sci. 2010, 29, 671–689. [Google Scholar] [CrossRef]

- Zhang, J.; Niu, B. Dynamic quality decisions of software-as-a-service providers based on customer perception. Electron. Commer. Res. Appl. 2014, 13, 151–163. [Google Scholar] [CrossRef]

- Jeong, Y.; Maruyama, M. Positioning and pricing strategies in a market with switching costs and staying costs. Inf. Econ. Policy 2018, 44, 47–57. [Google Scholar] [CrossRef]

- Guttentag, D. Airbnb: Disruptive innovation and the rise of an informal tourism accommodation sector. Curr. Issues Tour. 2015, 18, 1192–1217. [Google Scholar] [CrossRef]

- So, K.K.F.; Oh, H.; Min, S. Motivations and constraints of Airbnb consumers: Findings from a mixed-methods approach. Tour. Manag. 2018, 67, 224–236. [Google Scholar] [CrossRef]

- Trijp, H.C.V.; Hoyer, W.D.; Inman, J.J. Why switch? Product category-level explanations for true variety-seeking behavior. J. Mark. Res. 1996, 33, 281–292. [Google Scholar]

- Kahn, B.E. Dynamic relationships with customers: High-variety strategies. J. Acad. Mark. Sci. 1998, 26, 45–53. [Google Scholar] [CrossRef]

- Bigné, J.E.; Sánchez, I.; Andreu, L. The role of variety seeking in short and long run revisit intentions in holiday destinations. Int. J. Cult. Tour. Hosp. Res. 2009, 3, 103–115. [Google Scholar] [CrossRef]

- Nicolau, J.L. Variety-seeking and inertial behaviour: The disutility of distance. Tour. Econ. 2010, 16, 251–264. [Google Scholar] [CrossRef]

- Legohérel, P.; Hsu, C.H.; Daucé, B. Variety-seeking: Using the CHAID segmentation approach in analyzing the international traveler market. Tour. Manag. 2015, 46, 359–366. [Google Scholar] [CrossRef]

- Sajeesh, S.; Raju, J.S. Positioning and pricing in a variety seeking market. Manag. Sci. 2010, 56, 949–961. [Google Scholar] [CrossRef]

- Niu, B.; Chen, L.; Liu, Y.; Jin, Y. Joint price and quality decisions considering chinese customers’ variety seeking behavior. Int. J. Prod. Econ. 2019, 213, 97–107. [Google Scholar] [CrossRef]

- Narasimhan, C.; Papatla, P.; Jiang, B.; Kopalle, P.K.; Messinger, P.R.; Moorthy, S.; Proserpio, D.; Subramanian, U.; Wu, C.; Zhu, T. Sharing economy: Review of current research and future directions. Cust. Needs Solut. 2017, 9, 1–14. [Google Scholar] [CrossRef]

- Fang, Z.; Huang, L.; Wierman, A. Prices and subsidies in the sharing economy. In Proceedings of the 26th International Conference on World Wide Web, Geneva, Switzerland, 3–7 April 2017. [Google Scholar]

- Kung, L.C.; Zhong, G.Y. The optimal pricing strategy for two-sided platform delivery in the sharing economy. Transp. Res. Part E Logist. Transp. Rev. 2017, 101, 1–12. [Google Scholar] [CrossRef]

- Fraiberger, S.P.; Sundararajan, A. Peer-to-peer rental markets in the sharing economy. In NYU Stern School of Business Research Paper; New York University: New York, NY, USA, 2015. [Google Scholar]

- Jiang, B.; Tian, L. Collaborative Consumption: Strategic and Economic Implications of Product Sharing. Manag. Sci. 2018, 64, 1171–1188. [Google Scholar] [CrossRef]

- Tian, L.; Jiang, B. Effects of consumer-to-consumer product sharing on distribution channel. Prod. Oper. Manag. 2018, 27, 350–367. [Google Scholar] [CrossRef]

- Liu, Z.; Feng, J.; Wang, J. Effects of the sharing economy on sequential innovation products. Complexity 2019. [Google Scholar] [CrossRef]

- Feng, J.; Liu, Z.; Liu, B. Manufacturer’s Business Strategy: Interaction of Sharing Economy and Product Rollover. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3497308 (accessed on 15 November 2019).

- Narasimhan, C.; Papatla, P.; Ravula, P. Preference Segmentation Induced by Tariff Schedules and Availability in Ride-Sharing Markets; Working Paper; University of Wisconsin-Milwaukee: Milwaukee, WI, USA, 2016. [Google Scholar]

- Conrad, K. Price competition and product differentiation when consumers care for the environment. Environ. Resour. Econ. 2005, 31, 1–19. [Google Scholar] [CrossRef]

- Mendelson, H.; Parlaktürk, A.K. Competitive customization. Manuf. Serv. Oper. Manag. 2008, 10, 377–390. [Google Scholar] [CrossRef]

- Ülkü, M.A.; Hsuan, J. Towards sustainable consumption and production: Competitive pricing of modular products for green consumers. J. Clean. Prod. 2017, 142, 4230–4242. [Google Scholar] [CrossRef]

- Hotelling, H. Stability in competition. Econ. J. 1929, 28, 41–57. [Google Scholar] [CrossRef]

- Tirole, J. The Theory of Industrial Organization; MIT Press: Cambridge, MA, USA, 1988. [Google Scholar]

- Pine, B.J. Mass Customization: The New Frontier in Business Competition; Harvard Business School Press: Boston, MA, USA, 1993. [Google Scholar]

- Hamari, J.; Sjöklint, M.; Ukkonen, A. The sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2016, 67, 2047–2059. [Google Scholar] [CrossRef]

- Paulauskaite, D.; Powell, R.; Coca-Stefaniak, J.A.; Morrison, A.M. Living like a local: Authentic tourism experiences and the sharing economy. Int. J. Tour. Res. 2017, 19, 619–628. [Google Scholar] [CrossRef]

- Bhaskaran, S.R.; Krishnan, V. Effort, revenue, and cost sharing mechanisms for collaborative new product development. Manag. Sci. 2009, 55, 1152–1169. [Google Scholar] [CrossRef]

- Li, T.; Zhang, R.; Zhao, S.L.; Liu, B. Low carbon strategy analysis under revenue-sharing and cost-sharing contracts. J. Clean Prod. 2019, 212, 1462–1477. [Google Scholar] [CrossRef]

- Feng, J.; Liu, B. Dynamic impact of online word-of-mouth and advertising on supply chain performance. Int. J. Environ. Res. Public Health 2018, 15, 69. [Google Scholar] [CrossRef]

| Variables | Definitions |

|---|---|

| i | Product, i = N (traditional product), S (sharing product). |

| j | Period, j = 1, 2. |

| Ui,j | Consumer’s utility of choosing product i at period j. |

| θ | Consumer type, θ ∈ [0, 1]. |

| θm | Boundary consumer who is indifferent to buying either of the two kinds of products, m ∈ {0, 1, 2}. |

| ηi | Product’s positions. |

| ej | Standardized service level of traditional product in period j. |

| ωj | Personalized service level of sharing product in period j. |

| α | Consumer’s recognition degree of standardized service, α > 0. |

| β | Consumer’s recognition degree of personalized service, β > 0. |

| u | Consumer’s intrinsic utility. |

| di | Intensity of the consumer’s preference for product i. |

| δ | Fraction of the variety-seeking customers in the market, δ ∈ [0, 1]. |

| pi, j | Price of product i in period j. |

| qi,j | Demand for product i in period j. |

| k | Constant, k > 0. |

| λ | Sharing platform’s percentage fee, λ ∈ [0,1). |

| γ | Consumer’s boredom sensitivity, γ ∈ [0,1). |

| πN,j | Profits of traditional firm N in period j. |

| πSP,j | Profits of sharing platform S in period j. |

| πSO,j | Earnings of owner in period j. |

| NV | Benchmark with no variety-seeking behavior, denoted by superscript NV. |

| V | Variety-seeking behavior, denoted as a superscript V. |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Z.; Feng, J.; Liu, B. Pricing and Service Level Decisions under a Sharing Product and Consumers’ Variety-Seeking Behavior. Sustainability 2019, 11, 6951. https://doi.org/10.3390/su11246951

Liu Z, Feng J, Liu B. Pricing and Service Level Decisions under a Sharing Product and Consumers’ Variety-Seeking Behavior. Sustainability. 2019; 11(24):6951. https://doi.org/10.3390/su11246951

Chicago/Turabian StyleLiu, Zhenfeng, Jian Feng, and Bin Liu. 2019. "Pricing and Service Level Decisions under a Sharing Product and Consumers’ Variety-Seeking Behavior" Sustainability 11, no. 24: 6951. https://doi.org/10.3390/su11246951

APA StyleLiu, Z., Feng, J., & Liu, B. (2019). Pricing and Service Level Decisions under a Sharing Product and Consumers’ Variety-Seeking Behavior. Sustainability, 11(24), 6951. https://doi.org/10.3390/su11246951